Archive for December 2022

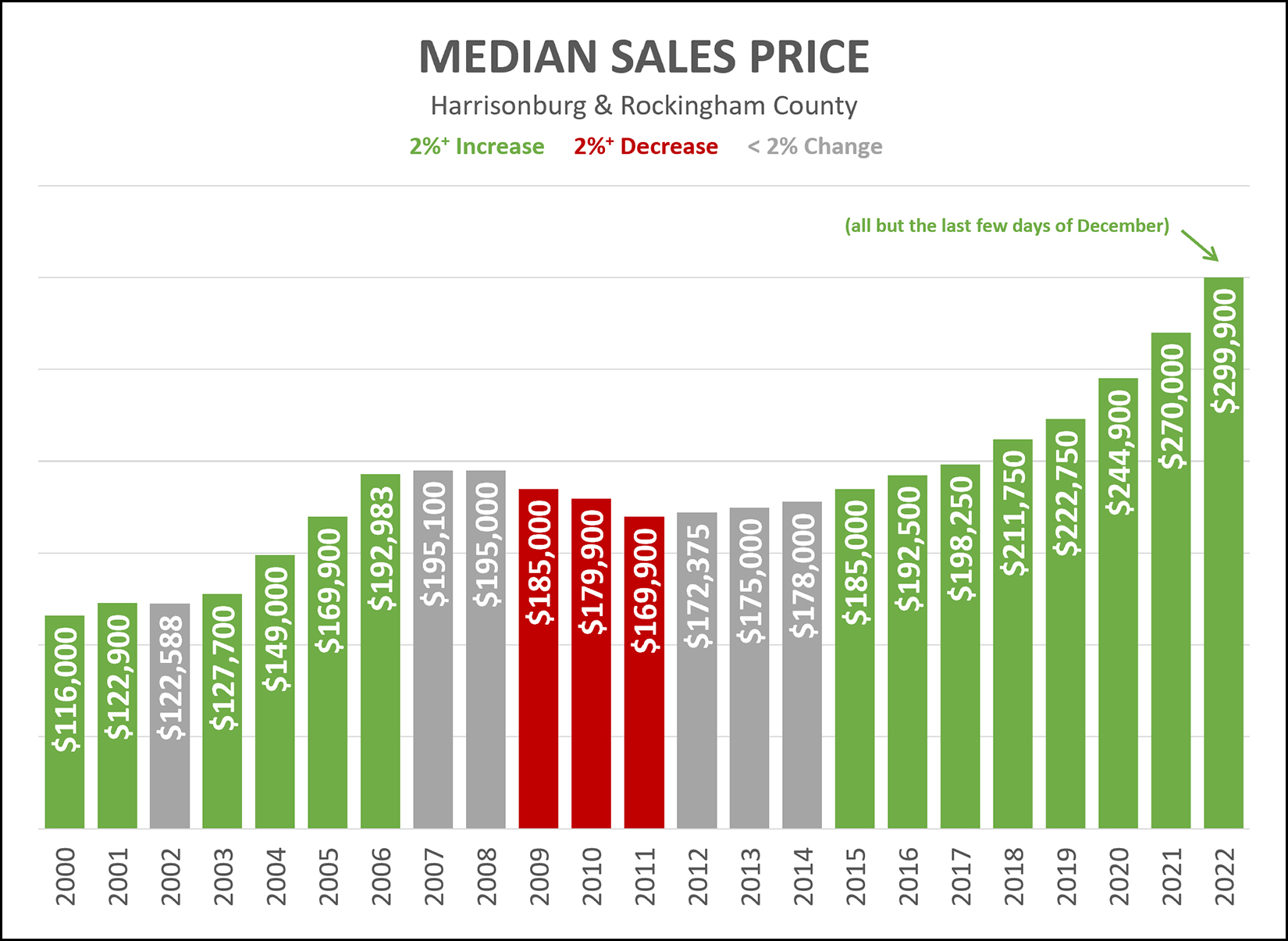

Median Sales Price In A Larger (Longer) Context |

|

We have seen three distinct periods of changes in the median sales price in the Harrisonburg and Rockingham real estate market... 2000 - 2006 = Growth 2007 - 2014 = Minor, Slow, Correction 2015 - 2022 = Growth What's on everyone's mind now is... what comes next! Will we see prices continue to rise in 2023? Will they level out? Will they decline a bit? I have no answers. ;-) I'll make some guesses next week. | |

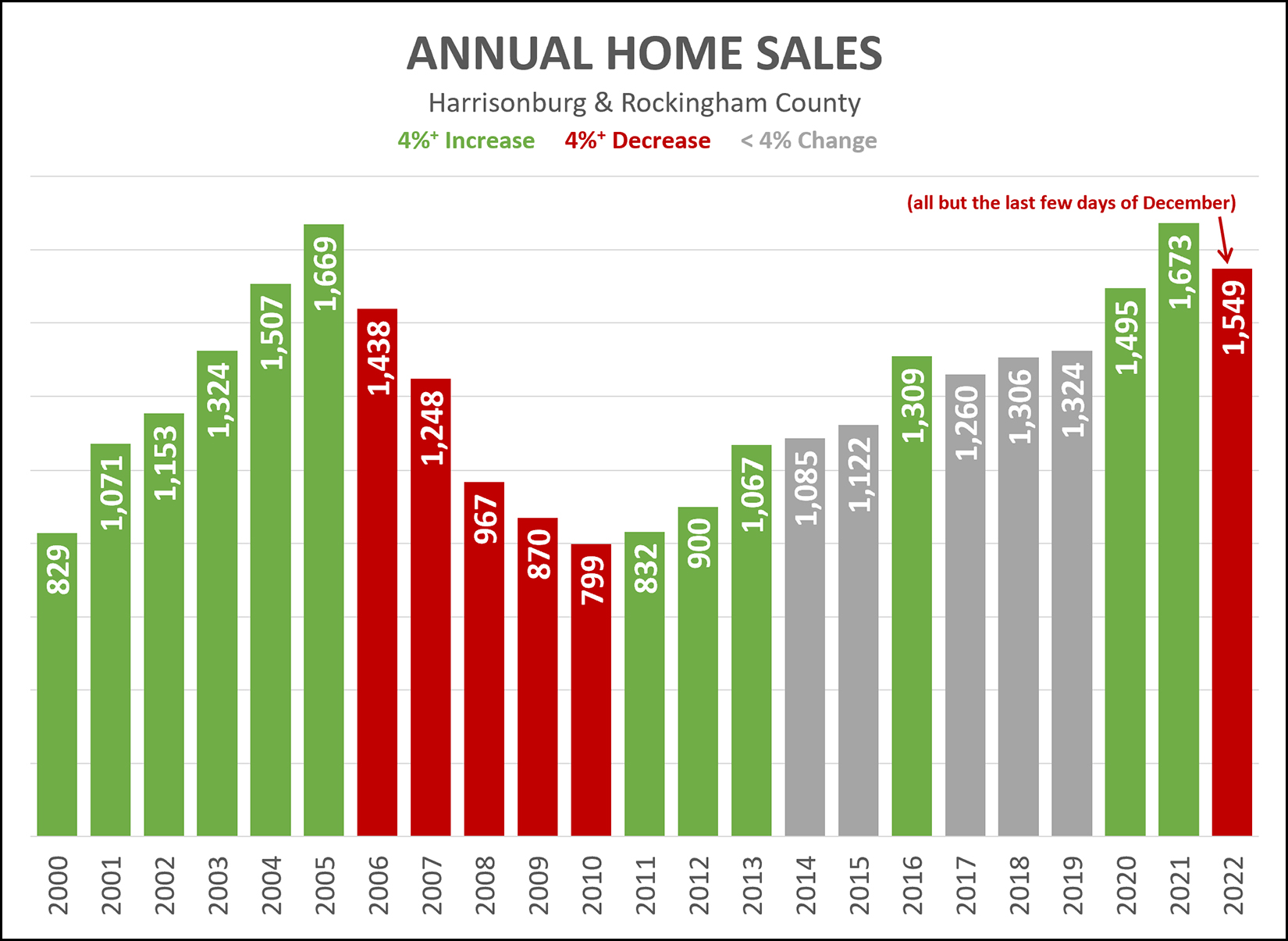

Annual Home Sales In A Larger (Longer) Context |

|

Even after the last few home sales of 2022 are tabulated, we'll see a net decline in the number of homes selling in 2022 as compared to 2021. In the graph above I have each year color coded as follows... GREEN = 4% or greater increase in # home sales RED = 4% or greater decrease in # home sales GREY = less than a 4% change in # home sales Thus, as you can see, we've seen an increase in the pace of home sales in the local market, or less than a 4% change in the pace of home sales, every year since 2000 except for in 2006, 2007, 2008, 2009 and 2010... and now, 2022. It's hard to say at this point what 2023 will look like, but it seems reasonable to think we may see another (+4%) decline in the numbers of homes selling in Harrisonburg and Rockingham County. | |

Even With A Slower Second Half Of 2022, It Will Have Been The Third Strongest Year Of Sales, Ever |

|

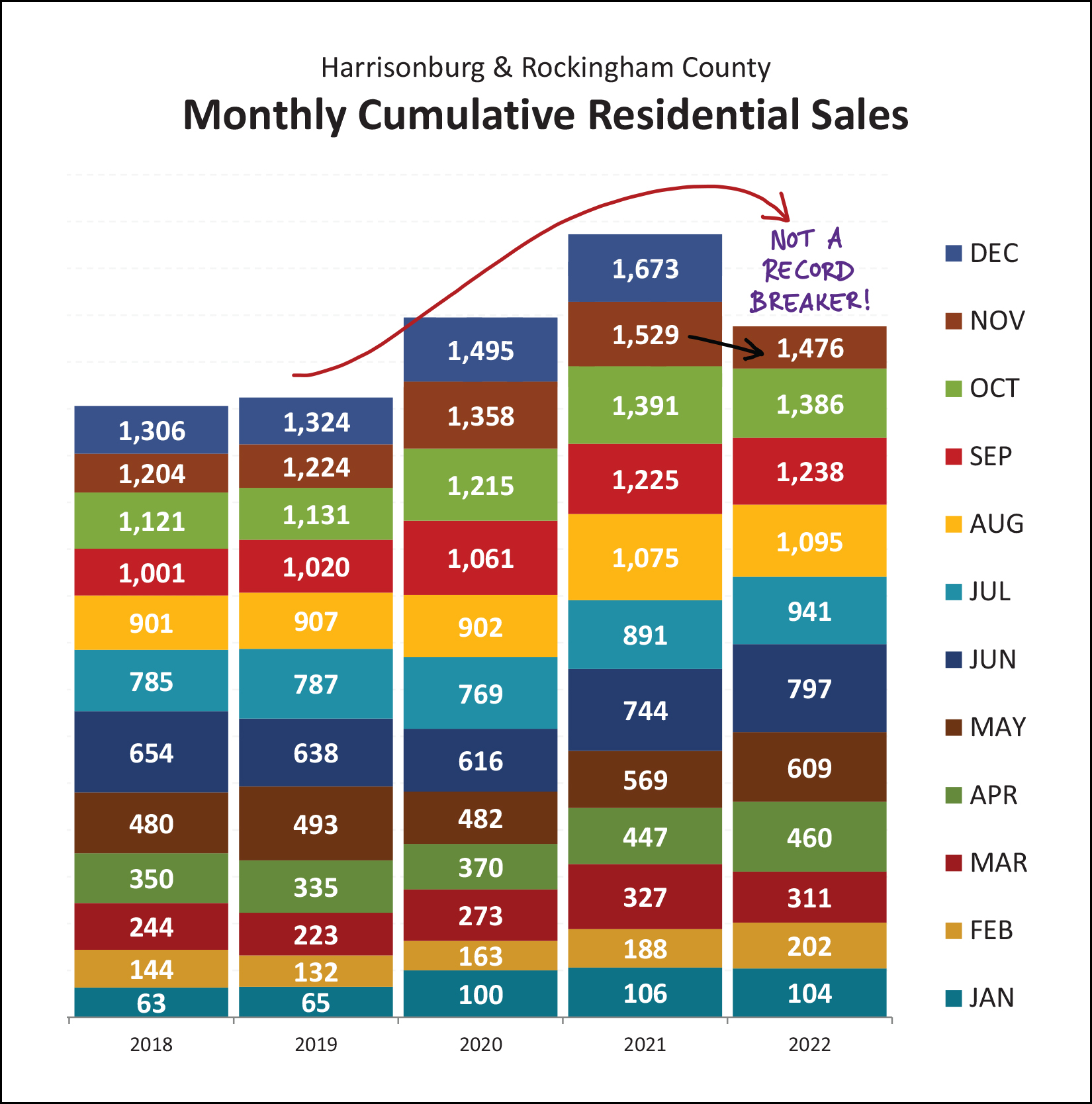

Mortgage interest rates rose considerably in the second half of 2022 -- actually, even as early as mid-April they had already surpassed 5%. These higher rates eventually (months later) lead to a slowdown in the number of homes selling in 2022. Yet, despite this slowdown, 2022 will close out as the second strongest year of home sales in Harrisonburg and Rockingham County, ever. Thus far in 2022 we have seen 1,548 home sales in Harrisonburg and Rockingham County as reported in the HRAR MLS. Last year, in all of 2021, there were 1,668 home sales. As such, yes, we aren't breaking any records this year. But, prior to 2021, there was never a year with more than 1,500 home sales in a single year. The closest (which was quite close) was 2020 with 1,495 home sales. So, was 2022 a much slower, much weaker year of home sales in this area? Not really. It was slightly slower than last year... but stronger than every other year before that, ever. NOTE: After having awarded 2022 with the beautiful second place ribbon above I then looked back even further beyond the past decade and found that there WAS one other year with more home sales than 2022... way back in 2005. So, 2022 will really end up being the third strongest year of home sales, ever. | |

Trading Up For A New House Will Likely Also Mean Trading Up Your Interest Rate |

|

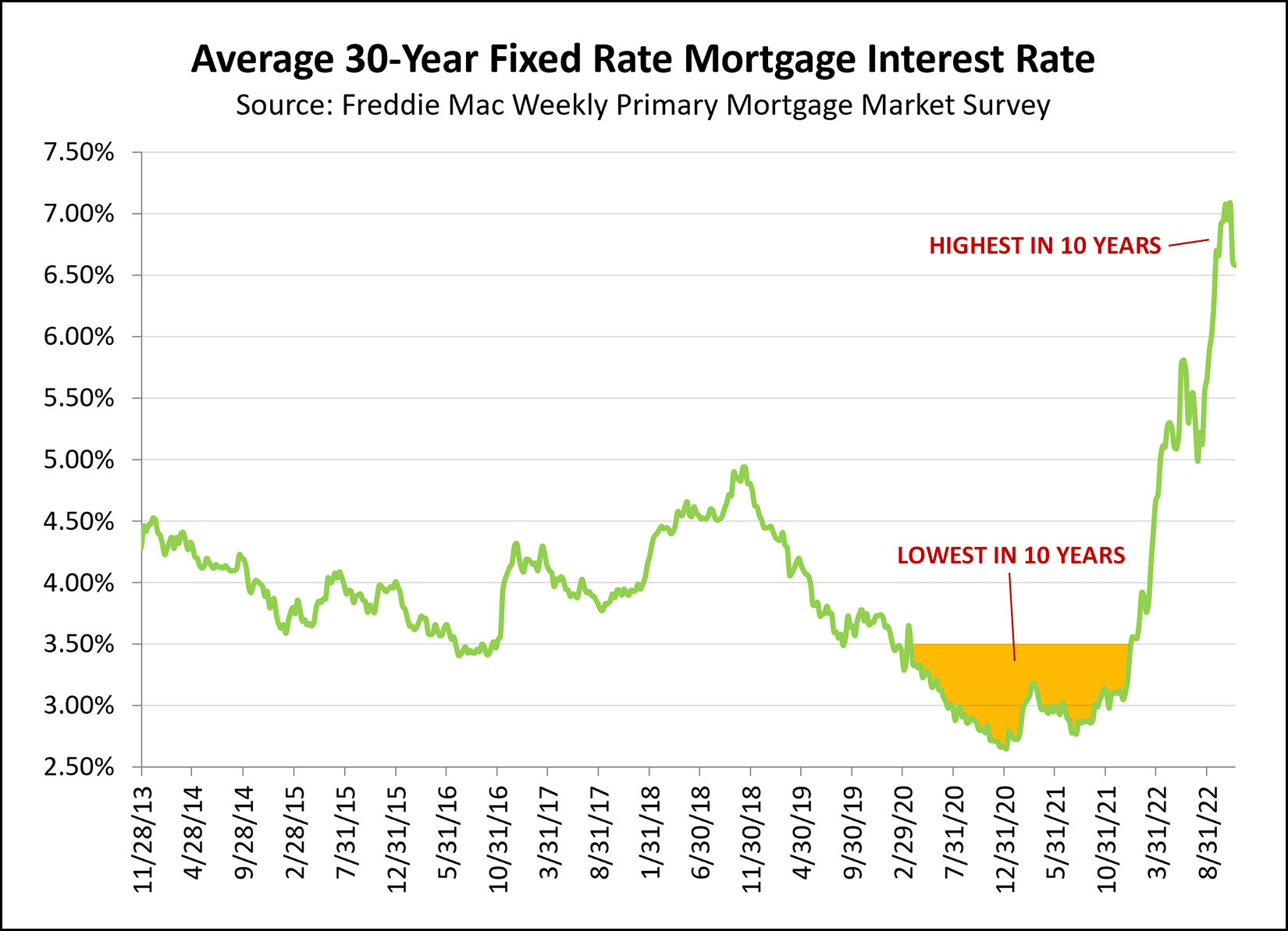

For about three years (2019-2021) the average mortgage interest rate for a 30 year fixed rate mortgage was less than 4%. It even dropped below 3% at times. As such, anyone who bought a home during that timeframe likely has a mortgage interest rate below 4%... and many (many) other homeowners refinanced during that timeframe to lower their rate and their mortgage payment. So now we find ourselves in a situation where many mortgage holders have a mortgage interest rate below 4% or even below 3%. Thus, when any such holder of a low mortgage interest rates considers selling their home to trade up for a new house... they will also be trading up their mortgage interest rate. It was often an easy decision to sell a $300K home and buy a $400K home when you were paying off a 5% mortgage and taking out a new 3.5% mortgage. Now, if you're selling a $300K home with a 3.5% mortgage and are considering the purchase of a $400K home with a 6.5% mortgage... the math is going to work out a BIT differently. I suspect there will still be plenty of people selling and buying homes in 2023, even with these higher mortgage interest rates, but I think there will be fewer people swapping one house for another unless it is a significant upgrade in the house... because it will more than likely be a significant upgrade in the mortgage interest rate. :-/ | |

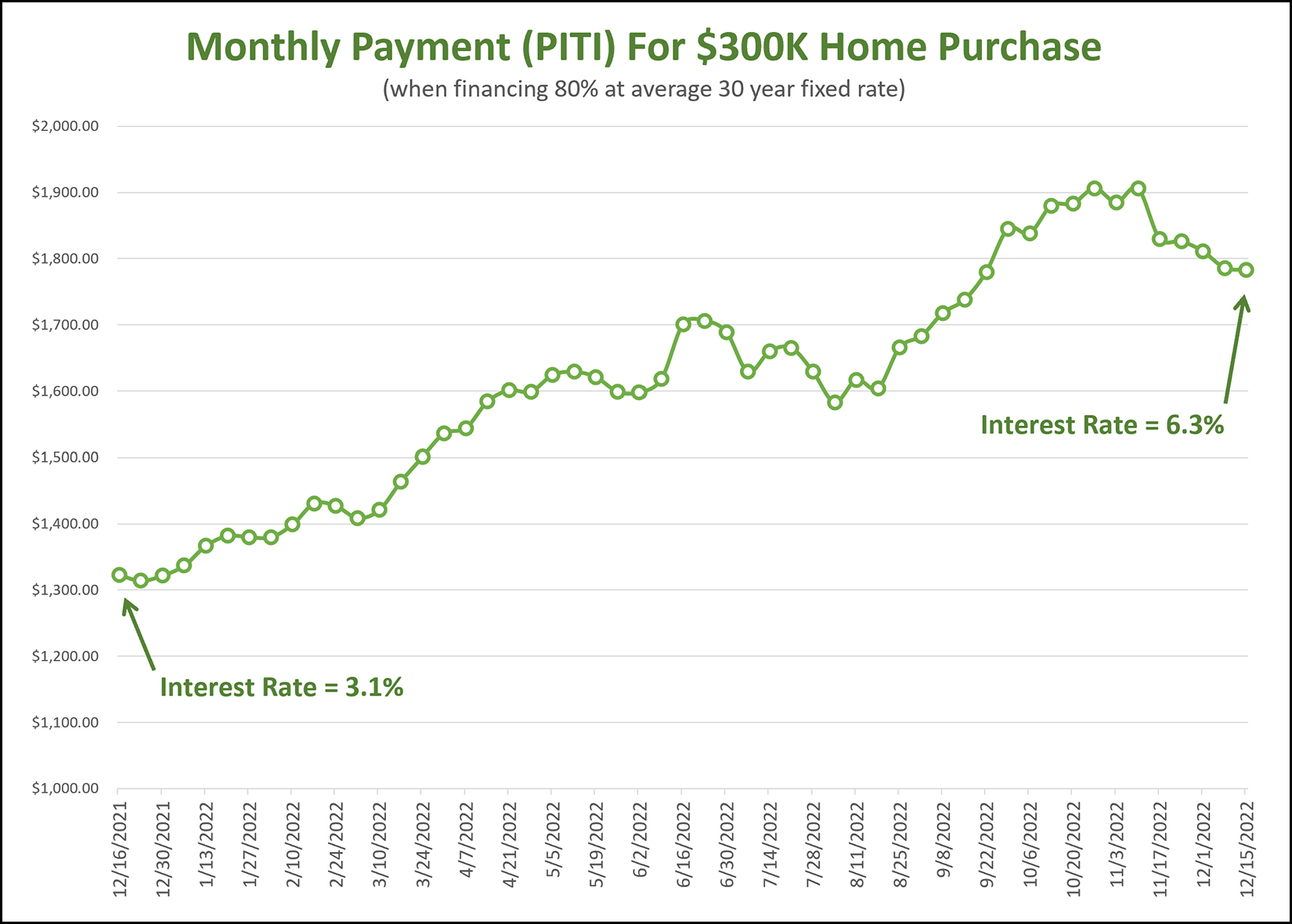

Monthly Housing Payments Have Changed A LOT In The Span Of A Single Year! |

|

With some regularity I take a look at trends in mortgage interest rates... but nobody really specifically cares about their mortgage interest rate... they really care about their monthly housing payment. The graph above shows how much monthly housing costs have changed over the past year. A year ago, a home buyer purchasing a $300K house in the City of Harrisonburg, with a 20% down payment, would lock in a housing cost of just over $1300 per month. Today, a home buyer purchasing a $300K house in the City of Harrisonburg, with a 20% down payment, would lock in a housing cost of just under $1800 per month. The slight bit of good news, I suppose, is that this potential monthly housing cost has been edging down over the past month-ish from over $1900 to under $1800 as mortgage interest rates have started to decline a bit. I don't think we're going to get back down anywhere close to the 3% ($1300) range in 2023 or 2024, but perhaps the monthly housing cost for a $300K home can work its way back down to $1700 (5.75%) or even $1600 (5.15%) over the next few years? | |

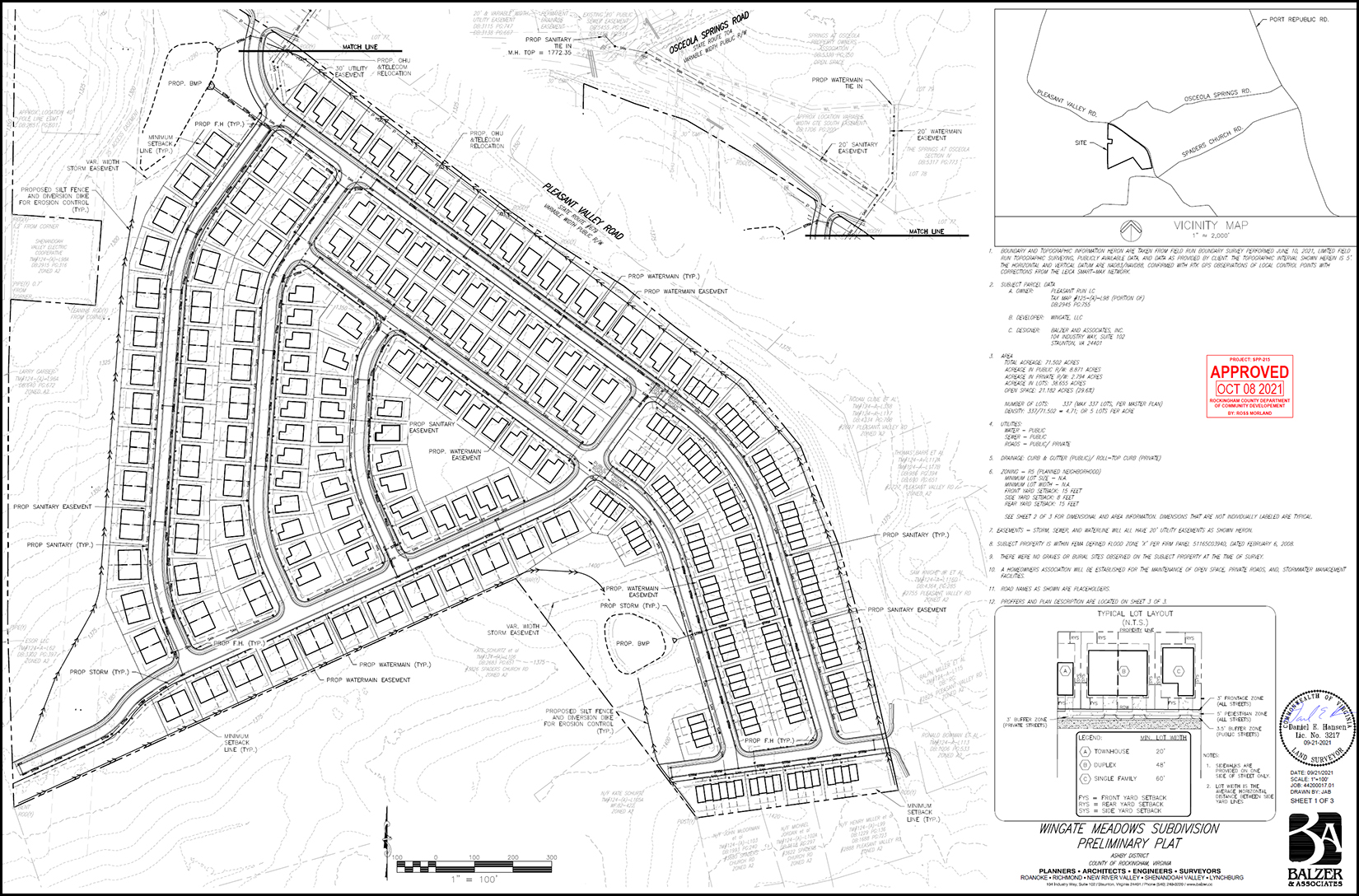

337 Homes Planned For Wingate Meadows On Pleasant Valley Road To Include 91 Detached Homes, 102 Duplexes, 144 Townhomes |

|

If you've driven by Wingate Meadows recently, you would see a new residential development under construction - in Rockingham County - at/near the intersection of Osceola Springs Road and Pleasant Valley Road. This new residential development is being built by Ryan Homes, will be called Wingate Meadows and the most recent site plan from Rockingham County (above) shows a layout that includes...

TBD on the pricing, though signage would suggest that homes will be in the $300K's. | |

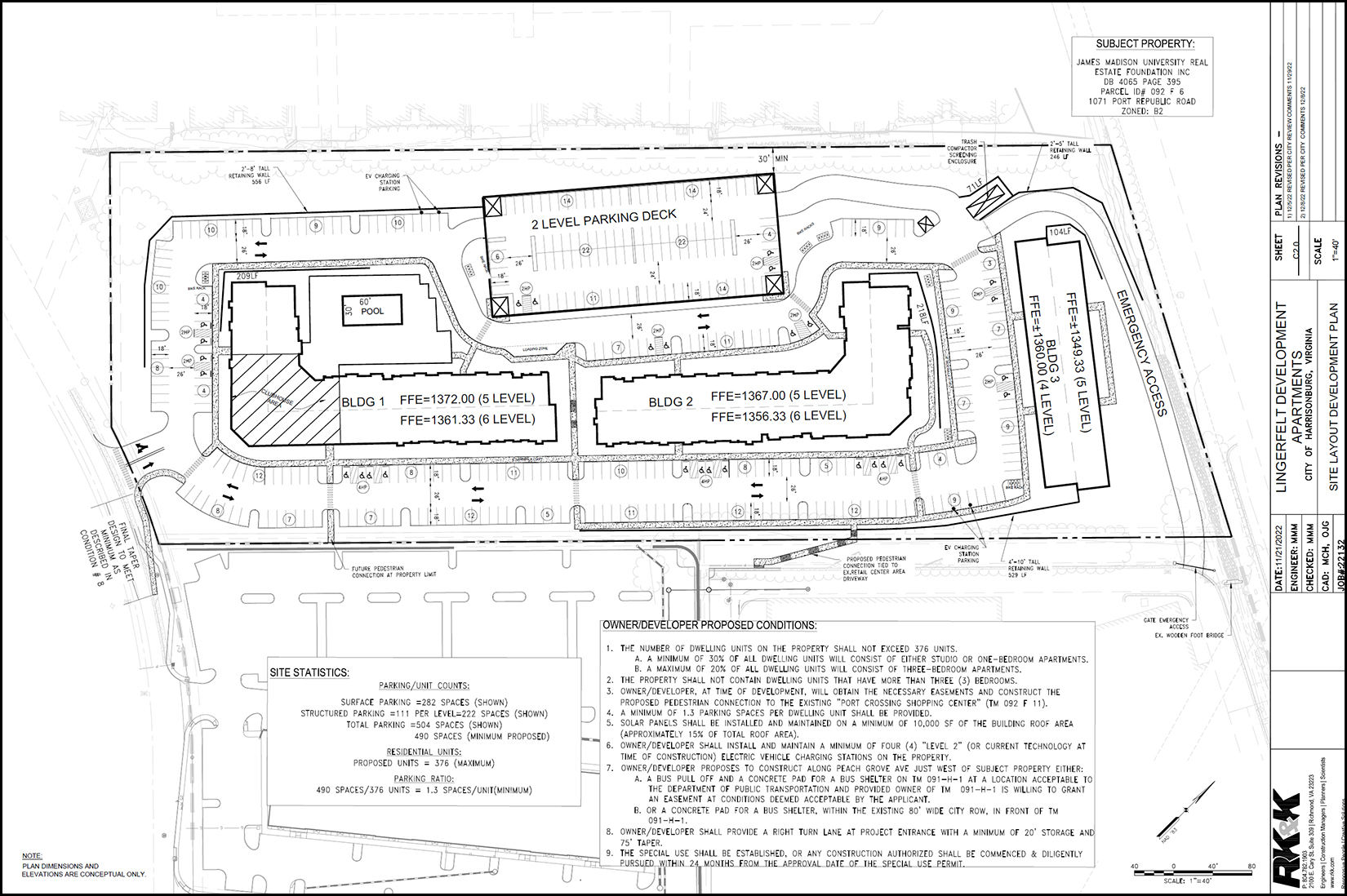

376 Apartments In Three Buildings, With Clubhouse, Pool and Parking Deck Proposed For Peach Grove Avenue |

|

Lingerfelt Development, LLC is requesting a special use permit from the City of Harrisonburg to allow for the development of a 376 unit apartment complex on Peach Grove Avenue on a 9.9 acre parcel of land between The Hills (Southview) Apartments and the proposed 460 bedroom student housing complex, Peach Grove Shoppes. This new proposal for 376 apartments would include... [1] A minimum of 30% studio or one bedroom apartments [2] A maximum of 20% of three bedroom apartments [3] No apartments with more than three bedrooms Here's the proposed layout of the development...  The land for this proposed development is currently owned by the James Madison University Real Estate Foundation. Here's the location of the proposed development...  Read up on all of the details of this proposed development in the special use permit application packet here. 12/14/2022 - tabled by Planning Commission

| |

An Appraisal Contingency Should Not Worry Most Home Sellers |

|

For a few years now, in a highly competitive seller's market, buyers were waiving contingencies left and right... No Home Inspection Contingency! No Radon Test Contingency! No Appraisal Contingency! No Home Sale or Home Settlement Contingency! Now, though, with much higher interest rates, and somewhat lower levels of buyer interest, we are sometimes seeing some of these contingencies sneaking their way back into offers. One of my general rules of thumb these days is that if you are making the only offer on a property, it is probably reasonable to include some of these contingencies that you might have waived if you had bought in 2020/2021... but if you are competing against multiple other offers, you may want to consider waiving some of these contingencies. As such... some sellers are now receiving offers with... my topic of the day... appraisal contingencies! Should a seller be concerned about an appraisal contingency? Should they counter back and propose not having an appraisal contingency? Generally speaking, I don't think an appraisal contingency should worry most home sellers. Appraisers are not personal crusaders with a mission of lowering market values by strategically coming up with low appraised value to wreak havoc on real estate transactions and to course correct the real estate market because they think homes are overvalued. ;-) Appraisers work to provide a detailed and objective estimate of the value of a house to the lender who is using that house as collateral for a mortgage. So, as a home seller, if your contract price is in line with recent sales prices of similar homes, you likely don't need to get too worried about an appraisal contingency. Certainly, it's another hoop to jump through, or another hurdle to clear, between contract and closing... but the existence of the contingency in an offer should not cause you undue stress or anxiety. | |

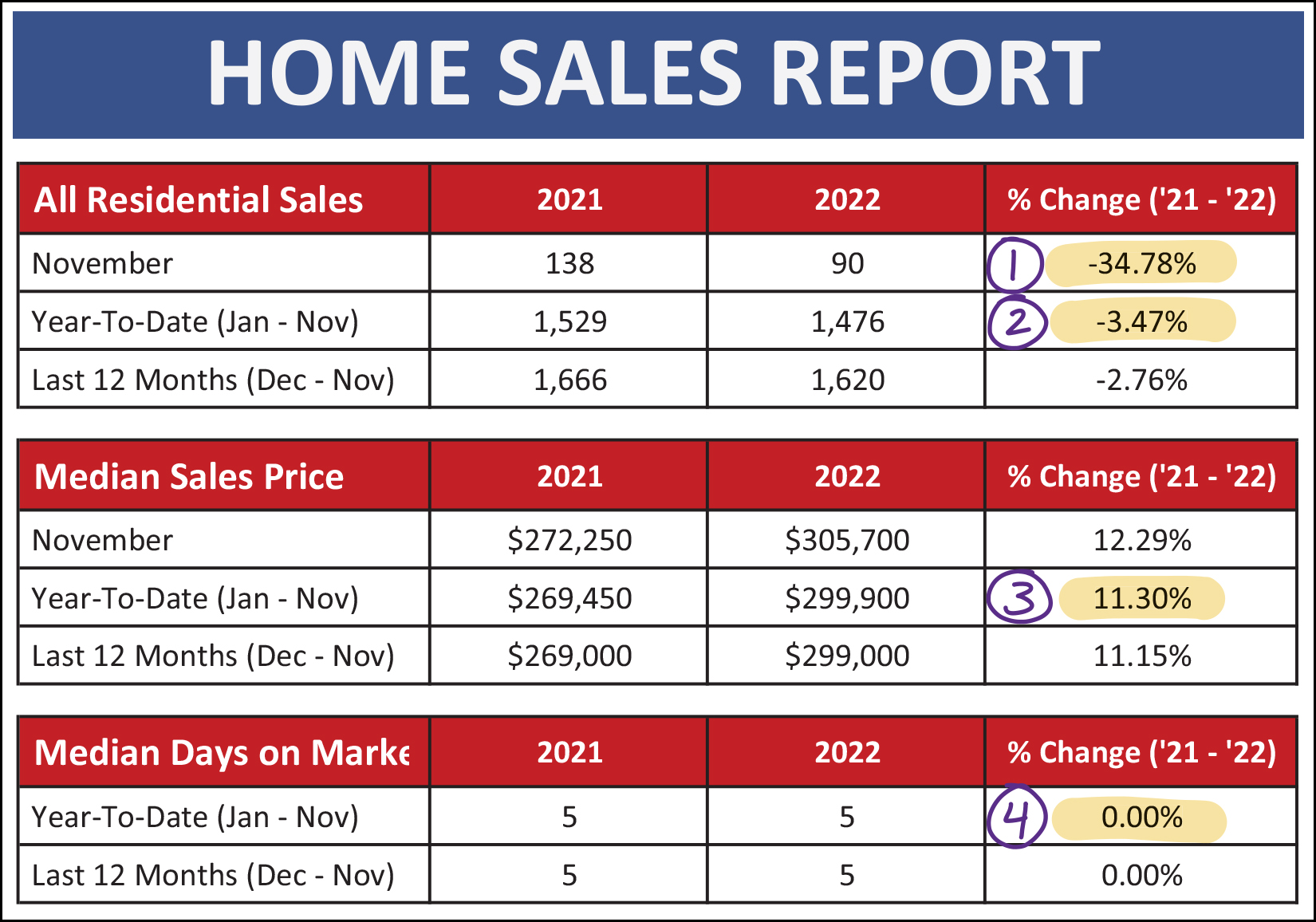

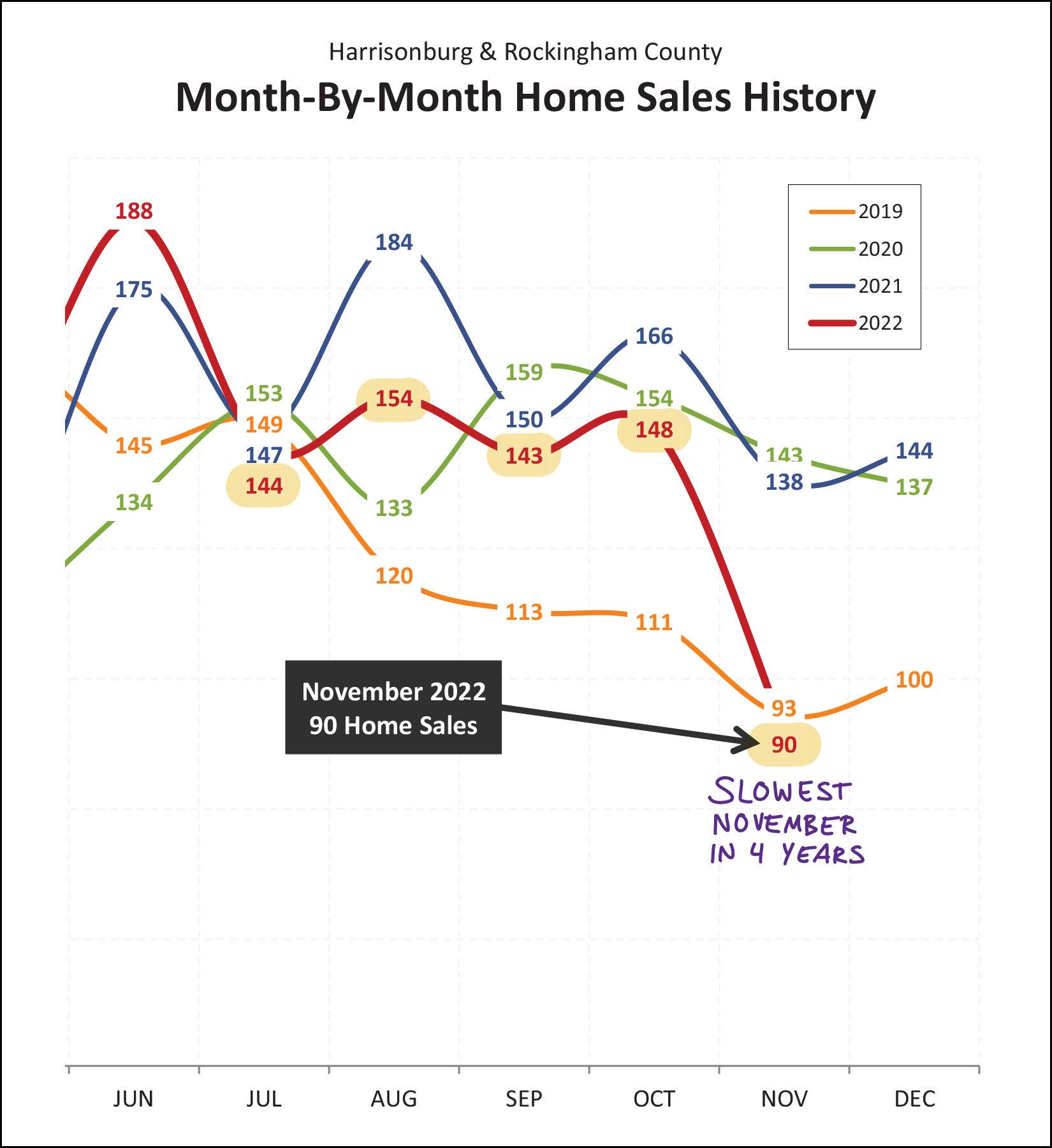

Home Sales Slow In November 2022, But Prices Keep On Rising |

|

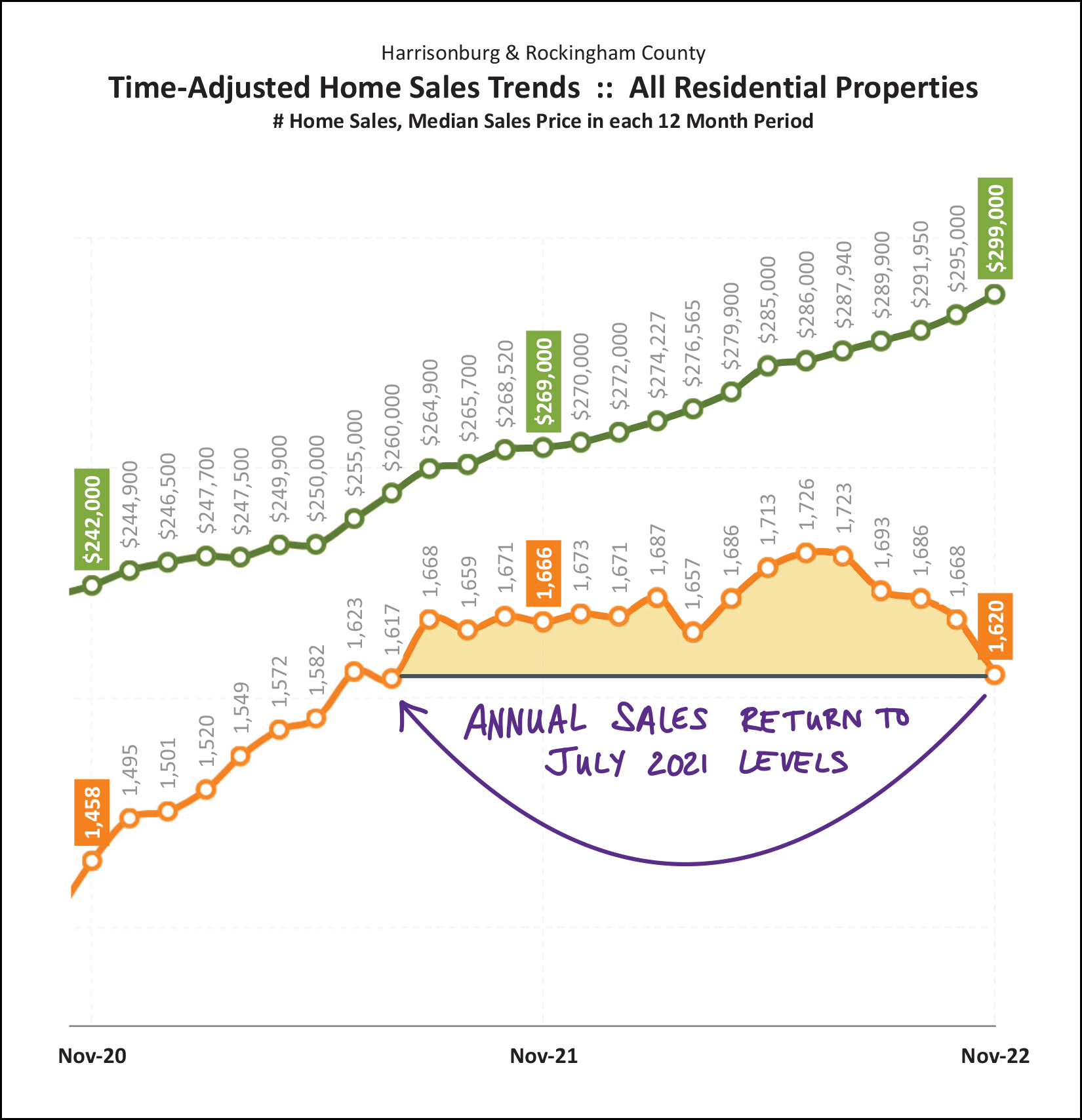

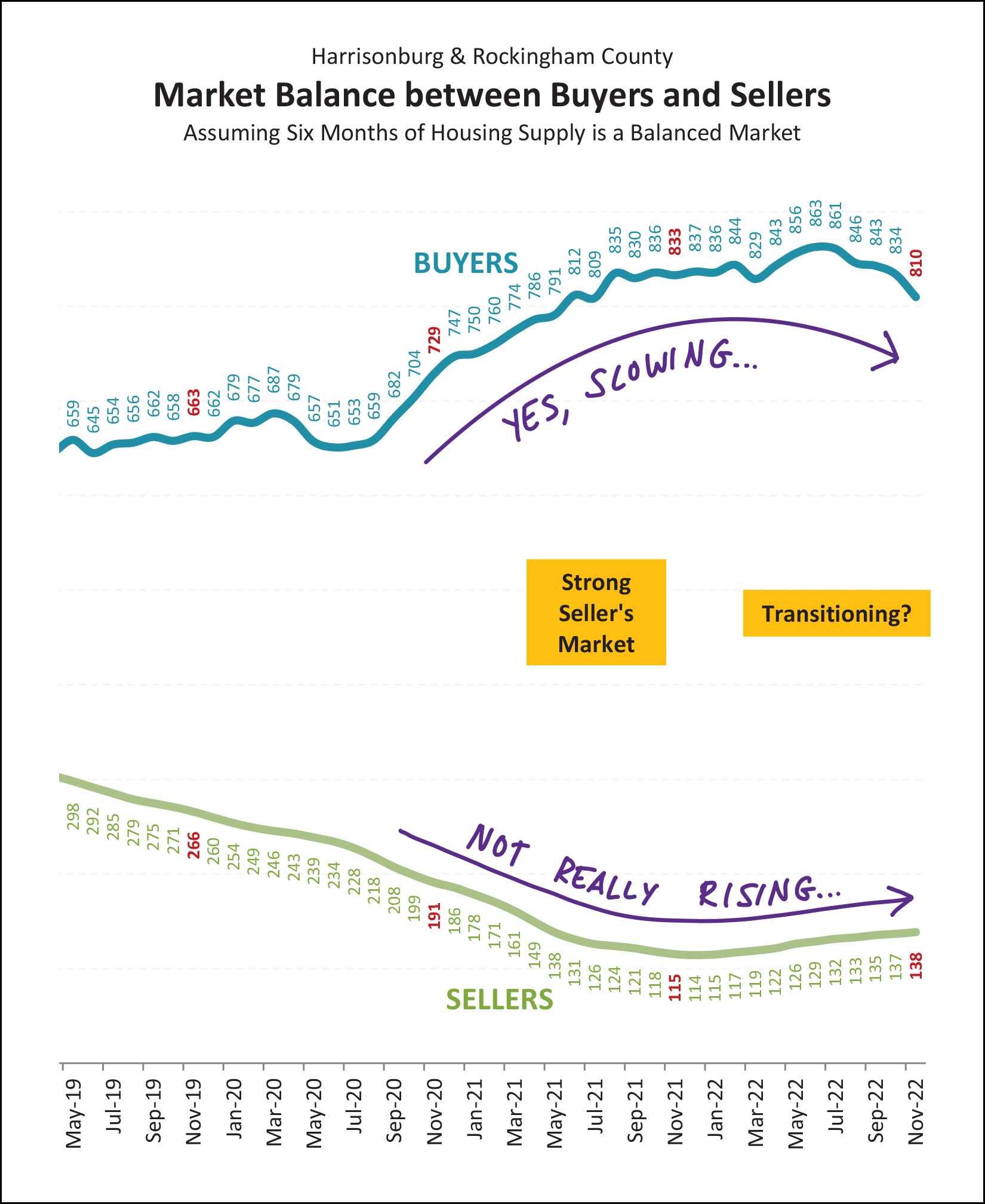

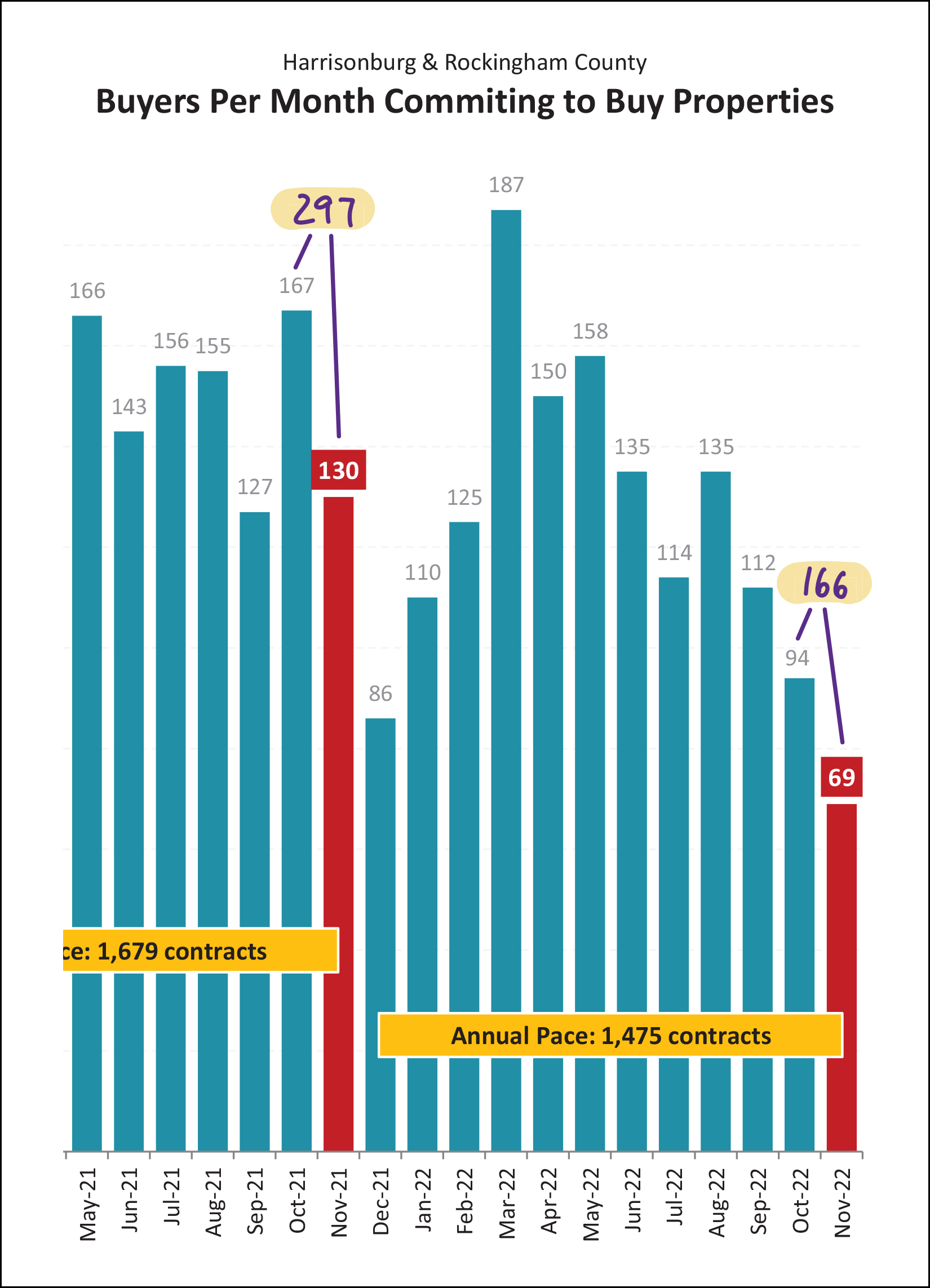

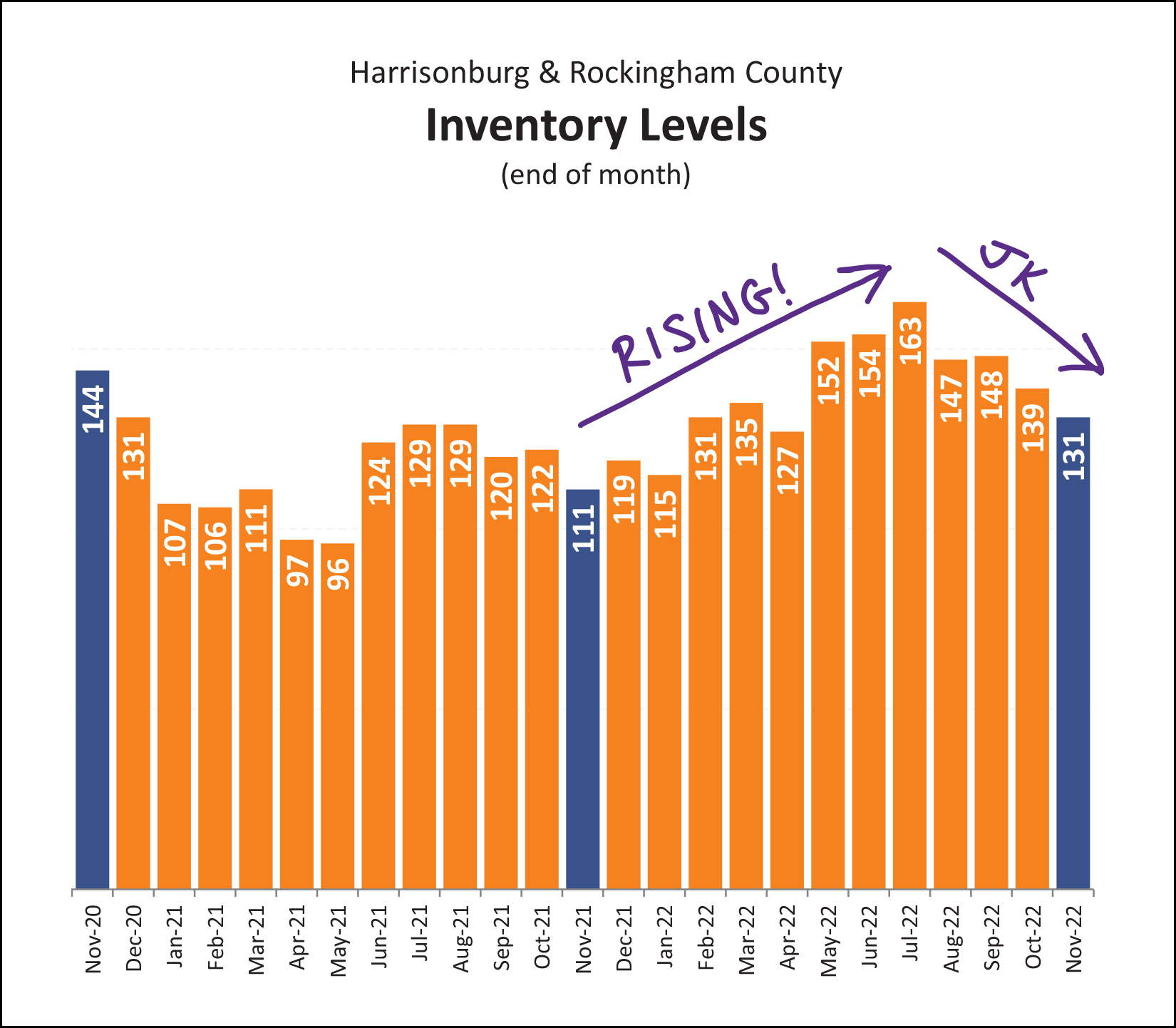

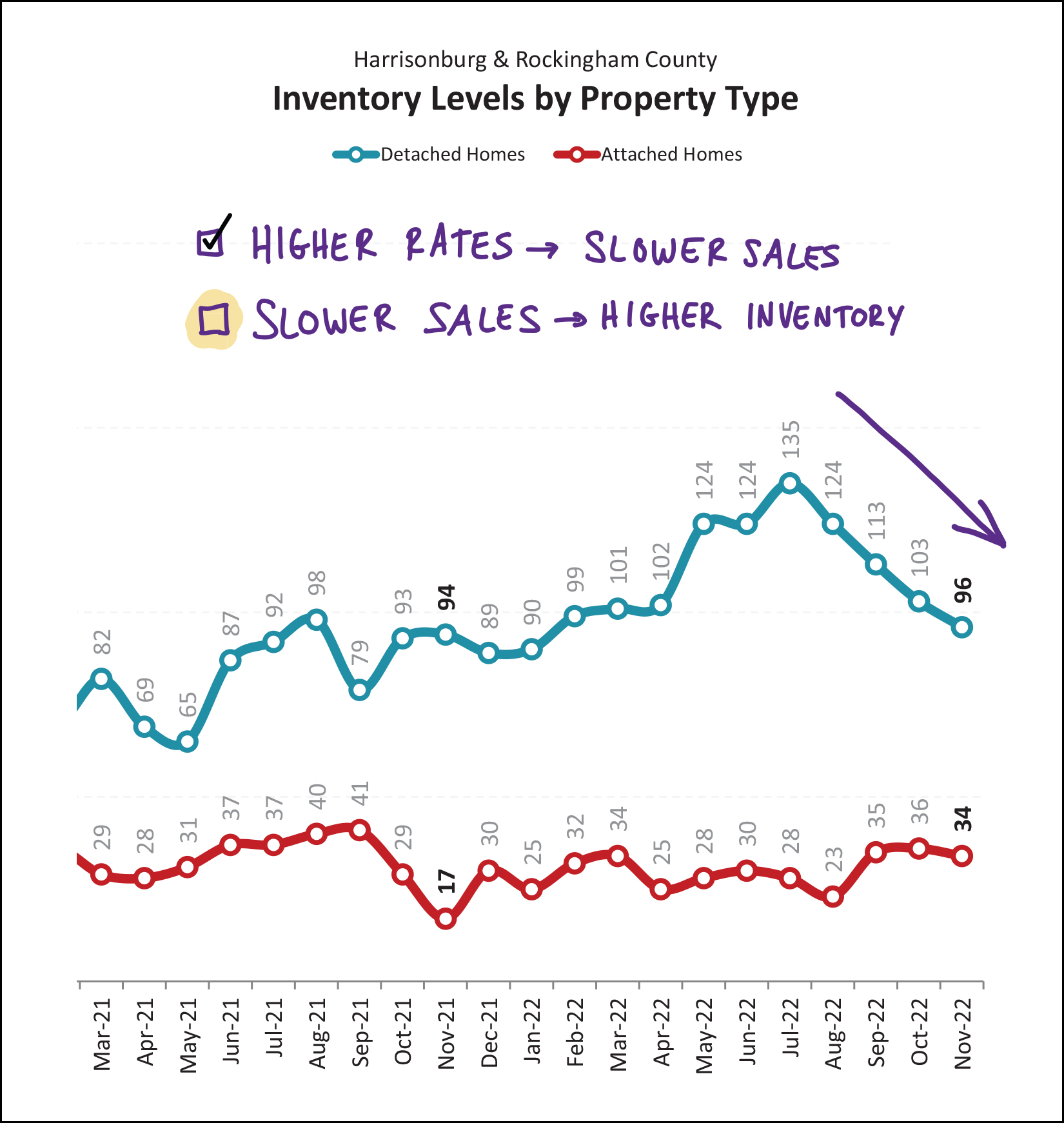

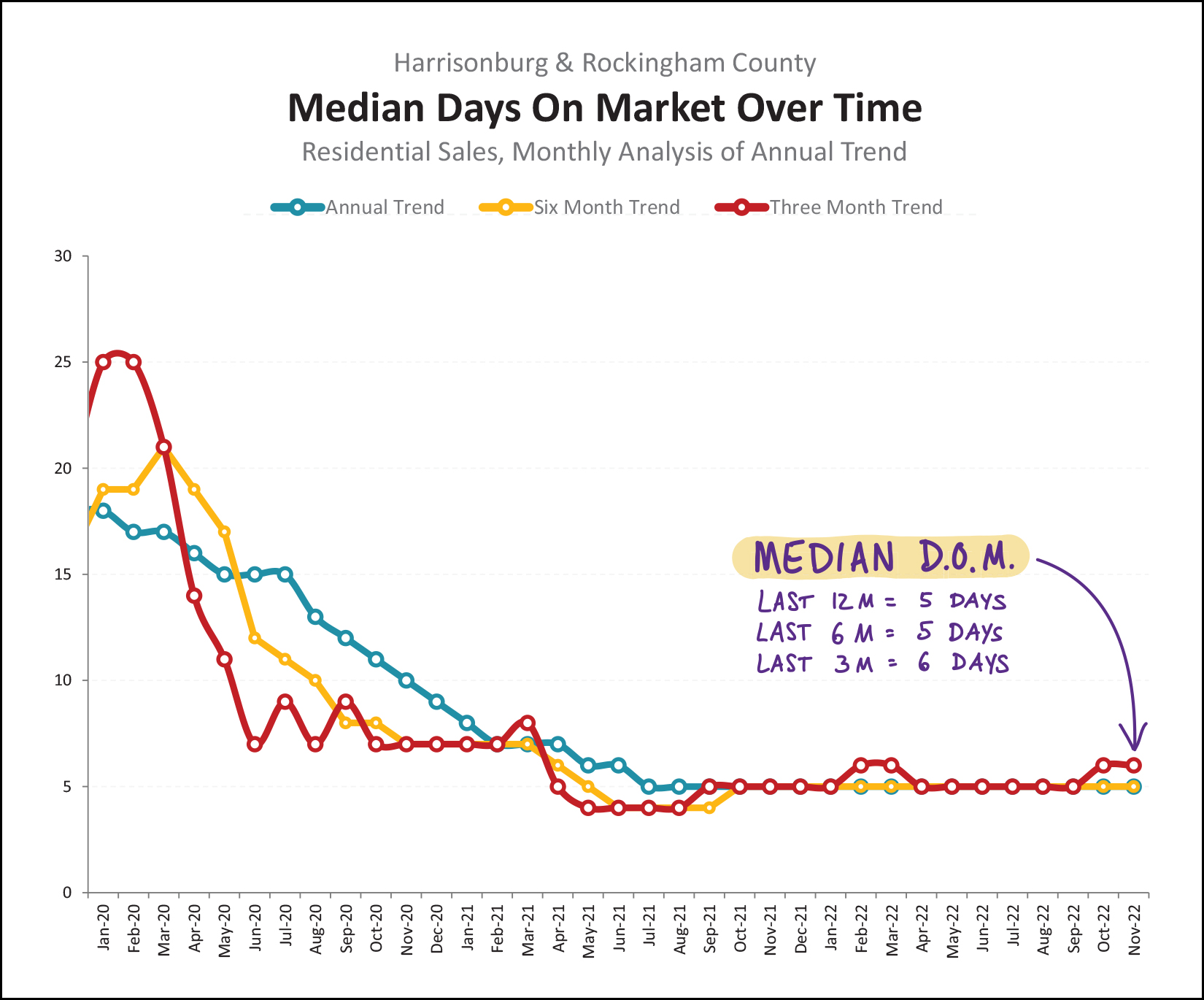

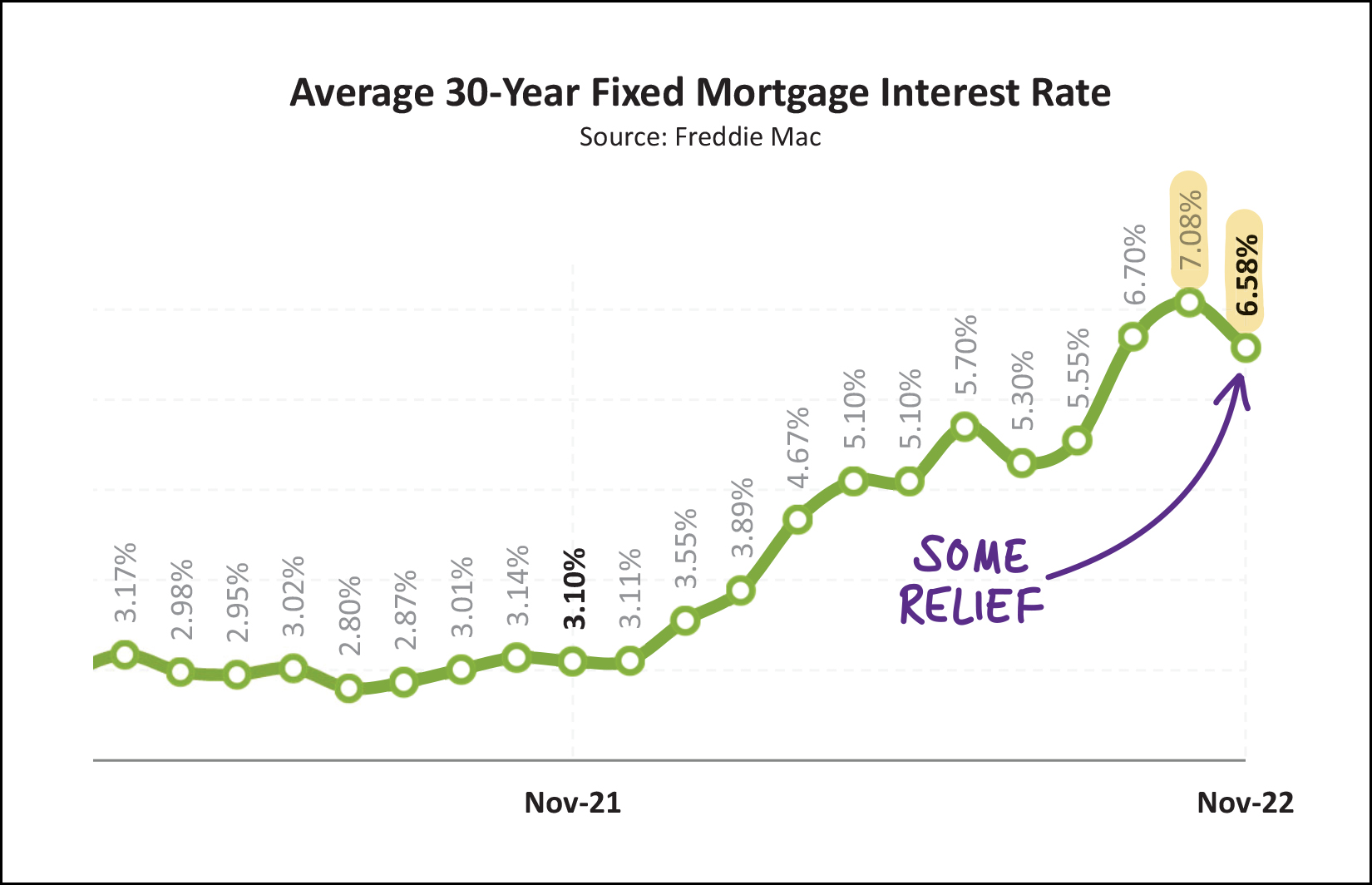

Happy Tuesday morning, friends! Winter is upon us. The holidays are upon us. I hope you have been enjoying the variety of Christmas light displays in and around Harrisonburg. Shaena and I, with several other family members, greatly enjoyed visiting the "Winter Wander" light display at the Boar's Head Resort in Charlottesville a few nights ago. Next time maybe we'll have to dine there or stay over as it was quite lovely! Check out the lights at Winter Wander yourself between now and January 7th...  Before we move onto the real estate data we're all waiting for, each month I offer a giveaway, of sorts, for readers of this market report, highlighting some of my favorite places (or things) in Harrisonburg. Recent highlights have included Walkabout Outfitter, Bella Gelato and the JMU Forbes Center. This month, I encourage you to go check out Grilled Cheese Mania on Main Street in Harrisonburg. If you find me at GCM, you'll likely find me enjoying the Triple Lindy with a side of Miss Tess' Tomato Mac. :-) Click here to enter to win a $50 gift certificate to Grilled Cheese Mania! Finally, take a few minutes to check out this month's featured home... a spacious, remodeled farmhouse on an acre in the Turner Ashby district with some excellent outdoor amenities located at 3667 Dry Hollow Road! Now, let's take a look at the latest data in our local real estate market...  Let's drive right into a few of the main metrics of our local housing market outlined above... [1] Home sales slowed considerably this November compared to last November... declining 35% from 138 sales to 90 sales. You'll see a clearer (and more startling) visual of that shortly. [2] This significant decline in the number of home sales in November 2022 resulted in an overall 3.5% decline in 2022 home sales as compared to 2021 home sales when viewing the first 11 months of the year. [3] But yet... the median sales price in our area keeps on rising, up 11.3% from a year ago to $299,900 when looking at the first 11 months of 2022. [4] Furthermore, homes are (as a whole) still selling just as quickly... with a consistent median of five days on the market thus far in 2022, which matches the speed of home sales a year ago. Now, that startling visual of the November 2022 dip in home sales...  Lots to note regarding the graph above... [1] We saw slower (fewer) home sales in each of the four months leading up to November. This was not altogether surprising, as mortgage interest rates have been steadily rising throughout 2022. [2] Home sales really (!!!) slowed down in November 2022... dipping down to 90 home sales as compared to 138 in the same month last year. [3] The 90 home sales this November is not actually that different than the 93 seen back in November 2019. [4] The past two years (2020 and 2021) may very well be anomalies given that they were during the Covid induced overheating of the local real estate market. If we look at the five Novembers prior to 2020 (thus, 2015-2019) we'll find an average of 94 home sales in November. So... home sales dropped significantly in November 2022. That's somewhat surprising, as it finishes off a long, multi-year, run of a super exuberant local housing market. It's also not that surprising, given rising mortgage interest rates, and given what usually happens in November if we're not in Covid times. As we'll see below, the temporary (crazy) boom in home sales brought on by Covid and super low mortgage interest rates may be coming to an end...  Prior to Covid (2020-2021) we had been seeing a relatively consistent 1300-ish home sales per year. Then, the market went crazy during 2020 and 2021 and home sales approached 1500 sales in a year, and then almost reached 1700 sales in a year. That string of two record breaking years in a row... won't continue in 2022. All the way up through September 2022, it was seeming that we'd have yet another record breaking year this year. But 2022 fell slightly behind in October, and even further behind in November. Looking ahead, it seems likely that 2022 will end up being the second strongest year of home sales ever in Harrisonburg and Rockingham County... just behind 2021. Looking at things from a slightly longer term perspective, we can see yet again how the local real estate market is slowing a bit after having peaked in 2021/2022...  A year and a half ago (ish) we were seeing home sales at an annual pace of 1,617 sales per year... back in July 2021... which included sales from August 2020 through July 2021. Now, we're seeing home sales at an annual pace of 1,620 sales per year... which includes sales from December 2021 through November 2022. So, the market has retreated a bit... with fewer sales per year now than we've seen for the past year and a half-ish. This was highly predictable given rather dramatic increases in mortgage interest rates. It is somewhat surprising, however, that the decline in annual sales has been as small as it has been given how much mortgage interest rates have increased. The pace of annual sales peaked at 1,726 sales... and we have only seen a 6% decline from that peak... to 1,620 sales per year. Now, then, given that home sales are slowing, we're almost certainly seeing inventory levels rising, right?  I'll make this point a few more times as we continue through these graphs, but here's your first visual showing that even if the market is starting to transition a bit, it's not doing it very rapidly. Yes, home sales are slowing. The graph above shows how many buyers are buying in a six month timeframe. We have seen a decline over the past year from 833 buyers buying every six months down to 810 buyers buying. So, yes, the pace of buyers committing to buy is certainly slowing. But... we're not seeing as much of an increase in sellers selling (inventory levels) as we might otherwise expect. We've seen an increase over the past year from 115 homes for sale up to 138 homes for sale, but that's still a notable net decline in inventory from two years ago and three years ago. So, is it a slightly less strong seller's market now? Yes. Is it still a strong seller's market now? Yes. Now, looking at contract activity for a moment, to predict where things might be headed from here...  As becomes evident with my handwritten note on the graph above... contract activity this October and November was MUCH slower than last October and November! After a combined total of 297 contracts being signed during that two month period last year... we have seen only 166 contracts signed this October and November, which is a 44% decline! Again, first, not a total surprise. Buyers are a bit less excited to sign contracts to buy homes with interest rates of 6% to 7% (this Oct/Nov) as compared to when interest rates are 2.5% to 3.5% (last Oct/Nov). Second, these lower contract numbers have started to result in lower sales numbers and that is likely to roll into December sales and January sales. Finally, it's important to remember that past two winters (2020, 2021) were a bit abnormal given Covid (lots of buyers wanting to buy a house) and super low interest rates (lots of buyers qualifying to buy a house) and this winter we seem to be returning to what was previously a typical seasonal trend of fewer contracts and sales during winter months. Now, then, back to inventory... certainly it must be rising, given fewer closed sales and fewer contracts being signed, right?  And... nope! Inventory levels rose through much of 2022... but have now been declining for the past four months... as is relatively normal for the fall into winter timeframe. Furthermore, inventory levels are still lower now than they were two years ago. This coming spring will be interesting, depending on how mortgage interest rates look at that time. It's typical to see lower inventory levels in the winter, and that makes the lower contract numbers less consequential. Lots of folks choose to sell in the spring and summer, and if we have lower contract numbers at that time, then we could see inventory levels starting to measurably increase. Driving this point home one more time...  The graph above shows inventory levels by property type. Inventory levels of attached homes (townhomes, duplexes, condos) have stayed relatively consistently between 25 and 40 over the past year and a half. Inventory levels of detached homes were rising between June 2021 and June 2022... but then have declined for the past four months. So, as my notes point out... higher mortgage interest rates did indeed lead to slower sales... but slower sales are not necessarily leading to higher inventory levels. Come spring, we may have new insights as to a potential new trajectory of the market if more sellers want to sell and this lower number of buyers are willing to buy. This next graph has become a bit more complex since I last referenced it...  First, conceptually, the timeframe in which homes are going under contract (days on market) is often an excellent indicator of the tone of the local market. As such, for some time I have been tracking the "median days on market" for homes that are selling in Harrisonburg and Rockingham County. The annual median days on market (blue line above) fell to five days (!) back in July 2021 and has remained at that level ever since. As the market has started to feel like it might be transitioning, or as we have though that maybe the market would have to be transitioning, several of you insightful and intelligent readers have asked if this "median days on market" trend looks different if we weren't looking at an entire year of data at a time. Basically asking the question... well, if the median days on market is five days over the past year... certainly it must be (might be?) higher if we looked only at the last few months, right? The new lines on this graph above address this inquiry. The gold/yellow line evaluates median days on market in a six month timeframe... and the red line shows this same metric in a three month timeframe. All that to say... even if we narrow our scope all the way down to the past three months... the median days on market has only risen to... six days instead of five. Half (or more) of the homes that have sold in the past three months were under contract within six days of being listed for sale. If (when?) the market transitions further, we will likely start to see this metric (median days on market) start to trend higher... but we're not seeing it yet. One of the main market impacting factors that I mentioned multiple times throughout this report is the change in mortgage interest rates over the past year...  A year ago buyers enjoyed mortgage interest rates right around 3%. Today... rates are twice as high... with an average rate of 6.58% for a 30 year fixed mortgage interest rate as of the end of November. Rates have actually trended down a bit further since that time... with a current average of 6.33% that is not yet shown on the graph above. Will significantly higher mortgage interest rates cause some buyers to not be able to buy? Yes. Will significantly higher mortgage interest rates cause some buyers to not want to buy? Yes. Will significantly higher mortgage interest rates cause a significant (10% or more?) decline in the number of buyers buying homes in our local housing market? Thus far, it seems not. And there you have it... the latest trends in our local housing market as we roll into the last two(ish) weeks of 2022. [1] We're starting to see fewer home sales... though the "fewer" is compared to a "higher" time that we might later conclude was well outside the norm for our local market. [2] We're still seeing higher and higher sales prices in our local market despite (non-cash) buyers financing their home purchase at some of the highest mortgage interest rates we've seen in over 10 years. [3] Despite slightly less buyer activity, inventory levels are remaining stable and may be starting to return to historical seasonal trends of fewer homes on the market in the winter and inventory levels rising again in the spring and summer. As we near the end of 2022, some of you may be considering the sale of your home (or the purchase of a new one) in 2023. If so, we should start chatting sooner rather than later about how all of these market trends potentially impact your plans and the timing of those plans. Feel free to reach out to start that conversation by emailing me or texting or calling me at 540-578-0102. I'll provide another update after the first of the year. Until then, I hope you enjoy the remainder of what is one of my favorite months of the year. December includes Shaena's and my anniversary, Shaena's birthday, and Christmas! Celebrations all month long. ;-) I hope you have an enjoyable, peaceful, fulfilling remainder of 2022 -- and that you find opportunities to spend time with the people you love during this holiday season! | |

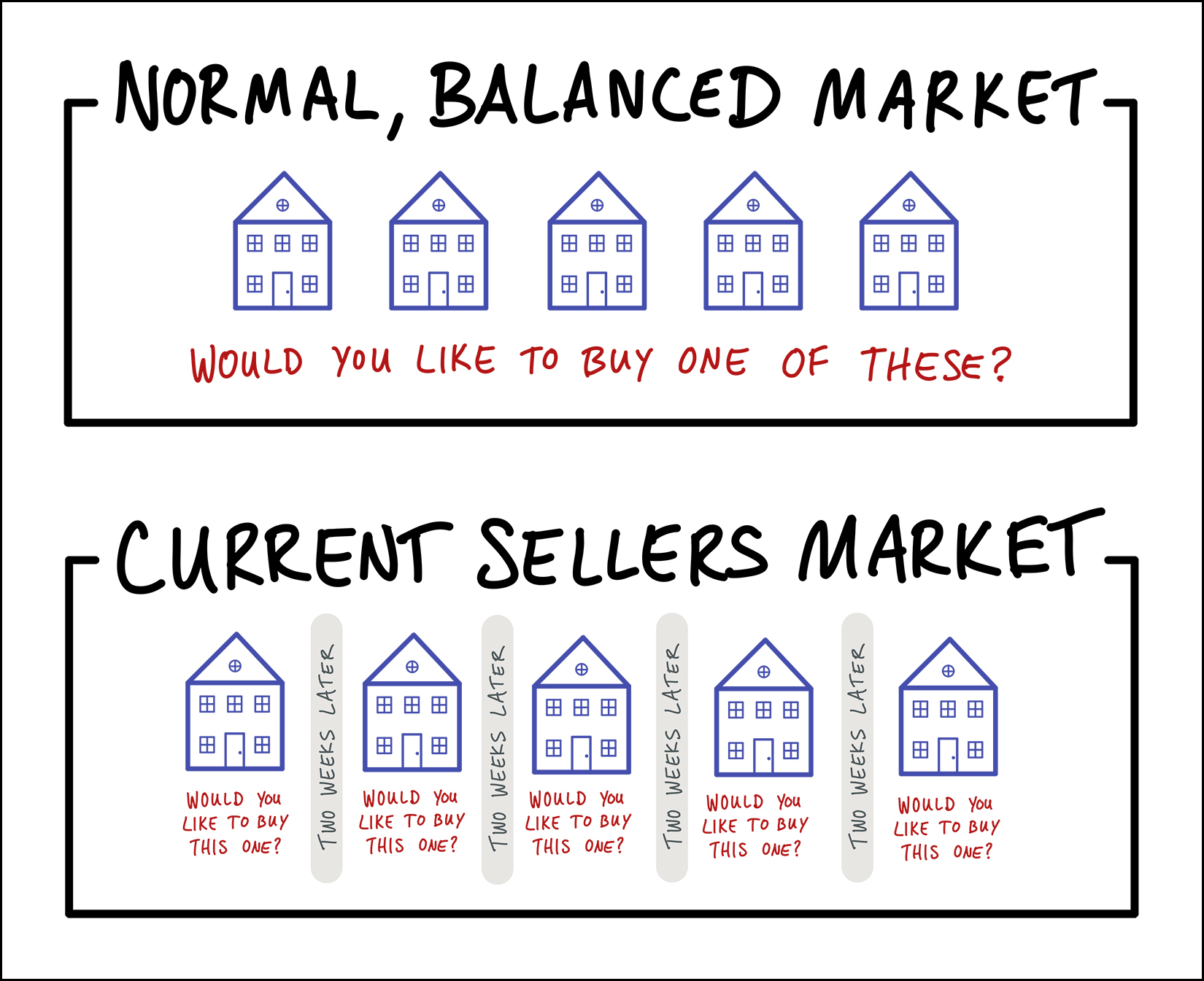

Comparison Shopping (For Homes) Is Difficult In A Low Inventory Market |

|

If you were going to buy a ____, it would probably be nice to look at multiple options, compare them, and then decide which one to buy, right? That is often possible with buying a home, whenever we have a balanced market (or a buyer's market) when buyers can find multiple houses on the market at any given time that might work for them. A buyer would then go view multiple houses, compare them, and decide if they want to make an offer on one of the available homes. These days (and for the past few years) we have been in a strong sellers market, with very low inventory levels. The same number of houses have typically been available for a buyer to consider... but they are often evaluating them one at a time, every few weeks... instead of all at once. Sorta like this...

Basically, home buyers have had to make a decision about whether to buy a house... one house a time... without the ability to compare multiple options that are available at the same time. That may eventually change, in some or most price ranges, if we start to see inventory levels increase over time. Until then, it can be a challenge to be a thoughtful and intentional comparison shopper when trying to buy a home! | |

So You Think Home Prices Will Decline? We Would Likely Need To See Much Higher Inventory Levels First! |

|

It's all about supply and demand. Over the past few years there have been plenty of home sellers... but WAY more home buyers. This resulted in buyers fighting over each new listing, competing to offer the most compelling terms, often being willing to pay a higher and higher price. Basically... [ Plenty Of Sellers ] + [ Way More Buyers ] = [ Rising Prices ] Some think that given higher mortgage interest rates and seemingly fewer buyers in the market, that we are certainly going to see home prices start to decline in this area. I suspect that will only happen if we see significantly higher inventory levels (of homes available for sale) such that sellers find themselves fighting over each new buyer, competing to be willing to offer buyers the most compelling terms, often being willing to accept a lower and lower price. (I'm exaggerating a bit here, but I just flipped the language above to show you what I mean.) That type of a market would look like this... [ Lots Of Sellers ] + [ Not Many Buyers ] = [ Falling Prices ] Until and unless we actually see measurable, significant increases in inventory levels, what I think we'll actually see is... [ Plenty Of Sellers ] + [ Fewer But Plenty Of Buyers ] = [ Stable Or Rising Prices ] Feel free to offer up your counterpoints or contrary perspectives. I'd love to hear them! | |

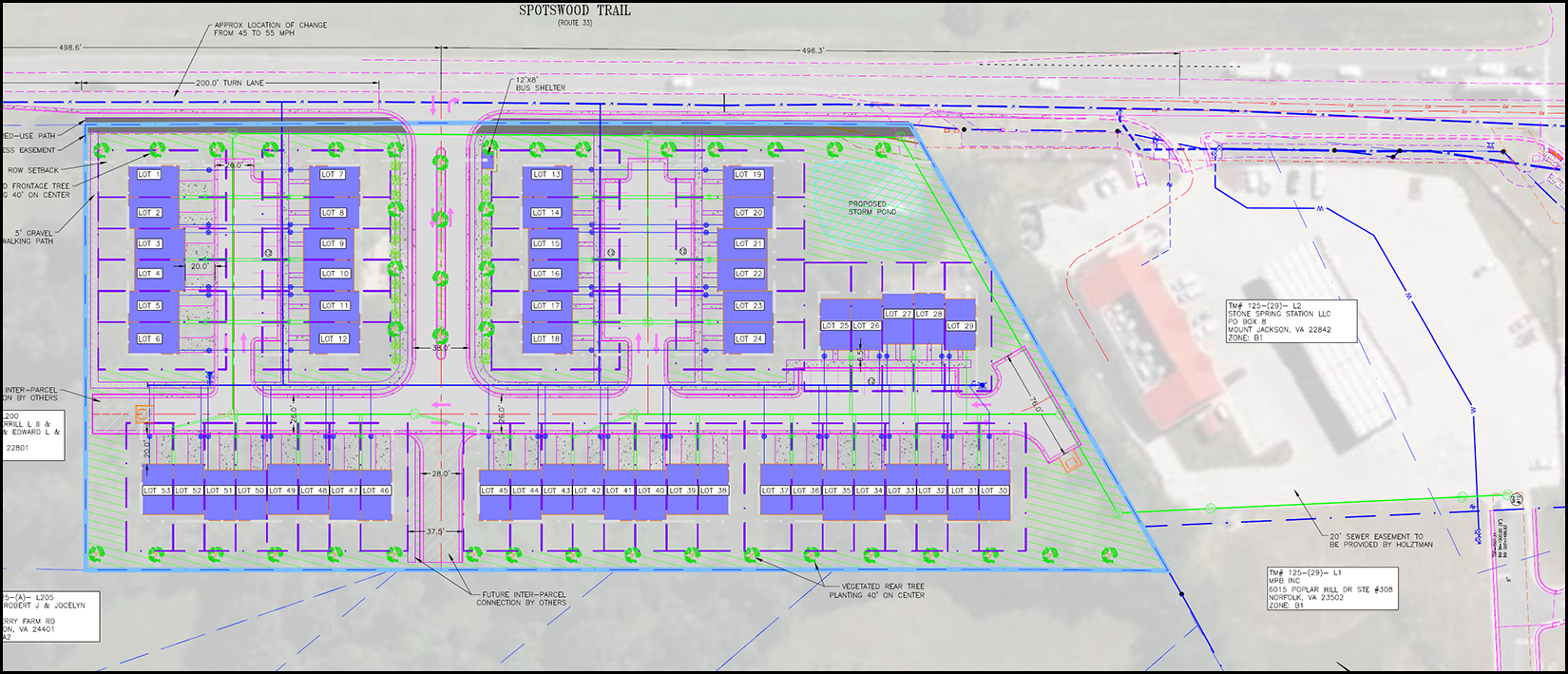

53 Townhomes Proposed Near Intersection Of East Market Street, Stone Spring Road |

|

A 53 unit townhome development is being proposed directly on East Market Street, just prior to the 7-11 gas station at the corner of East Market Street and Stone Spring Road when heading east. This residential development would be built on 4.43 acres that is currently zoned A-2 (general agriculture) and a rezoning is being proposed to allow for the residential development. Here's the proposed layout...  Rockingham County staff has some reservations about this proposed layout of this development because the development utilizes private streets (instead of public roads) and thus would not allow for connectivity between existing public roads and potential future public roads to be built on adjacent parcels. More specifically, from the County... "Privately maintained streets are an unreliable means of serving the long-term, publicly accessed street network that will be needed to serve all the land south and west of this site." Furthermore, the proposed layout (T turnaround) does not meet the requirements of the Rockingham County Fire Prevention Code. The Rockingham County Planning Commission considered this request on Tuesday, December 6th and tabled the proposal. Download the full rezoning application packet here. | |

There Are Still Plenty Of Buyers For Many Houses In Many Price Ranges |

|

Some segments of the local real estate market are slowing down... New listings that would have had 20 showings in the first week a year ago are now only having two or three showings in the first week. But... that slowing down is not affecting all properties equally. Plenty of homes coming on the market are still experiencing a flurry of showings (10+ in week one) and sometimes multiple offers. Perhaps it's the great unleveling? Before the COVID induced real estate boom of 2020 and 2021, there was plenty of variability between properties. Some new listings would have lots of showings immediately after hitting the market... and some new listings wouldn't have any at all. But then, in 2020 and 2021, it seemed that almost every listing out there (any location, any price, any property type, any condition) would have lots of showings... right away. It didn't matter if you had a steep driveway... or a small yard... or if your home needed cosmetic updates. During the home buying frenzy of 2020 and 2021, nearly every home would have lots of early interest. But now, the great unleveling... Now, some properties (in some locations and some price ranges) will have plenty of showings... and some will not. As a seller, it's nothing to fear or obsess over... but you do need to recognize this changing market dynamic as you are developing a pricing and marketing strategy for your home. | |

If You Bought A Home In 2020 Or 2021 You Should Be Retroactively Thrilled About Your Mortgage Interest Rate |

|

Did you buy a home in 2020 or 2021? If so, you likely locked in a mortgage interest rate that was the lowest we've seen in the past 10 years... and actually... the lowest we've seen... ever! So, for all of the buyers from the past two years, please look back and be thrilled that you were able to take advantage of that unique opportunity to lock in a very low interest rate on what is likely to be one of the largest purchases of your lifetime. Hopefully your home will work for you for many years to come and you will continue to enjoy the benefits of that super low interest rate. And... for would-be home buyers of 2022... yes, current mortgage interest rates are the highest we have seen in the past 10 years. In fact, we have to go all the way back to 2000 to find an interest rate above 7%. But... mortgage interest rates are starting to trend back down over the past month. They have dropped from about 7% to about 6.5%... and I have seen some recent prequalification letters much closer to 6%. Just as those record low mortgage interest rates didn't stick around forever, it seems unlikely that these record high mortgage interest rates will stick around forever... and they might pass more quickly than we realize. | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings