| Newer Post | home | Older Post |

City of Harrisonburg real estate tax rate likely increasing 7%, mirroring Rockingham County increase |

|

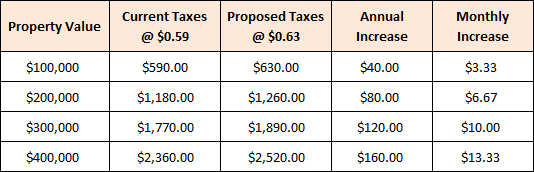

Rockingham County is considering raising the real estate tax rate from $0.60 to $0.64 per $100 of assessed value (details here). The City of Harrisonburg is now considering a similar increase, from $0.59 to $0.63 per $100 of assessed value. The reasons cited for the proposed tax rate changes are increased Virginia Retirement System costs, and decreased property values. There are a few other tax rates that would change, but here is how the real estate tax rate changes would impact homeowners in the City of Harrisonburg....  Of note, the City's real estate tax rate was $0.62 per $100 of assessed value very recently -- it was adjusted down to $0.59 per $100 of assessed value in the 2008 fiscal year. Thus, looking at this over six years (2007-2013) this is only an increase of $0.01 per $100 of assessed value -- thus an effective 1.6% increase in the tax rate over the past 6 years. Click here for the full article from the Daily News Record. Recent Articles:

| |

| Newer Post | home | Older Post |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings