Archive for May 2010

You Have Almost 1,000 Homes To Choose From in Harrisonburg and Rockingham County! |

|

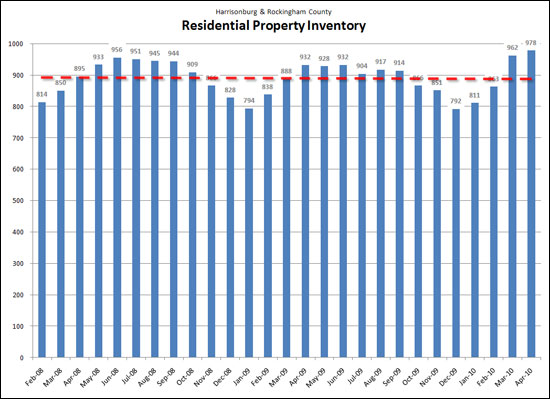

There are a LOT of homes for sale right now....995 residential properties in Harrisonburg and Rockingham County as I type. BUT.... the current levels aren't too much higher than we've seen during the past two spring/summer seasons!  Click the graph above to view a higher resolution PDF. Peak Inventory Levels:

If you're a buyer....what is your experience of the current inventory?

| |

How many homes are for sale in this price range and how many will sell anytime soon? |

|

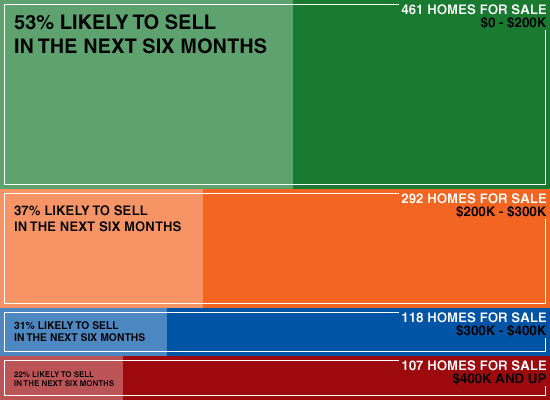

For the visual learners amongst us, here's a new take on the mix of homes for sale based on their price range, and the demand for such homes....  This (hopefully fun and self-explanatory) graph is based on inventory levels as of May 10, 2010, and average home sales per month from May 2009 through April 2010. Questions? Clarifications? | |

Low to Mid Priced Homes Are Sustaining The Market |

|

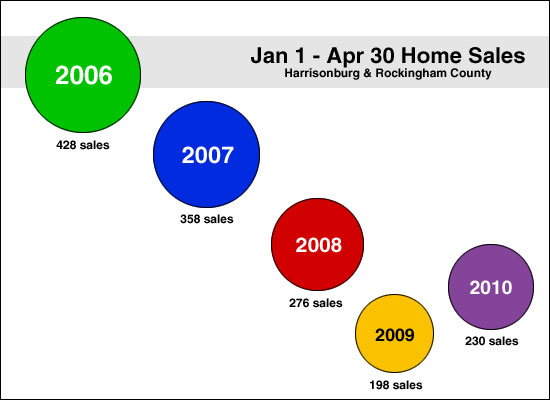

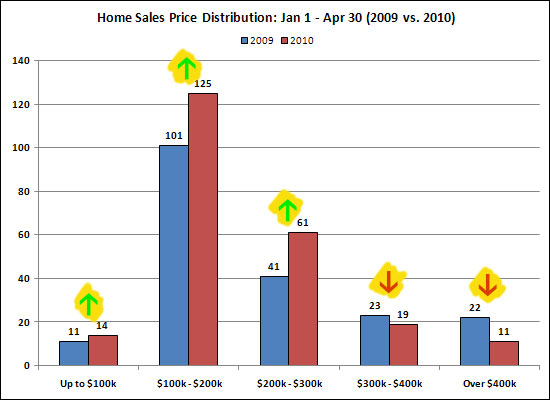

Home sales have certainly started to bounce back in 2010...  Skeptics certainly won't believe we're making any progress until we pass June 30th and the end of the tax credit season. Big picture thinkers will want to delve into why our market has outperformed so many others across the country.. But now let's examine what is actually selling this year:  Sales of homes priced under $300k have increased compared to last year. Sales of homes priced above $300k, however, have declined this year. Is it because of the tax credit? Is it because buyers of sub-$300k homes often don't have a home to sell before buying? Plenty of possibilities --- but so far the market is looking strong for the spring and summer! | |

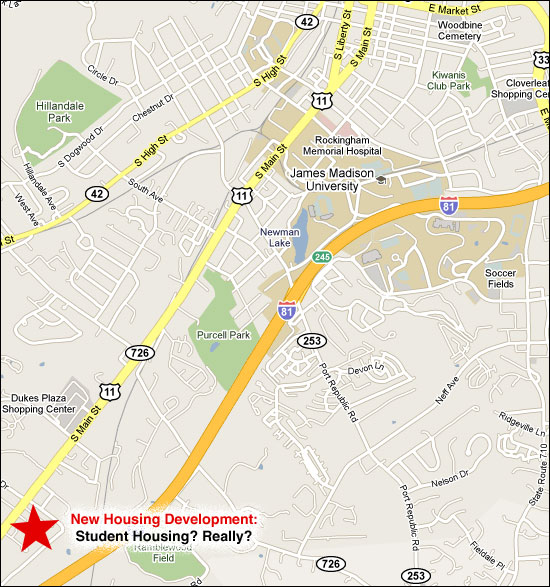

Do You Think Harrisonburg's Student Housing Vacancy Rates Are High Now? You Haven't Seen Anything Yet! |

|

As reported in detail at hburgnews, a new student housing complex is one step closer to being built on South Main Street. The 60 acre tract is proposed to feature 466 apartments for college students --- but wait, certainly the developer would first be examining the state of the current student housing market --- right?? Let's take a quick look at what has happened over the past several years in Harrisonburg's student housing market: In Fall 2007, there was a relatively even balance between JMU students living off campus, and housing available for said students. There were 11,654 students, and approximately the same number of "beds" (bedrooms in apartments, etc) available for those students. Between Fall 2007 and Fall 2009 the the number of off campus students increased by 382 students. But.... there were 3,313 new beds for these students! This huge increase in housing included new complexes (Charleston Townes, North 38, Campus View Condos, 865 East, Copper Beach, Urban Exchange) and additions to current complexes (Sunchase, new JMU residence hall). This left an off campus vacancy of roughly 20% --- with 12,036 off campus students compared to 14,967 off campus beds for students. While growth is still occurring at JMU, it is quite slow because of state budget cuts for higher education. Thus, the vacancy rate for Fall 2010 will likely only decline to 18.5%, and per my projections, by the time we get to Fall 2013, there will still be an off campus vacancy rate of 15% --- with 13,090 off campus students compared to 15,387 off campus beds for students. But it seems that a company out of Glen Allen, VA is ready to jump into this exciting student housing market, add help pump that vacancy rate up even higher. This new community will bring 466 apartments, described as 1, 2 and 4 bedroom apartments, laid out per the site plan below.  Let's assume 1/3 of the apartments are 1 bedroom, 1/3 are 2 bedrooms, and 1/3 have 4 bedrooms. This equates to roughly 1,087 new beds for students. They'd like to have them finished for Fall 2011, which means we'll have 12,588 off campus students available to fill 16,286 off campus beds, shooting us up to 23% off campus vacancy. But the best part yet --- where will this student housing be located? Next to JMU campus? In the midst of other student housing? No and No. This complex is quite a distance from JMU.  Again, read more at hburgnews, as there are a few detailed comments on that site that explain some of the history of the property. SUMMARY: Student housing vacancy in Harrisonburg currently hovers around 20%. A developer is planning to build, likely increasing the vacancy rate to 23%. If I were the developer, I would not develop it as a student housing complex in this community at this time. What are your thoughts? Questions? | |

Why Have Home Values Remained Stable in the Central Shenandoah Valley? |

|

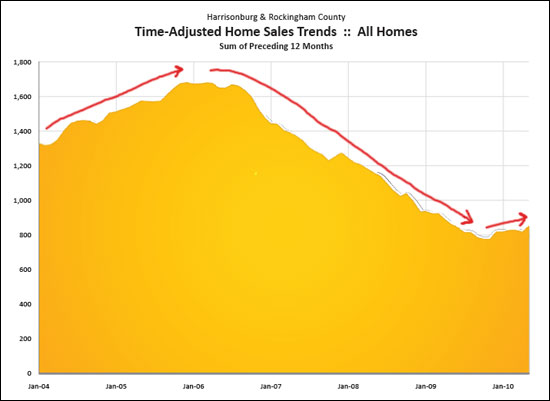

Some reports indicate that Americans lost over $1,000,000,000,000 (one trillion dollars) in home values in the last three months of 2009. When looking at the sum of the last several years, the figures are even more staggering – declining home values across the United States have resulted in trillions of dollars of losses for American homeowners. Yet during this same time period, homes values in Harrisonburg and Rockingham County have only been marginally affected. In fact, it wasn't until 2009 that this area saw any significant decline in median sales price, and then it was only a 5% decline. So why and how, in this time of rapidly declining home values, have homes in the central Shenandoah Valley held their value? First, while Harrisonburg and Rockingham County did see a sharp increase in home prices (51% increase in median home value between 2003 and 2006), our median sales price started out quite low ($127,700 in 2003) and only increased to $192,983 in 2006. Median sales prices in many other metropolitan areas increased to much higher levels leading to borrowers stretching pursuing riskier mortgages for their purchases. In such areas with significant increases in home values, many homeowners took on risky mortgage programs such as variable rate mortgages, interest only mortgages, or mortgages with a teaser rate. Those with 30-year fixed rate mortgages knew what to expect of their housing payment and likely were able to continue to pay their mortgages after buying several years ago, but those with these higher risk mortgages often had trouble keeping up with their mortgages and were foreclosed upon. Variable rate mortgages have been somewhat problematic, but not to a great degree because interest rates have remained relatively low for the last several years. Interest only mortgages have proven to be quite dangerous, because the homeowners has not been paying down any principal on their mortgage, and thus does not build up an equity in their home absent any appreciation in the market. Mortgages with teaser rates provided for a very low rate (1%, 2%) for a short time period in order to qualify a home purchaser. These teaser rate mortgages would then reset to a much higher rate after several years, then putting the homeowner in financial duress, unable to make their mortgage programs Since home values didn't go too drastically in this area, home buyers did not (in large number) feel pressured to obtain risky mortgages with variable or escalating future housing payments. As a result, we have seen a very low number of foreclosures in the central Shenandoah Valley. I have heard, anecdotally that earlier in 2009 over half of the homes on the market in the Winchester area were "bank owned" homes --- homes that had been foreclosed upon. This high, high number of foreclosures lead to rapid decreases in home values, as banks quickly reduced the prices at which they would sell their inventory in order to get these homes off their books. Thus while high foreclosure rates in other metropolitan areas lead to declining home values, the very low foreclosure rate in Harrisonburg and Rockingham County has lead to relatively stable home values. The Harrisonburg and Rockingham County market has also been greatly protected by its diverse and stable local economy. We have not seen significant losses of jobs over the past five years, which could have put large numbers of homeowners in a position where they had to sell their homes rapidly because they were unemployed, or because they were moving to another area to find work. Our economy includes jobs from many sectors, and is largely supported by the colleges in universities in our midst. It also helps that we have always had very low unemployment rates as compared to most every other metropolitan area in the country. Since 2005, the pace of home sales has declined drastically, with only 813 home sales in 2009 compared to 1,669 home sales in 2005. The law of supply and demand would suggest that such a large reduction in demand (a 51% decrease) would certainly lead to a drastic decrease in home values. Yet, in the same time frame (2005-2009), the median home price has shown a net increase from $169,900 to $186,300 (a 10% increase). While we have seen a 5% decrease in home values between 2008 and 2009, our local housing market continues to be amazingly resilient, without any significant shift in home values. While we can't point one particular factor that has protected home values in the central Shenandoah Valley, it is highly related to the relatively slow and small increase in home values, the conservative mortgage programs used by home buyers, our low foreclosure rate, and our stable local economy. | |

Dear Skeptics, What Will It Take For You To Believe? |

|

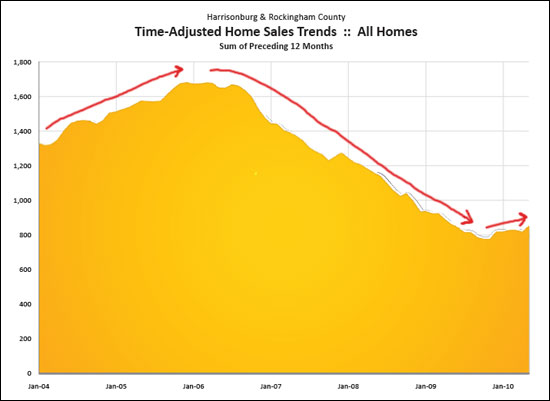

Earlier this week I posted my monthly market report for Harrisonburg and Rockingham County and I pointed out that there were several indicators that suggested we might be seeing an end to the local real estate downturn. Several of you were quite skeptical -- attributing any short-term positive indicators to the tax credit. A few clarifications before I get to some statistics:

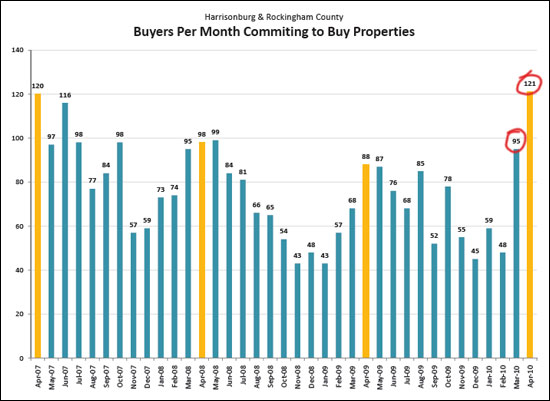

First let's look at signed contracts per month:

Each data point in the graph above shows the number of sales in a twelve month period. It often takes months for a trend to appear using this metric, but it seems pretty clear to me that over the past six months (which includes data from the last 18 months) we have seen a significantly different trend than we saw between 2006 and 2009. What do you think? Still skeptical? | |

Local Real Estate Market Recovery? |

|

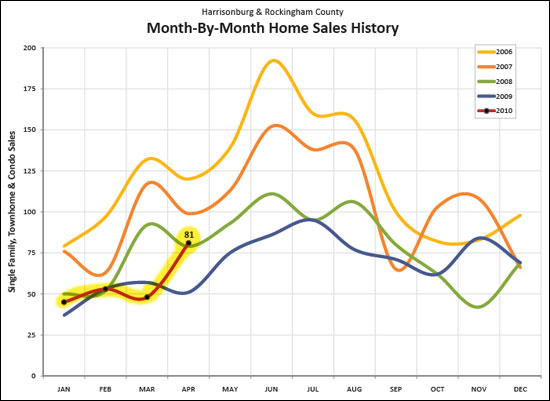

I have been waiting a long time to have tangible, factual, good news to share about a recovery of the Harrisonburg and Rockingham County housing market. I think that time is coming, and here's why --- April 2010 home sales increased 62% compared to April 2009! (see graph below)  Long term home sales indicators continue to show stabilization and growth! (see graph below)  Home buyers committed to buy homes in record numbers in March and April 2010! (see graph below)  Learn more about our local housing market by clicking the image below to read my full market report.  | |

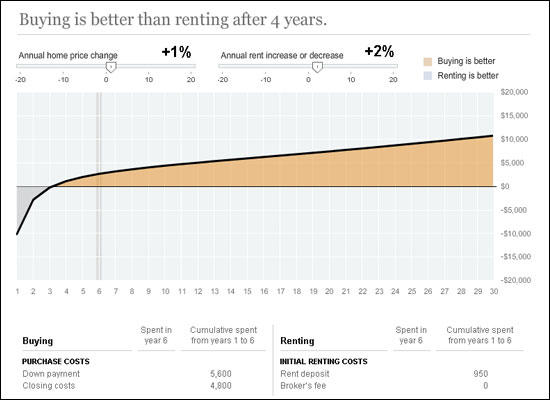

Is It Better to Buy or Rent? |

|

Lots of people who are renting have thought about buying . . . and lots of people who are thinking of buying wonder whether they should keep renting. Here's a highly interactive calculator to help you compare your options, thanks to the New York Times.  Using this online calculator, you can enter in all sorts of variables including all of your up front and ongoing costs for buying as well as renting. The resulting graph shows you how long it would take for it to have been worthwhile to have bought instead of renting. The illustration above is with a $160,000 townhome purchase, compared to renting the same townhome for $950 per month. With a 5% interest rate on a 97.5% mortgage, it would take four years to be worthwhile to buy --- if home values were increasing at 1% per year. In the first three years, your annual costs would be higher for having bought. Starting in the fourth year, your annual costs would be LOWER for having bought. Longer term normalized price increases per year range from 3% to 4%. With 3% per year increases in home values, you start having annual savings each year after only two years. If you are wondering whether you should rent or buy a home, feel free to use this handy calculator, or schedule a time to meet with me and I can help you explore the pros and cons of each option. | |

Harrisonburg Home Buyers Set Three Year Record High In April 2010 |

|

Perhaps it was the tax credit. Perhaps our local housing market is starting to recover. Perhaps it is a bit of both! In April 2010, an astounding 121 contracts were ratified on residential properties in Harrisonburg and Rockingham County. This is the highest number of contracts in a single month since March 2007! Despite the contract deadline having passed for the tax credit, I believe we will still continue to see strong sales as we move through the summer. | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings