Archive for November 2023

Trying To Buy A Home... A Story Of Being All In, Then Bowing Out, And Now Being Ready To Jump In Again |

|

This seems to be the story of quite a few folks in Harrisonburg and the surrounding area. Some of these folks graduated from a local college or university in the past five years and have been working -- and renting -- since that time. Some of these folks moved into the area in the past five years and have been working -- and renting -- since that time. Many such local residents... ... were ALL IN during 2020 and 2021, trying to buy a house... but missed out on house house that had multiple offers. ... opted to BOW OUT in 2022 and 2023 as mortgage interest rates rose, which -- combined with rising home prices -- made potential mortgage payments seem unrealistically high. ... are now READY TO JUMP IN AGAIN in 2024. Here's why some of these local residents -- who are still renting -- seem ready to jump back in as a home buyer in 2024... 1. Waiting for home prices to correct or drop or decline even a little bit over the past two years has only resulted in two more years of increases in home prices. 2. Waiting for mortgage interest rates to drop back down to 3% or 4% is now broadly understood to be highly unlikely anytime soon. Though rates have been trending down (a bit) over the past few weeks. 3. Rental rates keep climbing in addition to home prices -- which means that the cost of not buying (renting) is also going up, rather quickly! It certainly isn't the right time for every renter to jump into buying a home, but plenty of folks who haven't bought over the past two years seem to be re-thinking that now. | |

Sometimes Upgrade Your Home (Selling And Buying) Results In An Even Larger Upgrade In Your Monthly Payment |

|

"Our house isn't working well for us anymore. We are thinking of selling it and buying a new house." Sounds good, but let's look at a few basic numbers first... You bought for $190K, put $20K down and have a mortgage payment of $955 per month thanks to a refinance a few years back at 3.5%. Your house is now worth $275K and you are thinking of selling it to move up to a house priced at $375K. When you sell your $275K house, you'll end up with about $90K in your pocket after closing costs and paying off the $170K balance on your mortgage. You'll spend about $10K of that $90K on closing costs for your purchase, so you'll put down $80K as a downpayment. You'll be borrowing $295K ($375K - $80K) and you'll be financing it at a current mortgage rate of about 7.25%. Your new monthly payment will be $2,392. Wait... what!? You're moving from a $275K house to a $375K house and your monthly mortgage payment is going to increase from $955/month to $2,392/month. Yikes! Why is this happening? [1] Your current mortgage payment is based on your initial purchase price of $190K... which is a good bit lower than your home's current value of $275K. [2] Your current mortgage payment is based on on a mortgage interest rate of 3.5%... which is a good bit lower than the current rate of 7.25%. [3] The costs of selling and cost of buying reduce the amount of equity that you can roll from one home into the next. So... before you dive right into upgrading your $275K house (with a $955/month payment) to a $375K house... let's run your version of the numbers above to help you determine your new potential monthly payment. | |

Despite Fewer And Fewer Home Sales, There Are Plenty Of Reasons Why Buyers Will Still Buy And Sellers Will Still Sell |

|

January 1, 2022 through November 20, 2022 = 1,445 home sales January 1, 2023 through November 20, 2023 = 1,082 home sales As of this week we have seen 25% fewer home sales this year than last! With fewer and fewer homes selling, sometimes it might feel like there aren't that many homes selling in our area. But yet, there are still plenty of reasons why buyers are still buying and sellers are still selling. Sellers are selling because:

Buyers are still buying because:

We are likely to close out 2023 with 25% fewer home sales than in 2022 -- and at this point it seems likely that we'll see even fewer in 2024 -- but there will always be some buyers buying and some sellers selling, even if not in as great of numbers as we have seen over the past few years. | |

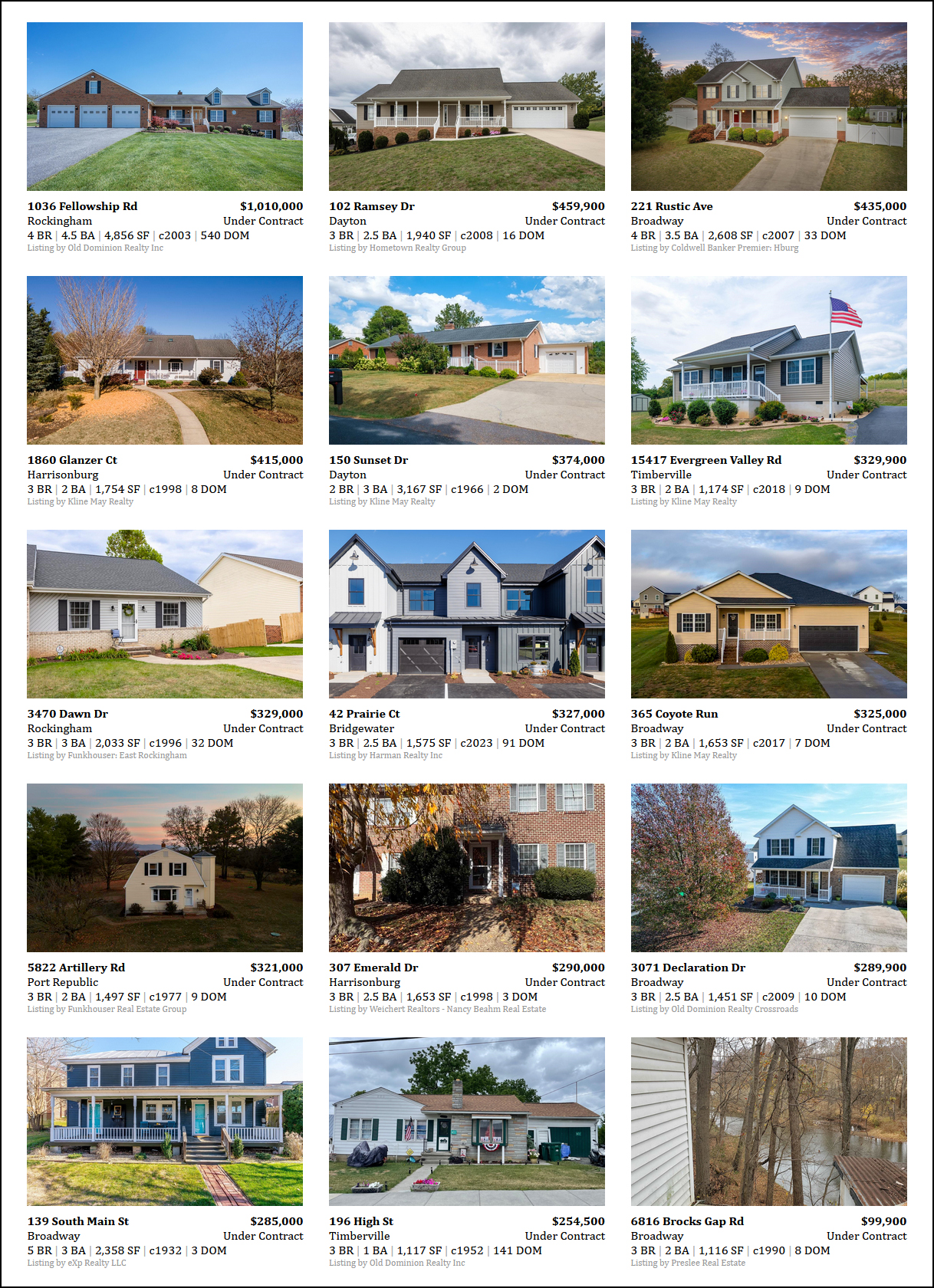

Home Buyers Signed Contracts On These 15 Homes Over The Past 7 Days |

|

Over the past week (15) home buyers in Harrisonburg and Rockingham County signed contracts to purchase (15) homes. A few observations...

What do you notice about these (15) homes that went under contract in the past week? What will go under contract over the next seven days? | |

Collecting, Organizing And Studying Showing Feedback Is Important, Again |

|

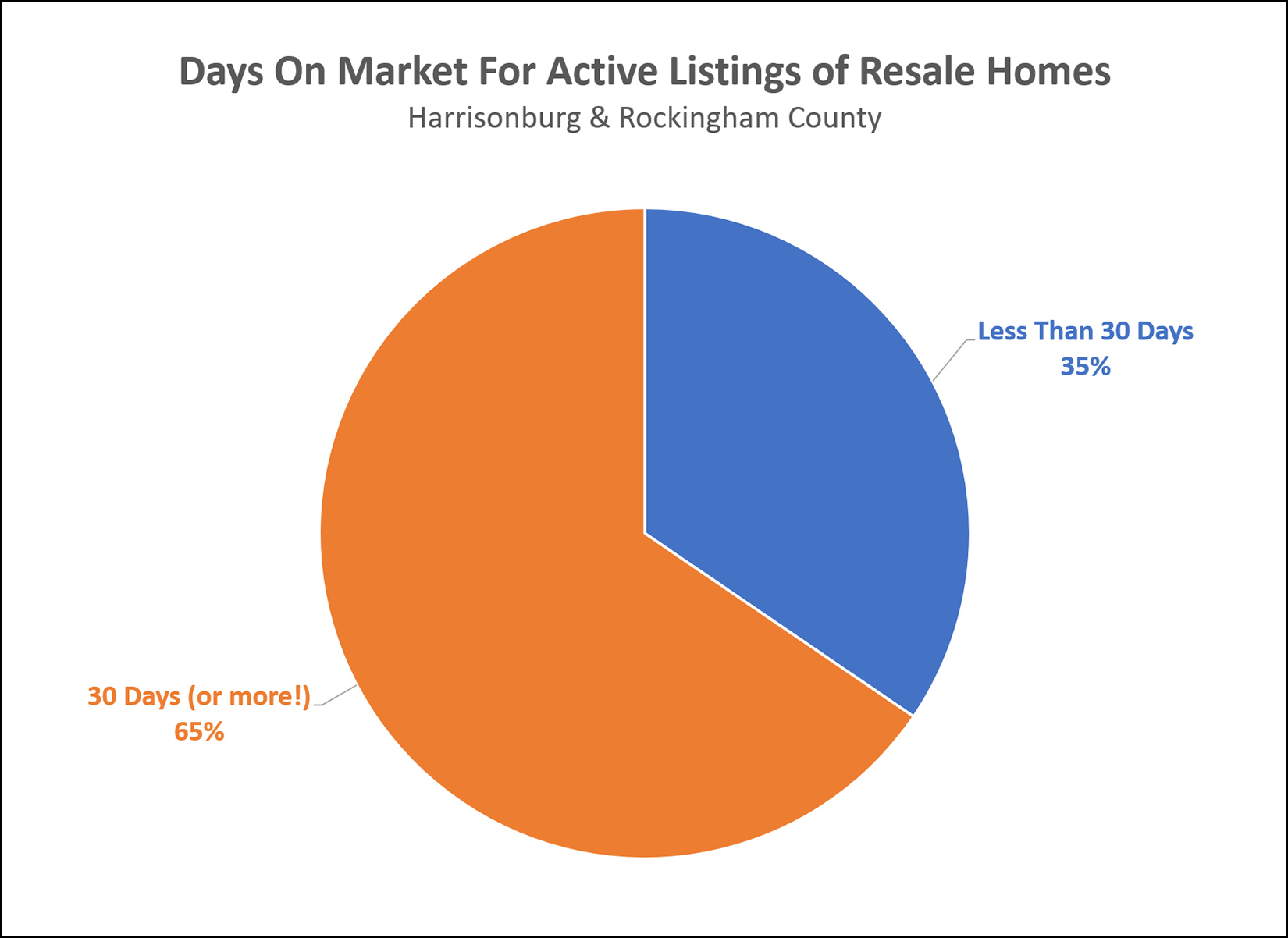

For most of 2020, 2021 and 2022, nearly every listing went under contract quickly - often with multiple offers. During that time, feedback on showings was collected, but it was mainly a question of... "Will your clients be making an offer? We have three so far." Now, with 65% of active listings of existing homes having been on the market for more than 30 days, it is important (again) to collect, organize and study showing feedback. And as we start collecting that showing feedback, sometimes we start wondering whether all showing feedback is really actually about price... My house is needs many cosmetic updates, but all of the potential buyers (who did not make an offer on my house) didn't provide feedback about price, they provided feedback about the need for cosmetic updates. My house is next to the railroad tracks, but all of the potential buyers (who did not make an offer on my house) didn't provided feedback about price, they provided feedback about the railroad tracks. My house has a steep driveway, but all of the potential buyers (who did not make an offer on my house) didn't provided feedback about price, they provided feedback about the steep driveway. Guess what --- unless you're going to flatten the driveway, move the railroad tracks (or the house), or make all of the cosmetic updates -- it really probably is an issue of price! If you're getting consistent feedback about your house that is unrelated to price, in almost all cases, you need to adjust the price to accommodate for that specific issue. If the price is lower then buyers might actually buy despite the specific issue that they were complaining about. | |

If Your Home Will Need Improvements Costing X After Closing, Consider Adjusting Your List Price By 1.5X |

|

Let's say your three neighbors just sold their homes for $400K... ...but when comparing your home to the homes sold by your neighbors... Your house needs $10K of painting - or your house needs $16K of new flooring - or your house needs a $22K new roof. When pricing your home, you shouldn't just subtract the price of that improvement from your neighbor's list price to arrive at... A list price of $390K - or $384K - or $378K. You likely need to subtract 1.5 times the cost of the improvement when pricing your home. Would be home buyers will likely round up somewhat in their mind when estimating the cost of making the improvement -- AND -- it will be much more of a pain for them to make the improvement after closing as compared to you have already completed it before selling your home. As such, it will likely be more realistic to consider a list price of $385K - or $376K - or $367K. | |

If Your Home Has Been For Sale For More Than 30 Days, You Are Not Alone |

|

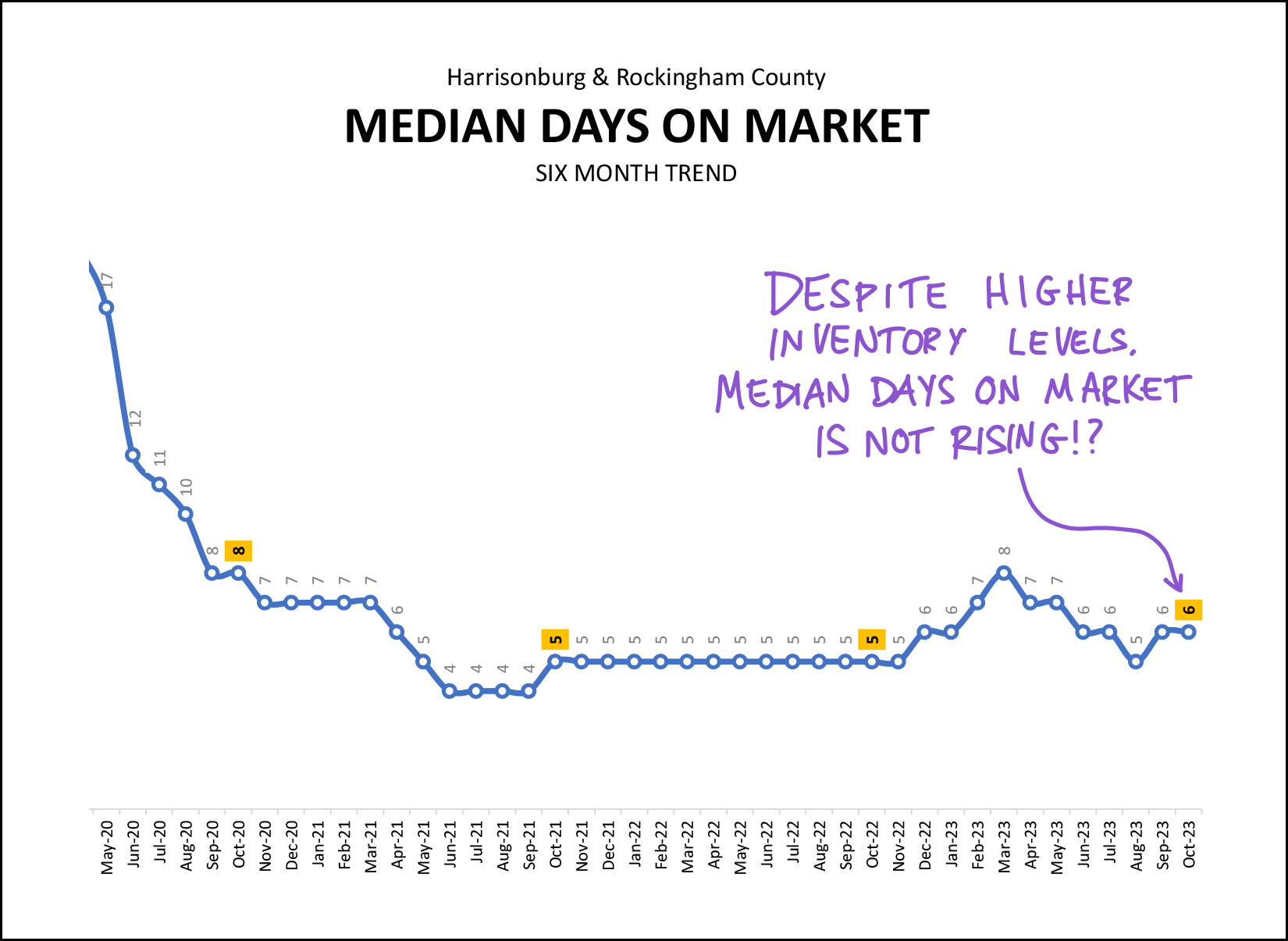

The numbers above might surprise you given that the median days on the market in 2023 is a mere six days. But that median of six days on the market is related to homes that have actually sold. We get a slightly different story when looking at currently available listings When considering active listings of resale homes (not new homes) we find that... 35% of active listings have been on the market for less than 30 days 65% of active listings have been on the market for more than 30 days So, if you are selling a home and it has not gone under contract within six days, or within 30 days, you are not alone. 65% of sellers with homes on the market for sale have had their homes on the market for more than 30 days. | |

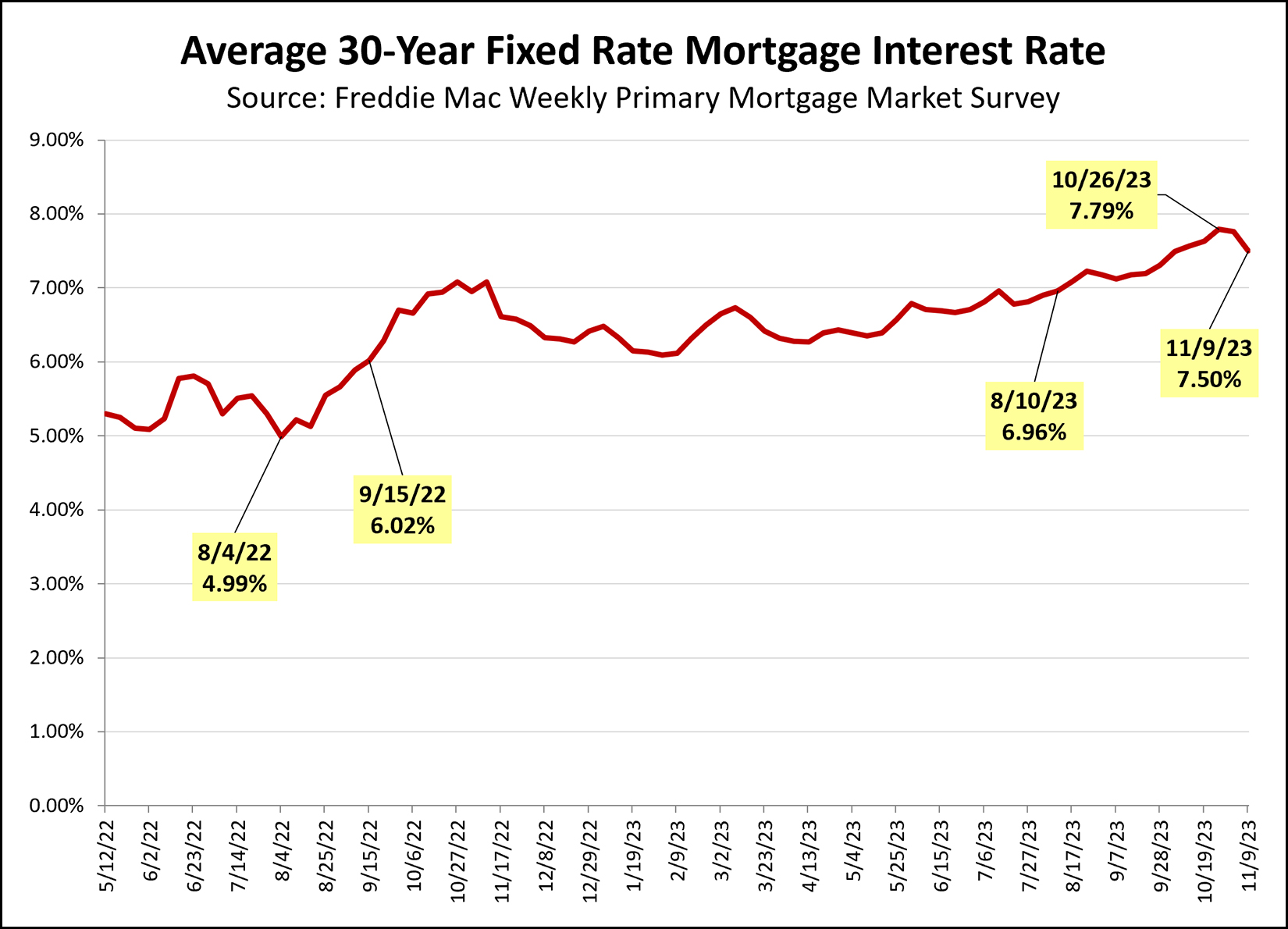

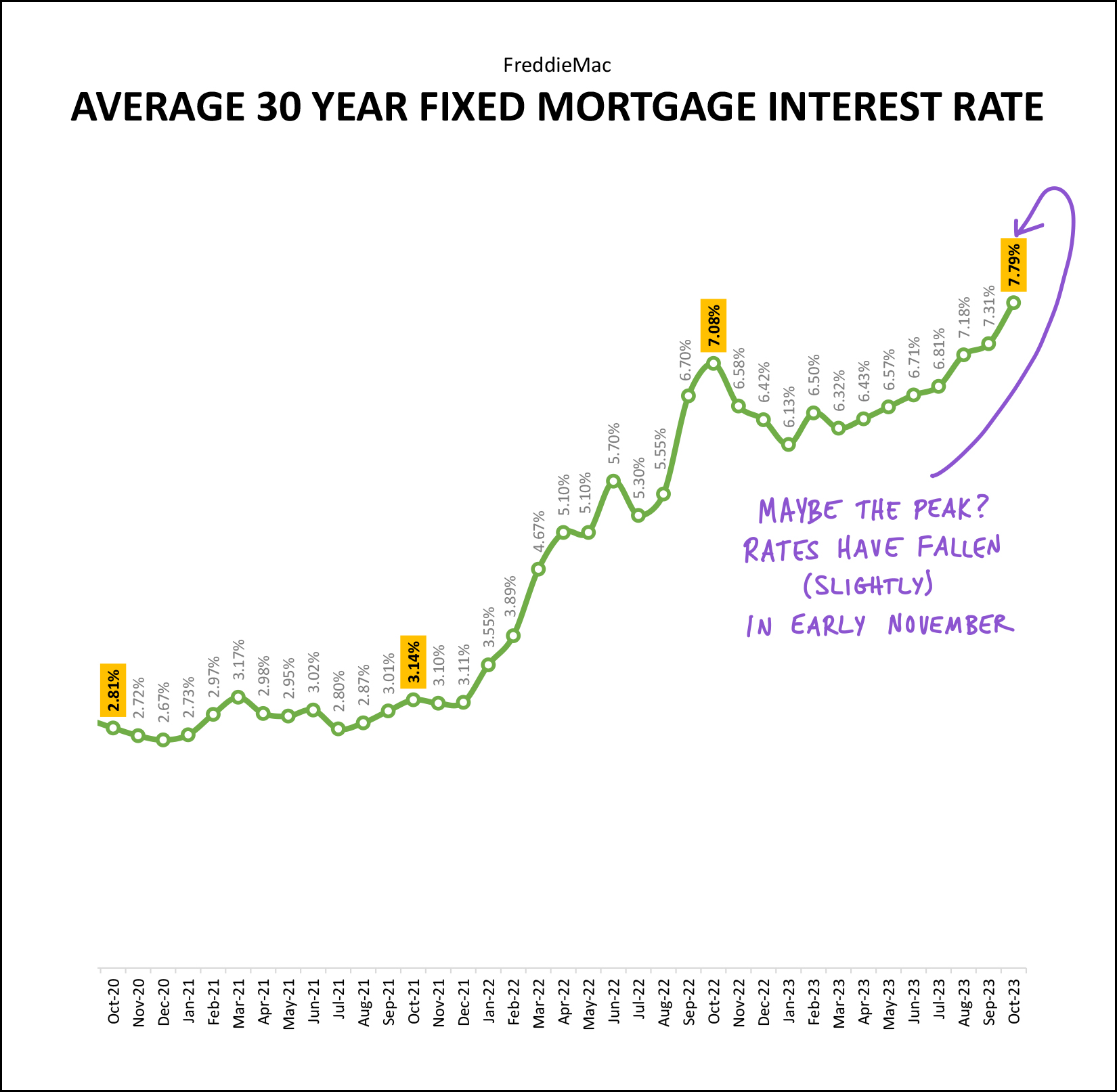

Checking In On Mortgage Interest Rates |

|

Mortgage interest rates have been declining for the past two weeks... or "plunging" as I saw it described in one news article. Let's put it all in a bit of a larger context. Mortgage interest rates rose above 7% in August... ...they peaked two weeks ago at 7.79%... ...and they have now dropped back down to 7.5% as of last week. Looking back further... ...rates rose above 5% in August 2022... ...and then very shortly thereafter rose above 6% in September 2022. I suspect we will see rates above 6% for at least the next year. I think it's possible that we'll see rates get down to 7% over the next few months, but if they stay above 7% I won't be completely surprised. If you are planning to buy a home, it will be important to check in with your mortgage lender for an updated payment projection. Here's a potential payment in Rockingham County for a $300K purchase with 90% financing... 7.79% mortgage interest rate = $2,175 / month 7.5% mortgage interest rate = $2,121 / month 7% mortgage interest rate = $2,029 / month 6.79% mortgage interest rate = $1,992 / month Lower or higher mortgage interest rates certainly affect a monthly payment pretty quickly. A full 1% drop from the peak of 7.79% down to 6.79% would reduce your mortgage payment by $184 / month. Let me know if you'd like some recommendations for qualified local lenders with whom you could talk through a variety of financing scenarios. | |

Home Prices Keep Climbing Despite Fewer Home Sales And Rising Inventory Levels |

|

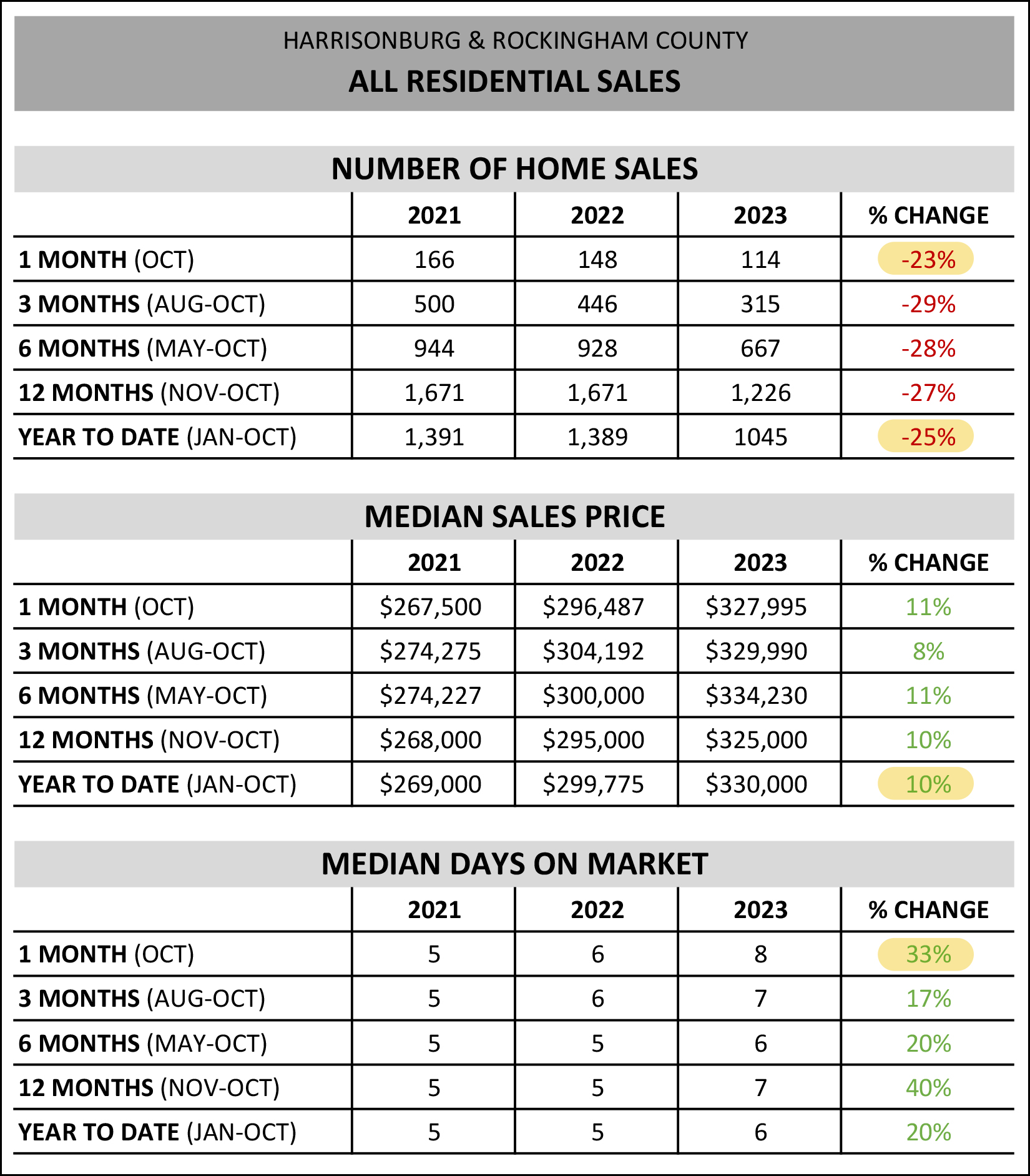

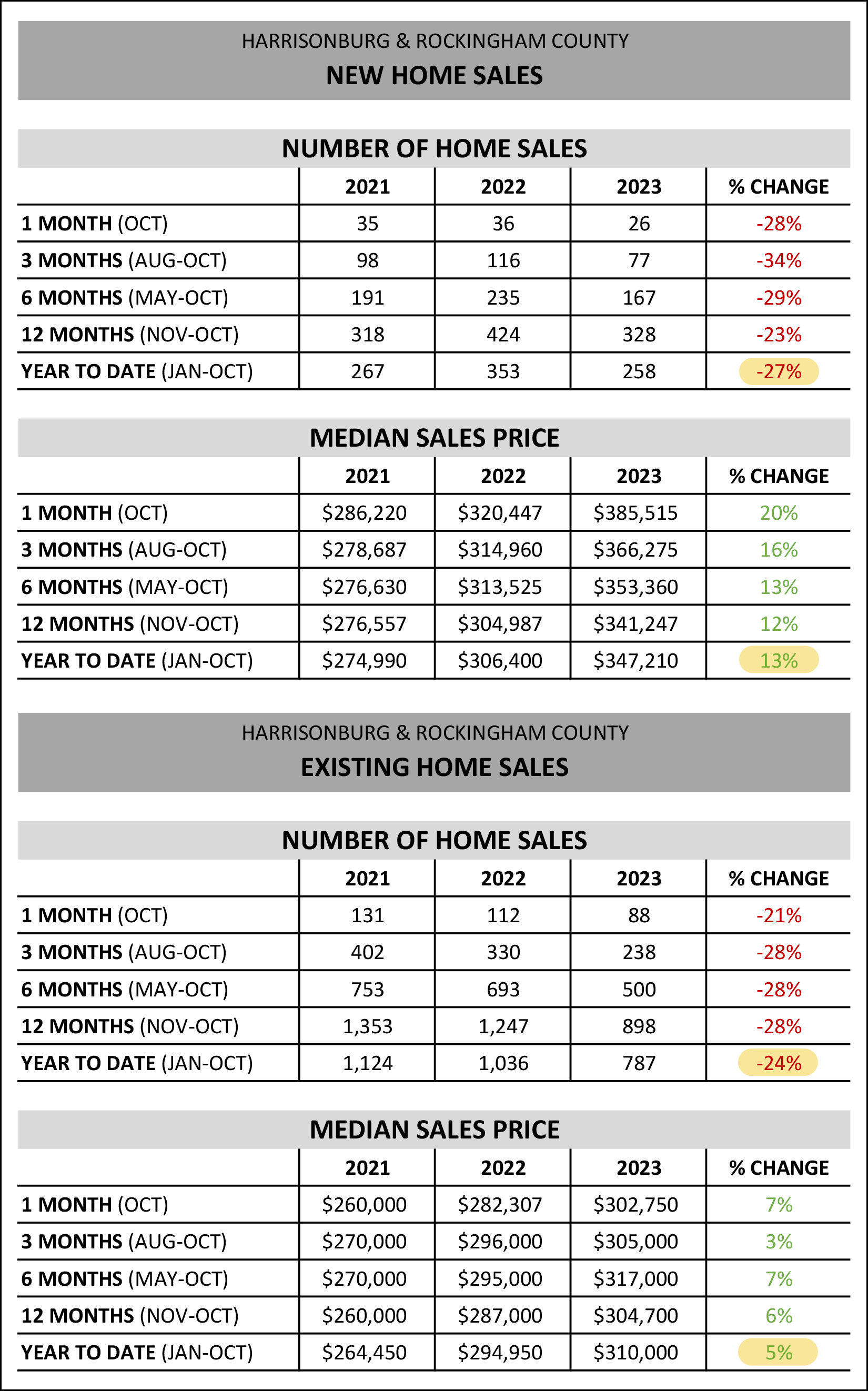

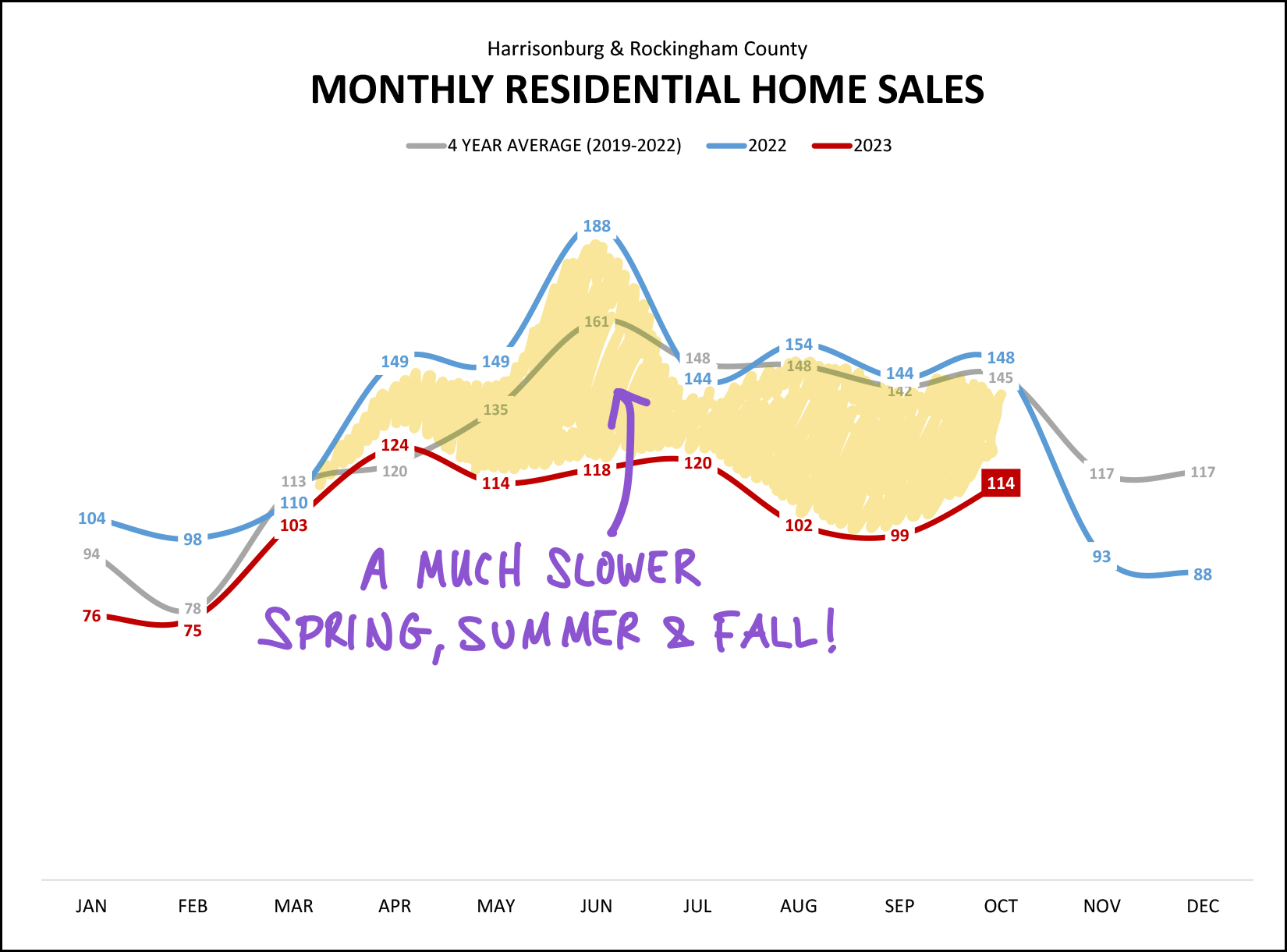

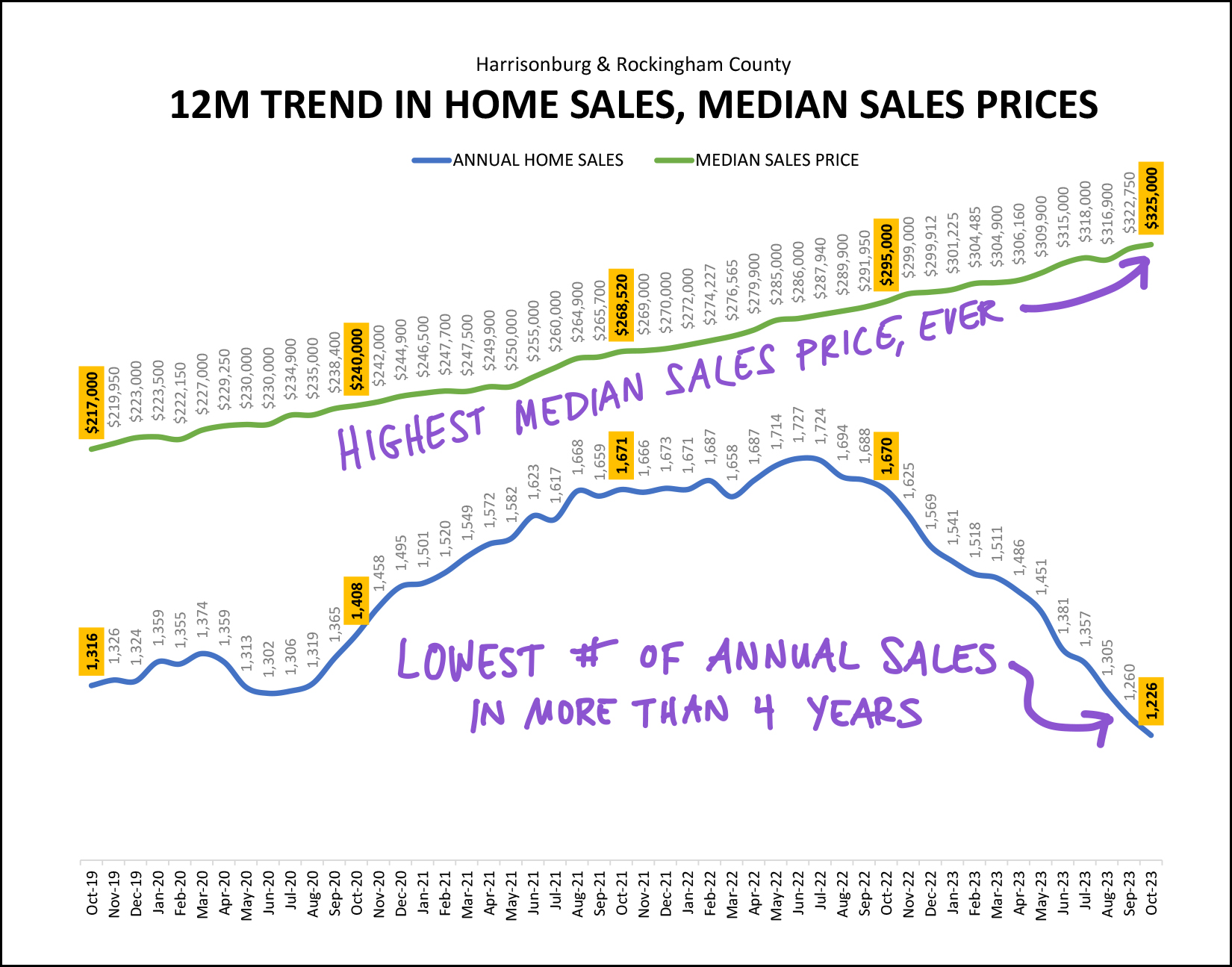

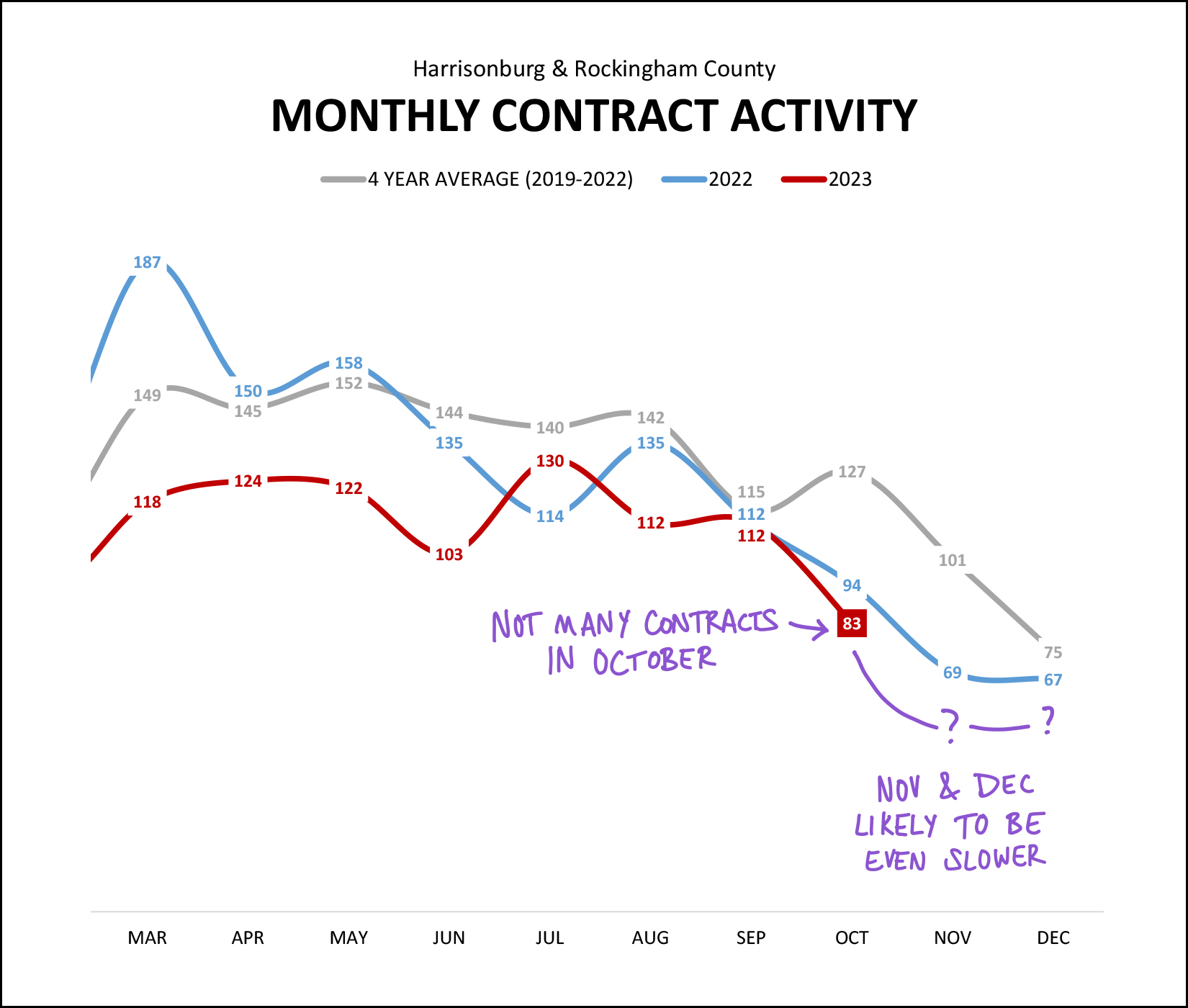

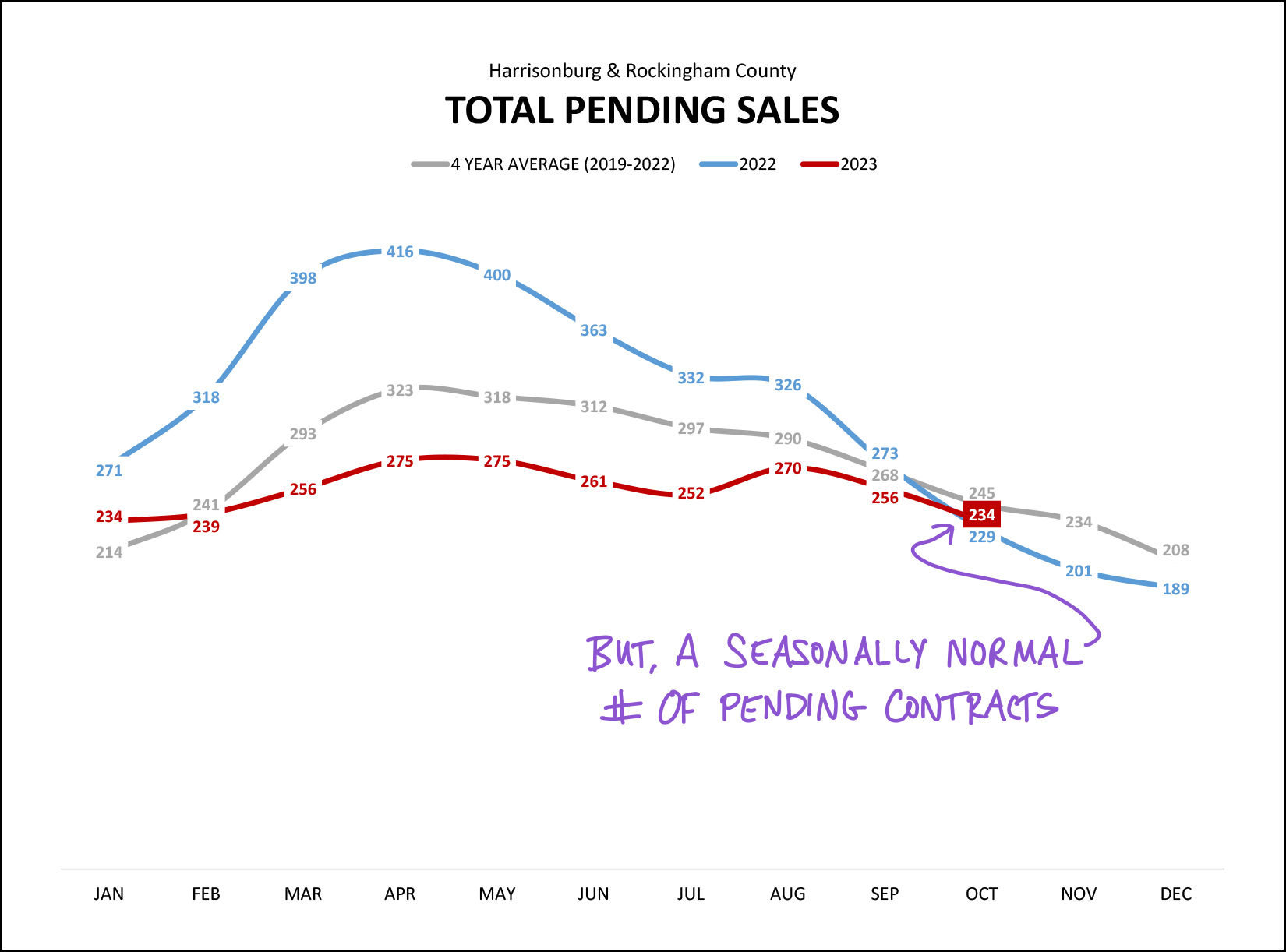

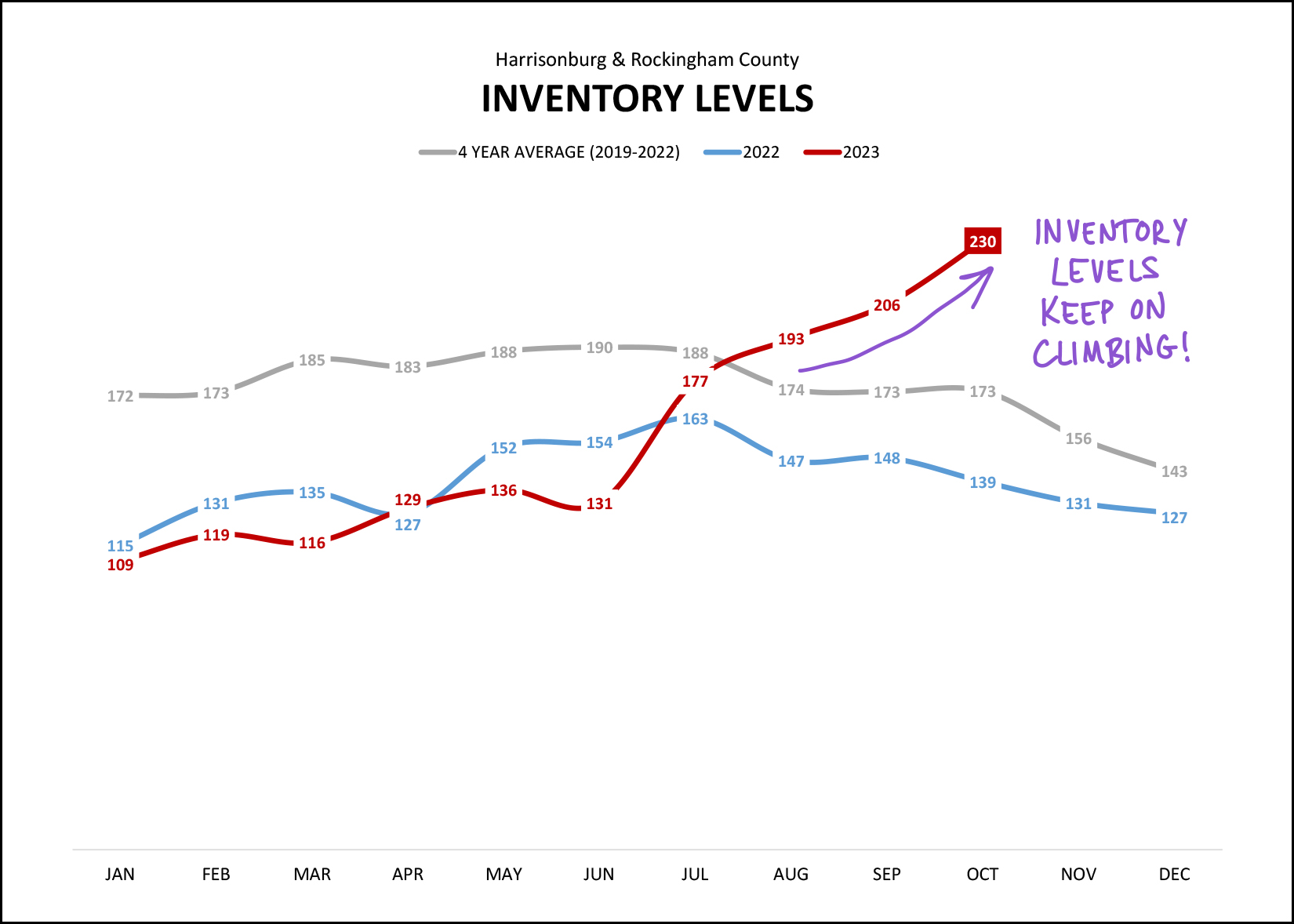

Happy Monday, Friends! Before we get to the real estate news...can we just start by saying... Go Dukes!?! JMU has been on a roll over the past few weeks and months in multiple sports. The football team remains unbeaten at 10-0 and will host ESPN's College Game Day this Saturday. The men's basketball team defeated #4, Michigan State last week followed by two more wins. The men's soccer team beat #1 UCF two weeks ago. The volleyball team is entering the Sun Belt Conference tournament as the second seed of the east division. And on, and on. This has been a fun year for rooting for the Dukes. If you live locally in the Harrisonburg area I hope you have been able to get out to watch some of these exciting games at JMU... and if you're an out of the area alum, come on back to get in on the action! And now... on to the latest data and trends in our local housing market! First, an overview of a few key indicators...  The highlighted trends above aren't all that new -- they are a continuation of what we have been seeing through most of 2023... [1] We continue to see fewer and fewer home sales in Harrisonburg and Rockingham County. This October there were 23% fewer home sales than last October. This year (Jan-Oct) we have seen 25% fewer home sales than last year during the same timeframe. [2] Despite fewer home sales taking place, home prices keep on rising. The median sales price thus far in 2023 is $330,000 which is 10% higher than the median sales price of $299,775 that we saw last year. [3] Homes are selling (as a whole) ever so slightly more slowly than last year -- even if it shows up as a 33% increase in the median days on market. Last year's median days on market in October was six days... and this year it's up 33% to eight days. So, many homes (at least 50%) are still selling quite quickly, even if ever so slightly more slowly than last year. Next up, though, let's take a look at a data table that might surprise you a bit...  The top two tables above look only at new home sales while the third and fourth table look at existing home sales. First, the decline in the number of homes that are selling (2023 vs. 2022) is relatively similar between new home sales (-27%) and existing home sales (-24%). But... the change in median sales price over the past year is where we notice some differences. The median sales price of new homes has increased 13% over the past year -- while the median sales price of existing homes has only increased 5% over the past year. Hmmmm.... so while the market wide median sales price has increased 10% over the past year, if we strip out the new home sales (and their impact on pricing) we are only seeing a 5% increase in the median sales price. This 5% increase in the median sales price of existing homes in 2023 follows an 11.5% increase in that metric in 2022. So, perhaps the increase in (existing) home prices is slowing? Now, moving on to some visuals of the latest trends we're seeing in our local housing market for all the visual learners amongst us. First, how much slower has this year been than last year?  My yellow scribbles above are filling in the area between last year's home sales figures (blue line) and this year's home sales figures (red line) to show how much of a gap we have seen in home sales between March and October. Last year (Mar-Oct) we saw 1,186 home sales. This year (Mar-Oct) there have only been 894 home sales. This is a big drop (25%) and it seems to mostly be a reduction in the number of sellers selling... though we can start to re-think that a bit as we move through another month of rising inventory levels. But all that is to come... keep reading. Next up, the long term trends in the number of homes selling and the prices of those homes...  The number of annual home sales has now dropped all the way down to 1,226 home sales... which (as this graph points out) is the lowest number of annual sales in over four years. And... it's actually much longer than four years. The last time we were seeing homes sell at an annual rate lower than 1,226 homes per year was way back in July 2016... over seven years ago! With home prices being as high as they are (illustrated by the top line in the graph above) and with mortgage interest rates being so high (now) compared to rates most homeowners have on their current mortgages -- I don't think we will see this annual rate of home sales start to increase in the near future. Shifting gears a bit, let's look forward to the remainder of the final quarter of 2023 as it relates to contract activity...  Only 83 contracts were signed in October 2023 which is slightly lower than last October (94) and significantly lower than the average October over the past four years (127). Looking ahead, it seems likely that we will see even fewer contracts being signed in both November and December. This is interesting to keep in mind when we get to the inventory graph in a bit. But before we get to the inventory numbers, here's a bit of a counter indication as to contract activity...  Despite slower contract activity, of late, the number of pending sales (under contract homes) is hovering around 234 contracts right now... which is very much in line with where we would expect it to be based on where we were at the end of last October (229) and the average end of October data from the past four years (245). Thus, perhaps we'll see normal-ish numbers of closed sales in November and December, given the normal-ish number of homes that are currently under contract? Now, inventory, the most interesting, unexpected and atypical indicator in this month's report...  Inventory levels are continuing to climb, as they have for the past four months now. The 230 homes that are currently on the market is 65% more homes than were on the market a year ago. What does this mean? [1] While the homes that are selling are still selling rather quickly, there is an increasing number of homes that are not selling right away and that is causing inventory levels to climb. [2] If you are listing your home for sale you might see it go under contract quickly -- contributing to the low "median days on market" figure -- or you might not see it going under contract quickly -- contributing to the increasing inventory levels. Yes, I understand very clearly which group every home seller would like to be a part of -- but every home seller is not automatically a member of the "my home sold in a flash" club any longer. Circling back a bit, here's the median days on market data, showing that plenty of people are still in that "my home sold in a flash" club, with a significant caveat to follow...  Let's be clear on what this graph (above) does and does not show... [DOES] This graph does show that half of the homes that have sold in the past six months have gone under contract in six or fewer days and half of the homes that have sold in the past six months have gone under contract in six or more days. [DOES] This graph does show that the time it is taking for homes to go under contract is about the same now as it was in the crazy times of 2021 and 2022. We were seeing a median of four to five days then, and a median of six days now. [DOES NOT] This graph does not show that all homes that are listed for sale will go under contract with a median of six days. These median days on market figures are calculated only based on homes that sell, once they have sold. I'll speak more to the "so what" or "now what" portions of these indicators a bit later. And finally, one of the main reasons for fewer home sales in 2023, those pesky high mortgage interest rates...  We now seen mortgage interest rates above 6% for more than a year... they have been over 7% for the past three months... and they were getting close to 8% at the end of October! These high (higher) mortgage interest rates put a damper on home sales activities... [1] Buyers think twice about buying after they calculate their monthly mortgage cost based on today's rates. [2] Sellers think twice about selling when they realize they'd be giving up their current (likely) low rate for a (likely) much higher rate today. I don't think we will see much of an increase in the number of homes that are selling until we see mortgage interest rates heading back down. It is worth noting that rates have come back down a bit in November, dropping from 7.79% down to 7.5% as of last week. Now, let's move on to the "so what" and "now what" portion of our conversation... If you plan to buy a home soon... [1] Yes, mortgage interest rates are high, so talk with a lender to make sure you have a clear understanding of your potential mortgage payment and make sure that it fits in your budget. [2] You likely are seeing more options of homes to consider now than you would have had over the past few years. Enjoy possibly having a few options at once instead of just one option at a time. [3] You might not have to make a decision about an offer within 30 minutes. Yay! Think it through, go back and look a second time, make sure you are comfortable with your potential offer and your buying decision. If you are selling your home and it's already under contract... [1] Congratulations. [2] Don't talk about it with anyone in the next category. ;-) If you are selling your home and it is not yet under contract... [1] We should take a look at how your pricing compares to other homes that buyers might currently be considering. We must make sure your pricing is competitive. [2] We should look at whether other buyers have contracted on similar homes in the past 60 days. Have buyers bought other houses -- and not your house -- or have they not been contracting to buy anything at all? [3] We will likely want to discuss if or how an adjusted list price might cause a buyer on the fence to make an offer... or a buyer looking at the fence to come view your home. ;-) [4] Sometimes the only solution is to be patient as there are no longer multiple buyers in the market, always, for every house regardless of size, location, features and price. If you plan to sell your home soon... [1] Pricing is key! Let's be super realistic (or overly realistic) with pricing so that you can join the "my home sold in a flash" club. [2] We will also need to take a look at how many buyers have purchased homes like your home over the past 60, 90 or 120 days to try to have realistic expectations for time on the market. [3] You might not have a flurry of showings in the first few days that your home is on the market. This does not mean that your home will never sell. It just means that it is not 2021 or 2022. :-) [4] Selling a home in 2021 and 2022 was a sprint... but you don't need to worry that it will now be a marathon... it is likely to be somewhere between a one mile run and a 5K. And for everyone... As all of these market trends (# sales, prices, inventory levels, time on market) adjust in our local market, it's more important than ever to delve deeper into the data related to your specific property type, price range, neighborhood, etc. - regardless of whether you are selling or buying. We must take a more thoughtful approach than ever to our selling strategy when it comes to pricing, preparation, marketing and negotiating... and a more thoughtful approach than ever to our offering strategy when buying. I'll wrap it up there for now, but feel free to reach out if you have questions about your particular housing situation -- or if you just want to talk things through. You can reach me most easily at 540-578-0102 (call/text) or by email here. | |

It Seems Likely That Home Buyers Will Have Fewer (Resale) Options In The Next 12 Months Compared To The Past 12 Months |

|

Not be Debbie Downer here but it seems likely that home buyers in Harrisonburg and Rockingham County are likely to have fewer options of homes to purchase in the next 12 months compared to the past 12 months. Why, might you ask? Roughly 80% of homeowners have mortgage interest rates below 5%. Mortgage interest rates are currently above 7%. Raise you hand if you'd sell your home with a mortgage interest rate below 5% and purchase a replacement home with a mortgage interest rate above 7%. <nobody raises their hand> So... as long as mortgage interest rates stay above 7% we're likely to see a lower than historically normal number of homeowners willing to sell their homes. So, if you're hoping to buy a home in the next 12 months, you should realize that you will likely have fewer options than in the recent past, and you might need to compromise a bit on what you are looking for in a home. Even though it seems unlikely that you actually will compromise... because of, again, the current high(er) mortgage interest rates. :-)

| |

The Higher The Mortgage Interest Rates, The More Perfect A House Must Be For A Buyer |

|

This is a totally made up graph. I don't know how I would actually measure "how perfect a house must be" to a buyer. But I will point out that... 1. When mortgage interest rates were super low, there were so many buyers competing over every new listing that home buyers were willing to compromise - often a lot - in how perfect a house had to be for them. They just wanted to secure a contract on a house. 2. Now, with mortgage interest rates a good bit higher (double) and with mortgage payments quite high as a result, buyers seem to have much more of a desire for a house to fit them well. If they're going to pay *that much* on a monthly housing payment, the house better fit them pretty well! | |

It Does Not Seem That Home Prices Are Declining, Overall, But Some Sellers May Elect To Sell At Lower Than Expected Prices |

|

The median sales price in Harrisonburg and Rockingham County has risen 10% over the past year. That's an increase from $292,000 to $322,750. As such, it really does not seem that home prices are declining, overall. But... some (but likely not many or most) sellers may elect to sell at lower than expected prices. Here's why... Let's say you're selling a home priced at $322,750 that you purchased five years ago. That $322,750 is the median sales price... so let's just walk it backwards to imagine what your home might have been worth 1, 2, 3, 4 and 5 years ago. Today = $322,750 1 Year Ago = $291,950 2 Years Ago = $265,700 3 Years Ago = $238,400 4 Years Ago = $215,250 5 Years Ago = $212,000 So... you bought your home for $212,000. Last year you estimated it was worth $291,950... a $79,950 gain in four years. Today you estimate it to be worth $322,750... a $110,750 gain in five years. So, if you are selling your house today, and you price it at $322,750... and it doesn't go under contract within the first few weeks... or not within the first month or two... will you keep it priced at $322,750 indefinitely? Likely not. You -- and some other sellers -- would likely be happy to sell for somewhere between $291,950 and $322,750. Selling (this fictional house) for $291,950 is certainly quite a bit below where we believe the value to be today, but it is also a $79,950 gain in five years. All this is to say, that if you are serious about selling, and you have your house on the market, and it hasn't gone under contract... we shouldn't get too stuck on what your house should be worth today, and what it is worth today... we should evaluate the price at which it makes sense for you to sell... and how we might price it to have it go ahead and go under contract... even if that is at a lower price than we might otherwise expect. Put more simply... home sellers from three or more years ago potentially have a LOT of equity to play with when pricing their home to sell... and can likely tweak the pricing to motivate a buyer to go ahead and commit to buying. | |

The High(er) Cost Of Money May Slow Down The Start Of Approved Residential Developments |

|

Over the past few years, thousands of potential new housing units have been proposed to be built in the City of Harrisonburg and Rockingham County. Some of these new developments are under construction, but many are sitting idle as undeveloped land that is approved for a new housing development but with no clear indication of if or when construction might begin on those new homes. One of the biggest potential limitations on when these new homes might be built is -- the high(er) cost of money -- current interest rates. Developers and builders are not going out to get traditional mortgages in order to build out these communities -- but they almost always do need to borrow money from a bank to start a new housing development. That money goes towards infrastructure (roads, water, sewer, sidewalks) as well as towards the construction of the housing units -- all of which are bills that have to be paid before the first home is sold or rented. So, will we see all of these thousands of proposed or approved new home developments be built over the next year or two? Almost certainly not... and one of the biggest things holding back the development of these new communities is the current economic climate with high(er) interest rates across the board. If/when interest rates start to decline, perhaps we'll then see some of or more of these new developments being built. | |

Monthly Housing Payments Are High But Seem Unlikely To Be Lower Over The Next Year |

|

Mortgage interest rates are higher they have been in over 20 years. Home prices are higher than they have ever been. Combine these two factors and you'll find monthly housing payments that are high. Quite high. Too high? Some would be home buyers are hesitating to move forward with a home purchase because of how high the monthly mortgage payment will be on their new home. This is understandable and quite reasonable. If your lender approves you for a mortgage payment of $2500 per month but you are only comfortable committing $2200 per month to a housing payment then perhaps you shouldn't buy that house that you love that would require a $2500 monthly housing payment. But... if you decide not to buy now (or soon) you probably shouldn't come to that decision within the context of waiting to buy in six to twelve months when you hope to have a lower housing payment. After all... what would we need to see in order to be experiencing lower housing payments? We'd need to see either... [1] Meaningfully lower mortgage interest rates -- which most economists don't seem to think will be showing up anytime in the next year. [2] Lower home prices -- which don't seem likely to exist anytime in the next year. Is it possible that mortgage rates will decline back to 5% or 6%? Sure, it's possible - but it doesn't seem likely, at all. Is it possible that home prices will decline over the next year? Sure, it's possible - but it doesn't seem likely, at all. So, a year from now, you'll likely have a very similar mortgage payment as you would have today -- or possibly even higher. Now, for all you contrarians out there -- tell me I'm wrong -- and tell me how. Will mortgage interest rates decline over the next year? Will home prices decline over the next year? | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings