| Newer Posts | Older Posts |

Home Sales Slow In February But Contract Activity Increasing |

|

Happy Spring! Yesterday's warm sunny afternoon was a welcome reprieve from our recent frigid temperatures - and it looks like we'll have continued warm-ish (or at least not frozen) days this week as well. And how about that local real estate market? Is it heating up as well? Breaking out of the winter doldrums? Well, maybe not quite - though technically this report only covers real estate activity through the end of February, so maybe we'll have to wait one more month for some more exciting news. But buckle up, and let's flip through the latest local real estate news to catch up on where things have been and where we're likely headed. Oh - but two quick notes, first:

And now, here we go...  As seen above...

OK - lots going on above - this is where I break things down between detached homes (green) and attached homes (orange) -- where "attached" homes are townhouses, duplexes and condos.

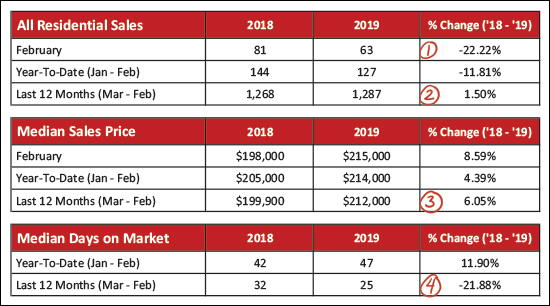

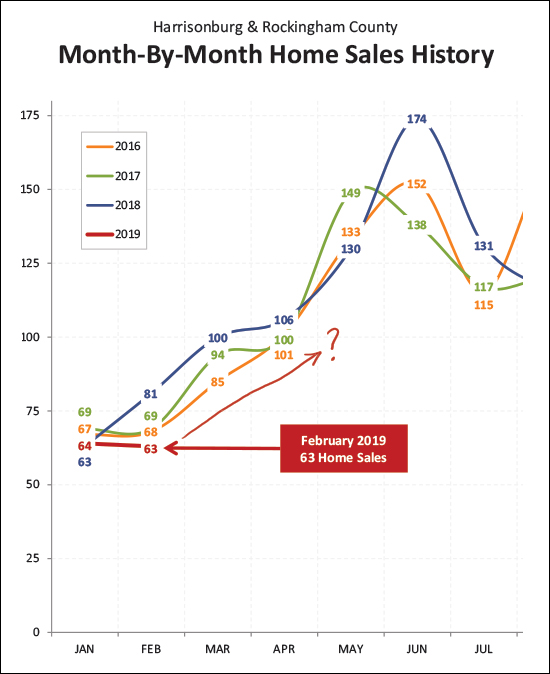

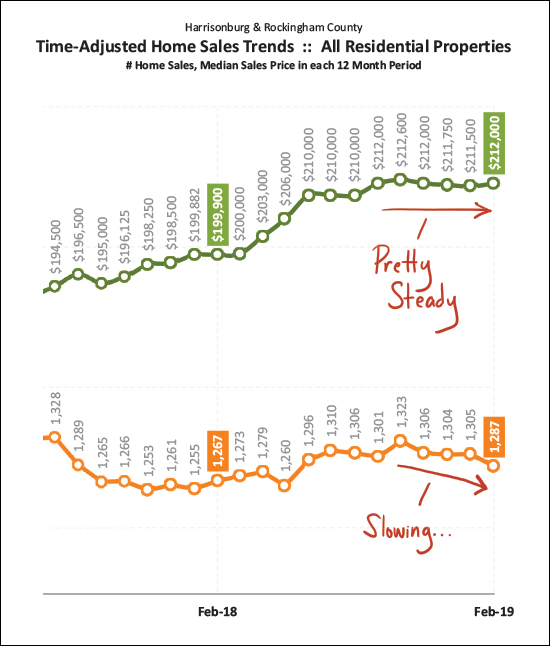

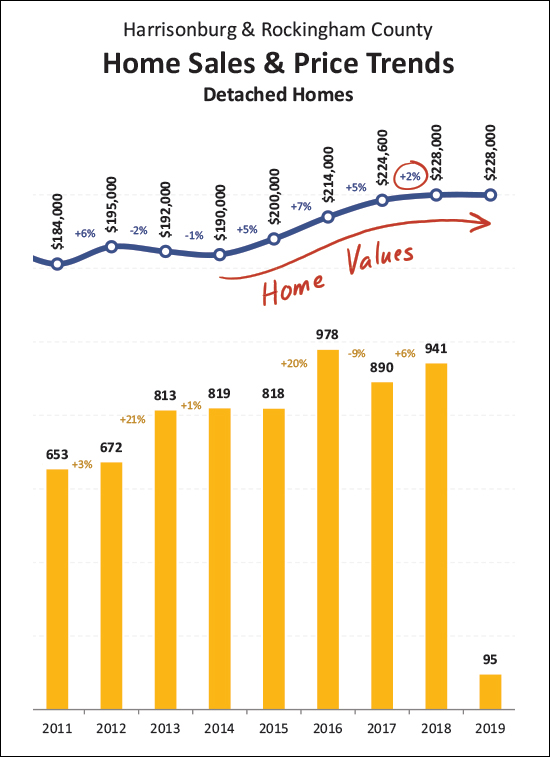

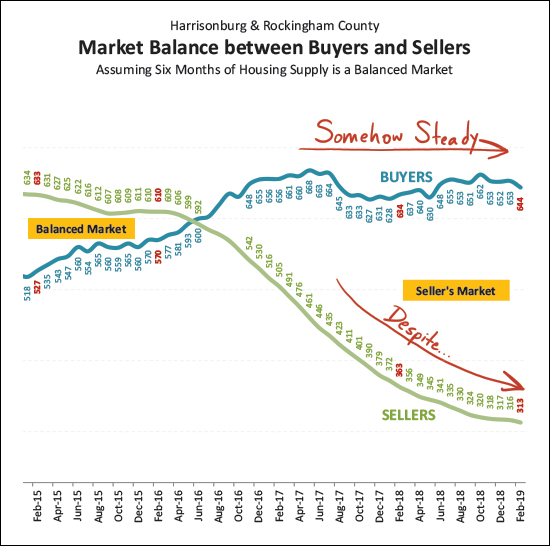

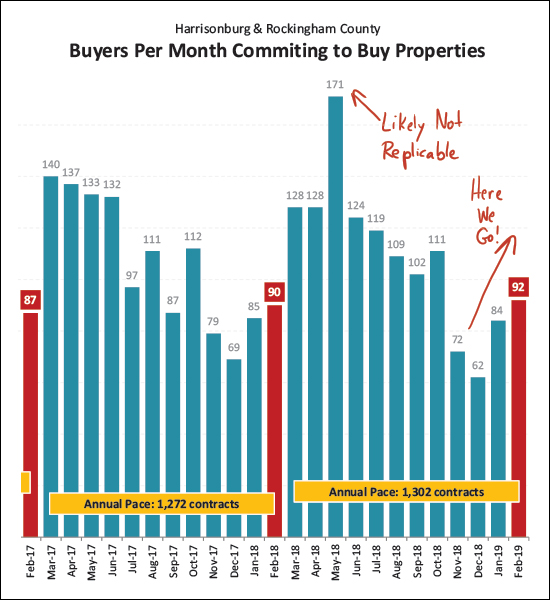

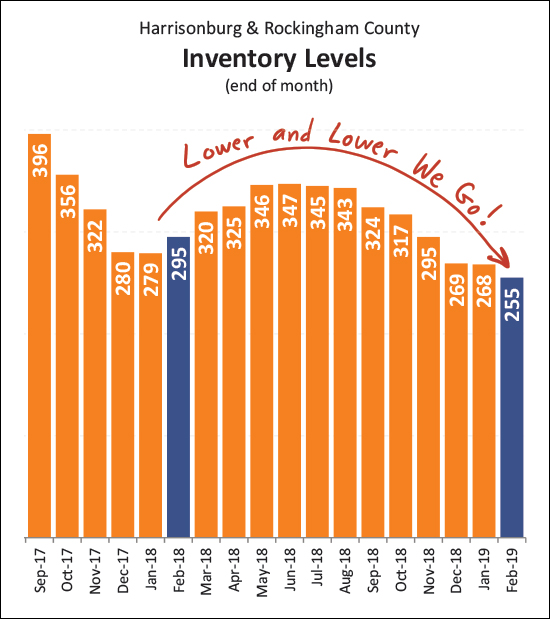

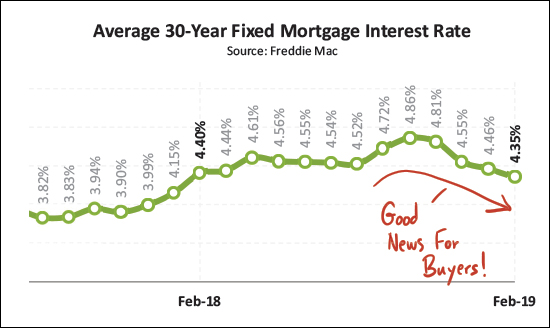

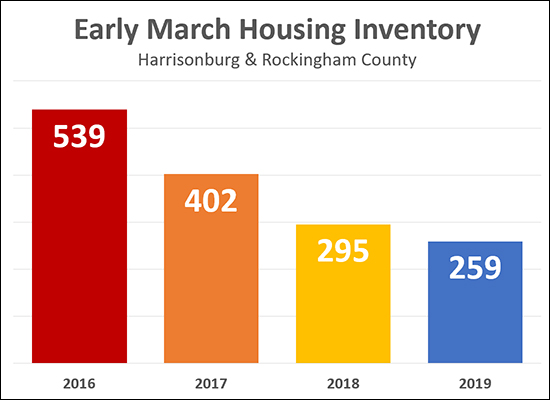

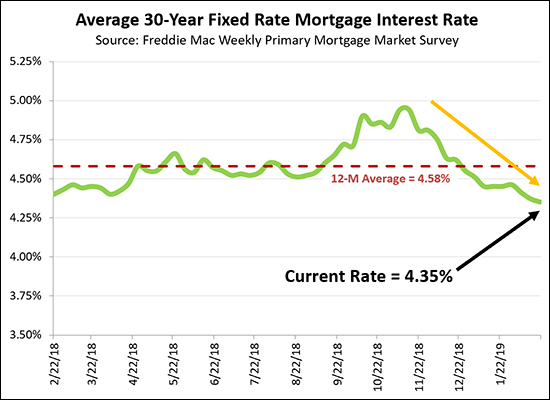

The red line above shows the sales trajectory for 2019 -- January sales (64) were right in the middle of the pack as January goes -- but February sales (63) were much slower (lower) than last year (81) though not too far off of the prior two years (68, 69). So - where in the world do we go from here? Do we see a relatively disappointing March with only 80 home sales (lowest since prior to 2016) or do things bounce back up to 95 or 100 home sales? Time will tell - but thus far the market performance has not been overwhelming in 2019 when it comes to the number of homes that are selling.  Now, looking beyond the month-to-month trends -- this graph (above) looks at a rolling 12 month timeframe to even out some of the ebbs and flows of market activity. The top (green) line shows that median sales prices have been relatively steady for the past six months -- hovering between $210K and $213K. The bottom (orange) line shows that the annual pace of home sales has actually been slowing in recent months. If home sales keep slowing down, eventually that could have an impact on sales prices, but for now they are holding steady. It is also certainly possible that the slowdown in home sales has more to do with a lack of available inventory than it does with any decrease in buyer interest.  Here (above) is another pretty graph to show the increasing home values in Harrisonburg and Rockingham County over the past few years. Though - curb the boundless enthusiasm for a moment - the annual increase was only 2% in 2018, down from 5%, 7% and 5% the prior three years. So -- 2019 will be a telling year -- will values hold steady, or increase slightly, or decline slightly? Stay tuned -- it's early yet.  And this (above) might be the missing piece of the puzzle. Buyer activity (blue line) is somehow staying steady-ish (except dipping a bit over the past few months) despite the quickly falling inventory levels (green line) over the past three (four!) years. I've said it recently but I'll say it again - it can be a fun time to be a seller right now - but it's not so fun to be a buyer. You'll be choosing from an ever smaller number of available properties, and potentially competing with ever more buyers.  Here's one graph of optimism as it relates to the next few months -- contract activity is on the rise with 92 contracts signed in February 2019, up from 90 last February and 87 the February before that. So - we will likely see a solid month of sales activity in March, and hopefully in April if we have another strong month of contracts in March. But, just to prepare you pretty early here -- I think it is HIGHLY unlikely that we'll see a month with 171 contracts like we saw last May.  And here is a visualization of those inventory woes I was describing earlier. The number of homes for sale has been creeping ever lower, hitting yet another new low at the end of February with only 255 homes for sale. Hopefully, maybe, possibly, we'll see that start to drift upwards as we get into March, April and May??  If buyers have anything (anything!?) to be glad about -- it's that their mortgage rate will likely be lower now than it would have been a few months ago. After average rates drifted all the way up to 4.86% -- and seemed to be ready to get back to 5% -- they started floating back down to their current average of 4.35%. If buyer activity increases over the next few months, they'll be enjoying more affordable financing of their home purchase. OK - admittedly - that was a lot. Kudos to any of you who made it all the way to the bottom of this commentary. Many trends stay relatively similar from month to month but it's always good to take a fresh look to give us a context to help make informed real estate decisions moving forward. If you're thinking of buying or selling soon... SELLERS -- even though it is a seller's market in just about every price ranges right now, you must still focus on price, condition and marketing. For further reading on buying or selling in this area, check out.... | |

If Only We Had Two Or Three Of These Houses! |

|

Sometimes, these days, sellers are seeing more than one offer coming in at the same time on their home. Not always, mind you, just sometimes. All people in Harrisonburg are nice. OK, well, maybe not all, but most of them seem to be. As such, sometimes two super nice, awesome, wonderful people make offers on the same house -- and sadly, only one of them can buy it! Sometimes a buyer tries to set their offer apart (above?) other offers by including a personal, heartfelt letter about why they LOVE the seller's home and how they will live happily ever after in it. These are often meaningful, helpful, touching and effective. But shoot - sometimes there are two awesome buyers who wrote these emotion evoking letters, and again, only one of them gets the house. It stinks to be that second (or third) buyer - as it's often quite the letdown for the contemplated home purchase to not have worked out. It's a bit easier as a seller -- you're selling your house to buyer #1, even if buyer #2 is crying in the corner -- but it's still not ideal. Sometimes a seller even knows buyer #2 or buyer #3 and feels terrible about not being able to sell them the house as well, but... Anyhow -- it's a good problem for a seller to have -- multiple buyers vying to buy their house. But it's just simply no fun at all for buyers. I feel for them - whether I'm working with them as my clients, or if I am representing the seller who effectively had to reject them. Stay strong, buyers! Hopefully some new, exciting listings will be on the market soon to ease the pain of missing out on the house you had been convinced you would be buying! | |

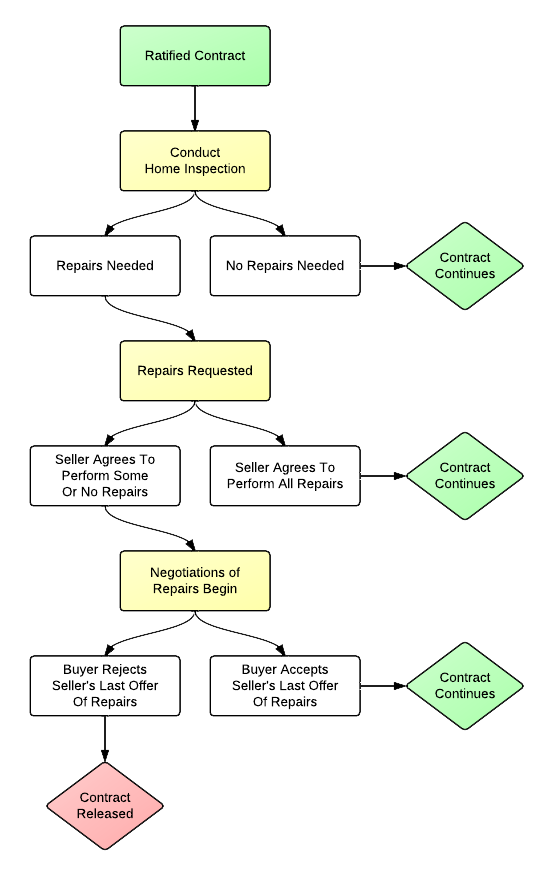

How To Think About Home Inspection Negotiations |

|

A buyer agrees to pay a price for a house based on what they know about the house at that time. The home inspection process allows them to learn more about the house to confirm that it is the house that they thought. But sometimes, they discover problems with the house that they'd like the seller to address....

So, how do these home inspection negotiations usually proceed? The short (and vague) answer is -- well, it depends on the terms of your contract. But, overall, here is how the inspection process typically flows....  As you can see above, after a buyer requests repairs (based on the home inspection) the seller can choose to make some, all or none of the requested repairs. The transaction (and negotiations) can then go in a few different directions based on that response. Learn more about the home buying process at....  | |

When A Realtor Represents a Home Buyer Do They Just Unlock Doors? |

|

It's a bit more involved than that -- we unlock doors AND turn on lights! :-) Just kidding, of course. There's more to representing a buyer than just unlocking doors and turning on lights -- so before you call the listing agent to see a home listed for sale, you should understand a bit more about buyer representation.

In representing you in your home purchase, your buyer's agent would be performing tasks such as:

So -- you can call the listing agent (who is contractually bound to represent the seller's best interests) or you can hire a Realtor to represent YOUR best interests as the buyer. Clearly, I recommend the second option. Beyond buyer representation, there is a lot more to know about and think about regarding the home purchasing process. Read more at....  | |

Three Main Obstacles Between Contract and Closing |

|

While every home sale is different -- with unique contingencies based on the needs and situations of the buyer and seller -- there are three main hurdles that most buyers and the houses they are purchasing must clear to make it to closing. So -- where is your contract in this process? Have you cleared 1, 2 or 3 of the hurdles, thus far? There will be plenty of other details to attend to, but these are the three main areas of focus. Evaluating the property condition, the property value, and the buyer's finances.... INSPECTION - This is an evaluation, by a home inspector, of the condition of the house. Clearing this hurdle typically involves requesting that the seller make some repairs to the house (or negotiate further on price) based on new information about the property condition discovered during the inspection process. APPRAISAL - This is an evaluation, by an appraiser hired by the purchaser's lender, of the value of the house. If the property appraises for the contract price (or higher), all is well -- otherwise, the buyer and seller may need to renegotiate the contract price based on the appraised value. LOAN APPROVAL - This is an evaluation, by a lender (and their underwriters) of the purchaser's financial situation. The lender must confirm that the buyer has the income to support the mortgage payment required for purchasing the home. Again - there are many other smaller hurdles (for example, a termite inspection) and larger hurdles (for example, a home sale contingency) that may need to be cleared in your purchase (or sale) of a home -- but these three main hurdles (inspection, appraisal, loan approval) are the three main mileposts during the contract-to-closing process that we'll be focused during the transaction. BUT WAIT -- THERE'S MORE.... Would you rather have three main hurdles to clear, or six? Let's imagine that you receive two offers on your house, which is listed for $250K....

| |

Are Home Sellers Waiting For Warmer Weather? |

|

OK, I know it's not Spring yet, but it's March! We're supposed to start seeing many more new listings coming on the market - finally - for all of the buyers who have been patiently waiting for more inventory from which to choose. But, it's just not happening yet this year. Or at least not at scale. Maybe it's the snow (despite a lack of accumulation) or maybe the frigid temperatures (looks like a cold week ahead) but whatever the cause, we're seeing much lower early March inventory levels as compared to the past few years. So, maybe mid-March? Maybe April? When will we finally see an increase in listing inventory? It hasn't happened yet! Sellers who are thinking of selling in April - maybe March is your month? Get ahead of the game -- avoid the competition! | |

Watch What You Say When Viewing A Home As A Buyer |

|

As a buyer, when you are walking through a home, keep in mind that the seller might be listening! These days, there are plenty of ways that a seller could be monitoring their home, with a security camera, or other recording device that could allow them to hear every word you are saying while you are in their house. And, these cameras (or other listening devices) are less and less obvious and less and less expensive! So..... 1. Don't insult their house. It won't help during negotiations.One way around this is to pretend (as a buyer) that the seller is walking through the house with you. By the way, sellers, it may not be legal for you to record conversations in your home while you are gone. You should likely either NOT record conversations, or disclose that it is taking place. P.S. I am not an attorney. Consult one if you want an actual legal opinion. Ask me if you need a recommendation. | |

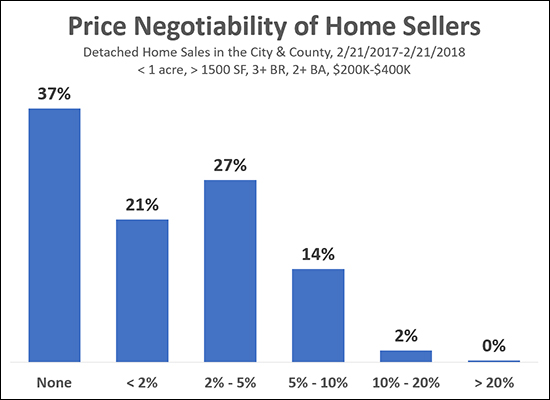

How Much Price Negotiation Should Home Buyers Expect? |

|

If you're looking to buy a home under $250K, should you only consider homes priced at or below $250K? Probably not - some sellers of homes priced above $250K will negotiate down to $250K. Should you look at homes priced above $500K? Probably not - most sellers of homes priced above $500K probably will not negotiate down to $250K. Both of those are probably obvious to most home buyers, but how do we understand the negotiability dynamics between those two mostly obvious statements? The data above is a first look at that puzzle - with some guide rails. Basically, I looked at one year of City/County home sales, but limited it to homes with 1500+ square feet, 3+ bedrooms, 2+ bathrooms, on less than an acre, between $200K and $400K. So, not a canvas of the entire market -- but a pretty reasonable chunk of the middle of our market not likely to be thrown off by lots of investors (lower priced or attached properties) or high end buyers (high priced properties). And - after that intro - here's (some of) what we find...

So - hopefully that provides some guidance as to what you might expect as a buyer. If you see a home listed for 11% above your budget -- there is likely only a 2% chance that the seller will sell at a price that works for you -- or, put another way, you might have to find 98 such properties (where the seller won't come down 10%) before you find the 99th and 100th where they will. Happy home shopping -- and negotiating! | |

Mortgage Interest Rates Are Falling, Falling, Falling |

|

In what can only be described as good news for home buyers -- mortgage interest rates keep declining! In November 2017 interest rates had climbed to 4.94% and it seemed we'd soon be seeing 5.something% rates. But then they started to decline again, now all the way back down to 4.35%. If you're planning a home purchase this Spring, this is an extremely enticing time to lock in your interest rate! | |

156 Apartments To Be Built on Reservoir Street |

|

Well, it looks like another 156 apartments will be built on Reservoir Street, just outside of the City limits in Rockingham County. The Board of Supervisors recently approved a rezoning of this 6.302 acres to essentially be a second phase of the Robinson Park apartments immediately adjacent to this new project. Per the Daily News Record the 156 apartment complex will be comprised of:

Apparently, the complex will also include a clubhouse and outdoor pool. Further review of the minutes from the January 23, 2019 meeting of the Board of Supervisors offers these insights...

So, there you have it. More apartments coming soon on Resevoir Street... which may or may not make Harrisonburg a place young alums can call home for decades... | |

Should I Wait For A Better House To Come On The Market? |

|

This is a common question at this time of year -- as new listings start to trickle onto the market -- but before the deluge (hopefully!?!?) of new listings in March and April. As a buyer in a low inventory environment, you (hopefully) know that you may have to compromise on some of what you're hoping for in your next home. Otherwise, you may be sitting here a year from now, still not having moved forward with a home purchase. But how much (!!??!!) should you compromise -- that is the tough question at this time of year. After seeing absolutely NO new listings that would work for you in November, December and January... ...when a new listing pops on the market in February that *could* work -- sort of -- but would requirement some relatively major compromises in areas A, B and C -- what do you do?? Do you go ahead and pull the trigger because it is much better than anything we've seen in months? Do you commit to buy because you're just tired of waiting around and you want to get this home buying show on the road? Do you decide to wait and then kick yourself a few months from now when we haven't found anything better for you to buy? These are not easy questions to answer -- but we can and should and will talk it through on a house by house basis. We'll be evaluating how far off the mark the house really is -- and how likely we think it is that another, better, option will come on the market in the coming months. So, don't just buy *anything* that comes on the market just because we've passed through a desolate winter without many new listings -- but at the same time, don't let a good (or good enough) option pass you by! Easier said that done, right? ;-) | |

It Is Hard To Find a City Home Under $200K These Days |

|

I've said this (it's hard to find a City home for under $200K these days) in about 10 different ways over the past year using data. In conversation with a fellow Realtor yesterday, while inside a house I'll reference in a moment, we reflected on this reality. If you're looking to buy a home in the City of Harrisonburg and were hoping to have a budget of $200K -- you'll have some difficulty doing so. Just a few (4 or 5?) years ago we recalled decent single family homes selling for $180K - $200K in the City. Now days, if a home is price under $200K it is likely either tiny, or still needs some updates. OK - reverting to what is most natural to me when thinking about real estate - here is the data to back up our observation... Detached homes sold in the City between under $200K with 1000+ SF...

So, it's not QUITE as terrible as I described above (data saves the day from my extreme rhetoric) but there has been a significant (41%) decline in sub-$200K homes selling (or able to be purchased) in the City of Harrisonburg In fact, today, there are only two such homes currently for sale... I'll be listing another sub-$200K home (just barely under that price point) later today -- and I expect it may sell relatively quickly. Buyers are hungry for homes in this affordable price range and there just aren't too many options any longer. Yes, there are plenty of townhouses under $200K, but detached homes are much harder to find in this price range. | |

Changes in Housing Inventory Levels By Price Range |

|

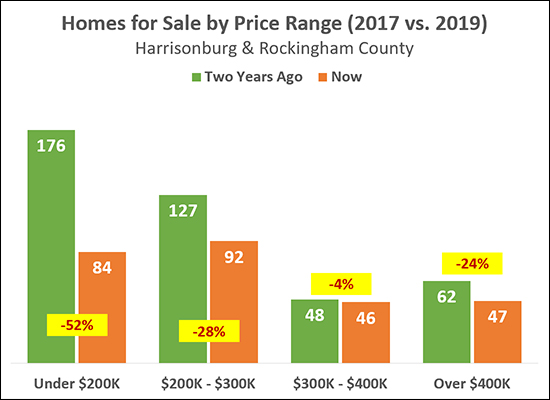

Not all price ranges are created equally, it seems. The hardest hit price range, perhaps unsurprisingly, is the under $200K price range -- where we have seen a 52% decline in the number of homes for sale over the past two years. Of note -- part of the problem here is increasing home values -- which prices some homes out of the "under $200K" price range. Regardless, though, buyers looking to stay under $200K for their home purchase are having an ever more difficult time doing so. The $200K - $300K market also had a sizable (28%) decline in the number of homes actively listed for sale as compared to two years ago. The $300K - $400K inventory levels stayed relatively level and the "over $400K" market saw a decline in the number of homes for sale, though this would certainly impact a much smaller number of buyers. Depending on the price range (and location, property type, condition, size, age) you are shopping in, you are bound to find something slightly different as to the current inventory levels and recent trends in those levels. | |

Would Be City Townhouse Buyers Finding Few Options |

|

Some time ago, I created a website (HarrisonburgTownhouses.com) for exploring townhouse communities in and around Harrisonburg, Virginia. This allows you to explore sales trends, value trends, see recent sales, current listings, etc. So -- feel free to explore the website -- but don't expect to find many townhouses listed for sale. If you were a buyer looking to buy a townhouse, built in the past 10 years, you'd have some difficulty. Current inventory (as of 1/8/2019) includes:

So - as excited as a first time buyer might be to purchase a townhouse in the City of Harrisonburg - they will find that they have very (!!) limited options right now. | |

Buying A Home Is, Unfortunately, Not As Simple As Buying Now With One Click |

|

Purchasing a home can be fun, exciting, thrilling, and fulfilling....but that very same process can also have its moments of being hard, frustrating, disappointing and overwhelming. In my role as a Buyer's Agent, I will be working with you through the entire home buying process to make it as educational and stress-free as possible. The very first step in this process is for us to discuss your needs, goals, dreams and desires. This may involve specifics such as the number of bedrooms and bathrooms, or may focus more on the layout of homes, the feel of a neighborhood, and the long term plans for your growing family. I will be focusing on listening well, and hearing what it is you are working to achieve with your home purchase – and then helping to identify the best housing options for accomplishing those goals. An important, parallel, part of starting the home buying process is to identify a target price range. This can best be determined through consultation with a reputable, local mortgage lender (just ask... I know who they are) but will involve more than just determining the highest priced home that they would allow you to purchase. It will be important to consider both your purchasing power, and your goals for how your housing costs will fit into your overall budget. You will also talk with your mortgage lender about how different loan programs might work better (or worse) for your situation. Once we have a shared understanding of what you are hoping to purchase, and we know what the price tag can and should look like, we can start to evaluate homes that are currently on the market. This will usually start online, perhaps through an exchange of emails, and saving some searches in your account on my web site. Then, you might choose to drive by some of the prospects before determining a list of homes to go view – or you may be ready to start seeing all of the homes on the list right away. As we view this first set of homes, we will learn a lot – about the opportunities in the market, and about your preferences. If we don't identify a home after looking at all of the homes on the market that seem to offer what you are looking for in a new home, we will either re-evaluate our criteria to expand our search, or we will wait to view new listings that come on the market. This extended home search process might take us weeks, or months, depending on the type of property you are hoping to purchase, and how often such a property becomes available. All along the way, I'll be following up on previous homes we have viewed to let you know if their prices have dropped, and will be letting you know of new opportunities as soon as those houses hit the market. Once we have identified the home you are hoping to purchase, we will prepare to make an offer. This will include researching similar home sales to guide our discussions of price, creating a negotiation strategy, and preparing and reviewing the pertinent contract documents. There is quite a bit of paperwork involved in making an offer on a home, and I want to make sure that you understand these contract documents and make sure that we have drafted them in a way to protect your best interests. Negotiating the final deal on the property you purchase may take a few hours, or a few days. We may go back and forth with the seller on price alone, or on many terms of the contract such as timing, contingencies, and more. Once we have a final agreement, all parties will sign and initial the final documents, and we will have a full ratified contract. Immediately following the ratification of the contract, we will need to schedule and perform a home inspection and radon inspection (assuming you are conducting both) to learn more about the property you are purchasing. If these inspections reveal new (detrimental) information about the property, we will have the opportunity to request that the seller make repairs to the property, which may result in a renegotiation on price. Typically, we are able to work through this second round of negotiations relatively quickly, so long as the seller is being realistic and rational given the new information about their property. Simultaneously with conducting these inspections, you will need to be starting the financing process to work towards obtaining full loan approval. This will start with signing your loan application and paying any applicable loan application or appraisal fees. Your lender will then be diligently working to further qualify you as a purchaser as well as the property via an appraisal. You will be providing many documents to your lender during this process as they work towards securing a loan for you to purchase the property. Within the first few weeks after your contract is in place, we will need to select service providers to coordinate the additional aspects of your home purchase. This will include a settlement agent or attorney who will conduct a title search of the property and prepare all documents for your settlement. You will also need to set up a new homeowners insurance policy on your new property, as well as schedule utility service to start in your name as of the settlement date. We'll now be just a few weeks before closing, and the final pre-settlement details will include reviewing the settlement statement (which shows all of the funds coming into and going out of the closing), conducting a final walk though of the property (to confirm the condition is as we expect it to be), and obtaining a cashier's check to bring the necessary funds to settlement. All of the details should be falling in place now, and if all goes well, we will be set for an on-time settlement. In nearly all real estate transactions (in this area) you will sign all of the loan and settlement documents at your real estate closing as well as receive the keys to your new property. The house will be your new home, and you can take possession and start moving in immediately after settlement. Later that day, the settlement agent will record the deed at the courthouse that officially transfers ownership of the property into your name. You are bound to have questions about the home buying process – before you begin, as we go, and even after settlement. I am here to answer all of those questions, or to guide you to the professional who can. There is plenty to learn about the home buying process, and I am here to help guide you through it and to help you make excellent decisions about your purchase of a home. Learn more about the home buying process at BuyingAHomeInHarrisonburg.com. | |

The Impact Of Higher Mortgage Interest Rates |

|

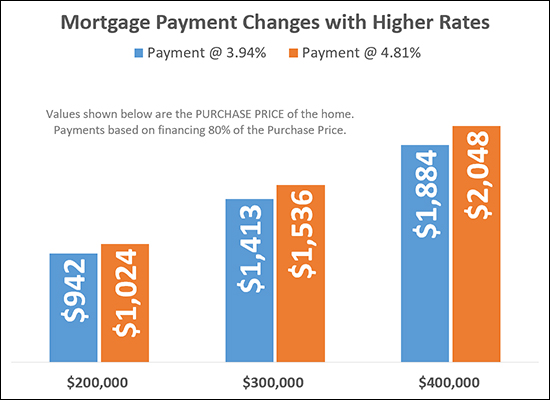

One year ago, the average 30-year fixed mortgage interest rate was 3.94%. Today, that same average rate is 4.81%. Does this rise in mortgage interest rates impact buyers? It sure does! A buyer purchasing a $200K home would pay $82/month more for their mortgage payment -- with the increased interest rate causing it to increase from $942/month to $1,024/month. A buyer purchasing a $300K home would pay $123/month more for their mortgage payment -- with the increased interest rate causing it to increase from $1,413/month to $1,536/month. A buyer purchasing a $400K home would pay $164/month more for their mortgage payment -- with the increased interest rate causing it to increase from $1,884/month to $2,048/month. Of note -- the estimated mortgage payments above include principal, interest, taxes and insurance -- and assume that the buyer is financing 80% of the purchase price. So.....

| |

Seven Building Lots Remain at Heritage Estates, an Active Adult Community in Harrisonburg, VA |

|

Only seven building lots remain in Heritage Estates, an active adult (55+) community in the western edge of Harrisonburg, Virginia. With low maintenance French Country style architecture, and single family homes with partial basements starting below $400K, this community has been a popular destination for many buyers both from Harrisonburg and retiring to the Shenandoah Valley. Call (540-578-0102) or email me to set up a time to meet with the developer/builder at Heritage Estates, Jerry Scripture. | |

When To Make An Offer To Buy If You Still Need to Sell Your Home |

|

Here's a good opportunity to practice patience... If your dream home is on the market -- either as a new listing, a newly reduced listing, or an old and stale listing -- it might be tempting to go ahead and make an offer to buy the house, even if you still need to sell your house. I'll recommend, in almost all instances, that we wait to make the offer until we have secured a contract on your house. And here's why... NOTHING GAINED - In almost all instances, the seller of your dream house will counter back (to our contingent offer) with a "kick out clause" allowing them to continue to market their house for sale to other buyers, and to allow them to move on to an alternative buyer who does not have to sell their home after giving you 48 or 72 hours to remove your home sale contingency after the new offer comes in. As such, unless you can buy without selling, having a contingent contract with a kickout clause is pretty similar to not having a contract at all. If another buyer comes along to buy your dream house, the only reason why you'd have an upper hand (over that new buyer) in already having a contingent contract in place is if you can somehow pull together a contract on your current house within that 48 or 72 hours period after that new buyers hows up. So -- having the contingent contract (with kick out clause) doesn't do a whole lot to defend your spot in line to buy your dream home. NEGOTIATION - We are likely to do better in negotiating a deal for you to buy your dream home if we already have your current house under contract. The seller of your dream home is not likely to be willing to negotiate as much if you still don't have your house under contract (or if you haven't even listed your house for sale) as your purchase of their house will seem significantly less certain. LEVERAGE - Any savvy seller (or seller's agent) will use your (contingent) offer against you. It's not personal of course, they're just trying to do their best to sell their home. If there have been other recent showings of your dream home, the moment your contingent offer is received, they are likely to notify all of those other buyers that they have received an offer -- and will try to use the existence of your (contingent) offer to generate enough interest and urgency for another buyer to also make an offer, which they would hope would not have a home sale contingency. Now, even if we make an offer once your current house is under contract, the seller will likely still try to generate additional offers to compete with us -- but at that point we can compete much better, already having your house under contract. Why allow the seller to use your contingent offer (with your house not yet under contract) to drum up other actionable interest from other buyers? So -- as hard as it may be for you to do -- I will almost always recommend that we **wait** to make an offer on your dream house until we have your current house under contract. | |

Mortgage Interest Rates At Highest Point in Eight Years |

|

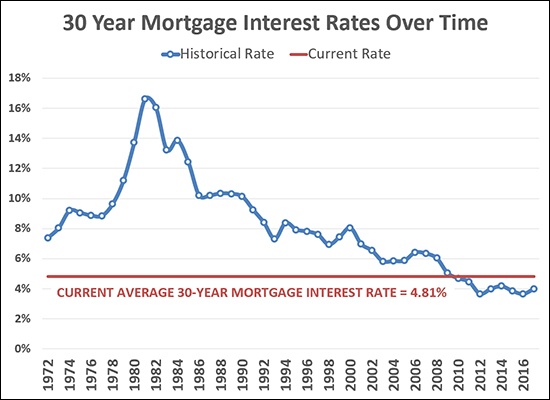

Mortgage interest rates keep on rising. The current average rate for a 30 year mortgage is 4.81%. These two statement are equally true... 1. Current mortgage interest rates are now higher than they have been for the past eight years. 2. Current mortgage interest rates have been higher than the current rate for 38 out of the past 46 years. The lingering question over the past few years has been whether rising interest rates, which pushes monthly housing costs higher, will eventually slow down buyer ability and buyer interest. We don't seem to be seeing that as a current widespread effect, but the more the rates increase the more likely that becomes. | |

Will housing inventory levels improve next year? |

|

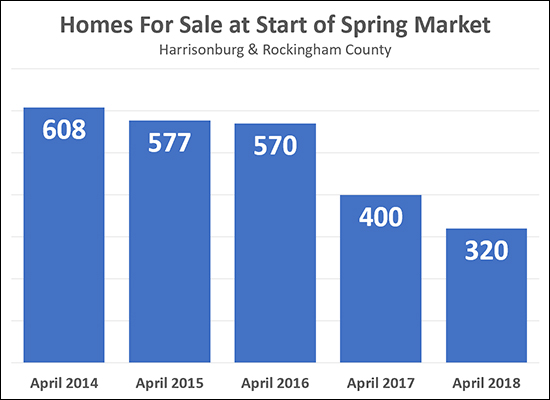

If you have been looking for a new home to buy all Spring and Summer and Fall of this year -- and didn't find one, which you blame on having very few homes from which to choose -- are you likely to have better luck next year? I'm guessing not. The graph above shows that inventory levels have dropped significantly over the past two years based on how many homes are on the market at the start of the main buying season, which I'm defining as April in the graph above. So -- after seeing a 20% decline in inventory levels between April 2017 and April 2018 -- are we likely to see inventory levels start increasing again in 2019? Again, I don't think so, and here's why.... To reverse this trends of declining inventory we would need one or more of the following to happen in our local market....

Again -- none of the changes above seem likely to happen at a scale that would allow inventory levels to see much, if any, of an increase next year. As such, I am expecting we'll see relatively similar inventory levels next Spring and Summer. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings