Do Solar Panels Add Value To Homes in the Harrisonburg Area? |

|

So, you're thinking of adding solar panels to your house? You might wonder if this will increase the value of your home -- or make it easier for your house to sell -- or make it more difficult for your house to sell. All good questions. I don't think there is one right answer. Here are some of my thoughts...

So -- if you're installing solar panels with the thought that you'll sell your home in the next year or two, it might not be advisable to do so. After all, you'd likely be passing on most of the cost savings over time to the next owner without the ability to cash in on that from a significantly higher sales price. If you're installing solar panels and you plan to stay in the home for a while, but want to be sure that you'll be OK selling the home in the future, I suspect you'll be just fine, and will likely sell your home for more than if it did not have solar panels. What are your thoughts on solar panels as it relates to home value? I'd love your input. Email me at scott@HarrisonburgHousingToday.com. | |

Differing Perspectives On Home Inspection Repairs |

|

While not always the case, a general rule of thumb is that... On home inspection repairs -- sellers usually have a short term fix mentality -- while buyers usually have a long term fix mentality. And, successfully negotiating agreed upon repairs after a home inspection can be a smoother process if we reflect on the difference in those perspectives. Inspector: Several roof shingles are missing, and the roof is past its life expectancy. Seller: Replace the shingles. Buyer: Replace the roof. Inspector: The air handler coils are dirty and the heat pump is reeaaallly old. Seller: Clean and service the heat pump and air handler. Buyer: Replace them both! These are a few extreme examples to start to show the differences in perspectives on repairs. Again, the important thing here is to recognize that a buyer and seller look at home inspection reports differently. A seller typically wants to minimize their repair costs while keeping the home sale on track. A buyer wants to make sure that any previously unknown property condition issues are addressed in a manner that is likely to prevent further near term maintenance needs in those areas. Both perspectives are reasonable, most of the time, depending on how it plays out related to specific deficiencies of a home.

So, what is a buyer to do? A few thoughts....

| |

Will We See Modest Sized New Homes Built Anytime Soon? |

|

Between 2000 and 2012, three centrally located townhouse developments were built in Harrisonburg:

Some of these townhomes were purchased by investors. Some were purchased by folks who have since sold and left the area. Some were purchased by folks who have since sold and bought a new, larger home, in or near Harrisonburg But I believe a lot of the original (or second) owners of these 614 townhouses are now looking around Harrisonburg wondering where they will, where they can go next. I believe our market desperately needs mid sized detached homes to be built, as these many townhouse owners are now older, often have started a family, and are looking for more space -- but can't jump up to buying a $350K to $400K home. What might these mid sized detached homes look like? Perhaps....

Note: This was written a year go -- and republished today -- and sadly, I don't think much has changed or improved over the past year. | |

Higher End Harrisonburg Area Homes Selling Well in 2018 |

|

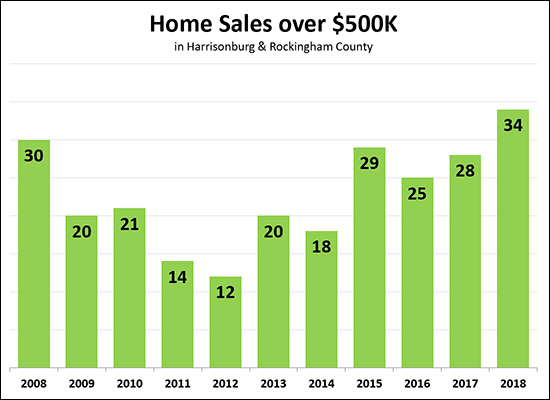

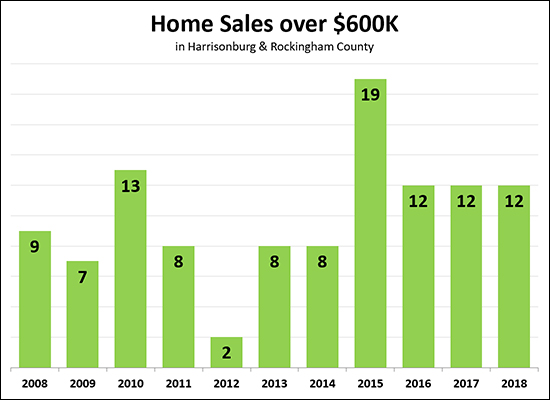

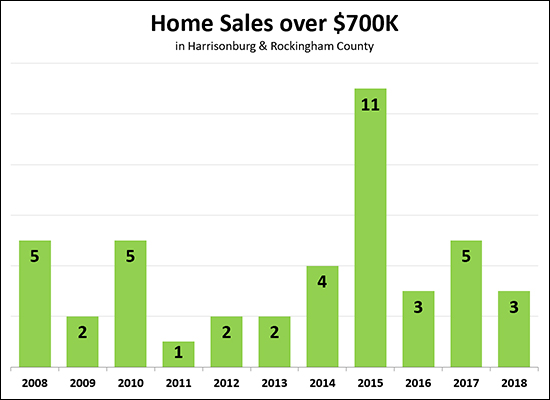

We're only 10.75 months through the year and it has already been a record setting year for higher end home sales in Harrisonburg and Rockingham County. As shown above, there have been 34 home sales over $500K thus far this year -- which is more than were seen in any full year in the previous 10 years. Of note -- there were 39 home sales over $500K in 2006 (not shown) -- and only time will tell if we can beat that this year.  Above, I have narrowed the market a bit, looking only at home sales over $600K. We have seen 12 such sales thus far in 2018, which already matches the full year of sales seen in 2016 and 2017. It seems relatively unlikely that we'll get up to 19 sales as were seen in 2015. As a side note -- only one buyer per month is paying over $600K for a home in Harrisonburg and Rockingham County, at least as recorded in the MLS.  And -- one last look. The over $700K market looks likely to finish out within what would seem to be a normal range of 2 to 5 sales per year. Looking back, clearly, 2015 was an absolutely crazy year for these high end home sales. | |

Is October, Or Even November, Too Late In The Year To List Your Home For Sale? |

|

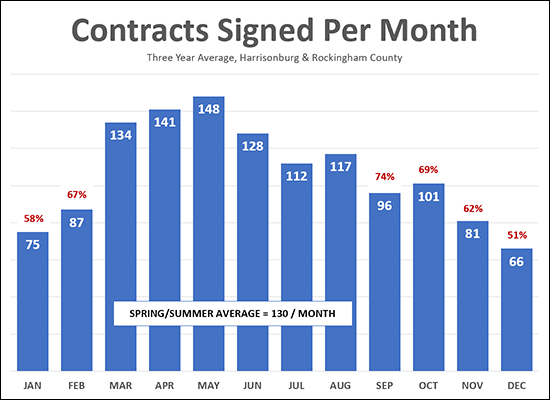

I believe this question is best answered by evaluating when buyers make an actual buying decision -- which is when they sign a contract. The data above shows when buyers sign contracts -- calculated by averaging data from the three most recent years. As can be seen, the busiest buying season is March through August when an average of 130 buyers per month make a buying decision. The remaining six months of the year (September through February) show anywhere between 51% and 74% as many buyers as the average of 130 per month seen in the busiest six months of the year. So -- listing your home on November 1st (for example) is not a terrible idea -- we'll see 62% as many buyers signing contracts in November as compared to the average busy month. That said, in the following month (December) we're likely to only see half as many buyers as compared to the average month. | |

When Making A Low Offer, Accentuate Your Other Offer Terms |

|

If you are making a low offer, you can increase the appeal of your offer by strengthening your other offering terms....

DEPOSITS Make the largest deposit you are comfortable with so the seller knows you have money "on the line" and that you won't risk losing that money by attempting to walk away from the deal. CLOSING COST ASSISTANCE Sellers don't just look at the contract price --- they calculate their net proceeds based on the offer price and any credits or closing cost assistance. Only ask for assistance if you truly need it. FINANCING Provide as much detail as possible about your financing intentions, and always include a pre-approval letter. Sellers who believe you are capable of financing the purchase will be less hesitant as they consider other terms of your offer. And yes -- offer cash, a large pile of it, if you are able. :) PERSONAL PROPERTY Don't automatically ask for everything the seller intends to convey --- if you don't need them all, leave them out of the offer. Allowing the seller to keep their washer/dryer (for example) may make them more flexible in other areas. INSPECTIONS Having a professional inspect the property you are purchasing is usually a good idea; however if you only intend to do it for informational purposes, consider leaving it out of the contract negotiations and conducting it post-settlement. SETTLEMENT & POSSESSION If possible, cater your settlement date and the details of transferring possession of the property to the needs or wants of the seller. This can go a long way towards gaining seller flexibility on other contract terms. Finally, research the seller's context for selling. That information can be invaluable in negotiating a successful contract. | |

There Is Nothing Quite Like Actually Viewing A Home In Person |

|

Internet cools are great but they still can't replace an in-person walk through. These days -- you can learn A LOT about a house online. You can typically review:

Sometimes you can even review:

But for many buyers, all of this online review of information and imagery still does not come close to the experience of being inside the home. So -- as a buyer... it's fine to absorb yourself in the online information available for a particular home... but don't hesitate to set up a time to physically view the home if it is of interest. With regularity, actually getting inside a home very quickly intensifies a buyer's interest in the property, or helps the buyer see that it will not work for them. And even more specifically, don't feel like you are wasting your Realtor's time if you want to go look inside homes that only "might" work for you -- you oftentimes aren't going to really know if they will work for you until you are physically inside the property. | |

The Citizen, A New Source for Local News |

|

Have you heard of The Citizen yet? This is a new online news source for Harrisonburg. Here's a bit more from their site... "The Citizen is an independent source of news for the people of Harrisonburg, Virginia. Our goal is to tell the important and interesting stories that are otherwise un- or under-covered in our community. We will report aggressively and fairly on behalf of everyone who lives here, and will not place any content behind a paywall. The Citizen is funded by local advertisers and readers who support its mission." Articles to date include:

Read it all over at The Citizen! | |

How To Appeal The Assessed Value of Your Home in Rockingham County |

|

Do you live in Rockingham County, and is your home's assessed value too high -- causing you to pay more real estate taxes than you think you should be paying? If so, now is the time to appeal that assessment. The Board of Equalization of Real Estate Assessments is meeting over the next month and you can make your case for having the assessed value of your home adjusted. Here are the dates of the hearings, each being from 9AM - 12PM:

Call 540-564-5079 to schedule a time and date for a hearing with the Board of Equalization. Of note -- in my experience, most assessed values in Rockingham County are not higher than market value. | |

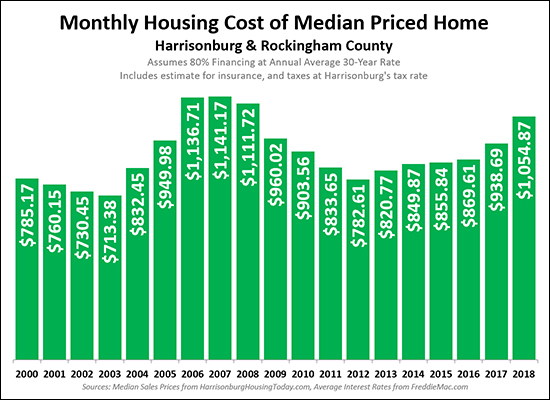

Monthly Housing Cost For Median Priced Home Climbs |

|

It costs more now than it did a few years ago to buy a home in Harrisonburg and Rockingham County, which should come as no surprise since...

The analysis above shows the combination of all of these factors -- the cost of a mortgage payment (principal, interest, taxes, insurance) based on a buyer financing 80% of a median priced home at the prevailing mortgage interest rate at the time, and with the prevailing real estate tax rate. We have now climbed above $1,000 per month on this metric -- which is the first time we've seen this since 2006 - 2008. Over the next few years, it seems likely we will see a continuation of this trend, as sales prices and mortgage interest rates are both likely to continue to slowly increase. | |

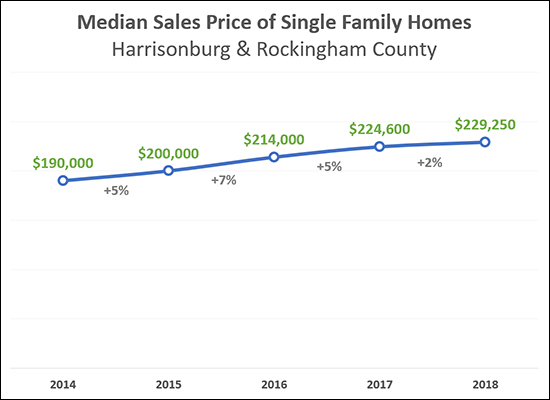

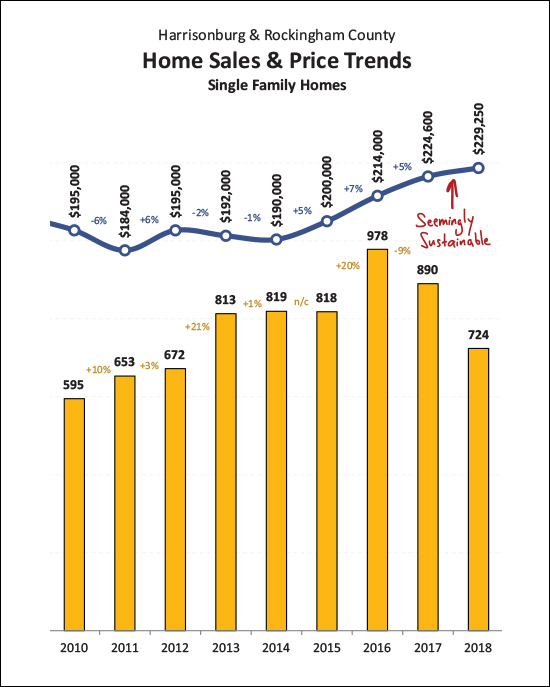

The Median Sales Price of Single Family Homes Has Risen 2 Percent in 2018 |

|

The housing market is hot, right? Home values are rising quickly, right? Well, sort of, but maybe it's not exactly like that. As shown above -- over the past three years (between 2014 and 2017) the median sales price of single family homes has increased by 5%, 7% and then 5%. But during 2018 the median sales price has only increased 2% as compared to 2017. The increases in single family home sales prices seems to be slowing in 2018. If you thought home values had risen much more than 2% over the past year, it may partly be a result of the overall residential sales price having increased 8.42% over the past year (read more here) but that is mostly a result of a change in WHAT is selling (more single family homes) as opposed to a change in the prices for which those properties are selling. So -- if you could have sold your home for $300K last year, perhaps you can sell it for $306K this year (+2%) and you probably can't sell it for $324K this year (+8%). | |

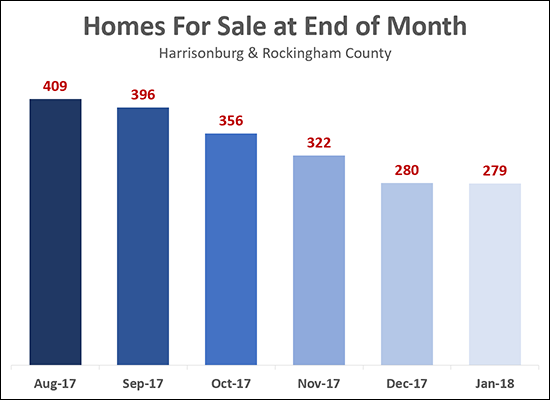

Housing Inventory Levels Likely To Fall Even Further |

|

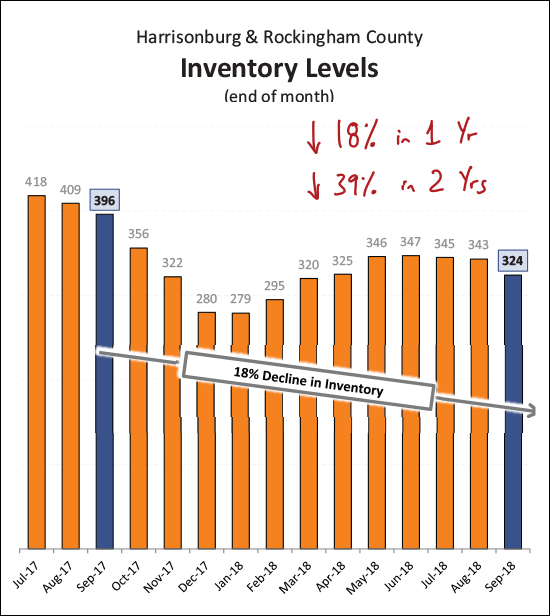

If last year is any indication, get ready to see inventory levels falling over the next few months as the weather gets colder. Inventory levels have fallen 18% over the past year -- and 39% over the past two years -- and we're about to head into the time of year (Fall to Winter) when inventory levels drop to their lowest levels. As shown above, inventory levels fell 32% last year between the end of August and the end of January. As such -- look at the meager supply of homes currently on the market -- and then eliminate 1 out of every 3 of those homes. That's likely where we're headed over the next few months. But here's the good news (sorta, kinda, with limitations) -- if you are thinking of selling your home in the next few months, you may have quite a few buyers angling to purchase it if it aligns well with what they are looking for in a home. The sorta/kinda part is that you'll only be good shape if you don't have to buy as well. After all, if we quickly sell your home (because of low inventory levels), but can't find something for you to buy (because of low inventory levels), then we still have problems. Who is the indisputable winner in today's local housing market? The home seller who does not have to buy a home as well. :-) | |

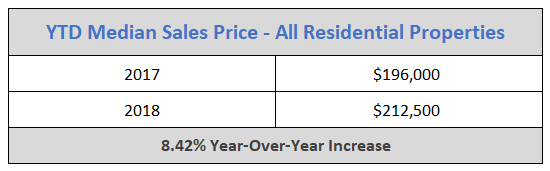

Are Local Home Sales Prices Actually 8 Percent Higher This Year Than Last? |

|

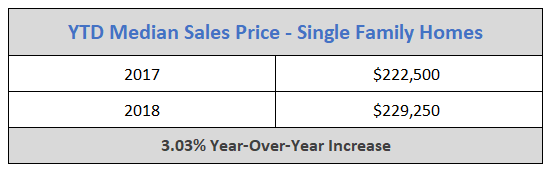

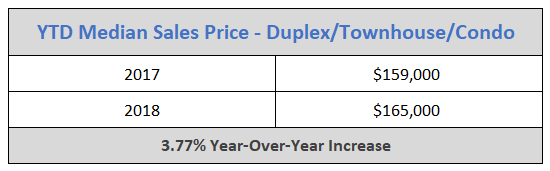

I'm going to say yes, but no, and mostly no. Keep reading -- this is important, as it can give us an indication of whether our local housing market is heating up too quickly. OK -- at first glance, it would seem that home prices have increased 8.42% over the past year...  But let's look closer -- breaking home sales down into two categories...

Here's where things get confusing -- if the median sales prices of all properties has increased 8.42%, why are we only seeing a 3% (+/-) increase in each of the two categories?   So, wait, what? Single family home sales prices are up 3.03% this year -- and duplex/townhouse/condo sales prices are up 3.77% this year -- but when you throw all of the data together it somehow appears as if prices have risen 8.42% over the past year??!!?? How can this be?? It turns out it's all about how many of each type of property are selling...  As shown above -- last year only 70% of home sales were single family homes, with 30% being duplex/townhouse/condo sales. This year, that ratio has shifted, and 75% of home sales have been single family homes, with only 25% being duplex/townhouse/condo sales And therein lies the answer. When single family homes sell for around $230K and duplexes/townhouses/condos sell for around $165K -- if there is a shift in how many of each property type sells (relative to the other) then the median sales price for the combined ALL residential sales will adjust more than sales prices of each property type are actually adjusting. So -- Sellers: You are likely to be able to sell your home for 3% more than you would have last year -- NOT 8% more. Buyers: You are not being expected to pay 8% more for homes this year than last. Everybody: Let's not be disappointed that we're not seeing an 8% increase in home prices -- let's be happy with 3%. An annual increase of 3% is (historically) normal, and seems to be quite sustainable. An annual increase of 8% (especially if back to back with another similar year) would likely mean that home sales prices are adjusting upwards too quickly and they may have to come back down at some point. So -- good news, bad news, but in my book, mostly good news! Home prices have risen 3% over the past year -- not 8%. | |

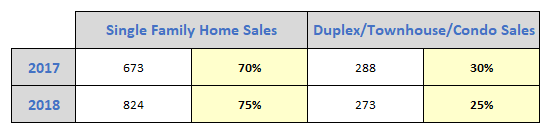

Home Sales Slow Slightly in September But Prices Still On The Rise |

|

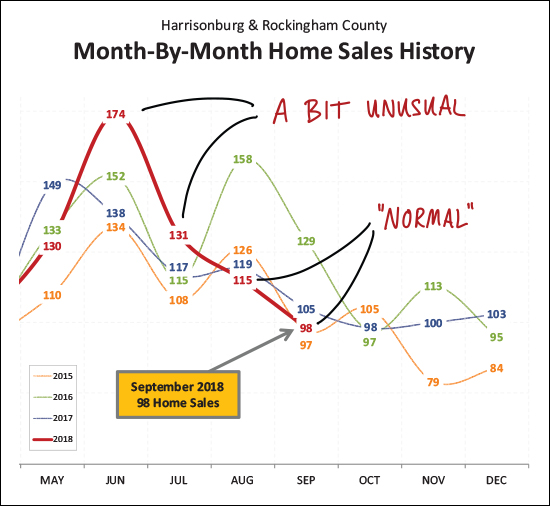

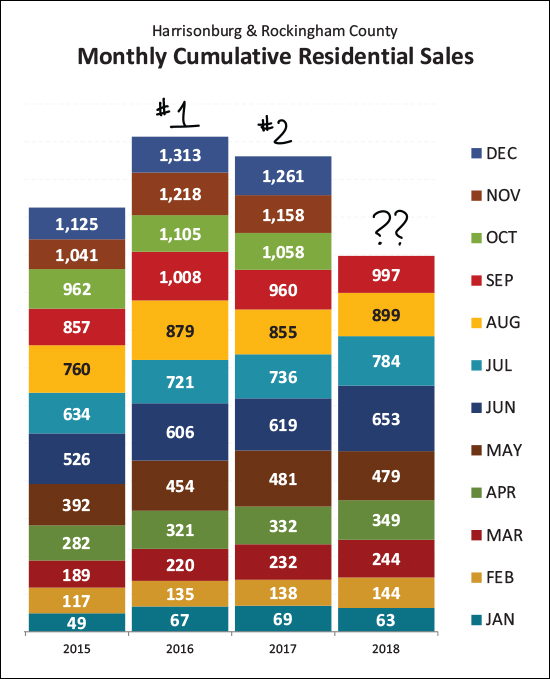

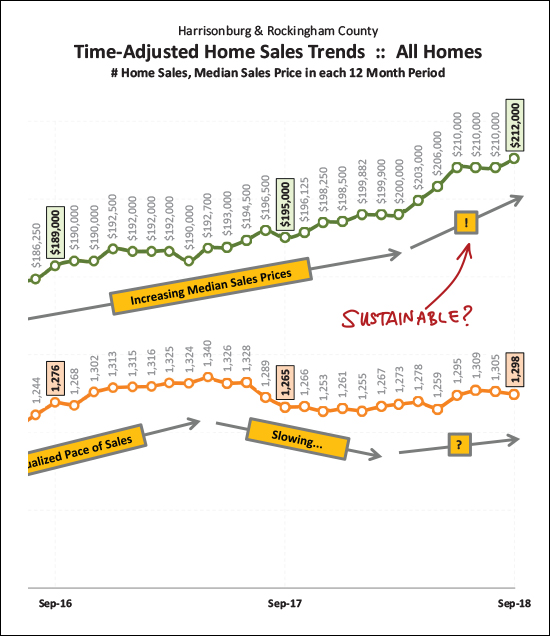

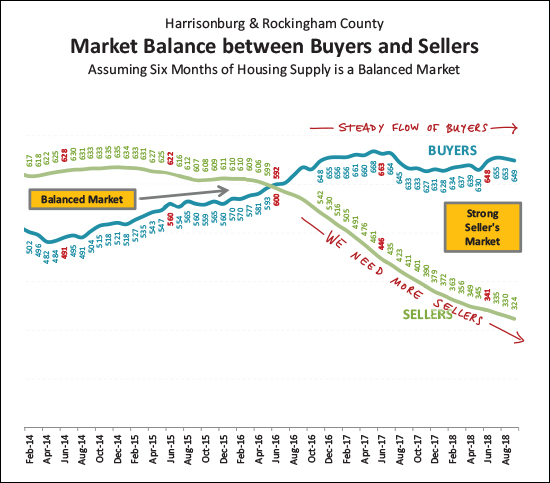

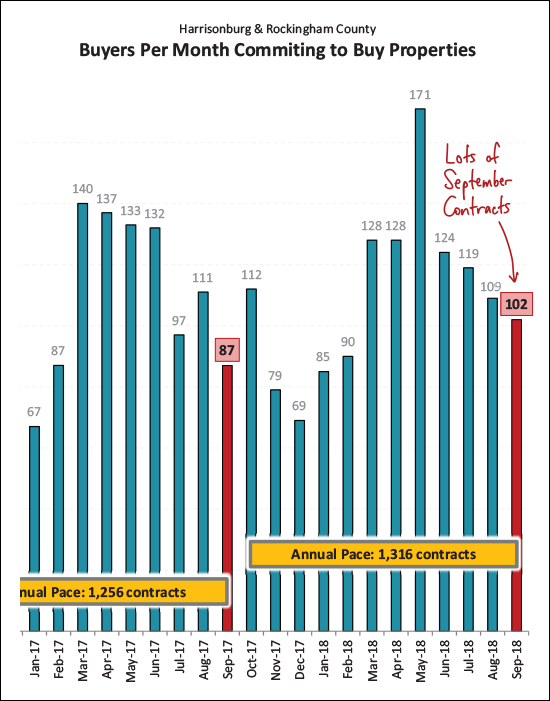

Before we dive into this month's market report, check out this featured home in Stone Spring Village by visiting 1520AppleRidgeCourt.com. Now, on to our local real estate market -- I just published my most recent monthly market report, and as usual, you can read on for an overview, download the full report as a PDF or tune in to my monthly video overview of our local housing market... VIDEO OVERVIEW: Click here to watch (and listen) to my overview of the market. Now, let's take a look at some the trends we're currently seeing in our local housing market...  As shown above...

Looking backwards a bit -- the crazy months of sales we saw in June and July of this year were a bit unusual -- way out of the norm. The slower months of sales seen in August and September were much more "normal" -- even if a bit slower than usual.  Two years ago was a rock star of a year of real estate sales. After only 1,125 home sales in 2015 -- the local market saw a huge increase to 1,313 home sales in 2016. And then -- 2017 -- darn, we slipped a bit. It's hard to say at this point where 2018 will fit into the mix. I am guessing we'll beat last year's 1,261 home sales -- but probably won't make it all the way up to 2016 levels.  So -- as shown above with a green line -- sales prices have sort of been escalating a bit lately. Less than a year ago we had just cleared a $200K median sales price -- and now we're way up to $212K. Hmmm -- doesn't seem sustainable. What gives? Read on.  If we dial it back a bit and just look at single family homes (not duplexes, condos, townhouses -- all of which are prime real estate investor targets) we see a much (!!) more modest increase in the median sales price. An increase from $225K to $229K over a one year period seems to be a much more reasonable increase in the local median sales price -- and one that seems like it could be sustainable. This calms my nerves a bit after having seen that sharp rise in the overall median sales price.  So -- how's the market, you might ask? Pretty balanced? Not at all! There are a steady flow of buyers in the local market -- and an ever smaller group of sellers. We desperately need some new sellers in the market -- preferably who aren't also buying -- which often will mean we need to see some new construction.  Looking ahead, we might see a bit of a pop in October home sales after all! September contracts were strong -- and markedly higher than last September. In fact, contracts over the past year (1316) were a good bit higher than the previous 12 months (1256). October sales figures might look better than expected!  And here is that inventory issue - visualized slightly differently. Today's buyers have 18% fewer choices as compared to a year ago -- and 39% fewer choices as compared to two years ago! What is a buyer to do these days? I'll pause there, for now. As usual, you can download the full report as a PDF, or tune in to my monthly video overview of our local housing market And a few tips for anyone thinking of buying or selling soon -- SELLERS -- even though it is a seller's market in many price ranges right now, you must still focus on price, condition and marketing. For further reading on buying or selling in this area, check out.... | |

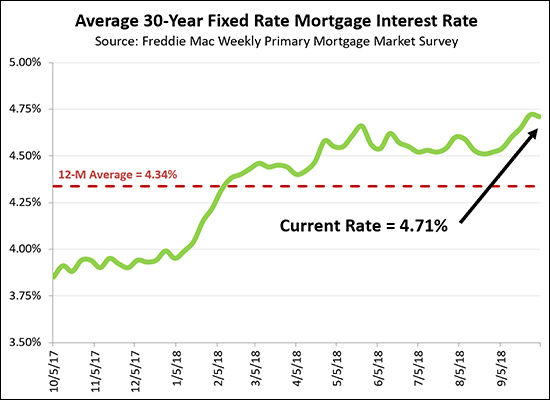

30 Year Fixed Mortgage Interest Rates Keep Rising |

|

Mortgage interest rates keep on rising. The question now seems to be whether the higher rates will take anyone out of the market to buy -- or will put a damper on rising home values / sales prices. Thus far, buyer activity has continued to be quite strong in 2018 despite these modest increases in interest rates. Interest rates have not quite risen a full percentage point over the past year.... 3.85% back in October 2017 4.71% today | |

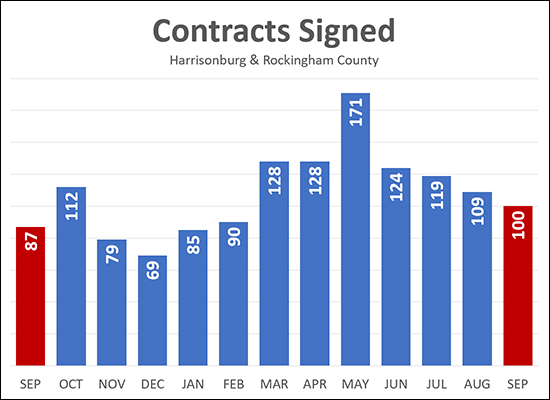

Early Indications Show Many Home Buyers Contracted in September |

|

Home buying activity slowed for the fourth straight month in September 2018 -- but -- it was 15% higher than it was last September! As shown above, 100 buyers signed contracts to buy homes in September 2018, a slight decline from 109 the previous month, but an increase over last September. If last year is any indication, we may see an uptick in buying activity in October before things then cool down between November and February. | |

The Local Housing Market Is Not Like An Outdoor Hose Spigot |

|

Generally speaking, folks don't use their outdoor hose spigots in the winter. I suppose you might use it from time to time, but it's just not as fun to wash your car in the driveway on most December days -- and your lush garden is not lush, and does not need watering. Oh, and if you did use your hose spigot, and left the hose attached, you'd potentially have serious problems when the water in the hose freezes, backs up into the spigot, maybe into the pipe, and something splits, cracks or bursts. So, once we get through Fall, most folks are turning off their hose spigots for the last time until Spring. But not so with the local housing marketing. Between March and August (Spring and Summer, as we'll call it) an average of 130 buyers signed contracts to buy houses each month. A pretty rapid pace of buyer activity. So, this winter, what should we expect? Will that supply of buyers be turned off like a hose spigot, and will the buyers slowly drip out at a rate of 13 buyers per month? Thus, 10% of the pace of buyer activity in the Spring and Summer? Nope! Looking at last Winter (December, January, February) there were an average of 81 buyers signing contracts per month! You read that correctly, only a 38% decline in buyer activity during the Winter months -- as compared to the Spring and Summer months. So, unlike your hose spigot, which will likely be barely used during the Winter -- the local housing market doesn't slow down, or cool down, or shut down, nearly as much. | |

Starting vs Finishing With A Price When Analyzing The Market Value Of Your Home |

|

It is always my recommendation that we finish with a price when we conduct a market analysis of your home -- but sometimes it can be helpful to work the other way around as well. FINISHING WITH A PRICE - With this approach we start with analyzing how your home compares to recently sold properties to determine its value. We are typically looking for homes that have sold in the past six months (or up to 12 months if needed) and are looking for homes that are in a similar location, with a similar structure (one-story, two-story, basement vs. not, etc.), of a similar age, and with similar finishes if possible. We then make adjustments to the sales price of those comparable properties to bring its attributes more in line with your home, and then the adjusted sales prices of those comparables will usually point to a potential market value (or value range) for your home. So, we start with your house, evaluate comparables, and finish with a price -- or market value -- at the end of the process. Sometimes we'll also then contextualize that potential value with currently active (or under contract) listings to see if they also support our theory on market value. STARTING WITH A PRICE - We might also start this process with a price, instead of finishing with a price. In this scenario, we're starting by saying that we think (or hope) that your home is worth $X and we evaluating (broadly, not narrowly) whether market data (both sold properties and active listings) can support that theory on market value. We might work through the process in this direction because the first method is not leaving us with a clear picture of value based on very few properties being similar to the house that you will sell. We might also start with a price if you have a price in mind for your house, and would only sell if you are able to obtain that price. Regardless of whether we are working through the market analysis to determine a price (finishing with price) or to try to affirm a price (starting with a price) it is important for us to have some candid conversations about market value before we put your house on the market. If we both have a clear understanding of market realities, then we will (hopefully) not be too terribly surprised by the feedback from the market once your house is listed for sale. | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings