Transparency

An eternal optimist? Who? Me? Couldn't be! :) |

|

I have been accused as being an eternal optimist. :) I can understand the observation, as after all, when median prices dropped 4% last month I made sure that you knew that sales (quantity) increased by 44%. Here's how I'll spin it -- I am particularly talented at finding the smallest of silver linings in any rain cloud, regardless of the enormity of said rain cloud. :) All kidding aside, I try to present things in a relatively balanced way -- helping you to see the hope you should have based on positive market indicators, but also helping you to see the reservations you should have given negative trends. Where do I see the market today and moving forward?

| |

Are Realtors Too Optimistic? |

|

I have been cautiously optimistic about the real estate market improving for almost four years now. Each year, instead of improving, the market declined. So -- would you like to know what I am predicting for the upcoming year in the Harrisonburg and Rockingham County real estate market? I am cautiously optimistic that things will start to improve. Hmmmm........ Now, of course hindsight is always 20/20, but check out my comments back in January 2008 (a bit over 3 years ago): Preparing for the 2008 Real Estate Market "As 2007 progressed, sales increased, and inventory levels decreased. In most price ranges, there is still somewhat of an oversupply of housing – but this will likely continue to correct itself in 2008. As we move through the first quarter of 2008, expect to see a continued gradual increase in the number of sales, and a continued gradual decrease in the inventory of available homes. The continuation of both of these trends will restore a healthy balance between buyers and sellers in our market." Was a healthy balance in the market restored in 2008? No. Things became worse. And then worse yet in 2009. And then worse yet in 2010. So where IS the real estate market headed in 2011? I believe the market will start to incrementally improve this year --- but again, I have thought that for years now, without my beliefs being born out in market realities. And yet as I look to the future and provide projections and predictions to my clients I try to strike a balance between totally unrealistic optimism and totally depressing pessimism. Let me know sometime whether you think I'm striking an appropriate balance: scott@HarrisonburgHousingToday.com | |

We won't know it's a dead end until we get there. |

|

In the past two weeks, two of my clients have apologized for taking up my time in pursuing properties that each ended up being a dead end. While I appreciated the sentiment, and I value my time, I was quick to point out that researching those possible paths was the only way to discover that they were indeed dead ends. Whether a large purchase, or a small purchase, when you are buying a home (or a building lot) it is a big decision -- financially and otherwise. Oftentimes, figuring out which house (or building lot) you want to buy requires lots of research and exploration of properties that you do not end up pursuing. It's OK! I'm happy to patiently help you explore the different options -- that's what I'm here for. Furthermore, I would much rather we spend a little bit "too much" time researching in order to make sure you are making the best possible decision than spend too little time and leave you with second thoughts after the fact. So, if you are preparing to buy a home, get ready for plenty of delightful exploration of possible properties that will only end up to be dead ends. Again it's OK --- that's the only way we'll find the perfect property for you. | |

Is Homeownership For Everyone? |

|

Several decades ago (and earlier) home buyers would wait to purchase a home until they had at least 20% of the purchase price saved up in their bank account, and they would only buy if they were going to stay in the same home and town for many years. At the time, the percentage of homes that were owner-occupied hovered between 40% and 50% (U.S. Census Bureau). Just a few short years ago, home buyers were buying with no down payment at all (or less), even if they planned to stay in the house for only a year or two. This led to an ever increasing homeownership rate, which peaked at 69.2% of families owning their home in the early 2000's (U.S. Census Bureau). Why the sudden change of pace? And what is a buyer to do today? Many of today's first time buyers are still buying with a very small down payment, and that can be o.k. Many loan programs are available with a small down payment, such as the FHA loan program which only requires a 3.5% down payment. The risk here is that a buyer doesn't have too much built-in equity in case they need to sell sooner than they think. Purchasing a $100,000 house with a 96.5% FHA loan results in a $96,500 loan, which has only been paid down to $95,000 one year later. With such a small down payment, it can be difficult to re-sell the home in a short time frame without bringing cash to closing. As becomes evident, the down payment and the length of ownership are quite intertwined. As shown above, a small down payment with a small length of ownership can be financially difficult. A small down payment with a longer length of ownership can work just fine. Conversely, a larger down payment provides security and makes even a small length of ownership feasible. What may become clear here is that homeownership is not for everyone. Even if you're making great money when you move to Harrisonburg for a new job, if there is a strong chance you'll be leaving again in 12 months, it may not make sense to buy right away. But for those with good credit, a down payment of some sort, and a solid job that will keep you employed and in the area for the next 3, 4, 5, 6, 7 years – homeownership may be a very exciting option for you right now. With low interest rates, lots of homes on the market, and many sellers ready to negotiate, this can be a most opportune time to act. Owning a home is a passive savings account of sorts, with money accruing as you pay down the principal of your mortgage each month. Owning a home also gives you the ability to establish yourself and potentially your family in a neighborhood that may be your home for years to come. Finally, owning your home gives you the ability to invest time, energy and money into your home that will provide a future resale benefit to you – as opposed to when you paint, re-model or otherwise improve a property that you are leasing. Now being excited about buying and thus owning a home, you might look around and realize that the local real estate market isn't booming right now. Median prices have dropped a few percentages per year for the last few years. Is the local market poised for a recovery? It seems that it might be, with sales volume possibly leveling off in 2011, but no one knows for sure. Is it wise to invest in real estate when the market, and prices are down? Many think that it is wise, given that you can fix your housing costs when prices are potentially the lowest that they'll ever be, and when interest rates are potentially the lowest that they'll ever be. In many ways, your housing costs compared to what you are buying couldn't be much lower than they are right now. Buying a home isn't for everyone, but excellent housing opportunities abound for those who plan to make the Central Shenandoah Valley their home for the years to come. | |

The Value Of Your House Will Only Increase, Always, Forever, For Sure |

|

Here's an interesting report from NPR telling the story of an employee of Freddie Mac who manages an online calculator that has (intentionally or unintentionally) been telling web users that home values will only go up! Read more from NPR: Housing Guy Apologizes For Housing Bubble It is interesting --- I do wish home values would only go up --- and during most years values do increase. The last few years, however, have not held that promised increase. That said, it depends on the time horizon that you consider. First, the year to year bad news -- home values decreased for 4 out of the past 10 years. That is to say that the first six years of the decade showed an increase ('01, '02, '03, '04, '05, '06) but the most recent four years have shown a decrease ('07, '08, '09, '10). But here's an interesting cumulative look at the value of a $200,000 home purchased in 2000:

| |

Harrisonburg / Rockingham MLS Changes Days On Market Accounting Practices |

|

Here's how it started, or so they tell me.... In some other city or town in Virginia, a relocating buyer swept into town looking to buy a house. He found a great house, discovered that it had only been on the market for a few weeks, and made a offer on the house relatively close to asking price given the short length of time on the market. After moving in, he was talking to a neighbor, and commented on how glad he was that he was able to secure the house even though it was such a new listing. The neighbor laughed, saying "What are you talking about? They had been trying to sell that house for three years!" How was it possible there? Was it happening here? The buyer's confusion, it seems, was based on the "Days on Market' field in the local MLS. The information that the buyer reviewed showed a very low number for "Days on Market" and he understood that to mean (as most people would) that it was a very recent listing. But in that area (and yes, in Harrisonburg and Rockingham County -- until recently) this "Days on Market' field could be conveniently reset by re-listing a property with a new company. Indeed, even around here, if a seller became worried about buyers' perceptions of an ever increasing "Days of Market' value, that seller could list their home with a new real estate company, and start over at ZERO! But now, things have changed around here.... Our local association of Realtors (HRAR) MLS changed in the past two weeks, introducing a new "Cumulative Days on Market" field. This field will now track the total length of time that a property has been on the market, even if it is listed by multiple companies. Thus, if Brokerage A has a property listed for 300 days, and after the listing agreement expires, the property owner hires Brokerage B, the "Days on Market" slate will no longer be wiped completely clean. "Days on Market" will indeed return to ZERO, showing the length of time on the market with the new listing broker, but "Cumulative Days on Market" will continue to increase, to 301, 302, etc. Does "Cumulative Days on Market" EVER reset?? If a property has been off the market (not listed) for 120 days (4 months), then both the "Days on Market" and "Cumulative Days on Market" will reset to ZERO when the property is re-listed. How does this affect buyers, or sellers? As a buyer, it will now be easier than ever for your Realtor to quickly discover how long a seller has truly been attempting to sell their home. As a seller, it will no longer be able to present your home as a NEW LISTING all over again just by switching real estate companies. So, good or bad? I'm glad the change has been made --- it makes it more difficult for a seller to be deceptive (which is reasonable) and it makes it easier for a buyer to have a clearer understanding of the status of the property. But what do you think? | |

Conflicting Real Estate Market Indicators |

|

Explain this....  The number of properties viewed online (on our company site and all of our company's agent sites) has increased dramatically over the past year. Thus, it seems that more buyers are hunting for homes. But when we compare the number of closings in the first 28 days of last March and this March, we see a rather significant decline. What is going on here?

| |

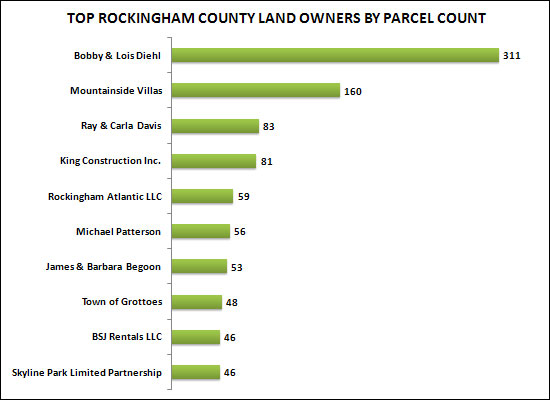

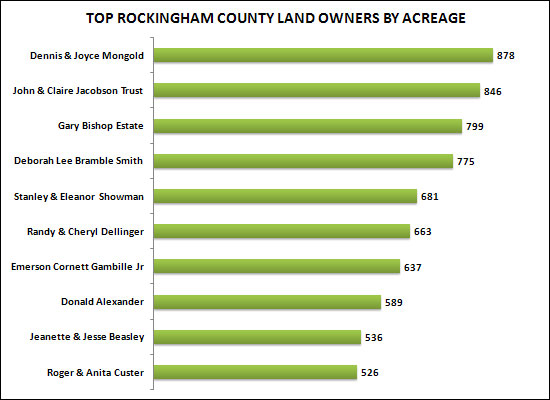

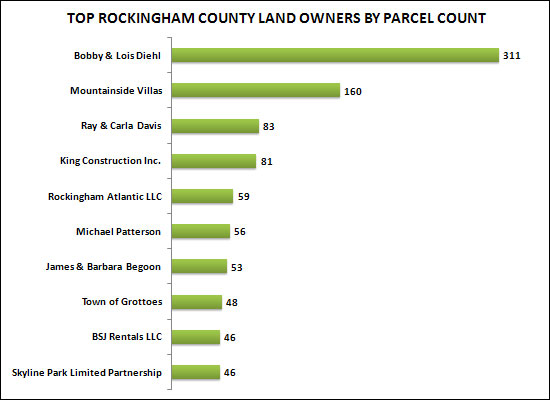

Top Rockingham County Property Owners |

|

A few days agoI provided information on the top 10 property owners in the City of Harrisonburg based on quantity of parcels owned, and total acreage owned. Today, let's take a look at the same breakdown for Rockingham County . . .    One significant note: This analysis does not account for the variety of property owners that own property in slightly different names or under entirely different entity names. | |

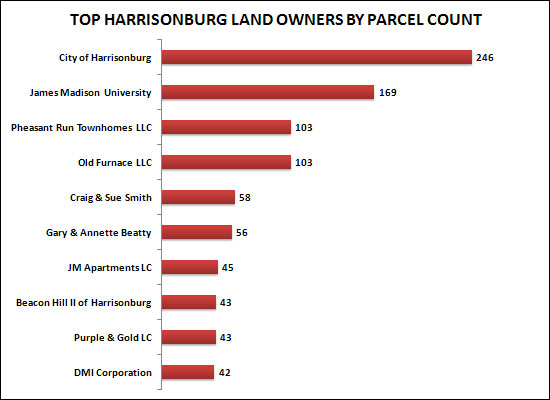

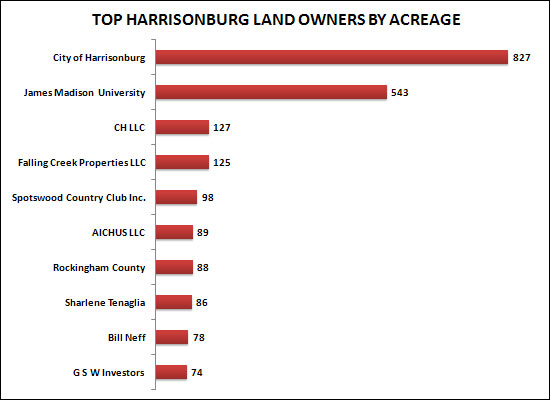

Top Harrisonburg Property Owners |

|

Last week we explored who owns Harrisonburg, based on where those property owners currently live. Below are two additional slices of this data set --- exploring the top real estate owners in the City of Harrisonburg based on the number of parcels that they own, as well as the total acreage of the parcels that they own. The top two in each category probably won't surprise you . . .   One significant note: I did some basic grouping for the City of Harrisonburg and JMU to combine the parcels owned by each in different variations of their names. This analysis does not, however, account for the variety of other property owners that own property in slightly different names or under entirely different entity names. | |

Who is getting involved in the conversations about local news and issues? |

|

One of the local blogs I read is hburgnews.com -- if you're not already reading it, you definitely should! One phenomenon that has been great to observe is seeing local government employees engaging in online conversations. One recent example is on a post about Delayed Green Arrows around Harrisonburg, where a several Harrisonburg staff people explain some recent improvements in traffic engineering. In the ensuing discussion concerns are brought forward and are then addressed by the city employees. Then, Brad Reed (Traffic Analyst with Harrisonburg Public Works) goes on to say... I'm excited to say that we will be finished with the new Traffic Engineering Division website in the near future. The site will go over the basics of how the city's signals are timed and coordinated and will give everyone a look at the components used to operate a signalized intersection. We would love to hear everyone's comments and suggestions, which is why the new site will also include a comment form dedicated to signal-related concerns. I encourage everyone to use the new form when it is released. In the meantime, if you would like to follow up or have any questions, please feel free to call the Public Works Department at (540) 434-5928. Another great example of engagement by the local government is outgoing City Councilman Charlie Chenault's willingness to jump in to provide the facts or clear up misperceptions. I appreciate you, my blog readers, who often comment and provide your feedback here --- and I recommend you also read hburgnews, and jump into the conversations happening in that forum. It's a great way to not only know about the latest news in Harrisonburg, but also to be a part of conversations that will shape our area's future. Here's to open, transparent, responsive local goverment! | |

Do you want to know what I really think? |

|

When asked for my professional real estate opinion, I used to ask "Do you want to know what I really think?" Or I would find myself prefacing some of my comments with "Well, if you want to know what I really think..." Over the past six to twelve months, I have had numerous conversations with buyers, sellers, builders and developers about the current real estate market. As such, I have dropped my prior vernacular from these conversations. For better or for worse, I'm telling people what I really think about our current market, or about their situation, proposal or property. Buyers, sellers, builders and developers need to know the facts within the context of their situation or property as they make huge financial decisions. So -- if you want to know how to make excellent buying, selling, building or development decisions, feel free to ask me -- just know that I may not always tell you what you want to hear. (Though, I suppose I will always tell you what you should want to hear!) | |

Have Questions? Get Answers! |

|

Buying or selling real estate can be a complicated process at times, and questions often abound. If you have questions about the process, or about the market, or about some other real estate related topic, feel free to leave a comment below, or e-mail me (scott@cbfunkhouser.com) or call me (540-578-0102). Many of the topics covered on this blog are a result of questions that people like you have asked --- so feel free to step up to the mic to get your question(s) answered! | |

Do Realtors Make Huge Profits On Home Sales? |

|

Josh posed the question of whether Realtors make extraordinary profits on home sales, and suggested I shed some light on the matter. I'd be happy to do so --- and I'll start with Josh's proposed example of a $100,000 home (though there aren't too many of those out there). One Quick Assumption . . . Upon the closed sale, Realtors are typically paid an amount derived from a percentage of the sale price of the property being sold. This percentage (the "real estate commission" or "brokerage fee") varies from company to company, from agent to agent, and can be negotiated. The sellers of all of the properties that I am currently marketing will pay either a 5% or 6% commission. Thus, for this example, we'll split the difference and use 5.5% as the sample brokerage fee. At First You Would Think . . . Many people would simply multiply the sales price ($100k) by the commission (5.5%) and assume that once I sell this fictional $100,000 home, I'd pocket $5,500. Could that be true?? "Sellers Agents" and "Buyers Agents" The total commission that the seller pays is actually split (typically in half) between the Realtor representing the seller and the Realtor representing the buyer. While it is legal for a Realtor to represent both buyer and seller in a transaction, and many Realtors do so quite skillfully, it is not a practice that I encourage, as it can limit the representation that each party receives. As a result, and since in 95% (plus) of my transactions I am only representing one party, we will now divide the $5,500 by 2, and have $2,750 remaining. The Company Has Costs Too The remaining $2,750 is now split (again!) between the Realtor representing the seller (or buyer) and the company for which they work. Different companies have different arrangements as far as this split --- ranging from 50% to the Realtor to as high as 90% to the Realtor. Most companies are within the 50% to 75% range, so I'll average the limits of that range, and use 62.5% for our example. This leaves $1,719 to the Realtor. However, in my case, we pay a small percentage of each commission to Coldwell Banker Corporate (since we are a part of a national franchise), which actually leaves me with $1,616. And Then There Are The Agent's Costs If we are to compare a Realtors income to anyone else's income, we must next take out my business expenses. Last year (2007) my expenses were approximately 21% of my gross income. Some of these expenses are related to a single transaction (marketing costs, for example), and some are related to my overall business (Realtor association membership, MLS membership, office expenses, education/training expenses, etc.). Thus, the figure above ($1,616) is now reduced to $1,277. Let's Extrapolate! That final "profit" on the $100,000 sale was $1,277 --- which is 1.28% of the sale price. Thus, if all of the variables remained the same, here are some additional profit points: $100,000 = $1,277 $185,700 = $2,377 (April 2008's median sales price) $300,000 = $3,840 (a very nice home) $500,000 = $6,400 (a very, very nice home) Let's Compare Again When we began, some might have made the assumption that I would have pocketed $5,500 on a $100k sale --- when in reality, I only profit $1,277. Along the same lines, someone selling a $300,000 home might think I would be pocketing $16,500 (wow!) --- when in reality, I only profit $3,840. The Question At Hand Returning to the original thought/question --- do Realtors make extraordinary profits? In my opinion, no --- in some transactions I am paid appropriately for the service, knowledge, marketing, representation, negotiation and expertise that I provided to my clients. In some transactions, I am underpaid. And in some cases, I provide such services to a buyer or seller for months, and am never compensated at all (if they do not buy or sell). I hope this has shed some light on how compensation works in the real estate world (at least in my real estate world), and I certainly welcome other thoughts, questions, and perspectives! | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings