Negotiations

| Newer Posts | Older Posts |

Prevent gazumping by getting deals in writing quickly |

|

We're starting to see multiple offers on some properties, likely because inventory levels are so low. In some other countries, that dynamic can lead to gazumping, a practice where a seller accepts an oral offer from one buyer, and then before firming it up in writing, accepts a second, higher offer. Read all about gazumping on the Matrix Blog. This is most common in England and Wales, where apparently it takes 10 to 12 weeks to get from an oral agreement to a written agreement. Blimey! Thankfully, it doesn't (usually) take more than a few days to move from an oral agreement to a written agreement here in the U.S.A. | |

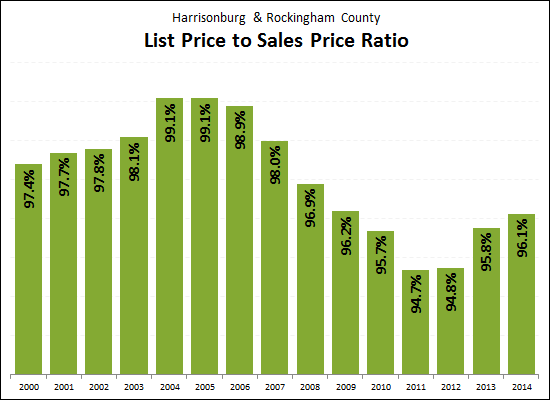

The best deals (compared to list prices) are behind us. |

|

It seems that 2011 and 2012 were the years when sellers had to negotiate the most off of their list price -- giving up over 5%, on average. Now, that has shifted down to less than 4%, and I expect that average amount of negotiating will continue to decrease through 2014. | |

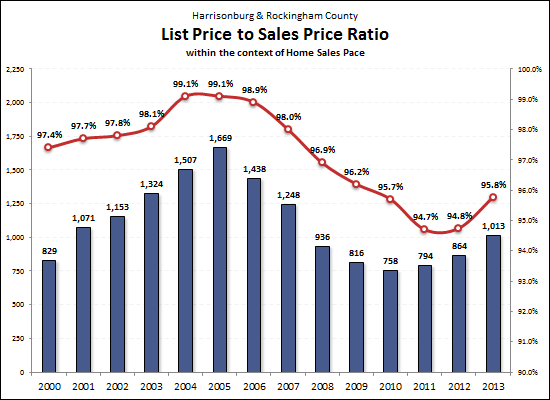

Price negotiability, pace of home sales seem highly correlated |

|

First, a disclaimer, I am not a statistician --- though I did take a fantastic stats class in grad school with Kevin Apple. That said, it sure would seem to me that there is a direct correlation between the pace of home sales, and the negotiability of home prices. Take a look at the graph above and let me know (online or offline) if you agree. Actual statisticians --- feel free to chime in. :) | |

Maximum Negotiability in Home Prices.....Has Passed Us By |

|

You can still get a great deal on a house these days --- but the amount you can expect (on average) to negotiate is a bit lower than it was over the past two years. We're back to 2010 negotiability levels, and that trend is likely to continue. Read more about what's going on in our local housing market at HarrisonburgHousingMarket.com. | |

How negotiable are bank owned (REO) list prices? |

|

As you'll note, above, banks aren't that much more flexible on price than the average seller on the market. That said, their list prices are oftentimes more compelling than typical listings, which makes the "normal" amount of negotiating room less of a concern for most buyers. View upcoming Trustee Sales View current bank owned listings | |

When to make a price adjustment? |

|

As I mentioned last month, after we have your house on the market for a month or two, if we aren't having many showings (or we're not satisfied with the feedback from those showings) we may want to adjust our pricing strategy to work towards a successful sale. But then the question comes to WHEN to make the price adjustment. In some ways, as soon as you have decided you need or want to make a change in pricing strategy --- MAKE THE CHANGE! However, one of my clients brought up a great point this past week, which is that there aren't always buyers for every house in the market at all times. So....if the right buyer is in the market now, great, a price reduction will help them decide to make a move now versus later. But....if the right buyer is not in the market now, the lowering our price now doesn't do much other than leave us with less negotiating room later. There is no one "right" answer here -- as we can't conclusively know whether the buyer of your home is in the market right now, or whether they will be later. That said, develop a pricing strategy that works for your timing, your life situation, your motivation level to sell, and stick to it. | |

Making a low offer? Beef up your other offering terms. |

|

I know, I know, you want to make a low offer on the house. It seems like every buyer does these days -- and why not, as it is certainly still a buyer's market in Harrisonburg and Rockingham County. But when making that low offer, you can increase the appeal of your offer by strengthening your other offering terms.... DEPOSITS Make the largest deposit you are comfortable with so the seller knows you have money "on the line" and that you won't risk losing that money by attempting to walk away from the deal. CLOSING COST ASSISTANCE Sellers don't just look at the contract price --- they calculate their net proceeds based on the offer price and any credits or closing cost assistance. Only ask for assistance if you truly need it. FINANCING Provide as much detail as possible about your financing intentions, and always include a pre-approval letter. Sellers who believe you are capable of financing the purchase will be less hesitant as they consider other terms of your offer. PERSONAL PROPERTY Don't automatically ask for everything the seller intends to convey --- if you don't need them all, leave them out of the offer. Allowing the seller to keep their washer/dryer (for example) may make them more flexible in other areas. INSPECTIONS Having a professional inspect the property you are purchasing is usually a good idea; however if you only intend to do it for informational purposes, consider leaving it out of the contract negotiations and conducting it post-settlement. SETTLEMENT & POSSESSION If possible, cater your settlement date and the details of transferring possession of the property to the needs or wants of the seller. This can go a long way towards gaining seller flexibility on other contract terms. Finally, research the seller's context for selling. That information can be invaluable in negotiating a successful contract. | |

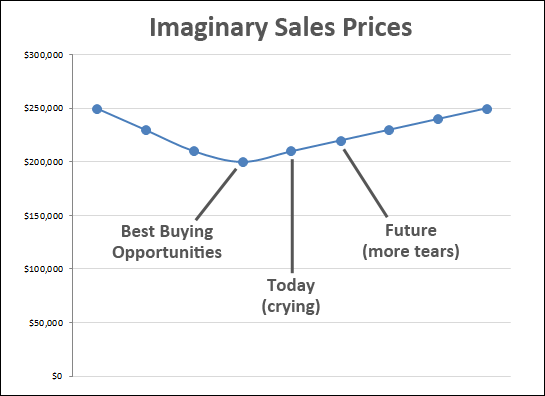

In a market upswing, crying over missed past buying opportunities can lead to even more tears |

|

In the fictitious value trend graph above, the best opportunities were yesterday (or some time before now). As a housing market starts to improve, some buyers have a tendency to get stuck on the fact that they just missed out on the lowest prices seen during a market downturn. It is important for those tearful buyers to remember, however, that there will likely be more tears and larger tears tomorrow (or some amount of time into the future) when prices have recovered even further. For example....

A few notes and disclaimers....

| |

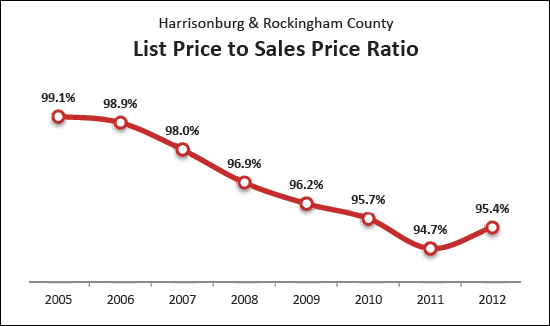

Is the window of maximum negotiating ability closing? |

|

Hidden in yesterday's monthly market report was this new graph that explores the amount that sellers negotiate off of their asking prices. As you can see, at the peak of the market (2005) sellers only negotiated 0.9% (on average) off of their asking price. That metric has since fallen all the way down to 94.7% in 2011 --- well below the assumed normal of 97.4% in 2000, before the real estate market started taking off like a rocket. The important thing to note, though, is that this metric is edging back upwards thus far in 2012 --- to an average of 95.4%. That means that sellers are finding themselves negotiating less on their asking price because of gradual overall market improvements. Sellers -- be encouraged that you won't be beat up as much on price as we move forward. Buyers -- if you want to negotiate heavily on price, consider buying now, not next year. | |

Evaluating a low offer as a seller |

|

Let's suppose you have a house listed for sale for $300K. But keep in mind that you just lowered it to $300K from it's previous price of $309K. How would you respond to an offer of $270K? You probably consider $270K to be way too low of an offer, after all you just reduced you price from $309K. These ridiculous buyers are offering you $39K less than your asking price last week. Certainly, you should be able to sell for around $295K, right? Well, maybe not. In the last 365 days, properties in Harrisonburg and Rockingham County sold for an average of 95% of their last list price. That means that if $300K is a fair asking price, you should probably expect to sell for around $285K -- if you hit that 95% average. Then, all of a sudden, maybe the $270K offer on a $300K list price isn't too low at all. If you met in the middle, after all, you'd be right at that 95% mark. So....let's make it really hurt....how would you respond to an offer of $250K?? The same logic above applies here -- if your house is an average performer, you'll end up selling for $285K. And the $250K again probably seems waaaaay too low. But what if your house still isn't listed at a fair price? If nobody comes to view it over the next month, it may still be overpriced. Then, perhaps you'll find yourself lowering the list price to $290K. And then, of course, you might sell for that 95% average and end up at $275,500. So.....if you're listed at $300K and you might (a month+ from now) end up at $275K....perhaps you shouldn't turn up your nose at that $250K offer. See how high they are willing to go. . If you can get them up to $275K, you might want to consider taking it (bird in hand! bird in hand!) -- and if their super low offer of $250K was just to try to get you down to $280K or $285K, all the better! As a seller, don't be discouraged about what you view as a low offer -- after all, it's an indication that somebody really wants to buy your house. Don't let those buyers slip away --- negotiate creatively and try to get to a reasonable and mutually acceptable price. | |

True Story: Bidding wars after lengthy time on market |

|

Timing is everything when it comes to real estate. For example, 2006 was not the best time to buy, and 2011 was not the best time to sell. But moving beyond those obvious realities, it is wild to see how the timing of offers can affect listings that have been on the market for "quite some time" -- sometimes defined as 6+ months, sometimes 12+ months, and sometimes even 18+ months. I have had two situations thus far this year when listings had been on the market for "quite some time" with no offers at all, and all of a sudden, two offers were received within the same week. It is quite a strange situation....

Now, let's be clear here -- multiple offer situations used to involve ultimate sales prices at or above the list price -- and that is rarely happening these days in multiple offer scenarios. However, sellers in such circumstances are certainly selling for a bit more than they would have if both offers had not happened to come in simultaneously. | |

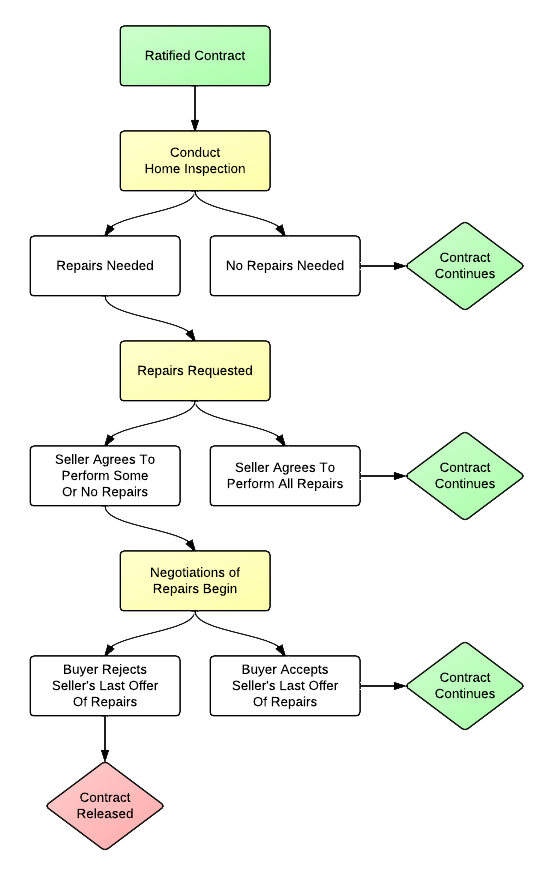

How does this home inspection process work, anyhow? |

|

Here's a reminder of how the typical home inspection process works in Virginia....  And a brief reminder of a few of the timing issues.....

To map this all out, here's how long a home inspection contingency could really take....

Yes, that innocuous 14 day inspection contingency can really turn into a month! | |

Let's look at this low offer as a compliment! |

|

Sellers are usually quite disheartened to receive a low offer on their house, for example, an offer of $250K on a $300K listing. But it is important to remember that even that low offer really is a complement!  If you have not yet had an offer on your house (that is listed at $300K) and you receive an offer of $250K, that doesn't necessarily mean your house is only worth $250K, nor does it necessarily mean that you should accept $250K or something close to it. It does, however, mean something quite exciting --- somebody wants to buy your house!!! Of course, negotiations won't always work out with low offers -- but recognize a low offer for what it is -- a buyer who wants to buy your house, and perhaps the first buyer who has declared as much through a written offer! If there is any way to put a deal together with those buyers, you ought to pursue it, as it's hard to know when the next buyer will work up the courage to tell you that they want to buy your house! | |

Another perspective on pricing, negotiating and low offers |

|

I received a low (LOW) offer on one of my listings at the end of this past week. I'll round the numbers a bit to protect the anonymity if my clients and I will suggest that it was equivalent to a $280K offer on a $350K listing. We were not (surprise, surprise) able to negotiate a contract after starting with such an enormous gap in pricing. After it was all said and done, I had a new insight on pricing that hadn't occurred to me before. I found myself thinking.... Wait, really?? The buyers thought the sellers priced their home $70,000 above a price that they'd really take for the house? Certainly, if I had clients who wanted to sell at or above $280K, I would never suggest that they list their home at $350K. Perhaps we list the home at $309,900 at first, and then we might reduce it to $299,900. But again, this is what it seems that the buyers must have been thinking --- that the sellers had come up with a list price that was $70,000 higher than what they would actually be willing to take. OK, I know, there are some other angles here:

That said, of course, I don't want buyers paying unreasonably high prices for homes. Thus, if a house should be listed at $300K but is listed at $350K, my advise above shouldn't restrain you from making an offer for what you really think the house is worth. | |

How much do banks typically negotiate in selling a bank owned property? |

|

Buyers can often find great opportunities in bank owned properties, but they often wonder how much they should expect to be able to negotiate off of the list price of a bank owned property. Let's take a look.... For all residential sales in Harrisonburg and Rockingham County in the past year, we find:

I suppose the important thing to remember is that the list-to-sell ratio of any property is largely dependent on how realistic the asking price is. Both a homeowner and a bank can price a home too high when putting it on the market. Perhaps banks do that less often, and thus achieve a (slightly) higher list-to-sell ratio despite still offering great deals on properties? Additional Relevant Information:

| |

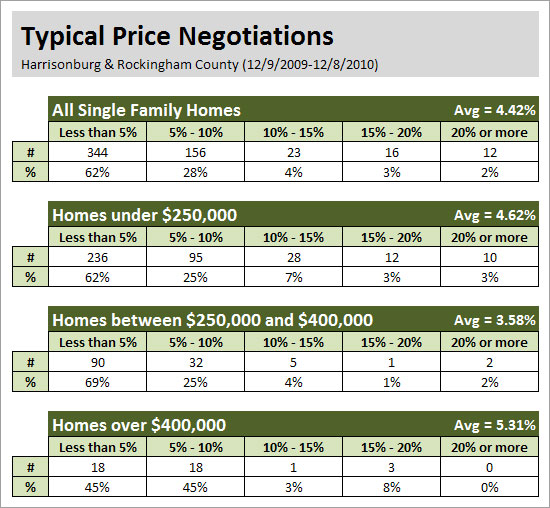

How much should I be able to negotiate on price? |

|

It is certainly a buyers market these days --- there are far more sellers in the market than buyers, so oftentimes buyers can negotiate quite effectively. Let's take a look at what the data shows us when examining all single family homes sold in Harrisonburg and Rockingham County in the past 12 months....  The first thing to point out is that sellers have (on average) accepted prices 4.42% below their asking prices. In fact, only 9% of sellers negotiated sold for 10% (or more) below their asking price. I thought the data might differ as we explored different price ranges, but the amount that sellers negotiated off of the list price didn't vary too much below $250k, between $250k and $400k versus over $400k. As helpful as this data can be, it does NOT account for several other factors:

| |

Is My House Overpriced? |

|

This is a question that many home sellers are wondering these days in and around Harrisonburg -- and perhaps all across the nation. Let's see why.... A real estate market is considered to be balanced (between buyers and sellers) if there are six months of supply available. Depending on the price range, there is quite a bit of excess supply in the Harrisonburg and Rockingham County housing market:

It was said by some, at one point, that if your house hadn't sold in 60 days, lower the price, and repeat. Thus, if you started at $300k, and you hadn't sold it within 60 days, you might lower it to $290k, and wait another 60 days and lower it again, etc. Eventually, you'd reach the point where the market (buyers) would respond to your price, and you'd sell the house. That logic might work in a balanced market, but when the market is so flooded with sellers, and so void of buyers, the logic doesn't work as well. Homes now sometimes sit on the market for months priced well below comparable homes, and don't sell. Will they sell if the price is lowered? Maybe, but maybe not! Time on the market is quite unpredictable at this point, and price is no longer the trump card. In many markets, if a price was lowered to a certain place, a house would definitely sell. If it appraised at $300k, and you lowered it to $280k, it would more than likely sell. Now, you could lower it to $260k, and it might sell, but it might not. You could then lower it to $240k, and it might sell, but it might not. Thus, as you can hopefully see, the answer to the aforementioned question (Is My House Overpriced?) is very difficult to answer. I suppose the answer is that if it has been properly marketed, and it hasn't sold, then it is probably overpriced, but even if the price is lowered, it still may not sell. One last illustration to explore this dilemma... Three comparable houses on your street sell for $245k, $250k and $255k. You assume your house is worth $250k, and put it on the market for $245k to be aggressive. It doesn't sell after four months, so we assume it is overpriced -- even though recent sales would not suggest that. After another four months at $235k, it still hasn't sold. Is it overpriced? I suppose the market would say yes, even though recent comparable sales still do not agree. If, after another four months at $215k it has still not sold, do we STILL say it is overpriced??? | |

The Five Best Deals In The Last Ten Days |

|

Over the past few weeks I have received (on behalf of my seller clients) quite a few offers that I considered to be quite low:

First, do note that of the 27 homes sold in Harrisonburg and Rockingham County over the last 10 days, on average, 5.4% was negotiated off of the list price. Now, for the houses where the buyers negotiated the highest percentage off of the list price....  4377 Hilltop Road (Massanetta Spring) - sold for 22% less than the list price  160 Wildwood Drive (Bridgewater) - sold for 15% less than the list price  253 S Sunset Drive (Broadeway) - sold for 11% less than the list price  2965 Pin Oak Drive (Belmont Estates) - sold for 10% less than the list price  545 Tabb Court (Preston Heights) - sold for 10% less than the list price So, with average negotiations of 5.4%, what do you think? Where the four offers of 10%, 15%, 16% and 20% below asking price reasonable? Perhaps negotiations have to start somewhere! | |

Oops! The Contract Price Is Higher/Lower Than The Appraised Value! |

|

Most sellers want to sell "above value" and most buyers wants to buy "below value." In a balanced world, however, a seller would sell for the "actual value" of their home, and a buyer would buy for the "actual value" of the home. That's in a balanced world --- obviously, it doesn't usually happen that way. We get one glimpse of whether the contract price is off the mark when we learn of the appraised value through the financing process. Here's an oddity (or is it?):

Rent-To-Own Prospect Wants The Best Of Both Worlds A prospective tenant/buyer (rent-to-own) wants to negotiate purchase terms for what is essentially their option to buy a year into the future. They want to buy for the lower of the price agreed to now, and the appraised value a year from now. Wait a minute!?!?! It would seem reasonable (balanced between buyer and seller) to either both take a gamble on ups/downs of the market and agree to a price now OR both agree to use a value determined in the future by an independent appraiser. The lower of the two doesn't seem very reasonable for this prospect who is already trying to negotiate by asking for a lease-to-own when it isn't the seller's intent. Buyer Thinks Seller Should Adjust, But Won't Do The Same This is a bit obvious from the above referenced ways that thisappraisal process works, but it does seem to be a bit odd from theperspective of trying to achieve a balanced transaction between buyerand seller. If the appraisal comes in low, the buyer gets tore-negotiate down. So why doesn't the seller get to re-negotiatehigher if the appraisal comes in high?? Seller Agrees On Price, Then Seeing Appraisal, Refuses Repairs I'm exaggerating this one a bit to make a point, but in a recent transaction, the lender (for some reason???) shared the appraised value with the seller's Realtor. The seller thus was told of the appraised value, which was more than $10,000 higher than the contract price. Certainly, the seller felt like they left money on the table, though the day before they had been quite thankful for the buyer and the price he was paying. As a result of knowing of the value supposedly left on the table, this seller loses much of their desire to negotiate on repairs, even making a remark about how the buyer can make repairs using the free equity inherited from the lower-than-appraisal contract price. And while we're on the subject of appraisals, here's another strange aspect of the appraisal world --- feel free to offer your opinions.... Wikipedia defines the "market value" as determined thorough a real estate appraisal to be: "...the estimated amount for which a property should exchange on the date of valuation between a willing buyer and a willing seller in an arms-length transaction after proper marketing wherein the parties had each acted knowledgeably, prudently, and without compulsion." So, wait a minute --- read that through again --- isn't that exactly what is evidenced in the real estate contract that is the basis for the appraisal in the first place?? | |

A Bird In The Hand Is Worth About 1,000 In The Bush! |

|

This is a well-known idiom, but it is sometimes left by the wayside when sellers are negotiating offers on their homes. Thankfully, I don't typically have clients who ignore this concept, but in the last week I have heard of three sellers who need(ed) to take this to heart. The details below have been fudged a bit to prevent you from determining which properties I'm referencing.. Scenario One: The owners of a townhouse arguably worth $170k let contract negotiations fail at $172k. Wait.....what?? They won't accept more than what it's worth?? I suppose this one is a bit subjective, but basically, we'll imagine that they have their townhouse listed around $180k, and have negotiated down to $172k, but won't go a penny lower. The issue is, of course, that the buyer, the buyer's Realtor, and several other Realtors all concur that it would be optimistic to assume that the townhouse is even worth $170k. So here, the homeowner's "sense" of the value of their home is preventing them from moving forward with an excellent offer in hand. Scenario Two: This townhouse has been on the market for roughly a year, and has been reduced in price by tens of thousands of dollars. The owner has actually had quite a few birds in hand, as there have been multiple offers on this property over the months. Here's what happens --- an offer comes in that is around $7k less than the asking price, the seller rejects it, a month or so passes, the seller lowers the price $10k, an offer comes in around $7k less than the asking price, the seller rejects it, a month or so passes, the seller lowers the price $10k, etc., etc., etc. Bird after bird in hand, and then flying away! Scenario Three: I met some homeowners today who made an offer about a year ago on a new construction duplex. Their offer was deemed to be too low by the builder, and thus rejected. Now, a year later, the duplex is still available for sale, and the asking price is now just a hair lower than these homeowners' offer on the property a year ago. With a (rounded) price of $230k, assuming the builder might have been carrying $150k of a construction loan on the property, at perhaps 6%, that decision has likely cost the builder $9,000 in interest over the past year. It is certainly reasonable to strive for the best possible price for your property if you are selling it, but you must carefully weigh the value of a bird (offer) in hand relative to the prospect of waiting (and waiting, and waiting) for the next offer to come along. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings