Enough Price Adjustments Will Eventually Overcome All Buyer Concerns |

|

My house is next to the railroad tracks, but all of the potential buyers (who did not make an offer on my house) didn't complain about price, they complained about the railroad tracks. My house has an unbelievably steep driveway, but all of the potential buyers (who did not make an offer on my house) didn't complain about price, they complained about the steep driveway. My house is needs many cosmetic updates, but all of the potential buyers (who did not make an offer on my house) didn't complain about price, they complained about the need for cosmetic updates. Guess what --- unless you're going to move the railroad tracks (or the house), flatten the driveway, or make all of the cosmetic updates -- it really is an issue of price! If you're getting consistent feedback about your house that is unrelated to price, in almost all cases, you need to adjust the price to accommodate for that specific issue. If the price is lower then buyers might actually buy despite the specific issue that they were complaining about. | |

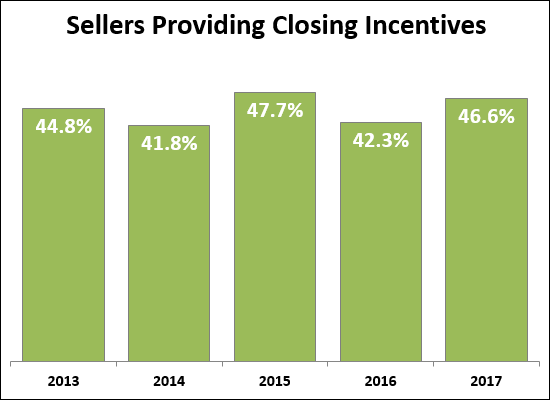

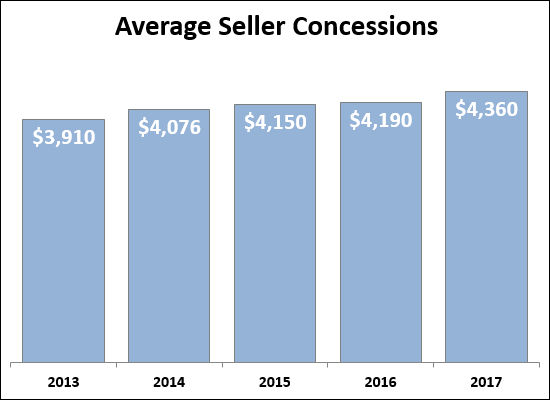

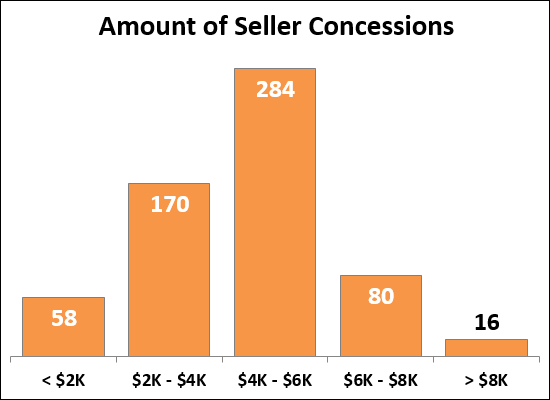

Sellers Paying More and More of Buyer Closing Costs |

|

Nearly half of sellers (46.6%) pay some portion of a buyer's closing costs in the form of a credit at closing. Over the past five years, the number of sellers providing a "concession" of this sort to buyers have stayed between 40% and 50%.  Here's the interesting one -- sellers have paid more and more of a buyer's closing costs over time. The average amount of seller concessions has increased steadily over the past five years. But why, you might ask? It's hard to say exactly -- buyers might be asking for more money, sellers might be agreeing to provide a larger credit, or perhaps the total amount of closing costs that a buyer has to pay is increasing as well?  If, as a seller, you are paying part of a buyer's closing costs, you are most likely to be paying between $4K and $6K --- or between $2K and $4K. And again, as a seller, if you pay part of the buyer's closing costs -- you are not alone -- 45% or so of sellers do so! | |

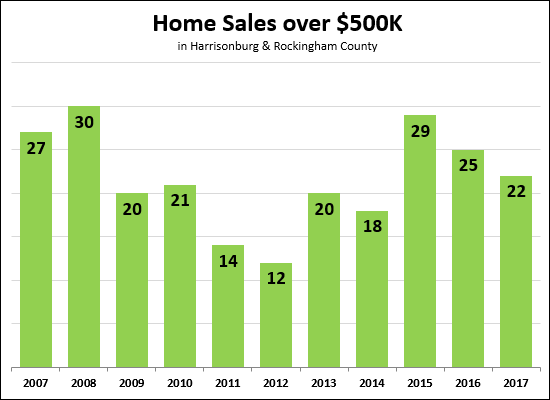

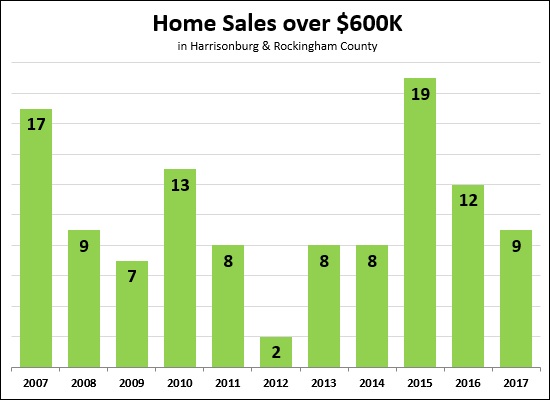

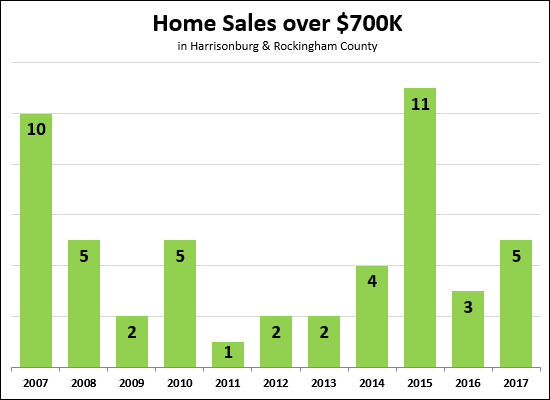

Harrisonburg Area High End Home Sales |

|

High end ($500K+) home sales slowed slightly in 2016 (25 sales) as compared to 2015 (29 sales) -- but it seems likely that this price range will rebound to those 2015 levels in 2017. With another four months of sales to go, it seems likely that we will see at least seven (and maybe more?) sales over $500K. In fact, there are currently three homes over $500K under contract.  Home sales over $600K, however, are another story. Looking back, 2015 was an incredible year of sales for this price range -- with 19 sales -- higher than any other year in the past ten years! While we will likely see more sales this year (9 so far) than last year (12 total) it does not seem we will match the 19 sales seen in 2015.  Finally -- the $700K+ price range -- where we seem to have returned to normal-ish levels in 2016/2017. Looking back, it is quite astounding that 11 of these homes sold in 2015 -- this was far and above the amount of $700K+ home sales we had seen in a single year since all the back in 2007. | |

Pick Sunflowers This Weekend at Hope Field to support RMH Foundation Hope Fund |

|

Have you seen thousands of sunflowers growing in a field at the intersection of Route 33 East and the Connector Road (Stone Spring Road) just East of Harrisonburg? This field is known as Hope Field, and you can stop by this Saturday and Sunday for Frazier Quarry's all-you-can-pick sunflower fundraiser. Per this article from the JMU Breeze.... "The Frazier family will dedicate this year's sunflower harvest to Carla Frazier, a family member who succumbed to brain cancer 13 years ago."So, mark your calendar, and stop by Hope Field this weekend! Saturday, August 26th, 8 AM - 6 PM Sunday, August 27th, 8 AM - 12 PM Per the Facebook event page, be sure to bring your pruners as well as close toed shoes! | |

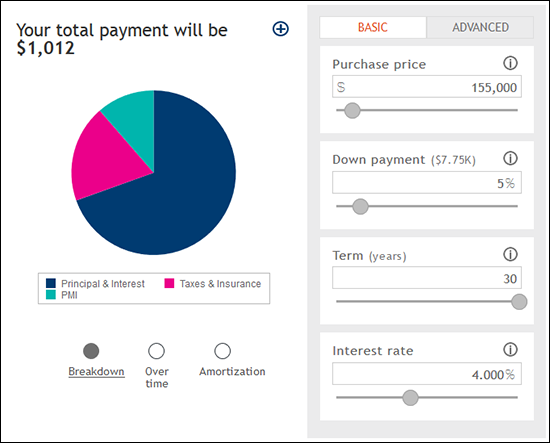

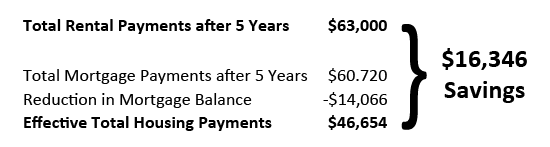

Should you buy or rent a townhouse in Harrisonburg? |

|

Given continued low interest rates and some increase in home values, let's take a new look at the opportunities of buying versus renting. RENT = $1050/m. There are regularly options for renting a two-story townhouse in Harrisonburg for approximately $1050 / month in Avalon Woods, Beacon Hill, Stonewall Heights, Liberty Square, etc. BUY = $1012/m. With a 95% loan, buying such a townhouse apparently may cost as little as $1,012 per month assuming a $155K purchase price and a 4% interest rate per SunTrust Mortgage's payment calculator....  This shows a rather small, $38/month, cost savings of buying instead of renting. If we then look at the difference between renting and buying over a five year time period, the advantages start to pile up.  As you can see, this builds a rather compelling case for buying instead of renting if you are going to be living in this potential townhouse for the next five years. Two other factors to keep in mind....

| |

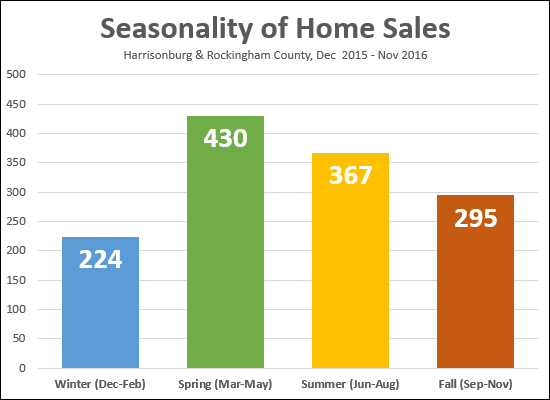

Fall is not the absolute worst time to sell your home |

|

Fall is, however, the second-worst time of the year to sell your home. :) The data above reflects the timeframe during which properties went UNDER CONTRACT -- not when they closed. Plenty of the Summer contracts turned into Fall closings -- but the 295 figure is a reflection of how many buyers made buying decisions (signed contracts) between September and November of last year. So....if you want to sell your home (and close on it) in 2017, you should be thinking about getting it on the market sooner rather than later. | |

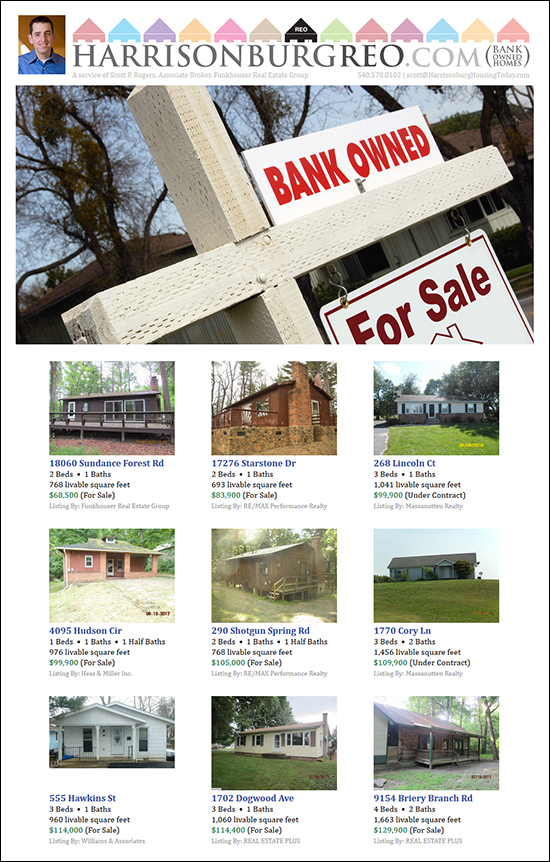

Bank Owned Properties in Harrisonburg, VA |

|

While there aren't many foreclosure sales scheduled, and we have been seeing fewer foreclosures compared to home sales, there are still a good number of bank owned homes in the system for sale right now. You can always find the most current listing of bank owned homes online at HarrisonburgREO.com. Feel free to contact me if you have any questions about these properties. | |

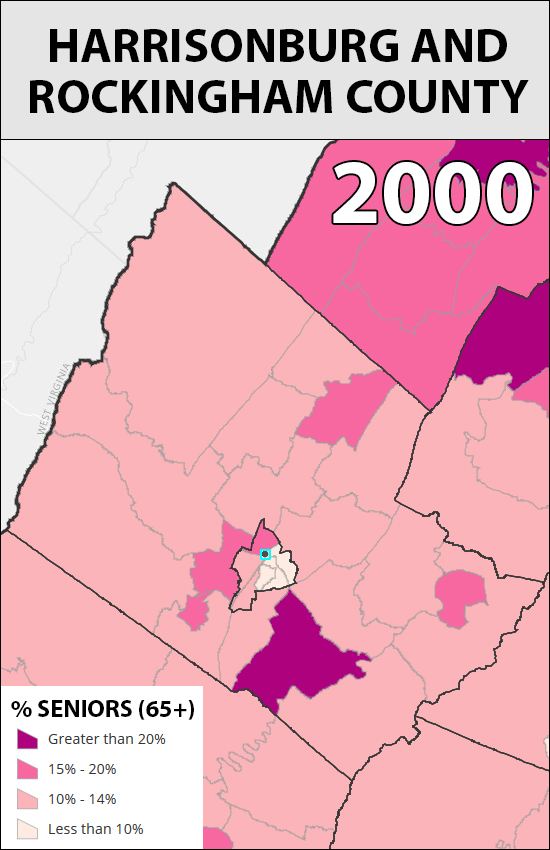

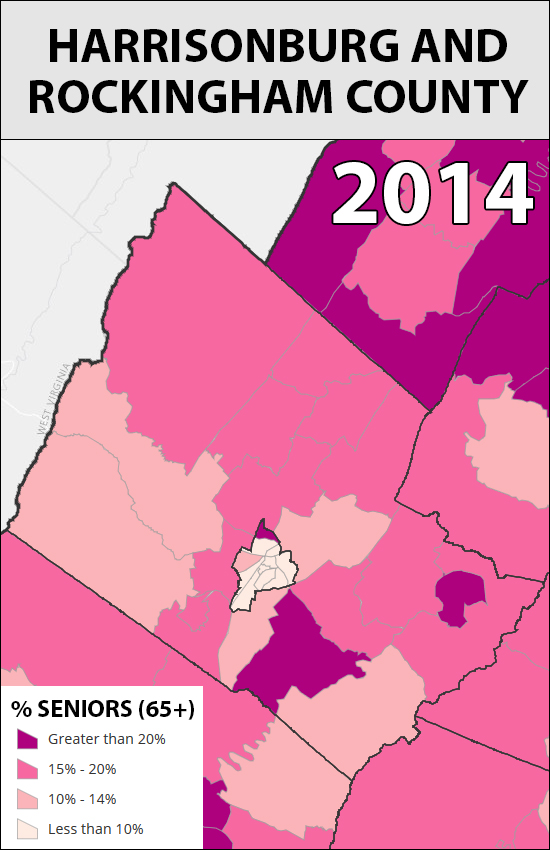

Proportional Senior Population Increasing in County, Decreasing in City |

|

The two maps above were generated here based on changes between 2000 and 2014 in the senior population -- those age 65 or greater. A few observations and thoughts....

| |

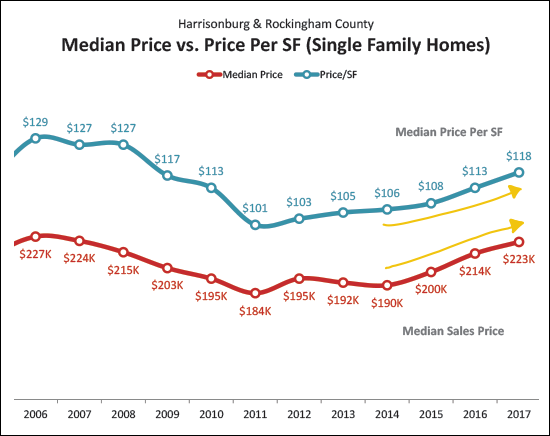

Price Per Square Foot Steadily Rising |

|

The price per square foot of homes in Harrisonburg and Rockingham County has been steadily increasing over the past six years....

That said -- while the median sales price ($223K) has nearly climbed backup to the high we saw in 2006 ($227K) -- the median price per square foot ($118) has actually not come anywhere closer to that 2006 high ($129). Which would seem to mean that you're getting slightly more house for your money now (as compared to 10-11 years ago) even if you're paying a similar price. | |

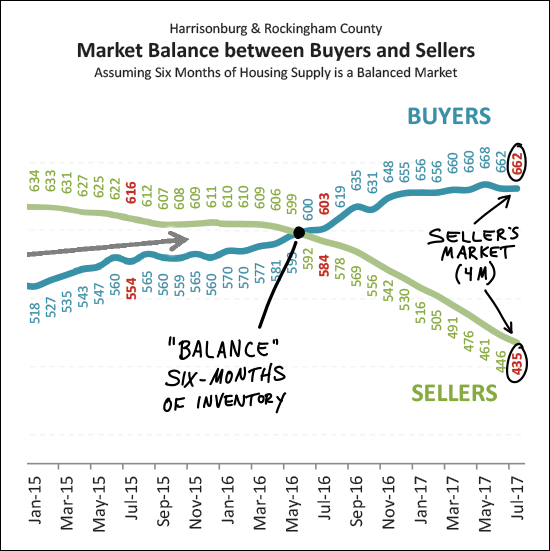

This is not a balanced real estate market |

|

Most housing market analysts consider six months of inventory (active listings) to be an indicator of a balanced market (between buyers and sellers). The "BUYERS" trend line above is illustrating how many buyers are buying in a six month period. The "SELLERS" trend line above is illustrating how many sellers are in the market (active listings) at any given time. Over the past four years we have seen a steady increase in buyers and a declining number of sellers. In June 2016, these two trajectories crossed, and there was no turning back. There are now many more buyers buying in a six month period than there are homes for sale -- creating a seller's market. Instead of having a six month supply of homes for sale, we now have a four (3.95) month supply. Of note -- it is not a seller's market in every price range, in every location, for every property type -- but overall, we are definitely seeing a seller's market. Find out more about our local housing market by clicking below for my monthly market report.  | |

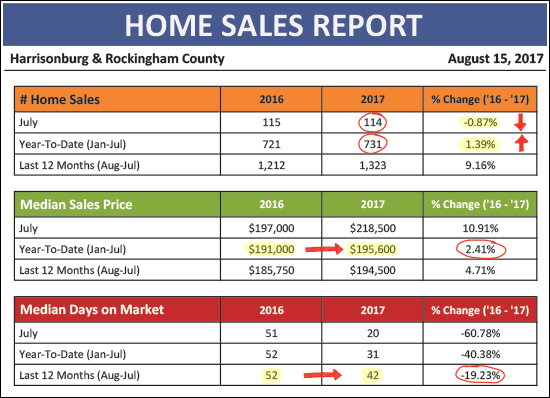

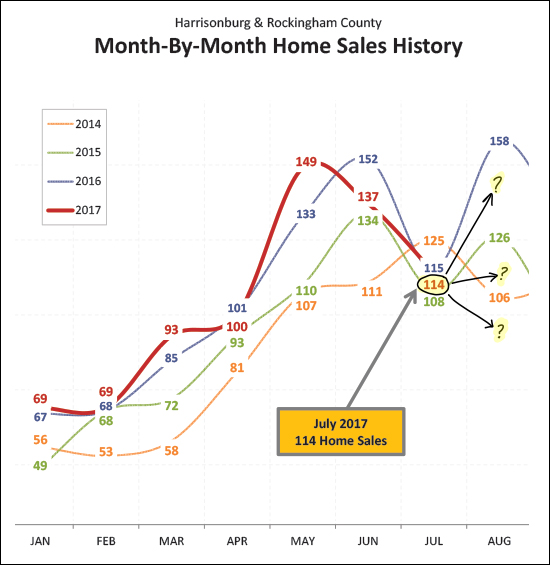

Home Sales Steady, Prices Rising in Harrisonburg Area |

|

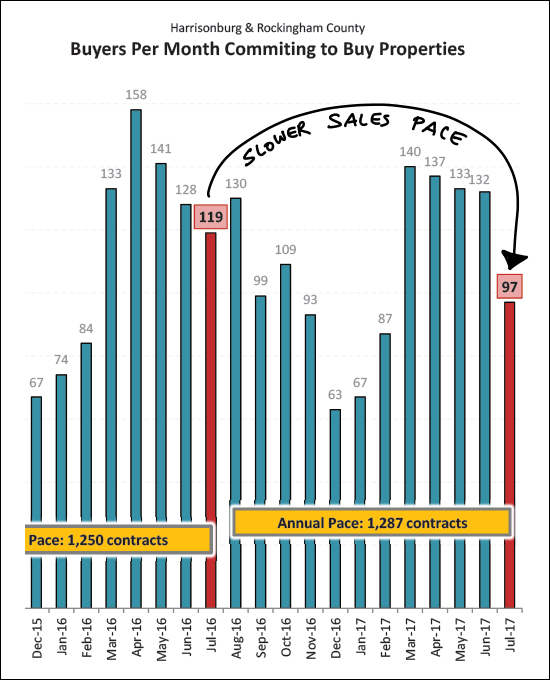

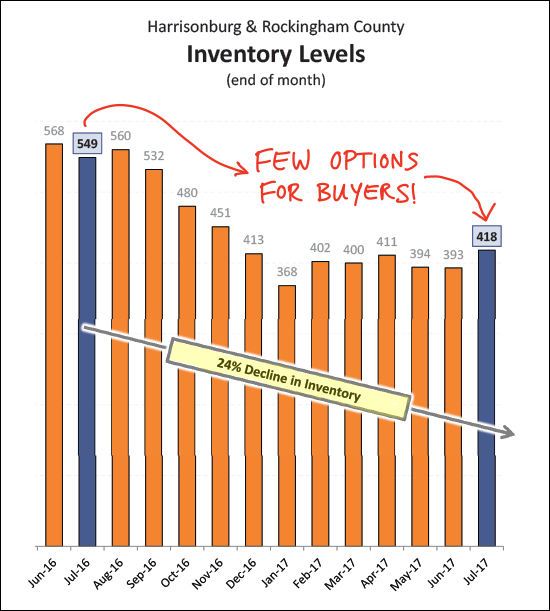

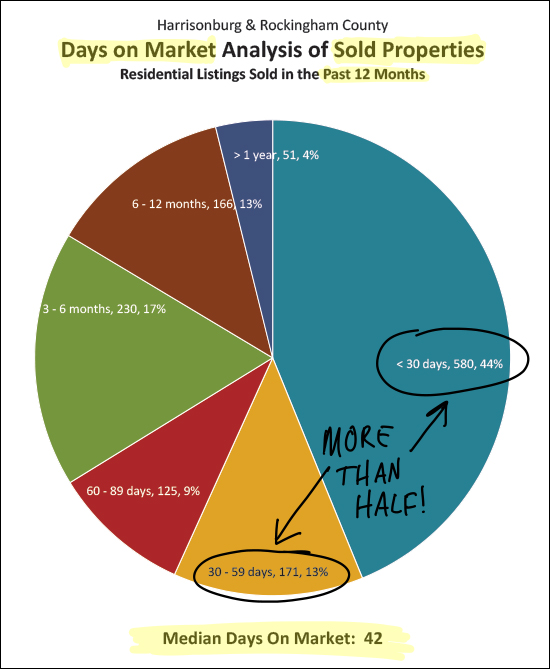

The beautiful home shown above is located in Kentshire Estates. Find out more here. July 2017 has come and gone -- and even if the temperatures don't yet feel like August -- that last month of summer is really upon us. I just published my most recent monthly market report, and as usual, you can read on for an overview, download the full report as a PDF, read the entire report online, or tune in to my monthly video overview of our local housing market...  You'll find that the video is in a new format this month, which I think you'll find much more helpful. Let me know. (click above to watch it) And now, a few items on our overall housing market....  As shown above, home sales slowed, ever so slightly, in July 2017 -- to 114 sales, as compared to 115 last July. Home sales for the entire first seven months of the year, however, remained strong, at 731 home sales -- an increase of 1.39% over the pace of last year's home sales. Also of note, the median sales price has increased 2.41% over the past year, to a price of $195,600 --- and homes are selling 19% faster this year, in a median of 42 days.  And....where do we go from here? We saw strong home sales in May and June -- but then a decline in July that put us in the middle of the pack as far as a typical July. Now, though, will we see a huge bump like last August? Or will home sales stay relatively steady, or even decline, in August?  Based on the slowing rate of buyers signing contracts (shown above) I'm guessing we'll won't see a big upward spike in home sales in August. And perhaps, the slightly slower sales we're starting to see this year is a result of continually declining inventory levels....  While we did see a slight upward tick in our inventory levels in July, overall, buyers still have significantly fewer options when buying in Harrisonburg and Rockingham County. And what does an increasing demand and decreasing supply lead to?  First of all, homes are selling quickly! Over half of the homes that sold in the past year went under contract within 60 days of being listed for sale. Actually, almost half of them (44%) went under contract in less than 30 days!?!  And, not only are homes selling faster, they are selling at higher prices as a result of more buyers and fewer sellers. The median sales price of single family homes has been increasing in recent years, which is likely at least in part due to more buyers buying and fewer sellers selling. Will we see another 5% or 7% increase in this median sales price this year? Only time will tell - but my money is on a 4% - 5% increase. There are actually quite a few astonishing tidbits in this month's report, but I'll get into those in the coming days on my blog. Until then -- feel free to download and read my full market report as a PDF, or read the entire report online. And, my reminders for buyers and sellers last month still apply.... SELLERS -- even though it is a seller's market in many price ranges right now, you must still focus on price, condition and marketing. For further reading on buying or selling in this area, check out.... | |

Harrisonburg could never have enough student housing! |

|

OK, OK, that's probably not true -- Harrisonburg probably does not have an infinite need for student housing. Just consider my title, then, to be an intro to all of the alternative perspectives that have been shared with me since I wrote these two posts.... Does Harrisonburg need more Off Campus Student Housing? Does New College Student Housing Increase the Demands on Local Elementary Schools? OK -- here goes -- all the reasons I might be wrong, and all of this new student housing might be OK, or even a good thing.... 1. JMU is growing! All of this student housing is necessary -- JMU is continuing to grow, and they are not building on campus fast enough for their growth, so the private sector must build and rent housing to students in order to meet that growing demand. 2. Denying growth just pushes it elsewhere. If the City decided to stop permitting new student housing communities to be built, that would just push developers to build them in the County, or push students to live in otherwise owner occupied neighborhoods. 3. This is an affordable way to get workforce housing. There isn't much truly affordable rental housing being built -- and older student housing complexes being effectively turned into workforce housing by virtue of students being attracted to new student housing communities is not necessarily a bad thing. It may be the most affordable way to create affordable or workforce housing. 4. Bring on the wrecking ball. If even more student housing is built, the rental rates will fall even lower on the oldest complexes, devaluing those properties to the point where it will make sense to just knock them down and build new housing -- thus, eliminating the older, outdated housing. 5. How much regulation do you want "the government" to do? If the government (planning commission, city council, staff) should start making judgement calls about how much student housing is too much student -- and thus regulating what landowners (and student housing developers) can and cannot do -- should they also start governing other segments of the private sector? Should they regulate how many hair salons exist? How many banks are permitted to operate? How many restaurants can open? How many Realtors can sell homes? :) OK -- again -- I don't necessarily agree with all of the perspectives above, but I believe it is important to consider these counterpoints when thinking about how our community should be planning for the future as it pertains to student housing, land use, property taxes, schools, etc. And, as I mentioned to a reader in response to their comments.... I don't know if new student housing projects should or should not be denied - but I think the local community needs to fully understand the impact of continuing to approve more student housing communities. If older student housing communities become workforce housing, great, no problem -- but let's realize that this is the result of approving new student housing communities, and make sure that infrastructure (schools, for example) are in place for the new workforce housing that we have indirectly created. | |

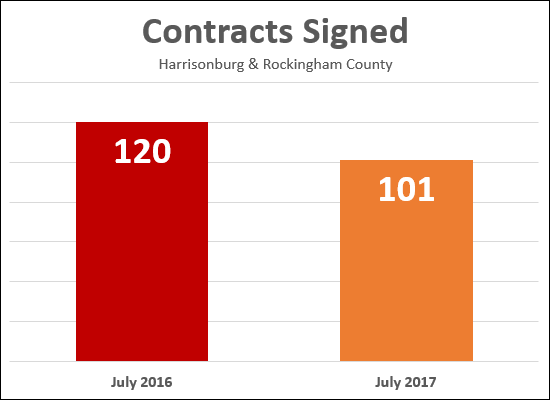

Home Buying Pace Slower This July Than Last |

|

16% fewer buyers signed contracts in July 2017 as compared to July 2016. It's hard to say if this is related to lower buyer interest (I doubt it) or lower inventory levels (I suspect it). I suspect we will still end up seeing just as many home sales in 2017 as we saw in 2016 -- but I don't think we'll see a significant increase in the number of homes selling this year. | |

Does New College Student Housing Increase the Demands on Local Elementary Schools? |

|

Traditional logic would say no -- the construction of new college student housing in Harrisonburg won't increase the load on elementary schools, as most college students do not have elementary school aged children.... Going a step further, I would guess that some local government staff and elected officials MIGHT (?) use this traditional logic when thinking about whether to approve rezonings, or other approvals, for new student housing to be built in the Harrisonburg area. But wait - what if the following sequence happens (thanks Deb, with some revisions)....

I think we have seen this happen over the past 20 years in Harrisonburg, in cycles, as large quantities of student housing is built in waves. And think about it, from the other direction, for a moment -- we all know that the local elementary school population is growing -- but why, and where? It's not as if local developers and builders are out building an extraordinary number of townhomes or starter homes for young families, causing an influx of new elementary school students. So -- if the elementary school population is rising, and it's not because of an increase in the stock of owner occupied real estate in Harrisonburg, then.... 1. Perhaps this elementary (or K-12, really) school enrollment growth is, contrary to what we'd otherwise believe, a direct result of an increase in college student housing. 2. Perhaps we need to think about the fiscal impact of educating more elementary (and then middle and high) school students when we think about approving yet another student housing complex. 3. Perhaps, if building new student housing when we might not really need it, leads to increased demands on our local K-12 schools, then maybe we need to pay more attention to whether that student housing is needed. Just some thoughts to ponder as we think about and plan for the future here in the City of Harrisonburg -- and Rockingham County. | |

Thank Goodness Home Prices Are Not Increasing Very Quickly! |

|

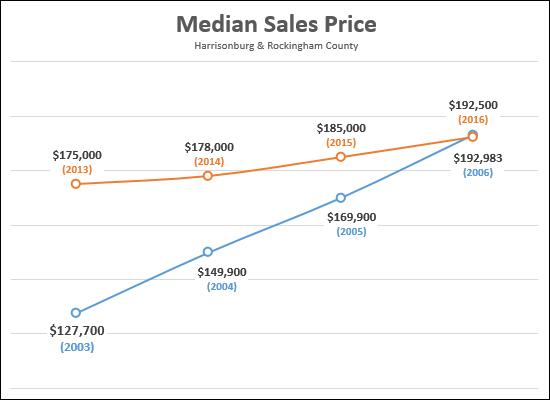

There have been two very unique four year periods in recent history where the local median sales price increased to $192K. When home values increased between 2003 and 2006 up to a high of $192,983 -- they did so by increasing by 13% - 17% per year!! As we now know, this was NOT sustainable! Household income was not increasing at that same rate during that timeframe, house prices became too high for many to afford, and we experienced a significant market correction downturn. In contrast, over the past four years our median sales price has increased by 1% - 4% per year up to last year's level of $192,500. This seems like MUCH more sustainable growth and provides hope that today's home prices are stable and will continue to slowly increase over time. | |

Fear Not, Mortgage Interest Rates Sticking Close to Four Percent |

|

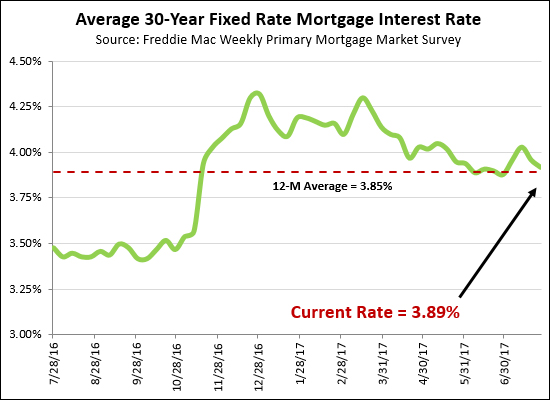

Another month -- and still no meaningful changes in the 30 year mortgage interest rate. Since the beginning of the year, these rates have slowly edged downward, and have now been below four percent for most of the past three months. This continues to provide a great opportunity for home buyers -- likely spurring on continued buyer interest in our local market. As I commented to someone last week, I have been thinking mortgage interest rates were going to start increasing for at least five years now -- and I have been wrong for at least five years now. Will they ever increase? Possibly. When? How? By how much? It's anyone's guess at this point. I think there is probably a 75% chance (maybe a 90% chance?) we'll finish out this year at or below 4.5% -- which is hard to believe. | |

JMU property ownership in the Maplehurst neighborhood |

|

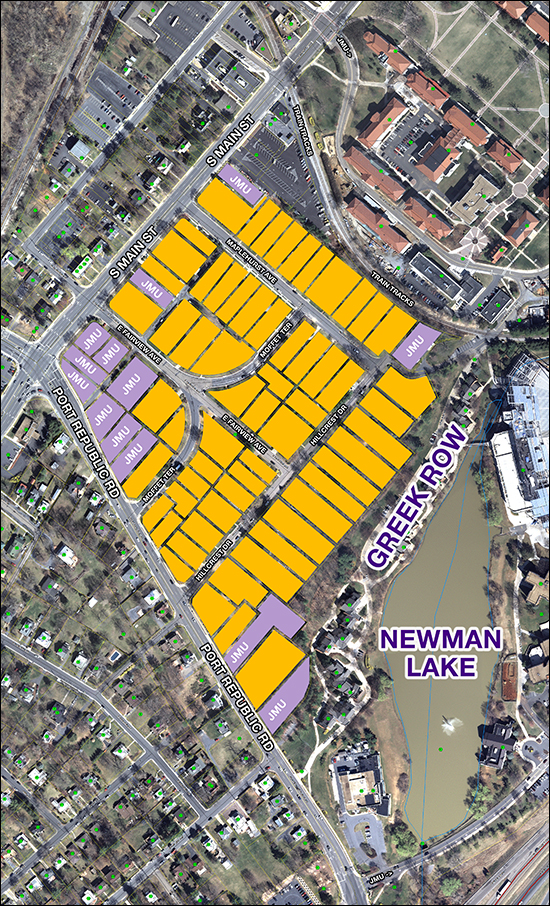

Perhaps not quite as interesting (or pervasive) as JMU's ownership in the Forest Hills neighborhood -- but interesting nonetheless. This is another older residential neighborhood adjacent to the JMU campus. It will be interesting to see over time if JMU purchases more of these homes as another potential direction in which to expand the campus. Thus far, their focus seems to be mainly on the corner of South Main Street and Port Republic Road. Download a larger (23MB) map here. | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings