| Newer Posts | Older Posts |

Be Careful With Your Words. The Seller Might Be Listening! |

|

As a buyer, when you are walking through a home, keep in mind that the seller might be listening. These days, there are plenty of ways that a seller could be monitoring their home, with a security camera, or other recording device that could allow them to hear every word you are saying while you are in their house. So..... 1. Don't insult their house. It won't help during negotiations.By the way, sellers, it may not be legal for you to record conversations in your home while you are gone. You should likely either NOT record conversations, or disclose that it is taking place. P.S. I am not an attorney. Consult one if you want an actual legal opinion. Ask me if you need a recommendation. | |

Why can this house be inspected for informational purposes only? |

|

Sometimes a seller is stating this as soon as they list a property: All inspections are for informational purposes only. But sometimes a seller will introduce this amidst negotiations. This can certainly trigger some warning signals for a buyer......but should it? Here are the top three innocent reasons why a seller would want a home inspection to be for informational purposes only....

| |

Monitor New Real Estate Listings via Twitter |

|

Are you a Twitter user? If so, you can keep up with new residential real estate listings in the Harrisonburg and Rockingham County area by following @NewListHburg. So, yes, per many of your requests, there are now LOTS of ways to keep track of new listings in this area.... 1. NewListingsInHarrisonburg.com - this is a mobile friendly website, and you can add a shortcut to your home screen on your phone. 2. New Listings by Email - every time there is a new listing, you'll get an alert by email. 3. New Listings via RSS - for those RSS feed readers among you. 4. New Listings via Twitter - tweet, tweet. I expect this to be a fast moving Spring and Summer real estate market -- so now (with the options above) there is no excuse for not keeping up with new listings for sale if you are in the market to buy this year. If you have further recommendations (carrier pigeon?) for ways to keep up with new listings, just let me know. | |

The Tension Between Buying and Building |

|

Most buyers looking to spend over $400K (or certainly those looking over $500K) will also be considering building a new home. Typically, the tension between buying vs building is one of: 1. Goals 2. Money 3. Timing If you build, you can get the house you want, but you'll pay more for it and it will take a lot of time and attention. 1. Goals = Win 2. Money = Lose 3. Timing = Lose If you buy an existing home, you won't get exactly what you want, but you will pay less for the house and the process will not be a drain on your time. 1. Goals = Lose 2. Money = Win 3. Timing = Win Don't let my oversimplification of this issue fool you -- this is something that buyers can get stuck debating for months, or even years, often while looking at resale homes to try to convince themselves to buy instead building. If you are stuck in this quagmire, I'd be happy to meet with you to talk through some of the pros and cons and try to help you come to a decision you'll be pleased with in the short and long term. | |

Considerations in a Modular Home Purchase |

|

image source According to Wikipedia, a stick-built structure is "one constructed entirely or largely on-site," as opposed to a modular home that is "divided into multiple modules or sections which are manufactured in a remote facility and then delivered to their intended site of use." My experience in chatting with buyers over the past 14 years has been that there are mixed opinions on modular homes. For example, some would suggest that . . .

Overall, my experience indicates that modular homes sell at slightly lower prices as compared to stick built homes -- and some of that is solely as a result of some buyers being hesitant to purchase a modular home. | |

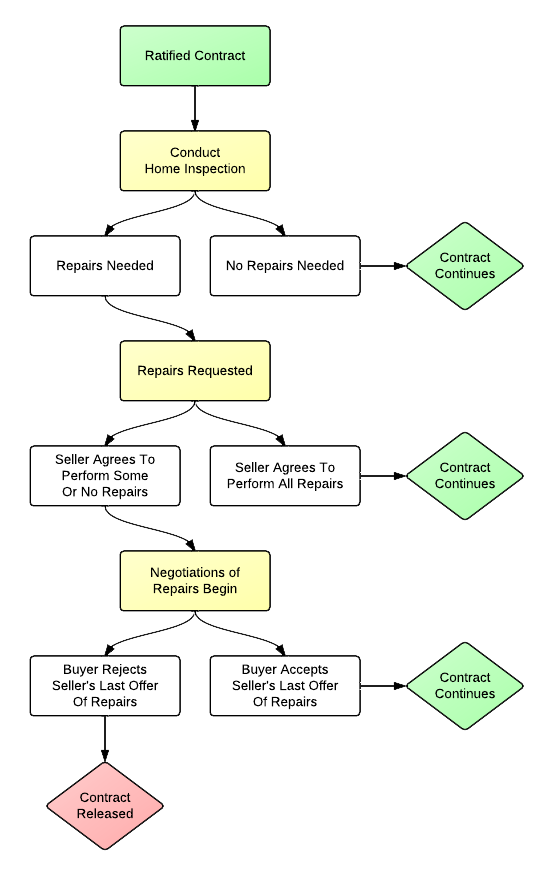

How do home inspection negotiations usually proceed? |

|

How do home inspection negotiations usually proceed? The short (and vague) answer is -- well, it depends on the terms of your contract. But, overall, here is how the inspection process typically flows....  As you can see above, after a buyer requests repairs (based on the home inspection) the seller can choose to make some, all or none of the requested repairs. The transaction (and negotiations) can then go in a few different directions based on that response. Learn more about the home buying process at....  | |

Most contracts will have to clear these three hurdles |

|

While every home sale is different -- with unique contingencies based on the needs and situations of the buyer and seller -- there are three main hurdles that most buyers and the houses they are purchasing must clear to make it to closing. So -- where is your contract in this process? Have you cleared 1, 2 or 3 of the hurdles, thus far? There will be plenty of other details to attend to, but these are the three main areas of focus. Evaluating the property condition, the property value, and the buyer's finances.... INSPECTION - This is an evaluation, by a home inspector, of the condition of the house. Clearing this hurdle typically involves requesting that the seller make some repairs to the house (or negotiate further on price) based on new information about the property condition discovered during the inspection process. APPRAISAL - This is an evaluation, by an appraiser hired by the purchaser's lender, of the value of the house. If the property appraises for the contract price (or higher), all is well -- otherwise, the buyer and seller may need to renegotiate the contract price based on the appraised value. LOAN APPROVAL - This is an evaluation, by a lender (and their underwriters) of the purchaser's financial situation. The lender must confirm that the buyer has the income to support the mortgage payment required for purchasing the home. Again - there are many other smaller hurdles (for example, a termite inspection) and larger hurdles (for example, a home sale contingency) that may need to be cleared in your purchase (or sale) of a home -- but these three main hurdles (inspection, appraisal, loan approval) are the three main mileposts during the contract-to-closing process that we'll be focused during the transaction. | |

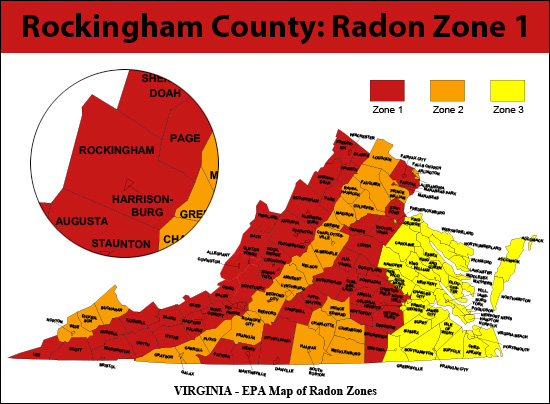

If you have a basement in Rockingham County, you should test for radon |

|

As you can see above, Rockingham County is in Zone 1 -- which means we are in an area that is likely to have high radon levels. What is radon, and what does it mean for you? Read on, from the EPA.... Radon is a radioactive gas that comes from the natural breakdown of uranium in soil, rock and water and gets into the air you breathe. Radon typically moves up through the ground to the air above and into your home through cracks and other holes in the foundation. Radon can also enter your home through well water. Your home can trap radon inside.Learn more about radon and real estate here. | |

Should you hire a Realtor to represent you in a home purchase? |

|

If you are purchasing a home, before you call the listing agent to see that home, you should understand a bit more about buyer representation. In representing you as a buyer in your home purchase, I would be performing tasks such as:

So -- you can call the listing agent (who is contractually bound to represent the seller's best interests) or you can hire a Realtor to represent YOUR best interests as the buyer. Clearly, I recommend the second option. Beyond buyer representation, there is a lot more to know about and think about regarding the home purchasing process. Read more at....  | |

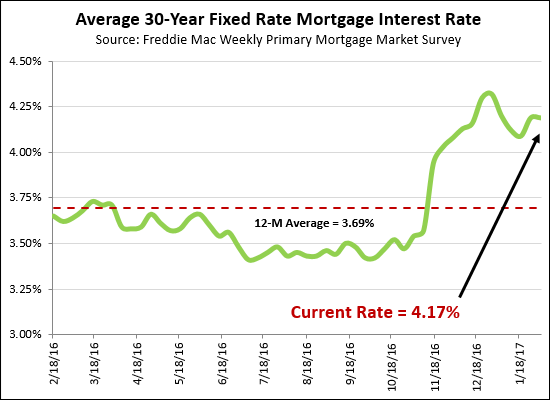

Maybe interest rates will stay below 4.25% after all |

|

Well, things weren't looking so good for a while there. Just after the election interest rates shot up from 3.6% (+/-) all the way up to 4.3% (+/-). In that moment, it seemed that there wasn't any stopping rising interest rates, and we might see 4.5% followed by 4.75% before we knew it. Now, however, things seemed to have shaken out a bit differently than anticipated (or feared) with interest rates now hovering between 4% and 4.25%. Yes, it was fantastic to have interest rates under 4% for the past year (and more) but if we stay just over 4%, I don't think they higher rates will have a significant negative impact on the buying market in 2017. | |

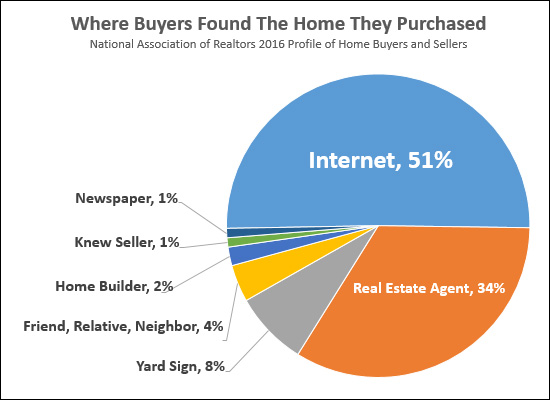

Where Buyers Found The Home They Purchased |

|

Updated numbers above! Does anything surprise you? It doesn't surprise me. Marketing your home should follow the lead of where buyers are looking for homes -- but even more importantly, where they are finding their homes. | |

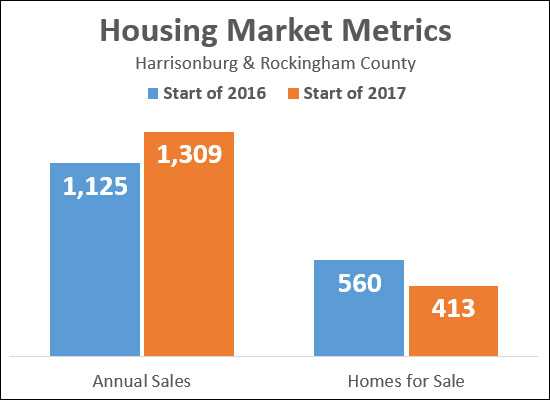

What do 2016 year end home sales mean for buyers and sellers in 2017? |

|

So -- 2016 is over, and 2017 has come. Let's use the data above to draw a few conclusions about what 2016 home sales mean for buyers and sellers in 2017.... HOME SELLERS....

Ready to buy or sell? Have questions? Just send me an email at scott@HarrisonburgHousingToday.com or call me at 540-578-0102.  And here are two handy references to prepare yourself to buy or sell a home.... | |

Does buying or leasing make more sense with a two year time frame? |

|

Does buying or leasing make more sense with a two year time frame? It depends on the price range, how much of a down payment you are making, whether you are willing to keep the property as a rental property after you move out, and many other factors. However, above I have included is a 2-year and a 3-year analysis of buying versus renting a property valued at $150K compared to $300K, which shows that....

There are, of course, plenty of extenuating circumstances. Many people might buy a $150K house (or townhouse) even if they are planning to be there for only 3 years --- because they want their own home (not their landlord's), or to get in a certain neighborhood, or because of the tax benefits, etc.

| |

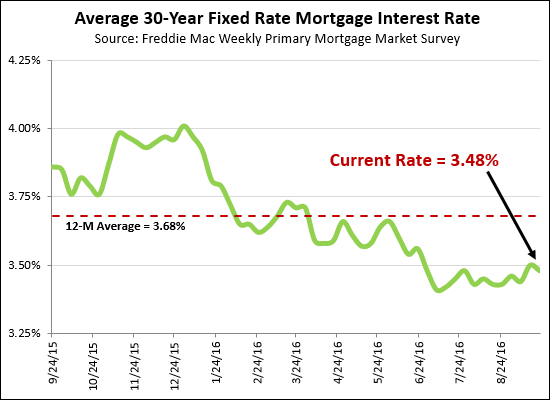

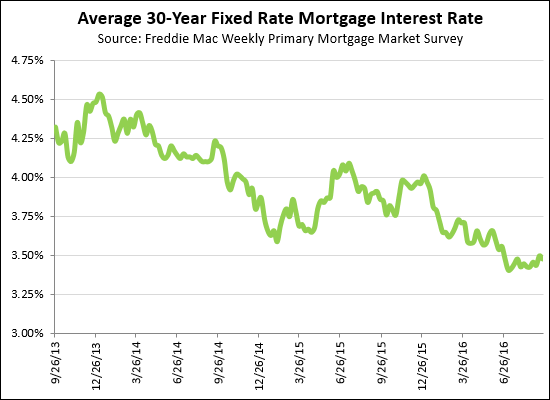

Mortgage Interest Rates Still Historically Low, For Now |

|

Mortgage interest rates were historically low a year ago, though they around 3.86%. Now, they are REALLY low, with the current average of 3.48%. But at the end of the day, they have been at or below (or just barely above) 4% for the past 12 months -- which means that it has been a fantastic year to lock in one's monthly housing costs. But, will the interest rate be rising in December or January? There is some talk that the Fed will increase the "Fed Funds Rate" in December, which could lead to an increase in mortgage interest rates. Oh, and just to put things in a slightly larger context, here is an illustration of average mortgage rates over the past three years....  | |

Is Every House Currently Listed For Sale Just As Exciting As The Next? |

|

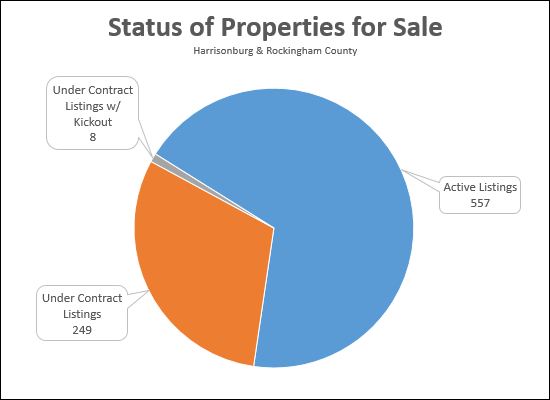

As shown above, many homes currently listed for sale have already been on the market for some time, picked over by all of the current buyers in the market. That said, it's possible that one of these homes is the PERFECT house for you, and that seller has been patiently waiting nine months for YOU, the perfect buyer for the house. As we start your home search, we'll first look through the homes currently for sale (realizing that they won't ALL be great and exciting options) and then we'll start to monitor new listings as they come on the market. | |

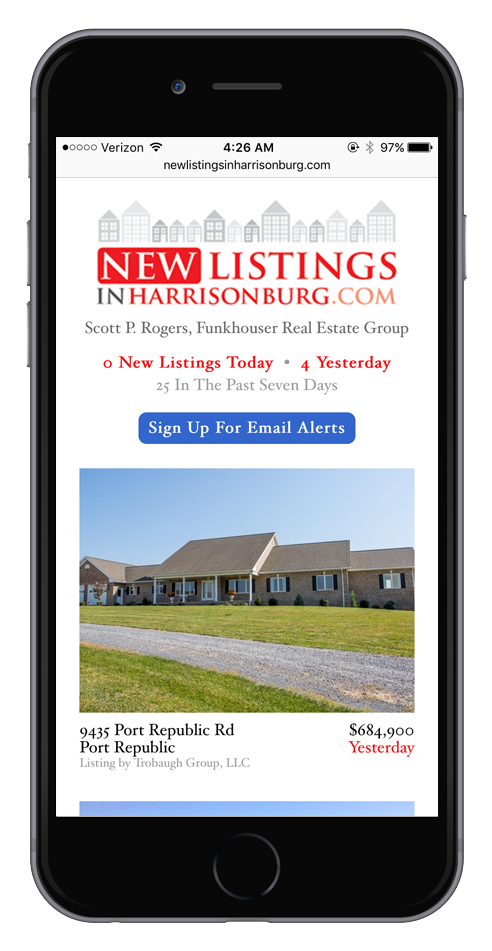

Find Out About Every New Home For Sale in Harrisonburg, Within Minutes |

|

If you are a fanatic about finding out about new listings -- especially since there aren't many houses on the market right now -- then you shoud know about NewListingsInHarrisonburg.com....  On this new-ish website, you can quickly and easily scroll through the most recent residential listings in Harrisonburg and Rockingham County, view the pertinent details, all of the photographs of the home, an area map, and then quickly and easily share that new listing with a friend, your spouse, your Realtor, etc. You can also sign up to receive an email alert every time there is a new listing....  And, finally, you can add the website to the home screen if you'd like, for quick and easy access....  If you have any questions about this new website, or suggestions for improving it, just let me know. Until then, go check it out, at NewListingsInHarrisonburg.com. | |

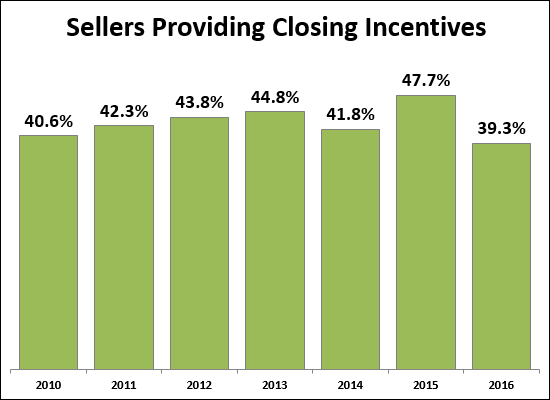

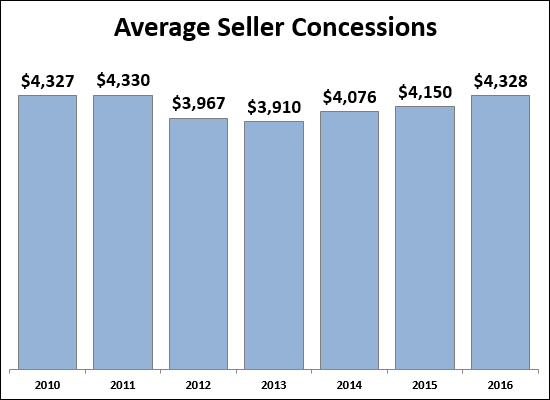

Fewer Sellers Providing Closing Cost Credits |

|

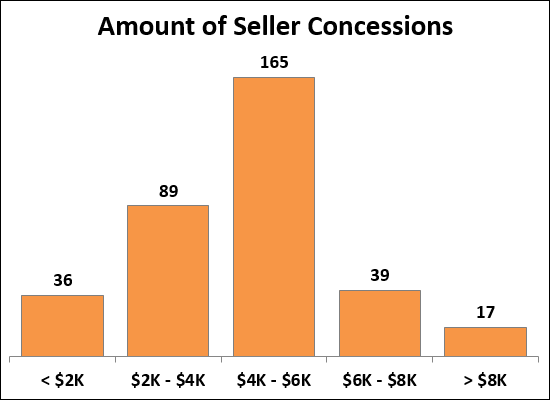

Only 39.3% of sellers have paid for a part the buyer's closing costs on home sales that have closed thus far in 2016. This marks a decline from the 47.7% of sellers who paid buyer closing costs last year. However....  As shown above, the amount of closing costs that sellers are paying is certainly increasing. The average amount of closing costs paid by a seller (when a credit was provided at all) has increased from $4,150 (in 2015) to an average of $4,328 in 2016. Also of note....  As shown above, of the sellers who are paying buyer closing costs, it is most common for them to pay between $4K and $6K towards the buyer's closing costs. So....if, as a seller, you are asked to pay the buyer's closing costs -- you are not alone (40-ish percent of sellers do) and you will likely be asked to pay $4K - $6K. | |

Should I run from houses that can only be inspected for informational purposes only? |

|

Sometimes a seller is stating this as soon as they list a property: All inspectors are for informational purposes only. But sometimes a seller will introduce this amidst negotiations. This can certainly trigger some warning signals for a buyer......but should it? Here are the top three innocent reasons why a seller would want a home inspection to be for informational purposes only....

| |

The layout (floor plan) of a home is one of the most important aspects for many buyers |

|

If a buyer is buying over $400K, or even over $300K, the layout of the home becomes very important to them. That is not to say that it is unimportant for a $200K buyer -- but someone buying a more expensive home oftentimes plans to stay in it for a longer time frame. If not the #1 feedback, the #2 feedback I receive from showings of homes priced over $400K is that the layout just didn't work for the buyers. They wanted another bedroom here, instead of there. They wanted a more open floor plan. They wanted a more formal dining room. They wanted a more spacious basement. Challengingly, the layout is something that is hard (nearly impossible) for a seller to change in order to appeal to a wider segment of buyers. Thus, if your home has a layout that continues to not work for buyer after buyer, you must either wait (and potentially wait and wait and wait) for the buyer who loves that layout -- or adjust the list price to make the house (even with its layout) more appealing to more buyers. That said, as reflected in the conversation at the top of this post -- a great deal on a house is not always enough to sway a buyer beyond the layout challenges that a house offers. | |

Should you accept a home sale contingency? |

|

Based on the analysis above, it would seem that sellers are not (in almost all cases) accepting home sale contingencies. Here's the logic....

I must say, I was quite surprised to find this to be the case --- I thought perhaps 10% - 20% of contracts might have kickout clauses (and thus home sale contingencies) because plenty of buyers have to sell before buying. It would seem that most buyers are likely waiting to make offers until they have their own properties under contract (thus eliminating the need for the kickout clause) AND/OR most sellers are not accepting offers with home sale contingencies unless the buyers' houses are already under contract (thus eliminating the need for the kickout clause). If you are a buyer, I would certainly suggest the strategy outlined above (and the only one that is apparently working with sellers right now) --- get a contract on your house and THEN make an offer on the property you would like to purchase! | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings