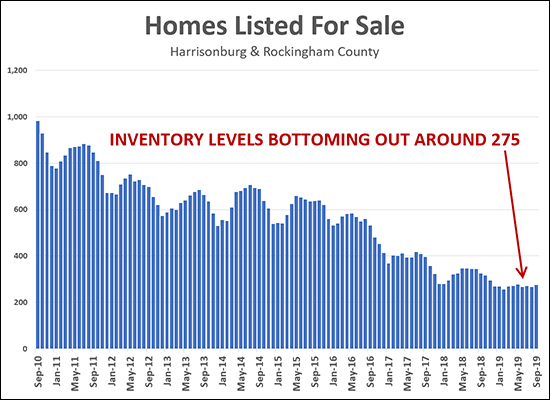

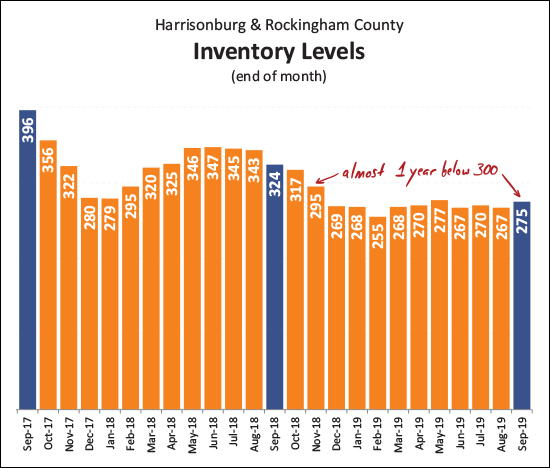

Inventory Levels Seem Unable To Drop Below 250 |

|

It's been the story for quite a few years now (at least 10 years, it seems) that inventory levels are dropping -- buyers have fewer and fewer homes from which to choose when they are looking to buy in Harrisonburg and Rockingham County. Here are how many homes have been on the market in October for the past 10 years...

So, it's certainly a more challenging time to be a buyer than anytime in the past 10 years -- but inventory levels seem to now be bottoming out around 275. Here's what the past six months have looked like...

So, over the next year, I wouldn't be surprised if we never dipped lower than 250 and we never rose above 300. Given these limited inventory levels, it is more important than ever that buyers in today's market are ready to be patient and then to ACT QUICKLY! :-) Buyers can make it a bit easier on themselves by knowing the market, knowing the process, knowing your buying power, and closely monitoring new listings! | |

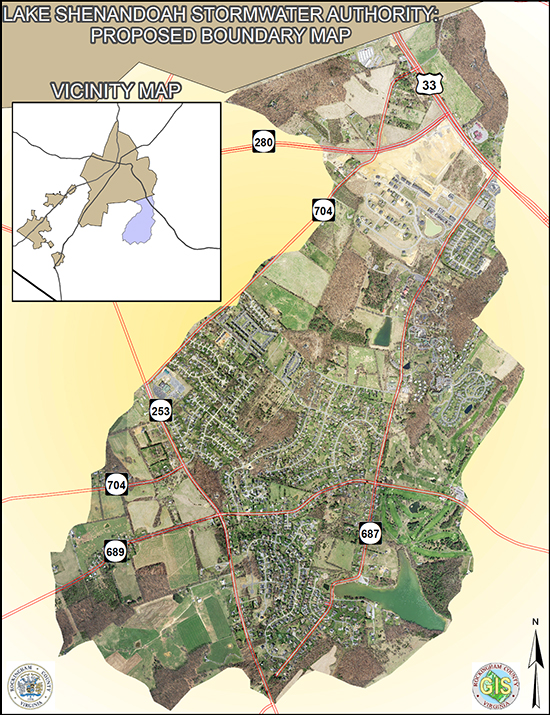

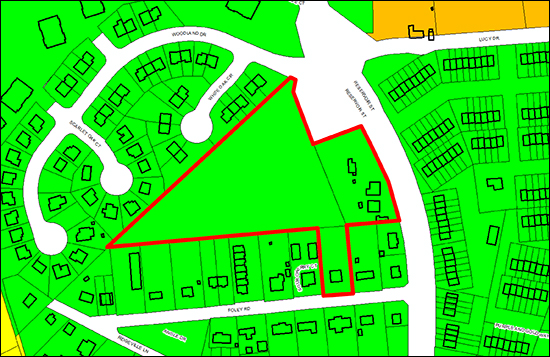

All The Areas That Will Pay A Bit Extra In Taxes To Help Manage Stormwater in The Lake Shenandoah Watershed |

|

download a high resolution PDF here In late August, the Rockingham County Board of Supervisors approved the creation of the Lake Shenandoah Stormwater Authority. The authority will work to manage stormwater and mitigate damage from that stormwater throughout the Lake Shenandoah Watershed. Read more via the DNR on 8/29/2019) here. The Authority will potentially spend around $3.2 million to improve the stormwater system by creating new detention facilities and increasing the capacity of ditches and pipes. Property owners in the area shown above will pay some additional taxes that will fund the work of this Stormwater Authority, though the Authority will also pursue grant funding for the needed infrastructure improvements. As shown on the map above, the Stormwater Control Authority will include all or part of the following areas:

| |

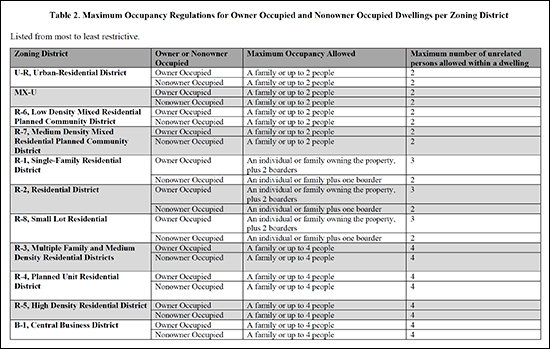

How Many Unrelated People Can Live In A Home In Harrisonburg |

|

It is a common misunderstanding that the zoning classifications can be interpreted as follows...

In fact, it doesn't work that way at all. So, how can we understand the limits of how many unrelated people can live in a property based on the zoning of that property? Below is a table of very helpful data -- tucked within the resource materials for the work session scheduled for tomorrow related to Short Term Rentals in the City of Harrisonburg. The same data can also be found, organized slightly differently, on the City's website here. download a PDF that you can actually read, here This table outlines how many unrelated people can live in a home (detached home, duplex, townhouse, condo, etc.) in Harrisonburg based on the zoning of that property. Of note, there can be exceptions to these generalities -- based on a special use permit for a property, or if a property use is "grandfathered in" based on that use existing since before zoning regulations limited the use. But this is a very helpful starting point for understanding how many unrelated people can live in a property in the City based on the zoning of that property. | |

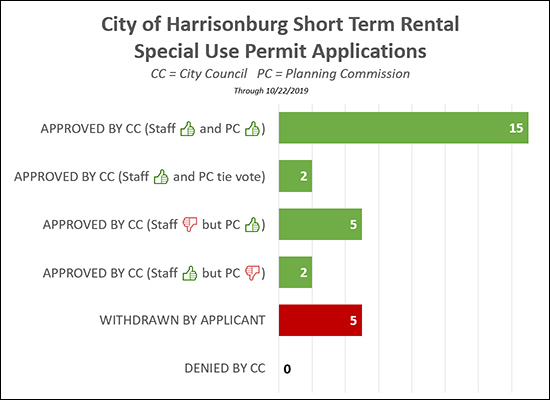

83% of Harrisonburg Short Term Rental Special Use Permit Applications Approved |

|

The Planning Commission for the City of Harrisonburg will hold a work session on October 29, 2019 at 2:00 PM to discuss Short Term Rental regulations. You'll find the agenda here and one of the attachments (this one) provides a concise overview of the status of each property for which a property owner has applied for a special use permit to use their property as a Short Term Rental. There are a few properties still working their way through the process, but of the 33 properties listed on the summary sheet, 29 have had an outcome of some sort and I illustrated those outcomes on the graph above. A few observations...

It will be interesting to see if there are any adjustments to the regulations or process for applying and reviewing those applications. Stay tuned -- or attend the work session! | |

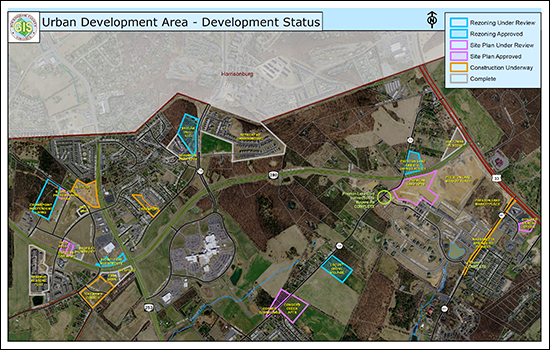

What Is Being Developed Where in the Rockingham County Urban Development Area as of October 2019 |

|

Rockingham County publishes this map each month with the status of developments within the Urban Development Area. Download a PDF of the Oct 2019 version here. Much, but maybe not all, of the stated developments are likely on your radar... Likely or Possibly Coming Soon at Stoneport:

Likely or Possibly Coming Soon on Boyers Road:

You'll find a few other odds and ends as well. Download a copy (here) and see what is under development or proposed to be developed. | |

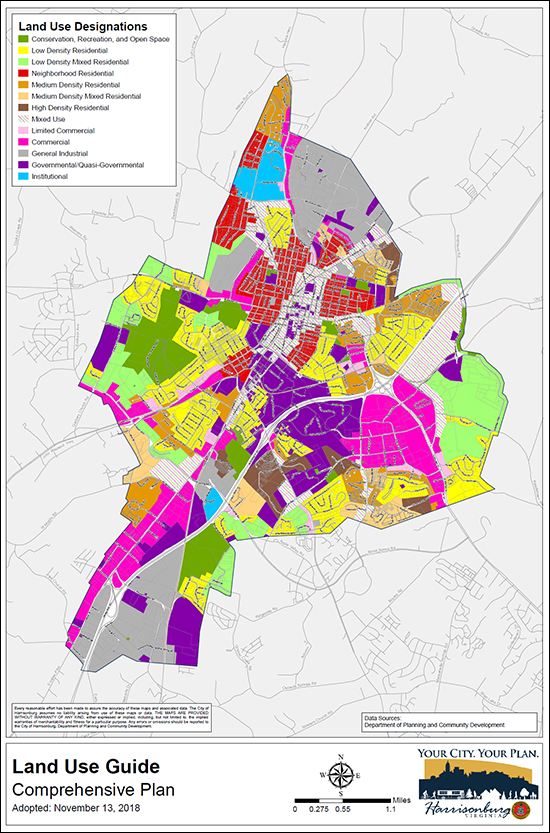

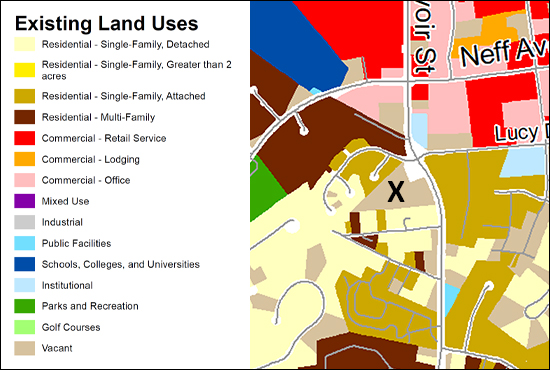

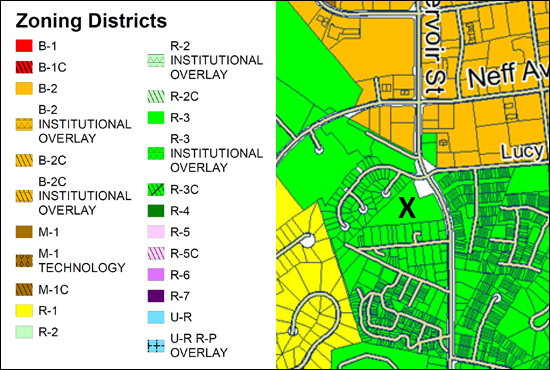

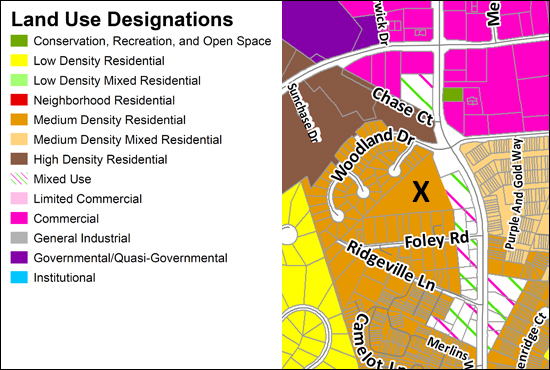

How Should Vacant Land Be Developed In The City of Harrisonburg |

|

There are still vacant parcels of land in the City of Harrisonburg that might be developed in the future. Should all of these vacant parcels become student housing? Should they all be for detached homes? Should they all be for retail or professional office space? Clearly, no. As a part of the comprehensive planning process, the City of Harrisonburg develops a Land Use Guide that outlines how land in the City should be used. The Comprehensive Plan is developed over multiple years with many stakeholders, and is intended to be a vision for what the City would like to be in the future. As such, the Plan (and the Land Use Guide) are not regulatory documents that mandate particular uses of land -- but they are a guide that City staff and elected officials use as a reference point when making decisions. Read the Comprehensive Plan here. Download the Nov 13, 2018 version of the Land Use Guide here. Case in point -- the six-story mixed-use building approved last night on 6.6 acres on Reservoir Street. Let's dive into this as an example. As you'll see, the existing land use of the parcel is described as "vacant"...  And when we look at the current zoning, we find that it is zoned R-3, as with most of the surrounding property. This zoning classification allows for single family homes, duplexes or townhouses.  But things get interesting when we look at the Land Use Guide...  Here (above) you'll see that the Land Use Guide recommends that the front of the property be used for Mixed Use and the back of the property be used for Medium Density Residential. You'll see quite a few parcels along Reservoir Street with a Mixed Use designation, likely because Reservoir Street has become more and more of a thoroughfare for the City, with lots of townhouses (Avalon Woods, Breckenridge Court) and student housing (Charleston Townes) in that vicinity. Thus, the City (staff, elected officials, citizens who participated in the comprehensive planning process) thought that it would be reasonable (and best) for those parcels fronting on Reservoir Street to be used for mixed use development. In this particular example, though, things get tricky when considering the intended use and the proposed use from multiple perspectives. The property owner and intended developer of the property proposed that the entire property be used for a mixed use development with retail, office and apartments. This makes sense to them, I suppose, because the front of the property is supposed to be used for mixed use development. Many of the neighboring property owners would seemingly not like to see a mixed use development take place on this site. I suppose I can't ascribe anything particular to how those neighboring property owners would like to see the property developed -- because the main focus of their recent comments have been about how they do not want it to be developed. They don't think that a mixed use development should be approved for this entire parcel. This makes sense to them, I suppose, because the back portion (majority) of the property is intended to be used for a medium density residential development, and not a mixed use development. So, as you can see, the Land Use Guide can be a helpful tool for property owners and developers to use when they are considering ideas for developing land in the City -- though sometimes what "should be done" per the Comprehensive Plan and Land Use Guide is not entirely clear depending on the particular property. Last night, City Council approved the requests from the property owner to rezone the property and allow for the mixed use development to move forward. Read more about the nuances of that decision and discussion here... Daily News Record: City OKs Mixed-Use High-Rise The Harrisonburg Citizen: Council narrowly approves mixed-use development in Reservoir St. neighborhood | |

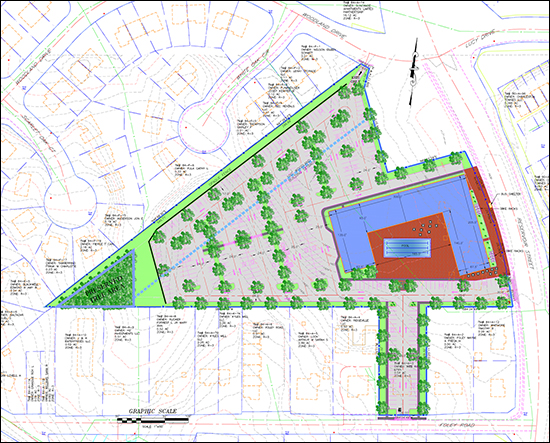

Six Story Mixed Use Building Proposed on 6.6 Acres on Reservoir Street |

|

view as PDF Two parcels totaling 6.6 acres might soon be home to six-story mixed use building to include:

Here's a map more clearly showing the surrounding properties... City staff recommends approving the development, noting that...

At the Planning Commission meeting, owners of some of the neighboring properties expressed concerns...

The Planning Commission recommended denial of three of the four requests from the developer. They recommended that City Council not rezone the property, not allow more than 12 units in a building on the property and not allow the building to be more than four stories or 52 feet -- though they did recommend that City allow non-residential uses in a building with R-5 zoning, though that would require the property to be zoned R-5. So -- City staff supports the proposed development and the Planning Commission does not. Next up -- City Council! When City Council met earlier this month they ended up holding off on a vote as to whether to allow for this development, since one of the members of City Council (George Hirschmann) was not present. They will meet today to review the requests again and to potentially vote on whether to approve them. | |

Your Home Is Not Likely Worth The Purchase Price Plus The Cost Of Your Home Improvements |

|

This math doesn't, generally, lead to an accurate understanding of market value -- but sometimes it is how homeowners start to think about market value... $250,000 - how much I paid for the house last year $10,000 - cost of my kitchen remodel $8,000 - cost of replacing my roof $4,000 - cost of replacing the carpet in all bedrooms $2,000 - painting all interior walls $3,000 - landscaping updates $2,000 - replacing some of the kitchen appliances -------------------------------------------------------------------------------- $279,000 - the new value of my home this year Is this home (as described above) now worth $279K? Maybe -- but if so, it is not likely a direct result of only the $29K of improvements -- but perhaps market improvements as well. Basically, the cost of most home improvements do not directly increase the value of your home by the amount you spent to make the improvement. If a home with an older kitchen is worth $250K -- and you spend $10K on a new kitchen -- your home might be worth $255K or $257K -- but not necessarily $260K. The same goes for almost all improvements you might make to your home - and in some ways, the less someone thinks about a home improvement on a daily basis, the less impact it is likely to have on value. If you owned a $250K house with an older but not leaky roof yesterday, and you spend $10K on a new roof today, your home is not likely to be worth $260K tomorrow. So, what then, does this mean for homeowners?

Thinking about making a home improvement but not sure if you should move forward with it based on how long long you might own the home? Feel free to touch base with me to discuss the decision. | |

This House Looks Good Online, But...Argh...Not Again!? |

|

If you're looking to buy a house right now, this might be a familiar experience... A new listing hits the market that seems to fit ALL of your needs...

Then, we go to view the house, and you discover that...

So, what is a buyer to do? Roll their eyes and say "not again!?!?!"? Trust nothing that they see online? Be highly skeptical of the merits of any new listing? Well, sure, those are probably reasonable responses - but in this low inventory environment, a buyer must also keep on exploring each new listing, as doubtful as they may be that it will actually meet their needs when viewed in person. You see, it is a seller's agent's job to present a house as positively as possible -- which can sometimes present a very different house online as compared to what will be understood when viewing the house in person. So -- despite your possible doubts, go ahead and rush out to that new listing that seems to meet all of your needs -- and hopefully you'll be pleasantly surprised! | |

Do Solar Panels Affect Home Values in Harrisonburg? |

|

So, you're thinking of adding solar panels to your house? You might wonder if this will increase the value of your home -- or make it easier for your house to sell -- or make it more difficult for your house to sell. All good questions. I don't think there is one right answer. Here are some of my thoughts...

So -- if you're installing solar panels with the thought that you'll sell your home in the next year or two, it might not be advisable to do so. After all, you'd likely be passing on most of the cost savings over time to the next owner without the ability to cash in on that from a significantly higher sales price. If you're installing solar panels and you plan to stay in the home for a while, but want to be sure that you'll be OK selling the home in the future, I suspect you'll be just fine, and will likely sell your home for more than if it did not have solar panels. Ironically, one of the reasons that I can't provide much guidance on how solar panels affect home values in our local market is because there aren't many homes with solar panels that sell -- likely because most people who install solar panels plan to stay a while, and thus, don't sell... | |

Focus On What You Can Control When Making Sense Of Buyer Feedback |

|

As a home seller, you will face rejection left and right -- many prospective buyers will come view your house and most of them will decide not to buy it. But how, as a seller, do you make sense of that feedback? I often hear the following types of feedback after a showing:

This type of feedback (size, location, floor plan) is difficult to do much with as a seller. You likely aren't going to build an addition to your house, nor will you physically move the house, nor will you reconfigure the floor plan. Sometimes the feedback is just a mild objection to be overcome -- did you realize that the unfinished bonus room could be finished quite inexpensively (size) and that the new South East connector will make your commute quite short (location)? Oftentimes, however, if you receive feedback about size, location or floor plan there isn't much you can do about it as a seller. I also, however, will hear the following types of feedback after a showing:

This type of feedback (price, condition, marketing) is completely in your control as a seller. Many buyers will not make an offer if they think your list price is too far from reality -- adjusting your pricing may be just what you need to either generate more showings, or have a chance of the showings turning into offers. I almost included AGE as a factor outside of a seller's control, but it's much more about condition -- how well has a property been maintained, and is it in top showing shape so that buyers don't feel overwhelmed by short-term cosmetic updates and long-term maintenance needs? Finally, if a house has not been marketed thoroughly and effectively, it will likely have a much longer "days on market" than other properties, worrying buyers that perhaps they shouldn't buy the home because nobody else has in the last ten months. Read more about, think more about, and learn more about selling your house at SellingAHomeInHarrisonburg.com. | |

Home Sales, Prices Continue To Rise in Harrisonburg, Rockingham County |

|

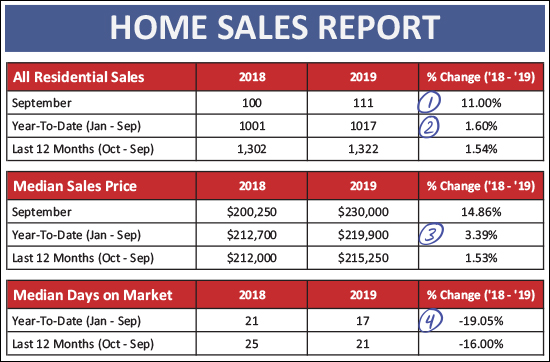

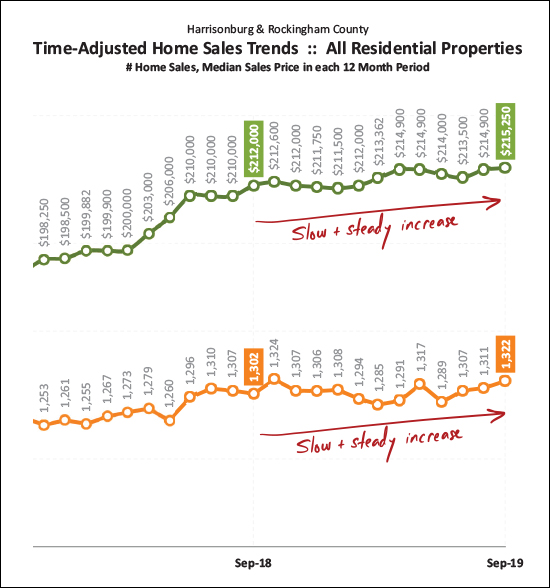

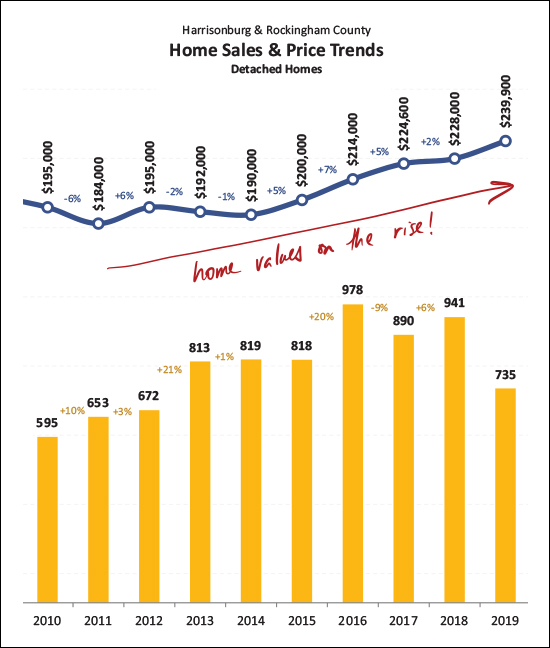

Autumn is here! Leaves are falling. Temperatures are falling. Home sales are not -- and prices are not! So, brew yourself a cup of coffee or tea, and let's take a look at some market trends for our local housing market... But first -- find out more about the new homes (rendering above) being built in McGaheysville by visiting IslandFordEstates.com. Now, onto the data, though you can skip to the full PDF report here.  September was another solid month of home sales in Harrisonburg and Rockingham County. As shown above...

Breaking things down between detached homes (single family homes) and attached homes (duplexes, townhouses, condos) we see some trends that have been consistent throughout the year...

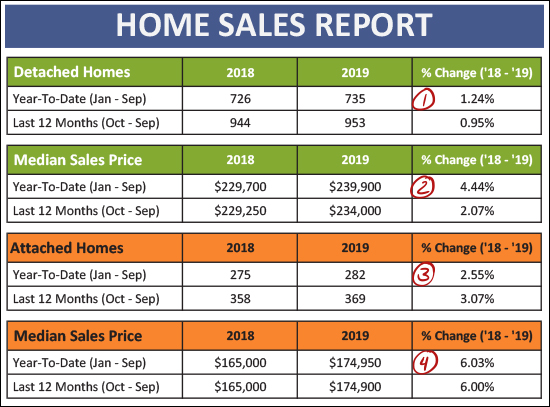

And let's look a bit closer at the month to month trajectory...  A few things stand out above...

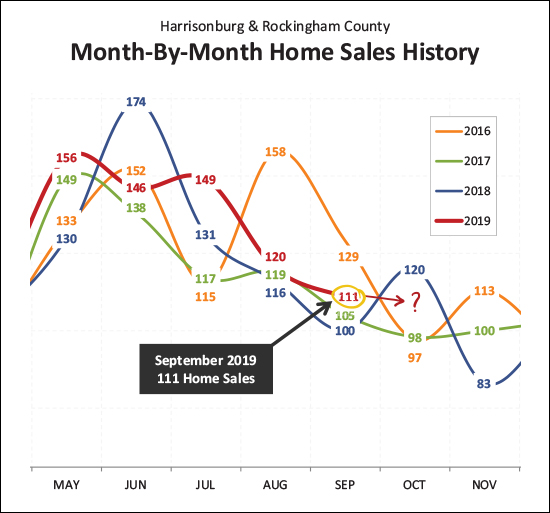

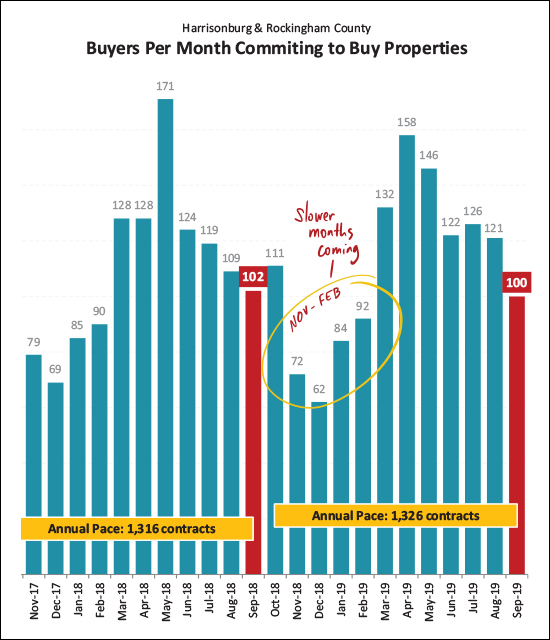

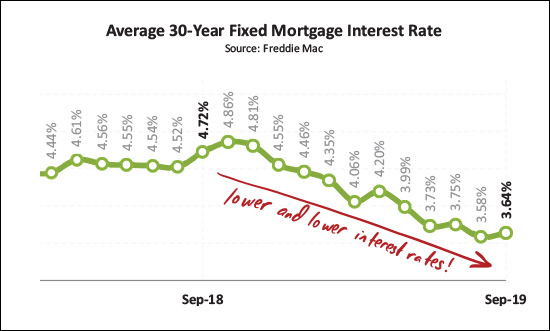

Looking afresh at how this year stacks up to prior years...  This has been the fastest (though not by a huge amount) start to the year that we've seen in a while. The 1,017 home sales through the first three quarters of the year surpasses sales seen during the same timeframe in each of the prior four years. So, it seems we may see another year of 1,300+ home sales in our area.  Zooming out -- looking at a rolling twelve months of market data -- we find a slow and steady increase in sales prices over the past year, and a slow and steady increase in the pace of home sales. All indications are that this could / might / should continue on into the remainder of 2019 and potentially 2020.  Taking one more look (above) at value trends we see that the median sales price of detached homes was a190K five years ago -- and has risen to $240K today. That's a healthy increase in home values, though with annual increases of 2% to 7%, it doesn't seem that the overall increases are as unsustainable as they were during the 2003-2007 market boom.  This (October) could be the last strong month of contract activity for a while. Above you'll note that contract signing slowed quite a bit between November and February -- and I expect we'll see something similar this year. The 100 contracts signed in September 2019 was on pace with the 102 seen last September.  The new norm seems to be fewer than 300 homes on the market at any given time. Over the past 11 months there have always been fewer than 300 homes for sale -- though no fewer than 255. This is a far cry from where inventory levels were a few years ago, but perhaps this is where we'll be staying for a while. Buyers don't have many options at any given time, and yet, we're on track for a record setting year of home sales.  If buyers are sad about declines in inventory levels, they certainly aren't sad about declining interest rates! A year ago, the average 30-year interest rate was 4.72% and now it's down over a full percentage to 3.64%. This certainly makes it an affordable time to lock in a housing payment. A few closing thoughts...

| |

New Duplexes Being Built in McGaheysville, VA |

|

Welcome to Island Ford Estates in McGaheysville, VA! The same builder who brought you The Glen at Cross Keys is now building a very similar floor plan just a few minutes further East in McGaheysville... The site is being prepared for these duplexes -- and wow -- what amazing mountain views! Island Ford Estates duplexes offer an open floor plan on the main level which includes a kitchen, dining area, living room, master bedroom, office or sitting room and laundry room. Enjoy spectacular mountain views and a cul-de-sac location in these thoughtfully designed homes. These homes feature 9 foot ceilings in many areas, light-filled living areas, luxury vinyl plan flooring, upscale cabinetry, granite countertops and many options and upgrades. Visit IslandFordEstates.com to find floor plans, a site plan, standard features, a vicinity map and more! | |

Spend How Much You Want To Spend On A Home, Not Necessarily How Much You Can |

|

Most folks who buy a home this year will not be paying cash. An important early stage of the home buying process is to talk to a lender to become pre-approved for a mortgage. As you meet with a lender, remember that there is often a difference between:

If you are looking for a qualified mortgage professional, shoot me an email (scott@hhtdy.com) and I can give you some recommendations. As you are navigating the home financing process, I am happy to help you understand the information you are receiving and the decisions you are being asked to make. There are a variety of loan programs that can likely work well for your situation, but we'll want to make sure you are aware of all of your options. Learn more about the home buying process at BuyingAHomeInHarrisonburg.com. | |

Is October Too Late In The Year To List Your Home For Sale? |

|

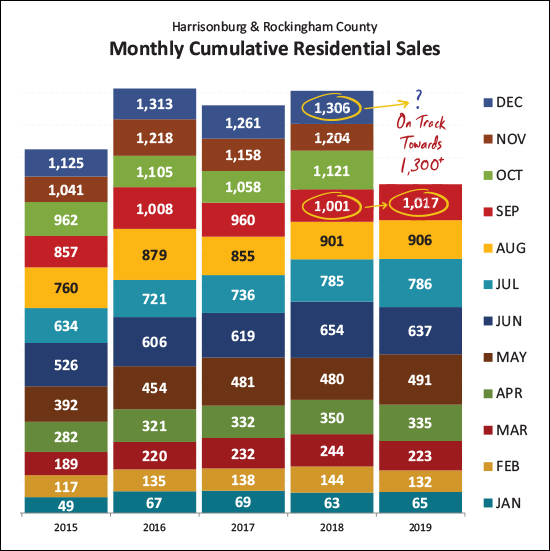

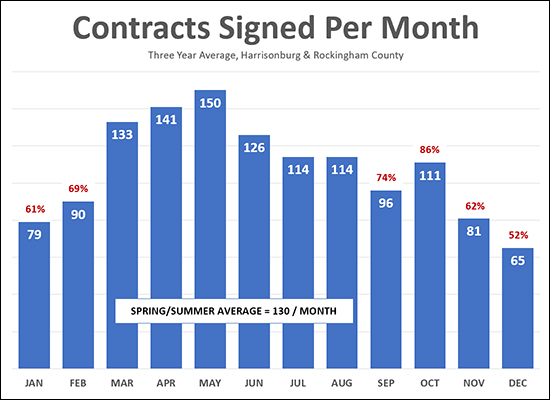

I believe this question is best answered by evaluating when buyers make an actual buying decision -- which is when they sign a contract. The data above shows when buyers sign contracts -- calculated by averaging data from the three most recent years. As can be seen, the busiest buying season is March through August when an average of 130 buyers per month make a buying decision. The remaining six months of the year (September through February) show anywhere between 52% and 86% as many buyers as the average of 130 per month seen in the busiest six months of the year. So -- listing your home in October is not at all a bad idea based on this data! As shown above, the it's likely the highest month of buyer activity that we'll see until we get to next March. Even late October can work, as we're likely to see 62% as many buyers signing contracts in November as compared to the average busy month. That said, in the following month (December) we're likely to only see about half as many buyers as compared to the average month. So -- looking to sell before next Spring? Now is the time! | |

Think Twice Before Rounding Up Your List Price |

|

Sometimes it is tempting for a seller to want to round up their list price. The seller says (or thinks)... "We think the house is worth $240K? And you're saying we should list it for $245K or $249K? I'm optimistic -- I think someone is going to be willing to pay $250K, so let's list it for $260K! A buyer can always make an offer!" That's all well and fine and good -- and somewhat logical -- unless every buyer that comes to see the house in the first three weeks really thinks it is worth $240K. Then, when leaving the house priced at $260K, if they are willing to pay $240K, they are likely thinking they'd need to offer $220K in order to negotiate you down to the value of $240K. And they almost certainly won't make the offer. If a house priced at $260K has been on the market for a few days, most buyers aren't going to make an offer of $220K. They might think it is a waste of their time. They might not want to insult the seller. Regardless of the reason, you are not likely to have $220K offers on a $260K listing within the first few weeks. Thus, the buyer who excitedly came to see your $260K house, and then concluded that it is probably worth $240K (where we started this conversation) is likely to conclude that they should just wait a month or so and see if you eventually reduce the price to $250K -- and then they might consider an offer. But by the time you reduce the price to $250K, you are bound to get significantly less buyer/market attention with that price reduction since it is no longer a new listing. And some of the originally interested buyers will have found something else to buy. And there will be much less urgency for any buyer to make a decision about an offer. So -- beware of rounding up on your list price too far above what we have concluded is your home's value in the current market. It's easy to talk yourself into it -- and it's likely you'll regret it later. | |

Should You List Your Rental Property For Sale For One Month Between Tenants? |

|

Depending on your short and long term financial goals - yes, it may be an excellent idea in the current market to do just that - list your rental property for sale for one month between tenants... In a recent conversation with the owner of a rental property, they were reflecting on the fact that after a tenant recently vacated their rental property (a townhouse) they were making quite a few updates and improvements to the townhouse based on some aging components and finishes in the property. They realized that the townhouse would be in better shape than it had been for years -- and that the condition would likely start to deteriorate (even if just a bit) as soon as they moved tenants back in. So, they wondered whether they should go ahead and just sell the townhouse instead of renting it again -- since it would be in great shape. But they lamented the fact that they'd need to keep it off the rental market for several months to see if it would sell at a price that would suit their financial goals - in other words, a sales price whereby it would make more sense for them to sell it than to continue to rent it. Here are a few thoughts I shared with this owner of an investment property...

So - here's an idea, if you own an investment property and you are about to have a tenant move out and you are about to make some improvements to the townhouse... Move the tenant out. Make the improvements. List the townhouse for sale for one month at a price for which you'd be happy to sell instead of continuing to rent the property -- so long as that value is generally in line with recent sales prices for similar townhouses. With this concept you don't have to commit to listing the property for six months, missing out on rental income, etc. -- but you can quickly determine if you could sell the townhouse while it is at its peak (from a condition perspective) at a price that would make it worthwhile for you to do so. OK - that was a lot. I'd be happy to talk it all through with you as well - in person, by email, by phone, etc. If you own a rental property and *might* want to sell it soon - be in touch (scott@hhtdy.com or 540-578-0102) and let's talk strategy... | |

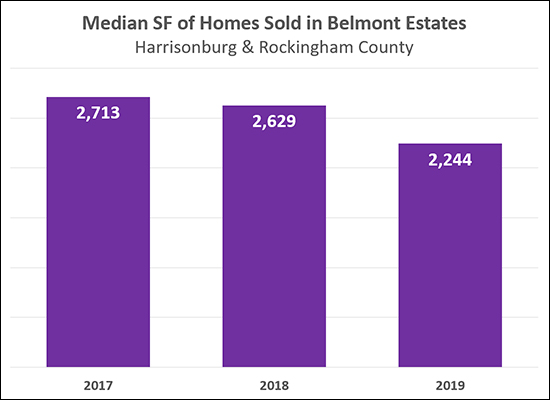

No, Home Values Are Not Falling In Belmont Estates |

|

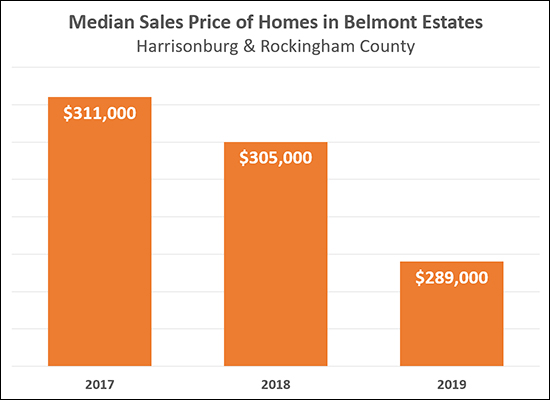

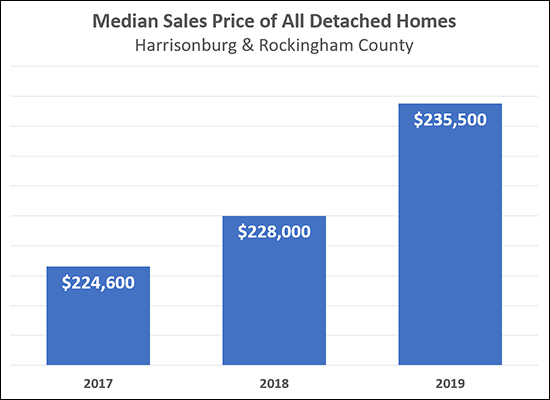

This post could also be called "The Dangers of Micro Market Analysis" as you'll discover... The graph above shows that the median sales price of homes in Belmont Estates has been falling over the past few years -- from $311K down to $305K and now down to $289K. How could this be!? After all, aren't home values generally going up right now?  Yes, in fact, home values are going up right now. Above you'll see that the median sales price of all homes in Harrisonburg and Rockingham County has risen from $224,600 in 2017 to $228,000 last year to $235,500 in 2019. So, if home values are going up in our overall market area, why is the median sales price going down in Belmont Estates? Do folks just not want to live there any longer? I would suggest that the decline in the median sales price in Belmont Estates is not a result of home values falling, but rather, a result of which specific homes happen to have sold in Belmont Estates over the past three years. We can see this when we look at the size of the homes that sold each year...  As you can see, smaller homes have sold in Belmont Estates as we moved from 2017 to 2018 to 2019. So -- either homes in Belmont Estates are shrinking (ha ha - just kidding) or the median sales price appears to have declined over the past two years because smaller and smaller homes have happened to have sold each year. And thus, this is the danger of analyzing a micro market -- a small amount of data points might lead you to incorrect conclusions. | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings