Archive for November 2022

What Home Improvements Should You Make (or not make) Prior To Selling Your Home? |

|

I don't have a master list of what improvements you should, and should not, make before you sell your home... but most improvements you might consider are probably worth discussing before you spend time and money making the improvements. Some of the questions we will be asking ourselves about each improvement will be... [1] What does this improvement cost and how much will it potentially increase the sales price of your home? [2] Will nearly every buyer want to make this improvement and who much will they estimate it would cost compared to the actual cost of the improvement? [3] Will making this improvement elevate your home into a different price bracket? [4] Does every other home comparable to your home already have this improvement completed? [5] Does the lack of making this improvement significantly affect the overall impression a buyer will have of your home? Again... there isn't a universal list of "do this" and "don't do this" -- but before you start making a LOT of improvements and/or before you decide to make ZERO improvements, let's walk through your house together and discuss the best strategy for how to improve your home before selling it. | |

The Conundrum Of What Price To Offer On A Slightly Overpriced New Listing |

|

Oh, silly sellers, why did you have to make this so difficult!? ;-) There's a fantastic new listing on the market... very likely worth $415K. But... the sellers listed it for sale with a price of $430K. Ugh. You want to make an offer on this house... you want to buy the house... but what do you offer? If the house had been priced at $415K, you would immediately make an offer of $415K. If the house had been priced at $420K, you may very well have made an offer of $420K. But the house is priced at $430K. So do you... [1] Offer $430K, the list price, ignoring the fact that you think this is too much to pay for the house? [2] Offer $415K, the likely value of the house, but $15K lower than the list price? If you offer $430K you are likely paying more for the house than it is worth in the current market. If you offer $415K the seller is almost certainly going to stall in responding to your offer, hoping for another offer that is higher... and is going to alert other interested buyers that they have an offer... which might result in other offers coming in as well. There is no easy answer to this question... it's situational in some ways... and your course of action should be guided by your level of interest in the house and the amount of other early interest in the house. But darn those sellers, pricing the house a bit of market value. ;-) | |

Are Things Slower Now In The Local Real Estate Market? |

|

This is the number one question I am asked these days when I am chatting with non-buyers and non-sellers around town. In other words, folks who are not currently buying or selling or trying to buy or trying to sell. Are things slower now? The answer is, as perhaps you might expect... yes and no. Yes, things are slower...

No, things are not slower...

So, things definitely feel slower - the hectic, crazed, frantic pace of 2020-2022 has cooled off. But in many ways (number of sales, price of homes sold) the market is just as strong, brisk, vibrant, as ever... it's just not over the top, unbridled exuberance as it has been for the past few years. | |

Some, But Not All, New Listings Will Still Have Multiple Offers Within Days! |

|

Some new listings are now remaining on the market for a week or two -- instead of a day or two -- before going under contract. That being the case, there are still plenty of homes going under contract in a matter of days, often with multiple offers. For example... in the past 60 days 175 properties have gone under contract... and of those, 62 of them were under contract within four days. So, yes, you may be able to pause for a day before making an offer, but keep in mind that plenty of properties are still going under contract quickly and they might require faster action. My advice... Go see a new listing of interest as quickly as possible, start working your way through your decision making process as quickly as possible, and ask to be notified if any offers have been received. | |

Many Home Buyers Now Find They Can Actually Think For A Minute Before Making An Offer |

|

For a few years now, many home buyers in Harrisonburg and Rockingham Countuy have felt the PRESSURE to make a decision QUICKLY after viewing a new listing. Monday, 8:00 AM - new listing hits the market Monday, 1:00 PM - go see the house Monday, 4:00 PM - make an offer Much of this mad rush, however, was due to an EXTREME number of home buyers pursuing every new listing. It was not uncommon to have 20+ showings on a new listing within 24 or 48 hours of the property being listed for sale. Higher mortgage interest rates have reduced overall levels of buyer activity and enthusiasm, resulting in many new listings having a more normal-ish three (or so) showings a day for the first few days that the house is on the market. As a potential buyer, when you are competing with other potential buyers -- instead of 19+ other buyers -- you have a bit more time to make a decision about whether you want to make an offer on a new listing. This change -- in my opinion -- is good, normal and healthy for our local housing market. It doesn't mean that houses aren't selling... or that they are taking ages to sell... or that they are selling for lower prices... it just means that sellers might have to wait a few days longer to have an exciting offer to review... and that buyers can actually take a minute to decide whether they want to make an offer on the exciting new listing. So, buyers... yes, let's go see houses quickly when they hit the market, but you might not need to make a decision about an offer within a matter of a few hours now... maybe you can sleep on the decision and let me know in the morning! | |

Current Housing Market Trends In Four Lines, Two Curves |

|

I sent out a long and detailed market report yesterday with lots of data, charts and graphs. You can find it here. But maybe you don't want to read something that long. ;-) For those that don't, enjoy a comprehensive(ish) understanding of the market described above with four lines and two curves. SALES - we have started to see fewer sales over the past four months PRICES - the median sales price keeps on rising INVENTORY - after starting to see some increases we are now seeing what is likely a seasonal decline in the number of homes for sale CONTRACTS - we have seen multiple months of declining contract activity DAYS ON MARKET - homes are still selling fast... very fast RATES - mortgage interest rates keep on rising Sure, this leaves out some of the nuance in yesterday's report, but it should give you a good enough primer to understand the basic market dynamics at play right now in the Harrisonburg and Rockingham County real estate market. Questions? Thoughts? Observations? Email me: scott@hhtdy.com | |

Slightly Fewer Homes Are Selling At Ever Higher Prices |

|

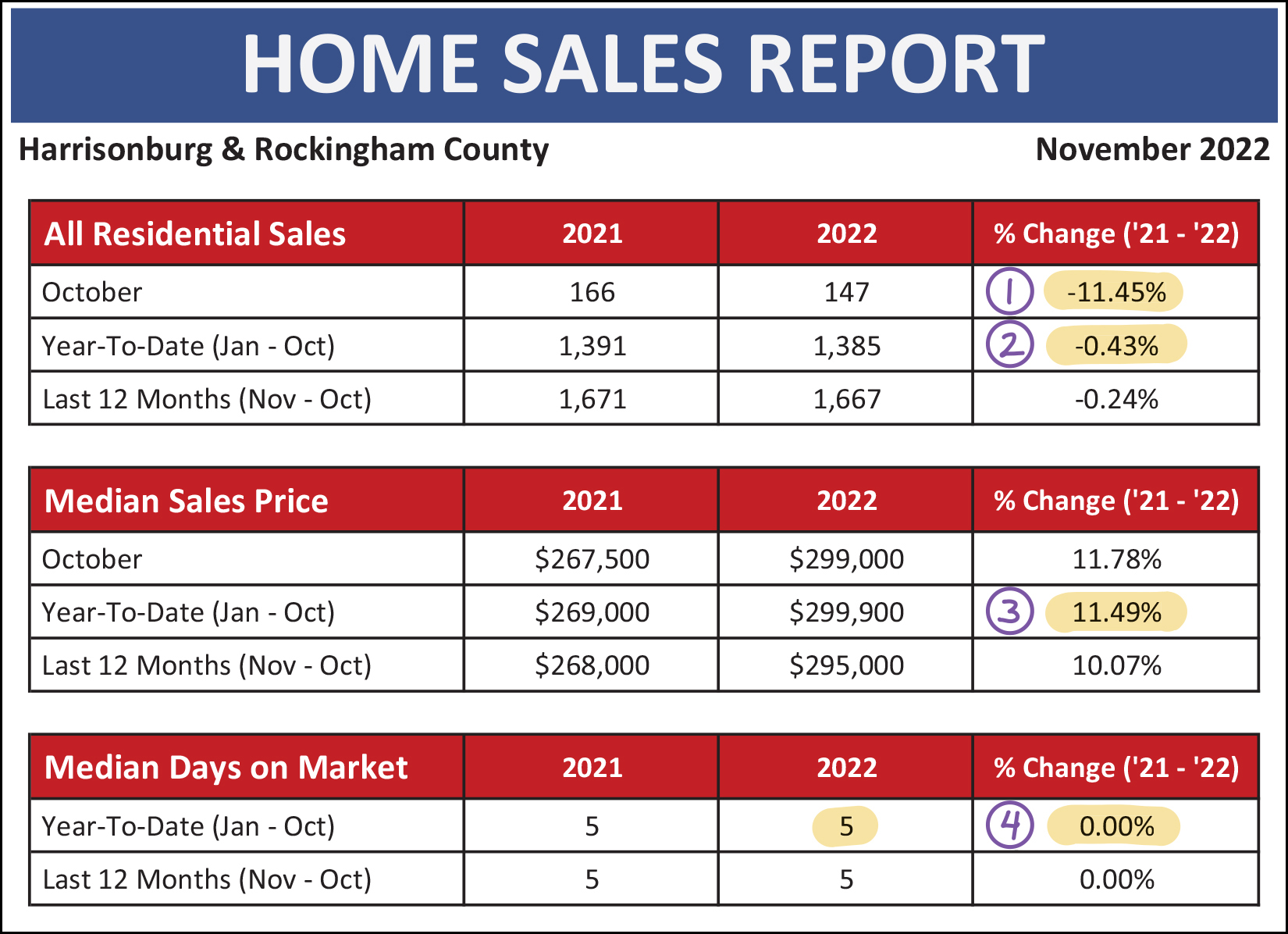

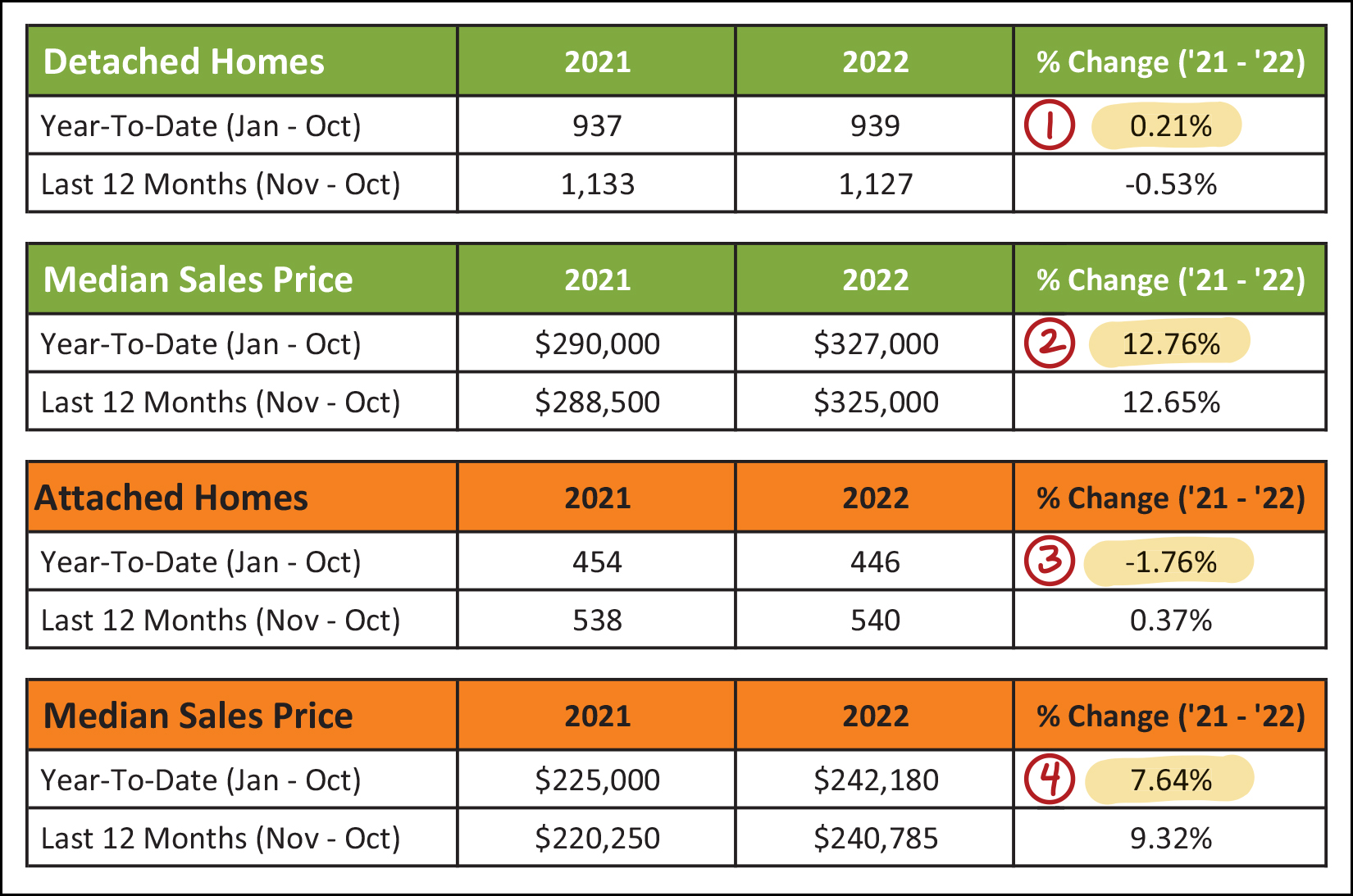

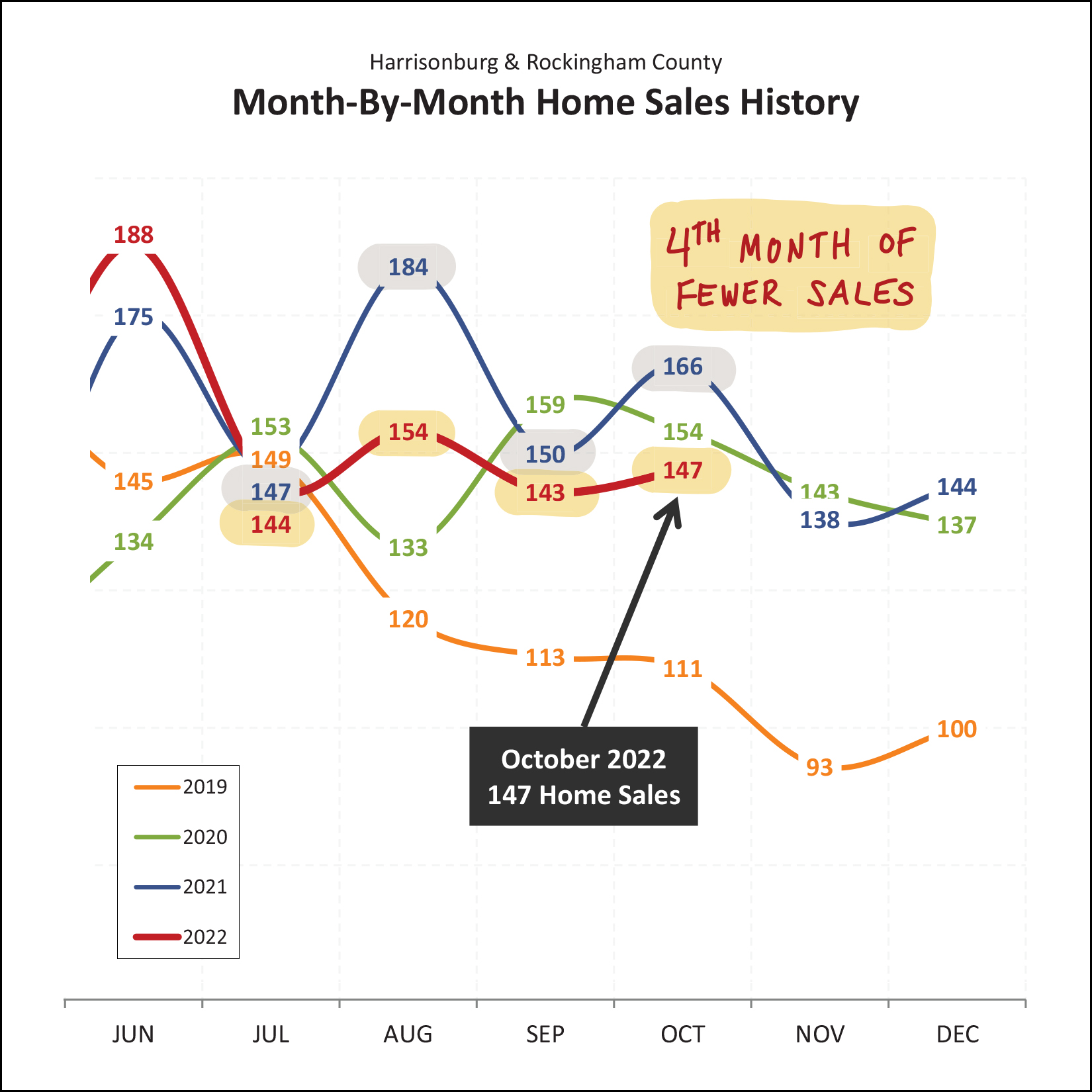

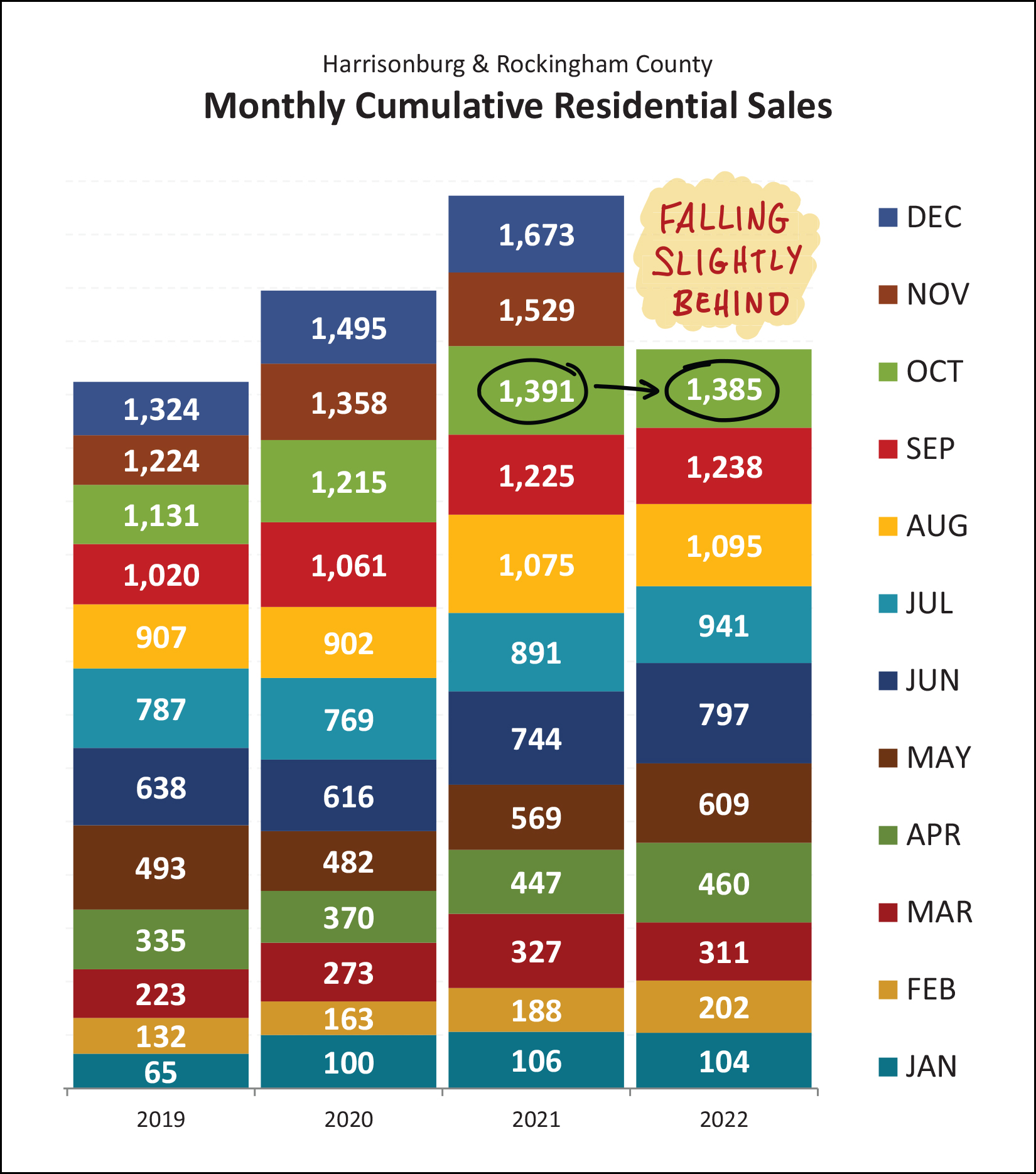

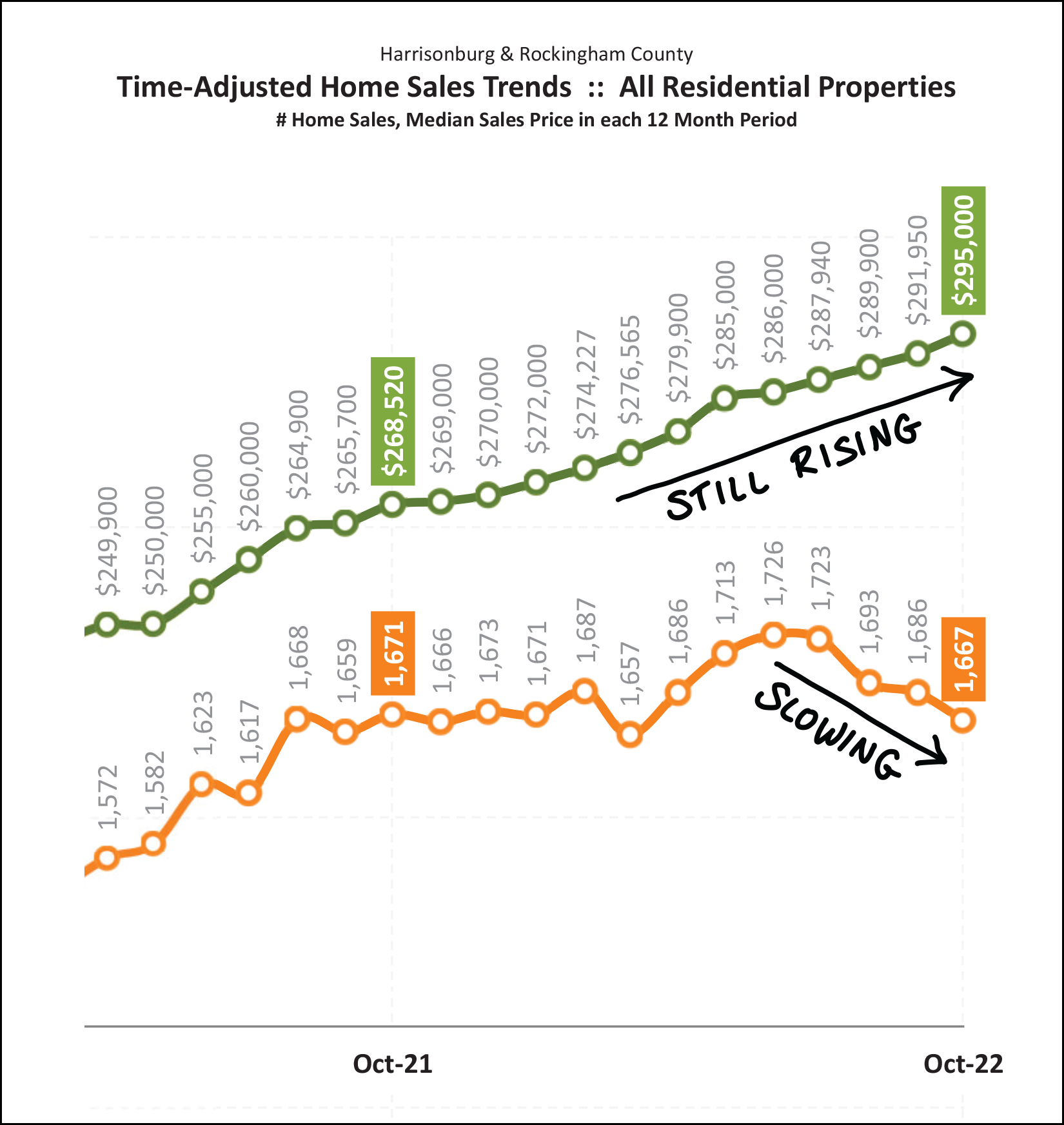

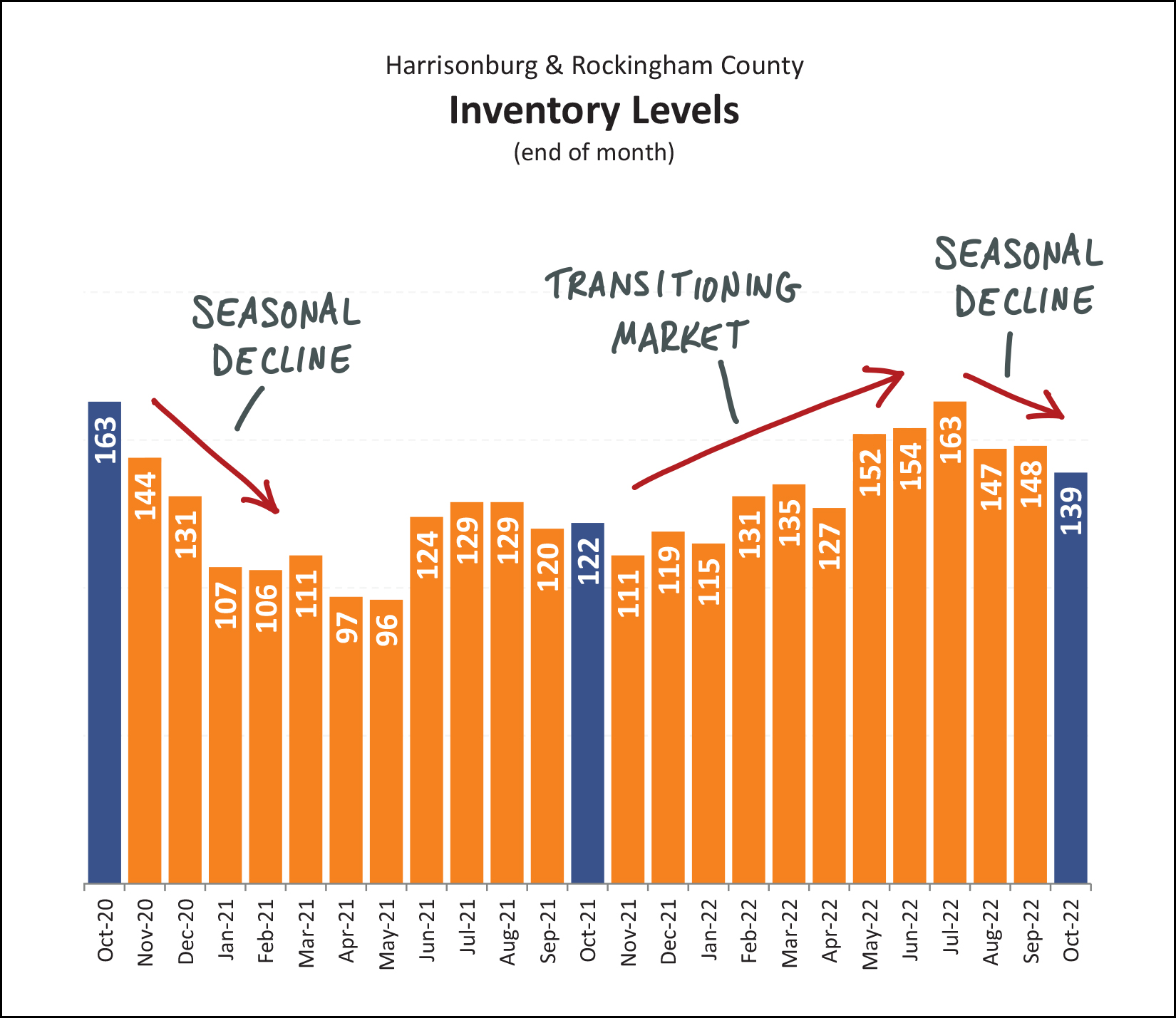

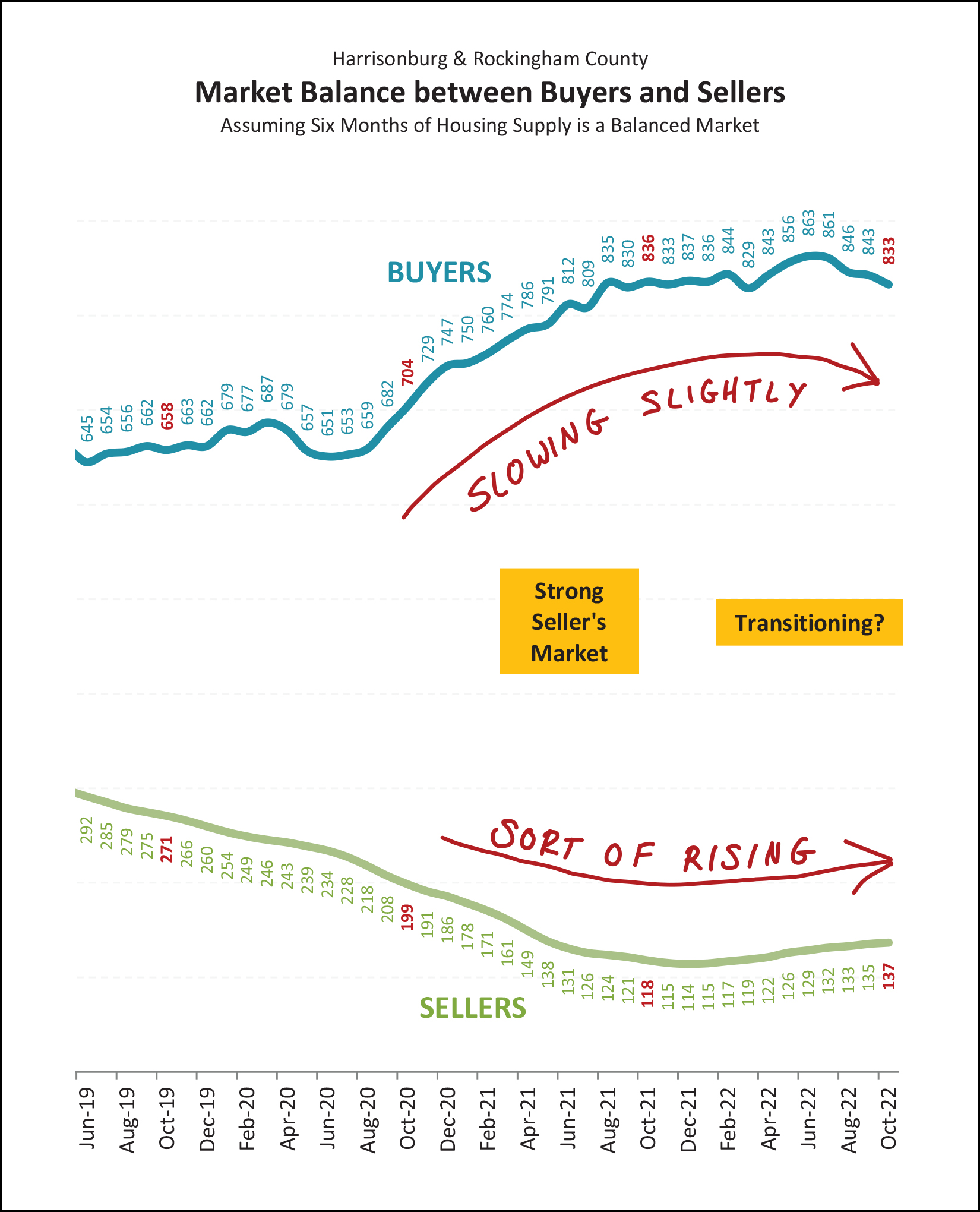

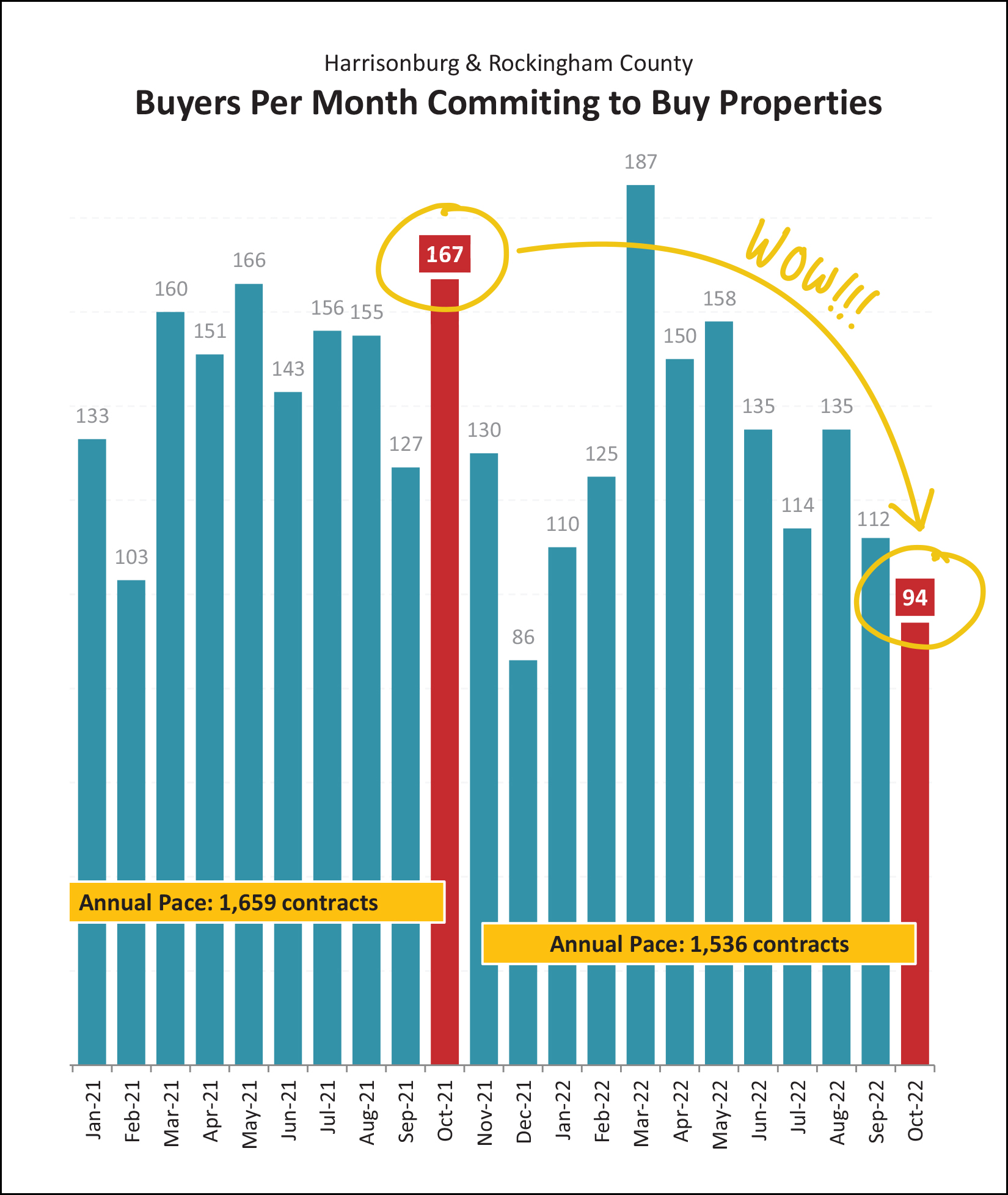

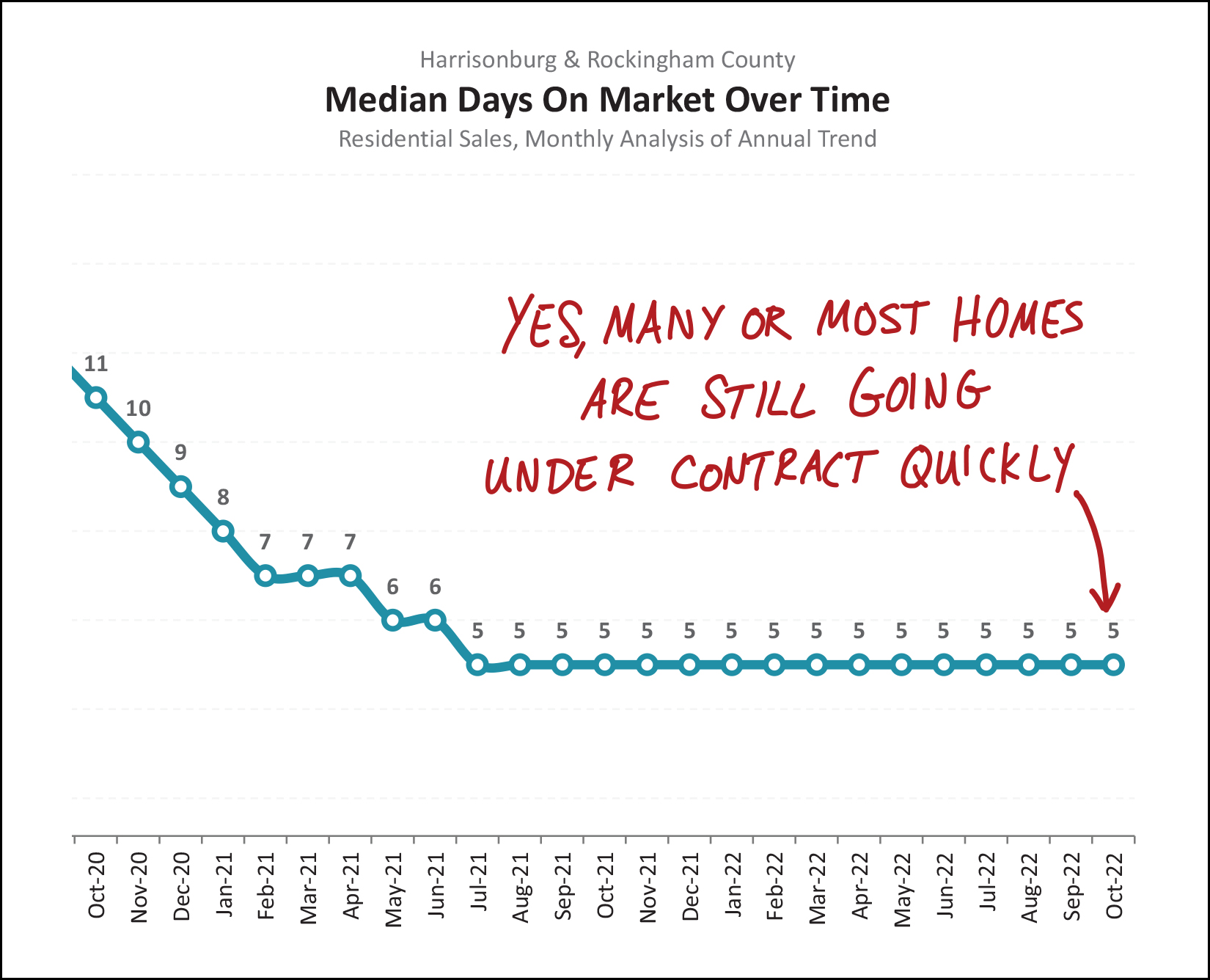

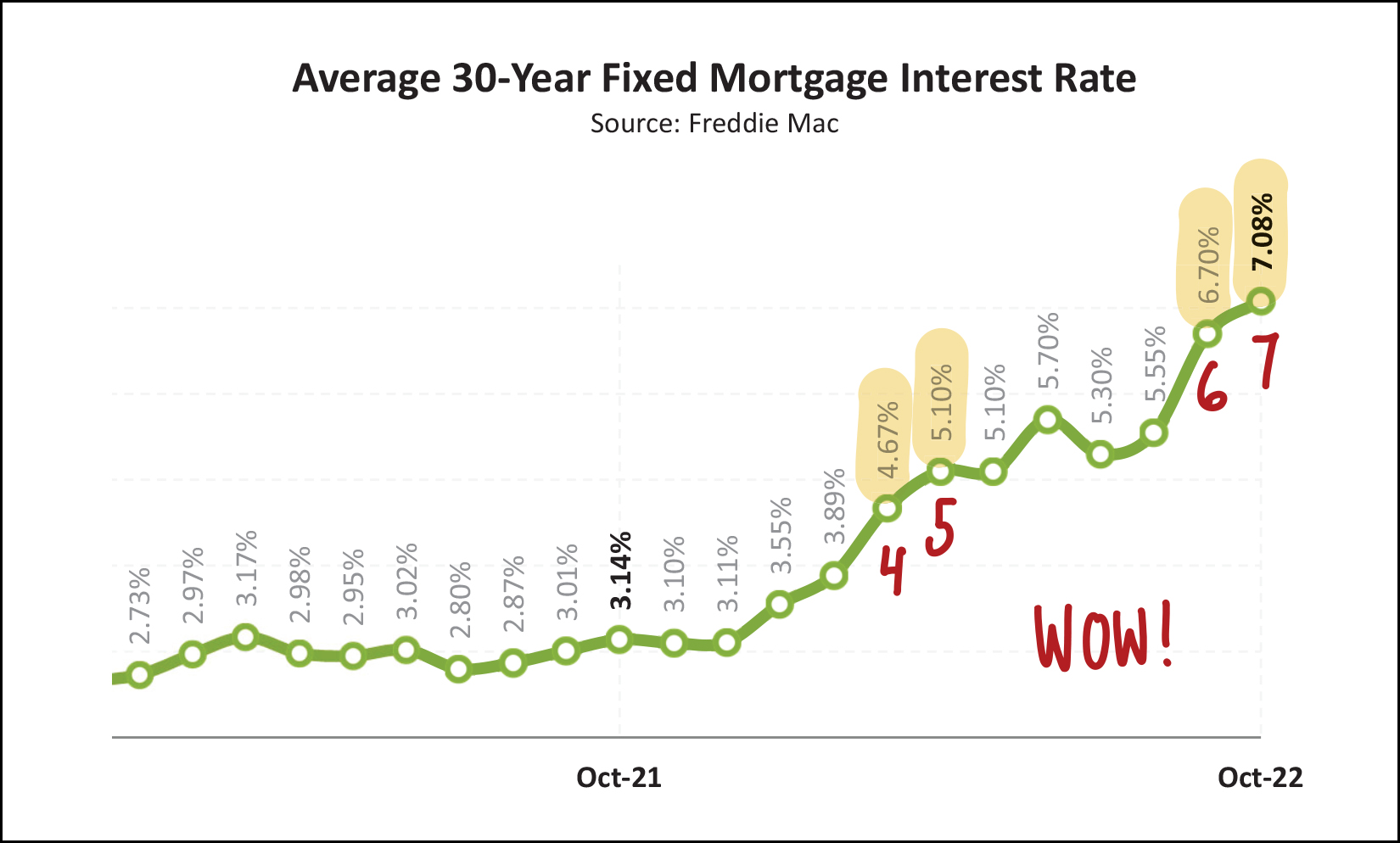

Happy Monday morning, friends! What a delightfully warm fall we had this year! I hope you have taken advantage of the beautiful weather and explored some of the many outdoor adventures the Shenandoah Valley offers us. Late last month, Shaena and I, with several other family members, enjoyed a 30 mile bike ride on the Greenbrier River Trail in West Virginia and took in many beautiful sights along the way. I highly recommend it as a day trip!  Before we get to latest happenings in our local real estate market, each month I offer a giveaway, of sorts, for readers of this market report, highlighting some of my favorite places (or things) in Harrisonburg. Recent highlights have included Bella Gelato, the JMU Forbes Center and the Harrisonburg Half Marathon. This month, I encourage you to go check out Walkabout Outfitter in downtown Harrisonburg where you will find plenty of awesome gear and apparel for your next outdoor adventure! As a bonus, click here to enter to win a $50 gift certificate to Walkabout Outfitter! Also, take a few minutes to check out this month's featured home... a spacious, five bedroom home in Highland Park located at 3658 Traveler Road! Now, then, let's dig into the data. I'll preface it by saying that the trends you might read regarding significant changes in housing markets across the country don't necessarily seem to be showing up in our local housing market at this time. Read on to see what that means from the latest available data...  A few things stand out to me as I look at the latest overall numbers in our local housing market above... [1] We saw fewer home sales in October of this year (147) compared to last year (166) which marked an 11% decline in monthly sales activity. [2] This decline in October sales piles onto January through September sales to show a tiny decline in home sales (-0.43%) when looking at the first ten months of this year compared to the first ten months of last year. [3] Homes are still selling for quite a bit more now than they were last year. The median sales price of homes sold thus far in 2022 has been $299,900 -- up 11.5% from last year when the median sales price was $269,000. [4] Homes are still selling (as a whole) just as fast now as they were last year. The current median days on market is five days... just as it was a year ago at this time. This means that half (or more) of homes that sell are under contract within five days of being listed for sale. So... a slower than expected October, but otherwise still quite a strong year of home sales activity. That theme will continue as we work our way through the rest of the data, with only a few exceptions. It is interesting to note the slight difference in performance of detached single family homes compared to attached homes, which includes duplexes, townhouses and condos...  [1&2] Detached single family home sales are shown in the first two green tables above and you'll note that there were just about the same number of sales this year (939) as last year (937) and that the median sales price has increased 13% over the past year. [3&4] In contrast, we have seen a slightly decline (-2%) in attached home sales over the past year and the increase in the median sales price (+8%) is slightly lower than that of single family homes. So, the "detached" portion of our local housing market has outperformed the "attached" portion of the market, but not significantly. Looking at the last few months graphically, it seems the lower month of home sales in October was actually... the fourth month in a row of fewer sales...  During each of the past four months (Jul, Aug, Sep, Oct) we have seen fewer home sales this year than during the same month last year. Looking ahead, it seems very likely that we will see fewer home sales in November and December as well, especially once we consider the number of contracts signed (or not signed) in October. Read on for more on that... Here, then, for the first month in quite a few years, I am reporting that the pace of home sales (the number selling) is declining... ever so slightly...  Don't get me wrong, it's been exciting to report each and every month for the past few years that there have been more, and more, and more home sales. But perhaps this rapid increase in the number of homes selling could not go on forever. This year and last are now relatively even when looking at the first ten months of the year, but 2022 is falling slightly behind. At this point, I am predicting that we'll see 2022 fall a bit further behind as we finish out the year. But despite fewer sales, prices are...  Yes, indeed, home prices are still rising. The orange line above shows the number of homes selling in a year's time. The last four months of declines in the annual pace of sales is a result of those four months of fewer sales shown in the previous graph. We have now seen a decline from a peak of 1,726 sales per year down to 1,667 sales per year. But despite fewer sales... home prices keep on climbing! The median sales price of homes sold in Harrisonburg and Rockingham County over the past year has now risen to $295,000. As one of my past clients once pointed out... most homeowners don't care how many homes are selling... they care about the prices of those homes that are selling. So, from an overall market perspective, things are still looking rather bright in the local housing market as prices seem to still be on the rise, even if we are seeing slightly fewer home sales. Another trend that is interwoven into this equation is housing inventory... how many homes are on the market for sale at any given point...  Over the past several years we have seen extremely low inventory levels at any given point in time. Plenty of homes have been listed for sale, but they have gone under contract very quickly given very strong buyer demand in almost all price ranges and locations. During much of 2022 we started to see an increase in the number of homes listed for sale...rising to 163 homes for sale in July... compared to only 129 the previous July. So, yes, the market seems to be transitioning a bit... perhaps we won't see super low inventory levels forever. But despite signs of a slowly transitioning market during the spring and summer of 2022, we are now seeing a normal seasonal decline in inventory levels as we work our way into the fall. The place where the rubber meets the road is when we combine buyer activity (demand) and housing inventory (supply) to see what balance does or does not exist in the market...  As shown above, we may be starting to see a slight, modest, tiny transition in the balance of the market. We are starting to see buying activity slow... slightly. We are also starting to see inventory levels rise... slightly. Do keep in mind, though, that this is likely a transition from an extremely strong seller's market to a very strong seller's market. There is still very strong demand in the market for most properties at most price points and in most locations. To get anywhere close to being a balanced market we would need to see much more significant declines in buyers who want to buy homes and much more significant increases in sellers who want to sell homes. I'm realizing now that my preceding paragraph might now seem like it was leading up to this next graph. Digest the next graph... don't fall off of your chair... and then keep reading below...  Somewhat surprising, right? There was a significant, large, drastic, huge decline in contracts being signed this October as compared to last October. Why? What happened? Does this mean the market is turning on a dime? Is buyer demand dropping off a cliff overnight? I'd point out a few things... [1] Mortgage interest rates did jump up again, significantly, in September and October - which likely played at least some role in slowing down buyer enthusiasm. Which, side note, was the intended effect -- or at least an understood side effect -- of the interest rate hikes. [2] If we're surprised by the low number of contracts signed this October we should probably be equally (or even more) surprised by the ridiculously high number of contracts signed last October. Last October was the peak of contract signing in all of 2021, which is odd -- that doesn't usually happen in October. All that is to say, the number of contracts signed in October (94) leads me to believe that we will see slightly slower months of home sales in November and December, but it does not cause me to conclude that the market changed drastically sometime in October. Clearly, though, only time will prove me right, wrong, mostly right or mostly wrong. ;-) So... with this big (but perhaps temporary) decline in contracts being signed... and with the slight decline in homes selling... it's probably safe to say that homes are not going under contract as quickly, right?  Ummmmm... nope! The "median days on market" metric continues to hover at five days on the market. Homes are still going under contract very quickly. To be clear, this data point above is looking at home sales over the past 12 months to arrive at this "five days" metric. You might then wonder if we would start to see higher "days on market" results if we looked only at the past six months, or three months or one month. Let's take a look... Median Days On Market Past 12 Months = 5 days Past 6 Months = 5 days Past 3 Months = 6 days Past Month = 6 days So, yes, it's taking... one extra day for homes to go under contract. ;-) Now, for our monthly opportunity to point the finger of blame...  Why oh why are home sales slowing down? Why is contract activity slowing down? What in the world could be causing these changes? ;-) Well, could it be higher mortgage interest rates? We started the year with interest rates below 4% and then proceeded to fly past 4%, 5%, 6% and now 7%. Home buyers will keep on buying as prices rise 10% (or more) per year when mortgage interest rates are between 2% and 4%... but when mortgage interest rates get to 6% or 7% that can start to impact buyer decision making... either because they can no longer afford the monthly mortgage payment... or because they don't want the higher monthly mortgage payment associated with current mortgage interest rates. Just as a bit of context (that is sure to make me sound old) back when Shaena and I bought our first home (a townhouse in Beacon Hill in 2003) our mortgage interest rate was... 6.25%. So, these mortgage interest rates of 6% or 7% aren't absolutely crazy from a long-term context, but after experiencing abnormally low mortgage interest rates for years, and years, and years... a 6% or 7% rate certainly sounds and feels high! Now then, where does all of this leave us? Lots of homes are still selling... rather quickly... at higher prices than ever before... but buyer activity is slowing a bit... at least partially related to high mortgage interest rates. Thus, my advice is as follows, depending on where you fit into our local market... SELLERS - Consider selling sooner rather than later in case mortgage interest rates keep climbing, or in case prices start to level out. BUYERS - Consult with an experienced lender to understand your best mortgage options to make sure you are buying at a reasonable and comfortable price point. HOMEOWNERS - Enjoy your (likely) low mortgage interest rate, and your still-increasing home value. If you're considering buying or selling yet this year... or in early 2023... let's chat sooner rather than later to formulate a game plan. The first step? Email me or text/call me at 540-578-0102. I'll provide another market update next month, but between now and then I hope you have a wonderful Thanksgiving and that you are able to let those dear to you know how thankful you are that they are a part of your life. Happy Thanksgiving! | |

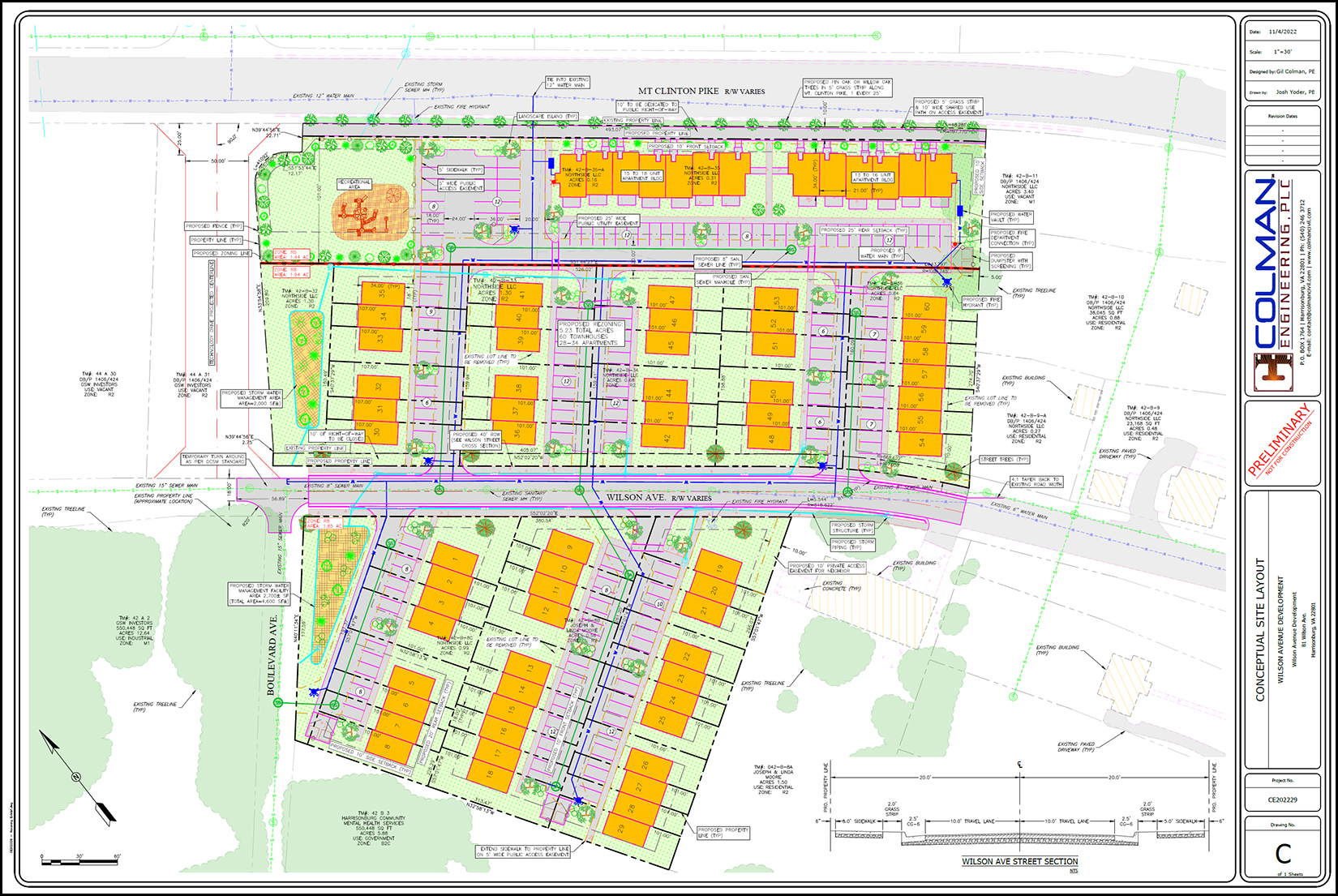

60 Townhouses And 34 Apartments Proposed For Corner(ish) Of North Main Street And Mount Clinton Pike |

|

A property owner has proposed the rezoning of a total of 12 separate real estate parcels near the intersection of North Main Street and Mount Clinton Pike to allow for the development of 60 townhouses and up to 34 apartments as shown on the conceptual plat above. In summary, City staff does not recommend that this proposal be approved Per the report, City staff does not think this project should be approved in this location at this time because they are concerned with: [1] the project not maximizing the site’s potential density; [2] the scale, design, and residential unit types clashing with the adjacent forthcoming commercial and planned mixed use spaces as well as the potential out of place context, detachment, or isolation of the residential neighborhood from the surrounding area; and [3] the overall precedent this development could establish for how the rest of the North Main Street and Mt. Clinton Pike corridors could develop. So, City staff basically thinks the property should be developed with greater density to include more housing units based on its location and surrounding present and potential future land uses. Update: Planning Commission split (3-3) on proposal. City Council to consider on December 13, 2022. | |

Upscale Townhouses And A Playground (!!) Under Construction At Congers Creek |

|

If you've drive by Congers Creek lately, on Boyers Road across from Sentara RMH Medical Center, you may have noticed lots of townhouses under construction. But if you drive a bit further back into this new townhome community, you'll find a playground under construction! This playground is the latest amenity at Congers Creek, beyond those in Phase One including a pavilion, basketball court, grills and a fire pit. Below is an updated aerial photo of the townhomes being built in Phase Two, as well as a rendering of the design for the playground that is currently being built.   Find out more about currently available townhouses at Congers Creek here. | |

10% Of A Big Number Is... A Big Number! |

|

Between 2020 and 2021, the median sales price of a detached home in Harrisonburg and Rockingham County increased by over ten percent! Between 2021 and 2022, the median sales price of a detached home in Harrisonburg and Rockingham County increased by over ten percent! I've told you about these back to back years of double digit increases enough times that you might not be surprised when you read the statements above. But, sometimes when we translate it into actual numbers, it can be surprising. Let's say a property was worth $460K two years ago. Based on the changes (+10%) in the overall market, that property may very well have been worth $506K last year. Based on the changes (10%) in the overall market, that property may very well be worth $556K today. Gasp! A house that was worth $460K two years ago is now potentially worth almost $560K today? An increase of nearly $100,000 in just two years!?! Indeed, these double digit increases in value can end up being very large increases in dollars when we start at a very high price point. | |

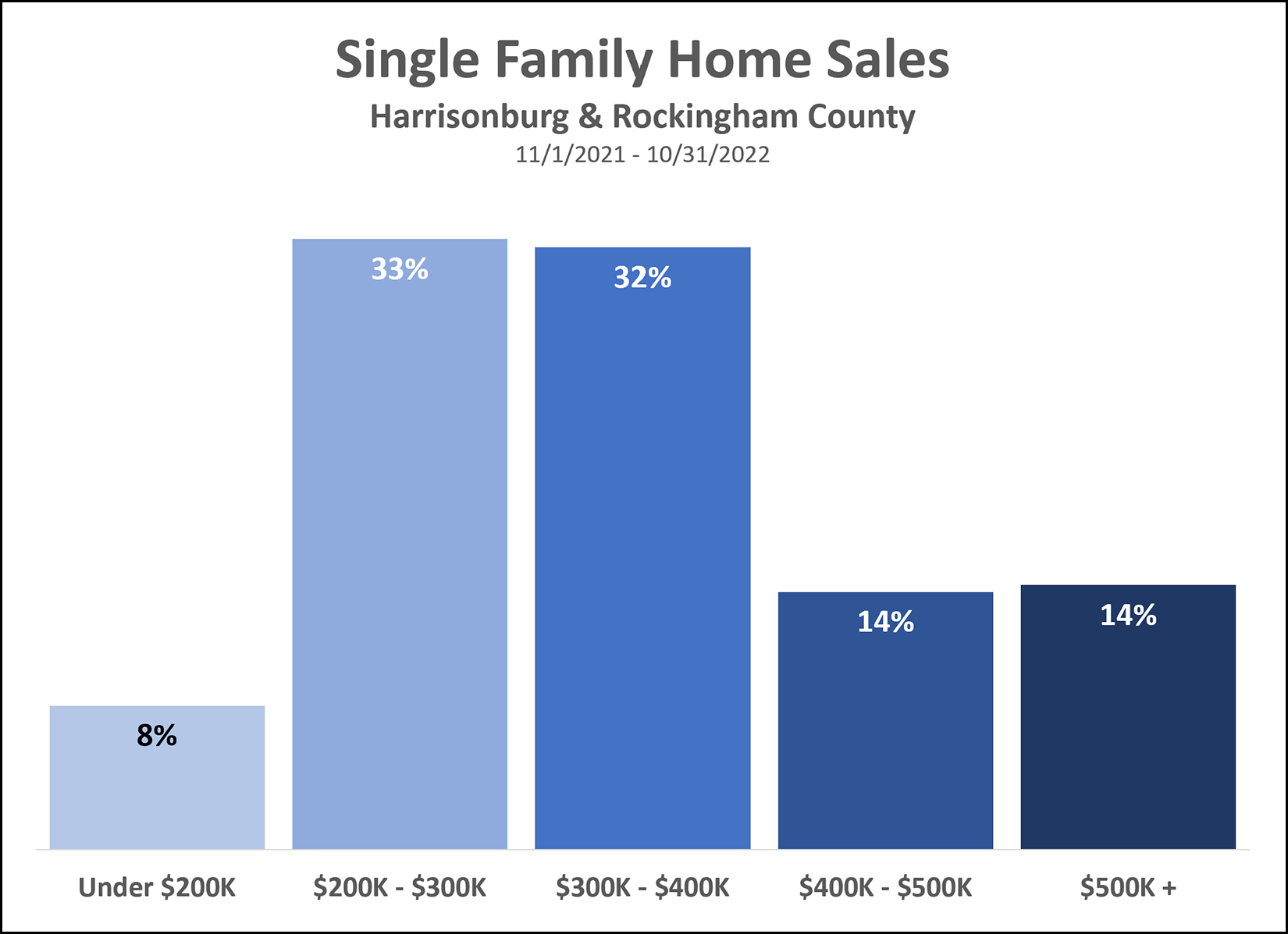

Fewer Than 10% Of Buyers Spend Less Than $200K On Single Family Homes In Harrisonburg, Rockingham County |

|

If you're hoping to buy a single family home for less than $200,000 in Harrisonburg or Rockingham County, you might find it challenging to do so. Only 8% of the single family homes sold in the past 12 months have sold for less than $200,000. Getting straight to the numbers... Total Detached Home Sales = 1,123 Detached Home Sales Under $200K = 86 | |

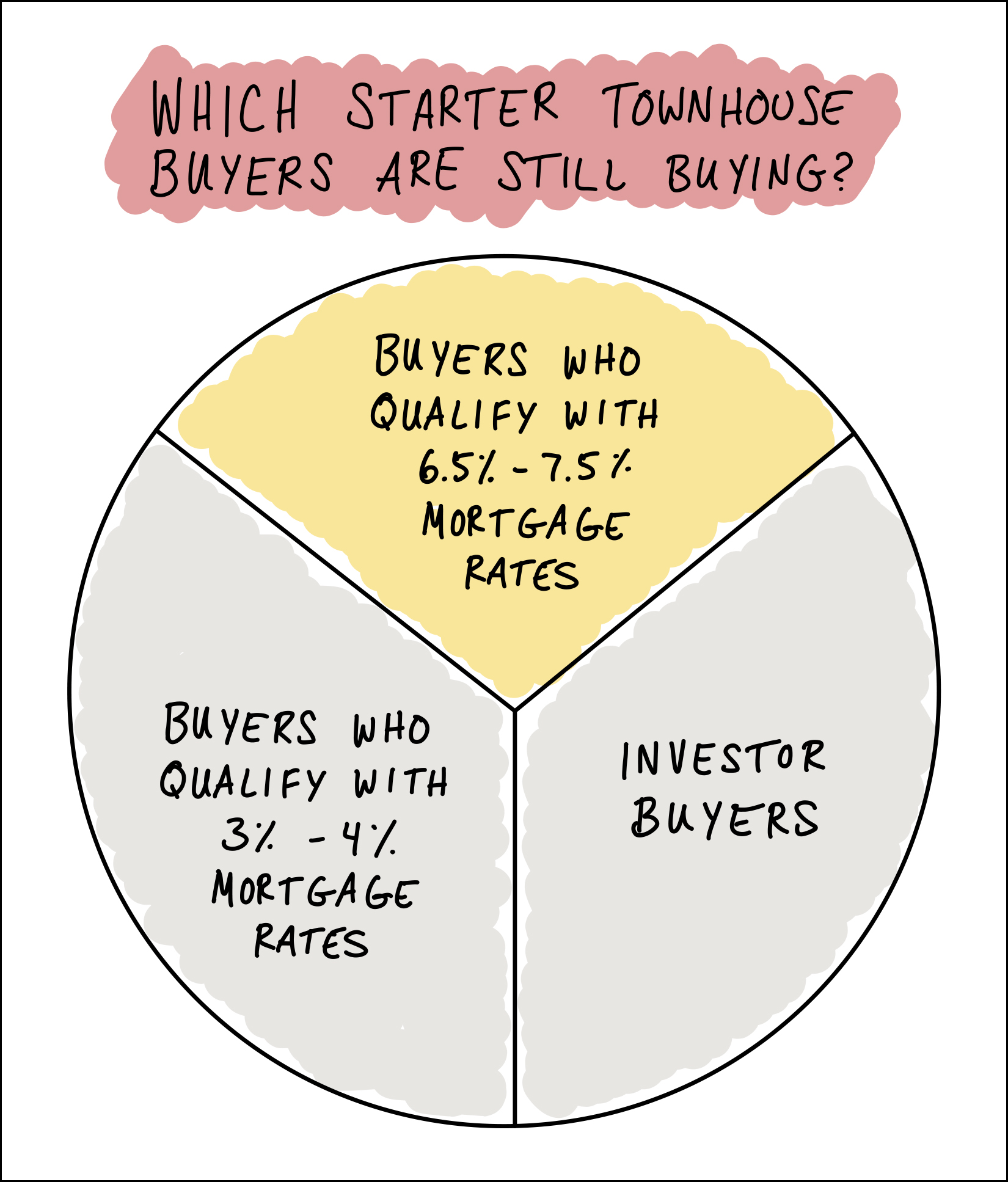

The Buyer Pool For Starter Townhouses May Be Smaller For Now |

|

Starter townhouses (think two story, 15 - 25 year old) in the City of Harrisonburg used to sell for $150K-ish but have increased in price over the past five years to a range of somewhere between $200K and $240K. Why have prices escalated so quickly? Similar to much of the market, it's largely related to low interest rates... [1] With mortgage interest rates of 3% to 4%, the pool of potential home buyers expanded considerably... lots and lots of potential first time buyers were delighted to find that they qualified to purchase a townhouse. [2] Real estate investors were also happy to scoop up these types of townhouses as they were able to finance those purchases with exceptionally low mortgage interest rates as well. Certainly, the interest rate would be higher for an investment purchase than for an owner occupant, but an interest rate that is higher than "very very low" is perhaps "very low" so plenty of investors were purchasing these properties as well. But now, mortgage interest rates are a bit higher... OK... twice as high. The current average 30 year fixed mortgage interest rate is 6.95%. As such, and as shown on the "not at all based on real numbers or data" graph above... [1] Would be home buyers who could only qualify to buy with a mortgage interest rate of 3% - 4% clearly do not quality any longer and thus are not buying. [2] Investor buyers who were delighted to buy when interest rates were quite low are also likely not buying right now. That just leaves owner occupant home buyers who still qualify with 6.5% to 7.5% mortgage interest rates. What does this actually mean for this segment of our local housing market? [1] There will likely be fewer buyers coming to see your townhouse if you are selling a starter townhouse in the City of Harrisonburg. [2] There will likely be fewer offers on said townhouse, and less competition from other buyers if you are trying to buy such a townhouse. [3] We might see these townhouses take a bit longer to sell. Maybe? [4] Maybe the price of these townhouses won't climb quite as quickly over the next year or two. Maybe? These are my observations about this segment of our local housing market, very unscientifically graphed above. Let me know if you have other observations, thoughts or questions about the market for this type of property moving forward into 2023. | |

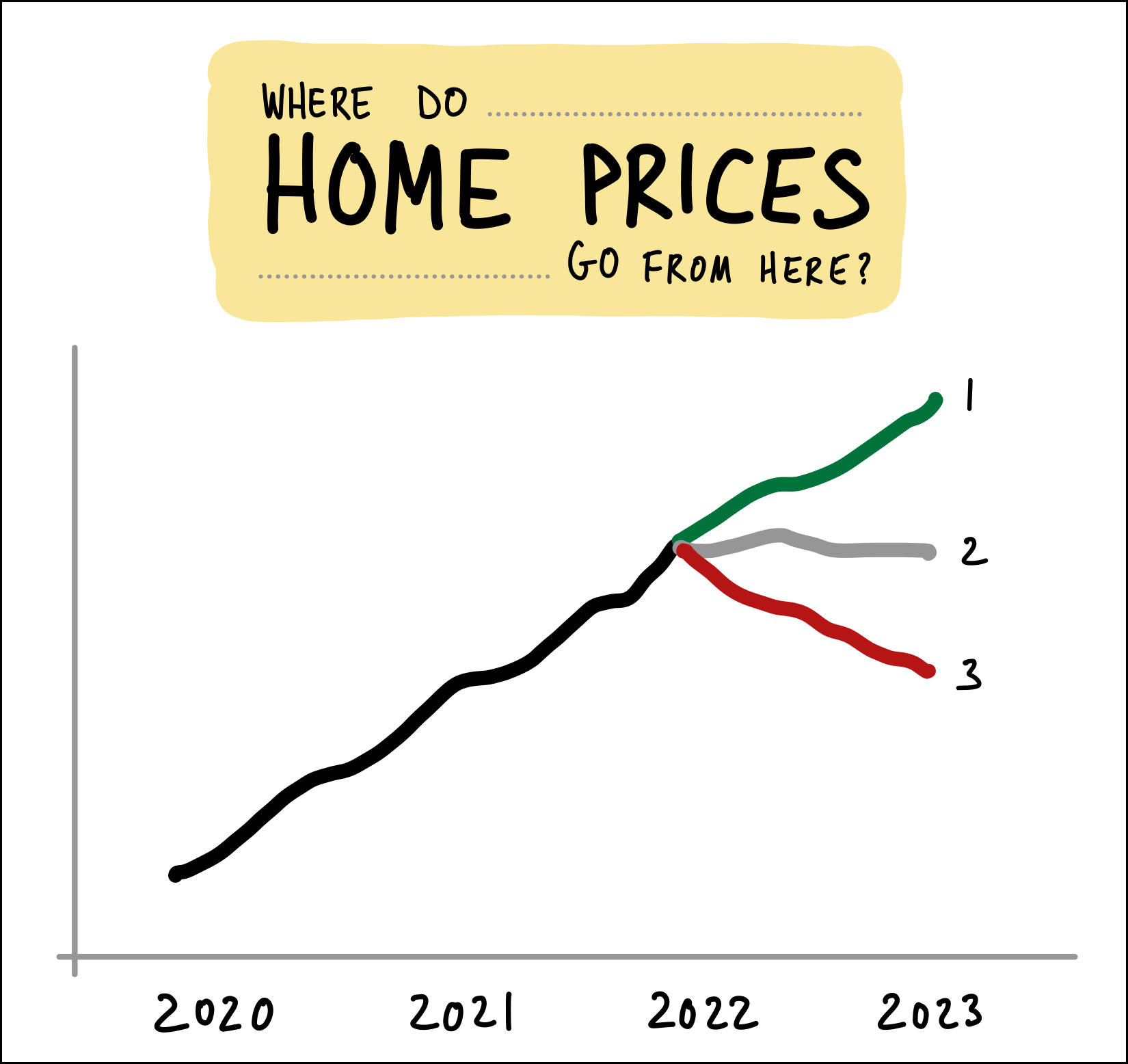

Where Do Home Prices Go From Here? |

|

This is a question very much on the mind of potential home buyers and potential home sellers in the local real estate market in late 2022... Where DO home prices go from here? As per the illustration above, do we see... 1. Home prices keep in rising, perhaps another 10% in 2023. 2. Home prices plateau in 2023, with similar prices as in 2022. 3. Home prices correct, drop, droop, decline by 10% in 2023. It's hard to imagine won't keep increasing (scenario one) given that they have through the first nine months of 2022 even in the context of quickly rising mortgage interest rates. But yet at the same time, it's hard to imagine that prices won't level out or decline some given those quickly rising mortgage interest rates. I can be convinced by those that I talk to (buyers, sellers, agents, bankers, appraisers) that prices will keep on rising in Harrisonburg and Rockingham County... and I can be convinced by those same folks (or a different set of them) that home prices will flatten out or decline slightly in 2023. So, I have absolutely zero answers as to what we should expect in 2023, but interestingly, even if home prices dropped by 10% in 2023... that would take us ALLLLL the way back to 2021 sales prices. ;-) | |

Talking Things Through With Multiple Lenders Makes Sense Again |

|

Over the past three or four years mortgage interest rates were sooooo low that there often wasn't too much of a difference in the interest rate quoted by one lender vs. another. Furthermore, buyers didn't have to think too creatively about different loan programs as far as fixed rate vs. adjustable rate, etc. The thirty year fixed mortgage rate was so exceptionally low that almost all buyers were purchasing with that program. But, now things have changed... Mortgage interest rates are quite a bit higher now... at or above 7% for a 30 year fixed mortgage rate! As such, savvy home buyers are... [1] Talking to more than one lender to see how interest rates and closing costs compare. [2] Considering fixed rate mortgages alongside adjustable rate mortgages that start out fixed for (usually) five or seven years. If you are buying a home in late 2022 or early 2023 it will matter now more now than ever that you talk to an experienced, professional, responsive, creative mortgage lender to make sure you are finding the financing program that is the best fit for your financial scenario and your plans for the coming years in your new home. | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings