| Newer Posts | Older Posts |

If Your Lease Ends This Summer, Start Looking For A Home To Buy Now! |

|

If you have a lease ending this summer and you are thinking about buying a home instead of renewing that lease, you might think you have PLENTY of time before you need to start looking for a home to purchase. You might actually want to start looking for that new home sooner than you think. Let's imagine that your lease ends June 30th. Here's one potential timeline...

A few details worth mentioning...

Finally, one thing that is not noted above is how this might all play out related to your monthly housing payments...

As you can see, above, in this scenario (closing on home purchase on May 31, lease ends June 30) you would not have any months where you would need to both make a rent payment and a mortgage payment. | |

Buying A Home Today Might Feel Like Mostly Waiting Around |

|

In days gone by, when you decided to buy a home, you would talk to a lender to get pre-qualified and then you would start going to view homes that were currently on the market to see if there was a house available that you wanted to buy - or whether you would decide to wait for some other houses to be listed for sale in the following weeks or months. Now days, that initial phase of looking at homes -- going to view homes that are currently on the market to see if there is a house available that you want to buy-- often does not exist. Many folks who decide to buy a home talk to lender to get pre-qualified and then find there are no homes on the market at that moment that they want to go to see. Now, to clarify, there may very well be homes "on the market" that are of interest -- but they'll all be under contract. And such is the fate of many home buyers these days -- get pre-qualified -- and then wait. Wait for the next new listing that is of interest and then hurry out to see it within the first few days to see if you want to make an offer. Interestingly, there are likely to be just as many (or more) choices of homes for a buyer to buy now as compared the "days gone by" described above -- it's just that now days those homes don't linger on the market, so there are very few available at any given time -- though there will certainly be more options hitting the market soon. So, if you plan to buy a home in 2022 - get pre-qualified - and then get ready to wait. :-) | |

Wow! Yes, You Read That Correctly, Local Home Prices Increased 40% In Five Years |

|

The median sales price five years ago (2016) was $192,500. Last year, five years later, it was $270,000. That's a 40% increase in the median sales price over five years! A variety of thoughts come to mind as a result...

| |

If You Will Sell Your Home This Spring You Should Be Planning For It Now |

|

A friend asked me yesterday if this is a busy time for real estate. It's busy - but not in the usual ways. It is not busy with showing lots of houses (there aren't many on the market) or with listing lots of houses (few sellers put their houses on the market in January) but it IS a busy time for planning. This January (as with most months of January) I'm spending much of my time meeting with homeowners who plan to sell their homes this Spring. Some are planning to put their house on the market on March 1, some March 15, some April 1 - you get the idea. We're making general plans about timing as it relates to their other preparations. The other items we are discussing and working on in January include... 1. Are you going to make any improvements inside or outside of your housing before getting it on the market in the spring? 2. What do you need to do as far as packing up, organizing, de-cluttering, cleaning, etc., to make your home show best to buyers? 3. Even though we'll look at the data again just prior to listing your home for sale, what does the current market data tell us as far as what price expectations are reasonable and what pricing strategy is advisable? So, if you are a homeowner who is thinking about selling this spring, now is the time to start planning for that big event. Feel free to email me or call/text me (540-578-0102) to set up a time to meet at your house and start developing a plan. | |

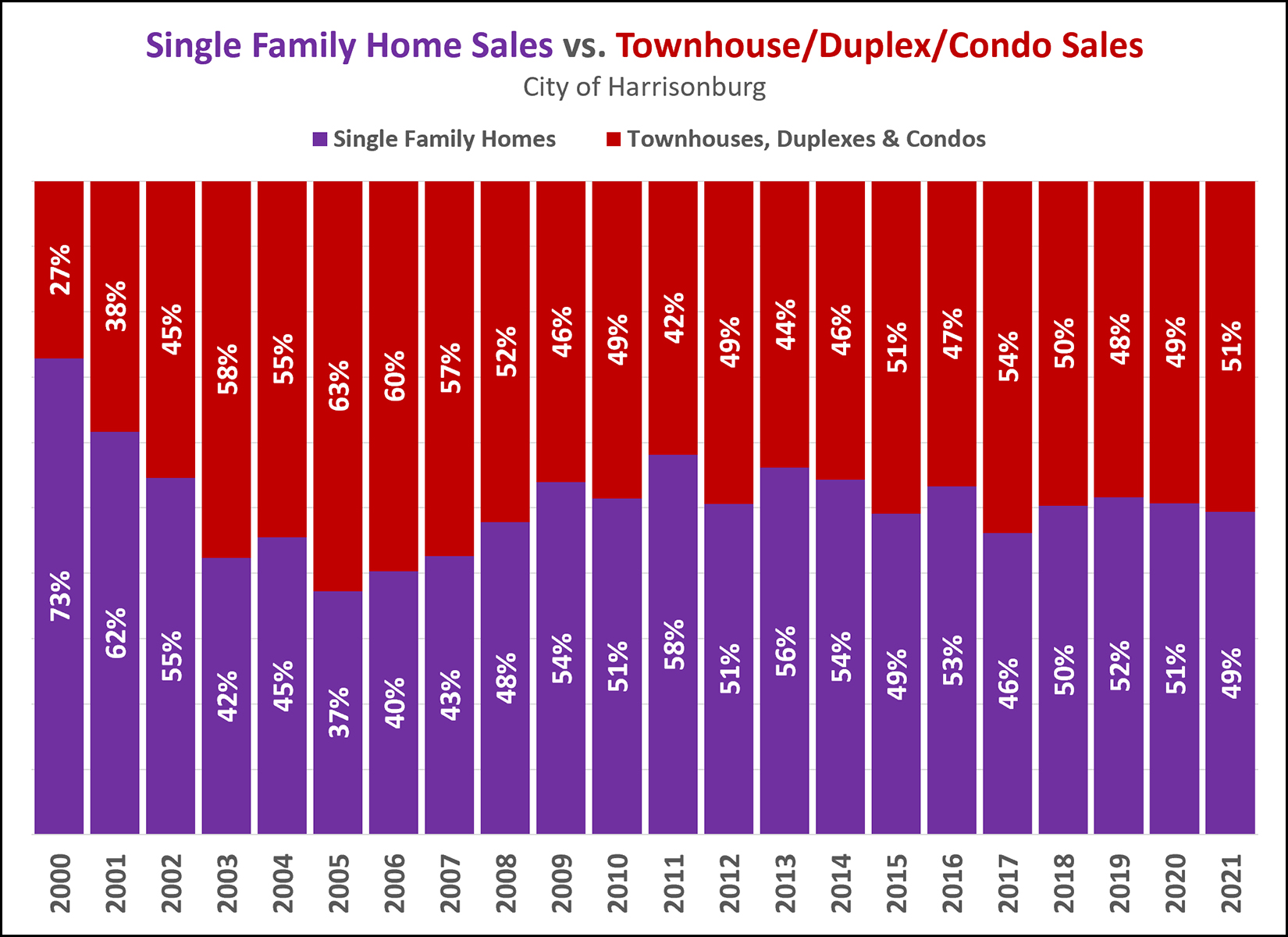

Only About Half of Home Buyers In The City Of Harrisonburg Buy Single Family Homes |

|

Yesterday I observed that about two thirds of home buyers in our area (City of Harrisonburg plus Rockingham County) buy single family homes each year. In the City alone, it's a different story. Only about half of buyers in the City of Harrisonburg buy single family homes each year. The other half buy attached dwellings -- townhouses, duplexes or condos. That ratio of approximately half and half detached vs. attached has remained mostly consistent over the past decade. In fact, looking even further back... It appears that before the townhouse building boom of 2002-2007, it was closer to 60/40 with more buyers buying single family homes. As lots (and lots) of townhouses were built in the City of Harrisonburg between 2002 an 2007, the share of buyers buying townhouses increased significantly -- getting as high as 63% in 2005. Given the existing inventory of housing in the City it seems likely that this ratio now may stay around 50/50 for the foreseeable future unless we see some major new construction developments within the City with homes (detached or attached) for sale. | |

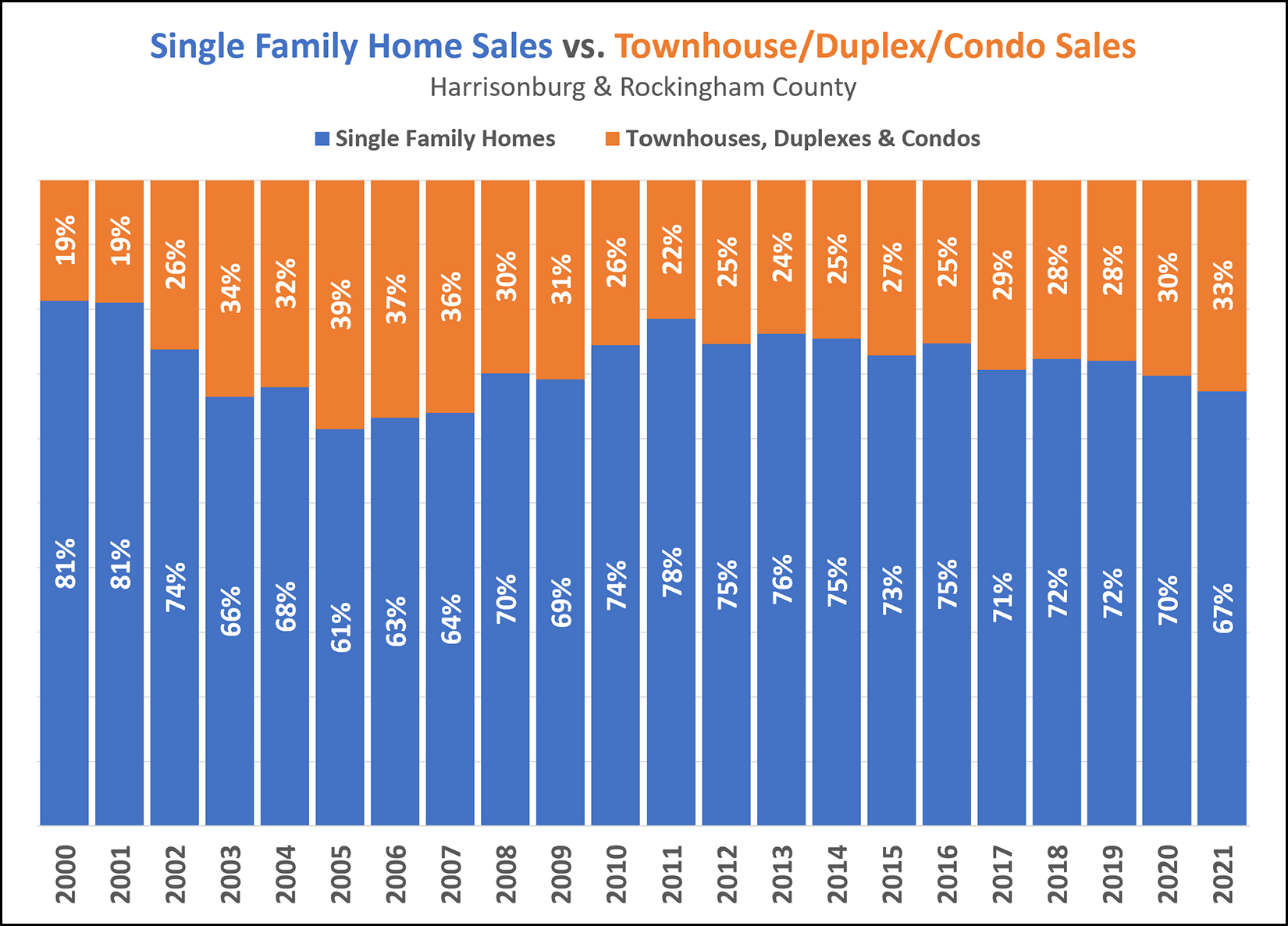

Two Thirds of Buyers Purchased Single Family Homes Last Year in Harrisonburg, Rockingham County |

|

Last year (2021) two thirds of buyers purchased detached single family homes in Harrisonburg and Rockingham County. The other third of home buyers bought townhouses, duplexes or condos. It's interesting to see how this breakdown between detached and attached homes has fluctuated over the years. Way back in 2000 and 2001 four out of five buyers (81%) were buying detached homes. 2005, 2006 and 2007 were the years with the highest proportional share of home sales falling into the attached categories. Lots of townhouses were being built in that timeframe in many new (at the time) townhouse developments in the City of Harrisonburg. Now, we are seeing townhouses (and other attached homes) gaining more momentum again as their share of the market has increased from 72% to 67% between 2019 and 2021. Finally, it is interesting to see how this breakdown differs between the City and County for 2021 home sales... City AND County = 67% single family homes (33% not) City = 49% single family homes (51% not) County = 75% single family homes (25% not) Yes, you read that correctly, more attached homes (townhomes, duplexes, condos) than single family homes sold in the City of Harrisonburg last year. | |

2021 Year In Review in the Harrisonburg Area Real Estate Market |

|

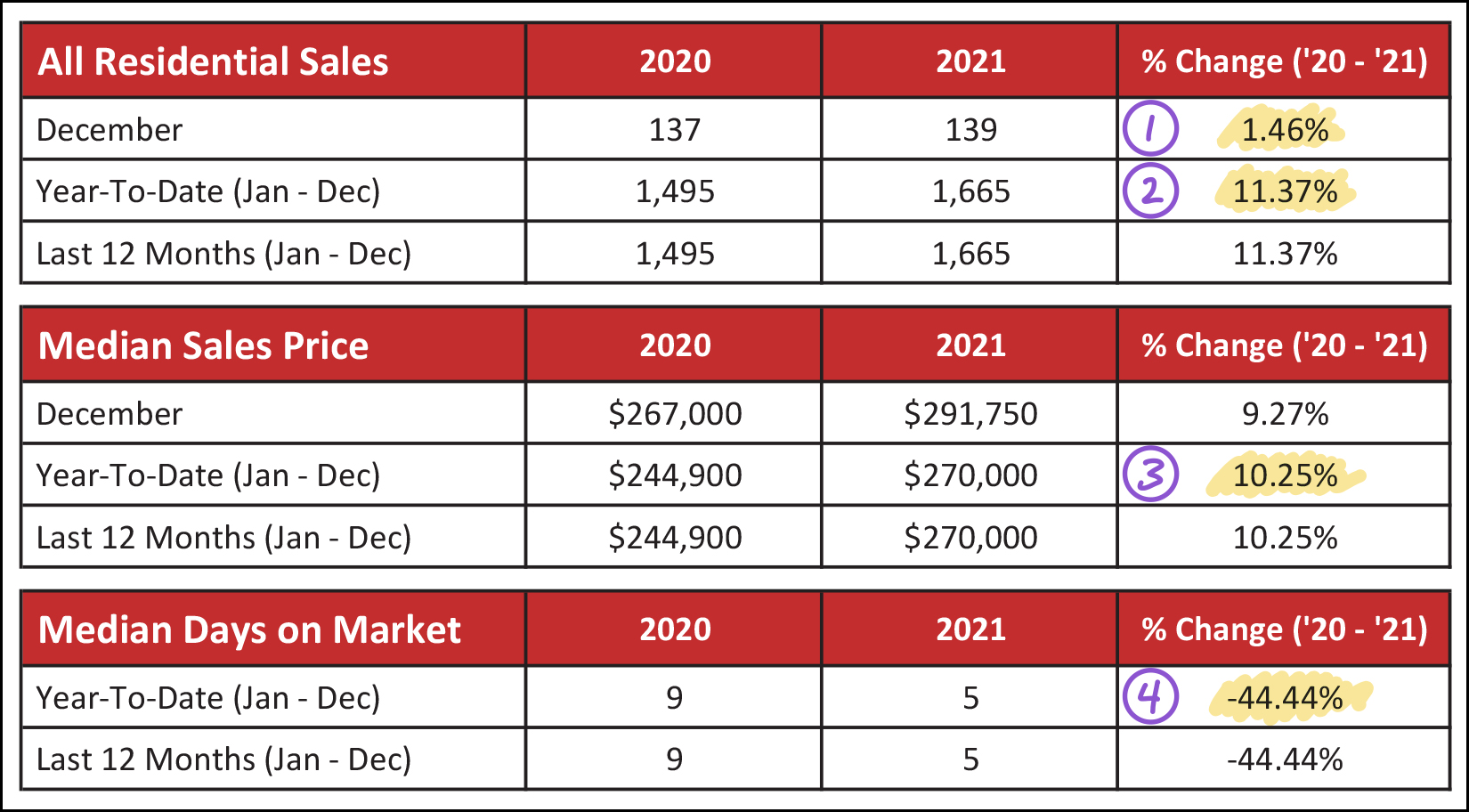

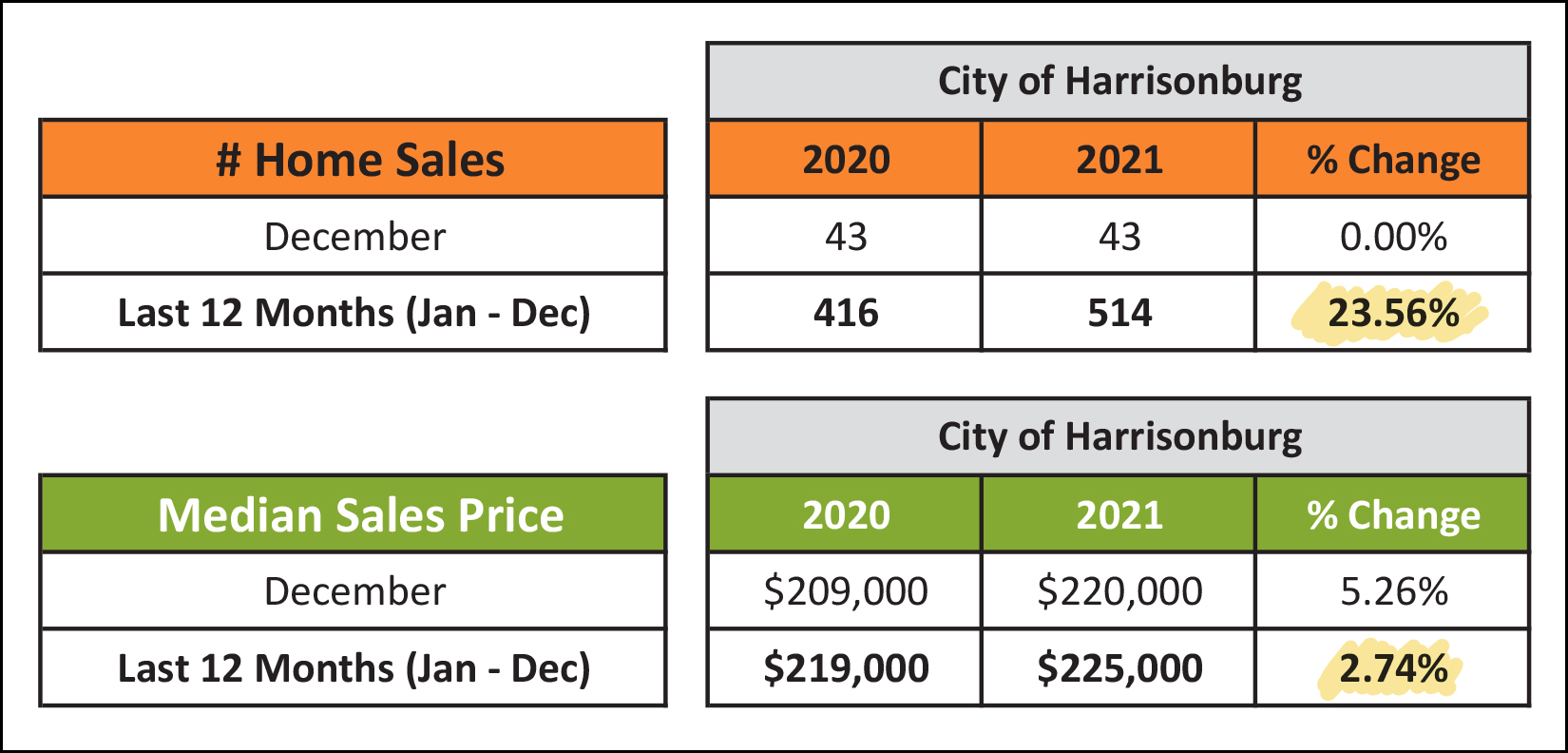

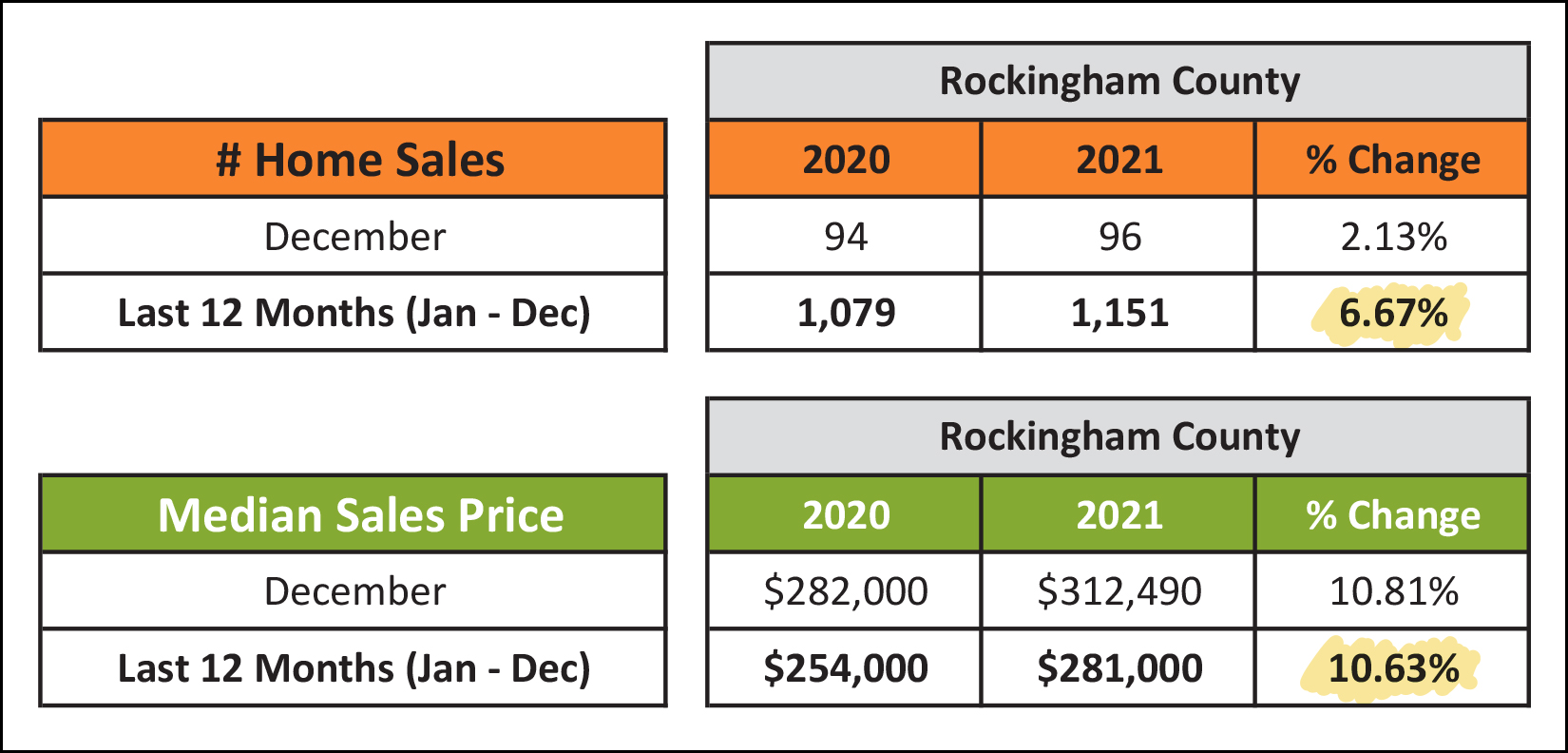

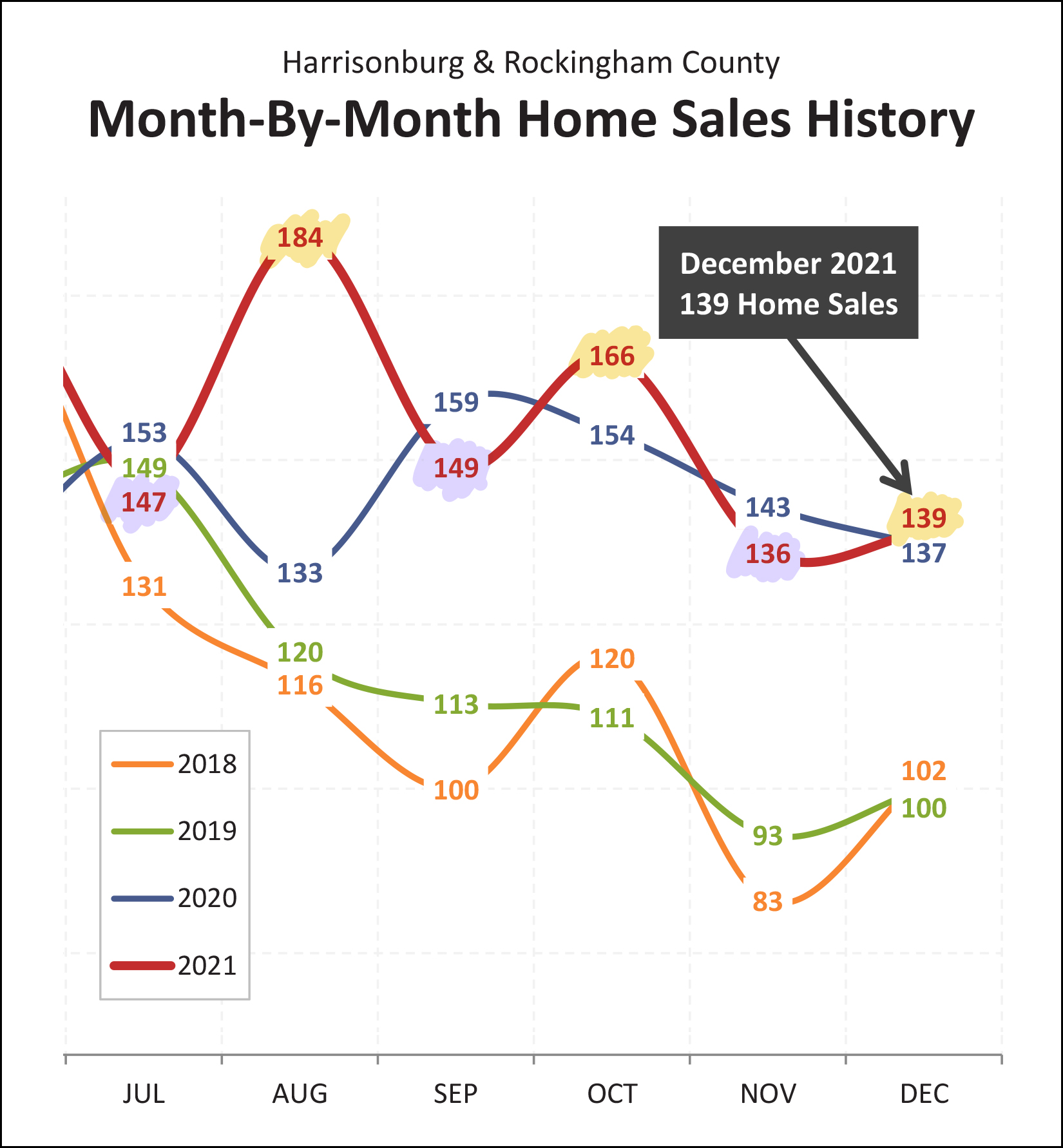

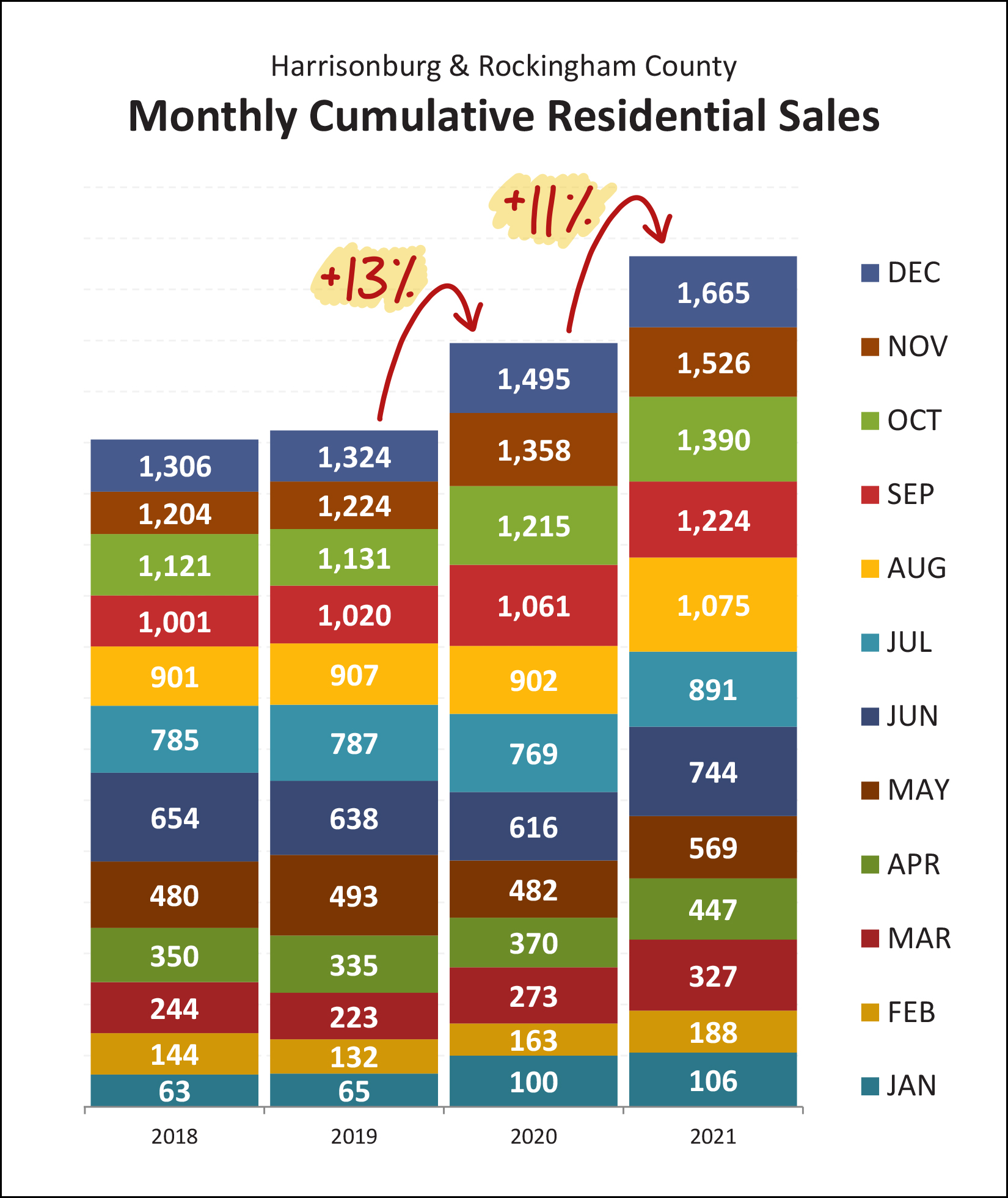

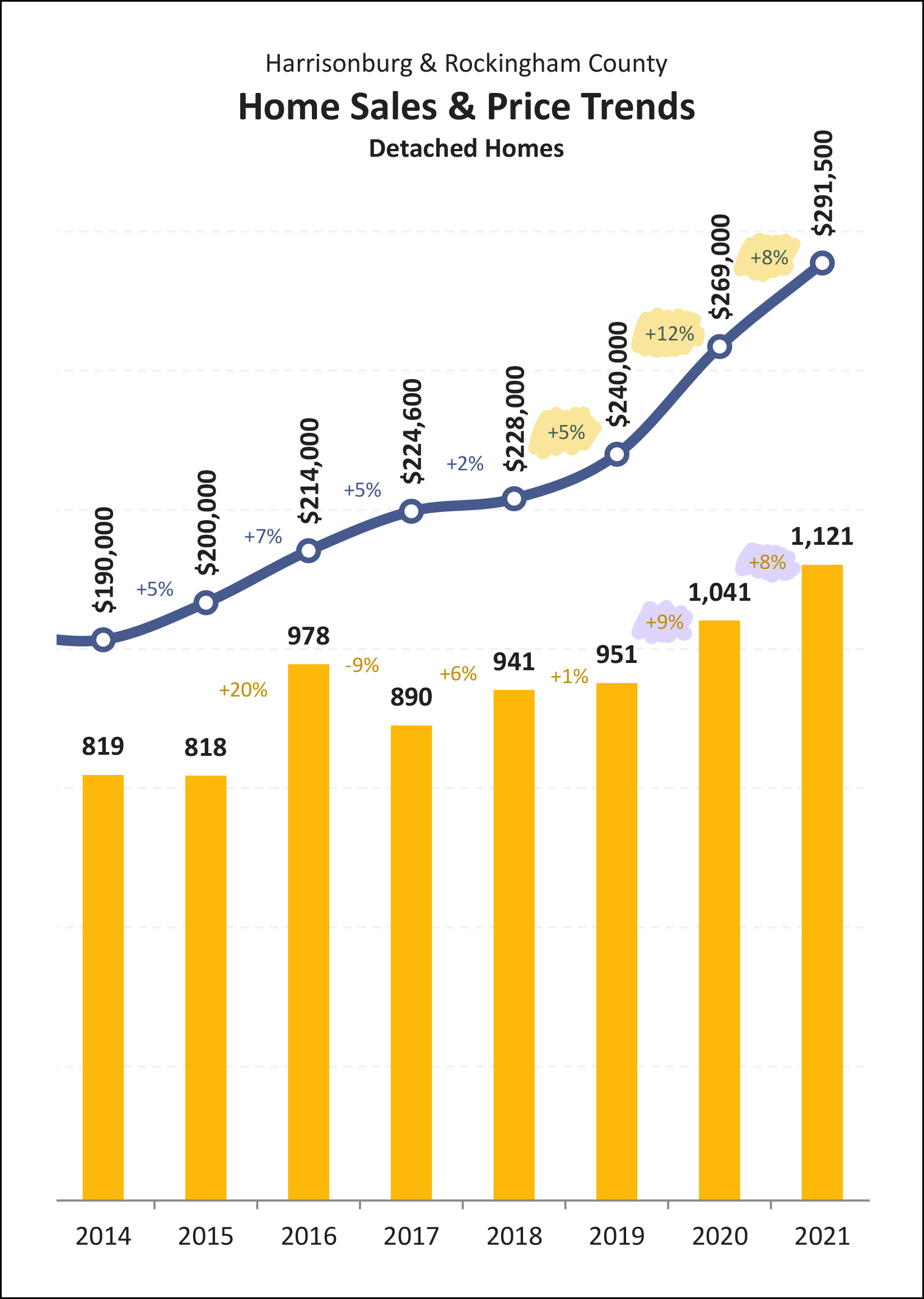

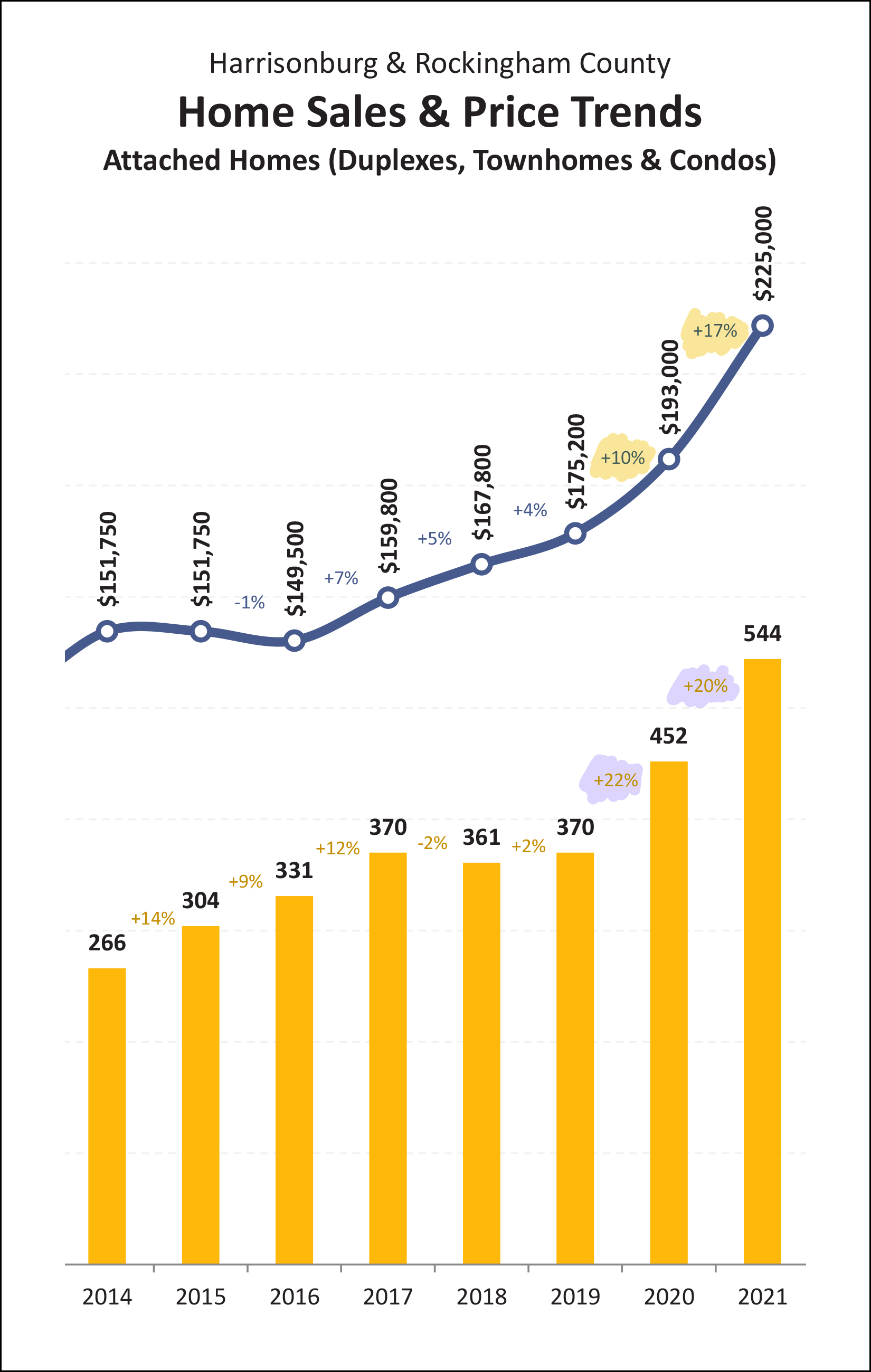

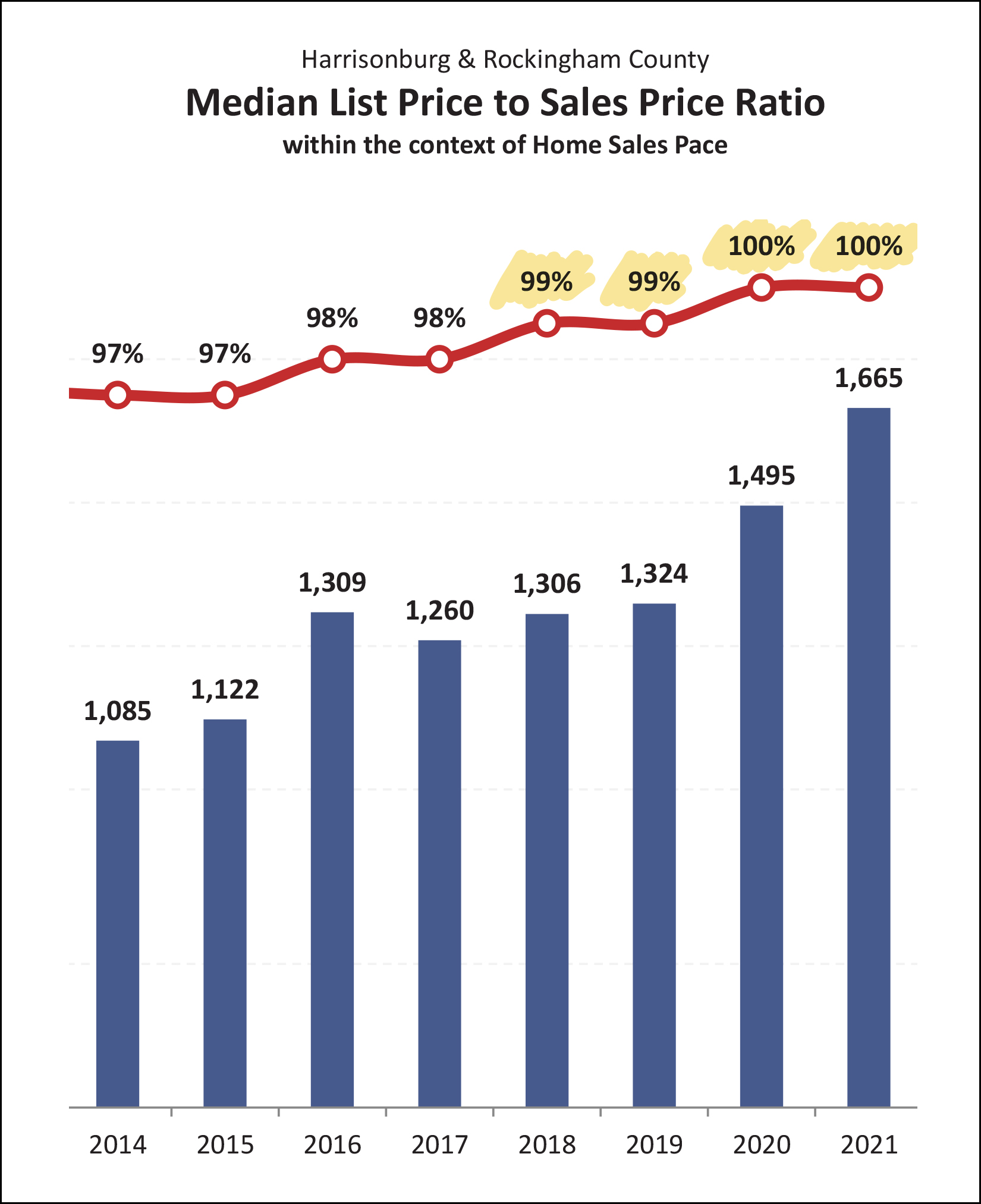

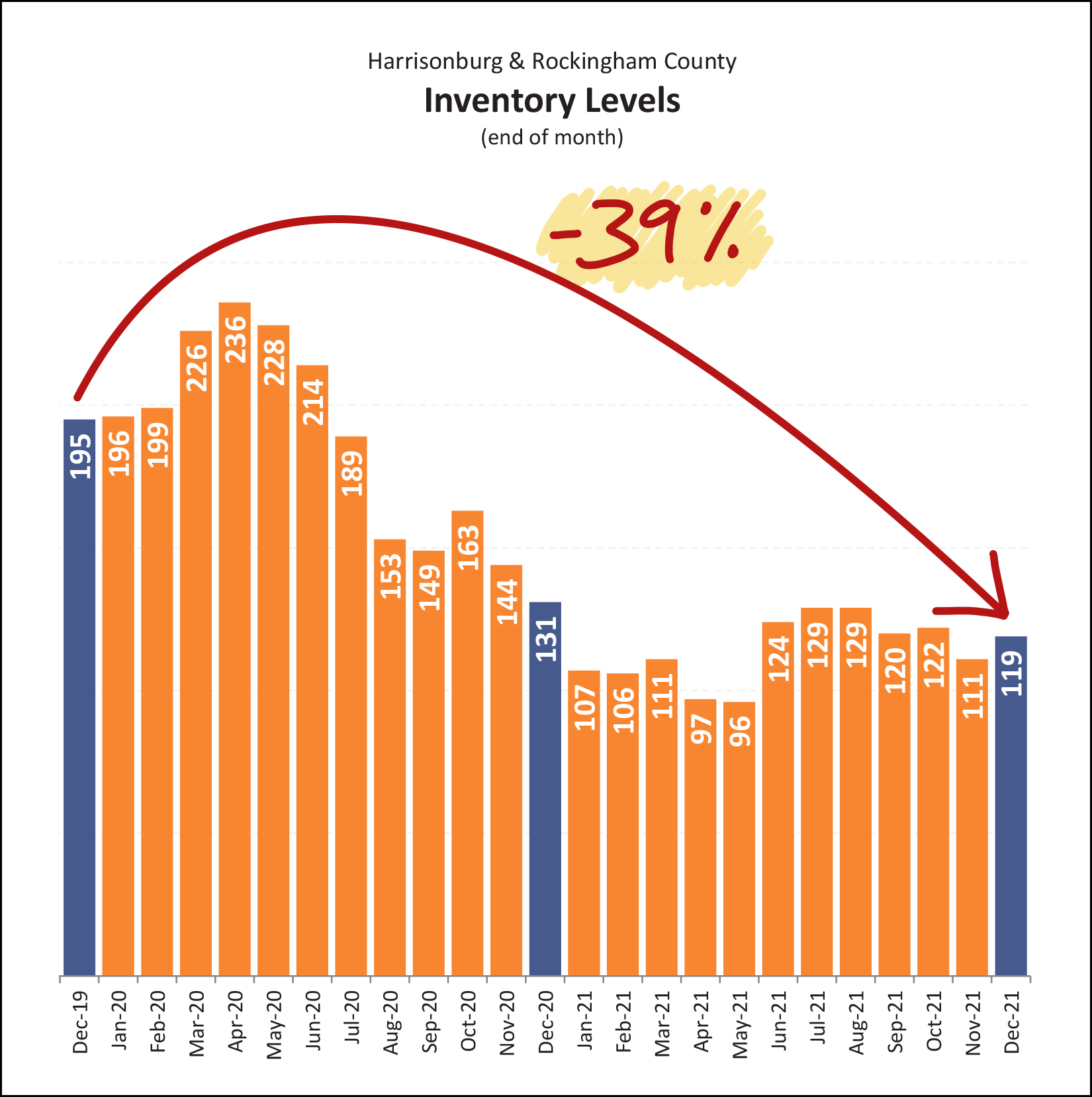

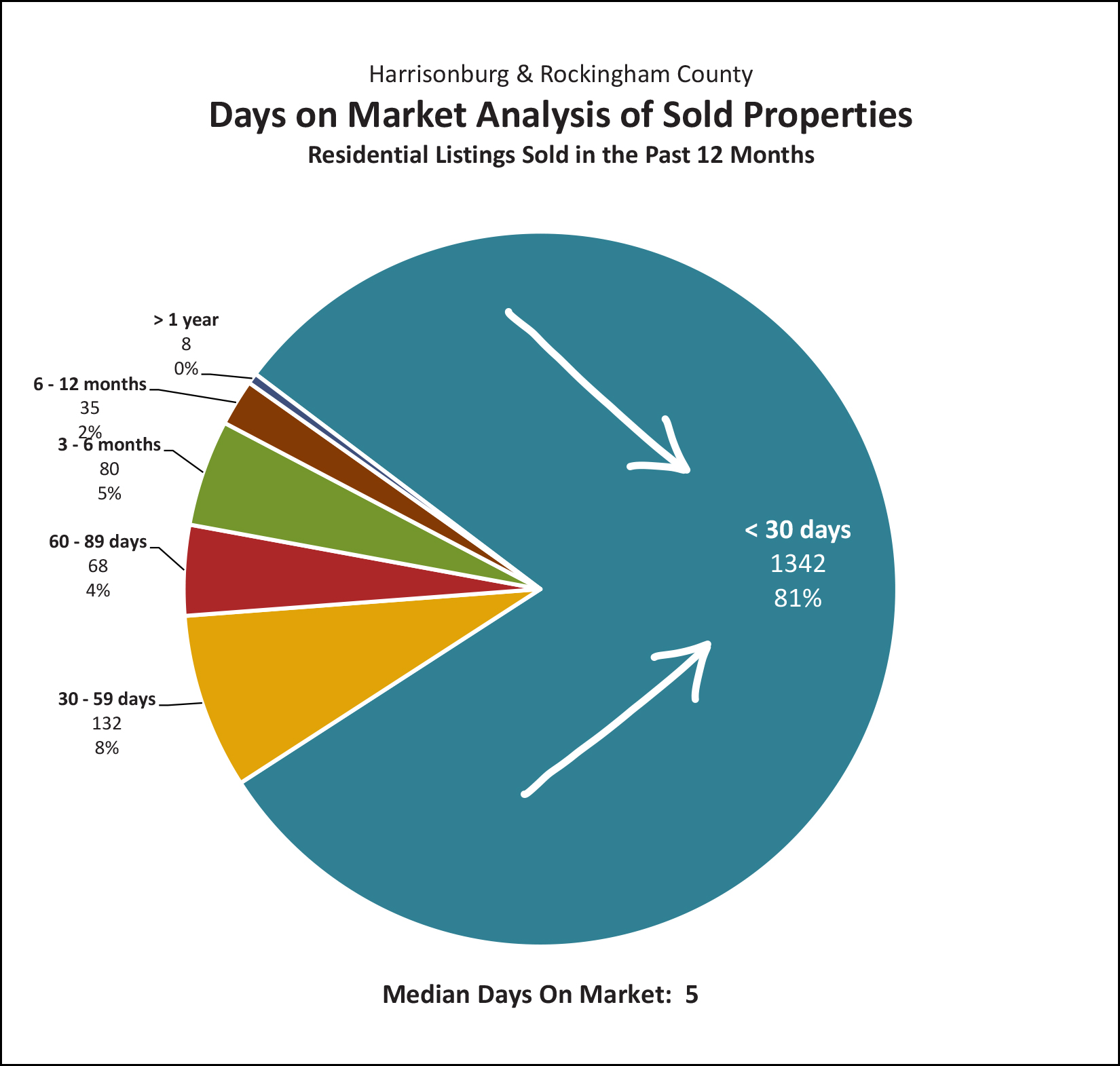

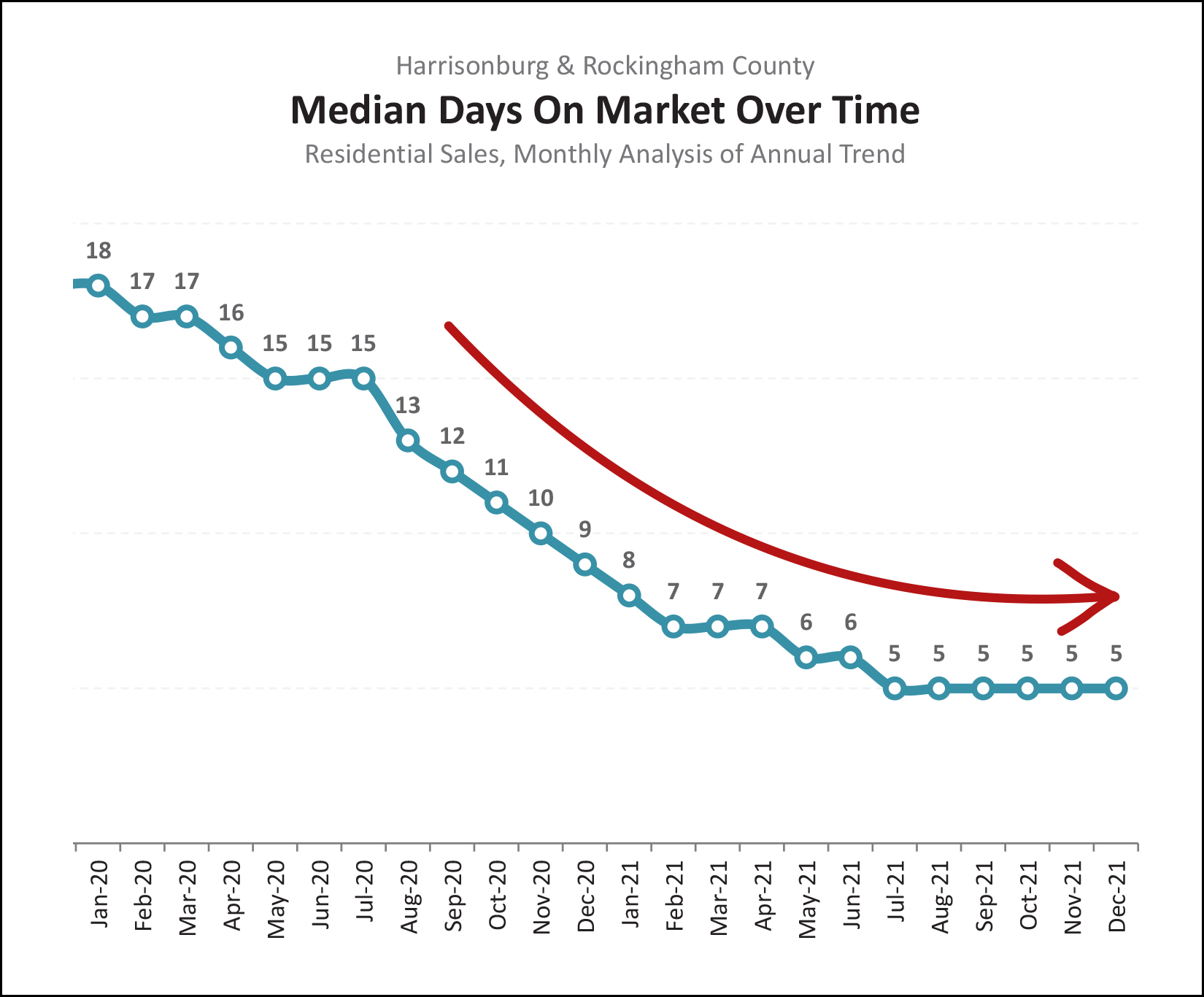

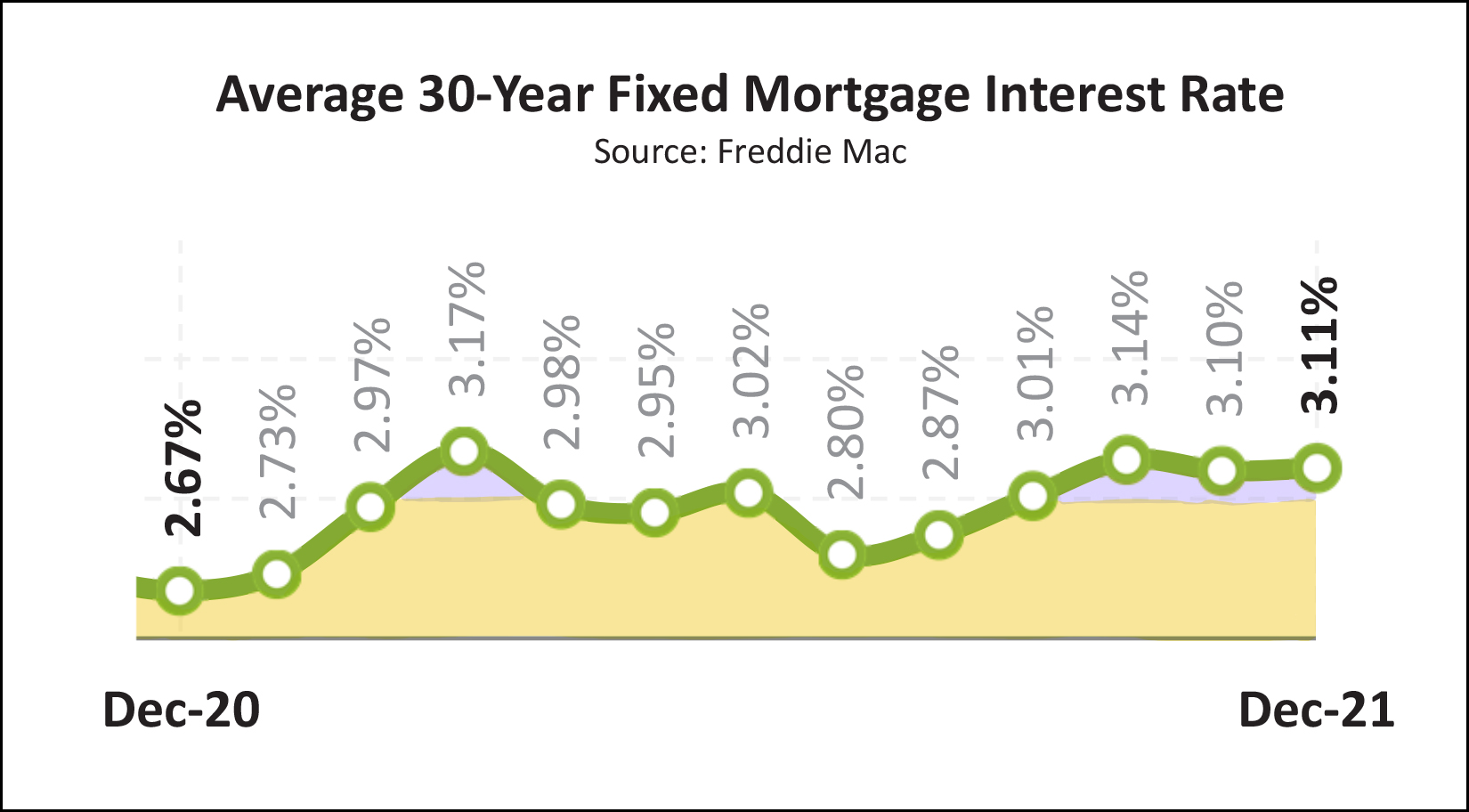

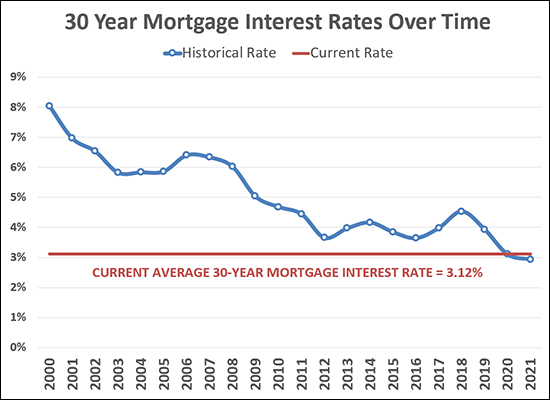

Happy New Year, Friends! I hope you had a delightful, relaxing, fun and healthy holiday season and New Year celebration. Today I am coming to you with a "year in review" of the Harrisonburg area real estate market in 2021. Before we get started, though, I'll introduce you to the sponsor of this month's market update. ;-) This month's market update is brought to you by... cookies!!!  A delicious part of our family's holiday celebration is the annual Christmas Cookie Contest and this year there were some fantastic entries! The photo above actually only shows six of the ten cookies from this year's 19th Annual Christmas Cookie Contest - and it does not show the winning cookie - congrats, Aiden! As you reflect back on your holiday celebrations, I hope you are reminded (as I am) of plenty of delicious food, and even better... wonderful, cherished time with family near and far! Now, though, let's dive into some real estate data to better understand how exactly the year wrapped up in the Harrisonburg and Rockingham County real estate market. For those that like to check out every graph, even those not in this narrative summary, download the PDF with all the graphs here.  The chart above quickly gets us into the big picture for our real estate market. First (1) you'll see that home sales ticked upwards a bit in December with a 1.46% increase over December 2020. But the numbers you've all been waiting for are shown as 2, 3 and 4 above... Home Sales Increased 11% in 2021. Sales Prices Increased 10% in 2021. Time On The Market Decreased 44% in 2021. So, a rather strong year for our local housing market! It was a fast paced market, with homes usually going under contract in less than a week. We saw more sales than in 2020, and prices were (as noted above) 10% higher in 2021 than 2020. I do think, however, that slicing and dicing this overall data a bit can be helpful. Let's first break it down by detached vs. attached, and then by City vs. County. Here is a summary of 2021 sales of detached homes...  As shown above, there was an almost 8% increase in the pace of detached home sales in Harrisonburg and Rockingham County in 2021. This increase (8%) is slightly less than the overall market-wide 11% increase, meaning that a greater share of the increase home sales were of attached homes. The median sales price of detached homes in 2021 was $291,500... up 8% over the median of $269,000 in 2020. A few thoughts here... first, the 8% increase in the median sales price of detached homes is less than the overall market-wide 10% increase, meaning that the sales prices of attached homes must have *really* increased in 2021. Stay tuned for that. Secondly, it is pretty wild to see the median sales price of a detached home now approaching $300,000. That means that in 2021, only slightly fewer than half of home sales were over $300,000! Now, then, about those attached homes, which includes townhouses, duplexes and condos...  Indeed, as predicted above... The pace of attached home sales increased more than that of detached home sales and more than the market as a whole. There were 20% more detached home sales in 2021 than we saw in 2020! The increase in the median sales price of these attached homes also increased much more in 2021 than the median price of detached homes. The median sales price of an attached home increased 17% from $193,000 to $225,000 in all of Harrisonburg and Rockingham County! So, half of buyers paid more than $225K for a duplex, townhouse or condo in 2021! Now, looking a bit more closely at the City vs. the County...  Despite seeing very few homes on the market for sale in the City at any given time through most of 2021, we managed to see a rather large (!) increase in the number of City homes selling in 2021. After only seeing 416 City home sales take place in 2020, there were 24% more in 2021... with a total of 514 home sales. Despite this significant increase in the number of City homes that sold in 2021, we actually only saw a 3% increase in their median sales price. The median sales price of City homes selling in 2021 was only $225,000. This is somewhat striking in comparison to the market-wide (City + County) median sales price of $270,000. So, then, how about the County?  Over the past year we actually saw a smaller increase in the pace of home sales, with only 7% more home sales in 2021 than in 2020. The median sales price of those County homes increased quite a bit more, though, with an 11% increase in the median sales price -- which moved up from $254,000 in 2020 to $281,000 in 2021! So, the pace of home sales increased more in the City than the County -- but the median price of those home sales was higher in the County than the City -- and that median price increased more, year-over-year, in the County than the City. Do what you will with that newfound comparative understanding of our local housing market. ;-) Next, looking at one of my favorite monthly graphs, the pace of monthly sales seemed to be just as chaotic as many of the other constant changes in our lives in 2021...  Monthly home sales were *anything* but predictable in 2021. They bounced all around, jumping to record new highs, usually followed immediately thereafter by surprising lows. The market seemed to want to take an "every other month things will be crazy" approach to the timing of sales through out the year!? And what if I told you that the market "slowed down" in 2021?  Yes, yes, I know, it's a bit of a stretch. Home sales rose 11% in 2021, so that's not really slowing down, right? Right. But... home sales increased 13% in 2020... and only 11% in 2021... soooo... slowing down, right? ;-) That's probably not an objective characterization of the market. By all accounts, the market sped up in 2021, even if the definitely-faster-than-normal acceleration was slightly slower than in 2020. We'll go with that. Looking now, at detached home sales trends on a graph...  When looking at detached home sales only: The pace of detached home sales increased 8% in 2021... after having increased 9% in 2020. The median price of detached home sales increased 8% in 2021... after having increased 12% in 2020. So, maybe flattening out, barely, slightly, slowly? Or maybe not. And how about the attached home sales market?  When looking at attached home sales only: The pace of attached home sales increased 20% in 2021... after having increased 22% in 2020. The median price of attached home sales increased 17% in 2021... after having increased 10% in 2020. Right, so, in such a strong seller's market are sellers having to negotiate much?  We'll say "nope" -- sellers are decidedly NOT negotiating much, at all! Half of buyers paid 100% or more of the list price of the house that they purchased in 2021... following the same trend as in 2020! So, unless a house is obviously overpriced, and perhaps has been on the market for weeks or months, you likely won't be negotiating much if any as a buyer. Sooooo much buyer interest and activity has lead to inventory levels falling, and falling and falling...  We are now experiencing (and have been for the past year) the lowest inventory levels I've ever seen. There are currently only 119 homes on the market in all of Harrisonburg and Rockingham County, which is 39% fewer options for buyers (at any given time) than where we were just two years ago! Which is probably why listings are going under contract SO quickly...  A whopping 81% of all houses that sold in 2021 went under contract in the first 30 days of being listed for sale. And as mentioned earlier, the median is five days... so half of properties sold are going under contract in five or fewer days. Speedy!  Visualized slightly differently, the graph above shows the annual trend in median days on market... so... homes have been going under contract faster and faster and faster over the past year and a half. It doesn't actually seem that they can go under contract any faster than they are now. If or when the market starts to slow down, we'll likely see it first in a change in this metric of how quickly homes are selling. Finally, did you hear mortgage interest rates are rising?  Ha ha, sort of, kind of, but not meaningfully. Mortgage interest rates stayed below 3.25% for the entirety of 2021! This is so low in any historical context, that an increase over the past six months from 2.8% to 3.1% is not overwhelming or concerning to most buyers. As shown above, the average mortgage interest rate was actually at or below 3% (!) for most of the year! And... just like that... we have reached the end of my recap of the 2021 housing market in Harrisonburg and Rockingham County. Do you have questions about this data or these graphs? Or do you have questions that this data and these graphs did not answer? Ask away... just reply to this email! Finally, if 2022 will be the year that you hope to buy or sell a home, let me know if I can be of help to you with that process. I'd be delighted to work to help you accomplish your goals of buying or selling this year. Just reach out by email, phone or text (540-578-0102) and we can set up a time to meet to discuss your dreams, goals and timing! Now, go find that snow shovel and start doing some stretches to prepare for some extended shoveling time... they're now calling for 11 inches of snow for the Harrisonburg area on Sunday! | |

Massanutten Resort Home Sales Up 34%, Prices Up 17% in 2021 |

|

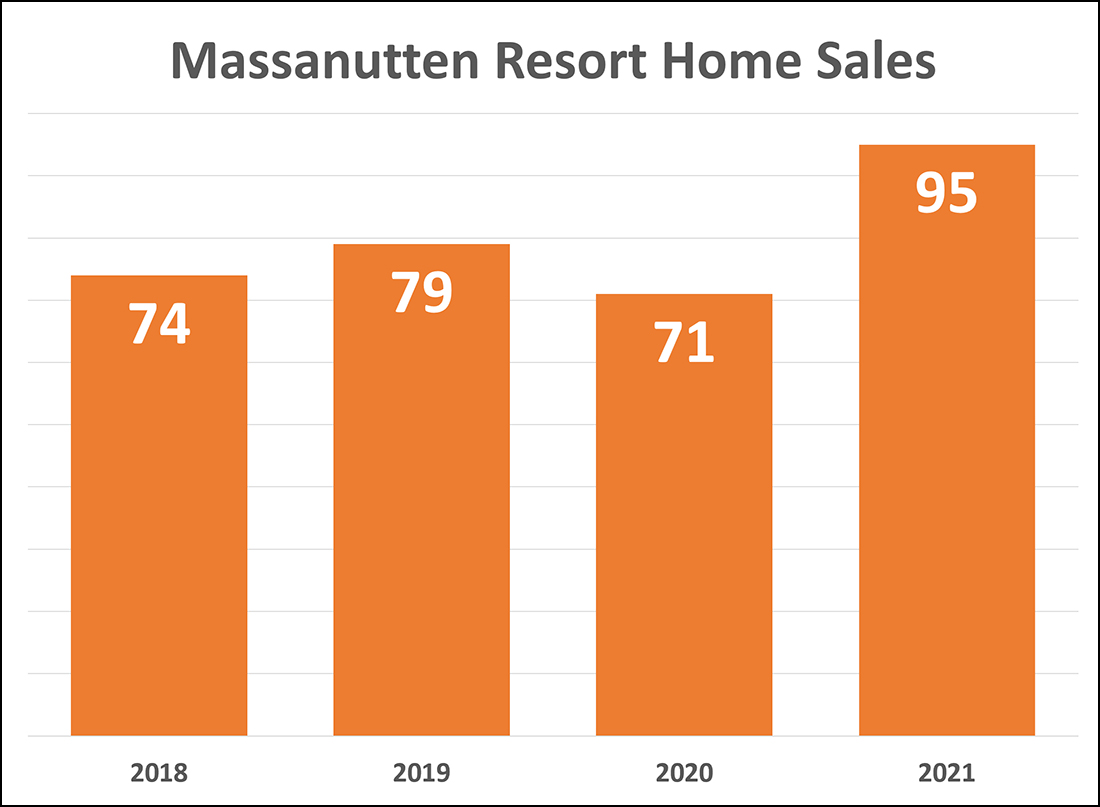

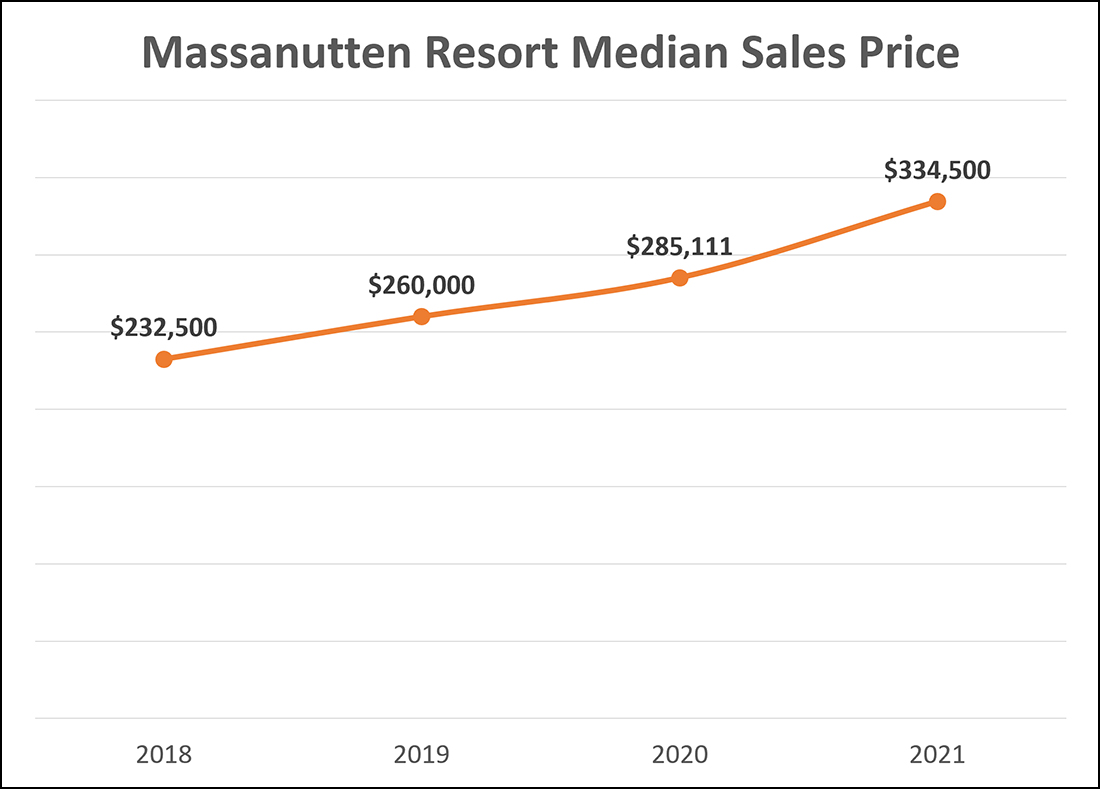

If there is one micro market that has outperformed the overall market in the Harrisonburg and Rockingham County area -- it's Massanutten Resort. Likely fueled by lots of buyers looking to purchase a vacation home or a short term rental, the home sales market in Massanutten Resort has seen some big changes in 2022. Home sales rose 34% in 2021 -- increasing from 71 sales in 2020 to 95 sales in 2021. The median sales price of homes sold in Massanutten Resort rose 17% in 2021 -- increasing from $285,111 in 2020 to $334,500 in 2021.  If you're looking to buy in Massanutten Resort, you'll likely have more competition than ever from other home buyers, and you will be paying a higher price than you would have over the past few years. If you are looking to sell in Massanutten Resort, you'll likely enjoy the strong seller's market and find yourself selling for a favorable sales price. Explore recent home sales in Massanutten Resort here. | |

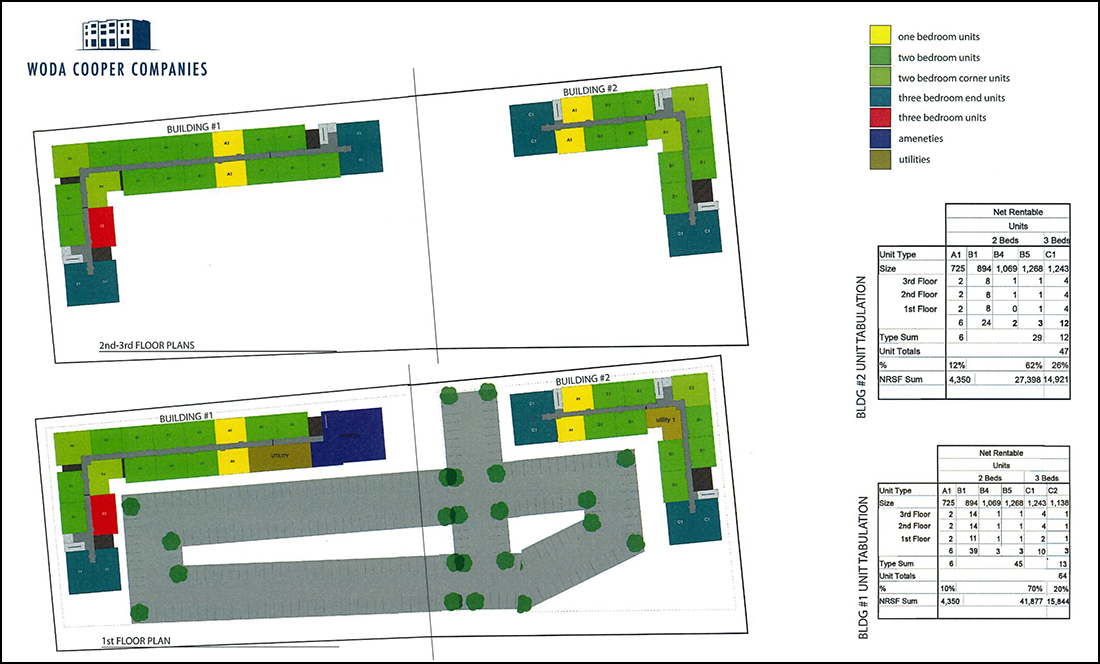

111 Affordable Housing Apartments Proposed on Lucy Drive |

|

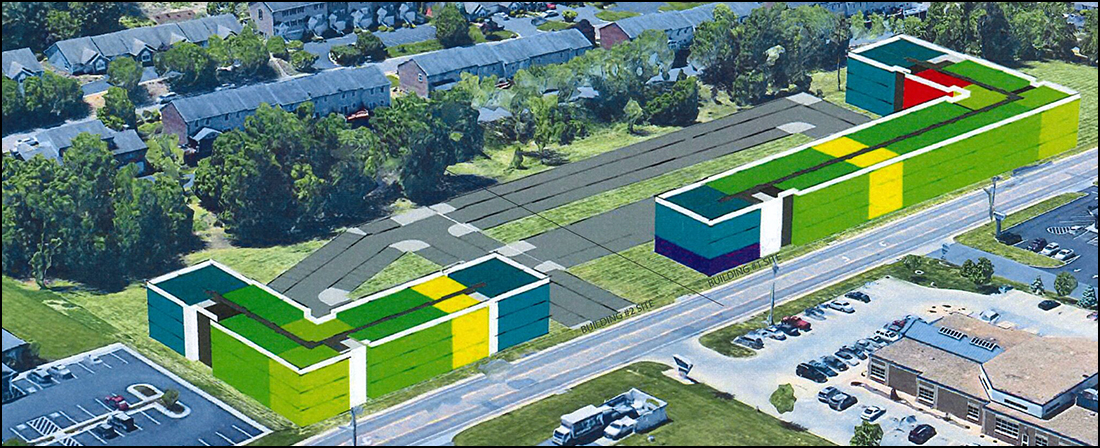

The Woda Cooper Companies, out of Ohio, are requesting the rezoning of a 4.731 acre parcel on Lucy Drive to allow them to build affordable workforce apartments. The apartments would be targeted to households that have incomes between 30% and 70% of the Area Median Income. This apartment complex would not have any market-rate apartments (normal market rent) and would not have any student housing apartments. A few other details from the proposal include:

The buildings would include:

For this development to move forward, the parcel (which is currently zoned R-3) would need to be rezoned to R-5. The parcel in question is situated between B-1 zoned land and townhouses. City staff recommends the approval of this rezoning, and next it will go before the Planning Commission for their review and consideration. Download a full packet of information about this proposal here. Here's another view of the site plan of the proposed development...  | |

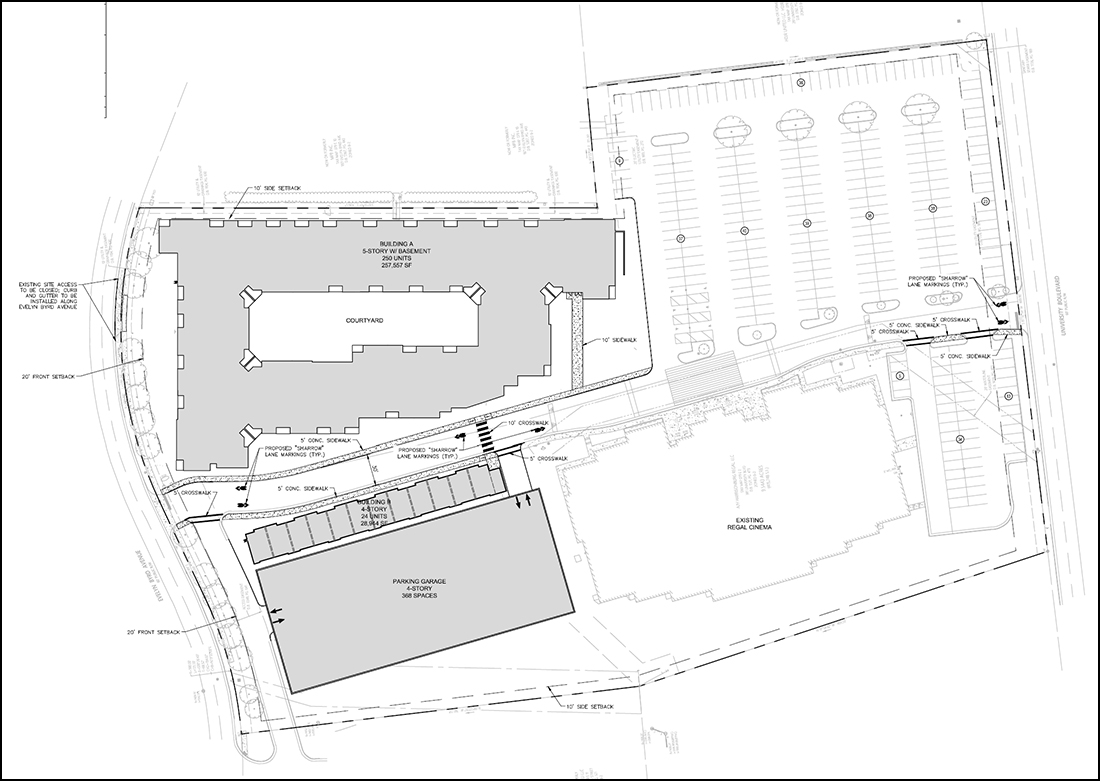

274 Apartments Plus a Parking Garage Proposed For Regal Cinemas Parking Lot |

|

The owner of the 9.5 acre parcel on which Regal Cinemas (and it's enormous parking lot) are situated is requesting a change in the Harrisonburg zoning ordinance, and the approval of a special use permit, to allow them to build two apartment buildings and a parking garage. Rest easy, though, movie fans -- they do not have any intentions of modifying the existing Regal Cinemas structure. The apartment building is intended to be approximately 72.5 feet tall -- with the parking deck being 54 feet tall. Here's the planned site plan... Click on either of the images above in this article and you can access a larger version of the image. You can see a few additional renderings of the parking garage, etc. by downloading the full Special Use Application Packet from the City. | |

A Few More Ways To Think About Your New Rockingham County Property Assessment |

|

Ahhhh! The real estate assessment for my house just went up 30 percent! No way!? Mine went up 40 percent! I heard Bob's down the street went up 55 percent! What is happening!? Below are a few more nuggets to further expand on my relatively extensive overview of the changes in assessments last week, which you can read here. So, some new thoughts... [1] Low assessments four years ago might make the increase in assessed value seem more extreme. If your assessed value four years ago was 10 to 15 percent lower than market value at that time (many seemed to be at the time), and your assessment today is truer to market value, then the apparent increase from "lower than it should have been" to "just about right" will seem larger than life. For example, if your home was worth $250K four years ago, but was assessed for $220K, and today is worth 30% more than four years ago ($250K x 1.3) then it would be worth $325K today. If your house was then assessed (last week) for its actual value of $325K you would see a 48% increase in your assessment -- but a good chunk of that would be due to the artificially low assessment four years ago. [2] If you sold your house tomorrow, would you sell it for more or less than the new assessed value? Many homeowners who have seen a large increase in their assessed value and are getting (reasonably) anxious about the possibility of a significant increase in their real estate tax bill are focusing on the change -- not the actual numbers. If your assessed value was $300K four years ago and it went up 35% to $405K, would you sell your house for $405K? Many of the folks who I have talked with about this issue quickly realize that their new assessed value may very well be on point as it relates to the increases in home prices that we have seen over the past few years. So, if you would plan to sell your home (if you were selling now) for a price around (or above) your new assessed value, then don't worry about the new assessed value being too high -- it sounds like it's not. :-) If you look at the new assessed value of your home and think there is absolutely no way in Harrisonburg that someone would way that price for your home -- next, talk to me (or your Realtor, if it's not me) to make sure you are thinking about market value in the context of the recent sales trends. If I agree (or your Realtor agrees) that the new assessed value is way out of whack with recent sales trends, then, yes, it might be worthwhile talking further with the County about the basis for your house's new assessed value. [3] Congratulations and Condolences. ;-) Both, it seems, are in order. Congratulations -- the real estate that you own is worth a good bit more than it was four years ago. You might not have realized it, so this might be both a *CONGRATS* and a *SURPRISE* all in one. Condolences -- yes, because your property is worth more now, your real estate tax bill is going to increase. It probably won't increase by as much as is outlined on your notice of reassessment, but it will increase. My condolences as it relates to that increase in your monthly housing costs. That's all for now. Keep passing on your questions or thoughts about these new assessments as they come to you -- or call the Rockingham County Reassessment Office at 540-564-5079. :-) | |

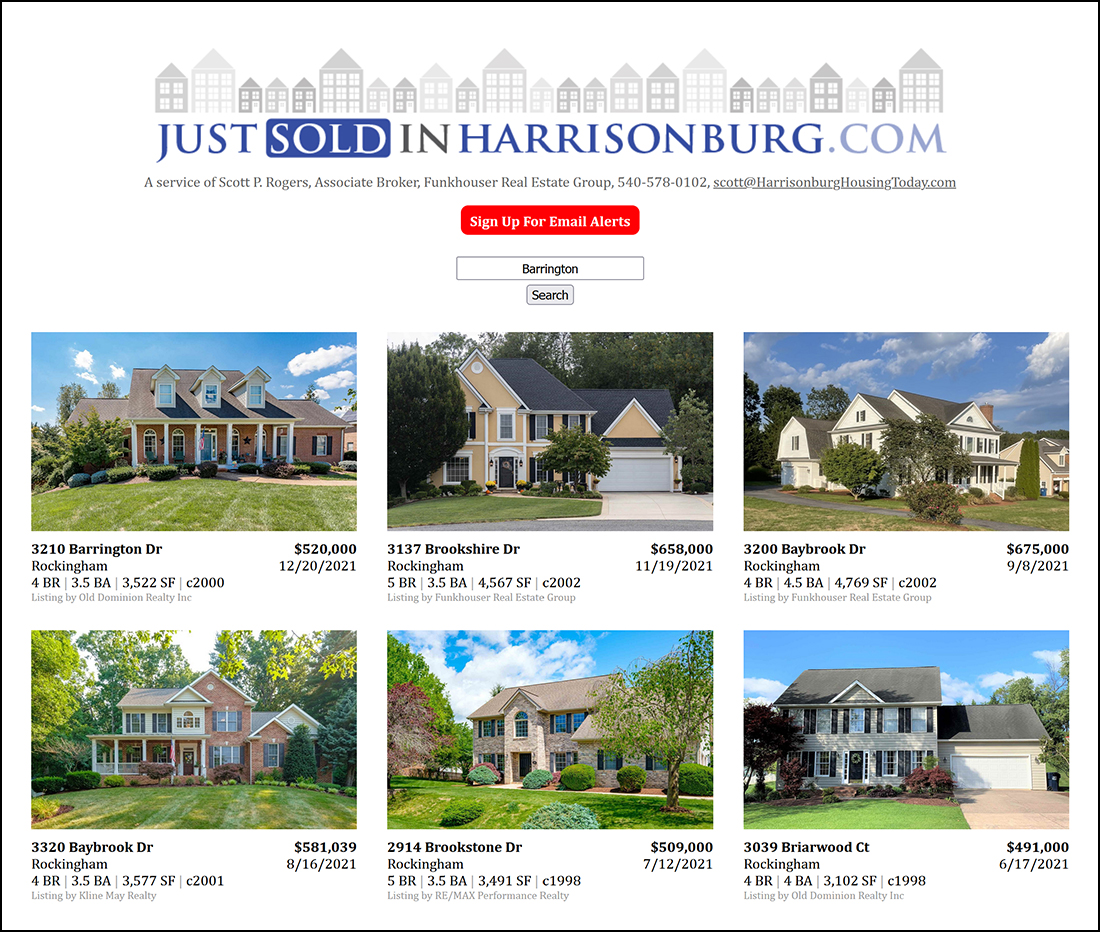

Thinking About Home Buying By Examining Past Sales |

|

You might be thinking about home buying by zeroing in on a neighborhood that you find interesting... -- I really think I'd like to live in ____ neighborhood. I love the style of homes in that neighborhood, and the location is ideal. So, let's go see some of the homes that are on the market in that neighborhood. Wait, what? There aren't any homes for sale in that neighborhood?? -- But, yes, this is a typical phenomenon... no homes for sale in a given neighborhood. So, what then are you to do if you want to better understand what options you might have for buying in the ____ neighborhood? Often, the best predictor of the future can be gleaned by looking into the past. It's certainly not an exact science, but the next five homes to come on the market for sale in ____ neighborhood are at least somewhat likely to be similar to the last five homes to sell in that same neighborhood. Certainly, this will be truer in neighborhoods with less variation in homes (age, size, style) and less true in neighborhoods with greater variation in homes -- but you get the idea. So, as you gaze out into the very, very small number of homes that are available for sale right now, perhaps will be more helpful to look backwards at past home sales to give you an idea of what types of houses at what types of prices might become available in the future. Here's one way to do this research... 1. Visit JustSoldInHarrisonburg.com 2. Click on the blue "Search by Street or Neighborhood" button 3. Type in the name of a street or neighborhood and click "Search" Happy researching... and let me know if you have questions or if you'd like help in fine tuning your research of past sales trends. | |

Real Estate Assessments On The Rise, Big Time, In Rockingham County |

|

If you own a property in Rockingham County you likely received a notice in the past week or so that your property has a new tax assessed value! I have heard from quite a few folks who are very surprised by the large increase in the assessed value of their property -- and the corresponding increase in their tax bill. Some property owners seem to have seen a 20%, 25%, 30% or an even larger increase in the assessed value of their property and their tax bills. A few important notes... Rockingham County reassesses real estate every four years. Even though it might seem like this increase in the assessment of your property is a one year change, from 2021 to 2022, it's really not. The last time your property was reassessed was back in 2018. Thus, this increased assessment is based on how the value of your property has changed over the past *four* years. The 2018 assessment would have been largely based on 2017 sales data and the median sales price (per the HRAR MLS) of detached homes in Rockingham County during 2017 was $220,000. The median sales price of detached homes in 2021 was $288,000. That change from $220K to $288K is a... 31% increase in the median sales price of detached homes in Rockingham County. That's some very rough math - but it would seem that many property values have likely increased 30% (or slightly more or slightly less) over the past four years. As such, it makes sense that assessed values would also have increased by a similar amount between four years ago and today. Finally, don't panic (yet) thinking that your tax bill will increase 25% or 30% this year. It might, but it seems likely it will not. The potential tax bill shown on your notice of a new assessed value is showing you what your tax bill would be with your new assessed value and the current tax rate. But... the County has not yet set the tax rate. Will the County keep the same tax rate, leading to you having to pay as much in property taxes as shown on your notice of your new assessed value? Let's see what would happen if they did keep the same tax rate... Per the "Budget in Brief" for 2021-2022 for Rockingham County (here) it seems that the revenue for property taxes in the budget was $101,297,000. Yes, that is 101 million dollars. Working backwards, given the current tax rate of $0.74 per $100 of assessed value, that means that all of the real estate that was taxed had an approximate combined value of $13,688,783,783. Yes, that is almost 14 billion dollars. So, let's say the 14 billion dollars (approx) of real estate increased in value by 25% given the new assessments. I rounded down a bit from the 31% referenced above. That means the combined taxable properties may very well be worth $17,110,979,730 today -- yes, a bit over 17 billion dollars. Stick with me here -- if the tax rate ($0.74 per $100 of assessed value) remains the same in 2022 it would potentially generate tax revenue of $126,621,250. This would be over 25 million dollars more tax revenue for the 2022-23 budget than existed in the 2021-2022 budget. So, will your property tax bill increase by as much as is shown on the notice of your updated real estate assessment? Maybe -- if the County needs an additional 25 million dollars of revenue to balance their budget. :-) Is that likely? It doesn't seem like it to me. While expenses may be increasing, I doubt there are 25 million dollars (a year) of new expenses that would require that much additional tax revenue. So, in summary, for Rockingham County property owners... 1. The change in your assessment really marks the change in your property value over four years -- not over one year. 2. Real estate values in Rockingham County (per sales prices) seem to have increased by about 30% over the past four years. 3. The actual amount of your property tax bill won't be known until the County sets the tax rate as a part of the budget process. Questions? Feel free to ask me... or call the Rockingham County Reassessment Office at 540-564-5079. :-) | |

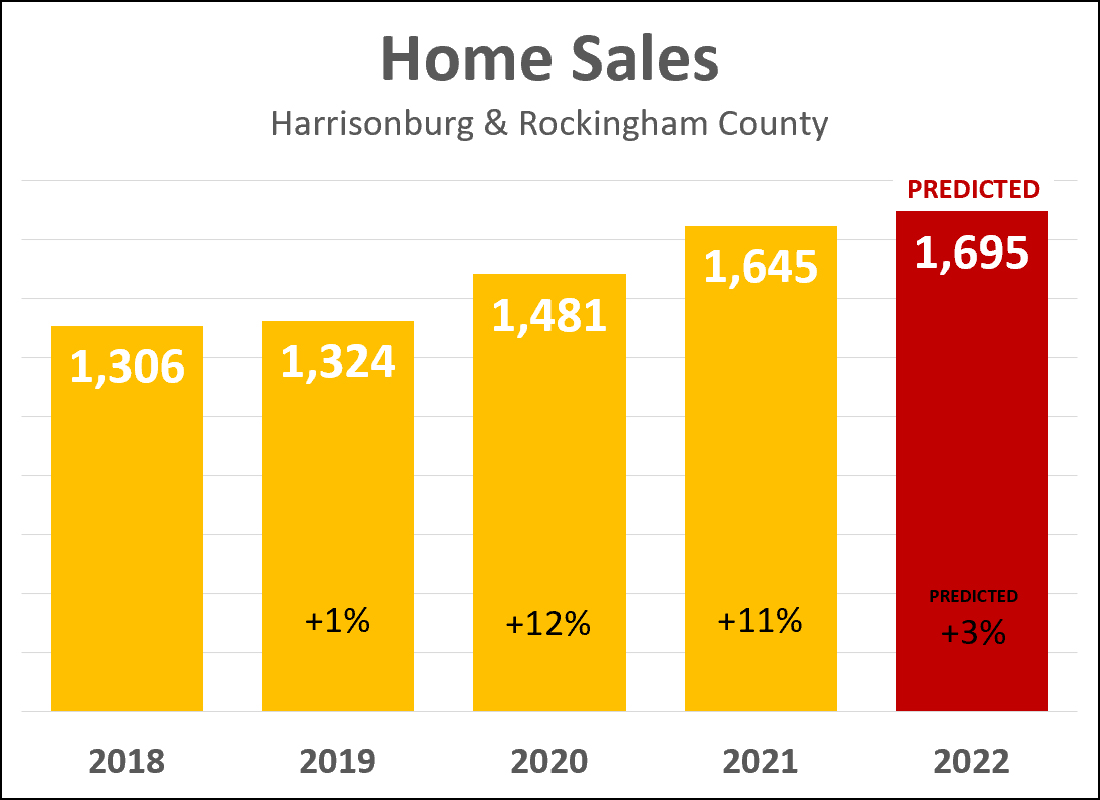

My Predictions for the 2022 Real Estate Market in Harrisonburg and Rockingham County |

|

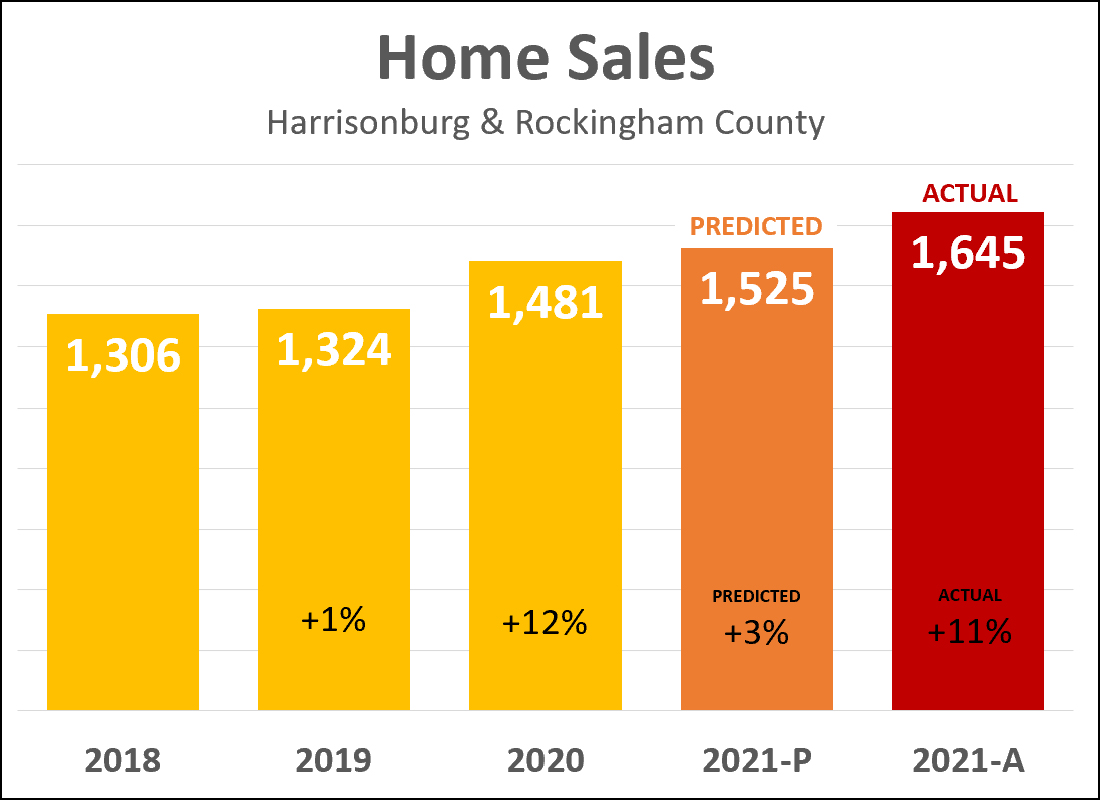

Keep in mind as you read this that I was horrendously off target with my 2021 predictions for our local housing market. :-) But, that being said, here's what I'm predicting and why... As shown above, there have been big gains in the number of home sales per year over the past few years in Harrisonburg and Rockingham County.

Why, then, am I being so conservative and predicting that we'll only see a 3% increase in the amount of homes selling in this area in 2022?

The usual disclaimer applies - I am very comfortable in saying that I might be completely wrong with this prediction...

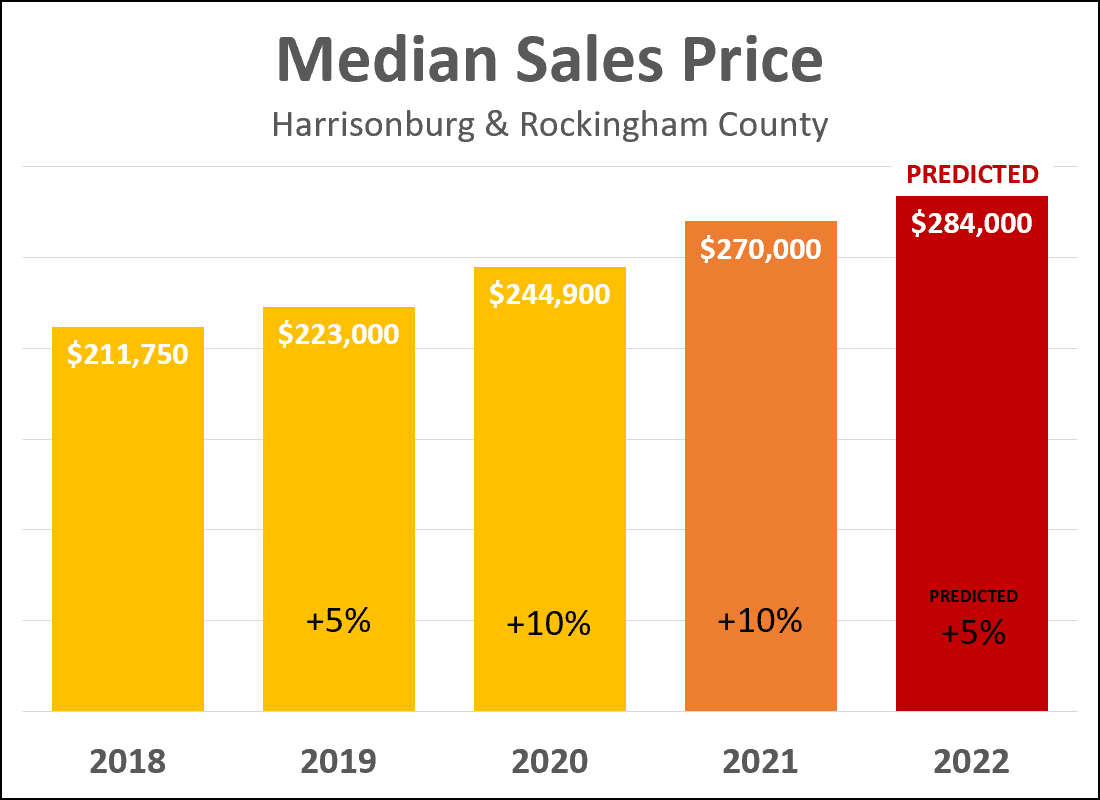

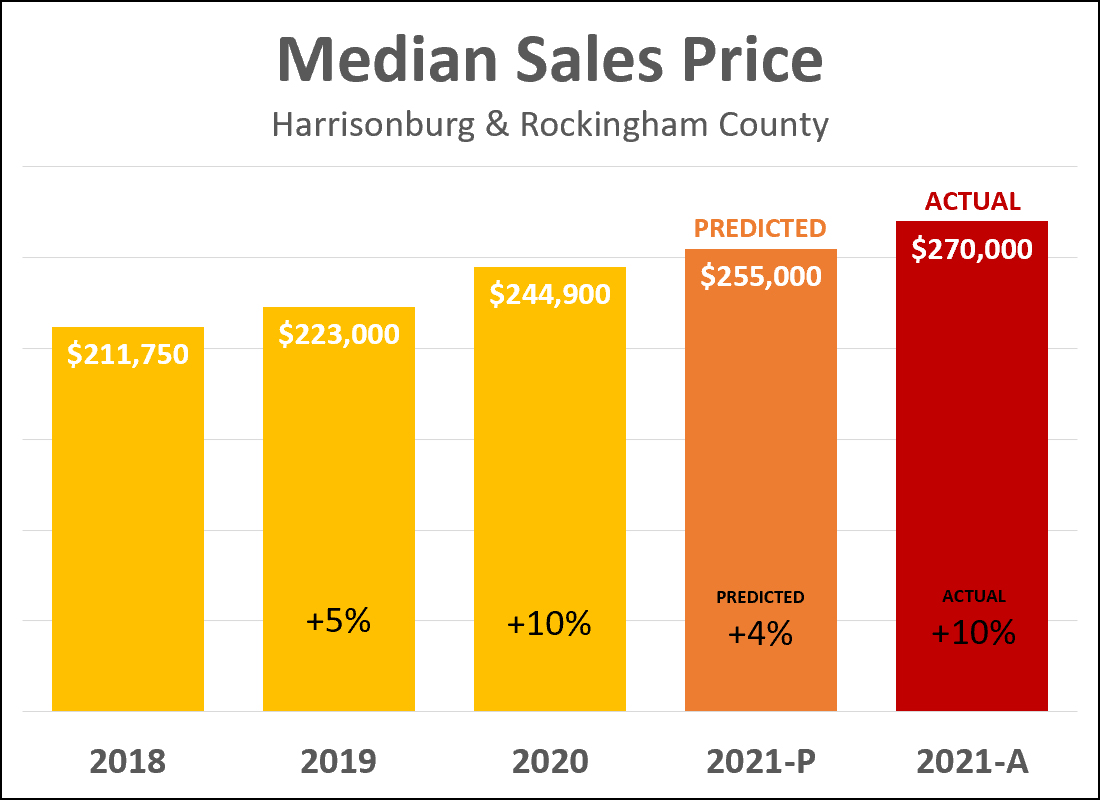

Now, then, where will prices be headed in 2022?  Sales prices of homes in Harrisonburg and Rockingham County increased dramatically over the past two years...

You'll note above that I am predicting a 5% increase in the median sales price over the next year. I'm actually split between two theories, and I ended up averaging them out for my prediction. :-)

So, which of these changes will we see this year in the median sales price? Will it be 0% or 2% or 5% or 10%? You'll note that I am not predicting a decline in the median sales price. Some (not many) home buyers seem to be thinking or hoping or theorizing that home prices will eventually come back down if they wait long enough. That seems relatively unlikely -- so I am not including declining sales prices as one of my predictions for 2022. Well, that about sums it up... I think we'll see 3% more home sales in 2022 at prices 5% higher than in 2021. But I'm ready to be wrong... quite wrong! What do you think? Where will sales and prices head as we move into 2022? | |

My Predictions for the 2021 Harrisonburg Real Estate Market Were Terribly Inaccurate |

|

It seems I have been much too conservative in my predictions for our local housing market over the past few years. After a 12% increase in the number of home sales in Harrisonburg and Rockingham County during 2020, I thought we'd see a much smaller increase in 2021. I predicted we would see 3% more home sales in 2021 than in 2020. In actuality -- we saw 11% more home sales in 2021! This was the second year in a row of double digit (12%, 11%) growth in the number of homes selling in the Harrisonburg and Rockingham County area via the HRAR MLS. And how about those sales prices? I was also terribly wrong on this prediction...  Again, we saw a big increase in 2020 -- with a 10% increase in the median sales price -- which led me to believe we'd see a smaller (4%) increase during 2021. Not so. The median sales price increased *another* 10% in 2021 up to $270,000 in Harrisonburg and Rockingham County. So -- in summary -- my predictions were not at all accurate. While 100% of the data is not recorded yet, it seems we saw an 11% increase in home sales during 2021 and a 10% increase in the median sales price! Stay tuned for my predictions for the 2022 real estate market -- which -- might be just as inaccurate as my 2021 predictions!? :-) | |

There Is Currently Only ONE Townhouse For Sale in the City of Harrisonburg!? |

|

Yes, it can be done... ...you can buy a townhouse in the City of Harrisonburg... ...but it's much more difficult now than it was in the past! Townhouses Sales in 2021 in the City of Harrisonburg = 195 Townhouses Under Contract Today in the City of Harrisonburg = 16 Townhouses Currently Available For Sale in the City of Harrisonburg = 1 I should also point out that the median sales price of townhouses in the City of Harrisonburg in 2021 was $194,900 -- up from $185,000 in 2020 -- and up from $166,000 in 2019. So, yes, you can buy a townhouse in the City of Harrisonburg, but you'll need to be ready to act quickly when one hits the market as they don't stick around long. The median "days on market" for the 195 townhomes sold in 2021 was only four days! | |

Record Number of Building Lots Sold In Harrisonburg, Rockingham County in 2021 |

|

While we are still a few days short of a full year, it is already quite clear that there was a significant surge in the number of building lots sold in Harrisonburg and Rockingham County in 2021. There have been 144 sales of building lots of less than an acre in Harrisonburg and Rockingham County in 2021. To put that in context...

Clearly, these 144 lot sales is a big jump from the number of lots that typically sell in a year in this area. Breaking it down a bit, here are the top locations where lots sold in 2021...

It seems plenty of would be home buyers may have elected to buy a lot and build a home given the shortage of available homes to purchase at any given time... and/or there may be some builders purchasing lots to build spec homes. | |

Moving to Harrisonburg, From Out of Town, and Buying A House Can Be.... |

|

Many people move to Harrisonburg, Virginia (or the surrounding area) each year and in 2021 many of those individuals and families have found it challenging to find a home to purchase. Why, you might ask? It's an "inventory at any given time" sort of problem. As I have mentioned quite a few times lately, more homes have sold this year than last... Jan - Nov 2020 = 1,385 home sales Jan - Nov 2021 = 1,525 home sales (12% more than in 2020) But most homes are under under contract less than a week after having hit the market for sale. The median "days on market" of homes sold in 2021 is a mere five days! So, most out of town buyers can identify plenty of homes that they'd would like to view -- and possibly buy -- in an extended timeframe of a month (for example) but if they are in Harrisonburg for a weekend for a home buying visit they are likely to see very, very few options of homes that they can tour and consider purchasing. So, what then, is the out of town (but moving into town) buyer to do? Idea #1 - Move first, buy later. Perhaps you can put most of your belongings into storage temporarily, and live with a friend or family member in Harrisonburg for a few months while you house hunt, viewing new listings in person shortly after they are listed for sale, and potentially making an offer on such a new listing and purchasing a home. Idea #2 - A Local Home Buying Ambassador Perhaps you have a family member living in Harrisonburg, or a long time friend, who can go see new listings on your behalf as soon as they hit the market to help you decide whether you want to make an offer on such a new listing even without having seen it in person. Idea #3 - Rent For A Year This is a variant of the first idea, but some would be home buyers relocating to this area resign themselves to renting a property for a year to get into the area and start viewing new listings in person so that they can take their time to find the right home to purchase in the Harrisonburg area. Idea #4 - FaceTime or Zoom If you don't have a local home buying ambassador to send along in your stead to view new listings, I am happy to walk you through new listings virtually, via FaceTime or Zoom. It's certainly not the same as seeing a house in person, but it can provide much more context for you as you consider a home purchase from afar. If you are moving to Harrisonburg in 2022, from out of town (or out of state), start giving some thought to how you will approach the remote home buying experience. I'd love to tell you that you'll be successful in just scheduling a weekend to come see a bunch of homes and make a decision -- but it seems unlikely that we are going to see inventory levels meaningfully rise in 2022, so you will likely need to consider one or several of the ideas above. | |

Will Mortgage Interest Rates Really Rise In 2022? |

|

Will mortgage interest rates really rise in 2022? Yes, he said, knowing he has said "yes" for years and has been wrong over and over. ;-) To be fair, I guess interest rates did rise between 2012 and 2014 and again between 2016 and 2018. But, they've been below 5% for over a decade now -- and have been below 4% for eight of the past ten years. So, again, will interest rates really rise in 2022? After steadily declining since 2018, yes, it seems likely that interest rates will start rising again in 2022. But, it seems quite likely that I could be wrong, again. :-) | |

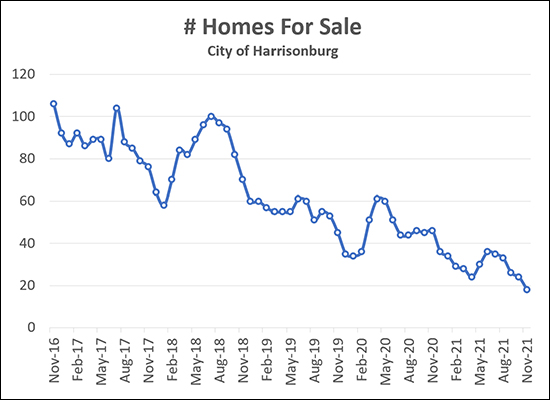

City of Harrisonburg Housing Inventory Levels Fall Below 20 Homes For Sale... For First Time Ever!? |

|

There are now fewer than 20 homes for sale in the entire City of Harrisonburg! As you can see, above, the number of homes for sale at any given time has been falling rather consistently over most of the past five years. The several times when you see inventory levels rising are typically in the spring season. These extremely low inventory levels do not mean that fewer houses have sold in the City over the past five years. Here are the annual City home sales during that timeframe...

So -- plenty of homes are selling in the City this year -- more, in fact, than any of the past five years. These extremely low inventory levels thus mainly mean that as soon as City homes are coming on the market they are almost always quickly going under contract -- keeping inventory levels at any given moment QUITE low! | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings