| Newer Post | home | Older Post |

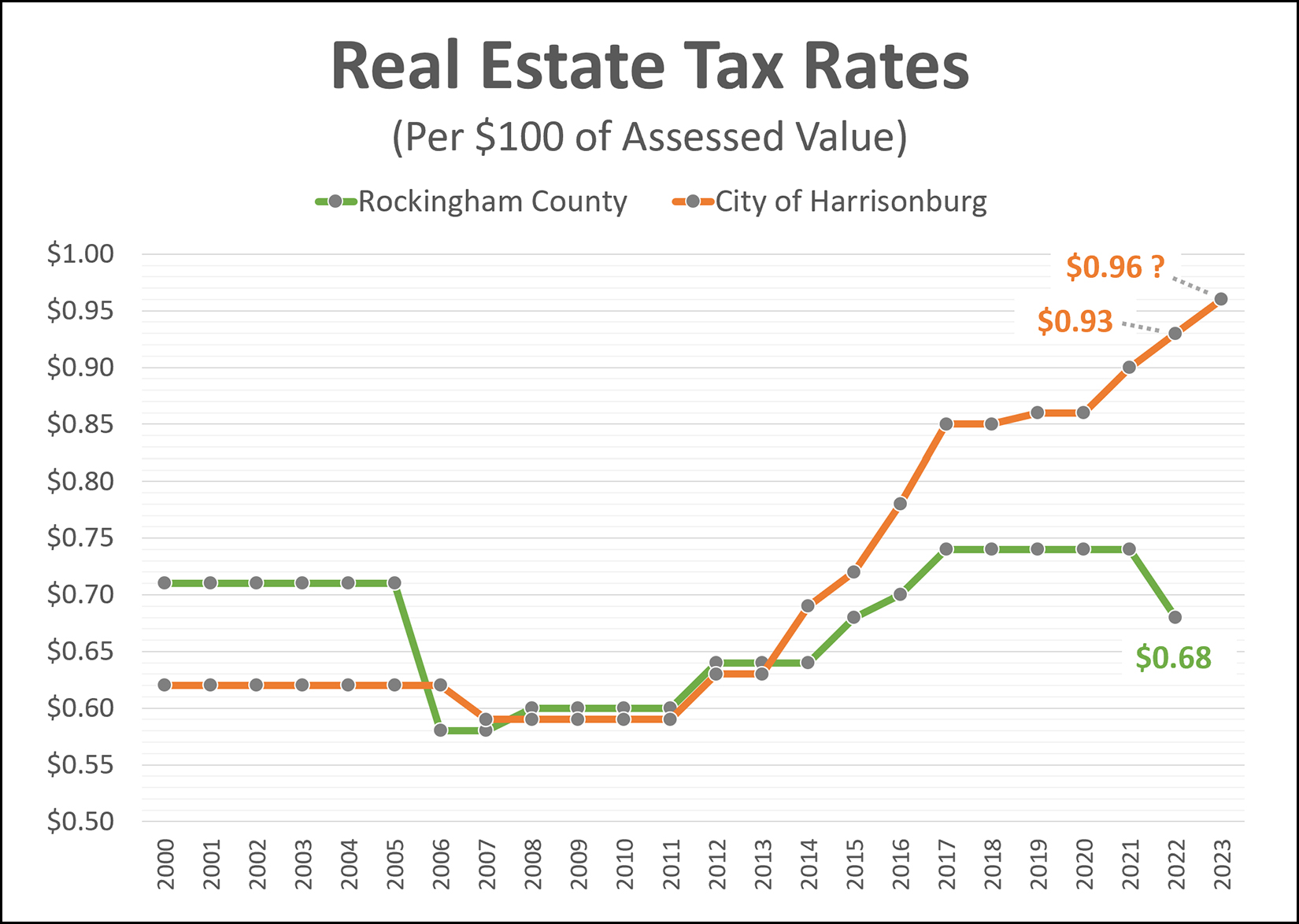

Harrisonburg Considers An Additional Increase In The Real Estate Tax Rate |

|

It's that time of year again... the City of Harrisonburg must decide how much money it can, will or must spend... and where that money will come from. City Council met last week and began to discuss a draft budget for Fiscal Year 2023-2024 presented by City staff. You can read more about the meeting and discussion here. You can view the draft budget here. In summary... the City is planning on a budget of around $362M in FY24, which is about a $27M increase from FY23. Where does all of that money come from? A variety of sources, including these top four funding sources... 34% from real estate taxes 11% from personal property taxes 11% from sales taxes 11% from restaurant food taxes The amount of real estate taxes collected (to fund the budget) depends on... [1] the value of real estate in the City [2] the real estate tax rate The planned budget includes (as shown on the graph above) a $0.03 increase in the real estate tax rate, from $0.93 to $0.96. What impact will this 3% increase in the real estate rate have on owners of real estate in the City of Harrisonburg? The median sales price of homes sold in the City of Harrisonburg over the past year was $255,000. Real estate taxes with a tax rate of $0.93 on this $255K home would cost a homeowner $2,371.50 per year. Real estate taxes with a tax rate of $0.96 on this $255K home would cost a homeowner $2,448.00 per year. So... a $76.50 increase per year... or about $6.38 per month. Two important notes related to these calculations... [1] The $255K figure of the median sales price is not necessarily perfectly aligned with the median tax assessed value of all residential properties in the City. The $255K figure is based on their sales prices... not the assessed values... and just of the homes that have sold... not all homes that exist. [2] The median sales price has increased 12% in the City of Harrisonburg over the past 12 months. This may mean that assessed values will rise when properties are next assessed by the City, which would result in a further actual increase in real estate taxes based on new assessed values. Finally, two other general notes... [1] For anyone wondering what the City spends $362M on in a year, the "Budget in Brief" document found on this page is a very helpful summary of the City budget. [2] From the article on The Citizen linked above (and here)... "This tax increase is a continuation of the city’s plan to raise that tax by 10 cents over three years to pay for the new Rocktown High School, which is expected to cost about $100 million." Recent Articles:

| |

| Newer Post | home | Older Post |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings