Archive for February 2024

Has The Value Of Your Specific Home Increased By Thirty Percent Over The Past Three Years? |

|

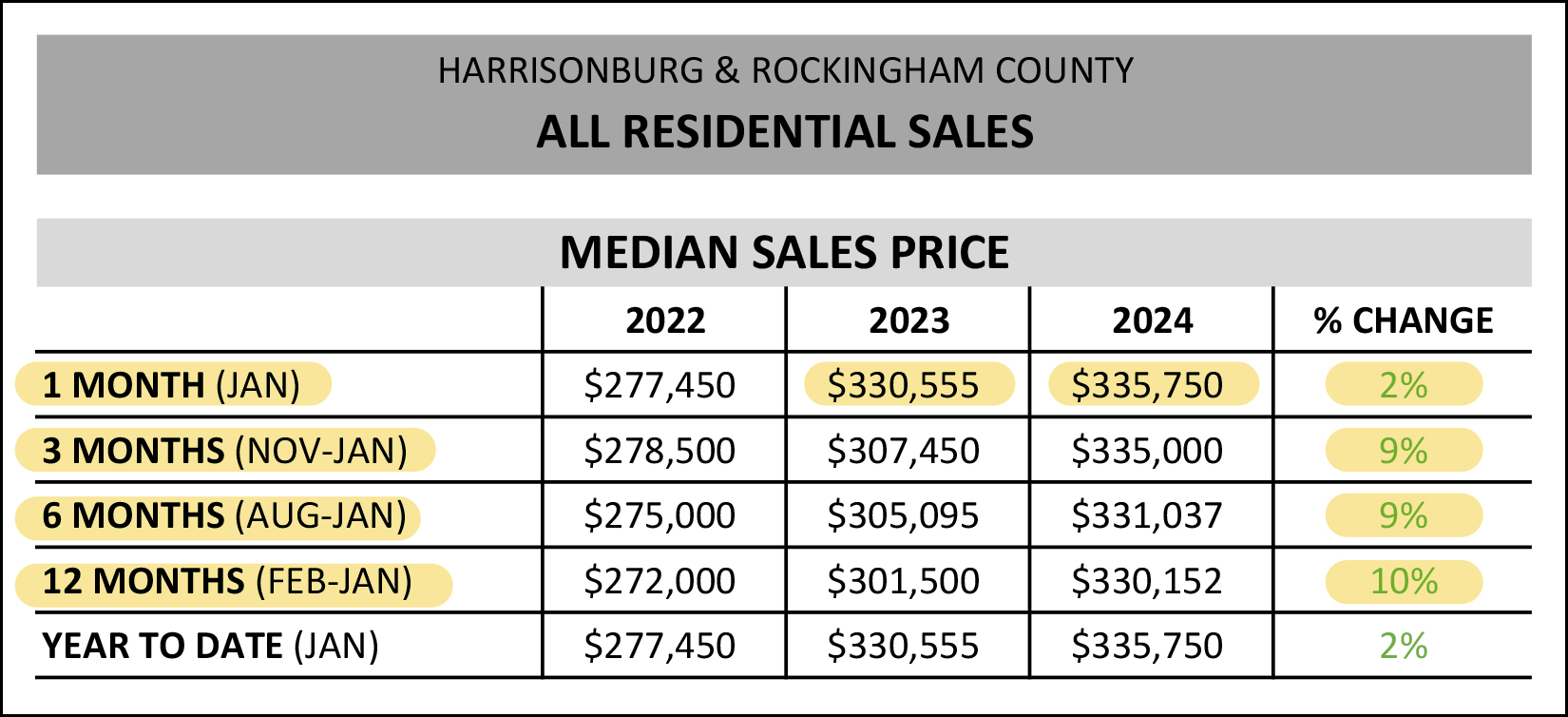

It's a reasonable question! The median sales price in Harrisonburg and Rockingham County has increased 10% per year for each of the past three years. Combining all three of those years together, the median sales price has increased 34% over the past three years. In real numbers... the median sales price has jumped from $246,500 to $330,152 during that timeframe. So, if you owned a $246,500 home three years ago, is your home worth $330,152 today? Possibly. But quite possibly, not. The other variable hidden within median sales price trends is WHAT sells, beyond HOW MUCH it sells for. For example (just an example - not real) if only tiny houses sold three years ago and only mansions sold this year, the median sales price would increase more than we might otherwise expect. As a slightly real-er example, we have seen a steady increase in the share of new construction homes that are selling in Harrisonburg and Rockingham County over the past five years... 2019 - 13% new home sales 2020 - 15% new home sales 2021 - 19% new home sales 2022 - 26% new home sales 2023 - 26% new home sales Given that new homes are almost universally more expensive than a comparably sized resale home, an increased share of new homes selling would push the median sales price higher than it would have been simply via changes in market values. All that is to say... while the median sales price has increased over 30% during the past three years... your home might not have increased in value by 30%. The median sales price is an evaluation of the prices at which particular homes sold and is not always a reasonable substitute for overall changes in market values. | |

Instead Of Thinking About If It Is THE Right Time To Buy Or Sell, Think About If It Is YOUR Right Time |

|

It's a great time to buy a home. It's a great time to sell a home. Those words are often tossed about, in a balanced market, in a strong buyer's market and in a strong seller's market. Is it always a great time to buy a home or to sell a home? How could that be possible? Forget all of that. Don't get stuck on whether it is THE right time to buy or sell a home. Instead, we ought to be focusing on whether it is YOUR right time to buy or sell a home. There are plenty of times when it is definitely the right time for you to buy a home -- and some when it is not. For example, if you don't have stability in your job or if you might want to move out of the area for a job advancement, it probably is not your right time to buy a home. There are plenty of times when it is definitely the right time for you to sell your home -- and some when it is not. For example, if you don't know where you'll go next after you sell, we certainly shouldn't be getting all geared up to sell your home. So... let's focus less on whether this, right now, is THE right time (or THE best time) to buy or sell a home. Instead... let's focus on whether this is YOUR right time. If the time is right for you to buy or sell, let's get down to it. If it's not your time, don't let the market or other influences make you think that you should be buying or selling. | |

Should You Price Your Home $10K To $20K Above Where You Hope To Sell? |

|

In the current local housing market, it is not advisable to price your home $10K to $20K above the price point where you hope to sell -- with the one caveat being that it depends on the price range. If you hope to sell for $250K, I don't recommend pricing your home at $260K or $270K. If you hope to sell for $410K, I don't recommend pricing your home at $420K or $430K. I suppose if you hope to sell for $760K, might matter a bit less (maybe) if you price your home at $770K or $780K. But, back to the first premise... here's why I don't recommend a list price of $260K or $270K if you hope to sell for $250K. Let's say you price your home at $265,000 - hoping to sell for $250,000. If five buyers come to see your home in the first few days it is on the market, and they all like the house, but conclude that it is likely worth $250,000... ...they are likely to not even make an offer. After all, they may very well think they would need to offer $235,000 or $240,000 in order to hope to negotiate you down to $250,000. And when a home has been on the market for just a few days, most buyers won't make a $235K or $240K offer if the list price is $265K. So... in almost all cases, your list price should be very close (or a touch above or a touch below) the price point where you hope to sell. | |

A Slightly Smaller Downpayment Allows You To Hold Onto Reserve Funds But Does Not Keep You From Paying Ahead On Your Slightly Larger Mortgage |

|

So... you're getting ready to buy a house... but you don't know how much of a downpayment you should plan to make. You have enough savings on hand to pay for your closing costs and have up to a 15% downpayment based on your purchase price. This would leave you with a bit of remaining savings, but not much. Should you... [1] Go for the 15% downpayment, financing 85% of the purchase price, and leaving you with minimal remaining savings? [2] Reduce your downpayment to 10%, financing 90% of the purchase price, and leave a bit more in savings. [3] Reduce your downpayment to 5%, financing 95% of the purchase price, and leaving a solid amount in savings. In most cases, I would recommend scenario #2 or #3. Reducing your downpayment *will* increase your monthly mortgage cost, but it will allow you to have savings on hand in the event that you need to pay some unexpected medical bills, make a major repair on your home, replace a vehicle, etc. And... you will still have the flexibility to pay more on your mortgage payment if you continue to have savings accrue and you want to pay down your mortgage more quickly. So, as you meet with a mortgage lender, don't assume that you will or you should put every last dollar of your savings into your downpayment and closing costs. Explore other possibilities that will result in a slightly larger mortgage but will allow you to still have some savings on hand in case you need them. | |

Given Current Low Inventory Levels, You May Want To Search More Broadly For Your Next Home |

|

Wouldn't it be grand if every would be buyer in the current market had (10) great homes to choose from on any given day? But we just aren't seeing that right now. If you'd like to buy a townhouse or duplex in the City of Harrisonburg for less than $275K, you have... one option. If you'd like to buy a detached home in the City of Harrisonburg for less than $300K, you have... five options. If you want to buy a detached home in the Turner Ashby school district for less than $400K, you have... three options. So, if you're are starting your home search right now (or continuing it) you might have to search a bit more broadly for homes than you had first imagined. Look a bit above and below your target price range. Look at homes with one fewer bedrooms than you would prefer. Look at homes in a nearby but different school district than where you hope to buy. Expanding your home search in this way will expose you to more options, one of which might be a great house for you, and it will help you further understand current market dynamics related to pricing. I hope we can find the perfect house for you, right away, amidst lots of other super options, but given lower inventory levels, we might have to look a bit more broadly to find some options. | |

58 Townhomes, 34 Apartments Likely Coming Soon On Mt Clinton Pike Near Intersection With North Main Street |

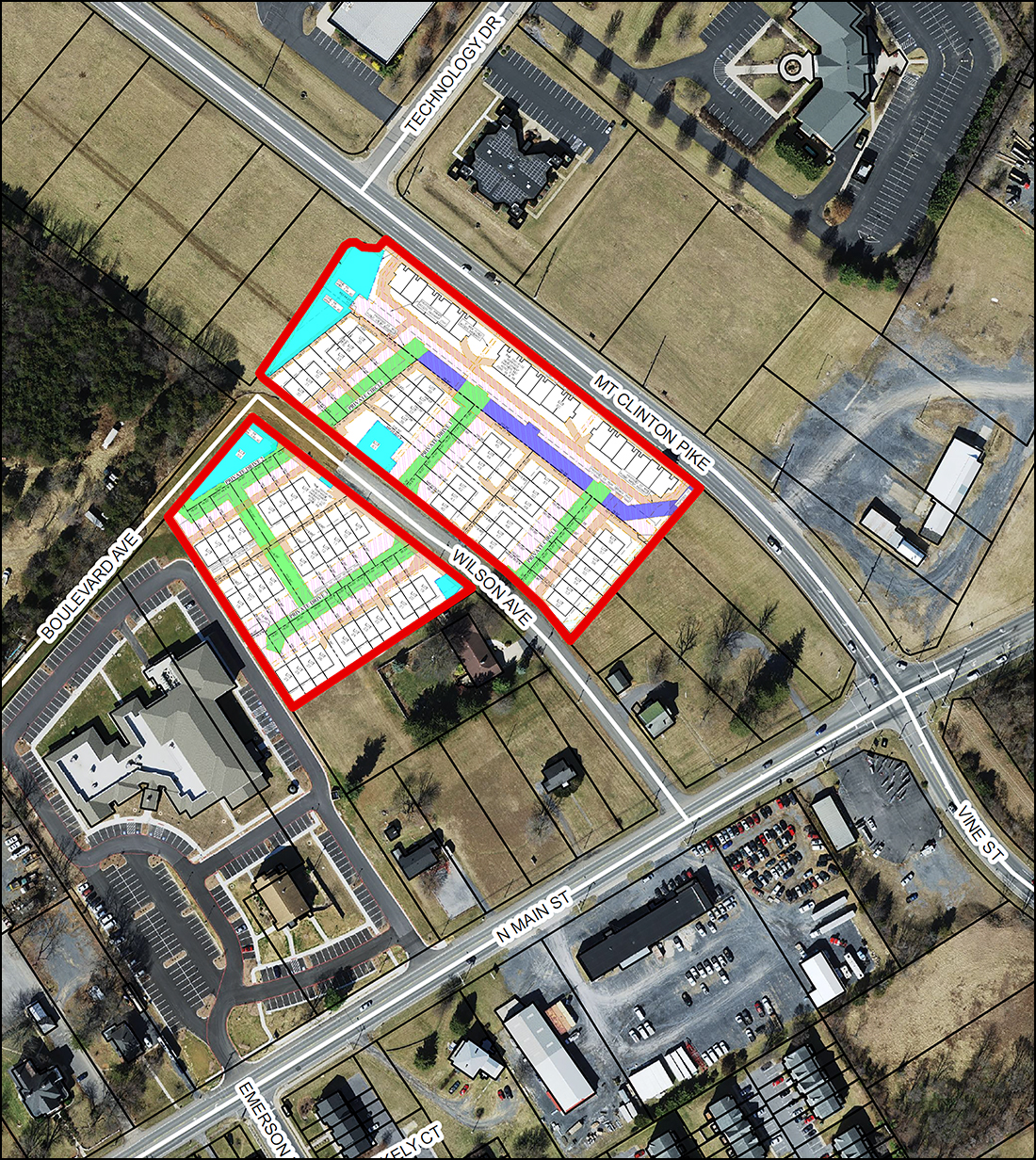

|

The 5.23 acre parcel shown above was rezoned back in December 2022 to allow for this new residential development and now the Planning Commission and City Council are reviewing and potentially approving the site plan to allow the development to move forward. The 5.23 acre property will include:

Here's the layout, zoomed in a bit...  Download the full Planning Commission packet (from their meeting last week) here. | |

Especially After Recent Increases In Property Values, Home Sellers Will Be Considering More Than Just The Offer Price |

|

Imagine you are a home seller... ...you purchased your home 10 years ago for $250K... ...you are ready to sell and hope it might sell for $340K... ...you list it for sale for $350K. After a few days on the market, you have three offers to consider... [1] Offer of $350K contingent on the buyer financing 80% of the purchase price. [2] Offer of $355K contingent on the buyer financing 95% of the purchase price. [3] Offer of $365K contingent on the buyer financing 97% of the purchase price and requesting a $5K closing cost credit. The first offer would get you $350K, the second $355K and the third $360K. Ignoring any other differences in the offer terms, which of these offers would you accept? Many buyers might think (or hope) that the highest offer price will win... but especially when home values have increased as much as they have over the past five years, home sellers might not always pick the highest sales price. Fictional Seller described above was hoping to sell for $340K, so all three of the offer are great -- they all results in higher prices than the goal of $340K. To pick on the third offer first, it provides for the highest sales price but the buyer has the least amount of funds to put into the transaction and is even asking the seller to pay for part of their closing costs. The artificially inflated sales price (to incorporate the closing cost credit) will mean that the property must appraise for $5K higher than it would otherwise. Furthermore, if there is an inspection contingency, this buyer seems likely to be the most concerned about any small or medium sized issues, as they do not appear to have a lot of funds to put towards the home purchase. The second offer ($355K with 95% financing) is certainly stronger than the first ($350K with 80% financing) but again, the smaller down payment can be an indication that something could go awry within the transaction to cause it not to make it to closing, such as discovering needed home repairs during the home inspection process. Thus, many sellers in this situation would end up choosing the lowest (!!) offer -- selling for $350K instead of $355K or $360K -- because of the greater certainty of the buyer successfully making it to closing given their seemingly more secure and stable financing situation. This is just one example of how home sellers these days will be comparing more than just the proposed purchase price when reviewing multiple offers -- especially if they bought their home 5+ years ago and have seen a sizable increase in their property value. | |

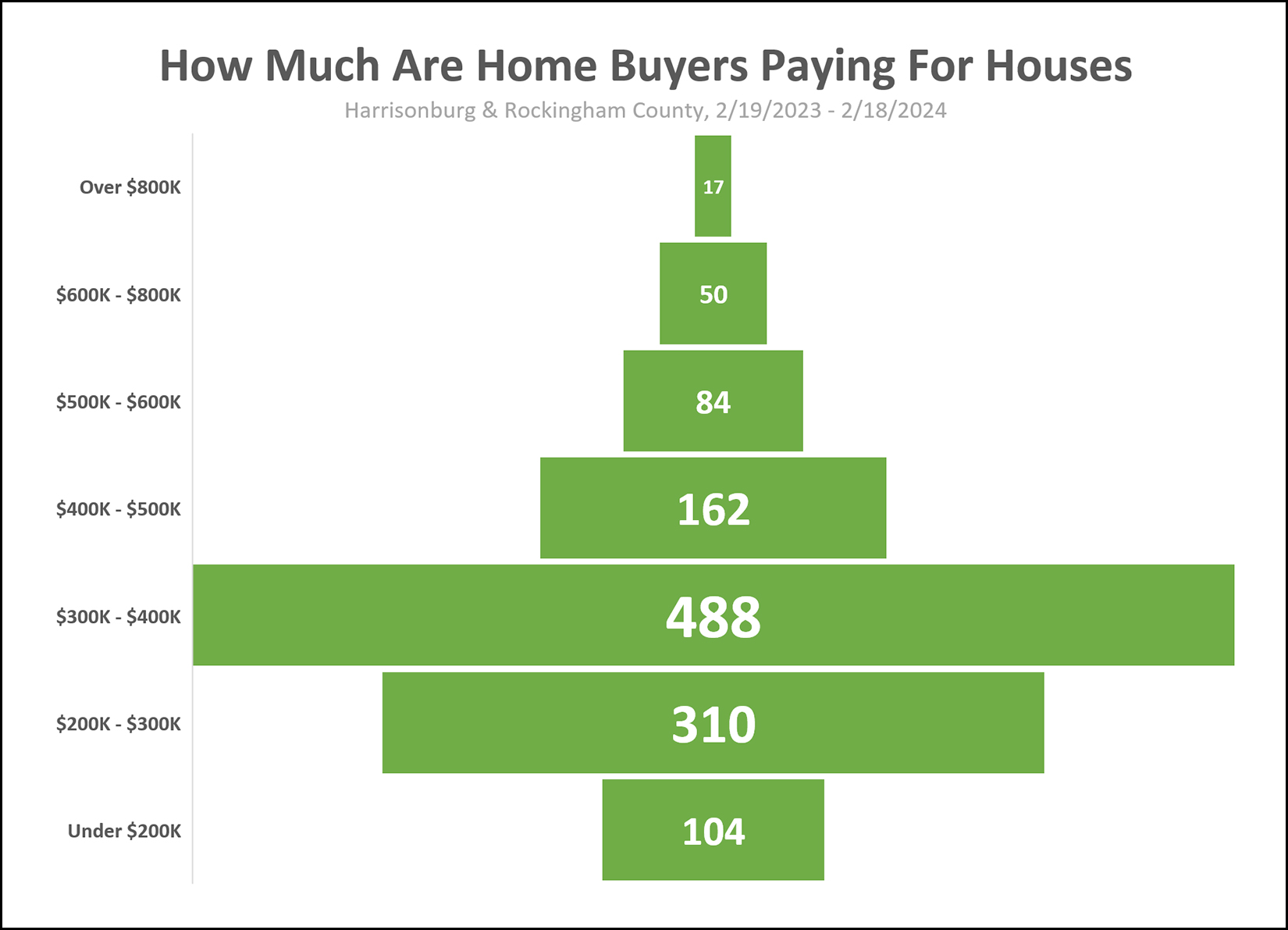

How Much Are Home Buyers Paying For Houses? |

|

How many buyers in the past year have been able to purchase a property for less than $200K? 104 buyers... or 9% of the buyers who bought in the past year. How many buyers paid more than half a million dollars for their homes? 151 buyers... or 12% of the buyers who bought in the past year. In what price range are the largest number of buyers buying? Just over 40% of home buyers paid $300K - $400K over the past year. As you prepare to sell your home you should take time to understand the size of the pool of buyers who will be potentially interested in buying your home. | |

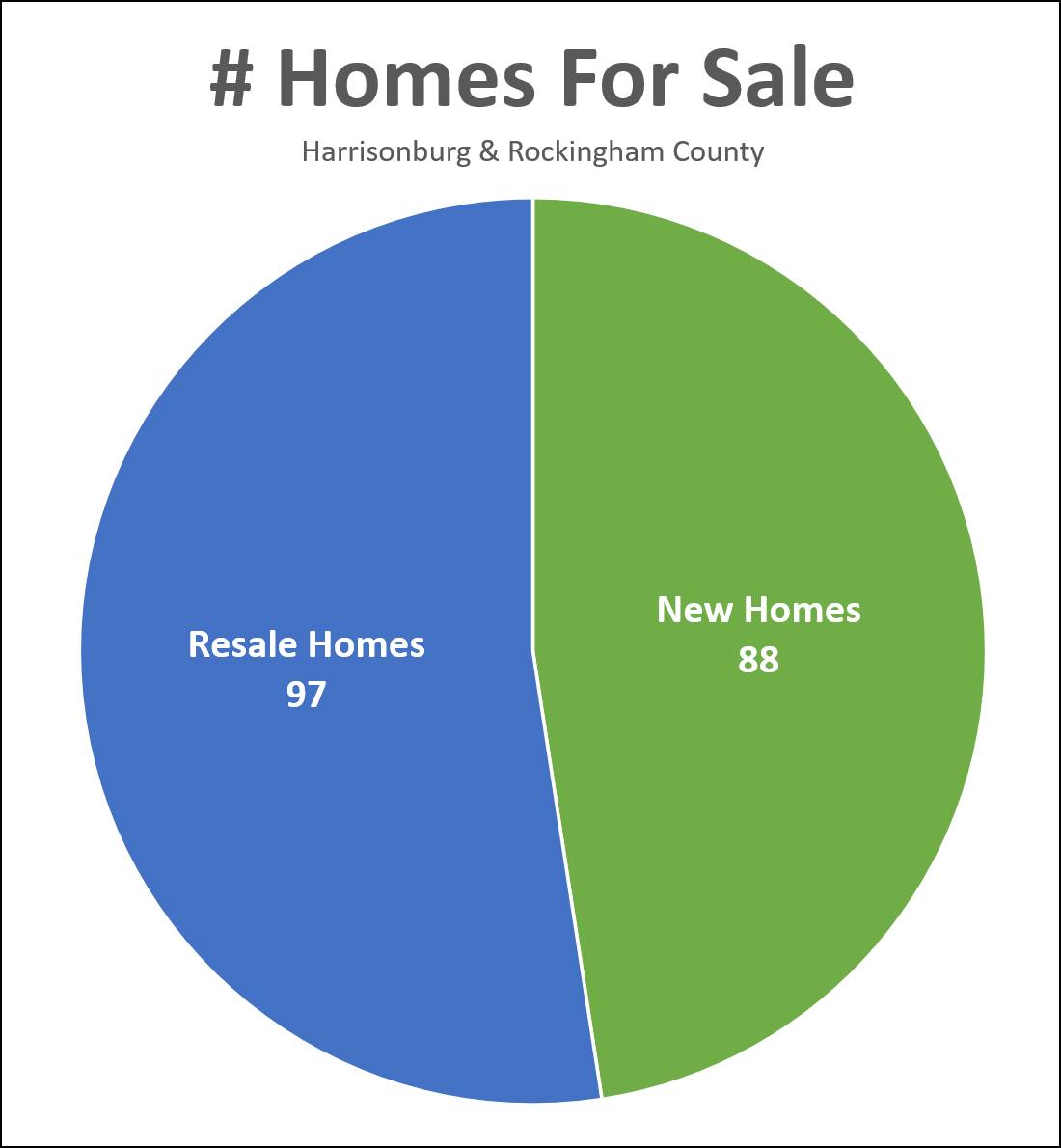

Almost Half Of Homes For Sale Are New Homes |

|

There are SOOOO many homes for sale... 185 of them right now, compared to only 109 a year ago. But... maybe there aren't as many homes for sale as you might think!?! As shown above, almost half of the homes currently listed for sale are new homes! New Homes For Sale = 88 Resale Homes For Sale = 97 So, even before we get to any price or location limitations, if you aren't looking to buy in a new home community you will only actually have 97 homes from which to choose, not 185 homes. These new homes for sale are mostly in these neighborhoods... | |

Despite An Increase In Home Sales In January, Contract Activity Is Down, Inventory Levels Are Up, Days On Market Is Up |

|

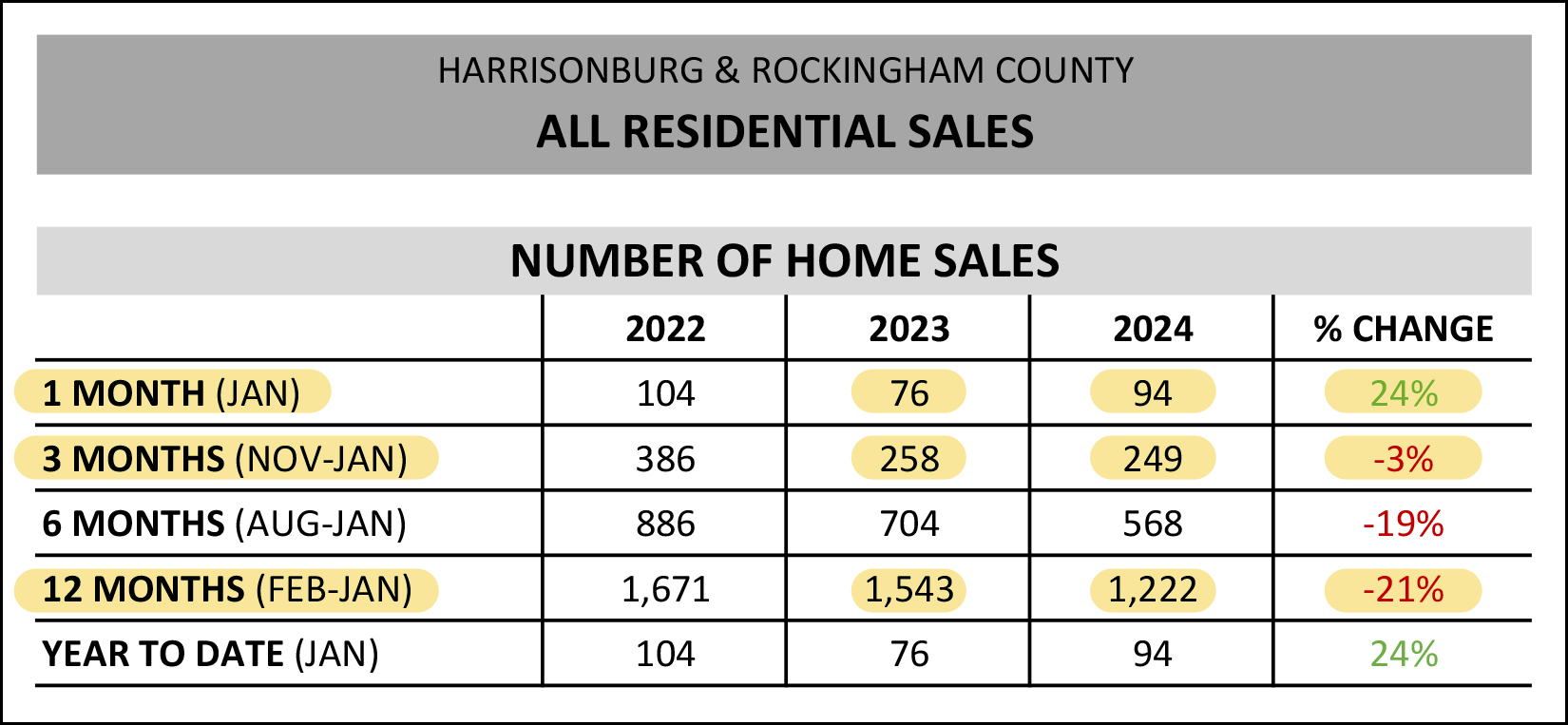

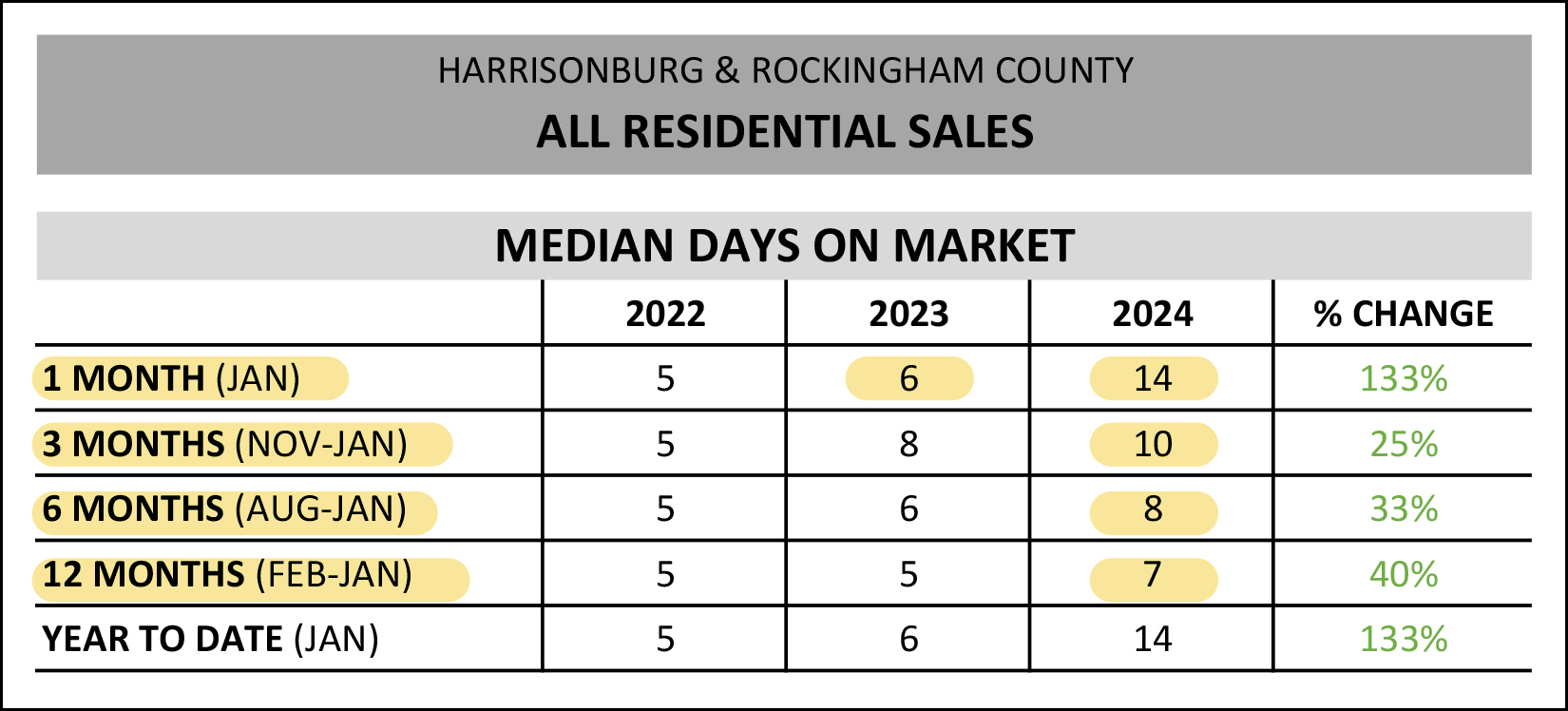

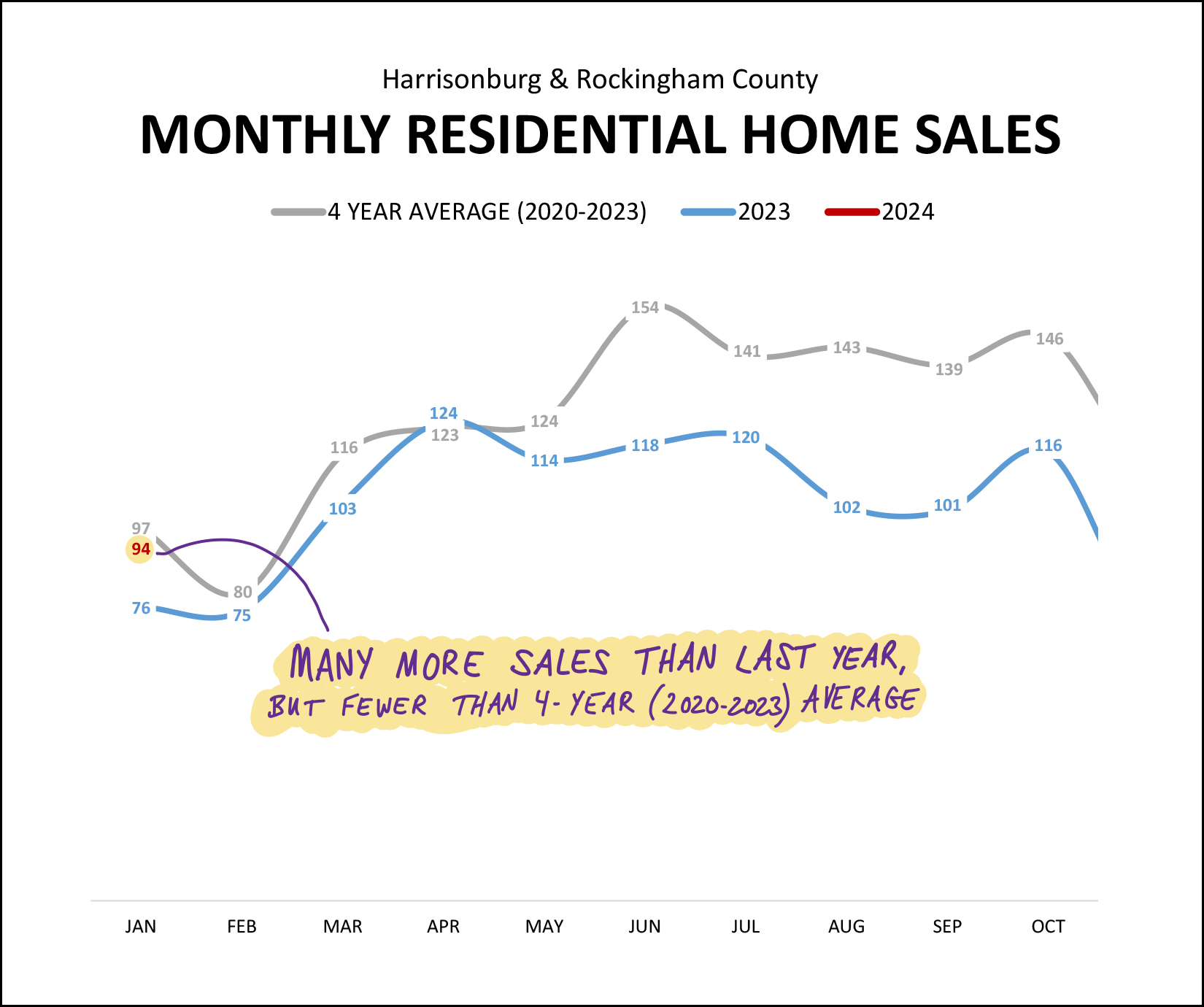

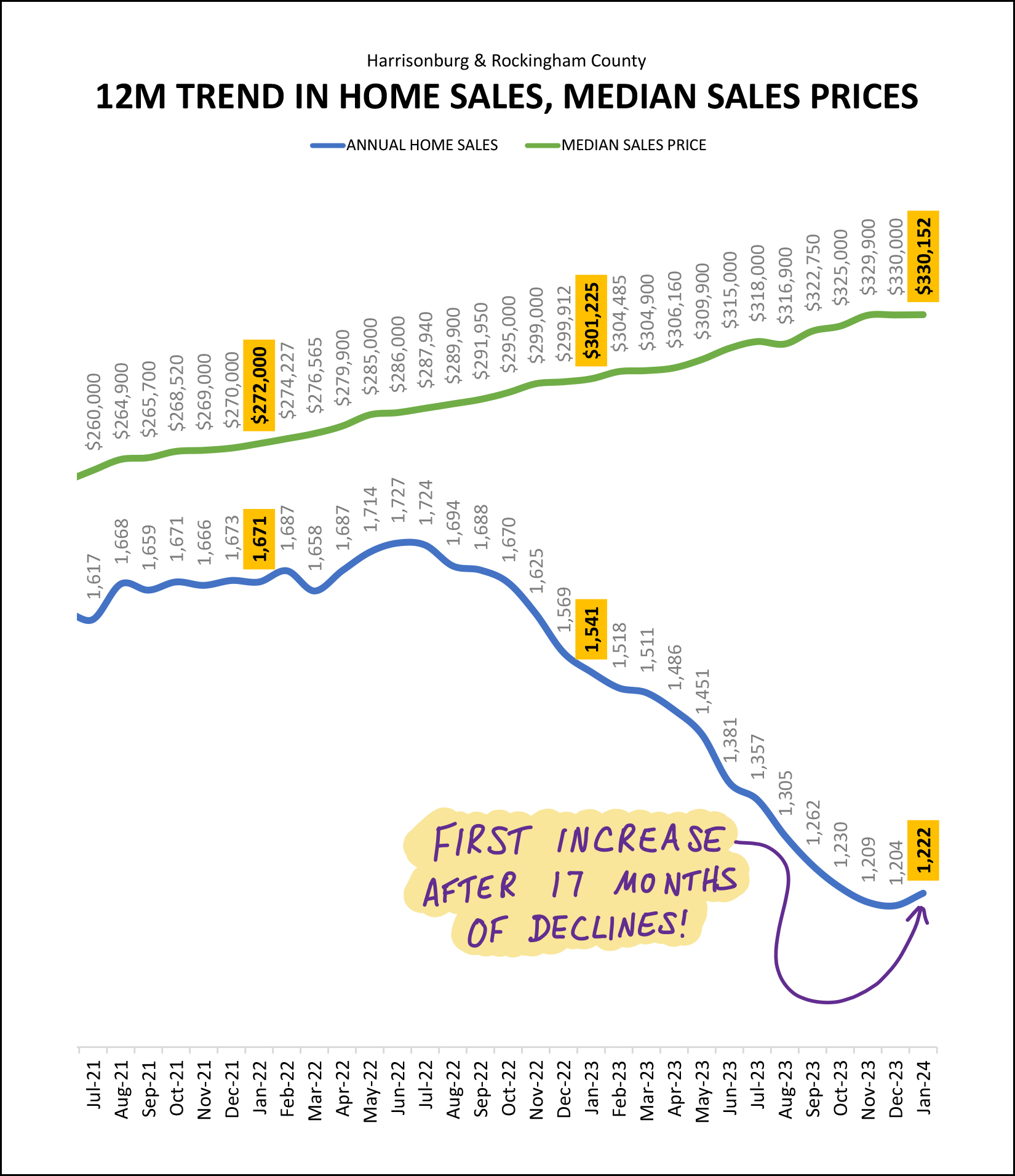

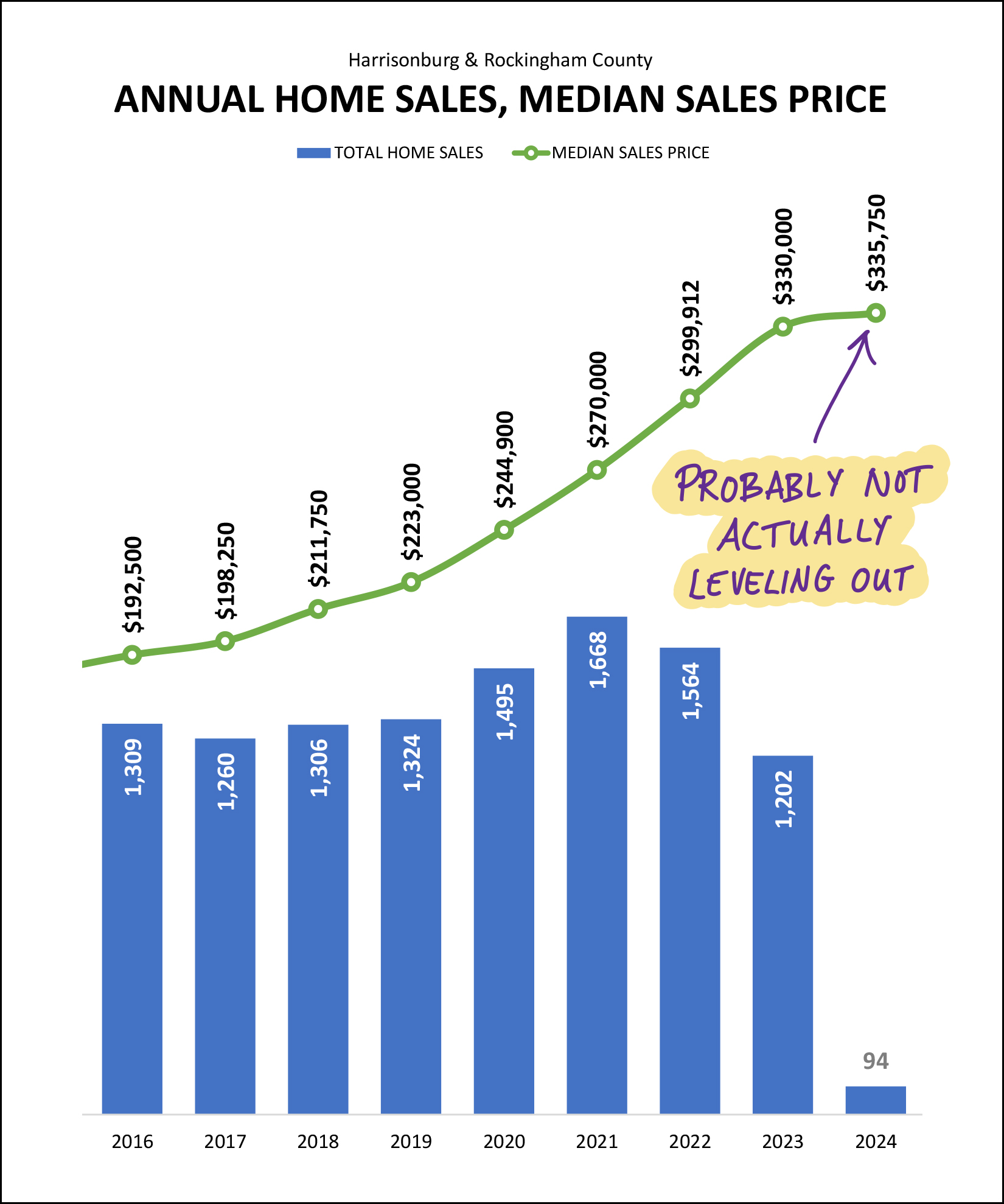

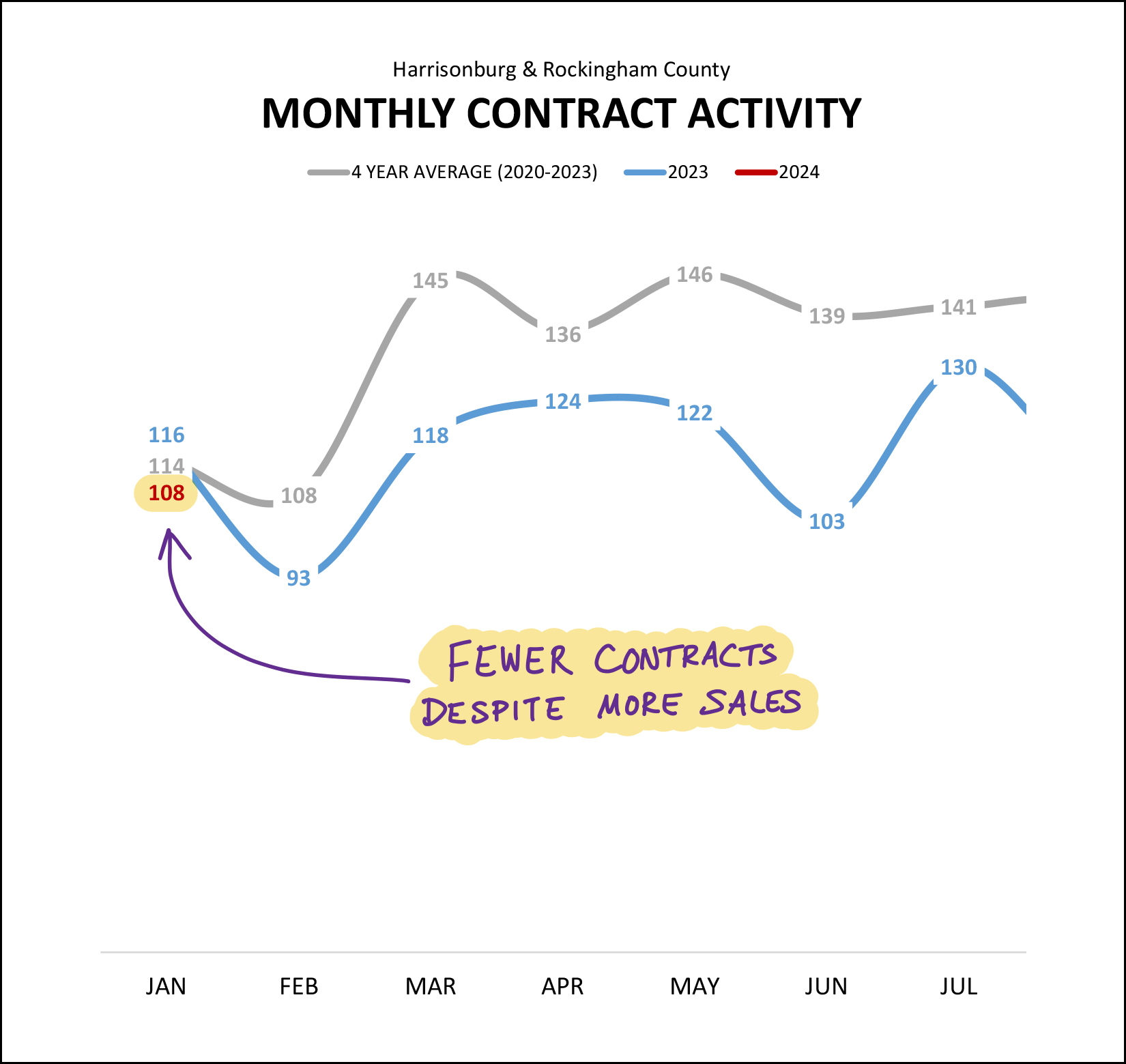

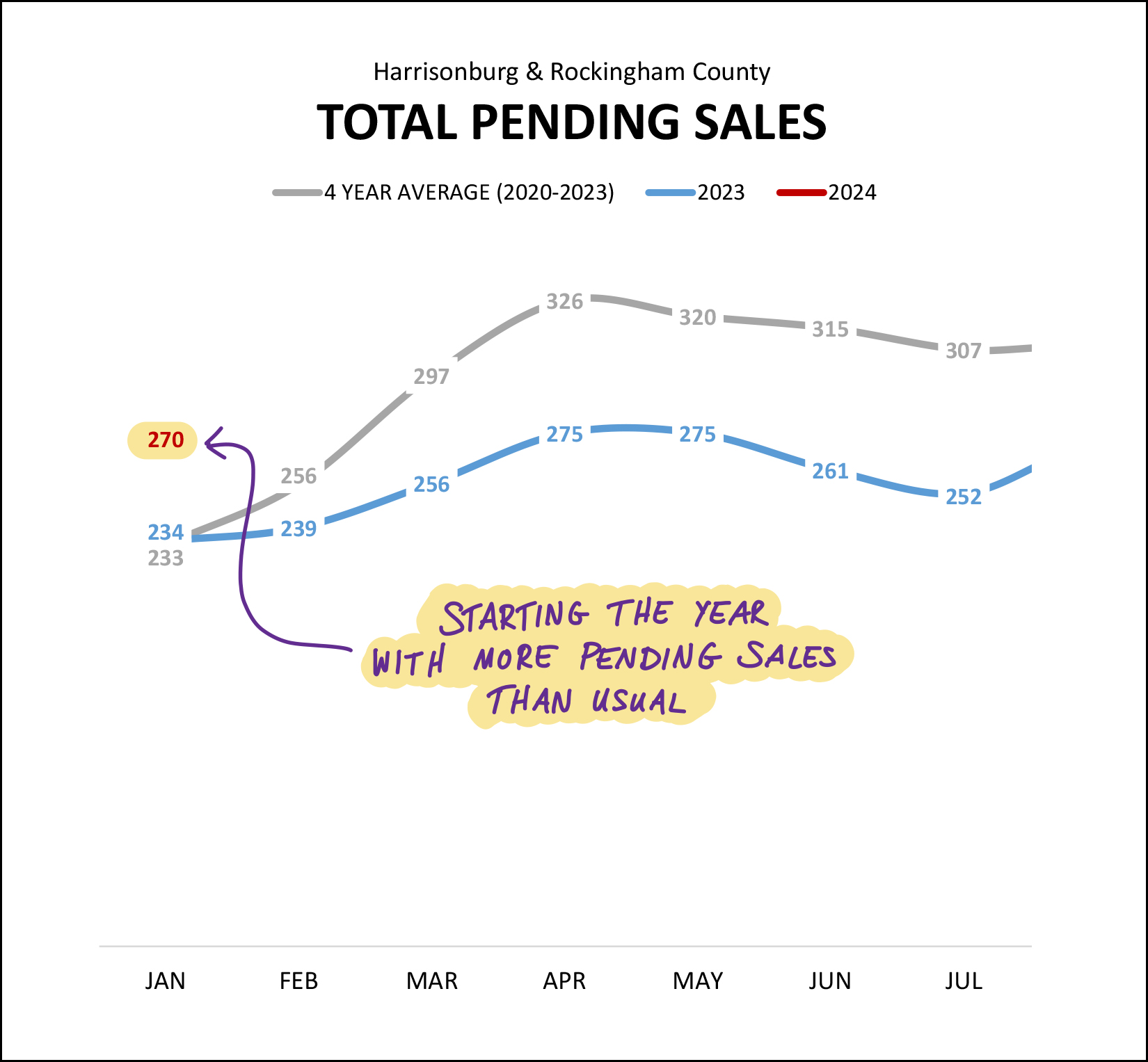

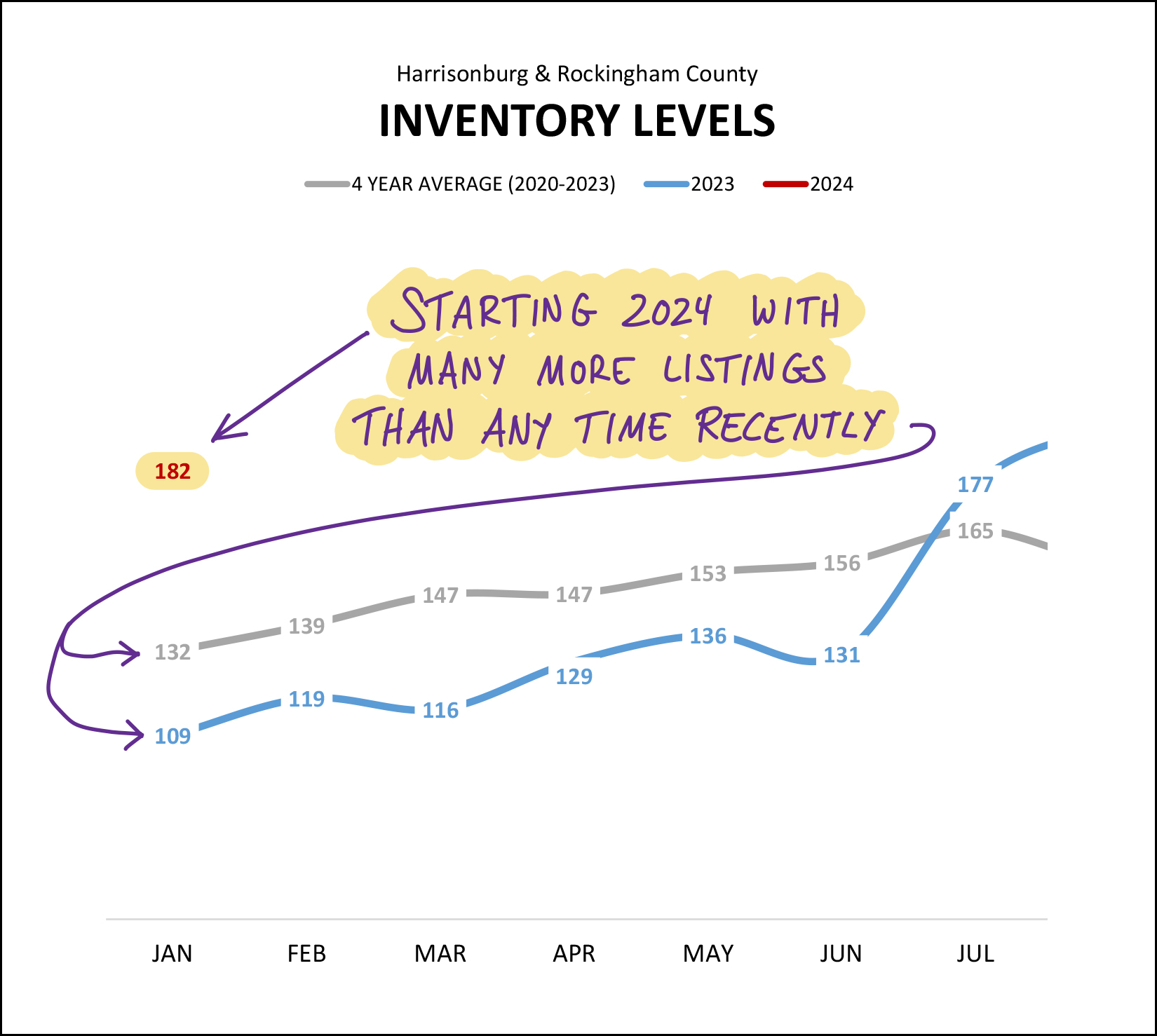

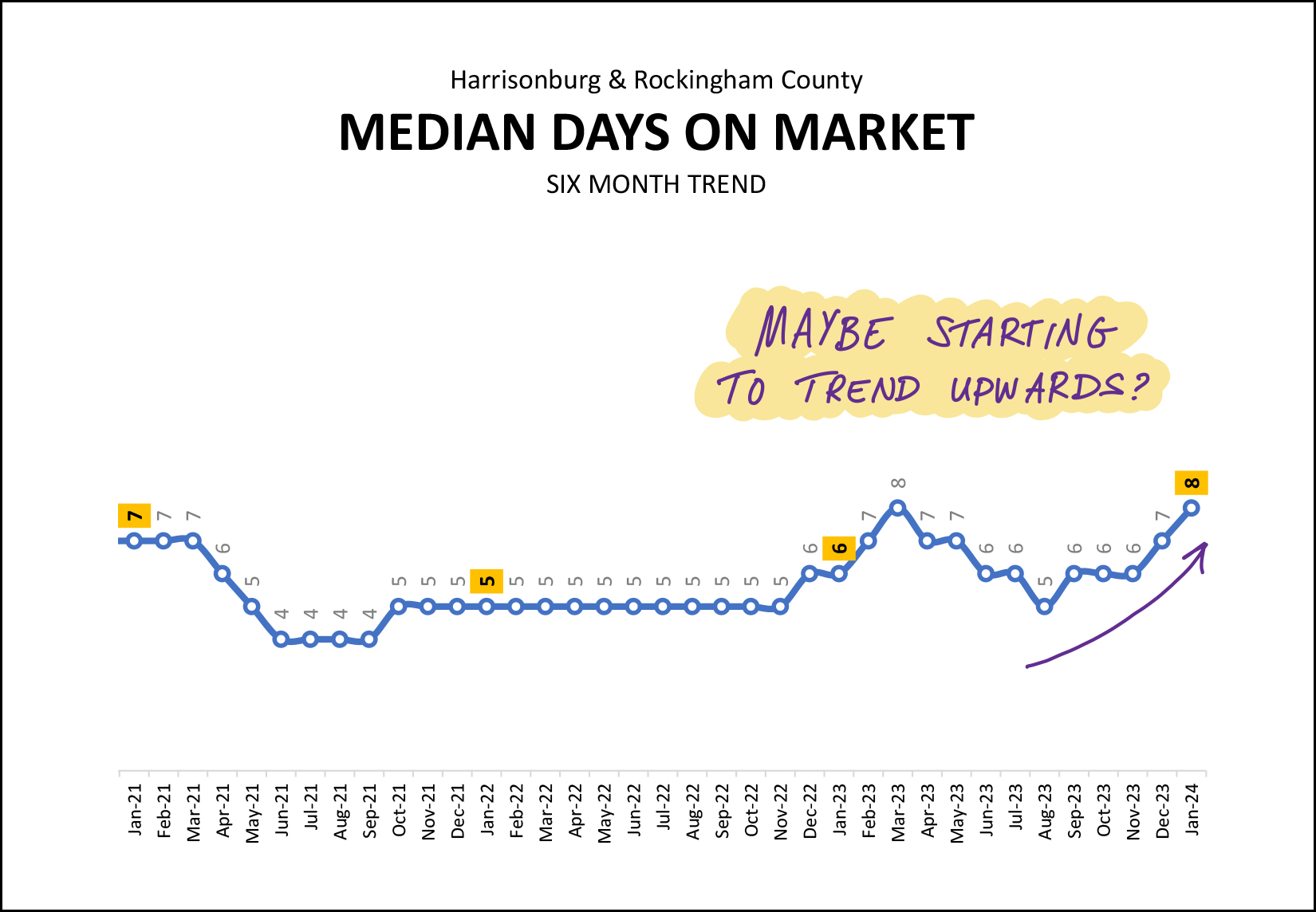

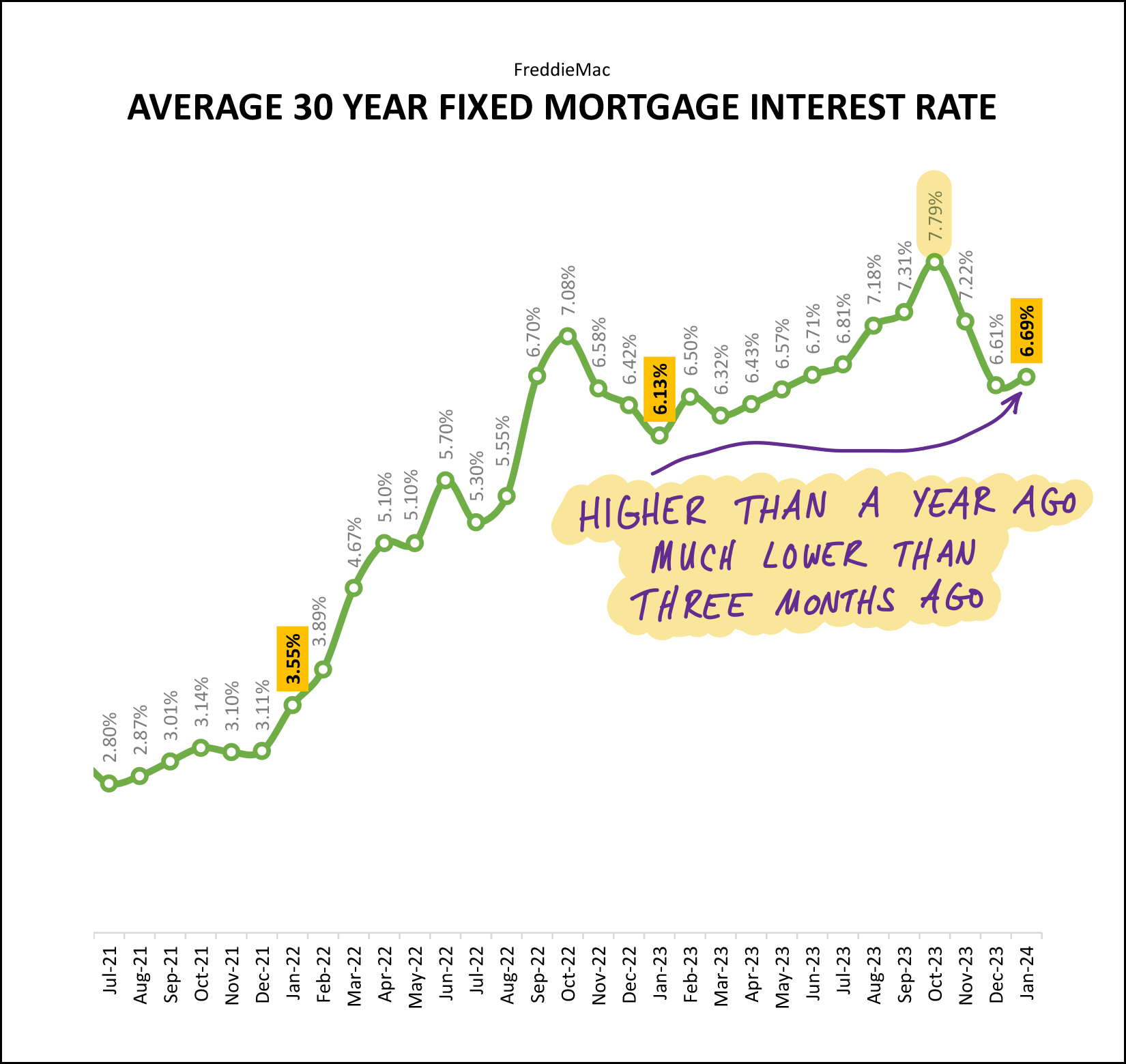

â¤ï¸ Happy Valentine's Day! â¤ï¸ For those of you that just *love* reading my market reports each month... consider today's report my valentine to you. ð That said, the real estate indicators this month aren't all hearts and candy and hugs and kisses... so TBD if you'll still consider this to be a loving Valentine's Day message by the end. But first, as a peace (love?) offering... each month I provide a giveaway, of sorts, for readers of my monthly market report. This month I'm highlighting a delightful cafe / coffee shop just outside Dayton called Harvest Table. They offer great coffee beverages, a delicious array of baked goods, and a solid (all-day) breakfast and lunch menu as well! If you haven't checked out Harvest Table -- you should -- and click here to enter your name for a chance to win a $50 gift certificate use on your next visit! Now, on to the real estate data, starting with how many home sales we saw in the first month of 2024.  If we start with how many homes are selling right now (see above) we'll be starting with some rather positive news. After over a year of steady declines in the number of homes selling in our area, we did see a bit of a turnaround in January 2024. A few things I am noticing above... [1] After only 76 home sales in January 2023 we saw 94 in January 2024. I wasn't expecting that we would see this 24% increase in the first month of 2024. I don't necessarily think that means we'll see a 24% increase in the number of homes selling throughout 2024 -- as this is just one month of data -- but it was a pleasant surprise to see more buyers able to buy homes this January than last January. [2] The third highlighted line (above) shows that over the past year we have seen a 21% decline in the number of homes that are selling in Harrisonburg and Rockingham County. This certainly stands in contrast to the 24% increase in January 2024... but if we want to broaden our view a touch we see (in the second highlighted line) that home sales have only declined by 3% when looking at the most recent three months (Nov-Jan) compared to the same three months a year prior. So... based on several bits of data... maybe (just maybe) we won't see another 20-ish percent decrease in the number of homes selling this year in our market... maybe we could actually see some stability in this metric, or a slight increase in the number of homes that are selling in 2024? Wait and see... only 11 more months to go. And how about those home prices...  Just as we can't necessarily believe that the 24% increase in home sales in January 2024 will be a lasting trend, we also shouldn't necessarily believe that the 2% increase in the median sales price in January 2024 will be a lasting trend. As shown above, when looking at three, six or twelve months of data, the median sales price in our area has been rising by 9% - 10%. When looking at just one month of data (January 2024 vs. January 2023) we only see a 2% increase in that median sales price, but I don't think we'll see that low of an increase once we get a few more months into the year. And how about how quickly homes are selling...  There are enough changes on this table (between 2023 and 2024) to give me confidence in saying that the market will almost certainly move at least a bit more slowly in 2024 than it did in 2023 (and 2022). The median "days on market" was 14 days in January 2024, which means that of the homes that sold in January, half of them took more than two weeks to go under contract. This is quite a bit slower than the median of six days last January. Also, if we zoom out a bit to look at the three month, six month and twelve month metrics, we also see higher median days on market in those timeframes as well. We started to see days on market creep up a bit in 2023 but I think we will see an even more significant increase in this "speed of sale" metric in 2024. Many homes will likely still sell very quickly in 2024, but not all homes. This next graph is a bit hard to read with only one data point for 2024, but see if you can find it... hiding on the left side, and highlighted...  That highlighted "94" is showing the number of homes that sold in January 2024... which was well above the 76 home sales we saw last January (in blue) and only barely above the four year average of 2020 through 2023. Looking and thinking ahead towards the next few months the question that remains is whether home sales in 2024 will remain stronger than in 2023, or whether the monthly sales count will drift back down towards 2023 levels. I'll hit on contract activity and pending sales a bit later to allow us to think more about what the coming months might look like. And now, a look at the overall big picture trends as it relates to how many homes are selling and the prices at which they are selling...  At this point you might be wondering why I warned you in the beginning of the report about some of the metrics not being entirely positive this month. Well, keep reading, but this graph (above) is still in the positive category. The blue line above tracks the number of annual home sales taking place in Harrisonburg and Rockingham County (per the HRAR MLS) when measured on a monthly basis. After 17 months of a declining pace of annual home sales, we saw the first increase in January 2024... from 1,204 home sales to 1,222 home sales. This change in direction in this trend is a result of strong January 2024 home sales compared to January 2023 home sales. If that continues in February 2024, we'll see this line continue to rise again. The top (green) line shows the median sales price over a year's time, measured each month. Clearly, the median sales price has been increasing for many (!!) months (years) now. This metric has flattened out a bit over the past two months, so stay tuned to see if the median sales price continues to increase in 2024 as quickly as it did in 2022 and 2023. Here's another look at that possible change in how quickly prices are rising...  At first glance, it would seem that the rapid increases in the median sales price that we saw in 2020, 2021, 2022 and 2023 might finally be coming to an end in 2024. And, that might be true. We could see a much smaller increase in the median sales price this year. But... keep in mind that the graph above is comparing 12 months of data in 2023 to only one month in 2024. Once we have a few more months of data to consider in 2024 -- a larger data set than the 94 January home sales -- we'll be able to have a better sense of whether we will see similar or smaller increases in the median sales price in 2024. Next up, contract activity, one of the indicators of what we should expect next...  I suppose I shouldn't focus too much on contract activity being slower in January 2024 than in January 2023 because it wasn't that large of a difference... a decline from 116 contracts last January to 108 contracts this January. But, after seeing a big uptick in closed sales in January 2024, I was expecting to see more contracts in January as well -- which would allow us to more confidently expect to see overall home sales activity to increase in 2024. So, with more sales in January, but fewer contracts, what will February (and March) look like in 2024? Well, here's another potential indicator... pending sales...  Pending sales is a measure (a count) of how many properties are under contract (pending) at any given moment in time. A year ago there were 234 pending sales at this time, which was in line with the four year (2020-2023) average of having 233 pending sales at this time of year. But then, January 2024. At the end of January (beginning of February) we are now seeing 270 pending sales -- much more than any time recently. So, despite fewer homes going under contract in January, the total number of homes waiting to make it to closing is much higher than we might have otherwise expected. All of this points to the possibility that we will actually see an increase in the number of homes selling in 2024 as compared to 2023. Give it a few more months to see if the data keeps reinforcing that hypothesis, but I am starting to think we'll see an increase in home sales this year as compared to last year. And perhaps more homes are selling because more are available for sale?  Not only are there many more (15% more) pending sales right now as compared to a year ago, there are also many more (67% more) homes for sale right now as compared to a year ago. That's actually a pretty significant (67%) increase in inventory levels in a year's time. One year ago a buyer would have been able to choose from 109 homes to give to their special someone on Valentine's Day. This year, they can choose from 182 homes for sale. If you've been hoping your loved one will give you a new home for Valentine's Day... you might be in luck, there are sooo many more options this year. If you don't get that new home along with some roses and a box of chocolates, don't let them blame it on the low housing inventory levels... Now, back to that median "days on market" metric...  Way back in mid-2021 the median days on market dropped all the way down to four days... and then stayed at five days for more than a year after that. We started to see the median days on market bounce around a bit more in 2023 as we went from a market where absolutely every home seemed to sell very (very) quickly to a market where many homes still sold very quickly, but not all of them did. As we look at the increase from a median of five days on the market back in August to a median of eight days on the market today, we may just be seeing a seasonal increase that we will start to see every year... or we may be seeing the beginning of a slight slowing in the market. But... keep in mind... if the median days on market increases from five to eight days, that is not a drastically different market. It's an increase, but it's not an increase to 10 or 20 or 30 days on the market. Thus, it will be important to continue to monitor this metric over the coming months to see if 2024 is and will be a more slowly moving market than last year. Finally, how about those mortgage interest rates...  One of the main causes for the decline in the number of home sales in 2023 was rising mortgage interest rates. In 2022 mortgage interest rates rose from 3.11% to 6.42%. Then as 2023 went on, they rose even further, up to a peak of 7.79%. Can you blame buyers for not wanting to buy with a mortgage interest rate above 7%... or for sellers not wanting to sell and then have to buy with an interest rate above 7%? Over the past few months we have started to see mortgage interest rates decline, back to around 6.7% by the end of January. If we continue to see declines in mortgage interest rates in 2024 that will likely encourage further buying activity, though I don't expect that they will get all the way down 6% by the end of the year. And there we have it, very much a mixed bag of market metrics this month. More home sales, fewer contracts but more pending sales, higher inventory levels, higher days on market. All of that likely adds up to 2024 being yet another interesting and not entirely predictable year in our local housing market. If you plan to buy this year - talk to a lender soon and then frequently over time to understand how changing mortgage interest rates affect your budget and monthly payment. If you plan to sell this year - prepare your home well, price it in line with recent similar home sales, and know that your home might be on the market for more than a few days. If you own a home and do not plan to sell it - this will likely be another good year for you with your home increasing in value and another year of paying down a mortgage that likely has a very low interest rate. And to each of you -- if I can be of any help to you with real estate or otherwise, don't hesitate to reach out. You can contact me most easily at 540-578-0102 (call/text) or by email here. I hope you have a wonderful Valentine's Day! XOXO -Scott | |

Evergreene Homes Proposed New Residential Development On Port Republic Road, Weston Park, To Potentially Include 74 Townhomes, 28 Duplexes And 26 Detached Homes |

|

The developer of Preston Lake, Evergreene Homes, is proposing a rezoning in the City of Harrisonburg to allow for the development of a new neighborhood across Port Republic Road from Westmoreland Drive...  This development would include 128 homes currently shown as:

The City of Harrisonburg Planning Commission will hold a public hearing about this rezoning request on February 14, 2024. City staff recommends that this rezoning request be denied, for two reasons... [1] The Comprehensive Plan shows this area as Low Density Mixed Residential which is intended to include large and small lot single family detached dwellings, sometimes with duplexes - but not with townhouses. The majority of the dwelling units in the proposal for Weston Park are townhouses. [2] Only 6.3% of the approved dwelling units between January 2021 and February 2024 have been single family homes and 1.6% have been duplexes. During that timeframe, 23.2% of the approved dwelling units have been for townhomes (589 of them) and 68.9% of the approved dwelling units have been for multi-family properties (1,747 of them). As the staff report summarizes... "Given the lower number of single-family detached and duplex dwellings that have been given use-approval compared to townhomes, and that the Comprehensive Plan recommends single-family detached and duplexes for the subject property, at this time, staff does not believe the subject property needs to be rezoned to allow for more townhome development." | |

To Everyone Not Selling Their Home This Year |

|

Plenty of you won't sell your home this year. You might not sell because... [1] You love your home. [2] You don't want to trade your mortgage's 3-point-something interest rate for a 6-point-something interest rate. [3] Even though you would sell your home for more than you might have imagined last year, you don't want to then have to buy a new home for more than you would have imagined last year. Whatever the reason... plenty of you won't sell your home this year. If you fall into that category (not a seller) I encourage you to think about what small or medium sized (or large!?) improvements you can make to your home. Here's why... [1] You'll love your home even more. [2] You'll make your home more appealing to buyers when you do eventually sell. [3] You'll be removing one item from your list of possible improvements years down the road when you sell. Homes that have not had any improvements or updates for 10, 15 or 20 years can be challenging for sellers to sell and challenging for buyers to get excited about buying. So, if you are not selling your home this year, give some thought to what changes or improvements you might make to your home in 2024. | |

An Interesting Side Effect Of Buyers Being Slightly Pickier Given Higher Mortgage Interest Rates |

|

OK, see if you can follow me on this one... When mortgage interest rates were low (below 4% for a while) buyers could afford most houses they wanted to pursue, competition amongst buyers was fierce, and buyers were willing to compromise on some of the ways in which any given house wasn't quite the perfect house. If it was good enough, they would very likely make an offer. With mortgage interest rates now being quite a big higher (above 6%) buyers can't afford as many houses, and they are often (reasonably) being a bit pickier about how well a particular house fits their needs and desires. If they're going to spend *that much* on a house payment, they want it to be a pretty darn good fit for what they want in a house. Here's an interesting side effect of this shift... Before... most or all houses would rapidly have offers, and often have multiple offers. Now... some houses aren't getting many offers at all, and some are getting a TON of offers. The houses that are the most widely appealing to buyers are feeling "just right" to so may buyers that they are generating lots of offers. The houses that are mostly appealing to buyers but have some "flaws" or some "not quite right" features in the eyes of some or many buyers are seeing fewer offers, or slower offers, or no offers. I understand a buyer's logic in this type of a situation... monthly mortgage payments are high right now given higher home prices and higher mortgage interest rates... so you want to love the house you intend to buy. | |

I Will Never Sell My House, He Exclaimed |

|

I think more of us might be in this category than anyone realizes. About 80% of homeowners have a mortgage rate below 5%. About 60% of homeowners have a mortgage rate below 4%. With current mortgage interest rates in the 6-point-something range, why would any of those homeowners want to sell their home!? I think we will continue to see depressed (lower) numbers of resale listings in 2024 as plenty of homeowners decide to keep making their current home work, given their very low mortgage interest rate. Or, as the guy said earlier this week who has an interest rate below 3%... "I Will Never Sell My House!" If you're in the market to buy a home right now, we are likely to see more resale listings coming on the market in the spring, but there will likely be fewer such listings than there are buyers who want to buy them, so competition will likely remain fierce especially in some price ranges and locations. | |

Some Houses Are Still Selling Super Fast With Many Offers |

|

Plenty of houses are taking a while to sell these days... sometimes weeks and even months. But... some are selling VERY fast, with LOTS of offers. Case in point - a house that shall not be named - with 12 offers within three days of being listed. Some would-be sellers thus wonder --- will my house be a three month sale or a three day sale. Oversimplifying a bit... it's all about supply and demand. If a house is listed for sale in a neighborhood where there are already two houses for sale and there are very few buyers looking for the combination of features that the house offers -- it might take a bit for the house to sell. If a house is listed for sale in a neighborhood where homes have rarely been listed for sale over the past two years and there are a ton of buyers who would love to live in that neighborhood -- it might take just a few days for the house to sell. We ought to analyze and evaluate the type of market your house might fit into (of the two general types above) before we list your home for sale -- but we won't really know with certainty how the market will respond until we list your home for sale. | |

Starbucks, Chipotle, Hotels, Storage And More Planned For Urban Development Area |

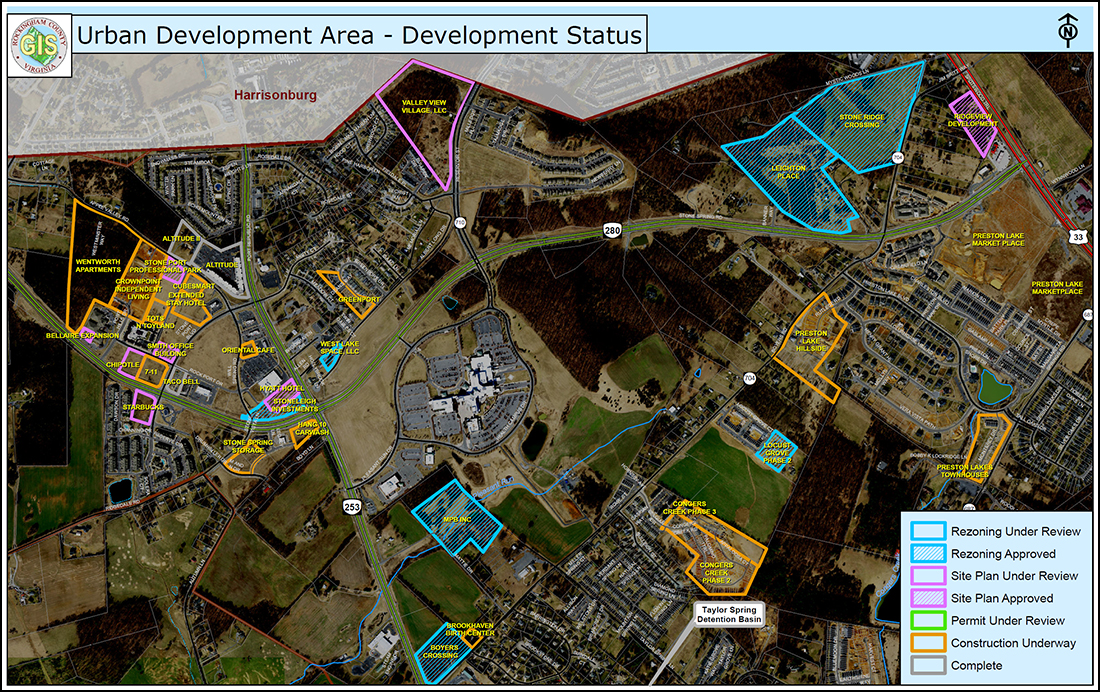

|

Above is a recently updated map of the Urban Development Area. Some updates to be aware of... [1] Site work has begun for Wentworth Apartments. [2] An extended stay hotel is being built on Stone Port Blvd. [3] A new Chipotle might be built on Stone Spring Road next to the new 7-11 gas station that is almost complete, which is next to Taco Bell. [4] A new Starbucks may be built on Stone Spring Road. [5] A Hyatt Hotel may be built behind Walmart. [6] CubeSmart Storage was recently completed and Stone Spring Storage is being constructed. Download the full sized map here. | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings