Archive for September 2022

Does Building College Student Housing In Harrisonburg Impact City Schools? |

|

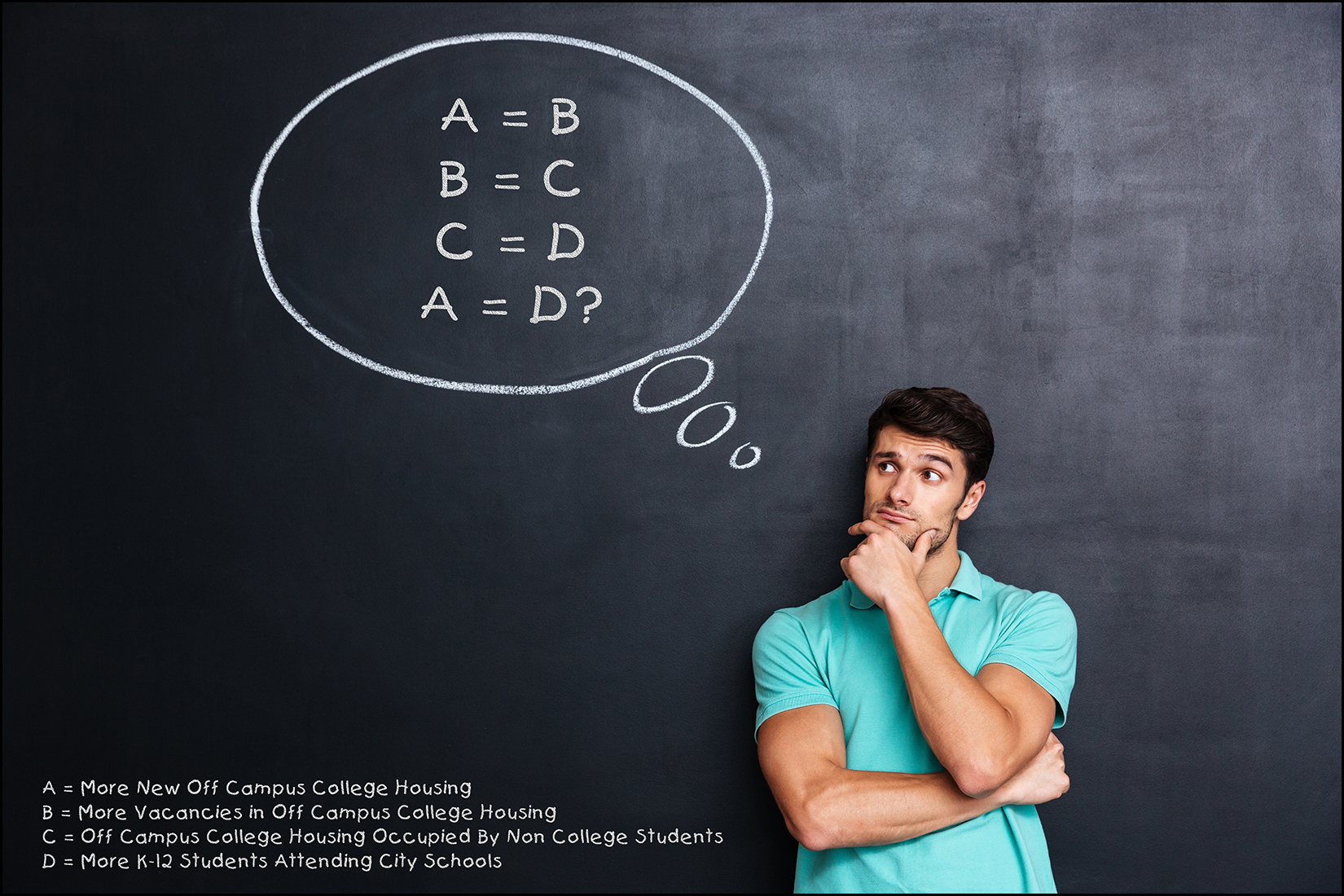

At first glance, the answer to this question seems obvious... If more college student housing is built in Harrisonburg, those college students are very unlikely to have children attending K-12 schools in the City of Harrisonburg. So, there is not a connection between college student housing construction and K-12 student population, right? Well... maybe there actually is an indirect connection... Using some rough, and certainly inaccurate numbers, let's pretend... [1] There are 21,000 students at JMU. [2] Of those, 7,000 students live on campus. [3] Thus, 14,000 students live off campus. And let's pretend that today, there is enough off campus college student housing for... magically... 14,000 students. Clearly, it's not this cut and dry, but I can pretend. Now, what happens when more off campus college student housing is built? What happens when there is enough new housing to fit 500, 1000 or 2000 more college students? First off, yes, JMU is growing and will continue to grow over time... but not that fast!? Now, after this new off campus college housing for 2,000 more students is constructed we will have off campus student housing for 16,000 college students... but only 14,000 college students who need housing! What seems to inevitably happen in Harrisonburg, is that when new off campus student housing is built... some of the existing (usually older) off campus student housing is no longer occupied by college students. And then, yes, the new tenants... who are not college students... may have children... who would attend City schools. So, while it may seem at first glance that building off campus college student housing does not impact the City school population (and thus the City budget to pay for educating more students) it seems that this new off campus college housing actually can indirectly impact City schools. As to the illustration above... A = More New Off Campus College Housing B = More Vacancies in Off Campus College Housing C = Off Campus College Housing Occupied By Non College Students D = More K-12 Students Attending City Schools If A=B and if B=C and if C=D... then, does A=D? A few pretty broad disclaimers... 1. I'm not saying it's a bad idea to build more off campus college housing. 2. I am saying it's a good idea to discuss and understand the primary and secondary impacts of building new off campus college housing... or any other type of housing. 3. I'm not saying it's a bad thing to have non college student rental housing created through increased vacancies at what were previously college student housing complexes. Perhaps that's a good thing... or a normal part of the housing cycle in a college town? As with most of my writing about the dynamics of our local housing market... I'm not trying to convince you that one thing or the other is a good or bad... I'm just trying to get some discussion points out there for you, and others, to consider and decide what you think. :-) | |

Will A 6% Mortgage Interest Rate Seem High After A Year Of 6% Rates? |

|

Many (though not all) home buyers in the market today have been shopping for homes for the past three, six or 12 months. As such, when they encounter today's mortgage interest rate of around 6.25% they find it to be high. Quite high! After all, six months ago, the average 30 year fixed rate mortgage interest rate was 4.25%... and a year ago, the average rate was a touch below 3%. So, of course, a 6.25% mortgage rate seems high compared to 4.25% or 3%. But... fast forward a year... if mortgage interest rates have remained around 6% for a full year, will they then stop seeming and feeling high? Clearly, a 6.25% mortgage interest rate a year from now will still result in the same mortgage payment as a 6.25% mortgage interest rate does today... but perhaps that payment (and that interest rate) will no longer be viewed in the context of what could have recently been... at 4.25% or 3%. Of course, I'm hoping mortgage interest rates don't really stay this high (around 6%) for a full year, but if they do, maybe they won't seem quite as high to home buyers a year from now. | |

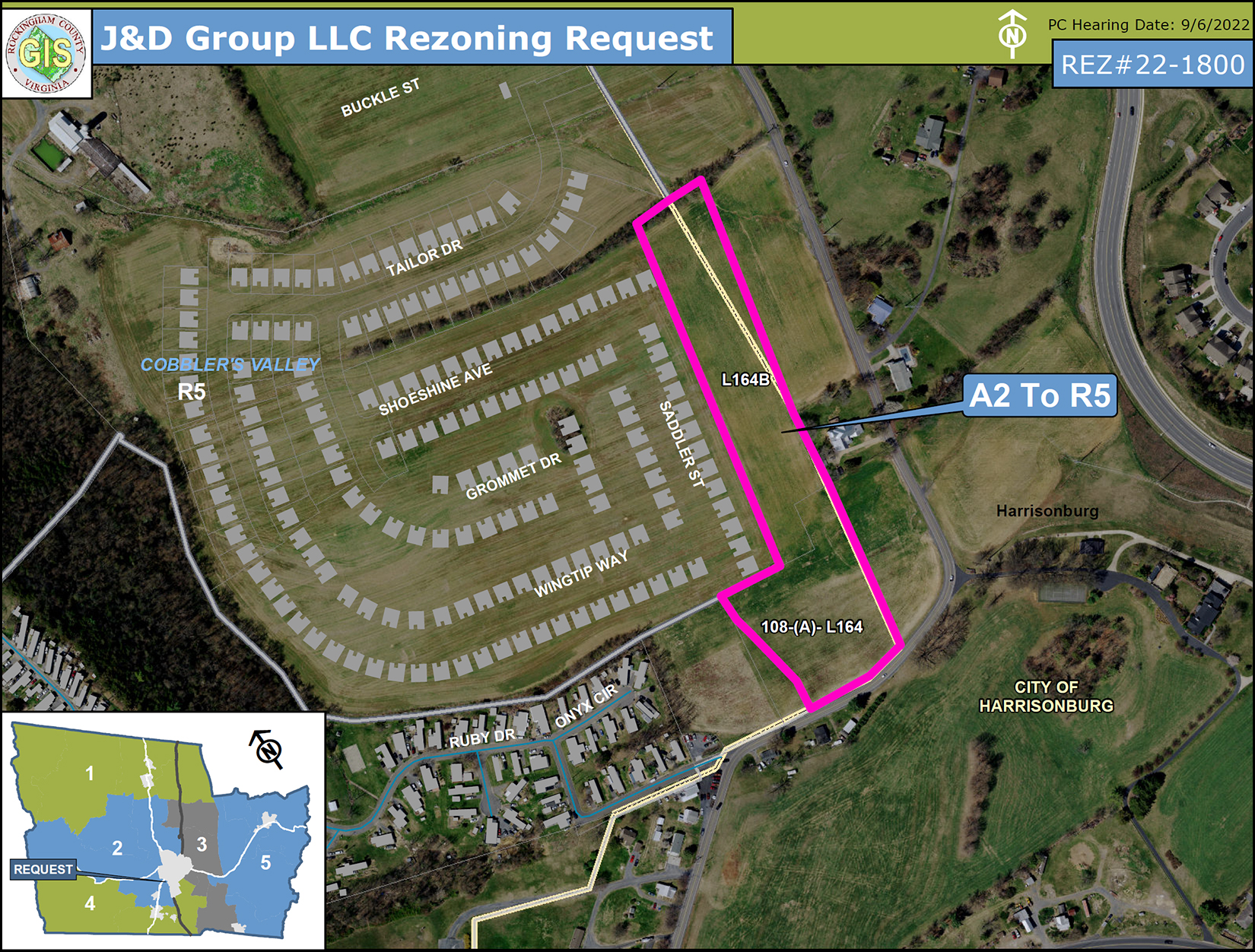

55 (More) Townhomes Proposed On Pear Street |

|

Just a short walk down Pear Street from where 33 townhomes are proposed there is now a new request for a rezoning of 6.77 acres to allow for 55 more townhomes to be built. This proposed development, to be called Zephyr Hill, is intended to consist of both two and three story townhomes, with and without garages. These 55 proposed townhomes would also be adjacent to the Cobblers Valley development currently being built by Ryan Homes. Here's the proposed site plan for these 55 townhomes...  The full County rezoning packet is available here. | |

As You Might Imagine, It Is Still A Pretty Swell Time To Sell A House |

|

Lots of homes are still selling, relatively quickly, at high prices. Yes, mortgage interest rates are higher, which limits the housing budget for some buyers, but thus far we are not seeing higher mortgage interest rates affect the prices for which homes are selling. Thus, home sellers are still enjoying the current market as a great time to sell... Lots of homes selling = YAY Low inventory levels = YAY Homes selling quickly = YAY Sales prices remaining high = YAY Higher mortgage interest rates = Yeah, so what? Certainly, if a home seller needs to turn back around and be a home buyer, the mortgage interest rates will impact their housing transition. But if you are just selling a home... it is still a very enjoyable time to sell... | |

I Was Going To Upgrade To A Larger Home Until I Saw That Larger Mortgage Payment!?! |

|

In more than a few conversations over the past week I have been chatting with friends and past clients who have shared that they had been recently toying with the idea of upgrading to a larger home. In each of these instances, they bought their home three to eight years ago and are now finding it to be a bit tight in various areas. A new kid (or two) stretching the bedroom usage... working from home part of the time with limited space in which to do so... older kids with friends coming over to hang out and wanting room to lounge, etc., etc. These various "life is changing and house needs are changing" situations prompted each of these homeowners to think about whether they ought to upgrade to a larger home. But... then they started running the numbers. At first, things look good... They bought their current home for $300K, have a mortgage payment of around $1600/month, they still owe $250K and could sell for $415K. Thus, they could walk away with about $140K after settlement. But then, things turn a bit... The larger home would cost them around $540K. They'd put $140K down, so they'd be financing about $400K. At current mortgage rates of around 6%, their monthly payment would be... $2900/month. As you can see from this rough math for this one homeowner's situation, even though their $300K home is now worth $415K, and even though they would be walking away with $140K after selling, and even though they'd only be upgrading from a $415K home to a $540K home... their mortgage payment would be jumping up from $1600/month to $2900/month. The big change here is, of course, the mortgage interest rate. Paying off that 3.25% mortgage and taking out a new 6% mortgage is going to cost ya! What does this mean for homeowners and our local market? I suspect there will be fewer elective home upgrades over the next few years if interest rates remain this high... which has the potential to further limit resale inventory of homes for sale. This story is not everyone's story... so if you're considering an upgrade (or a downgrade) let me know if you'd like to do some rough math together to evaluate the overall financial impact of making the change. | |

The Second Best Way To Know If Your House Will REALLY Sell For THAT Much!?! |

|

Home values have increased QUITE a bit over the past few years. The median sales price this year is 36% higher than it was three years ago in Harrisonburg and Rockingham County. That can leave a homeowner wondering... will my house REALLY sell for THAT much!? The best way to know if your house will sell for $____ is to put it on the market for sale and see what type of market response we have over the first few weeks. :-) The second best way to know if your house will sell for $____ is to see how quickly your neighbor's similar house sells and at what price. Very frequently, though not always, we can find a house that is relatively similar to your home that has sold in recent months that can provide concrete guidance on how you might price your home if you were to sell. If you are thinking about selling your home soon, let's start digging into the data now to see if it will REALLY sell for THAT much! ;-) | |

The Value Of The Smallest House In The Neighborhood |

|

How much should you be willing to pay for the smallest house in a neighborhood? Especially if it is a good bit smaller than all the other houses in the neighborhood? Let's imagine a neighborhood in Harrisonburg or Rockingham County where homes typically sell for $450K - $500K, with an occasional sale above $500K. All of these homes, however, are 3000 SF homes. There might be a 2800 SF homes that sells from time to time, but almost all are at, above, or well above 3000 SF. So -- when a 2300 SF home comes on the market in the neighborhood, how much should you be willing to pay? A seller might say $440K. After all, you have to pay $450K+ to buy any house in this amazing neighborhood, so even if my house is smaller than most, you'll need to pay pretty close to that floor of $450K. A buyer might say $400K. After all, the 2300 SF home is markedly smaller than just about every other home in the neighborhood, so the sales price should be quite a bit lower as well. If a 3000 SF home sells for $450K, I don't want to pay more than $400K for a 2300 SF home. I might say $420K. I think there is merit in both of the perspectives above, and a blending of those two concepts gets us close to what a buyer should be willing to pay. Keep in mind -- it is also possible that a buyer will come along who just LOVES the neighborhood and doesn't need much space at all. This buyer might just be willing to pay closer to that $440K - $450K price, especially if they are a cash buyer, or moving from a more expensive market, etc. | |

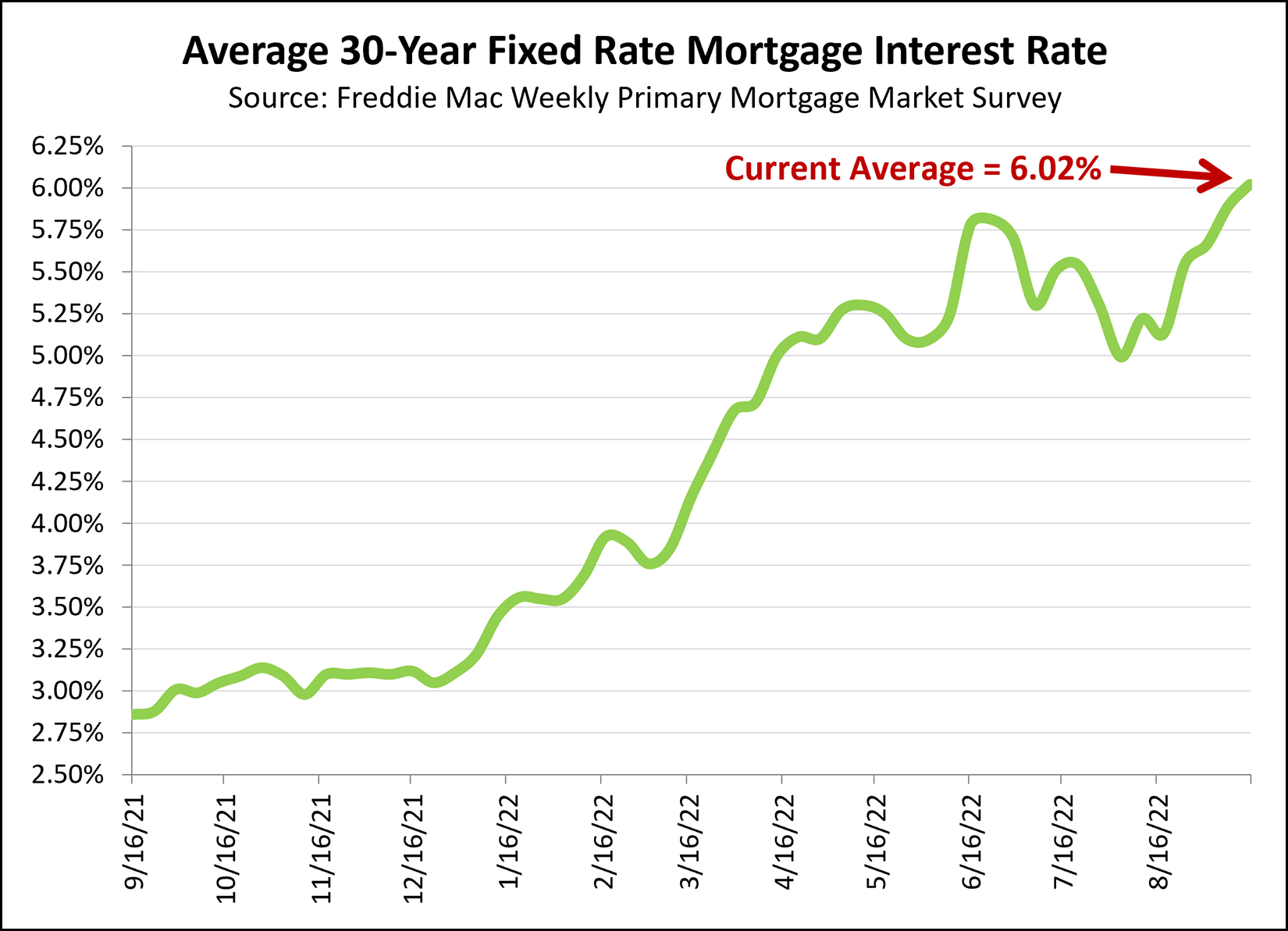

Mortgage Interest Rates Double Within A Single Year |

|

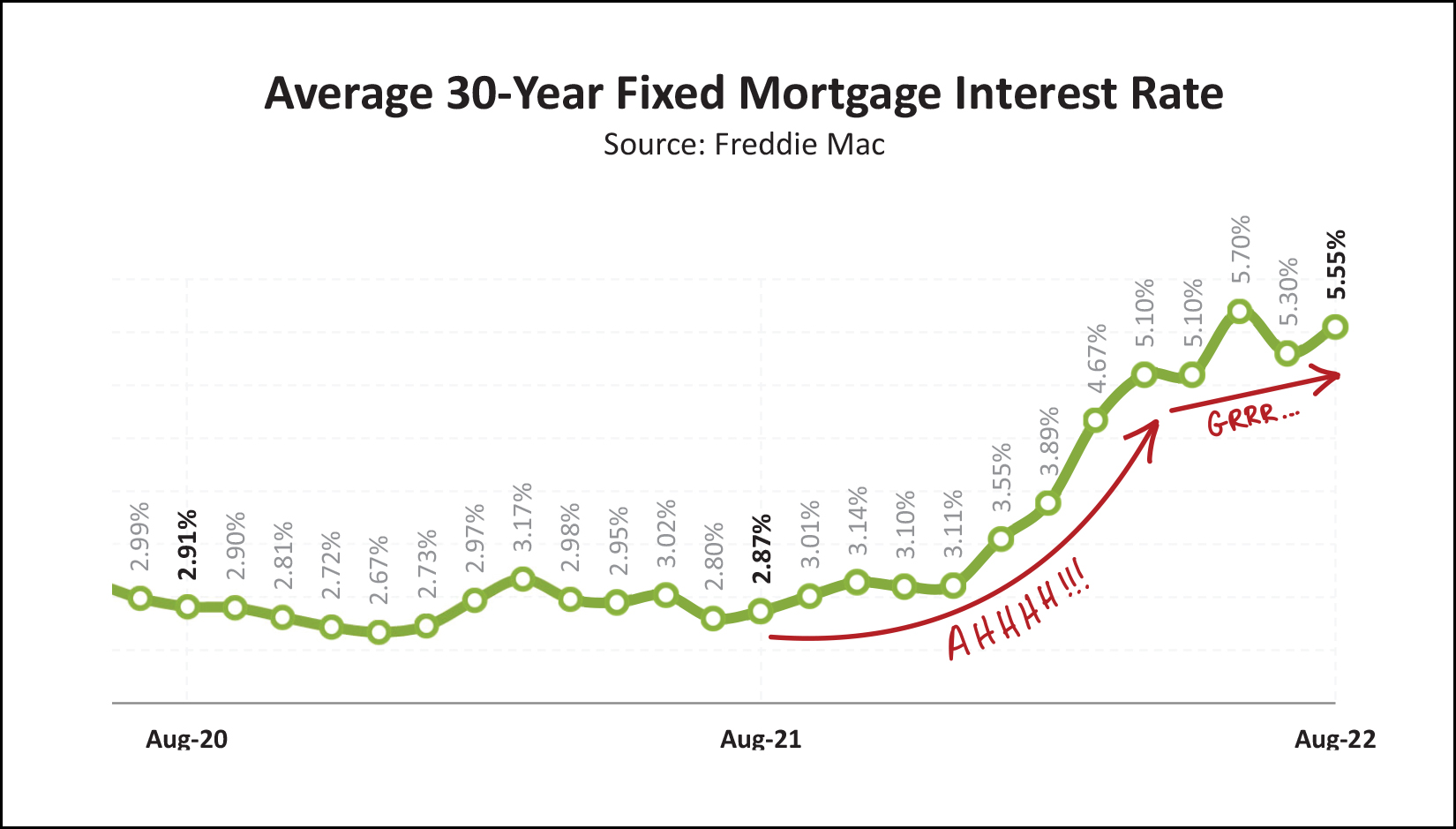

Well, then. A year ago, the average 30 year fixed rate mortgage interest rate was under 3%. Today, the average 30 year fixed rate mortgage interest rate is 6.02%. Yikes. Clearly, this affects mortgage payments rather significantly. Now, to create at least a bit of context... [1] Nobody really thought 3% mortgage interest rates were normal or sustainable. They were great, of course, for home buyers... but I don't think anyone really thought they'd stick around for as long as they did. [2] In some ways a buyer's monthly housing costs were held abnormally low by those abnormally low mortgage interest rates. So, while monthly housing costs have increased significantly over the past year given this shift in interest rates... it wasn't really from "normal" to "high" - it was more of from "low" speedily through "normal" and then to "high" today. [3] The last time this average 30 year fixed rate mortgage rate was above six percent was back in 2008. It's been a bit. Will mortgage interest rates continue to rise? Will they hover around six percent? Will they drop back into the five point something range? Stay tuned to find out. In the meantime, some home buyers today are opting for an adjustable rate mortgage instead of a fixed rate mortgage. The average rate for a 5/1 ARM is currently 4.93%. This type of mortgage product will keep that 4.93% rate for five years and then can adjust once per year thereafter. | |

Help Bring A Free Three-Year Outdoor Live Music Series To Downtown Harrisonburg |

|

Harrisonburg is in the running to win a $90,000 grant to bring a free outdoor music series to downtown Harrisonburg! But... your help is needed! Click here to go vote for Harrisonburg to be the recipient of this grant. Harrisonburg is one of the finalists in this contest and you just need to vote once to help Harrisonburg reach the finish line. Learn about the Levitt Foundation contest here. Vote for Harrisonburg here.

| |

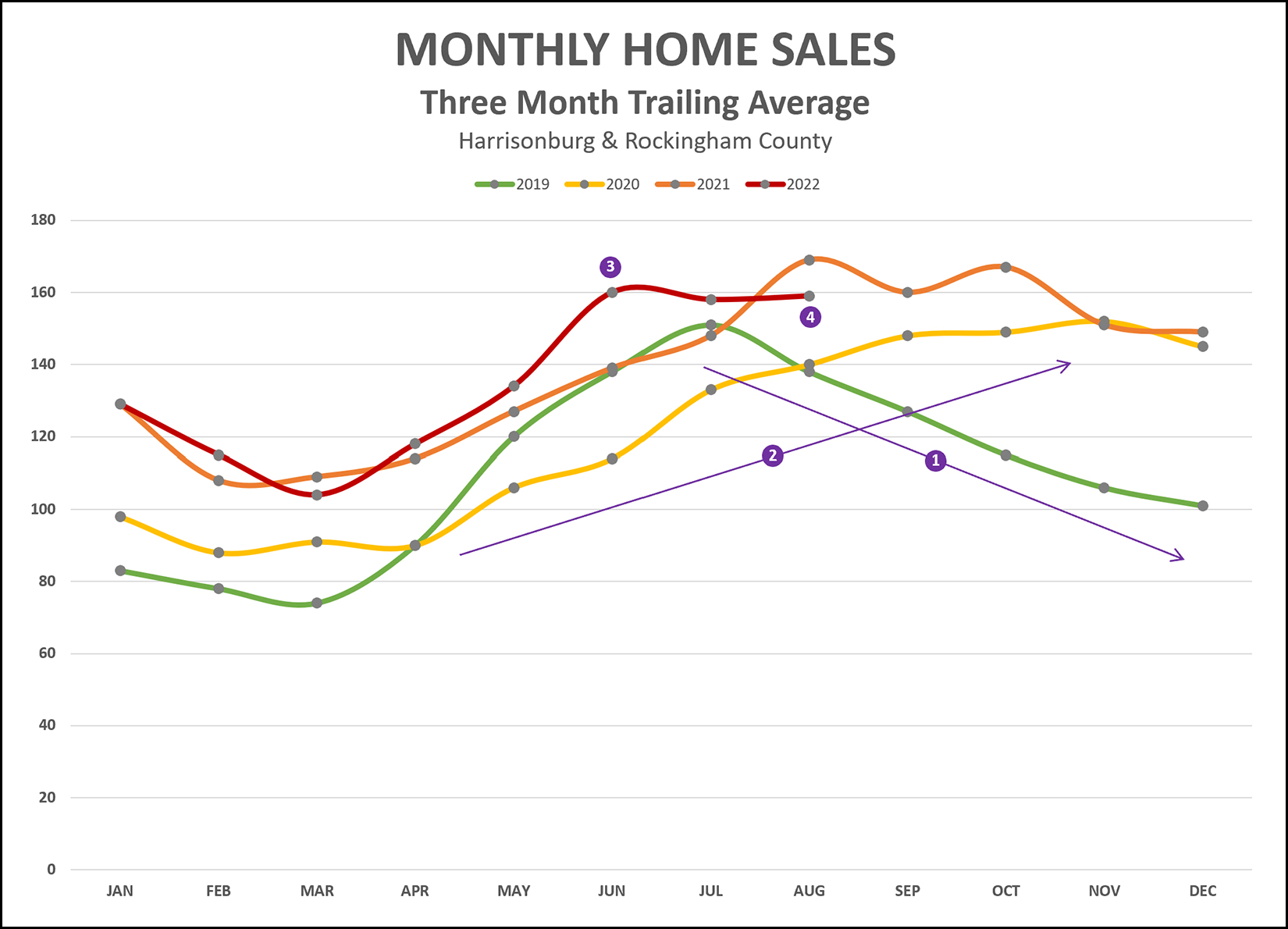

Another Visual Of A Slightly Slowing Pace Of Home Sales |

|

I usually look at the pace of home sales each month, which shows quite a movement up and down as some months are surprisingly slow and some are surprisingly active. I also usually examine the annual pace of home sales to see how home sales are trending from a long term perspective, though this view of the data is very slow to reveal any shorter term trends. Upon a recommendation from a reader, I have created the graph above that averages the three most recent months of sales in order to smooth out the monthly data but get faster insights into trends than the annual data can provide. Thus... The August 2022 data point is the average of June, July and August home sales. The July 2022 data point is the average of May, June and July home sales. Etc., etc. A few things, then, to point out on the graph above... [0] There are plenty of normal season trends illustrated on this graph. For example, home sales are typically lowest in the first quarter of the year, accelerate through the second and third quarter and then decline in the fourth quarter. This happens most years. [1] The green line (2019) took a nose dive in the second half of the year due to the uncertainty and anxiety of a pandemic sending many people home to work, for school and more. [2] As shown on the yellow line, things were rocking and rolling again by mid 2020 as buyers were snapping up houses as fast as they could because "home" was so important during the pandemic and because of rock bottom interest rates. [3] Looking at the red line (2022) we see that home sales activity was setting new records all the way through June 2022... though that data point is an average of April, May and June. [4] Now that we're into August, we have seen a slight decline in home sales activity as compared to 2021. We are still well above 2020 and 2019 at this point. It will be interesting to see how the remainder of 2022 plays out. It seems unlikely that the market will be as active as it was in the last five months of 2021. | |

Are Home Prices Rising Because Larger Homes Are Selling? |

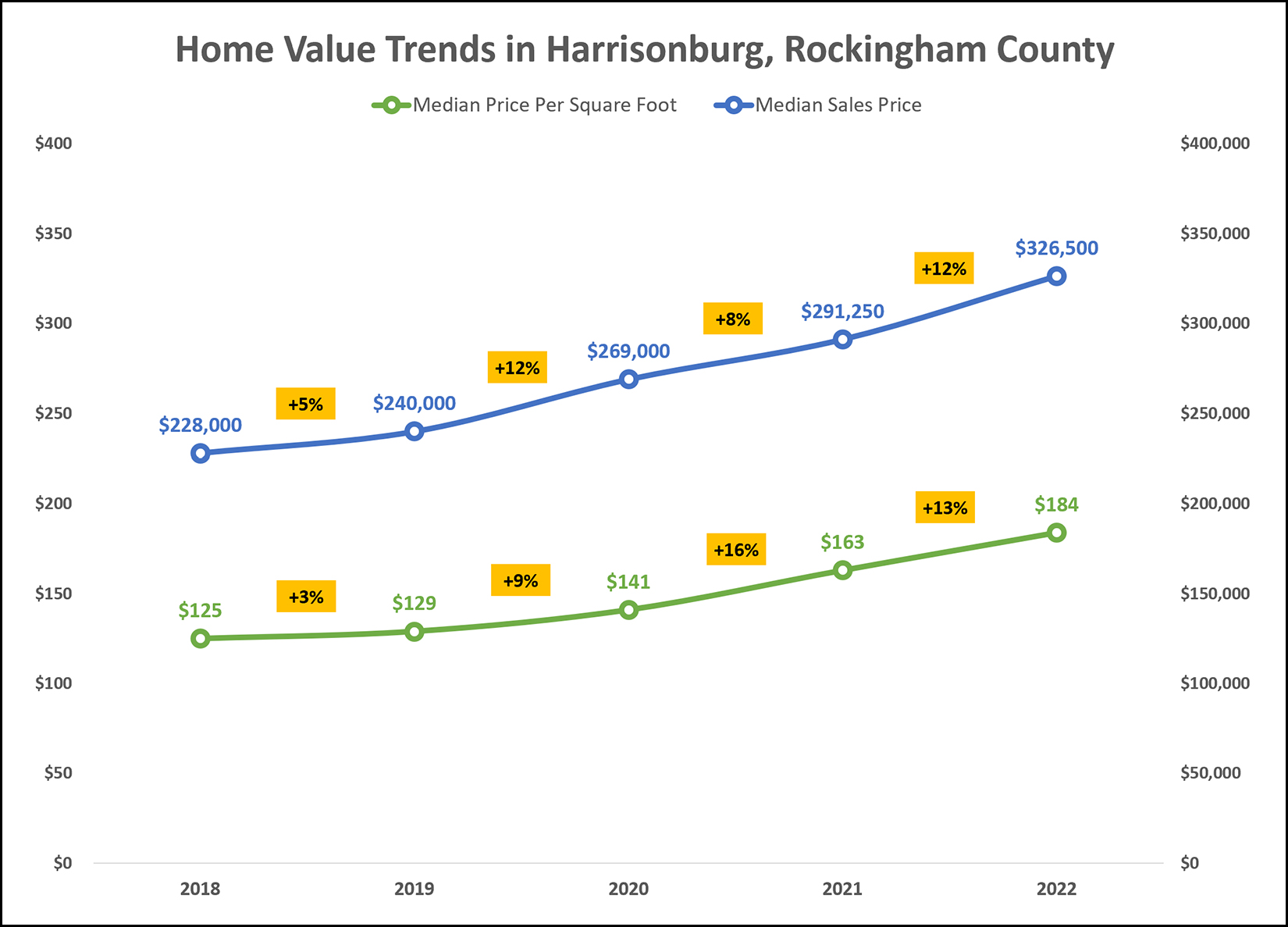

|

When you see a 12% increase in the median sales price between 2021 and 2022 you might wonder if it is just a result of larger homes selling this year than last. It's a reasonable question, and a relatively straightforward one to investigate... The graph above shows... BLUE LINE = median sales price of single family homes in Harrisonburg and Rockingham County GREEN LINE = median price per square foot of those same single family homes in Harrisonburg and Rockingham County If the 12% increase in the median sales price could best be understood as a collective increase in the size of homes being sold, we would see an increase in the median price per square foot that was smaller than 12%. In fact, over the past year, the median price per square foot has increased by 13%, right alongside the median price increasing by 12%. So, this significant increase in sales prices does not seem to be attributable to larger homes selling. | |

Home Prices Keep Rising in Harrisonburg, Rockingham County Despite Slightly Fewer Home Sales |

|

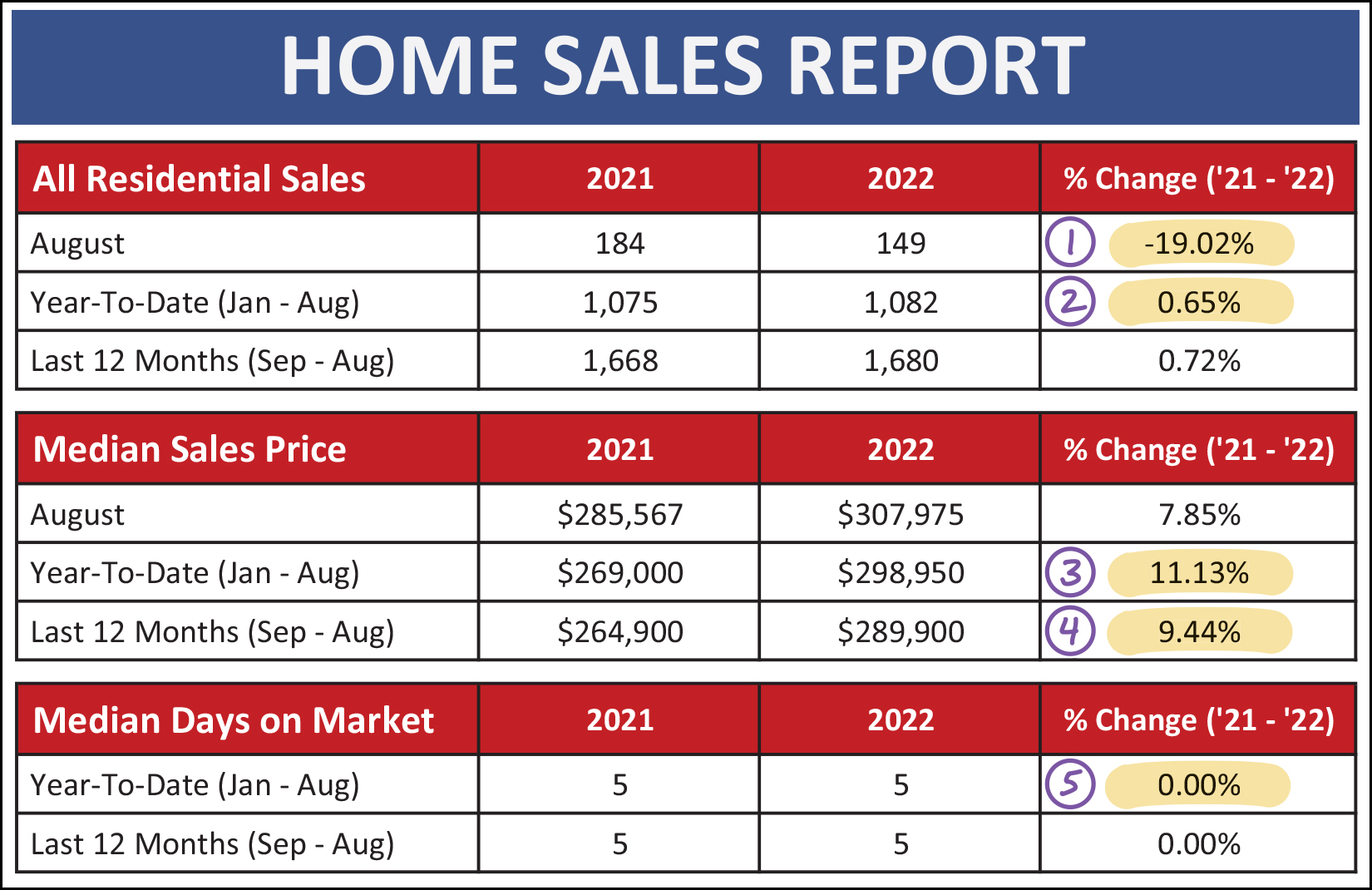

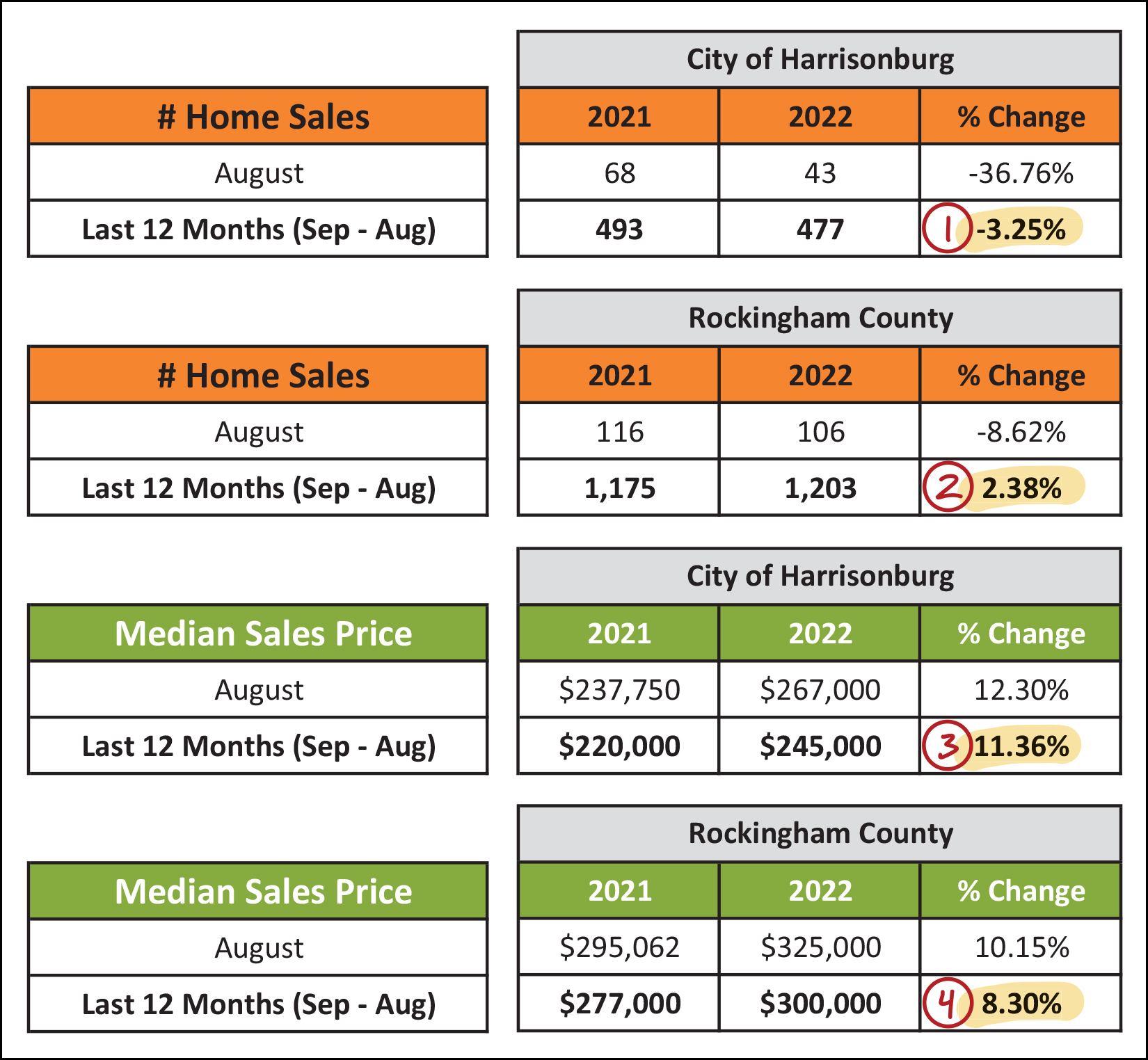

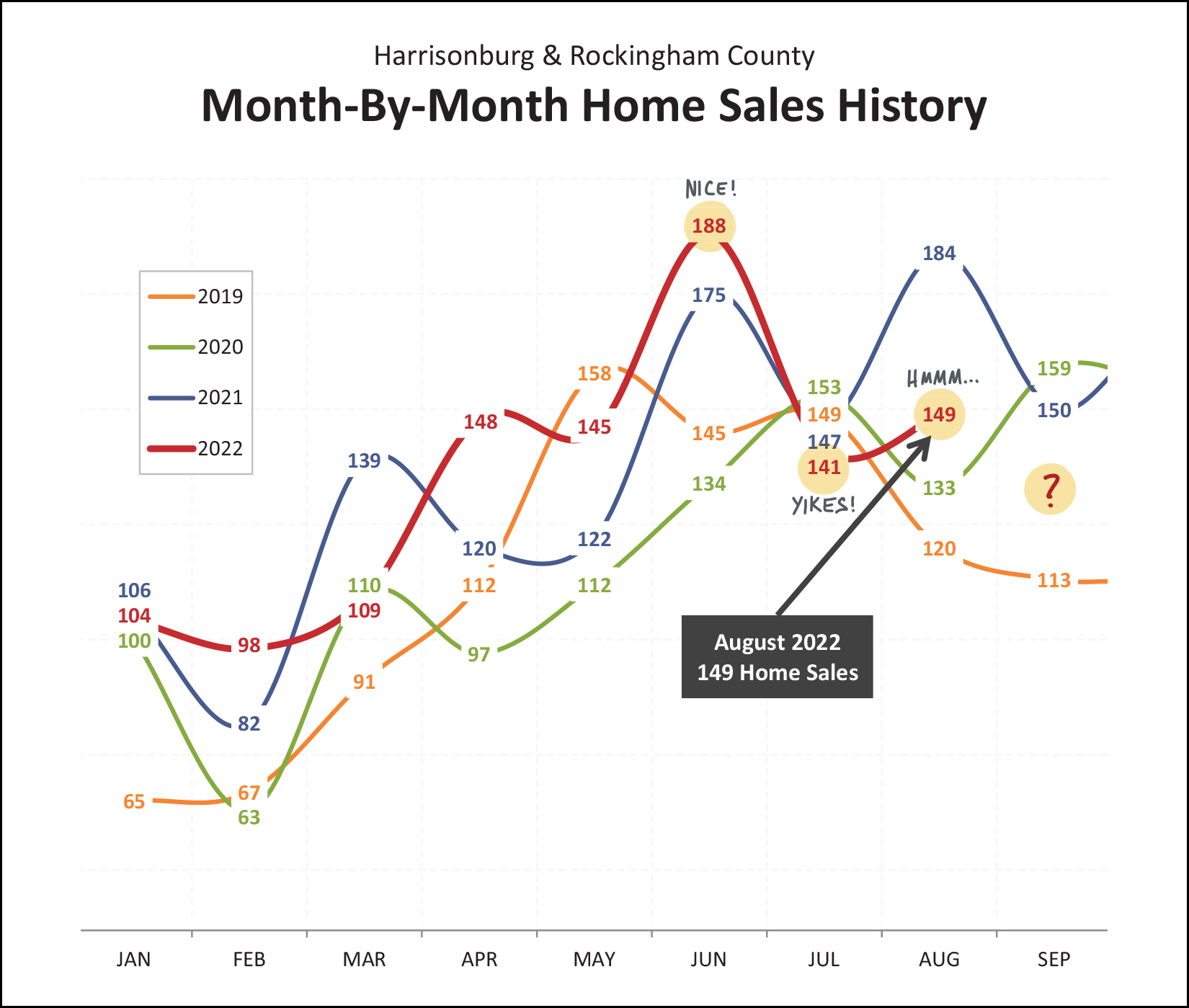

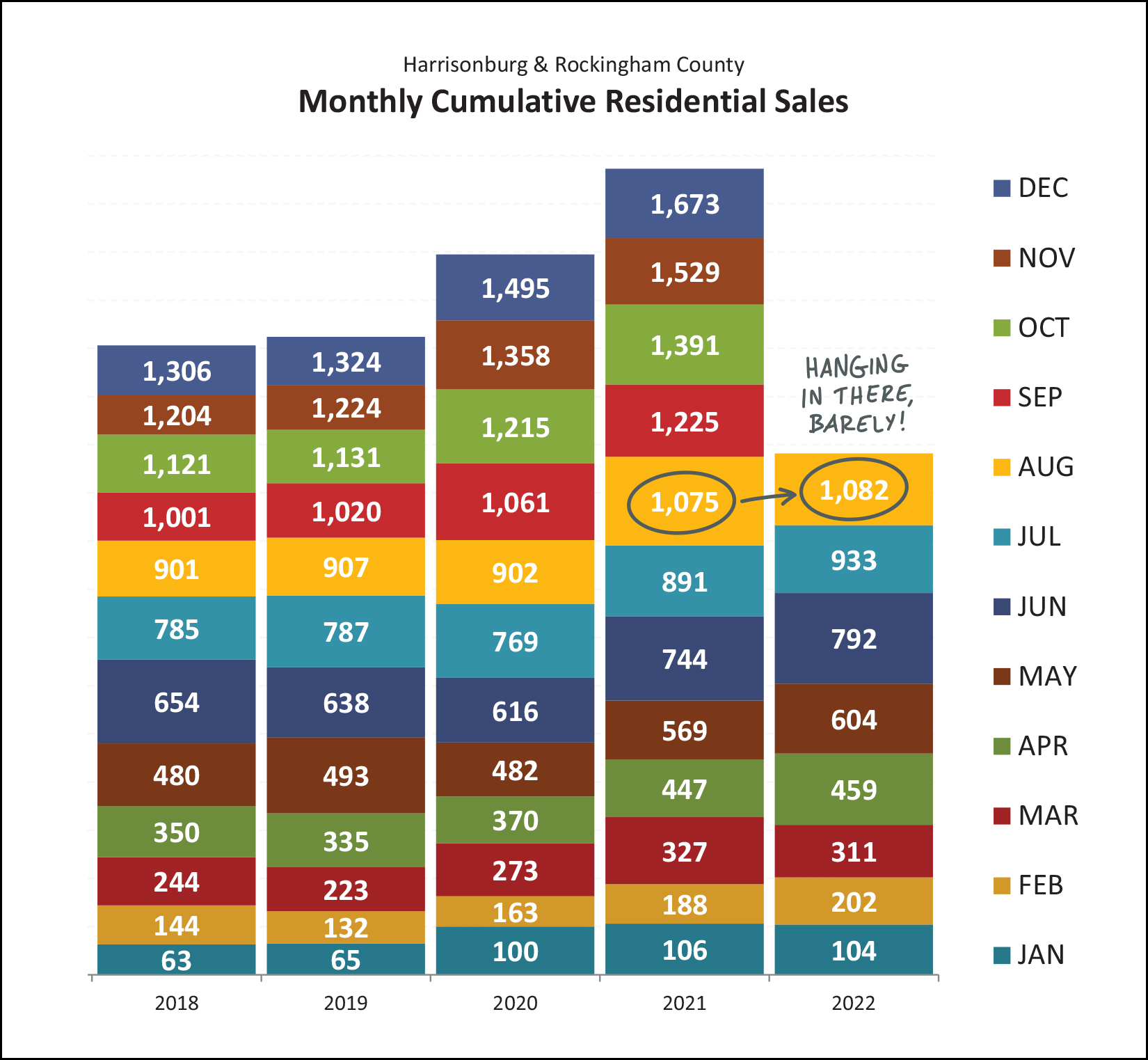

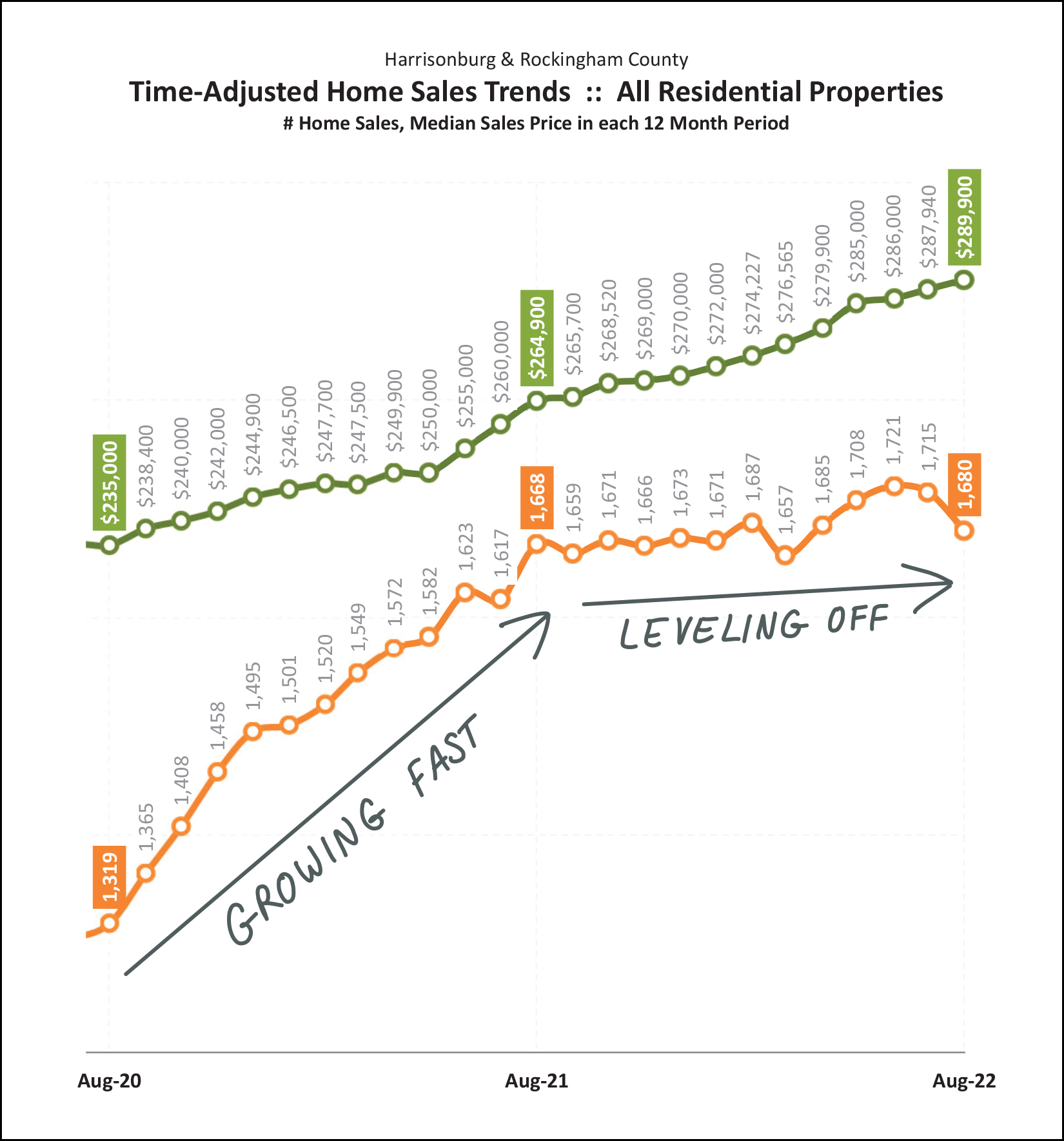

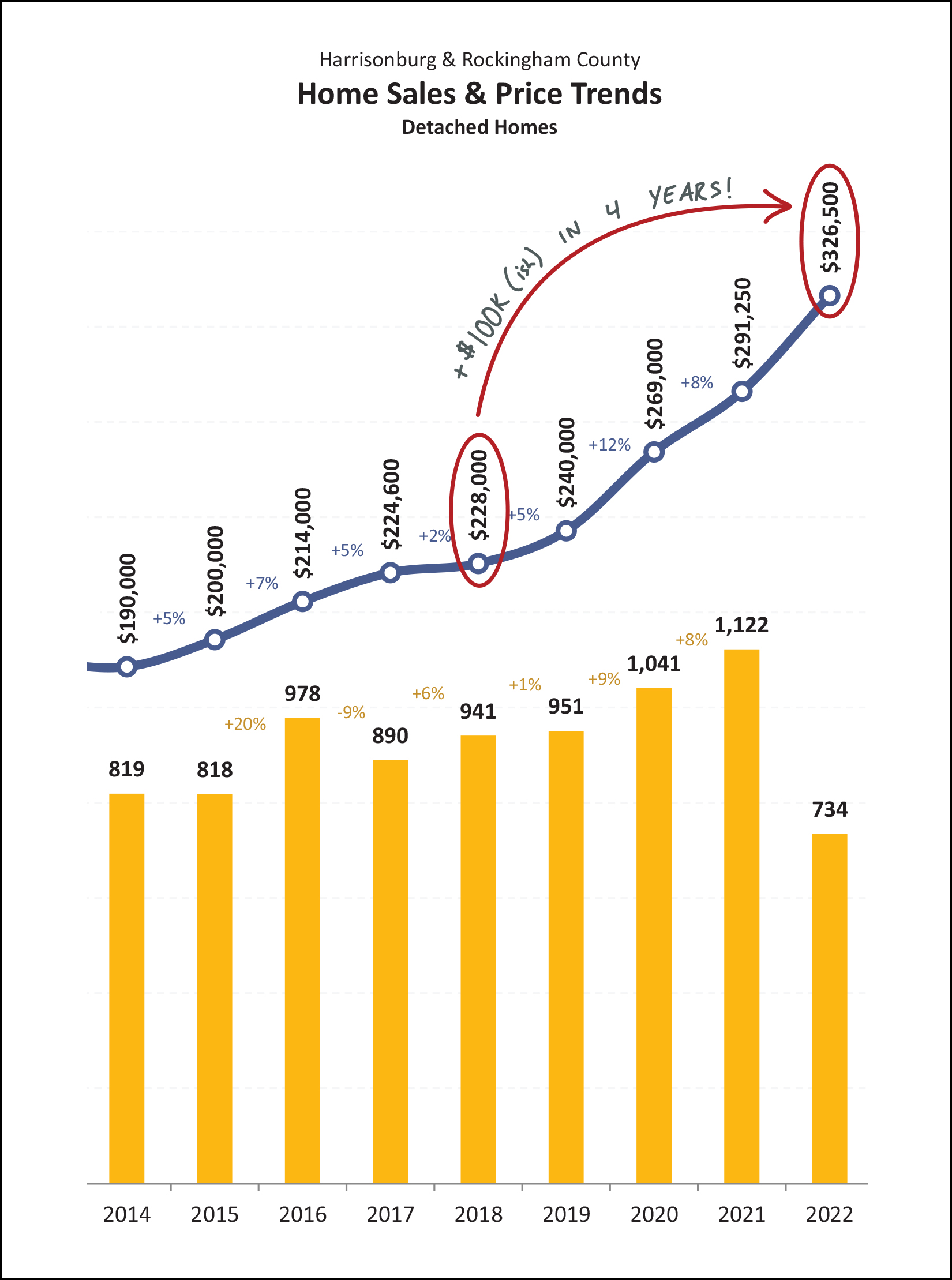

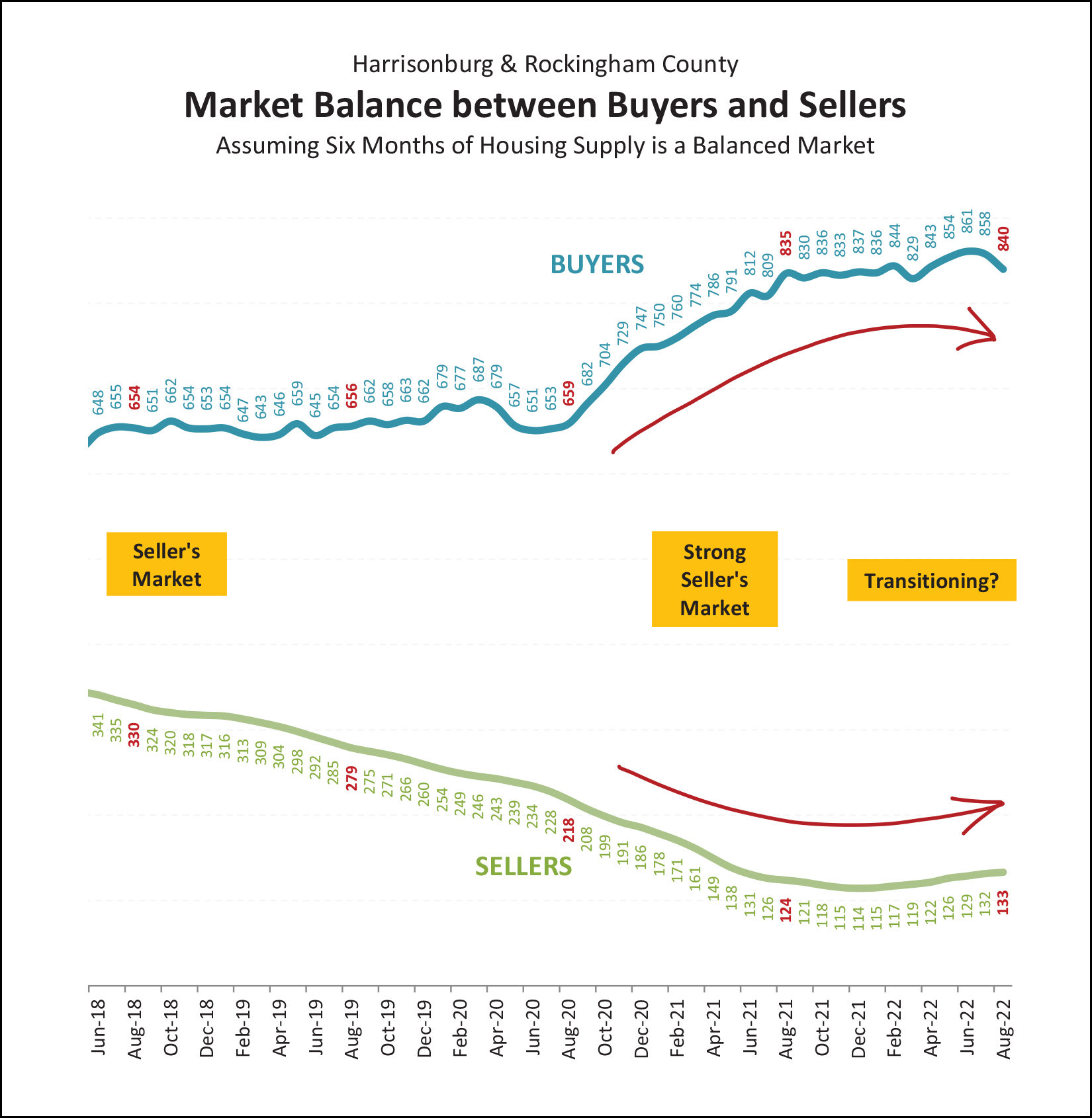

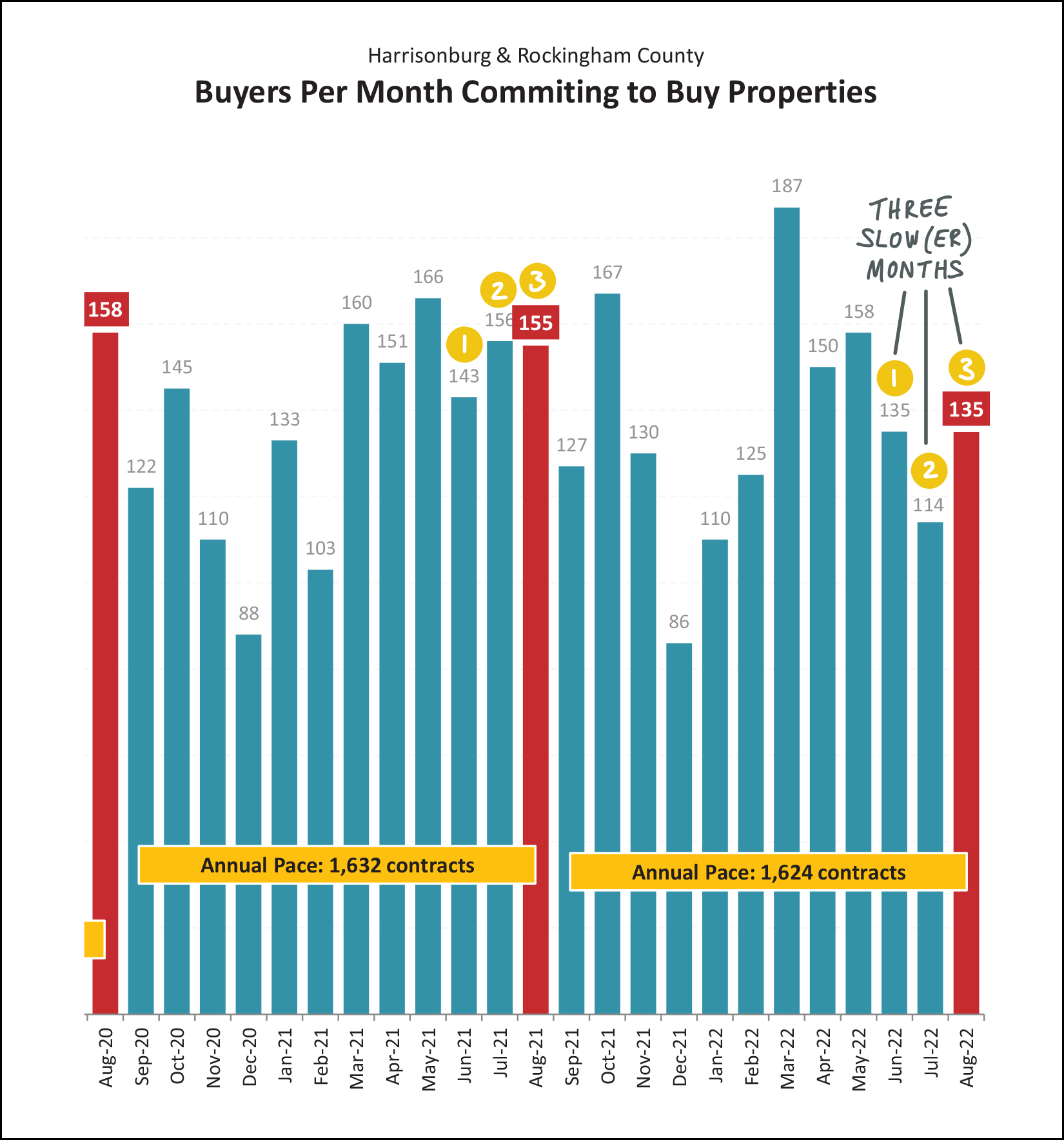

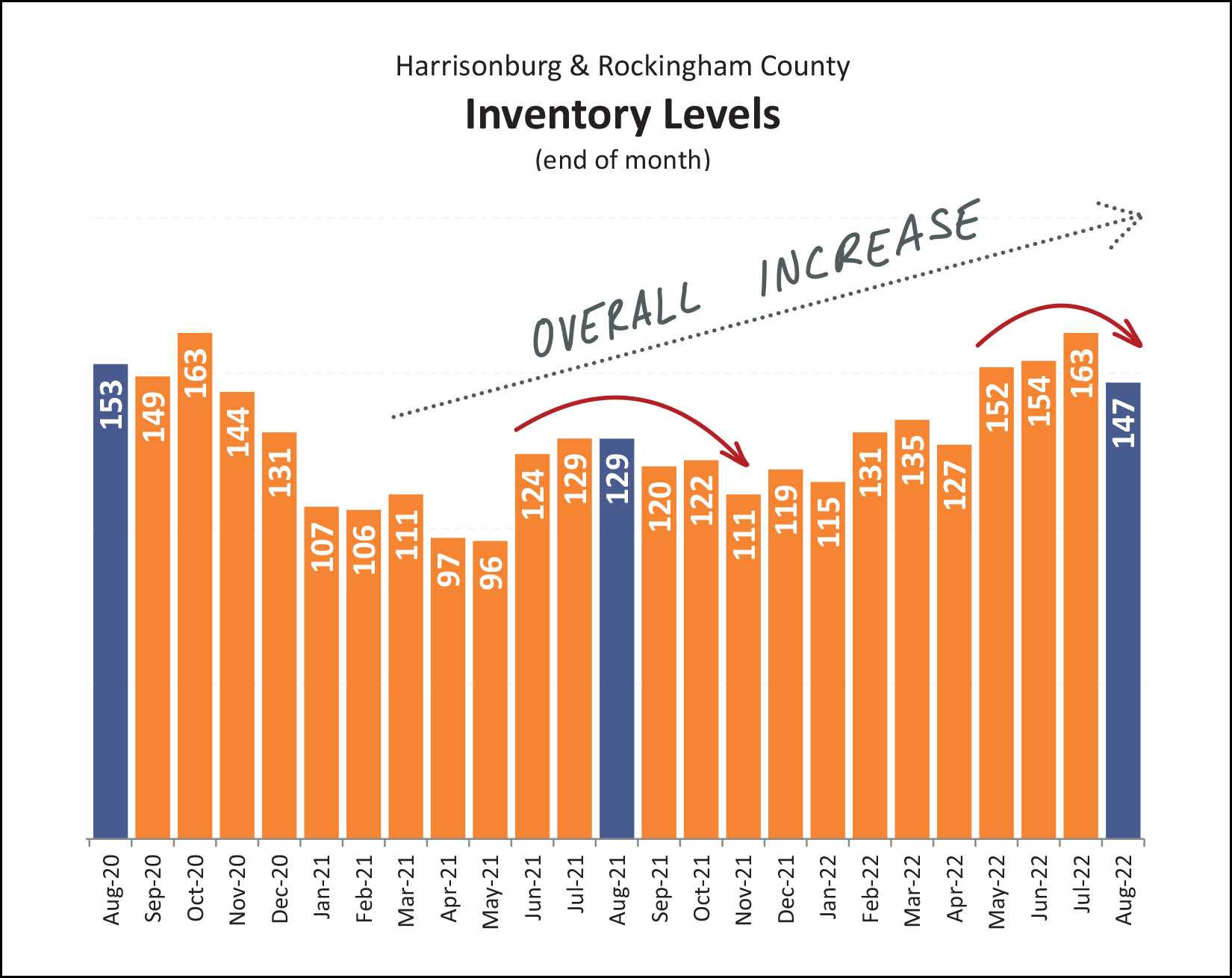

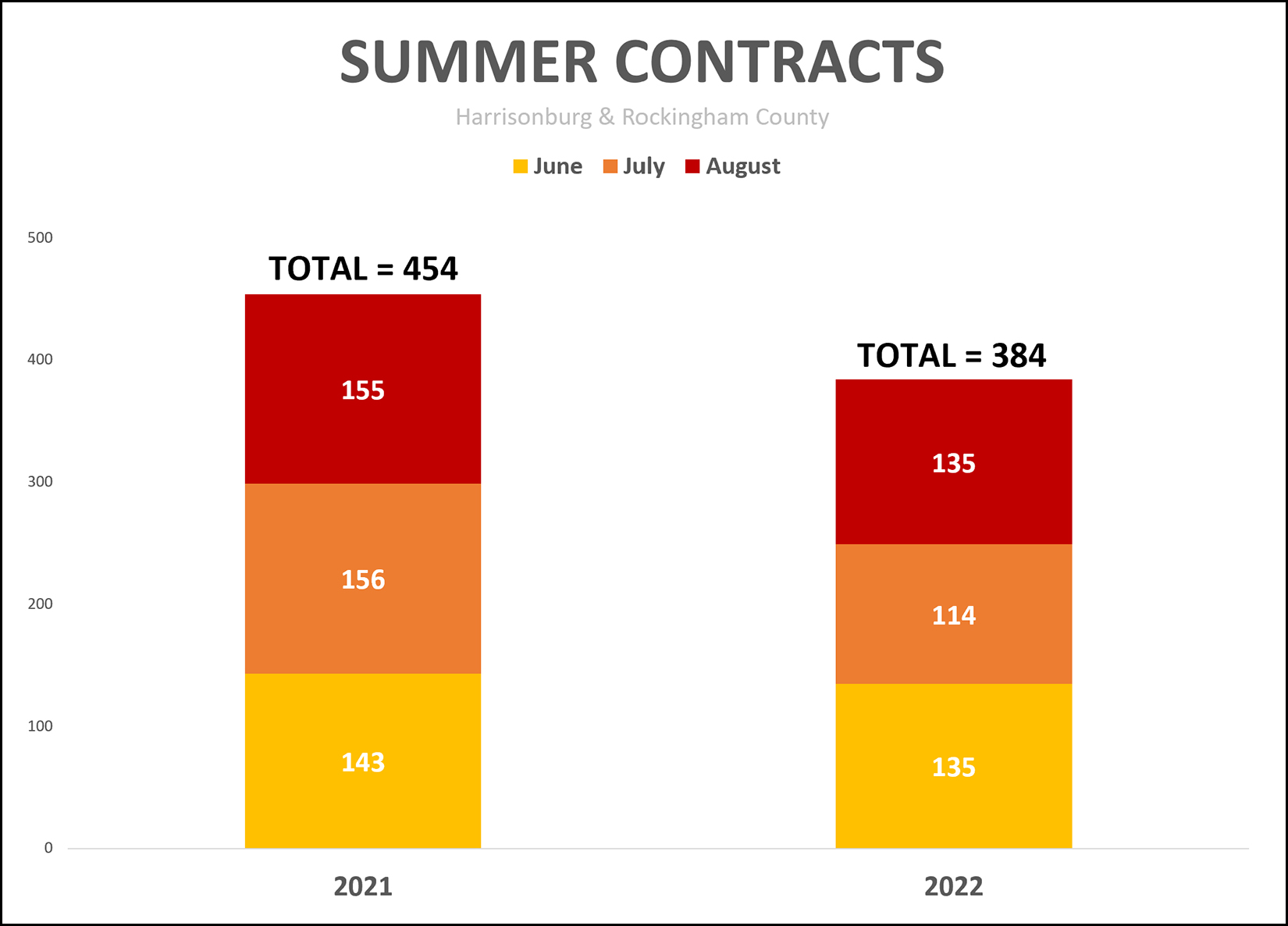

Greetings, and Happy Tuesday morning, friends! Would you believe it if I told you we're 70% of the way through 2022!? It's hard to believe, I know, but indeed, we only have about 30% of the year to go. Would you believe it if I told you I am now old enough to be the dad of an adult!? It's hard to believe, I know, but Luke recently celebrated his 18th birthday. Shaena and I are tremendously proud of the man he is and is becoming and we're excited to see what is in store for him in the coming years. Happy 18th, Luke! :-)  This Month's Featured Home... The upscale rowhouse on the cover of this month's market report is one of the original lakefront rowhouses at Preston Lake, and you can find out more about this beautiful property by visiting 3313PrestonShoreDrive.com. Another of My Favorite Places... Each month I offer a giveaway, of sorts, for readers of this market report, highlighting some of my favorite places (or things) in Harrisonburg. Recent highlights have included Village Juice & Kitchen, Black Sheep Coffee and the Harrisonburg Half Marathon. This month I'm highlighting the JMU Forbes Center for the Performing Arts which is the premier destination for arts in the Shenandoah Valley with countless top notch musical, dance and theatrical performances each year. Have you been to a show at the Forbes Center? Would you like to? I'm giving away a pair of tickets to what is bound to be a hilarious show at the Forbes Center... "Whose Live Anyway?" featuring current cast members of the Emmy-nominated television show "Whose Line Is It Anyway?" for 90 minutes of hilarious improvised comedy and song. The show is on Friday, September 30 at 8:00 PM. Enter here for a chance to win this pair of tickets. And now, let's take a look at the latest news from our local real estate market...  First off, let's get right to it... we saw significantly fewer home sales this August as compared to last August. We've been in "always more, every month more" mode for so long when it comes to home sales that it might seem jarring to see a 19% drop in August home sales, but it is important to realize that we couldn't necessarily always see more and more home sales forever and ever. We have seen an extraordinarily high amount of home sales activity over the past two years. Those home sales levels may have been inflated beyond the norm, so we may see a downward shift in the number of homes selling per year as we finish out 2022 and enter 2023. This isn't a catastrophe and it does not necessarily mean we will see any adjustments in home values and sales price in this area. In fact, in the "this is not a catastrophe" category, when we move beyond #1 above, where we see a 19% decline in August home sales, we'll also find... [2] The pace of home sales during the first eight months of this year are still slightly (0.65%) ahead of last year during those same eight months. Though, if home sales activity continues to be a bit slower through the rest of 2022, we should expect the annual pace of sales in 2022 to eventually fall behind 2021 levels. [3] The median sales price this year in Harrisonburg and Rockingham County ($298,950) is 11% higher than it was last year during the same first eight months of the year when it was $269,000. [4] When looking at a full year of data (September through August) we find that there has been a 9% increase in the median sales price over the past year, from $264,900 up to $289,900. [5] Homes are still selling just as fast as last year... with a median "days on market" of five days. So, while the number of homes selling might be slipping a bit compared to last year, prices are still rising, and homes are still selling very quickly. Now, let's break things up a bit by detached homes (green) and attached homes (orange) below...  This chart pull a few things out that provide some helpful comparisons... [1] There have been slightly more detached home sales this year (734) as compared to last year (722) for a total increase of 1.66%. This has been accompanied by a year-to-date increase of 12.59% in the median sales price of those detached homes. [2] There has been a slight decline in the number of attached home sales this year (348) as compared to last year (353) for a total decrease of 1.42%. This has been accompanied by a larger, 12.13%, increase in the median sales price of those attached homes. So... we're seeing a slight uptick in single family home sales and a slight downturn in townhouse / duplex / condo sales... though the median prices of both property types are increasing. Finally, slicing and dicing the data one more time to compare the City and County, here's what we find...  Here's what pops out to me in the chart above, when looking at a full year (Sep - Aug) of data... The pace of home sales has slowed a bit (-3%) in the City (#1) while the pace of County home sales (#2) has increased slightly (+2%). The median sales price has increased by double digits (+11%) in the City (#3) while the median sales price in the County (#4) has increased by a slightly lower amount (8.3%). So, again, lots of home sales at high prices in the City and County... but the pace of sales is slightly more robust in the County, and price increases are slightly higher in the City. Now, the summer that makes you say: Nice! Yikes! Hmmm...  It was a wild summer in the Harrisonburg and Rockingham County real estate market... JUNE = NICE! We saw an incredible number of home sales in June 2022. The 188 home sales this past June was the highest single month of home sales in many, many years! JULY = YIKES! After sky high home sales in June, we saw the slowest month of July home sales in at least three years. July 2022 home sales weren't drastically lower than the previous few years but it was surprising (yikes!) to go from the "best June in 3+ years" to the "worst July in 3 years." AUGUST = HMMM... Home sales this past month were markedly lower than last August, with a 19% decline from 184 home sales to 149 home sales. But... home sales this August were still higher than in August 2019 and 2020. So... were home sales surprisingly slow this August? Or do they just look slow compared to a surprisingly active month last August? At this point it can be helpful to stack all of those months of home sales on top of eachother to look at things from a broader perspective...  Here you can more clearly see that 2022 year-to-date home sales are barely sticking in the race with 2021. Yes, we have seen slightly more home sales thus far in 2022 than in 2021 (and than in the previous few years) but we're barely ahead now. It seems quite likely that the year-to-date pace of home sales will fall behind as we get through September and October of 2022, especially when we examine contract activity below. So, if you haven't picked up on it yet, it seems the rapid growth in the number of home sales we have been experiencing lately might be starting to... level off...  During the height of Covid (2020-21) we saw an ever-increasing number of home sales on an annual basis, seemingly due in large part to the size and shape of "home" being more important than ever as people were spending more time at home during the pandemic... and because of historically low interest rates. Now, however, many of life's patterns (actually going to work, actually going to school) seem to be returning... and mortgage interest rates (if you haven't heard!?) are quite a bit higher than they were a year ago. So, it seems very unlikely that we will continue to see rapid growth in the annual pace of home sales like we saw between August 2020 and August 2021, and it seems more likely that we will see a leveling off, or even a slight slowdown, in the number of homes selling in Harrisonburg and Rockingham County each year. All of this, though, is related to the orange line above... the number of homes selling. Quietly, in the background, the median sales price (green line) just keeps on rising, and rising. The unknown, at this point, is whether we will see home prices start to level out at all. Thus far, they are continuing to rise quite rapidly. Speaking of rising prices, here's a graph that will put these price increases in context pretty quickly...  In just four years (2018-2022) the median sales price of a single family home in Harrisonburg and Rockingham County has increased by almost $100,000... from $228,000 to $326,500! What a great time to have owned a home... and what a tough time to buy one now if you haven't owned a home for the past few years to be a part of a joyful ride up the roller coaster of home values. Here's another graph that provides further evidence of the likelihood that we will continue to see the market slow down when it comes to the number of homes selling...  I've drawn the arrows above to show where I think things have been going and are going... Top Arrow = slight, slow, decrease in the number of buyers buying Bottom Arrow = slight, slow, increase in the number of sellers selling as it relates to active inventory at any given time So, indeed, the market may be transitioning a bit. A few fewer buyers are buying and a few more sellers are selling. These dynamics are turning our market, ever so slightly, towards a slightly less strong seller's market. But, yes, still a strong seller's market. Several times in this synopsis I have spoken about home sales slowing and referenced that I anticipate a further slowdown in the next few months. Here's why...  The graph above is showing us contract activity per month in Harrisonburg and Rockingham County... counting how many homes go under contract each month. Last summer (the first set of 1, 2, 3) there were 143, 156 and 155 contracts signed for a total of 454 contracts. This summer (the second set of 1, 2, 30) there were 135, 114 and 135 contracts signed for a total of 384 contracts signed. So, indeed, fewer contracts for several months in a row has already started to translate into fewer home sales, and will continue to do so for at least another month or two in the future. With slightly fewer buyers buying are we seeing inventory levels starting to rise? Slightly...  A year ago there were 129 homes on the market for sale at this time... and that has risen, slightly, to 147 homes for sale. So, yes, we are seeing somewhat of an overall increase in the number of homes for sale... but not by that much. And... from a shorter term perspective, inventory levels are currently trending down as they usually do as we move from summer into fall. Finally, one last graph for a bit of AHHHHH and GRRR...  From the end of last summer (Aug 2021) through early 2022 we saw a rapid increase in mortgage interest rates. They rose from less than 3% up to over 5% in only eight months. Ahhhhh!!! Over the past few months, mortgage interest rates have shown they might not get all the way to 6%, but they haven't made their way back down to, or below 5%. Grrr... Comparably higher mortgage interest rates (as compared to the past few years) continue to have an impact on how many buyers are able to, or are willing to, buy a home right now... and it doesn't seem that these higher interest rates will be leaving us as quickly as they showed up. So... in summary... [1] The pace of home sales seem to be slowing, slightly, though 2022 is still ahead of 2021 at this point. [2] Contract activity is slowing, slightly, which means closed sales will also continue to slow. [3] Home prices continue to rise rapidly. [4] Inventory levels are rising, slightly. [5] Mortgage interest rates are still quite high. If you're thinking about buying a home, or selling a home, let's talk about how things are going in your segment of the market as it relates to the price, size, location and age of your home. The first step? Email me or text/call me at 540-578-0102. I'll check in on the market in about a month, but until then, enjoy the slightly shorter, cooler days ahead! | |

Taylor Spring Detention Basin Under Construction In The Lake Shenandoah Stormwater Authority Area |

|

Homeowners on low lying building lots within the Lake Shenandoah Stormwater Authority Area may soon have some relief when it comes to stormwater issues affecting their property. One of the main stormwater management interventions being put in place by the Lake Shenandoah Stormwater Authority is the construction of the Taylor Spring Detention Basin... and that is well under way! The localized flooding experienced in some parts of some neighborhoods in the stormwater authority area have been a result of water flowing through the area towards Lake Shenandoah... and now (soon) stormwater flowing through the area will be detained in this new (large!) stormwater basin before continuing downstream to Lake Shenandoah. Rockingham County purchased 28.9 acres back in 2020 and the County is now constructing a 6.7 acre detention basin. This basin is not designed to permanently store the water as it is expected to drain within a few days of a rain event. Read much more about this Stormwater Basin project and see many more photos in this update as of about a month ago. | |

Indeed, Fewer Homes Went Under Contract This Summer Than Last |

|

Indeed, as is shown rather clearly above, fewer buyers signed contracts to buy homes this summer than last. When I'm talking summer, in this instance, I'm referring to June, July and August...

So, about 15% fewer contracts were signed this summer than last. Why? A large part of it is likely the higher mortgage interest rates.

But despite fewer houses going under contract this summer than last...

If mortgage interest rates remain as high as they are now, it is reasonable to assume that home buying activity will continue to be a bit subdued this fall compared to last fall. | |

Which Comes First? Buying Your Next Home Or Selling Your Current Home? |

|

If you are getting ready to sell your home AND buy a home, it can sometimes be difficult to determine where to start... Do you start by finding a house you want to purchase? Or do you start by listing your home for sale? I would suggest that you start with whichever you anticipate will be the most difficult part of the two step process. If it will be difficult to sell your home (because of price, location, layout, features, age, etc.) and it will be at least slight easier to buy the next one (plenty of viable options are listed for sale) then you are likely best off starting with listing your home for sale. Work to get the more difficult half of the transition underway by getting your current home under contract, and then work on the easier side of the transition. If it will be more difficult to buy the next house (because of the specificity of your housing goals, or because of low inventory levels, etc.) and it will be at least slightly easier to sell your current home (because the property type, location or price are in high demand) then you are likely best off focusing first on finding the home to buy -- and then listing your home for sale. There are plenty of nuances we can discuss further to formulate a plan for attempting to simultaneously sell and buy -- but as a general rule of thumb, you'll be best off to start with the harder half of the transaction. | |

If You Are Hoping To Negotiate On Price, An Offer On Day One Might Not Make Sense |

|

Ooooh... an exciting new listing just hit the market! It's in the neighborhood where you hope to live, has just the right amount of space, has the garage you've been hoping for, and... oh wait... ugh... the price is a bit higher than you had hoped. This imaginary (but very exciting) new listing is priced at $425,000. You had been hoping to spend no more than $400,000. So, what to do... If you go see the house, and love it even more in person, do you make an offer of $400K on Day 1? Probably not. A home seller is not likely to accept your offer of $400K on Day 1. They will likely wait for other showing to happen, hoping to have another offer to consider... AND... they will let all other buyers who view the home know that they have an offer... and they won't need to clarify that it's only an offer of $400K. So... if you are hoping to negotiate on price, it probably does not make sense to make an offer on that first day... unless you were really willing to pay the full list price if needed. If you wait a few days, or a week, to make an offer... someone else might make an offer, which could then give you the option to make an offer as well... or if nobody else makes an offer, perhaps you will then be able to negotiate on price. | |

As Time On The Market Increases, Contingencies In Offers Often Increase |

|

Day 1 - If a buyer is interested enough to make on Day 1, and potentially be competing against other highly motivated buyers, there is a good chance they will waive some or many or all contingencies. They might not be proposing a home inspection, a radon test, or an appraisal contingency. Day 7 - If a listing is still available on Day 7, a buyer will likely tentatively feel comfortable proposing some contingencies (home inspection, radon test, appraisal, etc.) but perhaps not all of the above. Day 30 - If a listing is still available on Day 30, a buyer will likely feel comfortable proposing any and all contingencies, including a home inspection, radon test and an appraisal. Home Buyers -- Do you want to wait to make an offer to potentially be in a position to include contingencies that you'd prefer to have as a part of your purchase contract? Even knowing that waiting to make the offer might mean someone else buys the house before you make an offer? | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings