Opportunity

| Older Posts |

Will Mortgage Interest Rates Really Rise In 2022? |

|

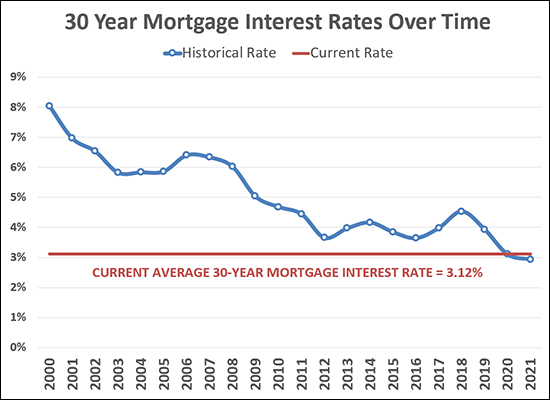

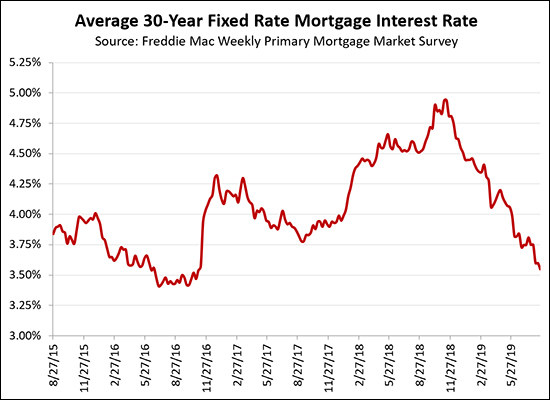

Will mortgage interest rates really rise in 2022? Yes, he said, knowing he has said "yes" for years and has been wrong over and over. ;-) To be fair, I guess interest rates did rise between 2012 and 2014 and again between 2016 and 2018. But, they've been below 5% for over a decade now -- and have been below 4% for eight of the past ten years. So, again, will interest rates really rise in 2022? After steadily declining since 2018, yes, it seems likely that interest rates will start rising again in 2022. But, it seems quite likely that I could be wrong, again. :-) | |

Townhomes Now Under Construction In Phase Two of The Townes at Congers Creek |

|

view larger photo here Have you driven by The Townes at Congers Creek lately? These newly built townhouses are located on Boyers Road just minutes from Sentara RMH Medical Center. (full disclosure - I represent the builder) The first phase of The Townes at Congers Creek is complete, with 26 townhomes plus a common area including a pavilion, patio, fire pit and basketball hoop. Construction is now beginning on townhomes in the second phase, and the first 20 townhomes are already under contract. Here's a view of the current site work under way on the second phase... view a larger photo here Learn more about this exciting townhouse community by viewing current availability, walking through the model home, viewing the standard features and upgrades. If you have questions, or if you'd like to schedule a time to view the model home in person, call/text me at 540-578-0102 or email me. | |

Perhaps This Would Be A Good Time To Sell Your Taylor Spring Townhome? |

|

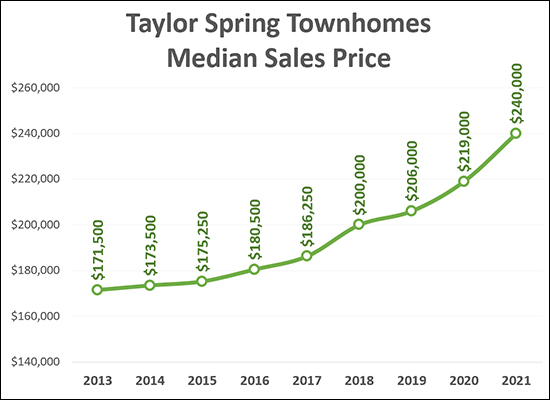

If you own a townhome in the Taylor Spring neighborhood -- or actually, in most townhome neighborhoods -- this could be a fantastic time to sell it. You have likely seen a $21K increase in its value over the past year, and a $34K increase in value over the past two years and a $40K increase in value over the past three years! Wow! Buyers are paying more (and more and more) for townhomes these days -- which can make it an ideal time to sell such a property if you own one. With two important caveats, of course... [1] If you own a Taylor Spring townhome and live in it, we'll need to make sure we have a plan in place for where you will buy after you sell. [2] If you own a Taylor Spring townhome and are renting it out, you'll want to consider the tax consequences of selling the property and whether you would want to roll the proceeds into the purchase of a different property. Townhomes have seen steady increases in their market value over the past few years, so if you own one and are thinking of selling it, this could be an ideal time to move forward with that plan! You can explore Taylor Spring townhome value trends here and explore value trends in most of our area's townhome communities here. | |

30 Year Mortgage Interest Rates Drop Below Three Percent Again |

|

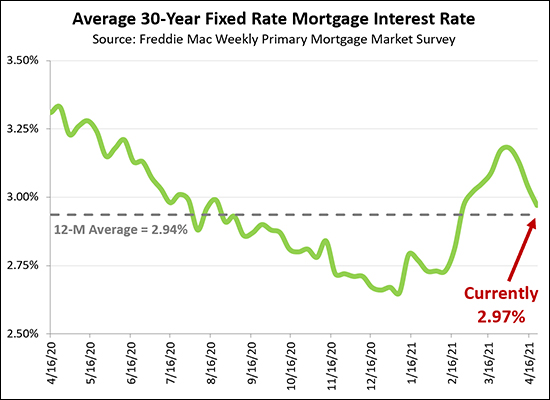

Mortgage interest rates started out at 2.65% this January and kept on rising -- all the way up to 3.18% on April 1st. But, then, they started declining again. Interest rates are now averaging at 2.97% for a 30 year fixed rate mortgage. That is well below where we were...

Today's home buyers are certainly happy to be seeing interest rates declining again, as it helps to offset the rapidly increasing prices that they find themselves paying for houses in this quickly moving and highly competitive market. | |

Will Buying A Home This Year Or Next Year Result In The Lowest Mortgage Payment? |

|

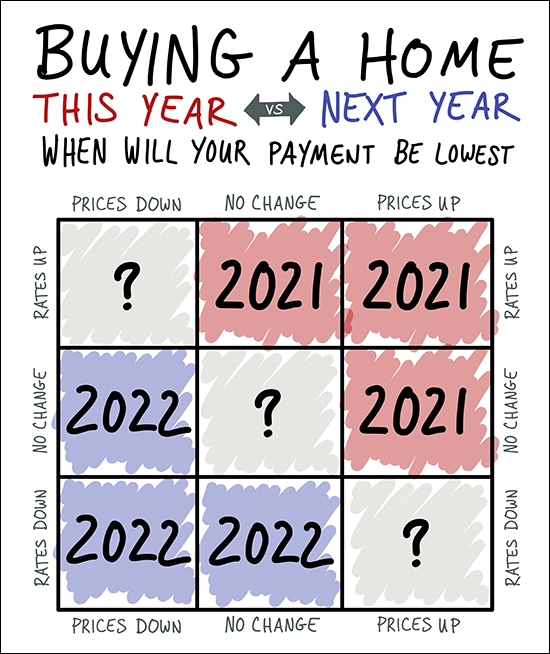

If you are hoping to minimize the amount of your monthly mortgage payment, should you buy a house this year? Or next year? Well, as shown above, it depends on whether you think home prices will be higher or lower (or the same) next year -- and whether you think mortgage interest rates will be higher or lower (or the same) next year. Most folks think mortgage interest rates will be higher next year than they are now. If so, it's most likely that you'd be better off buying this year rather than next to have a lower monthly payment. Even if rates continue to be this low, if prices continue to rise (as they seem likely to do) then again, you'll be better off buying this year than next. Since it seems relatively unlikely (highly unlikely?) that interest rates will go down over the next year, the only way you'd have a lower mortgage payment next year than you would now is if mortgage interest rates do NOT rise AND homes prices decline. So -- as to whether you should buy this year or next -- you tell me, based on your best guesses as to what interest rates and home prices will do over the next year. My best guess is that you'll pay more in a monthly payment for a house if you buy next year than you would if you buy this year. Now, all that said, we'll have to somehow secure you a home amidst a competitive market with lots of buyers -- but it's possible! | |

Last Home To Be Built In Heritage Estates Currently Under Construction! |

|

Heritage Estates is an active adult community located in Harrisonburg, Virginia boasting homes with superb French Country architecture with flowing interior floor plans that are wonderful for entertaining. Owners at Heritage Estates enjoy spectacular views of the Blue Ridge Mountains, the golf course immediately beside Heritage Estates, the community swimming pool, and a maintenance-free lifestyle. And now -- the very last home to be built at Heritage Estates is under construction! The home is under roof and the exterior is complete. The builder (my client... this is my listing) is getting ready to start finishing the interior of the home. If you, or someone you know, was hoping to live at Heritage Estates, this is the last chance to buy a brand new home. | |

Area Wide Sale On Houses On Day After Thanksgiving! |

|

No, not really. There is not an area wide sale on houses on the day after Thanksgiving. It's a joke. I mean... other than the fact that yes, most houses for sale today will probably still be for sale on the day after Thanksgiving. ;-) But... Any home seller who has had their home on the market for the past few months without it going contract...

Anyhow - if you're ready to buy a home, this Friday might be a great time to make an offer on a house that has been on the market for a bit and has not yet sold! Happy Thanksgiving, friends! :-) | |

Median Sales Price Increases $23,000. Monthly Payment Increases $3. Wait! What?? |

|

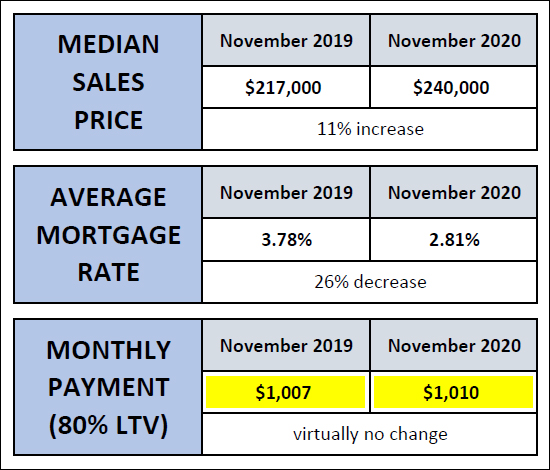

Yes, you read that correctly. Over the past year...

Oh, the magic and mystery of declining mortgage interest rates! :-) Over the past year we have seen a rather rapid increase in home prices. The median sales price in Harrisonburg and Rockingham County one year ago was $217,000. Today, it is $240,000. This is an 11% increase in the median sales price over the course of 12 months which is a much faster than normal increase. And yet, if a buyer finances 80% of the purchase price, their mortgage payment will only be $3 per month higher than it would have been a year ago. Wait! What?? That's all thanks to ridiculously low mortgage interest rates! One year ago the average mortgage interest rate was 3.78%. Today's average mortgage interest rate is 2.81% -- which is 26% lower than the rate from a year ago. So, if you're surprised that a buyer today is willing and able to pay 11% more for a house than they were a year ago -- don't be! Most buyers are financing their home purchases, and thanks to today's low mortgage interest rates, they are still paying basically the same amount as a monthly payment now as they would have been a year ago. Put slightly differently... A year ago, Fred was working in a job that paid him $X per year, which allowed him to afford a mortgage payment of around $1,000 per month, which allowed him to purchase a median priced home of $217,000. Today, Fred's cousin, Ted, is working in a job that pays him $X per year (the same amount as Fred), which allows him to afford a mortgage payment of around $1,000 per month, which allows him to purchase a median priced home of $240,000. Pretty wild. Now, if (when!) those mortgage interest rates start rising -- then the cost of housing will start to increase -- though that's what we generally expect it to do. | |

Mortgage Interest Rates Will Never Be This Low Again, I Said Countless Times In Recent Years |

|

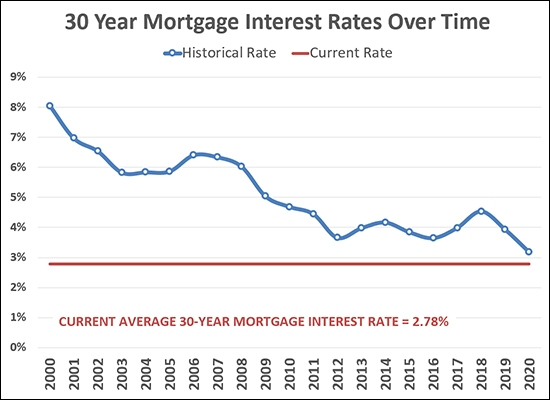

I've been in this business for 17 years now. When I started, mortgage interest rates were right around 6%, which was amazing, given that they had been up above 8% just three years prior. But then, after major housing market adjustments in 2007 and 2008, mortgage interest rates started dropping. They kept on going down until they were just below 4% in 2012. This was, again, amazing! We then actually saw some ups and downs between 2012 and 2018 -- though rates generally stayed between 3.5% and 4.5%. And where do we find ourselves now? Below 3%! Again, amazing! Current average interest rates are 2.78% -- and I have had clients buy homes this year with fixed rate mortgages as low as 2.5%. If you happen to be buying a home (or investment property) right now you are going to greatly enjoy the low rates that you will be able to lock in for years to come! | |

November 19 Meeting To Discuss Harrisonburg Comprehensive Housing Assessment and Market Study |

|

Mark your calendars for Thursday, November 19th at 6:00 PM to tune in to hear a presentation of the findings of the initial draft of the City's Comprehensive Housing Assessment and Market Study! From the press release from the City...

Here's how to tune in to this meeting... Watching on a computer or mobile device via GoToWebinar. Register in advance here - Webinar ID: 281-556-371. Calling in to listen by phone at +1 (951) 384-3421, Access Code 484-931-436. Watching the meeting live on Public Education Government Channel 3 | |

New Condos For Sale at Founders Way in Harrisonburg, Virginia |

|

New condos are now being offered for sale at Founders Way in Harrisonburg, Virginia. These brand new condos, just minutes from downtown Harrisonburg, offer low maintenance living at its best, in close proximity to dining, shopping, the JMU campus and more! Make your selections today for your cabinets, granite countertops, flooring, paint color and more! Condos at Founders Way feature an open floor plan a large primary bedroom suite and a second bedroom or office with walk in closet and attached bathroom, plus a covered porch! Enjoy high-speed internet access and cable service! Find out more about Founders Way by visiting FoundersWay.com.

| |

Welcome to The Townes at Congers Creek! |

|

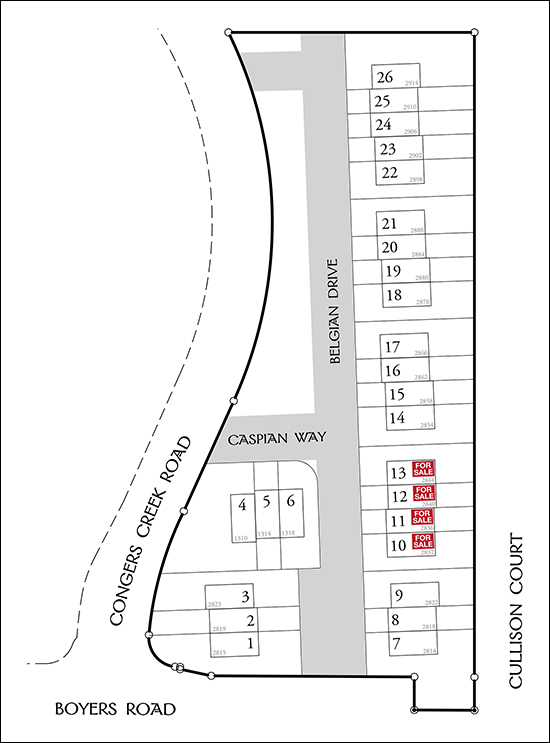

Welcome to The Townes at Congers Creek! Construction is beginning on brand new, upscale townhouses with garages are located off of Boyers Road, just minutes from Sentara RMH Medical Center, in the Cub Run Elementary school district. These beautiful townhouses will feature a large living room with plenty of natural light, an eat-in kitchen with a large island, Shaker Style cabinetry, stainless steel appliances, and three bedrooms and two full bathrooms. Enjoy nine foot ceilings on the main level, a master suite with walk-in closet, a single car garage and an unfinished bonus room behind the garage, with a roughed in bathroom, that would be perfect for a home office. Here is the layout of the neighborhood...  Find out more about these new townhouses by visiting CongersCreek.com. FYI - I am listing and marketing these townhouses, along with Suzanne Trow and Carey Keyes. | |

If You Have Not Heard, Mortgage Interest Rates Are SUPER Low Right Now |

|

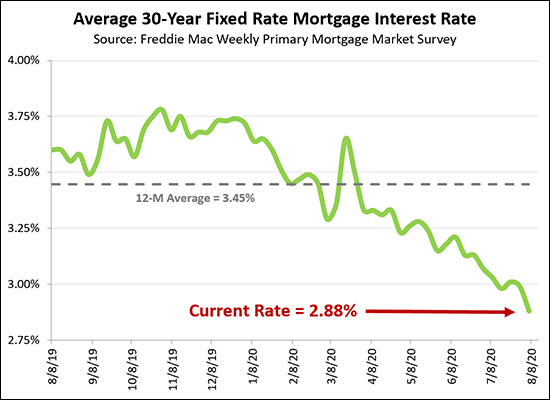

If you had asked me a year ago whether we'd see interest rates get as low as 3% - or lower than 3% - I would have said "no, definitely not, they couldn't get that low!" But, it seems I would have been wrong. The average mortgage interest rate (for a 30 year fixed rate mortgage) has continued to decline over the past four months from around 3.5% all the way down to the current rate of 2.88%. It seems likely that interest rates will continue to stay rather low in the coming weeks and months -- though I don't know if they will / can really stay below 3%. If you happen to be buying a home right now, PLEASE lock in your interest rate this week!! :-) | |

Mortgage Interest Rates Are Absurdly Low |

|

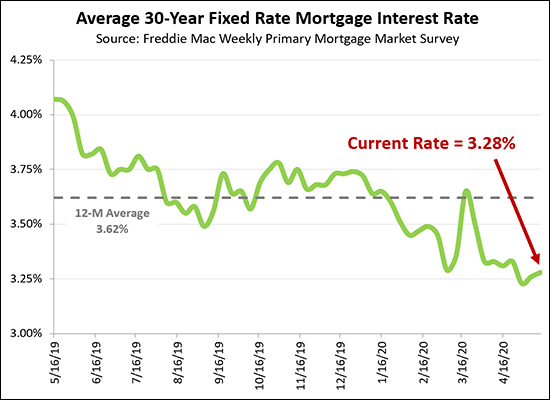

Fortunate are the home buyers who happen to be buying right now -- and locking in super low mortgage interest rates! Over the past year, interest rates have been at an average of 3.62% -- but that has varied widely from being over 4% a year ago, to now being right around 3.25%. Rates have never (ever, ever, ever) been this low! If you are buying right now, you are fortunate to be locking in a very low mortgage interest rate, and it will likely never make sense to refinance! | |

Refinancing Your Mortgage Might Make Sense |

|

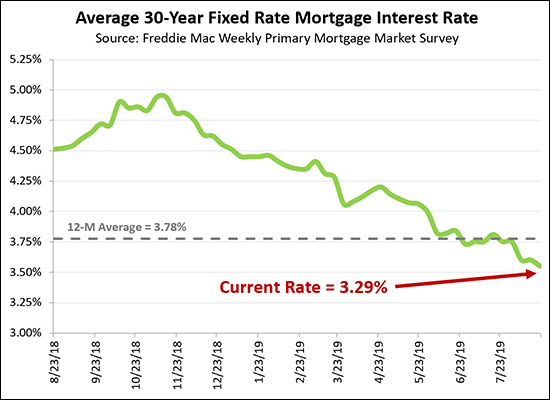

This is more of an alert to homeowners, not so much to buyers or sellers -- but if you haven't heard, re-financing your mortgage might make sense right now depending on your mortgage interest rate. The current average mortgage interest rate on a 30 year fixed rate mortgage is 3.29! This is the lowest we have ever seen, ever. If your current mortgage interest rate is higher than 4%, and you plan to stay in your home for the next few years, you should at least chat with a lender to see how these low interest rates could benefit you. You can likely either reduce your mortgage payment, or shorten the remaining life of your mortgage, or both! Feel free to touch base with me if you want some recommendation for local mortgage lenders. | |

Mortgage Interest Rates Hit All Time Low at 3.29% |

|

Mortgage interest rates have never been lower than right now. No, really! The current average 30-year fixed rate mortgage is 3.29% and that is the lowest level seen in the 50 years that this rate has been tracked! So, if you're buying a home in the near future, you will be locking in at historically low interest rates. And if your current mortgage is at an interest rate of perhaps 4.5% or higher, it might make sense to refinance! | |

High Temps, But Low Mortgage Rates Throughout Summer 2019 |

|

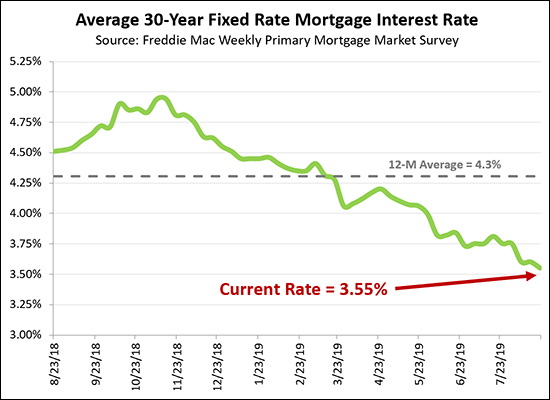

Mortgage interest rates kept dropping lower - and lower - and lower all summer long! The current average rate for a 30 year fixed rate mortgage is only 3.55%, well below the 12 month average of 4.3%. If we look back even further, we're approaching the lows of mid-2016...  All of this adds up to VERY favorable times to be buying a house - in that you can lock in your monthly housing costs at some of the lowest long term interest rates ever seen. | |

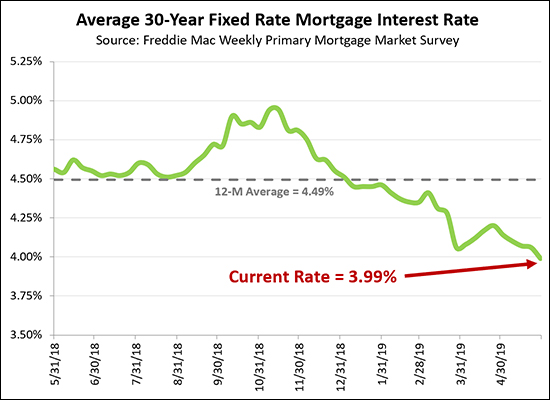

Summer Home Buyers Will Love These Low Mortgage Interest Rates |

|

Interest rates climbed nearly all the way to 5% this past Fall -- and over the past year have been at an average of 4.5%. But since the first of the year, mortgage interest rates have been falling, falling, falling, further and further! They are now, unbelievably at 3.99% for a 30 year mortgage. So - if you're contracting to buy a house in the near future you may want to lock your interest rate in sooner rather than later. It's hard to imagine we'll stay under 4% for long. | |

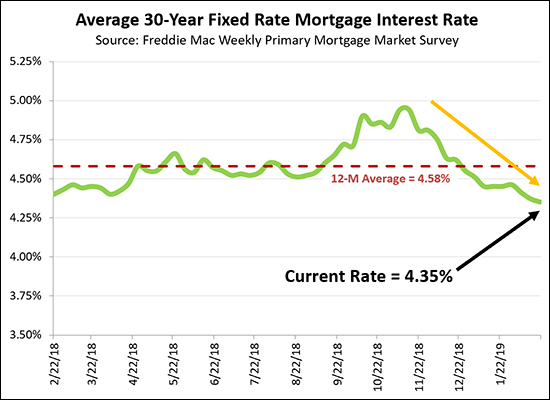

Mortgage Interest Rates Are Falling, Falling, Falling |

|

In what can only be described as good news for home buyers -- mortgage interest rates keep declining! In November 2017 interest rates had climbed to 4.94% and it seemed we'd soon be seeing 5.something% rates. But then they started to decline again, now all the way back down to 4.35%. If you're planning a home purchase this Spring, this is an extremely enticing time to lock in your interest rate! | |

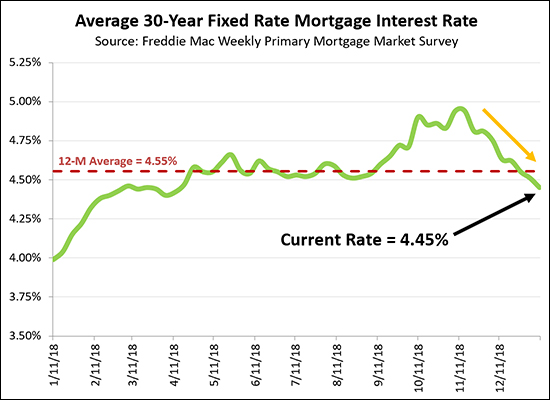

30 Year Fixed Mortgage Rates Dropped Half Percentage Over Past Two Months |

|

Mortgage interest rates have, indeed, steadily declined over the past two months -- from 4.94% down to 4.45%. That is a half of a percentage point, which is a large decline given the range of mortgage rates we're seeing today. So -- now we're back to where we were for much of 2018 -- or at least April through September. Today's buyers will luck out with a low housing payment compared to what they would have expected two months ago -- IF (this is a big if) they can actually find something to buy in this low inventory environment. Where do rates go from here? It's anyone's guess. This recent drop gives me hope that we could spend all of 2019 under 5%. We shall see! | |

| Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings