| Newer Posts | Older Posts |

Home Buyers Who Buy Houses Without A Home Inspection Should Do One After Closing! |

|

On many, many, recent offers on properties I have listed for sale buyers have not been including home inspection contingencies. This seems, in many circumstances, to be the only way to (hopefully) make your offer competitive enough to (hopefully) win out when there are multiple other offers in this frenzied seller's market. In a more balanced market, there are two general outcomes of a buyer having hired a home inspector to conduct a home inspection... [1] First, a buyer affirms their decision to buy based on new information gleaned during a home inspection that they did not know when viewing the house prior to making an offer. If the new information causes them to see the house in a significantly different light, they may very well ask the seller to make some repairs, reduce the price or they might decide not to proceed with the purchase. [2] Second, a buyer typically learns a lot more about the house than they knew before the home inspection. Even if the new information that they learn does not cause them to decide not to buy and does not cause them to try to renegotiate contract terms with the seller, it still helps them to understand what types of future home improvement or preventative maintenance they should anticipate in coming months and years. Given this second factor, particularly, my strong recommendation to home buyers in this current, frenzied market, is to hire a home inspector to inspect your home after you close on the purchase. You are likely to gain additional information and insight into the condition and systems of your home that will serve you well throughout your ownership of the property for years to come! | |

Many Home Sellers Are Enjoying Working Through Far Fewer Contract Contingencies |

|

I used to tell home sellers that they should expect to that we'll be working through three large, major, serious contingencies between the time that their house is under contract and when it makes it to closing... 1. Home Inspection 2. Financing 3. Appraisal We had to make over each of these hurdles, through each of these gauntlets to successfully make it to settlement. But, now, sellers are enjoying often only working through only two of these contingencies, or even just one of these contingencies. I recently listed a property for sale in the $300K range and we received six offers on the property within 48 hours of being on the market. None of the six buyers included a home inspection contingency. So, many sellers are finding themselves not needing to worry about making it through the home inspection process. On another recent listing six buyers did include an appraisal contingency and two buyers specifically said that they would be willing to pay $___ over the appraised value if the appraisal came in low. So, many sellers don't have to worry about an appraisal contingency at all, or not anywhere near as much as they had in the past. Thus, many sellers are finding the period of time between contract and closing to be much less stressful... and they realize that it is much more certain that they will make it successfully to closing. Buyers, on the other hand, well, yeah... you can imagine from my comments above... they are having to decide on each offer whether to include what used to be typical contingencies (inspection, appraisal) to protect their best interests. It's a bit of a crazy time right now, with a very imbalanced market, and thus far things are not seeming to be slowing down. | |

Rising Mortgage Interest Rates Are Causing Some Would Be Home Buyers To Adjust Their Target Purchase Price |

|

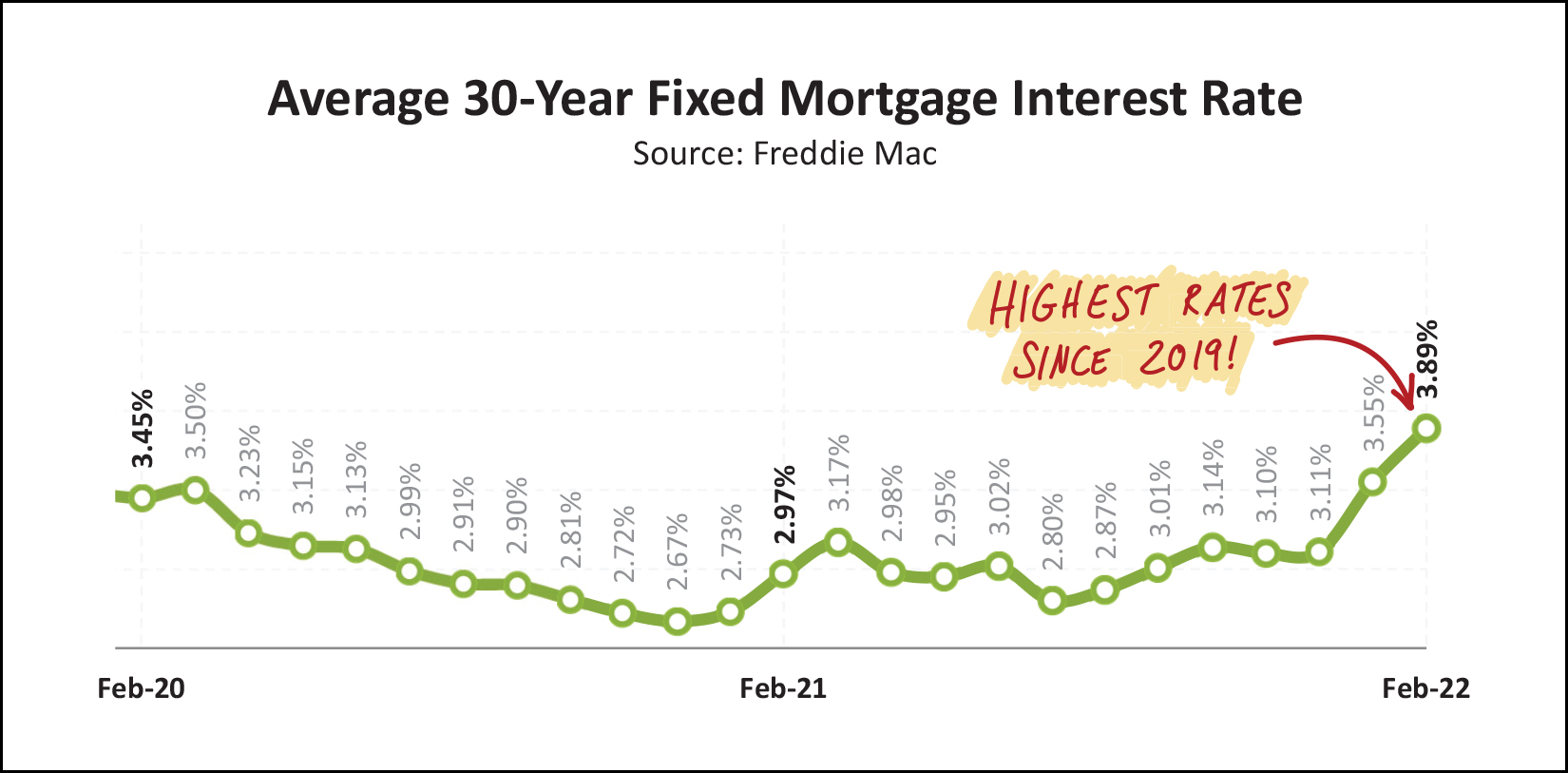

Have you heard? Interest rates are on the rise. In early January, the average mortgage interest rate was 3.22% on a 30 year fixed rate mortgage. Last week, the average mortgage interest rate was 4.67% on a 30 year fixed rate mortgage. That is quite an increase!!! Here are two examples of how that might -- and might not -- affect buyers. Buyer 1 - Buying Below Budget Our first set of fictional buyers was planning in January to buy a $450,000 home in Rockingham County while putting 20% down as a downpayment. Here's how things were looking in January with a 3.22% mortgage interest rate...

Here's how things are looking now with a 4.67% mortgage interest rate...

As you can see, these buyers will have to pay $300 more each month because of the increased mortgage interest rates -- but, they were originally qualified up to $600,000 so the $300/month increase is annoying and frustrating, but does not change their plans to buy a $450,000 home. Buyer 2 - Maxing Out The Budget Our first set of fictional buyers was planning in January to buy a $350,000 home in Harrisonburg while putting 10% down as a downpayment. Here's how things were looking in January with a 3.22% mortgage interest rate...

Here's how things are looking now with a 4.67% mortgage interest rate...

As such, here's how things really look for them if they are maxing out their $1,725 per month budget given these new mortgage interest rates...

As you can see, these buyers had to reduce their budget from looking at houses priced at $350,000 down to houses priced at $305,000. That's quite an adjustment, especially when home prices are currently increasing by 10% per year. So, what does this mean for our market? All this is to say that some buyers will *definitely* be affected by these rising interest rates -- finding themselves no longer able to buy the home they hoped to buy, or needing to lower the price point of houses they will be considering. At the same time, however, some buyers will still be able to afford to buy the same houses they had planned to buy -- though their monthly housing costs for having done so will certainly be increasing. If, in our local market, most buyers were maxing out their home buying budget, and thus now have to buy less expensive homes, that could cause values to stop increasing, or even to start decreasing. What is not clear is how many buyers in our local market were maxing out their home buying budget and how many had room to increase their monthly mortgage payment if needed. | |

Will Inventory Levels (of resale homes) Increase At All This Spring? |

|

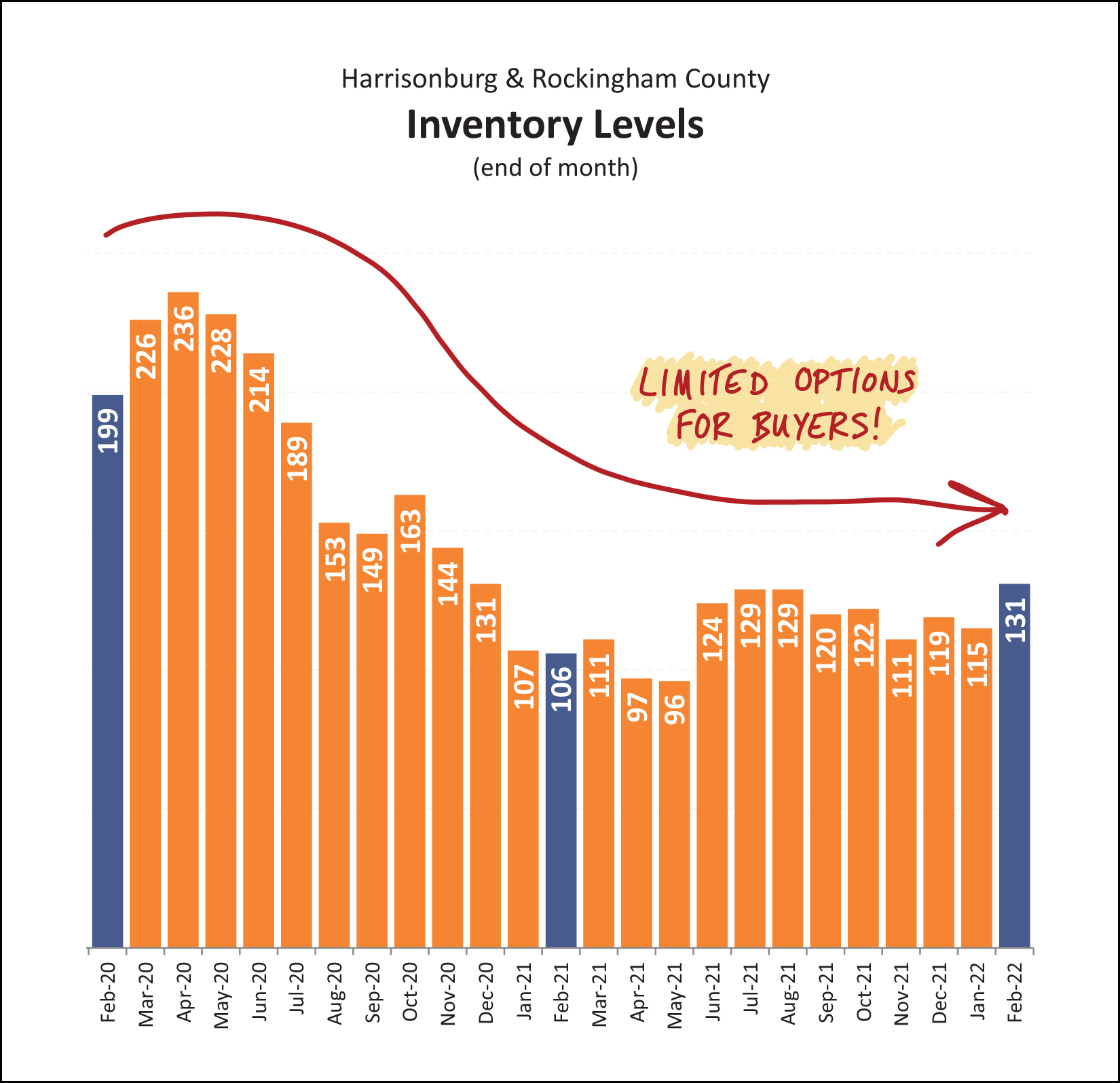

Many homeowners thinking about selling their homes this spring are considering selling sooner rather than later... because of the super low inventory levels right now. There are certainly houses on the market for sale, but many are new builds, and thus if a buyer wants to go ahead and buy and be able to move into their home, they are likely trying to do so with very few houses from which to choose. The logic of listing your home sooner rather than later is something along the lines of.... List Now = zero (or very little) competition from other sellers List Later = likely more competition from other sellers I totally agree with this logic, and listing sooner rather than later makes a lot of sense, though I also am not 100% sure we'll ever get to the point this spring or summer where you will be listing your home for sale amongst much competition from other sellers. After all, if eager buyers keep snapping up each new listing as it hits the market, the collective inventory of competing listings will never grow. So, yes, my first recommendation is to list your home sooner rather than later -- though it will probably work out just fine to list a bit later as well. P.S. Buyers -- sorry there are so few options for you!!! :-/ | |

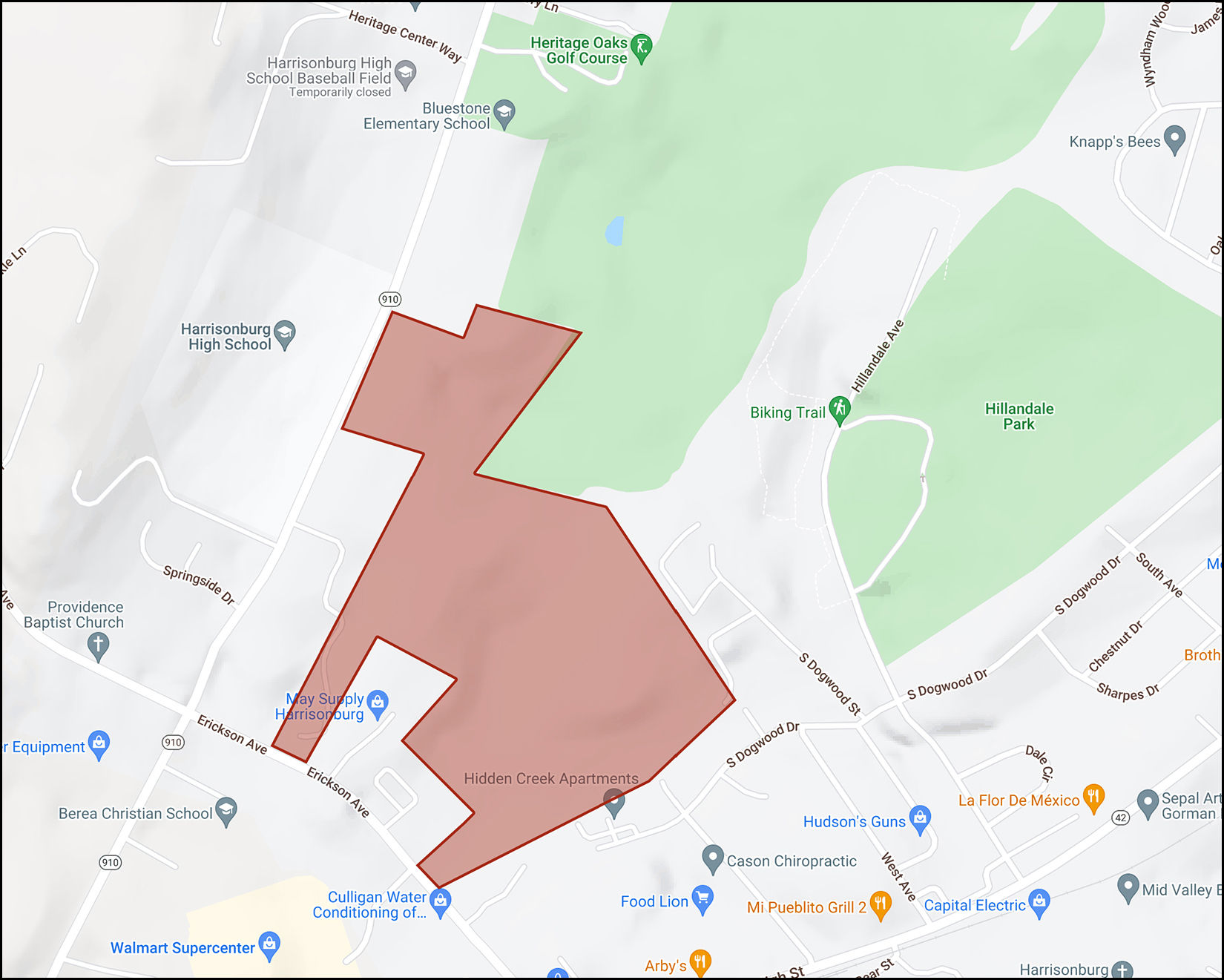

Harrisonburg Redevelopment and Housing Authority in Planning Stages of a 1,000 Unit Housing Development Across From Harrisonburg High School |

|

Specific details are still relatively limited, but the Harrisonburg Redevelopment and Housing Authority is planning a LARGE development on land that stretches from Erickson Avenue to Garbers Church Road. Here are some of the details that have been made public thus far...

More details here. Stay tuned for more details as they are made public. | |

Using An Escalation Clause To Make Sure You Do Not Pay More Than You Need To Pay For A House |

|

This might sound a bit counterintuitive to suggest in the current market, but I believe an escalation clause can (amidst other appropriate offer terms) be an effective way to make sure you are not paying more than you need to pay for a house.

Here’s the scenario… A lovely house comes on the market… it is **exactly** what you have been looking for… and you manage to snag a showing slot on the first day the house is available for showings. We discover that there are a **lot** of showings on the first two days of showing and we’re already feeling anxious before we get to the house for our showing. We haven’t been inside for more than a few minutes before you realize this is **definitely** the house that you would do anything to be able to purchase. The house is listed for $400,000. You would happily pay $400,000 for the house… or even $405,000 or $410,000… maybe even $420,000 or $425,000. It is, indeed, that perfect. It isn’t until day two that you have an updated lender letter showing you are pre-approved up to $425,000 and you are relieved to find out that the house is still available. We start talking through potential offer terms and then find out that after 48 hours there aren’t any offers on the house. We get the sense that there have been about 20 showings and about 10 of those buyers still haven’t decided whether to make an offer… but at the moment, there aren’t any offers. What to do, what to do. Do we offer $400,000 and ask to be notified if there are other offers… with the plan of revising the offer if we find out that we are in competition with other buyers tomorrow? This is a reasonable plan, but some seller won’t slow down and wait for your revised offer if they get a stronger, acceptable offer after they receive your offer. Do we just offer $415,000 or $420,000 to try to proactively put our offer above any other offers that might come in? This is also a reasonable plan, but you might then be paying $15,000 or $20,000 more than you need to pay if no other offers are made. One strategy for this situation (among many, for sure) is to make an offer at or just above the asking price with an escalation clause to automatically keep your offer a set increment above any other competing offers that come in later. This might be an offer of $402,500 with an escalation clause to automatically make your offer $5,000 higher than any other offer up to $425,000. Doing so (as described above) would give you the advantage of only paying $402,500 if no other offers came in, or if the other offers were right at the list price of $400,000 -- while also allowing your offer to be automatically be higher than any other offer unless they offered $425,000 or higher. So… if you are making an offer… and there aren’t any offers in play yet… consider an offering price at or just above the list price… with an escalation clause to hopefully keep you in first position if or when other competing offers do start rolling in. You will be giving yourself the best chance of actually buying the house, while also doing a decent job of making sure you don’t pay any more than you need to pay based on competing demand. | |

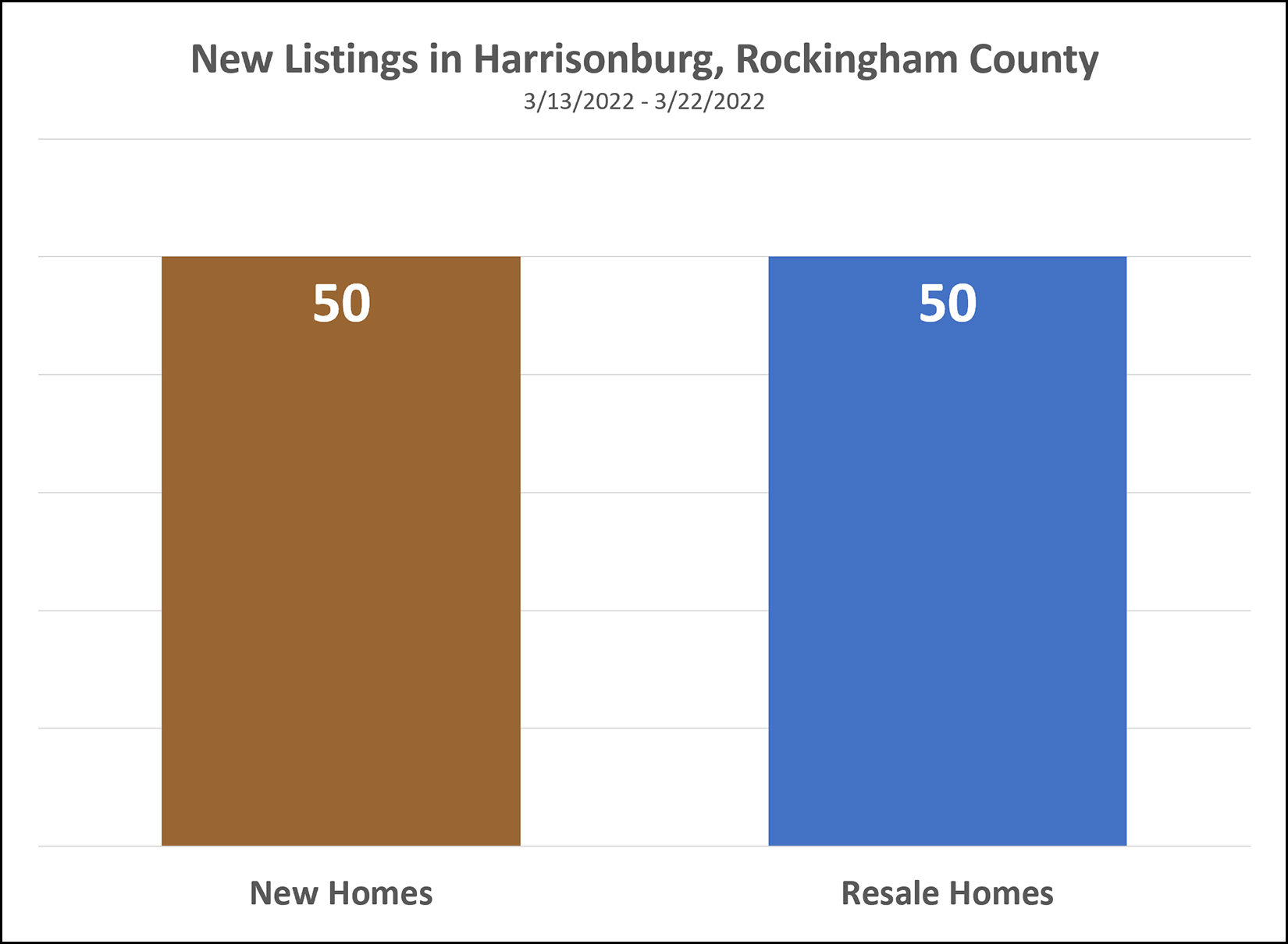

Half of All Homes Listed For Sale in the Past 10 Days Were New Homes, or To Be Built Homes |

|

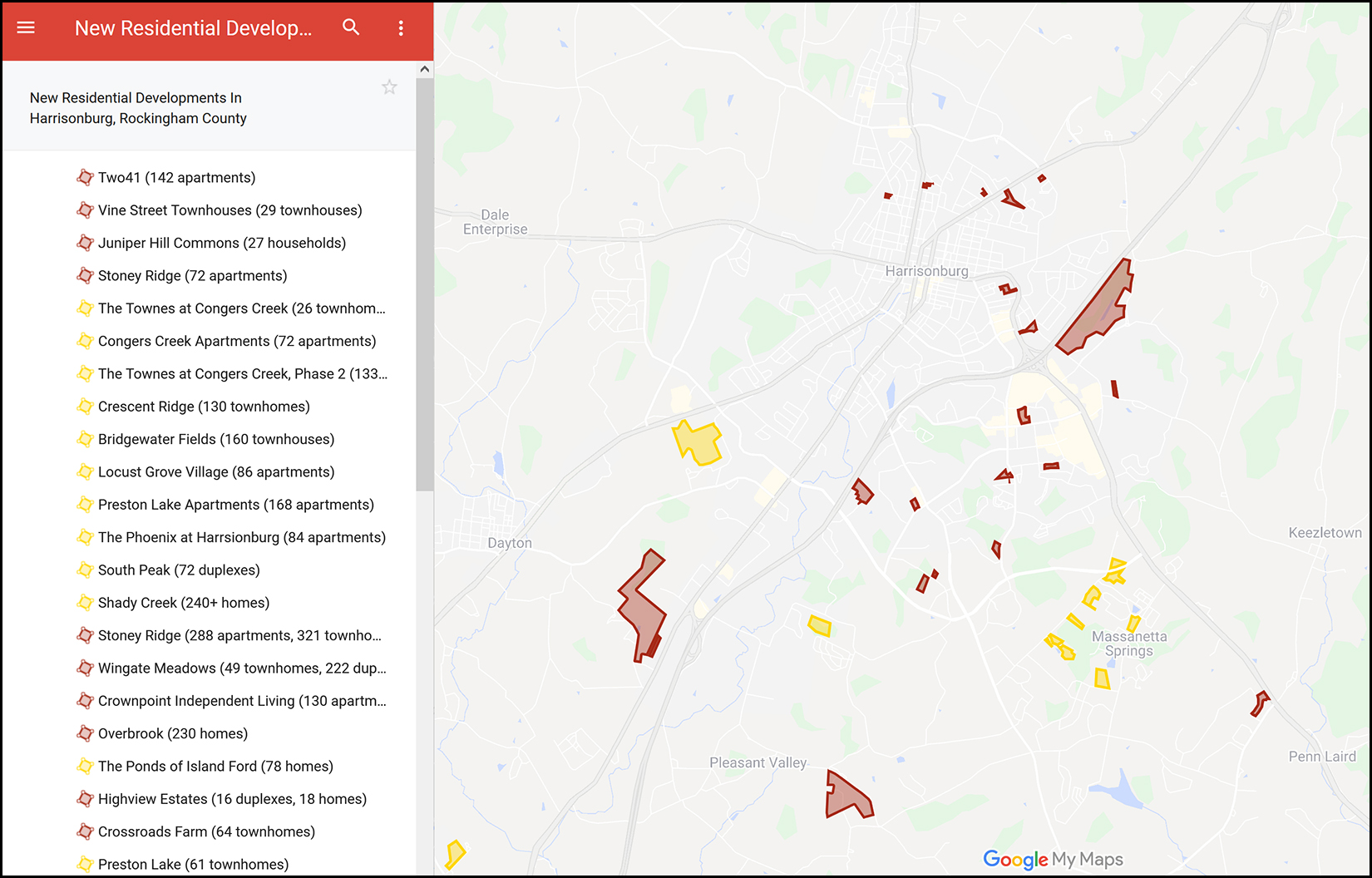

If you want to buy a home, great news... there have been 100 homes listed for sale over the past ten days! Oh, but wait. :-) Half of those homes were new homes or to-be-built homes, mostly in these neighborhoods...

So... [1] Great news that new homes are being built. Lots of people want to buy homes -- more than there are homeowners who want to sell their homes -- so it's great that new housing inventory is being built. [2] If you don't happen to want to buy a home in one of these new neighborhoods (based on location, property type, size, price, etc.) then you don't actually have 100 new listings from which to choose... it's really only 50. | |

Homeowners In Harrisonburg, Rockingham County, Likely Improved Their Net Worth By Approximately $25,000 Over The Past Year |

|

This fits into the category of...

The median value of a home sold in Harrisonburg and Rockingham County was $244,900 in 2020. One year later, in 2021, it was $270,000. This marks a $25,000 increase in the value of a median priced home over the course of a single year. So, if you have owned a home in Harrisonburg or Rockingham County over the past year you have likely seen a $25,000 increase in your net worth... or more if you own a home valued above the median sales price... or less if you own a home valued lower than the median sales price. So... Homeowners: Be thankful for the value of your home increasing so heartily over the past year. Would Be Home Buyers: Keep trying. It's a competitive market, but it is worth continuing to try to buy a home. Everybody Else: Some people may not be in a position to buy a home because of their job or income situation, because they are working to pay off debt, because they might need to move within the next few years, or for any number of other reasons. That's OK. But if you haven't bought a home and aren't planning to... but you could afford to do so, and you plan to live here for awhile... maybe we should chat. | |

Some Home Buyers Are Offering Sellers The Opportunity To Stay In The Home For A Few Weeks Or Months After Settlement |

|

In this VERY competitive market, would-be buyers are going to great lengths to try to be the winning buyer selected by a home seller. In many larger markets (think cities larger than Harrisonburg) where the housing market is even more competitive than it is here, many buyers are offering sellers the option of staying in the home they are selling after settlement - often for a few weeks or a few months. Wow! But... sometimes it's happening here in Harrisonburg and Rockingham County as well! I have now been a part of three transactions thus far in 2022 where this was the case -- where the buyer let the seller stay in the house after closing -- and I don't think those will be the last three this year. So how does it work? [1] Sometimes a seller will ask to be able to stay in the house after closing when they put their house on the market. This will often work for many but not all buyers. [2] Sometimes a seller won't ask to stay, but a buyer will offer it. [3] Sometimes a seller ends up staying for a few days or weeks... and sometimes several months. Every situation will be different as to what a seller desires and what works for a buyer. [4] In this market, currently, it seems that sellers are typically paying (rent) for the right to stay in the house after closing. In some other markets, buyers are offering sellers the right to stay without paying for that post-settlement occupancy. So... if you're buying (or hoping to) in 2022, perhaps we should chat about whether you would be able to work with a closing and moving timeline where the seller stayed in the home for some period of time after settlement. If you're selling a home in 2022, we shouldn't assume that many or all buyers will be willing to let you stay in the house after settlement, but there is a decent chance that it will work for some or many buyers, especially given the highly competitive current housing market. | |

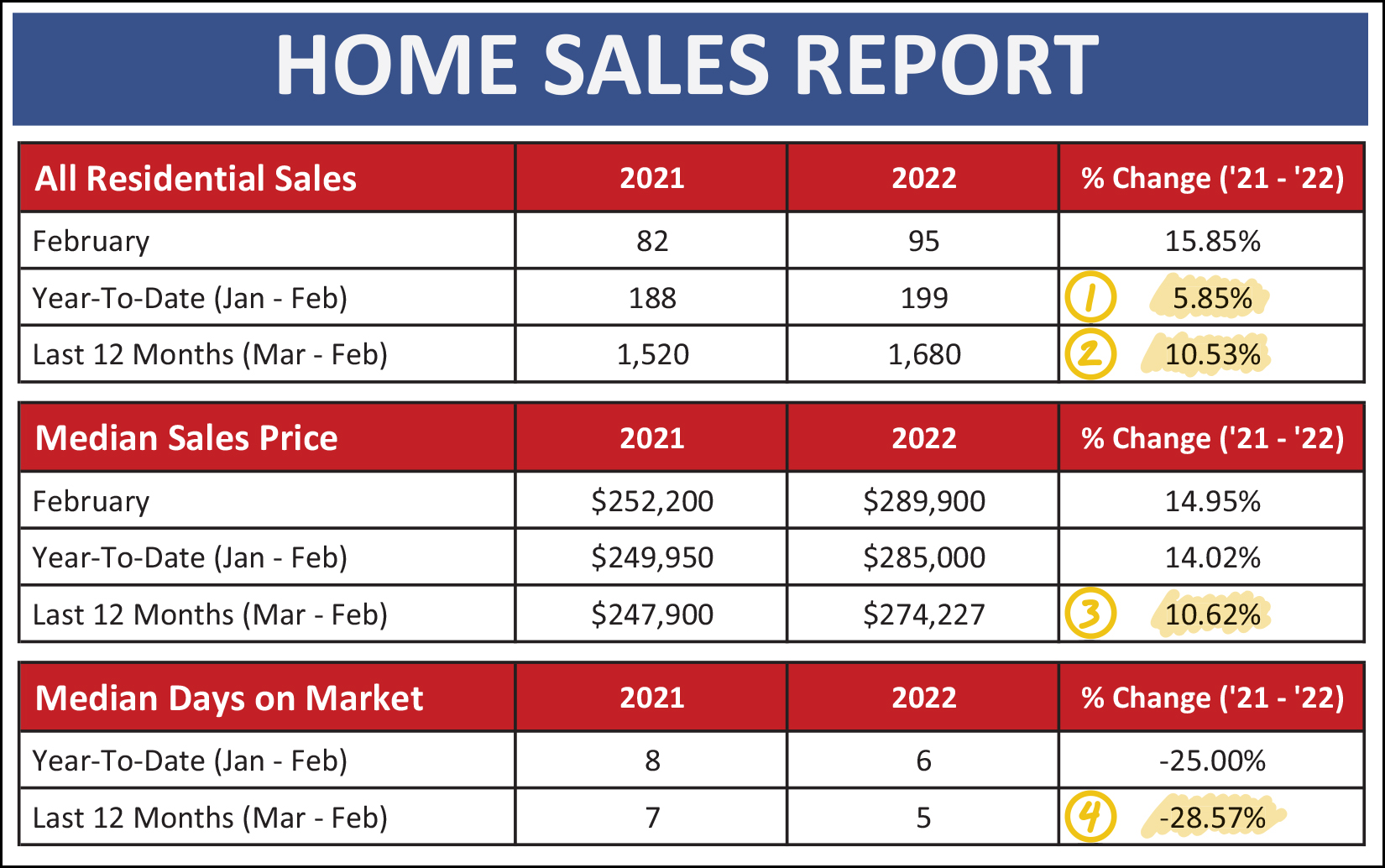

Home Sales Rise Again, Along With Prices, In February 2022 |

|

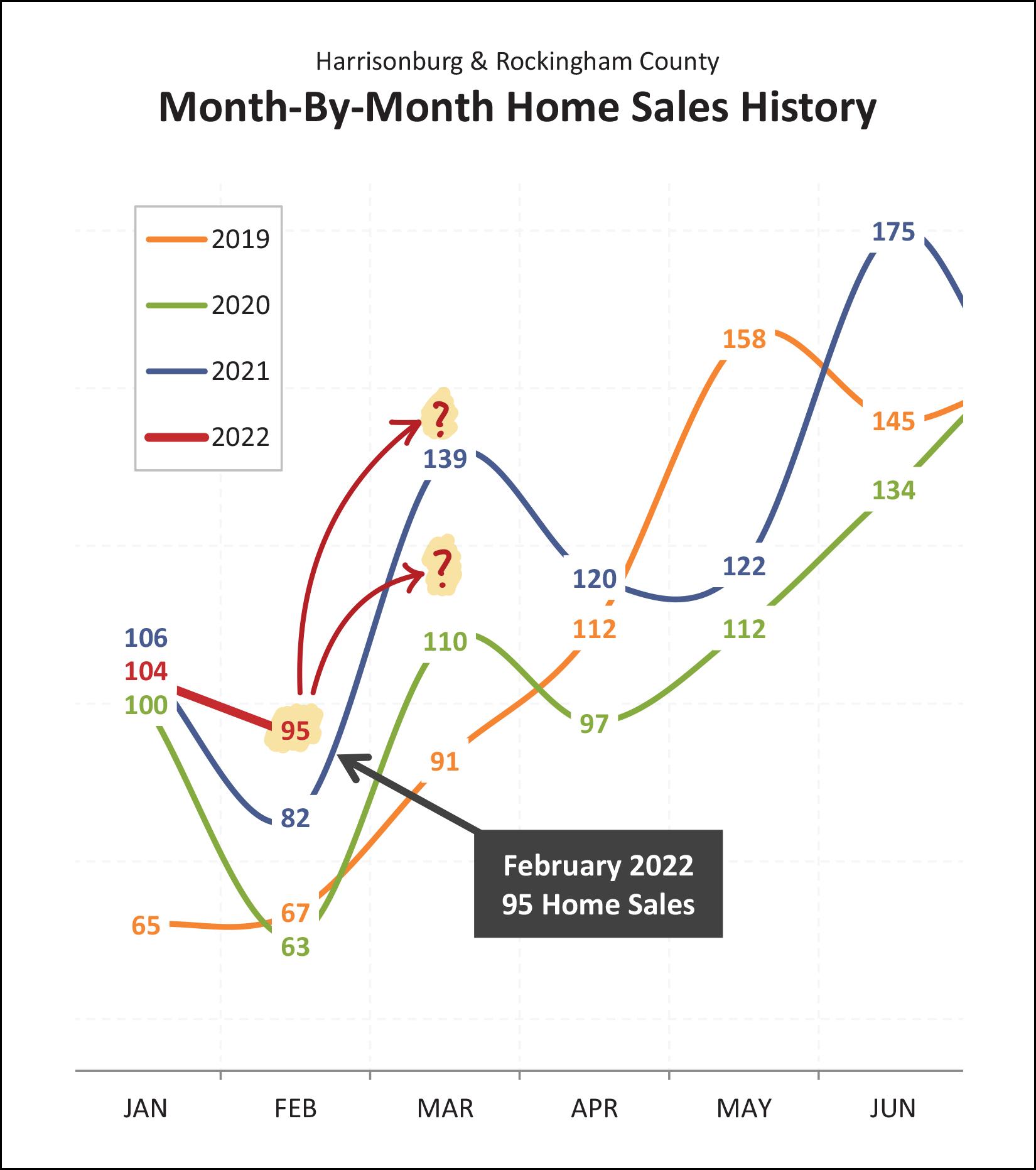

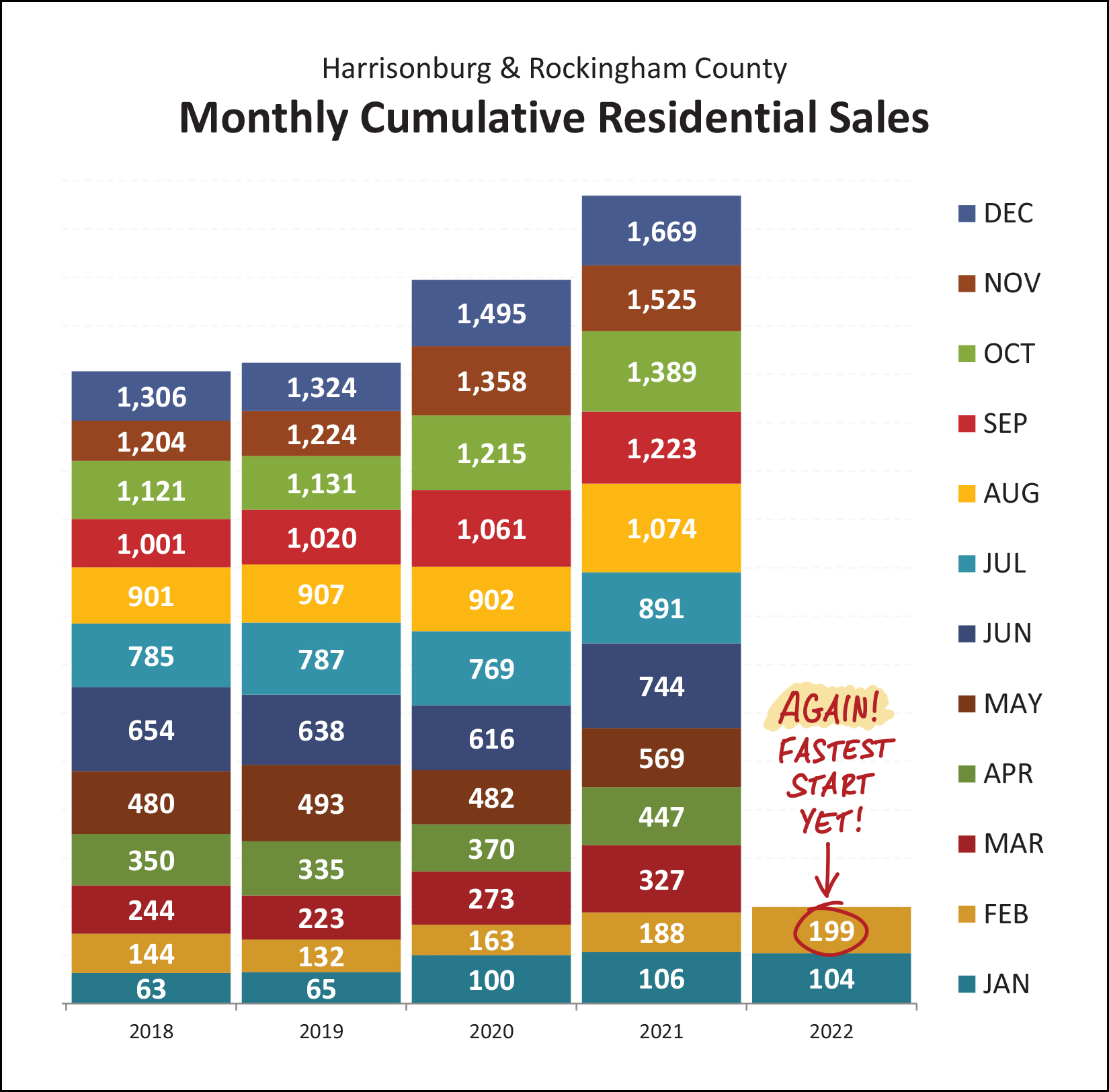

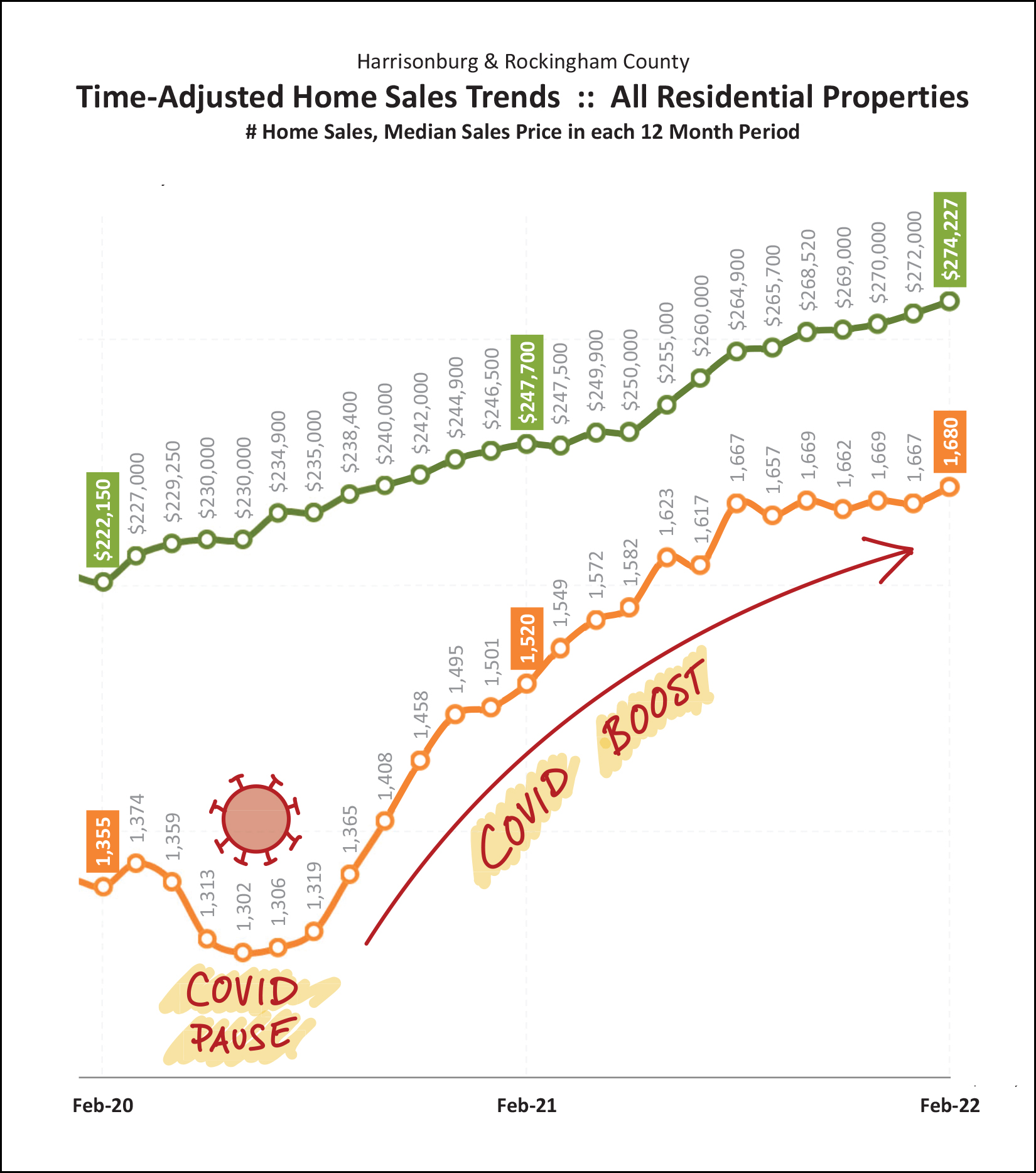

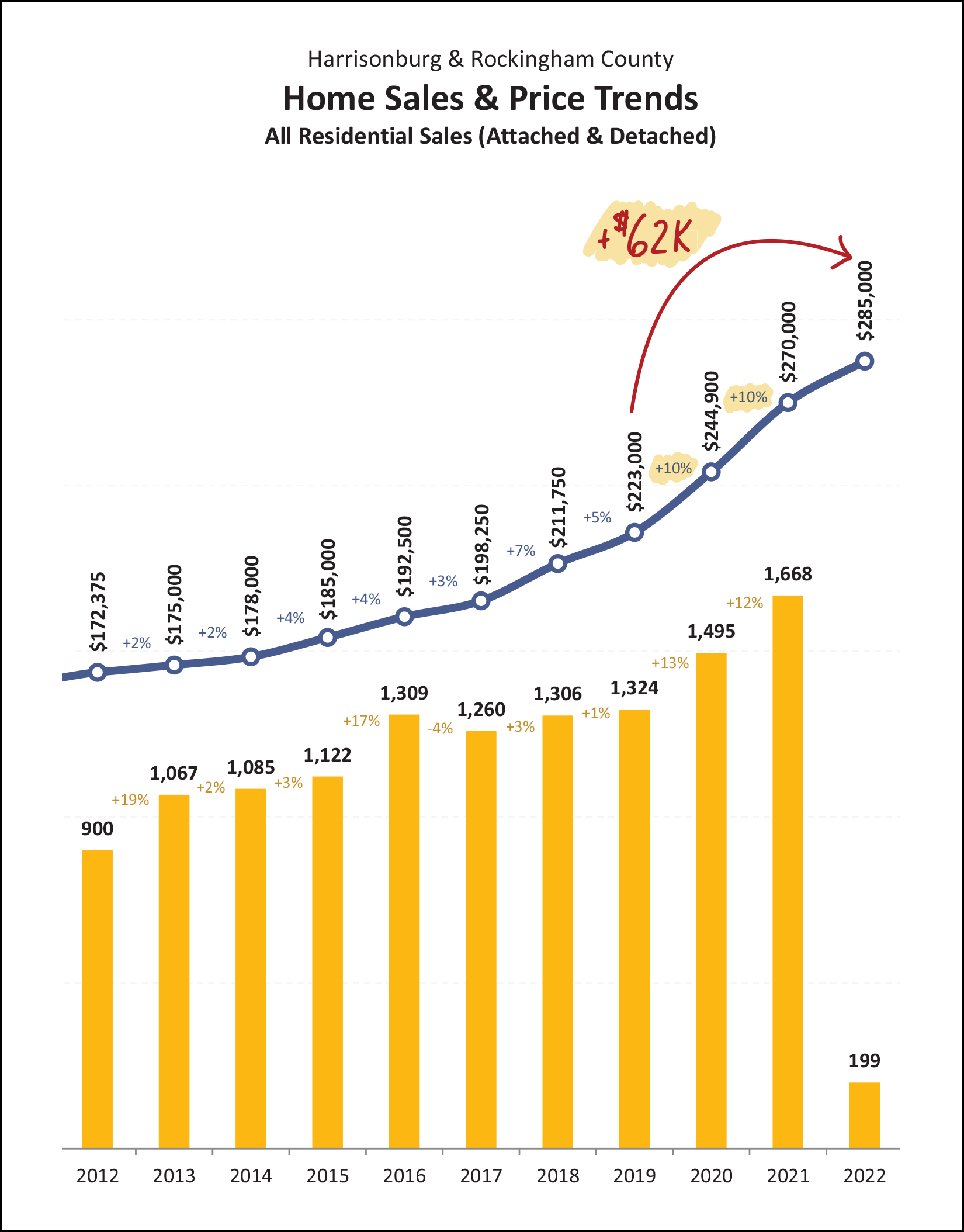

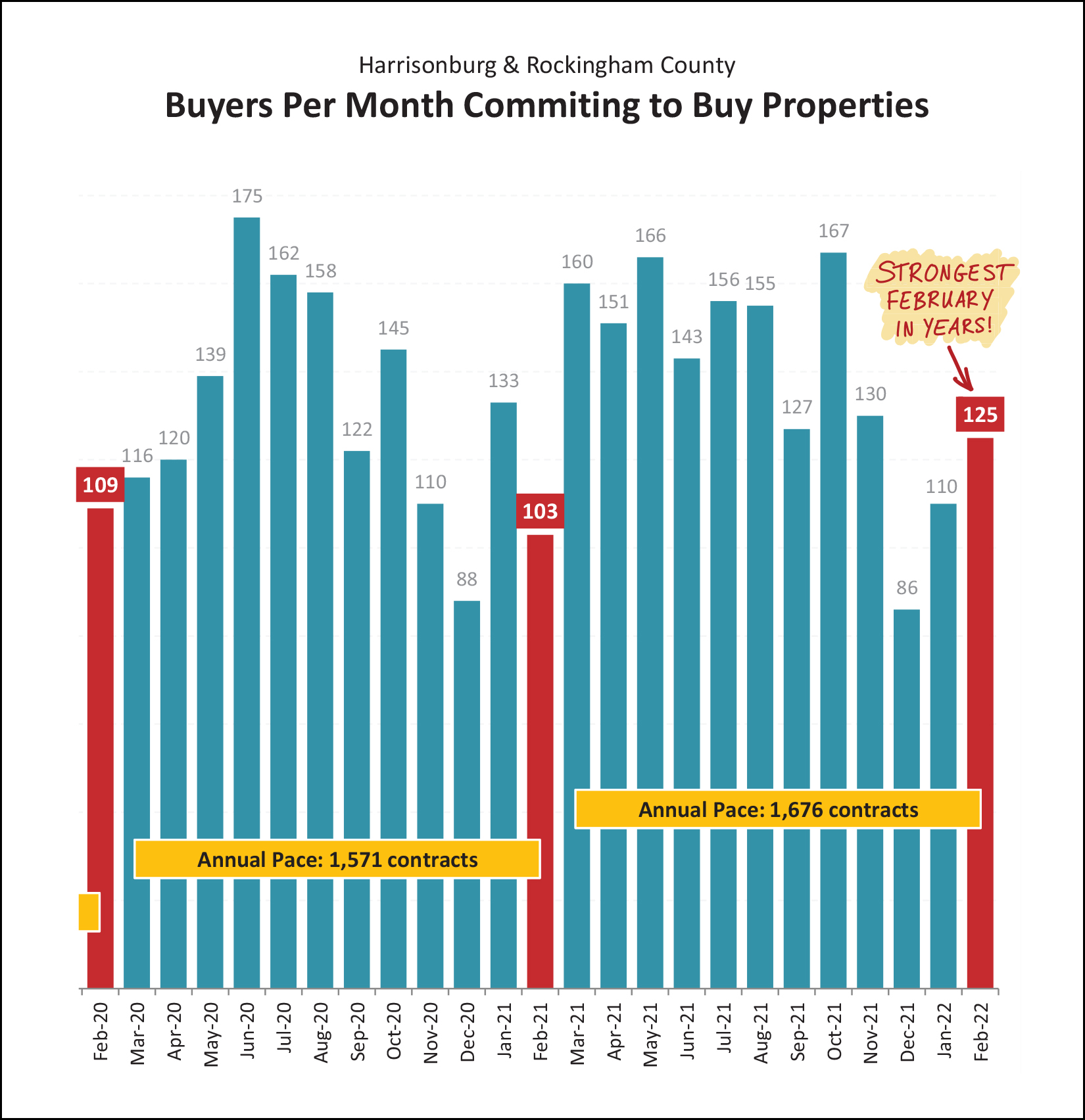

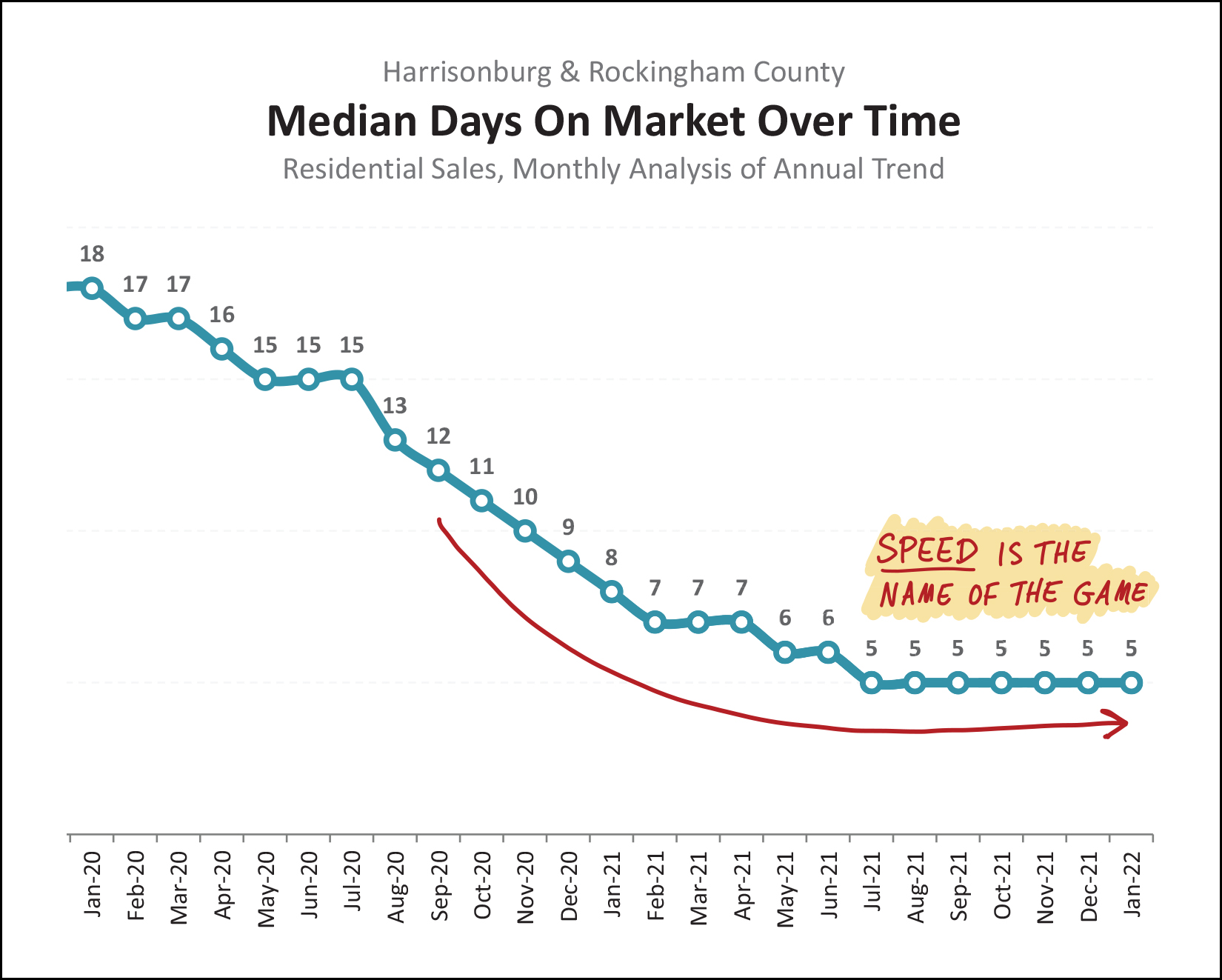

Happy Friday Morning, and for many of you, Happy (end of) Spring Break! I hope your week has gone well, whether you had a break or not. I was able to skip town for part of this week down to Virginia Beach where I was delighted to experience several beautiful sunrises like this one on Monday...  There sure is something relaxing about being near the water... and if the water (and air) were warmer, it probably would have been quite relaxing to be in the water as well! :-) Before I dive into this month's charts and graphs, a few quick notes... Check Out Magpie Diner... Each month in this space I'll be highlighting one of my favorite spots in the 'burg, or surrounding, where I enjoy dining, having a cup of coffee, etc. This month... it's Magpie Diner... a breakfast and lunch restaurant with a diner-inspired menu. If I'm at Magpie, I'll likely be having the french toast of the week with some scrambled eggs and a side of bacon. Yum! Have you checked out Magpie? If not, I highly recommend that you do so sometime this month. To make it even more fun, I'm giving away a $50 gift card to Magpie Diner. Enter your name/email here and I'll pick a winner in about a week. :-) Featured Home... The beautiful home pictured above is a custom built, single level home with amazing views from the top of Crossroads Farm. Check out additional photos and all of the details of this home by visiting 750FrederickRoad.com. Download All The Graphs... Some of you prefer to download the full slide deck of charts and graphs. You can do so here. Now, let's move on to the market data...  As shown above, things started getting busier in February... [1] There have been 199 home sales in Harrisonburg and Rockingham County thus far in 2022... which is a 5.85% increase from the same timeframe last year. [2] When looking at the past 12 months there have been 1,680 home sales in our local market, which is an even larger (10.53%) increase over the prior 12 months. [3] These increase in the quantity of home sales have been accompanied by an 11% increase in the median sales price over the past year. The median sales price of all homes sold in Harrisonburg and Rockingham County increased from $247,900 up to $274,227 in the last year alone! [4] If you thought homes couldn't sell any faster... you (and I) were wrong. The median "days on market" for Harrisonburg and Rockingham County has fallen 29% over the past year... from a median of seven days to a median of five days! But, despite these strong increases across the board... not all property types have seen the same changes over the past year...  As shown above, the "attached" portion of the local market (townhomes, duplexes and condos) have seen a bigger boom over the past year than detached (single family) homes... [1] We have seen 8% more detached home sales in Harrisonburg and Rockingham County over the past year as compared to the prior year, while... [3] We have seen a much larger 17% increase in attached home sales during that same time. [2] The median sales price of detached homes has increased 9% over the past year, while... [4] The median sales price of attached homes has increased by 18% in a single year! So, it has certainly been a good time to sell (and a tough time to buy) a townhouse or duplex lately! Looking at the monthly "play by play" we can see that things started to get a bit spicy in February...  As you might notice, above, the 104 home sales we saw this January fell right in the middle of the pack for what we might have expected in a January. But... February was different. We saw 95 home sales this February which was well and above any other recent month of January. Where do we go from here? We'll know within the next few weeks as we finish out March. Will we be able to surpass last March's very, very active month with 139 home sales? Will we fall somewhere between March 2020 and March 2021? Stay tuned to find out. I know we're only two months into the year, but...  Yes, again, we are setting new records. In 2020, the 163 home sales see in January and February was the fastest start in many years. Then in 2021, I said the same about January and February with 188 home sales. And yet, here we are again, with 199 home sales in the first two months of the year, we seem poised to see another fast paced and highly active year in our local real estate market! Someone asked me recently if Covid had been a real drag on the local housing market. Yes, I said, for a few months...  You'll notice on the graph above that Covid did seem to drag down the annual pace of home sales in early 2020... between April 2020 and September 2020. But then as we kept moving through fall 2020, and then into and through 2021, things just wouldn't let up. We saw month after month (with only a few exceptions) of stronger and stronger home sales. What caused this? At least some of it was, really, Covid. The place and space we call home became even more critical during the pandemic, and many folks found themselves living in homes that didn't work that well when all of a sudden they were working from home or had kids learning from home. So, "home" became even more important than ever -- causing plenty of homeowners to move to a new home. That, plus super low interest rates (to try to stabilize the economy), plus less discretionary spending, plus stimulus funds, all put more money in the bank accounts of would-be buyers, allowing many of them to jump on into the real estate market. Finally, an increasing number of people found themselves able to work from home... causing some folks to relocate to the Shenandoah Valley to work from a much more beautiful and relaxing place than they may have lived previously. As we continue to work our way through this pandemic that might eventually be considered an endemic, will we eventually see a flattening out or a decline in the pace of home sales in Harrisonburg and Rockingham County? I'm not convinced that we will. Alongside all of the factors referenced above, the overall population growth in this area persists based on employers expanding, local college graduates staying in the area, parents of local college graduates retiring to the area, and much more. I think it is relatively likely we will continue to see a similarly active local housing market over the next few years. OK... tangent over... back to the numbers. ;-)  This graph is showing the overall trends in home sales (quantity) and median prices over the past few years. I included it this month to draw out the magnitude of the raw data... we have seen the median sales price increase $62,000 over the past three years! That's great news for sellers, and for homeowners, but certainly is not very welcomed news for home buyers who have not yet bought a home. We saw a 10% increase in the median sales price in 2020 and 2021. I'm not thinking the increase will be as large in 2022, but I do think the median sales price will increase yet again this year.  And where might the market be going from here, you might ask? Well... with a very strong month of contract activity in February (see above) it seems very likely that we'll see a strong month of closed sales in March. So, yes, we're about to enter the busiest time of the year... between March and August. Get ready!  If you are hoping to buy a home soon, you might look at the graph above and get depressed by the low inventory levels. But... scroll back up to the previous graph for a moment and look at all of the contracts we usually see signed between March and August. Those buyers signing contracts (one could be you!) are almost all buyers signing contracts on homes that are listed for sale between March and August. So, while inventory levels at any given moment are not likely to increase over the next six months... there are almost positively going to be lots (and lots) of options of houses for you to buy over the next six months... or at least options of houses for which you can compete against lots of other eager home buyers. :-/  Indeed, the competition is fierce... and the market is moving quickly! The median "days on market" is five days right now... which means you need to go try to see any new listing of interest within the first day or two of when it hits the market for sale -- and you need to be ready to make an offer shortly thereafter if you are interested in buying that exciting new listing. Eventually we might (should?) see this metric start to increase a bit as the market slows... but we are definitely and assuredly not there yet.  Lastly, how about those interest rates? If there is one external factor that has the highest likelihood of affecting home buying activity in 2022... it is rising mortgage interest rates. Just six months ago, the average mortgage interest rate on a 30 year mortgage was 2.87%... and it has risen more than a full percentage point in the past six months to 3.89% at the end of March. As such, not only are today's home buyers paying a higher purchase price for nearly any home that they might purchase -- but their monthly mortgage payment will also be higher now (than it has been in recent months and years) because of rising interest rates. It seems likely that these rates will either level out near 4% or continue to rise even a bit above 4% as we continue through 2022. OK! That makes it to the end of this month's recap of our local housing market. A few reminders for you... [1] Go eat at Magpie Diner. You're certain to love it! :-) [2] Looking to buy soon? Email me so we can chat about what you'd like to buy, and talk to a lender ASAP. Let me know if you'd like some recommendations. [3] Planning to sell soon? Let's meet to talk about your house, any needed improvements or preparations, pricing, timing, the market and more. Email me to set up a time to meet to talk. That's all for now. Be in touch anytime (email me or call/text 540-578-0102) if I can be of help to you or your family, friends, neighbors or colleagues. Hope to talk to you soon! | |

It Can Be Difficult For An Owner Occupant Buyer To Compete With An Aggressive, Motivated, Investor Buyer With Cash |

|

Some properties that hit the market these days -- particularly townhouses -- appeal to two different pools of buyers... Owner Occupants - often first time buyers, hoping to buy the townhouse to move in, put down roots, establish some equity, and more. Investor Buyers - hoping to buy the townhouse to then rent it out to tenants to provide a return on their investment. Sometimes, owner occupants and investor buyers are on relatively equal footing when it comes to negotiations. They might offer similar prices... they might both be financing a part of the purchase price... they might both have inspection or appraisal contingencies, or they might not have either of those contingencies. But sometimes... ...sometimes aggressive, motivated investors with cash, make it *very* difficult for an owner occupant buyer to have a chance at all. Even if an owner occupant's offer price is identical to this aggressive investor' offer price... an investor who is paying cash removes the loan approval as a variable... and more importantly (especially in this market) they remove the appraisal as a variable. Let's say that townhouses in this particular neighborhood have been selling for $200K... but both the owner occupant buyer and cash investor buyer are willing to pay $225K. That $225K offer (times two) is great news for the seller... but... the owner occupant buyer who is financing their purchase will likely need the property to appraise for $225K (in many cases) and thus the investor buyer, paying cash, which will not require an appraisal, becomes a MUCH more compelling offer. And who can blame the seller of the townhouse... even if they would much rather sell their townhouse to an owner occupant buyer, it's hard for such a townhouse seller to choose a path that is objectively much more likely to have issues related to the appraisal. So... if you are a would-be owner occupant buyer making an offer on a townhouse... you better just hope you aren't competing against an aggressive, motivated investor buyer with cash! | |

Go, Go Now, Go Fast, Go See That House That Was Just Listed For Sale! |

|

This is not news to most of you -- but homes are selling QUICKLY these days. It's no longer sufficient to try to see a new listing in the first week that it is on the market. You should likely try to see it within the first one or two days that it is on the market. On one home I recently listed for sale there were 20 showings within the first two days -- and four offers within 24 hours of the first showing. I have been working with buyers who wanted to view several other recent listings but they weren't able to see the homes on the first day or two that they were on the market -- and the houses were under contract by the time they were ready to go see the houses. If you're planning to buy this spring or summer you will likely need to be ready to act very quickly. Plan to go see new listings on the day they are listed -- or the first day thereafter. Be prepared with a bank letter showing you have the ability to make whatever offer you might decide to make on the new listing. Finally, you may not have the luxury of sleeping on the decision and waiting until morning to determine if you will make an offer. It seems this will be another fast paced spring housing market in Harrisonburg and Rockingham County! | |

Where Are All Of These New Proposed Residential Developments Located? |

|

There are approximately 1,700 new homes being built or to be built in active residential developments... ...and approximately 4,400 new homes planned or proposed in residential developments that are not yet actively being developed. Where are they all located? You'll find an interactive map of them here... You'll find additional details about the developments here... Let me know if I missed anything on the list. | |

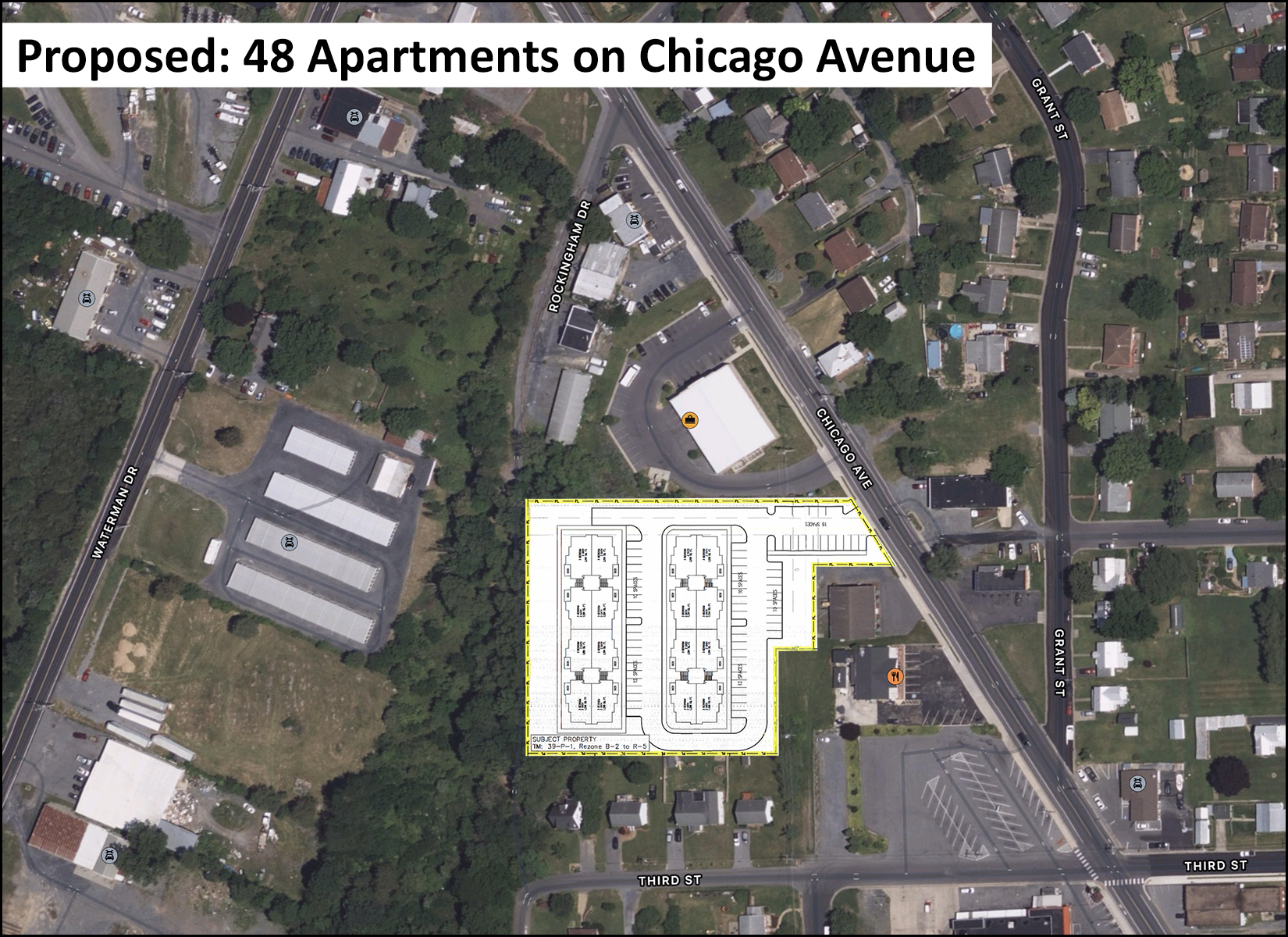

Rezoning Requested for 48 Apartments on Chicago Avenue, Behind La Morena |

|

The City of Harrisonburg Planning Commission will consider a rezoning request and special use permit request this week (3/9/2022) to allow for the construction of 48 apartments on 2.32 acres on Chicago Avenue behind La Morena. City staff recommends the approval of the rezoning request and special use permit. Download all the pertinent documents from the City here. In other apartment related news, City Council will review a request for a 156-unit apartment complex called The Edge on East Market Street today. | |

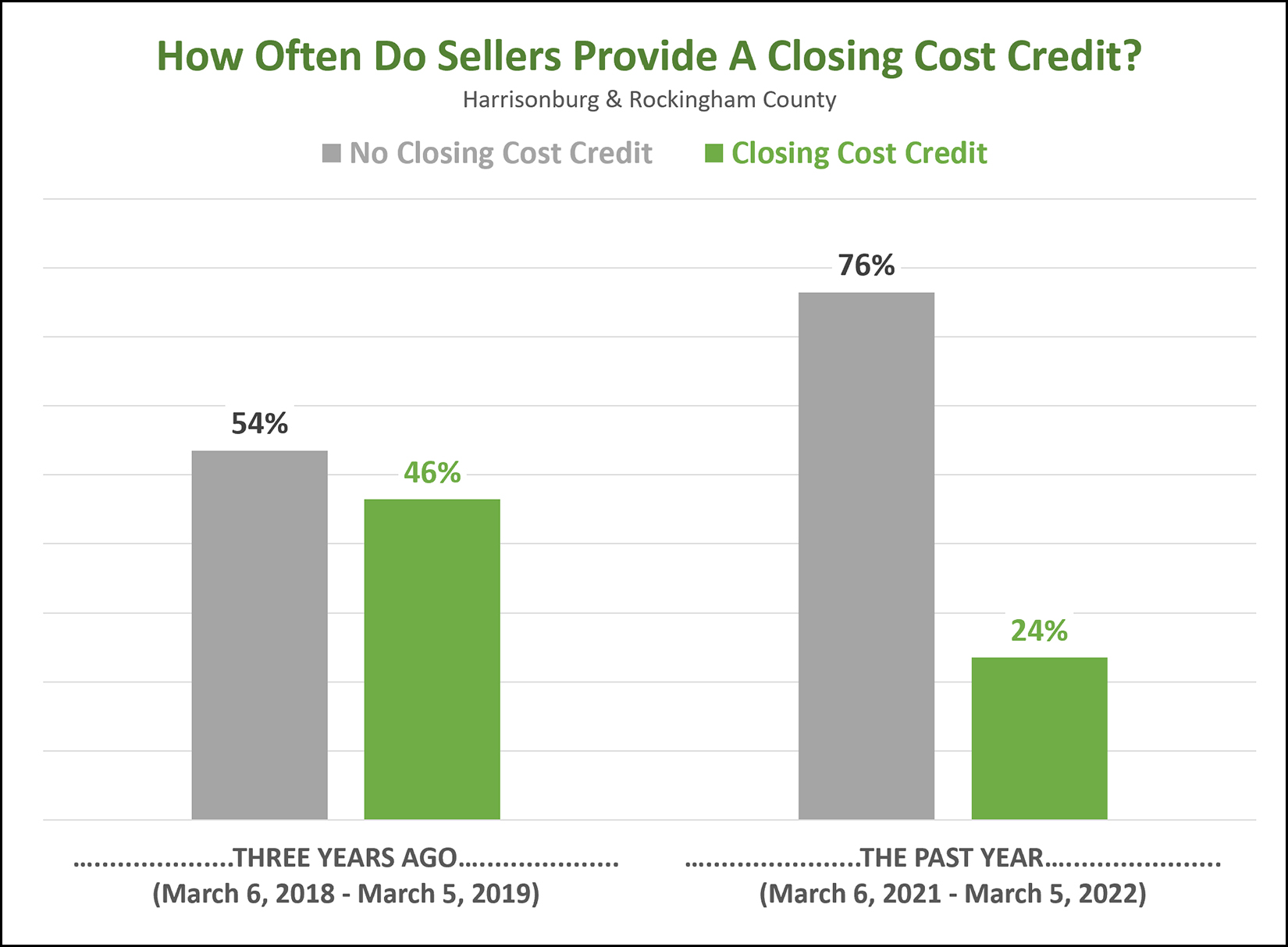

As You Might Expect, Most Home Sellers Are Not Providing Closing Cost Credits These Days |

|

Sometimes a home buyers doesn't have all the cash on hand that they need for both a down payment and the closing costs. In that situation, sometimes a buyer might propose a higher sales price with the seller providing a closing cost credit at settlement. For example... instead of the buyer paying $240K for the house, they could pay $245K and the seller would give them a $5K credit back at closing. But... these days... that isn't happening as often. Three years ago sellers were giving closing cost credits to buyers in nearly half (46%) of all home sales in Harrisonburg and Rockingham County. These days, it is only happening about one in four times. Why might these types of transactions (with closing cost credits) not be happening as frequently right now? First, many or most sellers seem to gravitate towards buyers who have the strongest financial position (largest downpayment) as that is often an indication that they will be more likely to make it successfully through the contract contingencies (inspection, financing, appraisal) to settlement. Second, artificially increasing a contract price in order to have part of your closing costs included in that contract price will most often raise the bar as far as the the price for which the house will need to appraise. If presented with a $240K offer and a $245K less $5K offer, nearly all sellers will choose the $240K offer so that the house only has to appraise for $240K and not $245K. So... if you need a closing cost credit when buying a home... that's fine, it's still happening sometimes... but not nearly as frequently as it was in the recent past. | |

Does It Make Sense To Wait To Buy A Home Until Prices Decline? |

|

Does It Make Sense To Wait To Buy A Home Until Prices Decline? I think not. I think it will be a long wait. But sure, I am willing to be wrong. ;-) Home prices have been rising quickly, of late...

How high can prices go? Will they decline at some point? Some would-be home buyers wonder whether they should just wait things out... with the thought that if homes prices are going up this quickly, certainly they will have to come back down again at some point... and maybe they should wait to buy until that time comes. I am not convinced that home prices will decline in the next few years. A few points to consider... [1] Longer Term Trends A decade ago, the median sales price was $169,900. Now, it is $270,000. Prices increased rather slowly in the first half of the decade (1% - 4%) and then more quickly in the latter half of the decade (3% - 10%). If home prices had increased a uniform amount each year, this ten year rise from $170K to $270K works out to be a 4.75% increase per year for 10 years. This is higher than my understanding of long term norms (3% - 4%) but not by much. [2] Supply and Demand We seem to continue to have more and more folks (individuals, couples, families) who want to call Harrisonburg (or Rockingham County) their home and would like to buy a home in this area. So, demand keeps climbing. Supply is trying to keep up, but is clearly failing, as inventory levels are remaining stubbornly low. So long as we continue to have well more people who want to buy homes than there are homes to buy, it seems likely that prices will keep rising. [3] My Crystal Ball OK, actually, I don't have a crystal ball. Darn. But as I look at likely scenarios for the next few years, I am not thinking it is very likely that prices will decline. Putting some arbitrary numbers to it, here's my best guess as to the probability of each of these scenarios... 10% chance that homes prices three years from now are lower than today 20% chance that home prices three years from now are within 3% of today's' prices (average of 1% increase per year) 40% chance that home prices three years from now are 6% - 9% higher than today's prices (average of 2% - 3% increase per year) 20% chance that home prices three years from now are 10% higher than they are today (average of more than a 3% increase per year) 10% chance that home prices three years from now are more than 15% higher than they are today (average of more than a 5% increase per year) So, is there a chance that home prices will be lower in the near future -- and you should wait until then to buy? Yes, it is possible, but it does not seem likely. | |

Missed Another Resale Home? Maybe Build A Home Instead? |

|

An age-old question is whether to buy a re-sale home or build a new home, especially as your price range gets above $500K or $600K.

Typically, the tension between buying vs building is one of: 1. Goals 2. Money 3. Timing If you build, you can get the house you want, but you'll pay more for it and it will take a lot of time and attention. 1. Goals = Win 2. Money = Lose 3. Timing = Lose If you buy an existing home, you won't get exactly what you want, but you will pay less for the house and the process will not be as much of a drain on your time. 1. Goals = Lose 2. Money = Win 3. Timing = Win Don't let my oversimplification of this issue fool you -- this is something that buyers can get stuck debating for months, or even years, often while looking at resale homes to try to convince themselves to buy instead building. AND -- two current market conditions are making it an even more complicated decision...

| |

Is Your Escalation Clause Working The Way You Think It Will? |

|

If you are making an offer on a house in 2022 there is a decent chance there will be other offers on the property as well. As such, you may find yourself considering the use of an escalation clause. What is an escalation clause, you might ask? An escalation clause allows you to offer one price but then to effectively increase your offer price to be above any other competing offers. Consider the following scenario on a house listed for $350,000

Offer 2 wins, right? If all the other terms were identical, then probably so. But if the first buyer didn't want to pay more than the asking price if they didn't have to -- but if they would have been willing to pay up to $360,000 -- then things could have worked out differently...

In this situation, Offer 1 becomes an offer of $352,000 and likely is the chosen buyer instead of Offer 2 which is then $1,000 lower. But let's add a layer here -- contingencies...

I see this type of scenario play out quite regularly. In many cases, the seller is will choose to move forward with Offer 2 - even though it is $1,000 less than Offer 1. Buyer #1 might have thought their escalation clause would do the trick and ensure they get to buy the property -- but that is not likely to occur. Why, you might ask? Buyer 2 seems to be better qualified to buy the home, with a larger down payment, plus they do not want to do a home inspection and they won't try to renegotiate after an appraisal. So, if a buyer has some other terms (financing, inspection, timing, etc.) that are possibly or likely to be less favorable to the seller, said buyer might consider leveraging their escalation clause a bit, such as the following...

In this scenario, Offer 1 becomes an offer of $356,000 compared to Offer 2 which is an offer of $351,000. This will cause the seller to think at least a bit longer and harder about whether they really want to go with Offer 2 that is more favorable from a contingency perspective. Think strategically when you are crafting your offer -- and your escalation clause -- knowing that a seller is looking at all of the terms of your offer, not just the offer price. | |

Lots Of Home Buyers Are Still Competing For New Listings |

|

For many new listings, the competition is still quite fierce in Harrisonburg and Rockingham County. Here are three recent examples I've been involved with or heard of in the past 10 days... [1] A townhouse in the City of Harrisonburg under $200K received 12 offers within three days. [2] A duplex in the County in the $300K's received 7 offers within three days. [3] A detached home in the City of Harrisonburg in the $300K's received 16 offers within four days. Wow! Now, this won't be the case for every new listing, in every price range, in every location... there are more buyers in some price ranges and for some locations than others. This also won't hold true independent of how a seller prices their home. A home that ends up selling for $200K will likely have a different number of offers based on whether they priced the property at $195K, $199K, $205K or $225K. But... yes... the market is still quite active, with plenty of buyers ready to buy, and many (to most) new listings being scooped up quite quickly. If you're getting ready to sell this spring, we should talk sooner rather than later about timing, preparations, pricing and more. | |

Timing The Sale Of Your Rental Property |

|

Do you own a property in Harrisonburg occupied by a tenant? When you are ready to sell it, how will you go about that process? In the past, many landlords would try to secure a buyer for the home before their tenant moved out -- because they did not want a potential gap of several months without rental income while they waited to see if the rental property would sell. These days, if you'd like to sell your rental property, I'd suggest... 1. Give your tenant a notice of the non-renewal of the lease. 2. Once the tenant moves out, do any necessary minor cleaning or repairs and consider whether it would make sense to paint the interior of the property and/or replace any flooring. 3. List your property for sale. 4. Get overwhelmed by an incredibly high number of showings and likely a multitude of offers. 5. Gleefully select the offer with the most favorable terms and the fewest contingencies. 6. Proceed quickly and smoothly to closing. It won't always go this way -- of course -- but the market is starved (!) for new listings right now, especially in the price range where many tenant occupied properties fall. If you have a rental property that you would consider selling in 2022, let's talk! | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings