Archive for February 2020

Should Buyers In A Low Inventory Market Consider the Purchase of Foreclosures? |

|

With some regularity, I am asked by potential purchasers how they would go about buying a foreclosure. First, here is a list of upcoming foreclosure sales, but more importantly, below is a description of a few ways to buy what you might be thinking of as a foreclosure.

SHORT SALES: While this does not happen as frequently in the current market, sometimes homeowners must sell their home, but market conditions won't allow them to sell it at a high enough price to be able to pay off their mortgage(s). In this example, a homeowner might have a $250,000 mortgage balance but can only sell the property for $230,000. As a prospective buyer, it is sometimes possible to purchase this type of a property through a process called a "short sale." In such an arrangement, the homeowner petitions their lender to accept less than the full payoff of the mortgage and in return to still release the deed of trust so that ownership of the property can be transferred over to you, the new owner. This can benefit the lender, as they skip the time delays and cost of the foreclosure process. This can also benefit the homeowner, as a short sale will have a slightly lesser negative impact on their credit as compared to a foreclosure. As a buyer, however, you must know that there are challenges to buying a property as a short sale. The biggest challenges of late seem to be the uncertainty of the purchase and the time table. Even if you and the homeowner agree to a price of $230,000, the homeowner's lender must still agree to accept that price – since it won't allow the homeowner to pay off their $250,000 mortgage balance in full. This process of waiting to hear back from a lender, and then complying with all of their various terms can sometimes take 60 to 120 days – or longer! TRUSTEE SALES: If a short sale does not take place, and a homeowner is behind on their payments (or not making them at all), eventually the property will be sold by the lender on the courthouse steps. Buying a property at a "trustee sale" can be exciting, and can be a great opportunity – but there are challenges as well. If a property to be sold at a trustee sale is also listed for sale with a Realtor, you can usually view the property ahead of time by calling your Realtor. Otherwise, you will likely not have the opportunity to see inside the property before the trustee sale, and thus you will not know too many details about the condition of the property. Furthermore, your purchase of the property at the trustee sale cannot be contingent upon viewing the property, or inspecting the property. In this instance, you are purchasing the property in "as is" condition, regardless of what you then find out about the property. It is also important to note that many times the lender will have an opening bid at the trustee sale that is close to (or sometimes higher than) the amount that they are still owed on the mortgage. Thus, in the example above, they might make an opening bid of $250,000. As a result of this opening bid process, many (or most) properties available for purchase at a trustee sale are not great opportunities. Occasionally, a property will be foreclosed upon that has had a mortgage in place for many years, whereby the balance of the mortgage is much lower than current market value – these are great opportunities for a buyer. Visit HarrisonburgForeclosures.com for a list of upcoming trustee sales. BANK OWNED PROPERTIES: If you don't buy the property before the auction (as a short sale), and don't buy it at the trustee sale, you'll have a third opportunity to buy it once the bank owns it. These properties are called "bank owned properties" or REO properties ("real estate owned"). Oftentimes, the prices on these properties are quite realistic, if not under market value. It would not be atypical for a house such as the one mentioned above to come on the market after the trustee sale at a price of $210,000. In such an instance, you should expect to be buying the property in "as is" condition, and you will also be buying with a slightly different contract document. Most lenders have a long standard contract or contract addendum that spell out a variety of additional contract terms designed to protect them from any future liability – and rarely will a lender agree to have these contract documents changed in any way. As you can see above, oftentimes buying the property as an REO property is where the best opportunity lies. Visit HarrisonburgREO.com for a list of bank owned properties currently on the market for sale. When a home goes into foreclosure it is often for very sad and unfortunate reasons – such as the loss of a job – and I do not wish such circumstances on any homeowner. However, if you are a buyer in today's market it is important to be familiar with different methods for buying a property when it will be, is being, or has been foreclosed upon. | |

Tips For Townhouse Buyers In A Competitive Market |

|

Over the past few months I have listed several townhouses for sale that went under contract quickly after a LOT of showings in a very short timeframe. For one such recent property there were six offers within 48 hours. One of the things that struck me as we worked through that process was that there were five other buyers who really (!!) wanted to buy that townhouse and couldn't -- because there was only one townhouse to be purchased. As such, I feel bad for townhouse buyers in the current market. Townhouse buyers have a LOT of competition and I can imagine a single buyer making an offer on multiple townhouses and missing out every time. So, a few tips for would be townhome buyers...

I suppose one critical aspect that I did not list above would be to hire a buyer's agent to represent you in finding, pursuing and purchasing your townhome. I'd suggest you select someone who is highly responsive, professional and knowledgeable about the market. Happy townhouse shopping! (Or may it just not be too unbearably difficult, frustrating and tiring.) | |

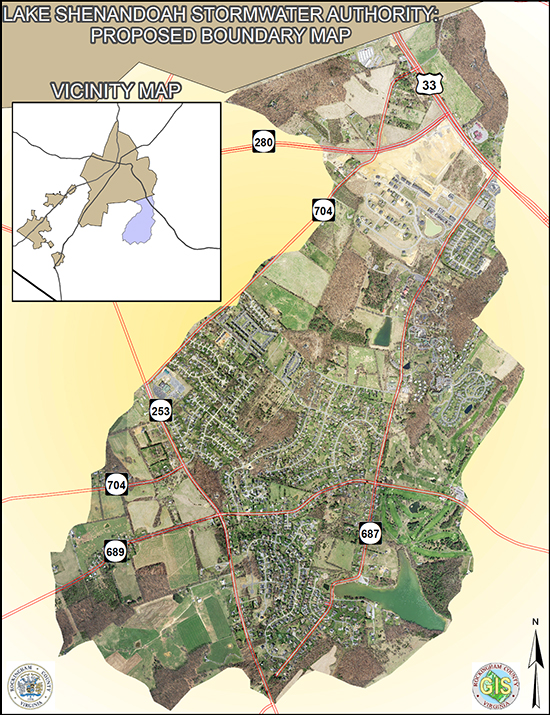

Fee Structure Proposed for Property Owners in Lake Shenandoah Watershed |

|

download a high resolution PDF here The Lake Shenandoah Stormwater Control Authority (currently made up of the members of the Rockingham County Board of Supervisors) have set a proposed fee schedule for collecting revenue from property owners within the Lake Shenandoah Watershed to allow for funding of the stormwater management improvements needed within the watershed. A public hearing will be held on March 25, 2020 regarding the fees, but here are some details of the proposed fee structure...

In other news, the Stormwater Authority is considering moving forward with The Timmons Group to provide engineering services to determine appropriate flood mitigation projects. As shown on the map above, the Stormwater Control Authority will include all or part of the following areas:

| |

Balancing Realistic and Optimistic Pricing Strategies |

|

Pricing a home in a low inventory, fast moving, market can be tricky... REALISTIC... I'm a firm believer that the best indication of the price for which your house is likely to sell is determined by the price that other buyers recently paid for similar houses. Perhaps we look at what buyers have recently paid and see that they have been paying $250K for houses similar to your home. Perhaps we then conclude that we should list your home for $255K or $259K. OPTIMISTIC... There is also merit in considering how many buyers and sellers are in your particular segment of the market. In many segments of the market there are a lot of buyers -- evidenced by listings in the price range receiving multiple offers. And in those same segments of the market there may very well be very few sellers -- evidenced by extremely low inventory levels. With such an imbalance between buyers and sellers it can be tempting (or reasonable?) to think about pricing your home higher than is justified by recent sales -- assuming that at least one buyer will be willing to outspend other recent buyers. Perhaps this means pricing your home at $275K. The upside of being realistic is that it will likely result in a relatively speedy sale and it may result in multiple offers. If you have multiple offers, you will then be able to carefully choose which buyer to work with based on all of the various terms of their offer. Perhaps this means selling your home for $260K or $263K. The upside of being optimistic is that it may result in a higher sales price than being realistic -- though that could backfire if no buyers make offers because they think your house is overpriced -- and it could be reeled back in if the appraisal performed by the buyer's lender does not support the price agreed to between buyer and seller. Perhaps this mean selling your home for $265K or $270K -- but maybe back down to $260K or $263K. So, in the end, these two different pricing strategies may result in different eventual sales prices -- or might actually result in the same eventual sales price -- but they are bound to result in different processes and experiences. We must be strategic in pricing your home. If you're planning to sell this Spring, let's chat soon about how to best balance being realistic and optimistic given market realities in your segment of our local housing market. | |

A Full Price Offer Does Not Always Win Negotiations |

|

I don't play poker regularly - though I have played it a few times lately with my kids. When I do play, I can become caught up in my excitement to see a strong hand. Wow! This pot is mine! I am bound to win this time! And often, that might happen with a strong hand in poker -- but not always. Sometimes, another player will have an even stronger hand, and I'll lose despite my strong hand. Here are the rating of poker hands, in increasing strength...

And here are some generic types of offers that might exist on a house, in increasing strength, generally speaking...

That order isn't actually always 100% accurate - it can depend on the property, the seller, etc. But the point should be clear... Even if you make a full price offer, with what would be considered to be normal contingencies (financing, appraisal, inspection) you could still lose in negotiations in several different ways. So -- play your strongest hand, but always know that there could be a stronger hand out there! | |

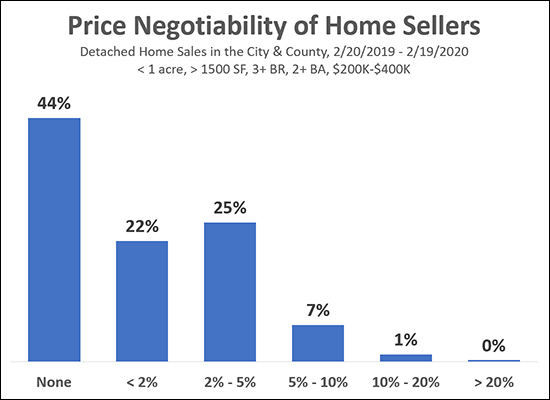

How Much Are Sellers Negotiating On Price These Days? |

|

If you're looking to buy a home under $250K, should you only consider homes priced at or below $250K? Probably not - some sellers of homes priced above $250K will negotiate down to $250K. Should you look at homes priced above $500K? Probably not - most sellers of homes priced above $500K probably will not negotiate down to $250K. Both of those are probably obvious to most home buyers, but how do we understand the negotiability dynamics between those two mostly obvious statements? The data above is a first look at that puzzle - with some constraints. Basically, I looked at one year of City/County home sales, but limited it to homes with 1500+ square feet, 3+ bedrooms, 2+ bathrooms, on less than an acre, between $200K and $400K. So, not a canvas of the entire market -- but a pretty reasonable chunk of the middle of our market not likely to be thrown off by lots of investors (lower priced or attached properties) or high end buyers (high priced properties). And - after that intro - here's (some of) what we find...

So - hopefully that provides some guidance as to what you might expect as a buyer. If you see a home listed for 11% above your budget -- there is likely only a 1% chance that the seller will sell at a price that works for you -- or, put another way, you might have to find 99 such properties (where the seller won't come down 10%) before you find the 100th where they will. | |

Flirting With Selling A Rental Property |

|

Depending on your short and long term financial goals - you may want to list your rental property for sale for one month between tenants... In a recent conversation with the owner of a rental property, they were reflecting on the fact that after a tenant recently vacated their rental property (a townhouse) they were making quite a few updates and improvements to the townhouse based on some aging components and finishes in the property. They realized that the townhouse would be in better shape than it had been for years -- and that the condition would likely start to deteriorate (even if just a bit) as soon as they moved tenants back in. So, they wondered whether they should go ahead and just sell the townhouse instead of renting it again -- since it would be in great shape. But they lamented the fact that they'd need to keep it off the rental market for several months to see if it would sell at a price that would suit their financial goals - in other words, a sales price whereby it would make more sense for them to sell it than to continue to rent it. Here are a few thoughts I shared with this owner of an investment property...

So - here's an idea, if you own an investment property and you are about to have a tenant move out and you are about to make some improvements to the townhouse... Move the tenant out. Make the improvements. List the townhouse for sale for one month at a price for which you'd be happy to sell instead of continuing to rent the property -- so long as that value is generally in line with recent sales prices for similar townhouses. With this concept you don't have to commit to listing the property for six months, missing out on rental income, etc. -- but you can quickly determine if you could sell the townhouse while it is at its peak (from a condition perspective) at a price that would make it worthwhile for you to do so. OK - that was a lot. I'd be happy to talk it all through with you as well - in person, by email, by phone, etc. If you own a rental property and *might* want to sell it soon - be in touch (scott@hhtdy.com or 540-578-0102) and let's talk strategy... | |

Why Investors Eventually Sell Their Rental Properties |

|

If you own a rental property, you might wonder from time to time whether you should keep or sell that property. I generally advise my clients to keep their rental properties, and not to sell them unless there is a good reason to do so. Here are some of those good reasons... VALUE - If the value of your rental property is currently high, and there is a reasonable chance that it won't be quite as high in the coming years, then now could be a good time to sell the rental property. INVENTORY - If there are very few competing properties for sale right now (which would lead to a speedy sale) but there will be many, many new properties built in the near future (which could result in a slow sale) then it might make sense to sell the rental property now vs. later. EQUITY - If you have owned the property for a decent period of time you may have a good bit of equity tied up in the property - and perhaps you'd like to do something else with that money. Maybe you'll use the sale proceeds for another investment (real estate or otherwise) or to pay off some debt, make a large purchase, go on a trip, who knows, but sometimes selling a rental property is a key part of freeing up some cash to make some other financial moves. HASSLE - Maybe you are tired of dealing with owning a rental property. Regardless of whether you manage the property yourself, or have a professional property manager, there can still be some annoying details to attend to with property maintenance, uncooperative tenants, etc. MAINTENANCE - Perhaps your rental property is 20 years old and you're pretty sure that if you keep it for another 3 - 5 years you'll have to pay for a new roof, new heating system and new water heater. If so, it might make sense to sell the property now to avoid those major capital expenses. TENANTS - If most of the prospective buyers for your rental property will be owner occupants, then the time between tenants might be the perfect time to sell your rental property. PARTNERS - If you purchased the rental property with a friend or family member, and they would like to move their investment dollars elsewhere, then it might be a good time to sell the property. RENTAL RATES - If rental rates are starting to decline, changing the performance of your investment, it might make sense to go ahead and sell, unless you see a turn around happening in the near future. IMPROVEMENTS - Perhaps your most recent tenant absolutely trashed the property, and you have just completely renovated it, such that the property has never looked better. This could be an ideal time to sell before the condition starts to deteriorate again. All of these potential reasons to sell are quite general - so feel free to touch base if you want to chat more specifically about your rental property and whether it would make sense to sell it now, or keep it for the next few years. | |

Potential Challenges of Selling A Rental Property in Harrisonburg |

|

Do you own a property in Harrisonburg occupied by a tenant? When you are ready to sell it, how will you go about that process? Will you list the property for sale while the tenant is still living in the property?

Will you list the property for sale after the tenant has moved out?

OK -- admittedly, I'm spelling out the worst case scenario of both sides of this issue -- hopefully making it clear(er) that there is no sure-fire easier, faster, better way to sell an investment property. There can be challenges in listing the property for sale while the tenant is still occupying the property, and likewise, if you list the property for sale after they move out. We'll need to work together to determine the best game plan for your property, perhaps considering...

It doesn't have to be difficult to sell a property occupied by a tenant, but we'll want to approach the process thoughtfully. Let me know if you're planning to sell an investment property in 2020. | |

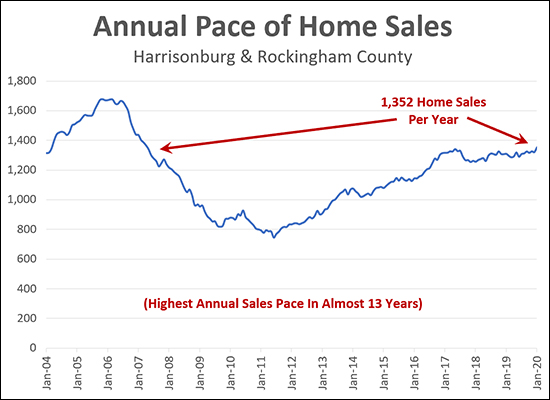

Highest Pace Of Home Sales In Almost 13 Years |

|

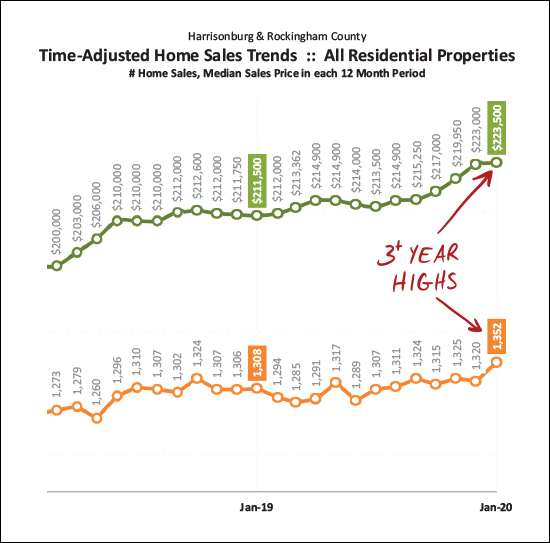

One more bit of context for you to digest as we start off the week -- at the end of January 2020 we hit an annual pace of 1,352 home sales in Harrisonburg and Rockingham County. That is the highest number of sales in a year that we have seen in almost 13 years! We have to go way back to 2007 to find a higher annual pace of home sales. For additional insights into the current (red hot) local housing market, feel free to check out my full market report and commentary here. | |

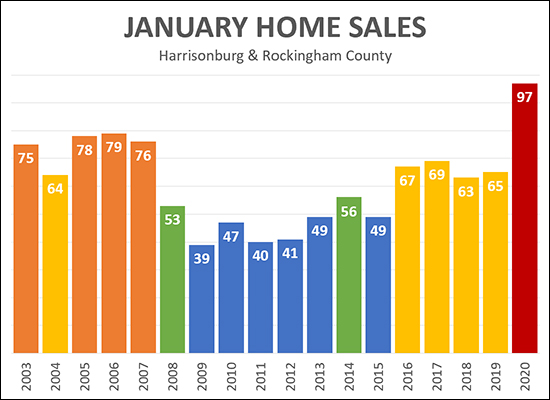

Just How Unusual Was The Pace of Home Sales In January 2020? |

|

Particularly unusual, I'd say. Looking back 17 years, the highest number of home sales we had ever seen in January was 79 home sales -- but this January (last month) there were 97 home sales! What a month! Stay tuned to see if we'll have another high octane month of sales in February. In the meantime, feel free to check out my full market report and commentary here. | |

Home Sales Soar To Surprising New Heights in January 2020 |

|

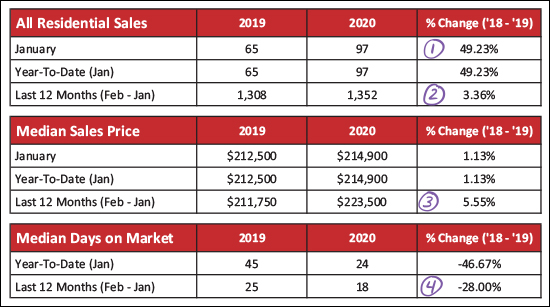

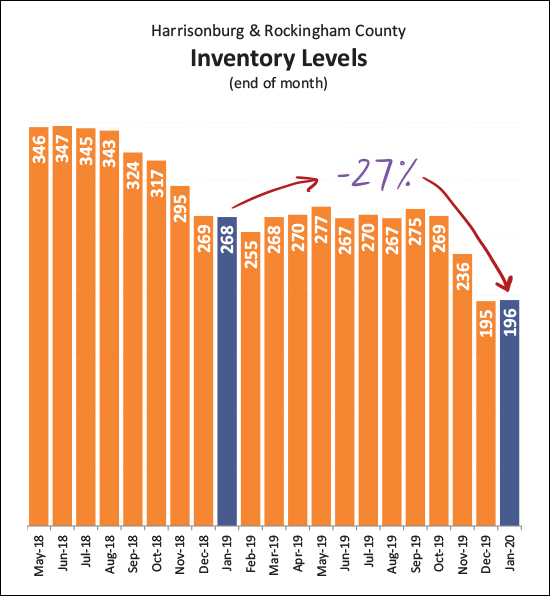

Time seems to be passing quickly these days, perhaps because my two kids are growing up faster than I can believe - age 15 (also known as "almost driving") and 11 (but 12 next month!). In the vein of time passing quickly, I was surprised to realize this week that the year is essentially 1/8th of the way over now!? How does the time slip by so quickly? Well, if you blinked, and missed January - you missed a LOT of home sales in Harrisonburg and Rockingham County. We'll get to that soon (keep reading) but first I'll point you to a few quick links... OK - now back to the business at hand - breaking down the latest trends in our local housing market. First, some of the basics...  As shown above...

If we then dive into detached (single family homes) and attached (townhouses, duplexes and condos) we find relatively similar trends...  In the breakdown above, you might note that...

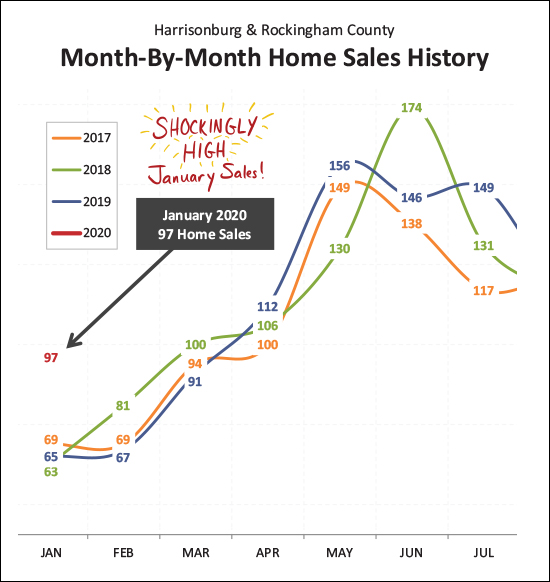

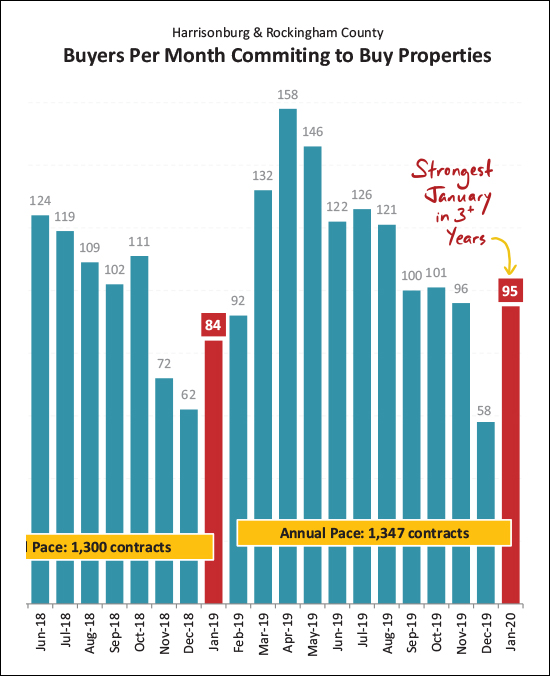

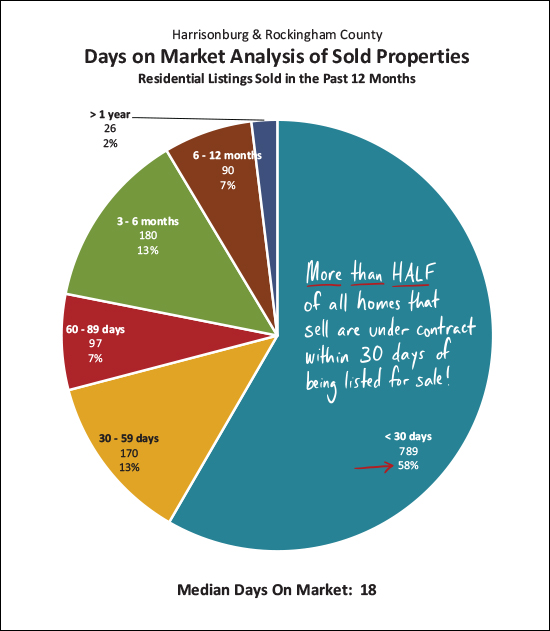

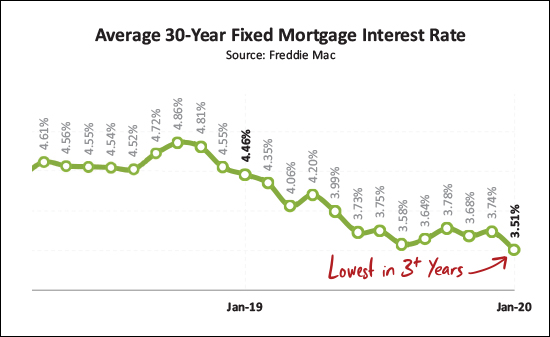

And now, the visual of what we'll call a crazy January...  If there was one thing it seemed we could count on, it was that we'd see between 60 and 70 home sales in January. That's what we've seen for the past three years - and looking back even further (2010-2016) we find even lower months of January sales - 47, 40, 41, 49, 56, 49, 67. But not this year. This year started off with a BANG with a shockingly high 97 home sales in Harrisonburg and Rockingham County. Could this be an anomaly? Will February sales be miserably slow, bringing a January/February average to more normal levels? Maybe. Will every other month this year fall back in line with normal historical trends? Maybe. Or -- will this year be unlike any prior with much higher sales than expected, all year long? Maybe. Stay tuned to see how things shape up after this blockbuster month of sales in January. And look what this crazy January contributed towards...  The data above looks at 12 months of data at a time - month after month - to see long term trends. These long term trends have now pushed us to the point of having 3+ year highs in both categories shown - the pace of sales and the price of sales. The median sales price of $223,500 is higher than it has been in many more than three years. Likewise, the annual pace of 1,352 home sales is higher than it has been in over three years. So, it's a wild time right now in the local housing market with steady growth in sales prices and stable but strong numbers of home sales. Circling back to the prior question - will home sales taper off in February?  I'm going to lean towards "no" -- given that 95 contracts were signed in January -- many of which will result in February home sales. As an aside - I have been tracking "under contract" data since 2008 -- and there has never been a January with quite so many contracts signed as we saw this January. So, maybe February will be a relatively strong month for home sales as well? And these increases, while one major metric keeps decreasing...  Indeed, despite increasing sales, the number of homes on the market at any given time keeps declining. We've seen a 27% year-over-year decline in the number of active listings on the market. So, how do more homes sell if fewer homes are on the market? It seems that plenty of homes are coming on the market for buyers to buy - but because buyers are contracting to buy them so quickly these new listing aren't staying on the market long enough to allow inventory levels to see an effective increase. Speaking of buyers contracting to buy homes quickly...  More than half (58%) of homes that have sold in the past year were under contract within 30 days of being listed for sale. Homes are, indeed, selling quickly. The median "days on market" currently stands at 18 days. A nice time to be a home seller if you're hoping not to have a prolonged period of time having buyers coming to view your house. Depending on your home's price, condition, layout, location, it may very well go under contract quickly! And today's buyers are paying lower mortgage interest rates than we've seen in a while...  The average mortgage interest rate on a 30 year mortgage has now dropped to 3.51% - the lowest rate seen in over three years. Buyers who are currently buying a home are fixing in lower monthly payments than they would have seen with any recent mortgage interest rate - though that is offset somewhat by the increases in median sales prices over the past few years. OK - that's it for now - I'll be diving into a few more market dynamics in the coming days. But until then... If you're planning to sell your home in 2020 -- let's chat SOON about the best timing for doing so, what you should do to prepare your home for the market, and of course, we'll want to start by analyzing your segment of the market. If you're planning to buy a home in 2020 -- get ready to compete with lots of other buyers in a low inventory housing market. To assist you, sign up to get alerts of new listings, talk to a lender to get pre-approved, and let's get ready to make a mad dash to see new listings as soon as they come on the market! As always -- shoot me an email if you have follow up questions or if you want to chat about your plans to buy or sell. | |

The Role of a Realtor in Representing A Home Buyer |

|

Home buyers would be well served to have a Realtor represent them in their home purchase. So, before you call the listing agent to see a home listed for sale, you should understand a bit more about buyer representation.

In representing you in your home purchase, your buyer's agent would be performing tasks such as:

So -- you can call the listing agent (who is contractually bound to represent the seller's best interests) -- or you can hire a Realtor to represent YOUR best interests as the buyer. Clearly, I recommend the second option. Beyond buyer representation, there is a lot more to know about and think about regarding the home purchasing process. Read more at....  | |

Who Is Winning In 2020 In The Local Real Estate Market? |

|

Sellers are winning - rather universally. Every market metric works in their favor. Buyers are losing - in most categories. Buyers are happy about low rates and low unemployment, but otherwise, all market metrics are working against them. Homeowners are winning - they are indifferent to most market shenanigans - but are glad home values are increasing. SELLER-BUYERS - If you will be a seller AND a buyer -- things may balance out -- you may benefit as a seller and struggle as a buyer. | |

City Townhouses Are Selling QUICKLY! |

|

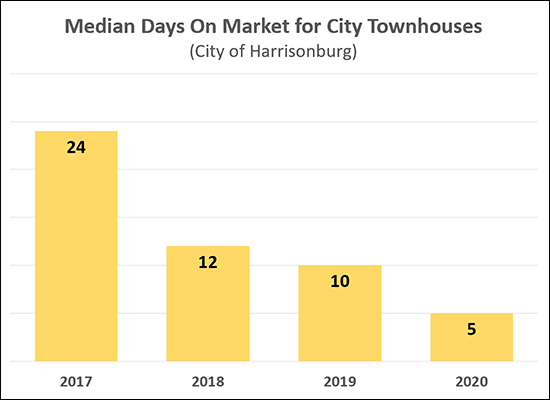

Townhouses in the City of Harrisonburg are selling QUICKLY! The "Days On Market" referenced above is the number of days between when a property is listed for sale and when it goes under contract. Just three years ago, the median days on market was 24 days - which means that half of the townhouses that sold went under contract in fewer than 24 days, and half took longer than 24 days. But now, the median days on market has dropped down to just FIVE days in 2020. Oftentimes, sellers of townhouses who want to buy a single family home are worried that they won't be able to sell their townhouse quickly enough to then make an offer on the house they want to purchase - this should be at least somewhat less of a concern now given the speed at which townhouses are going under contract! | |

Home Sales Rise In County, Fall In City |

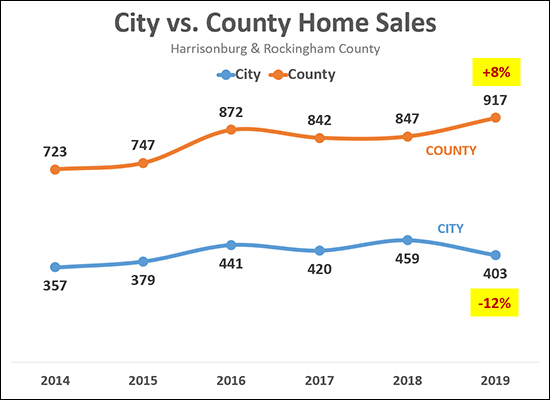

|

Home sales rose 8% in Rockingham County last year -- from 847 sales in 2018 up to 917 sales in 2019. This is the highest number of home sales we have seen in Rockingham County in at least the past six years. But in the City, it was a different story. Home sales declined 12% in the City of Harrisonburg in 2019, from 459 sales in 2018 down to only 403 sales in 2019. This is higher than some recent years, but the lowest number of homes ales in the past four years. A few more notes...

There are any number of factors that affect whether buyers end up buying in the City or County, including what type of property they are seeking, how much land they desires, school systems, employer locations, and much more. | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings