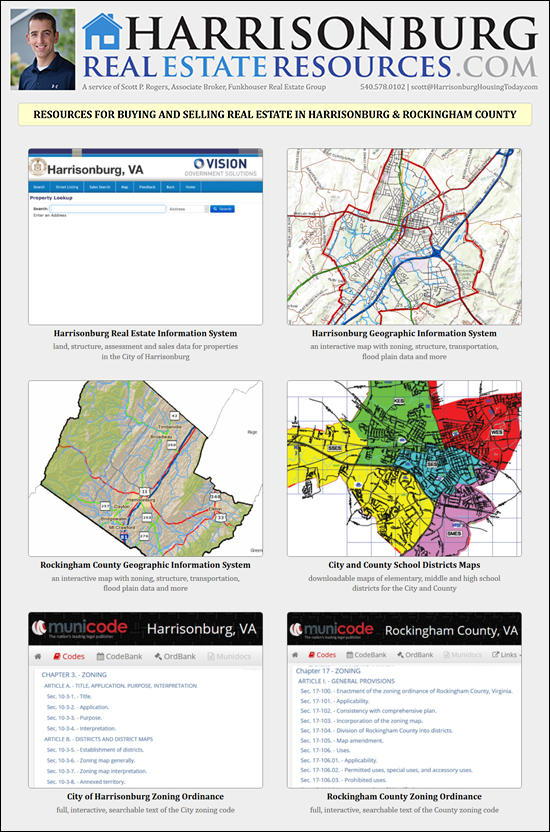

Pending Home Sales Down 7.5% |

|

The graph above shows the number of properties "under contract" at the end of the month for each month over the past three years. As you can see, at the end of November there were 160 properties under contract in Harrisonburg and Rockingham County -- down 7.5% from the 173 properties that were under contract at the same time one year ago. Of note, this past Spring (end of April, May) we reached a high point for this metric that we had not seen over the past few years. | |

Buying A Home Is, Unfortunately, Not As Simple As Buying Now With One Click |

|

Purchasing a home can be fun, exciting, thrilling, and fulfilling....but that very same process can also have its moments of being hard, frustrating, disappointing and overwhelming. In my role as a Buyer's Agent, I will be working with you through the entire home buying process to make it as educational and stress-free as possible. The very first step in this process is for us to discuss your needs, goals, dreams and desires. This may involve specifics such as the number of bedrooms and bathrooms, or may focus more on the layout of homes, the feel of a neighborhood, and the long term plans for your growing family. I will be focusing on listening well, and hearing what it is you are working to achieve with your home purchase – and then helping to identify the best housing options for accomplishing those goals. An important, parallel, part of starting the home buying process is to identify a target price range. This can best be determined through consultation with a reputable, local mortgage lender (just ask... I know who they are) but will involve more than just determining the highest priced home that they would allow you to purchase. It will be important to consider both your purchasing power, and your goals for how your housing costs will fit into your overall budget. You will also talk with your mortgage lender about how different loan programs might work better (or worse) for your situation. Once we have a shared understanding of what you are hoping to purchase, and we know what the price tag can and should look like, we can start to evaluate homes that are currently on the market. This will usually start online, perhaps through an exchange of emails, and saving some searches in your account on my web site. Then, you might choose to drive by some of the prospects before determining a list of homes to go view – or you may be ready to start seeing all of the homes on the list right away. As we view this first set of homes, we will learn a lot – about the opportunities in the market, and about your preferences. If we don't identify a home after looking at all of the homes on the market that seem to offer what you are looking for in a new home, we will either re-evaluate our criteria to expand our search, or we will wait to view new listings that come on the market. This extended home search process might take us weeks, or months, depending on the type of property you are hoping to purchase, and how often such a property becomes available. All along the way, I'll be following up on previous homes we have viewed to let you know if their prices have dropped, and will be letting you know of new opportunities as soon as those houses hit the market. Once we have identified the home you are hoping to purchase, we will prepare to make an offer. This will include researching similar home sales to guide our discussions of price, creating a negotiation strategy, and preparing and reviewing the pertinent contract documents. There is quite a bit of paperwork involved in making an offer on a home, and I want to make sure that you understand these contract documents and make sure that we have drafted them in a way to protect your best interests. Negotiating the final deal on the property you purchase may take a few hours, or a few days. We may go back and forth with the seller on price alone, or on many terms of the contract such as timing, contingencies, and more. Once we have a final agreement, all parties will sign and initial the final documents, and we will have a full ratified contract. Immediately following the ratification of the contract, we will need to schedule and perform a home inspection and radon inspection (assuming you are conducting both) to learn more about the property you are purchasing. If these inspections reveal new (detrimental) information about the property, we will have the opportunity to request that the seller make repairs to the property, which may result in a renegotiation on price. Typically, we are able to work through this second round of negotiations relatively quickly, so long as the seller is being realistic and rational given the new information about their property. Simultaneously with conducting these inspections, you will need to be starting the financing process to work towards obtaining full loan approval. This will start with signing your loan application and paying any applicable loan application or appraisal fees. Your lender will then be diligently working to further qualify you as a purchaser as well as the property via an appraisal. You will be providing many documents to your lender during this process as they work towards securing a loan for you to purchase the property. Within the first few weeks after your contract is in place, we will need to select service providers to coordinate the additional aspects of your home purchase. This will include a settlement agent or attorney who will conduct a title search of the property and prepare all documents for your settlement. You will also need to set up a new homeowners insurance policy on your new property, as well as schedule utility service to start in your name as of the settlement date. We'll now be just a few weeks before closing, and the final pre-settlement details will include reviewing the settlement statement (which shows all of the funds coming into and going out of the closing), conducting a final walk though of the property (to confirm the condition is as we expect it to be), and obtaining a cashier's check to bring the necessary funds to settlement. All of the details should be falling in place now, and if all goes well, we will be set for an on-time settlement. In nearly all real estate transactions (in this area) you will sign all of the loan and settlement documents at your real estate closing as well as receive the keys to your new property. The house will be your new home, and you can take possession and start moving in immediately after settlement. Later that day, the settlement agent will record the deed at the courthouse that officially transfers ownership of the property into your name. You are bound to have questions about the home buying process – before you begin, as we go, and even after settlement. I am here to answer all of those questions, or to guide you to the professional who can. There is plenty to learn about the home buying process, and I am here to help guide you through it and to help you make excellent decisions about your purchase of a home. Learn more about the home buying process at BuyingAHomeInHarrisonburg.com. | |

New Harrisonburg Real Estate Information System |

|

There's an all new Real Estate Information System for the City of Harrisonburg, and you can use it to find the proposed 2019 assessed value of properties in the City of Harrisonburg. Check it out here... As a reminder, you can find a list of many resource websites to assist you in considering the purchase or sale of real estate in Harrisonburg and Rockingham County by visiting... | |

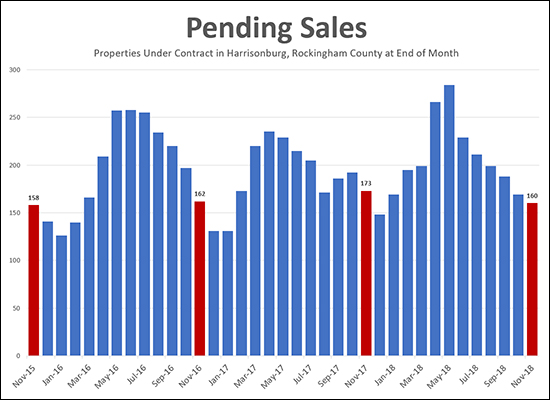

Very Few Homes For Sale in the City of Harrisonburg |

|

The number of homes for sale in the City of Harrisonburg keeps dropping. That's not to say that homes aren't selling -- a total of 423 homes have sold in the City of Harrisonburg during the first 11 months of the year -- putting us at a pace of 38 home sales per month. But the number of homes available to buyers continues to decline -- now down to 70 homes for sale. Here's a bit longer of a context....

If you're looking to buy a home in the City of Harrisonburg it might be difficult to find a home that is a perfect fit or you given a very limited supply of homes for sale. And when a home does come on the market that works for you, it is likely to sell quickly. | |

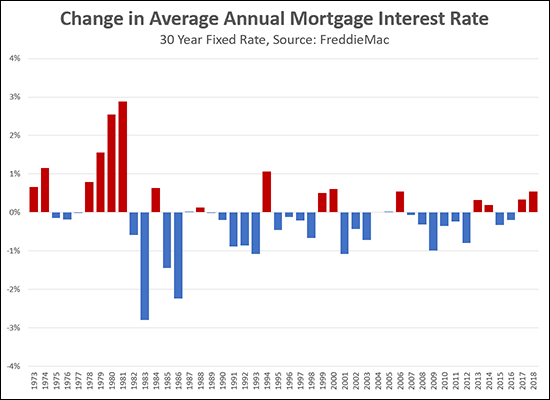

Some Perspective on Changes in Mortgage Interest Rates |

|

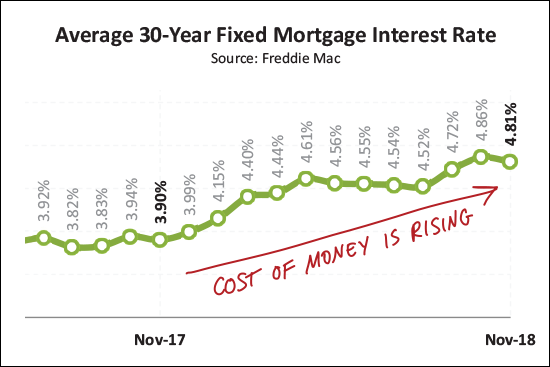

In some ways, my alarm bells are going off!

But yet -- it looks like the average rate for 2018 will only be 0.54% higher than in 2017 -- and the graph above puts that in what might be a somewhat more helpful context. The last red bar (all the way to the right) is an indication of how much the annual average rate will have increased between 2017 and 2018. Any red bar is an increase in the average annual rate. Any blue bar is a decrease in the average annual rate. As such -- the increases we have seen in 2017 and in 2018 are a far cry from the crazy increases seen in 1978, 1979, 1980 and 1981. And there have been several times in the past thirty years when there has been a year or two of increases of less than 1% in a year, that were then followed by decreases in subsequent years. So -- back to real rates -- you could get a mortgage with a rate less than 4% a year ago, and now it would be just under 5%. And it's possible that the rates will keep rising in 2019. But in the big picture:

| |

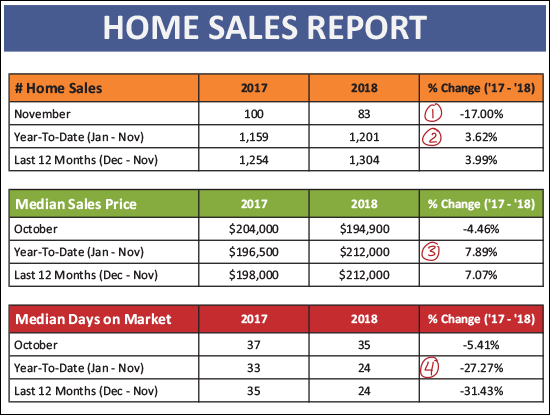

Despite Slower November, Home Sales Still Stronger Than Last Year |

|

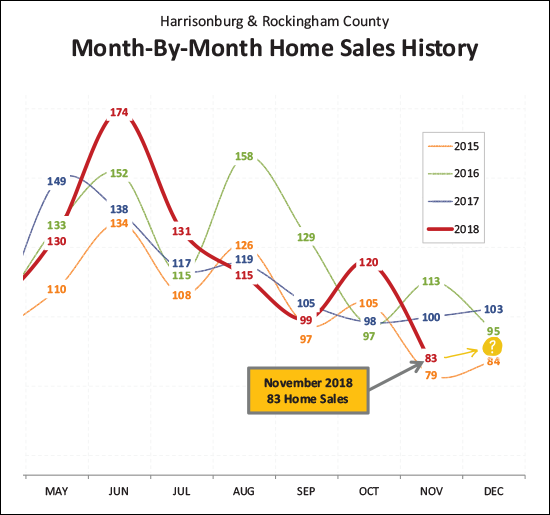

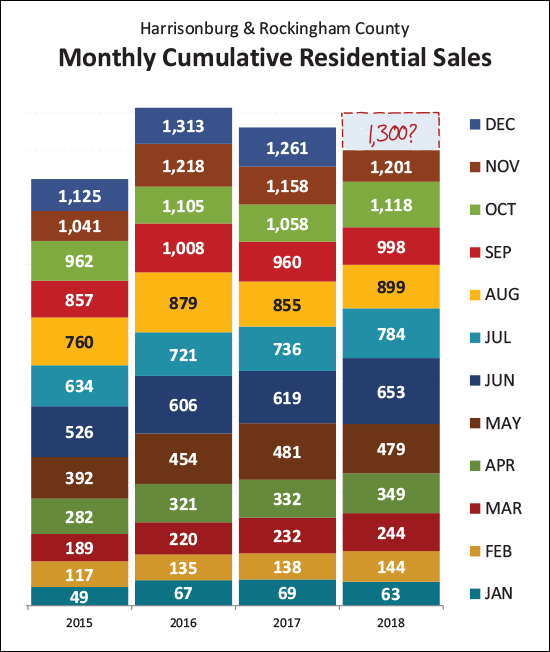

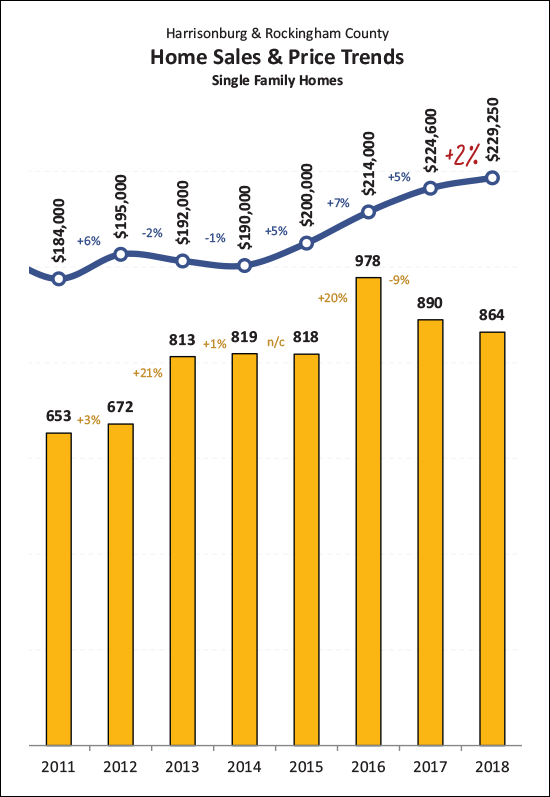

Before we dive into this month's market report, check out this featured home by visiting 819GreenbriarDrive.com. Now, on to our local real estate market -- I just published my most recent monthly market report, and as usual, you can read on for an overview, download the full report as a PDF or tune in to my monthly video overview of our local housing market... VIDEO OVERVIEW: Click here to watch (and listen) to my overview of the market. Now, let's take a look at some the trends we're currently seeing in our local housing market...  As we can see above...

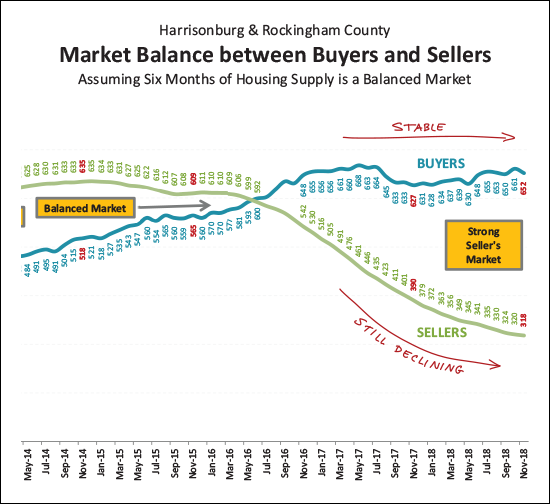

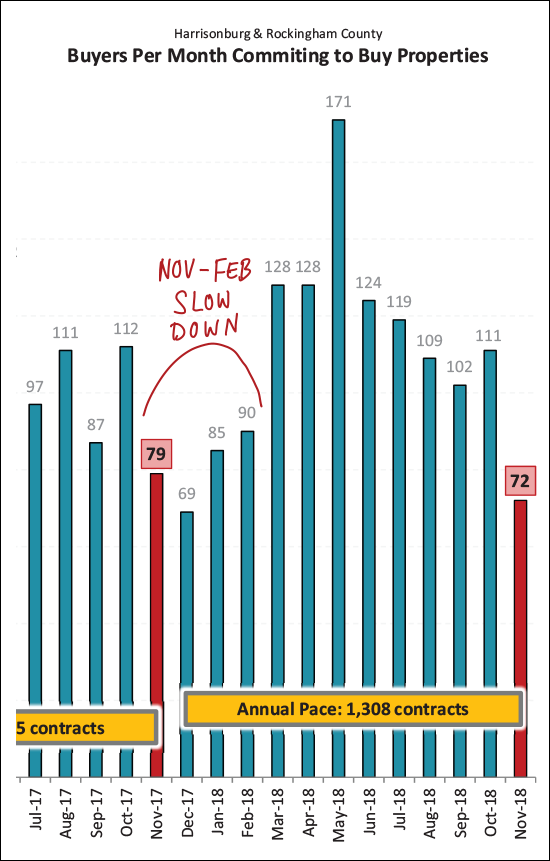

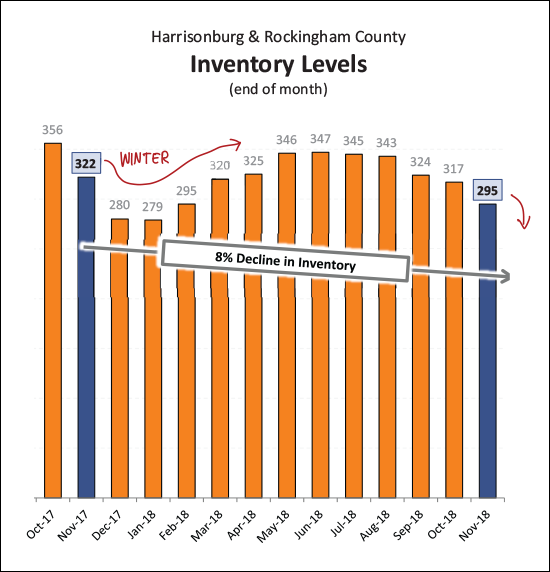

This has been a bit of an odd year, as shown above. We have seen quite a few months of new "highs" for monthly home sales. They aren't all shown above, but you can see that June, July and October were the highest such months in the past several years. But then you have months such as November -- where we fell to one of the lower such months of sales in recent years. So -- what about December? I'll guess we'll end up around 90 or so home sales -- maybe 95 -- or even 100?  This graph shows each month of home sales stacked upon the previous months -- and you can see that we're beating every recent year except 2016 when you look at home sales through November -- shown in a light brown color. It seems almost certain that we'll beat the 1,261 total we saw last year -- but will we get up to 1300 home sales this year? We'd need 99 home sales in December!  As I have mentioned in a few recent market reports -- the 7% (or so) increase that we're seeing in the median sales price for all residential sales might not mean that homes are selling for 7% more than they were last year. That 7% rise seems to be more a result of a greater number of (higher priced) single family homes selling in 2018 as compared to how many sold in 2017. Read more about this phenomenon here. That said, the graph above might give us a better idea of value trends -- where we see that the median sales price of single family homes has increased 2% over the past year.  It's a good time to be a seller right not -- and not as exciting of a time to be a buyer. As shown above, the supply of buyers is steady -- with right around 650 buyers buying in a six month period. But at the same time, the number of sellers (and their homes) in the marketplace keeps on declining -- giving those buyers fewer and fewer options from which to choose.  Hmmm -- 99 home sales in December might not be completely realistic after all. As shown above, only 72 buyers (and sellers) signed contracts in November 2018. This, combined with some lingering October contracts, means we're probably more likely to see 80 - 90 home sales in December. And -- for you current or near future sellers out there -- buyer activity is likely to stay a bit lower over the next few months. A strong surge of buyers is likely to return in March.  Well -- we dropped below 300 homes for sale again this month -- and we're likely to dip a bit lower as we move through December, January and February. Last year it took until March to rise above 300 homes for sale. So -- if buyers don't want to buy in the Winter, it seems that sellers also might not want to sell.  Unless you're paying cash -- it will cost you more (in your monthly housing payment) to buy a house now as compared to a year ago. The average mortgage interest rate on a 30 year mortgage has risen almost an entire percentage point (from 3.90% to 4.81%) over the past year. It ticked down slightly in November -- and hopefully we'll (somehow?!) stay below 5% as we roll into the new year. I'll pause there, for now. As usual, you can download the full report as a PDF, or tune in to my monthly video overview of our local housing market And a few tips for anyone thinking of buying or selling soon -- SELLERS -- even though it is a seller's market in many price ranges right now, you must still focus on price, condition and marketing. For further reading on buying or selling in this area, check out.... | |

JMU On Campus Headcount Likely To Exceed 22K in 2022 |

|

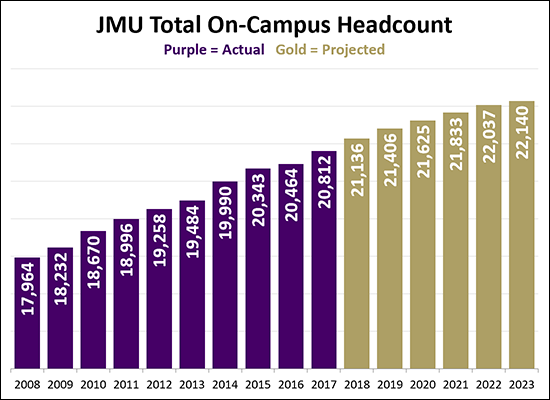

Based on enrollment projections approved by the State Council of High Education for Virginia, on campus enrollment is set to continue to increase in coming years....

| |

The Impact Of Higher Mortgage Interest Rates |

|

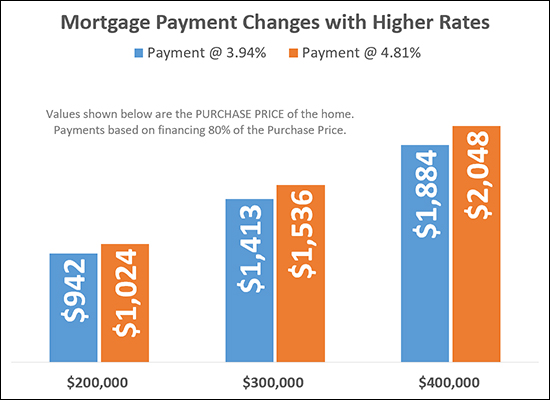

One year ago, the average 30-year fixed mortgage interest rate was 3.94%. Today, that same average rate is 4.81%. Does this rise in mortgage interest rates impact buyers? It sure does! A buyer purchasing a $200K home would pay $82/month more for their mortgage payment -- with the increased interest rate causing it to increase from $942/month to $1,024/month. A buyer purchasing a $300K home would pay $123/month more for their mortgage payment -- with the increased interest rate causing it to increase from $1,413/month to $1,536/month. A buyer purchasing a $400K home would pay $164/month more for their mortgage payment -- with the increased interest rate causing it to increase from $1,884/month to $2,048/month. Of note -- the estimated mortgage payments above include principal, interest, taxes and insurance -- and assume that the buyer is financing 80% of the purchase price. So.....

| |

Do Not Be Insulted By A Low Offer On Your Home |

|

Sellers are sometimes quite shocked, dismayed or disheartened to receive a low offer on their house, for example, an offer of $225K on a $275K listing. But it is important to remember that even that low offer really is a compliment!

If you have not yet had an offer on your house (that is listed at $275K) and you receive an offer of $225K, that doesn't necessarily mean your house is only worth $225K, nor does it necessarily mean that you should accept $225K or something close to it. It does, however, mean something quite exciting --- somebody wants to buy your house!!! Of course, negotiations won't always work out with low offers -- but recognize a low offer for what it is -- a buyer who wants to buy your house, and perhaps the first buyer who has declared as much through a written offer! If there is any way to put a deal together with those buyers, you ought to pursue it, as it's hard to know when the next buyer will work up the courage to tell you that they want to buy your house! | |

Should Your House Be Off The Market Over the Winter Months? |

|

In some ways, NO, you should NOT take your house off the market -- because inventory is lower than it has been for years and is not showing any signs of improving.

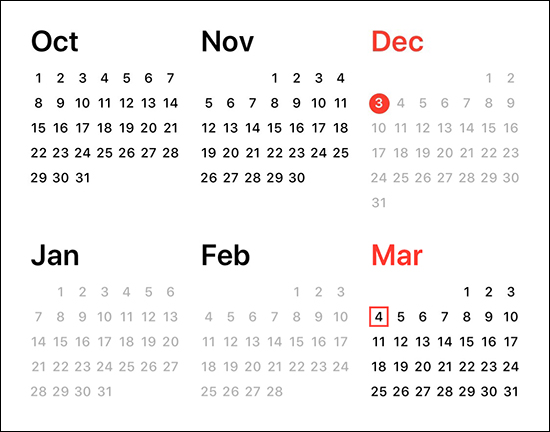

And yet, still, some folks will take their homes off the market for the winter. Our local MLS requires a house to be off the market for 90 days before the "Cumulative Days on Market" statistic resets. So, if you take your house off the market today, you could put it back on the market on March 4, 2018 and have that statistic reset. During these 90-ish days of being off the market, we will want to talk about price, condition and marketing....

| |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings