Archive for August 2022

Most Conditions Are More Favorable For Buyers Now Than A Year Ago, Though Not Mortgage Interest Rates |

|

If we ignore mortgage interest rates for a moment (how can we!?) I believe it is accurate to say that home buyers are finding conditions to be more favorable now than a year ago. Here are the main factors making the local real estate market at least a bit more favorable for buyers now compared to a year ago... INVENTORY IS UP - We aren't seeing a massive increase in the number of homes available for sale at any given time, but we are seeing a slow rise in the number of active listings, which gives a buyer slightly more choices at any given time. TIME ON MARKET INCREASING A SMIDGE - It's often hard to back this up with data, but it seems that some new listings are sticking around on the market for a few more days (or even a week - gasp) longer than a year ago. This gives buyers a touch more time to consider whether or not to make an offer. FEWER MULTIPLE OFFER SCENARIOS - Some houses are still seeing multiple offers within the first day or two of being on the market, but quite a few are only seeing one offer. This allows a buyer to think more rationally about the price they are willing to pay, and goes a long way towards curtailing the flurry of escalation clauses causing prices to increase ever higher. INSPECTION CONTINGENCIES ARE OK AGAIN - Some buyers are reintroducing this novel concept of a... home inspection!? What a wonderful world where buyers can spend more than 45 minutes in a house to learn about the house, and even with a trained professional that can give them a much fuller view of the house characteristics and potential deficiencies! APPRAISAL CONTINGENCIES MIGHT MAKE A COMEBACK - We're starting to see appraisal contingencies again on some offers, and why not!? If you're not competing with another offer, why not include an appraisal contingency. It only seems reasonable. So... even if buyers today are finding themselves in what is certainly still a seller's market, the buying environment is indeed marginally better in multiple categories today as compared to a year ago. The two downsides, though, are that mortgage interest rates are MUCH higher now than a year ago, and the price you will pay for any particular house is likely a good bit higher now than a year ago. | |

Are Home Buyers Walking Away From Contracts In Harrisonburg? |

|

You may have read in recent news headlines that home buyers are cancelling their contracts to buy homes left and right. Here is one such news story... Homebuyers are backing out of more deals as high mortgage rates persist and recession fears linger (CNBC) This would cause plenty of people in our local area whether this is also happening locally. Are home buyers walking away from contracts in Harrisonburg? I'm going to say, anecdotally, a strong NO. That phenomenon does not seem to be happening in any significant way in the Harrisonburg and Rockingham County real estate market. Buyers generally seem to know what their mortgage interest rate is going to be before they make an offer (via a conversation with their lender) and are then locking in their interest rate once they are under contract. So, should sellers now wonder if their buyer will really make it to closing or if they might decide to back out of the deal? That does not seem to be a concern a buyer needs to have any more than at other times in the past 10+ years... at least in Harrisonburg and Rockingham County. | |

The Strength Of The Local Housing Market Is Likely To Start Varying By Price Range, Location And More! |

|

For the past few years the market has been moving so quickly, with such an excess of buyers in nearly every price range, that just about every house would sell very quickly - regardless of the price range and location. But... as interest rates have been rising over the past six months, there seems to be some variation in how strong different segments of the market are, based on price range, location, property type and more. If you are planning to sell your home this fall we need to look carefully at homes in your particular neighborhood, price range, etc. to see how quickly they are selling... and to compare the prices for which they are selling now compared to three or six months ago. | |

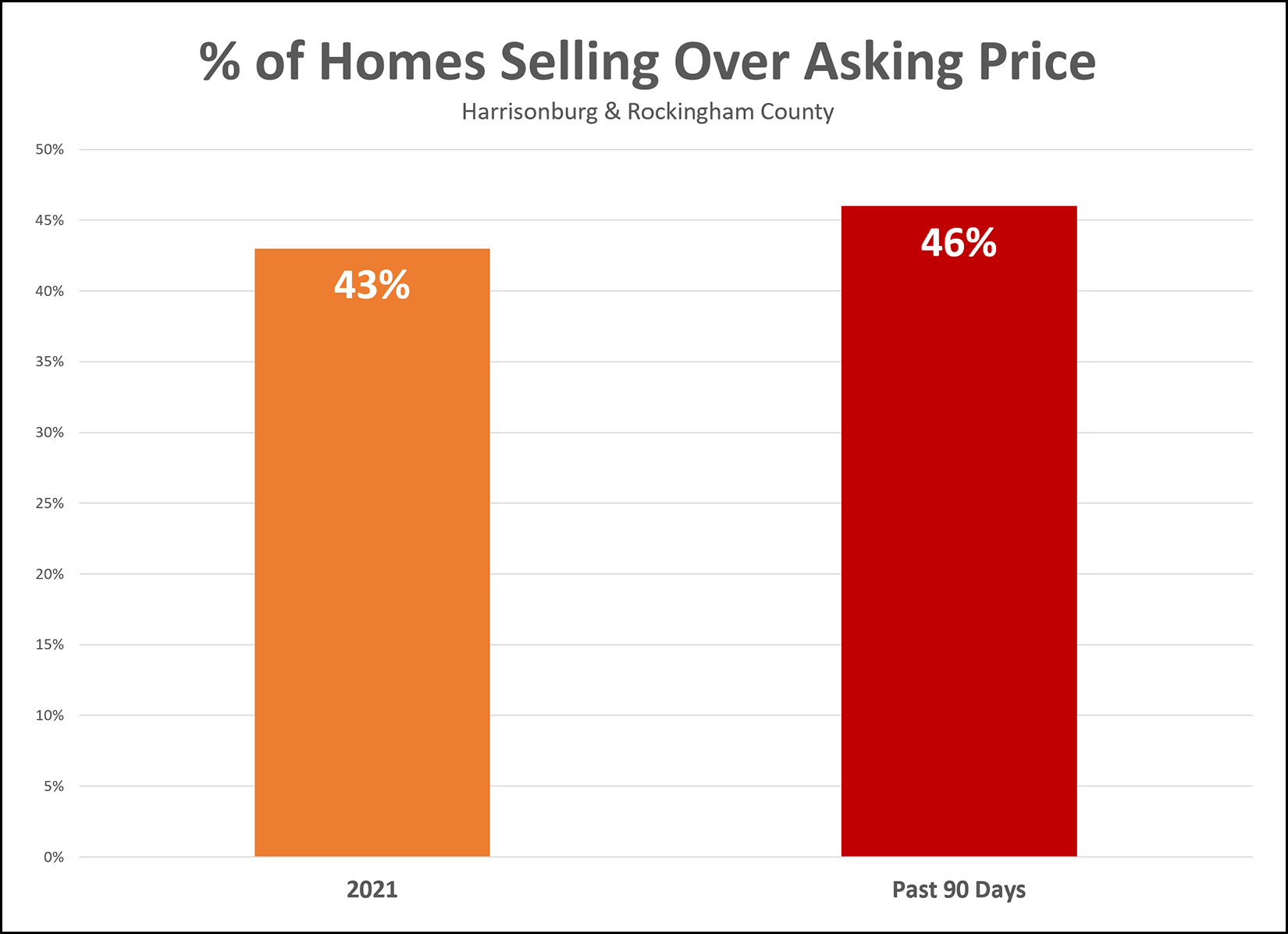

Just As Many Homes Are Selling Over Asking Price Now As Compared To In 2021 |

|

This statistic might surprise you. It surprised me. Just as many homes are selling over the asking price now (in the past 90 days) as compared to in 2021. And, technically, slightly more are selling over the asking price now as compared to in 2021. Sometimes it seems that the market might be "slowing down" in some ways... with fewer showings and/or fewer offers in the first week of a house being on the market. But then, you see that we're still seeing about half of homes selling for more than the list price and it doesn't seem like things are slowing down at all!?! | |

Is The Last Item On Your Back To School Shopping List... A House? |

|

Happy first (or second) week of school! It's at this time of year -- over the next few weeks -- that we often see a surge (or mini-surge) of home buying activity. Summer vacation is over, school is starting back up, and some folks will find themselves ready to make a move... buying for the first time, or buying a new home to upsize or downsize. Home sales activity is often topsy-turvy in the summer, affected by everyone's summer plans. Sellers put their houses on the market based on when they are around to prepare it for the market. Buyers go see houses and make offers based on when they are around to do so. But now, people will start settling back into their normal routines, and many may decide this is the time to contract to buy a home. None of this, of course, is based on hard, cold, data... just a general observation I have made over the years. We'll see what the numbers actually show as we move through the next month or two. If you're engaged in school, as a student, a teacher, a parent of a student, or otherwise... may your school year be off to a good start! | |

Plenty Of Properties Likely Sold Above Appraised Value Over The Past Few Years But Fewer Are Likely To Do So Moving Forward |

|

Home buyer attitude towards appraisals has certainly shifted over the past few years! PRE-COVID... Most buyers would include appraisal contingencies in their offers to reserve the right to have a conversation with the seller about the sales price if the appraised value ended up being lower than the contract price. Most sellers were comfortable with these appraisal contingencies and found them to be reasonable. EARLY COVID... Some buyers started to leave appraisal contingencies out of their offers to compete in multiple offer scenarios. These offers were no longer contingent on the property appraising at or above the contract price. IN THE THICK OF COVID... The market just kept heating up over the past few years, during Covid, and eventually, home buyers almost always found themselves competing with multiple (or many, or multitudes) of other offers. Home buyers started adding in specific language to their offers agreeing to proceed with the purchase so long as the appraised value wasn't any lower than $____ below the sales price, or agreeing to proceed with the purchase regardless of the appraised value. These offers would significantly reduce (or eliminate) the possibility of an appraisal disrupting the home sale. Home buyers were willing to go this route to try to compete to secure a contract on a house... and home sellers were delighted! NOW... Some new listings are still having 5+ offers within a few days, but plenty are only having one or two offers. With fewer competing offers, and with a feeling that the market might be slowing a bit, more home buyers are revisiting the topic of whether to include an appraisal contingency. Some buyers are now including appraisal contingencies in their offers once again. Buyers should likely decide whether to include an appraisal contingency based on whether they are competing with other offers, and based on how much they like a particular property. Some sellers find the return of the appraisal contingency to be quite reasonable. Some sellers think it is a terrible thing, and are insistent that they should be able to sell their home for more than an appraised value. Sellers should likely decide whether to accept an appraisal contingency based on how much interest exists in their home, how many offers they have, how long it has been on the market, etc. A shift in the way that home buyers and sellers see appraisal contingencies is normal as we start to see some early signs that the local housing market might be slowing down from a sprint to a fast run. As with all things housing market related right now, the dynamics described above to not equally apply to all property types, price ranges and locations. :-) | |

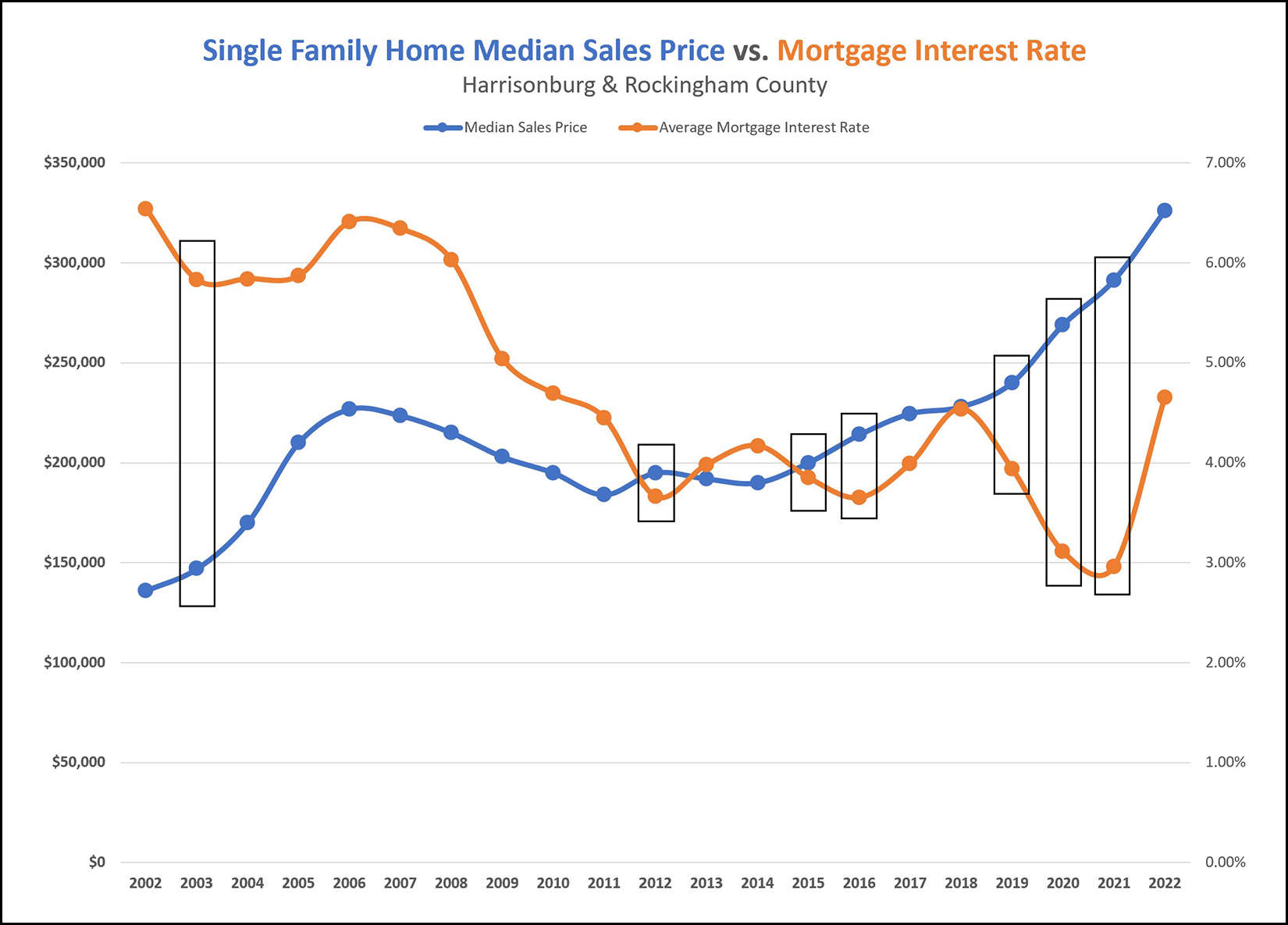

Do Home Prices Rise As Interest Rates Fall, And Fall As Interest Rates Rise? |

|

Q: Do Home Prices Rise As Interest Rates Fall, And Fall As Interest Rates Rise? A: Sometimes In the graph above I tracked the median sales price of single family homes sold in Harrisonburg and Rockingham County over the past 20 years (blue line) as compared to the average mortgage interest rate (orange line) to try to answer the question above. I then looked for years where there was a significant increase (or decrease) in the median sales price paired with a significant decrease (or increase) in the mortgage interest rate. I found 7 years where this happened... out of 20 years. There were also plenty of years where the two metrics tracked alongside each other in the same direction... prices fell while rates fell... or prices rose while rates rose. So... it does not seem that a decline in rates is likely to necessarily result in higher prices... or that an increase in rates is likely to necessarily result in lower prices. Though, of course, sometimes (not usually) that does happen. The question is asked, of course, in the context of rapidly rising mortgage interest rates. The answer we are all seeking, of course, is whether these higher rates will result in lower sales prices. History does not indicate that will definitely happen, but it is certainly possible given how higher mortgage interest rates affect how much a buyer can pay for a house and how many buyers can qualify to buy any given house. | |

If High Mortgage Interest Rates Having You Looking At Renting Instead Of Buying, Unfortunately You Will Also Find High Rental Rates!?! |

|

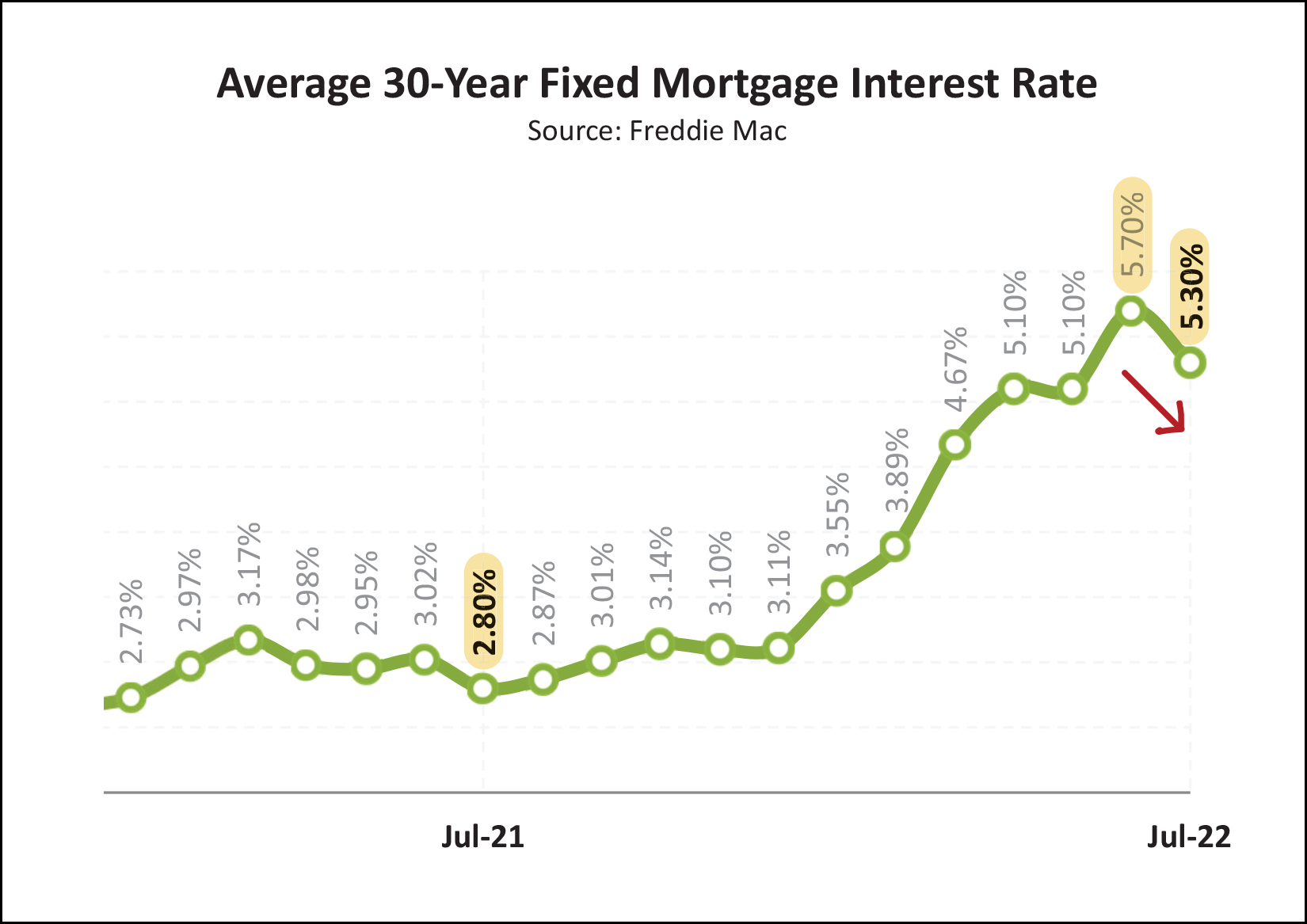

Some (many?) would be home buyers are discovering that mortgage interest rates are making their potential monthly housing costs much higher than anticipated. Just a year ago, the mortgage interest rate was 2.8% for a 30 year fixed rate mortgage and now it's 5.3%. Combine higher mortgage interest rates with higher home values and today's buyers find much higher mortgage payments... A Year Ago... $225,000 = 2021 Median Sales Price of Townhomes, Duplexes and Condos $1,038 = monthly payment assuming 10% downpayment, 2.8% mortgage interest rate Today... $241,767 = 2022 Median Sales Price of Townhomes, Duplexes and Condos $1,431 = monthly payment assuming 10% downpayment, 5.3% mortgage interest rate So, the potential monthly housing cost of buying a median priced townhouse has increased from $1,038 to $1,431 in the past year. This might cause some (many?) would be buyers to explore renting instead. But... rental rates have also increased significantly over the past year! I don't have a large data set to support this statement, but generally speaking, townhouses that might have rented for around $1,100 a year ago are now often renting for $1,350 or more. So, perhaps rental rates aren't increasing as quickly as monthly housing costs if you purchase a townhouse... but these higher rental rates mean that choosing to rent instead buy doesn't provide quite as much relief of your housing costs as you might imagine. | |

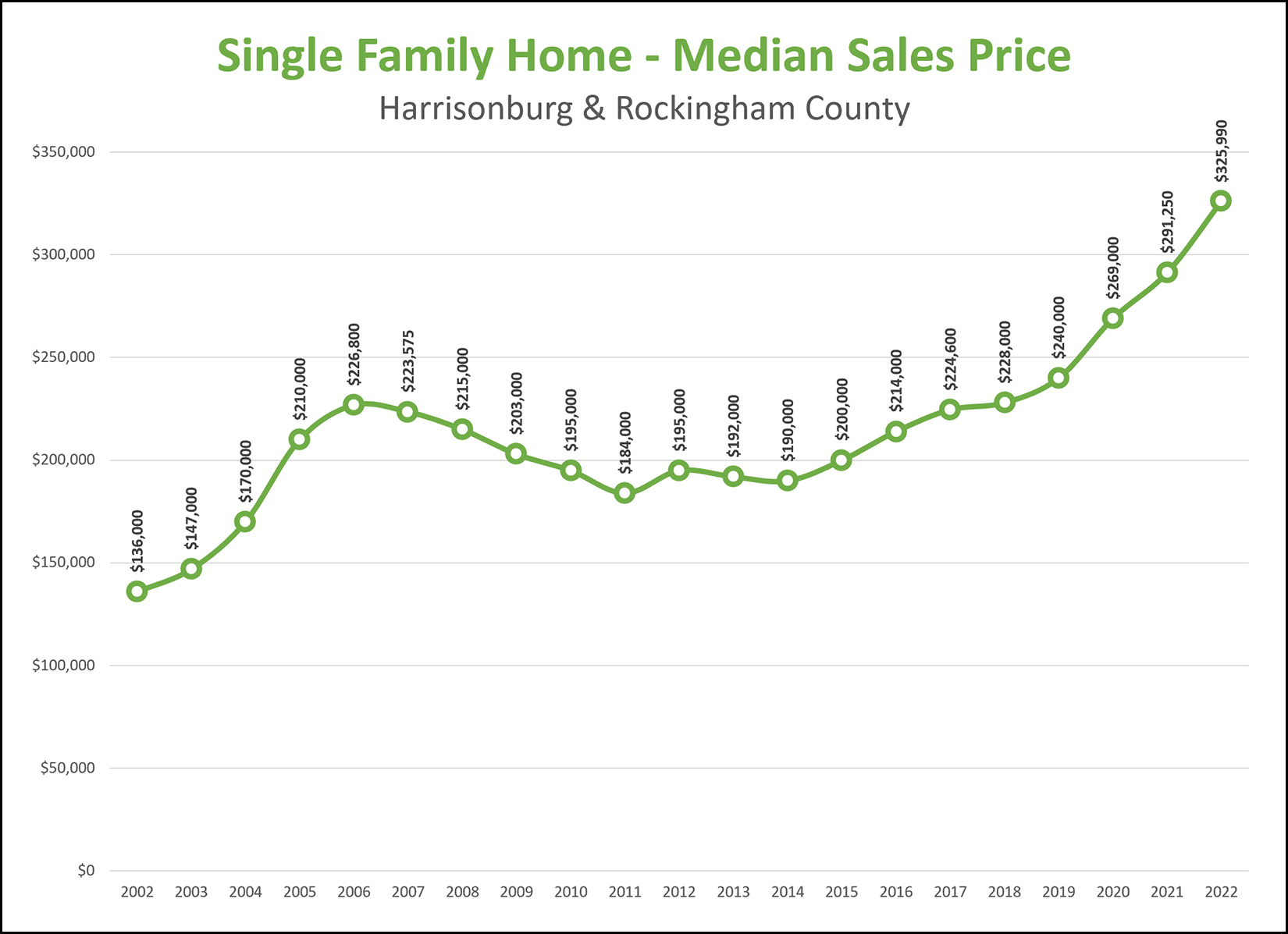

Median Price of Single Family Home in Harrisonburg and Rockingham County Rises 67% Over 10 Years, 140% Over 20 Years |

|

Single family home values have not always increased in Harrisonburg and Rockingham County over the past 20 years... but they have mostly increased, and they have significantly increased over a 10 year and 20 year time horizon. 10 Years Ago = Median Sales Price of $195,000 Now = Median Sales Price of $325,990 67% Increase over 10 Years 20 Years Ago = Median Sales Price of $136,000 Now = Median Sales Price of $325,990 140% Increase Over 20 Years Over these past 20 years, the median sales price increased during 12 years, decreased during four years and had a change (+/-) of less than 2% during four years. The average increase per year in the median sales price in Harrisonburg and Rockingham County was 4.5%. | |

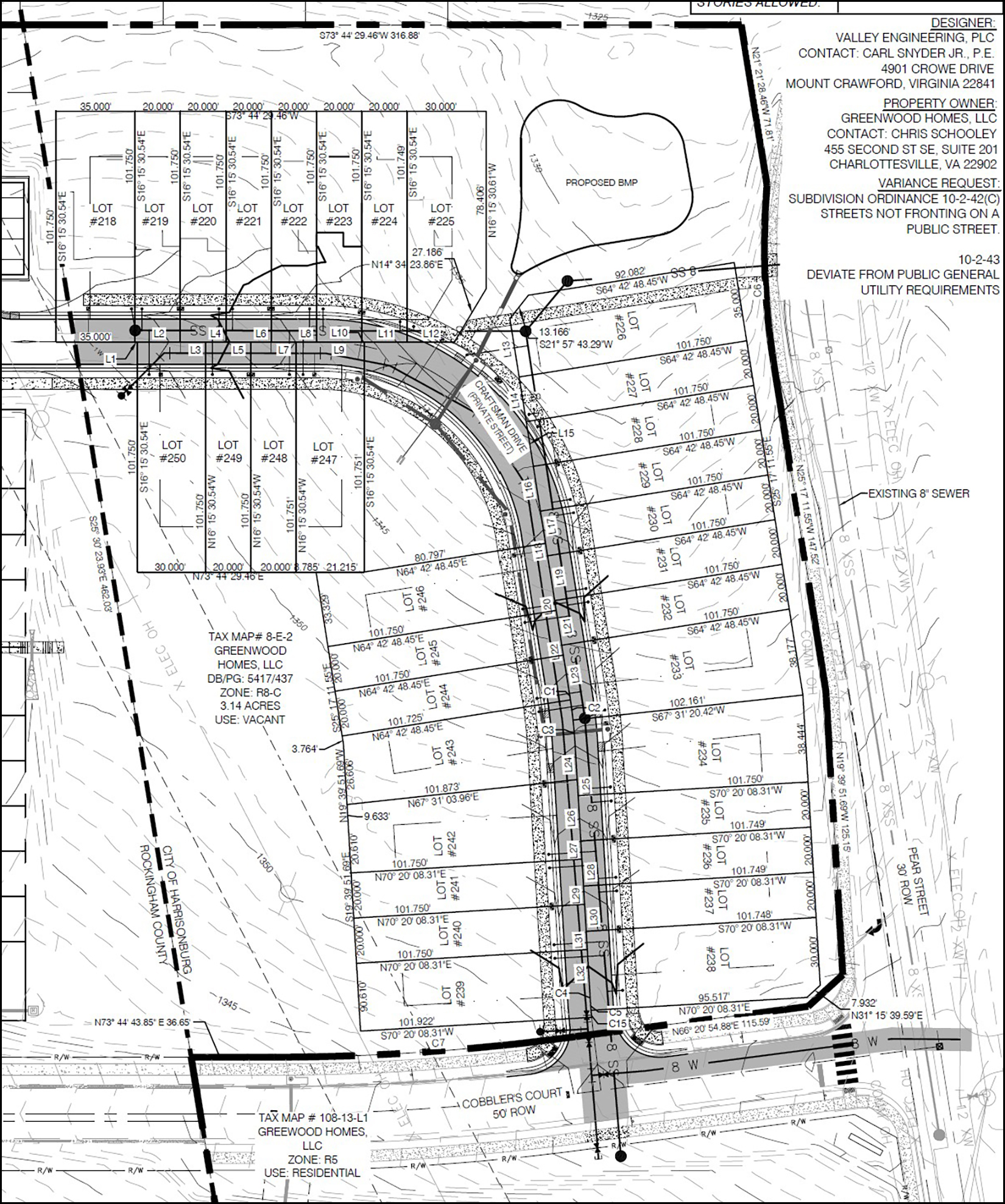

33 Townhouses Proposed To Be Built In The City of Harrisonburg, At The Entrance To Cobblers Valley |

|

Ryan Homes is currently building a neighborhood called Cobblers Valley in Rockingham County now 33 townhomes are proposed to be built in the City, at the entrance to Cobblers Valley. The property is already zoned for townhouses but the developer is requesting a subdivision ordinance variance to allow the townhouse lots to be built on a private street instead of a public street. You can download the reference documents from the Planning Commission's summary of the request here. This is the proposed layout of this small section of townhouses in the City...  | |

Harrisonburg Housing Market Still Showing Strength Despite Some Signs Of Slowing |

|

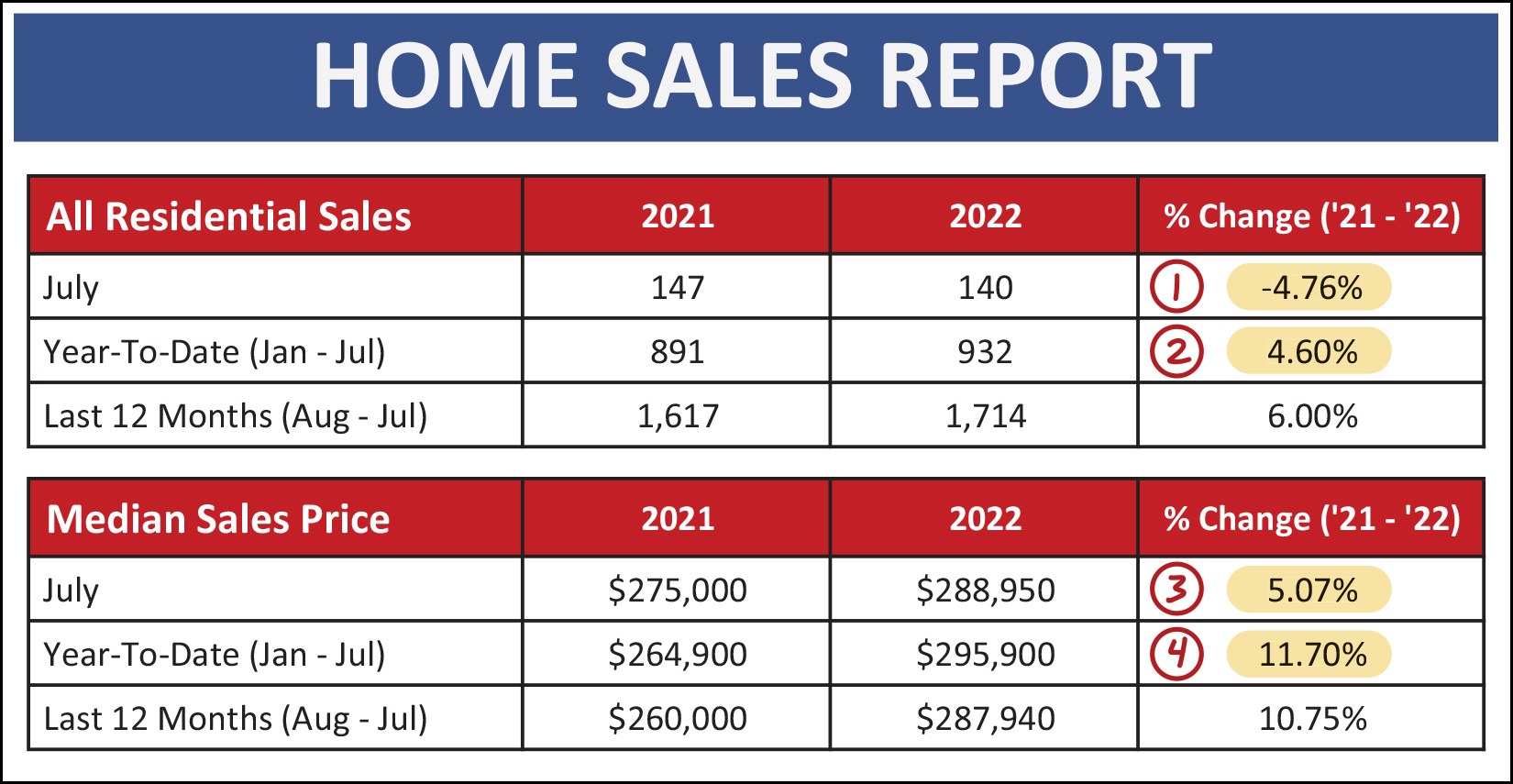

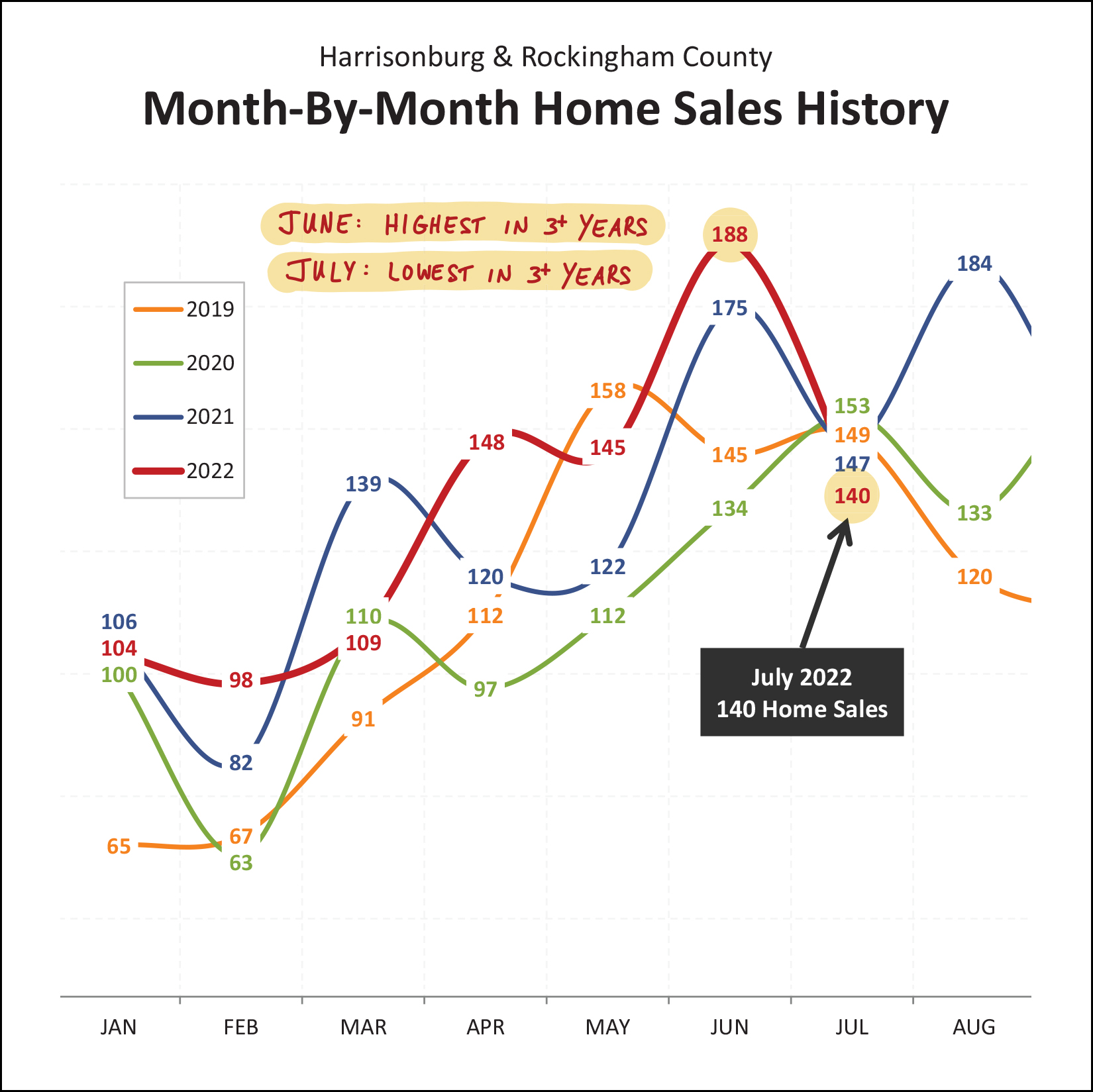

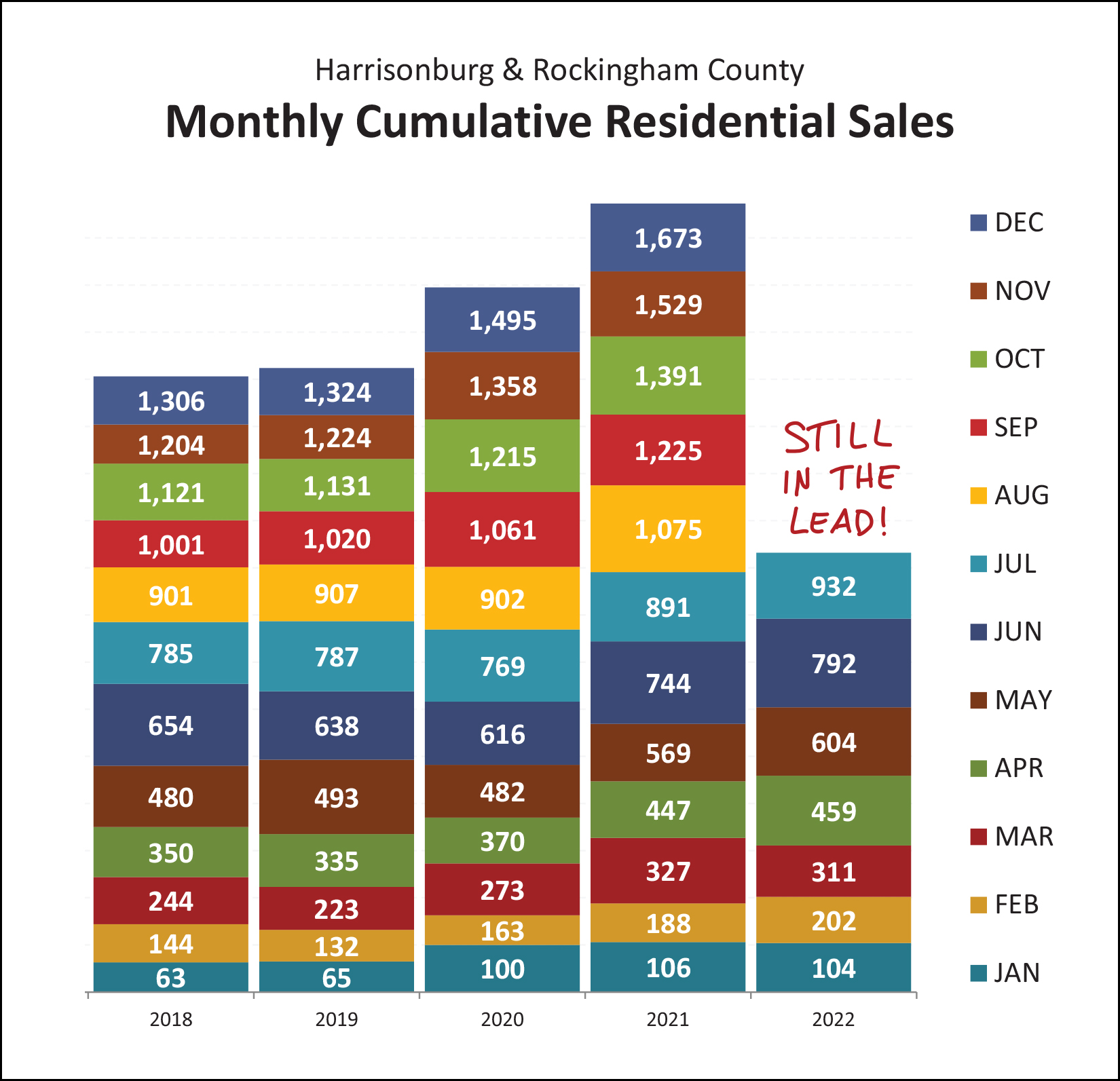

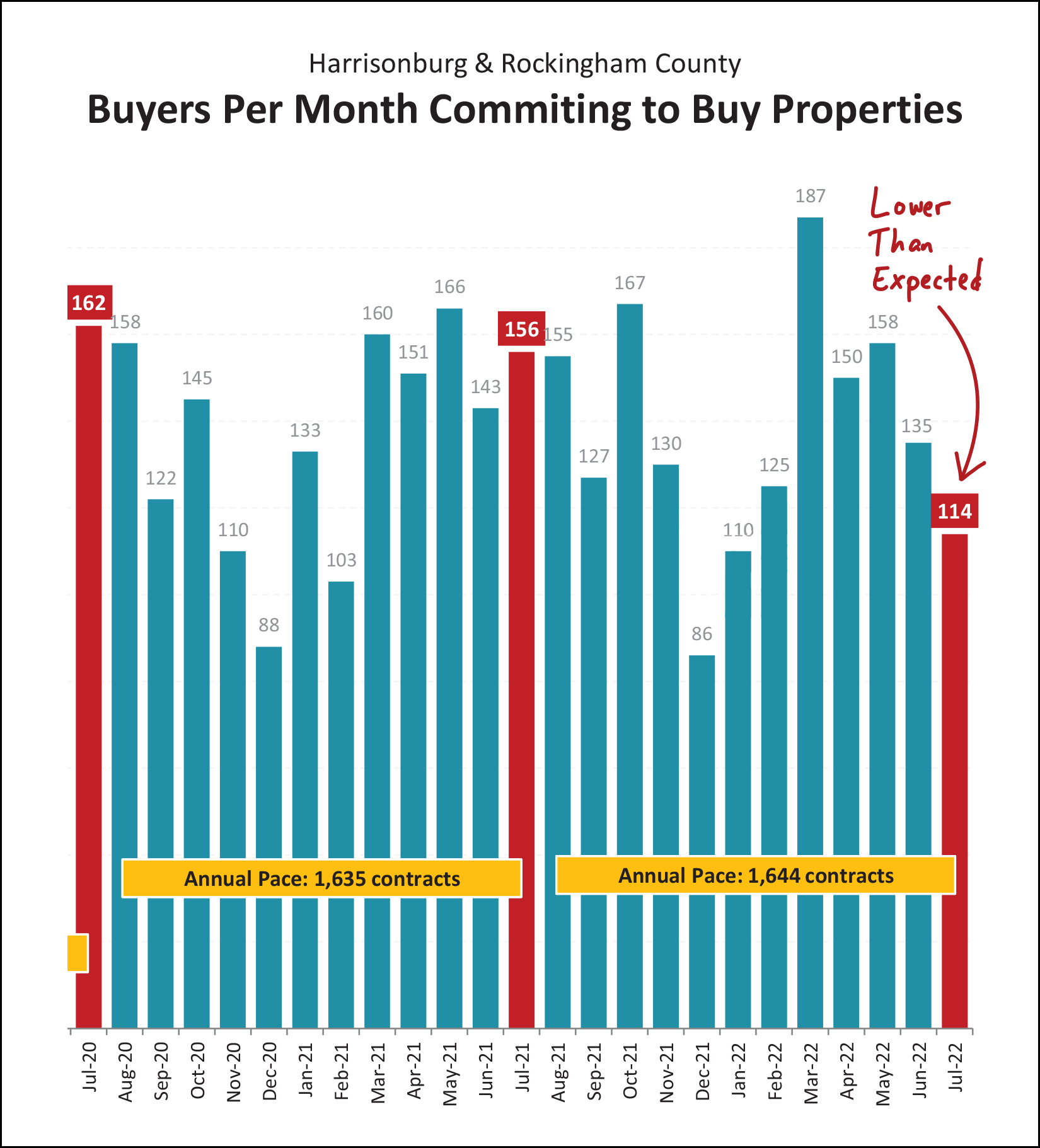

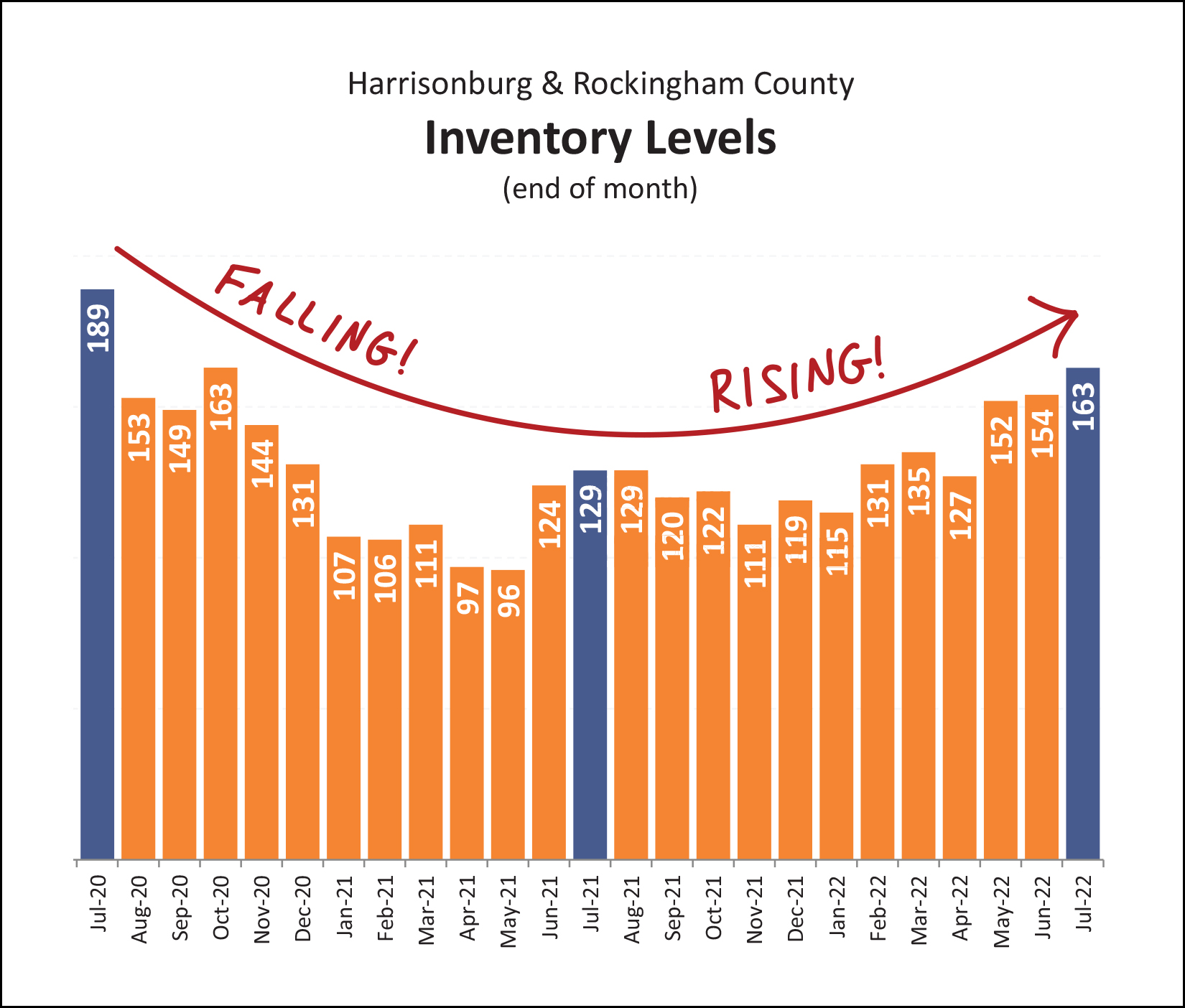

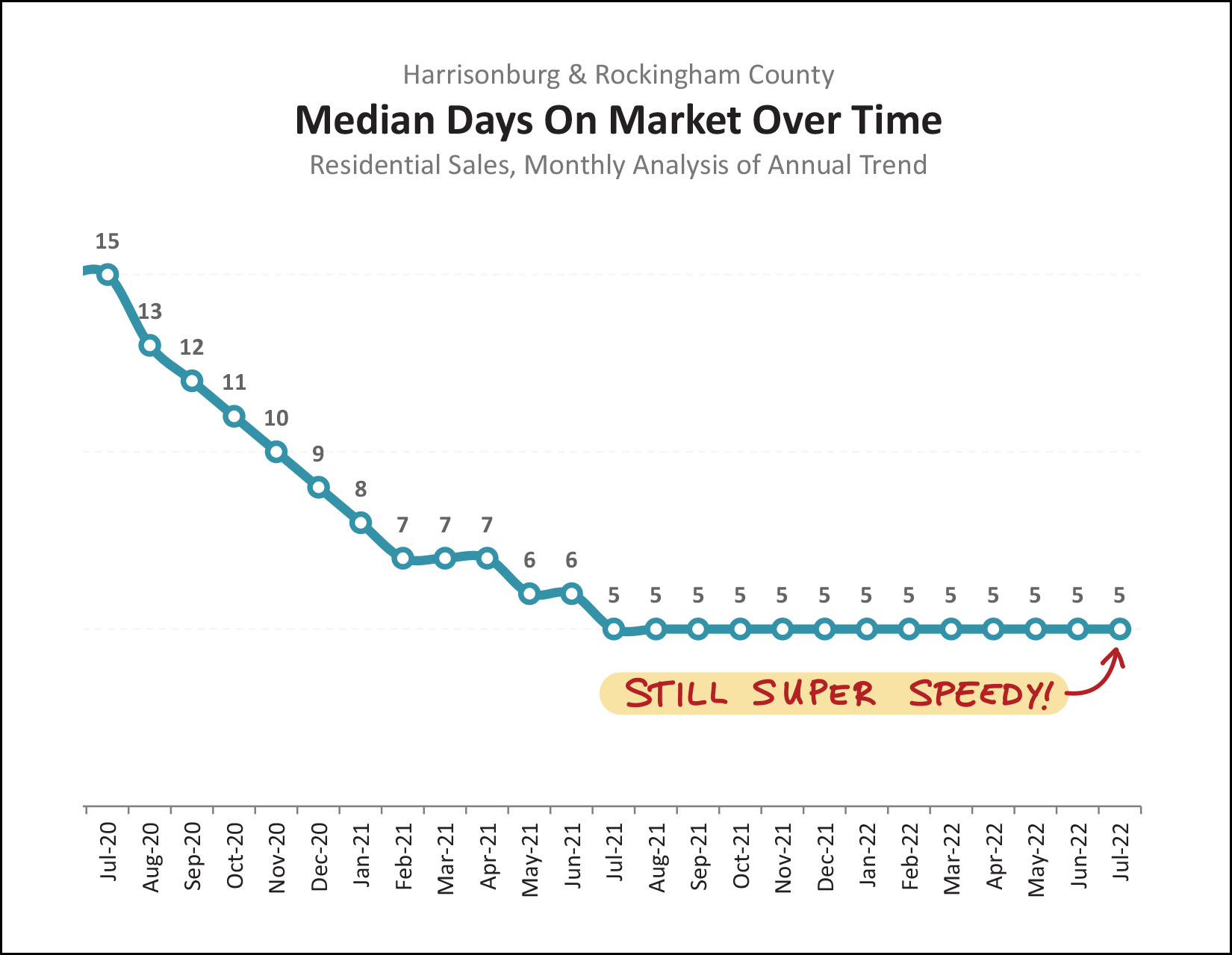

Happy Thursday afternoon, friends! As any student or teacher will tell you, summer is almost over! čśó I hope that you and your family had a wonderful summer and that you had at least one opportunity to sneak away... to the beach, the lake, a tropical island, a music festival, a rural AirBNB, a national forest, a campsite or a new city! One of my favorite spots to sneak away is Deep Creek Lake, MD...  But getting back to business... The beautiful house on the cover of this month's market report is located at 3161 Henry Grant Hill in Preston Lake and you can find out more about this spacious home here. Each month I have a giveaway, of sorts, for readers of this market report. This month's giveaway requires a special sort of market report reader... one who also likes to run... a lot. I enjoy running and frequently participate in races put on by VA Momentum, and thus I was excited to hear they are putting on a half marathon this fall. So... this month, you can enter for a chance to win a free registration to the Harrisonburg Half Marathon, to be held on October 15, 2022! Find out more about the half marathon here. Enter to win the free race registration here. Email me and tell me I'm crazy for thinking you'd run a half marathon here. čśë And now, after all that, let's dig in and see what is happening in our local housing market...  As noted in my headline above, there are some signs that our local real estate market might be slowing down a bit. This very well may mean, though, that it slows down from going 90 MPH in a 60 MPH zone to going 75 MPH in a 60 MPH zone. The latest numbers, as shown above, indicate that... [1] July home sales were slower (140) than last July. We'll see this again on a graph in a moment. [2] Thus far this year we have seen 932 home sales, which is 4.6% more than last year. We had a record number of home sales last year, so a further increase this year is... record breaking. [3] The median sales price in July was 5% higher than last July. [4] When looking at the first seven months of the year, the median sales price has risen 11.7% in Harrisonburg and Rockingham County. So... most of these indicators are quite positive, rosy, exuberant, except the slight slow down in July. This is seen a bit more clearly here...  Above, you'll note that in June 2022 we had an astronomical 188 home sales... higher than any of the past three months of June. But, then, July. In July 2022 we only saw 140 home sales, which is less than any of the past three months of July. Some might point out that looking at a single month of housing data, in a small-ish housing market, can make you think something is happening, when nothing is happening. I agree that can happen. If we smash the two months together, we find that there have been 328 home sales this June and July... compared to 322 home sales last June and July. So... maybe things are "just fine" right now, and maybe things are starting to slow, slightly.  As shown above, if things are starting to slow... they're only just starting to do so, and they're doing so verrrrry slowly. The 932 home sales seen thus far in 2022 is more than we have seen in the first seven months of any of the prior four years. Perhaps when we get another month or two into the year we will see things level out a bit in 2022?  Slicing and dicing the data once more, this graph (above) measures (each month) the number of sales in a 12 month period as shown with an orange line, and the 12-month median sales price (measured each month) shown with the green line. As you can see at the end of the orange line, it's possible that the overall pace of home sales is slowing a bit... but then again, maybe not. We'll need to watch this for a few more months to know for sure. Speaking of the future, our most reliable indicator of future sales is... current contracts...  This one surprised me a bit. We usually see around 150 to 160 contracts signed in any given month of July. But... not this July. There were only 114 contracts signed in July 2022, which is much lower than usual, and likely means we will see a lower than usual month of closed sales in August and/or September. This falls to the category of "things that make you say hmmmm...." and this will definitely be a trend we will need to continue to monitor. Somewhat fewer buyers signing contracts might mean that inventory levels would rise a bit...  Indeed, we are starting to see inventory levels creep up a bit. There are now 163 homes for sale in Harrisonburg and Rockingham County, which is a bit more than the 129 we saw at this time a year ago. It is important to note, though that these "slightly higher" inventory levels are really still VERY, VERY low. Many or most buyers in most price ranges and locations still have very few options of homes to buy right now. So, yes, inventory levels are creeping up a bit, but don't think that's necessarily giving buyers more choices... or giving buyers more leverage... at least not at this point. So... a few fewer sales... fewer contracts... slightly higher inventory levels... that probably means that homes aren't selling as quickly, right!? Well...  Looking at the 12 months of home sales prior to July 2021 (a year ago) the median "days on market" for those sales was only five days. That metric has remained constant for 13 months now... and today, when looking backwards by a year, the median "days on market" is still just five days. Narrowing the focus even more, to just the 114 properties that went under contract in July 2022, we might expect to see a higher "days on market" -- and we do -- but only barely. The median days on market during July 2022 was... six days. So, homes are still going under contract very, very quickly! Finally, maybe this (below) is a contributing factor to the slight slow down over the past 30 to 45 days?  A year ago, the mortgage interest rate was 2.8%. Six months ago it was 3.55%. During June and July it was as high as 5.81%, though it has started to decline now. It is quite possible that these higher mortgage rates have caused some buyers to not be able to buy any longer... or that it has at least partially dampened their enthusiasm. So, there you have it, friends. The housing market in Harrisonburg and Rockingham County is still showing great signs of strength with more sales than ever, at higher prices than ever. But... we might be seeing a slight slow down in home sales (from record high levels) and we might be seeing a slight increase in inventory levels (from record low levels). We'll have to give it a few more months to see how things continue to develop in the local market to know for sure. Until then... If selling a home is on your mind, let's talk sooner rather than later. Before you know it, we'll be halfway through fall and headed into winter. If you are planning to buy a home soon, let's start watching for new listings of interest and going to see them quickly when they hit the market. If I can be of any help with the above (selling, buying) please call/text me at 540-578-0102 or email me here so we can talk about working together to navigate your way through the ever changing Harrisonburg real estate market. | |

Anecdotally, A Smaller Percentage of Showings Seem To Be Resulting In Offers These Days |

|

I don't have any data to back this up, but it seems that a smaller percentage of showings are result in offers right now. A year ago, 20 showings might have resulted in 5 to 10 offers. Today, 20 showings seems to be resulting in 2 to 3 offers. It's hard to know what exactly is driving this change... [1] Home prices are certainly higher now than they were a year ago, and maybe it's harder for buyers who look at houses to get excited about paying today's prices as compared to the prices a year ago? Though, a year ago, prices seemed pretty high to most folks as well... [2] Mortgage interest rates are certainly higher now than they were a year ago, and maybe buyers are excited about Home X at Price Y but when they run the numbers and determine Mortgage Payment Z their excitement cools? Though, they could have known that before they decided to go see the house... [3] The housing market was on fire a year ago with no signs of cooling off, whereas now some markets are seeing sales and/or prices level off or decline slightly. So, maybe buyers are a touch more hesitant to act today as compared to a year ago because there is some small amount of doubt of whether home prices will continue to accelerate upwards over the next few years? Though, a year ago, there was some doubt about whether prices would keep accelerating upwards because they had been increasing so quickly up until that time... So, it's hard to say why, but a somewhat smaller portion of buyers who go to view homes seem to be deciding to make an offer on those homes right now. Does this matter to sellers? Not necessarily. [1] Homes are still selling very quickly. [2] Homes are still selling at prices that are very favorable to sellers. [3] Sellers are still often having more than one offer to consider, even if they don't have ten offers. So, changes are afoot, but they aren't necessarily changes that are affecting the pace of sales or sales prices in our local market. | |

Some Home Sellers Optimize For Speed, Convenience or Certainty Instead Of Price |

|

What are you optimizing for?

As a home seller, you are always optimizing for something. PRICE - Maybe you are willing to wait as long as it takes to get the price that you want for your house. Even if it takes months longer than you had hoped and even if it means that you aren't able to continue on with other life transitions that you had planned, at least you go the price you wanted. TIME - Maybe it's important to you that you wrap up your home sale (have the house under contract) within a few days or weeks. If so, you might be willing to price your home a bit lower to maximize the possibility that you accomplish your timing goals. CONVENIENCE - Maybe your strategy for when you list your home and your pricing strategy all revolve around making it a seamless transition to your next home. You're willing to be flexible on timing and on pricing so long as it lets you accomplish your goals of buying that perfect next home. CERTAINTY - Some sellers don't mind working their way through inspection contingencies, but some would opt for a slightly lower priced offer without an inspection if that meant they would have certainty that the sale would move forward. | |

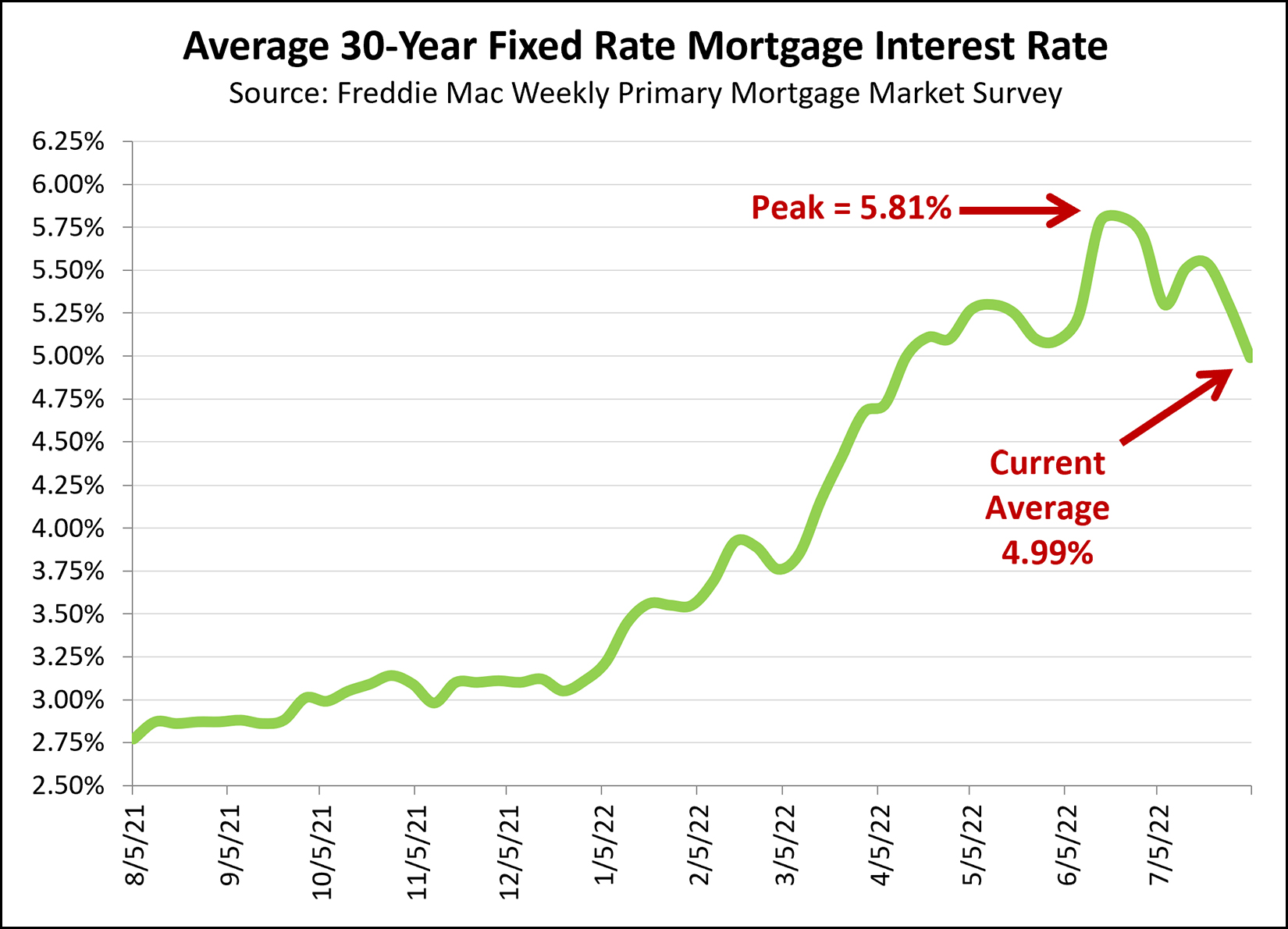

Happy Mortgage Interest Rate News As Average Rate Falls Below 5% Again |

|

Mortgage interest rates have been steadily climbing for most of the past six months -- peaking at 5.81%. But... in a bit of good news for buyers in today's housing market... the average mortgage interest rate (for a 30 year fixed rate mortgage) has fallen below 5% again... barely... to 4.99%. Just over a month ago with rates nearing 6%, some were thinking we were going to see them continue to rise to 6%, 7% or beyond. This moderation in rates is certainly helpful for home buyers looking to buy a home right now! | |

If You Can Buy A Home Without Selling, Get Your Ducks In A Row Sooner Rather Than Later |

|

It's hard to get a home seller to consider a home sale contingency these days. The market is still moving quite briskly, so why would a seller tie up their home in a contract with a buyer... who then has to go and sell their home!? Sometimes, though, a buyer can buy their next home before selling their current home. This allows said buyer to make an offer without a home sale contingency, and thus, have a shot at securing a contract on the home they hope to purchase. But... sometimes... being able to buy a home without selling requires a bit of research or planning or both... RESEARCH - If you are pretty sure you can buy without selling, don't wait to talk to your lender to confirm that until a house of interest comes on the market for sale. Talk to them now! Submit documentation to your lender to get to having a firm understanding of whether you can or cannot buy without selling... and get a copy of your pre-approval letter! PLANNING - Perhaps you have quite a bit of equity in your home... or perhaps it is entirely paid off! One option may be to take out an equity line on your current home to allow you to use those funds for a downpayment on the new house... and then pay off the equity line when you sell your current home. If you're looking for a good lender for getting pre-qualified or for exploring equity line options, let me know... | |

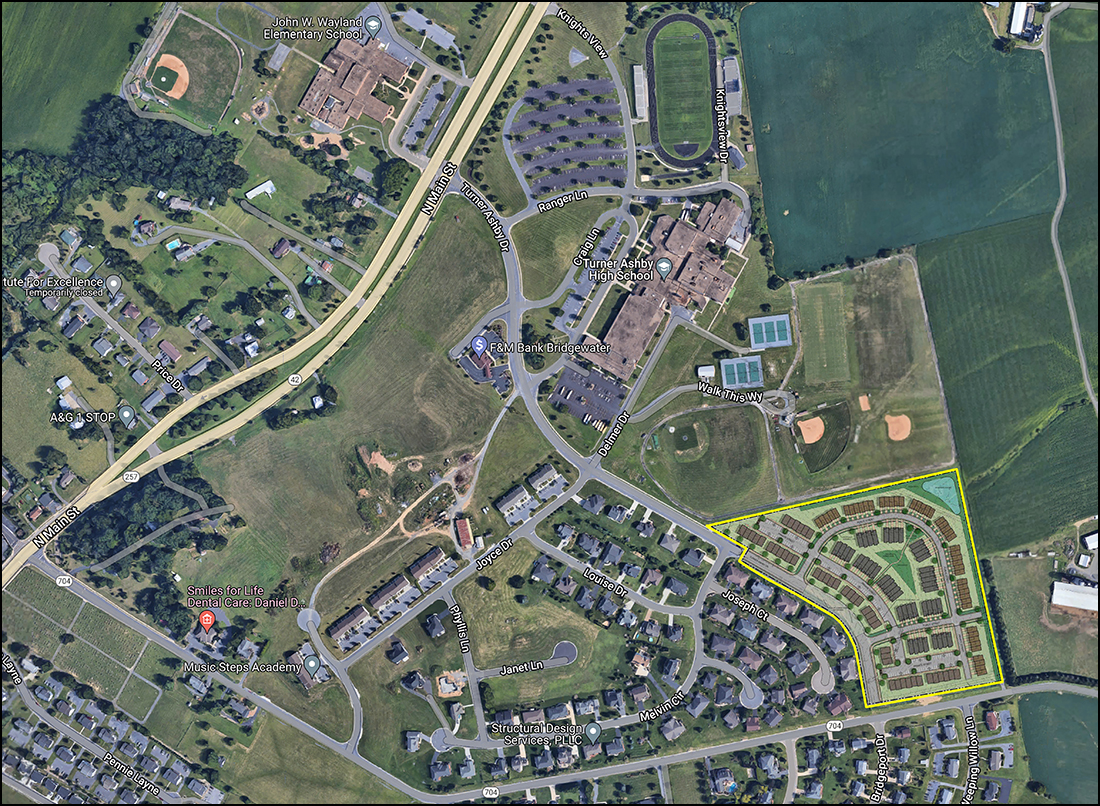

The Developer of Preston Lake Would Like To Build 139 Townhouses Behind Turner Ashby High School |

|

The developer of Preston Lake, Evergreen Homes, would like to build 139 townhouses behind Turner Ashby High School in the area outlined above. Bridgewater Town Council will review the proposal at their meeting in August. The potential townhouse development would be called The Glen at Cooks Creek and would be comprised of several different styles and sizes of townhouses. These townhouses would be built adjacent to Windsor West... and the land for these townhouses seems to currently be owned by the developer of Windsor West. Read a bit more this potential development over at the Daily News Record here. | |

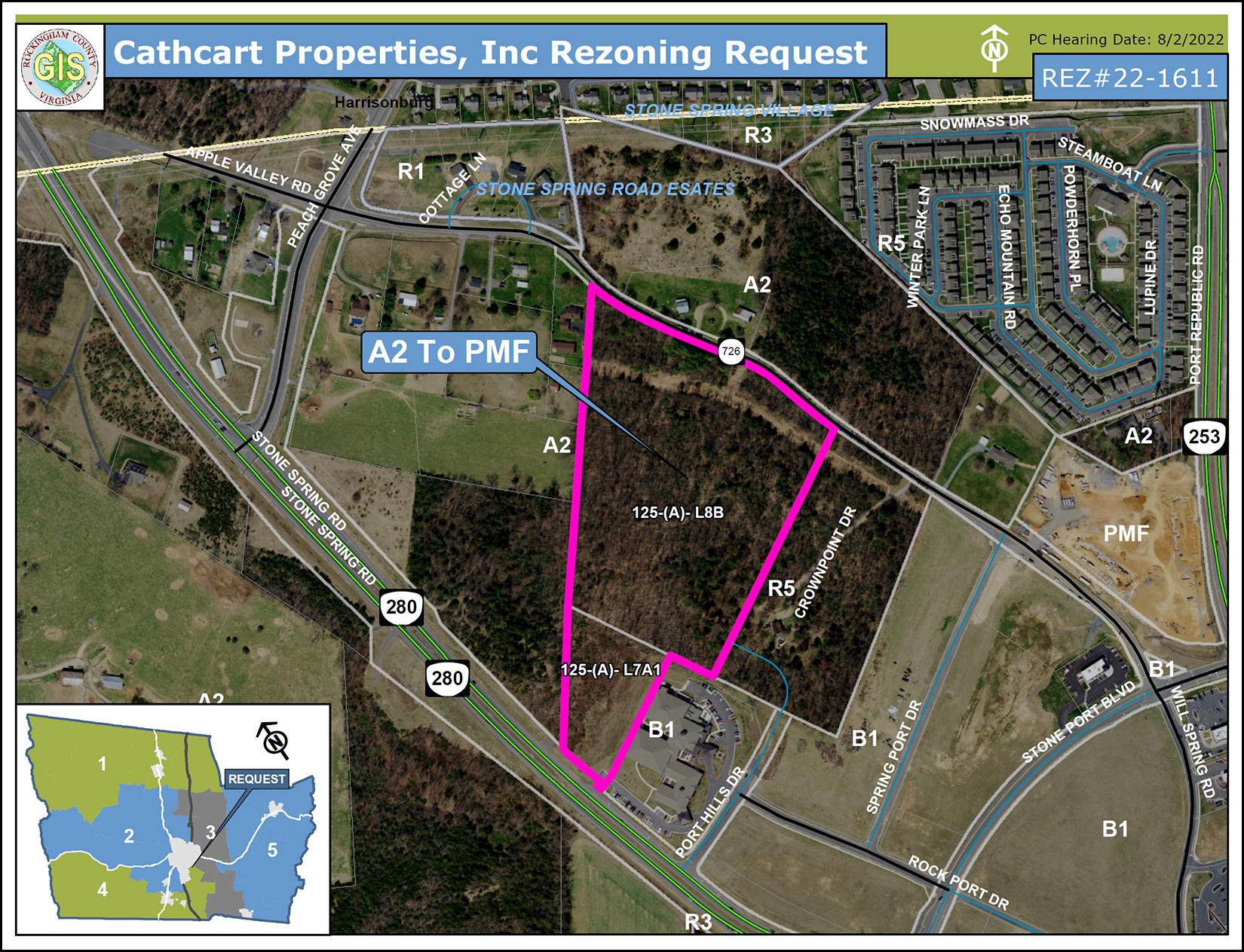

271 Apartments Proposed Between Stone Spring Road and Apple Valley Road |

|

Cathcart Properties Inc, a developer out of Charlottesville, is proposing a rezoning of 19.3 acres between Stone Spring Road and Apple Valley Road (as shown above) to allow for the development of up to 271 apartments in seven apartment buildings as shown below...  The potential unit breakdown per the site plan appears to include...

Per the developer's description of the proposed plan for The Wentworth we learn that the community will contain no more than 271 apartments and amenities are likely to include a clubhouse, pool, playground, dog park, multi-purpose court, bus stop, car wash and trash/recycling site. The Rockingham County Planning Commission will review this rezoning request at their meeting on August 2nd at 6:30 PM. Download the entire rezoning application packet here. | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings