Buying

| Newer Posts | Older Posts |

Is The Perfect The Enemy Of The Good In House Hunting? |

|

You may have heard of the expression - "Don't let the perfect be the enemy of the good" - and here are a few other similar phrases from philosophers over the ages...

So, how does this all apply to house hunting and home buying? Especially after a long home search process, when a buyer finally finds a house that could actually work -- they might get stuck in trying to determine conclusively whether good is good enough. It's understandable... Buying a house is an expensive and lasting decision. You'll likely live in the home for many years to come, and the various aspects of the house will shape some of the patterns of your life, relationships and more. So, it's important to get the right house -- and a great house -- right? Yes, 100%. That said, sometimes a house is great, but is not 100% perfect, and this can leave a buyer wondering whether to go ahead and jump on the pretty-amazing-but-not-perfect house, or to keep looking for something that is an even better fit for their needs or desires. There's no magical answer here -- it's not that you should always decide to buy a great-but-not-perfect house -- and it's not that you should always eternally wait for the perfect house. But as you mull over that pretty great house, make sure that you are not letting your (perhaps solely theoretical) ideas of a perfect house get in the way of you buying a house that would be a great home for you. | |

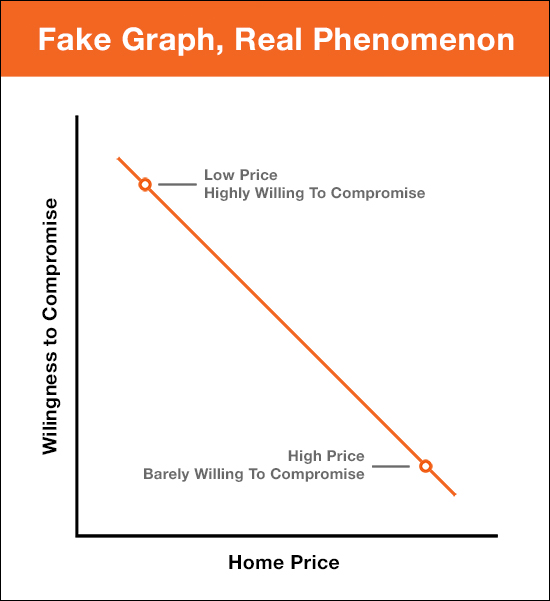

Buyers Of Expensive Homes Are Often Less Willing To Negotiate On Other Home Criteria |

|

Sometimes, if you can't find data to analyze to demonstrate a market dynamic, you should just make up the data or chart. Right? ;-) Well, not necessarily, but maybe just this once? Here's something I observe time and time again...

And it sort of makes sense when you think of it from a price perspective...

And it sort of makes sense when you think of it from a timeline perspective...

As a side note -- this is one of the main frustrations for sellers of "more expensive" homes -- why do all the buyers have to be SOOOO picky? Why aren't they willing to compromise even just a little bit!? Again -- a real phenomenon, but definitely a fake graph. :-) | |

Typical Obstacles Between Contract and Closing |

|

While every home sale is different -- with unique contingencies based on the needs and situations of the buyer and seller -- there are three main hurdles that most buyers and the houses they are purchasing must clear to make it to closing. So -- where is your contract in this process? Have you cleared 1, 2 or 3 of the hurdles, thus far? There will be plenty of other details to attend to, but these are the three main areas of focus. Evaluating the property condition, the property value, and the buyer's finances.... INSPECTION - This is an evaluation, by a home inspector, of the condition of the house. Clearing this hurdle typically involves requesting that the seller make some repairs to the house (or negotiate further on price) based on new information about the property condition discovered during the inspection process. APPRAISAL - This is an evaluation, by an appraiser hired by the purchaser's lender, of the value of the house. If the property appraises for the contract price (or higher), all is well -- otherwise, the buyer and seller may need to renegotiate the contract price based on the appraised value. LOAN APPROVAL - This is an evaluation, by a lender (and their underwriters) of the purchaser's financial situation. The lender must confirm that the buyer has the income to support the mortgage payment required for purchasing the home. Again - there are many other smaller hurdles (for example, a termite inspection) and larger hurdles (for example, a home sale contingency) that may need to be cleared in your purchase (or sale) of a home -- but these three main hurdles (inspection, appraisal, loan approval) are the three main mileposts during the contract-to-closing process that we'll be focused during the transaction. BUT WAIT -- THERE'S MORE.... Would you rather have three main hurdles to clear, or six? Let's imagine that you receive two offers on your house, which is listed for $250K....

So -- a slightly higher sales price, with a home sale contingency, is not always more valuable to a seller than a slightly lower sales price without a home sale contingency. | |

March Is Here, New Listings Will Be Coming, Get Ready To Pounce |

|

The market is moving QUICKLY -- homes are often going under contract in a matter of days instead of weeks -- so it is essential that you know about new listings immediately when they hit the market. Most of my clients use NewListingsInHarrisonburg.com to keep track of new properties coming on the market in Harrisonburg and Rockingham County. You can quickly and easily scroll through the most recent residential listings in Harrisonburg and Rockingham County, view the pertinent details, all of the photographs of the home, an area map, and then quickly and easily share that new listing with a friend, your spouse, your Realtor, etc. You can also sign up to receive an email alert every time there is a new listing....  Check it out, at NewListingsInHarrisonburg.com. | |

Should Buyers In A Low Inventory Market Consider the Purchase of Foreclosures? |

|

With some regularity, I am asked by potential purchasers how they would go about buying a foreclosure. First, here is a list of upcoming foreclosure sales, but more importantly, below is a description of a few ways to buy what you might be thinking of as a foreclosure.

SHORT SALES: While this does not happen as frequently in the current market, sometimes homeowners must sell their home, but market conditions won't allow them to sell it at a high enough price to be able to pay off their mortgage(s). In this example, a homeowner might have a $250,000 mortgage balance but can only sell the property for $230,000. As a prospective buyer, it is sometimes possible to purchase this type of a property through a process called a "short sale." In such an arrangement, the homeowner petitions their lender to accept less than the full payoff of the mortgage and in return to still release the deed of trust so that ownership of the property can be transferred over to you, the new owner. This can benefit the lender, as they skip the time delays and cost of the foreclosure process. This can also benefit the homeowner, as a short sale will have a slightly lesser negative impact on their credit as compared to a foreclosure. As a buyer, however, you must know that there are challenges to buying a property as a short sale. The biggest challenges of late seem to be the uncertainty of the purchase and the time table. Even if you and the homeowner agree to a price of $230,000, the homeowner's lender must still agree to accept that price – since it won't allow the homeowner to pay off their $250,000 mortgage balance in full. This process of waiting to hear back from a lender, and then complying with all of their various terms can sometimes take 60 to 120 days – or longer! TRUSTEE SALES: If a short sale does not take place, and a homeowner is behind on their payments (or not making them at all), eventually the property will be sold by the lender on the courthouse steps. Buying a property at a "trustee sale" can be exciting, and can be a great opportunity – but there are challenges as well. If a property to be sold at a trustee sale is also listed for sale with a Realtor, you can usually view the property ahead of time by calling your Realtor. Otherwise, you will likely not have the opportunity to see inside the property before the trustee sale, and thus you will not know too many details about the condition of the property. Furthermore, your purchase of the property at the trustee sale cannot be contingent upon viewing the property, or inspecting the property. In this instance, you are purchasing the property in "as is" condition, regardless of what you then find out about the property. It is also important to note that many times the lender will have an opening bid at the trustee sale that is close to (or sometimes higher than) the amount that they are still owed on the mortgage. Thus, in the example above, they might make an opening bid of $250,000. As a result of this opening bid process, many (or most) properties available for purchase at a trustee sale are not great opportunities. Occasionally, a property will be foreclosed upon that has had a mortgage in place for many years, whereby the balance of the mortgage is much lower than current market value – these are great opportunities for a buyer. Visit HarrisonburgForeclosures.com for a list of upcoming trustee sales. BANK OWNED PROPERTIES: If you don't buy the property before the auction (as a short sale), and don't buy it at the trustee sale, you'll have a third opportunity to buy it once the bank owns it. These properties are called "bank owned properties" or REO properties ("real estate owned"). Oftentimes, the prices on these properties are quite realistic, if not under market value. It would not be atypical for a house such as the one mentioned above to come on the market after the trustee sale at a price of $210,000. In such an instance, you should expect to be buying the property in "as is" condition, and you will also be buying with a slightly different contract document. Most lenders have a long standard contract or contract addendum that spell out a variety of additional contract terms designed to protect them from any future liability – and rarely will a lender agree to have these contract documents changed in any way. As you can see above, oftentimes buying the property as an REO property is where the best opportunity lies. Visit HarrisonburgREO.com for a list of bank owned properties currently on the market for sale. When a home goes into foreclosure it is often for very sad and unfortunate reasons – such as the loss of a job – and I do not wish such circumstances on any homeowner. However, if you are a buyer in today's market it is important to be familiar with different methods for buying a property when it will be, is being, or has been foreclosed upon. | |

Tips For Townhouse Buyers In A Competitive Market |

|

Over the past few months I have listed several townhouses for sale that went under contract quickly after a LOT of showings in a very short timeframe. For one such recent property there were six offers within 48 hours. One of the things that struck me as we worked through that process was that there were five other buyers who really (!!) wanted to buy that townhouse and couldn't -- because there was only one townhouse to be purchased. As such, I feel bad for townhouse buyers in the current market. Townhouse buyers have a LOT of competition and I can imagine a single buyer making an offer on multiple townhouses and missing out every time. So, a few tips for would be townhome buyers...

I suppose one critical aspect that I did not list above would be to hire a buyer's agent to represent you in finding, pursuing and purchasing your townhome. I'd suggest you select someone who is highly responsive, professional and knowledgeable about the market. Happy townhouse shopping! (Or may it just not be too unbearably difficult, frustrating and tiring.) | |

A Full Price Offer Does Not Always Win Negotiations |

|

I don't play poker regularly - though I have played it a few times lately with my kids. When I do play, I can become caught up in my excitement to see a strong hand. Wow! This pot is mine! I am bound to win this time! And often, that might happen with a strong hand in poker -- but not always. Sometimes, another player will have an even stronger hand, and I'll lose despite my strong hand. Here are the rating of poker hands, in increasing strength...

And here are some generic types of offers that might exist on a house, in increasing strength, generally speaking...

That order isn't actually always 100% accurate - it can depend on the property, the seller, etc. But the point should be clear... Even if you make a full price offer, with what would be considered to be normal contingencies (financing, appraisal, inspection) you could still lose in negotiations in several different ways. So -- play your strongest hand, but always know that there could be a stronger hand out there! | |

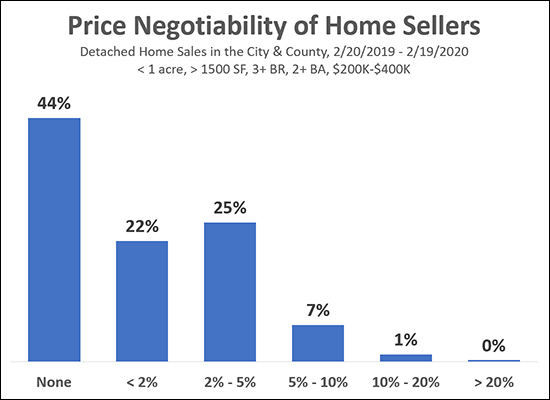

How Much Are Sellers Negotiating On Price These Days? |

|

If you're looking to buy a home under $250K, should you only consider homes priced at or below $250K? Probably not - some sellers of homes priced above $250K will negotiate down to $250K. Should you look at homes priced above $500K? Probably not - most sellers of homes priced above $500K probably will not negotiate down to $250K. Both of those are probably obvious to most home buyers, but how do we understand the negotiability dynamics between those two mostly obvious statements? The data above is a first look at that puzzle - with some constraints. Basically, I looked at one year of City/County home sales, but limited it to homes with 1500+ square feet, 3+ bedrooms, 2+ bathrooms, on less than an acre, between $200K and $400K. So, not a canvas of the entire market -- but a pretty reasonable chunk of the middle of our market not likely to be thrown off by lots of investors (lower priced or attached properties) or high end buyers (high priced properties). And - after that intro - here's (some of) what we find...

So - hopefully that provides some guidance as to what you might expect as a buyer. If you see a home listed for 11% above your budget -- there is likely only a 1% chance that the seller will sell at a price that works for you -- or, put another way, you might have to find 99 such properties (where the seller won't come down 10%) before you find the 100th where they will. | |

The Role of a Realtor in Representing A Home Buyer |

|

Home buyers would be well served to have a Realtor represent them in their home purchase. So, before you call the listing agent to see a home listed for sale, you should understand a bit more about buyer representation.

In representing you in your home purchase, your buyer's agent would be performing tasks such as:

So -- you can call the listing agent (who is contractually bound to represent the seller's best interests) -- or you can hire a Realtor to represent YOUR best interests as the buyer. Clearly, I recommend the second option. Beyond buyer representation, there is a lot more to know about and think about regarding the home purchasing process. Read more at....  | |

Who Is Winning In 2020 In The Local Real Estate Market? |

|

Sellers are winning - rather universally. Every market metric works in their favor. Buyers are losing - in most categories. Buyers are happy about low rates and low unemployment, but otherwise, all market metrics are working against them. Homeowners are winning - they are indifferent to most market shenanigans - but are glad home values are increasing. SELLER-BUYERS - If you will be a seller AND a buyer -- things may balance out -- you may benefit as a seller and struggle as a buyer. | |

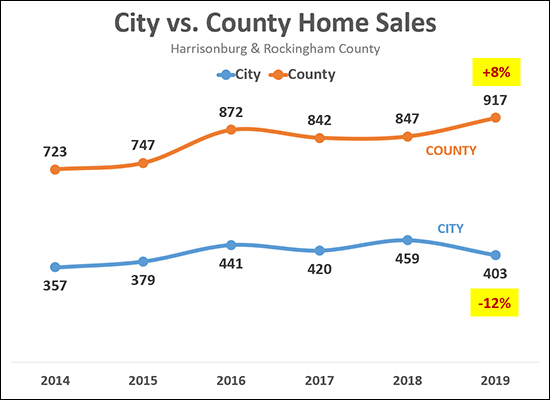

Home Sales Rise In County, Fall In City |

|

Home sales rose 8% in Rockingham County last year -- from 847 sales in 2018 up to 917 sales in 2019. This is the highest number of home sales we have seen in Rockingham County in at least the past six years. But in the City, it was a different story. Home sales declined 12% in the City of Harrisonburg in 2019, from 459 sales in 2018 down to only 403 sales in 2019. This is higher than some recent years, but the lowest number of homes ales in the past four years. A few more notes...

There are any number of factors that affect whether buyers end up buying in the City or County, including what type of property they are seeking, how much land they desires, school systems, employer locations, and much more. | |

Three Ways To Pay For Mortgage Insurance |

|

George Mason Mortgage has an excellent overview of the three main ways to pay for mortgage insurance. But before we go there, what is mortgage insurance? If your down payment is less than 20% of the purchase price, your lender may require that you pay for mortgage insurance to cover their greater risk because of your smaller down payment. Two quick points...

And now, the three main ways to pay for this mortgage insurance...

| |

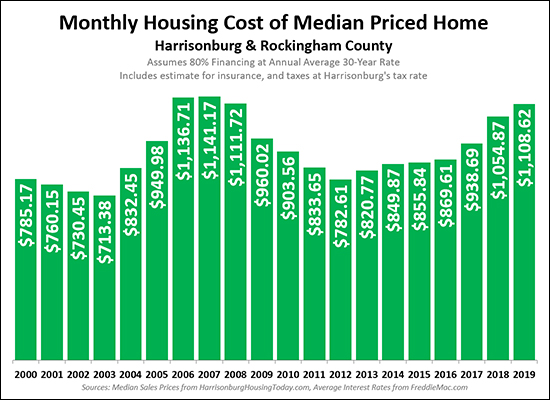

Monthly Housing Cost for Median Priced Home Climbs Further in 2019 |

|

As should come as no surprise, the monthly cost of housing is increasing -- and has been increasing more quickly over the past several years (2018, 2019) as compared to many prior years. The graph above devises a monthly cost of housing using the median sales price of homes sold in Harrisonburg and Rockingham County and the mortgage interest rate at the time. The payments above assume that a buyer finances 80% of the purchase price at the prevailing rate -- and these housing costs include an estimate of real estate taxes and homeowners insurance. Of interest -- this monthly cost...

Over the next few years, it seems likely we will see a continuation of this trend, as sales prices and mortgage interest rates are both likely to continue to increase. | |

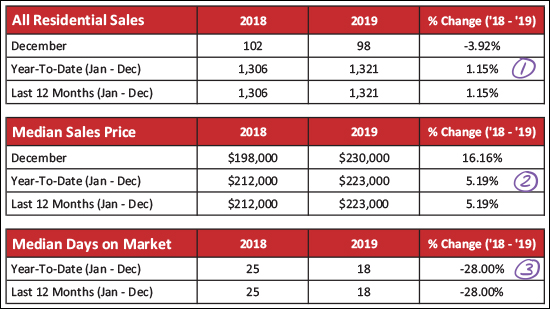

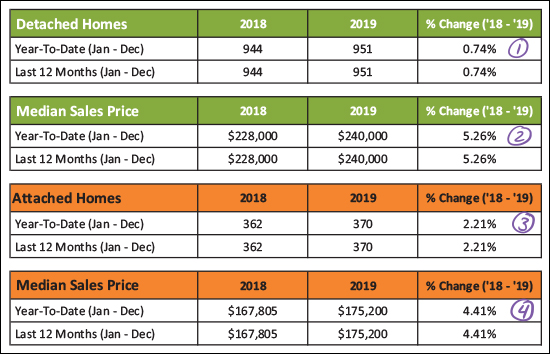

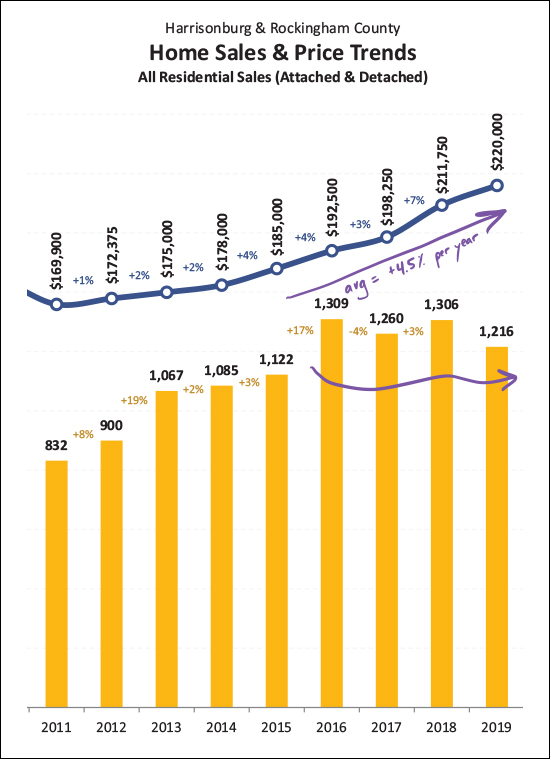

More Homes Sold... More Quickly... at Higher Prices in 2019! |

|

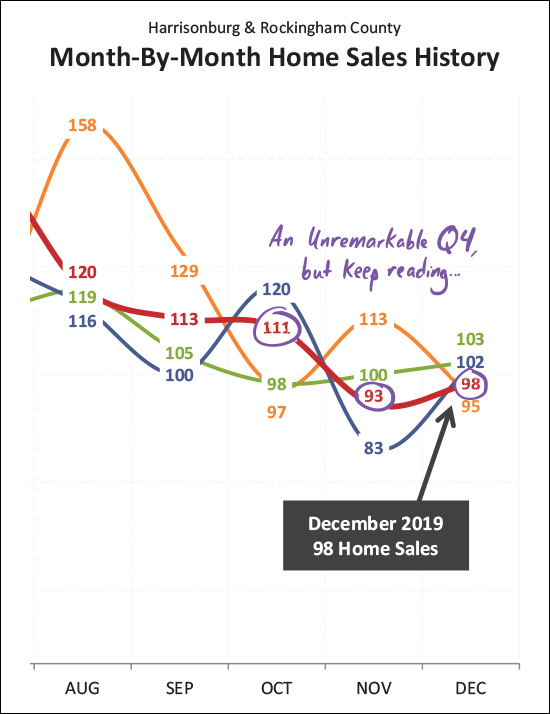

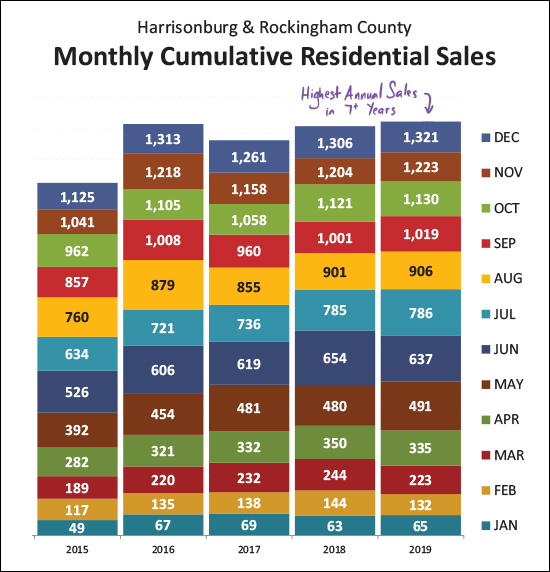

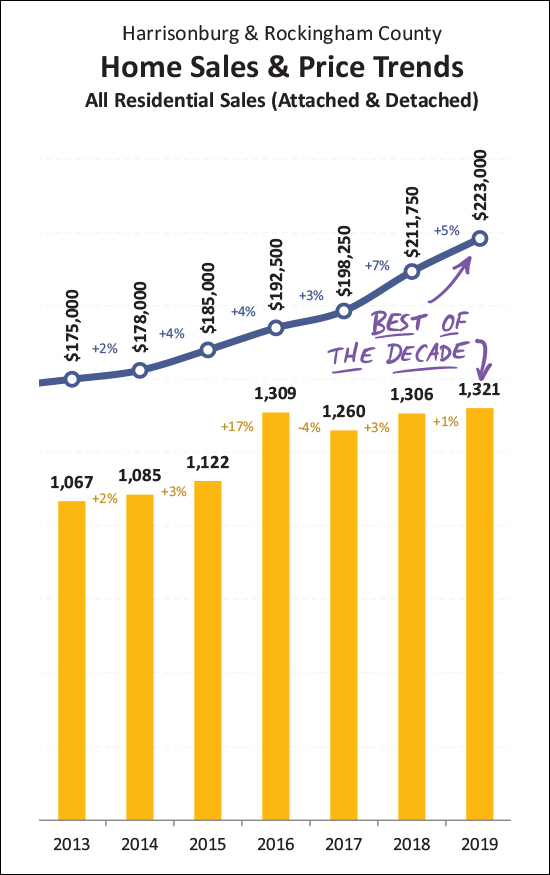

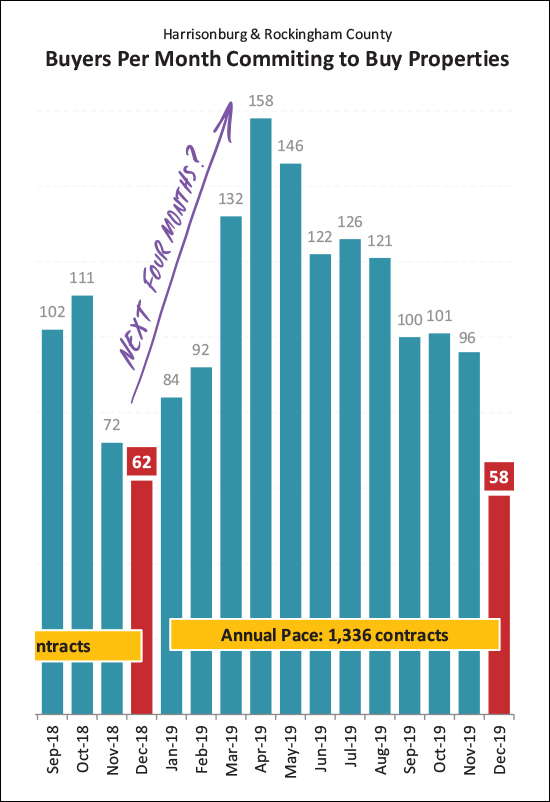

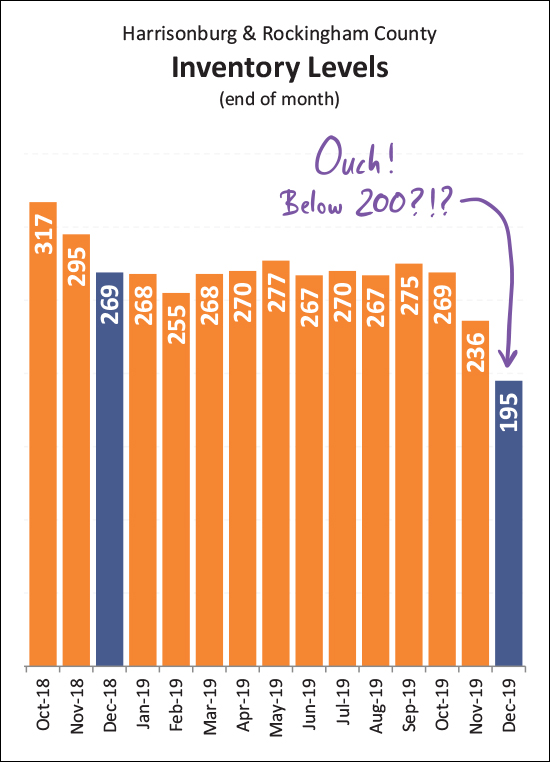

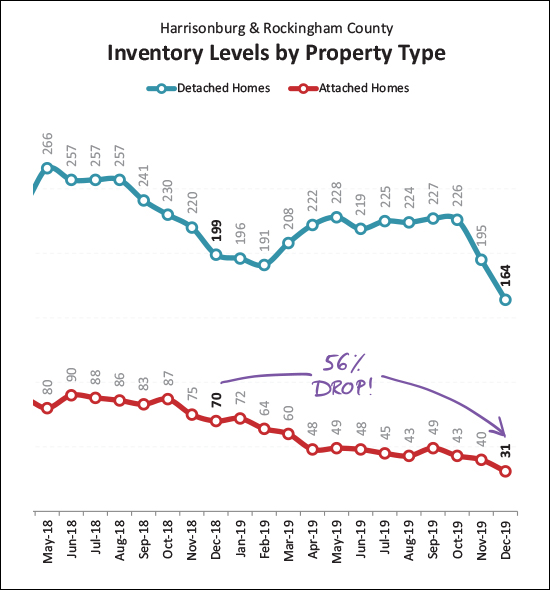

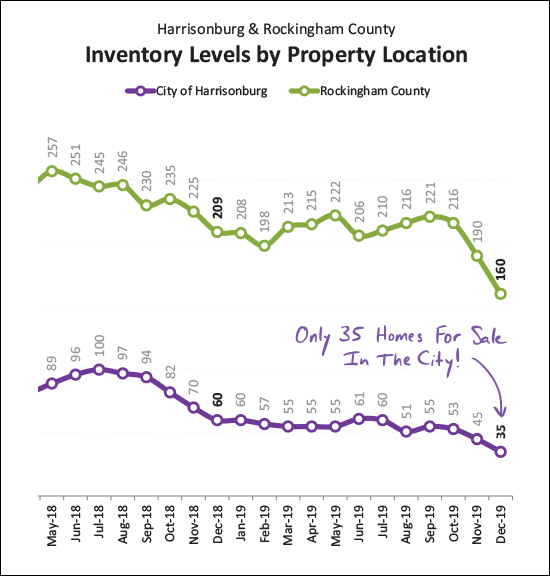

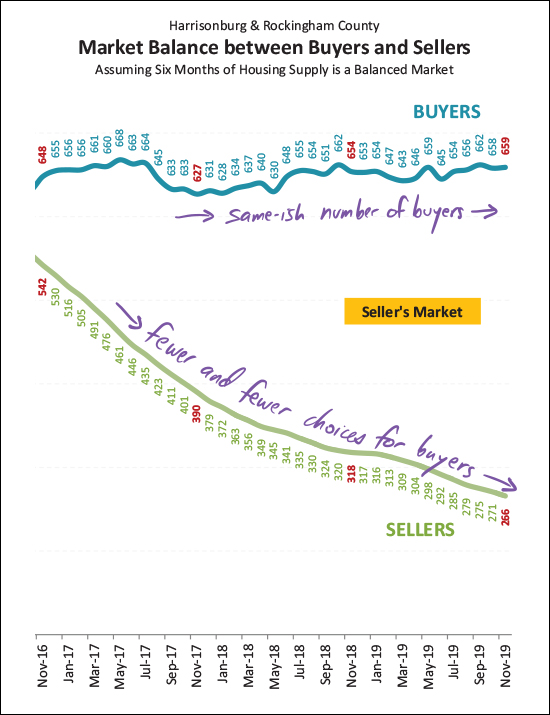

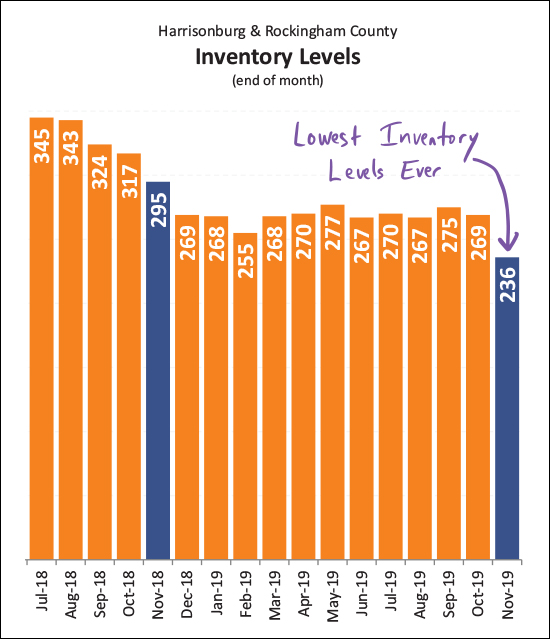

Happy New Year and New Decade! And what a decade it was for the Harrisonburg and Rockingham residential real estate market! Read on to learn more about the new highs (and lows) we experienced in 2019 to finish out the decade -- or download the PDF here. But first -- feel free to explore this month's featured home -- an upscale townhouse in Taylor Spring that just hit the market this morning. Visit 2930CrystalSpringLane.com for details. And now, on to the some highlights of what's new and exciting in our local real estate market...  [1] First things first -- we saw more home sales in 2019 than we did in 2018 -- though barely. There was a 1.15% increase in the number of homes selling in Harrisonburg and Rockingham County. This 1.15% increase did set some new (recent) records though, so keep on reading for that fun detail. [2] If the increase in the pace of sales was possibly smaller than expected -- the increase in the median price of those homes was probably larger than expected. I typically reference that median home prices usually increase around 2% to 3% per year over the long term -- but last year the median sales price jumped 5.19% in a single year to $223,000. This is certainly exciting for home owners and home sellers -- though not as thrilling for home buyers. [3] Finally, the time it took for homes to sell in 2019 dropped 28% to a median of only 18 days! This is a measure of how many days it takes for a house to go under contract once it is listed for sale. In summary, more homes sold, at higher prices, more quickly in 2019. But let's dig a bit deeper...  [1] The number of detached (single family) homes that sold in 2019 was only 0.74% higher than in 2018. So, we'll say about the same number of detached homes have sold in each of the past two years. [2] The median price of those detached homes has risen - a full 5.26% over the past year to the current median sales price of $240,000 for all of Harrisonburg and Rockingham County. [3] There was a slightly larger (+2.21%) increase in the pace of sales of attached homes (duplexes, townhouses, condos) in 2019 -- though that small increase (362 sales to 372 sales) isn't anything to write home about. [4] The median price of the attached homes that sold in 2019 was 4.41% higher than the prior year -- bringing us to a $175,200 median sales price for attached homes in Harrisonburg and Rockingham County. Zooming in a bit on December and the fourth quarter of 2019 we find...  ...just about nothing extraordinary. Darn. :-) Home sales during October, November and December of 2019 were squarely in the middle of the pack as compared to the past few years. So, no main takeaways there -- it seems we had a typical end of the year in our local housing market. But that typical end of the year piled on to the first nine months...  As shown above, it was only a small (small, small) increase in the number of homes selling between 2018 and 2019 -- but it was enough to push us above the two recent highs seen in 2016 and 2018. I cropped this graph a bit too tightly to see it, but 2019 home sales were the highest we have seen in 7+ years. Oh, and it seems I can make an even broader statement...  We hit some of the best number of the decade in Harrisonburg and Rockingham County... The 1,321 home sales seen last year was the highest number of home sales seen any time in the past decade! The median sales price of $223,000 seen last year was the highest median sales price seen any time in the past decade! So, there's that! Exciting, indeed -- again, for everyone except those looking to buy right now. Speaking of the future...  Looking back can often help us understand what we'll see when moving forward. The graph above illustrates when buyers sign contracts to buy homes and the purple arrow is marking the typical January through April trajectory in our local housing market. So -- January and February are likely to be slow for contract activity -- but we should see things starting to pop in March and April. Get ready! And now, possibly the worst news in this market re-cap...  Inventory levels were not contingent to have dropped below 250 homes for sale at the end of November -- they dropped even lower (!?!) by the end of the year to where there are now only 195 homes for sale! We can conclude several things here -- today's buyers won't have many choices -- and when good choices do come on the market they are likely to go under contract quickly! Just to further dissect the depressing decline in inventory...  The larger drop in inventory over the past year has been in attached homes (the red line above) where there are now 56% fewer homes on the market as compared to a year ago. This is largely because there haven't been many new townhouses constructed in the past year as compared to many previous years. And when we look at the City compared to the County (brace yourself) we find...  The purple line above is showing you that there are only (it's real folks) 35 homes on the market for sale in the City of Harrisonburg! This is a 42% decline from a year ago. There was also a sizable decline in the number of County properties on the market, but buyers looking to buy in the City right now will find it to be a particularly tight market. OK - that's it for now - I'll be diving into a few more market dynamics in the coming days. Until then... If you're planning to sell your home in 2020 -- let's chat soon about the best timing for doing so, what you should do to prepare your home for the market, and of course, we can chat about pricing. If you're planning to buy a home in 2020 -- sign up to get alerts of new listings, talk to a lender to get pre-approved, and let's get ready to make a mad dash to see new listings as they come on the market to give you a shot at buying a home in a very tight real estate market. Happy 2020, friends! I am looking forward to a great year and hope to work with many of you to help you accomplish your real estate goals. As always -- shoot me an email if you have follow up questions or if you want to chat about your plans to buy or sell. | |

It Might Be Hard To Find A Home To Buy In The City of Harrisonburg |

|

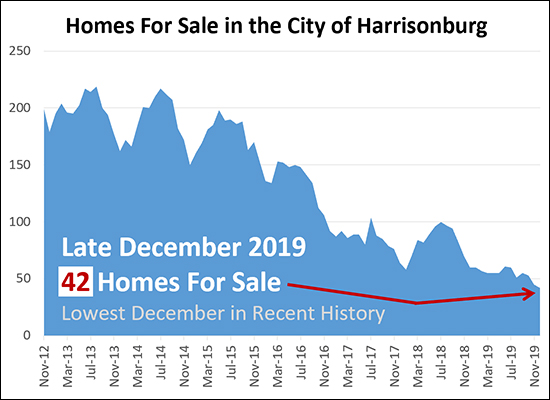

The number of homes for sale in the City of Harrisonburg keeps dropping. That's not to say that homes aren't selling -- a total of 390 homes have sold in the City of Harrisonburg during the first 353 days of the year -- putting us at a pace of around 34 home sales per month. But the number of homes available to buyers continues to decline -- now down to only 42 homes for sale! Here's a bit longer of a context....

And now -- only 42 homes for sale! If you're looking to buy a home in the City of Harrisonburg it might be difficult to find a home that is a perfect fit or you given a very limited supply of homes for sale. And when a home does come on the market that works for you, it is likely to sell quickly. | |

Last Chance To Build A New Home at Heritage Estates |

|

If you want to build a home at Heritage Estates -- an active adult community in Harrisonburg, Virginia with homes featuring French Country architecture -- this is basically your last chance to do so! There has been a flurry of buyer activity in the neighborhood and there is now only ONE remaining home site (Lot 18) on which you can build a home. The developer is also building a model home (rendering above) on Lot 30 (details in a PDF here) -- so that is an option as well, though it is framed in and under roof, so you don't have quite as much flexibility as to what you might build. Find our more about Heritage Estates here and email me if you have further interest or questions. | |

When Buying A Home, Keep In Mind That School Districts Can Change |

|

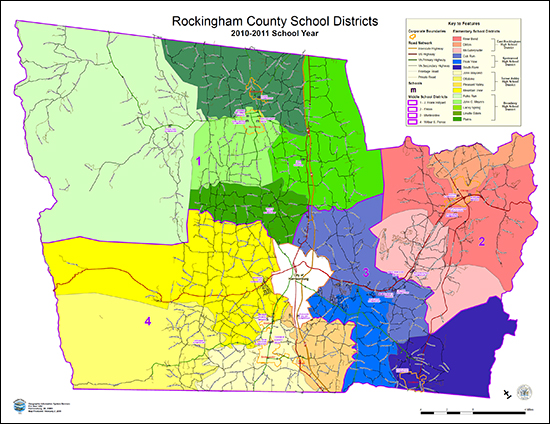

In the news lately...

There are a few more possible changes in Rockingham County, but the above is a sampling of possible changes. Read about the plans for change in Rockingham County Public Schools here. All of this is to say that if you are buying a home, and one of the critical factors is whether it is in school district X or school district Y, then we'll likely want to check to see if you are in an area that might be affected by changes that are currently being discussed -- AND -- you should know that further changes in school districts could take place before your sweet little Johnny (currently 2 months old) is old enough to go to high school. As a random side note, the Rockingham County school district map (shown above) downloadable here does not appear to have chnaged in the past nine years! So, I suppose change had to happen eventually... | |

Home Sales Solid, Contracts Strong, in November 2019 |

|

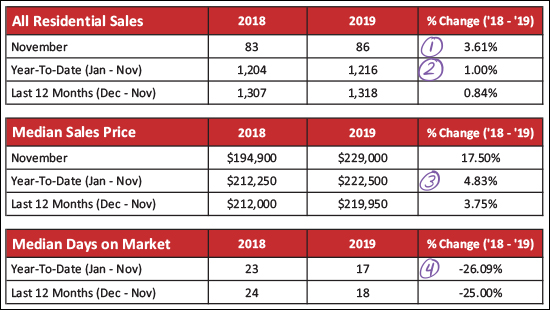

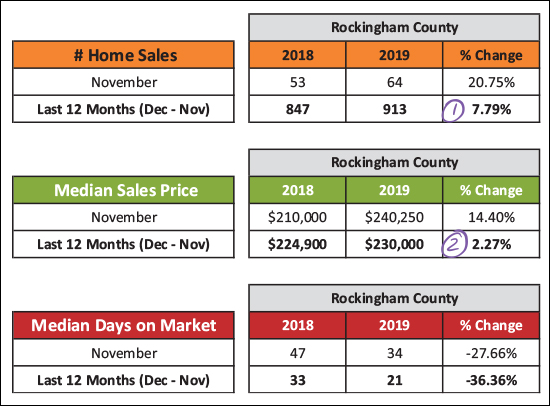

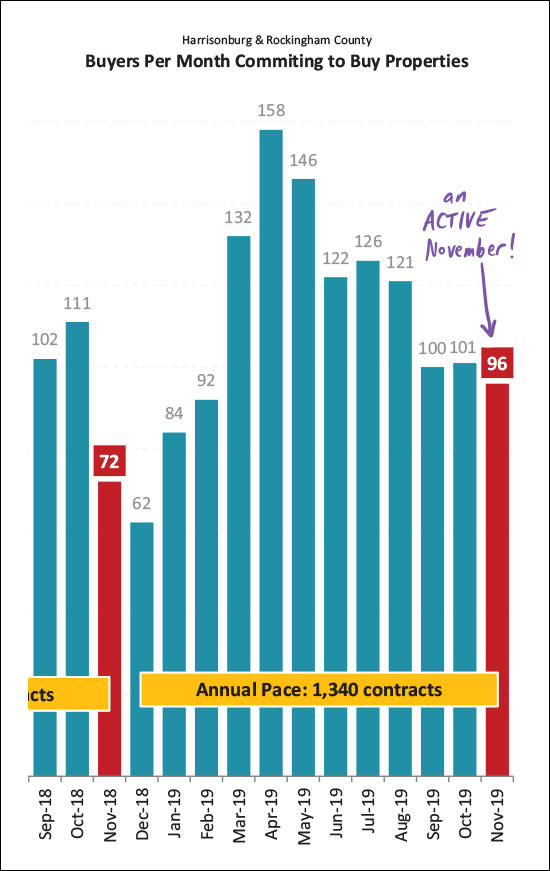

Happy December, friends! The end of the year is approaching, so let's take one last partial-year look at our local housing market before we have a full twelve months of data to analyze. You can download my full market report here or read on for the high points... But first -- check out this custom built home on six acres, pictured above, by visiting 3449WildwoodDrive.com. Now, to the data...  As shown above...

Now, breaking things down between detached and attached homes...  As shown above...

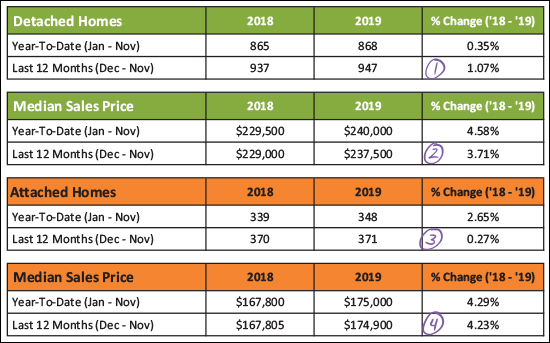

It can also be helpful to break things down between the City and County...  As shown above...

But in the County...  As shown above...

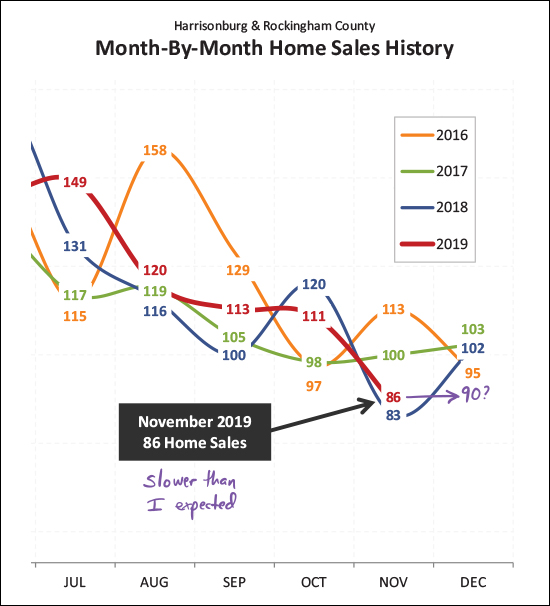

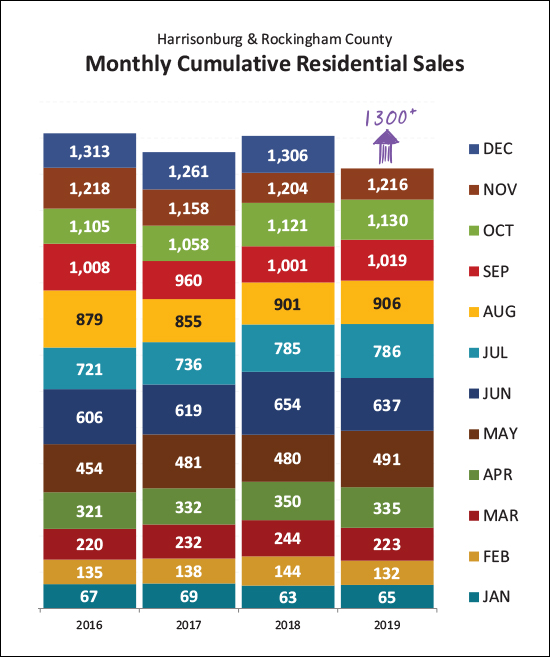

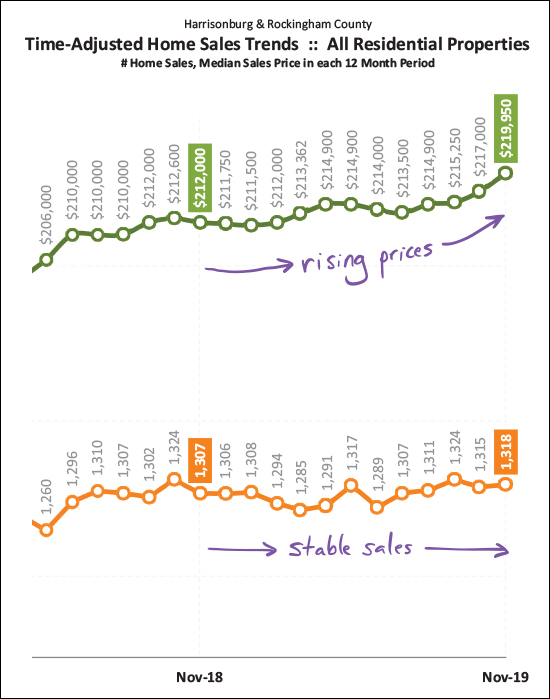

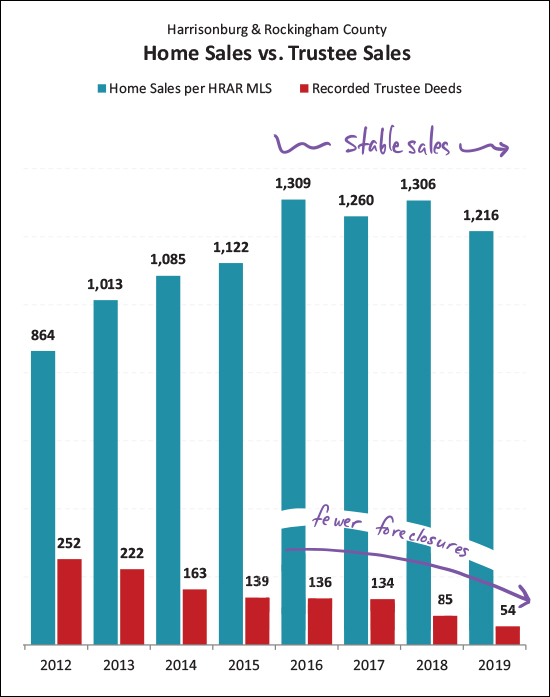

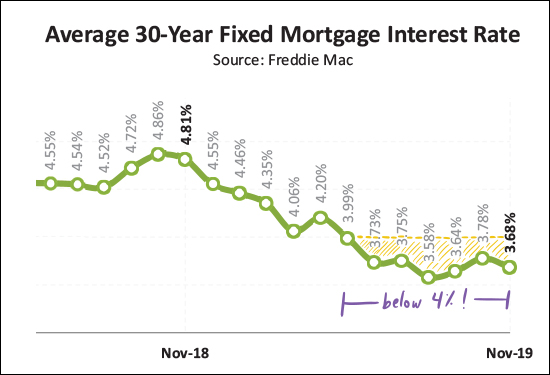

And now, for the roller coaster of month-by-month home sales activity...  I thought we'd see more home sales in November than we did end up seeing. The 86 sales this November was more than we saw last November -- but a good bit below the prior two months of November. Looking forward, I'd expect we'll see around 90 home sales in December.  When we stack up each of the past three years -- plus this year -- you'll note that we're almost certainly on track to see 1,300 home sales in 2019 -- and we may very well beat the recent high of 1,313 sales seen back in 2016.  When looking (above) at the annual pace of sales (the orange line) you'll note that it has bounced around some over the past year -- but has stayed right around 1300 sales per year. During that same timeframe, however, the median sales price has been slowly (and then more quickly) rising -- up from $212K a year ago up to $219,950 when looking at the most recent 12 months of sales data.  Examining a slightly longer (four year) trend we'll see that home sales have stayed right around (just above, just below) 1300 home sales per year -- while the median price of those homes has climbed, on average, 4.5% per year. This increase in prices is certainly higher than the 2% - 3% long term historic "norm" but is much more sustainable than the double digit annual increases we saw during the past real estate boom.  Here's (above) a curious one -- and an unfortunate one for buyers -- over the past few years the same number (more or less) of buyers have been buying -- but they have had fewer and fewer and fewer homes from which to choose at any given time. It has caused homes to sell more quickly and buyers to become more frustrated.  While closed sales were slower than I expected in November -- buyer activity in contracting on homes was much more active than I expected! We typically see a drop off between September/October and November when it comes to signed contracts -- but this year, we saw just about as many buyers commit to buy homes in November as we had seen in September and October. The 96 contracts signed in November gives me hope that we'll see 84 sales in December, which would get us up to 1,300 home sales for the year.  Did someone say inventory levels were low? Yes, inventory levels are low! You'll see that the number of homes on the market (for sale, not under contract) has now dipped down to 236 homes as of the end of November / beginning of December. Again -- a great time to be a seller, but not as exciting of a time to be a buyer. Maybe we need some new construction??  Over the past eight years we have seen more and more home sales -- and fewer and fewer foreclosures. Just two years ago 134 properties were foreclosed upon in Harrisonburg and Rockingham County -- and in the first 11 months of this year that number has only been 54 properties!  If, as a buyer, you somehow manage to find a home to buy -- you'll be excited to find extremely low mortgage interest rates. They have been below 4% for the past seven months now, giving you the opportunity to lock in a low housing cost with a fixed rate mortgage. OK, I'll wrap it up there for now. Again, you can download a PDF of my full market report here, or feel free to shoot me an email if you have follow up questions. In closing... If you're planning to sell over the next few months -- let's get going now/soon while inventory (your competition) is SUPER low. We can connect at your house or my office to discuss timing, preparations for your house, pricing within the current market and more. Call (540-578-0102) or email me and we can set up a time to meet to chat. If you're planning to (or hoping to) buy a home soon, be ready to be patient and then to ACT QUICKLY! :-) Make it a bit easier for yourself by knowing the market, knowing the process, knowing your buying power, and closely monitoring new listings! That's all for now. Enjoy the remainder of the year, and I'll be back in January with a full re-cap of our local housing market for all of 2019. | |

Home Buyers and Sellers Often Have Very Different Perspectives When Negotiating Repairs After A Home Inspection |

|

While not always the case, a general rule of thumb is that... On home inspection repairs...

Inspector: Several roof shingles are missing, and the roof is past its life expectancy. Seller: Replace the shingles. Buyer: Replace the roof. Inspector: The air handler coils are dirty and the heat pump is reeaaallly old. Seller: Clean and service the heat pump and air handler. Buyer: Replace them both! These are a few extreme examples to start to show the differences in perspectives on repairs. Again, the important thing here is to recognize that a buyer and seller look at home inspection reports differently. A seller typically wants to minimize their repair costs while keeping the home sale on track. A buyer wants to make sure that any previously unknown property condition issues are addressed in a manner that is likely to prevent further near term maintenance needs in those areas. So, what is a buyer to do? A few thoughts....

| |

How To Remove Cigarette Smoke Odors From A House |

|

I have shown a few houses lately to buyers where we couldn't help but notice a lingering cigarette smoke odor in the home. That smell was not the only factor that kept these buyers from making an offer on these houses -- but it certainly was a part of the discussion and decision. So how in the world do you get a pervasive cigarette smoke smell out of a house? I'm not an expert, but my understanding is that you may need to consider some or all of these techniques:

Even if you take all of those (not inexpensive) steps above, you may still have some lingering smells -- and if you do, you probably shouldn't be entirely surprised. You might then consider using an ozone generator which can help eliminate odors. If you're going this route, you'll likely want to consult with a professional. In the end -- if you are considering the purchase of a home that has a pervasive smell of cigarette smoke, don't assume that it will be easy or inexpensive to remove that odor! | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings