| Newer Posts | Older Posts |

National average rates at 5.17%, local rates at 4.875% |

|

As I mentioned a few days ago, low interest rates are helping people in this area cut down their monthly housing costs. And yet interest rates keep falling further --- according to MarketWatch: The benchmark 30-year fixed-rate mortgage tumbled to a national average 5.17% this week, the lowest level since Freddie Mac began its weekly rate survey in 1971. What is remarkable is that the national average rate is always somewhat higher than you can acquire from a lender locally. I reviewed a good faith estimate yesterday for a re-finance at 4.875% fixed for 30 years. If you'll definitely be buying in the next 3-6 months, now is a great time to consider doing so, given current rates. And if you aren't looking to buy / sell, but you have a rate higher than 6%, you should definitely investigate the cost savings of re-financing. | |

Current (Incredibly low) interest rates can make a significant difference in a monthly budget! |

|

Here's an insightful article from yesterday's Daily News Record that uses a local example to show what a significant impact current interest rates can have on a family. Grefe, a teacher and coach at Harrisonburg High School, currently has an adjustable-rate mortgage that has interest rates of both 7.5 percent and 11.5 percent - but he's refinancing to a rate nearer to 5.5 percent. Depending on your financial picture, some borrowers are currently obtaining fixed-rate mortgages at or below 5.0%, and some local lenders that I have talked to expect that rates should stay at (or just below) 5.0% into the near-term future."That should save me close to $200 to $250 a month," he said. "Monthly payment-wise this will work out pretty good." (source) Even if you aren't looking to buy a home right now, this can be a great time to examine potential savings from refinancing. | |

New rules limit real estate investors to four loans |

|

One of my clients forwarded me a story from the Atlanta Journal-Constitution, which discusses new Fannie Mae and Freddie Mac rules that states that Fannie and Freddie will only back up to four real estate loans by one person. This new four-loan rule apparently replaced a previous limit of 10 loans, and was is in place to keep inexperienced or start-up real estate investors from over-investing. The four-loan limit does not allow for any exceptions for income, assets or credit scores. In checking with a local lender, I was told that if a borrower has more than 4 non-owner-occupied homes and a primary residence, no one but a commercial lender can help them on their next investment purchase. So, what is the solution?? One option is to move several existing residential investment loans into a commercial "blanket loan" thus removing residential loans from their balance sheet. Commercial loans on residential properties don't count against the four loan limit if they are in an LLC. If any lenders or investors know of any other options with this new loan limit, please let me know! | |

Is Harrisonburg a safe place to live? |

|

My brother-in-law works for the Harrisonburg City Police, which makes me feel safe, but let's check another source.... Sperling's Best Places ranks cities and towns on factors such as cost of living, schools, crime, climate, and more. In the fifth annual report, Harrisonburg ranks #8 for small towns (less than 150,000 residents)! How is this all determined? According to BestPlaces.net... "The rankings took into consideration crime statistics, extreme weather, risk of natural disasters, environmental hazards, terrorism threats, air quality, life expectancy and job loss numbers in 379 U.S. municipalities." | |

Breaking Economic and Real Estate News |

|

All kinds of news over the last few days related to our local real estate market and our local economy... Bridgewater annexes 45 acres for new housing development Office Depot closes 112 stores including Harrisonburg's Site on Port Republic Road approves residential to commercial rezoning Public hearing to determine outcome of age-targeted development in Elkton | |

Who is getting involved in the conversations about local news and issues? |

|

One of the local blogs I read is hburgnews.com -- if you're not already reading it, you definitely should! One phenomenon that has been great to observe is seeing local government employees engaging in online conversations. One recent example is on a post about Delayed Green Arrows around Harrisonburg, where a several Harrisonburg staff people explain some recent improvements in traffic engineering. In the ensuing discussion concerns are brought forward and are then addressed by the city employees. Then, Brad Reed (Traffic Analyst with Harrisonburg Public Works) goes on to say... I'm excited to say that we will be finished with the new Traffic Engineering Division website in the near future. The site will go over the basics of how the city's signals are timed and coordinated and will give everyone a look at the components used to operate a signalized intersection. We would love to hear everyone's comments and suggestions, which is why the new site will also include a comment form dedicated to signal-related concerns. I encourage everyone to use the new form when it is released. In the meantime, if you would like to follow up or have any questions, please feel free to call the Public Works Department at (540) 434-5928. Another great example of engagement by the local government is outgoing City Councilman Charlie Chenault's willingness to jump in to provide the facts or clear up misperceptions. I appreciate you, my blog readers, who often comment and provide your feedback here --- and I recommend you also read hburgnews, and jump into the conversations happening in that forum. It's a great way to not only know about the latest news in Harrisonburg, but also to be a part of conversations that will shape our area's future. Here's to open, transparent, responsive local goverment! | |

Mandatory water conservation for Harrisonburg? |

|

A week or so ago I noticed an announcement on the City of Harrisonburg's web site stating that voluntary water conservation was in effect. I was a bit intrigued, but I couldn't find too many details explaining our current water situation. However, WHSV ran a story yesterday indicating that mandatory water conservation might soon be in effect. Apparently, Switzer Reservoir currently has 568 million gallons of water, and if the reservoir drops below 510 million gallons, it would trigger mandatory water conservation. From WHSV . . . "In mandatory conservation, you can't use more than three gallons of water to wash your car or water your lawn. You can't use a decorative fountain in your garden. Restaurants also aren't supposed to serve you water at a restaurant unless you ask." Thankfully most of us probably aren't planning to wash our car, water our lawn or fill our garden fountains anytime soon! | |

Money is cheap! Interest rates keep heading down! |

|

Interest rates keep going down --- the Daily News Record reports today that they're down to around 5.375% for a conventional 30-year fixed rate mortgage. If you're considering a home purchase in the next month or two, it might be worthwhile to consider getting the ball rolling now, while interest rates are so favorable! Of note --- one statistic in the article is way off base... "In addition to lower mortgage rates, home prices also have reached extreme lows. Prices of single-family homes plunged a record 17.4 percent in September from a year earlier, according to the Standard & Poor's/Case-Shiller Home Price Indices." That may be the case nationally, but locally, we have seen home sales prices remain stable. | |

Shall we have lunch in New York today? |

|

Exciting news from The Hook via RealCentralVA . . . Starting next fall, Charlottesville will have round-trip service to New York City, after passing through our nation's capital. With Charlottesville just over the mountain, this may open up some exciting transportation options for us here in the Shenandoah Valley! The real news is that this program (a three year pilot program) will be using state funds to reduce the cost of this new inter-city rail transportation option. Of note -- the funding must still be approved (on December 17) by the Commonwealth Transportation Board. Read more here. | |

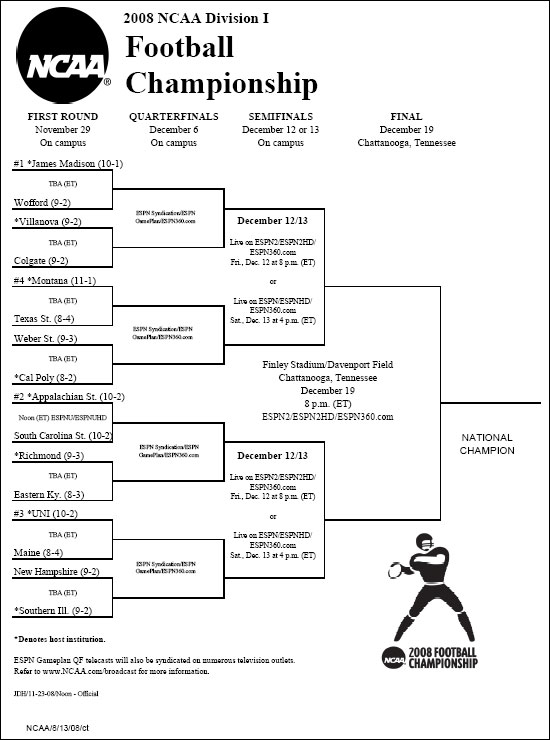

JMU Football Playoff Schedule 2008 |

|

After missing the 7pm announcement of the JMU Football Playoff Schedule, I was delighted to have such a fast response when asking about the results on Facebook. The good news --- JMU could be at home for all three playoff games leading up to the National Champtionship! | |

Books-A-Million moving to the Valley Mall!? |

|

From the building permit data in today's Daily News Record... From the building permit data in today's Daily News Record...Simon Property Group, interior renovations to existing space to create retail space for Books-A-Million, 1925-400A E. Market St., $1,275,000. It will be interesting to see who takes over the space on East Market Street where Books-A-Million currently exists. | |

Another sign of strength in Virginia's economy |

|

The Virginia Resources Authority sold an unprecedented $215 million in infrastructure revenue bonds to raise funds for projects around Virginia. This was, in fact, the largest transaction in the pooled financing program in VRA history --- in what is otherwise a challenging economic time. "Bricks and mortar projects mean jobs and income in Virginia communities," said Sheryl Bailey, Executive Director of the Virginia Resources Authority. "We can't over-emphasize the importance of such projects in stimulating the local and state economy. Infrastructure is a key to America's economic recovery. " According to the Daily Press, the projects to be financed will include "upgrades to bridges and wastewater treatment plants, replacement of water and sewer lines, and construction of a firehouse, a library, and a public safety academy." | |

The One Million Twenty Fifth customer. So close! |

|

As mentioned last week, Dave's Downtown Taverna was coming up on a huge milestone --- having served 1,000,000 customers! I had lunch at Dave's this past Friday, and wouldn't you know, the one millionth customer was sitting just a few tables away. IF ONLY I had come 30 minutes earlier! Ah well --- congratulations to Dave's for over 14 years of great food and service in downtown Harrisonburg! | |

Breaking Economic News: Rosetta Stone to go public? |

|

Rosetta Stone Inc., one of several prominent Harrisonburg-based technology companies, filed to raise up to $115 million in an initial public offering on Tuesday (9/23/2008). Rosetta Stone Inc., one of several prominent Harrisonburg-based technology companies, filed to raise up to $115 million in an initial public offering on Tuesday (9/23/2008).Of note from the MarketWatch report: "Rosetta Stone rang up net income of $2.9 million on revenue of $83 million in the six months ended June 30, compared to net income of $399,000 on revenue of $59.5 million in the year-ago period." Wow --- what an improvement in net income! This is likely to be great news for our local economy! Read more details/commentary at hburgnews.com. | |

Mortgage rates are down --- if you're buying, lock in now! |

|

If you have been holding off to lock in an interest rate on your purchase or re-finance, now may be the time! In a report released by Freddie Mac last Friday (9/12/2008), 30-year fixed-rate mortgages now average at 5.93%. That is a significant drop from the prior week's average of 6.35%. Yes, rates could go lower, but we're below 6% again --- which I hadn't thought we'd see for quite a while. If you have any questions, please e-mail me (scott@cbfunkhouser.com) or call me (540-578-0102). I'd be happy to talk things through with you, or to connect you with a qualified lender. | |

"First Time" Home Buyers --- Act Now! |

|

If you haven't owned a home in the last three years, you have a unique opportunity if you buy a home in the next 11 months (before July 1, 2009). If you haven't owned a home in the last three years, you have a unique opportunity if you buy a home in the next 11 months (before July 1, 2009).The new Housing Bill signed into law by the President this week provides a $7,500 tax credit to first time home buyers (anyone who hasn't owned a home in the past three years) with income up to $75,000 for single people and up to $150,000 for married couples. When do I get the money? A $7,500 credit will be applied to your income taxes for the year in which you close on your new home. This doesn't reduce your taxable income by $7,500 (a tax deduction) --- it reduces the taxes that you pay by $7,500 (a tax credit). I've heard I have to give the money back? Yes --- the $7,500 must be paid back over 15 years, starting two years after you take the tax credit. This is an additional tax liability of $500 per year for those 15 years. So if I have to pay it back, why is this tax credit so exciting? In essence, you are being provided with a $7,500 interest-free loan. This can be the needed advantage for first time buyers to know that they can make a home purchase work for them. The $7,500 will certainly make up for what you paid for closings costs (in most loan programs) and even part of your down payment. If you have more questions, check out this list of frequently asked questions. | |

$7500 interest-free loans, and other perks of the housing bill |

|

The president is expected to sign a new housing bill today (July 29, 2008) that may have significant implications for current and hopeful homeowners. Here are a few highlights:

| |

Urban Exchange - Done Digging, Now Building UP! |

|

After MANY weeks of digging down (down, down, down), the foundation for Urban Exchange is finally coming up out of the ground!  For those of you who are not familiar with the project, Urban Exchange is a new construction project in downtown Harrisonburg to feature condos, apartments and retail space. Check out more photos of the construction process here! | |

Wall Street Journal: "The Housing Crisis Is Over" |

|

"The dire headlines coming fast and furious in the financial and popular press suggest that the housing crisis is intensifying. Yet it is very likely that April 2008 will mark the bottom of the U.S. housing market. Yes, the housing market is bottoming right now." The article goes on to make some very interesting observations based on housing market data and historical comparisons. It's worth a read! | |

"The Recession That Never Was is Now Over" -- Briefing.com |

|

Thanks to a client of mine for pointing me to this great economic commentary entitled "The Recession That Never Was is Now Over" from Briefing.com. Thanks to a client of mine for pointing me to this great economic commentary entitled "The Recession That Never Was is Now Over" from Briefing.com.Some interesting thoughts from the article in regards to whether we have been or are experiencing a recession . . .

And touching on why everyone seems to think we're in a recession . . .

Again, be sure to read the full article here, from Briefing.com. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings

Yesterday (May 6, 2008), the Wall Street Journal ran an opinion piece entited "

Yesterday (May 6, 2008), the Wall Street Journal ran an opinion piece entited "