Trends

| Newer Posts | Older Posts |

March 2011 Home Sales Set New Record |

|

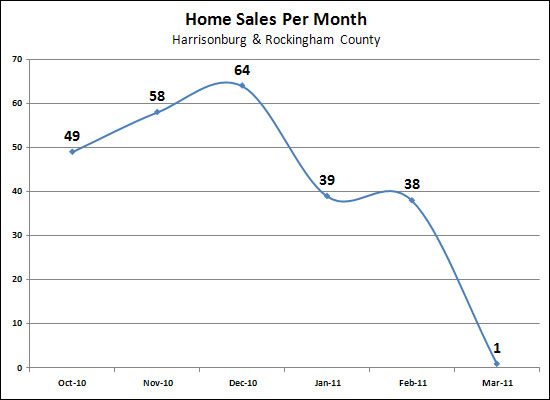

Bill Meadows, a new resident of Dayton, Virginia, holds a distinct honor -- he was the only person to buy a home anywhere in Harrisonburg or Rockingham County during March 2011.  As shown above, January and February sales were quite low, but most people were expecting that we would see a rebound in Harrisonburg and Rockingham County home sales during March 2011. Alas, we did not, as only one person (Bill Meadows) bought a home during the entire month of March. Most analysts are hoping for stronger sales in April, to at least hit the double digits. "I was quite surprised to find out that I was the only one to buy a house this month," Bill commented, "I was pretty sure I had heard several co-workers and friends also talking about buying a home this month." Home sellers are trying hard to keep this in perspective but some sellers, such as Sally Peters, are having difficulty staying calm about this new development. "With only 1 home sale last month, and 821 active listings, that shows a 68 year supply of homes on the market," Sally explained, "Since I'm already 52 years old myself, I am obviously a bit concerned that it might take 68 years to sell all of the houses on the market. I might be over 100 before my home sells!?!" Stay tuned for a full report on the housing market in roughly a week, until then, watch for additional details on these breaking stories:

| |

How Do 2011 Home Sales Stack Up To 2010 Home Sales? |

|

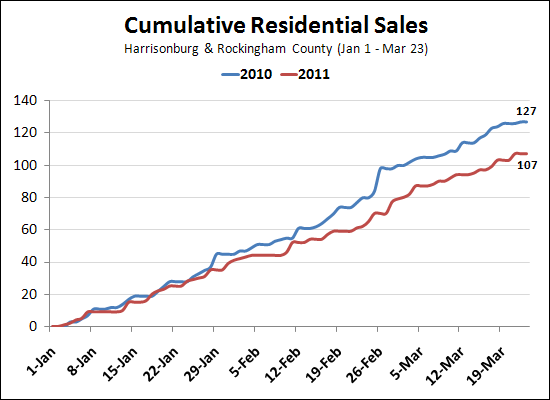

The graph above shows the cumulative number of home sales having occurred as we moved past each of the first 83 days of this year (as compared to last year). As you can see, we were doing well through the end of January, but the gap started to widen slightly through February, and more significantly through March. Due to the first time home buyer tax credit, we may see the gap widen even further in April, though hopefully we'll have some strong summer months of sales to keep us relatively on pace with 2010 home sales. | |

What can Google tell us about the real estate market? |

|

Apparently web searchers are a bit pessimistic (or realistic?) about the real estate market....  Google auto-complete suggests completing the query "why is the real estate market" with: failing, bad, down, important and falling. These results are based on Google's best guess as what you might be searching for. The searching public is losing interest in the real estate market....  Maybe it's the continual bad news, but fewer and fewer web searchers are looking for information about the real estate market. I suppose it's exciting to learn about and hear about the real estate market when things are going well, but when things aren't going so well.... Searching for properties for sale is quite seasonal....  It shouldn't be too surprising, but web searchers look for properties for sale in a rather regular pattern. The two big spikes in returning interest in real estate for sale seem to be in April/May and in December of each year. | |

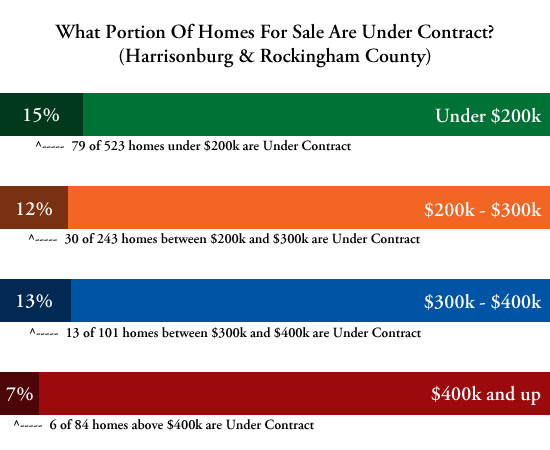

What Portion Of Homes For Sale Are Under Contract? |

|

Contracts have been strong over the past several months, but what has been going under contract? By the numbers, the following is the break down of the properties currently under contract:

The graph above, however, shows how the number of properties under contract in each price range compares to the total number for sale. A few observations:

| |

Big Picture Real Estate Predictions |

|

Am I being reasonable in these predictions? Change in number of single family home sales:

| |

Do most homes have bedrooms on the first floor? |

|

Apparently this varies by region --- in a conversation earlier this week someone was sharing with me that in each part of the country where they had lived, it was a bit different. In one part of the country, nearly every home had a bedroom on the first floor. In another part of the country, only a very small number of homes had a bedroom on the first floor. What is your guess for Harrisonburg and Rockingham County? 64% of currently available single family homes offer a bedroom on the first floor! This was a bit surprising to me, as I assumed it might be less than half of all homes. I will often have buyer clients that are requesting this feature in a home and it seems to limit their options --- but apparently not too significantly. Breaking it down by price range, there also isn't much variation:

49% of currently available multi-level single family homes offer a bedroom on the first floor! Looking just a little bit further, let's examine whether there is a difference in "sellability" of homes with vs. without a bedroom on the first floor. When examining multi-level homes sold in the last year:

Are you considering buying a home, or building a home? Do you have questions about what you should be looking for or avoiding in a house? I'm happy to share my opinion, or the facts as shown by home sales data. Call me at 540-578-0102 or e-mail me (scott@HarrisonburgHousingToday.com) and we can discuss your situation. | |

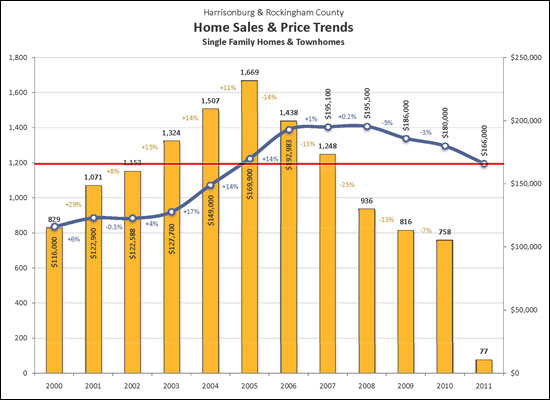

How Far Have Home Prices Retreated? |

|

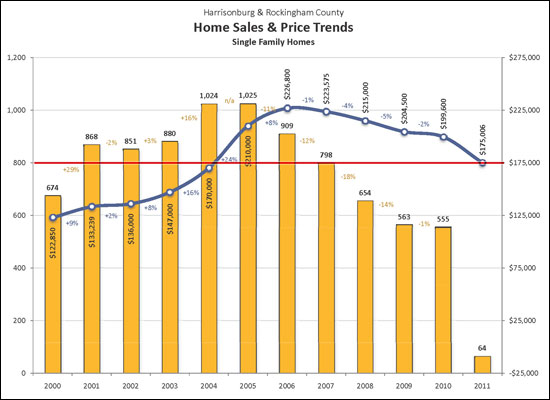

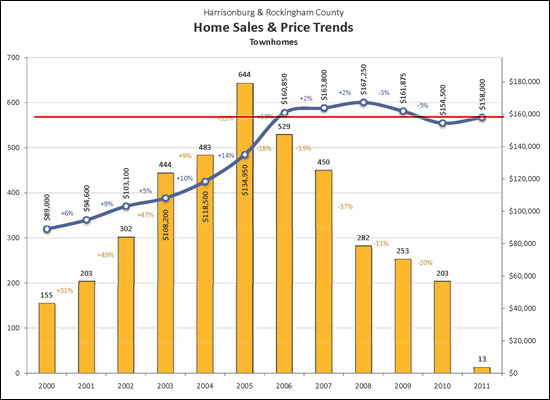

Thank goodness we experienced huge gains in home values between 2000 and 2006, because values have been steadily retreating since that time. Harrisonburg and Rockingham County are not in a unique situation in seeing a decline in home values (as measured by median sales prices) over the past five years (2006-2011). In fact, many areas of the state and our nation saw much more significant declines in home prices during the past five years. How far, though, did we retreat into the past with this decline of home values?  When examining single family homes and townhomes together (above), you'll note that the current median sales price (2011 year-to-date) of $166,000 marks a retreat back to 2004/2005 home values.  Single family home values (median price 2011 year-to-date = $175,006) have also retreated back to 2004/2005 levels.  Despite drastically low sales thus far in 2011, townhomes have fared better than the detached home market. Median sales prices of townhomes (2011 year-to-date = $158,000) have only retreated back to 2005/2006 levels. What does the future hold? I have long held to the prediction that we will not see an increase in median home values until the pace of home sales stabilizes and starts to increases again. Last year there was only a 1% decline in the number of single family homes in Harrisonburg and Rockingham County, so I am hopeful that 2011 may be the year that we see a stabilization in the pace of home sales, even if it is not until 2012 that value start to stabilize. | |

Home Sales Down, Prices Down, Is There A Silver Lining? |

|

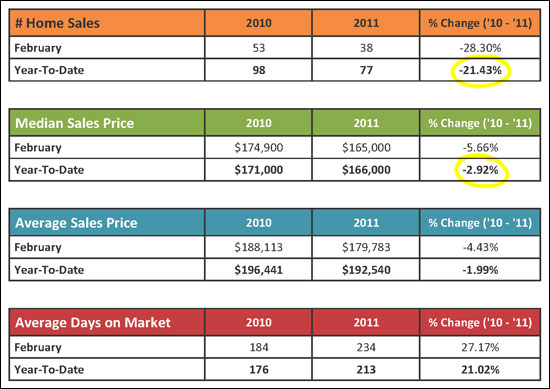

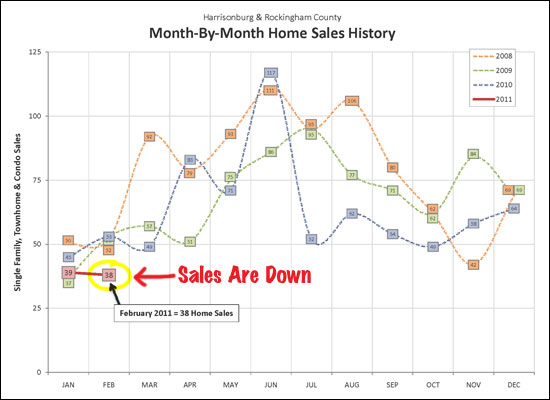

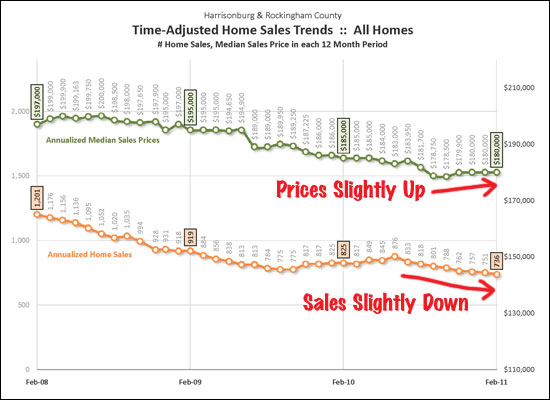

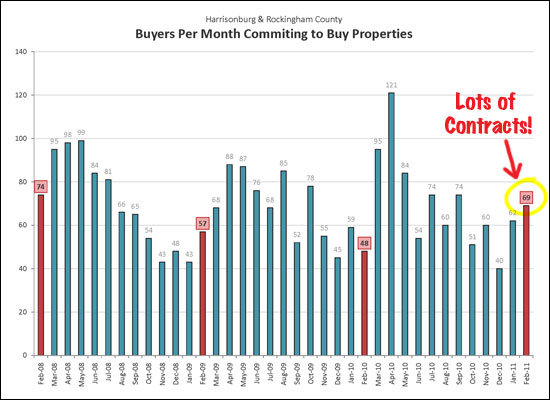

Despite many negative indicators in our local housing market, there may be hope for better news in the coming months. Click here to view a PDF of my most recent market report on the Harrisonburg and Rockingham County Real Estate Market, or read on for several excerpts....  As can be seen above, sales have dropped significantly as compared to a year ago -- both in February alone (28% decline) and in year-to-date figures (21% decline). Furthermore, we continue to see declines in both median sales prices (3% decline) and average sales prices (2%). As would be expected, this has lead to an increase (21%) in the time it takes to sell a house.  Above you will note that January home sales (39) were roughly equivalent to previous years' January sales. February 2011 home sales however (38) were significantly lower than February sales in 2008, 2009 and 2010. Thus far, the trend line for 2011 home sales is headed in the wrong direction -- if you're one of those people who likes to see positive improvement.!  The pace of home sales has declined steadily for three years (orange line above), as has the median sales price in this area (green line above). Of note, the median sales price has actually stabilized and increased somewhat over the past six months.  Above (in red and blue, instead of silver) is the silver lining of this month's housing market report. Buyers were out in full force in February 2011 --- with a full 69 properties going under contract. This marks a 44% increase over February 2010, which should lead to strong sales figures in March and April.  There's plenty more news in my monthly housing market report -- click on the image above (or here) to download and view the full PDF. As always, if you have questions about this report, or if I can be of assistance with real estate that you own, or that you'd like to own, please be in touch. You can reach me most easily at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

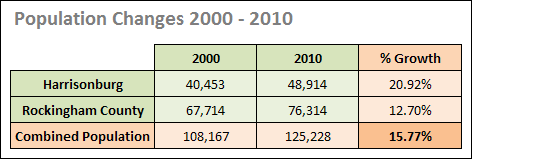

Harrisonburg and Rockingham County Population Grows 15.77% from 2000 to 2010. What does it mean for the housing market? |

|

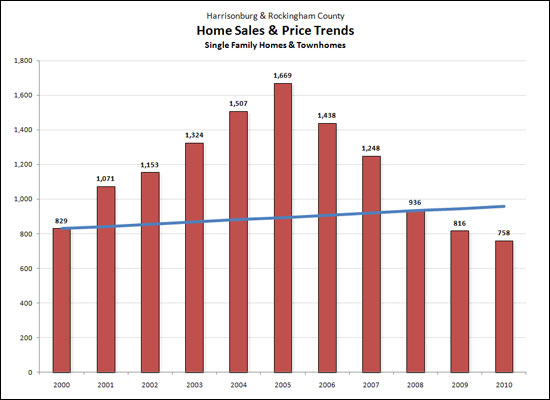

The housing market in Harrisonburg and Rockingham County was relatively normal in 2000 (as best as I understand -- since I started selling real estate in 2003). Given that the population in Harrisonburg and Rockingham County grew 15.77% between 2000 and 2010, what would have happened if real estate sales had tracked on that same path?  The red bars above show the actual pace of sales between 2000 and 2010. The blue line shows a straight line increase in sales assuming an overall sales increase of 15.77% between 2000 and 2010 to mirror the population growth. As you can see, if we assumed that the same portion of the 2000 population would buy homes in 2010, then the actual home sales last year were lower than they "should have been." My conclusion? Time will tell whether 2011 will show an equivalent (or higher) number of sales to 2010, but I believe in one to three years we will see higher total home sales in this area than we experienced last year. I don't believe the 758 home sales in 2010 should be considered the new norm. Per the 15.77% growth between 2000 and 2010, we should see, or could see, or might see, a pace of new normal home sales pace in the next few years around 960 home sales per year. | |

Where have all the listings gone? Long time passing... |

|

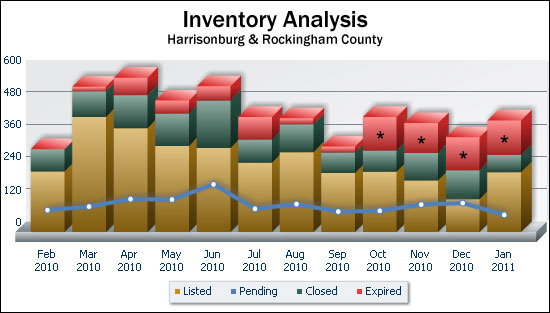

As referenced a few days ago, the inventory of listed homes in Harrisonburg and Rockingham County has dropped significantly (by 23%) over the past six months. But as Pete Seeger might ask... where have all the listings gone?  It turns out the listings expired. Take a look at the huge chunk of listings that expired during each of the past four months (Oct, Nov, Dec, Jan) -- each is a red bar with a star in it. As long as those late-2010 expired listings don't turn into early-2011 new listings, the market might stand a chance of heading towards more stability. Stay tuned! For the analytical minds amongst us, a few notes about the data:

| |

New home sales may be improving in and around Harrisonburg |

|

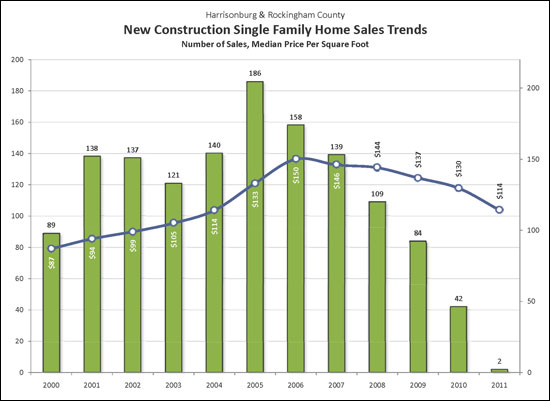

New home sales may be improving in and around Harrisonburg -- based totally on anecdotal evidence. Several of the builders I work with have seen significantly increased activity since the first of the year, and this is after several years of declining new home sales, as shown below.  It somewhat stands to reason -- as I pointed out yesterday, housing supply has been dwindling over the past six months. There was a 23% drop in listing inventory between July 2010 and January 2011, as compared to only a 5% drop during the same time period a year earlier. Fewer homes for sale leads to fewer selections for home buyers, leads some buyers to start exploring new construction homes once again. The trend over the past few years away from new homes was a matter of re-sale homes being more affordable than new homes. It was nearly impossible to build a new home at the same price that some re-sale homes were selling for in the market. Now, however, builders who have compelling products to offer, with competitive pricing, stand a chance to see a solid improvement in sales during 2011. | |

Quick, buy a house before they are all gone! |

|

Perhaps we're not really going to run out of houses, but inventory levels are certainly dropping in Harrisonburg and Rockingham County. Two years ago (in early February 2009) there were 838 homes for sale. One year ago (in early February 2010) there were 863 homes for sale (yes, an increase). But when I published my monthly market report a week ago there were only 778 homes for sale. Furthermore, that level of 778 homes for sale is a full 23% drop in listing inventory from six months earlier (July 2010). Now wait a minute, you might object, certainly there is always a big drop between July's supply of homes and February's supply, right? Well, perhaps so, but not this significantly of a drop! If we move the clock back one year earlier, February 2010's supply of 863 homes was only 5% lower than July 2009's supply of 904 homes for sale. So what could be going on here? One prevailing theory as I talk to my clients and to other local Realtors is that have been quite a few listings over the past several years that were homeowners that wanted to sell, but didn't have to sell. Perhaps these sellers have finally given up (at least for now) as they have realized that the market isn't going to experience a dramatic turn around in the near future. Do you have other theories? Why are there fewer and fewer homes for sale? Does it seem to you that inventory levels are dropping? Are they in your neighborhood? | |

Buying a Foreclosure |

|

If you are in the market to buy a home, some of the properties you might be considering are foreclosures – but there are some distinctions to be aware of at different stages of the foreclosure process. It is possible to buy a home from the owner before they are foreclosed on even if they cannot pay off their mortgage – this is called a short sale. Or, you might buy a property at the courthouse steps when it is being auctioned – this is called a trustee sale. Finally, if a property does not sell at the auction, you can buy the property from the lender after they have taken ownership of the property – this is called a bank owned property or REO property. Short Sales: Some homeowners must sell their home, but market conditions won't allow them to sell it at a high enough price to be able to pay off their mortgage(s). In this example, a homeowner might have a $250,000 mortgage balance but can only sell the property for $230,000. As a prospective buyer, it is sometimes possible to purchase this type of a property through a process called a "short sale." In such an arrangement, the homeowner petitions their lender to accept less than the full payoff of the mortgage and in return to still release the deed of trust so that ownership of the property can be transferred over to you, the new owner. This can benefit the lender, as they skip the time delays and cost of the foreclosure process. This can also benefit the homeowner, as a short sale will have a slightly lesser negative impact on their credit as compared to a foreclosure. As a buyer, however, you must know that there are challenges to buying a property as a short sale. The biggest challenges of late seem to be the uncertainty of the purchase and the time table. Even if you and the homeowner agree to a price of $230,000, the homeowner's lender must still agree to accept that price – since it won't allow the homeowner to pay off their $250,000 mortgage balance in full. This process of waiting to hear back from a lender, and then complying with all of their various terms can sometimes take 60 to 120 days – or longer! Trustee Sales: If a short sale does not take place, and a homeowner is behind on their payments (or not making them at all), eventually the property will be sold by the lender on the courthouse steps. Buying a property at a "trustee sale" can be exciting, and can be a great opportunity – but there are challenges as well. If a property to be sold at a trustee sale is also listed for sale with a Realtor, you can usually view the property ahead of time by calling your Realtor. Otherwise, you will likely not have the opportunity to see inside the property before the trustee sale, and thus you will not know too many details about the condition of the property. Furthermore, your purchase of the property at the trustee sale cannot be contingent upon viewing the property, or inspecting the property. In this instance, you are purchasing the property in "as is" condition, regardless of what you then find out about the property. It is also important to note that many times the lender will have an opening bid at the trustee sale that is close to (or sometimes higher than) the amount that they are still owed on the mortgage. Thus, in the example above, they might make an opening bid of $250,000. As a result of this opening bid process, many (or most) properties available for purchase at a trustee sale are not great opportunities. Occasionally, a property will be foreclosed upon that has had a mortgage in place for many years, whereby the balance of the mortgage is much lower than current market value – these are great opportunities for a buyer. Bank Owned Properties: If you don't buy the property before the auction (as a short sale), and don't buy it at the trustee sale, you'll have a third opportunity to buy it once the bank owns it. These properties are called "bank owned properties" or REO properties ("real estate owned"). Oftentimes, the prices on these properties are quite realistic, if not under market value. It would not be atypical for a house such as the one mentioned above to come on the market after the trustee sale at a price of $210,000. In such an instance, you should expect to be buying the property in "as is" condition, and you will also be buying with a slightly different contract document. Most lenders have a long standard contract or contract addendum that spell out a variety of additional contract terms designed to protect them from any future liability – and rarely will a lender agree to have these contract documents changed in any way. As you can see above, oftentimes buying the property as an REO property is where the best opportunity lies. When a home goes into foreclosure it is often for very sad and unfortunate reasons – such as the loss of a job – and I do not wish such circumstances on any homeowner. However, if you are a buyer in today's market it is important to be familiar with different methods for buying a property when it will be, is being, or has been foreclosed upon. For information about upcoming trustee sales, please refer to HarrisonburgForeclosures.com. For information about purchasing a property as a short sale, or purchasing a bank owned property, please e-mail me at scott@HarrisonburgHousingToday.com or call me at 540-578-0102. | |

Home buyers are probably getting GREAT deals these days, right? |

|

In a lot of ways, they are --- but it's not as extreme as you might think. After observing several houses go under contract at fantastic prices I was pondering aloud that it seemed that finding the right price would make buyers appear . . . because you'd be offering them a great deal. That prompted someone to ask me about current price per square foot prices for houses --- and whether buyers were getting great deals these days. Thinking about one of the houses that had recently gone under contract, I commented that yes, houses are DEFINITELY selling at GREAT price per square foot rates. That will teach me to make a broad statement based on one or two data points. This evening I dove into the data to take a closer look --- and to confirm what I was quite sure to be true. To get the best possible sense of the deals buyers are getting these days on a price per square foot basis, I decided to narrow down the sold properties I was examining. If I examined all properties of a variety of sizes and ages, there would be so many variables at play that it would be hard to draw any conclusions. Here's how I limited my two sample sets of data:

My second data set examined homes matching the same criteria that sold during 2010 -- there were 35 such homes, and they sold at an average of $111/sf. Hmmmmm......$4/sf better than a year ago.....is that a great deal for a buyer? That provides a $8,000 savings on a 2,000 square foot house. Instead of buying the house for $230k (in 2009) you'd have paid $222k (in 2010). That doesn't seem like an extraordinary cost savings to buyers --- so perhaps in the aggregate buyers aren't getting amazing deals now (compared to a year ago), even though they are getting slightly better deals. Examined one other way, 26% of these houses sold for less than $100/sf in 2009......and in 2010, 29% sold for less than $100/sf. So, it seems that while there are some isolated AMAZING DEALS in the current real estate market, you probably won't be able to get a FANTASTIC DEAL on EVERY house that's out there. But, of course, every seller trying to sell their house right now would like me to remind you that:

| |

Has the real estate market (finally) hit bottom in Harrisonburg and Rockingham County? |

|

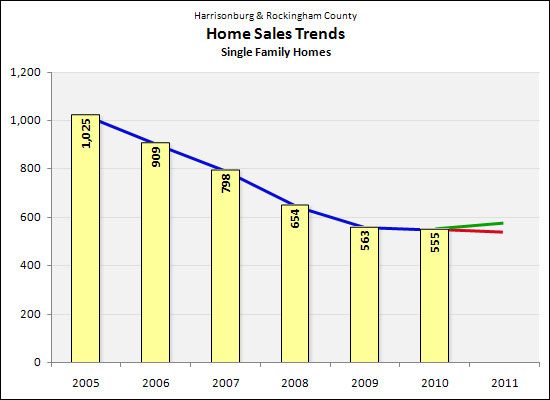

I say yes --- but do bear in mind, I've thought this a few times before. I recently realized that the overall trend I examine in my market report each month (total number of residential sales) might not be the best indicator of what is taking place in our residential real estate market. That overall trend, you see, not only includes single family (detached) homes, but also includes townhomes and condos. At least some number of townhomes and condos are investment properties, and thus that segment of the market can look better or worse than the more traditional "I'm buying a house to live in it" segment of the residential market. For that reason, I believe that we will likely get a better sense of the health of the residential (I'm buying a house to live in it) market by examining only single family home sales. And with that preface aside, here's what we find.....  As you can see, there were steady declines in the single family home market from 2005 through 2009 (-11%, -12%, -18%, -14%). That steady decline, however, slowed down significantly between 2009 and 2010 (-1%). That is a wonderful sign that the residential real estate market may truly be stabilizing. So, what are my predictions for 2011? I don't think we will see any more than a 2% decline in single family (detached) home sales --- as shown (approximately) with the red line. I also, however, don't think we will see any more than a 2% increase in single family (detached) home sales --- as shown (approximately) with the green line. After five years of a declining residential real estate market in Harrisonburg and Rockingham County, I think we might finally be poised to see an increase in sales activity. | |

Will Foreclosures Dominate 2011 Home Sales in Harrisonburg and Rockingham County? |

|

The Associate Press (AP) story below ran a few weeks ago in the Daily News Record. AP stories often don't reflect market realities here in Harrisonburg and Rockingham County, so I must admit I didn't really believe it to be true in our local area.  This headline came to mind again, however, when I was analyzing the 47 properties to go under contract in Harrisonburg and Rockingham County thus far in 2011. Each statistic below speaks to the types of properties that are actually selling these days, and the types of buyers that are actually buying. Of the 47 properties that have gone under contract thus far in 2011....    | |

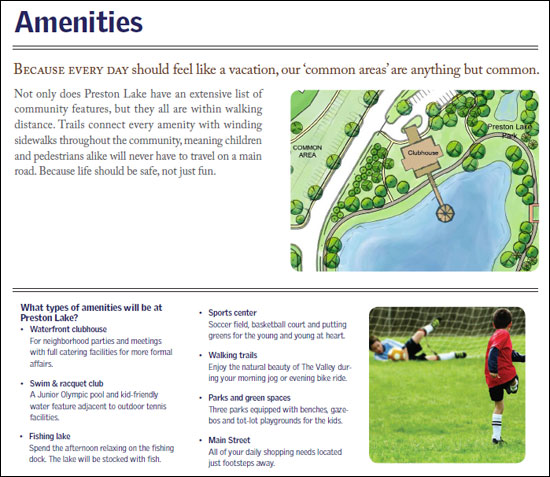

Preston Lake Headed To Foreclosure? |

|

Per a Trustee Sale advertised in today's Daily News Record (view ad), the bulk of the Preston Lake subdivision may be headed to foreclosure. This doesn't necessarily mean that the foreclosure sale will take place, but this is a significant step in that direction. Preston Lake is Harrisonburg and Rockingham County's first master planned community, intended to include nearly 500 townhomes and single family homes, a large section of retail stores with a main street appearance, and many amenities such as a community center, soccer fields, swimming pool, and more.  The vision....  Main Street renderings  Amenities at Preston Lake Now, however, all of those plans may be coming to an end, at least for now. On February 3rd at 12:00 p.m., 124.693 acres of Preston Lake is scheduled to be auctioned at the Rockingham County Circuit Court. Please note that an advertised trustee sale (all that has happened thus far) does not necessarily mean that the foreclosure process will take place. This wasn't the first sign of trouble for Preston Lake, as the developer of Preston Lake and its lender (Wachovia) have been in the midst of legal proceedings for almost a year now, as described in the Mar 2, 2010 article from the Daily News Record: Preston Lake Homes and its developer, the Hine Group, filed claims against Wachovia in Rockingham County Circuit Court on Dec. 11 for breaking its loan contracts, according to the lawsuit. Preston Lake is seeking $32.4 million in damages for lost profit. Wachovia filed a counterclaim in U.S. District Court in Harrisonburg on Dec. 29. The Charlotte, N.C.-based bank is suing Preston Lake for $15.6 million in outstanding debt. While it was happening quite slowly, residential construction at Preston Lake had been continuing even over the past year. Since the first closing in 2008, there have been 37 sales at Preston Lake recorded in the HRAR MLS, ranging from $318k to $883k, with a median price of $421k. Three of these sales took place as recently as the fourth quarter of 2010. Today, only four properties are being marketed for sale at Preston Lake per the HRAR MLS -- three are resale properties, and one is being sold by the developer. (view active listings at Preston Lake) A few notes about the foreclosure sale:

| |

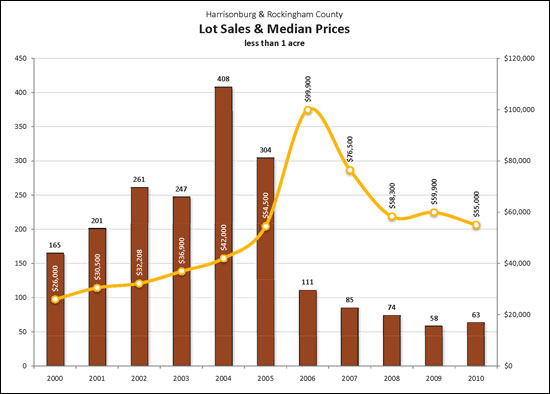

Building Lots Are Selling Slowly, So Where Are They Selling? |

|

The pace of lot sales (of less than an acre) has declined significantly in Harrisonburg and Rockingham County over the past several years, from a high of 408 lot sales in 2004 down to only 58 lot sales in 2009. We did see a slight increase in 2010, up to 63 lot sales.  So where were these 63 lots that sold in Harrisonburg and Rockingham County during 2010? BELMONT ESTATES: (4) lot sales between $74k and $90k view active listings in Belmont Estates BLUE STONE HILLS: (1) lot sale at $51k view active listings in Blue Stone Hills CROSSROADS FARM: (6) lot sales between $80k and $155k view active listings in Crossroads Farm GREAT OAKS: (1) lot sale at $65k view active listings in Great Oaks HARMONY HEIGHTS: (1) lot sale at $86k view active listings in Harmony Heights LAKE POINTE: (1) lot sale at $68k view active listings in Lake Pointe MAGNOLIA RIDGE: (12) lot sales between $55k and $84k view active listings in Magnolia Ridge MASSANUTTEN RESORT: (6) lot sales between $10k and $32k view active listings in Massanutten Resort MEADOWBROOK: (1) lot sale at $61k view active listings in Meadowbrook MONTE VISTA ESTATES: (1) lot sale at $80k view active listings in Monte Vista Estates OVERBROOK: (2) lot sales at $60k view active listings in Overbrook STONE SPRING MANOR: (4) lot sales between $29k and $39k view active listings in Stone Spring Manor THE CROSSINGS: (3) lot sales between $50k and $55k view active listings in The Crossings WOODBRIDGE: (2) lot sales between $37k and $50k view active listings in Woodbridge There were several other lot sales during 2010, that were not in subdivisions. Let me know if you have any questions about the building lot market in Harrisonburg and Rockingham County. | |

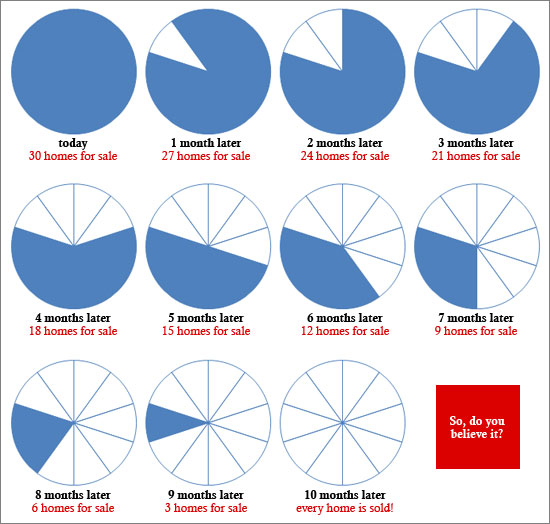

If there are 10 months of housing supply available.... |

|

Follow this "months of supply" logic with me....

Remember....30 houses for sale, 3 houses sell per months, so it probably looks like this....  Do you believe it? It doesn't really work that way. Here's the problem (for sellers) --- each month when three houses sell (go under contract), they will always almost be replaced by another three new listings. Thus, every month the odds are the same (roughly) --- there will again be 30 houses for buyers to choose from, and only 3 houses will be chosen. It then becomes clear that some houses will NOT be chosen, month after month. Again and again, a house will be a part of the 27 instead of a part of the 3. Thus, if 10 months of housing supply exists in a particular market segment, and a house has been on the market for 11 months, it isn't necessarily a terrible house --- it just has not been able to rise to the top 10% during any of the past 11 months. That, then, is an interesting object lesson for sellers. What do you need to do (with marketing, price, etc) to be in the top 10% of the houses for sale? Settling for being in the top 30% might not work so well for youIf the top 10% keeps selling, and new listings keep landing in the top 10% --- your "top 30% house" could sit on the market for month after month. | |

Founders Way Condos Proving Popular With Buyers |

|

Full Disclosure: I represent the developer of Founders Way. Harrisonburg home buyers haven't had too many condo options to choose from in the recent past if they actually wanted to live in the condo....

Now, however, there is a new option in town --- Founders Way Condominiums. The condos at Founders Way feature 2 or 3 bedrooms, and start at only $142,900 (see all pricing). These newly built condos feature upscale kitchens, an open floor plan and spacious master suites -- think hardwood laminate floors, granite countertops, contemporary lighting fixtures, nine foot ceilings, decorative archways and colonnades, etc. Oh, and quite a few of these new condos are selling! The community will eventually consist of 72 condos -- but for now the first building of 12 has been constructed, and the condos are at various stages of completion. Of the twelve condos in the first building at Founders Way....

Let me know if you'd like a tour of Founders Way --- I'd be happy to meet you on site. You can reach me at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings