Ravenous home buyers are still picky eaters |

|

Inventory is low -- buyers do not have many choices of homes to purchase -- but that doesn't mean they'll buy ANYTHING. Buyers are still being relatively picky, not wanting to compromise too much on their buying objectives. As such, all home sellers should not assume that as soon as their home hits the market for sale, multiple ravenous buyers will be fighting for the chance to snap it up. That is happening more now than it has in any recent years -- but not for all homes, in all locations in all price ranges. Here are some home characteristics that might make your house a vegetable that many home buyers turn down.... PRICE -- If your home price is high, but is appropriate given your home's value, you still might be pricing many buyers out of the market. If your home price is too high compared to the value of your home, you may be keeping buyers from getting excited about purchasing your home. LOCATION -- A wonderful home, in a distant or undesirable location, becomes a not as desirable home for most home buyers. CONDITION -- If your home requires many repairs or updates, that may keep buyers away, as they may not have the budget for those improvements after settlement. There are plenty of other aspects of a home that can keep your home from selling quickly when it hits the market. Before putting your home on the market, let's chat a bit about what is reasonable to expect from a timing perspective in selling your home. | |

Lock Your Mortgage Interest Rate NOW |

|

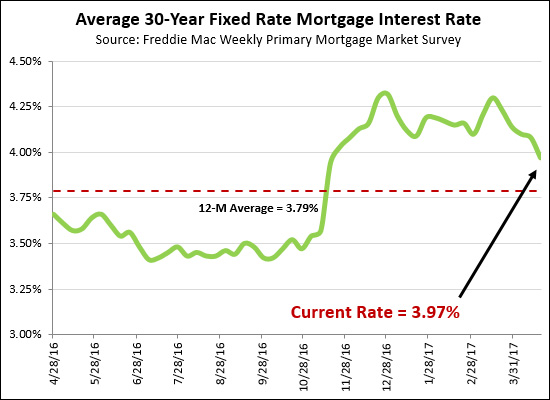

What??? Average mortgage interest rates (on a 30 year fixed rate mortgage) are back below 4% again. I truly did not think we'd see that this year -- or possibly ever. It seemed likely we'd stay between 4% and 4.5% or even up to 5% during 2017. Anyhow -- if you're in the market to buy, and have a contract signed on a house you are purchasing -- LOCK IN YOUR INTEREST RATE! Of note -- if you can swing it to finance your mortgage over 15 years instead of over 30 years, you'll be even happier at 3.23%! | |

Buyers have to be ready to act FAST these days! |

|

So many homes these days are going under contract QUICKLY and sometimes with MULTIPLE OFFERS! Depending on the house, and the location, and the condition, and the price, it may garner a lot of attention very quickly from buyers. This is mainly a result of the very low inventory levels we are seeing right now in many price ranges. So, what does it mean to be ready as a buyer?

The new listings are coming -- and one could be just what you are looking for -- will you be ready? | |

How many homes will you really be choosing from? |

|

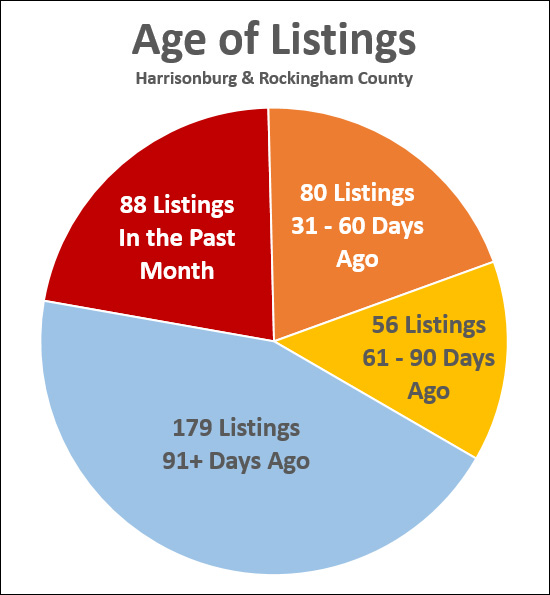

If you are entering the market to buy a home, the number of homes you will have to choose from will vary widely based on what you are looking for in a new home. Some buyers have a very narrow scope and find themselves on a prolonged hunt for what seems to be an elusive or mythical home. Some buyers find plenty of options, evaluate quite a few, make a decision and move forward with an offer. However -- keep in mind that as you consider the 403-ish homes currently on the market for sale, that some of them have been on the market for 3 months, 6 months, 9 months or even longer. The freshest of fresh listings are those that have come on in the past 30 days -- which (this time of year) is less than 100 of the 403-ish homes currently listed for sale. Depending on your time frame for buying, and the narrowness of your scope, sometimes it makes sense to quickly evaluate the current options -- and then to wait and see what new and exciting listings will be coming on the market in coming days and weeks. Steps to get started include talking to a lender to get a sense of your target price range, and then chatting with me (in person, by email, by phone) so that I can also be keeping an eye out for suitable properties for you. Learn more about the home buying process at....  | |

1 Pool, 2 Acres, 4 Bedrooms, 3184 SF, Infinite Views |

|

view a larger image by clicking here Have I mentioned that I enjoy flying my drone? For business purposes, of course -- definitely just a business tool.... Anyhow -- the drone does (in my opinion) well capture the property shown above -- which offers privacy (2.12 acres), space (3,184 finished square feet) a pool (20x46) and mountain views in nearly every direction! Find out more about the house by visiting the property website. Do you want a photo of your property by drone? All you have to do is sell it! :) Just kidding -- I'm always looking for an excuse to fly my drone.... As a bonus, here is another shot taken above (or somewhere near) the property referenced above....  view a larger image by clicking here | |

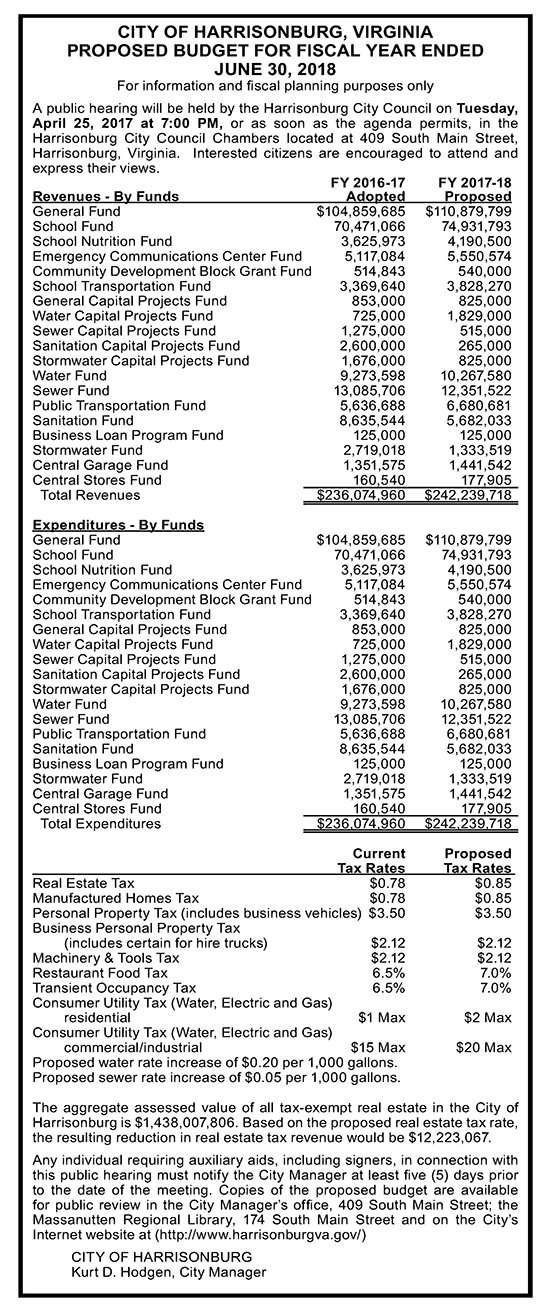

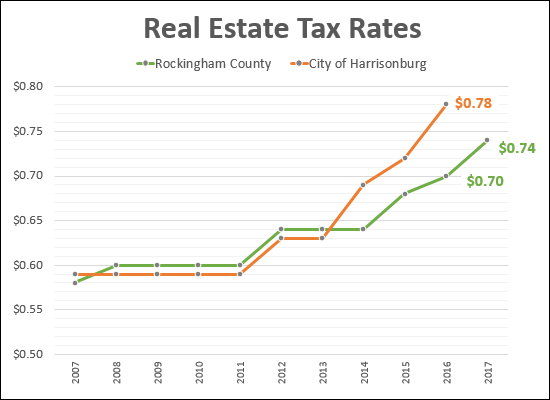

Proposed Budget for Rockingham County |

|

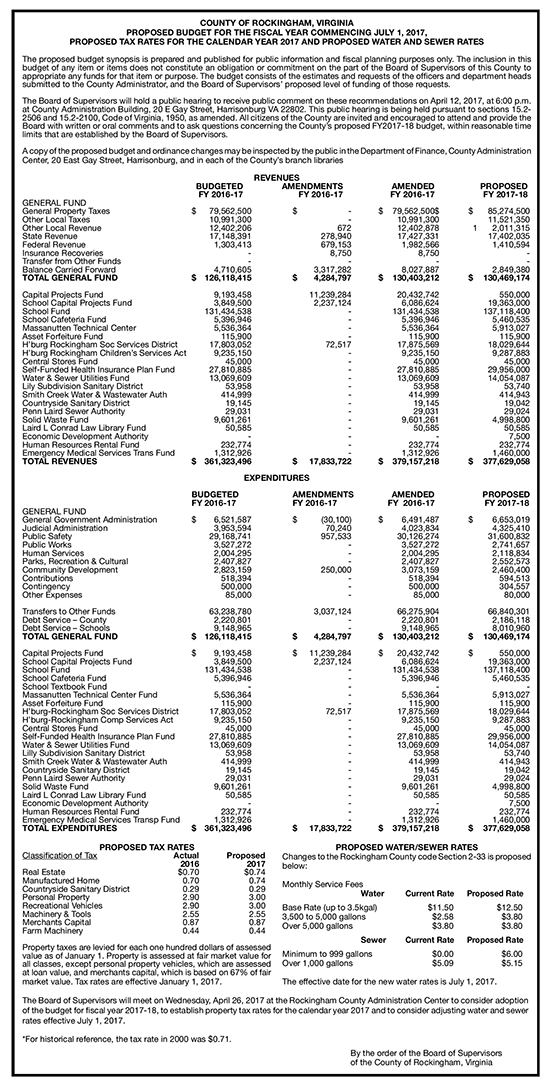

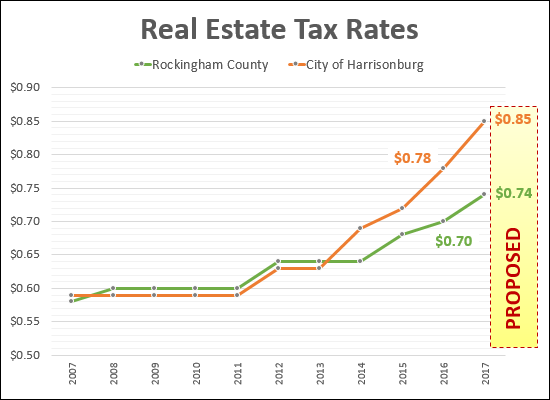

Click on the image above for a PDF of this summary of the proposed 2017-18 Rockingham County budget. As shown, this would require the real estate tax rate to increase from $0.70 to $0.74. Which turns out to be less than the proposed increase in the City of Harrisonburg....  Read lots more about WHY the tax rate needs to increase here.... County Eyes More Taxes, Fees Daily News Record, April 5, 2017 No Comments At Budget Hearing Daily News Record, April 13, 2017 | |

Can Home Buyers Keep Up The Pace in April 2017? |

|

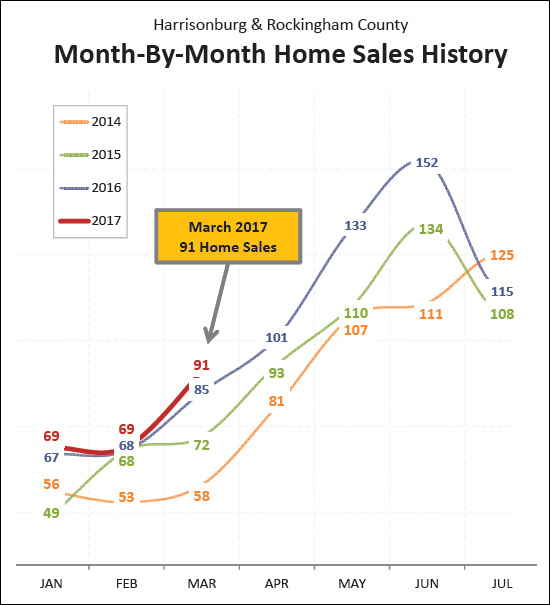

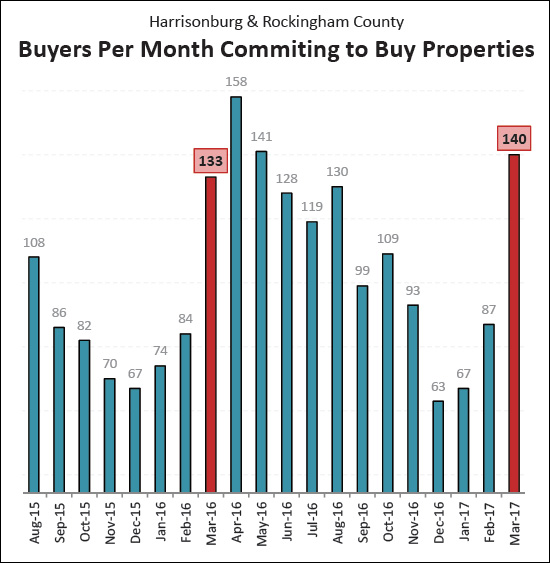

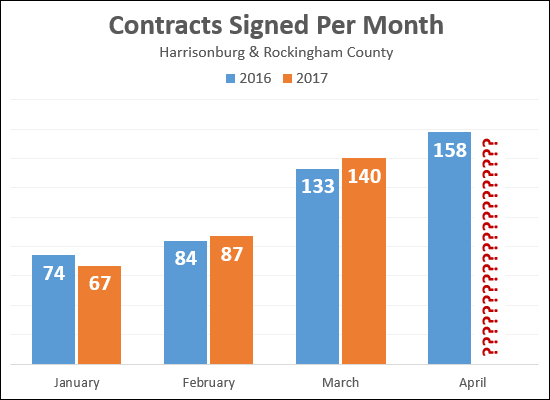

Last year (2016) was a startlingly strong year in the residential real estate market in Harrisonburg and Rockingham County -- and thus far, 2017 seems as if it will hold its own. The graph above shows the number of contracts signed per month over the past three months of 2017 (orange) -- and how that compares to the pace of contract signing in 2016. As you can see, despite a slightly slow start in January, both February and March of this year showed MORE contracts being signed than the year below. How, then, are we doing thus far in April??? Could we possibly see a jump all the way up to 158 contracts signed??? Here's what we can see so far.... April 1 - 18, 2016 = 91 contracts April 1 - 18, 2017 = 92 contracts ! ! ! So, yes, it seems April might continue on the strong streak of home sales in 2017! | |

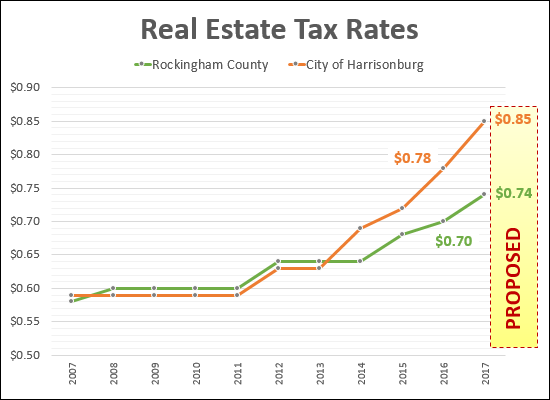

City of Harrisonburg Proposes 9% Increase in Real Estate Tax Rate |

|

The City of Harrisonburg has published their proposed 2017-18 budget, which includes a proposed increase in the real estate tax rate from $0.78 per $100 of assessed value to $0.85. This would mark a 9% increase in the real estate tax rate in one year, and a 35% increase over a four year period. A budget summary follows, or you can find the entire proposed budget here.  | |

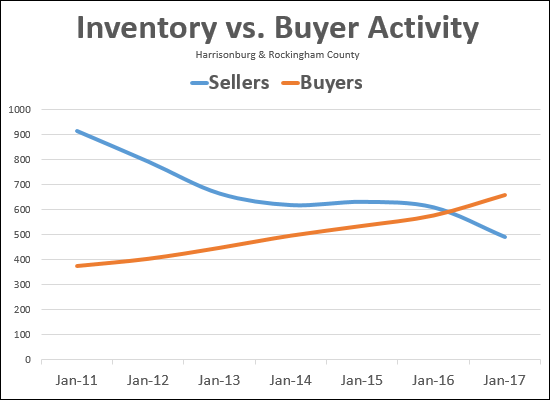

Is a balanced market always this fleeting? |

|

The graph shown above is an illustration of changing inventory levels (blue line) and the number of buyers buying in a six month period (orange line). The point at which the two lines meet is when there was exactly six months of inventory of homes on the market for sale. All of the months prior to when the lines met are times when (to varying degrees) there were many more homes on the market (housing surplus) than there were buyers to buy them (low demand). All of the months after the point when the lines met are times when (to varying degrees) there have been far fewer homes on the market (housing shortage) than there are buyers to buy them (high demand). Perhaps what has surprised me the most in the past year is how quickly the balance seems to be swinging towards a seller's market (low supply, high demand) when I thought we might stay in a relatively balanced market (high supply, high demand or moderate supply, moderate demand) for some time. | |

Rockingham County Likely to Increase Real Estate Tax Rate by Four Cents |

|

Rockingham County's budget for the 2018 fiscal year (which begins July 1) includes a proposed $0.04 increase in the real estate tax rate, which would increase from $0.70 to $0.74 per $100 of assessed value. Some context....

Read lots more about WHY the tax rate needs to increase here.... County Eyes More Taxes, Fees | |

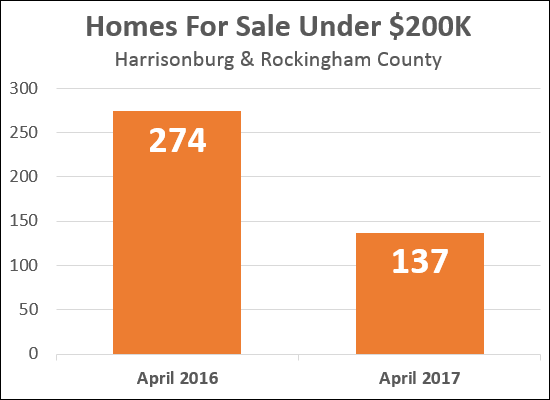

Half As Many Options for Buyers Under $200K |

|

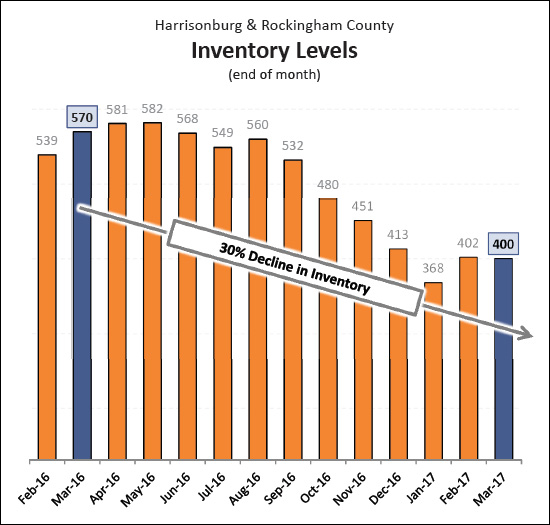

Housing inventory levels are declining in Harrisonburg and Rockingham County, but perhaps none so precipitously as the under $200K market. As shown above, there are HALF as many homes for sale under $200K now as compared to one year ago. This leaves many buyers in this price range in a difficult spot of trying to find a home to purchase that will fit their needs. I believe some of this is related to a lack of new construction of homes in this price range. Read more about our local housing market at HarrisonburgHousingMarket.com. | |

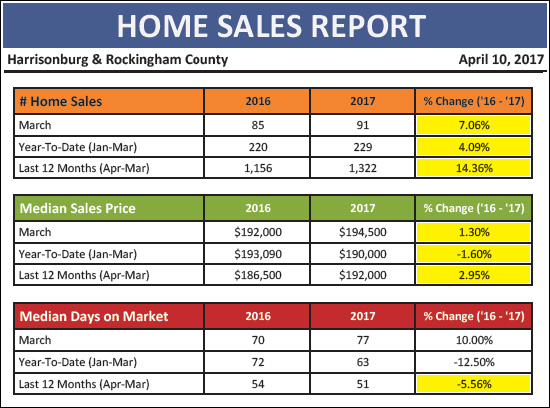

Strong Home Buying (Contract Signing) Activity in March 2017 |

|

This beautiful home is 2930 Brookstone Drive - check it out here! Wow! March was a wild and crazy month in the real estate world in Harrisonburg and Rockingham County. Let's put it this way -- in the past three years, there have only been three months when more buyers have signed contracts than in March 2017! But I'm getting ahead of myself -- read on.... As you'd guess from the header image above, I have published my monthly market report, which you can download as a PDF, or read online. For the abridged version of the most important things for you to know, read on.... First -- for those that would rather listen/watch than read -- tune in to my monthly video overview of our local housing market....  And now, some general indicators of market performance....  Some basic notes from this general market overview:

As shown above, each month of 2017 (so far!) has barely surpassed the same month of the previous year. That said, we may be about to see a significant change in that trend because....

As shown above, homes were flying off the shelf (buyers were signing contracts) faster (slightly) than I can eat donuts from Peace, Love and Little Donuts. No joking, though, as noted above, the 140 signed contracts in March 2017 exceeds all but three months from the past three years. So -- it seems likely that we'll see a pop in April 2017 home sales! With all of these homes selling, are we running out of homes for folks to buy?

Why yes, we are! There has been a 30% decline in the number of homes for sale over the past year. And -- get this -- if we look solely at homes under $200K, there has been a 50% decline in housing inventory levels! OK -- so, more homes are selling, at higher prices, more quickly -- sounds good for sellers, right? Yes, but I would still remind all sellers that even in a seller's market it is still essential to focus on price, condition and marketing. And what is a buyer to do in some crazy times as these? Be prepared! Know the market, know the process, know your buying power, and monitor new listings closely! If you're interested in even more market data, read my full online market report, download the PDF, or click here to sign up to receive my real estate blog by email. Here are two handy references to prepare yourself to buy or sell a home.... | |

Balancing RISK and REWARD when purchasing a rental property for your JMU student |

|

If you are looking to purchase a rental property for your JMU student to live in while they are a student at JMU, there are two basic paths you could go down.... Option 1 -- A property in a traditional student housing neighborhood. These will allow the most students to live in the property and will maximize the rental income per dollar spent on the purchase. However, it will also expose you to a more turbulent segment of the market, as rental rates and sales prices of these properties can vary quite a bit over time as the supply of competing student housing ebbs and flows based on large complexes being built by student housing developers. You can find purchase options in this category here. Option 2 -- A townhouse in a community that has many owner occupants, some non-student renters and some student renters. Many of these will not allow as many un-related students to live in the property (per zoning regulation or restrictive covenant) and will not provide quite as much rental income per dollar spent on the purchase price. However, they will be in segment of the real estate market that is much more predictable and less volatile from a rental rate and/or sales price perspective. You can find purchase options in this category here and here. I work with parents of JMU students each year who go down each path outlined above, each for different reasons. Most of the time, though, it boils down to their tolerance for risk or their desire for reward. It can also be related to their intended time horizon for owning the property. If you are interested in buying a rental property for your son or daughter to live in while they are at student at JMU, let me know. | |

Support Downtown Harrisonburg AND Fund Your House Down Payment? |

|

Get this -- you can support Downtown Harrisonburg AND have the opportunity to win funds to use as your down payment on a house! :) Harrisonburg Downtown Renaissance has launched FRIENDLY CITY FORTUNE -- a large scale raffle with $250,000 of prizes to be given away on July 4, 2017. Prices include thousands of dollars of cash (including a $3K winner, $5K winner, $10K winner and $30K winner!!) and a 2017 Ford F-150 4x4! Tickets are $100 -- 5000 of them will be sold -- and all raffle proceeds will support the vitality of downtown Harrisonburg through important redevelopment, beautification and community-building initiatives. Learn more about the Friendly City Fortune here, or buy your raffle ticket here. | |

Shenandoah Valley SING OFF, an a capella contest, to be held this Saturday! |

|

Don't miss the inaugural Shenandoah Valley SING OFF, this Saturday, at Harrisonburg High School, featuring the following groups....

Shenandoah Valley SING OFF April 8, 2017 @ 7:00 PM @ Harrisonburg High School 1001 Garbers Church Road, Harrisonburg, VA 22801 Buy Tickets Online Here | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings