Archive for August 2024

| Older Posts |

How Will I Pay For The Services Of My Buyer Agent In Addition To Paying For The House? |

|

Some current or near future home buyers may be amidst conversations with their agent... learning that they need to sign a buyer brokerage agreement... that outlines that they will be paying for their buyer's agent's services... and might be wondering... How Will I Pay For The Services Of My Buyer Agent In Addition To Paying For The House? Two immediate thoughts come to mind... [1] Plenty of home sellers (maybe most of them?) will likely be planning to pay for the buyer's agent commission out of the sales price of the house that you are paying them. You shouldn't assume this is the case... but your buyer agent can ask if a seller is planning to pay the buyer agent's commission. If the answer is "no" you can always propose that as a part of the offer that you make. [2] For any sellers that are not planning to pay for the buyer agent's commission... some buyers will be more capable than others to pay for the house plus pay for their buyer agent's commission. This popular listings with many offers this will likely be more of an issue for buyers (help - I can't pay for your house plus for my agent's services) than it will be for sellers. | |

If I Am Selling My House Do I Have To Pay A Commission For The Buyer Agent? |

|

If I Am Selling My House Do I Have To Pay A Commission For The Buyer Agent? Short answer - no. Longer answer - keep reading. For most of the transactions I have been involved with for the past 21 years... The sellers of most homes agreed in a listing agreement to pay a brokerage fee (commission) that would end up (in most transactions) being paid in part to the company and agent representing the seller and in part to the company and agent representing the buyer. But with home buyers now needing to sign buyer brokerage agreements before touring even a single house... ...and thus having more upfront conversations with their agent about compensation... ...some sellers might be wondering... If the buyer for my home is signing a buyer brokerage agreement to pay their agent for their services, do I have to offer to pay a commission to the buyer agent? Sellers are not required to offer to pay a commission to a buyer agent... though this is not actually new. You didn't have to offer to pay a commission to a buyer agent last year, nor do you this year. Given you don't have to offer to pay a commission to the buyer agent, what should you do, or what will most sellers likely do? WILL PAY - I imagine plenty of sellers will likely still plan to offer to pay the buyer agent's commission. In this scenario, the buyer will pay the seller X for the house and the seller will pay their agent's commission and the buyer's agent's commission out of the sales price. WON'T PAY - There will likely be some sellers who will not plan to offer to pay a buyer's agent's commission. In this scenario, assuming the buyer is represented by an agent, the buyer will pay the seller X for the house and the seller will ONLY pay their agent's commission out of the sales price. The buyer will then pay Y to their agent as a commission, resulting in the buyer paying X (sales price) plus Y (buyer agent commission) to purchase the home. What you as a seller might choose to do could be related to the balance of the market in your particular price range, or could be related to whether your target buyers are likely to have extra funds available to pay the buyer agent commission in addition to the sales price, or could be related to your overall pricing and marketing strategy. We will want to talk through all of these scenarios to determine your best course of action as to whether to offer to pay a buyer agent commission when you are selling your home. | |

If You Are Buying A Home, Who Is Paying Your Agent? |

|

So you're buying a home, and you have a real estate agent representing you in that purchase? Excellent. Some of the roles that agent will likely fulfill include...

But... this agent that is representing you in the purchase... who is paying for their services to you? Since I started representing home buyers back in 2003, most people would have said "the seller" and here's why... The sellers of most homes listed for sale agreed in a listing agreement with their agent to pay a brokerage fee (commission) that would end up (in most transactions) being paid in part to the company and agent representing the seller and in part to the company and agent representing the buyer. So, most home sellers would likely say that they were paying for the services that the buyer's agent was providing to the buyer. And most home buyers would likely say that the seller was paying for the services that the buyer's agent was providing. Since a buyer now has to sign a buyer brokerage agreement with their agent before touring even a single property, a buyer will likely have more conversations about their agent's compensation earlier in the process. Most buyers will hopefully understand that they are paying a specific brokerage fee to compensate their agent for their services. That said, many (or most?) home sellers may still offer to and plan to pay the buyer's agent's compensation. If they do, it's less clear how to answer the question of who is paying for the buyer's agent's services. If a buyer agrees to pay ___ for their buyer agent's services... ...and the seller of the house they plan to buy agrees to pay ___ for the buyer's agent's services... ...then who IS paying for the buyer's agent's services!? In this scenario, while the buyer agrees to pay for the services, the seller agrees to deduct that cost out of the purchase price of the house. Or, alternatively... If a buyer agrees to pay ___ for their buyer agent's services... ...and the seller of the house they plan to buy does NOT agree to pay for the buyer's agent's services... ...then clearly, the buyer is directly paying for the buyer's agent's services. In that scenario, a buyer pays a price for the house and pays for their buyer agent's services as an additional fee. Have we gone around and around in a few circles here? :-) Email me with any follow up questions that you might have.

| |

So If I Want To Go See A House, I Have To Commit To A Long Term Agreement An Agent I Barely Know? |

|

It is a fair question... if you're just getting started on searching for a house, do you really have to sign a long term agreement with an agent when you might not have even met them yet!?! The answer is no... on the "long term" part of the question. Yes, home buyers now have to sign a buyer brokerage agreement before touring a house. The buyer brokerage agreement will outline what services will be provided, how long those services will be provided, and any associated fees. The agreement outlines the working relationship between buyer and agent. But if you're just getting started on your home search, you might not be ready to sign on to a long term relationship with an agent you haven't even (or have just) met. So, remember that... It doesn't have to be a six month agreement for the agent to represent you in the purchase of any house in Harrisonburg and Rockingham County. The signed buyer brokerage agreement could be a 30 day agreement for the agent to represent you in the purchase of any house in Harrisonburg or Rockingham County. Or, the signed buyer brokerage agreement could be a 30 day agreement for the agent to represent you in the purchase of the house located at 123 Main Street, which is the first house you would like to tour. If you are getting ready to buy a house... 1. You might be ready to sign on to a long term agreement with an agent to represent you in your home purchase, perhaps because you already know the agent, have worked with them before, or have heard great things about them from your friends. ...or... 2. You might not be ready to sign on to a long term agreement with an agent to represent you in your home purchase, perhaps because you have yet to meet the agent with whom you hope to have represent you in your home search process. Don't get overwhelmed with the perceived need to commit up front to a broad and long lasting relationship with someone you have only recently met. (It seems this probably applies to both home buying and life in general.) Chat with the agent whom you hope to have represent you in your home purchase and work towards terms of a buyer brokerage agreement that are comfortable for you. | |

Yes, Would Be Home Buyers Must Now Sign A Buyer Brokerage Agreement Before Touring A House |

|

Backing up a bit... In Virginia, written buyer brokerage agreements have been required for over 12 years... since July 2012. That is to say that... if an agent is representing a buyer in a real estate transaction, the buyer and buyer's agent must sign a written buyer brokerage agreement to outline the services to be provided, how long the services will be provided and any associated fees. But... one aspect of this requirement has changed this month... when a buyer brokerage agreement must be signed. In the past, a buyer and buyer's agent could go view a property (or several properties) without a buyer brokerage agreement being signed. If a buyer was ready, willing and able to buy a house then they needed to sign a brokerage agreement before touring a house, but otherwise, it did not need to be signed at the time of touring a house. Now, not so much. Now, an agent can't show you a house unless you have signed a buyer brokerage agreement. It's interesting to think about two main categories that buyers might fall into... Definite Buyers - These buyers are definitely going to buy a home. When, what, where, etc., are not yet certain, but they are definitely going to buy a home. These buyers likely have an established working relationship with an agent -- thus it likely won't be confusing or strange for these buyers to sign a buyer brokerage agreement with their agent. Possible Buyers - These buyers might possibly buy a home, but they are often in the early stages of the home search, or just casually exploring the possibility of buying. These buyers might be reaching out to an agent to go view a house for the very first time -- thus it might seem a bit overwhelming or off-putting for these buyers to consider signing a buyer brokerage agreement. Eventually, this requirement of having a signed buyer brokerage agreement before touring a home will feel like it has always been a requirement -- but that might take years. For now, know that even if you are just casually considering a home purchase, you will be asked by your agent to sign a buyer brokerage agreement before going to see the house. | |

How Much More Will A Home Buyer Pay For THAT Feature? |

|

A common line of thinking among home sellers can be... I know that the last three buyers in my neighborhood paid $X for their homes... but those homes didn't have ___ feature that my home does offer... so certainly, a buyer will pay $X + Y for my house. Pardon my overly algebraic explanation. Put another way... if your home has a particularly unique feature... that will be seen as desirable by many, most or all buyers... we'll need to think about how much more a buyer will be willing to pay for your house based on that feature. This can be a rather mundane unique feature, such as a brand new roof compared to all of your neighbor's 25 year old roofs... or it can be a rather exciting feature, such as a freshly renovated primary bathroom compared to all of your neighbor's bathrooms that haven't been updated since the 1980's. Regardless of what the main point of differentiation that sets your home above and beyond nearby competing homes... we'll eventually have to translate that feature into a value difference. How much more will a buyer be willing to pay for THAT feature in your house compared to what another buyer paid for a similar home WITHOUT that feature? We can think about that question in a variety of ways...

In the end, though, we'll need to attach some dollar amount to the feature and decide if we are confident enough that a buyer will pay $20K for that feature (for example) such that we will price your home $20K higher than we would have otherwise. | |

Home Purchase Price In The Context Of Needed Or Wanted Further Improvements |

|

Many houses are still selling (going under contract) very quickly, sometimes with multiple offers. Some houses are not. Frequent feedback on houses that do not quickly go under contract is something along the lines of... We like the house... and the purchase price could work for us... but it's at the top of our price range... and we would want to (or need to) make a variety of further updates or improvements after closing. And so... these would be buyers of the could be home... don't make an offer. If you are in the process of selling your home, and you are getting this feedback (like the house, price is OK, but would want to make updates) this can almost always be translated into or better understood as... your list price is too high. Oversimplifying a bit... If a 2400 SF home is listed for sale for $500K and a buyer is comfortable paying $500K for a 2400 SF home... but they would want to (or need to) make $20K - $30K of improvements after purchasing the home... ...then they are not going to be willing to pay $500K for the house. If your house does not go under contract quickly once it is listed for sale, patiently sort through the feedback... but understand that much of the feedback (particularly the feedback described above) can be translated into feedback on your list price. | |

If You Have Some Flexibility With WHEN You Buy Your Home Then Low Inventory Levels Are Less Of A Concern |

|

Housing inventory levels are low... just about any way you slice or dice the data. That doesn't mean there aren't any houses listed for sale. There are quite a few houses listed for sale. That doesn't mean the houses currently listed for sale won't be interesting to you. They very well may be interesting to you. But... depending on what you are looking for in your next home, you are likely to only have a few options from which to choose right now... and it will likely be the same next week and the week thereafter. But... if you have some flexibility in WHEN you buy your home, then these lower inventory levels shouldn't be as much of a concern for you. If you have to buy a house in the next two weeks, then low inventories will directly impact you and you will likely have very few options. If you can buy a house anytime in the next three months, then you should have plenty of options from which to choose during that timeframe, and low inventory levels will not affect you nearly as much. Let's chat about your timeline for making a purchase, as it relates to your move to the area, or as it relates to your current lease, and then we can get a sense of how concerned you should be about low inventory levels. | |

Average Mortgage Interest Rates Are Just That, Average Mortgage Interest Rates |

|

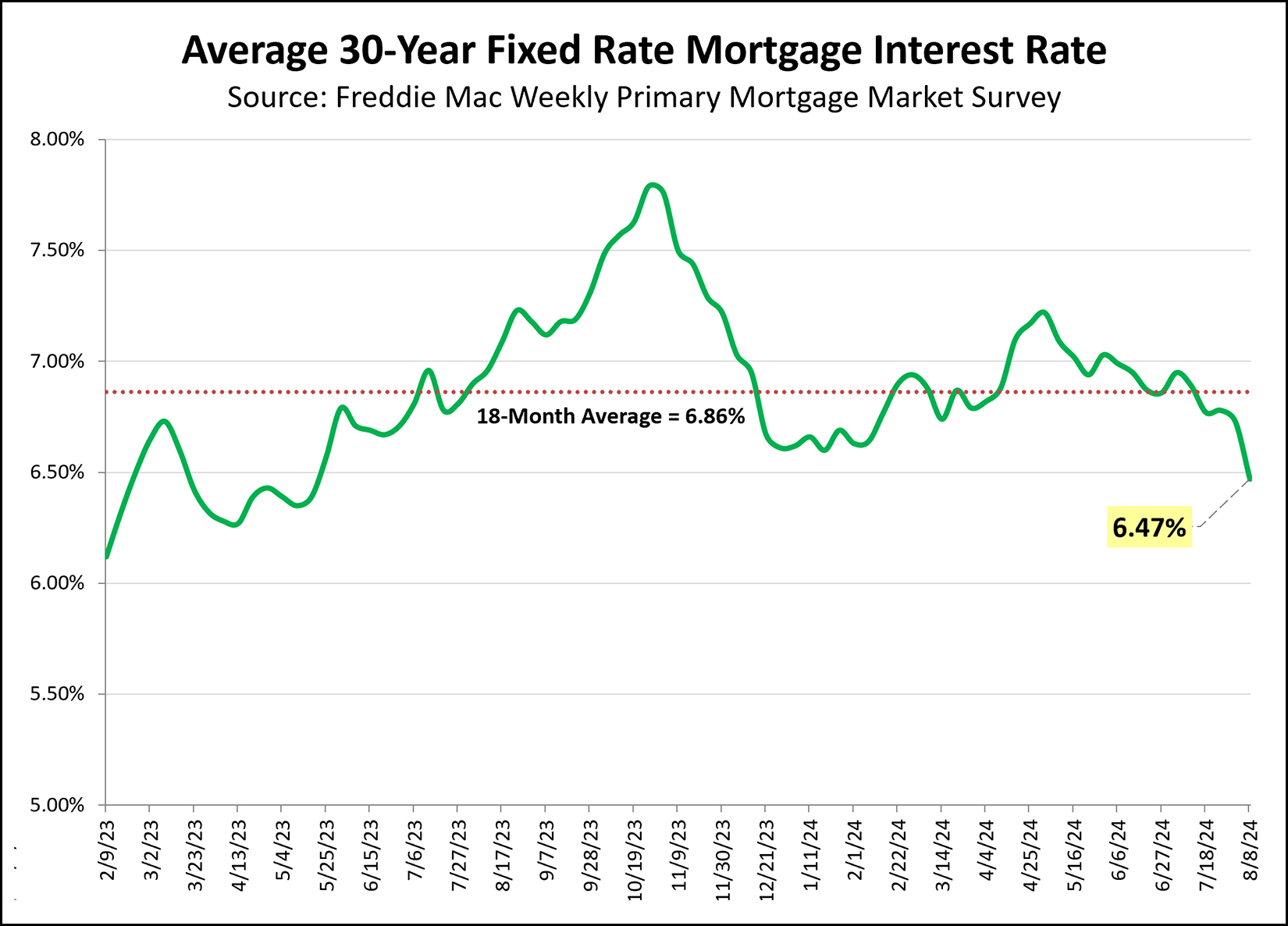

The average (30 year fixed) mortgage interest rate peaked at 7.8% last October. Now, the average rate is right around 6.5%. But... take that with a grain of salt... or however the expression goes... Home buyers that lock in their mortgage interest rate over the next week are likely to see rates anywhere from 6% to 7%, depending on...

So, yes, if you buy a home this week, you might have a rate of 6.5%... or it could be a decent bit lower... or higher. That average rate is just an average of the rates offered by lenders for 30-year fixed rate, conventional financing with an 80% loan-to-value ratio. So, don't ask your lender for that average rate... ask what rates are possible for you based on your credit, downpayment, loan program and points. | |

How Much Will You Compromise, And About What, When Buying A Home? |

|

Fair warning... most home buyers aren't able to actually figure this out until they have seen a house they want to buy. These days particularly (with fewer homes coming on the market for sale) it is likely that you will have to compromise a bit if you are buying a home. How, though, will you compromise...

Each home we go to view will likely have certain attributes that are just what you are looking for... and will also be missing some features that you would really like or you will really need. Thus, as we consider any given house, we'll be considering and discussing how the house fits your needs, what is still lacking, and whether the compromises that the house would cause you to make are ones you are comfortable with making. | |

Sometimes Buyer And Seller Price Expectations Conflict On New Listings |

|

Some home sellers decide they ought to round up their list price a bit because surely buyers will expect them to negotiate. This might result in a house worth $400K being listed for $410K. Some home buyers expect all listings to go under contract quickly at or above the list price. This might result in them assuming that house listed for $410K will really sell for $420K or $425K. In such an instance -- a home buyer deciding whether they are willing to pay $420K or $425K for a house they believe is worth $400K -- likely results in the buyer not making an offer at all. So... Sellers - Price your homes reasonably - don't round up too much, or any at all, above the market value of the house. Buyers - Consider the list price as the list price - don't assume every house will sell for $10K or $15K or $25K more than the list price. Some will, but not all, and probably not most. | |

Fewer City Home Sales, More County Home Sales In 2024 With Higher Prices All Around |

|

Happy Thursday morning to you! The summer seems to have flown by, and soon school will be starting for many of us... as parents of K-12 students, as parents of college students, as teachers or administrators at a K-12 school or professors or administrators at a local college or university. If you have a such a transition coming up, I hope you had a full and fun and relaxing summer and are excited for the school year ahead.  Shaena, Luke, Emily and I had a fun and fulfilling summer and soon Luke will be starting his second year of college and Emily will start 11th grade. The years fly by quickly! Before we start looking through the latest trends in our local real estate market, each month I offer a giveaway for readers of my market report. This month I'm giving away a $50 gift card to Jack Brown's. If you find me at Jack Brown's it will probably be enjoying one of their delicious burgers and some sweet potato fries. Click here to enter to win the gift card. Now then, where were we... ah, yes, the latest housing market data...  The chart above outlines some of the main trends in our local housing market and a few things stand out to me... [1] We have seen strong sales over the past three months as compared to last year, with a 14% year over year increase in the number of home sales taking place in Harrisonburg and Rockingham County. [2] This latest surge over the past three months (+14%) has been pushing back against the 7% decline in sales when we look at the past 12 months of home sales compared to the 12 months before that. [3] When looking just at the current calendar year, we have seen an 8% increase in the number of home sales taking place in Harrisonburg and Rockingham County in 2024 compared to 2023. ...and on sales prices... [4] Over the past year the median sales price has increased 6% from $318,480 to $337,500. [5] But when we look just at the current year to date (Jan-Jul) we have only seen a 4% increase in the median sales price compared to the same seven months last year. So, we're seeing more home sales in the first seven months of this year compared to the first seven months of last year... but sales prices seem to be rising a bit more slowly than they had been over the past few years. Sneaking a quick glance at detached single family homes, and then attached homes...  The median sales price of detached homes has increased 11% thus far in 2024 as compared to the same timeframe in 2023... to a median sales price of $388,000. That is to say that half of detached homes selling in Harrisonburg and Rockingham County are selling for $388K or more and half are selling for $388K or less. And how about those attached homes...  We have only seen a 5% increase in the median sales price of attached homes... which includes townhomes, duplexes and condos. The median sales price of these properties thus far in 2024 is $310,000... which means that half of the attached homes selling in Harrisonburg and Rockingham County are selling for $310K or more and half are selling for $310K or less. If you're looking to buy a home, the number of opportunities you might have will likely vary depending on if you want to buy in the City or the County. Here's what we're seeing in the City of Harrisonburg...  City home sales (shown above) have declined 17% in the first seven months of 2024 compared to the same timeframe last year. While 200 homeowners sold their homes last January through July, only 167 homeowners sold this January through July. This is largely a supply side issue... fewer sellers selling... not fewer buyers buying. Meanwhile, in Rockingham County...  If you have been hoping to buy a home in Rockingham County, you're in luck, there are many more opportunities to do so than in the City of Harrisonburg. In the first seven months of this year we have seen 17% more home sales in the County than during the same timeframe last year. But... one of the reasons why there are more home sales in the County than in the City is because most new homes currently being built are in the County (not the City) and new home sales are on the rise...  While only 175 new homes sold in the first seven months of 2023... we have seen 227 new home sales during that timeframe this year... which marks a 30% increase in new homes selling in our area. We have not, though, seen a 30% increase in existing homes selling...  We have seen... only a 1% increase in the number of existing homes selling in the first seven months of 2024 as compared to 2023. Looking one year further back on the chart above you'll note that the mid-500-ish home sellers who sold during this timeframe in 2023 and 2024 is well below the 708 existing home sales seen during that timeframe in 2022. Mortgage interest rates being what they are continues to impact how many homeowners are willing to sell their home. And now, some graphs to provide some visual insights into these latest trends...  May, June and July have been busy months for home buyers and sellers this year with a total of 401 home sales... as compared to only 352 in the same three months last year. Looking ahead, we are likely to see fewer home sales taking place in August if we track along last year's trend. These last three months have helped 2024 eek ahead of 2023...  After a significant decline in the number of homes selling in our area (1600-ish down to 1200-ish) between 2022 and 2023 we are now seeing a modest increase in home sales activity in 2024. The 789 home sales thus far in 2024 exceeds the 730 seen last year through the end of July, though it is well below the 943 seen in January through July of 2022. And as we have been seeing for quite a few months now, sales are slowly rising and price increases might be slowing a bit...  The bottom blue line, above, shows the annual pace of home sales in Harrisonburg and Rockingham County - measured monthly. Over the past seven months we have been (mostly) seeing this pace of home sales trend upwards. The top green line, above, shows the annualized median sales price in Harrisonburg and Rockingham County - measured monthly. We are still seeing steady increase in the median sales price, but it is not increasing quite as quickly as it has over the past few years. But of note... the median sales price of *detached* home sales is definitely still steadily increasing...  Market-wide median sales price trends can be affected by how many detached vs. attached homes are selling... or how many new vs. resale homes are selling. While the median sales price in our overall market is trending upwards a bit more slowly than in recent years, the detached median sales price is still *steadily* increasing. Just three years ago the median sales price of a detached home was just below $300K and now we are edging closer and closer to $400K. Lots of circles and arrows on this next graph... focus, folks, focus...  The graph above shows the number of contracts being signed each month. We saw much higher levels of contract activity this March, April and May than we did last March, April and May. Then, contract activity in June was about where it was last June... and July contracts were well below levels seen last July. This likely means that we will see fewer closed sales over the next few months, which is confirmed by the latest pending sales trends...  The number of pending sales (under contract homes) peaked in May 2024 and has been declining ever since. That said, current levels (267 pending sales) are still above where we were a year ago (252 pending sales) in Harrisonburg and Rockingham County. Another quirky metric of late has been inventory levels...  Inventory levels (the number of homes for sale at any given time) were steadily trending now between April and June, and then popped back up again in July 2024. The blue line above shows inventory levels last year and you can see a similar increase between the end of June and the end of July... so the increase this year is not unexpected, but does run counter to the steady decreases we had been seeing over the past few months. This following graph, tracking median days on market, has become much more interesting over the past year and a half...  For quite a few years (see the first third of the graph above) the median sales on market was sticking right around five days, regardless of the time of year. All homes were selling very quickly at all times of year. Now, we seem to be seeing a bit more seasonality in this trend, with median days on market (how quickly homes go under contract after they are listed for sale) trending upwards through the fall and winter and then back downwards in the spring and summer. So, don't be surprised if median days on market starts to rise again over the next few months. And finally, one of the main drivers of buying and selling activity of late...  Those darn, silly, pesky, mortgage interest rates. As mortgage interest rates rise, the cost of a monthly housing payment rises, assuming the same sales price. Over the past few years we have seen steadily rising home prices AND rising mortgage interest rates. When we see higher rates, buyers aren't quite as capable or as interested in buying... and sellers (if they would have to then buy again) aren't quite as interested in selling. If or as or when we see mortgage interest rates start trending downwards, we will likely see more buyers AND sellers enter the market. As noted above, during August, rates have fallen even further than shown on the graph... down to 6.47% and I have seen some buyers locking in as low as 5.99% recently. So, having absorbed all of those insights into the latest trends in our local housing market, what does it all mean for you? If you are thinking about buying a home in the next few months... things might see a smidge more hopeful. Mortgage interest rates are trending down a bit. Inventory levels are trending up a bit. Days on market might trend upwards a touch. Many segments of the market are still moving very quickly and are still very competitive, but not all segments of the market. Depending on what type of property you want to buy, and its location, and its price range -- you might be competing with multiple other buyers within a day of a house being listed for sale -- or you might actually be able to sleep on your decision about whether to make an offer on a new listing. If you are thinking about selling your home in the next few months... it is still relatively likely that it will sell quickly and almost certainly at a very pleasing price... but all property types, locations and price ranges are not performing equally right now. We'll want to dive a bit deeper into the data related to your specific home to devise the best pricing strategy and to give you reasonable expectations as to how quickly your home will sell. If you have questions about buying, selling, the process, the market or anything else, you are more than welcome to reach out anytime. You can contact me most easily by phone/text at 540-578-0102 or by email here. All the best to your and your family as this new school year begins... and if you don't have anyone in your life starting a school year, then just get excited about the eventual return of cooler temperatures as we head into the autumn months. :-) | |

Where Do All Of The People Work Who Will Live In All The New Housing Being Built? |

|

This is a good question and one that I have had multiple people native to the area and new to the area ask me over the past few years... Where Do All Of The People Work Who Will Live In All The New Housing Being Built? If you drive around the Harrisonburg and Rockingham County area, you'll see quite a bit of new housing at various stages of construction. My non-scientific, non data-driven answer is as follows... 1. Many mid-sized to large employers in this area keep on growing. 2. We continue to see smaller companies starting up or being created in the Harrisonburg area. ...and perhaps (maybe) most significantly... 3. The pandemic at least partially severed the connection between "where I work" and "where I live" as it relates to the Harrisonburg area. After a year (+) of allowing some (to many) employees to work from home, some (to many) employers have realized that remote work has its benefits. Employees can be more productive, spend less time commuting and have a higher quality of life. And sometimes, that higher quality of life for a remote worker means working for a company in a larger metro area, and living in... Harrisonburg! This is not to say that there are suddenly thousands of people living in Harrisonburg and working for companies outside of the area... but that reality is much more in play now than it ever has been in the past. Who wouldn't want to live in Harrisonburg if one's out of town employer allowed for it!? :-) | |

Mortgage Interest Rates Fall, Again, To Lowest Levels In Over A Year |

|

I suppose this might become an ongoing theme over the next few months but mortgage interest rates have fallen, again. The average 30 year fixed rate mortgage interest rate is now 6.47%... which is the lowest average rate we have seen since May 2023. These lower mortgage interest rates are likely to spur on more home buying activity as each time the rates drop it makes a home buyer's dollars go a bit further. If you plan to buy a home this coming fall, talk to a mortgage lender sooner rather than later to understand what your mortgage payment would look like given current rates... and perhaps you'll be able to keep requesting updated payment information if rates continue to fall. :-) | |

After X Days On The Market Without An Offer, You Should Consider Adjusting Your List Price |

|

Solve for X... After X Days On The Market Without An Offer, You Should Consider Adjusting Your List Price Arguably, X varies based on the property location, property type, price range and much more. But regardless, the point remains the same, if some amount of time has passed (X) without an offer on your house, you should probably consider lowering the list price. For sellers in a particularly active price range, that might be as little as 14 days. For sellers in much of the market, that might be 30 days. For sellers with a particularly unique property that might only appeal to a small portion of buyers, that might be 60 or 90 days. The same logic also applies after a price reduction... If another X days passes, without an offer, you might want to consider a price adjustment again. | |

Most Homeowners Make Home Improvements For Two Reasons |

|

Whether you are finishing some basement space, remodeling a bathroom, or upgrading your flooring, most homeowners are making home improvements for two reasons... 1. Greater Enjoyment and/or Utility This is typically the starting point for talking about or dreaming about a home improvement project. Homeowners will often imagine how they will get greater enjoyment out of, or greater utility from, their home after they complete their renovation project. If only we had some finished basement space for the kids to play and for guests to stay when they visit... if only we had a nicer primary bathroom... if only that old, tired, dated flooring looked a bit nicer... Homeowners almost always consider home improvements or renovations because they believe they will enjoy their home more after the work is complete... or their home will fill their needs (or their family's needs) better after the work is complete. 2. To Improve Their Home's Value Most homeowners wouldn't embark upon a home improvement project if it would lower the market value of their home. ;-) Thus, most homeowners consider making some home improvements or major renovations because they believe it will increase the value of their home. But... most home improvement projects have a less than 100% return on investment. That is to say that if you spend $50K on a home improvement project it might only increase your home's value by $20K to $30K... and if you spend $150K on a home improvement project it might only increase your home's value by $60K to $120K. Thus, in most cases, it is important that a proposed home improvement project checks off both criteria above... 1. You will get greater enjoyment or utility from your home after the work is complete. 2. The project will improve your home's value, even if not by the full cost of the work. | |

It Is Reasonable To Pay A Bit More Than Market Value If... |

|

Most home buyers do not want to pay more than market value for the home they will purchase. If a home is worth $325K in the current market, then they would prefer to pay no more than $325K... and actually, less than $325K would be even better! ;-) But... there can be circumstances where it is reasonable for a buyer to pay more than market value for a home. The two circumstances that most quickly come to mind are... 1. If a house fits this buyer particularly well. If a home buyer is looking for a home in a particular location, with a particular style, with a particular layout... with particular features... or some variation thereof... it's likely that most houses that come on the market don't fit a buyer's particular needs that well. Sometimes, a house will come on the market that fit a buyer perfectly, or nearly perfectly. For such a house, it would be reasonable for that buyer to pay a bit more than market value. 2. If houses that fit this buyer do not become available very often. If a home buyer is looking for homes in this location, in that price range, and with those features... it's possible that multiple homes come on the market each month that fit the bill... and it's also possible that homes only come on the market every few months that fit that description. If houses that fit a buyer's criteria do not come on the market that often, it would be reasonable for that buyer to pay a bit more than market value. So... most of the time a buyer only wants to pay market value for home... but sometimes it is quite reasonable to be willing to pay a bit more. For the home noted above, with an objective market value of $325K... a buyer might be willing to pay $335K if it is an absolutely perfect fit... and a buyer might be willing to pay $345K if it is an absolutely perfect fit AND homes like this only come along every few months or even less frequently. | |

How Many Days Did It Take For New Listings To Go Under Contract |

|

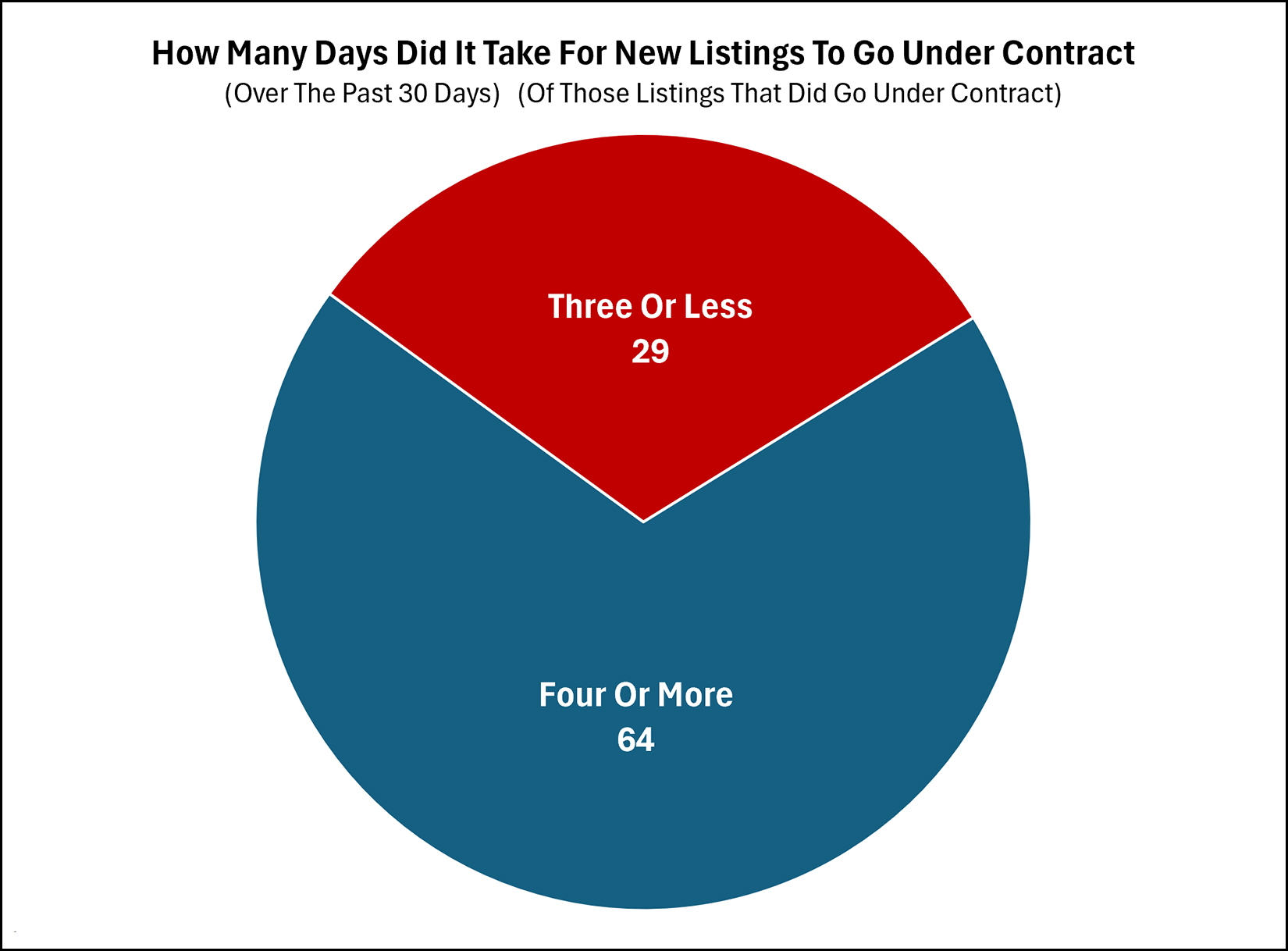

All new listings are not receiving multiple offers. All new listings are not under contract in a matter of days. But plenty of new listings are going under contract plenty quickly! Of the homes that have gone under contract over the past 30 days... approximately a third of them have been under contract within three days! Thus, if you are looking to buy in the near future... go see homes within a day of when they come on the market (whenever possible) and make sure you have a lender letter ready to go if you want to make an offer! | |

Mortgage Payments Drift Downward As Mortgage Interest Rates Slowly Decline |

|

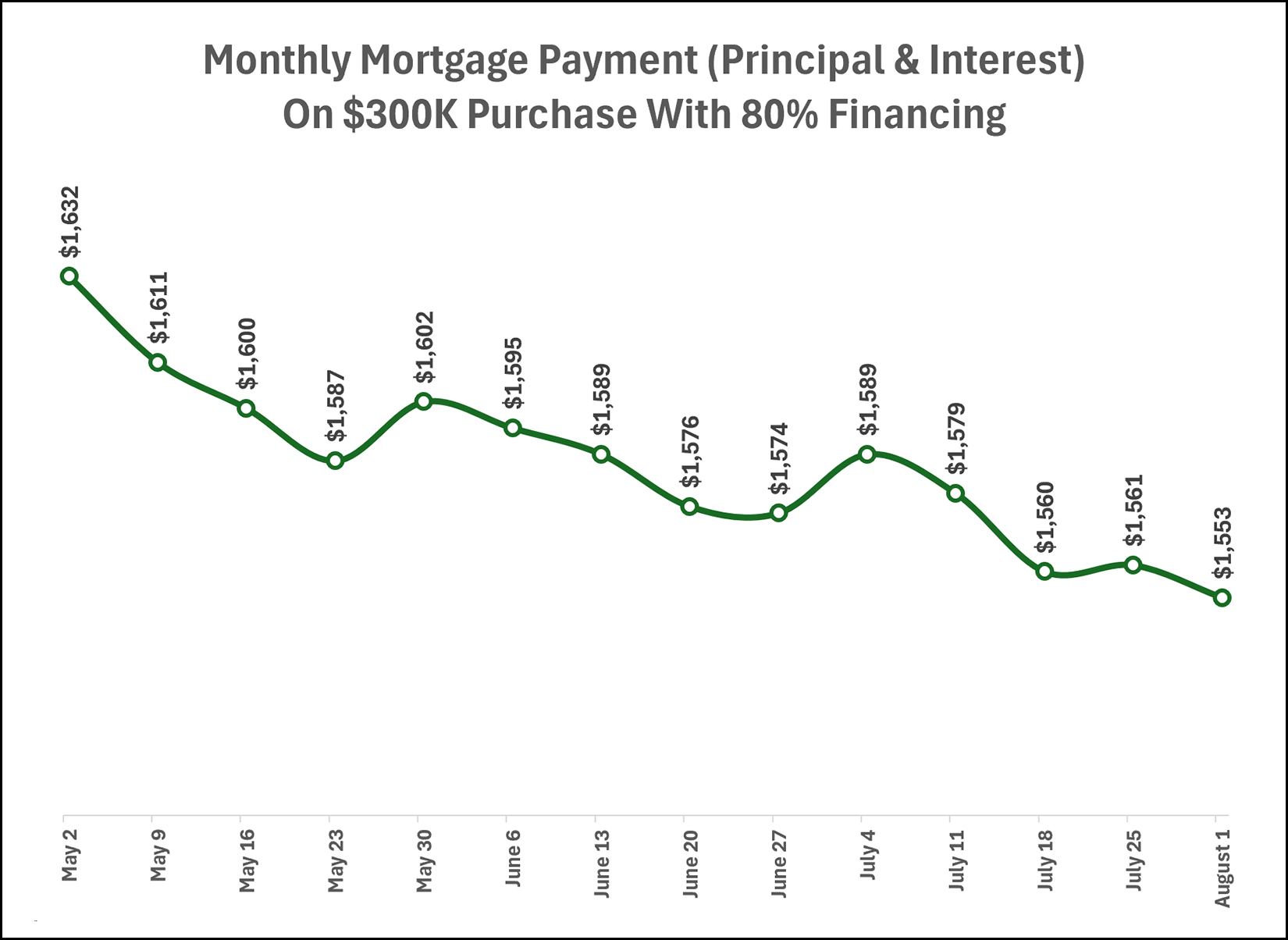

The average mortgage interest rate on a 30 year fixed rate mortgage has been slowly declining over the past three months, from 7.22% on May 2nd to 6.73% on August 1. Thus, as you would expect, monthly mortgage payments are trending downward as well. The graph above shows the principal and interest portion of the mortgage payment for a $300K purchase with 80% financing given the average mortgage interest rates each week for the past three months. As you can see, this theoretical mortgage payment has declined by about $80 over the past three months... which provides almost $1,000 per year of savings to a buyer given the lower mortgage interest rates. | |

With Home Inspections Back In Play Again, Do Not Assume Your Contract Price Will Definitely Be Your Sales Price |

|

Plenty of buyers are making offers that include home inspection contingencies these days - and reasonably so. A home purchase is a large purchase and a major decision and it makes sense to engage a professional to help you understand the condition of the house. As such, home sellers should not assume that their contract price will definitely be their sales price, because... 1. Your home inspection might reveal property condition issues that you did not know existed, resulting in negotiations on repairs or pricing. 2. The buyer for your home might be more concerned about some known needed repair items than you might expect, resulting in negotiations on repairs or pricing. So, when your home goes under contract, great! But wait until you get past the home inspection contingency to consider your contract price to (likely) be your sales price. All that said, as with most things, how true the above will be for you and your home will vary based on the price range of the home, it's condition, the age of the major systems, and based on how much other buyer interest existed when your current buyer made their offer. | |

| Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings