| Newer Posts | Older Posts |

All Contingencies Involve Uncertainty. As A Seller You Can Pick Which Uncertainty Worries You The Least. |

|

If you are selling your home and you have a few offers from which to choose, you'll have some decisions to make. Which contingencies are you most and least comfortable with? Certainly, ever seller would love to have a cash offer (no financing contingency and thus typically an appraisal contingency), without a home inspection contingency, and certainly without a home sale contingency -- but those offers don't come along that frequently. So, if you have to pick an offer that has some contingencies, which are you most and least comfortable with? Nobody's Favorite: Home Sale Contingency Only Slight Better: Home Settlement Contingency (home already under contract) Comfort Levels Vary: Inspection Contingency Financing Contingency Appraisal Contingency How a particular seller will feel about an inspection contingency, financing contingency and appraisal contingency will vary from seller to seller, house to house and buyer to buyer. Some sellers are quite comfortable with an inspection contingency because they have always been proactive with their home's maintenance over the years. Some sellers are quite comfortable with a financing contingency because the buyer has a significant down payment and/or the buyer is working with a familiar local lender. Some sellers are quite comfortable with an appraisal contingency because they are confident that there are multiple comparable sales that support the sales price. Given that offer terms almost always differ between multiple offers, it is important to discuss and decide which contingencies you are most comfortable with as a seller. | |

Sellers Are Often Making Price Reductions In A Matter Of Weeks Not Months |

|

Most segments of the local housing market are moving very quickly these days. Many homes are going under contract in a matter of days and not weeks. As such, the market is essentially giving feedback to home sellers very quickly as well. If your home goes under contract in the first week -- success -- you likely prepared it well, priced it appropriately, marketed it thoroughly and likely negotiated a favorable contract. If your home is not under contract after two or three weeks, any number of things could be going on... 1. You might not have prepared the property well enough. 2. You might not have priced the property appropriately. 3. You might not have marked the property thoroughly. 4. You might be selling a property for which there is a very small pool of likely buyers. Because the market is giving feedback to sellers so quickly (Did your house go under contract? Or not?) many home sellers are thus making adjustments very quickly as well - and if the home preparation is solid and if the marketing is thorough, then many home sellers find themselves considering a price adjustment. These days, it is best to price your home perfectly from the beginning (if that is even possible) but if it is not under contract within a few weeks it is better to go ahead and make a price adjustment now rather than waiting a few months. | |

Slightly More Homes Are Selling This Year Than Last, At Significantly Higher Prices |

|

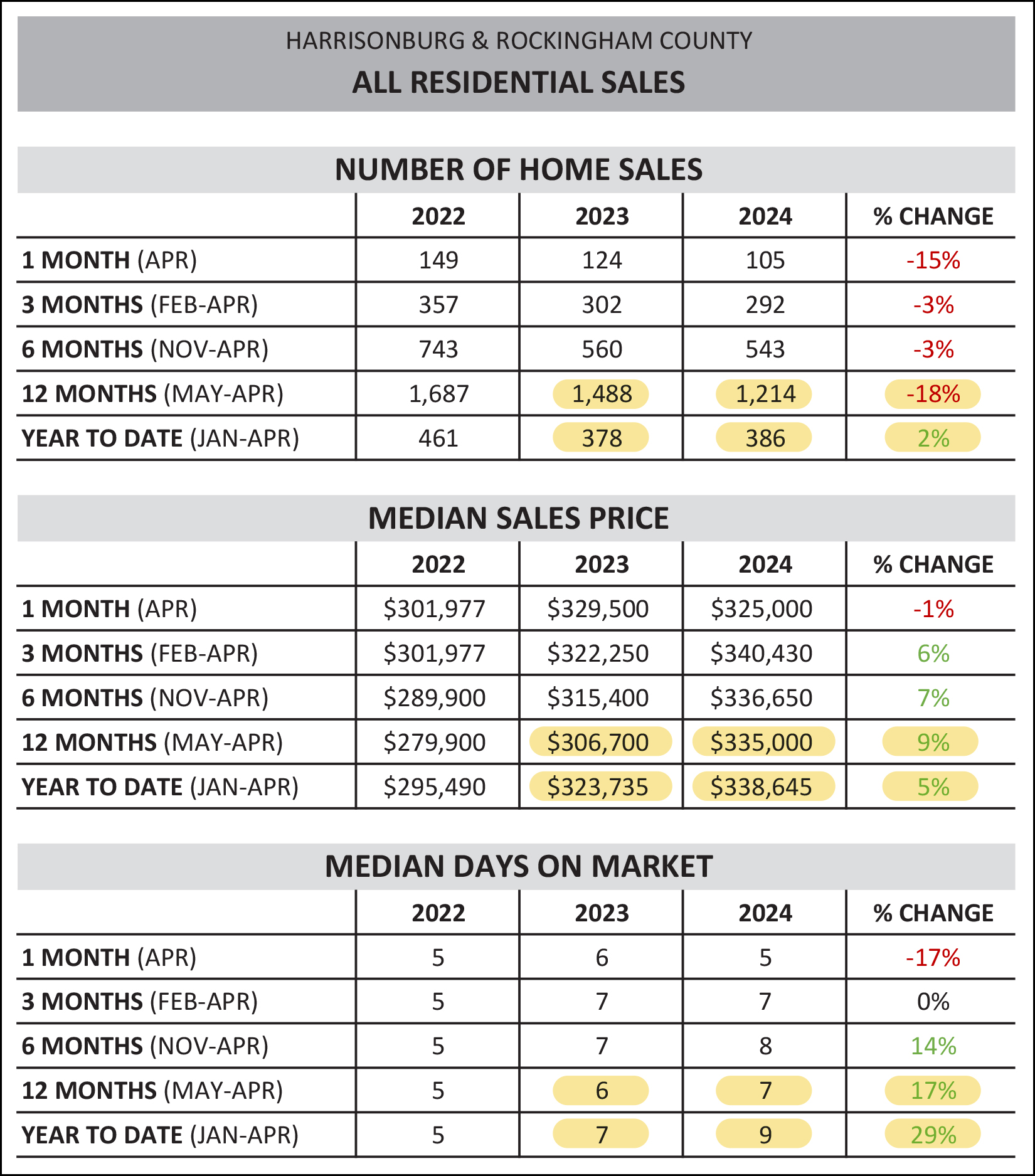

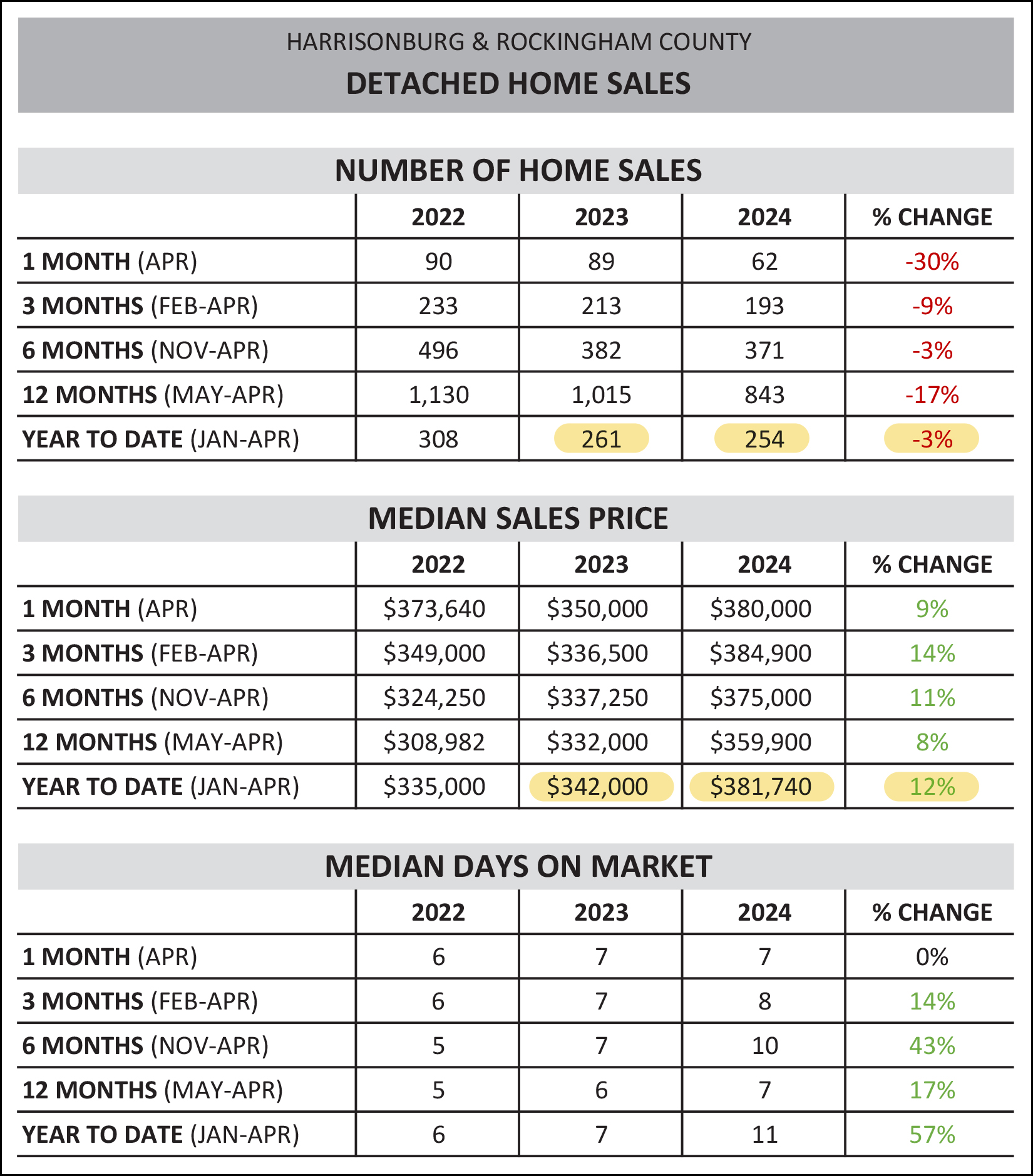

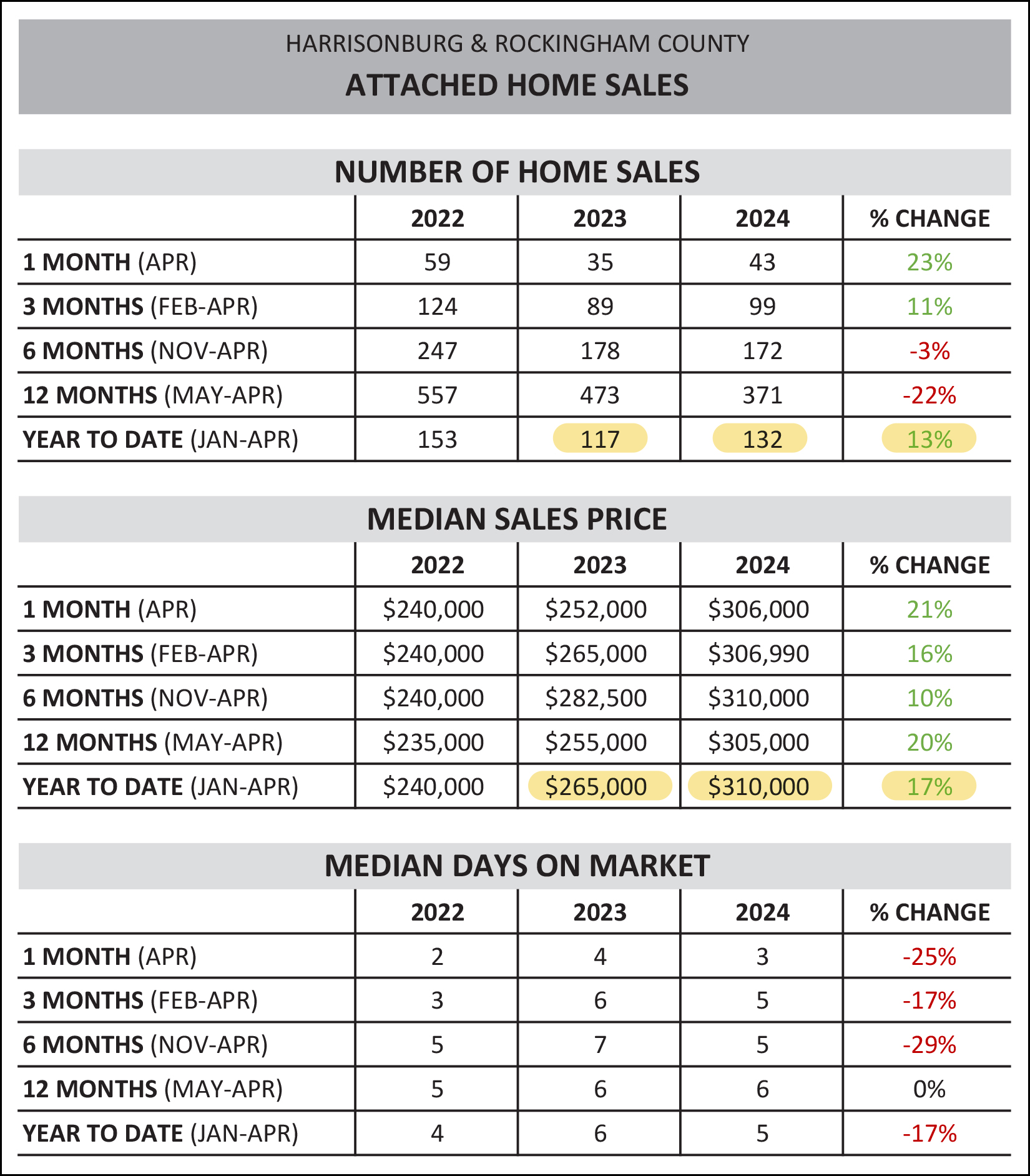

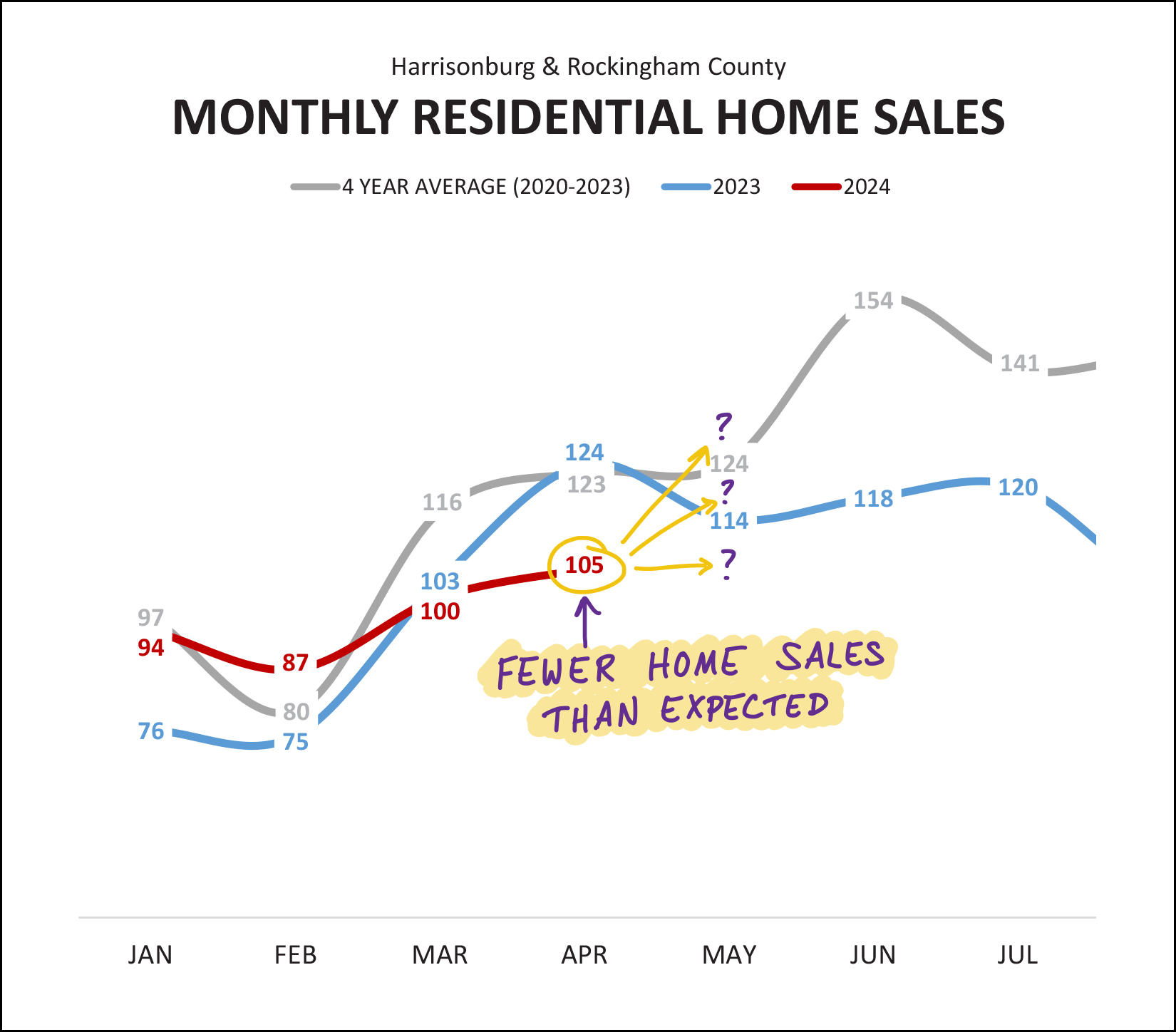

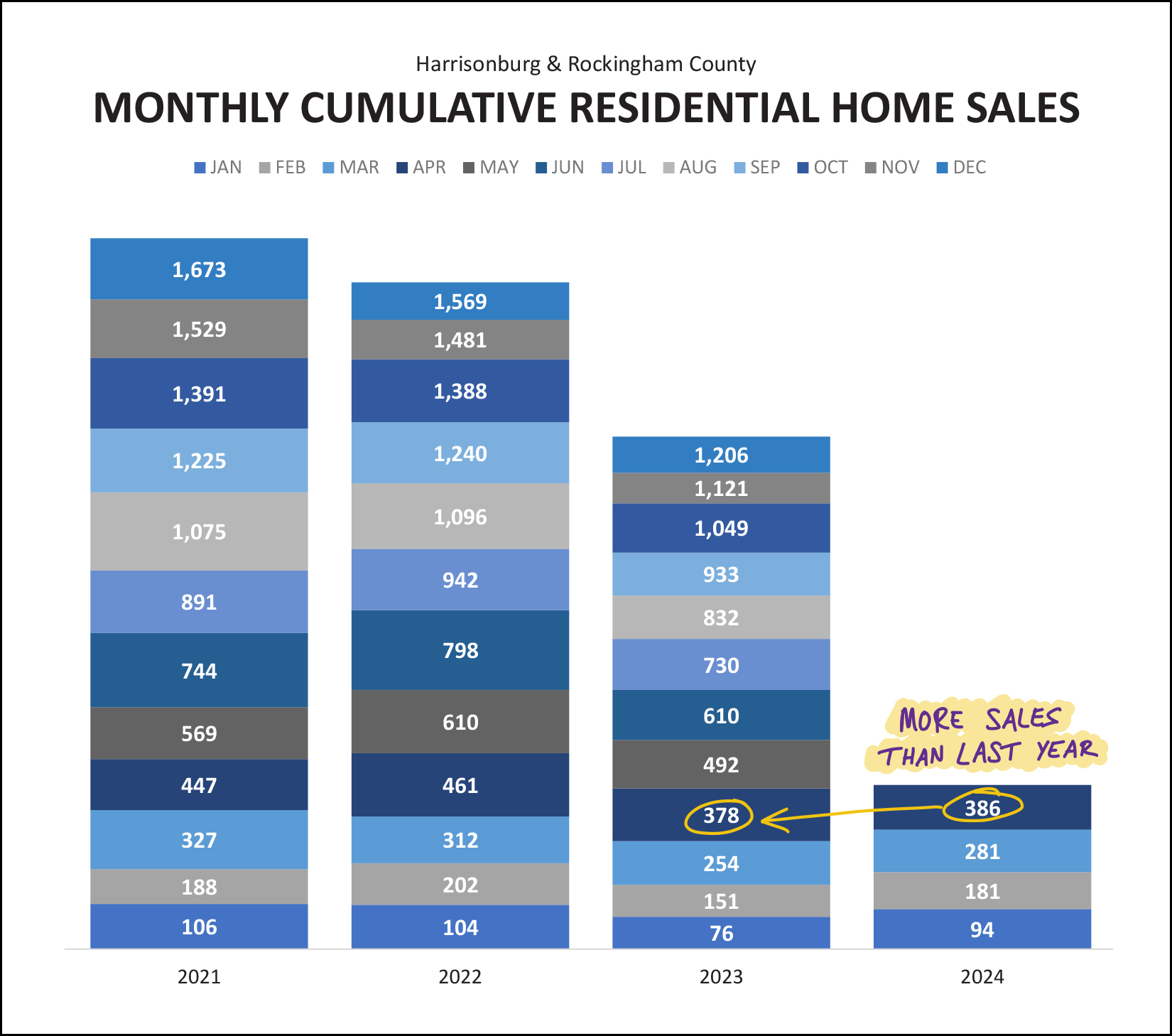

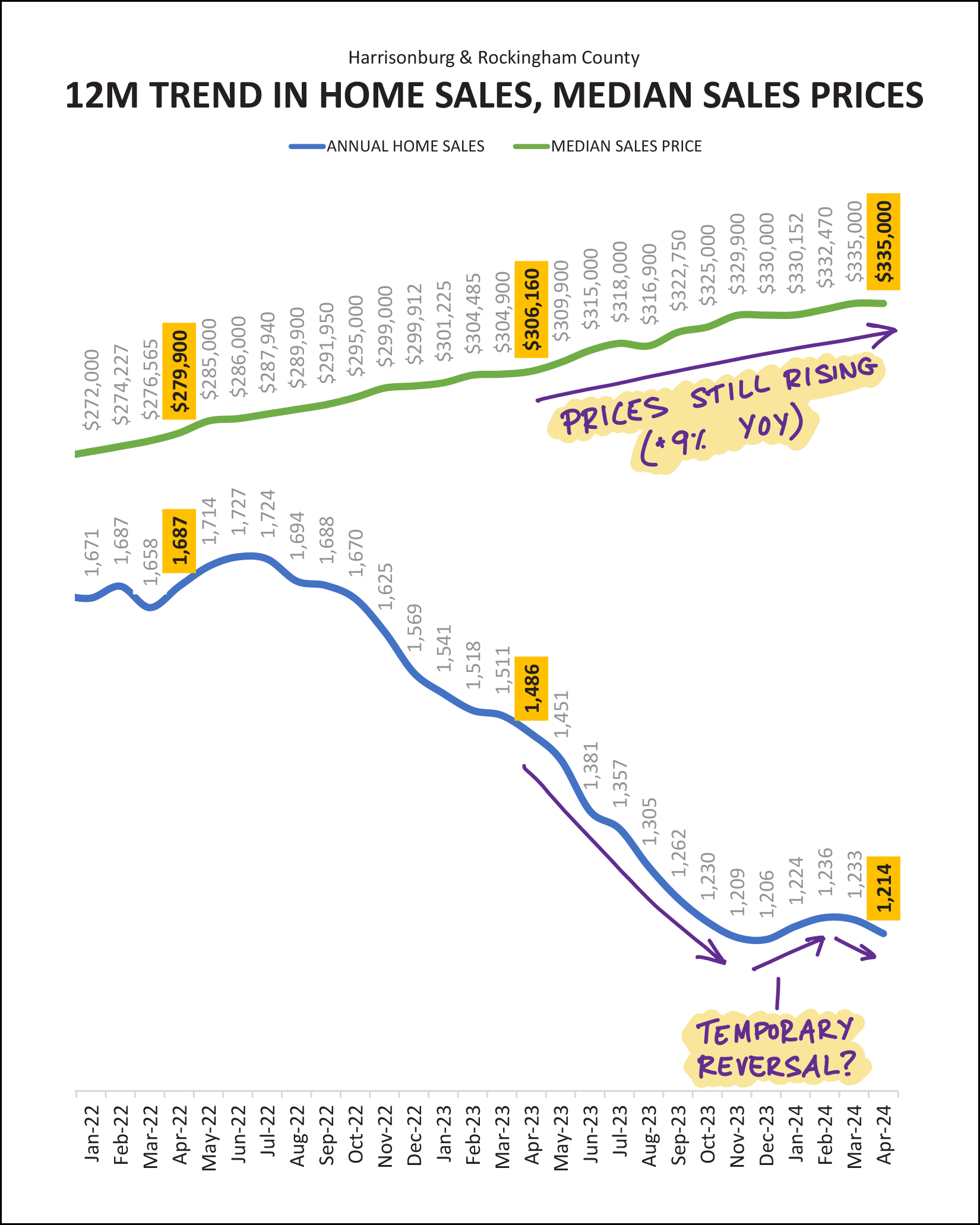

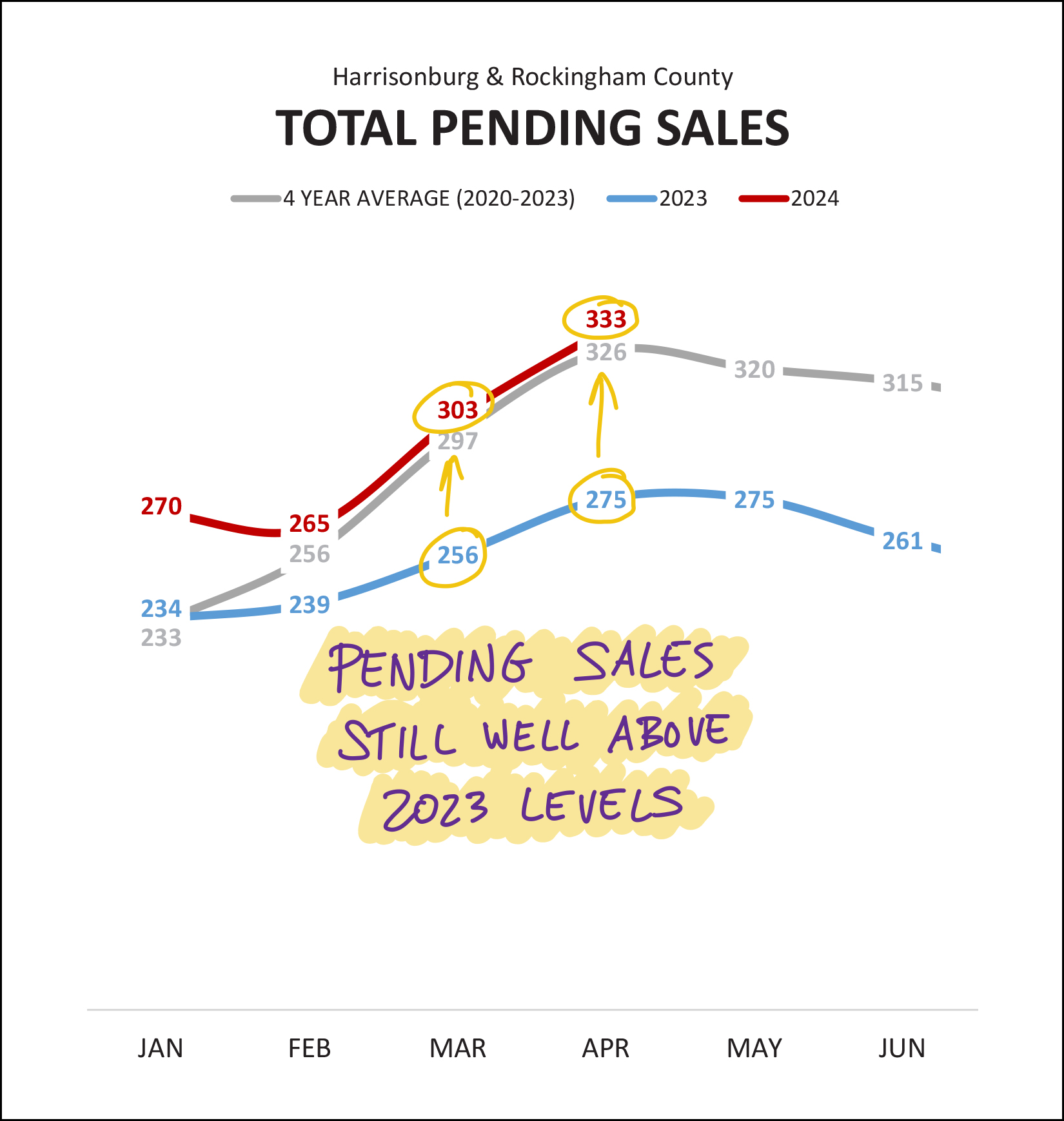

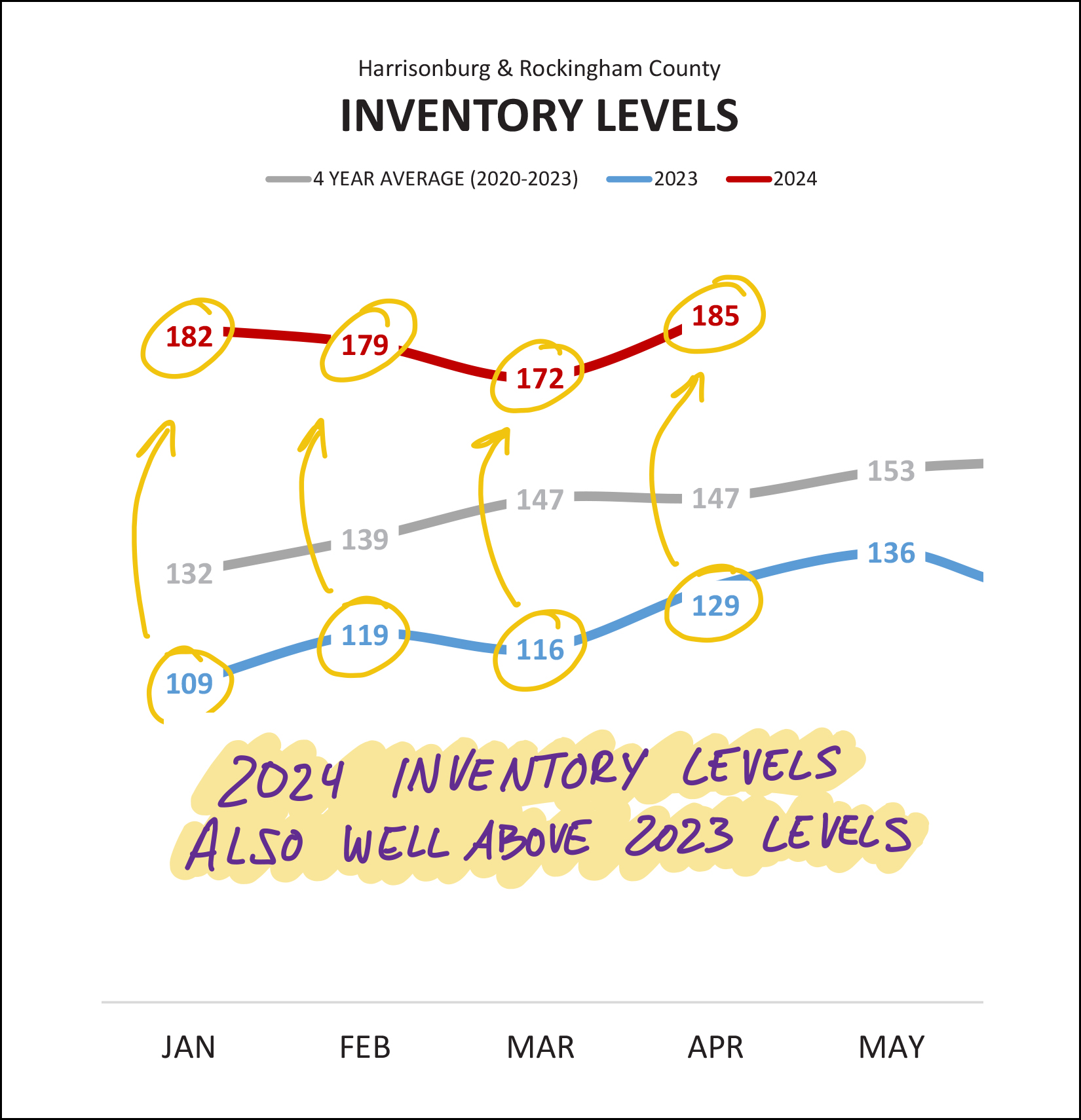

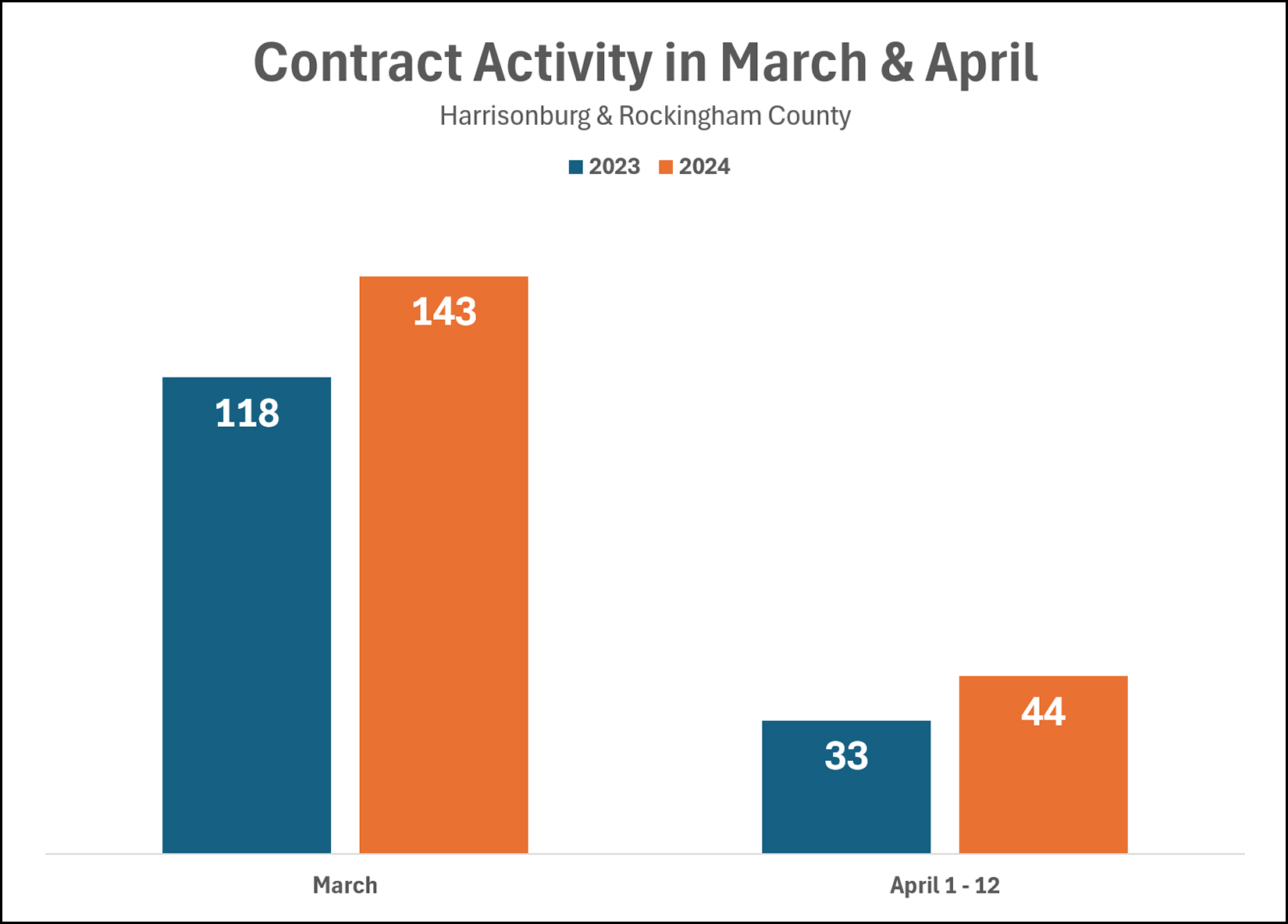

Happy Monday morning, friends! I hope you had an enjoyable weekend of seeing (or in my case, not seeing) the Northern Lights, celebrating the mothers in your life, and soaking in some delightful not-too-hot and not-too-cold spring weather here in the Shenandoah Valley! I was still at least partially in rest and recuperate mode this past weekend after running VA Momentum's Perfect Day 50K trail run the prior weekend with Luke. It was an amazing event with a community feel and great support from the family and friends as individuals and teams ran a 5K every hour on the hour for 10 hours straight, from 8AM until 5PM. It was definitely the longest Luke or I have run in a day!  Speaking of amazing events... each month I offer a giveaway for readers of this market report, and this month... I'm giving away a pair of 3-day tickets to one of my favorite events of the summer... the Red Wing Roots Music Festival!  This super-relaxing and family-friendly music festival from June 21 - 23 at Natural Chimneys Park in Mt Solon features wonderful music (on multiple stages throughout the weekend), great food, lots of activities (hiking, biking, running, yoga, kids events), and all around great fun with family and friends. Have you considered going to Red Wing but haven't been yet? Maybe this summer is the time for you to make it one of your favorite family traditions. I am looking forward to being there with my family and I'm hoping you'll join in on the fun... from June 21st through 23rd. And now, let's move on along to the latest numbers in our local housing market...  The chart above takes a look at our overall market during a variety of timeframes. Number of Home Sales -- As shown in the first set of highlighted numbers, over the past 12 months we have only seen 1,214 home sales in Harrisonburg and Rockingham County, compared to 1,488 during the 12 months before that. As such, we have seen an 18% decline in home sales when looking at a 12 month period -- but when looking just at this year, thus far, we are seeing a 2% increase in home sales, from 386 this January through April compared to 378 last January through April. Median Sales Price -- Over the past year we have seen a 9% increase in the median sales price in Harrisonburg and Rockingham County, which has now reached $335,000 (over the past 12 months) as compared to only $306,700 over the 12 months prior to that. Looking just at the first four months of this year we see a slightly smaller (5%) increase in the median sales price ($338,645) when comparing it to the first four months of last year ($323,735). Median Days On Market -- Homes are selling a bit more slowly this year than last. The median number of days it took for new listings to go under contract over the past 12 months has been nine days... which is an increase from the median of seven days during the 12 months prior to that. Now, looking at a subset of the market, for a moment, here are the same numbers when looking just at detached homes, and excluding townhomes, duplexes and condos...  Focusing just on the first four months of 2024 compared to the first four months of 2023, here are the differences we see between the detached home market and the overall market... There has been a 3% decline the number of detached homes that are selling... compared to the 2% increase in the overall number of homes selling. There has been a 12% increase in the median sales price of detached homes that are selling... compared to the 5% increase in the median sales price of all homes that have sold. So, when looking just at detached homes, slightly *fewer* are selling in 2024, and the increase in their median sales price is higher than that of the overall market. Meanwhile, in the attached home market...  When looking just at attached homes (townhomes, duplexes, condos) we have seen a 13% increase in the number of such homes selling in the first four months of 2024, compared to the first four months of 2023 -- and a 17% increase in their median sales price. As such, the attached home market is seeing a strong start to the year both in number of sales and the price of those homes. Now, let's switch gears learn about the latest trends via some graphs...  As you read above, we are seeing slightly more home sales in the first four months of 2024 compared to the first four months of 2023... but... April was not a contributor to that trend. Strong months of home sales in January and February were the biggest reason why we're seeing slightly more home sales in the first third of 2024 compared to the first third of 2023, as we saw fewer home sales this April (105) than we saw last April (124). Where do we go from here? We'll have to look at contract activity and pending sales (a bit further down this overview) to guess at whether home sales activity will rebound at all in May 2024. But first, let's see how the start of this year compares to the last few years...  The 386 home sales during the first four months of 2024 puts us slightly ahead of the 378 in the first four months of last year... though well below the 447 and 461 home sales levels reached during the first four months of 2021 and 2022. It seems reasonable to conclude we'll probably see around 1,200 home sales this year (similar to last year) and not 1,500 - 1,700 home sales such as were seen in 2021 and 2022. Now, then, looking at slow moving trends by examining rolling 12 months of data...  The top green line, above, shows the median sales price over a 12 month period, measured each month. Over the past year that median sales price has increased 9% from $306,160 to $335,000. Despite fewer home sales and higher mortgage interest rates, the median sales prices keeps... on... rising. The blue line, above, shows the number of homes selling in 12 months time, measured each month. Ever since the middle of 2022 we have seen this metric of annual home sales steadily falling... though in early 2024 that trend seemed to be reversing itself as the pace of annual home sales started to rise again. But... not so much in April 2024. Stay tuned to see if the annual pace of home sales levels out, declines even further, or starts rising again as we head through May, June and July. I haven't touched on it yet in this report, but a large portion of homes that are selling this year are new homes....  Thus far in 2024, 25% (1 in 4) home sales have been new home sales. This is a rather significant change from just a few years ago when only 13% (2019) and 15% (2020) of the homes that were selling were new homes. With soooo many current homeowners having rather low (to super low) interest rates on their current mortgages, we seem poised to have lower numbers of resale home sales for several years to come. As such, the new homes offered for sale (and being purchased) help to at least partially satisfy buyer demand for housing, and we are likely to continue to see around 25% (more or less) of buyers buying new homes over the next year or two. To get a sense of where the market might go next, let's look at contract activity...  Despite fewer home sales in March and April of 2024... the amount of homes going under contract was MUCH higher this March and April (red line) compared to last year (blue line). Given these higher months of contract activity, I believe we are likely to see higher numbers of home sales in May and June. This is reinforced when looking at the number of homes under contract at the end of March and at the end of April...  There are currently 333 homes under contract (waiting to go to closing) in Harrisonburg and Rockingham County... compared to only 275 homes being under contract at the same time last year. Higher numbers of homes going under contract in March and April of this year has resulted in this higher number of pending sales, which should (within the next month or two) translate into higher numbers of closed sales. And yet, just to throw one more metric into the mix to at least partially make you scratch your head and think on this Monday morning...  As shown above, inventory levels are tracking a good bit higher at the start of this year (172-185) than they were last year (109-129) and also well above the four year average (132-147). So, why are there more homes on the market (at any given point) this year than last? My two leading theories are... [1] Homes are going under contract (days on market) a bit more slowly this year than last, which could result in slightly higher inventory levels. [2] Quite a few (31%) of these active listings (58 of 185) are new homes... some of which have not yet been built or have not yet been finished, which might result in them remaining as active listings and not going under contract. Think on that mystery... home sales rising, contract activity rising, prices rising, but inventory... also rising... and let me know if you have any other theories. While you think on that, here's one more thing that is rising...  Mortgage interest rates have been above 6.5% for the entirety of the past year, and the sub-5% rates are now a distant (two years ago) memory. After steady declines in rates between October 2023 (7.79%) and December 2023 (6.61) we have seen rates trend back up over the past four months. Anyone who is waiting to buy a home until mortgage interest rates get back down to 5% -- or even 6% -- will probably have a long wait. So, what does all of this mean for you? Home Sellers - As has been the case for quite a few years now, you're in a great position. You will likely be selling your home at a higher price than would have been possible over the past few years. Remember, though, that mortgage interest are high, which make mortgage payments for buyers quite high, so make sure your list price is in line with recent sales so that you have enough buyer interest to hopefully see your home quickly go under contract. Home Buyers - Depending on your price range and the type of property you hope to buy, you may or may not have LOTS of competition. I am currently seeing some properties linger on the market for a week or more without any offers... and some going under contract within days with multiple offers. Talk to a lender to get a sense of where you can be and where you want to be with your mortgage payment and purchase price, and then let's start getting out there to see some homes and get a feel for the market so that you're ready to confidently move forward when the right house hits the market. Home Owners - If your current home works well (or well enough) for you - enjoy your likely low housing payment (depending on when you bought or refinanced) and enjoy the increasing equity you likely have in your home. As much as excited would-be home buyers might wish you would sell your home so they have more options for buying... I can't blame you for staying put and enjoying where you are. Renters - Plenty of folks are not homeowners and are not planning to buy anytime soon, or do not see themselves being able to buy anytime soon. This is completely understandable given the significant increases in sales prices and mortgage interest rates over the past five years. If you are on the edge of being able to or interested in buying, don't hesitate to have a preliminary conversation with a lender and/or with me to get a sense of what it would look like to buy a home... especially given how rental rates keep on increasing. And... that's a wrap, folks. You are about as well informed as is possible on the overall Harrisonburg and Rockingham County real estate market on this Monday morning. But if you have questions about a specific segment of the housing market, or about your neighborhood, or about your home... feel free to ask! Until next month... [1] Check out the complete set of May 2024 charts and graphs here. [2] If you're getting ready to buy, let's chat about the process, the market and what you hope to buy. You'll also want to talk to a lender sooner rather than later. [3] If you're getting ready to sell, let's meet soon to talk about the market, the process, your house, your timing and your goals. To touch base with me about any of the above, call/text me at 540-578-0102 or email me here. Enjoy your Monday! | |

Local Real Estate App Now Available For Download |

|

Funkhouser Real Estate Group has recently launched a real estate app that will make your home search easier than ever. Download it today by clicking here, or read on for some highlights. Enjoy an easy and intuitive map based search when you first launch the app, based on your current location...  View full property details for any home on the market with the ability to easily ask a question or schedule a showing...  Create a search area by drawing any shape you'd like, and save that search for notifications when a listing hits the market in your areas of interest...  Refine your search parameters with a variety of filters allowing you to find just the houses best suited for you...  Take this new local real estate app for a spin today by downloading it here. Let me know if you have questions or feedback! | |

It Is Prime Time For Getting Your House On The Market If You Want To Sell This Summer |

|

Lots of home buyers try to, prefer to, want to move into their next home during the summer months... which typically means contracting on that home in May or June. As such... sellers who are hoping to sell in the next six months should consider getting their home on the market now or soon. Just to spell out a bit of the potential timing for listing your home in May... May 15 - home listed for sale May 20 - home under contract (not always this fast, but often so) June 30 - closing on sale of home (typically 30 - 45 days after contract) Or, a bit later... June 1 - home listed for sale June 5 - home under contract July 15 - closing on sale of home A touch later... June 15 - home listed for sale June 20 - home under contract July 31 - closing on sale of home Many home buyers hoping to transition over the summer will want to close on their purchase by the end of July -- which means sellers will be an ideal position to sell to those buyers if they have their home listed for sale by June 15. Again, there are plenty of assumptions in the timelines above, such as the home going under contract in four days (when it might take 10 or 14 or 21) and a closing happening in about 40 days (when it might take 60). If you hope to sell this summer, we should chat sooner rather than later about a potential timeline for preparing your house for the market and getting it on the market. | |

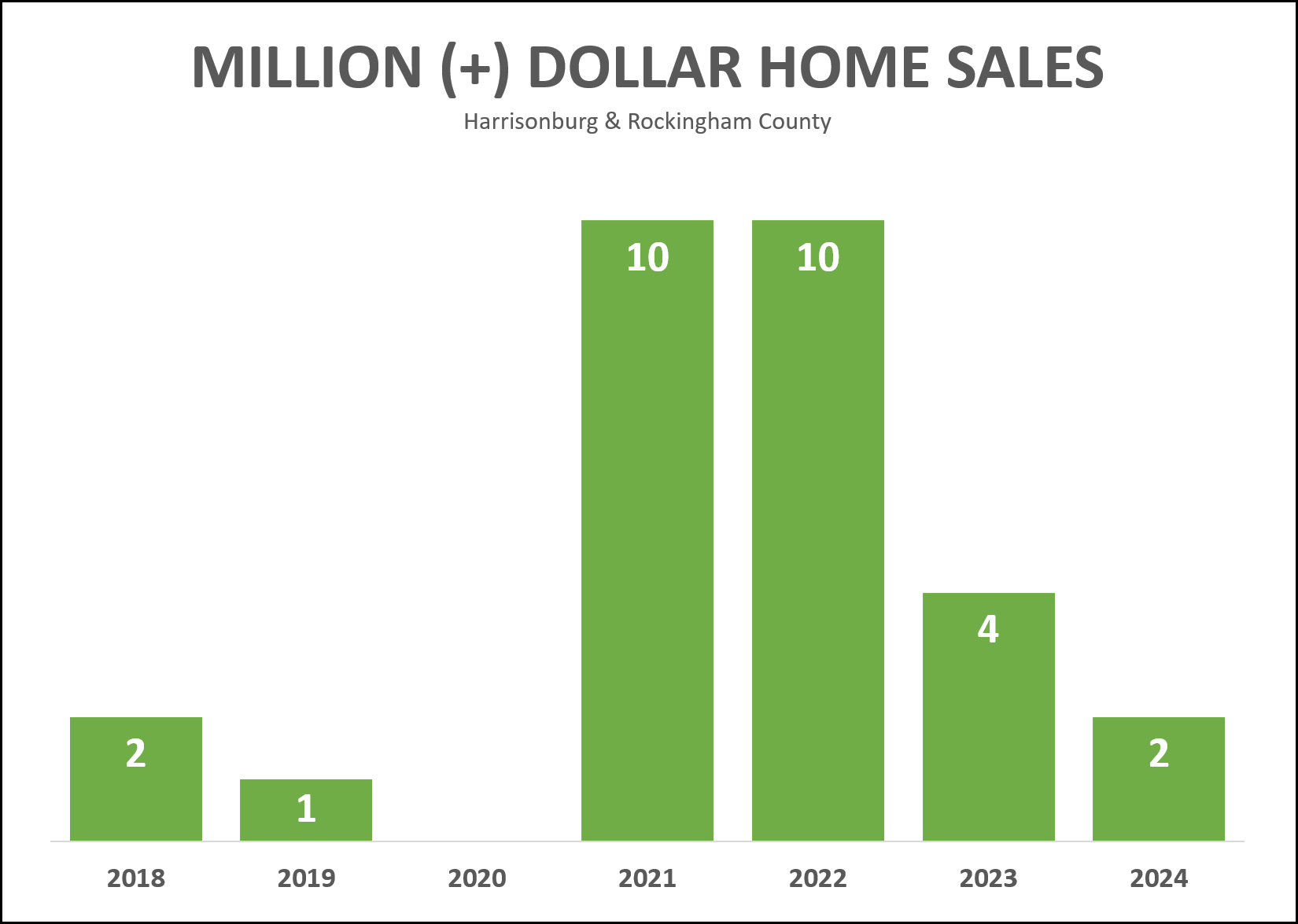

Million Dollar Home Sales Peaked In 2021, 2022 |

|

Between 2018 and 2020 there were only three million dollar home sales in Harrisonburg and Rockingham County area as recorded in the HRAR MLS. Then, in 2021, we saw (10) million dollar (+) home sales, and then (10) more such sales in 2022! Home prices were certainly increasing between 2018 and 2021, so one of the reasons we saw more million dollar home sales was certainly because of increases in those home values. But then -- we only saw (4) such sales in 2023. One theory here is that the increase in mortgage interest rates in 2022 and then 2023 resulted in fewer buyers being willing to pay a million bucks (or more) for a home. Thus far in 2024, we have seen two of these million dollar (+) home sales in the first four(ish) months of the year -- though there are four other million (+) dollar listings that are under contract and waiting to make it to closing. If you're eager to purchase a million dollar home in Harrisonburg or Rockingham County, these are your (14) current options. | |

How Much Will Your Mortgage Payment Change If You Sell Your Home And Buy A New One? |

|

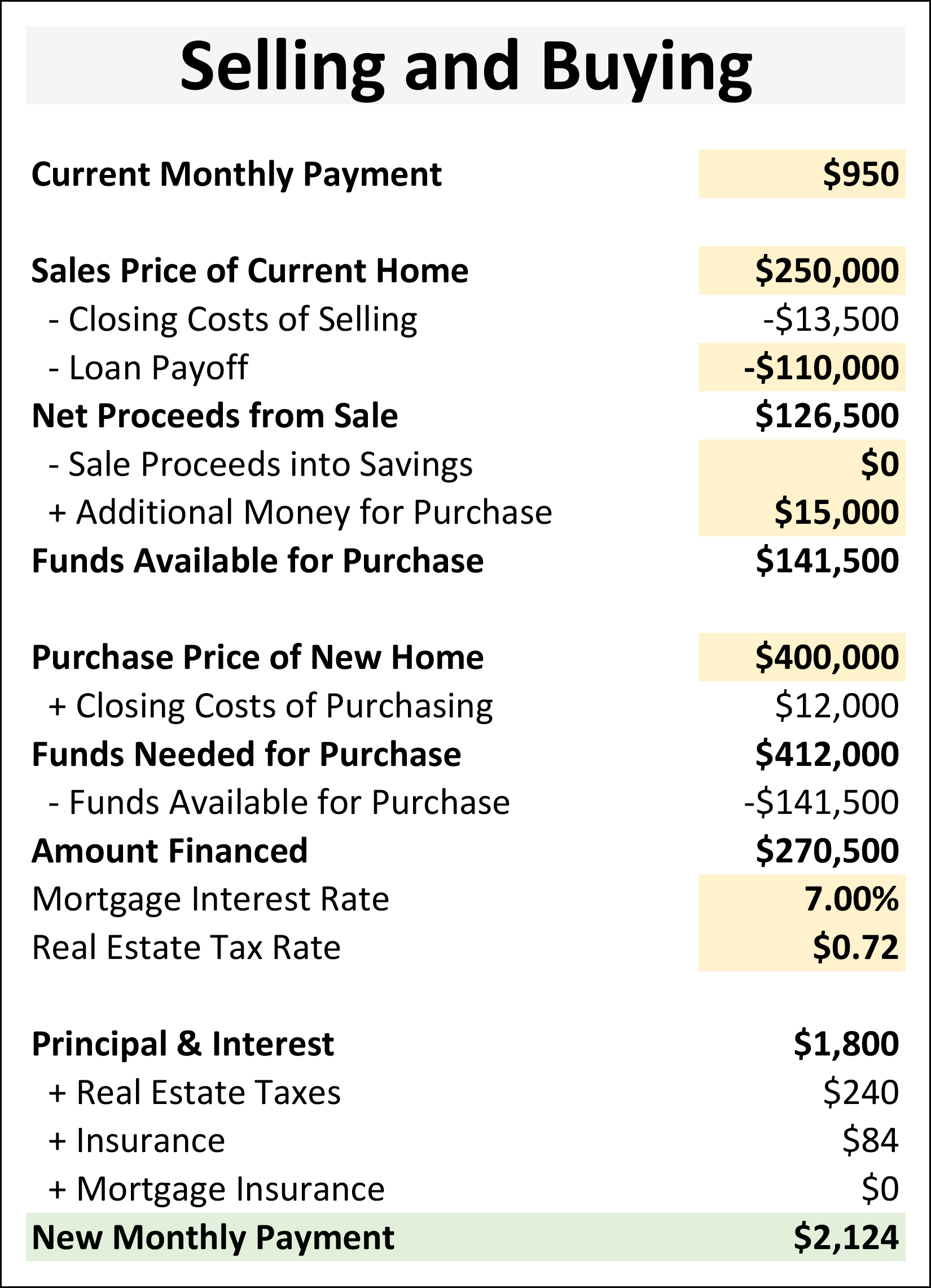

If you will be selling your home to buy another, there are a lot of numbers floating around....

Above you will see a spreadsheet I put together to help you think about some of these numbers as you are evaluating if and when you will make a move to a new house. In yellow, are all of the inputs you will need to provide, or that you and I can determine together, such as your current payment, your home's current value, your mortgage payoff, whether you will be putting any additional money into the transaction, etc. In green, I have identified your potential future mortgage payment and the net change in your monthly payment. All of the numbers without a background color will automatically calculate for you. Click here to download this worksheet as an editable Excel file. | |

Many (Or Most?) Home Sellers Prioritize Certainty Over Price |

|

When a seller signs a contract with a buyer, they want to be as certain as possible that the contract will proceed to settlement. The king of all offers, providing the most certainty to a seller would be a cash offer with no contingencies whatsoever. As each of the contingencies below are added to a contract, the seller's certainty decreases...

It is important, as a buyer, to remember that most sellers are thinking about certainty alongside price. Which of these offers is likely to succeed?

When presented with these three offers I think many or most sellers would choose offer #1 even though it is $1K or $5K lower than the other two offers in hand. Give careful thought to the contingencies you do and do not include in your offer and understand how they affect the seller's view of the certainty that your contract will make it to settlement. | |

Strong Contract Activity Continues Into April |

|

We saw a surprisingly high number of homes go under contract in March this year... 143 of them, compared to only 118 last March. And... this April is also starting off strong compared to last April. In the first 12 days of this month (through this past Friday) we saw 44 houses go under contract in Harrisonburg and Rockingham County compared to only 33 last April. It is turning into a busy spring in the local housing market! | |

How Long Will You Stay In Your Home? |

|

It seems homeowners are staying in their homes much longer now than they did two decades ago... with the median homeowner tenure having risen from 6.5 years in 2006 to 11.9 years today. This analysis of homeowner tenure is thanks to a recent analysis by Redfin... A few reasons for this increase in homeowner tenure seem to include... [1] Older Americans staying in their homes longer. [2] More recently, the sticky-ness of low fixed mortgage interest rates. A few results of this increase in homeowner tenure seem to include... [1] Lower inventory levels of resale homes. [2] Continued increases in home values. When I ask folks that I encounter on a day to day basis how long they will stay in their current homes, I often am told that they will stay in their current homes for a very long time, if not forever. This is largely because... [1] They bought their home when home values were lower or significantly lower than they are now, and they are enjoying a relatively low mortgage balance compared to current home values. [2] They bought their home when mortgage interest rates were below 4%... or they refinanced their mortgage when interest rates were below 4%, and they do not want their housing payments to increase if they obtain a new mortgage above 6%. How long will you stay in your home? I plan to stay in mine for quite a while! | |

How To Think About The Market Value Of Your Home When There Have been No Recent Sales In Your Neighborhood |

|

I think this is going to be a more common phenomenon over the next few years... In preparing to list your home for sale we start to take a look, together, at recent sales of similar homes to predict the price a buyer will be willing to pay for your home. But... there have been no sales in your neighborhood over the past year... or two years... or three years!?! What does one then do? It's probably best not to focus on sales prices in your neighborhood from more than two or three years ago as they won't be a very accurate indicator of the value of your home in the current market. We'll likely need to work to identify comparable sales outside of your neighborhood that are as similar to your home as possible to potentially include... [1] the same school district [2] a similar size home [3] a similar structure of home (one story vs. two story) [4] a similar age of a home [5] a home with similar interior and exterior materials and finishes We will then make adjustment to the sales prices of each comparable property based on differences in both the neighborhood and the other attributes listed above. It is certainly ideal when there are highly similar comparable sales right in your very own neighborhood to use as reference points when pricing your home -- but that is not always going to be our current context right now given that fewer homeowners are selling from year to year. | |

Home Sellers In Many Price Ranges Still Need To Plan To Be Kicked Out Of Their Houses For A Few Days |

|

Plenty has changed since the times of real estate during a pandemic... [1] Mortgage interest rates are now 6% instead of 3%. [2] Sellers are often receiving a few offers instead of a flurry of offers. [3] Homes are often selling at or just above asking, instead of waaaay above asking. But some things have not changed... Home sellers in many price ranges (and locations and property types) still need to be plan to be kicked out of their homes for a few days when they list them for sale. Is this happening for all new listings? No Are all or most of the showings turning into offers? No Can it get a bit logistically challenging for sellers to have so many showings within the first few days on the market? Yes Do most sellers decide it is worth it? Yes Happy Spring, and let me know if you want to get kicked out of your home for a few days... ;-) | |

Would You, As A Seller, Turn Down A Solid Offer In Hand For The Possibility Of One To Come? |

|

As usual, context matters, which I'll get to below, but... If you listed your home a few days ago and you have a solid offer... but are being told you might receive another offer in a day or two... would you turn down the solid offer? Or would you go ahead and decide to move forward. Let's add some context that might point us in a few different directions... House #1 - Listed for $750K (upper end of the market), three showings over five days, a full price offer with reasonable contingencies is received on the fifth day, and one of the other buyers that viewed the home says they might make an offer within a day or two, and no other showings are scheduled. Most sellers in this situation would probably go ahead and move forward with the solid offer - even though another offer might materialize. House #2 - Listed for $350K (highly active segment of the market), 15 showings scheduled over the first three days of being on the market, a full price offer with reasonable contingencies is received on the first day, after the third showing, and the buyer is anxious to have a response. Many or most sellers would hold off on responding to that first (solid) offer, for at least a day, given the other showings that are about to take place. These are two examples that are a bit more clear cut than many situations that sellers find themselves in -- having to balance the value of the solid offer in hand compared to the possibility of other offers to (maybe) come along soon. As we think through a response (or no response yet) we'll consider the context of your price range, the size of your market, the number of scheduled showings, the feedback we are getting from the showings, the length of time your house has been on the market and more. But there certainly is always plenty of value in the solid offer in hand! | |

Home Prices In Harrisonburg, Rockingham County Might Not Shoot Upwards Quickly If Or When Mortgage Interest Rates Fall Because Prices Did Not Drop When Rates Rose |

|

If or as mortgage interest rates drop, will we see home prices shoot upwards? Let's back up a few steps... When mortgage interest rates rose from 3.2% to 7.1% within 10 months (Jan 2022 - Oct 2022) some housing markets saw home prices decline. Understandably, if the mortgage interest rate doubles, a buyer's monthly housing payments will be much higher than the previous year -- directly and immediately affecting housing affordability. Thus, some markets saw prices decline during 2022 at least partially as a result of higher mortgage interest rates. Harrisonburg and Rockingham County, notably, did not see a decline in the median sales price during that (2022) timeframe. Many people in markets (often larger cities) where home prices did decline are now (reasonably) wondering if home prices will spike upwards if or when mortgage interest rates fall. If you are in a market where home prices dropped as interest rates rose... then yes, it is reasonable to think you'll see home prices rise (or rise faster) if or as mortgage interest rates drop. But... back to Harrisonburg and Rockingham County... I am not expecting that we will see an uptick in home prices if or as mortgage rates decline... mainly because we did not see prices drop when rates rose. This is not to say that home prices won't continue to rise in this area -- I think they will -- but I don't think we'll see an increase in home prices specifically related to mortgage rates dropping. | |

If Or As Mortgage Interest Rates Decline, Buyers Will Likely Jump Back In Sooner Than Sellers |

|

Mortgage interest rates peaked this past Fall at 7.79% and have been mostly declining since that time, to current levels of 6.74%. But, 6.74% can still feel high after interest rates were below 5% for 13 years... and below 4% for three years. As mortgage interest rates potentially continue to decline, perhaps back down to 6%, what will we see happening in the market? Will the lower mortgage interest rates spur on more home sales activity? Maybe, but perhaps not as much as you would likely expect. If / when / as mortgage interest rates move back down towards 6% -- or the low 6%'s or the high 5%'s we are likely to see more would be home buyers interested in buying. They will be able to afford higher sales prices and/or their monthly mortgage payment will be lower. But... in order for a home sale to take place... we need both a buyer AND a seller. Many homeowners (would be sellers) have mortgage interest rates below 4%. Quite a few have interest rates below 3%. Will a homeowner sell, paying off their mortgage that has a 2.75% or 3.5% rate... to then buy another home with a 6% mortgage interest rate? Somewhere between no and probably not? Will a homeowner sell, paying off their mortgage that has a 2.75% or 3.5% rate... to then buy another home with a 5.5% mortgage interest rate? Somewhere between probably not and maybe? Will a homeowner sell, paying off their mortgage that has a 2.75% or 3.5% rate... to then buy another home with a 4.99% mortgage interest rate? Maybe? I expect that as we move through 2024 and 2025, and as mortgage interest rates (likely?) continue to decline (at least somewhat) we are likely to see more buyers jumping back into the market before sellers are doing the same. Which means... that we are likely to still see a competitive market... if buyer demand rises more quickly than seller supply. | |

Consider The Size Of The Buyer Pool When Pricing Your Home |

|

This isn't an exact science, as I'll explain below, but... When you are pricing your home, it is important to consider the size of the pool of buyers who might be considering your home. If you're selling a townhouse in the City of Harrisonburg for less than $250K that's a pretty big pool of buyers -- there were 93 such sales over the past year. If you're selling a townhouse or duplex in the Spotswood High School district for more than $500K, that's a much smaller pool of buyers -- there were only 5 such sales over the past year. If you're selling a detached home in the Turner Ashby school district for less than $400K, that's a pretty big pool of buyers -- there were 82 such sales over the past year. If you're selling a detached home in the Turner Ashby High School district for more than $700K, that's a much smaller pool of buyers -- there were only 4 such sales over the past year. So, as you consider a pricing strategy for your home, we will want to dial in on how many buyers are paying that sort of a price for your sort of a home in a given timeframe so that we have reasonable expectations related to how much interest we will have in your home and how quickly it might sell. Two significant(ish) caveats... [1] We'll be predicting future demand based on past demand which is usually a reasonable estimate, but it's quite possible that -- for example -- 40 buyers wanted to buy your sort of home over the past year, but only 25 buyers will want to do so in the coming year. [2] Sometimes a seemingly small pool of buyers is actually a supply-side constraint. When we see that only five buyers paid over $500K for an attached home in the Spotswood High School district in a year's time part of that may be a result of only five buyers wanting to buy such a property, but it is quite possible (or even likely) that it is also a result of only five sellers being willing to sell such a property during that timeframe. Regardless of the caveats, it is important to understand how many buyers will potentially be considering your home when it hits the market based on how many buyers have bought such a home over the past 6 to 12 months. | |

What Improvements Should You Make Before Selling Your Home? |

|

Unfortunately, there isn't a magic answer to what improvements you should make before selling your home. I can't universally say that all homeowners should do X, Y and Z before selling their home. As with most topics I discuss with prospective home sellers, it depends... Here are a few ways to think about this topic... RETURN ON INVESTMENT Some improvements will cost more than others and some will make more of an impact than others. We can brainstorm a list of potential improvements together and then estimate the cost of each - or obtain quotes for each. With pricing in hand we can evaluate whether is is worthwhile to spend $___ to improve ___ in order to potentially sell for $___ more than you would otherwise. One other thing to keep in mind as we consider the return on the financial investment - is the time that it will take to make the improvement(s) and whether that delay is acceptable given when you want your home to hit the market for sale. COMPETING WELL If most homes in your neighborhood (or price range) have upgraded their ___ and you have not, it may make sense to make that improvement. As we look at improvements that you might make to your home, we should think about them in the context of what your competition is offering. If you haven't improved ___ and every other home that we'll be competing with once you are on the market has improved ___ then we won't compete well. YOU DON'T HAVE TO MAKE IMPROVEMENTS You may not actually want to make the improvements that we consider and discuss. You might not have the money in hand to pay for those improvements, or you might not want to delay getting your house on the market, or you might not want to deal with the logistics of making the improvements while still trying to live in your home and deal with all of life's other logistics. This approach (not making the improvements) is OK as well -- we will just need to understand or predict the impact that this decision will have on either the price at which you will be able to sell your home, or the time that it will take to sell your home, or both. | |

Spring Is Coming, And Perhaps More New Listings Too |

|

Spring is coming. We had to wait one extra day this year, but March will be here tomorrow. With spring officially starting in about 20 days -- many would be home buyers in Harrisonburg and Rockingham County are wondering if we will start to see more resale listings popping onto the market as or once spring begins. I suspect that... [1] Yes, we'll see more new (resale) listings hitting the market this spring (Mar, Apr, May) than we have seen over the past few months. [2] We will likely see fewer new (resale) listings this spring than last spring. [3] There will likely be fewer new (resale) listings this spring than there are buyers who would like to buy said homes. While the above may differ a bit from price range to price range or from location to location, this likely means that... BUYERS should go see new listings quickly when they hit the market and be ready to make a decision and an offer quickly if you like the house. SELLERS should be relatively optimistic that if your house is prepared well, priced appropriately and marketed thoroughly that you will likely still see it go under contract within the first few weeks, if not the first few days. I'm ready for spring! Are you? | |

Instead Of Thinking About If It Is THE Right Time To Buy Or Sell, Think About If It Is YOUR Right Time |

|

It's a great time to buy a home. It's a great time to sell a home. Those words are often tossed about, in a balanced market, in a strong buyer's market and in a strong seller's market. Is it always a great time to buy a home or to sell a home? How could that be possible? Forget all of that. Don't get stuck on whether it is THE right time to buy or sell a home. Instead, we ought to be focusing on whether it is YOUR right time to buy or sell a home. There are plenty of times when it is definitely the right time for you to buy a home -- and some when it is not. For example, if you don't have stability in your job or if you might want to move out of the area for a job advancement, it probably is not your right time to buy a home. There are plenty of times when it is definitely the right time for you to sell your home -- and some when it is not. For example, if you don't know where you'll go next after you sell, we certainly shouldn't be getting all geared up to sell your home. So... let's focus less on whether this, right now, is THE right time (or THE best time) to buy or sell a home. Instead... let's focus on whether this is YOUR right time. If the time is right for you to buy or sell, let's get down to it. If it's not your time, don't let the market or other influences make you think that you should be buying or selling. | |

Should You Price Your Home $10K To $20K Above Where You Hope To Sell? |

|

In the current local housing market, it is not advisable to price your home $10K to $20K above the price point where you hope to sell -- with the one caveat being that it depends on the price range. If you hope to sell for $250K, I don't recommend pricing your home at $260K or $270K. If you hope to sell for $410K, I don't recommend pricing your home at $420K or $430K. I suppose if you hope to sell for $760K, might matter a bit less (maybe) if you price your home at $770K or $780K. But, back to the first premise... here's why I don't recommend a list price of $260K or $270K if you hope to sell for $250K. Let's say you price your home at $265,000 - hoping to sell for $250,000. If five buyers come to see your home in the first few days it is on the market, and they all like the house, but conclude that it is likely worth $250,000... ...they are likely to not even make an offer. After all, they may very well think they would need to offer $235,000 or $240,000 in order to hope to negotiate you down to $250,000. And when a home has been on the market for just a few days, most buyers won't make a $235K or $240K offer if the list price is $265K. So... in almost all cases, your list price should be very close (or a touch above or a touch below) the price point where you hope to sell. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings