Archive for August 2021

Townhouses in Phase 2 of The Townes at Congers Creek Now Available For Purchase |

|

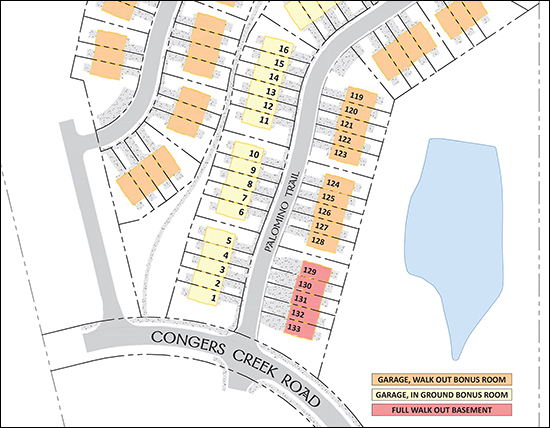

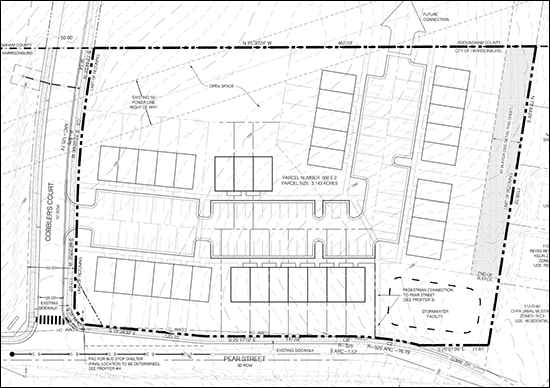

The Townes at Congers Creek is a new townhouse development located in Rockingham County, across Boyers Road from Sentara RMH Medical Center. The first phase of the development included 26 townhouses, all of which are under contract or sold. A second phase of townhouses is now under development that will include 133 more townhouses in a few different styles... view a larger plat here The three styles of townhouses will include...

You can find pricing, availability, a site plan, standard features, available upgrades and more at CongersCreek.com. The first (10) townhouses at Congers Creek hit the market yesterday and it seems likely that (5) of those will be under contract by the end of the weekend. You can also email me with any questions you might have, as I am the Realtor representing the builder/developer. | |

Preston Lake Apartments Now Available For Lease |

|

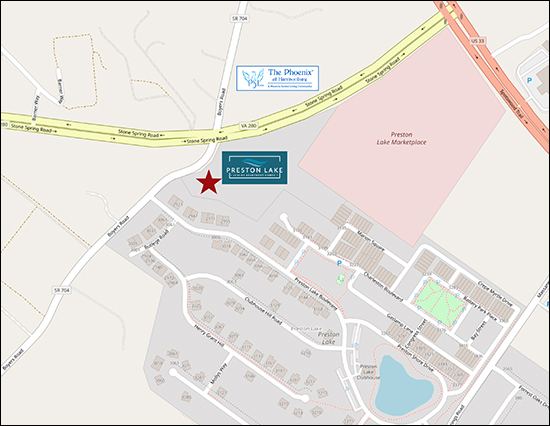

view a larger map here After having been under construction for quite a while now, it seems that Preston Lake Apartments are now available for lease. These apartments were built by and are owned by a different developer than the developer who is building out Preston Lake. Here's an overview of the types of apartments that are available...

| |

I Think Harrisonburg Has Created More Homeowners and Would Be Homeowners Over The Past Decade Than Builders Have Created New Houses For Purchase |

|

This won't deal with numbers or data -- just concepts and ideas, but here's the theory... I Think Harrisonburg Has Created More Homeowners and Would Be Homeowners Over The Past Decade Than Builders Have Created New Houses For Purchase Harrisonburg, Virginia is a popular place to live.

All in all, I think Harrisonburg has had sustained population growth over the past ten or so years -- many of whom bought homes or wanted to buy homes but couldn't find anything to buy. We could dig into the census and try to pin a number on that growth it but it would be imprecise at best. Let's just call them Net New H'burg Residents. Also over the past decade, builders have built some, but not a lot of new houses for purchase...

We could dig into building permit data and try to figure out what type of properties have been built, how many have been for homeowners (not renters), etc., but this would be imprecise at best. Let's just call them New Homes For Homebuyers. Having summarized these dynamics, I think you see where I'm going. I think... Net New H'burg Residents > New Homes For Homebuyers I actually don't even think those two numbers are close. I think the number of net new Harrisonburg residents far exceeds the new homes that have been built for homebuyers. If you bought into my theory, what, then, would this mean for the future?

So, that's what I think. What do you think? Does this seem like a reasonable understanding of some of the current dynamics in the Harrisonburg housing market? | |

Will We See Hundreds Of Covid Induced Foreclosured Homes Hitting The Market In Harrisonburg? |

|

Several folks have recently asked me if I think we will see hundreds of foreclosed homes hitting the market in Harrisonburg in the coming year as a result of Covid and if that could affect home values. I don't think we will see a rush of foreclosed properties hitting the market in this area. Here's why...

So - will we start to see some foreclosures taking place this year and next? Yes. Will it be a disproportionately larger number that will affect the overall housing market? I do not think that will happen. | |

The Phoenix at Harrisonburg, A Senior Living Community, Opening in Spring 2022 |

|

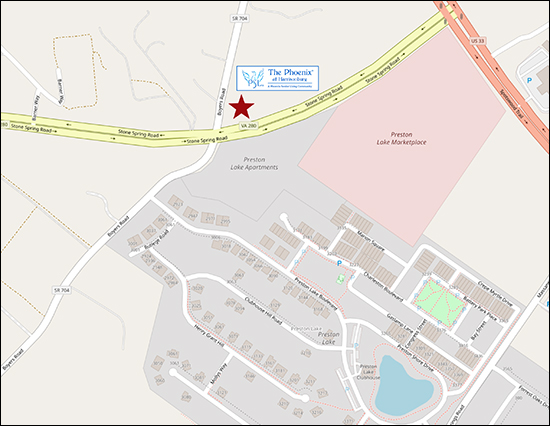

view a larger map here A Senior Living Community called The Phoenix at Harrisonburg is opening early next year at the intersection of Stone Spring Road and Boyers Road, across Stone Spring Road from Preston Lake Apartments. Per the the Phoenix Development Group Partners website, this community will include...

The community will also include "exterior amenities such as a bocce ball court, covered pavilion with fireplace and grill station, and three interior courtyards." | |

Are Increasing Home Prices In 2021 A Sign Of A Housing Bubble? |

|

There's a great article over at NPR / Planet Money related to whether current high home prices are an indication of a housing bubble. Thanks, Andy, for sending me this article! Home Prices Are Now Higher Than The Peak Of The 2000s Housing Bubble. What Gives? You should read it. All of it. It addresses...

Read the whole article here... Do you think we are in a bubble? Translated: Do you think home prices will decline sometime in the next 1 to 5 years? Email me and let me know what you think. | |

Harrisonburg and Rockingham County Home Prices Have Risen 10% In The Past Year |

|

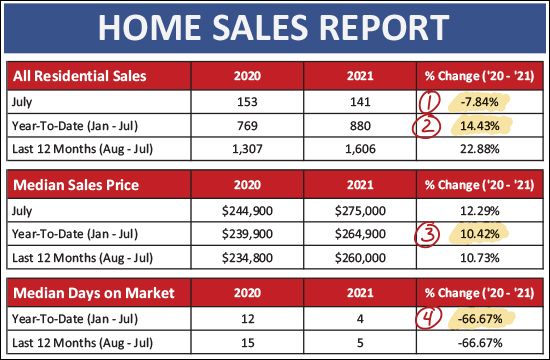

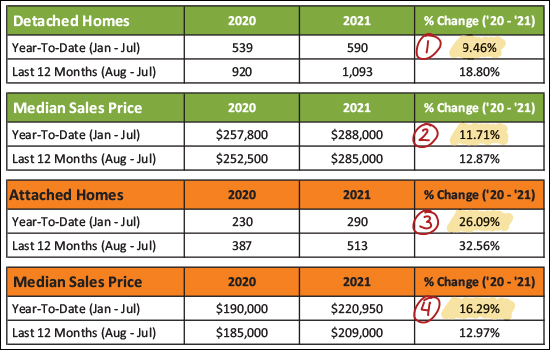

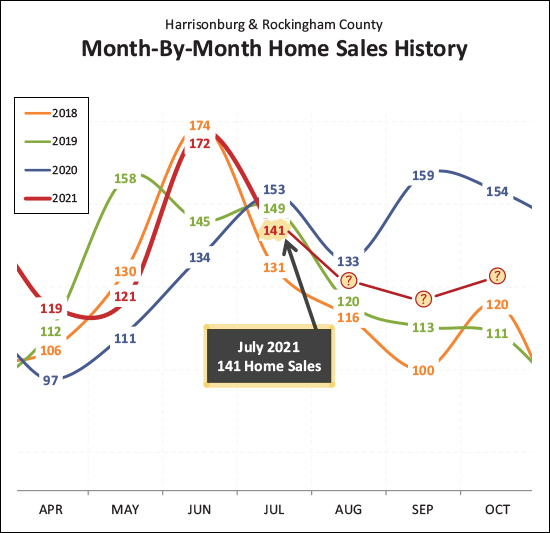

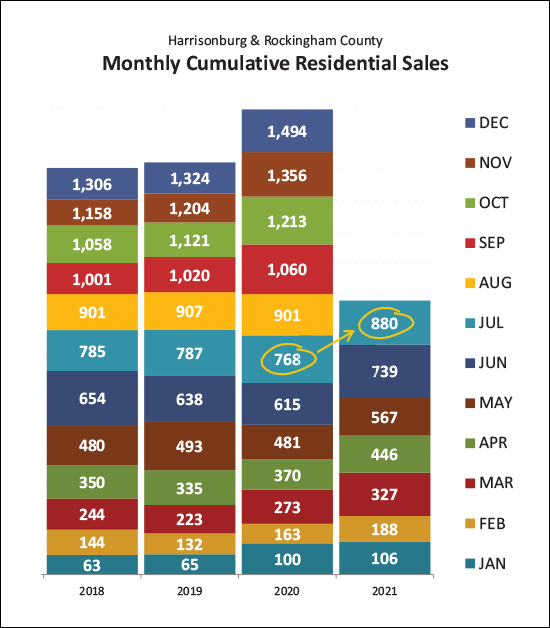

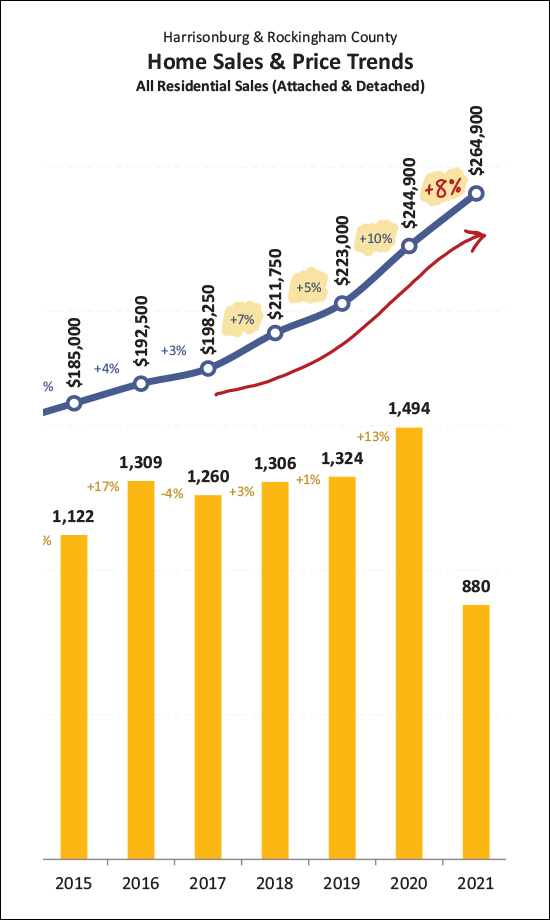

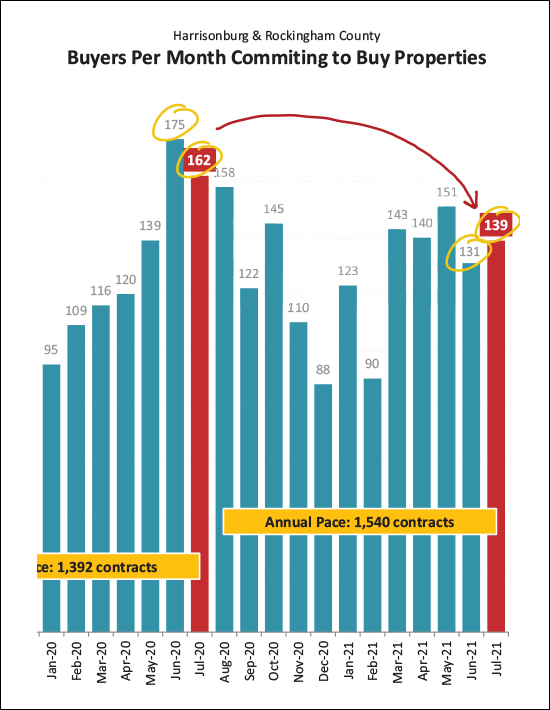

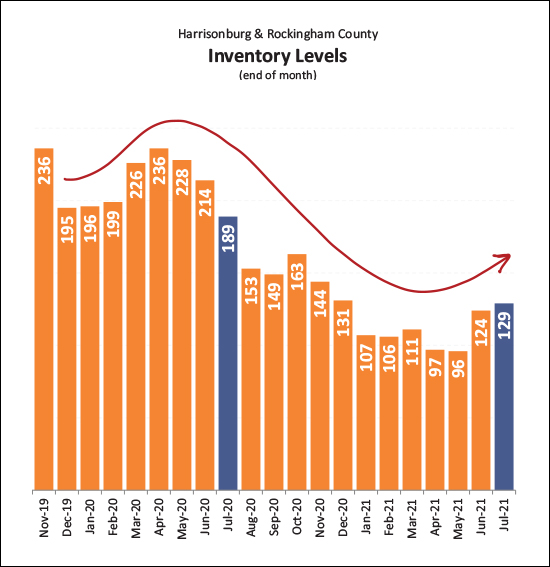

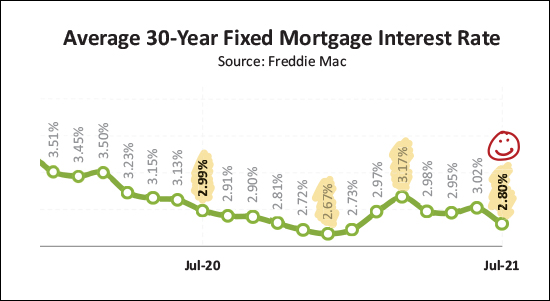

Happy Wet Wednesday morning to you! It looks like this will be the fourth (?) day in a row of rain in the valley, which is a welcome trend for many given the previous few weeks of very, very dry weather in the Harrisonburg area. I hope at least some portions (or most!?) of your summer have been enjoyable and relaxing amidst all that is going on in the world right now. I escaped dry Harrisonburg to visit even drier Utah with my family in early August -- and was impressed by both the lack of humidity :-) and the beautiful landscapes of Arches National Park. I'm back now, though, and Luke (11th grade) and Emily (8th grade) are transitioning into a new school year. If you have little (or big) ones starting school now or soon, I hope that transition goes well for you and them. Now, then, let's chat for a bit about our local housing market. Or, rather, I'll chat -- while you read -- and if you want to chat back, shoot me an email me with what's on your mind or let me know if you'd like to grab a coffee and we can chat in person. But one last note -- you'll find a PDF of all of the charts and graphs in my market report here and you can learn more about the amazing Highland Park home pictured above here. Now, to the data...  This first data table (above) gives you a quick overview of the basic market dynamics we're seeing right now in the Harrisonburg and Rockingham County area -- and most of it is probably what you would have guessed that you would see... [1] This first one might be a bit of a surprise. There were 8% fewer home sales this July compared to last July. But... you need to keep last July (and last June) in context remembering that they were extraordinary busy months for home sales after the usually strong spring real estate market was delayed by a few months by Covid, resulting in slower spring 2020 home sales and much stronger summer 2020 home sales. Thus, while there were fewer home sales this July compared to last -- that's mostly a story about how crazy things were last July. [2] Here you'll note that the year-to-date pace of home sales (880 sales) is 14% higher than it was last year (768 sales) when evaluating only the first seven months of the year. So, yes, despite extraordinary low inventory levels -- at any given time -- 14% more homes are selling this year than last! [3] Those home prices keep on rising. You might have noted the headline of this update was related to the increase in sales prices. After receiving one of my market reports that lauded a strong pace of home sales, one of my past clients once commented that he could care less how many homes sold -- he just wanted to know what prices were doing -- going up or down. So, in that spirit, I lead this month's update with the fact that the median sales price has increased 10% between last year ($239,900) and this year ($264,900) when looking only at the first seven months of the year. [4] Finally, sales are still happening very (very) quickly in our local market. The median "days on market" for homes that sold in the first seven months of this year was... four days. That is to say that half of the homes that sold went under contract in four days or less! Wow! Now, then, a slightly (just slightly) deeper dive into the basic sales data...  The data table above provides a slightly more nuanced analysis of detached homes in green as compared to attached homes in orange. An attached home is a duplex, townhouse or condo. Splitting out the data in this way calls attention to the fact that while we've seen 9% more detached home sales thus far in 2021, we have seen a much larger, 26%, increase in the number of attached homes that have sold in 2021. Lots of duplexes, townhouses and condos are selling -- though mostly townhouses, and many of them are new townhouses. Looking at sales prices between these two data sets we find that the median sales price of detached homes has increased 12% to $288,000 -- while the median sales price of attached homes has increased 16% to $220,950. So -- at least some portion of the overall increase in home sales in this area is a big increase in the number of attached homes that are selling. Now, to the monthly sales trends...  There is a lot going on in this graph, above, but focus on the bright red line for the current year and the dark blue line for last year. By doing so, you'll note that April, May and June home sales were extremely strong in 2021 compared to 2020 -- though that was mostly because home sales were sloooooowwww during those months last year as a result of Covid pushing last year's home sales later in the year. When we then look at June and July home sales in 2021 they look slow compared to 2020 -- but again, this is largely a result of Covid pushing last year's home sales later in the year. So, what then should we expect for August and thereafter in 2021? As illustrated above, I think we are likely to see more home sales than in the same month of 2018 and 2019, but likely fewer home sales than seen in the same month in 2020. The second half of last year was absolutely bonkers as far as the number of homes that sold per month and as strong of a year as 2021 has been, I just don't think it can keep pace with last year. But... in the end, I do think we'll see more home sales this year than last...  This graph (above) piles each month of home sales on top of the previous months that year, and you'll see that 2021 has established a serious lead over 2020. We are now 112 home sales ahead of the pace of last year's local housing market. So -- even if home sales are a bit slower in the last five months of 2021 than they were in 2020, I still think we'll see more home sales in all of 2021 than we did in all of 2020. Looking back, then, at home sales prices -- some folks have asked if home prices are going up too much or too quickly...  As shown above, there was a 10% increase in the median sales price in 2020, and depending on how you crunch the numbers an 8% of 10% increase in 2021. So, will home prices keep going up? Will they come down? As I mentioned on my blog earlier this week, I don't think home prices are going to decline in the next year, because... [1] I believe housing (for purchase) has been under built for many years in this area. I believe there are more homeowners or would-be homeowners in the market than there are homes to be owned. [2] Even if lots and lots of homes are being built or being planned, it takes a long time (relatively speaking) for those homes to be planned and built. [3] There are a flurry of showings and often multiple offers on most new listings. So, home prices are rising (10-ish percent in the past year) and I don't see that changing significantly in the near future. Now, technically closed home sales are old news -- it's the contract activity that gives us the freshest data, so let's take a look...  As shown above, contract activity in June and July has been dreadfully slow compared to last June and July. ;-) While technically true, this doesn't tell the whole story, in my opinion. During early 2020, Covid caused a major slow down in the number of homes coming on the market and thus the number of buyers contracting to purchase homes. The spring months are usually some of the busiest months for contract activity and that didn't happen in 2020. As a result, contract activity spiked to record or near record highs in June, July and August. Last year's incredibly and unusually strong months of contract activity during those summer months does make this summer's contract activity look a bit pitiful, but again, it's only because of the crazy highs last summer. Now, how about those inventory levels? Are we getting any relief?  Maybe? Possibly? A little? Inventory levels crept up a bit in June and July of 2021 from terribly, dreadfully low all the way up to... yeah, still terribly and dreadfully low. Inventory levels in early August over the past few years have been 345 homes for sale in August 2018, 270 homes for sale in August 2019 and 189 homes for sale in August 2020. So, before you get too excited about inventory levels increasing from 96 homes *all the way* up to 129 homes, keep in mind that this is still far fewer homes on the market at any given time than we have seen... ever. And finally, a happy recap of recent trends in mortgage interest rates...  Interest rates were around 3.5% a year and a half ago, fell to 3%, then all the way down to 2.67% back in December before rising again until they were above 3% again. But, no longer. The average mortgage interest rate (on a 30 year fixed rate mortgage) has declined for a few months now and is right around 2.8% -- a welcome sign for home buyers. OK -- I'll wrap it up there for now. All in all... [1] Lots of homes are selling in 2021 -- well more than in 2020. [2] Home prices are much higher this year than last. [3] Buyers need to be prepared to see new listings as soon as they hit the market and to make a quick decision about making an offer. [4] Sellers are likely to continue to see favorable market conditions for at least the next six to twelve months. You'll still need to price your home appropriately, prepare it to show well and market it thoroughly -- but you'll likely enjoy the price for which you sell your home. If you made it this far, thanks for reading. Drop me a line to let me know if you have any questions about our local housing market -- or even more interestingly, to tell me about about your favorite adventure of summer 2021! I'd love to hear from you!

| |

No, I Do Not Think Home Prices Will Decline In The Next Year |

|

As stated above, I do not think home prices will decline in the next year. That said, I am completely willing to be wrong. A common question that would be sellers ask me is whether I think home prices will decline in the next year. "I can't believe how much my house would sell for right now -- maybe I should go ahead and sell now -- because home prices might start coming back down soon, right!?" It is hard for me to justify selling your home right now simply because of a concern (or fear) that home prices are going to come back down soon. Yes, it is possible that home prices will decline in the next year, but I think that is unlikely, because...

So, are things going to slow down soon? It sure doesn't seem like it! I think prices will hold (likely rise) for at least another year -- and quite possibly well beyond that as well! But enough about my opinions -- what do you think? Email me and let me know. | |

Is A Cash Offer Really That Much Better Than One With Financing? |

|

Many sellers, when receiving a cash offer and one with financing, ask themselves (or their agent) whether a cash offer is really that much better than one with financing. As with many questions in real estate, it depends... First, a $400K cash offer and a $400K offer with financing will both (any other contingencies aside) result in the same amount money going to the seller -- $400K less mortgage payoffs and transaction costs. So, in that way, a cash offer and an offer with financing are pretty similar -- the seller gets the same amount of money. These two offers, though, start to feel pretty different...

In this case (above) the second buyer is likely is not very financially capable and that could mean there would be difficulties in the buyer obtaining financing to complete the home purchase. The fact that the lender is an unknown variable can also give a seller pause as they compare the two offers. These two offers, though, may very well seem pretty similar to a seller...

In this case (above) the second buyer would seem to be very financially capable, in that are putting a sizable deposit down and have a significant amount of funds to use as a down payment. The fact that the lender is a known variable (local, reliable) means that the offer is very likely to proceed quickly and smoothly to closing. So, in the end -- should a seller look at a cash offer as being undoubtedly better than any offer with financing? Not necessarily. An offer that is similar in offer price, with 80% financing, a sizable deposit, and where a buyer is working with a known local lender is just about as strong as a cash offer in almost all circumstances. | |

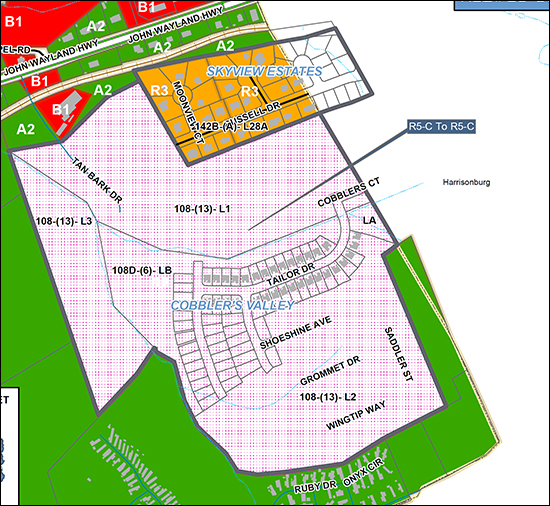

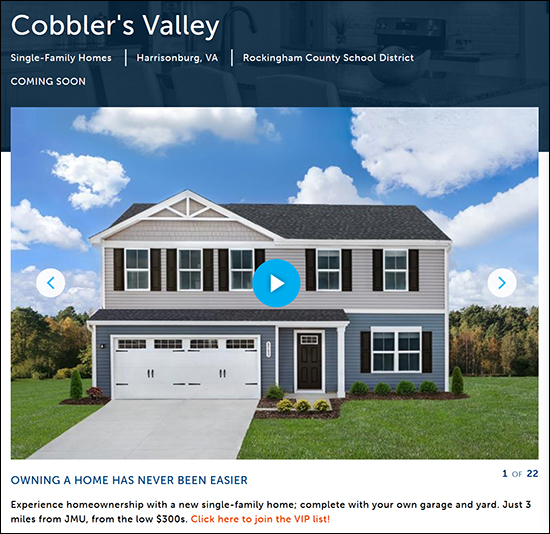

Further Details Of Cobblers Valley, The Latest Ryan Homes Community In Rockingham County |

|

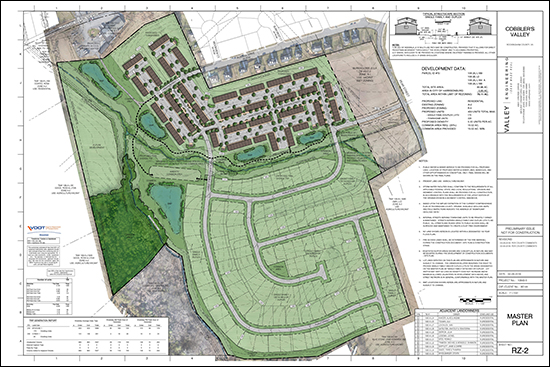

Ryan Homes is currently building duplexes in McGaheysville (South Peak) and single family homes and townhomes in Grottoes (Shady Creek) and now they will be building more single family homes and townhomes in Harrisonburg and Rockingham County. Here's what we know so far... Here's the original (perhaps now out of date) plat of the neighborhood... view a larger jpg here The Ryan Homes website indicates that the single family homes will have garages... and yards... and will start in the low $300K's. TBD if that's $305K or $349K. ;-) Ryan Homes (via the current landowner) is asking the City approve a rezoning to allow for up to 40 townhomes to be built on the City's portion of the development. Here's the plat from the City Planning Commission's packet... view it larger here The full packet of information from the City Planning Commission can be downloaded here. In the County, Ryan Homes (via the current landowner) is asking permission to only limit their construction to 80 homes per year (instead of 40 homes per year) -- and they would not be planning to build townhomes until July 2022. You can see a bit of the site plan from Ryan Homes here... view it larger here You can download the full packet from the County Planning Commission here. | |

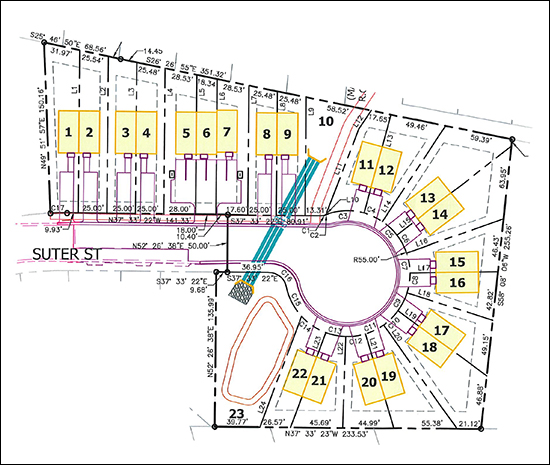

22 Townhouses Proposed For Suter Street In Harrisonburg |

|

A property owner on Suter Street, in the City of Harrisonburg, is proposing to build 22 townhouses on a 2.03 acre parcel of land zoned R-2. The City of Harrisonburg Planning Commission will review this requested rezoning (R-2 to R-8C) on August 11, 2021. City staff recommends that this rezoning be approved. The owner of the property, Philip Yutzy, purchased the two acre tract of land and wants to develop the property into "an attractive family oriented neighborhood" with primarily duplexes and one triplex. The owner sites a lack of "affordable housing" and they plan to address it by building these townhomes to be priced between $200K and $270K. They anticipate that families earning $40K - $60K would be able to purchase these homes. Read all about this proposal in the City Planning Commission's packet here. | |

460 Bedroom Student Housing Complex Proposed For Neff Avenue |

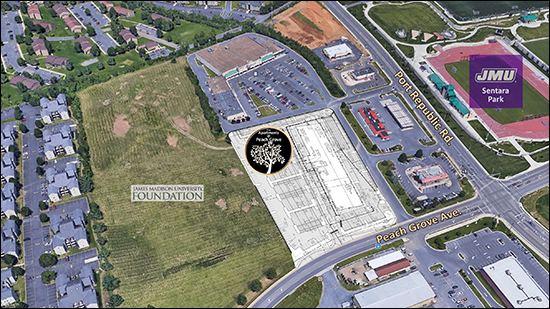

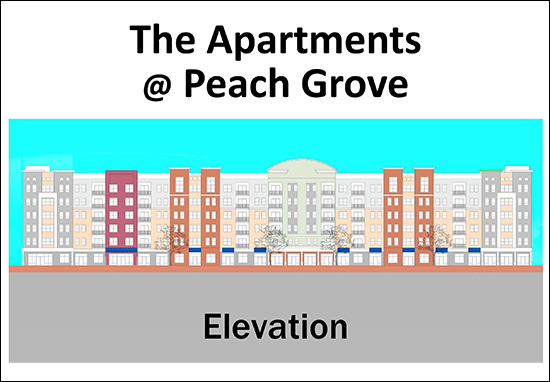

|

On August 11, 2021 the City of Harrisonburg Planning Commission will consider a request from Forbes Development to amend the proffers for a 5.44 acre parcel on Neff Avenue near its intersection with Port Republic Road. The property is currently zoned R-5C and the developer previously planned to build one, six-story mixed-use building with non-residential and multi-family residential units. The plan was for the building to include 16,000 SF of retail space such as restaurants, coffee shops, bookstores, clothing retailers, convenience stores, etc. When the developer had gone through the process of rezoning the property to R-5C and obtaining special use permits to allow for the construction of the above referenced project, the developer had referenced the building including a mix of (20) one bedroom apartments, (20) two bedroom apartments, (30) three bedroom apartments and (50) four bedroom apartments - which presumably might be student housing, or possibly not... Within a year of the rezoning and special use permits being approved, the developer began the further planning of the project but began to only reference including (100) four bedroom units -- which would clearly be designed to be entirely student housing.  Now, however, the developer does not want to build the project as previously planned as a multi-family development -- with apartments over top of commercial / retail space. The developer is now asking the City for permission to amend the proffers to allow for the project to be a single six-story apartment building without any commercial or retail uses and they want the project to allow for more bedrooms in the apartments. The original proffers would have allowed for 400 bedrooms and the developer is now requesting permission to have 460 bedrooms in total. The developer indicates they are requesting the removal of the commercial/retail space because of changes in the commercial real estate market due to Covid. The developer does not seem to have spoken to their pivot from having 1, 2, 3 and 4 bedroom apartments -- to having almost all (104 of 126) four bedroom apartments. City staff does not recommend that these changes be approved because they do not believe more student housing is needed at this time. Planning Commission will now review this request and will forward their recommendation to City Council who will make the final decision about whether to allow these changes for another 460 bedrooms of student housing on Neff Avenue. Read up on more details of these proposed changes in the City Council packet here. | |

Contract Activity In 2020 Is Somewhat Useless For Understanding 2021 Market Activity |

|

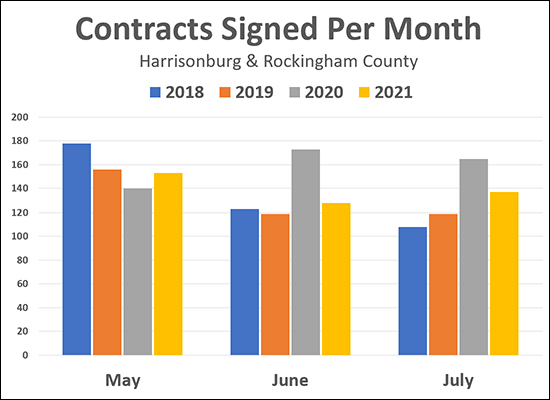

If we just compared this year's contract activity (yellow bars) to last year's contract activity (gray bars) for the past three months we might conclude the following about this year...

The conclusion above are likely pretty far off base as a result of what was actually going on (Covid related) last May, June and July -- and thus last year's contract activity is mostly useless in helping us understand this year's contract activity. MAY: Contract activity was higher this May than last, but that was actually lower than in 2018 and 2019. May was essentially the last month of Covid suppressed contract activity last year. The entire market slowed down in March, April and most of May as everyone tried to figure out whether Covid would affect the real estate market. As such, while this May's contract activity was stronger than last May, it was actually a bit slower than we'd normally expect in May since last May was not normal. JUNE: Once June (and July) rolled around last year, contract activity started to spike to abnormally higher levels -- likely as a backlog of buyers who would have bought in the spring found themselves scrambling to find something to buy in the summer. Thus, while this June's contract numbers are significantly lower than last June -- they are on par with, and slightly above, the pace of signed contracts in June 2018 and 2019. JULY: While there were quite a few less contracts signed this July than last -- this July's numbers were quite a bit higher than July of 2018 and 2019. Again, this seems to be a weird month of July last year that makes this July look off (slow) when in fact it is the opposite. In the end, we all know that the local housing market has been booming for the past year (plus) and more particularly this year and even more particularly, this spring and summer. Thus, if a quick glance at a data set at first leads you to a conclusion (contract activity is falling) that seems contrary to a general understanding of current market dynamics, it is often helpful to zoom out a bit and try to see a clearer picture on a larger data set. | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings