Buying

| Newer Posts | Older Posts |

Diving Deep Into APPRAISAL DELAYS |

|

Silly me! Appraisal delays are NOT only related to increasing sales. Teri Robinson, of Vision Appraisal Services, kindly educated me on some of the other factors that are affecting appraisal delays. In summary....

So, it's not just more than just more sales, more fully, it is.... More Sales + More Paperwork + Fewer Appraisers = Appraisal Delays Still want to read more? Keep reading, from Teri....Since the 2008 downturn and subsequent housing collapse, the turmoil in the financial industry created many burdensome regulations on the only Licensed/Certified person in the financial process (prior to Loan Officers having to be Licensed/registered).So -- I stand corrected since yesterday -- yes, higher sales volume is contributing to slower appraisal timelines -- but there are other big picture factors at work here as well. | |

High Sales Volume (GOOD) Creates Long Appraisal Delays (BAD) |

|

Most folks are pretty excited about the fantastic pace of local home sales in the first half of 2016 -- however, there is a downside. As shown above, there are three main hurdles to buying and selling a home -- the home inspection, appraisal and loan commitment. Well, right now, on many if not most of the transactions I am working with, we are experiencing significant delays on appraisals being completed. It seems that local appraisers are having difficulty keeping pace with the roaring pace of home sales. This, then, creates ripple effects as buyers and sellers are either delayed in knowing that the transaction will be successfully moving forward -- are closing dates are pushed back. Again, it's great that we're seeing so many home sales (no complaints there) but the much slower than normal timeframe for appraisals being completed is creating some real headaches for buyers and sellers. So, if you're buying (or selling) EXPECT DELAYS when it comes to the appraisal. | |

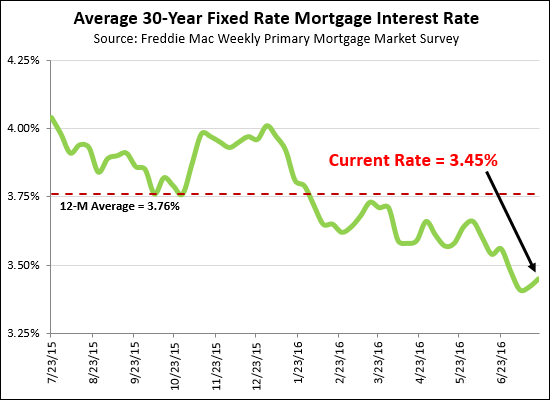

Current mortgage rates still WELL below 12 month average |

|

If I said, a year ago, that mortgage interest rates were going to rise soon --- I was WRONG!!! Current mortgage interest rates are just below 3.5%, and while I am still thinking that they could or will start to increase soon --- I would not be surprised if they are still below 4% a year from now. Buyer still have great buying power, and the opportunity to lock in super-low interest rates for the next 30 years. | |

Where to start when considering the purchase of an investment property |

|

If you are considering the purchase of an investment property, I believe the first things you need to think about are.... BUDGET How much are you able or willing to spend on an investment property? This can be determined by your financing ability, or by the amount of cash you have to put into the purchase (for the down payment or closing costs), or simply by how much of an investment in a rental property you want to make at this time. INVESTMENT GOALS Are you planning to purchase and hold this property indefinitely? Or are you looking at a five year time horizon? Based on the amount of money you are putting into the transaction (compared to how much you are financing) are you hoping to break even on a monthly basis? Are you hoping to clear $X / month in positive cash flow? What are you hoping to get in return for your investment in the short term and long term? RISK TOLERANCE Relatively early on, you will need to decide how comfortable you are with risk, particularly because the more risk you take on, the more potential reward you have for taking that risk. The easiest way to think about this (in our local investment property market) is whether you are comfortable with buying student housing -- which comes with high rental income, but also the potential for more property damage and vacancy. If we gain some clarity on your budget, your investment goals and your risk tolerance, we can then narrow the scope on which properties it will make sense for you to consider as a potential investment property purchase. | |

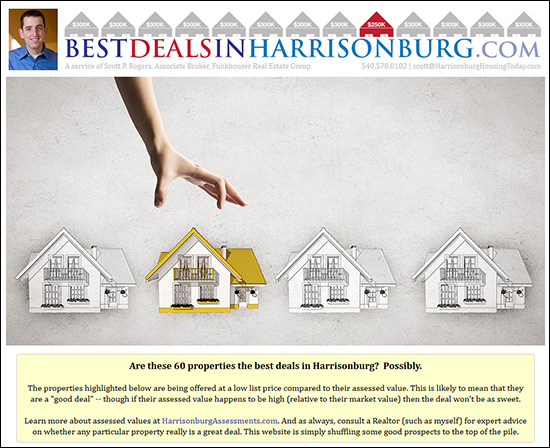

Where to find the best deals on houses in Harrisonburg |

|

One way for investors to identify the best deals in Harrisonburg is to compare the list price of each active listing to its assessed values. To make it super easy for you (and any other aspiring investors) I have created BestDealsInHarrisonburg.com which features properties that are being offered at a low list price compared to their assessed value. This is likely to mean that they are a "good deal" -- though if their assessed value happens to be high (relative to their market value) then the deal won't be as sweet. As always, consult a Realtor (such as myself) for expert advice on whether any particular property really is a great deal. BestDealsInHarrisonburg.com is simply shuffling some good prospects to the top of the pile for your consideration. What are you waiting for? Go check it out at BestDealsInHarrisonburg.com. | |

When making a low offer, accentuate your other offer terms |

|

If you are making a low offer, you can increase the appeal of your offer by strengthening your other offering terms.... DEPOSITS Make the largest deposit you are comfortable with so the seller knows you have money "on the line" and that you won't risk losing that money by attempting to walk away from the deal. CLOSING COST ASSISTANCE Sellers don't just look at the contract price --- they calculate their net proceeds based on the offer price and any credits or closing cost assistance. Only ask for assistance if you truly need it. FINANCING Provide as much detail as possible about your financing intentions, and always include a pre-approval letter. Sellers who believe you are capable of financing the purchase will be less hesitant as they consider other terms of your offer. And yes -- offer cash, a large pile of it, if you are able. :) PERSONAL PROPERTY Don't automatically ask for everything the seller intends to convey --- if you don't need them all, leave them out of the offer. Allowing the seller to keep their washer/dryer (for example) may make them more flexible in other areas. INSPECTIONS Having a professional inspect the property you are purchasing is usually a good idea; however if you only intend to do it for informational purposes, consider leaving it out of the contract negotiations and conducting it post-settlement. SETTLEMENT & POSSESSION If possible, cater your settlement date and the details of transferring possession of the property to the needs or wants of the seller. This can go a long way towards gaining seller flexibility on other contract terms. Finally, research the seller's context for selling. That information can be invaluable in negotiating a successful contract. | |

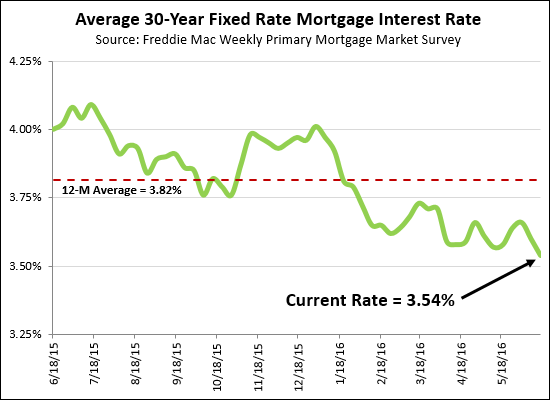

Mortgage interest rates continue to fall, now almost to 3.5% |

|

Well -- there has never been a better time to lock in an interest rate this year than RIGHT NOW! The average 30-year fixed mortgage interest rate has continued to drop over the past month, to the current average rate of 3.54%. Perhaps it's silly, but I don't even have "rates will be going up soon" as a part of my vocabulary anymore. I said that for years (because that is what everyone assumed) and I was wrong, year after year. Sure, rates would go up a bit, but they'd then come right back down a few months later. So -- buyers, rejoice! If you are buying now/soon, you can lock in a super low mortgage interest rate on your mortgage! | |

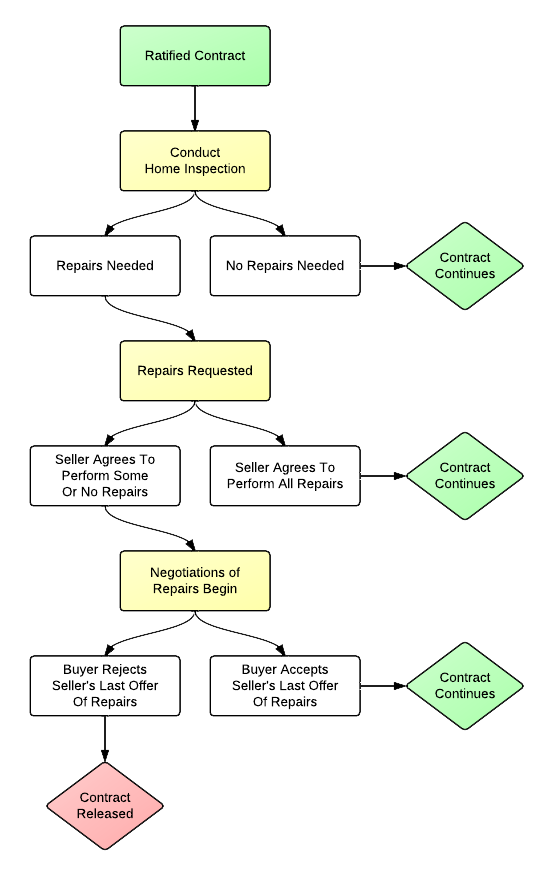

Does a seller have to make all repairs discovered via a home inspection? |

|

The short (and vague) answer is -- well, it depends on the terms of your contract. But, overall, here is how the inspection process typically flows....  As you can see above, after a buyer requests repairs (based on the home inspection) the seller can choose to make some, all or none of the requested repairs. The transaction (and negotiations) can then go in a few different directions based on that response. Learn more about the home buying process at....  | |

May was a STRONG month for showings |

|

There have been lots of showings in recent months, leading to lots of contracts -- and the latest (May 2016) data shows another strong month of showings, with 25% more showings as compared to last May. I expect this will have resulted in another strong month of contracts, which I'll verify in the next week or so with a thorough look at our overall residential sales market. Getting ready to buy a home? Learn more about the process at BuyingAHomeInHarrisonburg.com. | |

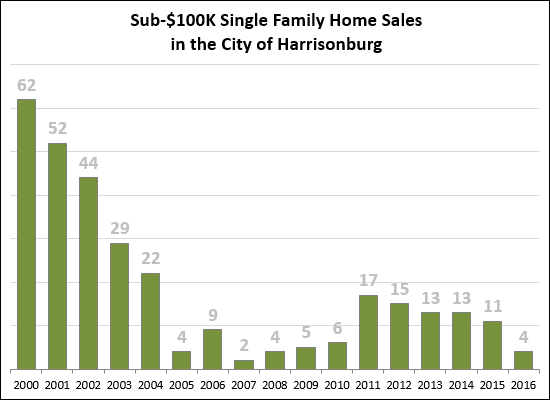

Fewer and Fewer Single Family Homes Under $100K in Harrisonburg |

|

It remains difficult to buy a single family home in the City of Harrisonburg for less than $100K. While the 2016 data point (above) is based only on the first four months of the year, it is clear that fewer and fewer detached homes are selling in Harrisonburg for less than $100K. Here are the currently available detached homes for sale under $100K in the City of Harrisonburg: search now (4 listings as of 5/4/2016) | |

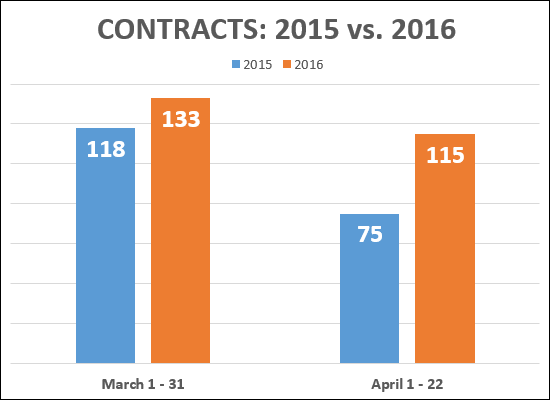

Buyers are at it again in April |

|

There were a record number of buyers (signing contracts) in March -- the 133 contracts shown above was a 13% improvement over last March, and was the highest month of March contracts on record as far as I can tell. Thus far in April, buyers are still quite active! In the first 22 days of April last year there were 75 contracts -- this year, 115 contracts! Stay tuned at the beginning of May for a final count of April contracts. | |

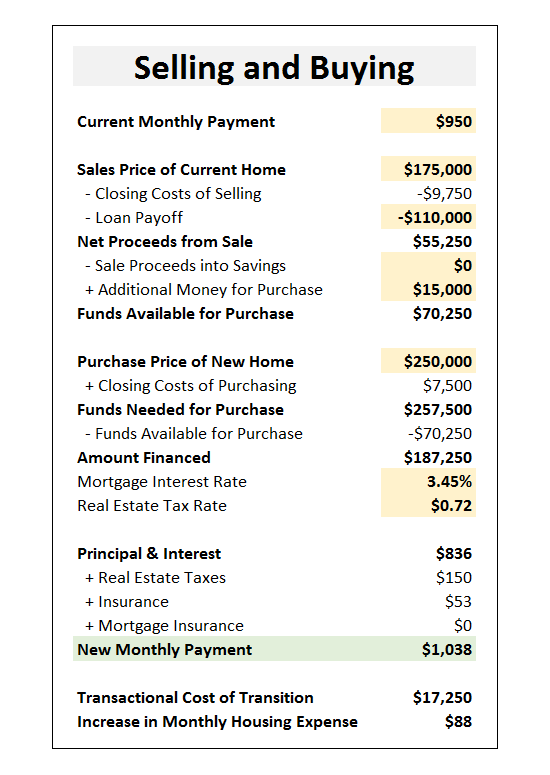

Calculating how your mortgage payment will change if you sell and buy |

|

If you will be selling your home to buy another, there are a lot of numbers floating around....

This is a spreadsheet I put together to help you think about some of these numbers....  Click here to download this worksheet as an editable Excel file. | |

Showings on the rise in March 2016 |

|

Showing activity is on the rise in March 2016 -- with 8% more showings than last March. This is after a slower December/January as compared to the same time a year ago. I anticipate that this will be a busy Spring season for our local real estate market. | |

New Loft Floor Plans at The Townes at Bluestone |

|

The Townes at Bluestone will soon feature a new floor plan -- with construction starting in the next few weeks. Previously, the floor plans at The Townes at Bluestone included:

These new "loft" floor plans will feature two large master suites on the bedroom level, plus a third level loft that could be a third bedroom (with optional bathroom), or a play room, or exercise room, or office, or so much more. Explore the pricing and floor plans for these new townhouses here. | |

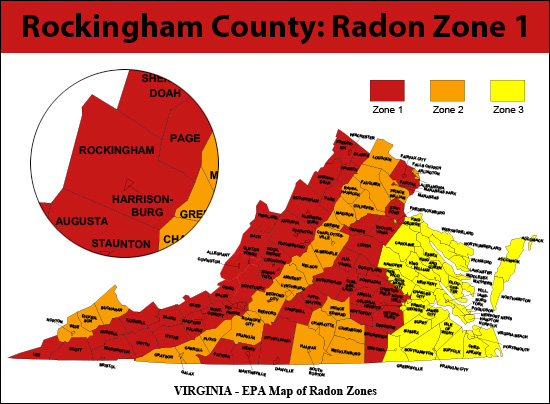

Homes with basements in and around Harrisonburg are (at least somewhat) likely to have radon |

|

As you can see above, Rockingham County is in Zone 1 -- which means we are in an area that is likely to have high radon levels. What is radon, and what does it mean for you? Read on, from the EPA.... Radon is a radioactive gas that comes from the natural breakdown of uranium in soil, rock and water and gets into the air you breathe. Radon typically moves up through the ground to the air above and into your home through cracks and other holes in the foundation. Radon can also enter your home through well water. Your home can trap radon inside.Learn more about radon and real estate here. If you are buying a home with a basement, I would recommend that you consider a radon test as a part of your home inspection process. | |

Preparing for actually making an offer on a house |

|

How, you might ask, do we go about getting from the point of wanting to make an offer --- to actually making the offer? Here's a brief overview....

When we get to step seven, above, we will be discussing and deciding on the terms of the offer. Below is a list of the main contract terms we will need to discuss in preparing to make an offer.

Before and after making an offer, there is a lot more to know about and think about regarding the home purchasing process. Read more at....  | |

If you will be buying a home soon, you should understand buyer representation |

|

If you are purchasing a home, before you call the listing agent to see that home, you should understand a bit more about buyer representation. In representing you as a buyer in your home purchase, I will be performing tasks such as:

You should also note that it is possible that you will fall in love with a property where I already represent the seller. As we tour homes, I will tell you whenever I represent the seller of a property we are viewing. If you want to make an offer on such a home, we'll have two options:

Each year, I have multiple buyers who choose each option. Some buyers choose Option #1, because they want advice and guidance on pricing and negotiations. Some buyers choose Option #2, because they intend to make all negotiating decisions independently. If you decide you want to purchase one of my listings, we will discuss and determine a new game plan. Of note - my compensation for representing you will be paid by the seller's real estate company or by the seller. Beyond buyer representation, there is a lot more to know about and think about regarding the home purchasing process. Read more at....  | |

The Three Main Hurdles when Buying (or Selling) a Home |

|

While every home sale is different -- with unique contingencies based on the needs and situations of the buyer and seller -- there are three main hurdles that most buyers and the houses they are purchasing must clear to make it to closing. INSPECTION - This is an evaluation, by a home inspector, of the condition of the house. Clearing this hurdle typically involves requesting that the seller make some repairs to the house (or negotiate further on price) based on new information about the property condition discovered during the inspection process. APPRAISAL - This is an evaluation, by an appraiser hired by the purchaser's lender, of the value of the house. If the property appraises for the contract price (or higher), all is well -- otherwise, the buyer and seller may need to renegotiate the contract price based on the appraised value. LOAN APPROVAL - This is an evaluation, by a lender (and their underwriters) of the purchaser's financial situation. The lender must confirm that the buyer has the income to support the mortgage payment required for purchasing the home. Again - there are many other smaller hurdles (for example, a termite inspection) and larger hurdles (for example, a home sale contingency) that may need to be cleared in your purchase (or sale) of a home -- but these three main hurdles (inspection, appraisal, loan approval) are the three main mileposts during the contract-to-closing process that we'll be focused during the transaction. | |

So.... 65% of Home Buyers Compromise, Will You? |

|

The odds are, you'll have to compromise on SOMETHING when you are buying your next home. The question becomes -- what are you you willing to compromise on? The easiest (at first) sometimes seems to be price -- you still get everything you want, you just have to pay more for it. But if you're drawing a firm line on price, then likely some other need or want will have to be imagined differently. Here is what buyers tend to compromise on based on the the 2015 Profile of Home Buyers and Sellers from the National Association of Realtors....  | |

Winter can be the best time to purchase an investment property |

|

Many of my savvy investor clients wait for the winter months to acquire additional rental properties. Their reasons are pretty logical....

Of note -- this advice is most applicable to townhouse properties that might be purchased by investors or owner occupants. This does not necessarily apply to multi-family properties or student housing properties. If you are looking for some advice on how to get started with real estate investing, check out HarrisonburgInvestmentProperties.com. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings