| Older Posts |

Rockingham Memorial Hospital celebrates 100 Years of Compassionate Care to the Community |

|

Rockingham Memorial Hospital is getting ready to celebrate 100 Years of Compassionate Care to the Community. Mark your calendar for Sunday, September 30th from 2p-4p for a special 100th Anniversary Celebration! | |

Hunters Ridge Townhomes rebrands as Camden Townes |

|

Hunters Ridge Townhomes --- located on Port Republic Road immediately adjacent to Hunters Ridge Condos has now rebranded and is being called Camden Townes Townhouses. The common name (Hunters Ridge) between the condominium development (Hunters Ridge Condos: 3-story, 12-unit buildings) and the townhouse development (Hunters Ridge Townhomes: rows of 6+ side-by-side two-story townhouses) likely caused some confusion about the connection (or lack thereof) between the two neighborhoods.

| |

Smiling: I absolutely LOVE your house (whispering: but I have to sell mine) |

|

I've been on both sides of the table, multiple times, in the past three weeks. Deals that should come together, but won't necessarily, yet. These days, it seems that there are plenty of both.... ....SELLERS who are elated to see so many showings of their house, especially when it is new on the market, and further delighted that buyers have nothing but wonderful compliments about the property and its value in the current market. ....and BUYERS who have found the house of their dreams, and know it is priced quite well, but (BUT) are not yet able to take action, because they need to sell their own house before buying. So, what is each party to do in such a circumstance? Let's flip it around..... If serious about the house they'd like to buy, then BUYERS should quickly get their own house on the market (if it isn't already) to try to generate a buyer in time to make an offer on the house of their dreams. Don't be greedy when listing your home --- price it fairly, and appropriately per the market, so that it has a good chance of selling in time for you to buy your dream home. Don't bother (in most circumstances) making an offer contingent upon the sale of your home, as that can be quickly moved out of the way when a more qualified buyer comes along. SELLERS, balance carefully the pro's and con's of accepting a contingent offer if you should receive one. It can certainly lock in a buyer, but that might discourage other buyers from considering your home --- and if a buyer already has your home under contract, it might make them less anxious to sell their own house quickly. It's a tricky thing, this proposition of buying and selling simultaneously, but it can happen --- and does happen, regularly. When you're ready to buy, or sell, I'd be happy to consult with you and help make the transition a smooth one. | |

Funkhouser Goes Independent |

|

As seen in the Daily News Record today....  Funkhouser Goes Independent Longtime Area Realtor Sheds Coldwell Banker Affiliation By DOUG MANNERS, Daily News-Record HARRISONBURG — Coldwell Banker Funkhouser Realtors, one of the largest real estate firms in the Shenandoah Valley, is going independent and dropping its affiliation with the national franchiser. A new website already has launched and about 500 blue-and-white "for sale" signs are being swapped out with new signage — white with a lighter blue — to mark the official start of the Funkhouser Real Estate Group today. The move returns the company that Joe Funkhouser founded 42 years ago to its roots as an independent real estate agency. Funkhouser first franchised with Prudential in 1992 before teaming up with Coldwell Banker in 2002. "The landscape of real estate has dramatically changed over the past few years," said Funkhouser, president of the agency, which has offices in Harrisonburg and Woodstock. "[Technology has] eliminated the need for franchised real estate business." National brand recognition isn't as relevant in today's marketplace, he said, noting that most homebuyers search for information on the Internet before calling a real estate professional. Going independent gives the agency greater control over technology resources and the ability to make decisions quicker, according to Funkhouser. The Funkhouser Real Estate Group has partnered with a Colorado-based technology firm that designs websites only for independent real estate agencies. "We researched for many months to find the best real estate provider," said Kemper Funkhouser, Joe's son and chief operating officer at the agency. "We have market exclusivity. It's a service that is unmatched in our marketplace." The new website features an expanded search functionality and more tools for customers looking to buy or sell a home, he said. Dropping the agency's franchise agreement also means it no longer must pay fees to Coldwell Banker. The Realtors didn't say how much money the agency would save, but several sources online indicate that fees usually amount to about 8 percent of total gross sales. The Funkhouser Real Estate Group has about 60 licensed agents and primarily serves Rockingham, Augusta, Shenandoah, Page and Frederick counties. Contact Doug Manners at 574-6293 or dmanners@dnronline.com | |

Innovating Real Estate Service in the Shenandoah Valley |

|

I am pleased to announce an exciting change for our company and the services we will be able to provide to our clients. As of this Saturday, our company will become Funkhouser Real Estate Group. As an independent real estate company, we will be able to provide additional services and resources to our clients, as we continue to innovate real estate services in the Shenandoah Valley. Within the coming days we will be replacing hundreds of yard signs in the Central Shenandoah Valley, and over the coming weeks and months we will be rolling out new tools, a new web site, and many other exciting initiatives. Some have asked -- isn't this just a name change? Far from it! We will be bringing an exciting host of new real estate technologies and services to our clients -- these are tools and services not offered by any other real estate company in this area! I'm pleased to be a part of what will now be Funkhouser Real Estate Group, and am excited for the future. Feel free to call (540-578-0102) or e-mail me if you have any questions. | |

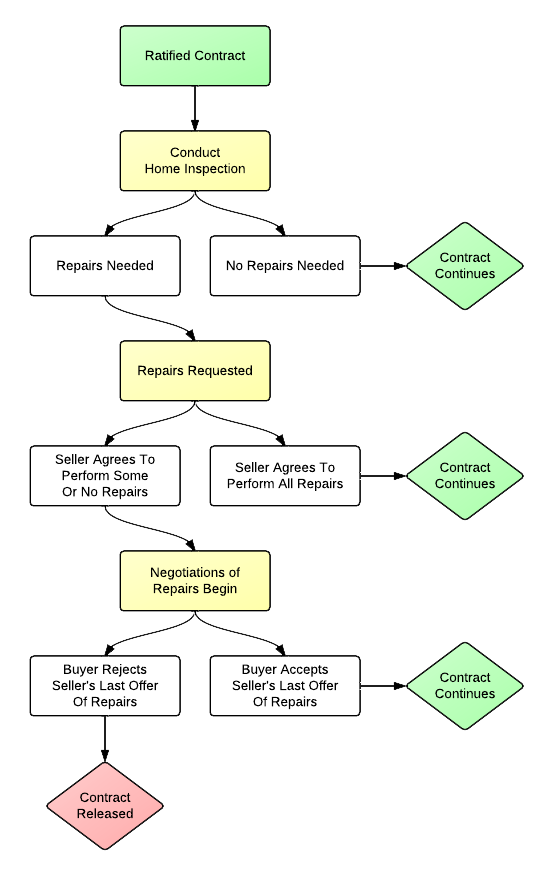

How does the home inspection process work in Virginia? |

|

The first thing to know about the home inspection process is that it is a process for the benefit of the buyer. However, the standard contingency form and negotiation document typically used in our market are balanced documents that attempt to respect the needs and priorities of both the buyer and seller. The Context When making an offer on a property, a buyer negotiates the price and other terms based on their understanding of the property at the time of the offer. However, often buyers will include a home inspection contingency to allow themselves an opportunity to learn more about the property with the help of a professional home inspector. Thus, if a buyer negotiates a contract on a house that has two broken windows, it would not be reasonable to try to negotiate for the repair of the windows during the home inspection process, since that fact was already known about the house --- but if a leaky sink is discovered, it would be perfectly reasonable to request that repair. The Substance The standard inspection contingency references a long list of areas for inspection, including: geotechnical inspections, inspections of the structure, foundations, roof, flooring, HVAC systems, electrical system, plumbing system, appliances, exterior insulation finishing systems, drainage, windows, well and septic systems, and lead-based paint and radon. Yet at the same time, the inspection contingency specifies that the buyer may only request the repair of "material defects" which is described as "those items that could affect the decision of a reasonable person to purchase the Property" and would not include "cosmetic items, matters of preference, or grandfathered systems or features that are properly functioning but would not comply with current building codes if constructed or installed today." The Flow Post-inspection, a buyer may provide the seller with a list of requested repairs. The seller would then respond by offering any of the following:

The Problems Potential pitfalls during the inspection and re-negotiation process include:

| |

Making a low offer? Beef up your other offering terms. |

|

I know, I know, you want to make a low offer on the house. It seems like every buyer does these days -- and why not, as it is certainly still a buyer's market in Harrisonburg and Rockingham County. But when making that low offer, you can increase the appeal of your offer by strengthening your other offering terms.... DEPOSITS Make the largest deposit you are comfortable with so the seller knows you have money "on the line" and that you won't risk losing that money by attempting to walk away from the deal. CLOSING COST ASSISTANCE Sellers don't just look at the contract price --- they calculate their net proceeds based on the offer price and any credits or closing cost assistance. Only ask for assistance if you truly need it. FINANCING Provide as much detail as possible about your financing intentions, and always include a pre-approval letter. Sellers who believe you are capable of financing the purchase will be less hesitant as they consider other terms of your offer. PERSONAL PROPERTY Don't automatically ask for everything the seller intends to convey --- if you don't need them all, leave them out of the offer. Allowing the seller to keep their washer/dryer (for example) may make them more flexible in other areas. INSPECTIONS Having a professional inspect the property you are purchasing is usually a good idea; however if you only intend to do it for informational purposes, consider leaving it out of the contract negotiations and conducting it post-settlement. SETTLEMENT & POSSESSION If possible, cater your settlement date and the details of transferring possession of the property to the needs or wants of the seller. This can go a long way towards gaining seller flexibility on other contract terms. Finally, research the seller's context for selling. That information can be invaluable in negotiating a successful contract. | |

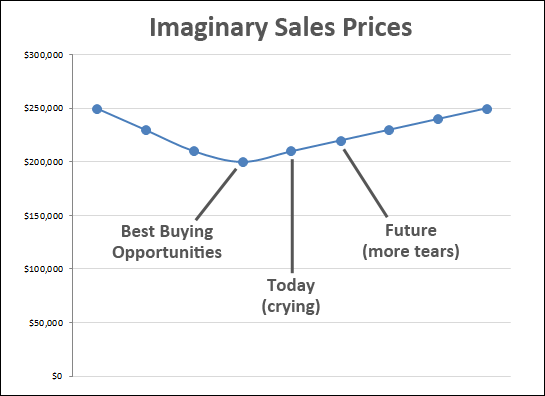

In a market upswing, crying over missed past buying opportunities can lead to even more tears |

|

In the fictitious value trend graph above, the best opportunities were yesterday (or some time before now). As a housing market starts to improve, some buyers have a tendency to get stuck on the fact that they just missed out on the lowest prices seen during a market downturn. It is important for those tearful buyers to remember, however, that there will likely be more tears and larger tears tomorrow (or some amount of time into the future) when prices have recovered even further. For example....

A few notes and disclaimers....

| |

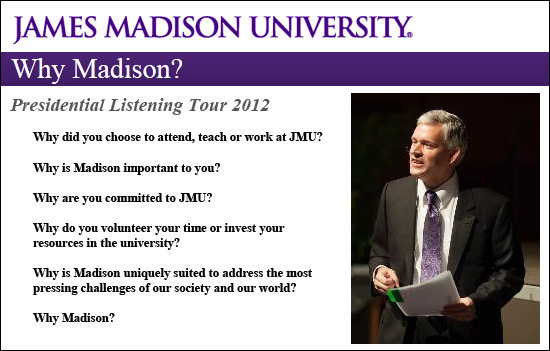

Why Madison? President Alger kicks off the Presidential Listening Tour 2012 |

|

I attended a fantastic event last night at the Forbes Center, the kickoff event of President Alger's Presidential Listening Tour. President Alger, JMU's new president, lead us through discussions on a series of topics including:

On a personal note, I graduated from JMU in 2000 and 2002, met my wife at JMU, and we decided to stay in Harrisonburg in part because of JMU's contribution to making this such a wonderful area to live and raise a family. My experience at JMU was transformative and has prepared me extraordinarily well for my life and work since graduation. If you have the opportunity, attend one of the future listening tour events, or submit your answer to "Why Madison?" online here. | |

Estimating your housing payment as a first time buyer |

|

I often have conversations with people considering their first home purchase who want to first get an idea of how much they would have to pay for housing on a monthly basis. I have devised an Excel mortgage calculator that I can use to give them a rough idea, or I recommend that they call a lender to get pre-approved. But --- for those of you looking to get just a rough idea, at a few price points, here are some examples of monthly housing costs... The condo or least-expensive townhomes in Harrisonburg ($125K) There are not very many options for housing below $110K in Harrisonburg, but there are some between $120K and $130K. We'll assume a price in between of $125K. 96.5% financing = $652/month ($4K down payment) 90% financing = $614/month ($13K down payment) 80% financing = $556/month ($25K down payment) All of these estimates include taxes and insurance, and are based on a 30-year mortgage with a 3.75% interest rate. The new-ish, starter Harrisonburg townhome ($150K) There are quite a few two-story townhomes on the market right now built in the last 5-10 years, priced between $145K and $155K, located in the City of Harrisonburg. We'll assume a price somewhere in between, of $150K. 96.5% financing = $782/month ($5K down payment) 90% financing = $737/month ($15K down payment) 80% financing = $668/month ($30K down payment) All of these estimates include taxes and insurance, and are based on a 30-year mortgage with a 3.75% interest rate. The entry-level Harrisonburg single-family home ($200K) While there are some single family homes priced below $175K, there are quite a few more options between $180K and $220K, again located in the City of Harrisonburg. 96.5% financing = $1,042/month ($7K down payment) 90% financing = $982/month ($20K down payment) 80% financing = $890/month ($40K down payment) All of these estimates include taxes and insurance, and are based on a 30-year mortgage with a 3.75% interest rate. BUT....DON'T FORGET ABOUT THE TAX SAVINGS! If you're renting now, you should also consider the tax savings of buying a home. All of the interest you pay on your mortgage can be deducted from your income for tax purposes. $125K @ 96.5% financing = $1,131 tax savings in the first year $150K @ 90% financing = $1,265 tax savings in the first year $200K @ 80% financing = $1,500 tax savings in the first year The tax savings above assume a 25% tax rate and aren't realized until the end of the year, but if you factor in these monthly savings, the effective monthly housing costs (including property taxes, home owners insurance and the tax savings) would be... $125K @ 96.5% financing = $558/month $150K @ 90% financing = $632/month $200K @ 80% financing = $765/month And...one final disclaimer...I am not a lender, nor do I offer any type of financing. E-mail or call me and I'd be happy to recommend a few lenders to you. | |

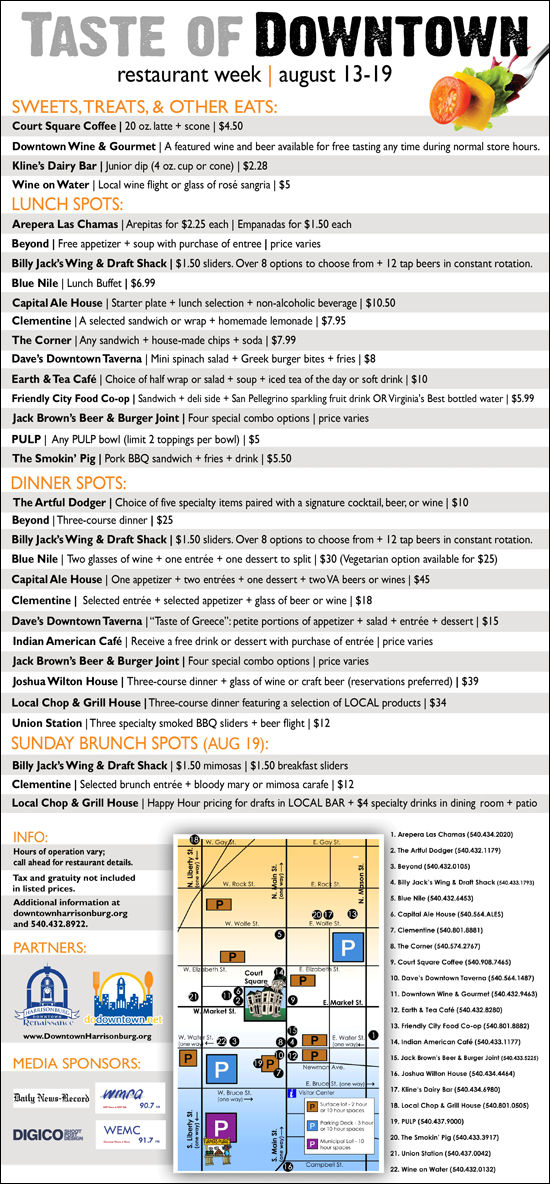

This Week - Taste of Downtown (Harrisonburg) 2012 - Don't Miss It! |

|

The balancing act of a home seller. Don't price too high, or too low! |

|

This eternal pricing challenge is true more than ever now, in a market that still favors buyers.... FIRST -- It is imperative to price your home competitively (not too high). Over-pricing will often lead to significantly fewer showings, and lower levels of interest from buyers. BUT -- In today's market, nearly every buyer will want to negotiate with you, not being satisfied with paying too close to asking price. So what is a seller to do!?! Let's suppose, for a moment, that your home is worth $250,000 based on recently sold properties. Competitive pricing would mean pricing your home between $240k and $255k. With elevated inventory levels, you must stand out on price, being seen as a good buying opportunity. But then, when a buyer comes along, they'll likely want to negotiate you down $10k - $15k, or even more. If you priced the home at $260k or $265k to leave yourself room to come down $10k to $15k to $250k you likely wouldn't have near the interest as compared to pricing the home at $249k. But if you price the home at $249k, you certainly won't be excited about coming down to $239k or lower. Suggestion #1 -- Use other "for sale" properties as a guideline. If comparable properties are available for $240k-$249k, you'll need to price your home lower in the $249k range, but if comparable properties are priced between $260k and $270k, you can likely get away with a higher asking price, perhaps around $255k or $259k. Suggestion #2 -- Price your home "just above" the value suggested by recently sold homes. If that value is $250k, consider a price of $252,500 or $254,500, or something in that general range. Pricing is always an essential component of marketing a home to sell --- and in a fluctuating market, it becomes even more difficult than usual! | |

Yet another indicator that the revitalization of Downtown Harrisonburg is working |

|

Click the image above to read the full article at WHSV.com. Per the news article above, it seems that downtown Harrisonburg is doing pretty well. Things have switched all of a sudden, and now some restaurants that are NOT downtown are apparently feeling the impact of having the prosperous and vibrant city center that is mentioned in HDR's mission statement.... The mission of Harrisonburg Downtown Renaissance....While there is still plenty of work to do to continue to revitalize downtown Harrisonburg, this is yet another indicator that progress is being made! | |

Has the local housing market started stabilizing and/or recovering in all price ranges equally? |

|

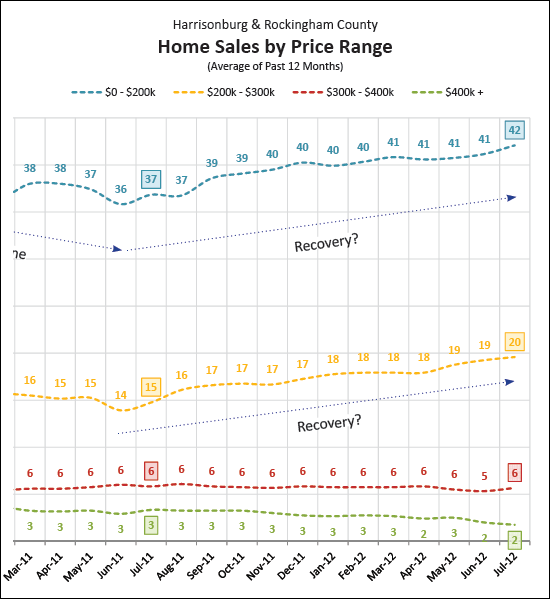

Yesterday, I was chatting with two different people about the housing market and both were wondering how the potential local recovery (or at least stabilization) impacted different price ranges. The increased pace of home sales over the past year has not affected all price ranges equally, as shown in the graph above:

The winner, it seems, is the $200K - $300K price range, though the lowest price range (under $200K) is also doing quite well. | |

Is the window of maximum negotiating ability closing? |

|

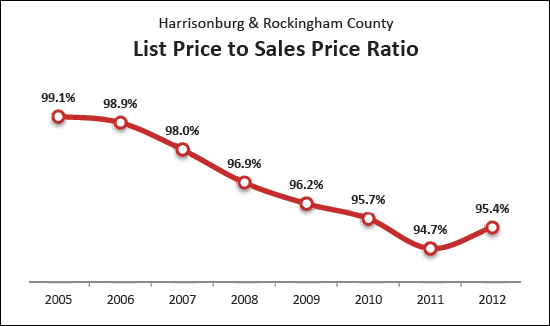

Hidden in yesterday's monthly market report was this new graph that explores the amount that sellers negotiate off of their asking prices. As you can see, at the peak of the market (2005) sellers only negotiated 0.9% (on average) off of their asking price. That metric has since fallen all the way down to 94.7% in 2011 --- well below the assumed normal of 97.4% in 2000, before the real estate market started taking off like a rocket. The important thing to note, though, is that this metric is edging back upwards thus far in 2012 --- to an average of 95.4%. That means that sellers are finding themselves negotiating less on their asking price because of gradual overall market improvements. Sellers -- be encouraged that you won't be beat up as much on price as we move forward. Buyers -- if you want to negotiate heavily on price, consider buying now, not next year. | |

Home Sales Up 8%, Prices Up 3% in Harrisonburg, Rockingham County |

|

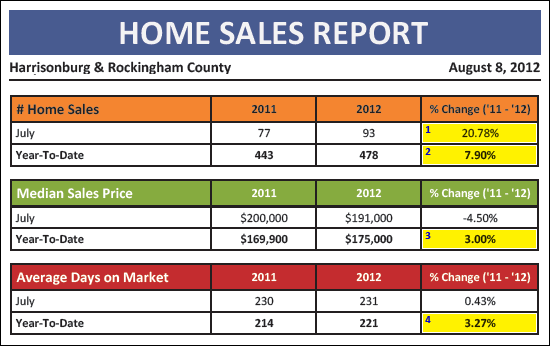

Seven months into 2012, the Harrisonburg and Rockingham County housing market is showing signs of steady improvement in the pace and price of home sales. Click here to download the PDF of my full market report, or read on for highlights.  Most indicators above show signs of a stabilizing local housing market:

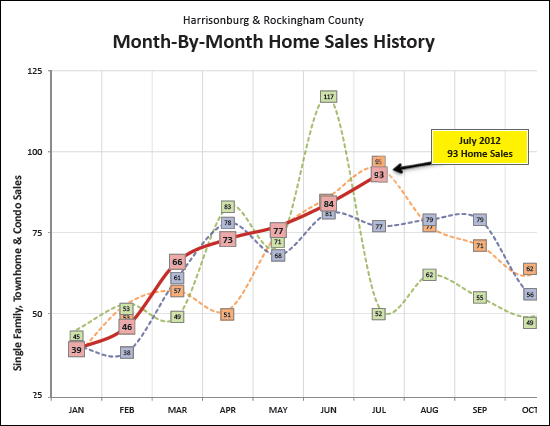

July 2012 was quite a month for home sales --- and this year has shown a strong upward May-June-July sales trajectory, not unlike the 2009 sales trajectory.

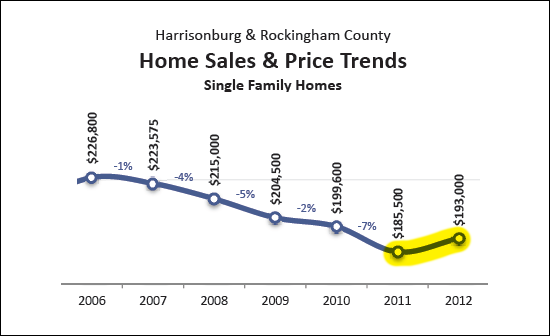

While the graph above only shows price trends for single family homes (not the overall market) it is encouraging (for sellers, at least) to see a halt to the multi-year decline in home prices in the area.

Among other market trends to improve, the list price to sales price ratio has also started to improve in Harrisonburg and Rockingham County. This means that sellers are (on average) negotiating less off of their asking prices when selling their homes. This is more welcome news for sellers --- and buyers should take note that their window of maximum negotiating ability might be starting to close.

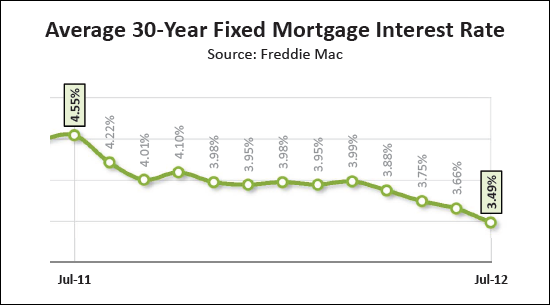

Record low mortgage interest rates have certainly helped to spur on the local housing market as buyers continue to take advantage of their opportunity to lock in their housing costs for now and the future. For much more insight and analysis, click on the image above to download my full market report specifically focused on Harrisonburg and Rockingham County. | |

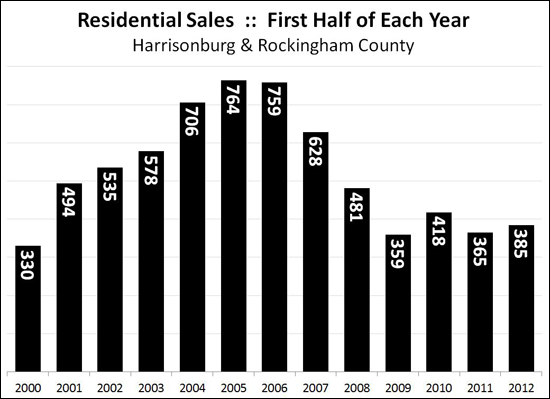

Local Housing Market Shows Signs of Strength in First Half 2012 |

|

Halfway through 2012, the Harrisonburg and Rockingham County housing market is showing signs of returning stability and strength. As shown in the accompanying graph, the pace of local home sales (in the first half of the year) has been slowly increasing ever since 2009 – aside from temporary spike in 2010 related to the federal home buyer tax credit. In even better news, however, the local market is finally experiencing stability in prices. The median price of homes fell 10.5% between 2008 and 2011, but is finally starting to increase again. The median sales price during the first half of 2012 was $172,000 – which marks a 4% improvement over the first half of last year when the median sales price was $165,000. If you're looking to buy a home sometime in the next year, you will be well served do so sooner rather than later. A changing tide in the local housing market and the historically low interest rates make it a great time to buy. Despite falling inventory levels, you will still have plenty of choices and a good amount of negotiating ability. If you're looking to sell your home in the next year, things will hopefully be brighter and brighter from here. The pace of sales has increased and prices are stabilizing, so hopefully you won't see further declines in your home's value. If you absolutely have to sell now or soon, it shouldn't be as tough to do so as it has been recently --- but if you can wait, you would be well served to do so for another year or two to allow home values to recover further. After two wild five year cycles (up between 2000-2005, and down between 2005 and 2010) we are finally starting to see stability and growth in the Harrisonburg and Rockingham County housing market. The pace of home sales increased in 2011, and is set to do so again in 2012 – and it now appears that we may also see an increase in median sales prices during 2012. | |

Tenants can make or break an investment property |

|

Especially when it comes to student housing, it can be quite helpful to view an investment property once the tenants are in place. I took the above photo when showing an investment property last week -- as you can tell, the tenants moved the most important items in first.... | |

Which seller do YOU want to be? |

|

Believe me -- there are an abundance of both types of sellers in the current market. Keep in mind, of course, that all sellers who don't sell in the first 90 days are not necessarily sellers who priced their home based on other list prices instead of sold prices. Sometimes (many times) there are other factors that also affect the speed of the sale. It is important, though (very important!) to be basing your pricing decisions on what buyers are actually paying for houses --- not what long-standing would-be sellers are hoping that buyers will pay for their houses. It is, of course, easier to figure out what would-be sellers are asking for their houses (view any public real estate web site) and harder to easily ascertain what buyers are actually paying for houses. That is where I can help -- if you're getting ready to sell, let's start by reviewing recent sales similar to your house -- not just active listings similar to your house! | |

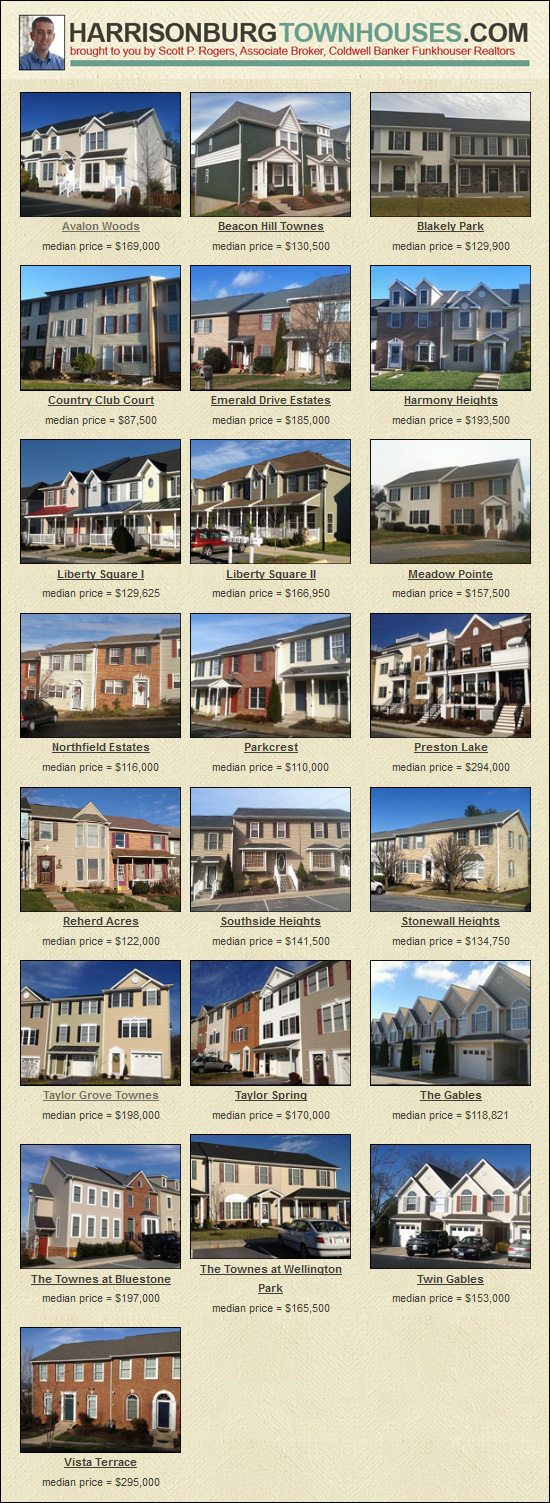

Researching townhouses in Harrisonburg? Visit HarrisonburgTownhouses.com |

|

I have just updated the market data and other information on HarrisonburgTownhouses.com --- your all encompassing resource for finding out about townhouses in the Harrisonburg area.  For each townhouse community, you will find....

If you are considering buying or selling a property in any of these townhouse communities, please contact me (Scott Rogers) at 540-578-0102 or scott@HarrisonburgHousingToday.com, as I would be delighted to have the opportunity to work with you in your purchase or sale. | |

| Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings