Selling

| Newer Posts | Older Posts |

Especially After Recent Increases In Property Values, Home Sellers Will Be Considering More Than Just The Offer Price |

|

Imagine you are a home seller... ...you purchased your home 10 years ago for $250K... ...you are ready to sell and hope it might sell for $340K... ...you list it for sale for $350K. After a few days on the market, you have three offers to consider... [1] Offer of $350K contingent on the buyer financing 80% of the purchase price. [2] Offer of $355K contingent on the buyer financing 95% of the purchase price. [3] Offer of $365K contingent on the buyer financing 97% of the purchase price and requesting a $5K closing cost credit. The first offer would get you $350K, the second $355K and the third $360K. Ignoring any other differences in the offer terms, which of these offers would you accept? Many buyers might think (or hope) that the highest offer price will win... but especially when home values have increased as much as they have over the past five years, home sellers might not always pick the highest sales price. Fictional Seller described above was hoping to sell for $340K, so all three of the offer are great -- they all results in higher prices than the goal of $340K. To pick on the third offer first, it provides for the highest sales price but the buyer has the least amount of funds to put into the transaction and is even asking the seller to pay for part of their closing costs. The artificially inflated sales price (to incorporate the closing cost credit) will mean that the property must appraise for $5K higher than it would otherwise. Furthermore, if there is an inspection contingency, this buyer seems likely to be the most concerned about any small or medium sized issues, as they do not appear to have a lot of funds to put towards the home purchase. The second offer ($355K with 95% financing) is certainly stronger than the first ($350K with 80% financing) but again, the smaller down payment can be an indication that something could go awry within the transaction to cause it not to make it to closing, such as discovering needed home repairs during the home inspection process. Thus, many sellers in this situation would end up choosing the lowest (!!) offer -- selling for $350K instead of $355K or $360K -- because of the greater certainty of the buyer successfully making it to closing given their seemingly more secure and stable financing situation. This is just one example of how home sellers these days will be comparing more than just the proposed purchase price when reviewing multiple offers -- especially if they bought their home 5+ years ago and have seen a sizable increase in their property value. | |

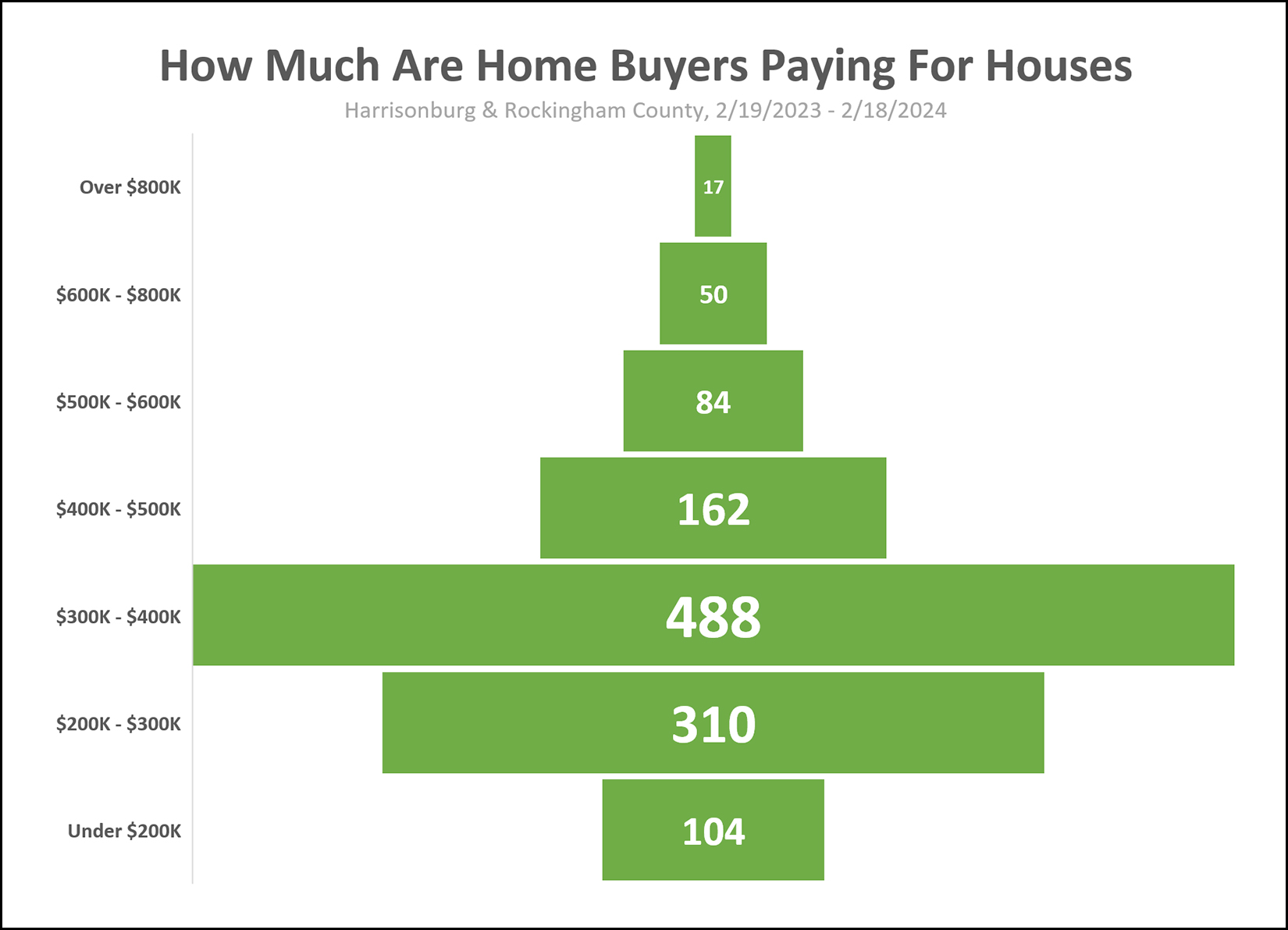

How Much Are Home Buyers Paying For Houses? |

|

How many buyers in the past year have been able to purchase a property for less than $200K? 104 buyers... or 9% of the buyers who bought in the past year. How many buyers paid more than half a million dollars for their homes? 151 buyers... or 12% of the buyers who bought in the past year. In what price range are the largest number of buyers buying? Just over 40% of home buyers paid $300K - $400K over the past year. As you prepare to sell your home you should take time to understand the size of the pool of buyers who will be potentially interested in buying your home. | |

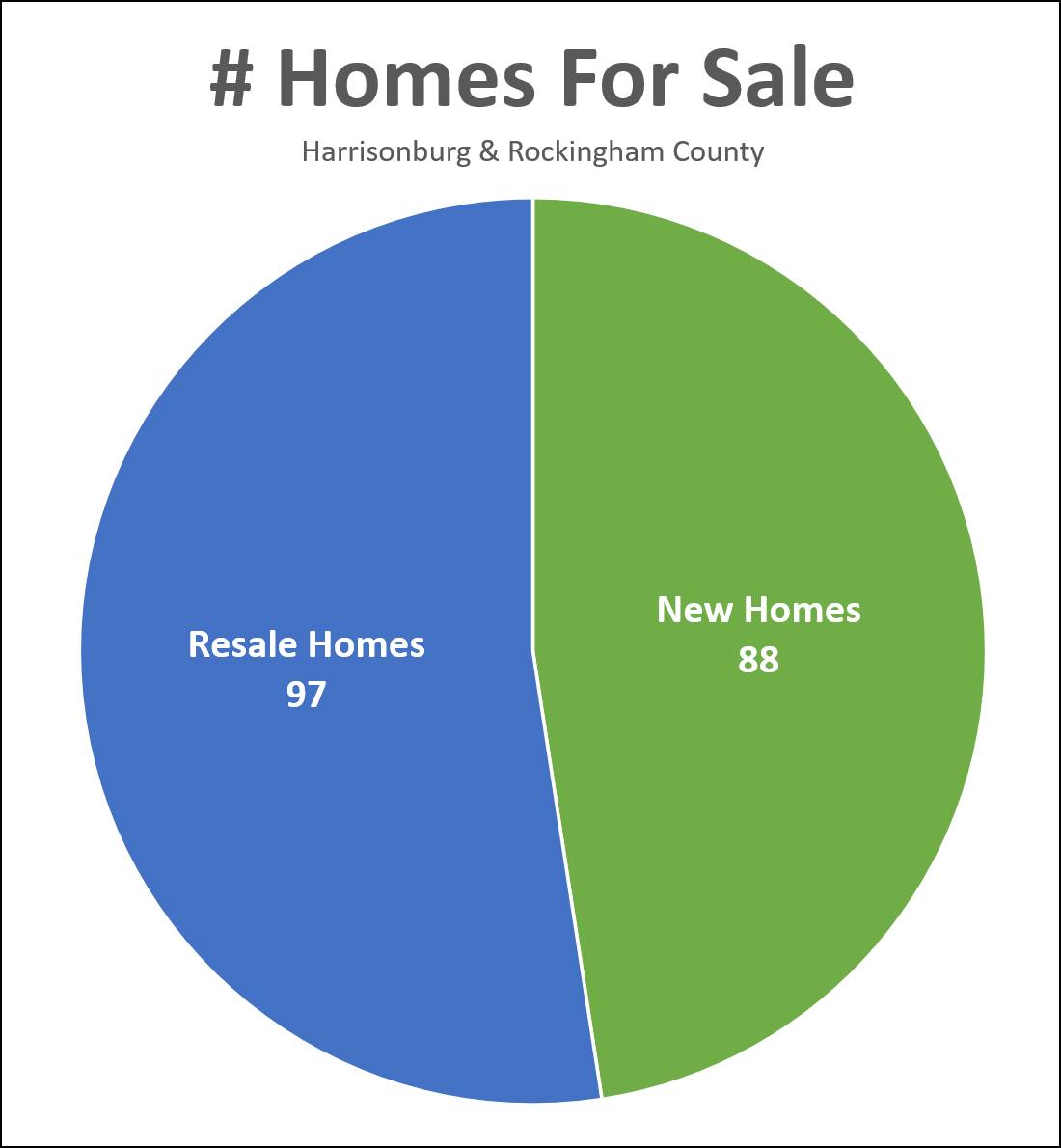

Almost Half Of Homes For Sale Are New Homes |

|

There are SOOOO many homes for sale... 185 of them right now, compared to only 109 a year ago. But... maybe there aren't as many homes for sale as you might think!?! As shown above, almost half of the homes currently listed for sale are new homes! New Homes For Sale = 88 Resale Homes For Sale = 97 So, even before we get to any price or location limitations, if you aren't looking to buy in a new home community you will only actually have 97 homes from which to choose, not 185 homes. These new homes for sale are mostly in these neighborhoods... | |

I Will Never Sell My House, He Exclaimed |

|

I think more of us might be in this category than anyone realizes. About 80% of homeowners have a mortgage rate below 5%. About 60% of homeowners have a mortgage rate below 4%. With current mortgage interest rates in the 6-point-something range, why would any of those homeowners want to sell their home!? I think we will continue to see depressed (lower) numbers of resale listings in 2024 as plenty of homeowners decide to keep making their current home work, given their very low mortgage interest rate. Or, as the guy said earlier this week who has an interest rate below 3%... "I Will Never Sell My House!" If you're in the market to buy a home right now, we are likely to see more resale listings coming on the market in the spring, but there will likely be fewer such listings than there are buyers who want to buy them, so competition will likely remain fierce especially in some price ranges and locations. | |

Some Houses Are Still Selling Super Fast With Many Offers |

|

Plenty of houses are taking a while to sell these days... sometimes weeks and even months. But... some are selling VERY fast, with LOTS of offers. Case in point - a house that shall not be named - with 12 offers within three days of being listed. Some would-be sellers thus wonder --- will my house be a three month sale or a three day sale. Oversimplifying a bit... it's all about supply and demand. If a house is listed for sale in a neighborhood where there are already two houses for sale and there are very few buyers looking for the combination of features that the house offers -- it might take a bit for the house to sell. If a house is listed for sale in a neighborhood where homes have rarely been listed for sale over the past two years and there are a ton of buyers who would love to live in that neighborhood -- it might take just a few days for the house to sell. We ought to analyze and evaluate the type of market your house might fit into (of the two general types above) before we list your home for sale -- but we won't really know with certainty how the market will respond until we list your home for sale. | |

The Snow Has Melted, Bring On The Power Washing, Mulching And Exterior Painting In Preparation For Listing Your Home Soon Or This Spring |

|

For anyone preparing to sell a home shortly-ish after the first of the year, they may have had a temporary setback in the way of SNOW -- that didn't melt in the short 48 hours that snow usually sticks around in the Valley. A decent bit of snow, plus some cold (COLD) temperatures kept the snow around longer than many had anticipated. But, it's mostly gone now -- and I'm not seeing any snow in the forecast over the next two weeks. So, if you're hoping to list your home soon, now is the time do that final outdoor prep... [1] Maybe some pressure washing? [2] Touch up paint on any wood trim areas that need some attention. [3] Add some fresh mulch and clean up the edges of your lawn and landscaping beds. If you need help with any of these sorts of jobs, let me know, and I can point you towards some resources to help you get the job done. And then... assuming you've been working on prepping your home's interior as well... it will be time for photos, some conversations about pricing, and we'll be ready to get your house on the market. For home buyers that haven't been seeing many options of homes for sale over the past two months, I hope there will be some good options for you over the next two months. Just listen for those pressure washers starting up... the home sellers are getting ready for you! | |

Will We See A Fast Moving Real Estate Market In Spring 2024 In Harrisonburg And Rockingham County? |

|

Many or most resale homes have been going under contract very quickly when they have been listed for sale over the past four years in Harrisonburg and Rockingham County -- largely because demand for these homes has exceeded supply. I don't expect that we will see supply exceeding demand this coming spring, but I also don't know that most sellers should expect to have their homes under contract within just a few days as has often been the case for the past few years. Looking at resale homes that have closed in Harrisonburg and Rockingham County over the past 60 days...

Will we see a fast moving real estate market in Spring 2024 in Harrisonburg and Rockingham County? Likely so. Will most home sellers be able to count on their homes being under contract within a few days? Maybe not. | |

So Many Different Ways To Consider Buying A Home If You Also Need To Sell A Home |

|

If you have own a home... but are ready to buy a new one... sometimes the biggest challenge is figuring out how to buy the next home while selling the current one. This list doesn't include all the possible ways to do it... but it includes quite a few options to consider and explore... Buy First, Seller Later. If you are qualified for a mortgage to purchase the next home before you sell your current home, this may be the way to go. This will allow you to make an offer on a house you love without a home sale contingency, which often won't be be accepted by a seller. Certainly, there are some risks to this approach -- you won't know how quickly your home will sell or for what price -- but it will be a lot easier logistically. In addition to being able to make an offer without a home sale contingency, you will also be able to move into the new home before having to move out of your existing home. List Your Home For Sale After Having A Contract To Buy The Next Home. Shifting pretty far from the prior strategy - the concept here would be waiting to list your home until you have secured a contract to buy the home you want to buy. But... this isn't necessarily a realistic strategy in the current market. Most home sellers aren't going to be interested in your offer if it is contingent on you listing your home, getting it under contract, working through any contingencies and then getting to closing. So... it's fine to make offers with this contingency but it is not necessarily realistic to think that a seller will go along with your proposed plan. List Your Home For Sale After Seeing The Perfect House To Buy. This one is a bit tricky from a timing perspective, but it's trying to end up somewhere between the two strategies noted above. This game plan would involve waiting until a perfect house comes on the market for sale, and then listing your home for sale. The hope would be that you could get your current house under contract quickly enough to then make an offer contingent on your (under contract) home making it to closing -- instead of contingent on your (not yet listed) home being listed, going under contract and making it to closing. Most sellers will be more excited about your offer this time -- since your house is already under contract -- but your offer will still likely be seen as less favorable compared to an offer without a home sale contingency at all. List Your Home For Sale, Contingent On You Finding A House To Buy. If you have tried the above strategy (listing your home for sale as soon as a perfect house to buy comes on the market) a few times without success -- because another buyer jumped on that perfect house before your house was under contract -- then maybe this strategy is for you. We can list your home for sale without knowing what you will buy. When a buyer is ready to commit to buying your home, we can propose contract terms that make the sale of your home contingent on you securing a contract on a home you would like to purchase. Some buyers might go along with this, but some won't like the uncertainty of whether they are really buying your house. This strategy is asking the would-be buyer of your house to take on the risk of whether you will be able to find a house to buy and have your offer on that house accepted. List Your Home For Sale, Hope For The Best For A Next House. If you have tried the above strategy (listing your home for sale, contingent on you securing a contract on a house to buy) and it didn't work -- because buyers don't like that uncertainty -- then maybe this strategy is for you. We can list your home for sale, when a buyer comes along we can propose a slightly longer (60-75 day) closing timeframe, and then hope that a perfect house comes along in the next few weeks, allowing you to (hopefully) contract on the next house, with both closings to coincide. Certainly, if the right house doesn't come along, or if that seller doesn't like your contingent (on home settlement) offer then you might not be able to secure a contract to buy a home -- and you would still need to sell your current house (and move out of it) per the terms of your contract with a buyer. Eek. List Your Home For Sale, Hoping For A Flexible Buyer. We wouldn't want to bank on this being possible -- but if we list your home for sale, and a buyer comes along that is either an investor (planning to rent out your house) or is very flexible about when they would move in -- then you could contract with this flexible buyer knowing you wouldn't have to move out right away when the settlement date rolls along. This might buy you a few extra months to find the right home to contract to buy -- either making an offer contingent on your home getting to settlement (if closing hasn't happened yet) or not contingent on a home sale at all if the closing has taken place. Come To Terms With Moving Twice. This is perhaps the least exciting logistically. Nobody really likes moving. Moving twice is just about twice as bad as moving once. But... if the fact that you need to sell your home limits your ability to purchase the home (or homes) that you want to buy -- then you may need to sell your home, move into a rental, and then make offers without having a home sale contingency. If you will be buying a home -- but you need to sell a home -- we'll talk through all of these options and more to figure out the best strategy for getting you to that next home. | |

Many Homeowners Are Not Motivated To Sell Their Homes And Do Not Anticipate Being So Motivated Anytime Soon |

|

Over the past five-ish years we were all living in a world of rapidly rising home prices, a fast moving real estate market and super low mortgage interest rates. Thus, if you owned a home but saw another home hit the market for sale that tickled your fancy, you might very well decide to sell your home. After all... [1] Your home was worth a good bit more than it was last year or a few years ago. [2] You were certain to be able to secure a contract on your home very quickly. [3] Your new mortgage payment would be oh, so low given 3% - 4% mortgage interest rates. But... some of these factors have changed now, though admittedly, some have not... [1] Your home is still likely worth a good bit more than it was last year or a few years ago. [2] Your home still relatively likely to go under contract quickly, though that is not the case for all homes any longer. [3] Your new mortgage payment will be oh... so... high !?! given mortgage interest rates above 6%. That last point... the potential housing payment for your new place if you decide to sell... is what is keeping many homeowners right where they are. Most homeowners are not very motivated to sell their homes right now -- because of their current low mortgage interest rate compared to the much higher rate if they sold and bought today -- and that low motivation level to sell does not seem positioned to change anytime soon. | |

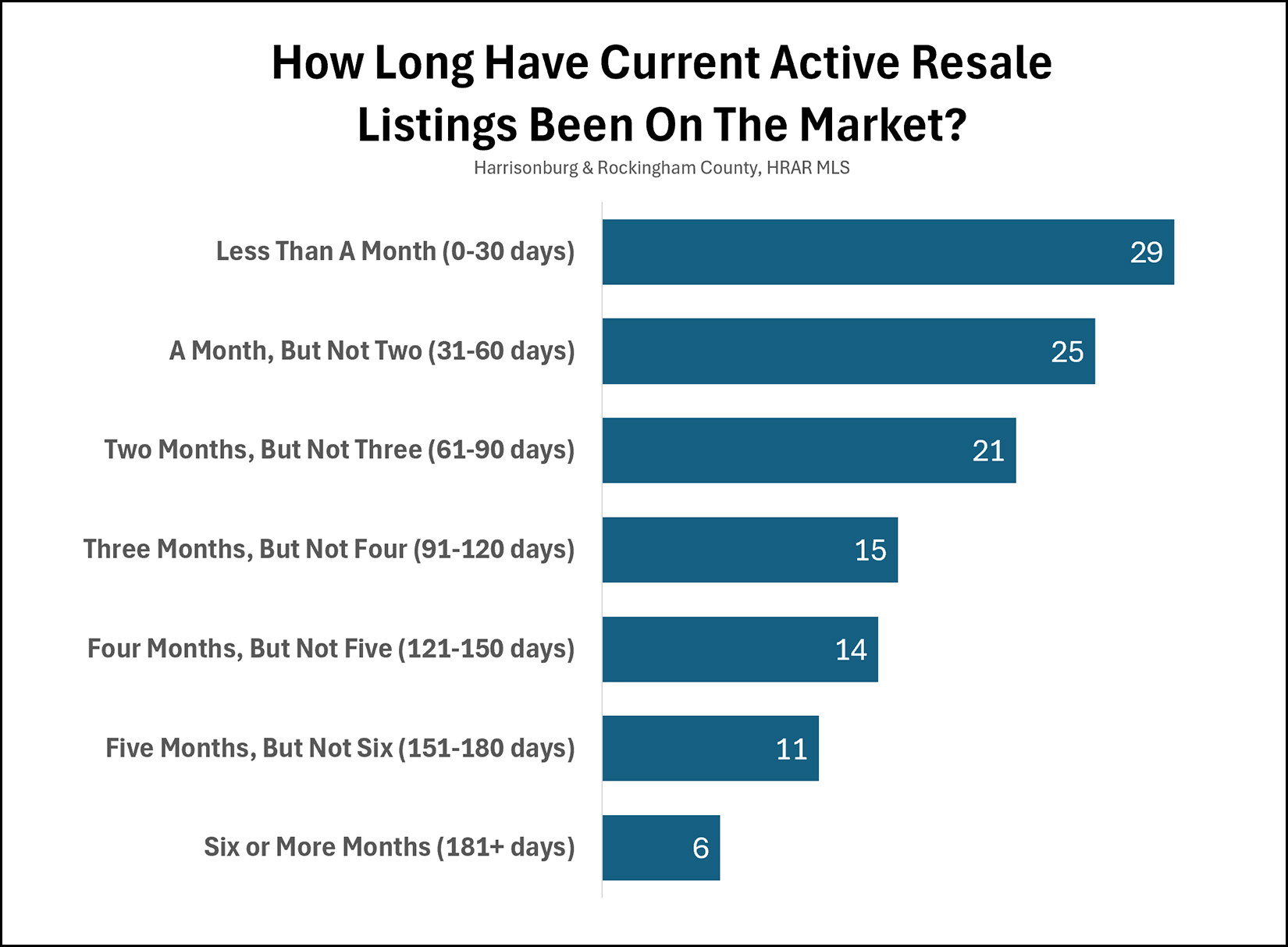

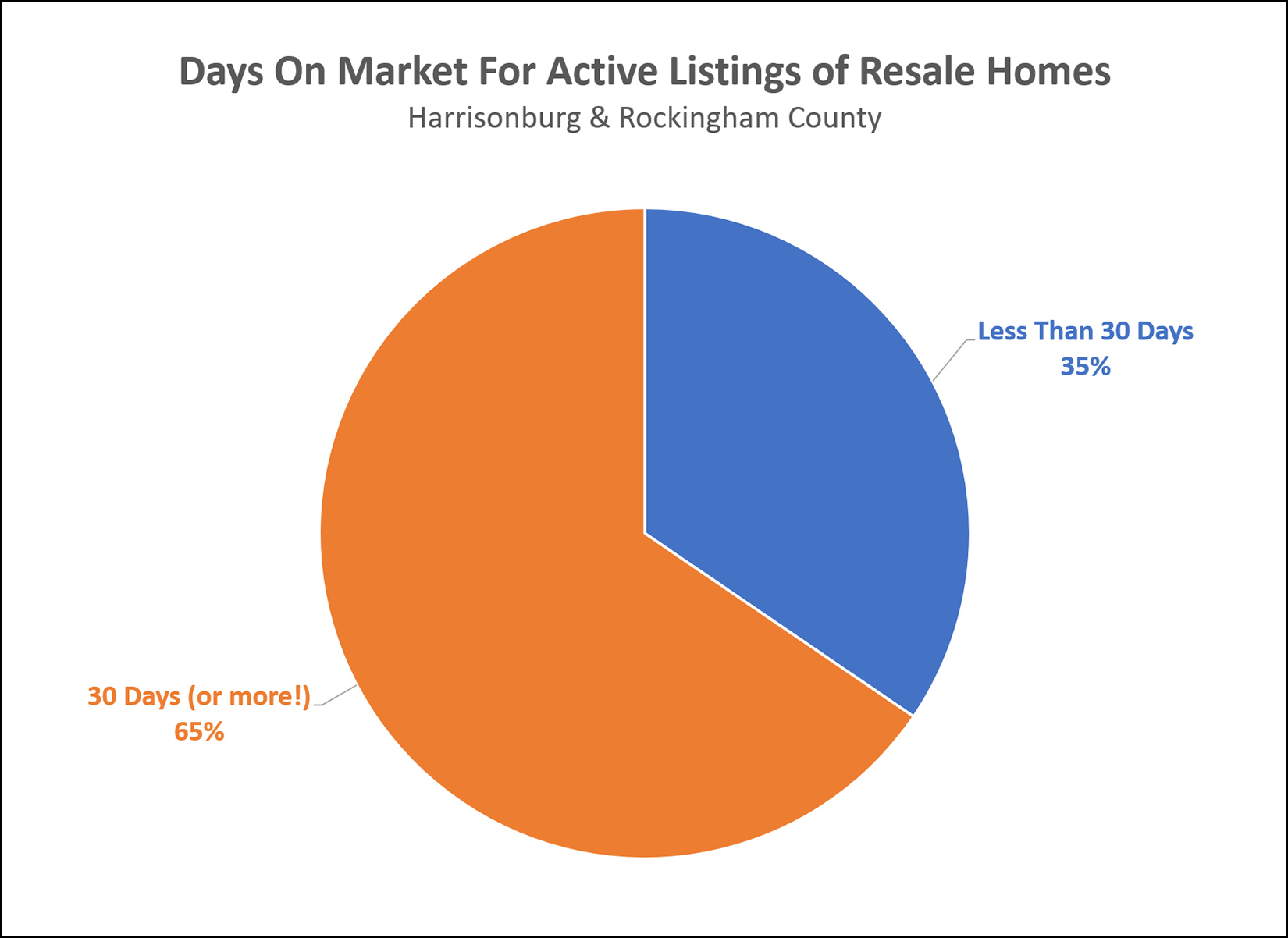

How Long Have Current Active Resale Listings Been On The Market? |

|

The graph above speaks for itself, but I'll point out a few more things that aren't explicitly referenced above... 76% of currently active resale listings (not new homes) have been on the market for more than a month. The median days on market of all 121 active listings is 65 days. That is to say that half of the current resale listings on the market have been on the market for 65 or fewer days... and half have been on the market for 65 or more days. The data above is relative to active listings. Let's contextualize this a bit further by looking at pending listings and then sold listings. Of the 87 resale homes currently under contract, the median days is 33 days. Of the 114 resale homes sold in the past 60 days, the median days on market was 17 days. Of the 894 resale homes that sold in the past 365 days, the median days on market was 7 days. So... Active listings = 65 days Pending listings = 33 days Sold in past 60 days = 17 days Sold over past year = 7 days Days on market -- the time it takes a home to sell -- seems to be drifting upward, at least recently, at least on resale homes. | |

Despite Fewer Home Sales, We Are Seeing Higher Prices, And Recently, More Contracts And Lower Inventory Levels |

|

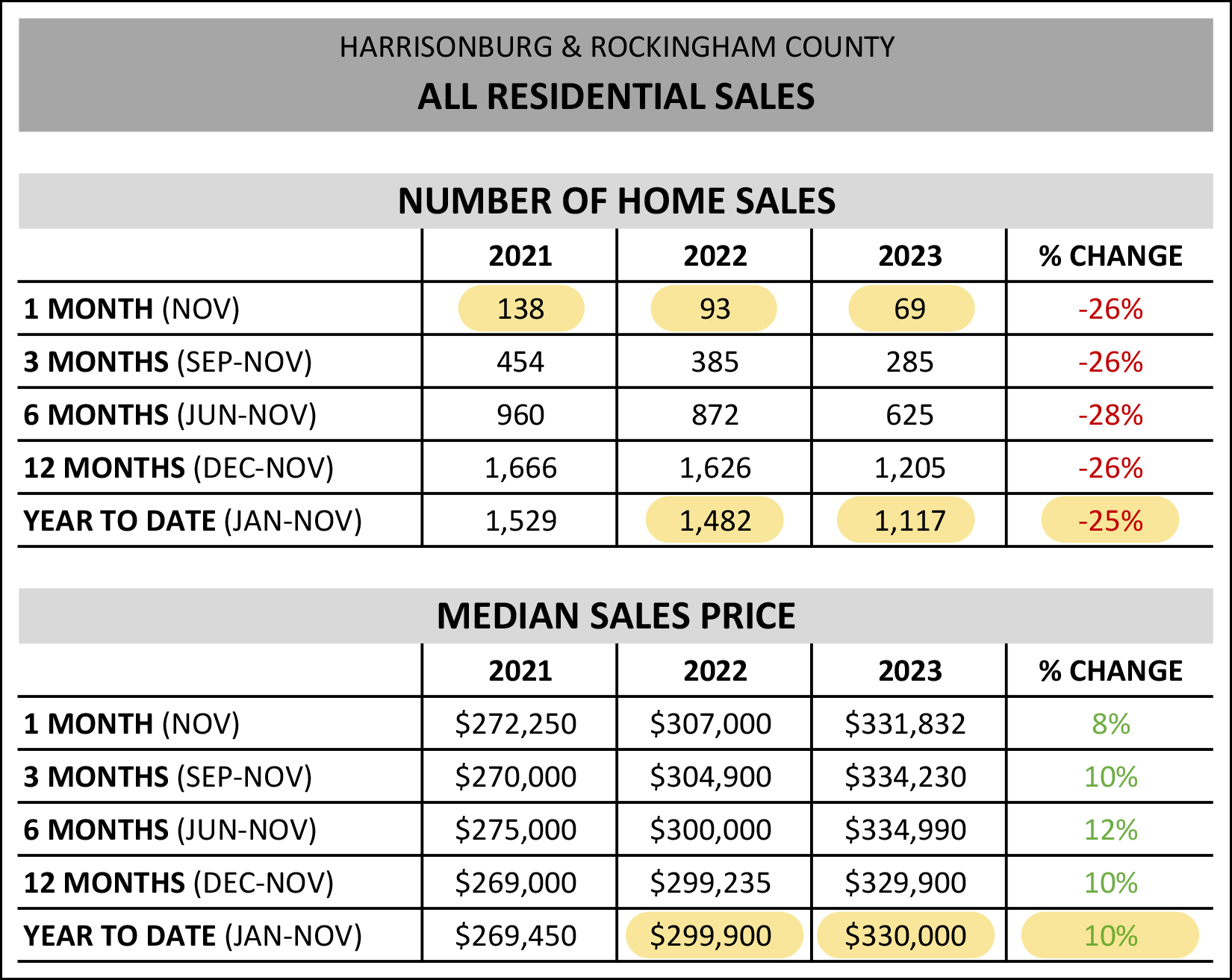

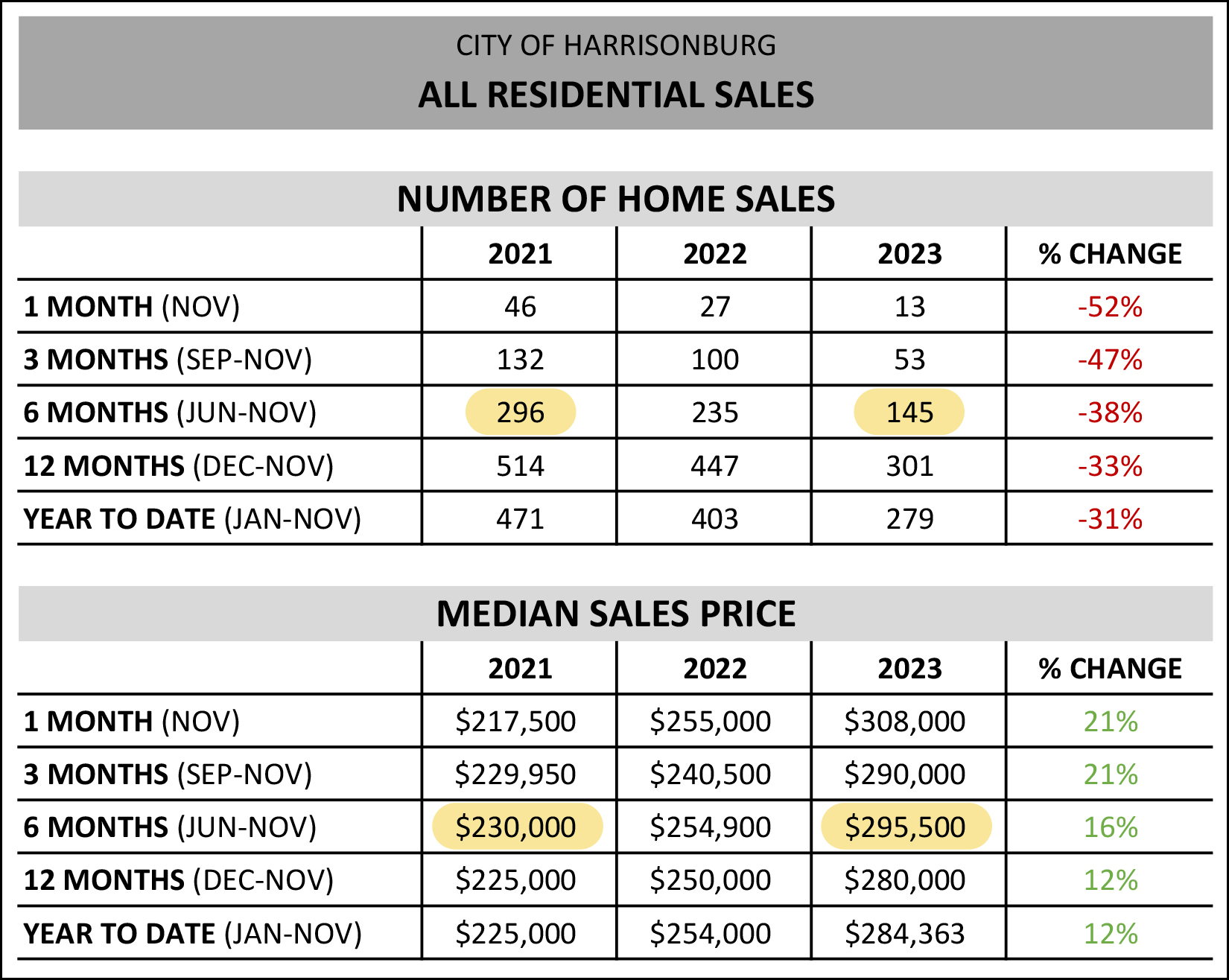

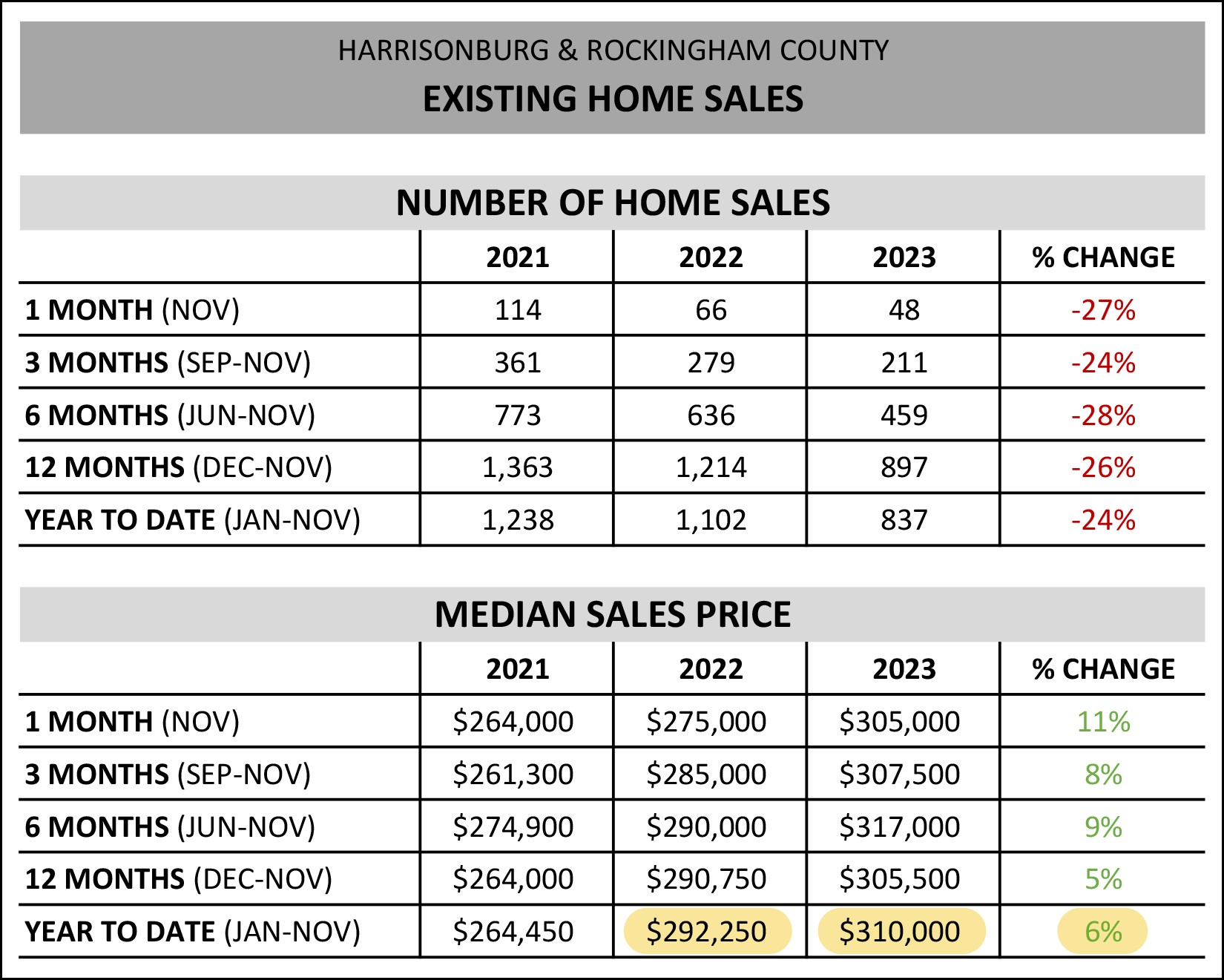

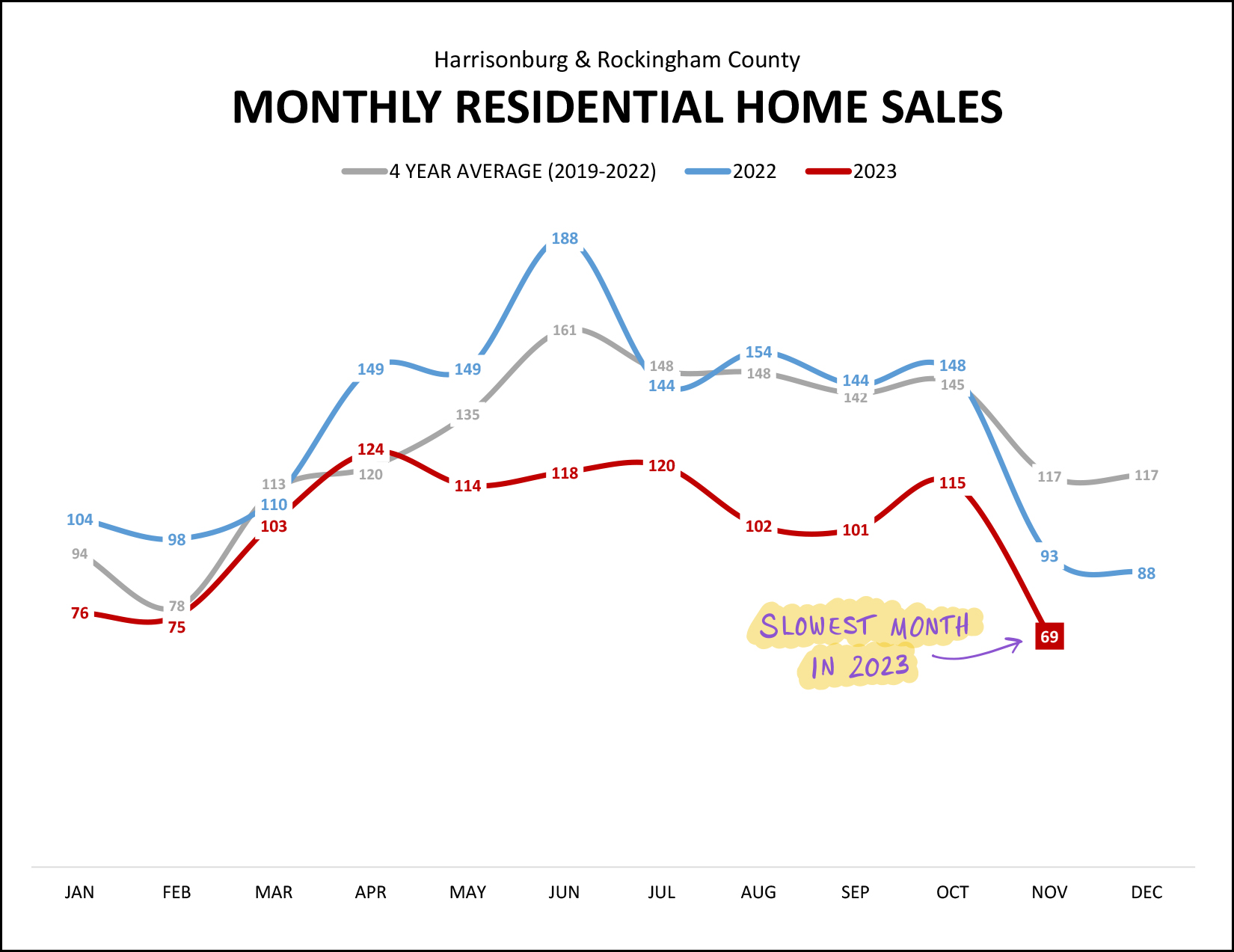

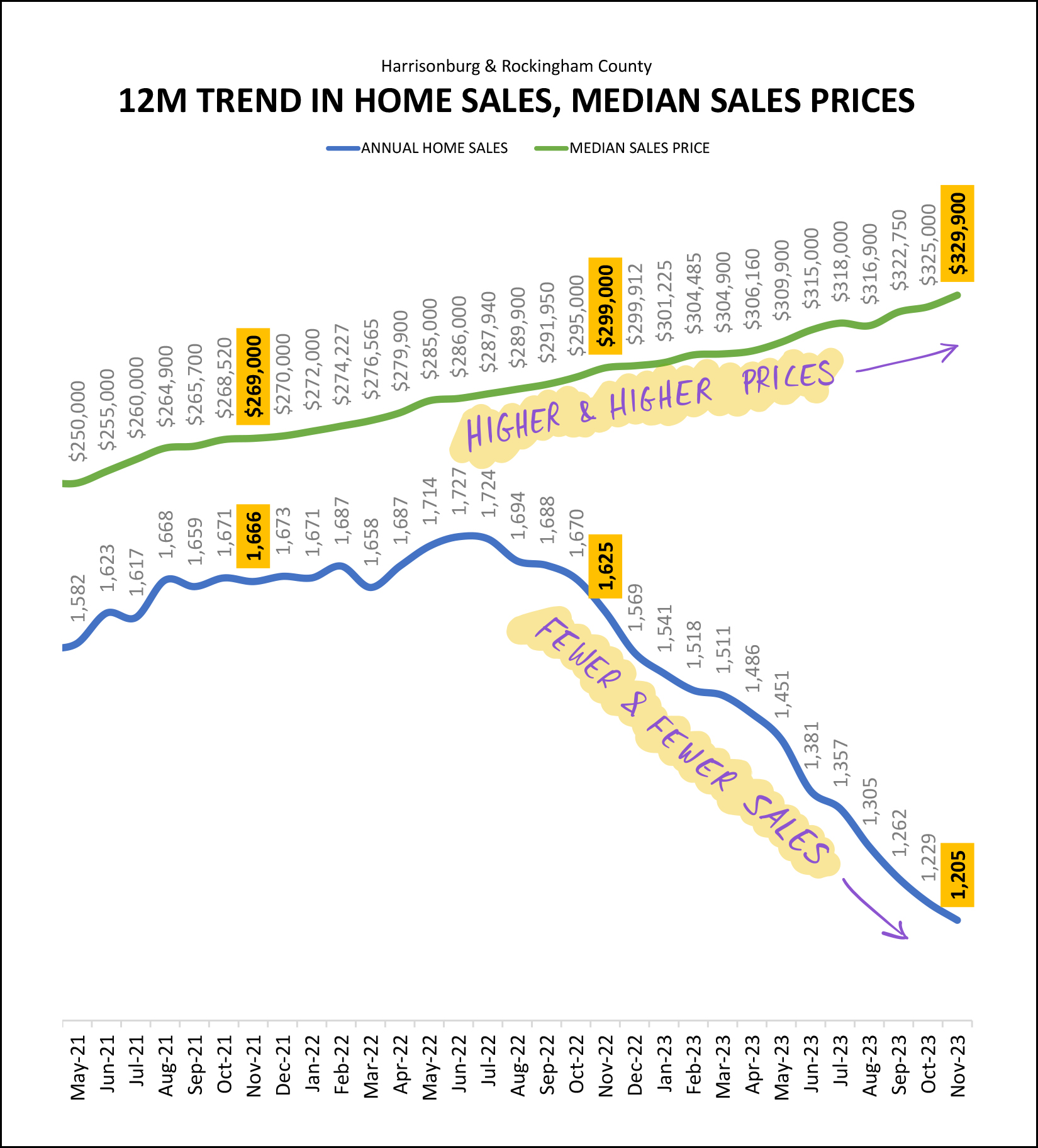

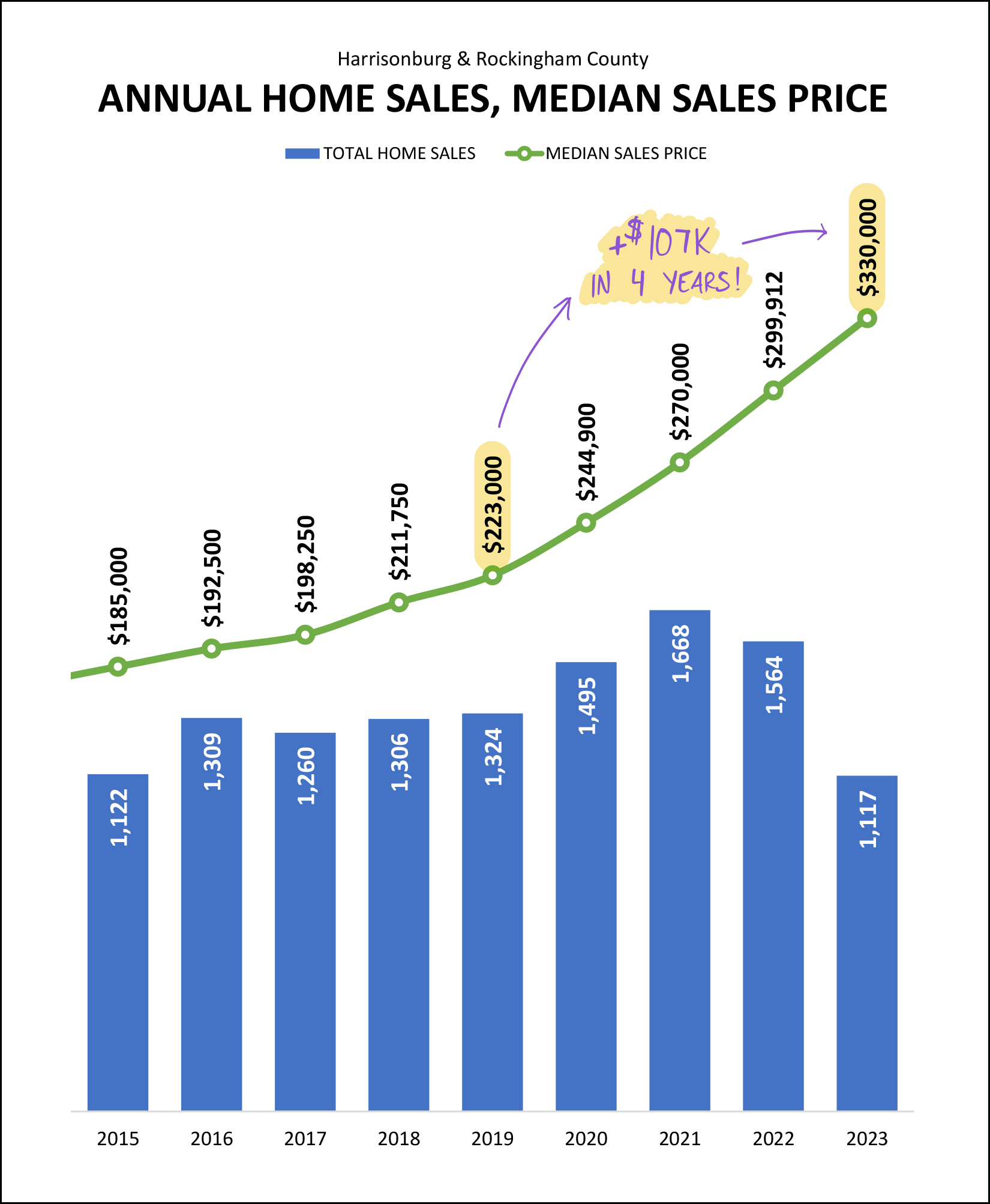

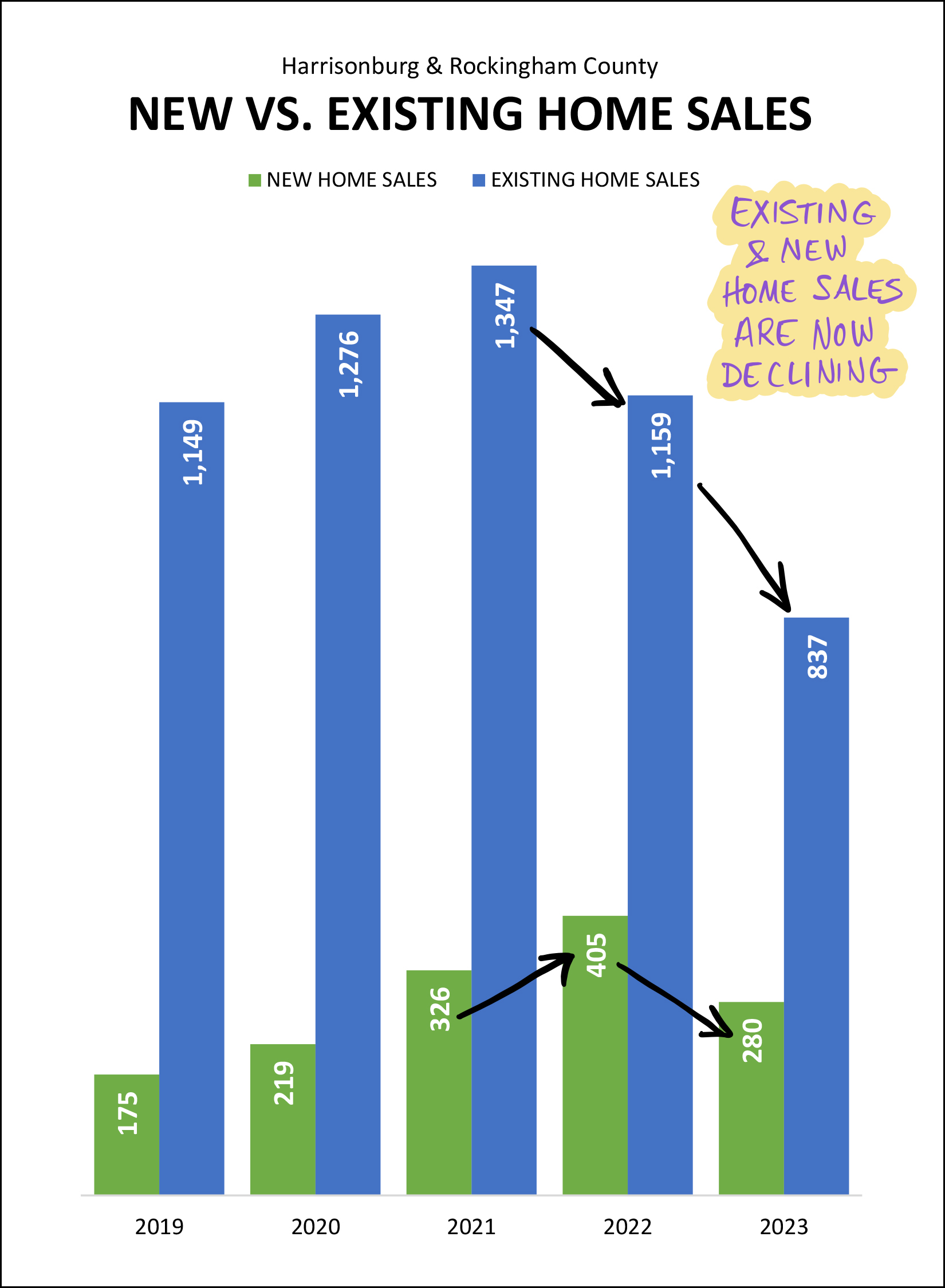

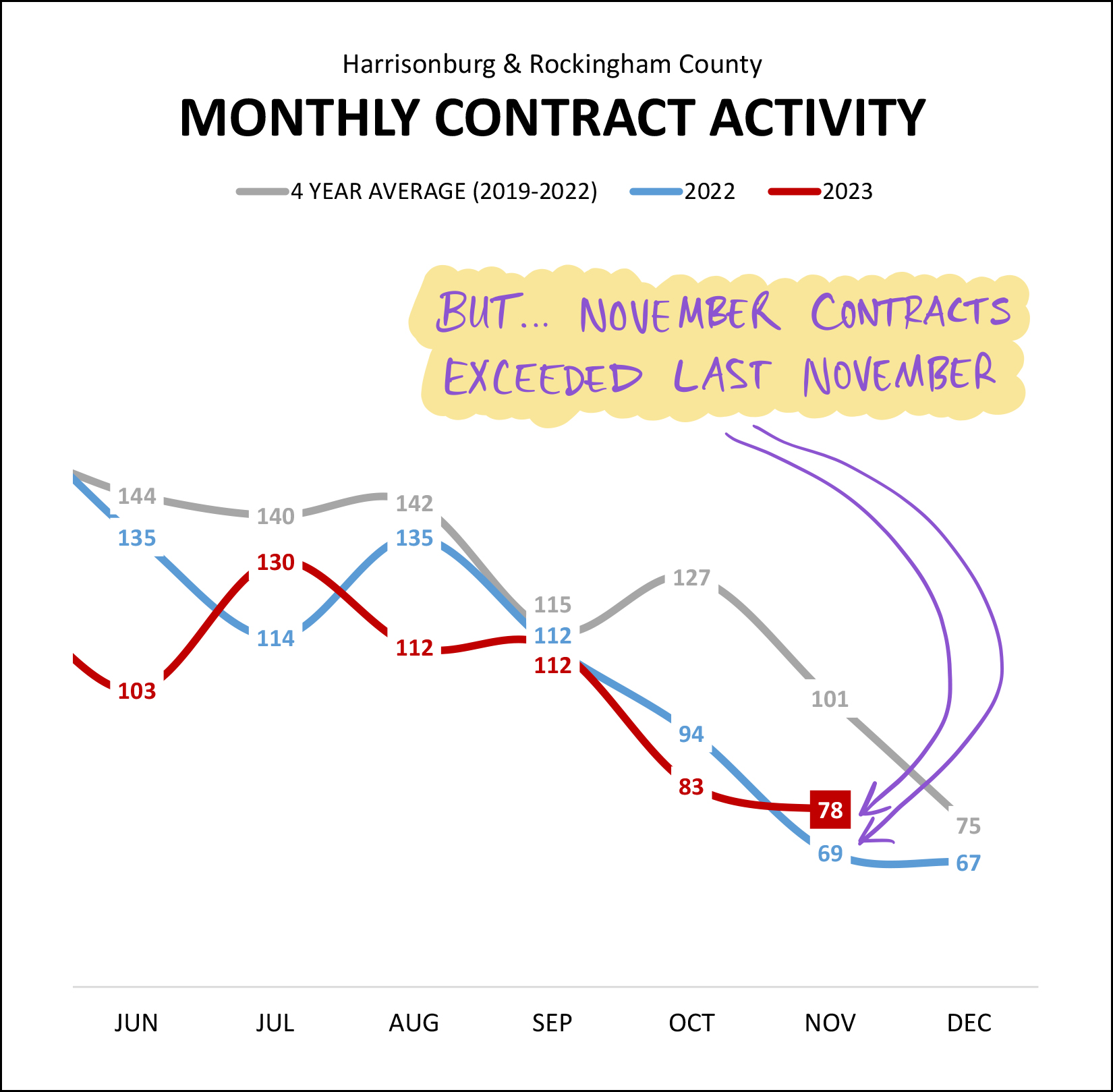

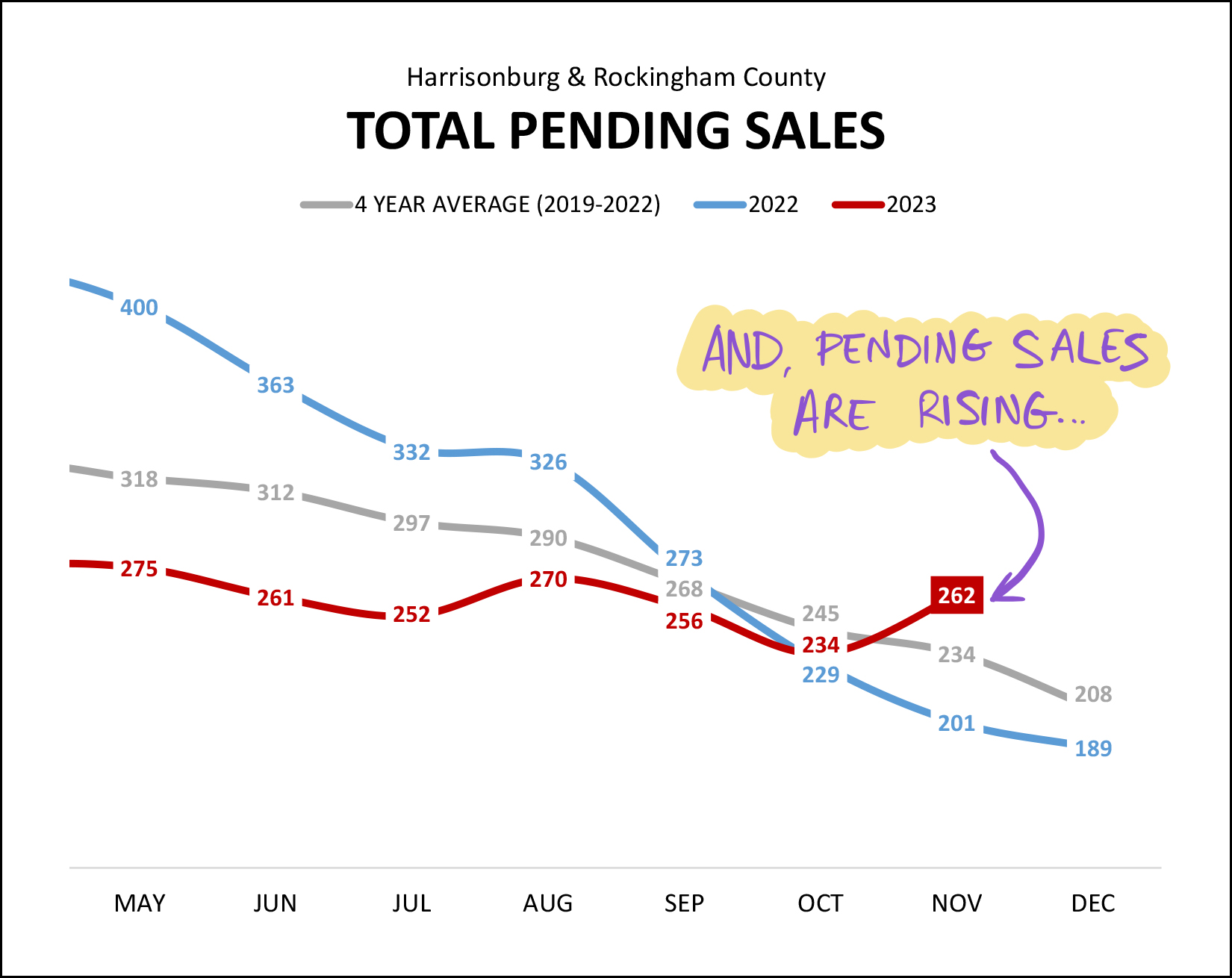

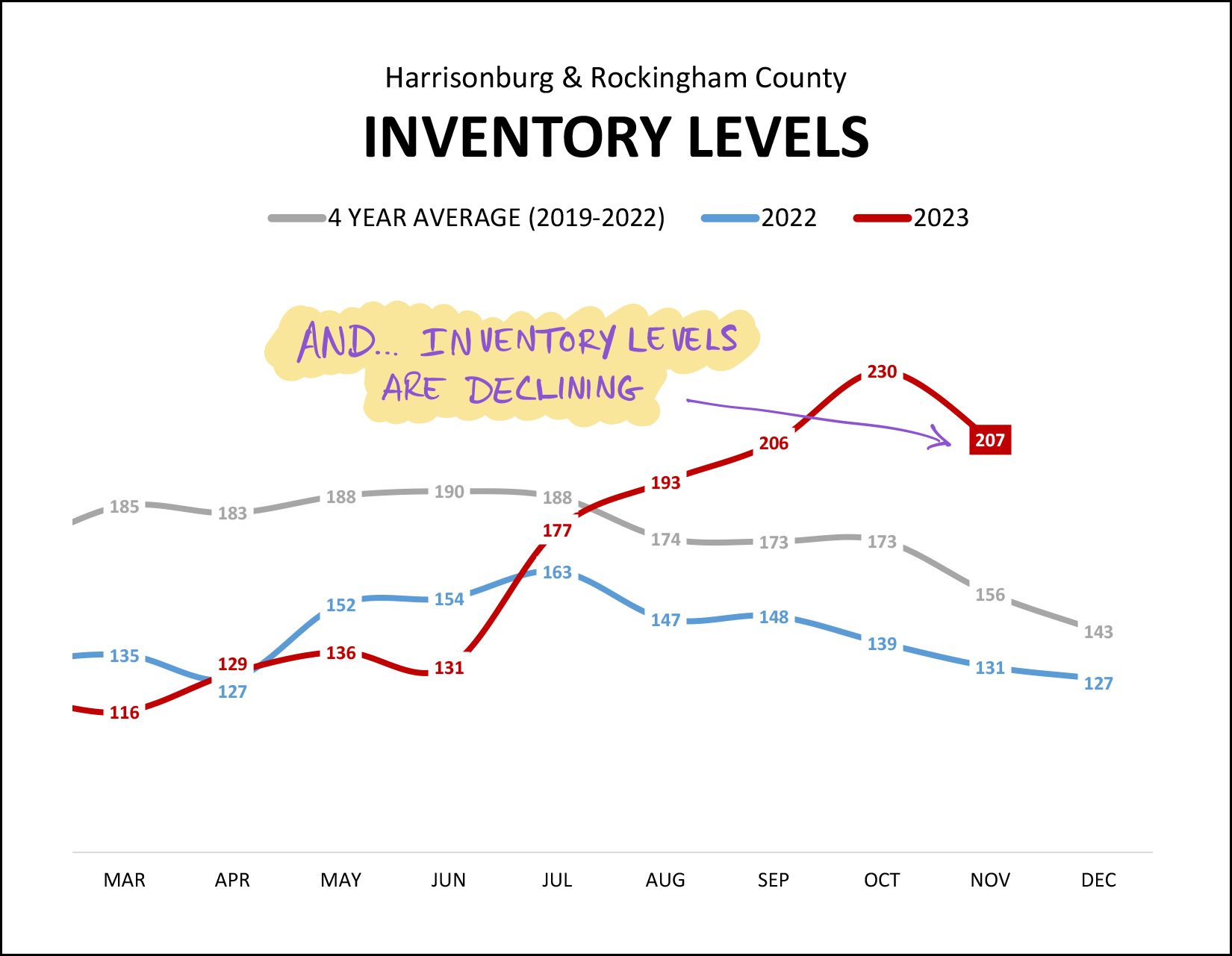

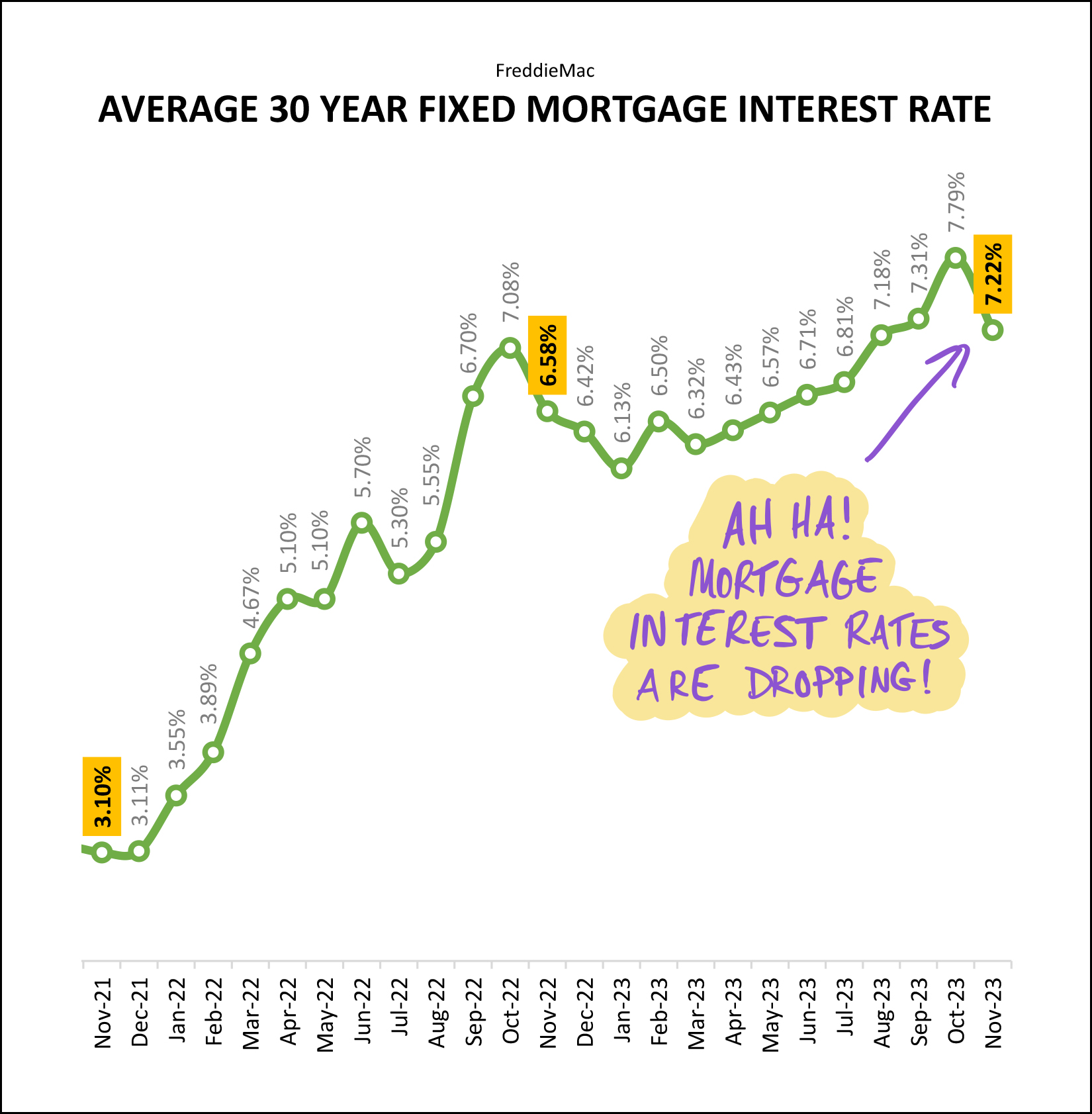

Happy Friday afternoon, Friends! I hope that your week has gone well and that you are looking forward to the next few weeks - presumably with some holiday celebrations, rest, relaxation and time with family and friends! Whether you are staying here or traveling afar, I hope it is a fulfilling and meaningful time for you and that you are able to spend some time with your loved ones! Before I dive into the housing data, I'd like to invite you to join me at a fun concert in January. The Steel Wheels are putting on an album release show with special guest Lindsay Lou on Saturday, January 20th at 7:00 PM in JMU's Wilson Hall. You can buy tickets online from JMU here, or... click here to enter to win the pair of free tickets I'm giving away! Regardless of whether you win the pair of free tickets, or buy your own tickets, I hope to see you in Wilson Hall in January to hear The Steel Wheels and Lindsay Lou! And now, on to the housing data and trends in our local market, starting with a few key indicators for our overall market...  A few observations related to the data above... [1] Looking just at November sales data, we see a striking year over decline from 2021 through 2022 to 2023 when examining the number of homes that are selling each November. Two years ago there were 138 November home sales... last year only 93... and this year just 69 home sales in November. While it's only one month of sales data, that is a 50% decline over the past two years. It was a particularly slow November. :-) [2] When looking at the first eleven months of the year (the year is almost over!?) we see that there have been 25% fewer home sales this year (1,117 in 2023) as compared to last year (1,482 in 2022) in Harrisonburg and Rockingham County. It was markedly slower year this year than last. [3] Despite fewer home sales taking place this year, home prices keep on rising. The median sales price of all homes sold in the first eleven months of last year was $299,900... and this year it was 10% higher at $330,000. So, fewer home sales, but higher prices. Next up, one particular segment of our local market that has seen a particularly striking change... the City of Harrisonburg...  I suppose I should have highlighted one other bit of data on data table above -- the first row. Pretend it is highlighted too... [1] With only 13 home sales in the City of Harrisonburg this November, we have seen a 52% decline compared to last year and a 72% decline as compared to two Novembers ago. Again, this is just one month, but still. If you want to buy a home in the City of Harrisonburg, it has been a tough time to try to do so. Very few homes are selling in the City. [2] A few lines down in the data table you'll see I have highlighted the data for the past six months. Over the past six months of this year we have seen 145 home sales in the City... compared to 296 in the same six months two years ago. Again, a rather striking decline... of 52% over two years. As I alluded to above, this is mainly a supply issue... there aren't enough sellers willing to sell this year to allow the same number of City home sales to take place. [3] In that same two year period I have referenced above, the median sales price of a home sold in the City has increased from $230,000 to $295,500! That is a 28% increase in the price of homes selling in the City... over a span of just two years. Now, let's look at existing home sales only (excluding new home sales) to contextualize the 10% increase in home sales prices in the overall market that I referenced earlier...  All the way at the bottom of the data table above you'll note that when we look at the median sales price of existing homes only, it has risen by only 6% over the past year, not 10%. What does this mean? [1] The value of existing homes has not necessarily risen 10% over the past year in Harrisonburg and Rockingham County as was suggested when looking at the entire market of existing and new home sales. Existing homes (resale homes) prices have only actually increased by 6% over the past year. [2] The increases in new home sales prices over the past year, and the number of new versus existing home sales, have combined to drive the overall median sales price of all homes (new and existing) up 10% over the past year. Let's simplify things... for all you homeowners out there... [1] Don't assume that your home has increased in value by 10% over the past year, because the existing home median sales price has only increased by 6% over the past year. [2] Don't assume that your home has increased in value by 6% over the past year. It might have. Or, that increase might be somewhat larger, or somewhat smaller. The change in the median sales price is a general indicator of changes in the overall market, not a specific indicator that each and every home in a market area has shared that same change in value. Now, let's reflect on a moment on what a slooooooowwww November it was as far as the number of homes selling in Harrisonburg and Rockingham County...  There were fewer home sales in Harrisonburg and Rockingham County in November 2023 than in any other month in 2023... and fewer than in any month in 2022... and fewer than in any month in 2021. But, keep on reading for some signs that perhaps we are seeing a slight reversal of this slow down. First, here's that downward ski slope (blue) of the number of homes are selling in a year's time in Harrisonburg and Rockingham County...  The annual pace of home sales in the City + County has now declined to 1,205 home sales... which is the slowest annual rate of home sales in over five years! But yet, as we have seen for quite some time now... fewer home sales is not causing home prices to also start declining... in fact, the further home sales have declined, the higher sales prices have increased! These two trends are an indicator that while there are certainly fewer buyers buying, it is likely at least partly a result of fewer sellers being willing to sell. If we were seeing a decline in buyer interest and we were seeing the same number of sellers wanting to sell, then we could more reasonably think home prices might start to decline -- but that's not where we are right now in the local housing market. Let's say you sold your house in 2019 and left town and decided to move back just four years later in 2023. Oof. Here's what you'd find...  When you (the imaginary you) left town in 2019 the median sales price of homes in Harrisonburg and Rockingham County was only $223,000. Now... just four years later, that median sales price has shot upwards to $330,000. That is a $107K increase in just four years. This is yet another view into some tricky timing aspects of when folks bought or didn't buy a home in this area... [1] If you bought your home in 2020 or prior, and still own it, you're in great shape. You likely paid much less for your home than it is worth now and you likely have a very low mortgage interest rate. [2] If you bought your home in 2021 or 2022, you're likely still in great shape as to how much your home value has increased, and you might have a great mortgage interest rate or not quite as great. [3] If you didn't buy a home and are working on buying one now, you are buying at the highest prices we have seen lately (until 2024 prices) and at higher mortgage interest rates than we've seen in over a decade. If you are thinking about buying a home right now, does #3 above make you want to pause and think twice before buying? If you don't buy in 2023 (yes, I know there are only 16 days left) you'll likely be paying an ever higher price in 2024 or 2025. This is not to say that everyone should buy a home right away, but many buyers who have been waiting to buy for the past few years because prices were increasing (and they hoped they would decline) likely wish they had gone ahead and bought last year, earlier this year, etc. One of the other metrics I follow is how many new versus existing homes are selling, and we have seen a bit of a shift in this break down in 2023...  Last year, in 2022, we saw a decline in existing home sales compared to 2021... but new home sales kept on rising. Not so in 2023. When comparing this year (2023) to last year (2022) we see that existing home sales have declined... and new home sales have declined as well. We have also seen *the highest* mortgage interest rates in many (many!) years in 2023, which is likely a major contributor to this slow down in both existing and new home sales. But... what follows are a few slight changes in direction in our local market as of the past month...  Monthly contract activity in 2023 (red line above) has been below 2022 (blue line) more often than not over the past six months, but in November... contract activity rose above where it was last November. Hmmm... why could that be... I wonder if mortgage interest rates started to decline from their 20+ year peak? And how about the number of homes that are under contract in total...  As shown above, we saw a big jump in the number of pending (under contract) homes through the month of November. There are 262 homes under contract right now, compared to only 201 a year ago. This is a significant improvement from last month when we were even with the prior year, and an even more significant improvement from the prior six (plus) months when pending home sales were lagging significantly behind last year. Hmmm... why could that be... I wonder if mortgage interest rates started to decline from their 20+ year peak? Next up (before we get to mortgage interest rates) let's look at inventory levels...  After four months of big increases in inventory levels in Harrisonburg and Rockingham County -- from 131 homes for sale up to 230 homes for sale -- we have now seen inventory levels start to decline again. Perhaps this is a result of more contract activity (causing inventory levels to drop as homes go under contract) or perhaps it is fewer sellers putting their home on the market during the holidays -- but regardless, November showed at least a temporary reversal in the trend of increasing inventory levels. Now, then, how about those mortgage interest rates...  Indeed, mortgage interest rates are dropping. At this point it seems rates peaked at 7.79% at the end of October. Since that time, as shown, they dropped to 7.22%. Since the end of November, not shown, they have dropped even further... to 6.95%. Certainly, the three years or so when rates stayed below 4% were *not* normal times... and rates below 4% were *not* normal -- but it's been tough for many would be home buyers to afford a home (or to rationalize paying the requisite mortgage payment) over the past year with mortgage interest rates above 6%, and for quite a few months over 7%. The pace of sales slowed the most in Harrisonburg and Rockingham County over the past few months with mortgage interest rates over 7%. The news that they have now broken back down through that barrier to six-point-something is welcome news for home buyers as we head towards 2024. I'll wrap things up there for now, though if you want even more charts and graphs you can review them all here. At this point in our local housing market, we're mostly looking ahead towards 2024, so here are a few thoughts for a variety of positions you might find yourself in... If your home is on the market now but not under contract... You may very well find renewed interest from buyers after the first of the year, especially with slightly lower mortgage interest rates -- but you should make sure your home is priced appropriately. If a price reduction is in order, it might make sense to wait until just after January 1 to make that change since there will be less buyer activity than normal over the next few weeks. If you plan to sell your home in 2024... Let's chat sooner rather than later about pricing, preparation and timing. It's not enough any longer to simply whisper "I'm selling" out your front door to bring on the throngs of eager buyers with 3% mortgage interest rates. We'll want to make sure to price your home appropriately, prepare it well to show best to buyers and market it thoroughly from day one but knowing that the marketing may need to continue on for a few weeks or more. If you plan to buy a home in 2024... It seems very likely that you'll be financing your purchase with a lower mortgage interest rate than would have been available to you over the past few months, which is good news. That said, with home prices continuing to climb, your projected monthly payment might still be higher than you prefer. It's important to talk to a lender early in the process to understand how much you could spend and to consider how much you want to spend on your next home. If you own a home and don't plan to sell it anytime soon... Enjoy your likely increasing home value and your likely low mortgage interest rate. It's been a great few years to own a home... a much better than average, much better than normal, few years! And for any and all of you... if I can be of help to you related to real estate, or otherwise, don't hesitate to reach out. You can contact me most easily at 540-578-0102 (call/text) or by email here. I hope you and your family have a wonderful holiday season and I look forward to connecting with you in 2024! | |

47 Home Sellers Reduced Their List Price In The Past 30 Days And 15 Of Those Listings Are Now Under Contract |

|

One indication that our local housing market isn't quite as overheated as it used to be is that we are starting to see sellers making price adjustments. For a few years there, nearly every home listed for sale went under contract in a matter of days, often with multiple offers and escalation clauses. Now, many (most) listings are still going under contract quickly -- but plenty of sellers are finding themselves needing to make a price adjustment to generate enough buyer interest to have an offer to consider. As a snapshot of those price reductions and their impact... Over the past 30 days... we have seen price changes on 47 homes in Harrisonburg and Rockingham County... and 15 of the homes are now under contract. If your home is listed for sale and 30 (or more) days have passed without an offer, you may also be considering adjusting the price... and that new price may attract enough additional buyer interest to generate an offer for you to consider. | |

Home Buying Activity Will Slow But Not Stop Over The Winter |

|

Generally speaking, folks don't use their outdoor hose spigots in the winter. I suppose you might use it from time to time, but it's just not as fun to wash your car in the driveway on most December days. Oh, and if you did use your hose spigot, and left the hose attached, you'd potentially have serious problems when the water in the hose freezes, backs up into the spigot, maybe into the pipe, and something splits, cracks or bursts. As such... Once we get into Winter, most folks are turning off their hose spigots for the last time until Spring. But... Not so with the local housing marketing. Looking back over the past five years... Between March and August (Spring and Summer, as we'll call it) an average of 140 buyers signed contracts to buy houses each month. A pretty rapid pace of buyer activity. So, this winter, what should we expect? Will that supply of buyers be turned off like a hose spigot, and will the buyers slowly drip out at a rate of (for example) 10 - 15 buyers per month? Nope! Looking at last Winter (December, January, February) there were an average of... 95 buyers signing contracts per month! Yes, you read that correctly, we only saw a 32% decline in buyer activity during the Winter months -- as compared to the Spring and Summer months. So, unlike your hose spigot, which will likely be barely used during the Winter -- the local housing market doesn't slow down, or cool down, or shut down, nearly as much. | |

Demand Is Likely To Keep On Rising For Contractors And Home Renovators |

|

We seem likely to see a continued increase in demand for contractors and home renovators in Harrisonburg and Rockingham County in 2024. If you're thinking about getting into the home renovation and repair business -- this might be your time! There are two main factors that seem to be creating this increased demand for home renovation professionals... 1. Higher mortgage interest rates are causing plenty of homeowners to decide to stay and upgrade rather than sell and buy. If you bought a home a few years ago and have a 3.5% mortgage interest rate, you aren't likely to sell your home and buy a new one with a 7% mortgage interest rate just to get that one extra room, or nicer interior finishes, or larger back deck. You're much more likely to stay in your very nice home -- with a very, very nice mortgage interest rate -- and hire a home renovation professional to help you add a deck, finish a room in the basement, update your interior paint or flooring, and on and on. 2. The several year period of having multiple offers on every new listing within days (or hours) seems to have drawn to a close. During those years, home sellers often didn't need to make many updates to the condition of their home before selling it. Now, with the possibility that your home won't go under contract within five minutes, many sellers are evaluating whether to have some repairs or upgrades completed prior to listing their homes for sale. So... 1. If you're in the home renovation business - you'll likely be busy over the next year or two - or more. 2. If you're a homeowner who is staying - or selling - you might have a slightly longer wait for someone to help you with your home updates. | |

Sometimes Upgrade Your Home (Selling And Buying) Results In An Even Larger Upgrade In Your Monthly Payment |

|

"Our house isn't working well for us anymore. We are thinking of selling it and buying a new house." Sounds good, but let's look at a few basic numbers first... You bought for $190K, put $20K down and have a mortgage payment of $955 per month thanks to a refinance a few years back at 3.5%. Your house is now worth $275K and you are thinking of selling it to move up to a house priced at $375K. When you sell your $275K house, you'll end up with about $90K in your pocket after closing costs and paying off the $170K balance on your mortgage. You'll spend about $10K of that $90K on closing costs for your purchase, so you'll put down $80K as a downpayment. You'll be borrowing $295K ($375K - $80K) and you'll be financing it at a current mortgage rate of about 7.25%. Your new monthly payment will be $2,392. Wait... what!? You're moving from a $275K house to a $375K house and your monthly mortgage payment is going to increase from $955/month to $2,392/month. Yikes! Why is this happening? [1] Your current mortgage payment is based on your initial purchase price of $190K... which is a good bit lower than your home's current value of $275K. [2] Your current mortgage payment is based on on a mortgage interest rate of 3.5%... which is a good bit lower than the current rate of 7.25%. [3] The costs of selling and cost of buying reduce the amount of equity that you can roll from one home into the next. So... before you dive right into upgrading your $275K house (with a $955/month payment) to a $375K house... let's run your version of the numbers above to help you determine your new potential monthly payment. | |

Despite Fewer And Fewer Home Sales, There Are Plenty Of Reasons Why Buyers Will Still Buy And Sellers Will Still Sell |

|

January 1, 2022 through November 20, 2022 = 1,445 home sales January 1, 2023 through November 20, 2023 = 1,082 home sales As of this week we have seen 25% fewer home sales this year than last! With fewer and fewer homes selling, sometimes it might feel like there aren't that many homes selling in our area. But yet, there are still plenty of reasons why buyers are still buying and sellers are still selling. Sellers are selling because:

Buyers are still buying because:

We are likely to close out 2023 with 25% fewer home sales than in 2022 -- and at this point it seems likely that we'll see even fewer in 2024 -- but there will always be some buyers buying and some sellers selling, even if not in as great of numbers as we have seen over the past few years. | |

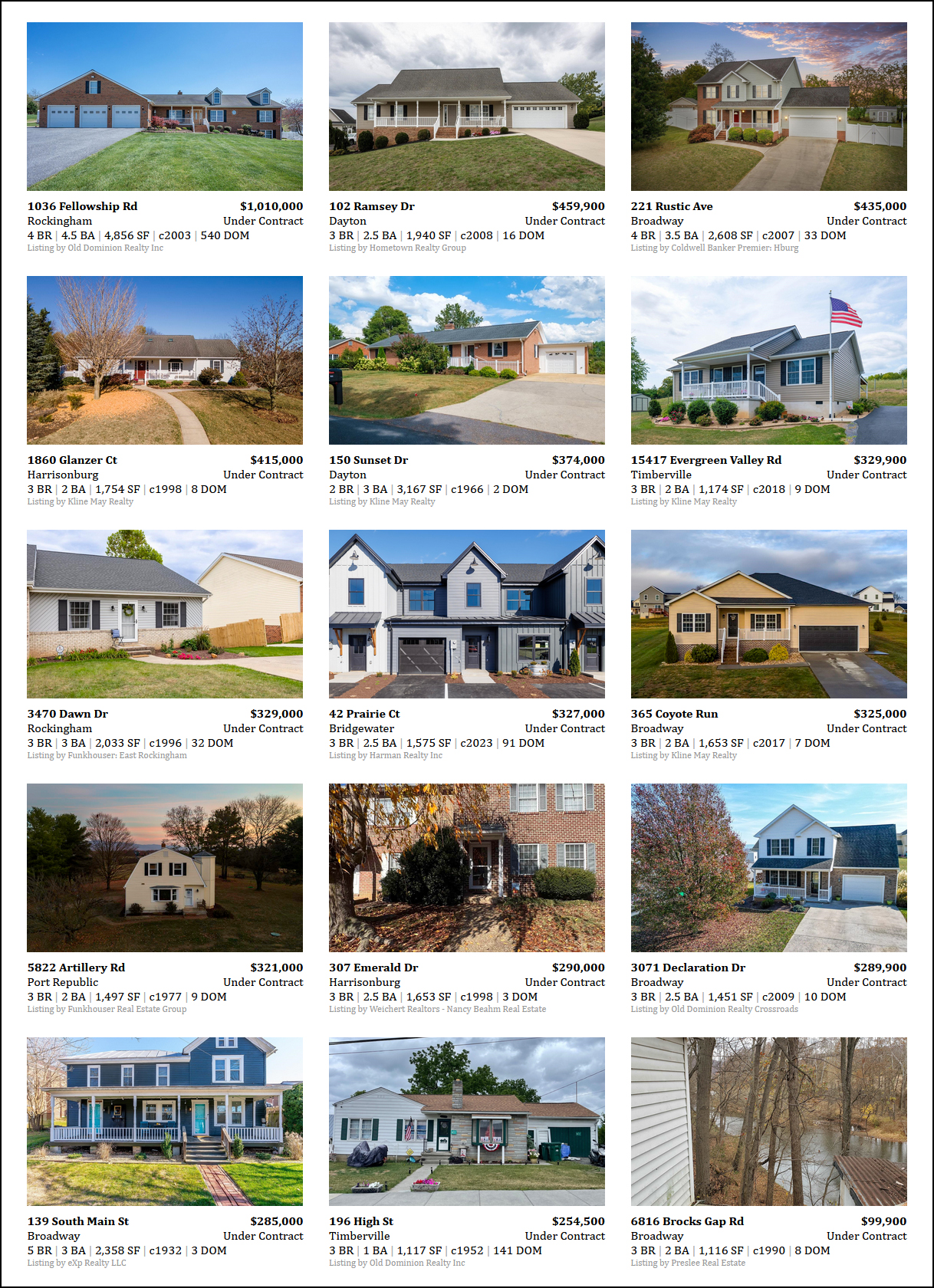

Home Buyers Signed Contracts On These 15 Homes Over The Past 7 Days |

|

Over the past week (15) home buyers in Harrisonburg and Rockingham County signed contracts to purchase (15) homes. A few observations...

What do you notice about these (15) homes that went under contract in the past week? What will go under contract over the next seven days? | |

Collecting, Organizing And Studying Showing Feedback Is Important, Again |

|

For most of 2020, 2021 and 2022, nearly every listing went under contract quickly - often with multiple offers. During that time, feedback on showings was collected, but it was mainly a question of... "Will your clients be making an offer? We have three so far." Now, with 65% of active listings of existing homes having been on the market for more than 30 days, it is important (again) to collect, organize and study showing feedback. And as we start collecting that showing feedback, sometimes we start wondering whether all showing feedback is really actually about price... My house is needs many cosmetic updates, but all of the potential buyers (who did not make an offer on my house) didn't provide feedback about price, they provided feedback about the need for cosmetic updates. My house is next to the railroad tracks, but all of the potential buyers (who did not make an offer on my house) didn't provided feedback about price, they provided feedback about the railroad tracks. My house has a steep driveway, but all of the potential buyers (who did not make an offer on my house) didn't provided feedback about price, they provided feedback about the steep driveway. Guess what --- unless you're going to flatten the driveway, move the railroad tracks (or the house), or make all of the cosmetic updates -- it really probably is an issue of price! If you're getting consistent feedback about your house that is unrelated to price, in almost all cases, you need to adjust the price to accommodate for that specific issue. If the price is lower then buyers might actually buy despite the specific issue that they were complaining about. | |

If Your Home Will Need Improvements Costing X After Closing, Consider Adjusting Your List Price By 1.5X |

|

Let's say your three neighbors just sold their homes for $400K... ...but when comparing your home to the homes sold by your neighbors... Your house needs $10K of painting - or your house needs $16K of new flooring - or your house needs a $22K new roof. When pricing your home, you shouldn't just subtract the price of that improvement from your neighbor's list price to arrive at... A list price of $390K - or $384K - or $378K. You likely need to subtract 1.5 times the cost of the improvement when pricing your home. Would be home buyers will likely round up somewhat in their mind when estimating the cost of making the improvement -- AND -- it will be much more of a pain for them to make the improvement after closing as compared to you have already completed it before selling your home. As such, it will likely be more realistic to consider a list price of $385K - or $376K - or $367K. | |

If Your Home Has Been For Sale For More Than 30 Days, You Are Not Alone |

|

The numbers above might surprise you given that the median days on the market in 2023 is a mere six days. But that median of six days on the market is related to homes that have actually sold. We get a slightly different story when looking at currently available listings When considering active listings of resale homes (not new homes) we find that... 35% of active listings have been on the market for less than 30 days 65% of active listings have been on the market for more than 30 days So, if you are selling a home and it has not gone under contract within six days, or within 30 days, you are not alone. 65% of sellers with homes on the market for sale have had their homes on the market for more than 30 days. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings