Archive for August 2023

August Contract Activity Was Slower Than In Recent Years |

|

We are seeing fewer home buyers signing contracts to buy homes right now... compared to the past few years. The graph above shows the numbers of homes that went under contract in the first 28 days of August for each of the past six years. The 101 contracts signed in the first 28 days of August 2023 is decidedly lower than the contract activity seen in August 2020, 2021 and 2022 -- though most of those years were much more active than normal given COVID-induced buyer enthusiasm and super low mortgage interest rates. As such, it is not totally surprising to see us return to around 100 contracts signed in August, which is the average of how many we saw in August 2018 and August 2019. With mortgage interest rates around 7% right now, I expect we will continue to see slower months of contract activity as we continue into and through the fall months of 2023. | |

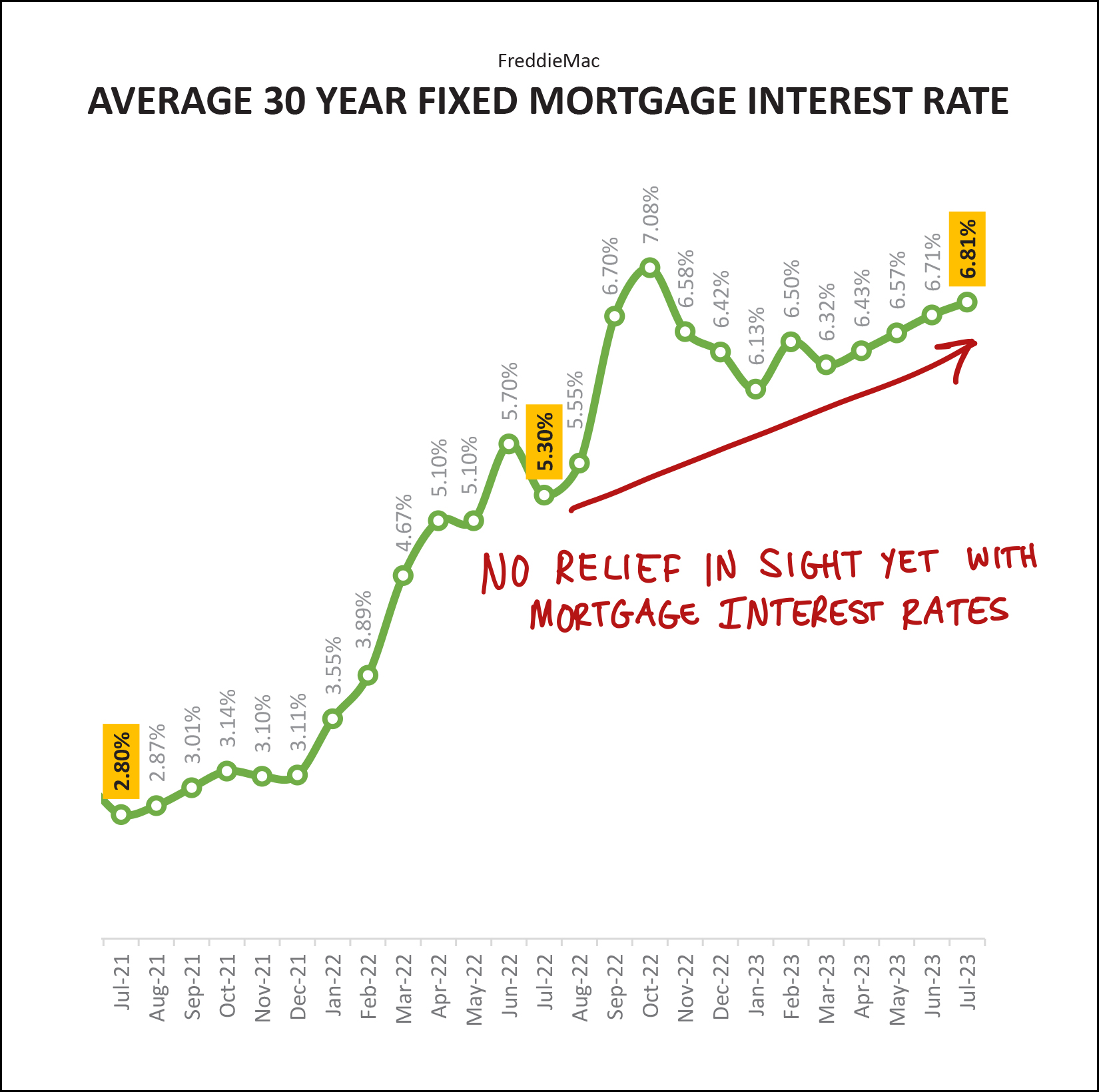

Yes, Mortgage Interest Rates Are Still High. |

|

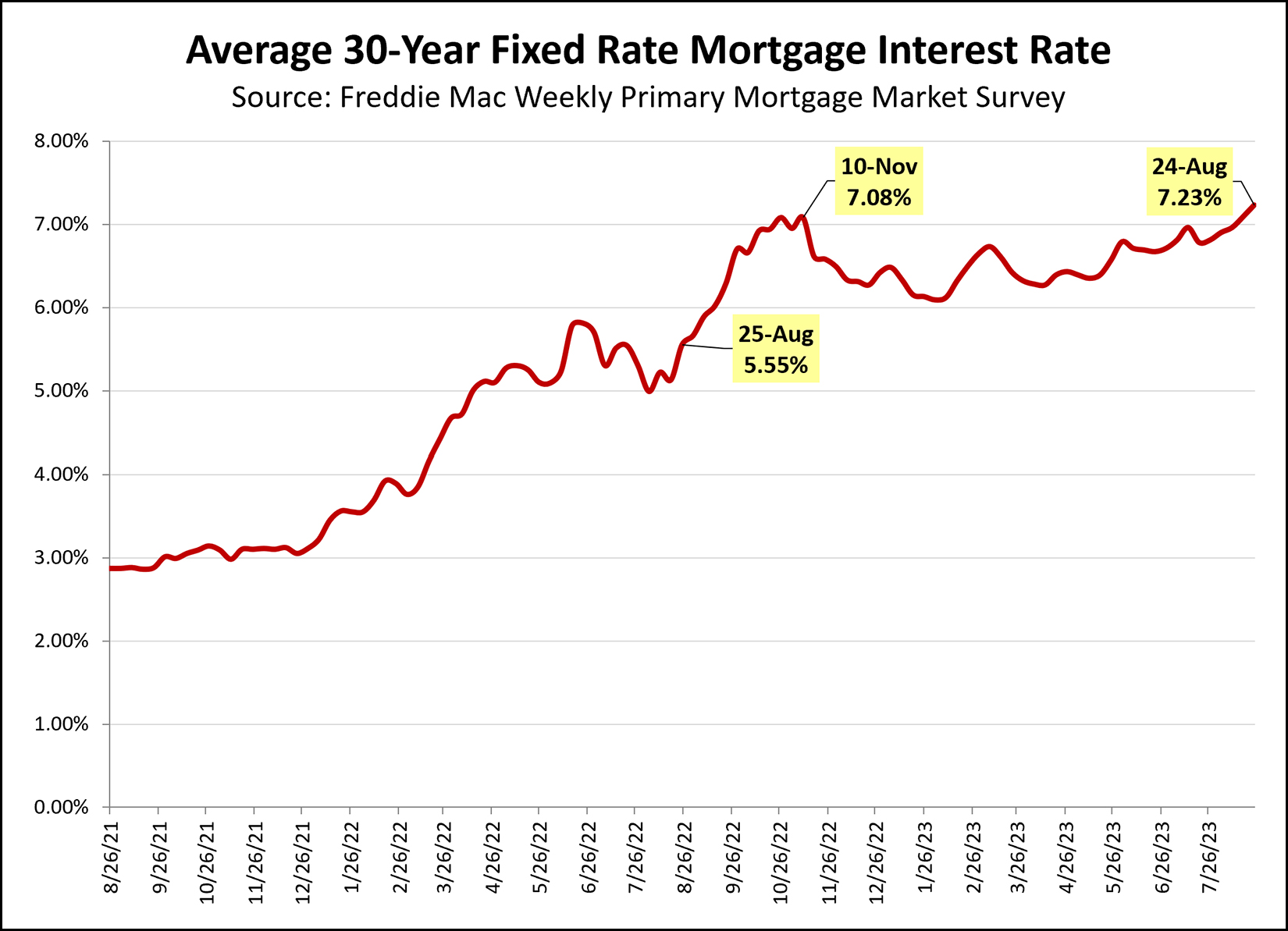

The current average 30 year fixed mortgage interest rate is 7.23%. That is the highest it has been in over 20 years. Actually... 22 years, it seems. The last time it was higher was back in June 2001 when it was 7.24%. What lies ahead? Per this NY Times article... "Economists predict that mortgage rates will remain elevated for at least a few more months. And even when they start to come down, they are expected to settle well above the 3 percent rates that home buyers enjoyed during the early stages of the pandemic." ...and... "The Mortgage Bankers Association, an industry group, recently forecast that the average 30-year mortgage rate would fall to 5 percent by the fourth quarter of next year." So... hopefully these historically high mortgage interest rates (that followed some historically low mortgage interest rates) will eventually start to decline again... but we're not seeing it yet. | |

Yes, We Seem To Be Back In A Time When Some Offers Might Be Under The Asking Price |

|

Many homes are still going under contract quickly, often with multiple offers. But not all homes. I know it's hard to believe after the past few years of craziness in our local real estate market -- but some homes are actually going under contract below the list price. Between 2020 and 2022: You want to pay less than list price!? Ha ha ha ha ha ha. You're so silly. Now: Let's see whether they have had many showings and if they have any offers. If a few days or a few weeks have passed and the house is still available, yes, we may very well be successful with making an offer under the list price. That's all on the buyer side. On the seller side... it's more important than ever to price your property appropriately for the market. | |

Home Buyer Demand Is Becoming Much More Variable By Price Range, Property Type And More |

|

Between 2020 and 2022, despite record levels of buyer demand, I would still tell sellers... We can't know for sure how much buyer demand will exist for your home until it is actually on the market and we can see how many times it is being viewed online, how many people are driving by to look at your home, how many people are scheduling a showing etc. During those three years (2020-2022) it seemed that regardless of the property type, location, price, condition, etc., once the house was listed for sale we would have lots and lots of showings and multiple offers. Detached home i great condition with main level master bedroom = 10+ buyers ready to buy. Older home that hasn't had any renovations or updates in 25 years = 10+ buyers ready to buy. Townhouse with small bedrooms = 10+ buyers ready to buy House on a busier than average road = 10+ buyers ready to buy House with a steeper than average driveway and yard = 10+ buyers ready to buy For a few years there, regardless of what home you were selling, you could count on there being plenty of buyers, right out of the gate, and your home would almost certainly be under contract very quickly. This seemed to have been partly related to buyer demand far exceeding the supply of homes for sale -- and perhaps even more significantly -- related to super low mortgage interest rates. Now, home buyer demand is much more variable by price range, property type, size, location, condition, and much more. You can no longer count on absolutely and certainly having lots of showings and multiple offers within a week. Some sellers will still see this. Some particular combinations of property type, location, price range, condition, features are still resulting in lots of early interest and the potential for multiple offers. These sellers don't think the market has changed. ;-) Some sellers will definitely not see this. Some properties will have some early interest -- but no offers -- or very little early interest. What should such a seller do? First, don't panic, it's not that nobody wants to buy your home. Second, be patient, let some time pass and see if you start seeing enough traffic (online views, drive bys, showings) to suggest you'll receive an offer. Third, consider adjusting the price (at some point) to attract further buyer interest. To those sellers who have not yet listed their home for sale -- we won't actually know what camp you'll be in (early offers vs. no early offers) until your house is on the market for sale. | |

Fewer Home Sales, But Prices Are Rising!? More Contracts But Inventory Levels Are Rising!? |

|

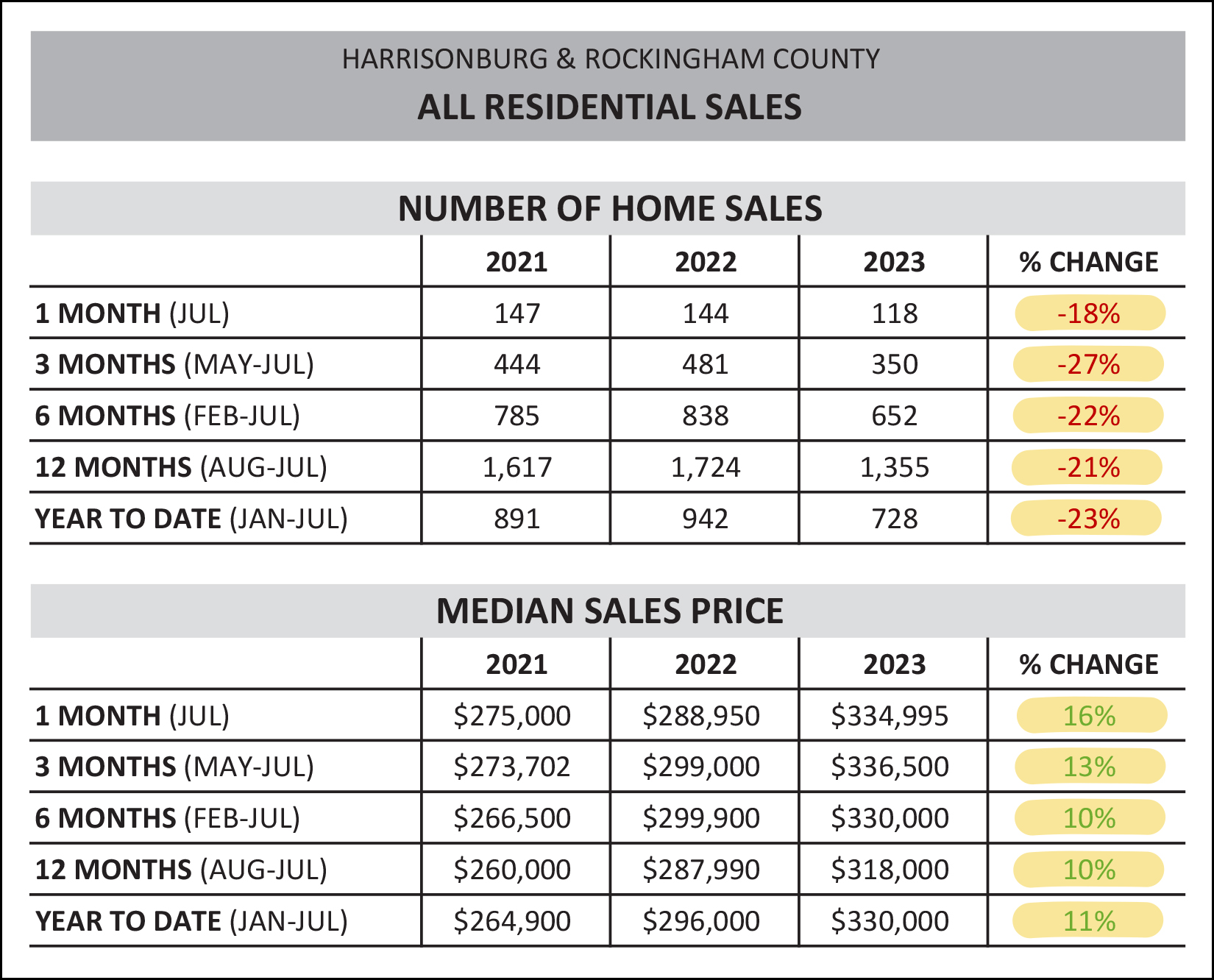

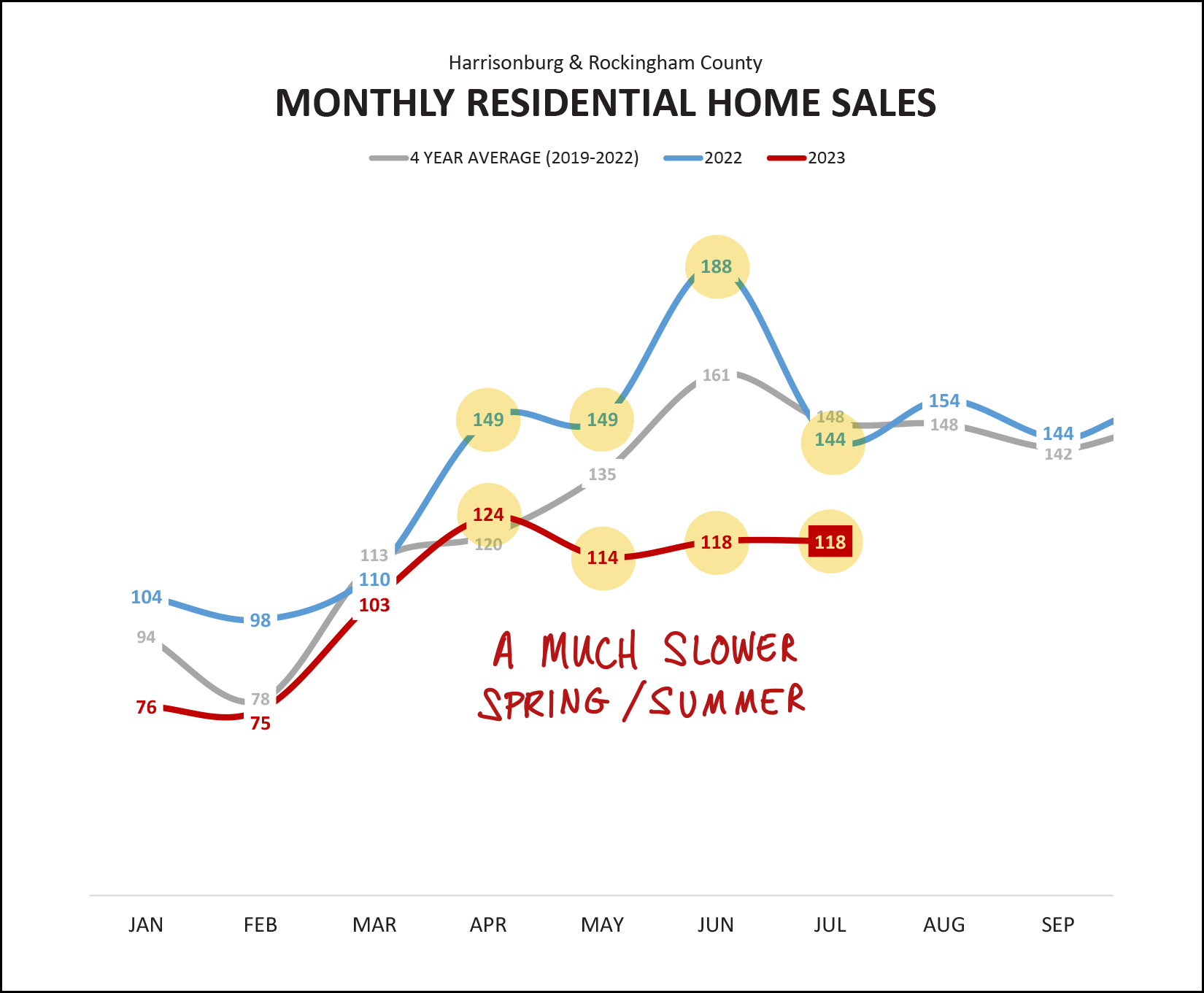

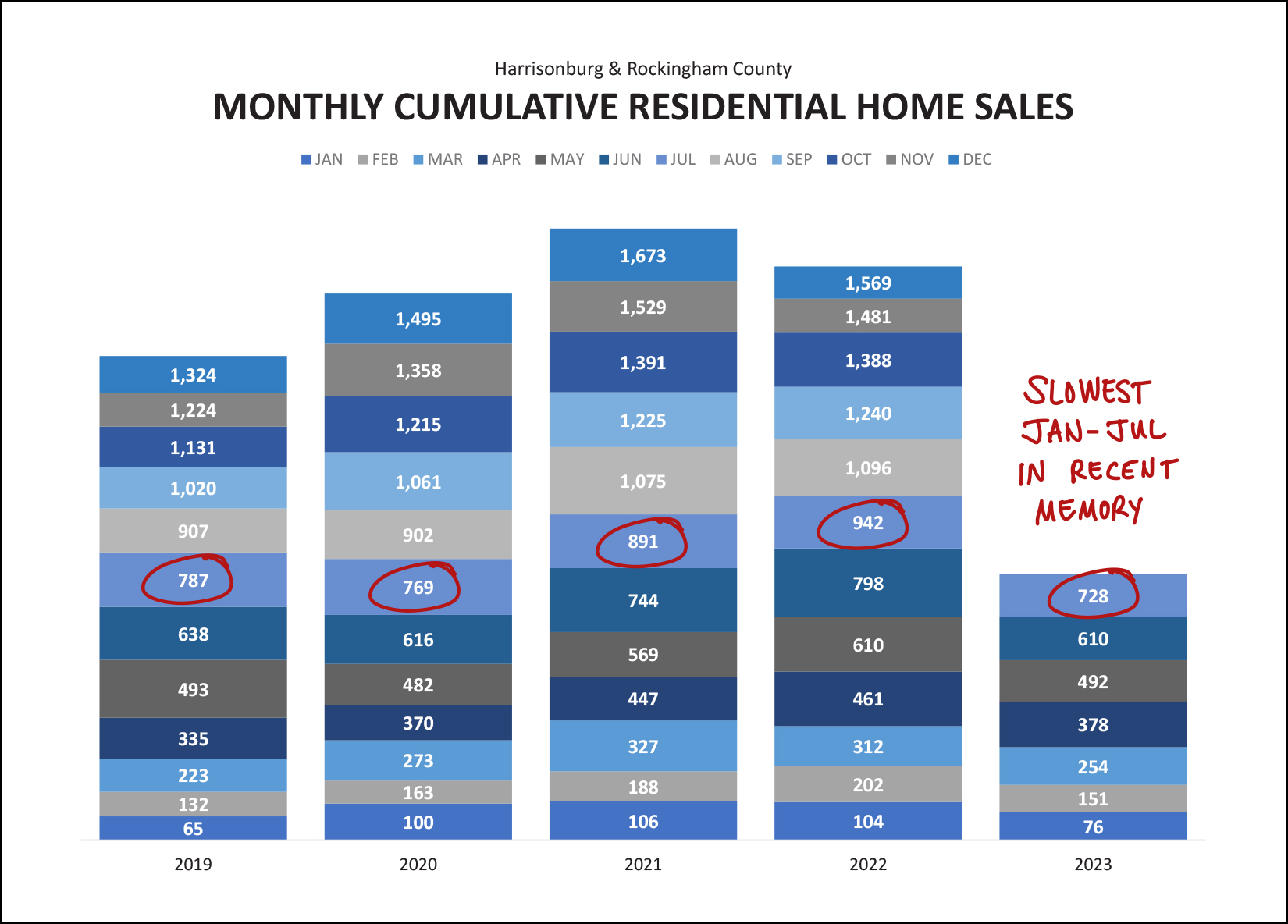

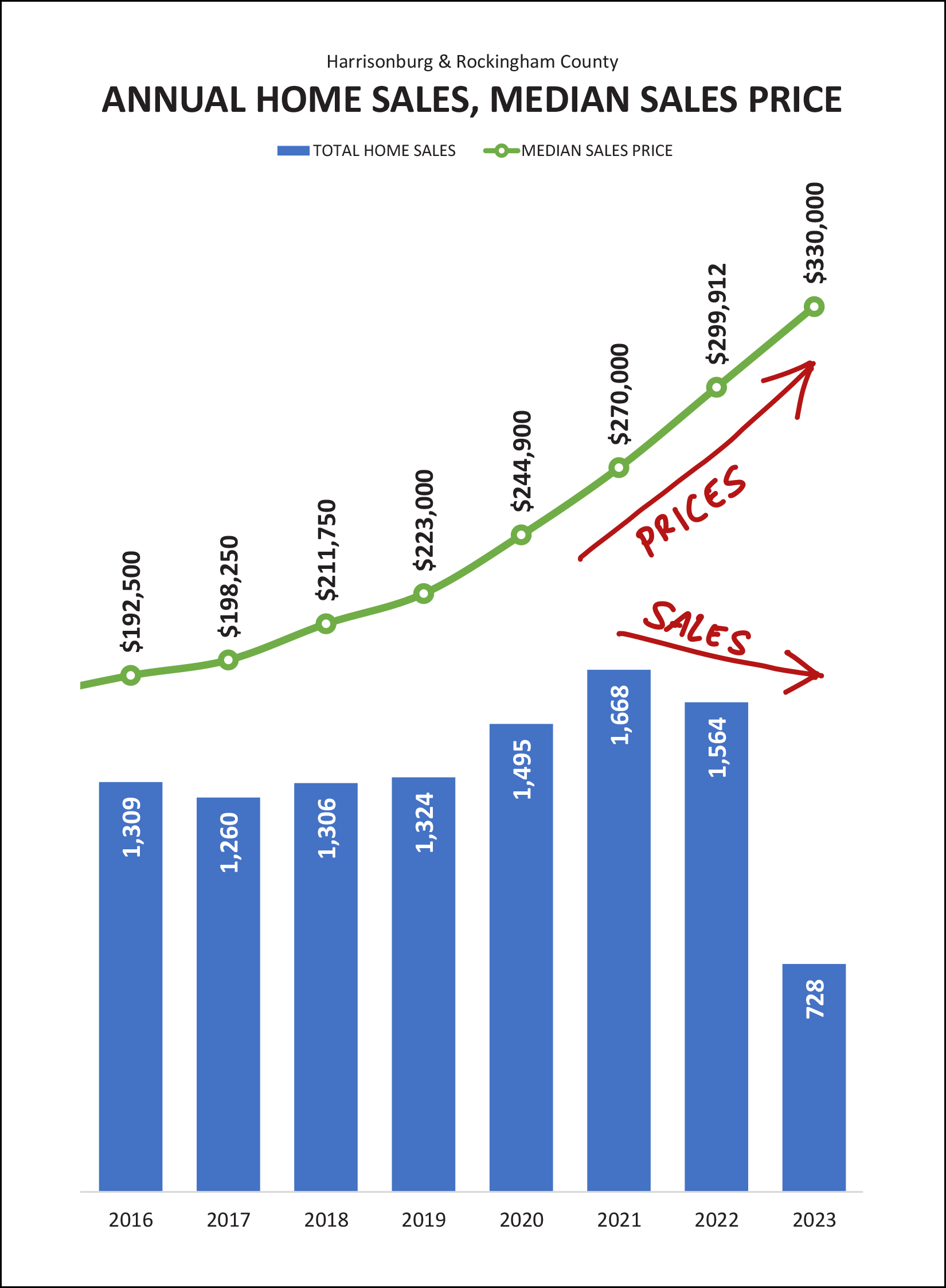

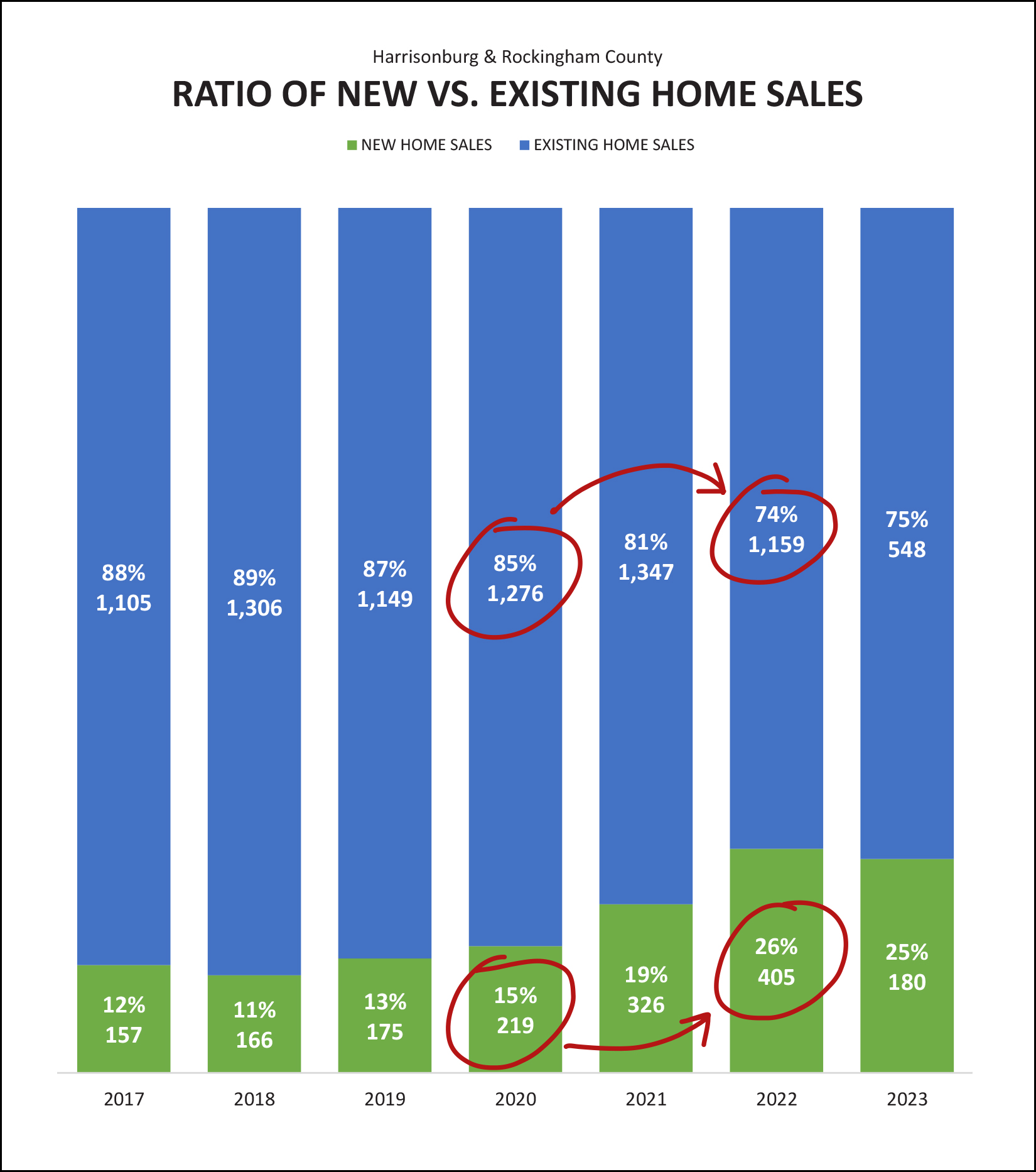

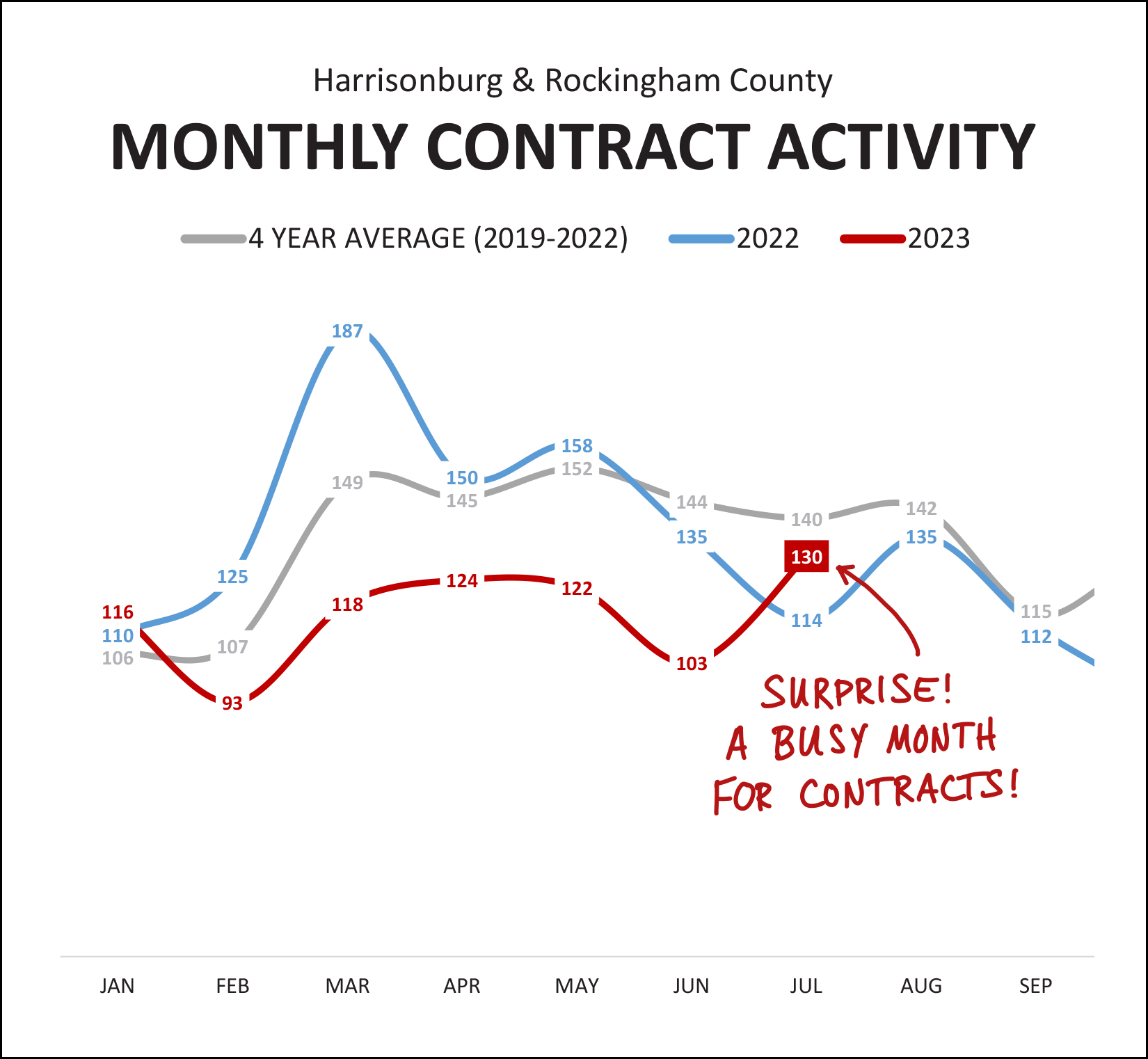

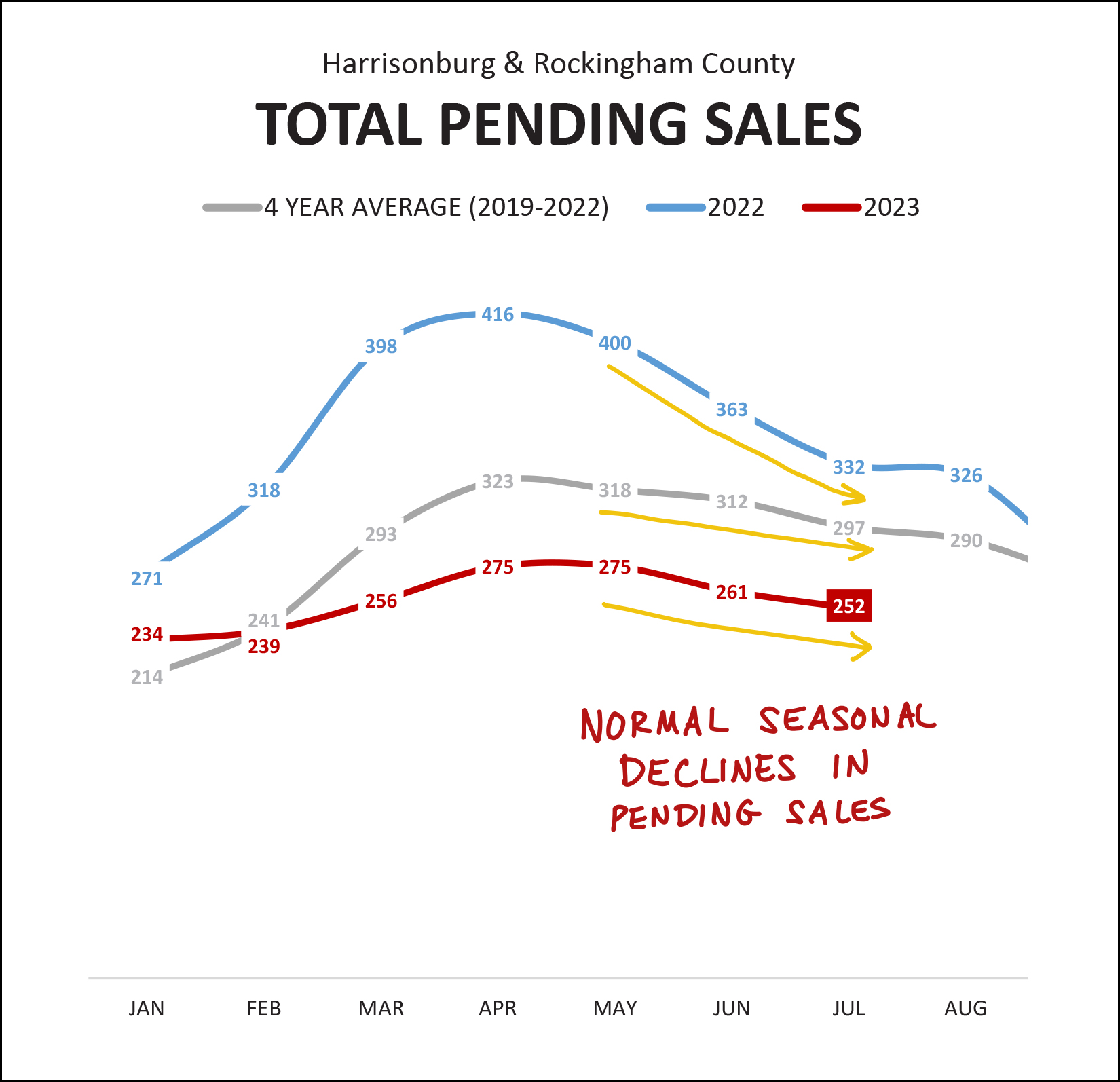

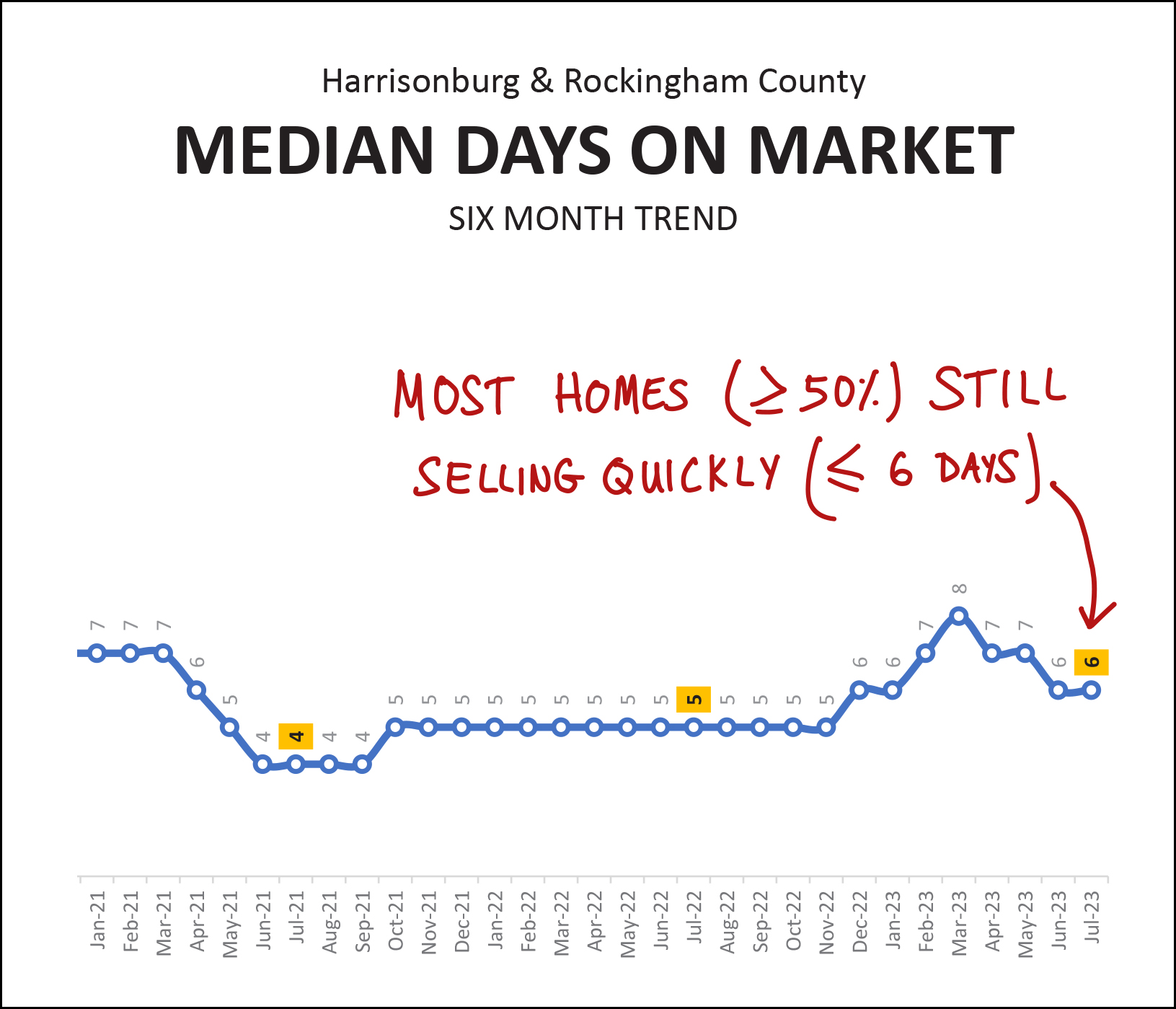

Happy Monday afternoon to you, friends! This monthly market report is one of some enigmas, some contradictions, some puzzlement. Some of these will be familiar, some new, some unrelated to real estate... [1] How can it be that we are seeing fewer home sales, but higher prices!? [2] So, contract activity is increasing, but inventory levels are also rising!? [3] How can I feel so young, yet have a son heading off to college this Friday!? :-)  Indeed, Luke heads off to Wake Forest University this Friday! We are tremendously excited for this next step in his life and educational journey, but we will miss him and his friends greatly as they head off in new directions. Swiveling quickly back to real estate before I spend too much time thinking about the aforementioned major life transition (!!) I'll point you towards a few of my current listings that might be of interest... 9926 Goods Mill Road - A spacious home / farmette on 3.3 acres with wonderful mountain views in the Spotswood High School district. $585,000. 150 Autumn Bluff Drive - A like-new, upscale, custom-built, single-level home in Autumn Breeze on a large corner lot. $445,000. 1210 King Edwards Way - A four bedroom home in the City with an attached two car garage and a large back deck. $389,500. 3211 Charleston Boulevard - An upscale townhouse in Preston Lake with a two-car garage with access to many amenities. $375,000 Congers Creek Townhomes - Three-level, new construction townhomes across Boyers Road from Sentara RMH Medical Center. $306,900 and up. And finally, before we get to the real estate data... Each month I offer a giveaway, of sorts, for readers of this market report, highlighting some of my favorite places, things or events in Harrisonburg. Recent highlights have included Jimmy Madison's, Red Wing Roots tickets and The Little Grill. Now, then, on to the data. You can likely skim this chart of data rather quickly to get a sense of what I'm going to say...  Regardless of the timeframe outlined above... [1] We are seeing fewer homes selling now than in the recent past in Harrisonburg and Rockingham County. Year to date (Jan-Jul) we have seen a 23% drop in the number of homes selling as compared to last year. [2] We are seeing higher and higher sales prices in Harrisonburg and Rockingham County. Year to date (Jan-Jul) we are seeing a median sales price that is 11% higher than a year ago. Here's a month-by-month visualization of those slower sales we're seeing this year...  The grey line above shows the average number of home sales per month between 2019 and 2022. You'll note that a typical trend is to see more and more home sales (closings) as we move from April through June before starting to see things decline a bit in July. The blue line above shows last year, when April, May and June were well above where we might have expected them to be. Then, there's this year... the red line. We just haven't seen the typical boost in home sales during April, May and June that we would usually expect to see. In fact, July was the third month in a row of between 110 and 120 home sales. So, this year is not a typical year. We are experiencing a much lower spring and summer in the local real estate market. Why, you might ask? Likely because of mortgage interest rates -- which are quite a bit higher than over the past few years -- and because there aren't as many homeowners selling their homes. Stacking all of those months on top of each other, you can see how this year compares to previous years, thus far...  Clearly, this year seems unlikely to come anywhere near the level of sales seen over the past few years (2021 and 2022) and we're likely to finish out the year with fewer home sales than in 2019 and 2020 as well. Here's an illustration of that puzzling increase in sales prices and decline in the number of homes selling...  This is, as some of you would undoubtedly point out, both puzzling... and not. Typically, if demand decreases, sales decrease, and prices decrease. But despite fewer home sales (as shown above) we are not seeing prices decline. Which means... we are not seeing a net overall decrease in demand... but rather... a decrease in supply. So long as home prices keep climbing, I think the decrease in the number of home sales can be almost entirely attributed to fewer sellers selling. Given fewer homeowners being willing to sell, we're likely going to need new construction homes to fill in the gap to help meet buyer demand...  Overall, over the past few years, we have seen new home sales (green bars above) increasing. After only 219 new home sales in 2020, that climbed to 405 in 2022... leading to one in four (26%) homes selling being new homes. We are still seeing similar (75% / 25%) numbers this year. During that same timeframe (2020-2022) we saw a decline in existing home sales... from 1,276 existing home sales in 2020 down to 1,159 existing home sales in 2022. I expect we will see even fewer existing home sales in 2023 based on data from the first seven months of this year. Now, here comes a surprise this month...  Last year we saw a month after month decline in contract activity as we moved from May through July. This year we started to follow that same trend as we saw fewer home sales in June that in May. But, then, July. Contract activity was quite a bit higher than I expected it would be in July 2023. In fact, this was the month with the largest number of contracts signed thus far in 2023. And yet, two other indicators keep me scratching by head a bit...  Despite that uptick in contracts being signed in July 2023... the number of pending (under contract) homes followed its normal seasonal trend of declining slightly between May and July. There are (as shown above) 252 homes under contract in Harrisonburg and Rockingham County right now... which is lower than a month ago (261) and lower than a year ago (297). Furthermore...  Despite lots of homes going under contract in July... inventory levels jumped up quite a bit (131 to 177) in a single month's time. This brings current inventory levels to the highest point that we have seen anytime in the past year. I'll take a closer look at some of these overall trends in the coming days to try to dial in whether there is another story to be told and understood. For now, it's clear that there are quite a few more listings on the market now than anytime of late. Moving through the next few months, it will be interesting to watch... [1] Will inventory levels bounce back downward after buyers have a chance to contract on some of these new listings? [2] Will we see more price reductions on listings as sellers have slightly more competition from other sellers in some price ranges and with some property types? [3] Will we see homes staying on the market longer than they have in the past? I don't know that we need to instantly jump to any conclusions about this increase in inventory levels, but the data over the next few months will help color in the picture of whether we are seeing any sort of a transition in our local housing market. Speaking of median days on the market... is it starting to rise?  Mmmm... nope. Most homes (at least half of them) are still going under contract very quickly (in six days or less) in Harrisonburg and Rockingham County. This metric will continue to be helpful to gauge whether buyer enthusiasm is slowing at all in the local market. What could slow buyer enthusiasm, you ask? How about those mortgage interest rates!?  Don't look too far back on the chart above or you'll note that 2.8% mortgage interest rate two years ago. Wow! Even if we ignore the first year (first half) on the chart above, we still see a significant increase in mortgage interest rates over the past year... from 5.3% to 6.8%. We still aren't seeing any relief in sight with mortgage interest rates. Yet. I am hopeful that we move through the remainder of 2023 we'll start to see mortgage interest rates settle down a bit... but I'm guessing they will almost certainly stay above 6%. So, given all of the data above, what should you be thinking about if you are a home buyer, seller or owner? Home Buyers -- Many new listings are still seeing plenty of action... so you very likely may still find yourself in a competitive offer situation... but not always. Understand how current mortgage interest rates affect your potential monthly mortgage payment... and get out there quickly to see new listings. Home Sellers -- You might talk to friends who saw their home go under contract within three days with multiple offers. You might talk to other friends who have had their home on the market for three or four weeks without an offer. Both of those market realities currently exist... and it varies based on price range, property type, location, and many other factors. We need to take a close look at your corner of the local real estate market to devise a reasonable and realistic pricing and marketing strategy for selling your home in a timeframe that suits your needs. Homeowners -- Enjoy your ever increasing home value. If you're talking to a friend who is trying to buy a home, don't mention your mortgage rate, or how glad you are that you already own a home. ;-) And... that's all for today. I hope that the remaining days or weeks of your summer break (if you had one) are enjoyable, and that the start to the school year goes well for you if you are a parent, teacher or administrator. As always, feel free to reach out to me if I can be of any assistance to you as you make plans to buy or sell. You can reach me most easily at 540-578-0102 (call/text) or by email here. | |

Adjusting Our Thinking About Time On Market |

|

For the past three years we have seen most homes going under contract very quickly. The median days on market (# days between list date and under contract date) has been at or below seven days for 33 out of the past 36 months. But now, some properties seem to be lingering on the market a bit longer than they might have over the past few years. A few related thoughts come to mind based on recent conversations with a variety of sellers, future sellers and fellow agents... [1] The median was always just the median - not the all. :-) When the median days on market was five days -- which it was for about a year -- that didn't mean all homes were going under contract within five days -- it meant that at least half of them were. Thus, there were plenty of homes that were taking longer than five days to go under contract. [2] In the six months leading up to the start of the Covid-19 pandemic, we were seeing median days on market between 14 days and 21 days. As such, if (or when) we see the median days on market figure start to drift upwards there is a lot of room for it to rise before it gets to levels we were seeing prior the past 3.5 crazy years. [3] Flipping backwards five (and six) years -- the median days on market was 29 days (in the 12 months leading up to and including July 2018) and was 42 days (in the 12 months leading up to and including July 2017). [4] It will be a jarring reality for some (or many) home sellers over the next few years if it is taking a month or two for houses to go under contract -- instead of just a week or two. [5] If or as the market continues to adjust relative to how quickly homes are going under contract -- we are going to have to adjust our thinking about "time on market" -- and realize that just because a house isn't under contract within a week, or two, or three -- that doesn't mean it's a terrible house that nobody will ever want to buy. | |

Two Startling (Nationwide) Stats That Show Why Many Homeowners Are Not Likely To Sell Within The Next Few Years |

|

Current mortgage interest rates for a 30 year fixed rate mortgage are averaging at 6.9% per Freddie Mac. Here are the two startling statistics as reported by Business Wire as well as by many others over the past few months... [1] 82% of homeowners have a mortgage interest rate below 5%. An enormous share of homeowners have super low mortgage interest rates on their homes because they bought their home between 2020 and 2022 when we were seeing ridiculously low, historically low, mortgage interest rates -- or they refinanced their mortgage during that time. Most of these 82% of homeowners with a mortgage interest rate below 5% are rather unlikely to sell their home (and pay that off) and buy a new home at current mortgage interest rates that are near 7%. [2] 60% of homeowners with mortgages have lived there for four years or less. We saw record numbers of home sales between 2020 and 2022, as the Covid-19 pandemic (and super low mortgage interest rates) prompted lots of folks to buy a home. Many homeowners eventually find that their home doesn't work as well for them -- based on size, layout, features, etc. -- but that doesn't usually happen within four years. As such, many or most of these 60% of homeowners who have been in their homes for less than four years are not likely to be selling anytime soon. What does all of this mean for our real estate market? We are likely to continue to see low numbers of resale homes coming on the market over the next few years as more homeowners opt to stay put rather than selling their home that likely has a super low mortgage interest rate - and that likely is a home they purchased in the past few years. | |

164 Apartments Proposed On Mosby Road As Affordable Housing, With More Likely To Be Proposed In The Future |

|

A developer out of Georgia, the Beverly J. Searles Foundation, is proposing to build a 164 unit apartment complex on West Mosby Road. The Harrisonburg Planning Commission will hold a public hearing related to this proposed development today, August 9, 2023. You can download the full packet of information to be reviewed and discussed at the planning commission meeting here. These are a few key points I have pulled out of the information packet... [1] The developer intends to build a "diverse and affordable residential community serving seniors and potentially workforce and other citizens qualifying for affordable housing options." [2] None of the apartments would have more than three bedrooms. [3] At least 25% of the apartments would be one bedroom apartments. [4] A minimum of 82 apartments would be age-restricted, such that at least one member of the household must be 55 years or older. [5] The developer plans to build some amenities that might include a dog run, gazebo, koi pond or picnic pavilion. A clubhouse would also be constructed with a minimum of 2500 square feet. [6] An important contextual note here is that the applicant (the developer from Georgia) is apparently intending to purchase around 28 acres of land that includes this 12 acres that they would like to rezone and develop right now. If the developer had proposed to rezone all 28 acres they would have been required to conduct a Traffic Impact Analysis (TIA) which would delayed the development beyond a timeframe when they could be elgible for the early Spring 2024 low-income housing tax credits. As such, the applicant is only requesting that 12 of the acres be rezoned... though the applicant seems likely to be returning in the future to request that the other 16 acres be rezoned as well for further development. City Staff is supportive of this application for a rezoning (and special use permit) and the Planning Commission will hold a public hearing regarding the proposal this evening. | |

119 Apartments, Convenience Store, Restaurant Proposed At Intersection Of Port Republic Road and Devon Lane |

|

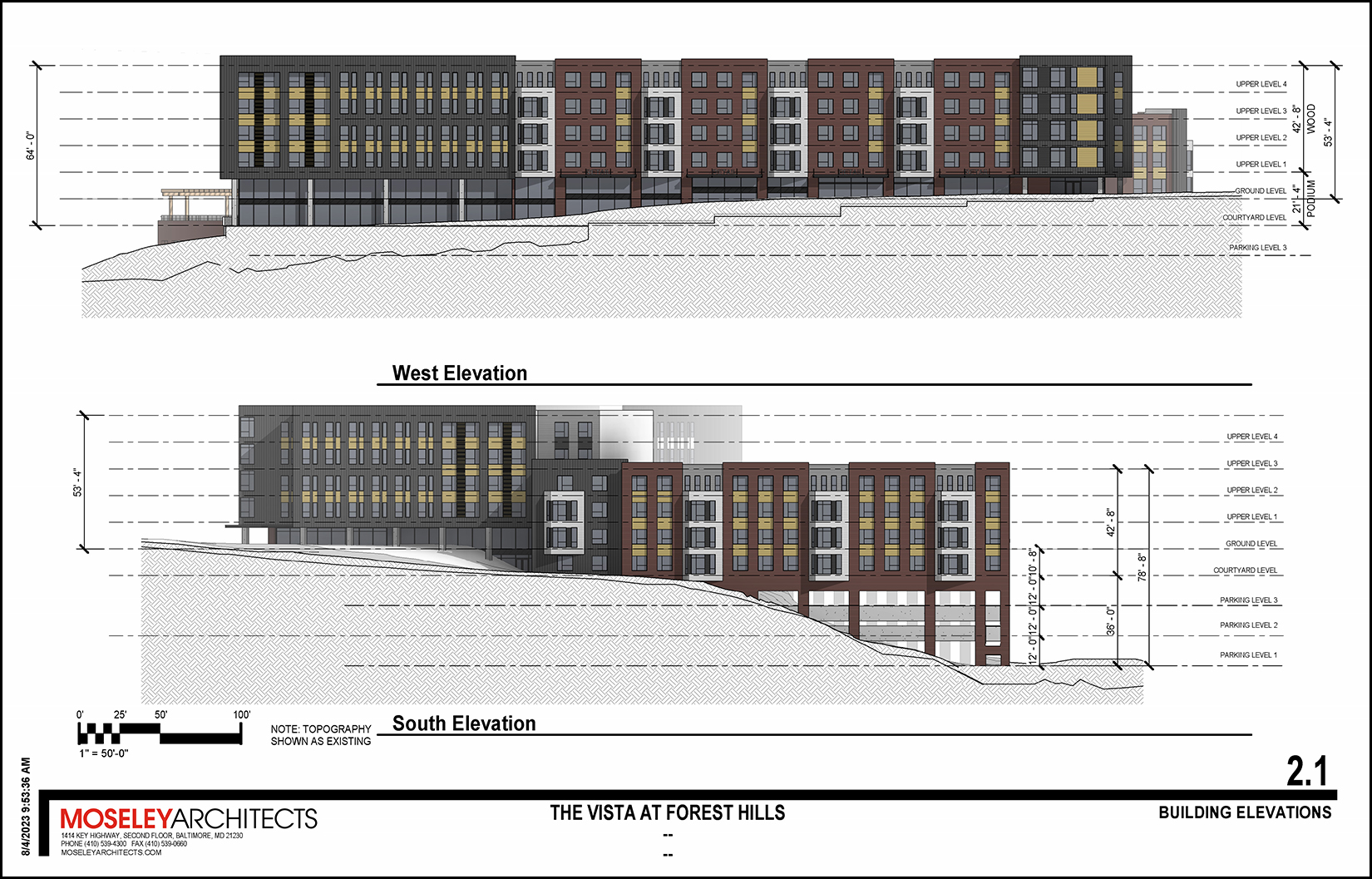

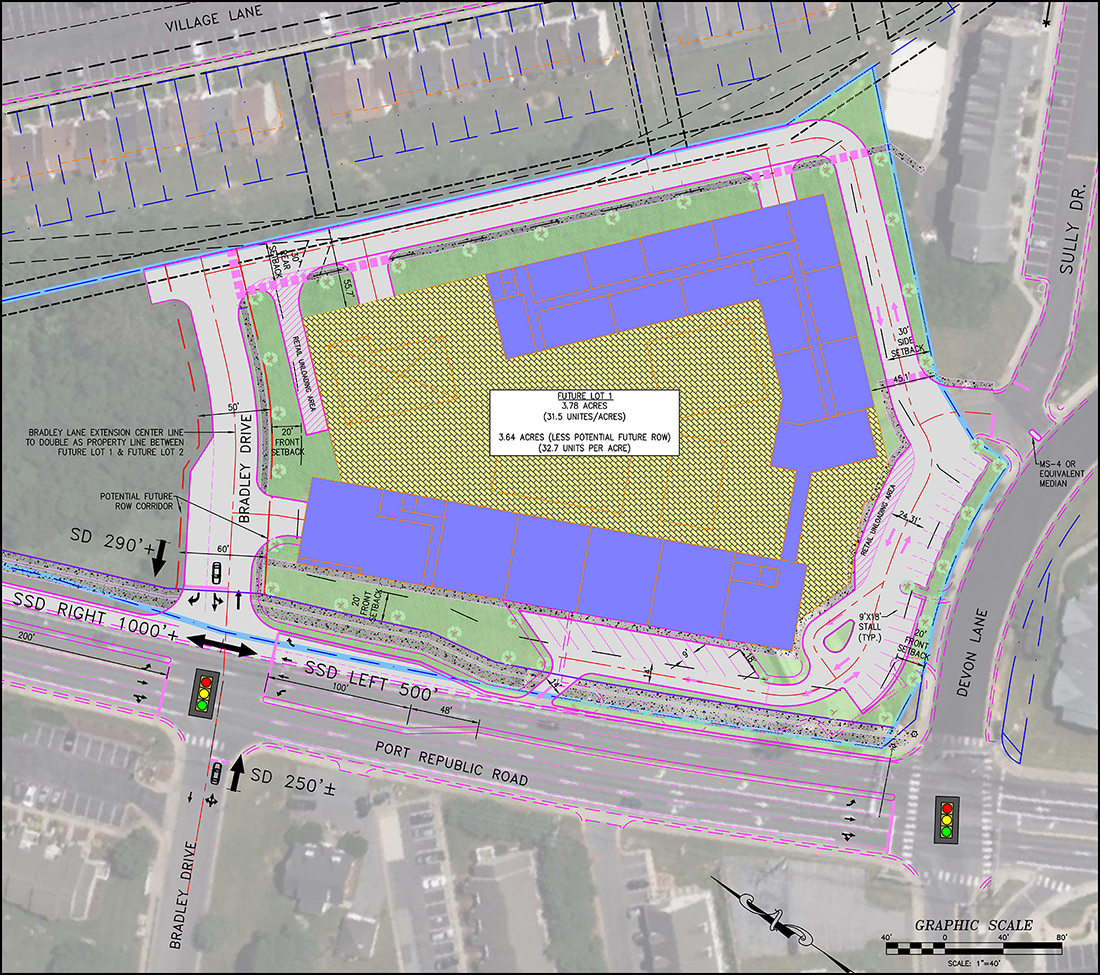

A new development, The Vista at Forest Hills, is being proposed at the intersection of Port Republic Road and Devon Lane, at the current location of a Citgo gas station. The applicant would like to redevelop the site to include a convenience store, restaurant and 119 student apartments. Per the letter from the developer's engineer... [1] The student apartments would consist of no more than 440 bedrooms. [2] The development would have up to three floors of parking garages. Here's another rendering of the proposed structure, from another angle... For one more vantage point, here are two elevations showing how the building will work with the grade of the site... Finally, here's the site plan where you can see how this parcel relates to Port Republic Road, Devon Lane, Bradley Drive and Village Lane... A public hearing will be held on August 9th (Wednesday) related to this proposed development during the City of Harrisonburg Planning Commission meeting. This proposed development would require both a rezoning and a special use permit. Per the Planning Commission packet, City staff has significant concerns about this proposed development regarding "compliance with the SUP development plan requirements and matters associated with the maximum height and minimum setback requirements, parking lot landscaping requirements, and questions regarding proffer statements." Staff is recommending that the Planning Commission hold the public hearing on August 9th but then table the request until their following meeting to allow staff to complete more analysis of the proposed plan and provide further feedback to Planning Commission. | |

How Often Are We Seeing Multiple Offer Scenarios These Days? |

|

Pre-COVID, multiple offer scenarios were the exception not the rule -- we would see them from time to time, but not often. During most of 2020, all of 2021 and much of 2022, multiple offer scenarios were the norm. Nearly any property being listed for sale would have multiple offers within just a few days. Buyers were desperate to secure a contract on a house and were including escalation clauses, waiving contingencies, and more, just to try to be the winning buyer. Now, mid-way (a bit more) through 2023, we are still sometimes seeing multiple offer scenarios, but not on all listings, and perhaps not on most new listings. So... BUYERS - You may very well have fallen in love with a house that is going to have multiple offers, so prepare for that and be ready to act quickly - but ask about other interest (and offers) before automatically including an escalation clause and/or dropping contingencies. SELLERS - You may very well be listing a home that buyers will fall in love with and that will have multiple offers, but that also might not happen. You should be super realistic (instead of super optimistic) when it comes to the pricing of your home, and then wait to see what the market response is once your house is listed for sale. I'm sure we'll still see a significant number of multiple offer scenarios moving through the remainder of 2023, but I don't think we'll see it on most/all listings any longer. | |

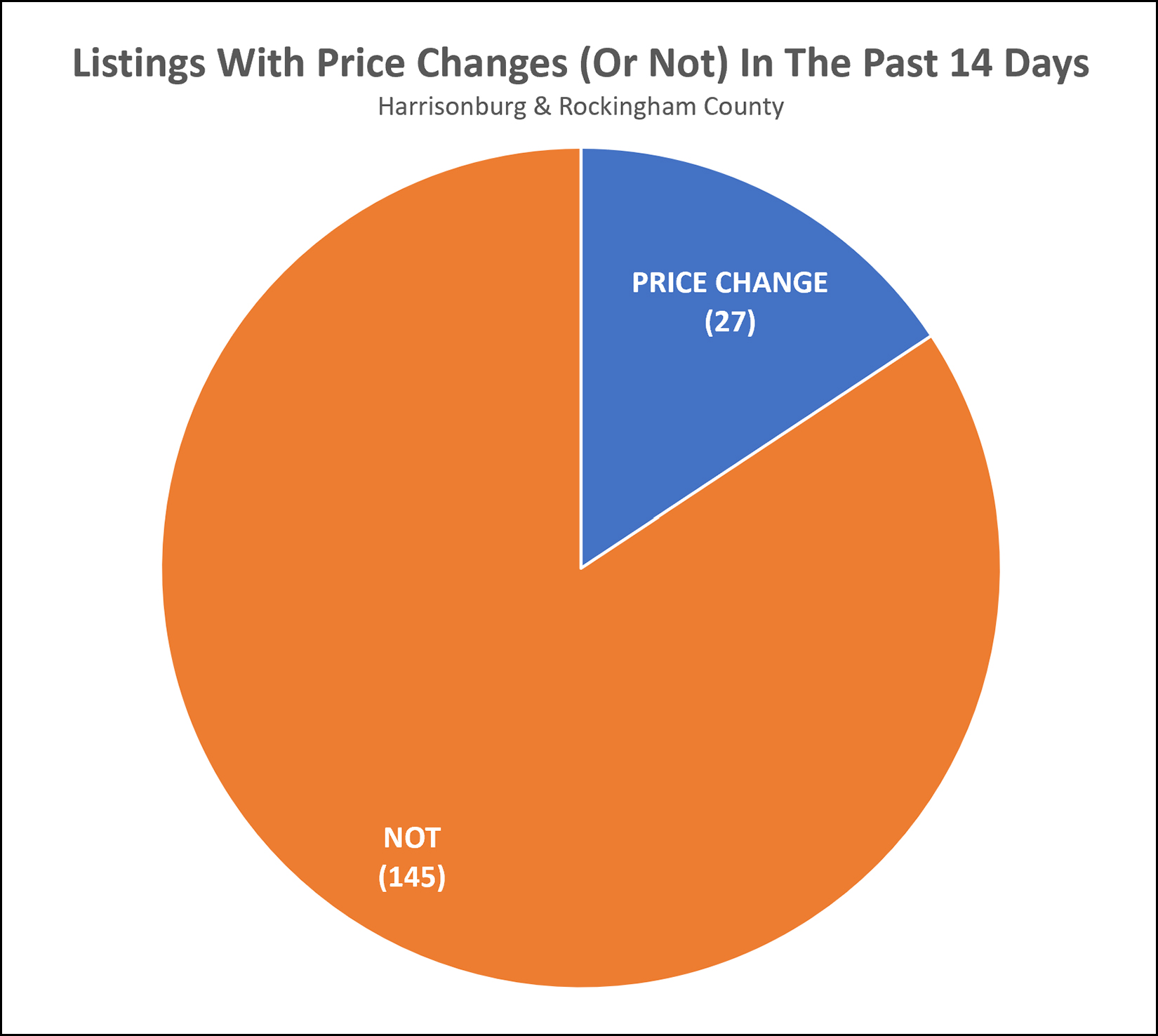

We Are Starting To See A Few More Homes With Price Changes These Days |

|

There are 172 active listings (homes for sale) in Harrisonburg and Rockingham County right now. Of those... 27 have had price changes in the past two weeks... and 145 have not. I don't think this number of price changes suggests that homes are selling for less... or that home prices are or will be declining... but some home sellers seem ready to start make adjustments in their asking price if their home is not going under contract as quickly as anticipated. | |

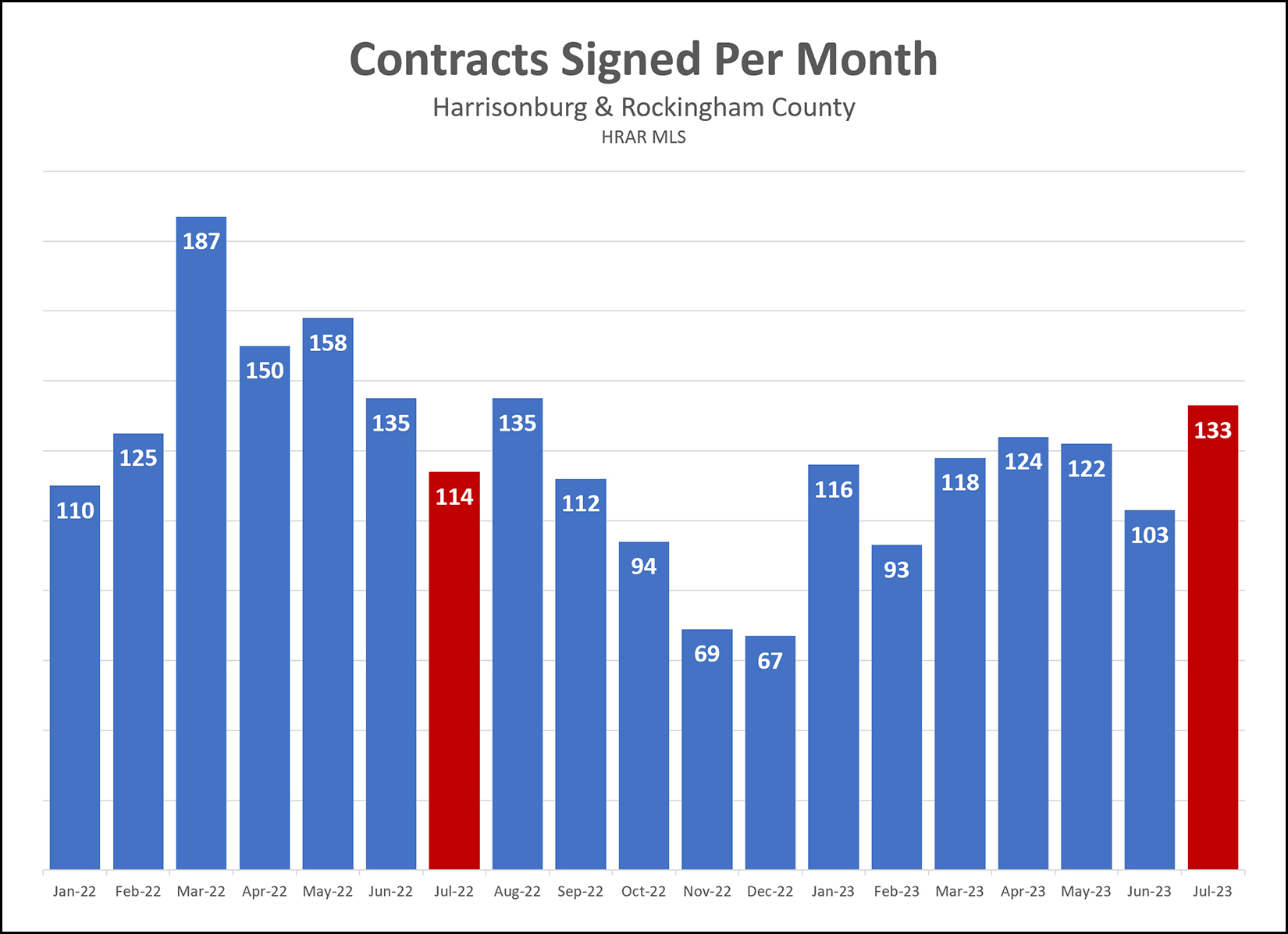

Quite A Few Home Buyers (And Sellers) Signed Contracts In July 2023 |

|

Looking back at the number of contracts signed last month in Harrisonburg and Rockingham County -- there were 133 contracts signed. These 133 contracts signed in July 2023 were... [1] The most contracts signed in a single month thus far in 2023. [2] About 17% more contracts than were signed last July. But... when you look (above) at all of last year and this year thus far, you'll see we never experienced the 150+ contracts per month that we saw last March, April and May. So, perhaps the pace of contract activity is picking up a bit as of last month... but we are still well behind where we were a year ago. | |

The Goldilocks Principle In Pricing Your Home To Sell |

|

Per Wikipedia... The Goldilocks principle is named by analogy to the children's story "The Three Bears", in which a young girl named Goldilocks tastes three different bowls of porridge and finds she prefers porridge that is neither too hot nor too cold, but has just the right temperature. Let's see how it applies to pricing your home to sell... Too High If recent comparable sales point to a value of $475K for your home... and you price it at $495K, you are unlikely to sell it quickly or for a great price, as you priced it too high. Buyers may come to view your home... but if they conclude that it is worth $475K, they'll be faced with a decision of whether... [1] to offer $475K (which will likely result in a counter offer from you that they will not accept), or [2] to offer $455K (which you likely won't counter at all), or [3] to not make an offer at all. Most buyers these days, in this market, don't make the offer at all. Thus, pricing your home too high, likely won't work out well for you. Too Low Arguably, this strategy isn't terrible, or at least not as bad as pricing your home too high. If recent comparable sales point to a value of $475K for your home... and you price it at $450K, you are likely to sell it quickly, but not necessarily at a great price. If there are enough buyers in the market when your home is listed for sale, perhaps you'll have multiple offers that will drive the price up to $475K or a bit higher... but if there is only one buyer in the market, they'll probably offer $450K and you be selling for less than you might have otherwise expected. Just Right This is right where we want to be. If recent comparable sales point to a value of $475K for your home, you should likely consider a list price somewhere between $472,500 and $479,500. Buyers who come to see your home in the first few days, or first week, will find it to be priced appropriate given recent sales, and will likely feel comfortable making a full price offer. Perhaps you are even more fortunate, and there are several buyers in the market and there are competing offers with escalation clauses. Your best strategy in the current market (and perhaps in nearly every market) is to price your home just right -- not too high, not too low -- just right -- in line with recent comparable sales. | |

280 Unit Rental Community, Stone Ridge Crossing, Proposed For North End Of Boyers Road |

|

Remember the north end of Boyers Road? It used to be connected to Route 33 but now it ends in a cul-de-sac. The proposed development shown above, Stone Ridge Crossing, is proposed for the west side of the north end of Boyers Road. The proposed developer of this parcel is requesting that Rockingham County rezone 27 +/- acres from A-2 (agricultural) to R-5 (residential) to allow for the construction of this apartment style development. According to the developer's Plan Description in the Rezoning Application Packet in the Planning Commission Packet for August 1, 2023 (tonight), the actual residences will be a mix of single family detached, duplex and townhouse style apartment housing -- but they will all be owned by, and rented by, a single entity. As such, this 280 unit residential developments would all be rentals... with none of the residences offered for sale. The developer intends to include a clubhouse fitness facility, swimming pool, and multiple picnic areas, fire pit and grilling areas, as well as pocket parks. Of the proposed 280 residential units, no more than 33% of the units would be 3-bedroom units and none would be 4-bedroom (or more) units. This proposed development would include up to 280 residential rental units, which would join the list of approximately 3,368 other rental units that are already under construction, approved, planned or proposed in the City Harrisonburg and/or in the areas of Rockingham County just surrounding the City. Here are all of the other potential upcoming rental developments on that list of 3,368 potential new rentals...

I imagine many people in our local community would probably prefer that a new 280 unit residential development would be single family detached homes, duplexes and townhomes offered for sale -- instead of for rent -- but the developer who is proposing the rezoning prefers to keep the residences and rent them to tenants. It will be interesting to see how the Rockingham County staff, Planning Commission and Board of Supervisors respond to this request. The Planning Commission will have a public hearing regarding this proposed rezoning tonight, August 1, at 6:30 PM. | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings