| Older Posts |

Understanding Real Estate Assessments |

|

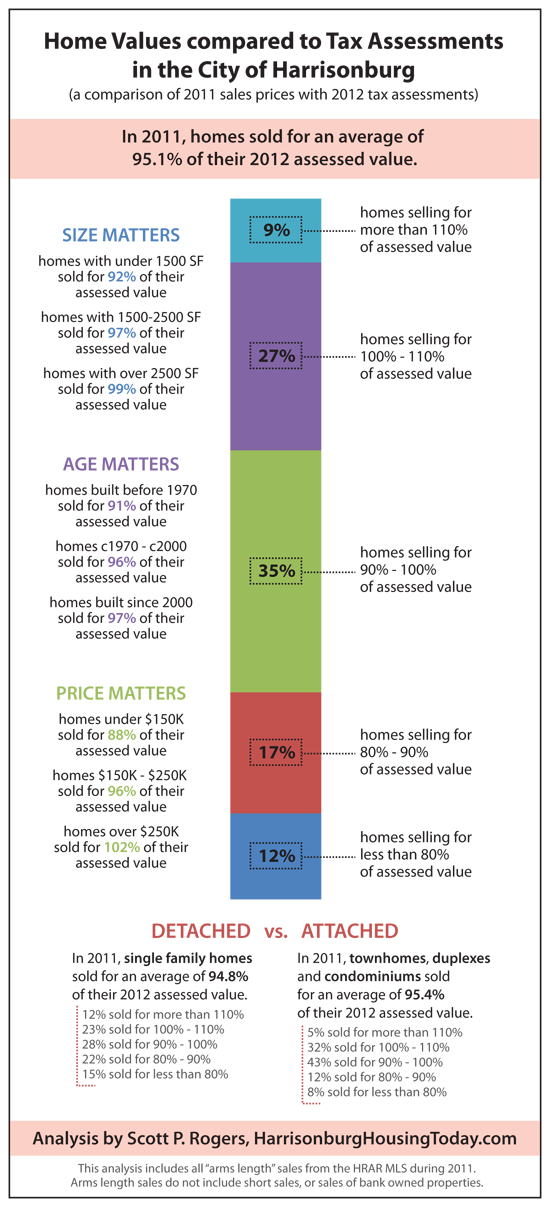

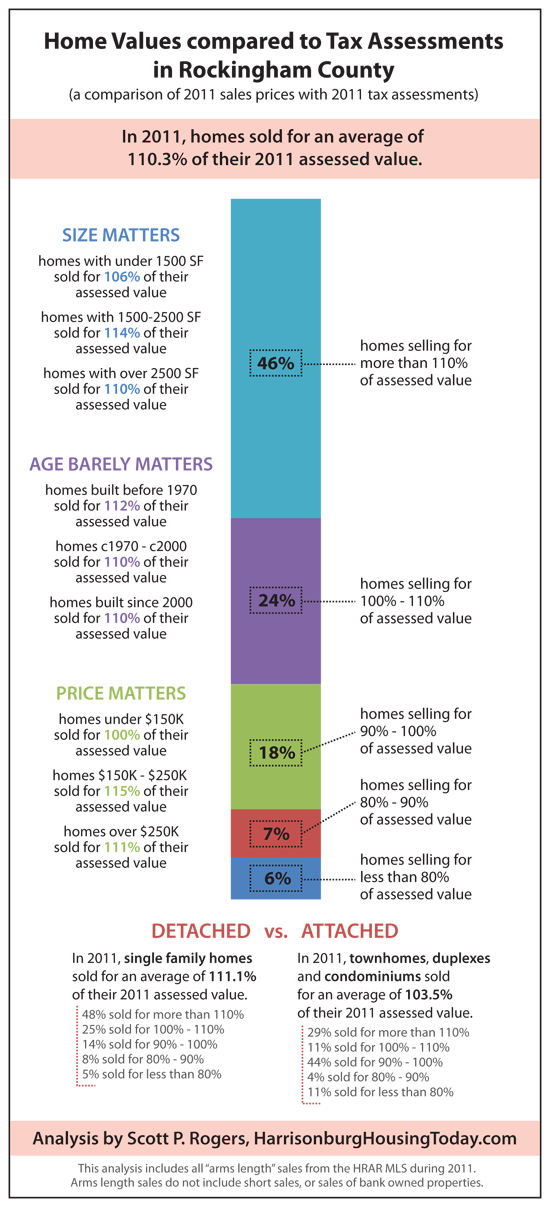

As published yesterday in the Shenandoah Valley Business Journal. Many people believe the assessment of their property istheir home's value. In actuality, theassessed value of a property is the value assigned to the property by the localassessor's office, for the purpose of determining how much you will pay intaxes. Certainly, the assessed value is intended to be the precise valueof your home – but quite frequently there is a disparity in this assessed valueand market value. The market value ofyour home is the price at which it would sell in the current market. Of interest, the City of Harrisonburg real estateassessments are currently a bit more accurate than those in RockinghamCounty. As can be seen in theinfographic, homes sold during 2011 in the City of Harrisonburg sold for 95.1%of their current assessed value. Breaking it down further, 64% of the homes that sold during 2011 in theCity of Harrisonburg sold at a lower price point than their assessed value. This is an indication that many City propertyassessments are likely a bit too high. In Rockingham County, most property assessments are too low –as 70% of properties that sold in 2011 sold for more than their assessed value– and on average, properties sold for 110% of their assessed value. Of note, homes in the City of Harrisonburgare re-assessed every year, while homes in Rockingham County are onlyre-assessed every four years. In thepast, this has resulted in lower than expected assessments in Rockingham Countydue to the infrequent updates to their assessed values. Given the great variation in assessed values and marketvalues, homeowners should not rely on their tax assessment for an understandingof their property's value. Furthermore,home buyers should not rely on assessed values to guide them in understandingthe market value of a home that they might purchase. Both buyers and sellers should strive tounderstand the market value of a particular piece of real estate my analyzingsimilar homes that have recently sold and those currently on the market in agiven neighborhood or price point. Click on either image below for a printable PDF.... | |

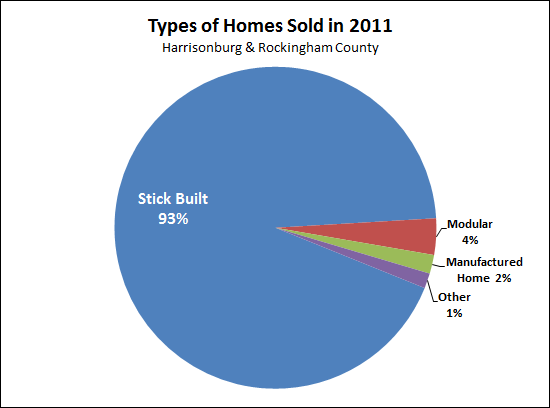

Are modular homes common in our local market? |

|

Before we get to the presence of modular homes in our local market, let's review some terminology.... According to Wikipedia, a stick-built structure is "one constructed entirely or largely on-site," as opposed to a modular home that is "divided into multiple modules or sections which are manufactured in aremote facility and then delivered to their intended site of use." And here is a breakdown of the types of homes sold via the HRAR MLS last year....  Click here to read about some opinions of stick built homes versus modular homes. | |

Oops, sorry, that's already under contract |

|

I've been hearing that a lot lately.....  Contracts are on the rise --- and more and more of the competitively priced listings are selling, and selling relatively quickly. In the first 25 days of May there have been 81 contracts --- that is compared to only 60 in the same time period last year! Buckle up, it looks like we might have a strong summer sales market on the way! | |

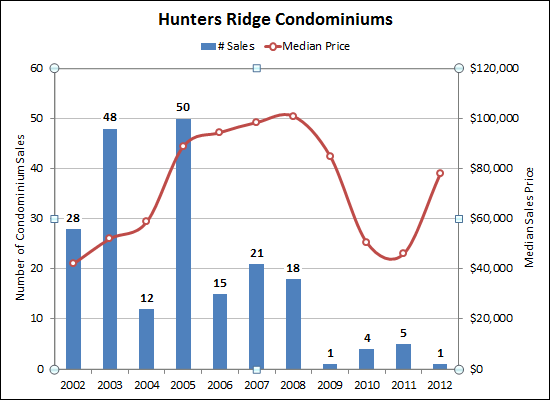

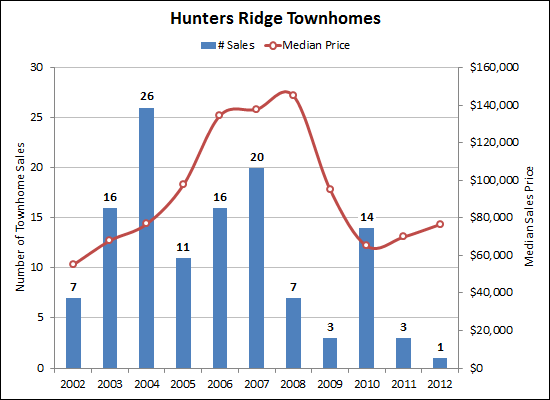

Property values increasing in Hunters Ridge? |

|

Is it possible that values at Hunters Ridge have bottomed out and are on the rise? Don't read into the upswing too much, as there is only one data point for each property type so far this year --- but this will be a trend to continue to monitor.   View currently available condos and townhouses in Hunters Ridge. | |

You're largely on your own in finding a rental property |

|

I help people to buy houses and sell houses all day long. When it comes to helping people find a property to lease, it's harder for me to help, for these reasons....

If you are looking for a rental property, I would love to help you find a place to live -- but I won't be able to be much help based on how things currently work in the Harrisonburg area. Fellow Realtors -- tell me I'm wrong! Do you approach this any differently than I do? Local Innovators -- fix this problem! Create a solution to make it easier for tenants to obtain rental housing in this area! | |

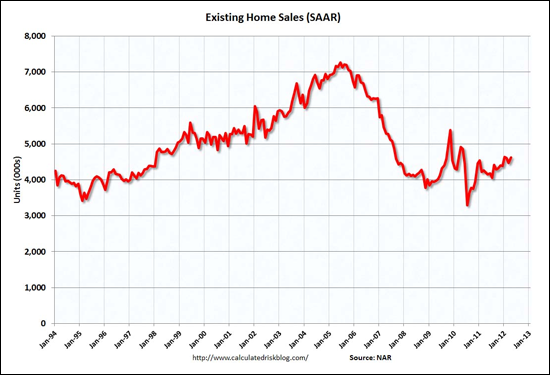

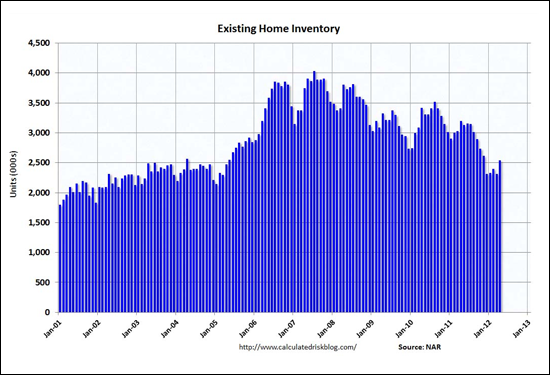

Nationally, sales are up, inventory down per NAR, Calculated Risk |

|

Just as we have seen over the past 6 to 12 months in Harrisonburg and Rockingham County as well as in Virginia, home sales are increasing and inventory levels are dropping on a national level as well.   Read more from NAR and Calculated Risk. | |

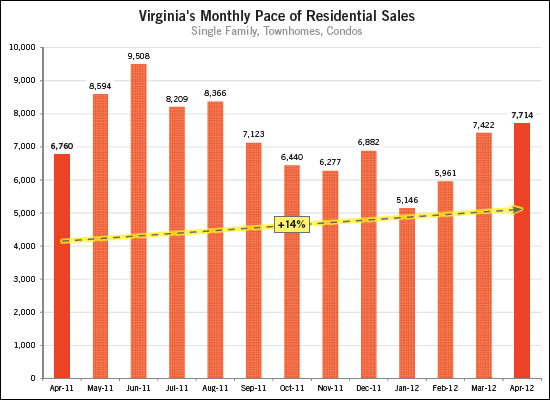

Overall Virginia housing market continues to gain strength |

|

From the Virginia Association of Realtors this morning....  Home sales (# of sales) and median prices are both up across Virginia! Click the image below to download the full Virginia Home Sales Report.  | |

Demand grows for new homes |

|

A new foundation (pictured above) is going in at The Glen at Cross Keys as a result of growing local demand for new homes. Photo by Carey Keyes. Along with Carey Keyes and Suzanne Trow, I represent several of the main builders in the Harrisonburg area. In the past 30 days the model home at each of these communities was sold....

| |

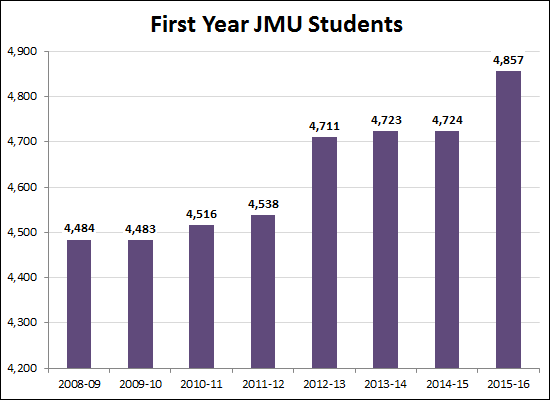

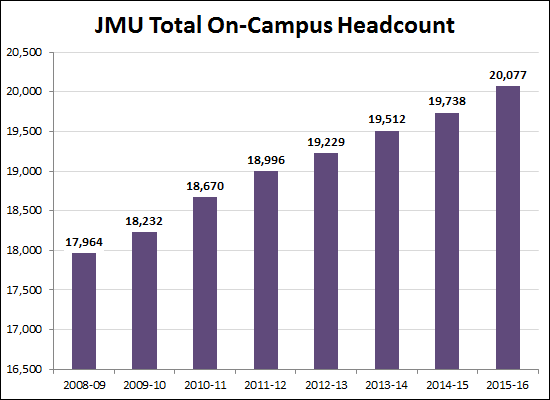

JMU (slightly) boosts first year student count, continuing steady growth trajectory |

|

After several years in a row of relatively similar sized classes of first year students at JMU, the first year headcount will jump up a bit this coming year, as shown above.  Despite this jump in first year students, the overall growth trajectory will stay relatively similar to what JMU has experienced over the past several years. These increases in enrollment will (gradually) help the over-supplied student housing market in Harrisonburg. If you haven't heard, there are many more places for students to live than there are students. (read up here) These increases are also (continued) great news for the local economy, as JMU is a major economic engine for the local economy -- as both students and faculty/staff live here, work here, spend here, etc. This is not, of course, to ignore the significant contributions made to our local economy by Bridgewater College, Eastern Mennonite University and Blue Ridge Community College. The data for the graphs above is based on JMU's enrollment projections. "Total On-Campus Headcount" is the number of students who are taking classes on the JMU campus. | |

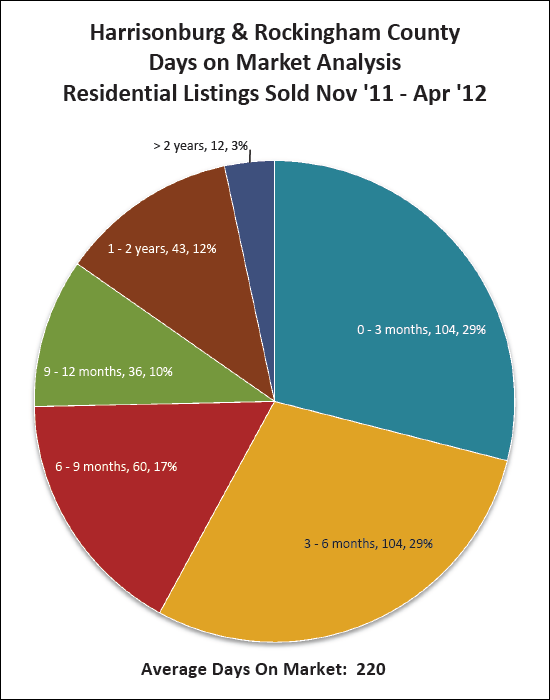

Don't get distracted by YTD average days on market |

|

Some sellers might despair when they see that the average days on market for homes sold thus far in 2012 is a whopping 229 days. Wow! But wait....  Don't despair yet -- the above analysis is based on listings that have sold in the past six months, and you should take note that....

The lesson here is the importance of pricing correctly from the start in order to sell in a reasonable time frame. So....don't despair thinking that you'll likely have to wait 8 or more months for your house to sell...and don't price it so that you will end up waiting that long! | |

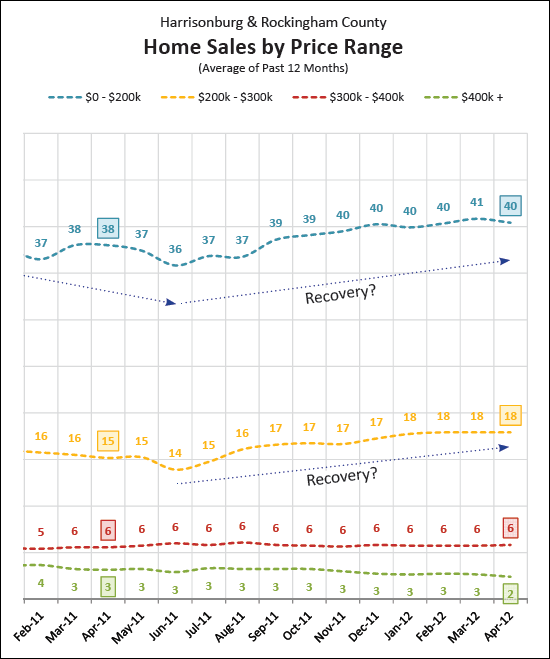

Housing recovery more evident in lower price ranges |

|

The graph above shows the average number of home sales per month (in each of four price ranges) when evaluating a 12-month time period. For example, the last data point shows the average number of home sales per month for May 2011 - April 2012. As is quite evident, the recovery (in the pace of home sales) is more pronounced in the lower price ranges. | |

Evaluating a low offer as a seller |

|

Let's suppose you have a house listed for sale for $300K. But keep in mind that you just lowered it to $300K from it's previous price of $309K. How would you respond to an offer of $270K? You probably consider $270K to be way too low of an offer, after all you just reduced you price from $309K. These ridiculous buyers are offering you $39K less than your asking price last week. Certainly, you should be able to sell for around $295K, right? Well, maybe not. In the last 365 days, properties in Harrisonburg and Rockingham County sold for an average of 95% of their last list price. That means that if $300K is a fair asking price, you should probably expect to sell for around $285K -- if you hit that 95% average. Then, all of a sudden, maybe the $270K offer on a $300K list price isn't too low at all. If you met in the middle, after all, you'd be right at that 95% mark. So....let's make it really hurt....how would you respond to an offer of $250K?? The same logic above applies here -- if your house is an average performer, you'll end up selling for $285K. And the $250K again probably seems waaaaay too low. But what if your house still isn't listed at a fair price? If nobody comes to view it over the next month, it may still be overpriced. Then, perhaps you'll find yourself lowering the list price to $290K. And then, of course, you might sell for that 95% average and end up at $275,500. So.....if you're listed at $300K and you might (a month+ from now) end up at $275K....perhaps you shouldn't turn up your nose at that $250K offer. See how high they are willing to go. . If you can get them up to $275K, you might want to consider taking it (bird in hand! bird in hand!) -- and if their super low offer of $250K was just to try to get you down to $280K or $285K, all the better! As a seller, don't be discouraged about what you view as a low offer -- after all, it's an indication that somebody really wants to buy your house. Don't let those buyers slip away --- negotiate creatively and try to get to a reasonable and mutually acceptable price. | |

True Story: Bidding wars after lengthy time on market |

|

Timing is everything when it comes to real estate. For example, 2006 was not the best time to buy, and 2011 was not the best time to sell. But moving beyond those obvious realities, it is wild to see how the timing of offers can affect listings that have been on the market for "quite some time" -- sometimes defined as 6+ months, sometimes 12+ months, and sometimes even 18+ months. I have had two situations thus far this year when listings had been on the market for "quite some time" with no offers at all, and all of a sudden, two offers were received within the same week. It is quite a strange situation....

Now, let's be clear here -- multiple offer situations used to involve ultimate sales prices at or above the list price -- and that is rarely happening these days in multiple offer scenarios. However, sellers in such circumstances are certainly selling for a bit more than they would have if both offers had not happened to come in simultaneously. | |

Good news round up |

|

Mortgage rates hit all-time low again: 3.83% on 30-year fixed rate. WSJ: Home prices rise in most of United States. NAHB: Harrisonburg added to list of improving markets. Gas prices drop again | |

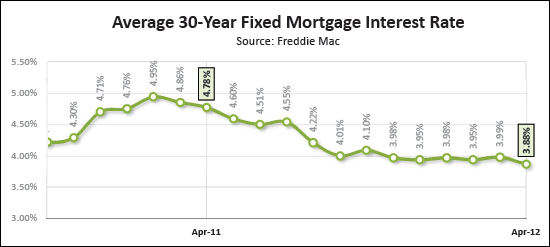

Low mortgage interest rates offer unique opportunities |

|

At some point, we will look back at early 2012 and marvel at how inexpensive money was at the time. After all, for over six months now, mortgage interest rates have stayed at phenomenally low levels – right around 4% for a 30-year fixed rate mortgage. While these interest rates won't necessarily disappear tomorrow, it is important for homeowners and would-be homeowners to consider whether current interest rates should prompt some action or decision today, rather than six months from now. Countless homeowners have found great benefit in refinancing their current mortgages, often against all odds. Today's low interest rates can make significantly lower your monthly housing costs depending on your mortgage's current interest rate. Many homeowners assume that they will not be able to refinancing their home if it has declined in value since they bought it, but this is not always the case. Several new programs, such as the Home Affordability Refinance Program (HARP) create provisions that may allow you to refinance your mortgage even if you owe somewhat more than the current value of your home. If your current mortgage interest rate is 5% or higher, I would recommend that you meet with a local lender to discuss your options in the current mortgage market. Beyond refinancing your current mortgage, today's interest rates offer a fantastic opportunity for would-be homeowners. As you may recall, some buyers felt priced out of the home of their dreams a few years ago during the real estate boom as home prices increased quickly. Those same buyers are now finding themselves priced back into the home of their dreams given both market adjustments (lower prices) and lower mortgage interest rates. After all, a $200,000 home five years ago with a 5.5% interest rate would have carried a cost of over $1,000 per month including taxes and insurance, and provided you were making a 20% down payment. That same house today, if purchasable at only $175,000, would have a monthly cost of less than $800 per month. Some home buyers are taking advantage of these low mortgage interest rates to get into a modest home, with a much lower monthly payment than they anticipated. Other buyers are taking the opportunity to buy a larger or nicer home than they anticipated being able to purchase – so that they will be able to stay in the home for a longer period of time. Whatever the decision as to how you make use of your broader financial capabilities, the key realization for today's home buyers is that a home purchase during 2012 allows you to lock in your housing costs for the future at what may be the lowest possible point we'll see anytime soon. Based on recent market analysis, home prices seem to be starting to steady themselves – thus, one year from now, you will likely not be able to buy a home at the same low prices as are found today. Combine this with somewhat higher interest rates that are bound to eventually materialize and it creates a unique window of opportunity for today's home buyers. | |

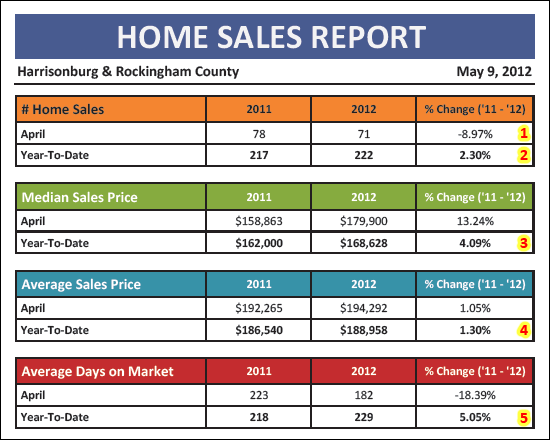

Harrisonburg, Rockingham County housing market continues to gradually improve with home sales up 2%, prices up 4% |

|

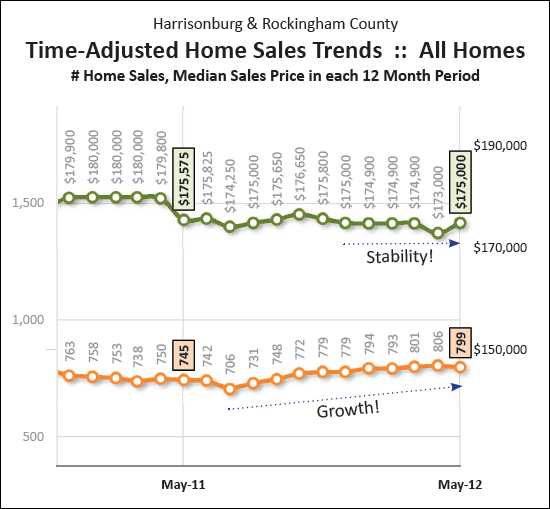

Many aspects of the local housing market have improved over the past year, and there are signs that this gradual recovery will continue.  As shown above, most market indicators are positive when looking back at recent real estate activity in Harrisonburg and Rockingham County:

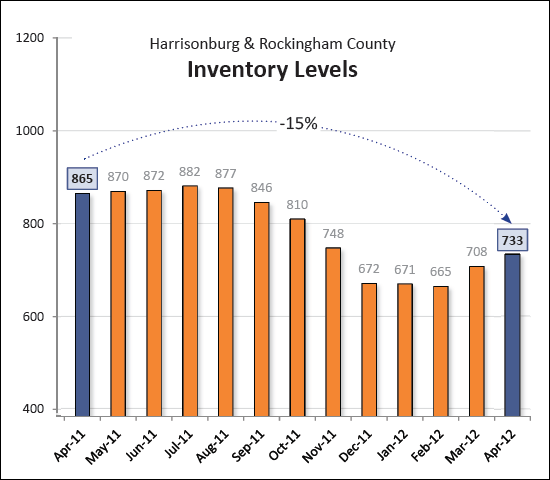

As another sign of an improving real estate market, inventory levels have dropped 15% over the past year, despite recent seasonal increases.

Long term trends shown above (rolling 12 month calculations for sales pace and price) also indicate that the local housing market is stabilizing (price) and starting to grow (pace).

Also, despite prior warnings of potential increases, mortgage interest rates remain extraordinarily low. There is plenty more to read, analyze and understand. Click here (or on the market report cover above) to download my full monthly market report. | |

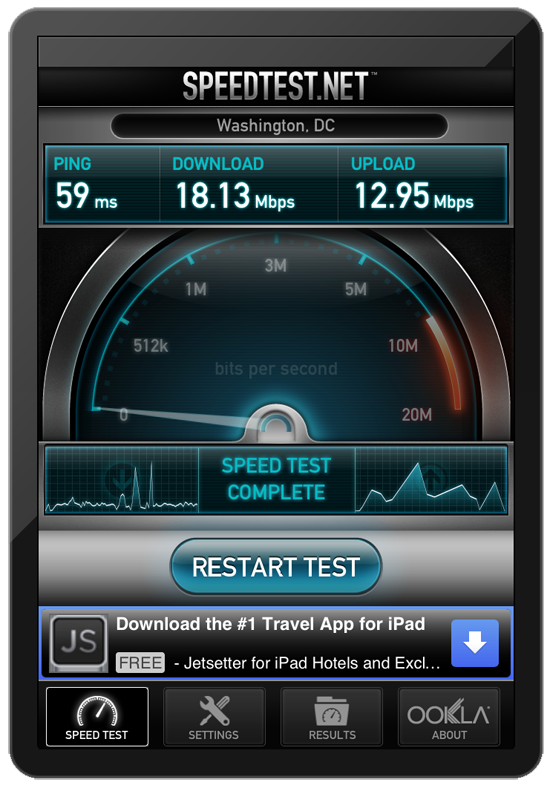

Verizon Wireless 4G (LTE) is now in Harrisonburg, VA and it is FAST! |

|

18MB down and 12MB up is quite an improvement over 3G speeds. I ran this speed test in Harrisonburg, despite the fact that it is labeled "Washington, DC" on the app. I suppose Harrisonburg is a part of Verizon Wireless' Washington DC network now. You do, of course, need to have a device capable of running on the new 4G (LTE) network. | |

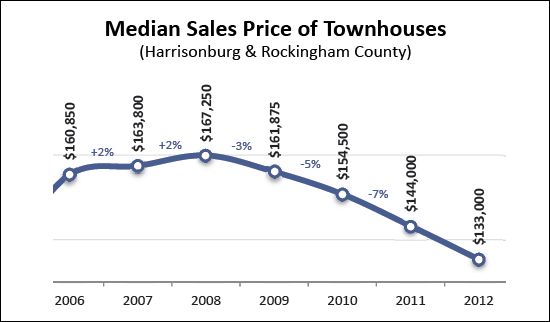

Leasing instead of selling your townhouse |

|

Plenty of townhouse buyers from the past five years would now like to sell their townhouse and move up to a single family home. But it has been difficult to do so recently because of adjustments in townhouse values.  Thus, I have counseled many townhouse owners that if they really want to move up to a single family home, that they ought to seriously consider leasing their townhouse instead of selling it. This doesn't work for everyone (especially if you need to free up some equity in your townhouse) but it can be a great long-term decision. Read about how unwillingly keeping your townhouse might be your best (unintentional) financial move yet to see how the owner of such a townhouse could potentially experience $230,000 of gain over 30 years of owning the townhouse. If you can't sell, you should seriously consider leasing your townhouse, and I'd be happy to help you analyze the opportunity to see what would make the most sense for your situation. | |

Gold, Real Estate, Stocks, Savings |

|

photo by digitalmoneyworld According to a recent survey by Gallup, Americans value gold as the best long-term investment, with real estate coming in second place, followed by stocks.  Read the entire story here. | |

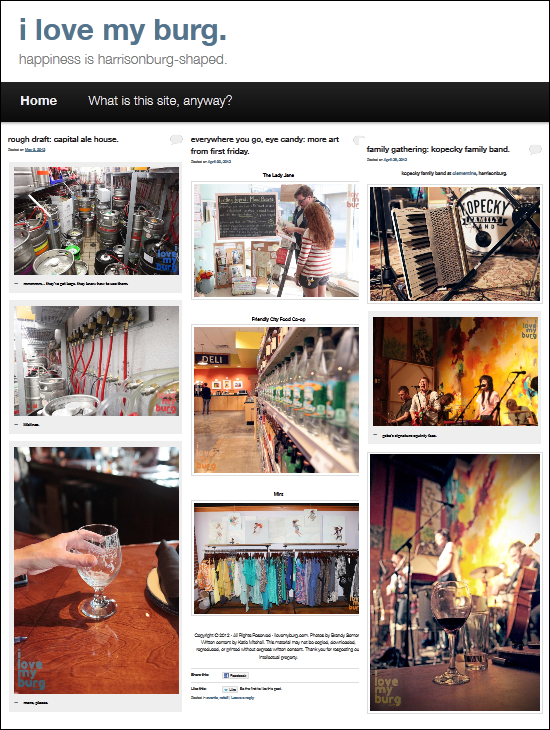

i love my burg |

|

If you haven't connected with i love my burg, check it out today.  It is an entertaining blog featuring many restaurants, venues and businesses in Harrisonburg with excellent photography and engaging commentary. Recent topics have included the Capital Ale House, First Fridays, Kopecky Family Band at Clementine, MaCRoCk, Mint, Rock Lotto and Union Station. Visit www.ilovemyburg.com, or on Facebook. | |

| Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings