| Newer Posts | Older Posts |

One Of The Best Market Indicators Right Now Is How Quickly Houses Similar To Your Home Are Going Under Contract |

|

Are you getting ready to list your home for sale this spring? Are you trying to figure out how to price your home? Step one - as usual - is to look backwards, at past sales, to see how much buyers have paid for houses similar to your home over the past six (or more) months. But another market indicator that we shouldn't overlook is... ...how quickly houses similar to your home are going under contract. FOR EXAMPLE... If we look around at past sales and we find that buyers have recently paid $410K, $415K and $420K for houses similar to your home... ...we might plan to list your home for $415K or $419K or $425K. Let's say we're super optimistic and we're planning to list your home for $425K. But, then, if you're not putting your home on the market for a few weeks, we should carefully monitor similar houses coming on the market for sale. If we see... [1] Three similar houses come on the market for $420K, $425K and $429K, each of which go under contract in a matter of days... then we should be encouraged to stick with our plan of pricing your home at $425K. [2] Three similar houses come on the market for $410K, $412K and $415K, all each of which are still available for sale after being on the market for two weeks... then we might want to consider a list price of $415K or $419K instead of $425K. So, with pricing these days, we need to look backwards at past sales, but we also need to see how quickly buyers are contracting to buy houses similar to your home. Let me know if you're ready to start thinking through potential pricing (and timing) for selling your home this spring. | |

Buyers Should Choose Their Words Carefully When Talking About A House While Walking Through It |

|

As a buyer, when you are walking through a home, keep in mind that the seller might be listening. These days, there are plenty of ways that a seller could be monitoring their home, with a security camera, or other recording device that could allow them to hear every word you are saying while you are in their house. So..... [1] Don't insult their house. It won't help during negotiations. [2] Don't discuss negotiations. You might be revealing your strategy. By the way, sellers, you'll need to disclose if there is a recording device in your home. There is a field in our local MLS specifically for this disclosure. | |

Nationwide Median Sales Price Declines For First Time In More Than 10 Years... But, What About Locally? |

|

I saw the headline over at CNN yesterday... home prices are falling (nationwide, barely) for the first time in over a decade. The median sales price of a home in the United States was $363,000 in February 2023... ...marking a (tiny) 0.2% decline from a year ago. How do those numbers compare to Harrisonburg and Rockingham County? February 2022 - February 2023

February 2023

So, as usual, we're just doing our own thing over here in Harrisonburg and Rockingham County. Will we see home prices decline in Harrisonburg and Rockingham County? Before that happen, we'd need to see them level out (stop going up) which isn't happening at this point. So, read the national news (if you must) but as usual, it's much more important to keep tabs on the local trends. | |

Buyer Demand Exceeds Supply In Varying Degrees By Price Range |

|

As one might expect, there are more buyers able to and interested in buying a home for $200K than for $300K... and more buyers able to and interested in buying a home for $300K than for $400K. You get the picture. As such, we currently find buyer demand exceeding supply in varying degrees by price range. These numbers are completely made up, but are likely not too far off base given recent listings or transactions I have been a party to or have heard about in our local market... SHOWINGS IN WEEK ONE, BY PRICE RANGE:

If you're seeing more showings than outlined above, your house may be slightly more popular than the average house based on its location and condition - or you might have priced it "just right" for the current market. If you're seeing fewer showings than outlined above, your house maybe slightly less popular than the average house based on it's location and condition - or you might have priced it "a bit too high" for the current market. Again, the data above is completely fictional (not based on actual showing data) but is included to paint a general picture of the differing amounts of buyer demand in different price ranges in the current market. | |

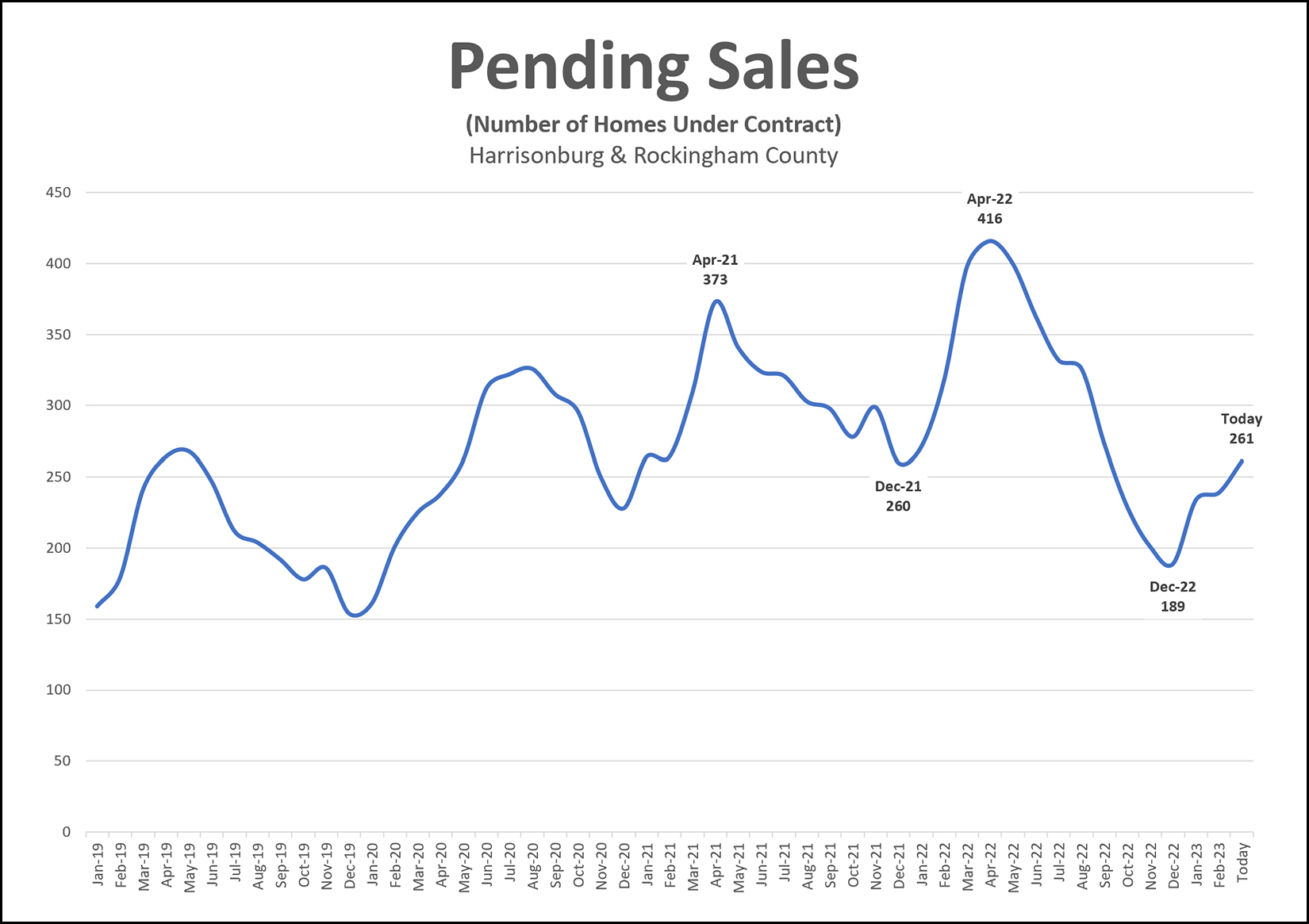

Pending Home Sales Data Points To Slower Months Of Home Sales Ahead |

|

Pending home sales is the most timely indicator of what we should expect in the very near future for closed home sales. A pending home sale is a house that is under contract. Two springs ago (2021) the number of pending sales peaked at 373. Last spring (2022) the number of pending sales peaked at 416. There are currently only 261 pending home sales. As such, it seems likely that we'll see fewer closed home sales over the next few months. But, interestingly, this lower level of pending home sales does not necessarily seem to be a result of an insufficient number of buyers wanting to buy -- but rather, an insufficient number of sellers willing to sell. This seems to be a supply side issue inventory levels (the number of homes on the market for sale) remain stubbornly low. If we were seeing fewer pending home sales, and inventory levels climbing, this would be an indication that buyer demand is declining. That is not what we're seeing. So long as fewer sellers are willing to sell, we are likely going to continue to see lower numbers of pending home sales, and lower numbers of closed home sales unless new construction options increase to provide additional housing options for home buyers. | |

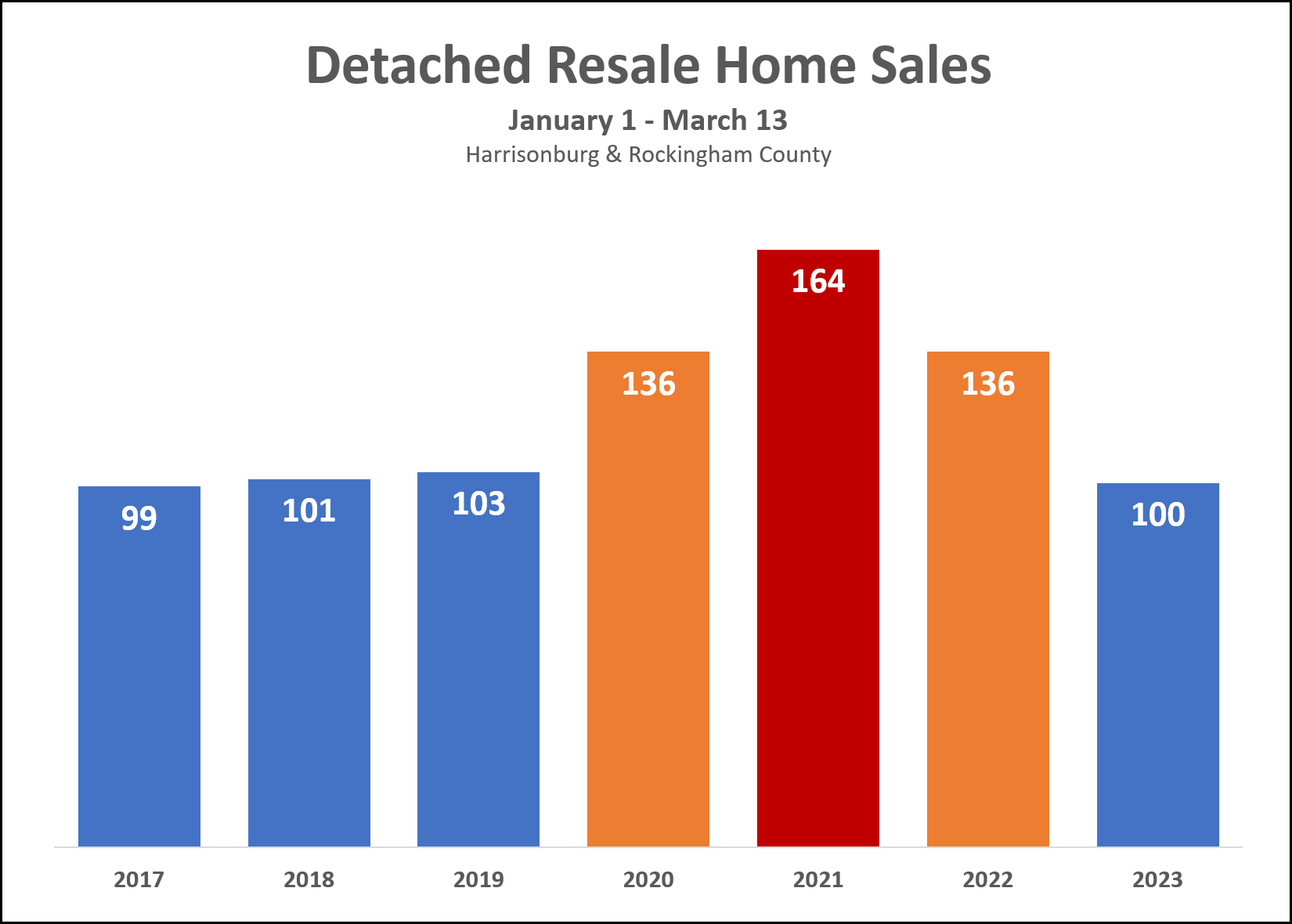

Detached Resale Home Sales Decline 39% In Two Years, Down To... Pre Covid Norm |

|

First, a definition... Detached Resale Home Sales = not townhouses, not duplexes, not condos, not new homes Now, then, an observation... Detached Resale Home Sales have declined 39% over the past two years when looking at first 2.5 (ish) months of the year. Oops, wait, another observation... Detached Resale Home Sales have dropped all the way down to... pre covid norms. In the three years leading up to Covid (2017, 2018, 2019) we saw home sales between January 1 and March 13 totaling 99, 101 and 103 home sales for each of the above referenced years. But then, the three most recent years showed a very different pace of sales... Jan 1 - Mar 13 of 2020 = 136 sales! Jan 1 - Mar 13 of 2021 = 164 sales! Jan 1 - Mar 13 of 2022 = 136 sales! But, then, back to what seems to have been the pre-Covid norm... Jan 1 - Mar 13 of 2023 = wait for it... 100 sales So, two things seem to be true right now... There are significantly (!!!) fewer detached, resale homes selling right now compared to how many we saw during the same timeframe over the past three years. But, yet, the number of detached, resale homes selling right now is quite normal per the historical trends before Covid started messing with the housing market. Prospective home buyers in 2023 should thus realize that... [1] There will likely be a historically normal number of homes that you could buy this year... if we ignore the three most recent years. [2] There will be far fewer options of homes to buy this year compared to last year and the year before. [3] There may very well be more competition from other buyers for that smaller number of homes that will be available for purchase. As you can see through all of this -- the decline in home sales is very much due to a restrained supply (only so many sellers willing to sell) rather than a restrained demand (only so many buyers wanting to buy). | |

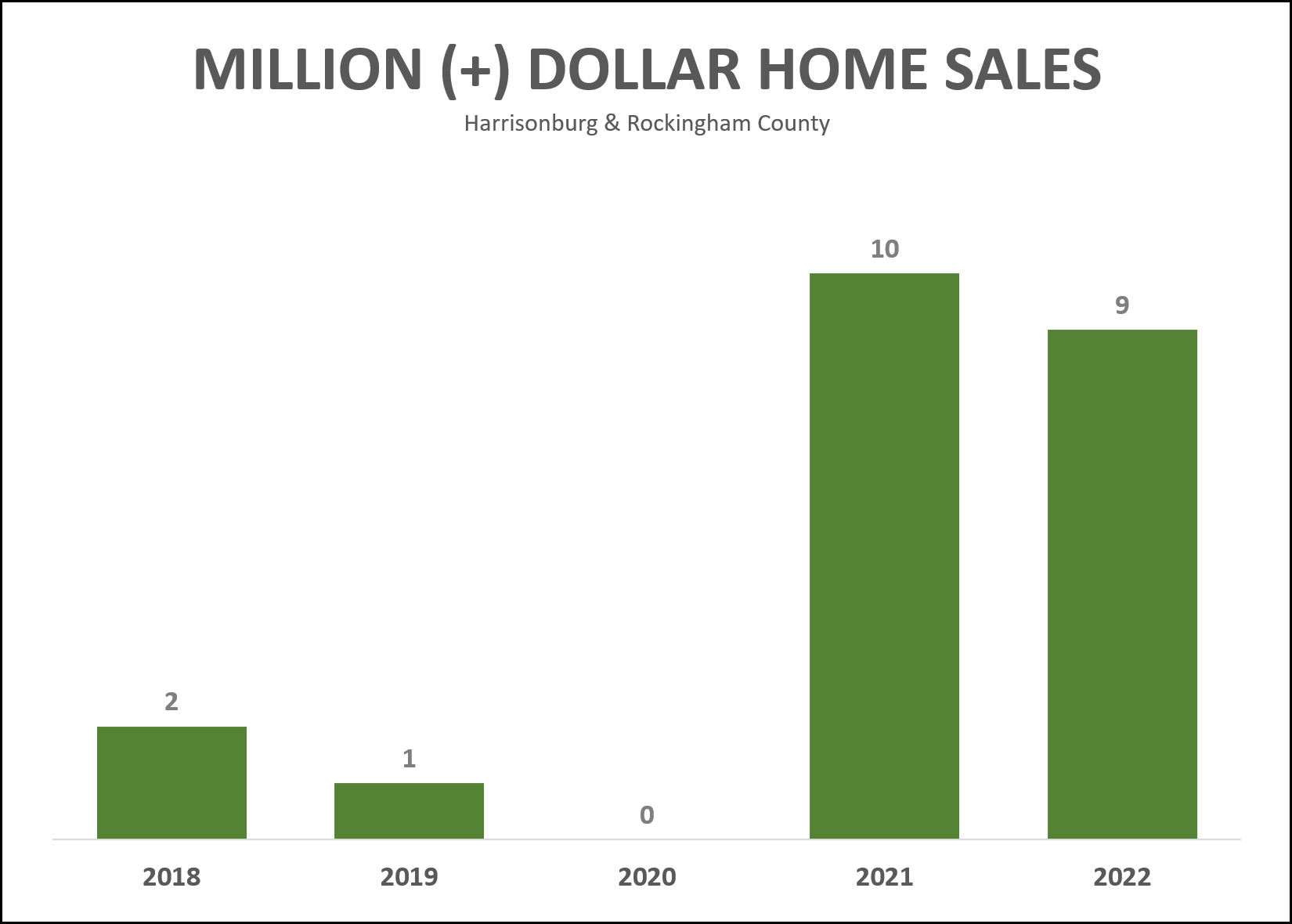

What A Great Time To Sell Your Million Dollar Home |

|

It's been a good time to sell a million (+) dollar home lately. After only three million dollar sales over three years (2018-2020) we have seen 19 million dollar sales over the past two years. Wow! Check out what people have been paying $1,000,000 for lately here. If you're ready to sell your home for one million dollars... let me know. ;-) | |

Home Buyers Who Bought Homes Two Years Ago Thought They Were Paying Crazy High Prices For Their Homes |

|

I think those home buyers look at things a bit differently now. Three years ago the median sales price in Harrisonburg and Rockingham County was $222,150. One year later it had risen 11.5% to $247,700. Home buyers who were paying $247,700 thought they were paying WAY TOO MUCH for their homes. Why in the world did they need to pay 11.5% more than a similar buyer one year earlier!? My how those numbers look different today. Now, just two short years later, the median sales price has risen 22.9% (in two years) to $304,485. So, do you think those same home buyers who reluctantly paid $247,700 two years ago are upset for having paid 11.5% more than buyers were paying the previous year? Nope, not at all. They're delighted to have paid 22.9% less than buyers are paying today. Yes, this is an unusual time. I don't think we're going to see several more years of double digit annual increases in median sales prices. That said, I also don't think we're going to see home prices decline. So, while it can seem like today's home prices are high compared to home prices in the past -- your perspective might change a bit over the next few years when you're looking backwards at today's home prices. | |

How Likely Is It That We Will Find A House That Fits You Better Than This One In The Next 90 Days? |

|

We will try to find you the perfect house to buy... that checks off all of the boxes on your list of needs and wants. If we happen upon a nearly perfect house... we should probably be asking ourselves... How Likely Is It That We Will Find A House That Fits You Better Than This One In The Next 90 Days? These days, with relatively low inventory levels in many price ranges and for many property types... ...and with quite a bit of buyer interest in most of those price ranges... ...we may very well conclude that we are NOT likely to find a house that is a better fit for you in the next 90 days. The moral to the story, I suppose, is that in a low inventory (few sellers) competitive (many buyers) market... you might need to settle for a nearly perfect house instead of a perfect house. That way, you might actually end up with... a house! | |

Fewer Home Sellers, Thus Fewer Home Buyers, But Ever Higher Sales Prices In Early 2023 |

|

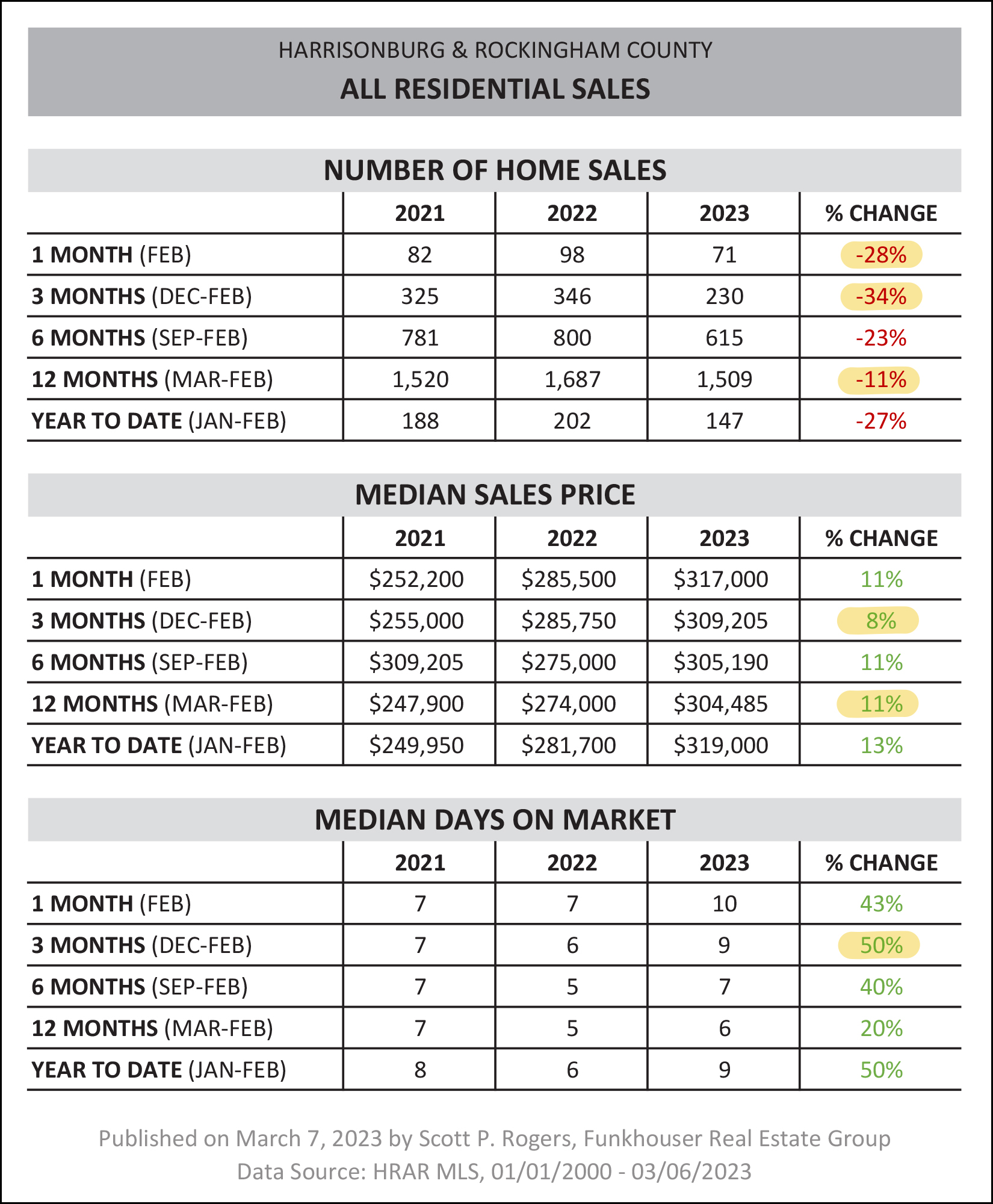

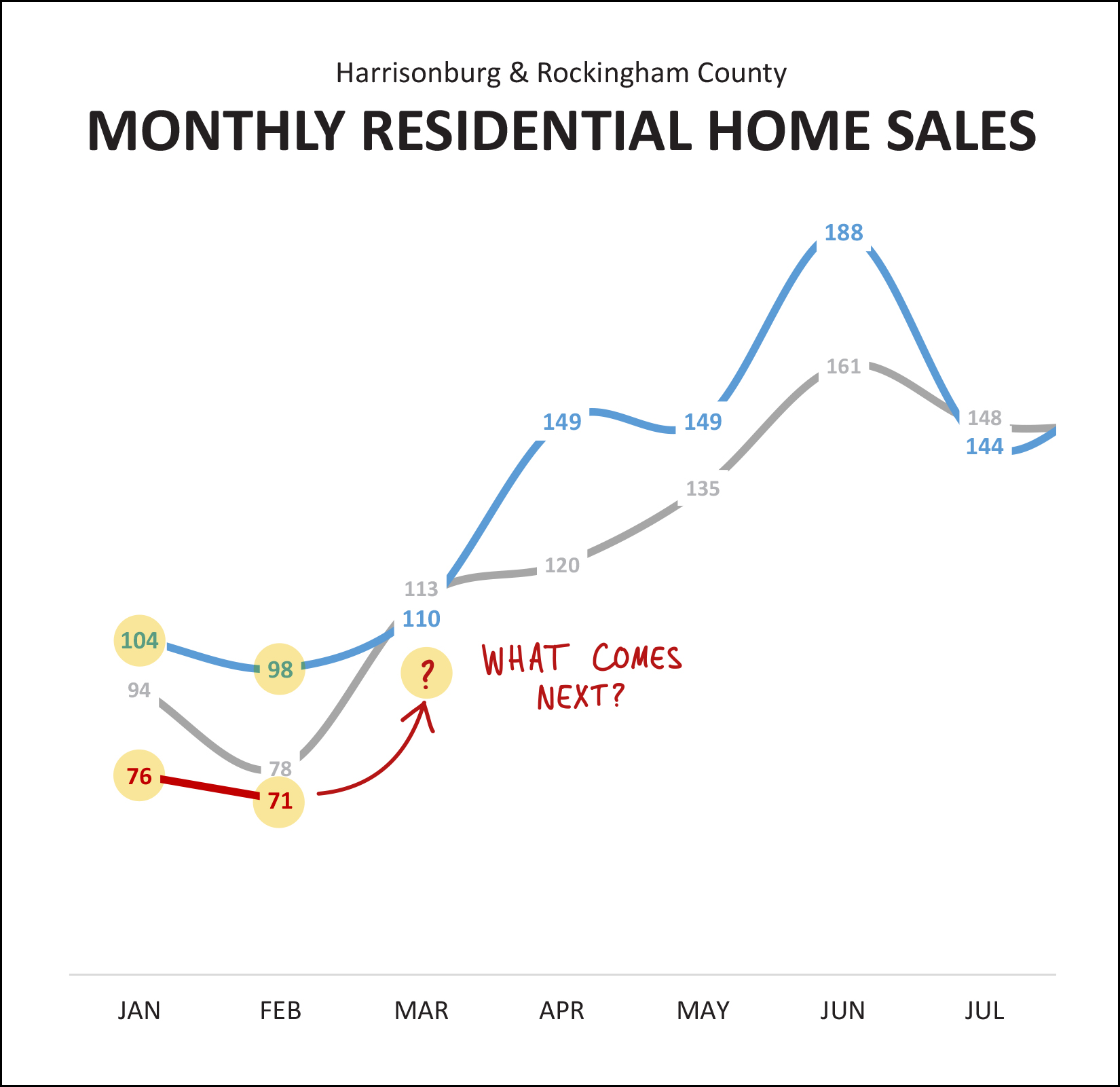

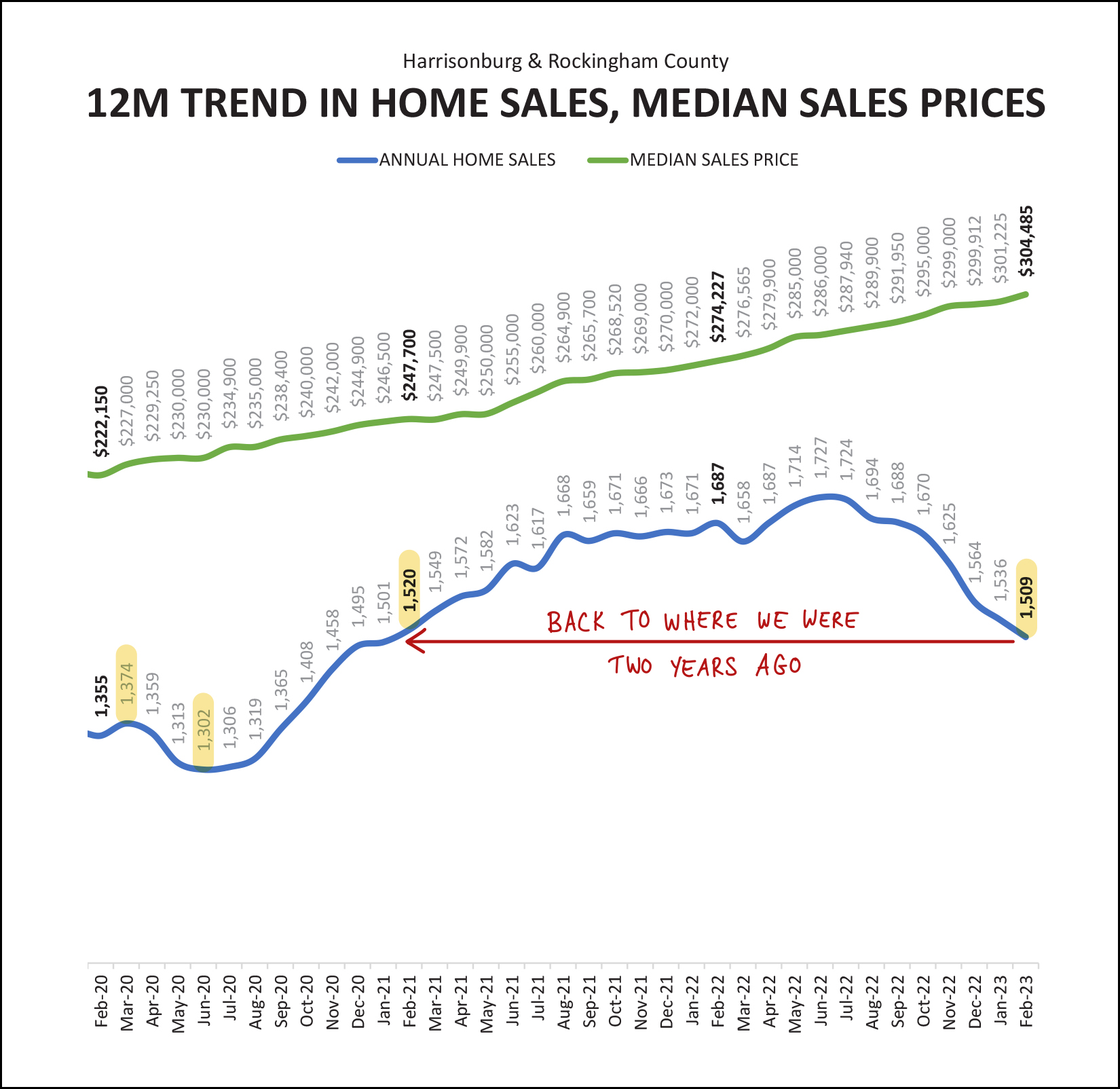

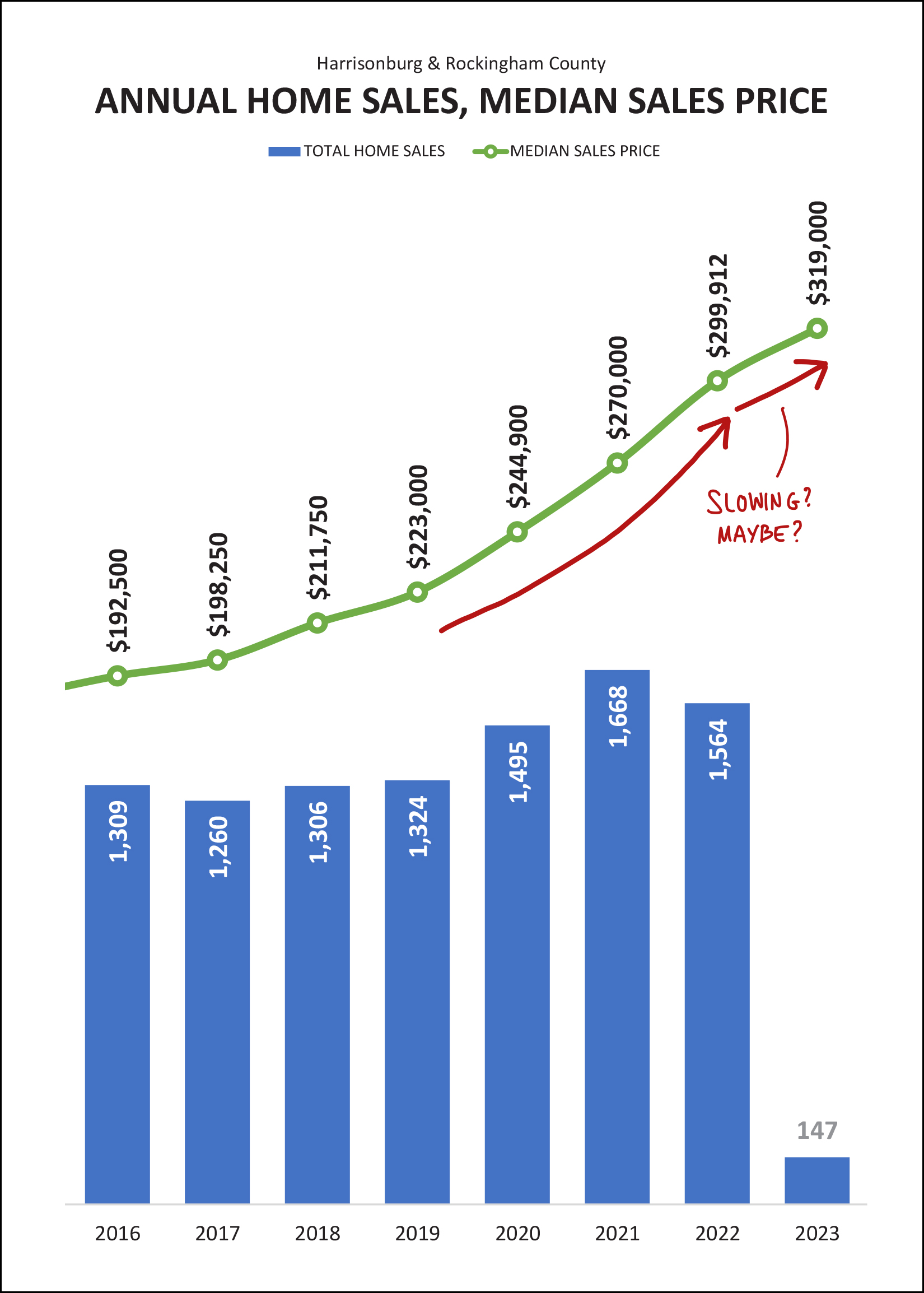

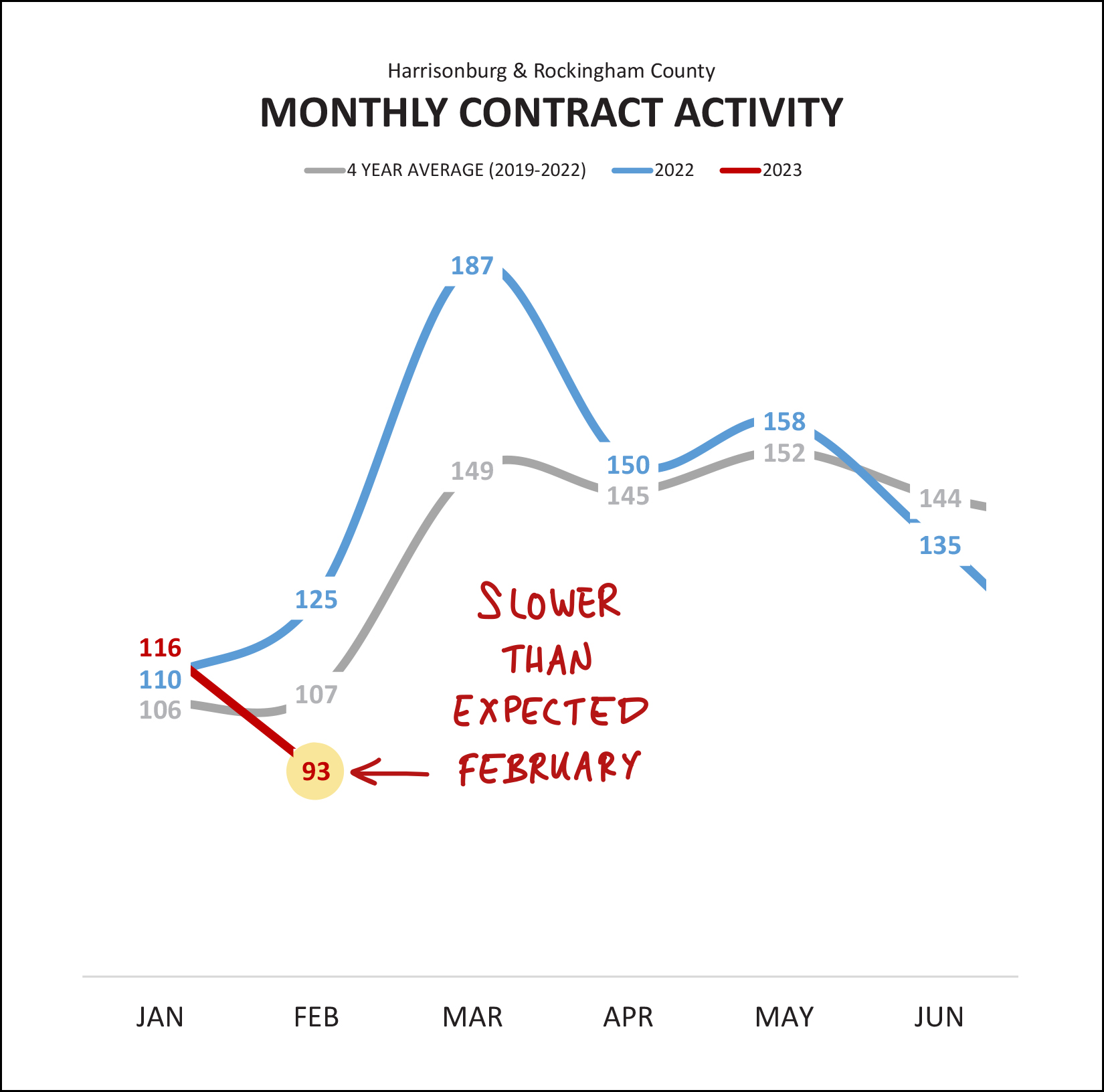

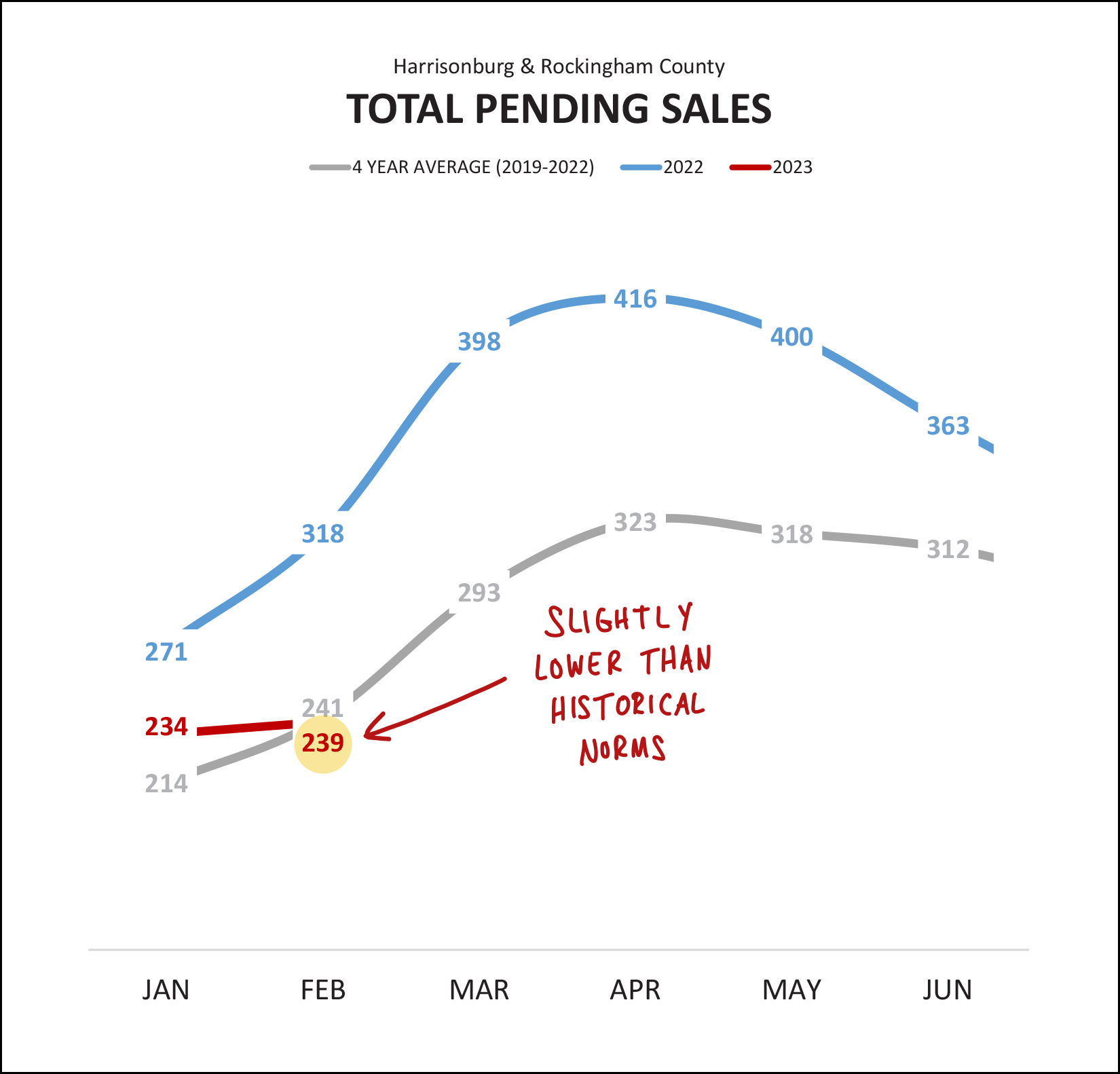

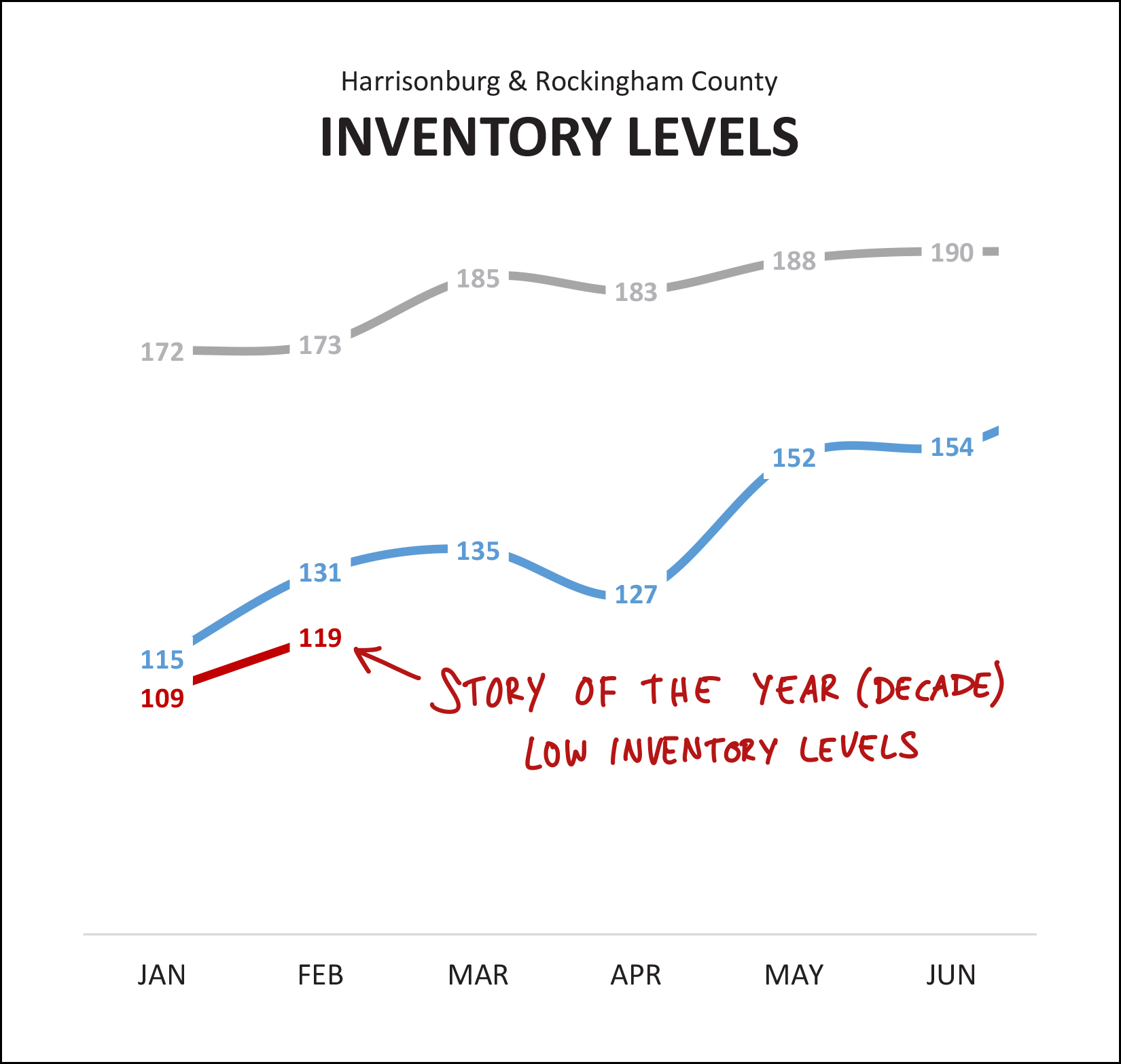

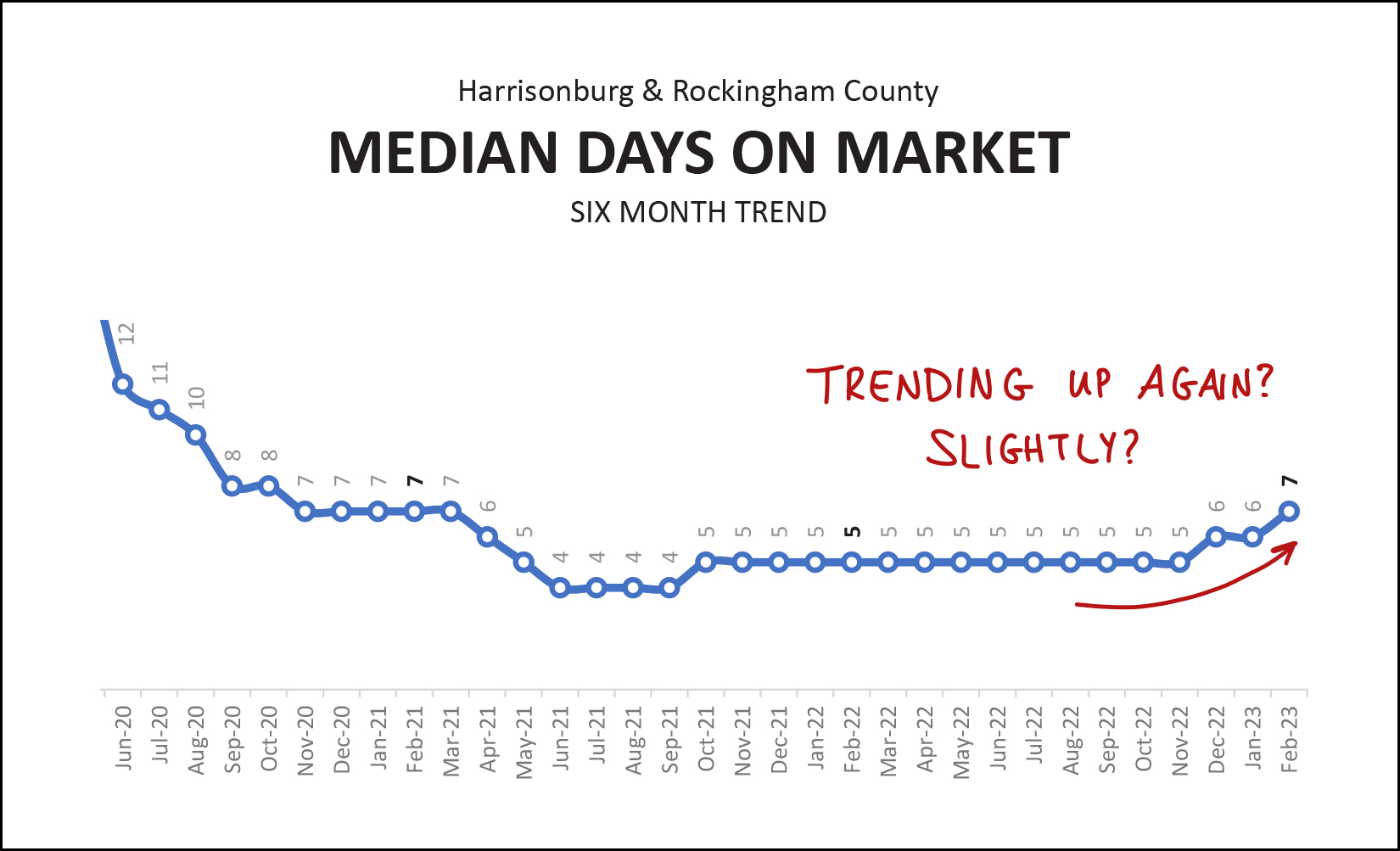

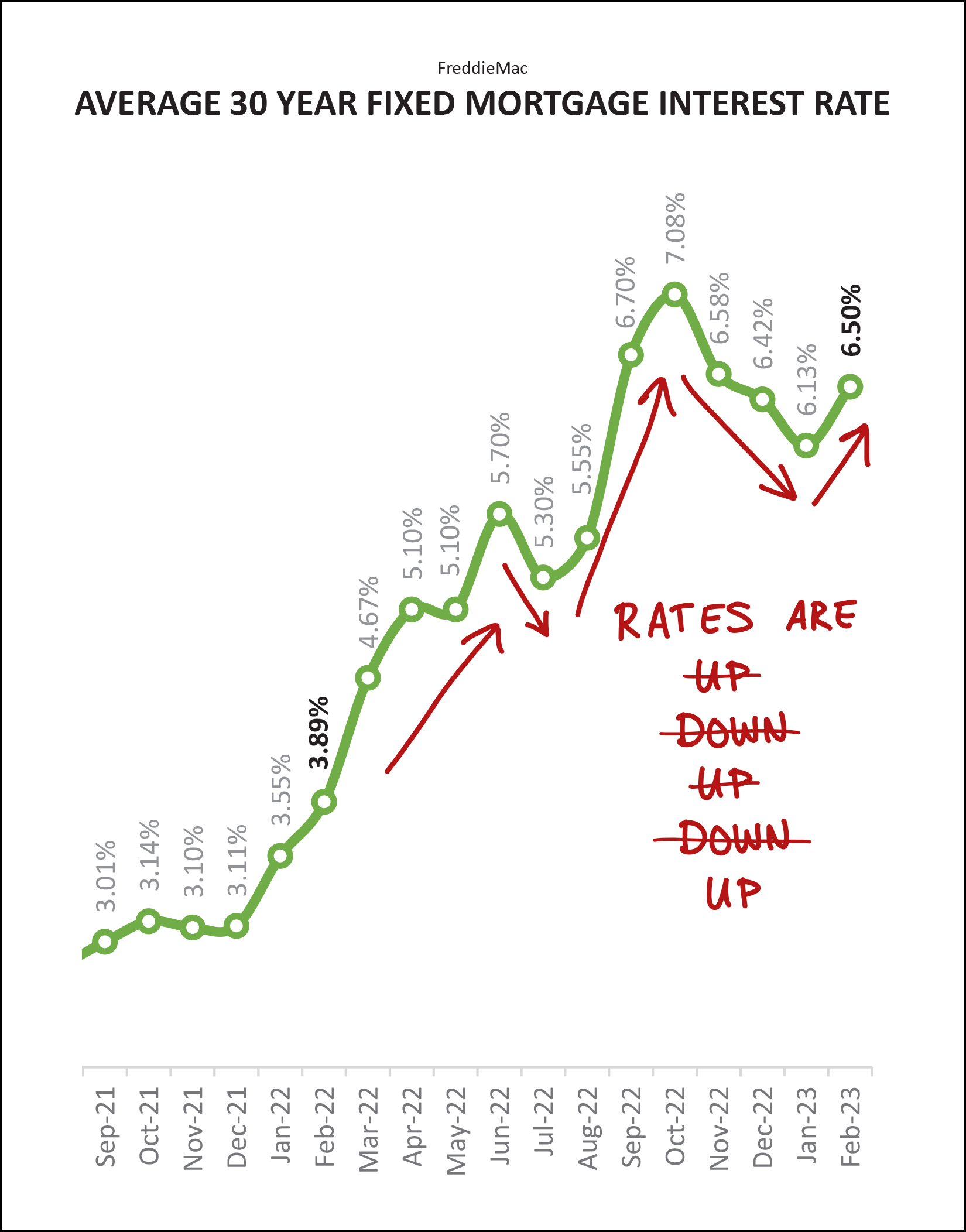

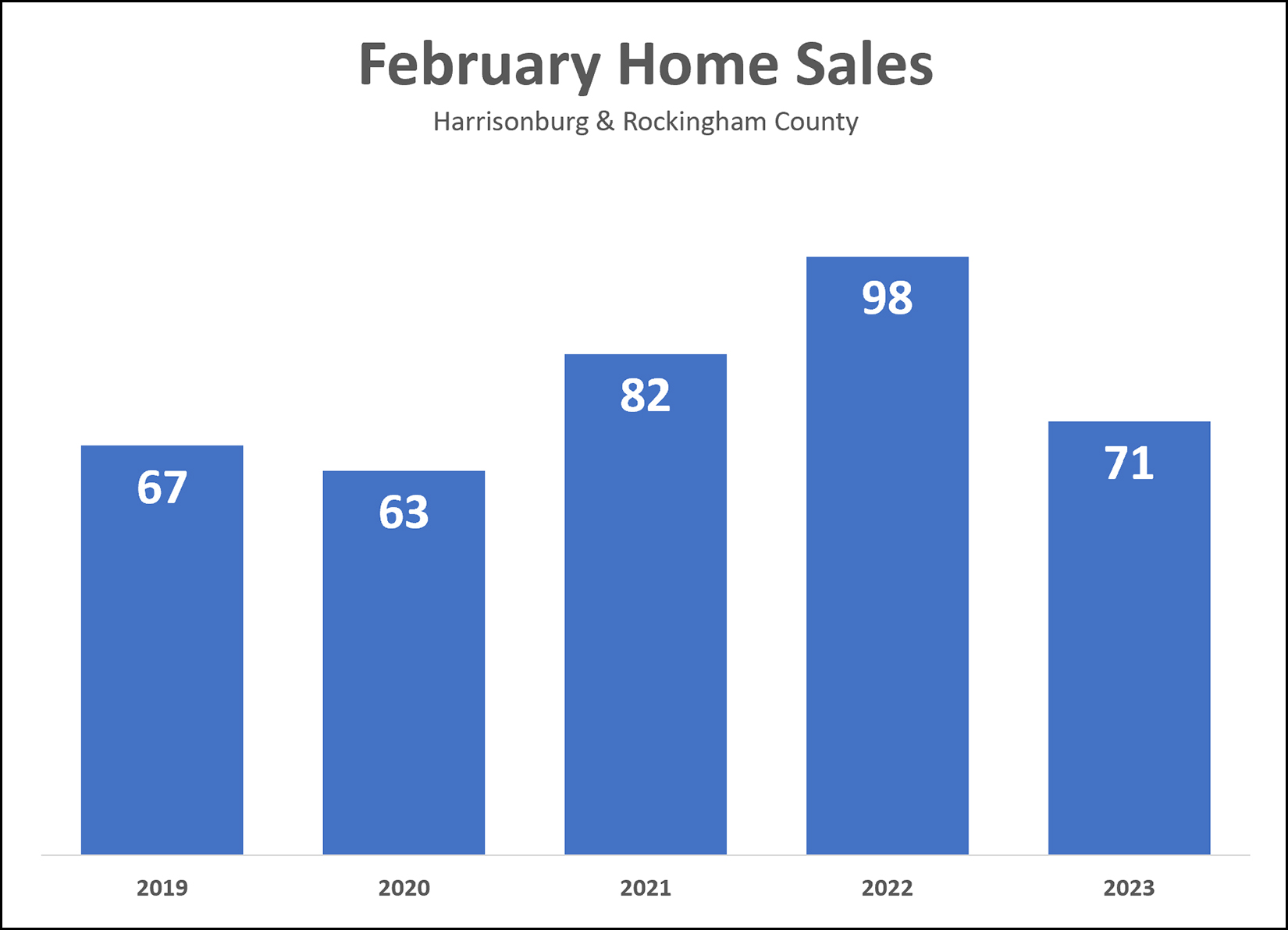

Happy Tuesday morning, friends! Indeed, February flew by quickly -- such a short month ;-) -- and now we're headed into what is typically a very busy spring in our local real estate market. Read on for an overview of everything happening right now in our local market... but first... a local highlight and an opportunity for you to be a winner! :-) Each month I offer a giveaway, of sorts, for readers of this market report, highlighting some of my favorite places, things or events in Harrisonburg. Recent highlights have included A Bowl of Good, a Steel Wheels concert, and Grilled Cheese Mania. This month... I'm giving away a $50 gift card to another of my favorite local restaurants, Taste of India. My go to order is the Chicken Tikka Masala, but you will find an extensive menu of unique and flavorful dishes at Taste of India, located on University Blvd. Click here to enter for a chance to win the $50 gift card! And now, let's move on along to the most recent data on our local real estate market...  As per my headline, there are definitely fewer buyers buying homes right now, but I am fairly confident that it is a result of fewer sellers selling homes right now - as inventory levels are not rising. As shown above... [1] There were 28% fewer home sales this February (71) compared to last February (98) in Harrisonburg and Rockingham County. [2] Looking at the past three months (Dec, Jan, Feb) there was an even larger drop off in home sales... with a 34% decline from last year (346 home sales) to this year (230 home sales). [3] If we look back at an entire year of sales we will only find an 11% decline in home sales (from 1,687 sales to 1,509 sales) indicating that the majority of the slow down is in the more recent months. [4] Despite these decreases in the number of homes that are selling... home prices keep rising! The median sales price during the past three months (when the number of sales was 34% lower than last year) was $309,205... which is 8% higher than the median sales price one year ago of $285,750. [5] Looking back at the entire year again, the median sales price over the past 12 months was $304,485 which is 11% higher than in the 12 months before that when it was $274,000. [6] The number of days it takes for a home to go under contract is -- maybe, possibly -- on the rise. This (most recent) December through February homes went under contract with a median "days on market" of nine days... which is (50%) higher than the median of six days a year ago during those same three months. So, fewer homes are selling, slightly slower, but at ever higher prices!?! Now, let's look at the number of home sales January and February compared to past norms for these months...  The red line above is the current year -- 2023 -- and you can see that the number of home sales in January and February is quite a bit lower than... [1] The number of home sales last January and February -- shown in blue. [2] The average number of home sales in each month over the past four years -- shown in grey. So, there have been fewer home sales this January and February than in other recent years. Thus, what comes next? I expect we will continue to see lower number of home sales per month as we move through March, April and May 2023 as compared to last year and as compared to the average of the past four years. Let's put the declining number of home sales in a bit of a historical context...  The annual pace of home sales peaked at 1,374 home sales back in March 2020 after declines in monthly home sales in early 2020 due to the start of the COVID-19 pandemic. The annual pace of home sales slowed for a few months... but bottomed out at 1,302 home sales per year just three months later. Then, the annual pace of home sales started climbing, and climbing, and climbing. Two years ago, homes were selling at an annual pace of 1,520 home sales per year in Harrisonburg and Rockingham County. Then, annual home sales accelerated all the way up to 1,727 home sales per year in in June 2022 -- before they started declining again. Now, as we close out February 2023, the annual pace of home sales (1,509) has returned to the same approximate place that we were in two years ago. I expect that this annual pace of home sales will continue to decline over the next six months. But, yes, sales prices keep on rising, as shown with a green line above. The annualized median sales price seems intent on continuing to rise, month after month. It has now risen from $222,150 to $304,485 in just three years! But, perhaps the increase in the median sales price is... slowing?  If you stare intently at the green line above, you'll see the slope changing a bit, which perhaps is an indicator that the rate of price increases is slowing. Maybe. 2020 increase in median sales price = 9.8% 2021 increase in median sales price = 10.2% 2022 increase in median sales price = 11.1% 2023 increase in median sales price = 6% Don't read this too quickly... home prices are not declining... but the pace at which home prices are increasing... might be slowing. Or, then again, maybe not. We are only working with two months of data for 2023. Stay tuned over the next few months to see how the 2023 median sales price adjusts as we move further through the year. Now, to predict where home sales might go next, let's look at contract activity...  After a decent month of contract activity in January (116 this year compared to 110 last year) we saw a marked decline in contract activity in February. The 93 contracts that were signed in February 2023 was significantly lower than the 125 contracts signed last February, and also well below the four year average of 107 contracts in a typical February. Thus, it is unlikely that we'll start to see an increase in home sales in March, given the decline in contracts signed in February. Furthermore, the number of pending sales (homes under contract) also declined in February...  There are currently 239 homes under contract (pending) in Harrisonburg and Rockingham County which is quite a bit lower than a year ago (blue line) when there were 318 homes under contract... and is also lower than the four year average of 241 homes typically being under contract at this time of year. All of these different metrics are all showing the ways in which our market is cooling off -- as it pertains to the *number* of homes that are selling -- not as it relates to the value of homes in our area. Circling back to my headline this month... I think the cause of fewer home sales is mainly due to fewer sellers selling, which is resulting in fewer buyers buying, because...  Inventory levels are lower than ever. There are currently 119 homes for sale (not under contract) in Harrisonburg and Rockingham County which is even lower than the inventory levels a year ago at this time of the year (131 for sale) and significantly lower than the four year average of 173 homes for sale at this time of year. If fewer buyers were buying... and just as many sellers wanted to sell... we would start to see inventory levels increasing. Fewer home sales, combined with ever lower home sales, is a very good indicator that the decline in the number of home sales is a result of fewer sellers being willing to sell -- more so than a result of fewer buyers wanting to buy. All that said, there is one trend in our local market that runs at least a bit counter to all of the other trends...  The median "days on market" figure has started to trend upwards over the past few months. For over a year, the median number of days it took for a home to go under contract was only five days. That has now drifted slightly upward to seven days. This means something... but maybe not much. Homes are going under contract *slightly* more slowly now than they were over the past few years. It is now taking them (as per the median calculation) about seven days to go under contract, instead of only five days. I'll continue to monitor this over the coming months to see if this trend continues when we get into the thick of the spring market. And one last graph... that looks like it had one too many cups of coffee this morning with all of its jittering all over the place...  Mortgage interest rates have been all over the place over the past year. A year ago the average 30 year mortgage interest rate was 4%, and now it's 6.5%. But during the past year we have seen multiple months of increases and some decreases. It's hard to say what will happen next with mortgage interest rates. Perhaps the only reasonable prediction is that rates will go up and go down in the next six months. ;-) So... if you're looking to buy or sell a house in Harrisonburg or Rockingham County this spring, what should you conclude based on all of the data above? If you will be selling... [1] The market is still very favorable for home sellers. [2] Home prices have never been higher. [3] Half (or more) of homes that well are still going under contract in a week or less. [4] Diligent preparations, proper pricing and thorough marketing will likely still result in a speedy and favorable home sale for most sellers of most homes in most price ranges and locations. If you will be buying... [1] The market is still very competitive in most price ranges and for most property types. [2] It is still important to be pre-approved and to go see homes within the first day or two that they are on the market. [3] There will likely be fewer options for buying this year than last as fewer home sellers are seeming willing to sell. There's plenty more that we can discuss about your particular scenario if you are thinking of selling or buying, so feel free to reach out (call or text me at 540-578-0102 or email me here) if you'd like to chat or find a time to meet. If you're not quite ready to sell or buy yet, but have questions about the market or the process, I'd also be delighted to hear from you. Touch base anytime. That's all for today, folks. I hope that March treats you well and that you enjoy the suspense of not knowing whether we'll get that surprise March snowfall that we sometimes see in the Valley. ;-) Regardless of whether we get some snow or not, I hope you enjoy the changing of the seasons as we move through March. It is certainly a beautiful time in the Shenandoah Valley! P.S. If you want even more charts and graphs than I have included above, you'll find them here. | |

First Look At February 2023 Home Sales |

|

Perhaps unsurprisingly, February 2023 home sales don't quite match up to February 2021 or 2022. Of course, during 2021 and 2022 we were experiencing... [1] Surging buyer interest due to super low interest rates. [2] Many, many buyers trying to upgrade their living arrangements due to Covid induced life changes with working from home, etc. Interest rates are higher now, and there is a bit less urgency to upgrade ones living arrangements if you haven't already done so as we seem to be settling back into life after Covid. And what do you know... home sales in 2023 aren't quite as crazy high as they were in 2021 and 2022. I should also note that... [1] Home sales in February 2023 were (a bit) higher than in 2019 and 2020. [2] The decline in home sales is not (thus far) leading to an increase in housing inventory levels. Fewer buyers are buying... but fewer sellers are selling as well... so inventory levels are remaining low. I'll publish a full accounting of February housing market updates soon. | |

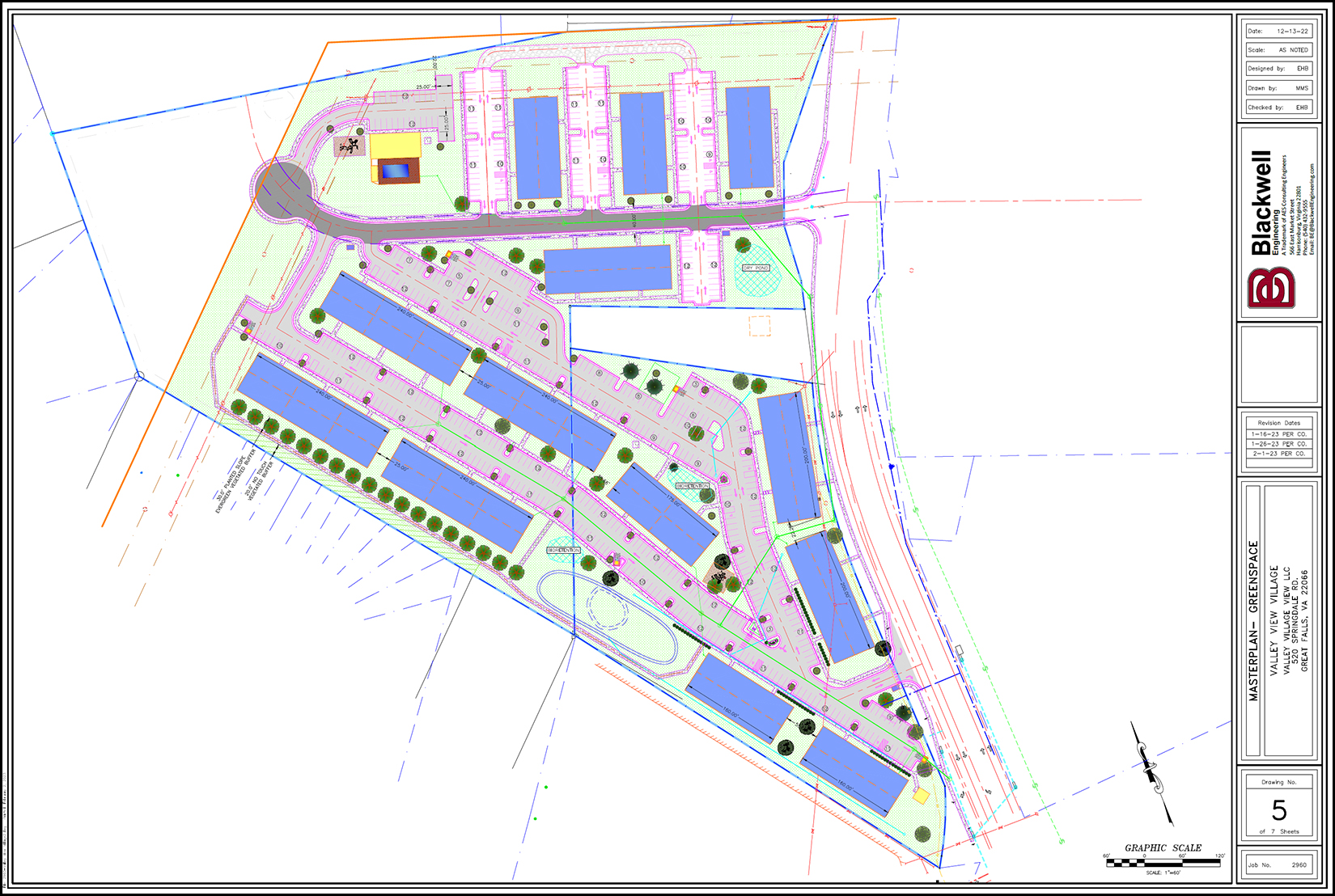

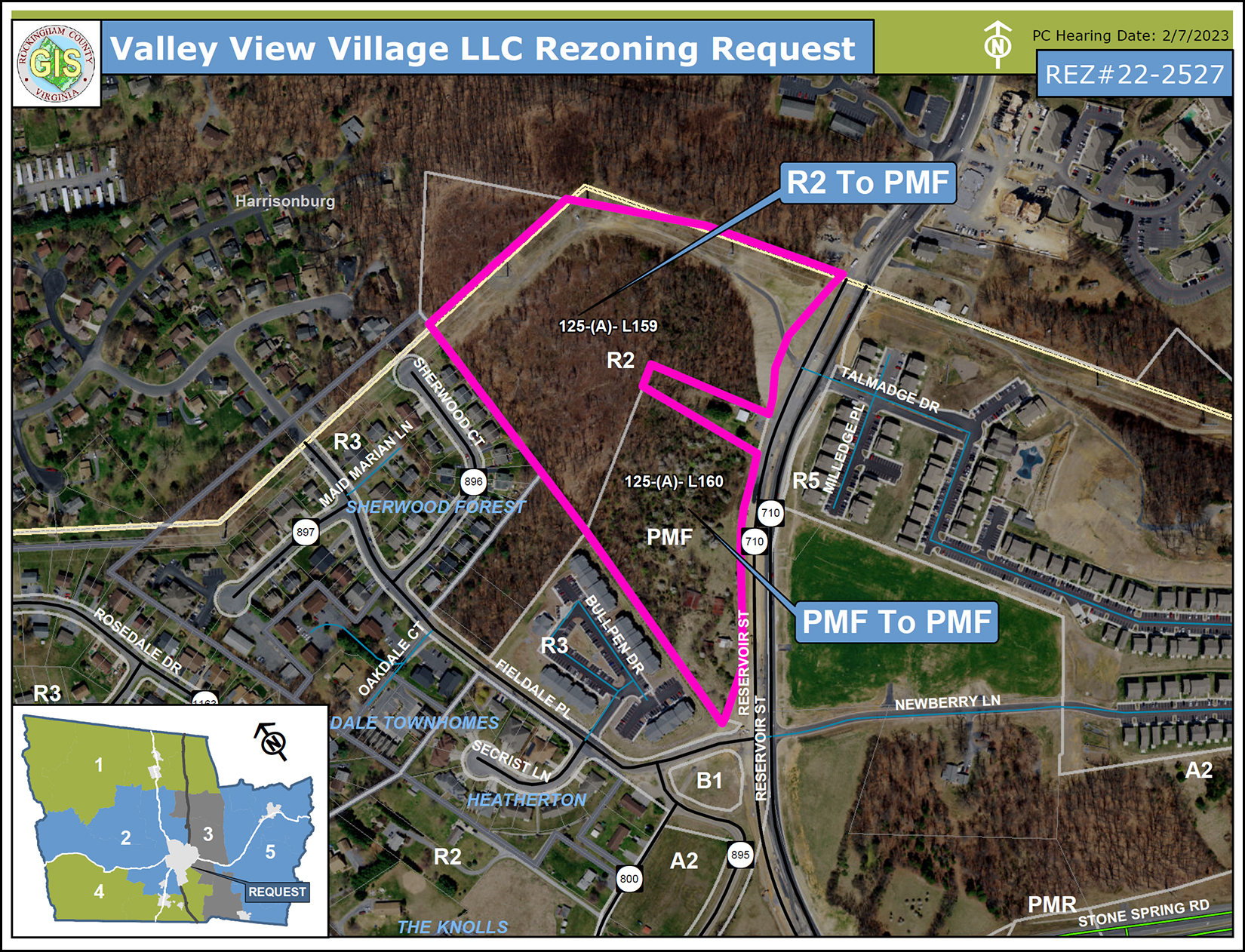

Valley View Village, To Include 420 Apartments, Proposed For Reservoir Street |

|

Back in 2019, a proposal was approved for 156 apartments on 5.3 acres on Reservoir Street... but the apartments have not been constructed. Now, a new proposal is being considered by Rockingham County (Planning Commission, Board of Supervisors) to include two unimproved parcels totaling 18.125 acres. The applicant is proposing to build approximately 420 apartments in 13 apartment buildings with a variety of amenities such as a pool, dog wash, tot lots and a walking trail. The original 5.3 acres is already zoned Planned Multi Family (PMF) and the applicant is seeking to rezone the second parcel from R2 to PMF. As you'll note below, the two parcels are mostly surrounded by apartments, a few duplexes, and some undeveloped land.  Per the applicant's representative at Blackwell Engineering, the apartment buildings will vary in size with anywhere from 28 apartments to 42 apartments per building. The apartments will be a mixture of 1, 2 and 3 bedroom units. This rezoning will go before the Planning Commission and then potentially the Board of Supervisors in the coming months. Download the entire information packet here. | |

Balancing Optimism, Pessimism And Realism When Thinking About An Almost Perfect House |

|

Yahoo! You have found an "almost perfect" house -- and you're thinking about making an offer. But... it's early spring (pre spring?) and there will be many more new listings coming on the market in the next few months, right? So... do you go ahead and make an offer on the almost perfect house now? Or do you wait to see what else hits the market that might be even more exciting!?? OPTIMISM tells us to wait for that perfect house. Don't compromise. There will be plenty of new options over the next 60 to 90 days. You won't want to miss out on the perfect house because you settled for an almost perfect house. PESSIMISM tells us that there probably won't be perfect houses, and if there are, there will be way too many buyers pursuing them, and your chances are low of winning a multiple offer scenario. REALISM tells us that (especially in the current fast moving, low inventory, real estate market) an almost perfect house is likely the perfect house to pursue. There are likely very few absolutely perfect houses, so if you have found one that is almost perfect, don't wait! It's tricky buying a home these days because you often can't compare one house to another, as the first will be under contract by the time the second house comes on the market. Thus, buyers often find themselves asking if "almost perfect" is perfect enough. | |

Thinking About Investment Properties Like Trees |

|

A (not very well sourced) proverb goes something like this... "The best time to plant a tree was 30 years ago, and the second best time to plant a tree is now." And so it goes with purchasing investment properties. The best time to purchase an investment property was (certainly!) 30 years ago... or 20 years ago... or even 10 years ago! (or in this crazy market, even five years ago) The second best time to purchase an investment property is now. A bit of explanation and plenty of caveats are necessary here... I've had a variety of conversations with real estate investors over the past few months as they have considered various properties that have come on the market for sale. We have lamented (together) that prices have risen so much that it's harder to justify some investment property purchases with today's prices and today's interest rates. On multiple occasions, my clients have said commented that they wish they had bought an investment property (or two... or five) about 5 to 10 years ago. But, as we have reflected further, we have realized that there is not likely going to be a future time when conditions will be more favorable for an investment property purchase. Prices do not seem likely to decline significantly (if at all) and while interest rates may decline some over the next year or two they seem unlikely to decline significantly. As such, if you didn't buy an investment property (or properties) 10 or 20 years ago... but you want to own one in 10 or 20 years, perhaps today is the best time to do so. OK, OK, plenty of caveats... [1] Investment property values do not always increase over all periods of time. I'm not trying to tell you that they do. Investing (in real estate or otherwise) includes risk. [2] You still need to make sure the numbers work from a monthly cash flow perspective, etc. [3] I do recognize that if you buy a property as an investment property it might keep an owner occupant buyer out of the market for buying that same property. This observation is not me telling you that you should not buy the investment property - but just an acknowledgement that any purchasing decision has other follow on consequences. If you're hoping to buy an investment property in the next few years (or this year!) let's chat sooner rather than later to make sure you understand what numbers to expect -- from a purchase price perspective and from a rental income perspective. And then... let's go find you a tree to plant... I mean... an investment property to purchase! | |

March Is Right Around The Corner And Every Would Be Home Buyer Hopes It Means Lots Of New Listings Are Coming Soon! |

|

Where are all of those houses for sale? Yes, I know, I know, they're already under contract. Plenty of homes are selling these days -- but because they go under contract so quickly -- there are rarely many on the market at any given time. But, March is coming! The spring market is often the busiest time of year for new listings, and we may start to see that surge of new listings coming at some point in March. And if not, April. While I'm thinking we will definitely see fewer resale homes hitting the market this year, we will likely start to see more of them coming on the market as we move through March and into April. So, if you're a hopeful home buyer, excited for whatever new listings might be coming on the market in March... or April... 1. Make sure you have an up to date lender letter. 2. Start tracking new listings to be amongst the first to know of new opportunities. 3. Get ready to jump on a new listing quickly -- seeing it quickly -- and then quickly deciding whether to make an offer. March is coming. Spring is coming. Hopefully, many more new listings are coming. | |

This (Late February, Early March) Can Be A Magical Time To List Your Home For Sale |

|

The first day of spring is March 20th. The spring real estate market is often seen as kicking off in mid to late March, or certainly by the first part of April. So, what about this timeframe we're in right now -- late February and early March? Is this a decent time to list one's home for sale? It can actually be quite a magical time to list your home for sale... 1. You will have very little competition from other sellers, as many sellers will choose to wait another month or more to list their home for sale. 2. You will potentially have pent up demand from lots of home buyers that have not found anything to buy over the past few months when there have been very few new listings from which to choose. Homes that hit the market in this pre-spring timeframe often get lots of attention and sell with very favorable terms. So, while your flowers may not have started blooming yet, and your grass might not be as green as it will be in another month, there can be some specific and magical benefits to getting your house on the market sooner rather than later! | |

In A Multiple Offer Scenario, Consider Making The Strongest Offer You Are Comfortable Making |

|

It seems we might still be finding ourselves in plenty of multiple offer scenarios this coming spring in the Harrisonburg and Rockingham County real estate market. And sometimes... a buyer discovers that the house they have just walked into is one that works very, very well, for their needs. What sort of an offer should that interest translate into? I recommend that buyers make the strongest offer that they are comfortable making. PRICE - If the house we just viewed is listed for $400K, and we believe it is worth $400K, perhaps we offer $400K. Or, perhaps we include an escalation clause to demonstrate a willingness to pay as much as $410K, or $425K, given that this property fits your needs (and wants) very, very well, like no other house has to date. INSPECTION - If you are comfortable making an offer without a home inspection, based on your level of risk tolerance, and the condition and age of the property, and your available resources for making improvements, then perhaps we make an offer without an inspection contingency. Or, perhaps you are not comfortable making an offer without an inspection contingency. RADON - If you are comfortable testing for radon after you purchase the home, and installing a radon mitigation system at that time if needed, then perhaps we make an offer without a radon test contingency. APPRAISAL - If, based on the size of your downpayment, a slightly low appraised value would not affect your financing, and if you are comfortable paying the offering price regardless of what value the appraiser determines through their appraisal process, then perhaps we make an offer without a specific appraisal contingency. As you can see here, if we are going to be competing with other buyers and offers, we need to make a strong offer, but only as strong as you are comfortable making given your financial picture, the particular property, how well the property suits you, your tolerance for risk, etc. | |

Real Estate Has Seemed Like An Abnormally Liquid Asset Over The Past Few Years |

|

What is a liquid asset? Per Investopedia... "A liquid asset is an asset that can easily be converted into cash in a short amount of time." ...and further... "Liquid assets are often viewed as cash, and likewise may be called cash equivalents because the owner is confident the assets can easily be exchanged for cash at any time." ...and finally... "Generally, several factors must exist for a liquid asset to be considered liquid. It must be in an established, liquid market with a large number of readily available buyers. Ownership transfer must also be secure and easily facilitated." Real estate is generally understood to NOT be a liquid asset... as it can take time to sell real estate, the value for which a property will sell is not always certain, selling quickly to convert real estate to cash might result in a lower sales price, etc. But... over the past few years real estate has certainly SEEMED like a liquid asset for many property sellers. You want to sell your house? No problem. What to sell it quickly? We can make that happen. For an amazingly high price? Yep, that will happen too. So, while real estate was not (over the past few years) and is not (now) a liquid asset, it certainly seemed like it was to many property owners. Will this dynamic continue on into 2023 and 2024?

So, real estate -- which is definitely NOT a liquid asset -- might start to feel slightly less liquid over the next year or two based on the trends noted above. Or, maybe not. Maybe just about every home will continue to sell, without question, very quickly, at a very favorable price. The key takeaway here, as a buyer (or homeowner) is to remember that real estate is NOT a liquid asset. Don't buy a house today, paying any price, waiving all contingencies, if you might want to sell it again in 3, 6, 9 or 12 months. There are significant transactional costs of selling (and buying) a home and it is not a liquid asset - so it cannot always be quickly converted back into cash in your pocket. | |

Yes, More Houses Will Come On The Market For Sale In The Spring. Yes, More Buyers Will Be Competing For Them. |

|

It's a common question at this time of year... Will more houses come on the market in the spring? There don't seem to be many options at all right now. Great news... There will be more homes coming on the market in the spring. The spring season is one of the most active times of the year for new listings of homes for sale to be coming on the market. But... Bad news... There will also likely be more buyers competing for each of those new listings, as the number of buyers shopping for homes also typically increases significantly in the spring. So... Yes, more houses will come on the market for sale in the spring AND yes, more buyers will be competing for them. :-) :-( I suppose though, that as a buyer, it's still nice to have more listings from which to choose from, even if you have more competition as well? Even with higher mortgage interest rates (relative to the past few years) and even with prices edging higher and higher -- it still seems that the coming spring season will be quite an active one in the Harrisonburg and Rockingham County real estate market. | |

Should Home Sellers Expect Offers With Home Sale Contingencies? |

|

You're getting ready to list your home for sale. You aren't desperate to sell, and you don't need a lightning fast sale... but you want things to move along at a steady pace. Should you expect to receive offers with a home sale contingency? It's not thrilling to think about a home sale contingency as a home seller... you'd just be trading in needing to sell your home... for needing someone else to sell their home. Is it reasonable to hope to or plan to only consider offers without a home sale contingency? Good news, home sellers (and bad news contingent home buyers) as current local housing market conditions still favor home sellers. As such, most home sellers are not finding it necessary to consider offers with home sale contingencies. Typically, if a home seller were to accept a contract with a home sale contingency, they would do by also adding a "kickout clause" that would allow them to continue to market their property to other buyers and to kick out the primary (home sale contingent) buyer if a new (not home sale contingent) buyer makes an offer. As such, one way to evaluate whether home sellers are readily accepting contingent contracts is to evaluate how many listings fall into each of the following two categories in the HRAR MLS. Pending - this means the property is under contract, in almost all cases without a home sale contingency, and certainly, without a kickout clause as per the status below. Active with Kickout - this typically means the property is under contract, but has a kickout clause, likely because the buyer still needs to sell their home in order to buy the listing. Here's how things currently shake out as of 2/19/2023... Pending = 231 properties Active with Kickout = 2 properties So, indeed, most home sellers do not seem to be finding it necessary to accept an offer with a home sale contingency. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings