| Newer Posts | Older Posts |

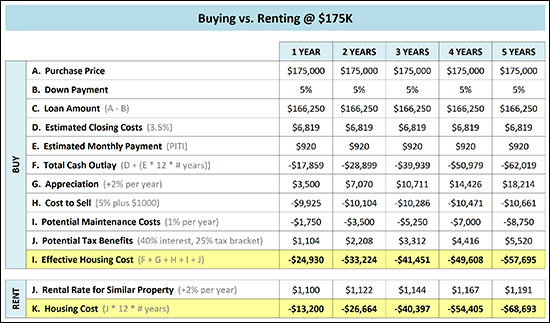

How Often Do Home Sellers Provide A Closing Cost Credit? |

|

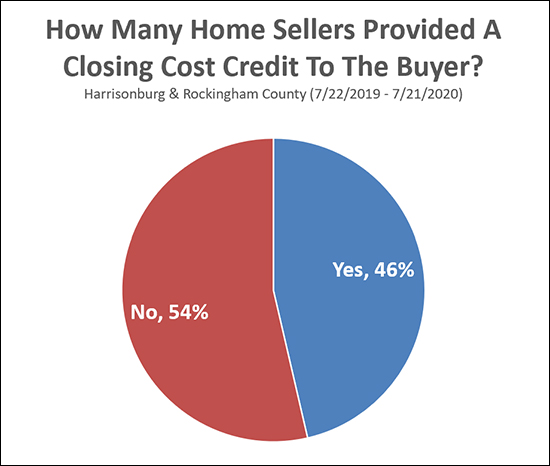

Looking back over the past year it seems that slightly fewer than half (46%) of home sellers provided a closing cost credit to the buyer for their home. It is not altogether surprising that many buyers ask for a seller paid closing cost credit. With interest rates so low, it is not a crazy idea to incorporate some of your closing costs into the mortgage by increasing the purchase price and mortgage amount by a few thousand dollars. Here, then, is how much sellers paid in buyer closing costs over the past year in the 46% of the cases where the seller did provide such a credit...  So, if, as a seller, you are paying part of a buyer's closing costs, you are most likely to be paying between $4K and $6K --- or between $2K and $4K. And again, as a seller, if you pay part of the buyer's closing costs -- you are not alone -- 46% or so of sellers do so! | |

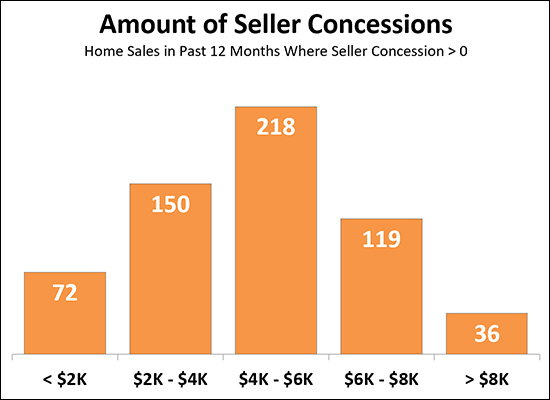

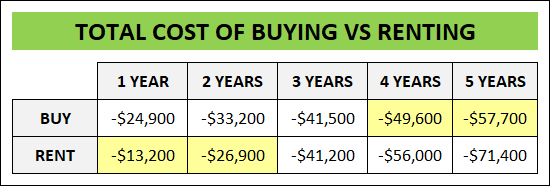

Renting or Buying A Home Within A 5 Year Time Horizon |

|

If you will only be in your next home for two (or 1, 3, 4 or 5) years -- should you buy that home? Or just rent a home instead? Let's take a look, assuming a price point in the current market of around $175K - which is likely to be a townhouse and might be what you are considering as a first time buyer...  As becomes pretty quickly, above, it doesn't necessarily make much sense to buy if you are only going to be in your home for 1 or 2 years -- and once you get to a time horizon of 4 or more years, it almost certainly makes sense to buy a home. For clarity, let's look at how I'm determining the cost of renting and buying this fictional house... The Total Cost of Renting Includes... Monthly rental rate x 12 x # years Yep, that's it The Total Cost of Buying Includes... Monthly mortgage payment x 12 x # years + closing closing costs when buying your home (3.5%) + cost of selling your home (5% + $1K) + potential maintenance costs (1% / y) - appreciation of your home's value (2% / y) - potential tax benefits of interest paid (int x 40% x 25%) Here's a visual (click for a closer look) as to how those numbers line up over a one through five year time horizon... I should also note that it is quite possible to be "just fine" from a financial perspective if you buy and only end up being in the home for a year or two if...

As you are thinking through whether you should buy or rent -- at a $175K price point or otherwise -- feel free to touch base with me and I can give you some feedback and advice based on your overall circumstances. | |

Which Terms Are Usually Most Important To Home Sellers When Receiving Multiple Offers? |

|

It's all about money, right? Well - not always. If you are making an offer on a house and you will be competing with other buyers who are also making offers, there is more to think about than just the price you are offering to pay. Some of these terms will be outside of your control, but keep in mind that these contract terms are ones that a seller will likely be comparing when they have multiple offers... PRICE - Certainly, if some offers are higher than others on price, they are more likely to be accepted by the seller. This can be accomplished by making a strong initial offer -- or by making an offer with an escalation that would increase your offer if other competing offers are higher than your initial offer. CLOSING COSTS - Don't ask for the seller to pay for them if you can avoid it. A $250K offer asking the seller to pay $5K is not equivalent to a $245K offer without a closing cost credit - even though they have the same net to the seller. The $250K offer requires the house to appraise for $250K, whereas the $245K offer only requires it to appraise for $245K. DOWN PAYMENT - The larger your down payment is, the more likely the seller is to consider your offer if comparing it to other offers with buyers making a smaller down payment. A larger down payment shows that you are potentially more financially capable or stable than other buyers who need to finance a greater portion of the purchase price. DEPOSIT - The amount of your deposit ($500, $1000, $2000, $5000) doesn't make a huge difference to the seller (it usually goes back to the buyer if a contract contingency doesn't work out) but a larger deposit shows greater financial capability. LENDER LETTER - This one should be obvious, but make sure to include a letter from your lender showing you are qualified to purchase the home at the price you are offering to pay. PERSONAL PROPERTY - If the seller only wants to include the kitchen appliances with the house, don't potentially miss out on buying the house because you're asking for the clothes washer, clothes dryer, lawn mower, porch swing and pet hamster. ;-) CLOSING DATE - Take a moment and ask the seller what closing date would be most convenient for them, and then work with that if you can. In the absent of that knowledge, offer a speedy closing date but verbally confirm that you can be flexible on timing. HOME INSPECTION - If you are comfortable buying without a home inspection, don't add the contingency. If you do decide to conduct a home inspection (most buyers do) then consider taking the "I did the inspection and I'm walking away from the deal without even asking for any repairs" off the table. This is one of the standard clauses in the home inspection contingency, and if you are willing to remove that clause -- basically showing a willingness to make a good faith effort to negotiate any inspection findings -- it will be noticed and appreciated by most sellers. Also, if you can go ahead and get a home inspection scheduled within 10 days, then offer a shorter inspection contingency timeframe (such as 12 day) instead of the 18 to 21 days we typically see in offers these days based on limited availability of inspectors. FRIENDLY LETTER - Consider writing a cover letter to introduce yourself to the seller and explain who you are and why you are excited to buy their particular home. If there are multiple offers with similar terms but only one buyer took the time to provide some personal context, that could go a long way towards helping the sellers gravitate towards their offer. These items above are just a few of the terms that a seller will likely be comparing when they receive multiple offers on their home. Price is certainly one of the most important factors, but oftentimes the prices of multiple offers are relatively similar -- and the seller will be looking for other ways that an individual offer stands out from the other competing offers. Best of luck, home buyers, in this fast and furious seller's market! | |

How To Make An Offer On Your Dream House |

|

How, you might ask, do we go about getting from the point of wanting to make an offer --- to actually making the offer? Here's a brief overview....

When we get to step seven, above, we will be discussing and deciding on the terms of the offer. Below is a list of the main contract terms we will need to discuss in preparing to make an offer.

Before and after making an offer, there is a lot more to know about and think about regarding the home purchasing process. Read more at....  | |

New Home Communities Boost Listing Inventory, Contract Activity, Closed Sales |

|

Inventory levels have been low and getting lower for the past few years - but several new home communities have launched during that time that have provide more options for buyers in our local market. Here are details of four communities that have started up in the past year...  Island Ford Estates - view current listings Duplexes in McGaheysville off Island Ford Road currently priced between $327,900 and $329,900. 2 For Sale, 2 Under Contract, 0 Sold  Crescent Ridge - view current listings Townhouses near the intersection of Taylor Spring Lane and Massanetta Springs Road currently priced between $244,900 and $249,900. 3 For Sale, 14 Under Contract, 7 Sold  Eastwood - view current listings Townhouses on Boyers Road backing up to Sentara RMH Medical Center currently priced between $189,900 and $196,500. 0 For Sale, 19 Under Contract, 2 Sold  South Peak - view current listings Duplexes in McGaheysville currently priced between $251,870 and $293,975. 3 For Sale, 11 Under Contract, 0 Sold | |

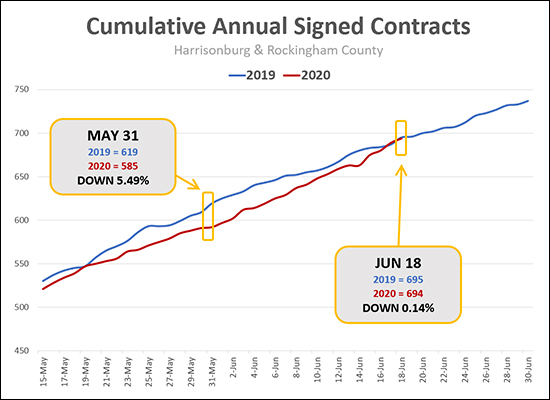

Boom, Just Like That, 2020 Buying Activity Is On Par With 2019 Trend |

|

Buyer activity has been lagging this year -- in fact just a few weeks ago there were 5.5% fewer contracts signed in 2020 as compared to 2019. But, not any longer! As of the end of the day yesterday (June 18) the pace of buying activity in 2020 is right back on track with 2019. OK, fine, less one home. Jan 1, 2019 - Jun 18, 2019 Contracts = 695 Jan 1, 2020 - Jun 18, 2020 Contracts = 694 It seems that COVID-19 might have even less of an impact on overall market activity than I had thought. Stay tuned to see if 2020 will cross over to surpass 2019 in the coming weeks. | |

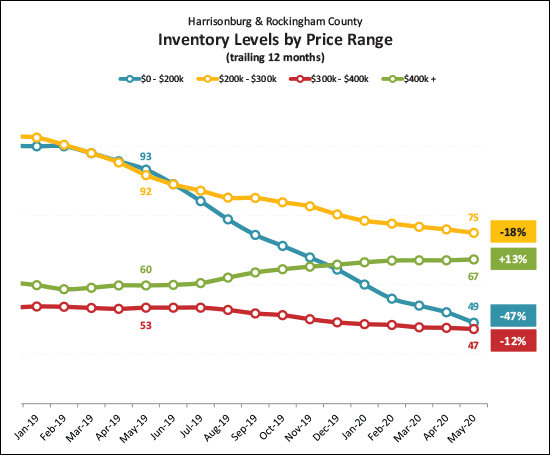

Having Difficulty Finding Homes Under $200K? Here Is Why! |

|

The blue line shown above is showing you the change in the number of homes for sale under $200K in Harrisonburg and Rockingham County. As you can see, this segment of our housing market has offered fewer and fewer choices at any given time over the past few years. Some further explanation and caveats...

So, if you are having difficulty finding a home to buy under $200K, maybe now you can see why you are having this experience! Be ready to pounce on any new listing of interest and you better already have a pre-approval letter in hand from your lender! | |

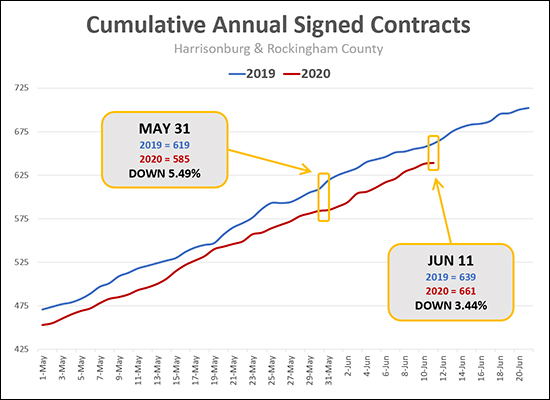

Gap In 2020 Home Buyer Activity Starting To Close? |

|

Welcome to June! It seems that the pace of home buying activity might (??) be starting to pick back up again during June...

Give it a few more weeks to know for sure, but it seems that slightly more buying (and selling) is happening as we have started rolling through June. | |

Sometimes A Full Price Offer Just Is Not Enough! |

|

It has happened to several of my clients lately -- we have made a full price offer with reasonable contingencies (home inspection, radon test, appraisal, financing) and we have lost out on the house. What does it, or might it, mean?

So, unfortunately, on a well priced new listing in a competitive price range -- seeing the house on the day it is listed and making a full price offer that same day won't necessarily mean you will be buying the house. As such, it's a great time to be a seller. It's not necessarily as exciting to be a buyer right now. | |

How To Plan Your Move If You Are Both Buying and Selling A Home |

|

Moving from one house to another is tough work! Even tougher (sometimes) is arranging the timing and logistics to work well for all parties. If you're selling a house in order to buy a house, it's possible that...

The spot for you to be can be somewhat easier -- you could stay at a hotel or with a friend for a night if needed. It's decidedly harder to put all of your belongings in the hotel room or in your friend's house. The options, generally speaking, are...

If none of these are possibilities -- I have even had some clients who had to put everything in storage, just for a few days -- and then move it out of storage into the new house. Again - even moving is tremendously hard - but arranging for it within the tight confines of closing timelines and when you do and do not have access to the old house and new house can make it even more difficult! | |

Are Some Newly Listed Properties Already Under Contract When Listed For Sale? |

|

A question from a reader... "I have noticed several properties that sold within 3 to 10 days. The quick selling properties appeared attractive in the photos on their websites and the asking prices seemed realistic. I heard a rumor that some of these properties were already sold before they were even listed...that the listing/offering was a formality." I have only very occasionally found that to be true. From time to time, a property will be entered into the MLS as a new listing and then will be immediately marked under contract. This will often be accompanied by language in the remarks (public remarks or internal agent remarks) to indicate that the listing was "entered for comp purposes" or "sold on a one time showing." This language would, indeed, indicate that the property in question was already under contract when it was listed for sale -- but I'm not seeing that very often in our local market. More often than this, I am seeing a new listing that goes under contract quickly that often...

These new listings that go under contract within just a few days are almost always NOT already under contract when they hit the market -- but because they are prepared well, priced well and marketed well -- they go under contract very quickly in this current market with very few homes for sale. So, no, I don't think very many homes are already under contract (or sold) before they come on the market - though it might feel that way sometimes with how quickly homes are going under contract! | |

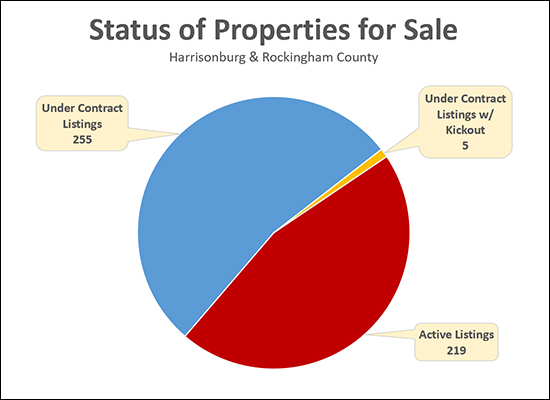

Are Home Sellers Accepting Offers Contingent On The Sale Of Homes Not Yet Under Contract? |

|

Based on the analysis above, it would seem that sellers are not (in almost all cases) accepting home sale contingencies unless the home that must be sold is already under contract. Here's the logic....

It would seem that most buyers are likely waiting to make offers until they have their own properties under contract (thus eliminating the need for the kickout clause) AND/OR most sellers are not accepting offers with home sale contingencies unless the buyer's house is already under contract (thus eliminating the need for the kickout clause). If you are a buyer, I would certainly suggest the strategy outlined above (and the only one that is apparently working with sellers right now) --- get a contract on your house and THEN make an offer on the property you would like to purchase! | |

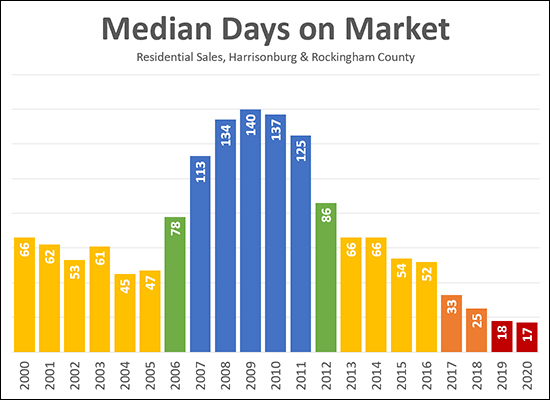

Homes Have Never Sold Faster Than They Are Selling Right Now! |

|

OK, admittedly, I was only able to look back 20 years -- but still -- I think it is fair to say that... Homes Have Never Sold Faster Than They Are Selling Right Now! As you can see after the real estate boom of 2003 to 2006, the time it took for homes to sell (median days on market) got to be as high as four (plus) months and stayed there between 2008 and 2011. Since that time, homes have been selling faster and faster -- largely due to the demand for housing increasing steadily and the supply of homes declining steadily. In 2018, the median days on market dropped below one month -- and it has continued to decline in 2019 and 2020. The current "17 days" in 2020 means that half of the homes that sell in Harrisonburg and Rockingham County are under contract within 17 days of being listed for sale -- and the other half of the homes that sell take longer than 17 days. It is certainly a fast paced world we live in these days! Buyers have to be ready to move quickly when a new listing of interest hits the market! | |

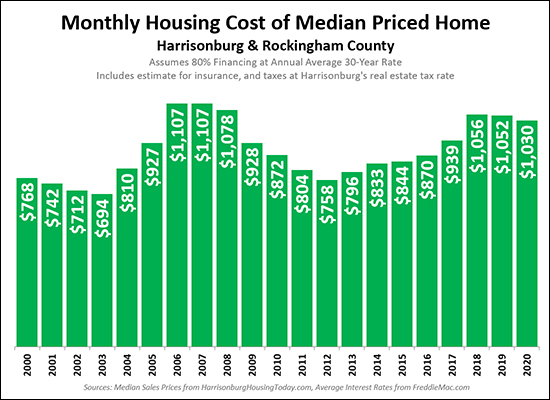

Monthly Housing Costs Decline A Bit In 2020 Thanks To Record Low Mortgage Interest Rates |

|

The monthly cost of a mortgage on a median priced house has actually declined a bit this year! For this analysis, I am measuring "monthly housing cost" by determining the mortgage payment amount (principal, interest, taxes and insurance) for a median priced home in Harrisonburg and Rockingham County, if a buyer were financing 80% of the purchase price and paying Harrisonburg real estate taxes. Over the past year...

So, even though prices are higher now than over the past two years, the monthly housing cost for financing 80% of the purchase of a median priced home has actually declined. | |

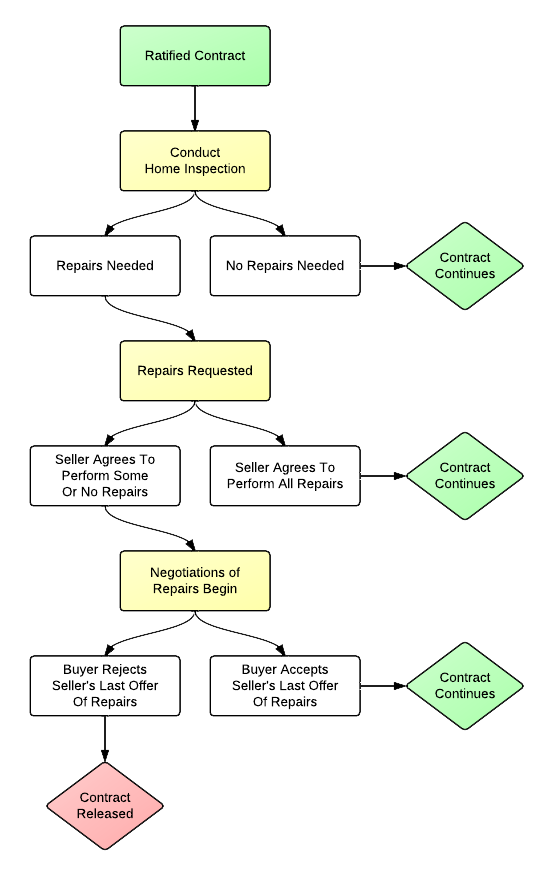

How Do Home Inspection Negotiations Usually Proceed? |

|

A buyer agrees to pay a price for a house based on what they know about the house at that time. The home inspection process allows them to learn more about the house to confirm that it is the house that they thought. But sometimes, they discover problems with the house that they'd like the seller to address....

So, how do these home inspection negotiations usually proceed? The short (and vague) answer is -- well, it depends on the terms of your contract. But, overall, here is how the inspection process typically flows....  As you can see above, after a buyer requests repairs (based on the home inspection) the seller can choose to make some, all or none of the requested repairs. The transaction (and negotiations) can then go in a few different directions based on that response. Learn more about the home buying process at....  | |

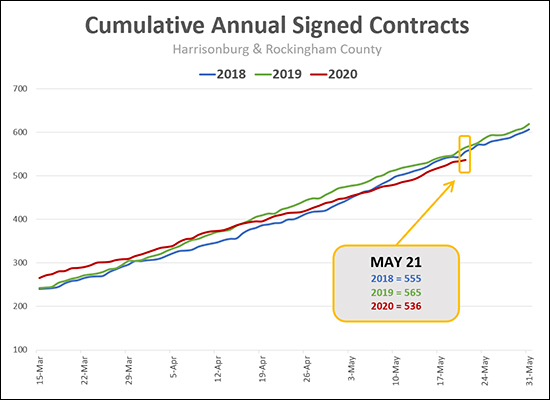

Home Buyers Keep On Buying |

|

You almost have to squint to see major differences between the trajectory of each of these lines over the past few years. The three lines above are showing the cumulative number of buyers signing contracts at any given point in the year. Looking back to the middle of March, just when we were starting to see effects of COVID-19 on our daily lives, the pace of contract activity in 2020 was ahead of the past two years... Jan 1, 2020 - Mar 15, 2020 = 265 contracts Jan 1, 2019 - Mar 15, 2019 = 242 contracts Thus, as of March 15, buyers were 9.5% ahead of last year's pace. Now, two thirds of the way through May, things have flipped flopped... Jan 1, 2020 - May 20, 2020 = 536 contracts Jan 1, 2019 - May 20, 2019 = 565 contracts Thus, as of May 20, buyers are 5% behind last year's pace. So... 1. Home buyer activity has slowed in 2020 over the past two months. 2. Home buying activity in 2020 is only 5% behind last year! I expect we'll see things start to speed back up at some point -- but it hasn't seemed to have started yet... | |

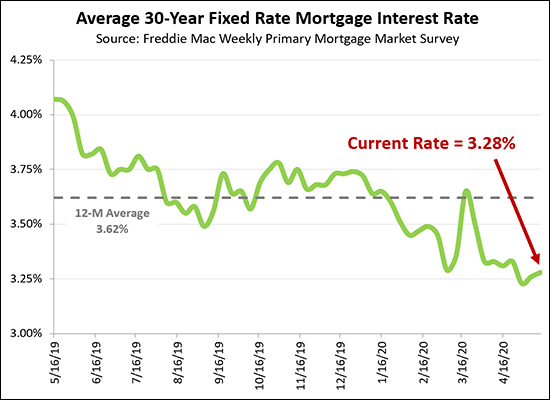

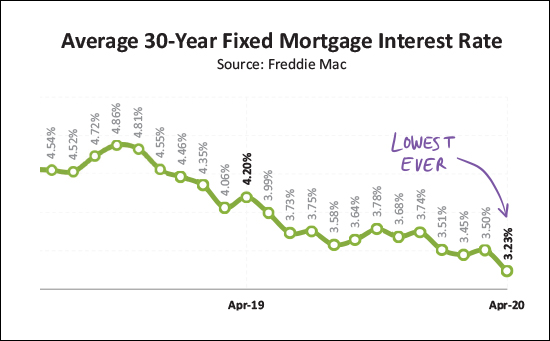

Mortgage Interest Rates Are Absurdly Low |

|

Fortunate are the home buyers who happen to be buying right now -- and locking in super low mortgage interest rates! Over the past year, interest rates have been at an average of 3.62% -- but that has varied widely from being over 4% a year ago, to now being right around 3.25%. Rates have never (ever, ever, ever) been this low! If you are buying right now, you are fortunate to be locking in a very low mortgage interest rate, and it will likely never make sense to refinance! | |

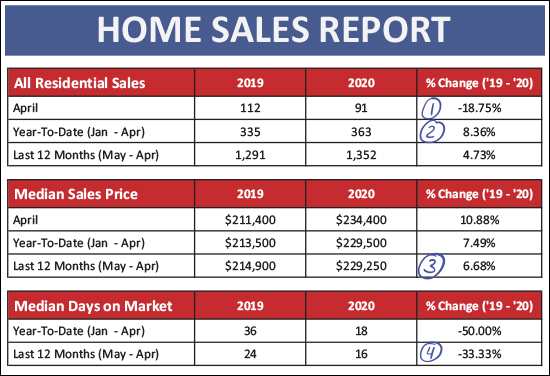

Home Sales and Prices Still Rising Despite Declining Contract Activity |

|

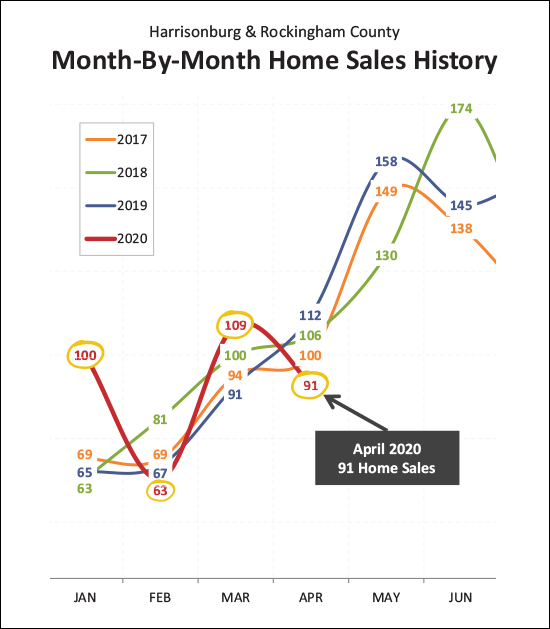

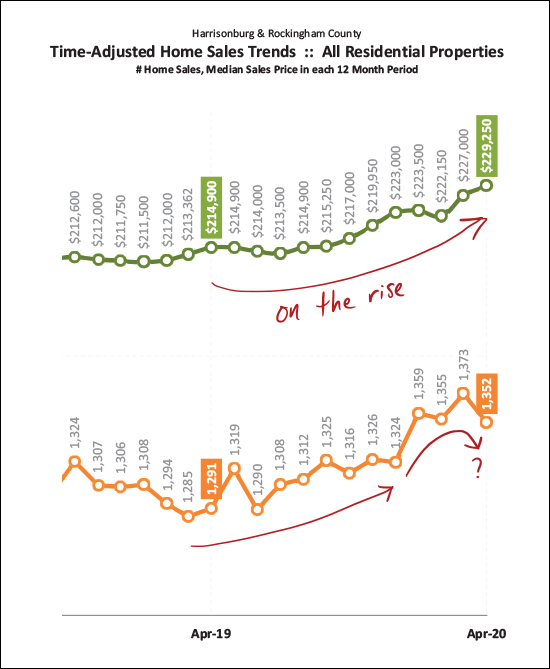

I just published my monthly market report, which you can download as a PDF here, or read on for the highlights of what is happening these days in our local housing market. But first, check out the details of the house shown above, located adjacent to the JMU campus, by visiting 80MaplehurstAvenue.com. Now, let's dive into the housing data and see what we can learn about the latest trends in the Harrisonburg real estate market...  As you can see above, the pace of home sales dropped off a good bit in April 2020 (see #1) as there were only 91 closed sales as compared to 112 last April. This is not altogether surprising, as we had seen contract activity starting to decline slightly in March. The year-to-date pace of sales (see #2) is actually still quite a bit higher (8.36%) this year as compared to last year. There was a surge of home sales in January 2020 which has kept us ahead of last year when it comes to year-to-date sales despite slower sales in April. The median sales price is still on the rise (see #3) over the past year -- having risen from $214,900 a year ago to $229,250 at the end of April. Homes are selling faster and faster and faster (see #4) with a 33% decline over the past year in the median days on market. And now, let's look at how sales have bounced all over the place thus far in 2020...  If you're feeling dizzy in 2020 trying to keep track of how the housing market is doing, you're not alone...

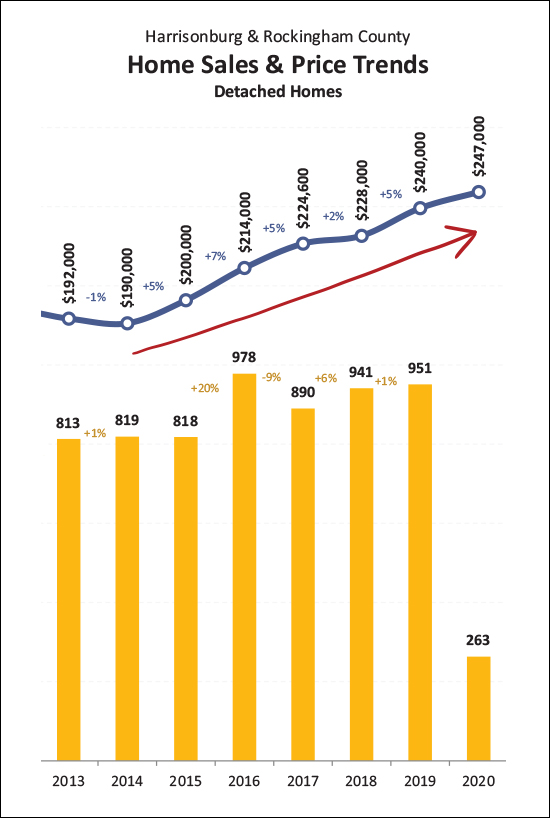

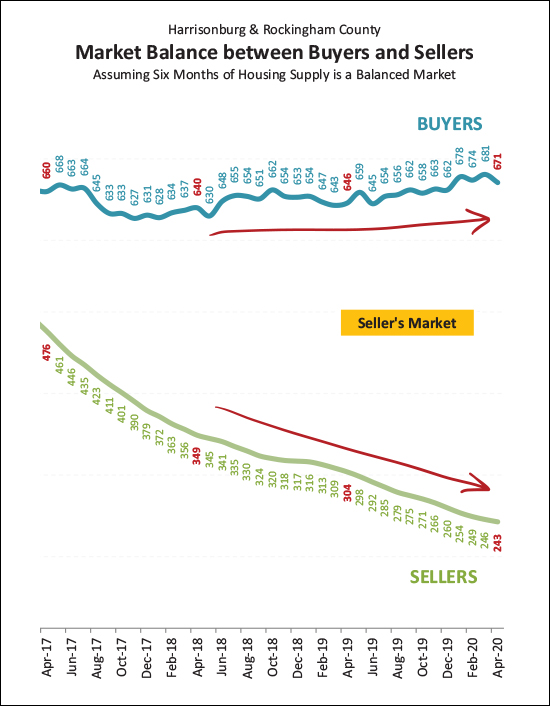

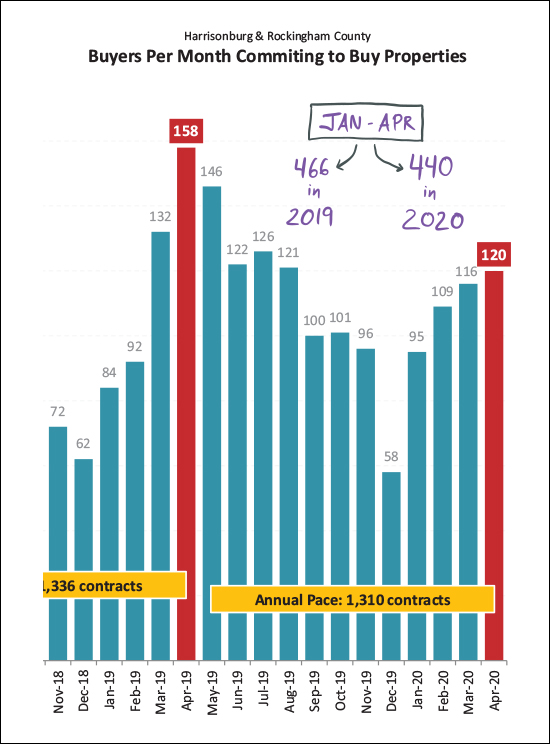

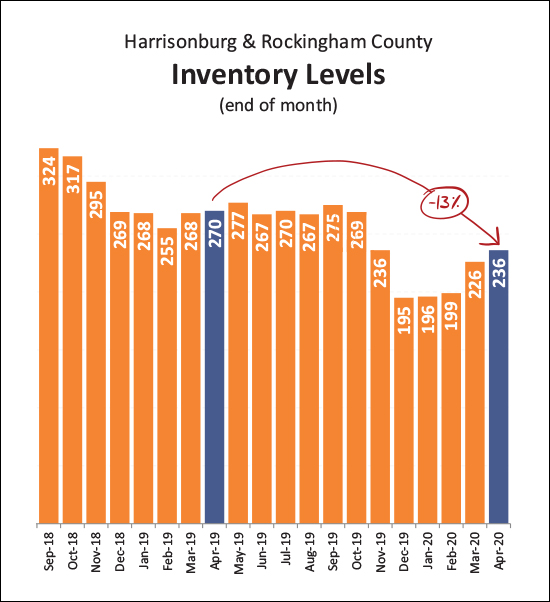

So, yeah - the net effect is still an increase between 2019 and 2020 - but that might shift when we include May home sales. We are likely to see fewer than 130 home sales in May based on contract activity in April. Only time will tell whether these short term interruptions of long term trends will impact those long term trends, as shown below...  As you can see (in green) the median sales price has been steadily rising over the past year (quite a bit longer actually) to the current median sales price of $229,250. So far, we're not seeing any indications that we'll see a flattening or decline in market values in this area. Over the past year, we have seen an increase (even if choppy) in the pace of home sales, but that dropped a bit in April 2020, and might drop a bit more in May 2020. I think this is mostly related to fewer sellers being willing to sell which is resulting in fewer buyers being able to buy. It's also helpful to look at values over time just for single family homes, as the townhouse/condo market often includes investors which doesn't show owner occupant buying activity as clearly...  The figures above are showing the median sales price of detached homes over the past six plus years. The median sales price has risen between 2% and 7% for each of the past five years, and seems to be ready to increase again in 2020, perhaps by around 3%. Part of the reason that prices are going up is because we're seeing steady buyer demand amidst fewer and fewer options of homes for sale at any given moment...  Above, we're looking at the number of buyers buying in a six month period -- which has been relatively steady over the past few years -- as compared to the number of homes on the market at any given time. The buyers are consistently ready to buy -- but they're fighting over fewer and fewer homes for sale. All that has made this an increasingly strong seller's market over the past few years. That said, buyer activity has faded a big over the past two months...  Last year, April was the strongest month of buyer activity for the entire year -- this year, not so much. We've seen an increase each month this year in the number of buyers buying -- but it has only resulted in a total of 440 contracts, as compared to a slightly higher pace of 466 contracts last year. So, slightly fewer buyers have contracted to buy in 2020, which will eventually result in a slower year-to-date sales figure, though that hasn't shown up yet. And why are fewer buyers buying, you might ask? I think the largest factor is fewer sellers being willing to sell...  As shown above, we have seen a 13% decline in the number of homes for sale over the past year. Last year, the number of homes for sale rose to around 270 homes and stayed around that number between March and October. This year, it is not clear that we'll see inventory levels get that high. Those buyers that are able to buy, though, are financing their home purchase at a historically low mortgage interest rate...  The mortgage interest rate at the end of April was 3.23%, which is the lowest on record -- ever. If you are buying in today's market, and are able to secure a contract on a house in this low inventory environment, you are certain to be pleased with your mortgage interest rate. OK, well, I'll leave it at that for now. You can review all of the trends and graphs by downloading a PDF of my market report here, or follow my blog at HarrisonburgHousingToday.com where I'll continue to monitor trends in our local market. In summary, the local housing market continues to see more homes selling, faster, at higher prices - but a small slow down in seller (and thus buyer) activity over the past two months will likely start to translate into slightly slower pace of sales, even if prices are not affected. Until next month, stay healthy, stay sane, and be in touch if I can be of any help to you or your family - with real estate or otherwise. | |

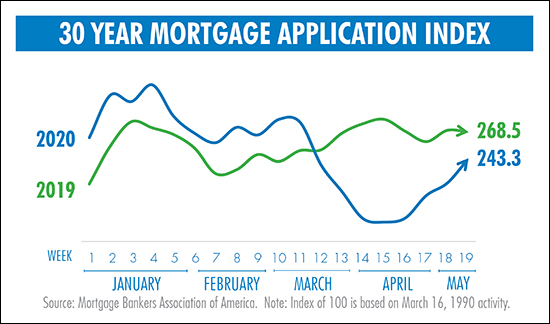

Mortgage Applications, Often A Good Leading Indicator Of Buyer Activity, Rising Quickly! |

|

The number of people making applications for mortgages tends to be a good indicator of current and future buyer activity. The graph above shows that mortgage applications in 2020 were a good bit above 2019 through the middle of March and then they took a nose dive. That said, over the past two weeks, the rate of buyers making mortgage applications has started to rise quickly again -- and is nearing the same place it was a year ago at this time. Mortgage applications precede close sales by a month or two (or more) so this may be an early indicator that buyer activity is starting to stabilize and increase again. of note -- this is a national trend - locally, we did not see as much of a drop off in buyer activity in March and April as this graph would suggest. | |

Looking At The Big Picture, Financially, Of Both Selling AND Buying a House |

|

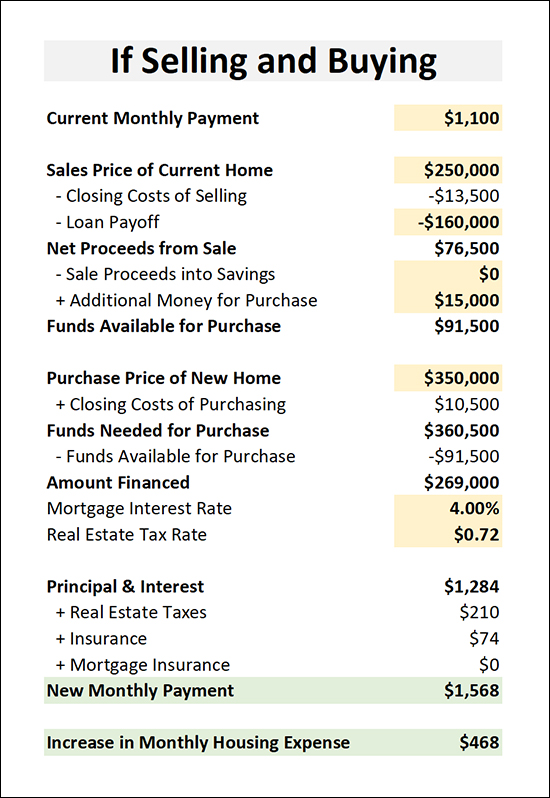

If you will be selling your home to buy another, there are a lot of numbers floating around....

Above you will see a spreadsheet I put together to help you think about some of these numbers as you are evaluating if and when you will make a move to a new house. In yellow, are all of the inputs you will need to provide, or that you and I can determine together, such as your current payment, your home's current value, your mortgage payoff, whether you will be putting any additional money into the transaction, etc. In green, I have identified your potential future mortgage payment and the net change in your monthly payment. All of the numbers without a background color will automatically calculate for you. Click here to download this worksheet as an editable Excel file. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings