Increased Mortgage Interest Rates Can Significantly Decrease Your Home Purchasing Power |

|

If you have $2,000 per month in your budget for your mortgage payment, that budget won't allow you to buy quite the same house now as compared to six months ago. Six Months Ago = 3.22% Mortgage Interest Rate = $451,000 house Six months ago, you could purchase a $451,000 house in the City of Harrisonburg, put 20% down, finance the purchase with a 30 year fixed rate mortgage at 3.22%, pay your tax bill and homeowners insurance all for a smidge less than $2,000. Today = 5.81% Mortgage Interest Rate = $353,000 house Today, you can purchase a $353,000 house in the City of Harrisonburg, put 20% down, finance the purchase with a 30 year fixed rate mortgage at 5.81%, pay your tax bill and homeowners insurance all for slightly less than $2,000. $98,000 of Purchasing Power... Gone! As such, if you have a fixed budget for your housing costs, you have lost $98,000 of purchasing power over the past six months given the increased interest rates. But Remember... Six months ago, plenty of buyers with a $2,000 budget may have been buying $353K houses... not $451K houses... so for some buyers the increased monthly costs are likely painful, but may not change their purchasing decisions. -- This article was inspired by an even more thorough analysis of this dynamic over here. | |

Homes Not In Property Owners Associations Might Still Have Restrictive Covenants |

|

Just because the house you are buying is not located in a Property Owners Association... that does not mean that there are not rules that affect your ownership of the property. Many neighborhoods developed in the past 20 to 30 years do not have Property Owners Associations... but do have Restrictive Covenants. These restrictive covenants often set down guidelines such as... [1] If you want to make exterior changes to your house or add an outbuilding, etc., you may need to first seek approval from an architectural review committee. [2] Non domestic animals (chicken, pigs, goats) are often prohibited. [3] There may be restrictions on parking commercial vehicles, campers, trailers or boats on your property. ...and the list goes on! So, if you are buying a house that is not a part of a Property Owners Association, let's also take a moment to check for any restrictive covenants that may affect your ownership of the property and make sure you are familiar with and comfortable with those restrictions. | |

Is The Local Real Estate Market Softening? |

|

Anecdotally, it seems like a maybe the local real estate market is softening... but the data certainly doesn't show it yet. Here are a variety of current market anecdotes for you... [1] Many new listings are still having a flurry of showings and multiple offers and are selling at or above the list price with very few contingencies. [2] Sometimes a hot new listings receives just two offers instead of the five to eight that might have been anticipated. [3] Sometimes, new listings are coming on the market and sitting for a week or so before generating an offer. [4] Sometimes sellers start at one asking price and adjust it down a few weeks later after not having received any offers. And some data... [5] Thus far (Jan - May) in 2022, 4.75% more homes have sold than last year. So... is the market softening? Items 1 and 5 above would indicate... no. Items 2, 3 and 4 would suggest... maybe. I'll keep monitoring the data to see if it starts to show anything different... but for now, I'm leaning more towards believing the story told by the data more than the story told by the occasional anecdote. | |

It Can Be Particularly Challenging For Relocating Home Buyers To Buy Right Now |

|

There have been three instances in the past week where I really wish the fictional private jet shown above existed... ;-) It is particularly challenging for a relocating home buyers to buy houses in Harrisonburg and Rockingham County right now. If you plan to move to the Harrisonburg area at the end of the summer, and you live four hours (or more) away from Harrisonburg, when a new listing of potential interest hits the market, you're often caught in a dilemma. I can "show" you the house virtually via FaceTime, but then, do you... [1] Make an offer without having seen the house yourself, in order to have a chance at having an offer submitted in time for it to be considered. [2] Hop in the car or book a plane ticket to get to Harrisonburg to see the house yourself, the following day, to make a decision about submitting an offer after having seen the house in person. Neither option seems great to relocating home buyers. Many buyers just simply aren't comfortable with buying a house without having seen it themselves, in person, and having walked through it. Understandably. Some buyers are reluctant to hop in the car for an eight (+) hour adventure, or a two day excursion by plane, to see a house in person... perhaps to then either not like it as much as they thought... or to love it even more but then submit an offer that is not accepted. So, what is a relocating home buyer to do? Our company does not currently have plans to purchase a private jet to fly buyers in to see homes... but I'll let you know if we start exploring that possibility. Private jets aside, the options seem to be... [1] Get comfortable with submitting an offer to buy a house without having seen it yourself in person. You might not feel better or worse about this depending on the property, its condition, and how well it fits your needs. [2] Commit to making the trek (by car or plane) to Harrisonburg to see new listings of interest, even though sometimes the trip will not yield a contract on a house. [3] Plan to rent an apartment or townhouse for six months upon arriving in Harrisonburg to then be able to explore houses for sale, in person, quickly, as they hit the market. If the pace of the market were to ever slow down, the dynamic described above could change... but right now that doesn't seem to be happening. | |

The Summer Housing Market Often Provides An Irregular Flow Of New Listings |

|

Starting and stopping and starting again. Home buyers hoping to buy a house in Harrisonburg or Rockingham County over the next month or two might become confused, or frustrated (or both) with the start and stop nature of the market during the summer months. There might be 300 homes listed for sale over the next two months... but there won't be five new listings per day for the next 60 days. Why, you might ask? Mostly because of seller's vacation plans. "I'm going to get the house ready to go on the market on ___. Oh, wait, we're going on vacation just before that, so let's push it back a few weeks." "I'm going to be ready to have the house photographed by ___. Oh, wait, then we leave on vacation immediately after that and I don't want to be out of town when the house is being shown." If you are a home buyer hoping to buy soon... don't get overly discouraged when there is a slow week or so of new listings... that will almost always be followed by a burst of new listings in the following few weeks. | |

Will Mortgage Interest Rates Decrease Again, Somewhat, In The Next Few Years, Allowing 2022 Home Buyers To Refinance? |

|

It's an interesting question that I have discussed with several home buyers lately. The economy is on a tear... inflation is rampant... housing markets (including our own) are seeing double digit per year increases in sales prices. One action that the Federal Reserve is taking to combat these factors is to raise interest rates. Mortgage interest rates are now approaching 6% -- after having started the year just over 3%. Wow! But... if the rates have risen this high to get things (the economy, inflation, housing markets) to cool off a bit... if/when they do, will interest rates eventually decline again? I don't know that they'll ever go back down towards 3%, and maybe not 4%... but is it possible within the next few years that we will see mortgage interest rates of 4.5% or 5%? It seems possible? I certainly won't say that it is likely, but it is certainly possible. This possible future reality is providing some residual comfort to home buyers who are going ahead and buying in 2022. They can afford the mortgage payments at the current rates of close to or at 6%, but they'd love to be paying a lower mortgage payment for their home at some point in the future. If their theory holds true... perhaps we will see interest rates eventually decline, somewhat, allowing 2022 home buyers to refinance to take advantage of future lower rates. Clearly, there is no guarantee that this will happen... but it does seem possible. | |

Harrisonburg Area Housing Market Reaches New Heights |

|

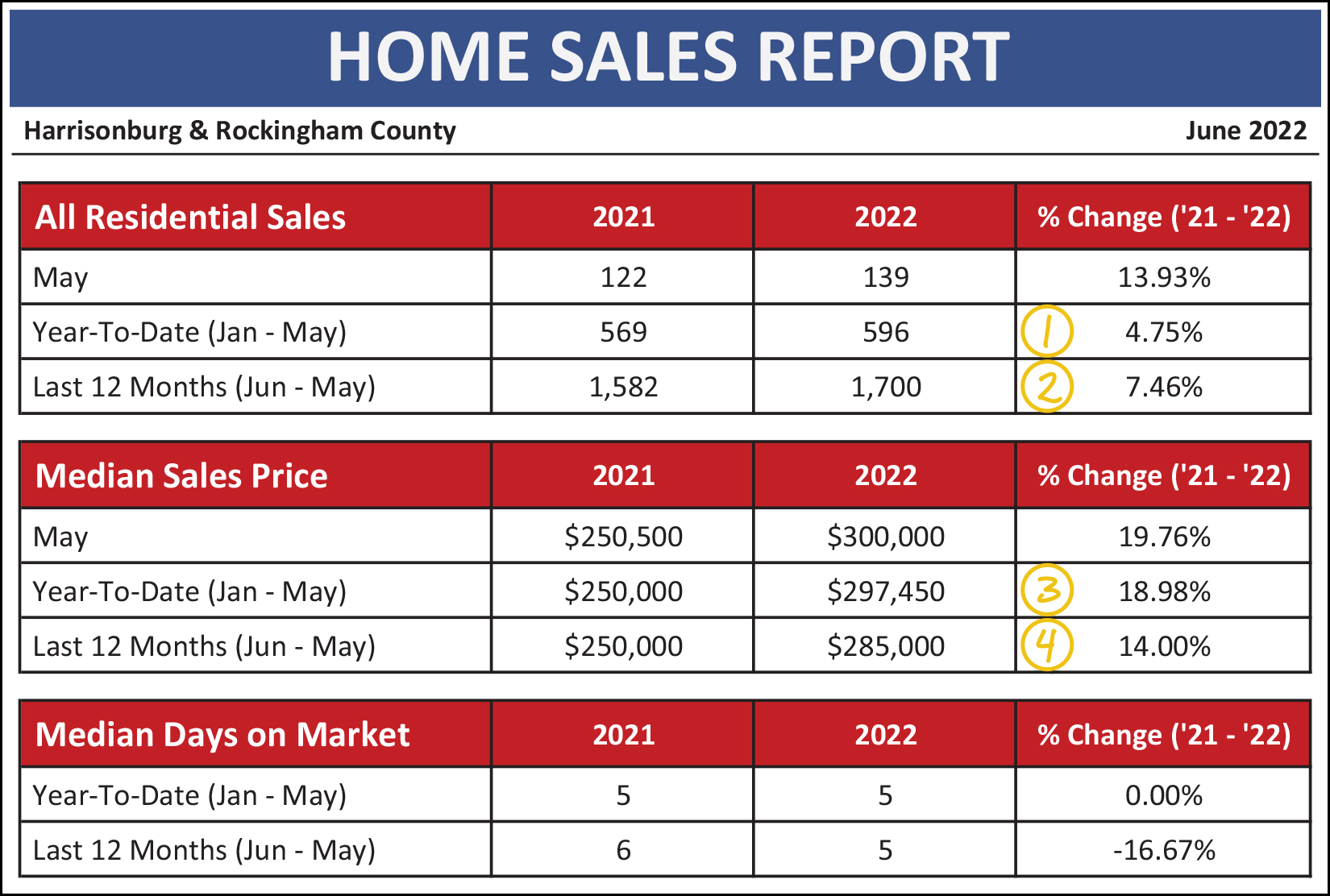

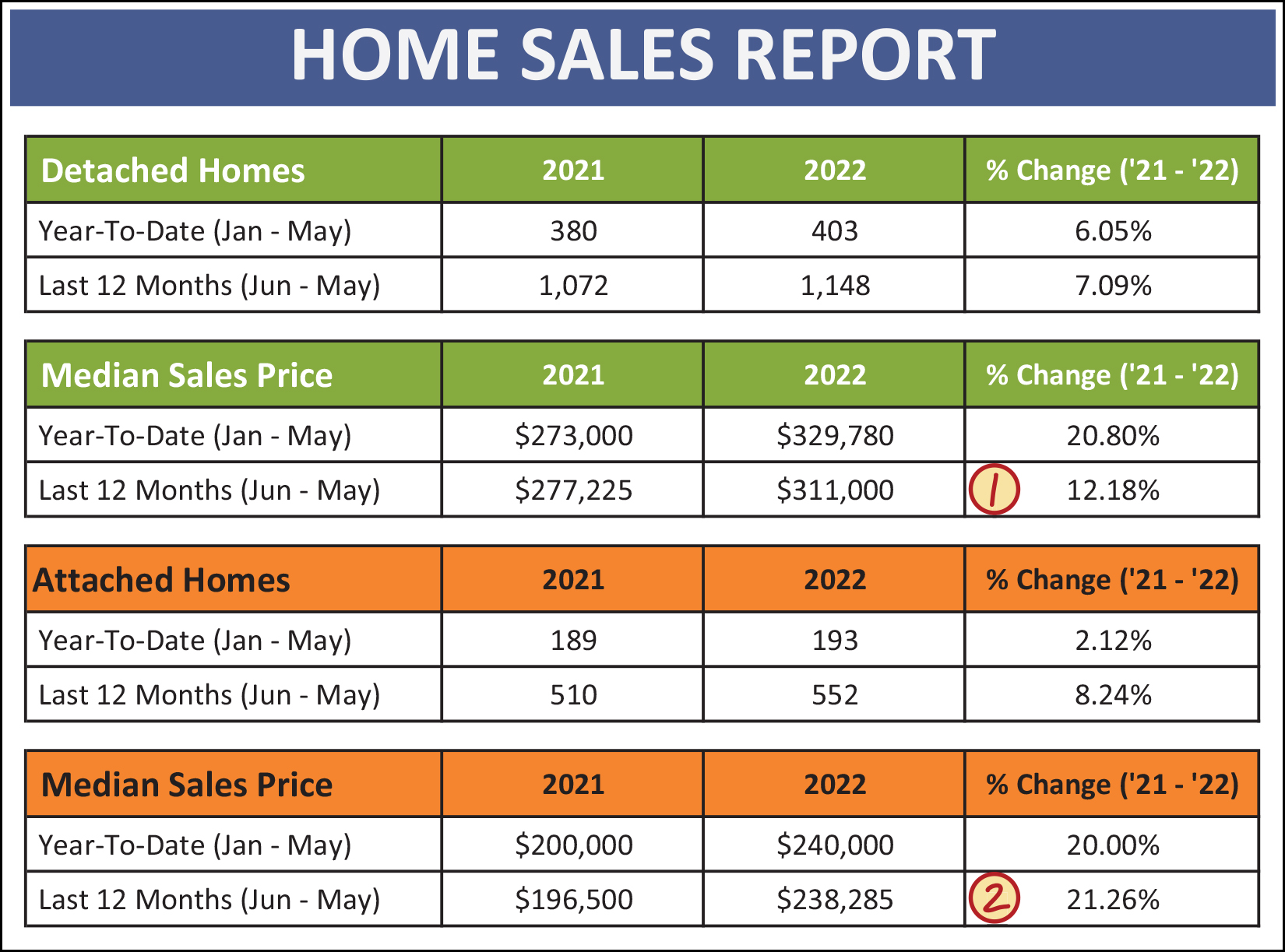

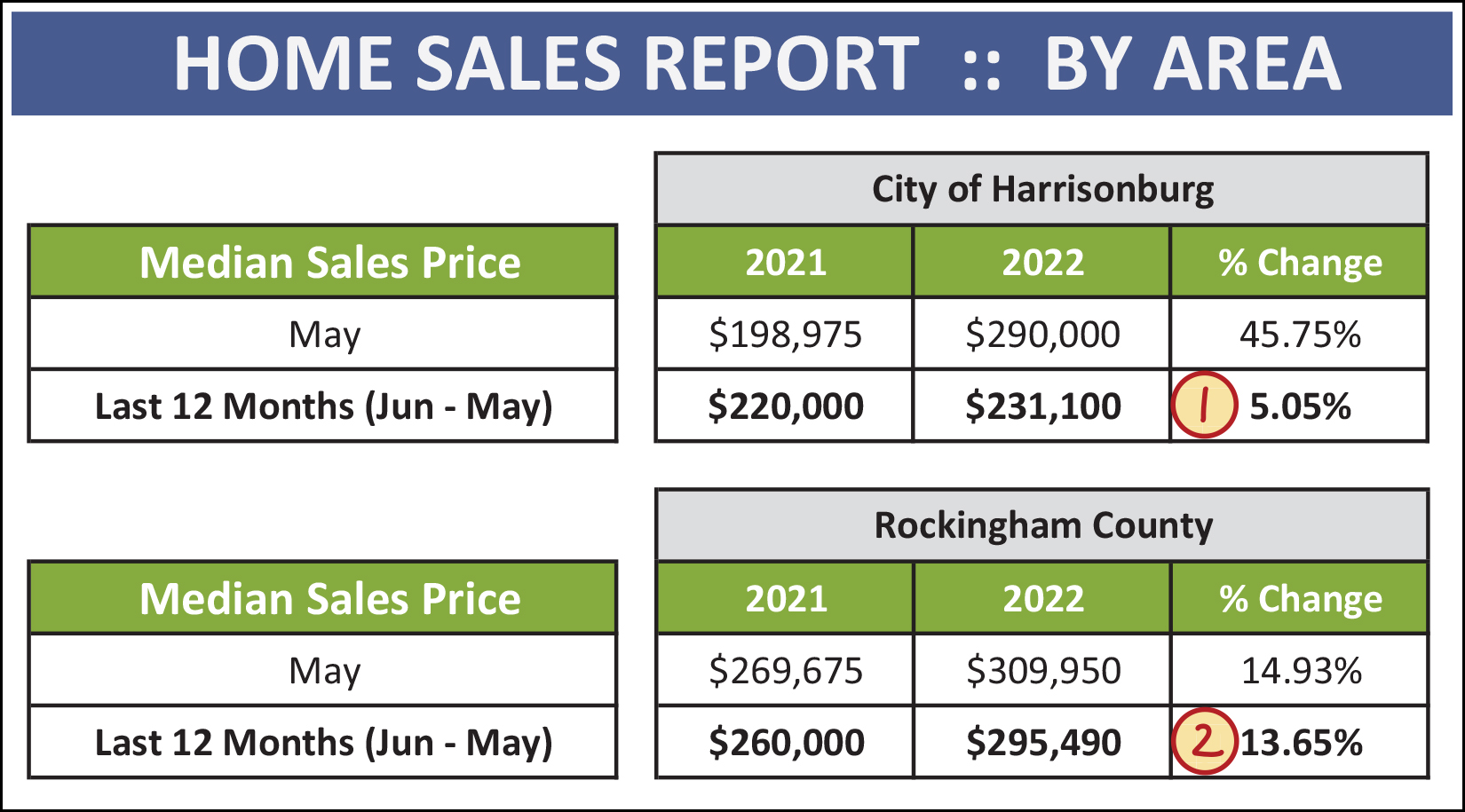

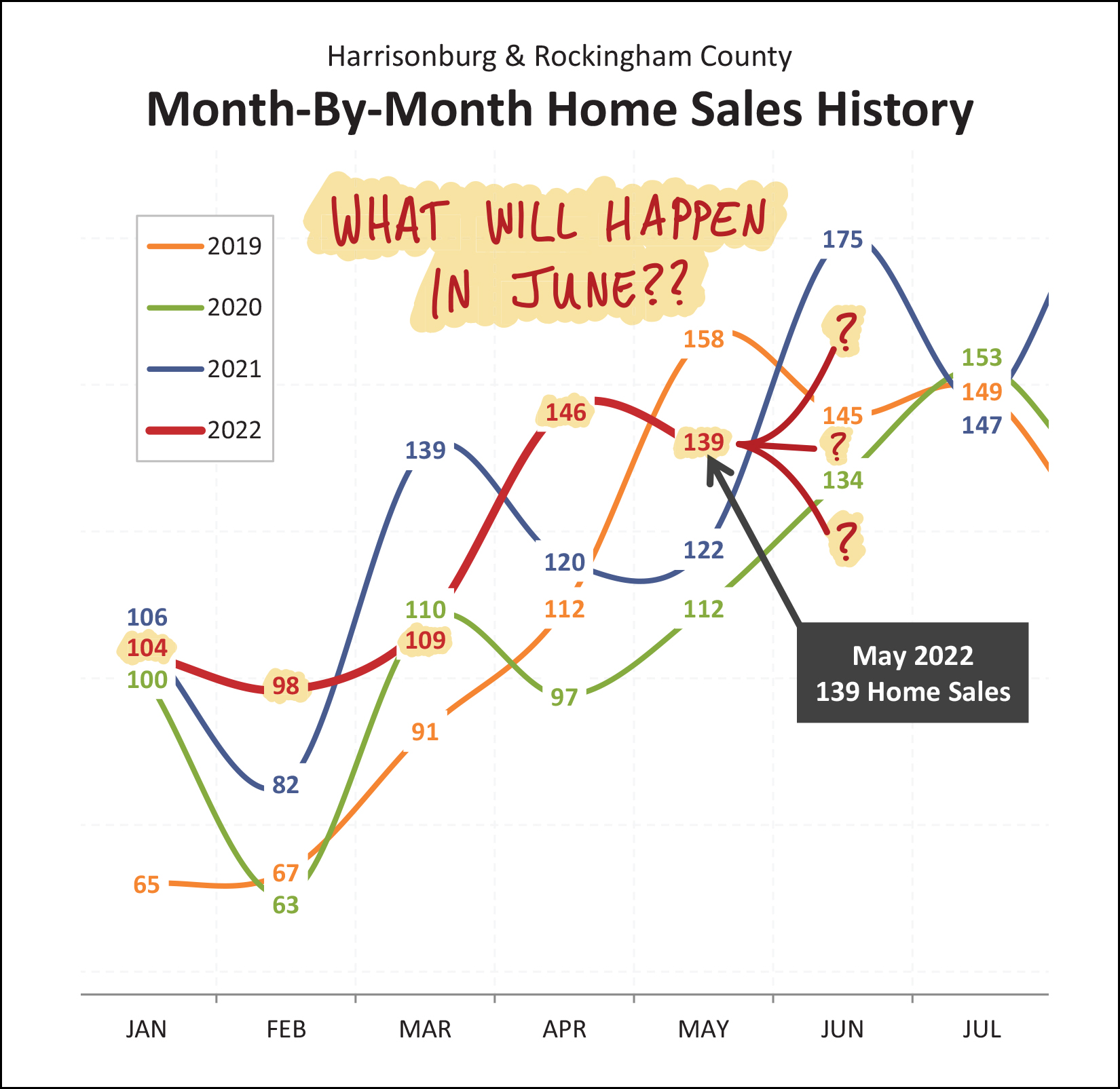

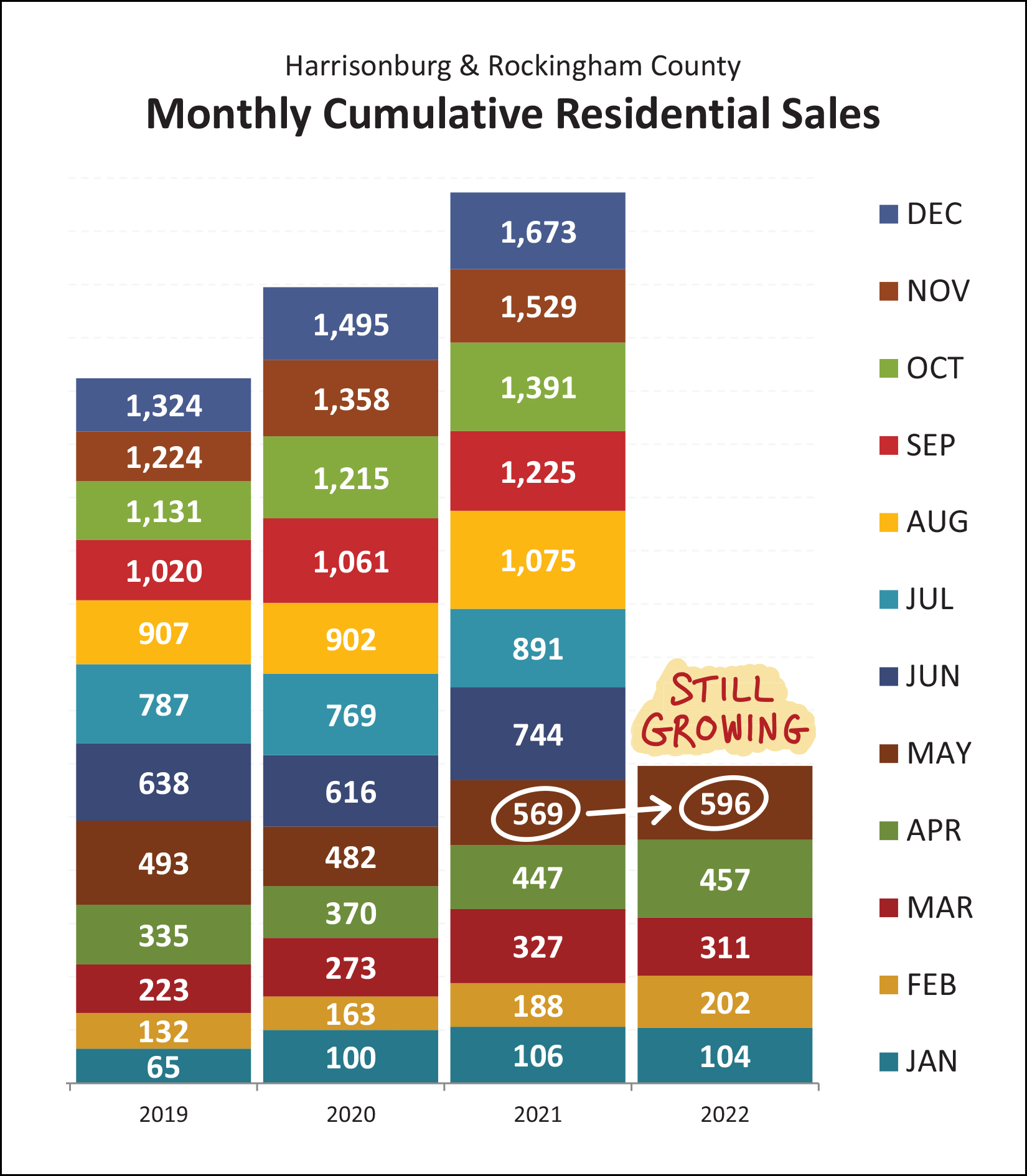

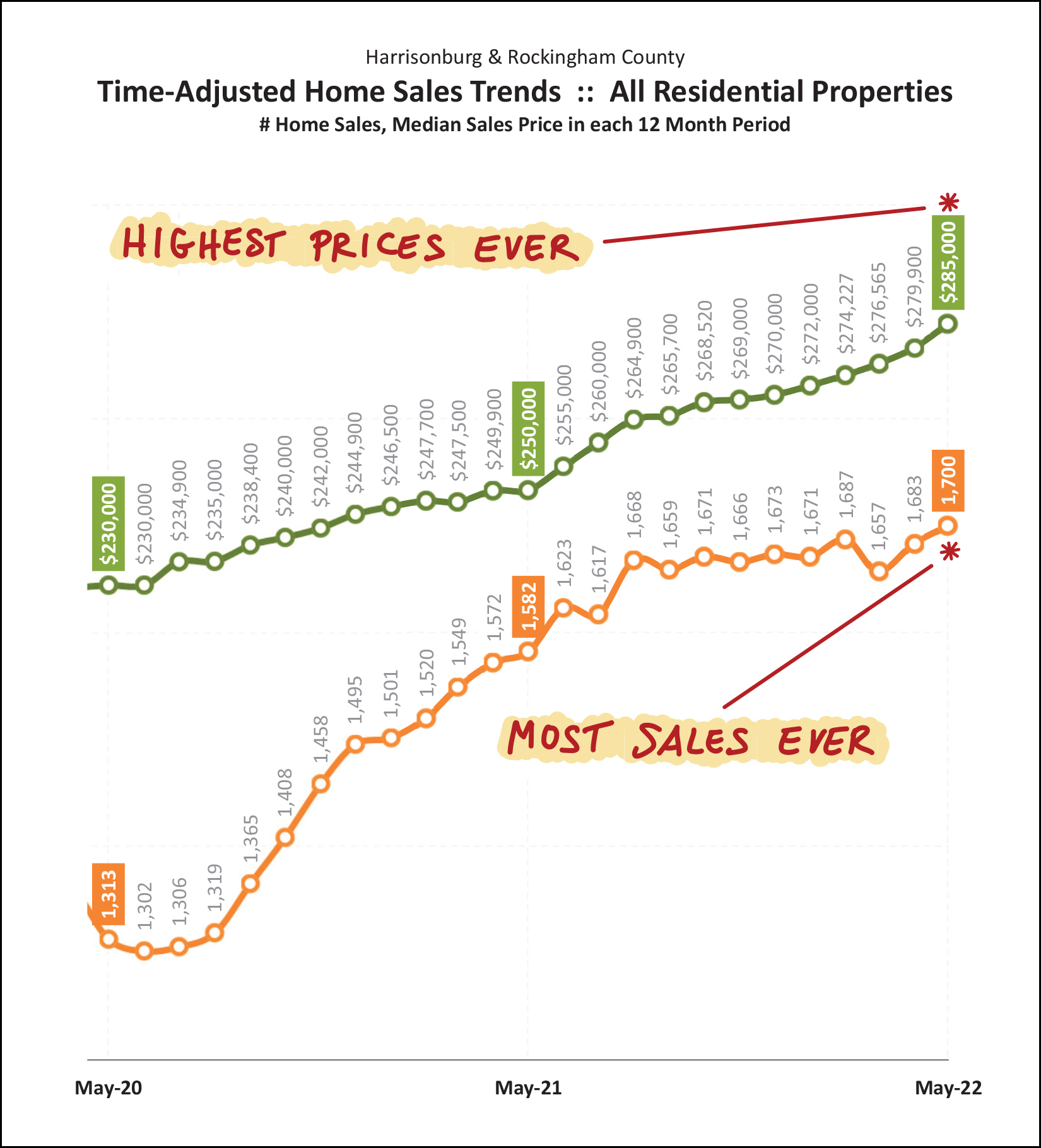

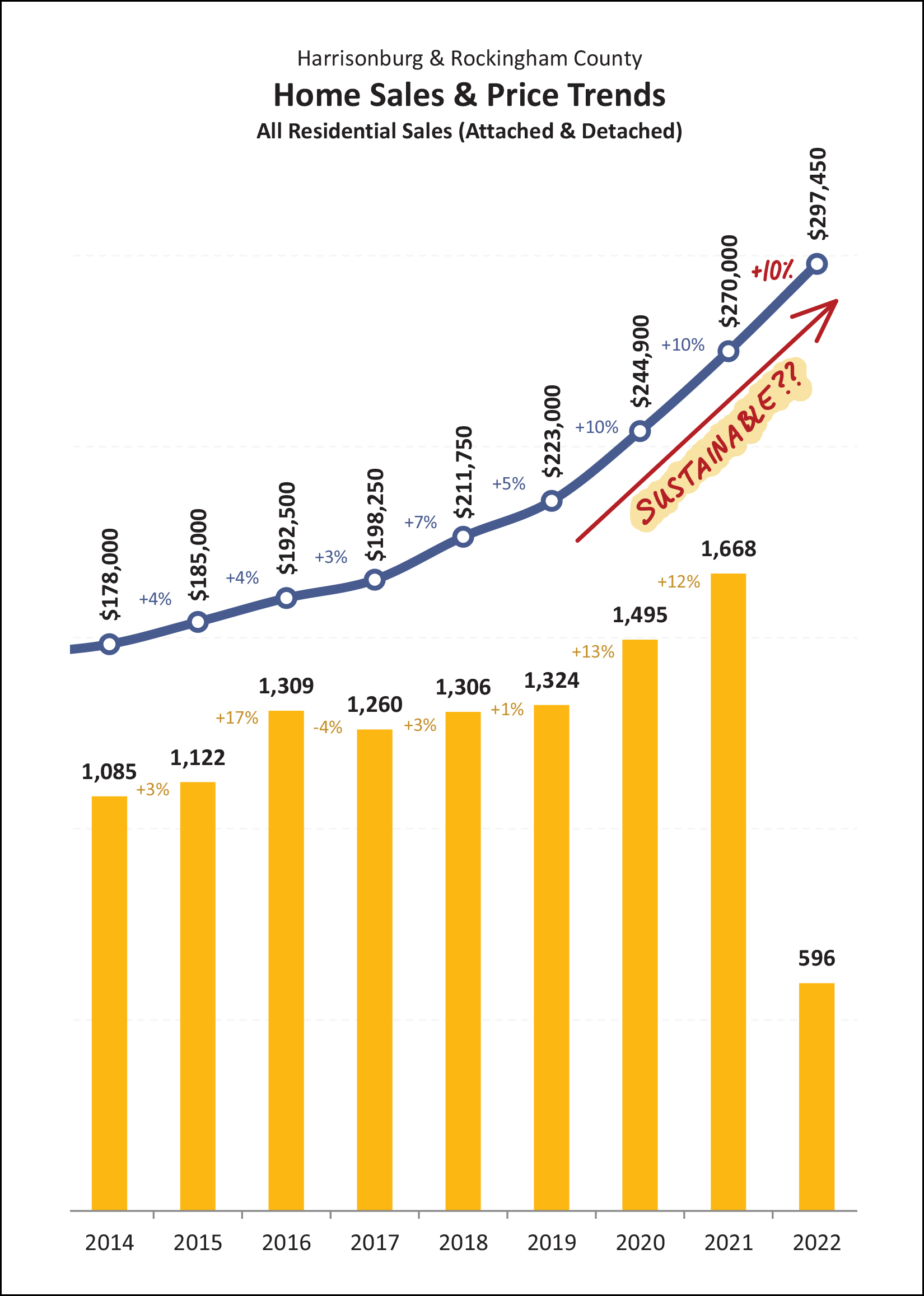

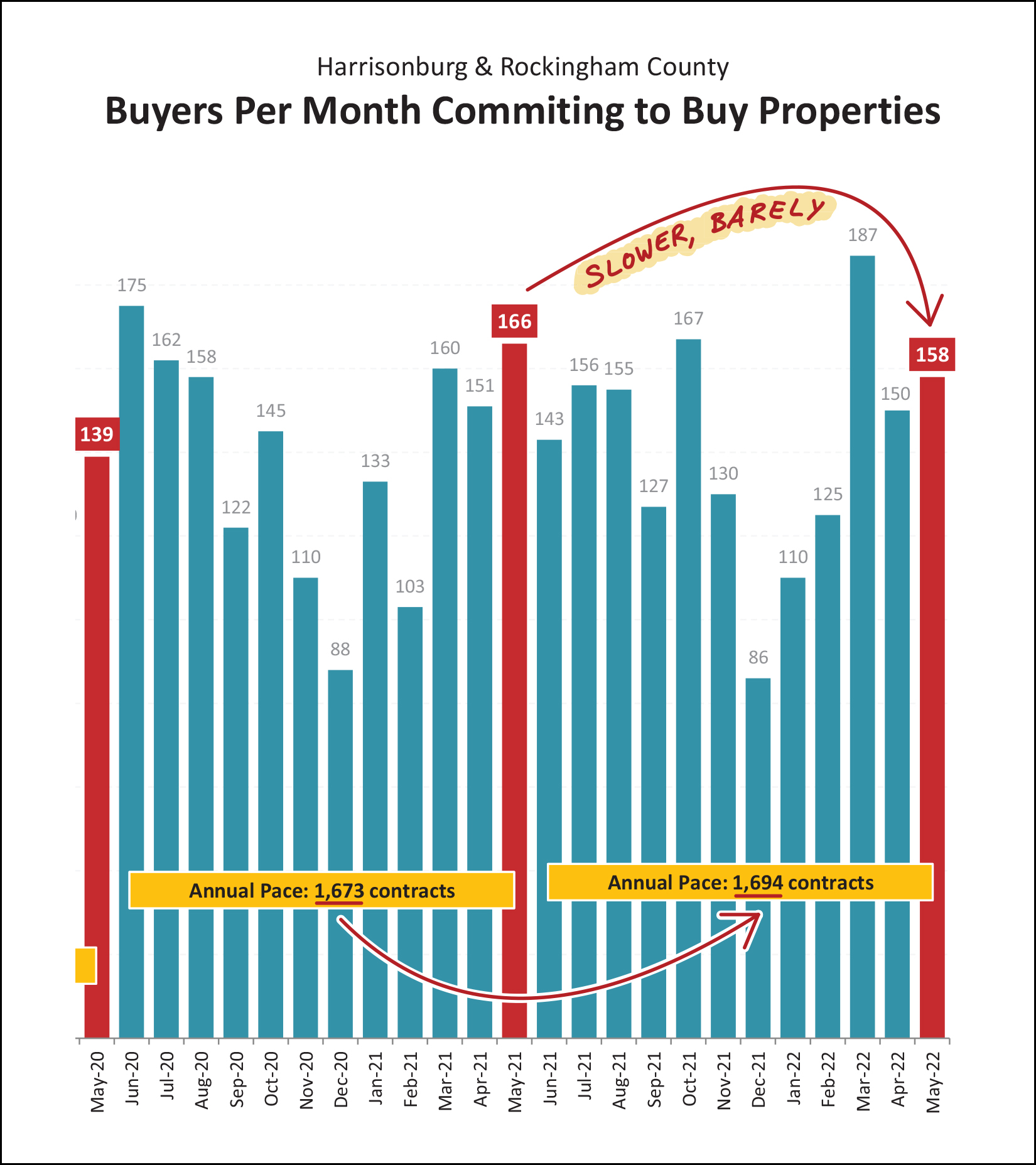

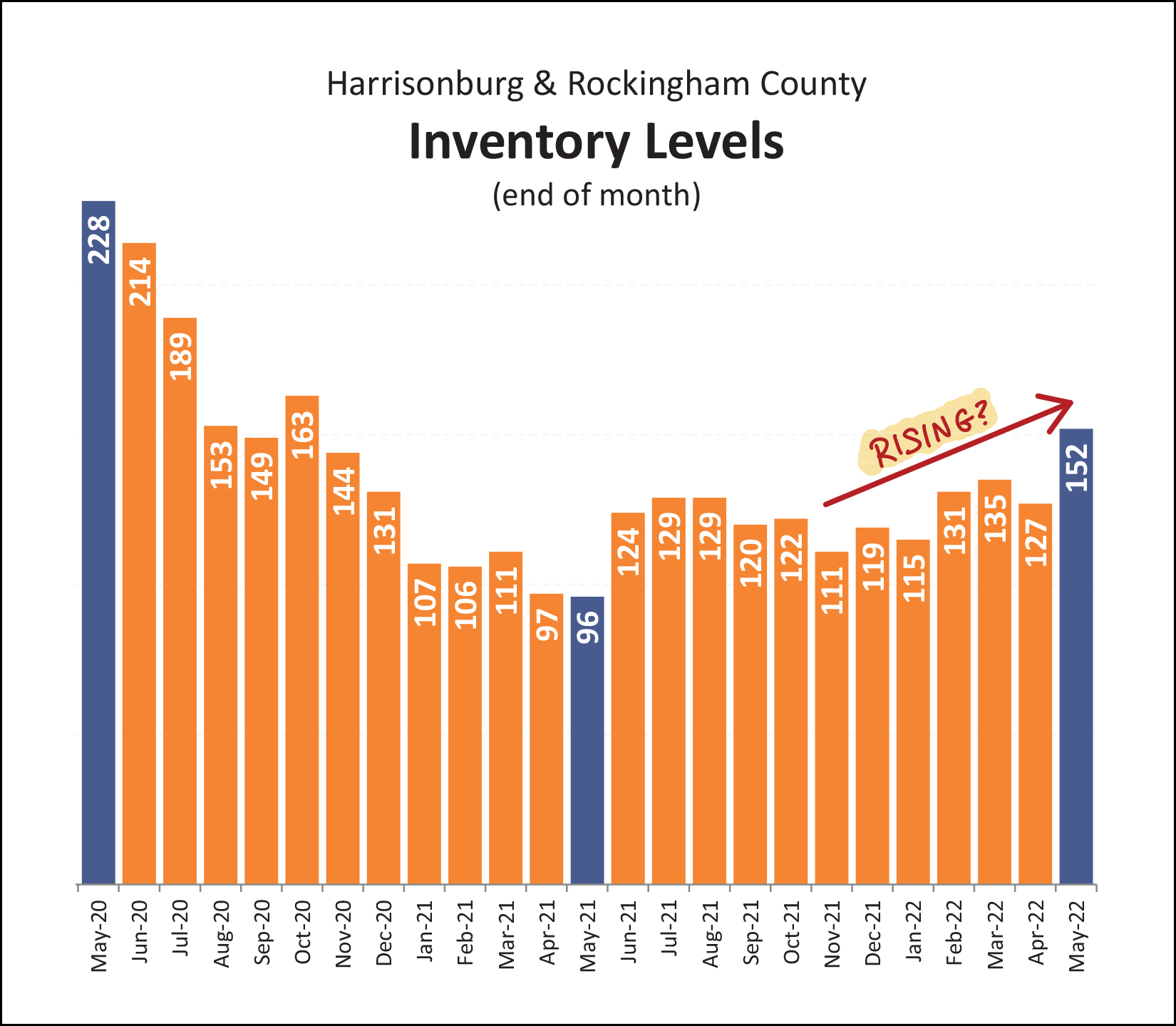

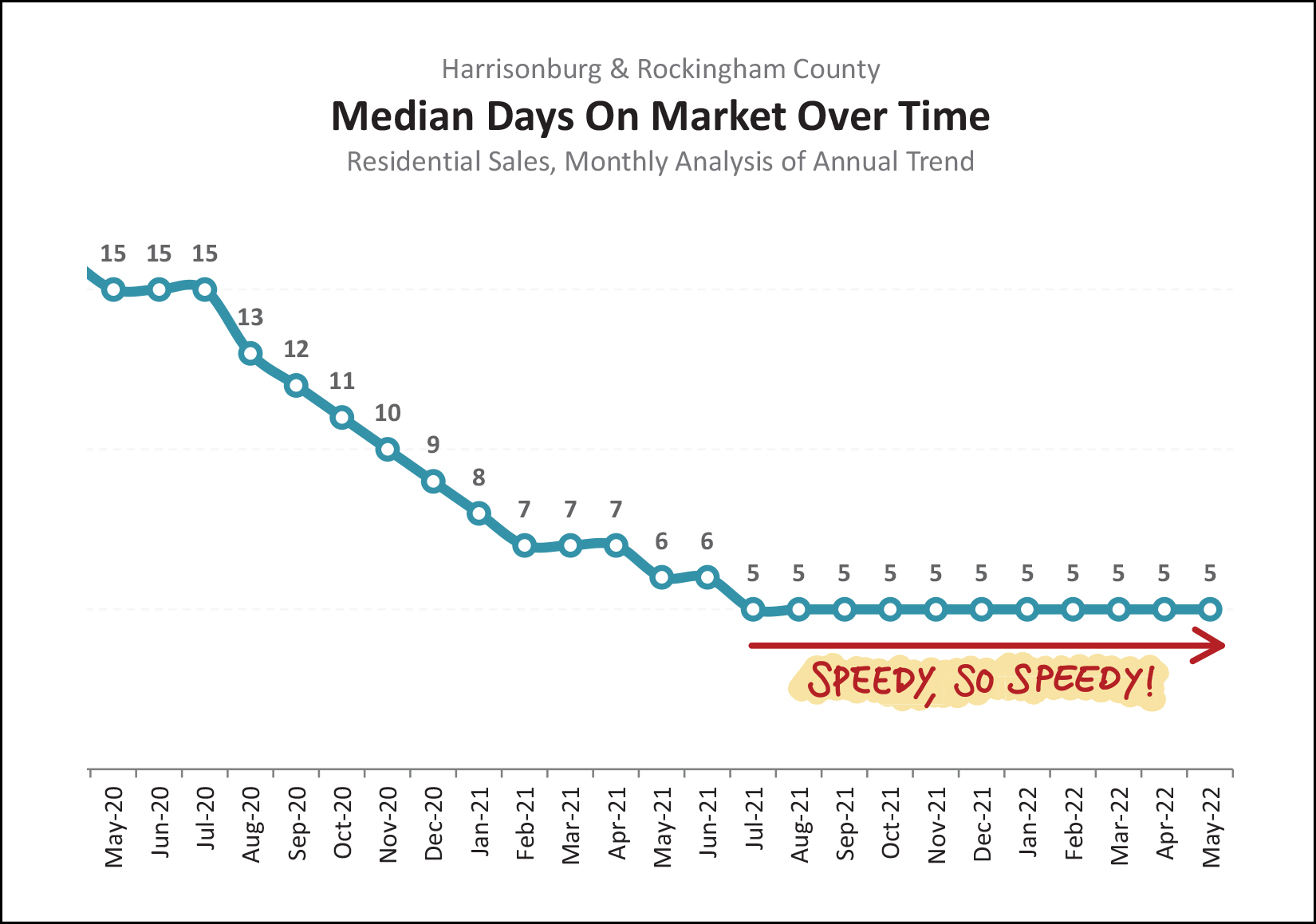

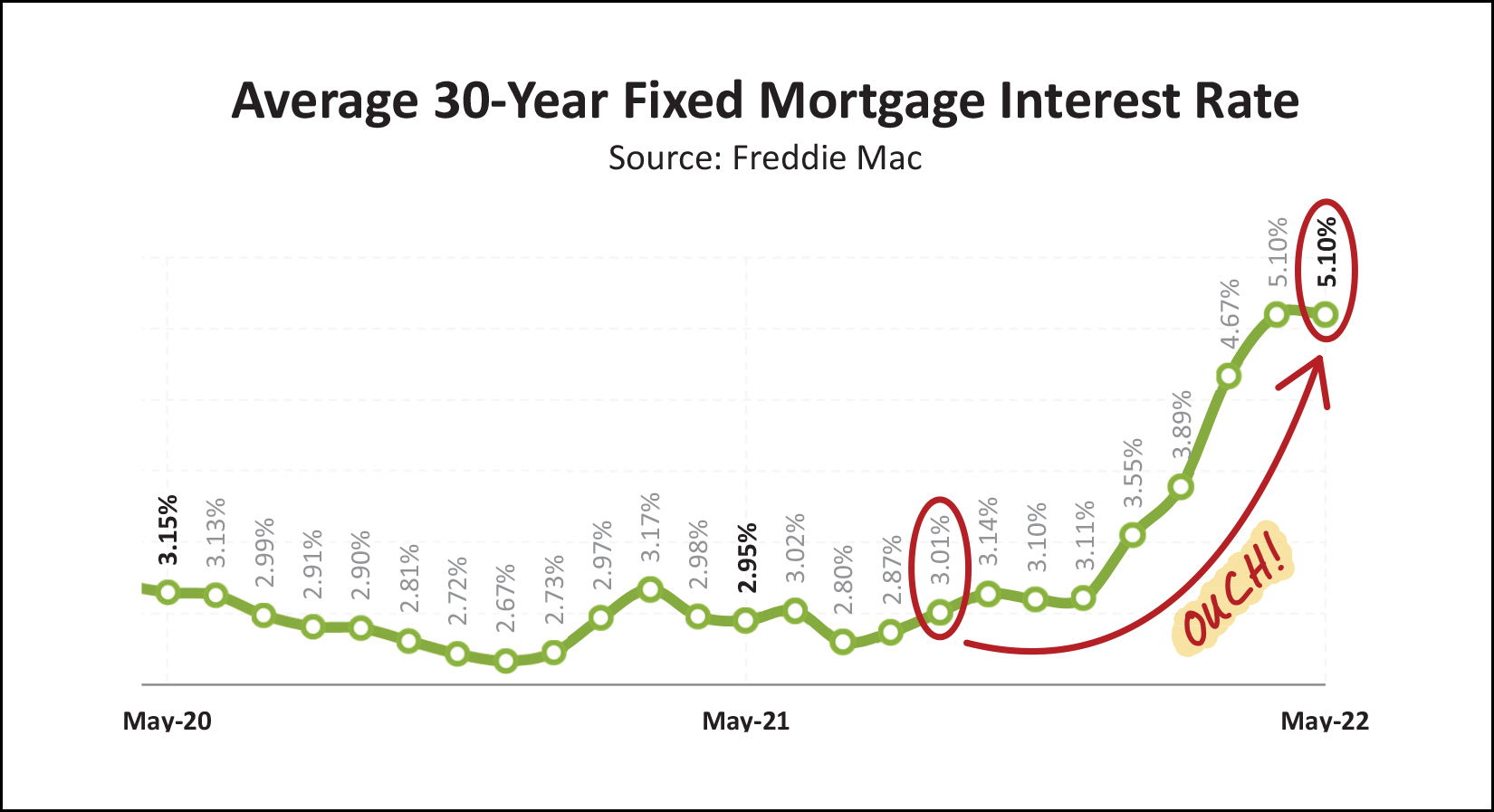

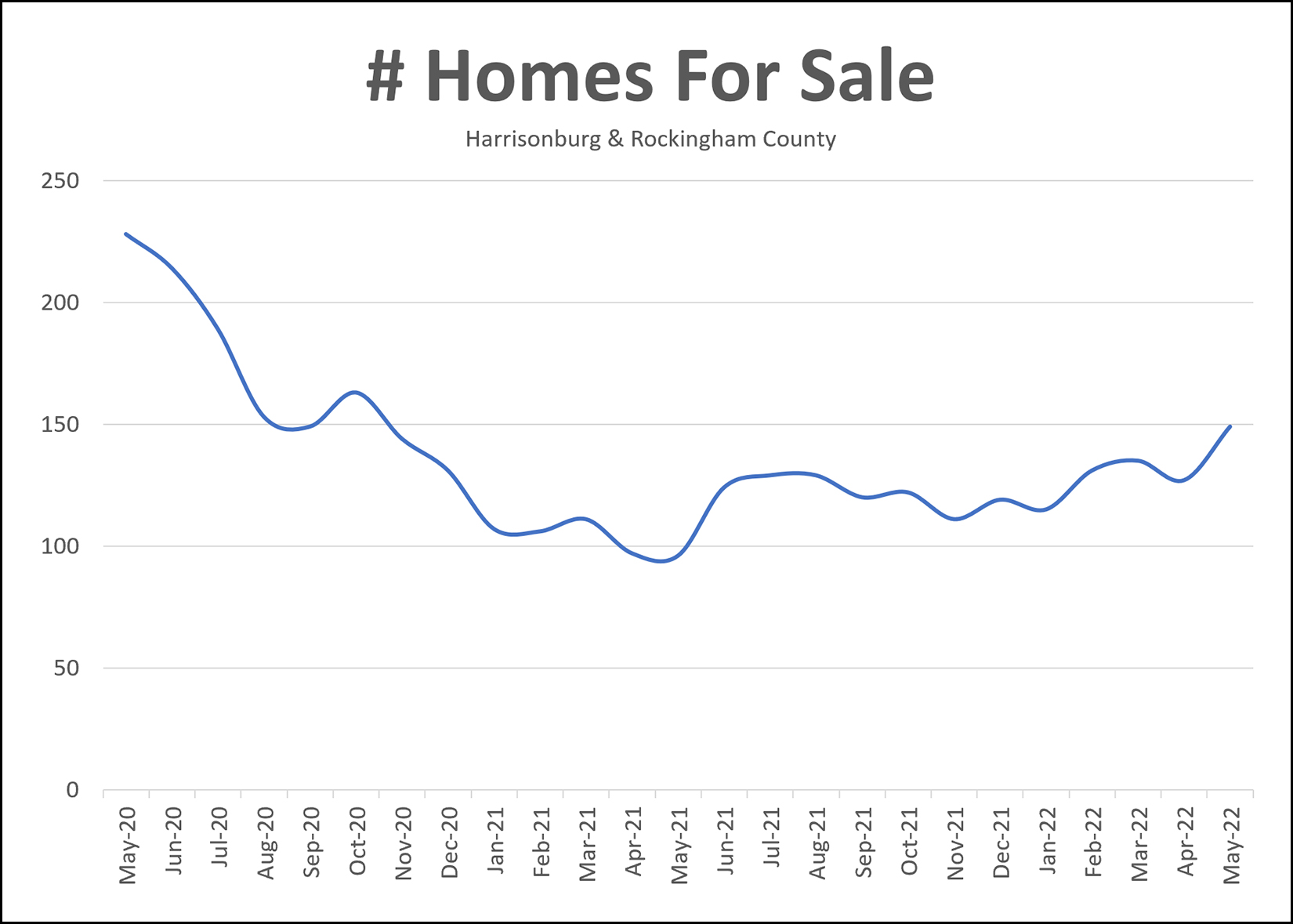

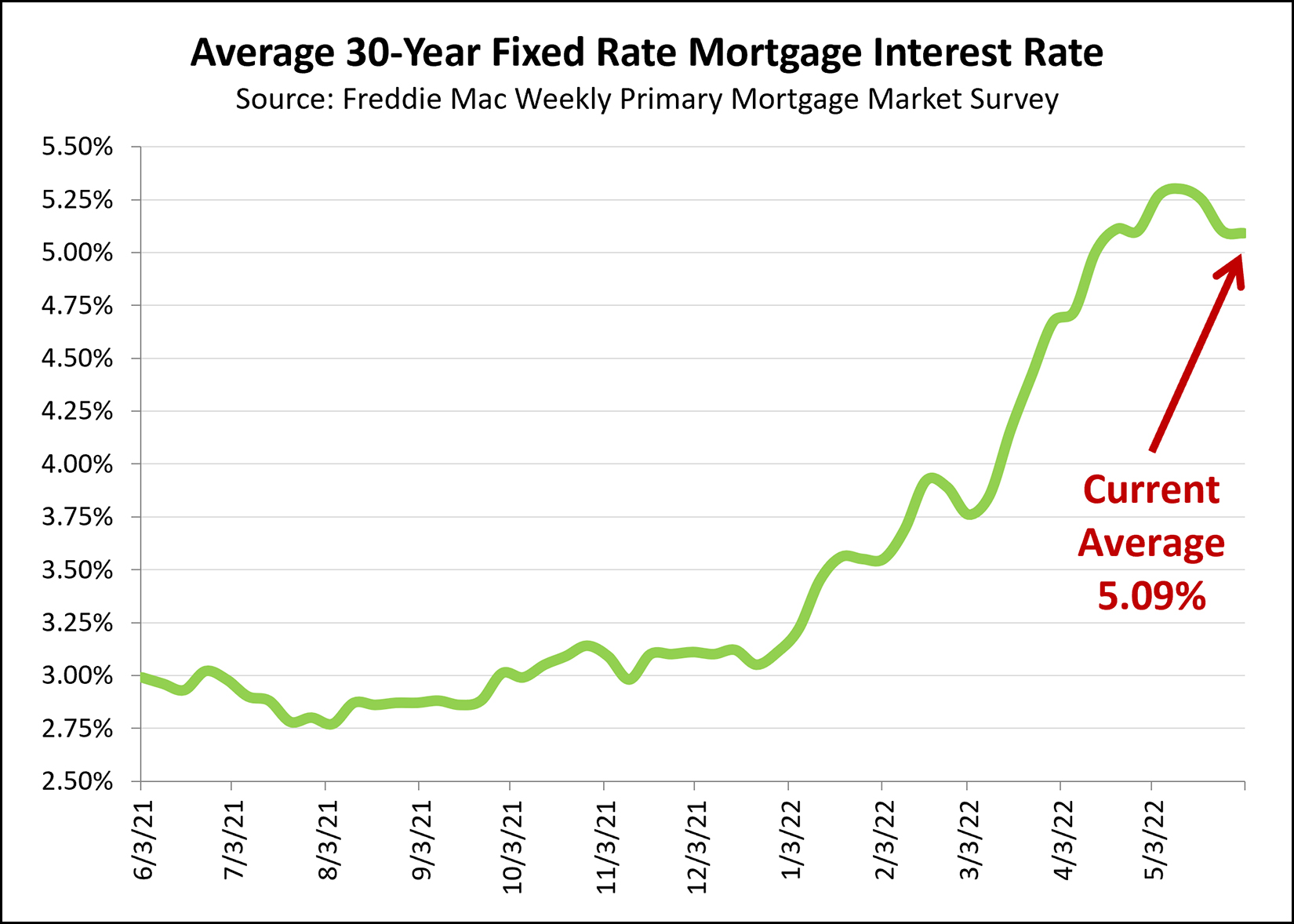

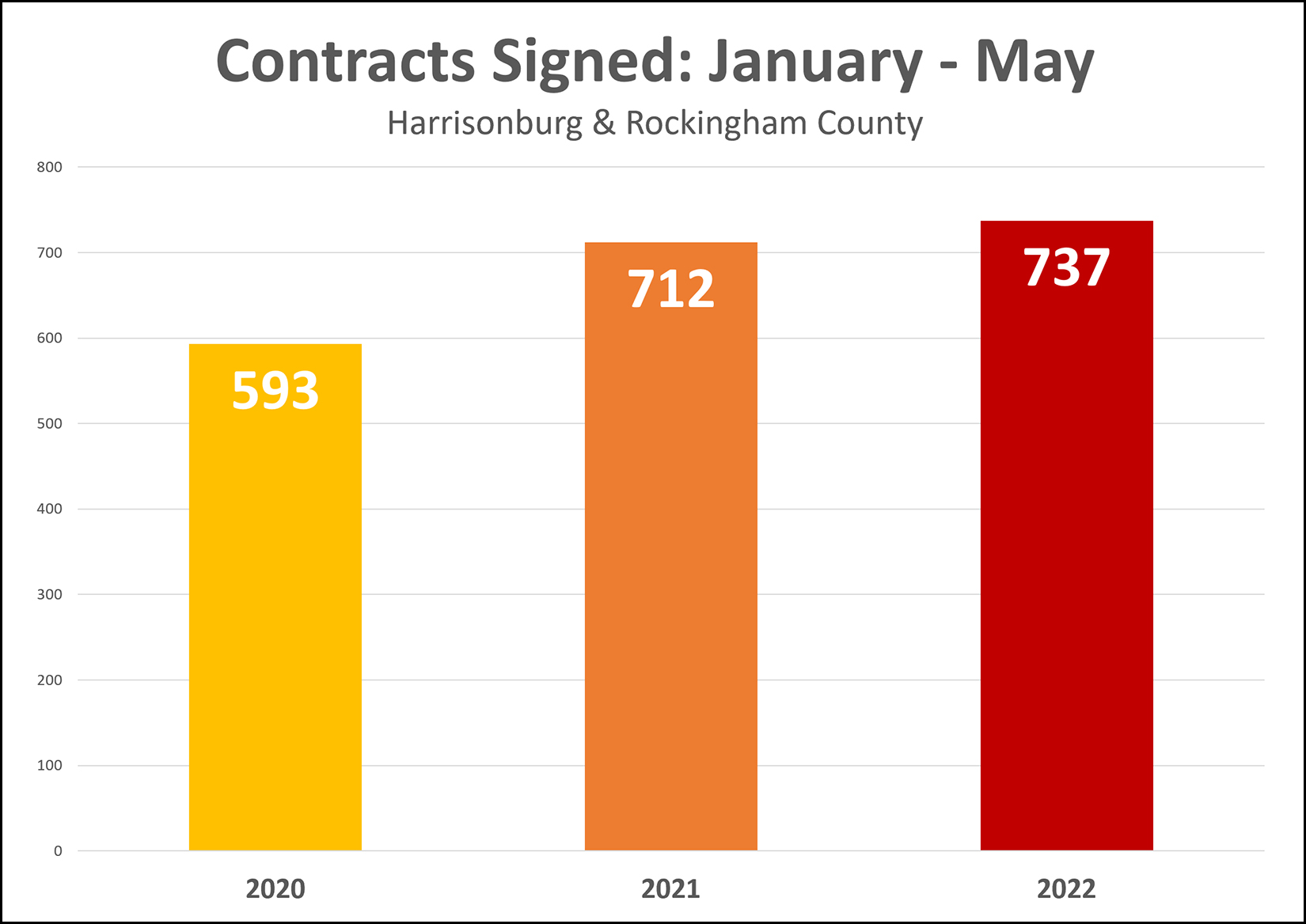

Happy Friday morning, friends... and Happy Summer! If you have school age kids, or college age young adults, I hope the school year finished out well and that they (and you) are ready to relax a bit over the summer. Luke just finished 11th grade and is gearing up for his senior year (gasp!) and Emily finished out middle school and will be in 9th grade in the fall. Here they are in the obligatory "last day of school" photo...  Transitions it seems, are upon us. School is ending and summer is beginning. Cooler spring days are being replaced by hot and humid summer days. And... as some folks seem to be wondering these days... are we seeing a transition in our local housing market? I don't think any of us will really know the answer to that question for another six to twelve months when we can look back and reflect on what happened in the second half of 2022, but here are some things that seem to be true... [1] Mortgage Interest Rates Are Rising [2] Some Home Buyers Are Getting Priced Out Of the Market [3] The Stock Market Is Not Doing So Well [4] Inflation Is Upon Us ...and yet, with all of these transitions taking place, this month you'll learn that... [1] More homes sold in the past 12 months than ever before in any 12 month period in Harrisonburg and Rockingham County. [2] The median sales price in the past 12 months is the highest it has ever been. So, is our local housing market transitioning? Is it cooling? Is it leveling off? Is it settling down? Maybe it is and the data doesn't show it yet? Maybe it will eventually? Maybe there are some early signs that it might soon? We'll explore the data together below, but I'm not finding many, if any, signs that our local housing market is undergoing significant changes. But first... My Favorite Spots... Each month in this space I highlight one of my favorite spots to enjoy a meal, a cup of coffee, or an experience. This month, I'd encourage you to check out Village Juice & Kitchen on West Bruce Street in downtown Harrisonburg where you'll find delicious smoothies, smoothie bowls, salad and grain bowls, juices and so much more! My favorite smoothies (so far) are Mint Chip and Mocha Nana. Explore the menu at Village Juice & Kitchen, on me, by entering to win a $50 gift certificate here. I'll pick a winner in about a week. Download All The Charts & Graphs... Now... let's take a look at the data together...  Looking at all of the numbers above, a few things jump out to me... [1] Looking only at the first five months of this year (Jan-May) we have seen a 4.75% increase in the number of homes selling in Harrisonburg and Rockingham County. [2] Looking at a slightly longer timeframe, the past 12 months, the increase in the number of home sales has been over 7%. [3] The median price of homes sold thus far in 2022 has been $297,450... almost 19% higher than a year ago when it was only $250,000! [4] Looking at a full year of data, the median sales price in Harrisonburg and Rockingham County over the past year was $285,000... which is 14% higher than a year ago when it was $250,000. This is a significant increase in home sales prices over a single year. Can we break it down any further to understand why these prices are going up so much?  At least one observation that can be made is that change in prices are happening a bit differently when looking at detached homes compared to attached homes... [1] The median sales price of a detached, single family home, is now up to $311,000 in Harrisonburg and Rockingham County, over 12% higher than a year ago. ...but... [2] The median sales price attached homes (townhomes, duplexes, condos) has increased 21% over the past year to $238,285! This much larger increase in the median sales price of attached homes seems likely to be a result both of townhomes selling at higher prices... and most newly built townhouses being larger and more expensive than townhomes as a whole. Beyond property type (detached vs. attached) can we find any other differences in changes in property values? Why yes, we can...  Above you'll note that... [1] The median sales price of homes sold in the City of Harrisonburg over the past year has increased 5% to $231,100. ...while... [2] The median sales price of homes sold in Rockingham County has increased over 13% during the past year. Again, this may be at least partially a result of what happens to be selling... with many newer, larger, more expensive homes being built in the County right now... which causes the median sales price (of what has sold) in the County to increase. Now, looking visually at how this year has played out on a month by month basis...  After a comparatively strong month of home sales in April 2022 (well above previous months of April) we saw a slight decline in monthly home sales from 146 sales in April to only 139 in May. Looking ahead, it's anyone's guess as to what exactly will happen in June. It seems somewhat unlikely that we'll exceed the shockingly strong 175 home sales seen last June... but perhaps we'll be in the 160 range, or maybe right around 140 again (like this month) or could we have the slowest June in the past three years? Stay tuned to find out. Sorting the data out and stacking it up a bit differently, you'll notice that 2022 is looking pretty solid...  Those circled brown numbers might look pretty similar, but one is 569 and one is 596... so we have seen more home sales in the first five months of 2022 than we saw in the first five months of last year, and of the year before that, and the year before that! We're still on track to meet or exceed the 1,673 home sales seen last year, though we are certainly experiencing some headwinds now with rising mortgage interest rates. If our local housing market does slow down a bit, when will it happen, or when will we see it? In June? July? Again, illustrating the story of the market that has not yet slowed down...  Two "highest ever" or "most ever" data points above... [1] The median sales price of $285,000 over the past 12 months is the highest such median sales price we have ever seen in Harrisonburg and Rockingham County. [2] The 1,700 home sales seen in Harrisonburg and Rockingham County in the past 12 months is the most, ever, that we've seen in that timeframe in our local market. So, yes, there are plenty of reasons why our local market could be slowing down, or might eventually slow down, but thus far the data doesn't seem to be showing it. If or when the data does show it, I'll be sure to point it out. There are a few possible leading indicators below...  I suppose I could take the title and numbers off of the graph above and we could imagine it to be a graph of any variety of things these days... the cost of health care, the cost of higher education, the cost of gas, the cost of groceries, but in this case... it's the cost of housing. The median sales price just keeps... on... going... up! This might be the third year in a row where we will see a 10% increase in the median sales price in our local market! OK... now... to "cool our jets" a bit, as my mom used to say...  While it's still quite a bit higher than May 2020... only 158 contracts were signed for properties in May 2022, down a bit from the 166 that were signed a year ago in May 2021. Furthermore, over the past year there have been 1,694 contracts signed... compared to only 1,673 in the prior year. So... as a possible early, early, early leading indicator that the market might be slowing, slightly... contract activity might be getting close to leveling off. Right now, it's still on the rise... more homes went under contract in the past year than the previous year... but they're getting close to being even. And another indicator that we might be seeing a transition in the market...  Inventory levels, as shown above, are starting to creep up, a bit in our local market. The market bottomed out with fewer than 100 homes for sale a year ago... but now we're up to 152 homes for sale in Harrisonburg and Rockingham County. Admittedly, many of these options are new homes in a handful of communities that will only appeal to some pockets of the buying public (based on size, price or location) but regardless of what the options are that are for sale... there are more options for sale now than there were a year ago. There are, clearly, still well fewer options now than two years ago or earlier, but inventory levels are no longer declining... and they seem to actually be increasing! But, despite a possible leveling off of contract activity... and despite inventory levels creeping up a bit... most homes seem to be selling just as fast as ever...  As shown above, the median "days on market" for homes sold in Harrisonburg and Rockingham County fell all the way down to five days about a year ago... and has been there ever since. Two years ago, the median was over two weeks, but we're just not in those times any longer. If the market does slow, we should see it taking an extra day or two (or 7 or 10) for homes to go under contract... but that is not yet happening in our local market. Finally, how about those mortgage interest rates?  Towards the end of last year, mortgage interest rates were as low as 3% but have since risen to 5%, and in the past few weeks (not shown on this graph) they have risen even higher... now exceeding 5.5%. Your mortgage payments will, clearly, be higher if you buy a house this year as compared to if you had bought a house last year. These higher mortgage interest rates could (should?) decrease the demand for housing... which might cause the real estate market to slow down or cool off a bit. Again, we haven't seen it yet. And with that, I'll draw this to a close. In summary... [1] More homes are selling on an annual basis than have ever sold before. [2] Homes are selling at higher prices than ever before. [3] Rising mortgage interest rates could cause our local housing market to slow down or cool off. [4] We don't yet seem to be seeing any slowing down or cooling off. [5] Even though we aren't seeing it yet, that doesn't mean it won't happen. Is a five point summary condensed enough to be considered a summary? Hopefully so. BUYERS: Check in with your lender to update your expectations as to mortgage payments. If you'd like to buy a home soon, let's chat about what to expect related to contingencies, competing offers and escalation clauses. SELLERS: You should probably get your house on the market sooner rather than later to hedge against interest rates rising even further, causing some portion of would be buyers to not be able to afford your home any longer. If you're planning to get your house on the market this summer or fall, let's talk sooner rather than later to discuss timing, pricing and more. If I can be of any assistance to you, feel free to call or text me at 540-578-0102 or email me here. | |

I Like This House! I Will Buy This House! Right? |

|

If only it were so easy. :-/ If you see a new listing of interest... ...and when we walk through it on the first day on the market you love it... ...and if you are pre-approved for a mortgage... ...and you make a strong offer, above the asking price, without a home inspection contingency or appraisal contingency... ...you'll get to buy the house, right!? Maybe!? Sometimes!? Our local market is still very competitive, especially under $300,000. There are lots of buyers ready to pounce on each new listing... some who already live here (and are renting) and some who are moving to the area. On many or most new listings under $300K it seems that there are still plenty of buyers ready to move quickly and aggressively in making strong offers, even with mortgage interest rates having risen steadily over the past few months. So, as a buyer in this market, especially if you're hoping to buy under $300K... we might end up having to find a few perfect houses on which to make an offer before you secure a contract to buy a home in Harrisonburg. It can be done... but it's not as simple as just seeing a house that you like and deciding to buy it. The competition is still high! | |

Ideally, We Should Talk About Potential Contingencies Well Before Making An Offer On A House |

|

In a fast moving housing market, it's important to be ready to make an offer quickly after seeing a house that you like. But... making an offer includes a variety of other decisions that may require more a bit of thought and planning. FINANCING This one is perhaps the most straightforward. By the time you are going to view a house for sale you should have already talked to a lender and have a pre-qualification or pre-approval letter in hand. You don't want to be in a situation where you like a house but haven't even talked to a lender yet to be able to have a letter documenting your financial ability to purchase the house. A seller in this market (and in most markets) will not seriously entertain an offer with a financing contingency if a lender letter is not included. Ideally, you should know how high you can go on price... and have a sense of what the monthly payment will be at a few different price points. This will allow you to thoughtfully consider the price that you might want to offer when we are viewing a house. INSPECTION Many offers are made without inspection contingencies these days. Are you willing to do so? It's fine to include an inspection contingency in your offer, but you should know that doing so will make it less competitive if there are other offers on the house that may not have inspection contingencies. You should think this through (whether you are comfortable buying without a home inspection) before going to see houses... even if you plan to make the decision on whether to conduct an inspection on a property by property basis related to the agent and condition of the house. APPRAISAL Most offers used to include appraisal contingencies, allowing the buyer the opportunity to try to renegotiate the sales price if the appraisal came in below the contract price. These days that is much less common... and some buyers are specifically indicating that they can and will proceed with the purchase at the contract price regardless of the appraised value... or are stating in an offer that they are willing to proceed at the contract price so long as the appraised value is within $___ of the contract price, etc. Are you comfortable paying a bit above the appraised value in order to secure a contract on a house? Are you willing to pay a contract price regardless of the appraised value? These are, again, questions we should discuss generally even before we think about them specifically related to a house we are viewing. Furthermore, you should understand (through a conversation with your lender) how a low appraisal will or will not affect your loan terms related to the LTV (loan to value) ratio, mortgage interest rate, funds required for closing, etc. Yes, we will talk about all of these potential contingencies when we are considering an offer on a specific house... but it can be helpful to think about them generally, and talk to me about them, ahead of time so that you can give some thought to what you are and are not willing to do in the current competitive market. | |

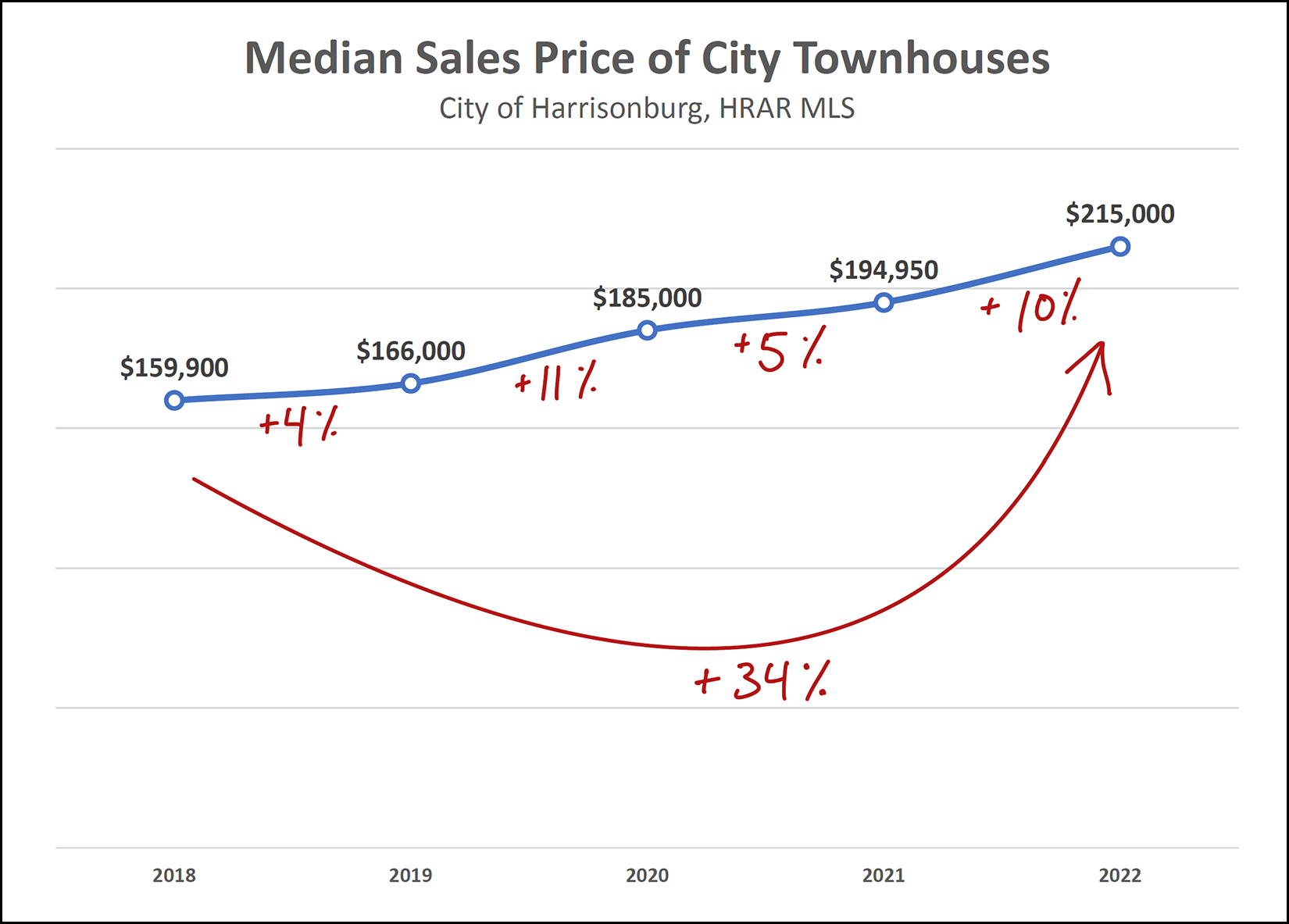

City Townhouse Sales Prices Increase 34% Over Four Years |

|

Townhouse values in the City of Harrisonburg have certainly increased rather quickly over the past few years... As shown above, we have seen a 4% to 11% increase in median sales prices for each of the past four years. There has been an overall 34% increase in the median sales price since 2018. If you happened to buy a townhouse a few years ago, you'll likely be in great shape if you're selling now or soon! Also helping this segment of our local housing market is that most new townhouses are now in the $250K+ price range. | |

How Should The Square Footage Of Your Home Be Measured? |

|

So -- are you trying to figure out the square footage of your home? Here are a few methods that are not certain to give you the correct answer....

So, how do you really measure square footage? It starts outside the home! You'll need to measure the exterior dimensions of each level of your home -- and then subtract any open areas, such as the open space above a foyer. This measurement method, as odd as it may be, is what is used by nearly every appraiser, as it is how "gross living area" is defined by Fannie Mae, HUD, FHA, ERC and ANSI. As such, it is important that you're measuring the square footage of your home in the same way that nearly every appraiser and Realtor would be measuring it, so that you're comparing apples to apples when comparing the size (SF) of your home to another home that has sold or that is on the market for sale. And here's why I consider it to be an odd way to measure square footage....

While the City and County measurements for tax assessment purposes are often very accurate, it is often a good idea to double check the square footage of your home when we're putting it on the market for sale. | |

Housing Inventory Levels Seem To Be Slowly Rising, With One Third Of Them Being New Homes |

|

There are almost 150 homes for sale now in Harrisonburg and Rockingham County... we're at 147 at the moment... and this would be the first time since late 2020 that there were 150 options for home buyers. But... do note that more than a third of them (53 of 147) are new homes. This isn't a bad thing... it's just that new homes in new home communities are only going to work for some buyers... they are particular property types, at particular price points in particular locations. Higher inventory levels means more choices for buyers which could mean -- if inventory levels were to keep climbing -- that there wouldn't be quite as fierce of competition for some new listings. That said, I have been a part of several "multiple offer" scenarios over the past two weeks, so the overall market isn't necessarily calming down or cooling off yet. | |

Almost 1,700 New Homes (or home sites) Are Being Developed or Built in Harrisonburg and Rockingham County With Another 4,000 Planned or Proposed |

|

LOTS of new housing is currently being developed in Harrisonburg and Rockingham County... though mostly in Rockingham County. Below are most that I am aware of, with approximate unit counts, though you can find it in spreadsheet form, with some links, here. 369 Apartments

647 Townhouses & Duplexes

287 Single Family Detached Homes or Home Sites

This is not to mention the 4,314 homes that are being planned or proposed...

The important, and perhaps unanswerable, big questions are... [1] Is enough housing being built or planned to support a growing population? [2] Is too much housing being built or planned beyond what our growing population needs? [3] Is the right type, size, and price of housing being built? | |

If You Expected The Local Housing Market To Slow Down Drastically, This Probably Is Not What You Meant |

|

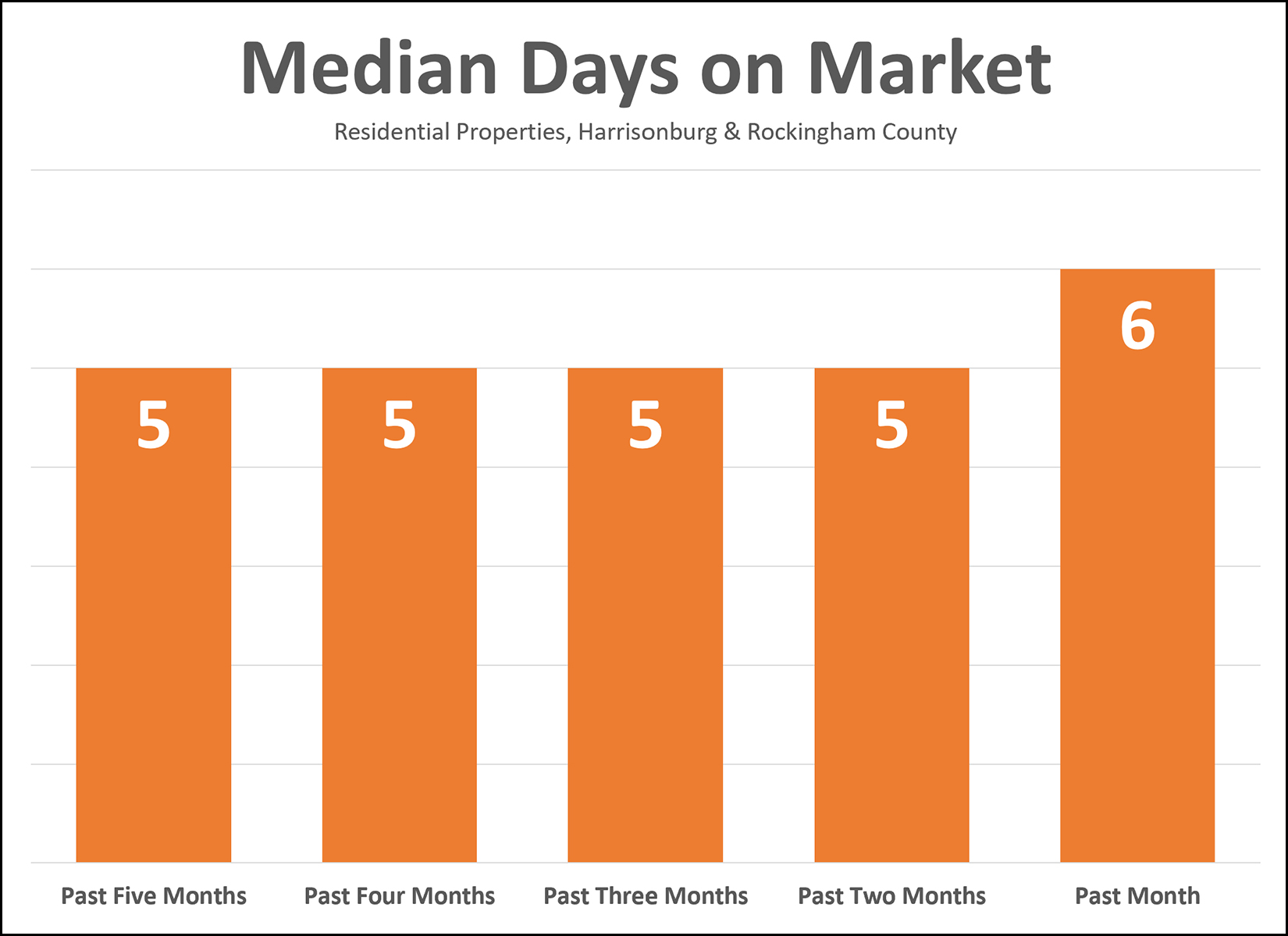

Two years ago the "median days on market" was 15 days in Harrisonburg and Rockingham County. By a year ago, it had dropped to a median of six days on the market. Given that interest rates are rising, I thought perhaps we might be seeing this metric (how quickly homes are going under contract) start to rise in Harrisonburg and Rockingham County. And I was right! Things are SLOWING DOWN! ;-) Wink, wink, nudge, nudge. The graph above starts by looking at the median days on market over the past five months... the median was five days. Then, over just the most recent four months... still a median of five days. Next, over just the past three months, when interest rates started to rise... still a median of five days. Well what about over the past two months... still a median of five days. But, ah ha! I finally found it. The sign the market is really slowing down. The median days on market has increased 20% (!!!!) when we get to that last data point... the median days on market over the past month is... SIX days! :-) So, bottom line, did things go under contract more slowly over the past month than in previous months? Oh, yes, by one day. Is it a sign that the market is slowing? I suppose so. Barely. We'd need to see more of a change than what is described above and shown above to conclude that buyer enthusiasm is measurably declining. Stay tuned to see if that median days on market figure will scrape and claw it's way back up to SEVEN days sometime in the next few months. | |

800 Mixed Income Housing Units Planned For Bluestone Town Center |

|

800 (or more) new housing units may soon be coming to Garbers Church Road and Erickson Avenue... at Bluestone Town Center... potentially featuring...

This is a potential joint venture between the Harrisonburg Redevelopment and Housing Authority (not the City of Harrisonburg, but a "political subdivision of Virginia") and Equity Plus (a private entity seemingly out of Mississippi). This potential residential development is intended to offer...

Find out more about this potential development by visiting BluestoneTownCenter.com or by attending the informational session on June 7th (today) from 4:00 PM to 6:00 PM at the Lucy Simms Auditorium. Updated... Daily News Record, June 8, 2022

| |

Renting vs Buying a Townhouse at Congers Creek |

|

Most of the townhouses at Congers Creek are being purchased by homeowners, but some are being purchased by investors as rental properties... which means you will likely have the opportunity to buy or rent at Congers Creek in the near future. Let's see how those two options compare... RENT = $2,000 / month. The rental rates I have seen thus far at Congers Creek range between $1,950 and $2,200 per month. These rental rates are for a three level townhouse with a garage and (finished or unfinished) bonus room. BUY = $1,785 / month. With a 90% loan, buying such a townhouse apparently may cost as little/much as $1,711 per month assuming a $300K purchase price and a 5.25% interest rate... and when we add the $75/month association fee, we get to $1,785. Total Rental Payments over 5 Years = $120,000 Total Mortgage Payments over 5 Years = $107,100 Principal Reduction of Mortgage over 5 Years = $21,196 Effective Total Housing Payments over 5 Years = $85,904 Savings over 5 Years = $34,096 As you can see, this builds a somewhat compelling case for buying instead of renting if you are going to be living in this potential townhouse for the next five years. A few other factors to keep in mind....

P.S. I represent the builder at Congers Creek. | |

Mortgage Interest Rates Have Been Trending Back Down A Bit |

|

After soaring from 3.2% in January 2022 to 5.3% in May 2022, mortgage interest rates have actually started to level off and even decline in recent weeks. The graph above shows the average 30-year fixed rate mortgage interest rate each week for the past year. Clearly, rates have been rising quickly for the past four to five months... but if you look at the past four weeks, you'll see a different trend. May 12 = 5.30% May 19 = 5.25% May 26 = 5.10% June 2 = 5.09% It is certainly encouraging to see mortgage interest rates leveling out a bit with the potential for sticking right around 5% in coming weeks and months. Certainly, I'd rather today's buyers were able to obtain a 3.5% or 4% mortgage interest rate if possible... but given the possibility of 5%, 5.5%, 6% or even higher, something right around 5% sounds just fine! | |

Strong First Five Months of Contract Activity in 2022 |

|

Look out... before you know it, I'll be saying the year is halfway over!? As usual, the months are flying by in 2022 and we are now looking backwards at a full five months of contract (and sales) activity. The graph above illustrates how many buyers (and sellers) have signed contracts to buy (and sell) homes in the first five months of 2020, 2021 and 2022. As you can see, the pace of home buying activity increased quite a bit between 2020 and 2021... and this year, it has increased even further. Higher mortgage interest rates in 2022 might slow down overall home sales activity, but thus far we don't seem to be seeing it here locally. | |

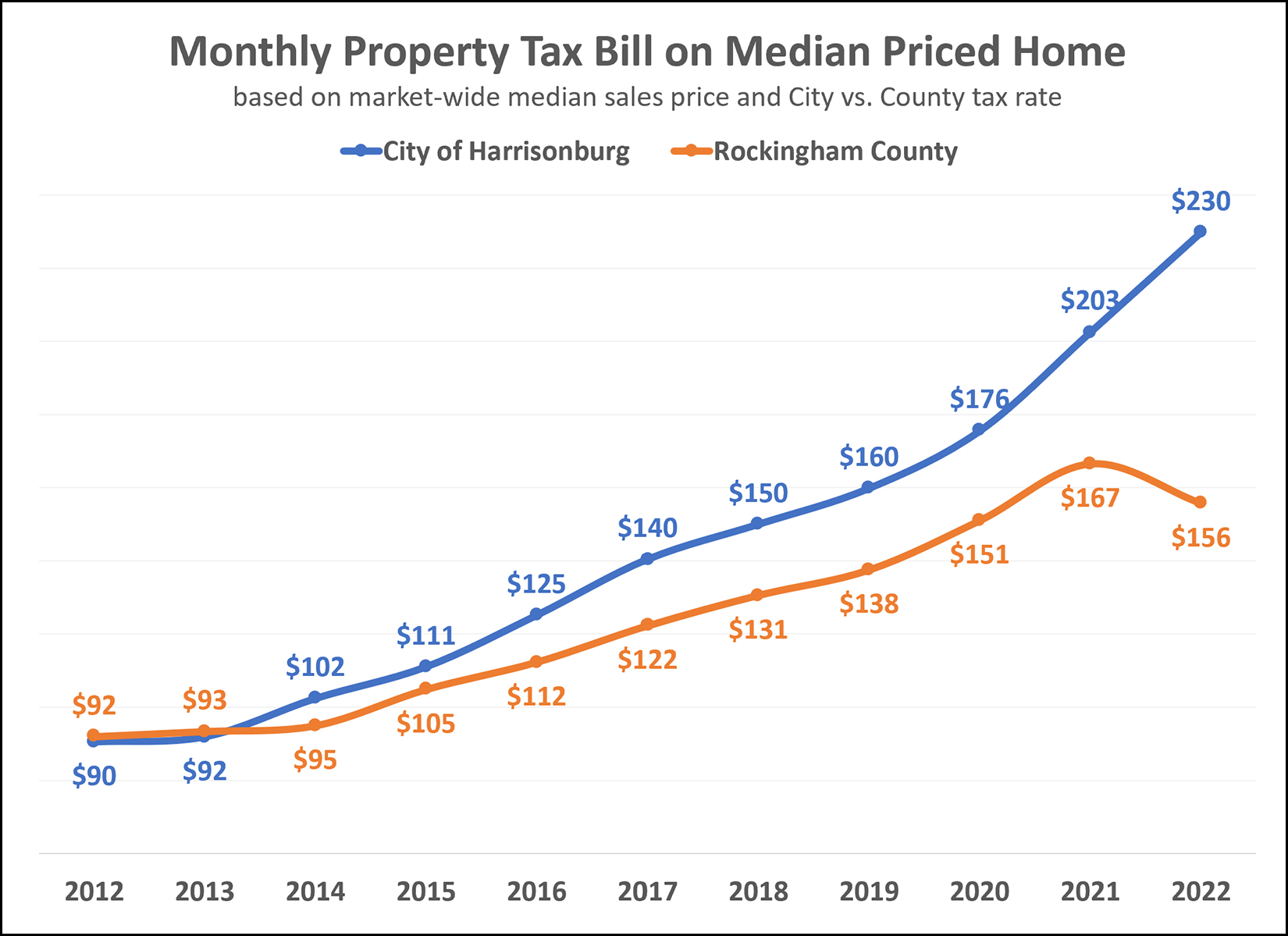

Comparing Tax Bills in the City of Harrisonburg and Rockingham County Over Time |

|

If you're buying a $300K house, will you pay more in property taxes if that house is in the City or the County? In most cases, you will pay more property taxes if you live in the City. The analysis above looks at how a monthly property tax bill has changed over the past decade for a median priced home in the City and County. To be clear, this analysis uses:

As shown above, City property taxes have increased by 155% over the past decade while County property taxes have increased by 70% during the same timeframe. | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings