| Newer Post | home | Older Post |

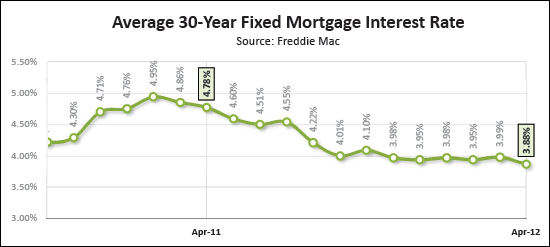

Low mortgage interest rates offer unique opportunities |

|

At some point, we will look back at early 2012 and marvel at how inexpensive money was at the time. After all, for over six months now, mortgage interest rates have stayed at phenomenally low levels – right around 4% for a 30-year fixed rate mortgage. While these interest rates won't necessarily disappear tomorrow, it is important for homeowners and would-be homeowners to consider whether current interest rates should prompt some action or decision today, rather than six months from now. Countless homeowners have found great benefit in refinancing their current mortgages, often against all odds. Today's low interest rates can make significantly lower your monthly housing costs depending on your mortgage's current interest rate. Many homeowners assume that they will not be able to refinancing their home if it has declined in value since they bought it, but this is not always the case. Several new programs, such as the Home Affordability Refinance Program (HARP) create provisions that may allow you to refinance your mortgage even if you owe somewhat more than the current value of your home. If your current mortgage interest rate is 5% or higher, I would recommend that you meet with a local lender to discuss your options in the current mortgage market. Beyond refinancing your current mortgage, today's interest rates offer a fantastic opportunity for would-be homeowners. As you may recall, some buyers felt priced out of the home of their dreams a few years ago during the real estate boom as home prices increased quickly. Those same buyers are now finding themselves priced back into the home of their dreams given both market adjustments (lower prices) and lower mortgage interest rates. After all, a $200,000 home five years ago with a 5.5% interest rate would have carried a cost of over $1,000 per month including taxes and insurance, and provided you were making a 20% down payment. That same house today, if purchasable at only $175,000, would have a monthly cost of less than $800 per month. Some home buyers are taking advantage of these low mortgage interest rates to get into a modest home, with a much lower monthly payment than they anticipated. Other buyers are taking the opportunity to buy a larger or nicer home than they anticipated being able to purchase – so that they will be able to stay in the home for a longer period of time. Whatever the decision as to how you make use of your broader financial capabilities, the key realization for today's home buyers is that a home purchase during 2012 allows you to lock in your housing costs for the future at what may be the lowest possible point we'll see anytime soon. Based on recent market analysis, home prices seem to be starting to steady themselves – thus, one year from now, you will likely not be able to buy a home at the same low prices as are found today. Combine this with somewhat higher interest rates that are bound to eventually materialize and it creates a unique window of opportunity for today's home buyers. Recent Articles:

| |

| Newer Post | home | Older Post |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings