| Newer Posts | Older Posts |

City of Harrisonburg Home Sales Slow But Prices Rise |

|

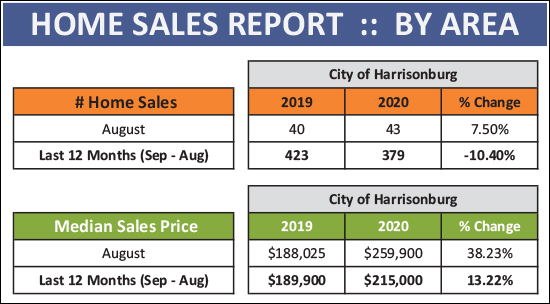

Focusing in just on the City of Harrisonburg for a moment... Home Sales Slow -- There have only been 379 home sales in the past 12 months in the City of Harrisonburg, as compared to 423 home sales in the previous 12 months. This is a 10.4% year-over-year decline in home sales activity in the City. Prices Rise Sharply -- The median price of the homes sold in the past 12 months was $215,000 which is 13.22% higher than one year ago when it was $189,900. What does it all mean?

Are you looking to buy, or sell, in the City of Harrisonburg? Feel free to touch base with me if I can be of any help to you. You can reach me at scott@hhtdy.com or via phone/text at 540-578-0102. | |

Harrisonburg vs Rockingham County Inventory Levels |

|

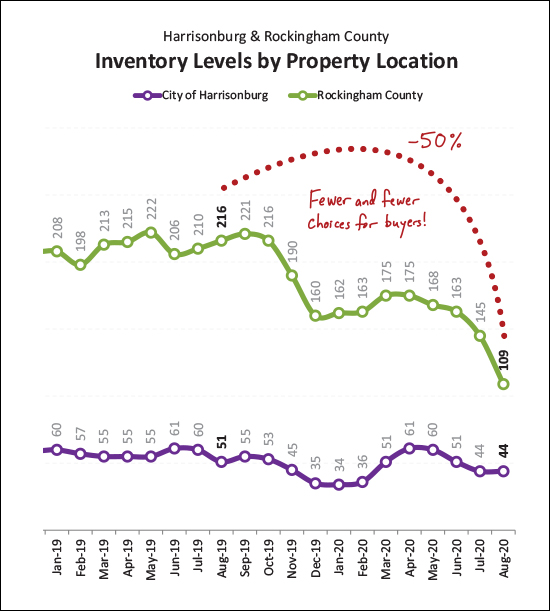

Perhaps the City inventory levels were just so low that they didn't have far to fall? Multiple things to note here (above) regarding City vs. County inventory levels...

In theory, inventory levels might (???) start to climb a *bit* this fall, but my general sense is that there is still pent up buyer demand and inventory levels could stay this low all through the fall and winter. Sorry, buyers! :-/ | |

Welcome to The Townes at Congers Creek! |

|

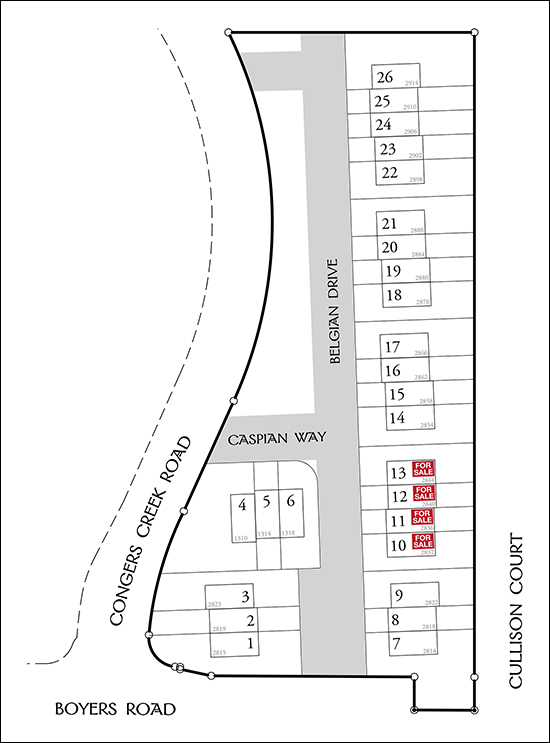

Welcome to The Townes at Congers Creek! Construction is beginning on brand new, upscale townhouses with garages are located off of Boyers Road, just minutes from Sentara RMH Medical Center, in the Cub Run Elementary school district. These beautiful townhouses will feature a large living room with plenty of natural light, an eat-in kitchen with a large island, Shaker Style cabinetry, stainless steel appliances, and three bedrooms and two full bathrooms. Enjoy nine foot ceilings on the main level, a master suite with walk-in closet, a single car garage and an unfinished bonus room behind the garage, with a roughed in bathroom, that would be perfect for a home office. Here is the layout of the neighborhood...  Find out more about these new townhouses by visiting CongersCreek.com. FYI - I am listing and marketing these townhouses, along with Suzanne Trow and Carey Keyes. | |

When The House Purchase Price Is Not The Whole House Purchase Price |

|

A first time buyer looking to buy a detached home (not a townhouse or duplex) under $225K might find themselves considering mostly homes that are at least 50 years old. Said buyer might find the **perfect** home built in 1945 that is "move-in ready" with pretty paint on the walls, and beautiful furnishings, and a well-kept garden, and a quaint covered front porch, and on and on. This buyer is likely head-over-heels excited about the house at this point, as it is priced at $230K, just barely above their target maximum of $225K. But before the buyer signs that contract to make an offer on the house they should probably pause at least for a moment to ask some questions and to consider...

There are plenty of other items that might need updates or replacements in the next three years, but they are all either of a lower cost or elective - though these costs could also add up:

But circling back to the first two items - the roof and heating system - these are pretty much non-negotiable. If either quits working as it should, you'll need to replace it. And if you're maxing out your housing budget with a $225K-$230K home purchase, and then within a year or two you need to spend $8K - $15K on a roof and $8K - $15K on a heating system, that will likely create some financial stress for you. | |

Only 1 in 10 Home Buyers Spends More Than $400K |

|

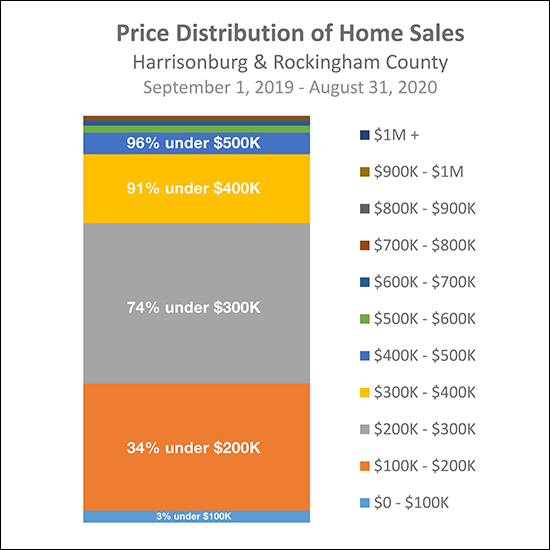

Lots to observe / conclude here...

| |

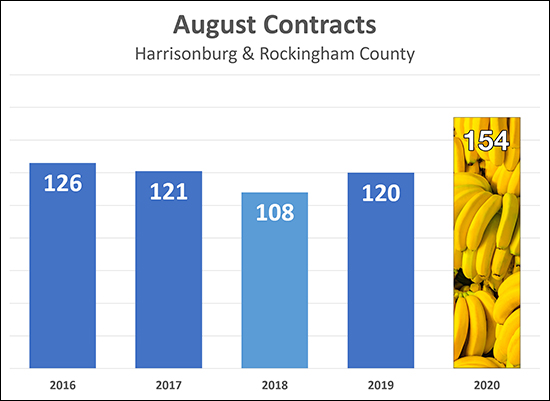

Home Buyers Went Bananas In August 2020 |

|

A little later this month I'll take a thorough look at all of the home buying (and selling) activity in Harrisonburg and Rockingham County. But before we get there - I thought I'd take a quick peek at how many buyers (and thus, sellers) signed contracts in August 2020. I was surprised to see a BIG increase in August contract activity as compared to the month of August in each of the past four years! Buyers still seem to be out in full force, ready to pursue houses as they hit the market for sale. It seems this fall might be busier than usual in our local housing market! | |

When It Comes to The Local Housing Market, The Early Bird Truly Does Get The Worm |

|

I suppose we have all heard of the proverb "the early bird gets the worm" which has a pretty helpful definition on Wikipedia...

That is, indeed, where we find ourselves in the local real estate market for many properties at many price ranges. If a newly listed house in a local and price range with plenty of buyer interest is well prepared, reasonably priced and thoroughly marketed...

So, figure out how you're going to track new listings and let's make sure to go see new listings of interest as quickly as possible when the hit the market - hopefully within hours or a day, instead of within days of a week. | |

When Buying A House To Rent To Students, Call Community Development First! |

|

With great regularity, potential buyers (either investors or parents of JMU students) will ask if a single family home can be purchased and rented to a group of JMU students -- often an intended group of four or more students. I let them know that it will be no problem at all -- the adjoining property owners in the quaint neighborhood probably won't mind as long as the students aren't too bothersome -- and the City doesn't mind at all if their zoning ordinances are violated, so long as it's just "nice college kids".... WAIT! NOT REALLY! READ ON!!!! It seems that some buyers are really getting that feedback of "sure, it will be fine" -- though I'm not sure if they're getting it from their Realtor, or from someone else advising them in the transaction, or if they just aren't thinking about whether their planned use of a property is allowable. The REAL answer, and the feedback that I ACTUALLY provide to my clients is.... 1. We need to check to see how this property is zoned, and whether that zoning classification allows for that number of unrelated people to live in the property. 2. We need to check to see if there are recorded restrictive covenants for this neighborhood that restrict the number of unrelated people who live in the property. A few notes.... 1. Most single family homes in the City of Harrisonburg are zoned R-1 or R-2 and do NOT allow for three or more unrelated people (students or otherwise) to live in the property. 2. If a property has been used in a non-conforming manner (for example, four students living in it) since before the zoning ordinance was put in place, without a 24 month gap in the non-confirming us, it MIGHT be possible to continue to use the property in that non-conforming manner. And, if #2 above is starting to get confusing, then we arrive at my main reason for writing today.... CALL COMMUNITY DEVELOPMENT TO UNDERSTAND ALLOWED USE OF A PROPERTY! Yes, in fact, there are very helpful City staff in the Community Development department -- who can very quickly help you understand whether a property can be legally used as you intend to use it. And it is imperative that you make this call BEFORE you buy the property, and even BEFORE you make an offer on the property! | |

So You Are Saying You Are Having A Hard Time Finding A Home To Buy? |

|

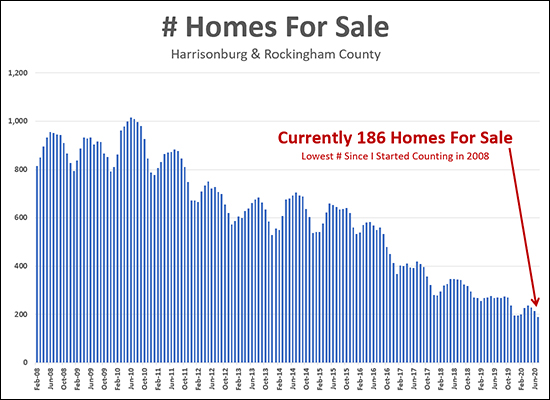

So - there are only 186 homes for sale in all of Harrisonburg and Rockingham County. Which, as you can see above, is much lower than the number of homes for sale for most of the past 12 years. Breaking it down a bit further by location...

...and by property type...

...and by price...

Regardless of how you break it down, there are fewer options for buyers today than there have ever been at any other point in the past 12 (plus) years. One important caveat is that the lack of inventory at any given point does not mean that there aren't as many houses selling. There have been 1300-ish home sales per year for the past few years, despite continually declining inventory levels. So, basically, homes are coming on the market - but they are going under contract VERY QUICKLY - so inventory levels have been staying low or getting lower! What does this mean for buyers?

It's not necessarily a totally fun time to buy a home right now because of these low (low!!!) inventory levels -- but it is possible to buy a home. Let me know if you'd like to chat about inventory levels in your particular segment of the local housing market. | |

Buyers Seem To More Frequently Be Willing To Pay Above Appraised Value For Houses |

|

In today's local housing market we're seeing...

This disconnect (buyers being willing to pay more than appraised value) is likely because of how appraisals are defined and conducted. An appraisal is an indication of the value of a property based on what other buyers have paid for other similar houses in the recent past - often the last six months. What we now seem to be seeing is that today's buyers are willing to pay more for houses than buyers paid zero to six months ago - which can cause an appraisal to come in lower than the price that the buyer had agreed to pay for the house. So, when there is a low appraisal, where do things go from there? It's different in every transaction and it's all negotiable.

If the appraisal on your house comes in low...

Current conditions in your segment of the local housing market will likely ultimately dictate what a buyer and seller will agree to do with a low appraisal. | |

Sellers Consider More Than Just Price, So Your Escalation Clause May Need To Be Tweaked Accordingly |

|

If you are trying to buy a home in a price range (under $250K) where there are often (usually?) multiple offers on the table, you may find yourself considering the use of an escalation clause. What is an escalation clause, you might ask? An escalation clause allows you to offer one price but then to effectively increase your offer price to be above any other competing offers. Consider the following scenario on a house listed for $225,000

Offer 2 wins, right? Probably so. But if the first buyer didn't want to pay more than the asking price if they didn't have to -- but if they would have been willing to pay up to $230,000 -- then things could have worked out differently...

In this situation, Offer 1 becomes an offer of $228,000 and likely is the chosen buyer instead of Offer 2 which is then $1,000 lower. But let's add a layer here -- the financing contingencies...

I see this type of scenario play out quite regularly. In many cases, the seller is will choose to move forward with Offer 2 - even though it is $1,000 less than Offer 1. Why, you might ask? Buyer 2 seems to be better qualified to buy the home, with a larger down payment. This will likely be to the seller's advantage when it comes time to negotiate the home inspection (a buyer with more cash available is less likely to be worried about small repair items) and the appraisal (a buyer with more cash available is likely more willing/able to come up with an extra $1K if the appraisal is slightly low). So, if a buyer has some other terms (financing, inspection, timing, etc.) that are possibly or likely to be less favorable to the seller, said buyer might consider leveraging their escalation clause a bit, such as the following...

In this scenario, Offer 1 becomes an offer of $229,500 compared to Offer 2 which is an offer of $227,000. This will cause the seller to think a bit longer and harder about whether they really want to go with Offer 2 that has the more favorable financing contingency. Think strategically when you are crafting your offer -- and your escalation clause -- knowing that a seller is looking at all of the terms of your offer, not just the offer price. | |

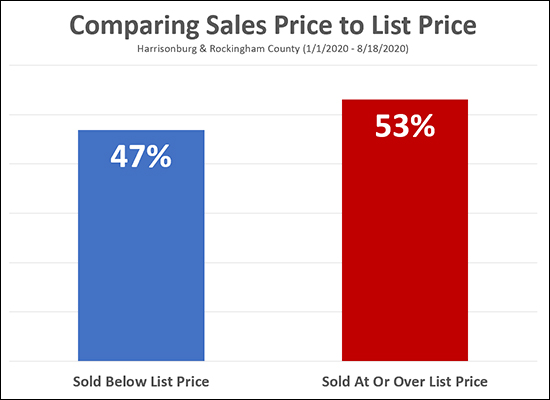

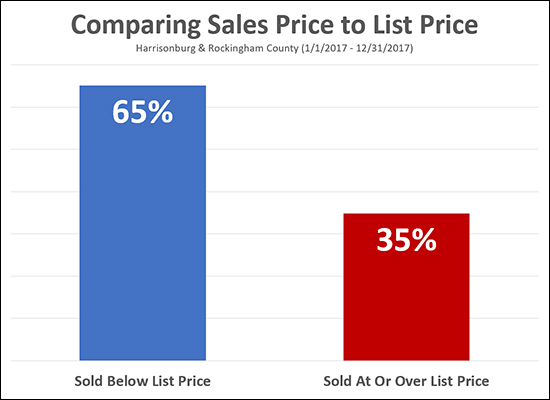

Should You Be Surprised If Your Home Sells At Or Above List Price? |

|

No. You should not be surprised if your home sells at or above the list price. As shown above, 53% of homes that have sold thus far in 2020 have sold at or over their list price. It's a sign of the times, I suppose. There are LOTS of buyers fighting over very few homes for sale and this often leads to...

Just to put this in context, let's see how things looked three short years ago...  Things were quite a bit different in 2017, it seems! Way back in 2017 only about a third of homes sold at or above their list price! As with many other recent market indicators, this is great news for sellers and rather unexciting news for buyers. | |

Home Buyers And Sellers Made Up For Lost Time In June, July |

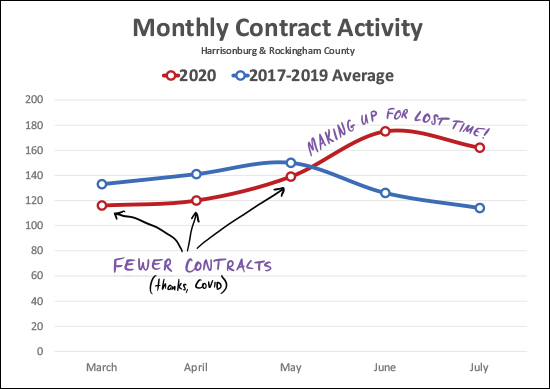

|

Well - hello June and July! The red line above shows the number of contracts signed for each of the past five months. The blue line shows the average number of contract signed in that same month during 2017, 2018 and 2019. Basically, comparing the monthly pace and pattern of 2020's contract activity to the three most recent years to see if this is what we should have expected. It's not what we should have expected. Typically, contract activity peaks in May and then slowly declines in June and July. But not this year. During 2020, contract activity was lower than would have been expected in March, April and May -- but then -- wow! Thinks really started to move in June and July. All in all, I think this is the impact of COVID. It slowed the local housing market down for a few months, but things are speeding right back up to likely eventually catch up to where we were last year. Stay tuned to see what happens come August... | |

If You Have Not Heard, Mortgage Interest Rates Are SUPER Low Right Now |

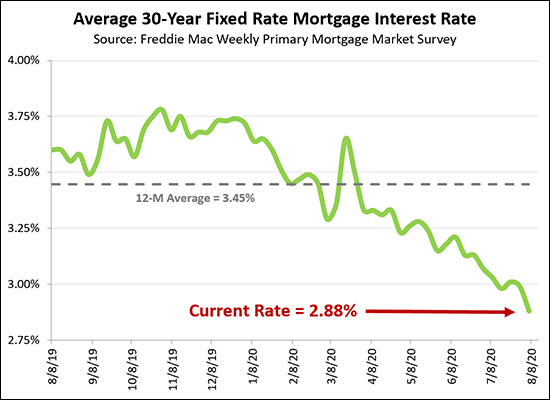

|

If you had asked me a year ago whether we'd see interest rates get as low as 3% - or lower than 3% - I would have said "no, definitely not, they couldn't get that low!" But, it seems I would have been wrong. The average mortgage interest rate (for a 30 year fixed rate mortgage) has continued to decline over the past four months from around 3.5% all the way down to the current rate of 2.88%. It seems likely that interest rates will continue to stay rather low in the coming weeks and months -- though I don't know if they will / can really stay below 3%. If you happen to be buying a home right now, PLEASE lock in your interest rate this week!! :-) | |

Housing Inventory Levels May Have Peaked For The Year |

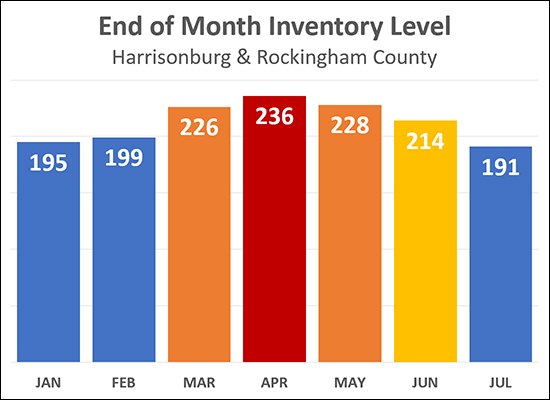

|

The number of options that you have today as a buyer (hint = not many) may be the most options you'll have at any given point between now and the end of the year. As shown above, inventory levels (the number of active listings in the MLS at the end-ish of each month) climbed through the first four months of the year, but seemed to peak in April and have been declining since that time. Surprisingly, the inventory level at the end of July was lower (!!??) than in January and February! Now, certainly, there will be some new listings over the next five months of this year -- so there will be some new inventory options -- but the total inventory available at any given point is not likely to increase again until next Spring. | |

The Floor Plan Or Layout Of Your House Can Make Or Break The Sale |

|

If a buyer is buying over $400K, or even over $300K, the layout of the home becomes very important to them. That is not to say that it is unimportant for a $200K buyer -- but someone buying a more expensive home oftentimes plans to stay in it for a longer time frame. If not the #1 feedback, then perhaps the #2 feedback I receive from showings of homes priced over $400K is that the layout just didn't work for the buyers....

| |

How To Run The Numbers On Upgrading To A New Home |

|

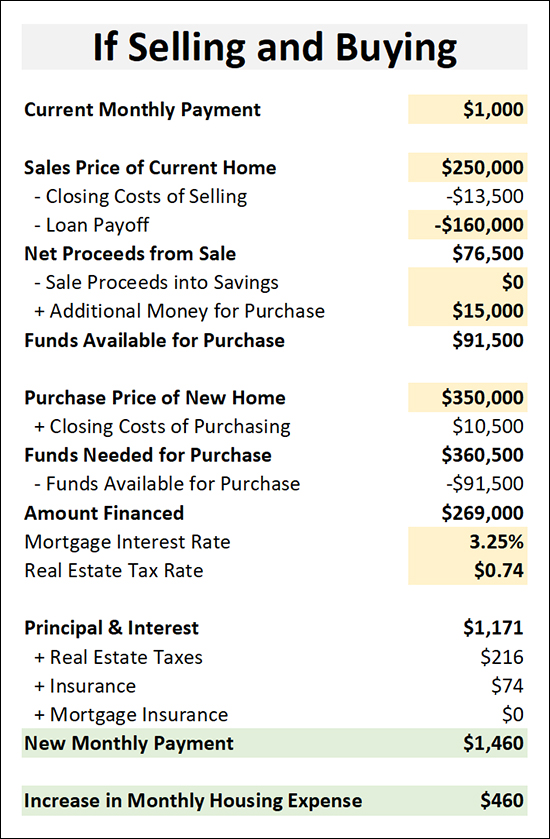

If you will be selling your home to buy another, there are a lot of numbers floating around....

Above you will see a spreadsheet I put together to help you think about some of these numbers as you are evaluating if and when you will make a move to a new house. In yellow, are all of the inputs you will need to provide, or that you and I can determine together, such as your current payment, your home's current value, your mortgage payoff, whether you will be putting any additional money into the transaction, etc. In green, I have identified your potential future mortgage payment and the net change in your monthly payment. All of the numbers without a background color will automatically calculate for you. Click here to download this worksheet as an editable Excel file. | |

You Might Not Want To Spend As Much As You Are Qualified To Spend On A Home |

|

Most folks who buy a home this year will not be paying cash. An important early stage of the home buying process is to talk to a lender to become pre-approved for a mortgage. As you meet with a lender, remember that there is often a difference between:

If you are looking for a qualified mortgage professional, shoot me an email (scott@hhtdy.com) and I can give you some recommendations. As you are navigating the home financing process, I am happy to help you understand the information you are receiving and the decisions you are being asked to make. There are a variety of loan programs that can likely work well for your situation, but we'll want to make sure you are aware of all of your options. Learn more about the home buying process at BuyingAHomeInHarrisonburg.com. | |

Why Is This Home Being Sold In AS IS Condition? |

|

Sometimes a seller is stating this as soon as they list a property: All inspections are for informational purposes only. or This house is being sold in "as is" condition. Here are the top three innocent reasons why a seller would want a home inspection to be for informational purposes only....

| |

How To Count Bedrooms In A House |

|

You don't have to be a math major to count bedrooms, right? Well, technically, that's true -- but counting bedrooms for real estate purposes can become a bit nuanced. Now -- the National Appraiser Roster has all sorts of nuances surrounding this topic....

Wow. OK. Lots to consider there. So -- the short answer is that you can count your bedrooms based on whether they have windows and closets -- but it may require a bit more thought and analysis before we decide how many bedrooms we'll say that your home has when we put it on the market. Oh, and two final notes....

| |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings