| Older Posts |

Finding a home builder (or other building professional) in Harrisonburg, Rockingham County |

|

If you're looking for a builder (or a roofer, or a window company, etc.) I would be happy to help you connect with a local professional who can best serve your needs. For the past six years I have served on the Board of Directors for the Shenandoah Valley Builders Association (SVBA) and have come to know local professionals in many areas of the building and remodeling industry. If you're looking for a builder (or a roofer, or a window company, etc.) I would be happy to help you connect with a local professional who can best serve your needs. For the past six years I have served on the Board of Directors for the Shenandoah Valley Builders Association (SVBA) and have come to know local professionals in many areas of the building and remodeling industry.To find a local professional, feel free to browse the SVBA Directory or e-mail me at scott@HarrisonburgHousingToday.com to let me know who or what you're looking for. | |

What will I need to provide when applying for a mortgage? |

|

Here is a comprehensive list from Jon Ischinger at Wells Fargo Home Mortgage of the items you'll need to provide when applying for a mortgage.

Ready to get pre-approved for a loan? Start gathering the items, and click here to start the loan pre-approval process. | |

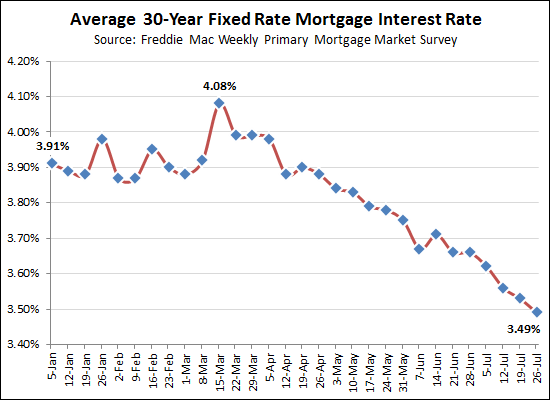

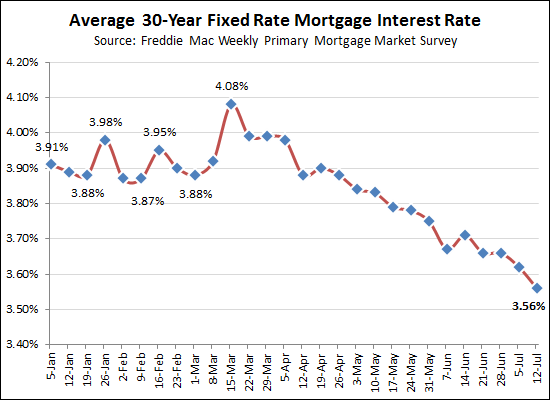

Mortgage interest rates continue to do the limbo . . . how low CAN they go? |

|

The average 30 year fixed mortgage interest rate is now below 3.5% -- and for that matter, has only been above 4% for one week this year. If you're buying, talk to your lender today (OK, or the next business day) and lock in your interest rate! | |

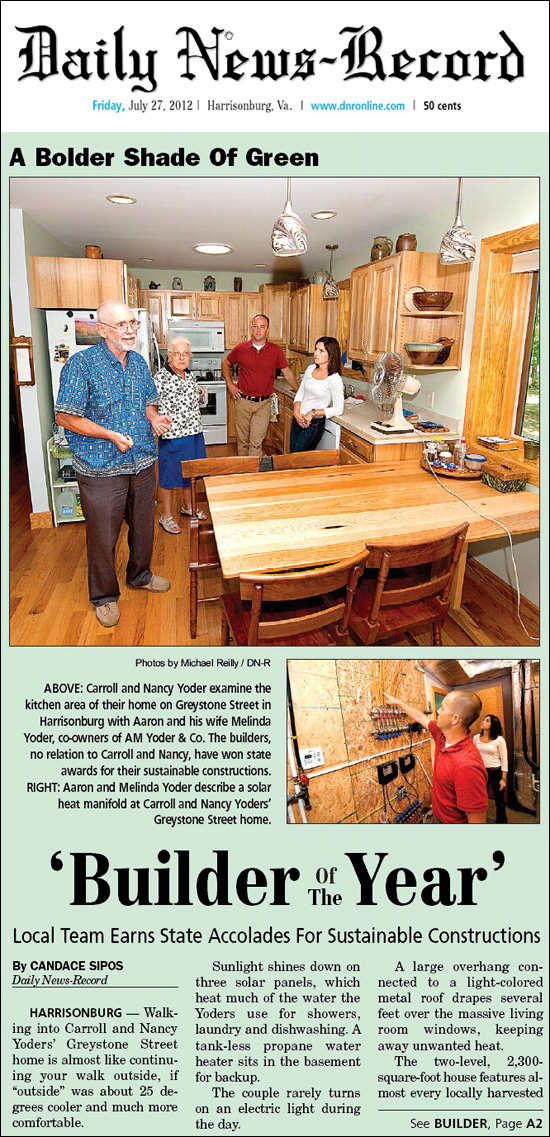

AM Yoder & Company Earns State Accolades For Sustainable Construction |

|

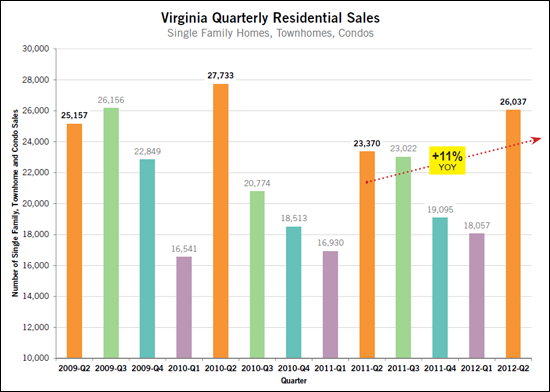

Virginia home sales continue to rise, 11% YOY |

|

And.....Virginia's median sales price has increased 7.5% year-over-year. Read more in the recently released 2012-Q2 Virginia Home Sales Report. | |

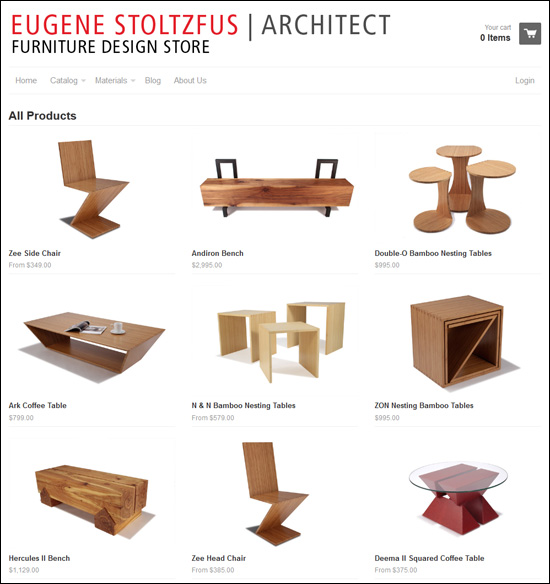

Eugene Stoltzfus: Architect, Furniture Designer |

|

Eugene Stoltzfus, prior Chairman and President of Rosetta Stone, has also created some amazing architectural works -- and is now offering many of his own furniture designs to the public.  Most recently, the New York Times selected one of Eugene's pieces (the Double-O's) as a must have. As I type this, I am developing pain in my lower back, hunched over a table in front of the couch where I am sitting. Oh, how I wish I had a Double-O to use as I type about the Double-O's. :) | |

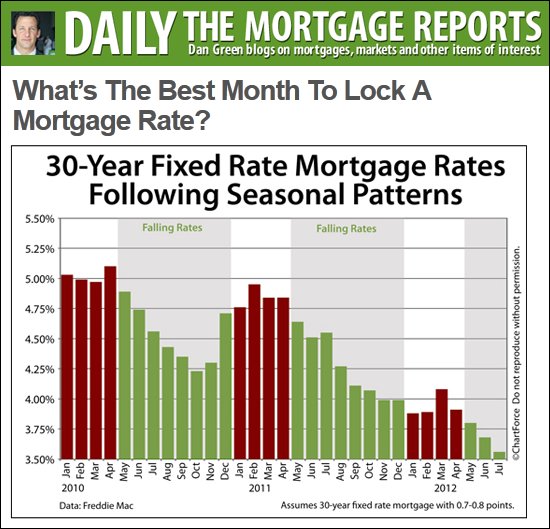

Summer, Fall best time to get low mortgage interest rate |

|

Check out this interesting analysis from Dan Green, showing that interest rates are typically lowest in the summer and fall. Talk to a lender now if you're thinking of buying this summer or fall! | |

Check out these apps if you're in the market for a home! |

|

If you're in the market to buy a home, and you have an iPhone or Android phone, you might consider some of these apps profiled by Fox Business.... Ten Apps Every Homebuyer Should Have | |

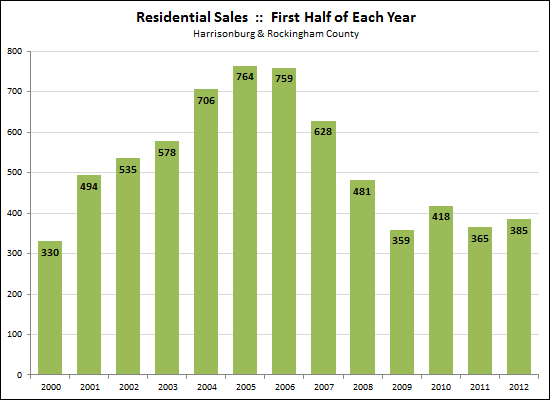

How did the first half of 2012 compare to previous years? |

|

Things to note....

What this means for you....

| |

Supporting others in meal giving and receiving |

|

Other than working lots (and lots) of hours each week helping people buy and sell real estate, there's this other thing I spend some time on as well....a little web site I built a few years ago called TakeThemAMeal.com. That little web site is now used by over 250,000 people per month and has 50,000 Facebook fans. If you're looking to buy or sell real estate, I'd be delighted to help you, as that's how I use the vast majority of my time..........but if you're looking to help others with coordinating meals for them, be sure to check out TakeThemAMeal.com. | |

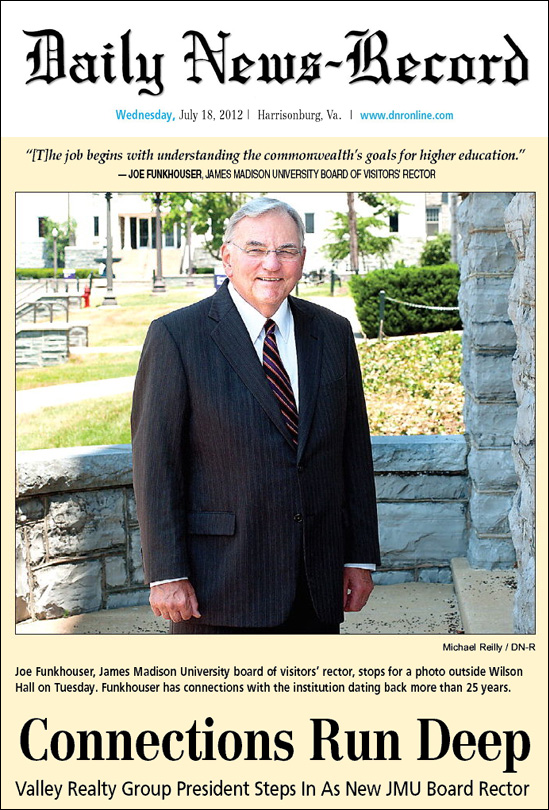

Joe Funkhouser named Rector of JMU Board of Visitors |

|

Coldwell Banker Funkhouser Realtors' principal broker, Joe Funkhouser, was named the Rector of JMU's Board of Visitors last month -- a high honor for Mr. Funkhouser, and a great responsibility for providing leadership at James Madison University. From today's Daily News Record article.... Funkhouser says his and the board's job lies in meeting state and federal educational goals, including turning out more graduates — especially in science, technology, engineering and math fields — and ensuring the accessibility and affordability of a JMU education. Boards of visitors at the state-run universities are responsible for approving budgets, policies and the schools' top administrators and faculty, and making other decisions affecting the schools' long-term direction. Holding a leadership position is nothing new for Funkhouser, who has a breadth of experience on local, state and national boards, including the Virginia and National associations of Realtors, Rockingham Memorial Hospital board of directors, Harrisonburg Electric Commission, RMH Capital Campaign and Rockingham Heritage Bank Board. He also served on the Virginia Real Estate Board from 1995 to 2003 and was reappointed by McDonnell to the board in 2010. Nearly seven of the first eight years Funkhouser served on that board were as chairman. In 2009, Funkhouser was named the Harrisonburg-Rockingham Chamber of Commerce Business Person of the Year. Read the entire article here. | |

Map of Hunters Ridge Condos and Townhouses in Harrisonburg, VA |

|

Out of town investors often wonder where a particular property is located at Hunters Ridge --- now they need wonder no longer. Click the map above for a printable version (4.8M) of this map of Hunters Ridge. I have labeled each condo building and group of townhouses by its address. View properties for sale in: Hunters Ridge Condos, Hunters Ridge Townhouses | |

Mortgage Interest Rates Drop Yet Again |

|

Yet another ALL TIME HISTORIC LOW. How low can they go? How about 3%? Can we get there?? | |

To rent, or to buy a Harrisonburg townhouse |

|

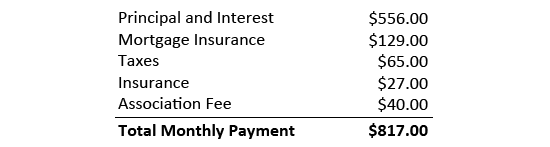

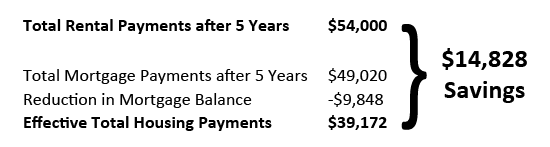

In meeting with a potential buyer of a City townhouse yesterday, we found ourselves comparing the opportunities in buying versus renting. RENT = $900/m. There are regularly options for renting a two-story townhouse in Harrisonburg for $875-$950 in Avalon Woods, Beacon Hill, Stonewall Heights, Liberty Square, etc. BUY = $817/m. With an FHA loan, buying such a townhouse apparently may cost as little as $777 per month assuming a $130K purchase price, 3.25% interest rate, 3.5% down payment.  This shows an $83/month cost savings of buying instead of renting. If we then look at the difference between renting and buying over a five year time period, the advantages start to pile up.  You'll also want to keep closing costs in mind (for buying) but as you can see, there are some compelling reasons to consider buying a townhouse if you are in the market to rent one but know that you'll be in the area for the next five years. The mortgage details were generated using Wells Fargo's online mortgage estimate tool and this is the scenario I was considering. | |

Your mortgage dollars are going further these days |

|

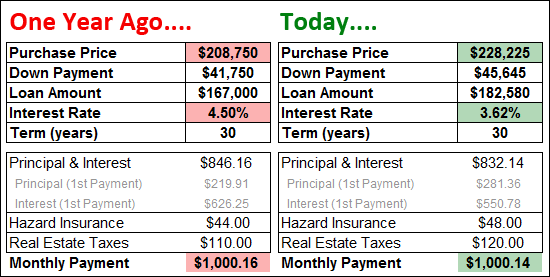

If you were qualified to buy a nice house a year ago, you can likely buy an even nicer house now! Lower interest rates will allow you to buy a more expensive house and keep the same mortgage payment. As shown above, a year ago you could have bought a $208,750 house for $1,000/month. Today, you could buy a $228,225 house. That is a an increase of almost $20,000 in purchasing power! Assumptions: 20% down payment, property located in the City of Harrisonburg | |

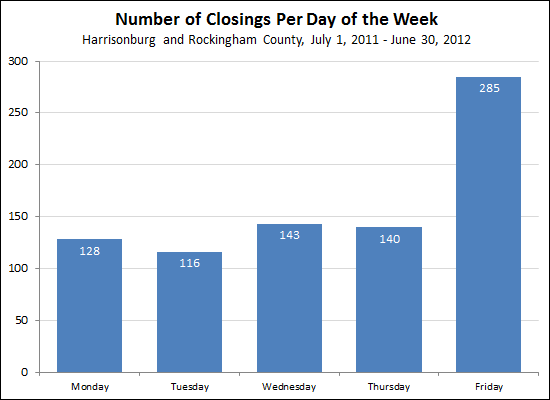

When Do Homes Close in Harrisonburg? |

|

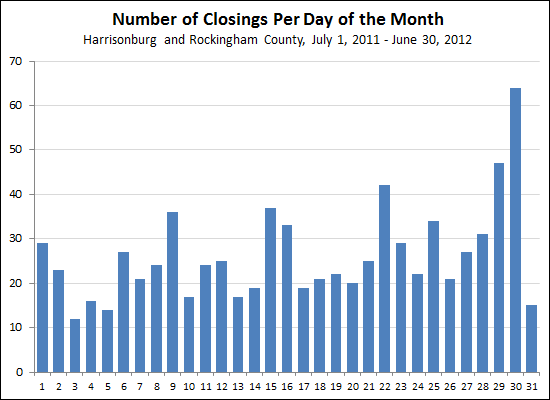

Inspired by Jim's analysis of the timing of closings in Charlottesville, I thought I'd take a look to see how many closings typically happen on each day of the month.  The data above shows how many homes closed in Harrisonburg and Rockingham County on each day of the month for the past year. There are certainly plenty of closings pushed towards the end of the month --- though not as many as I suspected. Buyers often tend to close towards the end of the month to bring less money to closing --- though you the end up owing your first mortgage payment more quickly. August 15 closing

August 30 closing

| |

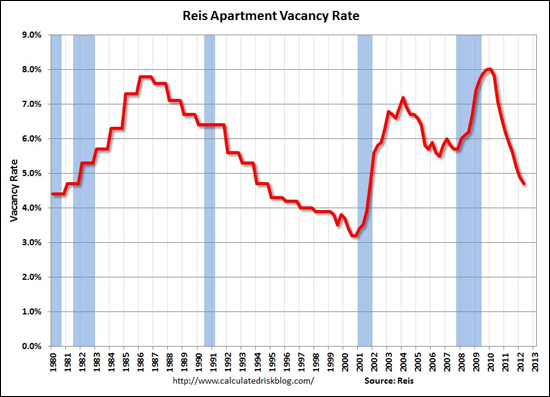

Apartment vacancy rates (nationally) hit new 10-year low |

|

Per Calculated Risk, REIS is reporting the lowest apartment vacancy rates in 10 years. The REIS metric is just based on large cities, but this is an overall trend being seen in many markets across the country. In Harrisonburg, there continue to be surpluses in student housing apartments, but vacancy rates do seem to be quite low for non-student rental properties in and around Harrisonburg. | |

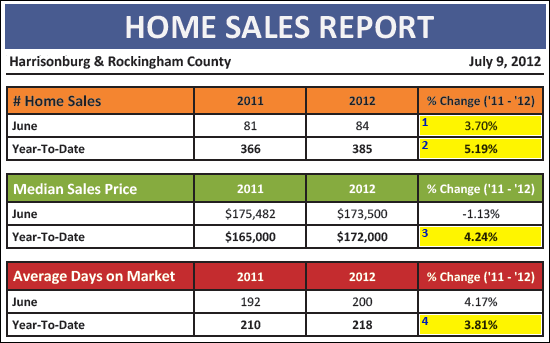

Six months into 2012, local housing market shows signs of steady improvement |

|

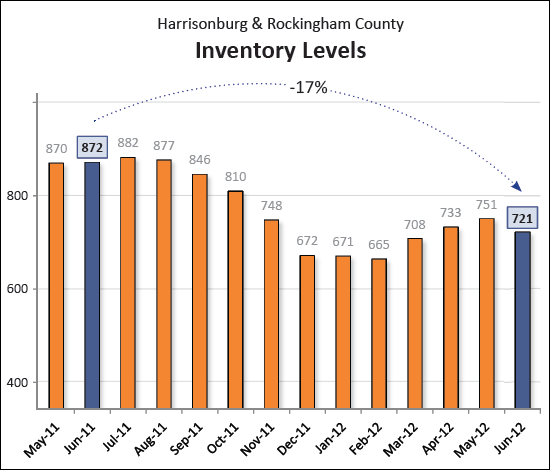

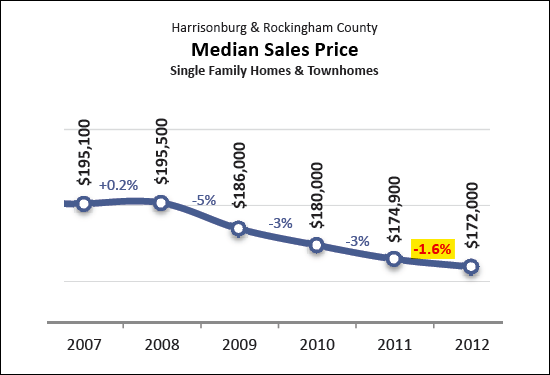

BREAKING NEWS -- six months into 2012, home sales are up, prices are up, inventory is down, and mortgage interest rates are down! All of this spells good news for the Harrisonburg and Rockingham County housing market! Click here to download a PDF of the July 2012 report on the Harrisonburg and Rockingham County housing market, or read on for some highlights.  There were many signs of improvement in the local housing market this month, shown above:

In not quite as rosy news:

One reason for the improvement in the local housing market is that we continue to see declines in the number of homes on the market --- fewer sellers results in a more balanced market. Not only have inventory levels dropped 17% over the past year, but they have also declined 4% in the past month --- which is not a typical trend for this time of year.

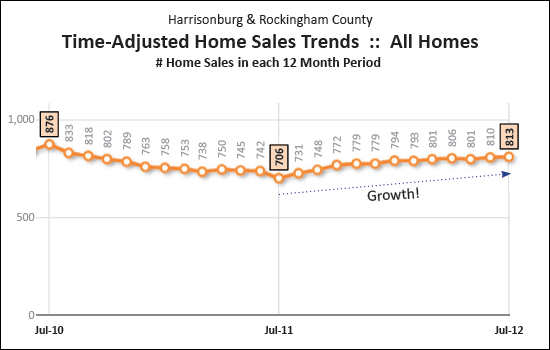

Not only are there fewer sellers in the market, there are also many more buyers in the market. The annualized pace of home sales (shown above) measures the number of sales in twelve month periods to reduce the impact of month-to-month fluctuations. As shown above, buyers are currently buying homes at an annualized pace of 813 sales/year -- up 15% from one year ago.

For much more insight and analysis, click on the image above to download the full 27-page market report specifically focused on Harrisonburg and Rockingham County. And -- if you have questions about the local housing market, or if I can be of assistance to you with real estate that you own, or that you'd like to own, please be in touch. You can reach me most easily at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

30 acres of development land for sale on Boyers Road |

|

Click the image above to see a larger version. There is a 30 acre parcel on Boyers Road currently for sale amidst quite a few popular subdivisions, and across the street from the new Rockingham Memorial Hospital. It will be interesting to see what may be developed in this area, and when it will happen. The black lines shown on the map are my estimation of property lines, and are by no means precise. This property is listed by Jim Sipe, Jr. of Coldwell Banker Commercial Funkhouser Realtors. | |

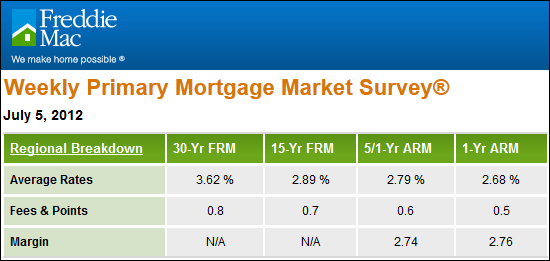

Consider a shorter loan term when refinancing |

|

I bet you thought rates were low on 30 year mortgages at 3.62%. How about a 15-year fixed rate mortgage at 2.89% -- now that is low! If you are refinancing your mortgage because you have a high current interest rate --- be sure to check to see what would happen if you reduced the term of the mortgage. Let's consider the scenario of someone who bought a $250,000 house ten years ago with 80% of the purchase price financed at 6%. Somehow, this homeowner has still not refinanced (suspend your disbelief) but now is finally considering it. Current Mortgage Payment (principal and interest only) = $1200 Option 1: Refinancing balance of $167,371 at 3.62% over 30 years. New Mortgage Payment = $763 Option 2: Refinancing balance of $167,371 at 2.89% over 15 years. New Mortgage Payment = $1147 So.....after having paid for 10 years, this homeowner can take their remaining 20 years of intended mortgage payments ($1200/m) and lower that payment to $1147/m all while paying off the mortgage in 15 years instead of 20 years! Opportunities abound given today's low (low) mortgage interest rates. Whether refinancing or buying, now is a great time to consider taking out a new mortgage and locking in your interest costs at all-time record lows. | |

| Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings