| Newer Posts | Older Posts |

Where Will Recent JMU Graduates, Staying In Harrisonburg, Buy Houses? |

|

It's a numbers games, folks.... Some percentage of each graduating class at JMU (and EMU, and Bridgewater College) will decide they want to stay in Harrisonburg and make it their home. These three institutions seem to graduate around 6,000 students each year. How many might decide to stay in Harrisonburg? In chatting with several folks about this yesterday, I pondered aloud whether enough new "for sale" housing is being built for recent grads to buy, once they decide they want to stick around and buy a home. Or, more broadly, is our housing stock growing as fast as our population. I suspect that it is not -- based on how quickly homes are selling and how low our inventory levels remain month after month. So, what are these recent (within the past few years) JMU grads to do? Perhaps make several offers on several properties, missing out on most because of multiple offer situations, and then eventually securing a contract to buy a home. Or, perhaps they just rent because there is so little to buy. But if many or most of them do rent, it is -- at least in the short term -- a net loss for our community. If they buy a home, they will be putting down roots, committing to stay in the area, investing even further in our local economy, etc. If they are renting, not so much on any of those fronts. Not so long ago (ok -- fine -- 16 years ago) I was a recent JMU graduate -- having just finished up my master's degree -- and my wife (fiancé at the time) and I decided we wanted to stay in this area. We were able to find a townhouse to buy, and were excited to make this our home. The landscape now, at least for recent graduates buying homes, is a bit different. | |

Is $250K The Sweet Spot of our Local Housing Market? |

|

As Hannah observed out this morning (thanks Hannah!) the $250K price point seems to be the sweet spot for our market. As a random aside, while I use the expression "sweet spot" with some regularity, I had forgotten its primary meaning, which Google informs me is... "the point or area on a bat, club, or racket at which it makes most effective contact with the ball" As a further aside, I have no idea if the tennis player pictured above is about to hit the tennis ball at the sweet spot of the racket!? But I digress. The second definition of "sweet spot" per Google is... "an optimum point or combination of factors or qualities" And that, I believe, sums up Hannah's point about the $250K price point... 1. There are LOTS of buyers who would like to buy $250K-ish homes. 2. Inventory is extremely low around the $250K-ish price point. 3. Builders aren't really hitting that $250K price point with many new homes being built. So - if you own one of these homes already - congrats, and know that you could likely sell it if you need to do so. And if you want to buy one of these homes, consider my usual advise for buyers in this fast paced market -- know the market, know the process, know your buying power, and closely monitor new listings! | |

Sometimes The Home You Want Will Dictate Where You Will Buy |

|

Wouldn't it be nice if you could buy a restored early 1900's home in five different areas in Harrisonburg, east of the City, west of the City, etc.? Wouldn't it be nice if you could buy a mid-range $225K single family home in any school district you'd like in Harrisonburg and Rockingham County? Wouldn't it be nice if you could buy a four bedroom home built in the past 10 years in downtown Harrisonburg, or on a variety of one acre lots in many different parts of the County? Yeah -- it would be nice. But, this is a rather small area. Sometimes, the home you want to buy will dictate where you will live. This is the most surprising to buyers moving here from larger metro areas -- where any different type of home (style, price range, age, etc.) is available in countless areas in and around the ___ metro area. Not so much in Harrisonburg and Rockingham County. So -- we can talk about what you want to buy -- and where you want to buy. But then we'll have to pause to make sure the what and the where appropriately overlap to give you a chance of finding that home. If not, we'll either have to adjust the what, or the where! | |

Understanding the Total Financial Impact of Selling AND Buying a Home |

|

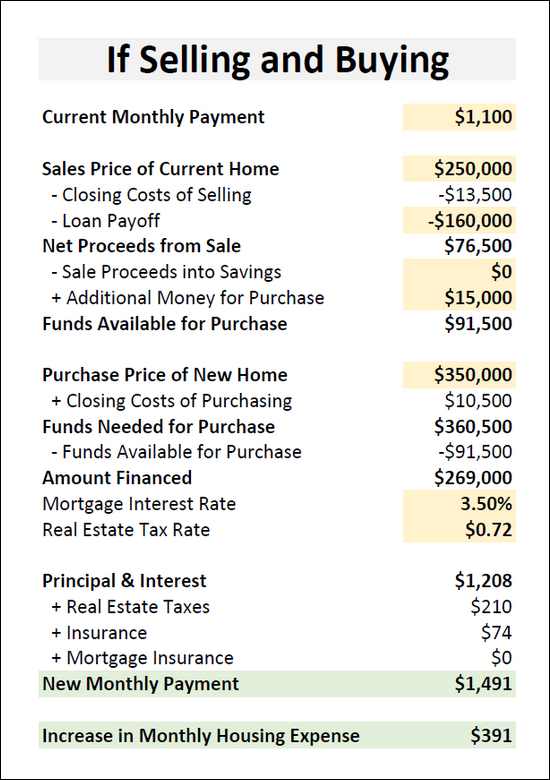

If you will be selling your home to buy another, there are a lot of numbers floating around....

Above you will see a spreadsheet I put together to help you think about some of these numbers as you are evaluating if and when you will make a move to a new house. In yellow, are all of the inputs you will need to provide, or that you and I can determine together, such as your current payment, your home's current value, your mortgage payoff, whether you will be putting any additional money into the transaction, etc. In green, I have identified your potential future mortgage payment and the net change in your monthly payment. All of the numbers without a background color will automatically calculate for you. Click here to download this worksheet as an editable Excel file. | |

What Does a Realtor Do in Representing a Buyer? |

|

If you are purchasing a home, before you call the listing agent to see that home, you should understand a bit more about buyer representation. In representing you as a buyer in your home purchase, your buyer's agent would be performing tasks such as:

So -- you can call the listing agent (who is contractually bound to represent the seller's best interests) or you can hire a Realtor to represent YOUR best interests as the buyer. Clearly, I recommend the second option. Beyond buyer representation, there is a lot more to know about and think about regarding the home purchasing process. Read more at....  | |

How Historic Are Our Current Low Housing Inventory Levels? |

|

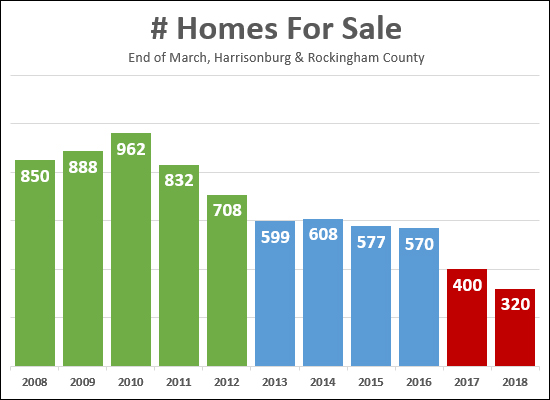

Just how historic are the current low housing inventory levels? Quite historic, it seems. The graph above shows the inventory level at this time of year (end of March) for each of the past 11 years. As you can see, we have been seeing steady declines since 2010 -- though things were relatively steady with around 600 homes for sale between 2013 and 2016. Last year, however, we saw a 33% decline -- and this year we have seen another 20% decline. Low inventory levels leads to homes selling much more quickly, and buyers often having a more difficult time securing a home to purchase. Stay tuned to see whether we start to see increases in inventory levels as we continue through the Spring and Summer. Read more about our local housing market at HarrisonburgHousingMarket.com. | |

Buying vs Building A $400K+ Home |

|

Most buyers looking to spend over $400K (or certainly those looking over $500K) will also be considering building a new home. Typically, the tension between buying vs building is one of: 1. Goals 2. Money 3. Timing If you build, you can get the house you want, but you'll pay more for it and it will take a lot of time and attention. 1. Goals = Win 2. Money = Lose 3. Timing = Lose If you buy an existing home, you won't get exactly what you want, but you will pay less for the house and the process will not be a drain on your time. 1. Goals = Lose 2. Money = Win 3. Timing = Win Don't let my oversimplification of this issue fool you -- this is something that buyers can get stuck debating for months, or even years, often while looking at resale homes to try to convince themselves to buy instead building. If you are stuck in this quagmire, I'd be happy to meet with you to talk through some of the pros and cons and try to help you come to a decision you'll be pleased with in the short and long term. | |

Be Careful What You Say When Touring A Home For Sale |

|

As a buyer, when you are walking through a home, keep in mind that the seller might be listening. These days, there are plenty of ways that a seller could be monitoring their home, with a security camera, or other recording device that could allow them to hear every word you are saying while you are in their house. So..... 1. Don't insult their house. It won't help during negotiations.By the way, sellers, it may not be legal for you to record conversations in your home while you are gone. You should likely either NOT record conversations, or disclose that it is taking place. P.S. I am not an attorney. Consult one if you want an actual legal opinion. Ask me if you need a recommendation. | |

The Layout of a Home Often Trumps Nearly Everything Else! |

|

If a buyer is buying over $400K, or even over $300K, the layout of the home becomes very important to them. That is not to say that it is unimportant for a $200K buyer -- but someone buying a more expensive home oftentimes plans to stay in it for a longer time frame. If not the #1 feedback, the #2 feedback I receive from showings of homes priced over $400K is that the layout just didn't work for the buyers....

| |

14% Increase in Home Buyers Signing Contracts in January and February |

|

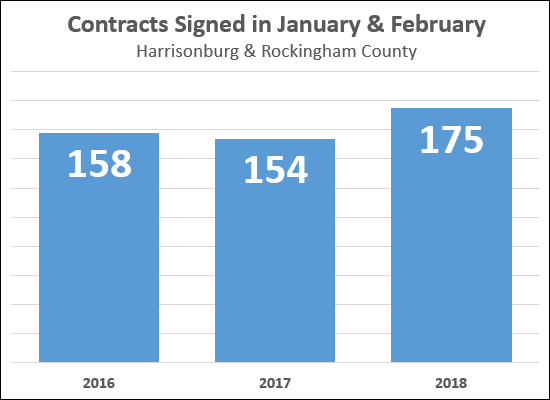

Mortgage interest rates are edging up again, as you may have heard. The average 30 year fixed rate at the end of February was 4.4% -- up from 3.9% just three months prior. Could this (slight) rise in the cost of financing your home be affecting the pace at which buyers are signing contracts? Possibly. It seems that 14% more buyers signed contracts this January and February as compared to last year during the same timeframe. This is a likely indicator that we'll see stronger months of closed sales in March and April. Then, the questions will be....

Let's hope for yes and no, in that order. | |

As Home Price Increases, So Does Pickiness |

|

Here's one thing I have found to be true of most buyers.... As the price of a home increases, so does a buyer's desire for that home to be a wonderful fit for their needs and wants, both now and in the future. And it makes sense -- 1. If you're buying an expensive (fill in your own definition here) home then you are likely to be planning to stay for a while, and thus the home should work quite well for you. 2. If you're buying an expensive home, it is a major investment (or more major than if it was a less expensive home) and thus you want to make sure the home is exactly what you want. 3. If you're buying an expensive-ish home you could probably also consider building a home -- which would give you exactly what you want in a house -- so the resale home you are considering better come darn close to that ideal. Anyhow -- this is just what I consider to be a reality of buyers considering the purchase of higher end homes. Some of the resulting implications are.... 1. Buyers of expensive homes often spend more time in the home search process -- waiting for "the right" home to come along. 2. Sellers of expensive homes should expect to hear "it just wasn't a good fit" quite a bit when asking what buyers thought after viewing the house. 3. Buyers of expensive homes are typically willing to be very patient in waiting for the ideal fit, as it is a big investment. 4. Sellers of expensive homes sometimes have to sell for less than they feel their home is or should be worth -- if there aren't any buyers (over a prolonged time period) for whom the house is an ideal fit. Oh, and one last note, this correlation between price and pickiness does not necessarily extend in both directions. Buyers of lower priced homes are not universally non-picky or hasty to buy or overly willing to compromise. | |

The Rights Of A Home Buyer In Negotiations |

|

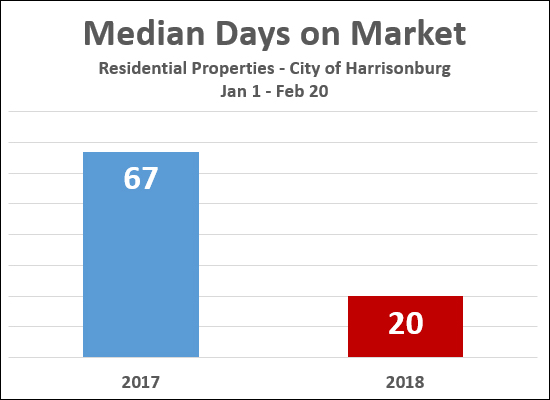

Have you heard that homes are selling rather quickly? Especially in the City of Harrisonburg? During the first two months of 2017, homes went under contract in around (median of) 67 days. In the first two months of 2018 -- it is only taking (a median of) 20 days!?! So -- if you are a buyer, entering into the fray of trying to buy a home in a fast moving, low inventory, housing market -- you must know your rights....

Revised for accuracy, you can hang these on the refrigerator....

| |

City Homes Selling Three Times Faster This Year Than Last |

|

Here is a somewhat startling statistic.... Looking at the start to last year (Jan 1 - Feb 20) the homes that sold (went under contract) in the City of Harrisonburg did so with a median "days on market" of 67 days. This year during the same timeframe (Jan 1 - Feb 20) the homes that sold (went under contract) in the City of Harrisonburg did so with a median "days on market" of 20 days. So -- homes are selling (more than!) three times faster than they were last year. Wow! And -- a few more homes are selling.... Contracts between Jan 1 and Feb 20:

Buckle up! It seems like it might be a fast paced market for much of 2018. Low inventory levels and rising interest rates certainly are contributing to this. | |

Local Home Sales Off To Slightly Slow Start In 2018 |

|

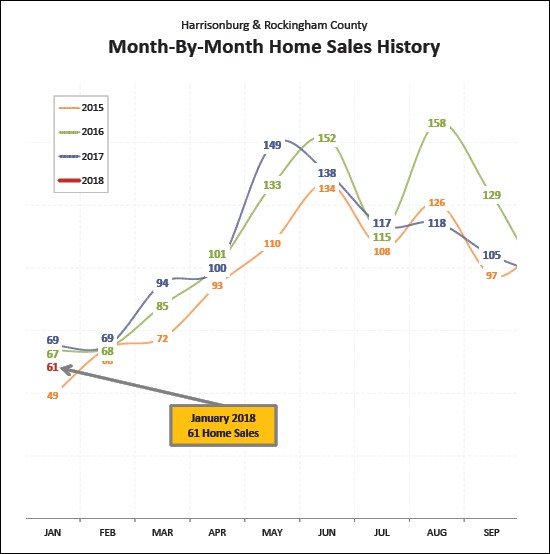

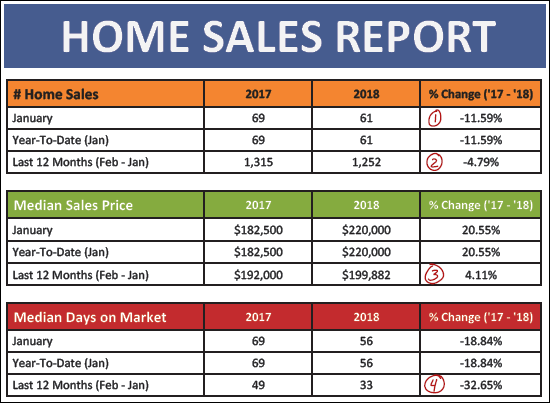

Find out more about this newly built home in Lakewood Estates at 1644CumberlandDrive.com. I just published my most recent monthly market report, and as usual, you can read on for an overview, download the full report as a PDF, read the entire report with commentary online, or tune in to my monthly video overview of our local housing market...  OK -- now, let's take a look a few of the main indicators for our local housing market....  As shown above....

As shown above, January 2018 home sales were right in the middle of the pack as contextualized by the previous three years. And in some ways, we should expect to see around 70 home sales next month -- however....

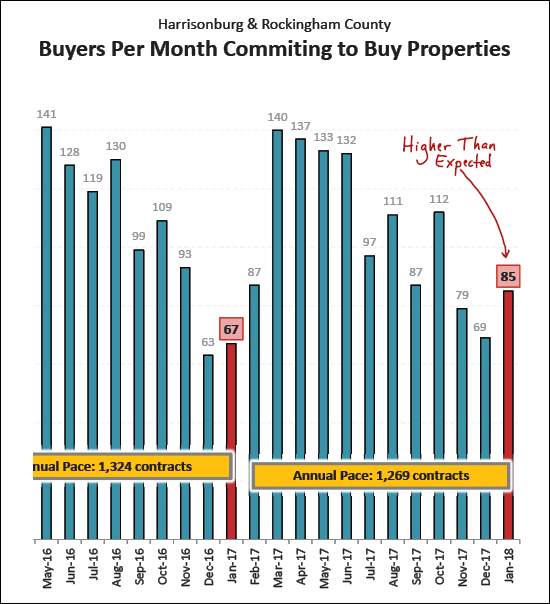

Contract activity in January 2018 was much stronger than could have been expected. Buyers (and sellers) signed 85 contracts in January -- as compared to only 67 last January. Thus, it is reasonable expect we'll probably see somewhat of a bump in home sales in February.

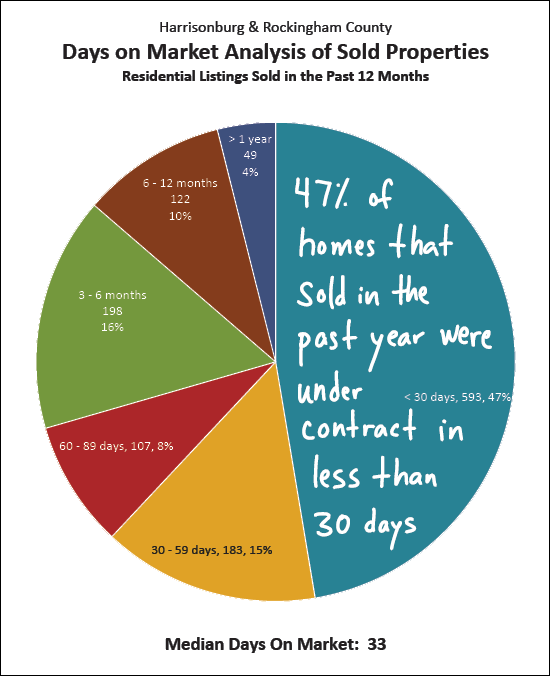

And perhaps that is why so many homes are selling so quickly. Almost half of the homes that have sold in the past year have gone under contract within 30 days of coming on the market! OK -- I'll stop there for now. Again, you can download the full report as a PDF, read the entire report with commentary online, or keep reading my blog in the coming days for further commentary. If you're thinking of buying or selling soon --- SELLERS -- even though it is a seller's market in many price ranges right now, you must still focus on price, condition and marketing. For further reading on buying or selling in this area, check out.... | |

Winter Is Often The Best Time For Purchasing Investment Properties |

|

Many of my savvy investor clients wait for these winter months to acquire additional rental properties. Their reasons are pretty logical....

Of note -- this advice is most applicable to townhouse properties that might be purchased by investors or owner occupants. This does not necessarily apply to multi-family properties or student housing properties. If you are looking for some advice on how to get started with real estate investing, check out HarrisonburgInvestmentProperties.com. | |

Basements in Harrisonburg, Rockingham County Should Be Tested For Radon |

|

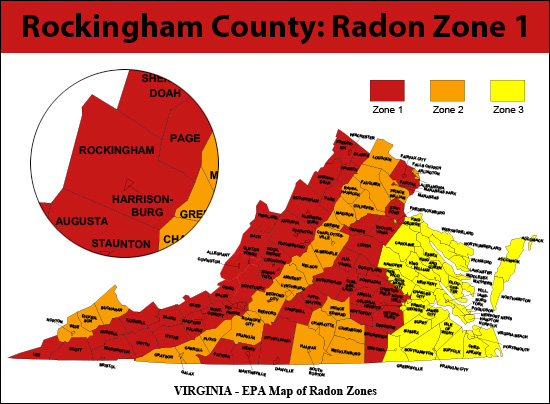

As you can see above, Rockingham County is in Zone 1 -- which means we are in an area that is likely to have high radon levels. What is radon, and what does it mean for you? Read on, from the EPA.... Radon is a radioactive gas that comes from the natural breakdown of uranium in soil, rock and water and gets into the air you breathe. Radon typically moves up through the ground to the air above and into your home through cracks and other holes in the foundation. Radon can also enter your home through well water. Your home can trap radon inside.Learn more about radon and real estate here. | |

Understanding Home Inspection Negotiations |

|

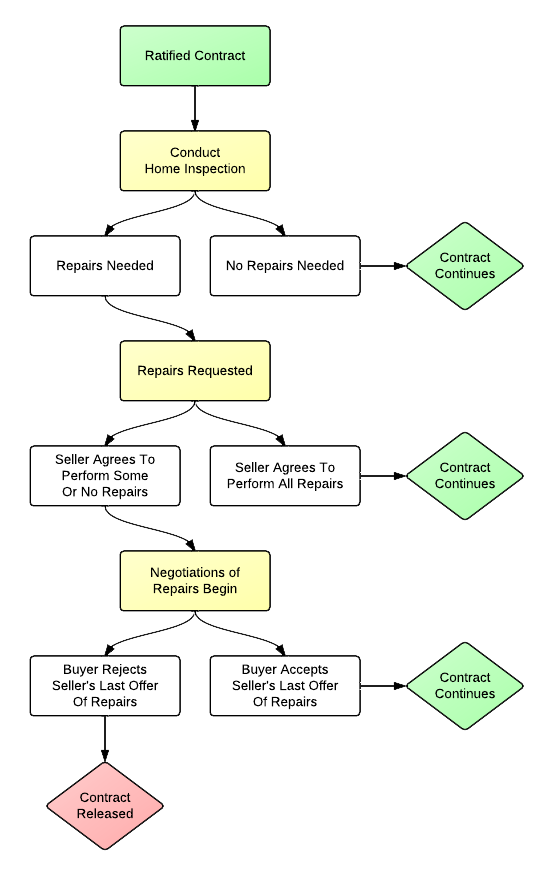

A buyer agrees to pay a price for a house based on what they know about the house at that time. The home inspection process allows them to learn more about the house to confirm that it is the house that they thought. But sometimes, they discover problems with the house that they'd like the seller to address.... So, how do these home inspection negotiations usually proceed? The short (and vague) answer is -- well, it depends on the terms of your contract. But, overall, here is how the inspection process typically flows....  As you can see above, after a buyer requests repairs (based on the home inspection) the seller can choose to make some, all or none of the requested repairs. The transaction (and negotiations) can then go in a few different directions based on that response. Learn more about the home buying process at....  | |

Would You Move To The Other Side (!?!?!) of Interstate 81? |

|

If you have lived in Harrisonburg for a while (more than a few years) which side of I-81 do you live on? The East or the West? Would you consider moving to the other side of I-81? Regardless of which side you are on now, I'm guessing most of you wouldn't flip-flop to the other side. Most people stay on one side of I-81 after they buy on that side -- because they get used to the patterns of life on that side of our community. Nothing is necessarily better or worse on one side or the other -- but they are different, that's for sure. EAST: Most of the residential development over the past 15 to 20 years has been on the East side of Harrisonburg, in the general vicinity of the new hospital. This makes it an exciting place to live -- for some people. There are many newer developments where homes have recently been built, and there are newer commercial destinations (Stone Port, Martin's grocery store, Target, etc) all on the East side of town. But this also makes it a bit more hectic for getting around. Of note, there is also plenty of outbound traffic East of town, towards Massanutten, Elkton, Charlottesville, etc. WEST: There hasn't been as much residential development West of Harrisonburg over the past 15 to 20 years (other than Belmont and Monte Vista Estates) and this is just fine with most people who live on the Western side of Harrisonburg. Things are a bit calmer, without as much hustle and bustle, and in some cases with more established neighborhoods. The towns of Dayton and Bridgewater end up falling into this side of town as well for many people. I am not doing justice to all of the differences between the East side of town and the West side of town, but I believe that most people in this area are oriented towards one side of town or the other, for very specific reasons. Furthermore, most people who have spent any considerable amount of time living on one side of Harrisonburg likely wouldn't think about moving over to the other side of Harrisonburg. So -- if you're just moving to the area -- choose East or West carefully -- you might never switch to the other side! | |

How to Buy a Foreclosure in Harrisonburg, Rockingham County |

|

With some regularity, I am asked by potential purchasers how they would go about buying a foreclosure. First, here is a list of upcoming foreclosure sales, but more importantly, below is a description of a few ways to buy what you might be thinking of as a foreclosure. SHORT SALES: Some homeowners must sell their home, but market conditions won't allow them to sell it at a high enough price to be able to pay off their mortgage(s). In this example, a homeowner might have a $250,000 mortgage balance but can only sell the property for $230,000. As a prospective buyer, it is sometimes possible to purchase this type of a property through a process called a "short sale." In such an arrangement, the homeowner petitions their lender to accept less than the full payoff of the mortgage and in return to still release the deed of trust so that ownership of the property can be transferred over to you, the new owner. This can benefit the lender, as they skip the time delays and cost of the foreclosure process. This can also benefit the homeowner, as a short sale will have a slightly lesser negative impact on their credit as compared to a foreclosure. As a buyer, however, you must know that there are challenges to buying a property as a short sale. The biggest challenges of late seem to be the uncertainty of the purchase and the time table. Even if you and the homeowner agree to a price of $230,000, the homeowner's lender must still agree to accept that price – since it won't allow the homeowner to pay off their $250,000 mortgage balance in full. This process of waiting to hear back from a lender, and then complying with all of their various terms can sometimes take 60 to 120 days – or longer! TRUSTEE SALES: If a short sale does not take place, and a homeowner is behind on their payments (or not making them at all), eventually the property will be sold by the lender on the courthouse steps. Buying a property at a "trustee sale" can be exciting, and can be a great opportunity – but there are challenges as well. If a property to be sold at a trustee sale is also listed for sale with a Realtor, you can usually view the property ahead of time by calling your Realtor. Otherwise, you will likely not have the opportunity to see inside the property before the trustee sale, and thus you will not know too many details about the condition of the property. Furthermore, your purchase of the property at the trustee sale cannot be contingent upon viewing the property, or inspecting the property. In this instance, you are purchasing the property in "as is" condition, regardless of what you then find out about the property. It is also important to note that many times the lender will have an opening bid at the trustee sale that is close to (or sometimes higher than) the amount that they are still owed on the mortgage. Thus, in the example above, they might make an opening bid of $250,000. As a result of this opening bid process, many (or most) properties available for purchase at a trustee sale are not great opportunities. Occasionally, a property will be foreclosed upon that has had a mortgage in place for many years, whereby the balance of the mortgage is much lower than current market value – these are great opportunities for a buyer. Visit HarrisonburgForeclosures.com for a list of upcoming trustee sales. BANK OWNED PROPERTIES: If you don't buy the property before the auction (as a short sale), and don't buy it at the trustee sale, you'll have a third opportunity to buy it once the bank owns it. These properties are called "bank owned properties" or REO properties ("real estate owned"). Oftentimes, the prices on these properties are quite realistic, if not under market value. It would not be atypical for a house such as the one mentioned above to come on the market after the trustee sale at a price of $210,000. In such an instance, you should expect to be buying the property in "as is" condition, and you will also be buying with a slightly different contract document. Most lenders have a long standard contract or contract addendum that spell out a variety of additional contract terms designed to protect them from any future liability – and rarely will a lender agree to have these contract documents changed in any way. As you can see above, oftentimes buying the property as an REO property is where the best opportunity lies. Visit HarrisonburgREO.com for a list of bank owned properties currently on the market for sale. When a home goes into foreclosure it is often for very sad and unfortunate reasons – such as the loss of a job – and I do not wish such circumstances on any homeowner. However, if you are a buyer in today's market it is important to be familiar with different methods for buying a property when it will be, is being, or has been foreclosed upon. | |

Will Single Family Home Sales Ever Return to 2016 Peak? |

|

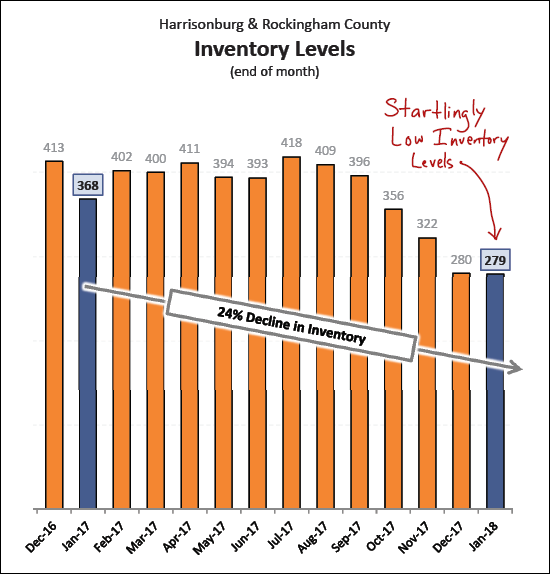

Apparently, 2016 was a special year for single family home sales in Harrisonburg and Rockingham County. After three years straight (2013, 2014, 2015) of seeing a very consistent number of single family homes in the City and County (813-819) there was a 20% increase in 2016 to 978 home sales! Then, in 2017 -- sales of single family homes fell 10% to 884 sales. Hmmm..... This was likely at least partially an inventory issue....

And inventory levels got even worse during 2017....

All that is to say that I would be shocked if we saw more than 978 home sales in 2018. I think we may have peaked in 2016 -- and we might not return to that peak for some time. Perhaps some home builders need to start creating new single family home supply in this area?? | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings