| Newer Posts | Older Posts |

Prices of Single Family Home Sales Relatively Close to Harrisonburg |

|

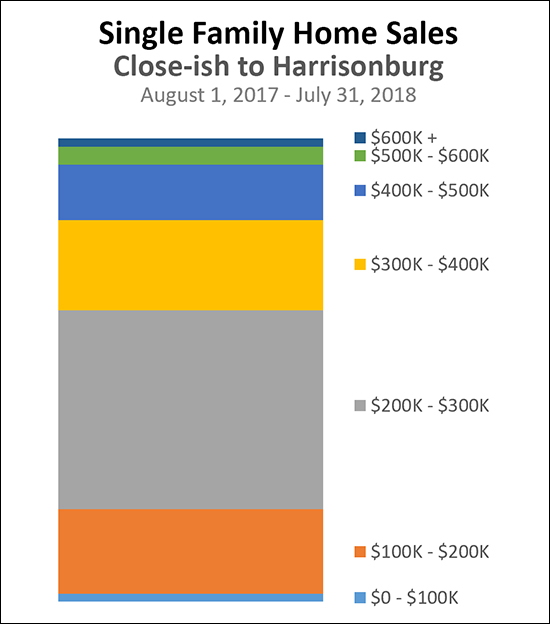

Here is a break down of a year's single family home sales by price range:

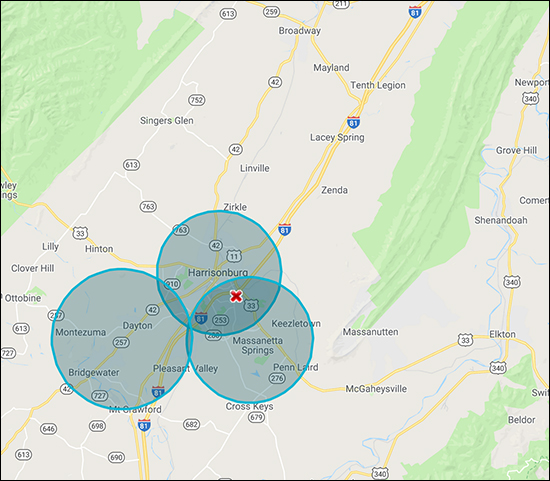

A reader asked the following in response to my analysis earlier this week of all home sales in Harrisonburg and Rockingham County... "These stats don't seem to portray the same market in which I hunted unsuccessfully for months in the 200-300k range and, ultimately, felt pushed to purchase far beyond my comfort zone amid intense competition. How does the picture change if you include only detached single family properties? (i.e., are the numerous sales of sub-100k student townhome units skewing things?) I'm just trying to understand why my experience seems to have differed so greatly from the market reality." This is an excellent point. When we look at a large amount of data (all sales in Harrisonburg and Rockingham County) the large number of home sales in a particular price range can obscure some market realities that are hiding just below the surface. In the case of the buyer commenting above, the reason that she found very few options in the $200K - $300K price range relates to property type, location, size, age and features. Property Type - Indeed, the original analysis includes all property types, including townhouses and condos. Under $100K, this includes many student rentals. Between $100K and $200K, this includes many townhouses, some of which are rental properties. Between $200K and $300K this also includes quite a few townhouses. In the new analysis (above) I have only included single family detached homes. Location - Rockingham County is a large county. It's actually the third largest county in Virginia, behind Pittsylvania and Augusta. Many buyers looking to be close-ish to Harrisonburg aren't going to be looking at homes in Broadway, Elkton or Massanutten, based simply on location. In the new analysis (above) I have only included areas close-ish to Harrisonburg, as shown below.  Size - It's easy to look at the data above and wonder how there could really be 182 homes that sold between $200K and $300K, in the geographic area bounded above, and to not (as a buyer) have thought any or many were good options. A whole lot of this has to do with the size of the home -- many buyers need more than X bedrooms, or more than X square feet. When we start putting some lower bounds on the space needed in a house, we quickly narrow down the number of viable homes. Age - The age of a home doesn't narrow things down quite as quickly as the size of a home, but it makes an impact. Many buyers are going to be significantly less excited about buying a 60 or 80 or 100 year old home as compared to buying a home that has been built in the past 10 to 20 years. Features - Then, when we start adding on needs (garage, basement) or wants (open floor plan, level lot), we narrow it all the way down to a relatively small number of homes that often match exactly what a buyer is hoping to buy. So -- when you look at the large number of homes selling in a given price range, don't think that all of those homes will be homes that will be viable options for you and your family. Once we add some of your additional (reasonable) criteria, the options will start constricting, often rather quickly. | |

Housing Inventory Levels May Have Peaked For The Year |

|

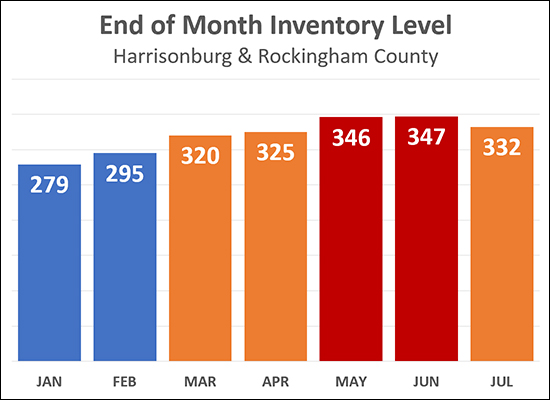

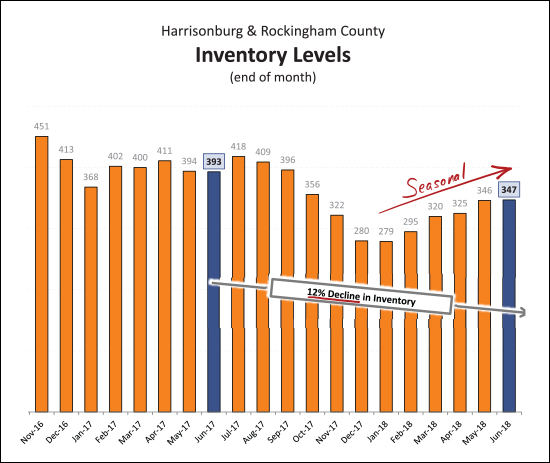

The number of options that you have today, as a buyer, may be the most options you'll have at any given point between now and the end of the year. As shown above, inventory levels (the number of active listings in the MLS at the end-ish of each month) climbed through the first six months of the year, but seemed to peak in May/June and now would appear to be starting to decline again. Now, certainly, there will be new listings over the next five months of this year -- so there will be some new inventory options -- but the total inventory available at any given point is not likely to increase again until next Spring. | |

With Few Homes On The Market, You May Have To Compromise A Bit |

|

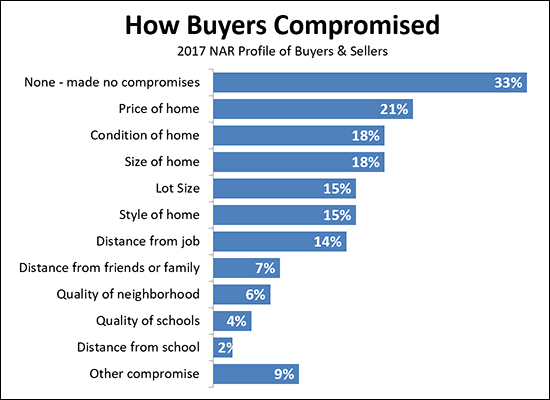

The odds are, you'll have to compromise on SOMETHING when you are buying your next home. The question becomes -- what are you you willing to compromise on? The easiest (at first) sometimes seems to be price -- you still get everything you want, you just have to pay more for it. But if you're drawing a firm line on price, then likely some other need or want will have to be imagined differently. Above is a breakdown of what buyerscompromised on based on the the 2017 Profile of Home Buyers and Sellers from the National Association of Realtors. | |

How To Determine The Square Footage Of Your Home |

|

So -- are you trying to figure out the square footage of your home? Here are a few methods that are not certain to give you the correct answer....

So, how do you really measure square footage? It starts outside the home! You'll need to measure the exterior dimensions of each level of your home -- and then subtract any open areas, such as the open space above a foyer. This measurement method, as odd as it may be, is what is used by nearly every appraiser, as it is how "gross living area" is defined by Fannie Mae, HUD, FHA, ERC and ANSI. As such, it is important that you're measuring the square footage of your home in the same way that nearly every appraiser and Realtor would be measuring it, so that you're comparing apples to apples when comparing the size (SF) of your home to another home that has sold or that is on the market for sale. And here's why I consider it to be an odd way to measure square footage....

While the City and County measurements for tax assessment purposes are often very accurate, it is often a good idea to double check the square footage of your home when we're putting it on the market for sale. | |

Do Most Sellers Accept Offers With Home Sale Contingencies? |

|

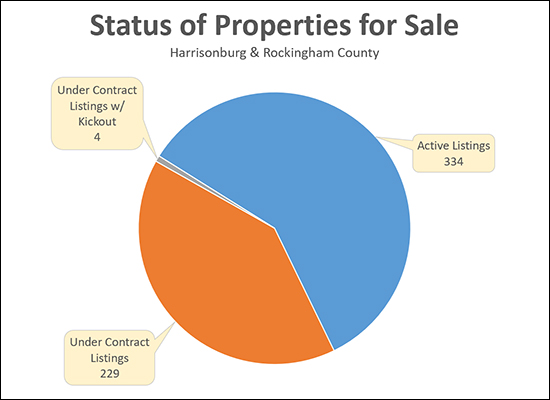

Based on the analysis above, it would seem that sellers are not (in almost all cases) accepting home sale contingencies. Here's the logic....

I must say, I was quite surprised to find this to be the case --- I thought perhaps 10% of contracts might have kickout clauses (and thus home sale contingencies) because plenty of buyers have to sell before buying. It would seem that most buyers are likely waiting to make offers until they have their own properties under contract (thus eliminating the need for the kickout clause) AND/OR most sellers are not accepting offers with home sale contingencies unless the buyers' houses are already under contract (thus eliminating the need for the kickout clause). If you are a buyer, I would certainly suggest the strategy outlined above (and the only one that is apparently working with sellers right now) --- get a contract on your house and THEN make an offer on the property you would like to purchase! | |

The Best Deals on Houses in Harrisonburg, Rockingham County |

|

One way for investors to identify the best deals in Harrisonburg is to compare the list price of each active listing to its assessed values. To make it super easy for you (and any other aspiring investors) I have created BestDealsInHarrisonburg.com which features properties that are being offered at a low list price compared to their assessed value. This is likely to mean that they are a "good deal" -- though if their assessed value happens to be high (relative to their market value) then the deal won't be as sweet. As always, consult a Realtor (such as myself) for expert advice on whether any particular property really is a great deal. BestDealsInHarrisonburg.com is simply shuffling some good prospects to the top of the pile for your consideration. What are you waiting for? Go check it out at BestDealsInHarrisonburg.com. | |

Local Home Sales, and Prices, Soar in June 2018 |

|

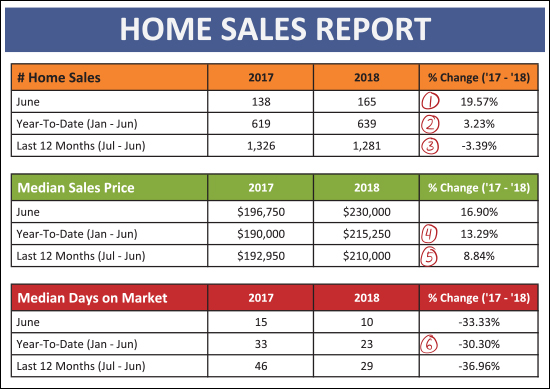

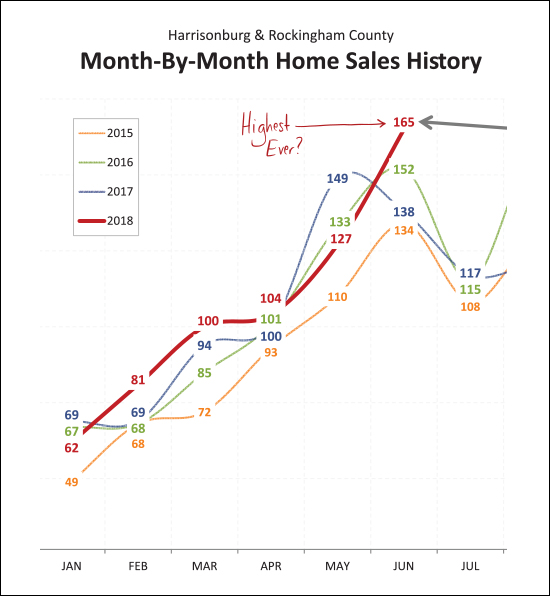

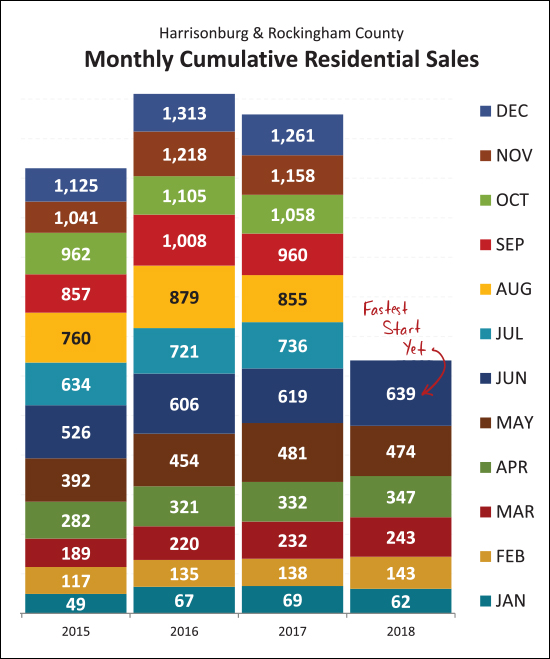

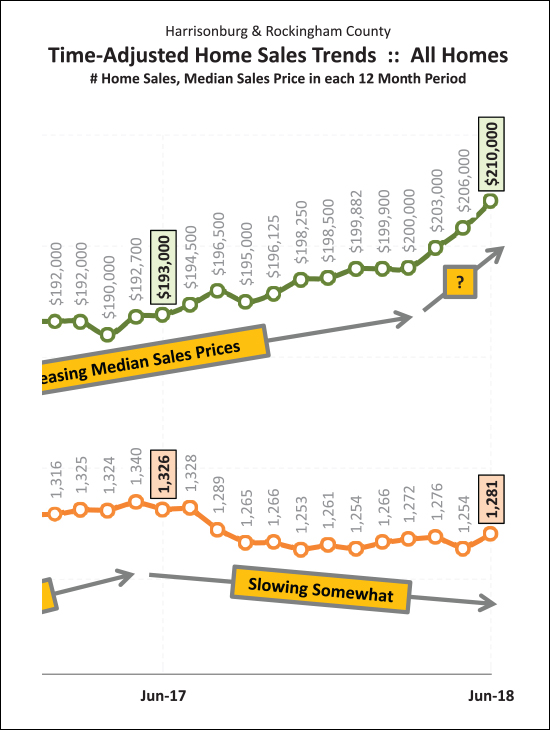

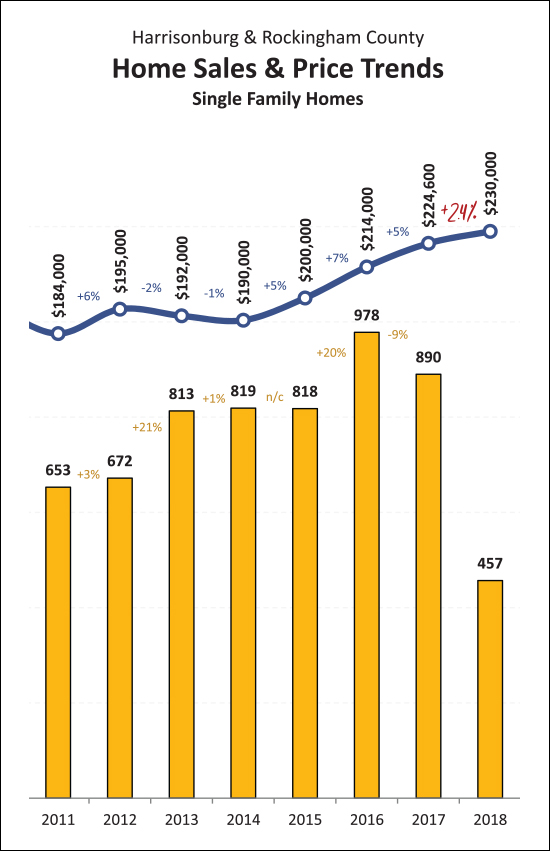

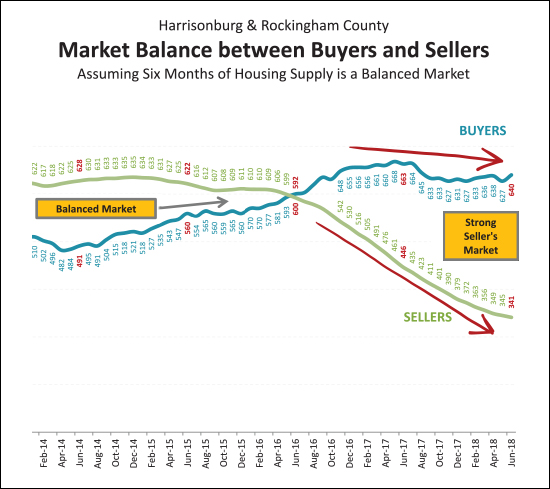

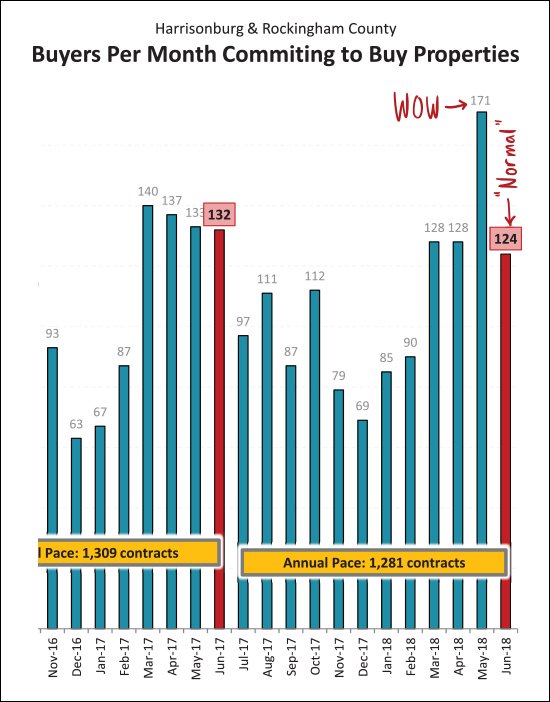

Learn more about this fantastic home in Massanutten Resort: 127FortRoad.com. I just published my most recent monthly market report, and as usual, you can read on for an overview, download the full report as a PDF, read the entire report with commentary online, or tune in to my monthly video overview of our local housing market... OK -- now, let's take a look at some of the overall market indicators this month...  As shown above...

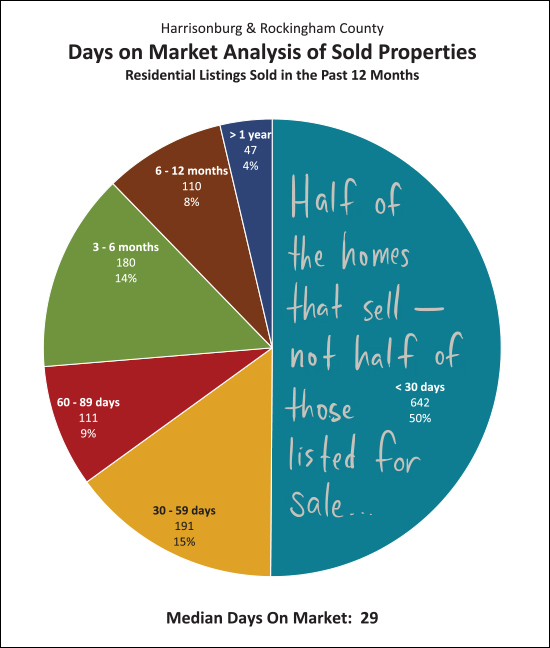

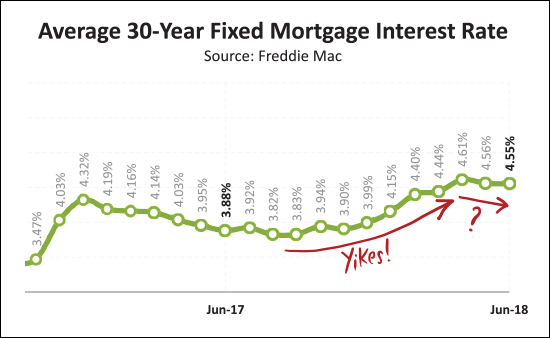

Wow! Just wow! The 165 sales seen in June 2018 is the highest seen any time in the past several years -- in fact -- it is the most sales in a single month any time in the past 10 years! I actually have data back to 2003, and the only times that we have seen more than 165 home sales in a single month have been: June 2004 (174), June 2005 (173), July 2005 (166), August 2005 (183) and June 2006 (192).  Needless to say, this is the fastest start to the year we have seen anytime in recent history. As shown above, the 639 home sales in the first half of 2018 exceeds the number seen in the first half of the past three years. Looking back further, the only times we saw more home sales in the first half of the year were in 2004 (706), 2005 (764) and 2006 (759).  As shown above, despite slowing sales over the past year-ish, median sales prices have been slowly rising -- and over the past three months have started escalating quickly -- from $200K to $210K between March 2018 and June 2018. So -- record numbers of sales, quickly rising prices -- hmmm -- something about this seems familiar. Should we be worried? Maybe, or maybe not...  The figures shown in all prior charts and graphs has been for all residential sales -- including detached homes, duplexes, townhouses and condominiums. The graph immediately above focuses only on Single Family (detached) Homes and this can often give us the truest indicator of market trends. Perhaps it is (or could be) some comfort, then, that the median sales price of these detached homes has only risen 2.4% over the past year. This may mean that the rapid increases in prices we are seeing has more to do with what is selling (property type, price range) and/or is being skewed by non-owner occupied home sales/purchases.  It is also important to note that while the number of home sales has been dropping slowly (3% decline comparing past 12 months to prior 12 months) part of that may be due to a change in market balance. It is a strong seller's market now, as there are a roughly equivalent number of buyers in the market as compared to a year ago -- with a drastically lower number of sellers in the market.  And here, folks, is the reason why we saw so many home sales this month -- it was a result of the crazy number of contracts signed last month. Last month's 171 contracts was the highest number I have seen anytime since I have been tracking these figures. Thus, slightly slower contracts in June is to be expected -- and we are likely to still see a strong month of sales in July based on some May contracts rolling over into July closings.  And here it is again -- declining inventory levels. While inventory levels have seen a seasonal increase over the past six months, there has been a net year-over-year decline of 12% in the number of homes on the market. Fewer homes for sale, with a roughly equivalent number of home buyers, has lead to a strong seller's market -- and a frustrating time for many buyers!  Perhaps because there are so many buyers fighting over each listing, homes are selling more quickly. Half of the homes that have sold in the past year have been under contract within 30 days of having been listed for sale. Again, this is not half of all properties that are listed going under contract in 30 days -- just half of those that actually do sell.  As shown above, mortgage interest rates have been increasing over the past year -- almost an entire percentage point. This has not seemed to have made a drastic difference in the pace of buyer activity (yet) and it has been nice to see these edge downward somewhat over the past few months. OK -- I'll stop there for now. Again, you can download the full report as a PDF, read the entire report with commentary online, or tune in to my monthly video overview of our local housing market One last note for anyone thinking of buying or selling soon -- SELLERS -- even though it is a seller's market in many price ranges right now, you must still focus on price, condition and marketing. For further reading on buying or selling in this area, check out.... | |

Now That You Are Ready To Make An Offer On A Home, Where Do We Start? |

|

How, you might ask, do we go about getting from the point of wanting to make an offer --- to actually making the offer? Here's a brief overview....

When we get to step seven, above, we will be discussing and deciding on the terms of the offer. Below is a list of the main contract terms we will need to discuss in preparing to make an offer.

Before and after making an offer, there is a lot more to know about and think about regarding the home purchasing process. Read more at.... | |

How Many Current Homes For Sale Will Actually Be Interesting To YOU? |

|

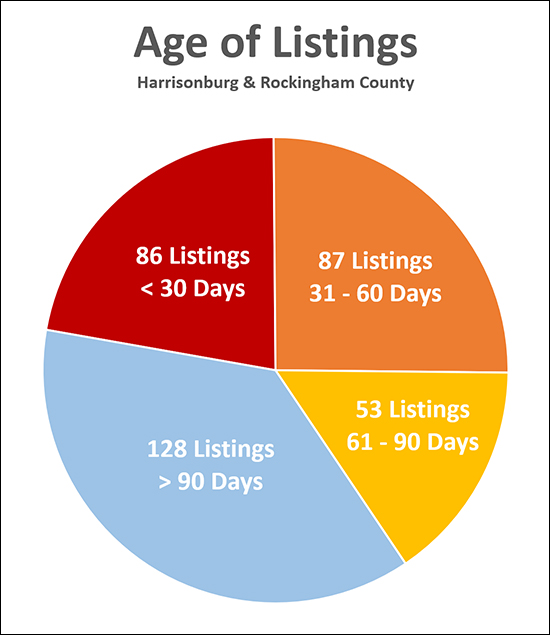

If you are entering the market to buy a home, the number of homes you will have to choose from will vary widely based on what you are looking for in a new home. Some buyers have a very narrow scope and find themselves on a prolonged hunt for what seems to be an elusive or mythical home. Some buyers find plenty of options, evaluate quite a few, make a decision and move forward with an offer. However -- keep in mind that as you consider the 344-ish homes currently on the market for sale, that some of them have been on the market for 3 months, 6 months, 9 months or even longer. The freshest of fresh listings are those that have come on in the past 30 days -- which (this time of year) is less than 100 of the 344-ish homes currently listed for sale. Depending on your time frame for buying, and the narrowness of your scope, sometimes it makes sense to quickly evaluate the current options -- and then to wait and see what new and exciting listings will be coming on the market in coming days and weeks. Steps to get started include talking to a lender to get a sense of your target price range, and then chatting with me (in person, by email, by phone) so that I can also be keeping an eye out for suitable properties for you. Learn more about the home buying process at...  Keep up with new listings at ... | |

Renting vs Buying a Townhouse in Harrisonburg |

|

Given continued relatively low interest rates and some increase in home values, let's take a new look at the opportunities of buying versus renting. RENT = $1050/m. There are regularly options for renting a two-story townhouse in Harrisonburg for approximately $1050 / month in Avalon Woods, Beacon Hill, Stonewall Heights, Liberty Square, etc. BUY = $1104/m. With a 95% loan, buying such a townhouse apparently may cost as little/muchas $1,272 per month assuming a $160K purchase price and a 4.7% interest rate per SunTrust Mortgage's payment calculator. So -- at first glace, it would seem to be about $54/month more expensive to buy a townhouse as compared to renting one right now. That said, if we then look at the difference between renting and buying over a five year time period, we start to see a bigger picture... Total Rental Payments over 5 Years = $63,000 Total Mortgage Payments over 5 Years = $66,240 Principal Reduction of Mortgage over 5 Years = $13,025 Effective Total Housing Payments over 5 Years = $53,215 Savings over 5 Years = $9,785 As you can see, this builds a somewhat compelling case for buying instead of renting if you are going to be living in this potential townhouse for the next five years. A few other factors to keep in mind....

| |

Only Four New Homes Remain at The Glen at Cross Keys |

|

Construction is moving along steadily at The Glen at Cross Keys -- with 74 out of 78 homes now sold or under contract. Most of the recent builds have been the Sycamore and Paired Sycamore model that feature an open first floor plan with a two story great room. Click on the image below to view a photo set from a recent Sycamore home at The Glen at Cross Keys.  Click here to view available homes at The Glen at Cross Keys. | |

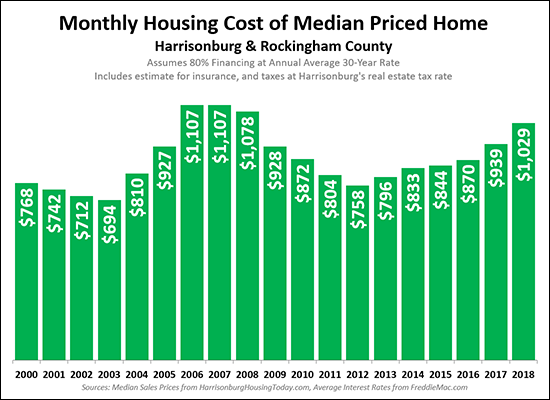

Monthly Housing Costs On The Rise |

|

It should come as no surprise that monthly housing costs are increasing, after all...

Thus, the 22% increase in monthly housing costs over the past three years should not be too surprising. For this analysis, I am measuring "monthly housing cost" by determining the mortgage payment amount (principal, interest, taxes and insurance) for a median priced home in Harrisonburg and Rockingham County, if a buyer were financing 80% of the purchase price and paying Harrisonburg real estate taxes. Looking forward, I would expect that all three of these factors (prices, interest rates, tax rates) that influence housing costs would likely continue to increase. | |

When To Get Serious About A Mortgage For Your Home Purchase |

|

Here are the three sequences I see buyers follow most frequently....

As Late As Possible

Incredibly Proactive

A Reasonable Middle Ground

I try to encourage all of my clients to at least be in the "reasonable middle ground" sequence as outlined above. This gives them a firm idea of what they can afford and how a home price will compare to a loan payment. This also allows them to make a stronger offer, already having a pre-qualification letter in hand. I strongly discourage my clients from following the "as late as possible" sequence as outlined above. This doesn't help them make the best decisions about which houses to pursue, how far to negotiate, etc. This also doesn't allow us to make as strong of an offer on a house. Occasionally, one of my clients will fall into the "incredible proactive" sequence as outlined above, and wow, this makes the financing process a joy to work through! These buyers have already done so much of their work with the lender before even thinking about which house to buy -- which then allows them to focus on buying, negotiating, inspecting, etc., rather than be bogged down in the process of securing their mortgage. Let me know if you have questions about how I have described these sequences -- and let me know if you would like a few recommendations for lenders in the Harrisonburg area. | |

Can All Homes In Harrisonburg Be Rented To Groups of JMU Students? |

|

With great regularity, potential buyers (either investors or parents of JMU students) will ask if a single family home can be purchased and rented to a group of JMU students -- often an intended group of four or more students.

I let them know that it will be no problem at all -- the adjoining property owners in the quaint neighborhood probably won't mind as long as the students aren't too bothersome -- and the City doesn't mind at all if their zoning ordinances are violated, so long as it's just "nice college kids".... WAIT! NOT REALLY! READ ON!!!! It seems that some buyers are really getting that feedback of "sure, it will be fine" -- though I'm not sure if they're getting it from their Realtor, or from someone else advising them in the transaction, or if they just aren't thinking about whether their planned use of a property is allowable. The REAL answer, and the feedback that I ACTUALLY provide to my clients is.... 1. We need to check to see how this property is zoned, and whether that zoning classification allows for that number of unrelated people to live in the property. 2. We need to check to see if there are recorded restrictive covenants for this neighborhood that restrict the number of unrelated people who live in the property. A few notes.... 1. Most single family homes in the City of Harrisonburg are zoned R-1 or R-2 and do NOT allow for three or more unrelated people (students or otherwise) to live in the property. 2. If a property has been used in a non-conforming manner (for example, four students living in it) since before the zoning ordinance was put in place, without a 24 month gap in the non-confirming us, it MIGHT be possible to continue to use the property in that non-conforming manner. And, if #2 above is starting to get confusing, then we arrive at my main reason for writing today.... CALL COMMUNITY DEVELOPMENT TO UNDERSTAND ALLOWED USE OF A PROPERTY! Yes, in fact, there are very helpful City staff in the Community Development department -- who can very quickly help you understand whether a property can be legally used as you intend to use it. And it is imperative that you make this call BEFORE you buy the property, and even BEFORE you make an offer on the property! | |

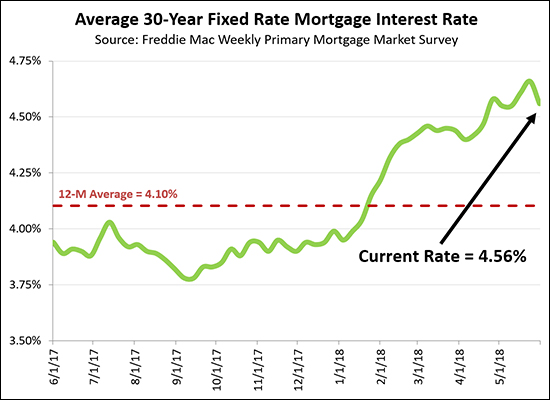

Mortgage Interest Rates Edge Back Down, A Bit |

|

Mortgage interest rates have steadily climbed over the past nine months -- from 3.78% last September to 4.66% about two weeks ago. Now, however, they have drifted back down a bit to 4.56%. Will this be a trend? Are we headed back below 4.5%? Not necessarily. But -- it might be an indication that we're not going to keep on rolling all the way up to 5% anytime soon. If you are buying a home and are under contract to buyer a particular property and have not yet locked in your mortgage interest rate, this week would seem to be a particularly good time to do so. Explore historical interest rates here. | |

Showing Feedback Unrelated To Price Might Really Be Related To Price |

|

My house has an unbelievably steep driveway, but all of the potential buyers (who did not make an offer on my house) didn't complain about price, they complained about the steep driveway. My house is next to the railroad tracks, but all of the potential buyers (who did not make an offer on my house) didn't complain about price, they complained about the railroad tracks. My house is needs many cosmetic updates, but all of the potential buyers (who did not make an offer on my house) didn't complain about price, they complained about the need for cosmetic updates. Guess what --- unless you're going to flatten the driveway, move the railroad tracks (or the house), or make all of the cosmetic updates -- it really is an issue of price! If you're getting consistent feedback about your house that is unrelated to price, in almost all cases, you need to adjust the price to accommodate for that specific issue. If the price is lower then buyers might actually buy despite the specific issue that they were complaining about. | |

FOMO (Fear Of Missing Out) in Real Estate is Real and Reasonable |

|

OK -- I'll bend the definition of FOMO a bit to make a point. The "real" definition -- "anxiety that an exciting or interesting event may currently be happening elsewhere, often aroused by posts seen on a social media website" But then, for real estate... Sometimes a property can be on the market for a few weeks (or even a few months) without an offer -- and then when an offer comes in, all of a sudden a 2nd or 3rd buyer is also then ready to make an offer. So, what's happening here? Is it random timing? Likely not -- I think it is FOMO -- Fear Of Missing Out...

So, as a seller -- if you have had a good number of showings, but no offers -- don't be surprised if a second offer quickly materializes after the first offer comes in. And as a buyer -- if you are still potentially interested in a house, but have not made a decision about making an offer -- make sure the seller's Realtor knows of your continued interest, so that they can alert you or your agent if an offer does show up. The seller will want to make sure you have the opportunity to make an offer as well. | |

This House Is Sold AS IS, Inspection For Informational Purposes Only |

|

Sometimes a seller is stating this as soon as they list a property: All inspections are for informational purposes only. or This house is being sold in "as is" condition. And, sometimes a seller will introduce this amidst negotiations. This can certainly trigger some warning signals for a buyer......but should it?

Here are the top three innocent reasons why a seller would want a home inspection to be for informational purposes only....

| |

Your 1200 SF In Your Basement Is Not The Same As My 1200 SF Above Grade |

|

So -- your neighbor's 2400 SF, circa 2000, 4 BR, 2 BA home just sold for $300K. It's probably reasonable to think that your 2400 SF, circa 2000, 4 BR, 2 BA home will also sell for $300K, right? After all, you have made the same updates (systems and cosmetic) over time -- and you're on the same street!

Well, maybe -- but maybe not! Consider the possibility that....

These two homes will not be seen as having an equivalent value -- not by potential purchasers and not by an appraiser. Above grade square footage has a higher value attached to it -- both specifically by appraisers, and generally by purchasers. Even if all of the other factors (condition, age, location, bedrooms, bathrooms) are the same between two houses, if one has a significant portion of the square footage in the basement then it will be seen as less valuable than the home that has all of its square footage above grade. | |

Focusing Only On One Comparable Sale Can Lead Us Astray |

|

It's easy to want to do this -- as either a buyer or a seller. Let's think about it using the mostly fictional illustration below...

THE BUYER'S STATED PERSPECTIVE I know that your house is listed for $400K, but this one other home a few streets over sold for $350K last month, and it was a larger, so I'm not paying any more than $350K for your home. THE LARGER CONTEXT Just a few items...

Furthermore, aside from all of these differences in the two houses --- the other ($350K) house is not available any longer --- and there aren't three other houses just like it that the buyer can decide to buy. In this case, by focusing on this one not-actually-that-similar sale, the buyer has put themselves in a situation where they might miss out on purchasing a great home because of how they are viewing the market based on one comparable sale. THE SELLER'S STATED PERSPECTIVE I am confident that I can sell my house for $350K. After all, my friend owned a very similar house and he just sold it in a week, with multiple offers, for $360K! THE LARGER CONTEXT Just a few items...

Again, by focusing on this one not-actually-that-similar sale, the seller has put themselves in a situation where they might miss out on selling their home because of how they are viewing the market based on one comparable sale. So -- as a buyer or as a seller -- don't focus on just one comparable sale when deciding on a reasonable price to pay or to ask -- look for the larger context! | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings