| Newer Posts | Older Posts |

How to buy a foreclosure in Harrisonburg |

|

With some regularity, I am asked by potential purchasers how they would go about buying a foreclosure. First, here is a list of upcoming foreclosure sales, but more importantly, below is a description of a few ways to buy what you might be thinking of as a foreclosure. SHORT SALES: Some homeowners must sell their home, but market conditions won't allow them to sell it at a high enough price to be able to pay off their mortgage(s). In this example, a homeowner might have a $250,000 mortgage balance but can only sell the property for $230,000. As a prospective buyer, it is sometimes possible to purchase this type of a property through a process called a "short sale." In such an arrangement, the homeowner petitions their lender to accept less than the full payoff of the mortgage and in return to still release the deed of trust so that ownership of the property can be transferred over to you, the new owner. This can benefit the lender, as they skip the time delays and cost of the foreclosure process. This can also benefit the homeowner, as a short sale will have a slightly lesser negative impact on their credit as compared to a foreclosure. As a buyer, however, you must know that there are challenges to buying a property as a short sale. The biggest challenges of late seem to be the uncertainty of the purchase and the time table. Even if you and the homeowner agree to a price of $230,000, the homeowner's lender must still agree to accept that price – since it won't allow the homeowner to pay off their $250,000 mortgage balance in full. This process of waiting to hear back from a lender, and then complying with all of their various terms can sometimes take 60 to 120 days – or longer! Visit HarrisonburgShortSales.com for a list of potential short sale properties currently on the market. TRUSTEE SALES: If a short sale does not take place, and a homeowner is behind on their payments (or not making them at all), eventually the property will be sold by the lender on the courthouse steps. Buying a property at a "trustee sale" can be exciting, and can be a great opportunity – but there are challenges as well. If a property to be sold at a trustee sale is also listed for sale with a Realtor, you can usually view the property ahead of time by calling your Realtor. Otherwise, you will likely not have the opportunity to see inside the property before the trustee sale, and thus you will not know too many details about the condition of the property. Furthermore, your purchase of the property at the trustee sale cannot be contingent upon viewing the property, or inspecting the property. In this instance, you are purchasing the property in "as is" condition, regardless of what you then find out about the property. It is also important to note that many times the lender will have an opening bid at the trustee sale that is close to (or sometimes higher than) the amount that they are still owed on the mortgage. Thus, in the example above, they might make an opening bid of $250,000. As a result of this opening bid process, many (or most) properties available for purchase at a trustee sale are not great opportunities. Occasionally, a property will be foreclosed upon that has had a mortgage in place for many years, whereby the balance of the mortgage is much lower than current market value – these are great opportunities for a buyer. Visit HarrisonburgForeclosures.com for a list of upcoming trustee sales. BANK OWNED PROPERTIES: If you don't buy the property before the auction (as a short sale), and don't buy it at the trustee sale, you'll have a third opportunity to buy it once the bank owns it. These properties are called "bank owned properties" or REO properties ("real estate owned"). Oftentimes, the prices on these properties are quite realistic, if not under market value. It would not be atypical for a house such as the one mentioned above to come on the market after the trustee sale at a price of $210,000. In such an instance, you should expect to be buying the property in "as is" condition, and you will also be buying with a slightly different contract document. Most lenders have a long standard contract or contract addendum that spell out a variety of additional contract terms designed to protect them from any future liability – and rarely will a lender agree to have these contract documents changed in any way. As you can see above, oftentimes buying the property as an REO property is where the best opportunity lies. Visit HarrisonburgREO.com for a list of bank owned properties currently on the market for sale. When a home goes into foreclosure it is often for very sad and unfortunate reasons – such as the loss of a job – and I do not wish such circumstances on any homeowner. However, if you are a buyer in today's market it is important to be familiar with different methods for buying a property when it will be, is being, or has been foreclosed upon. | |

December 2015 Harrisonburg Housing Market Report |

|

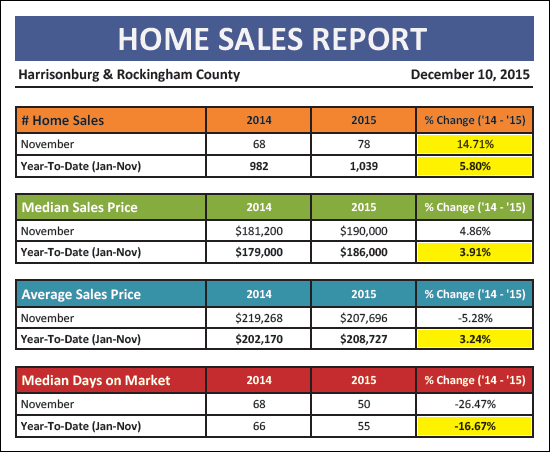

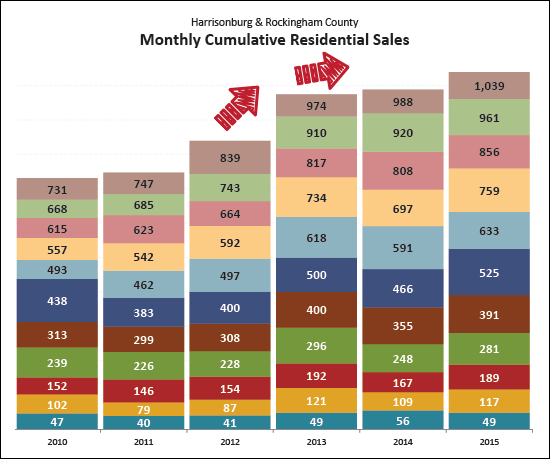

Learn more about this month's Featured Property: 6600 Lawyer Road I just published my monthly report on the Harrisonburg and Rockingham County real estate market. Jump to the full online market report, or download the PDF, or read on for highlights....  There is plenty to be excited about in this month's report on our local housing market....

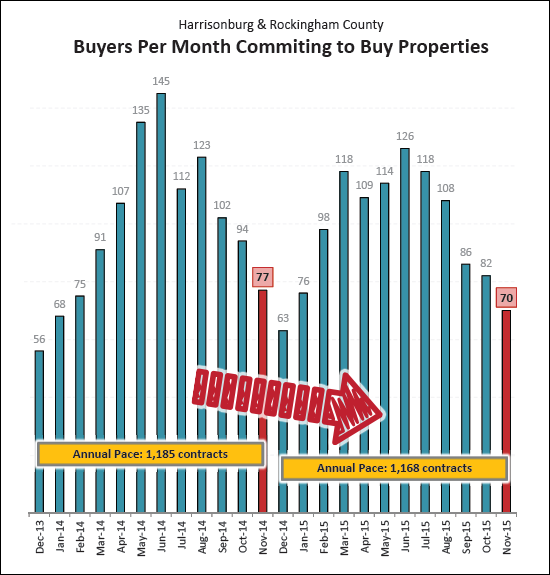

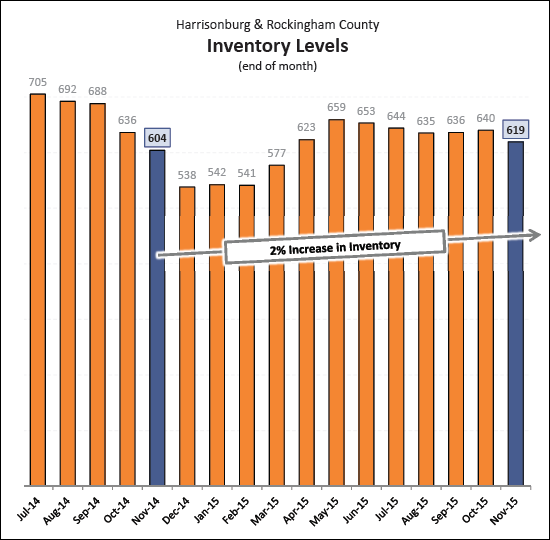

Home sales are piling up in 2015 -- as shown above, the 1,039 home sales we have seen between January and November this year is well above the number of home sales seen anytime in the previous five years.  The pace at which buyers are signing contracts to buy real estate is often an excellent indicator of the future sales performance of our local market. Curiously, we are seeing fewer people signing contracts in the most recent 12 months (1,168) as compared to the previous 12 months (1,186). Since closed sales are increasing, this likely means that more contracts are making it successfully to closing.  Inventory levels are both up, and down. There are actually 2% more homes on the market now as compared to a year ago -- however, inventory levels have dropped by 6% over the past six months, as is typical for this time of year. OK, that's it for now. You can read further commentary in coming days on my blog, HarrisonburgHousingToday.com, or dive right into the full market report, which you can read online or download as a PDF. And as is always my encouragement -- if you will be buying or selling a home in the near future, become a student of the housing market! Learn what has been happening recently, what is happening now, and what is likely to happen next. Being informed will allow you to make better real estate decisions. If you are ready to buy or sell a property in Harrisonburg or Rockingham County, contact me at 540-578-0102 or scott@HarrisonburgHousingToday.com to get the process started. | |

Resources for Buying and Selling Real Estate in Harrisonburg and Rockingham County |

|

Much of my time and energy in real estate is dedicated to working with buyers and sellers on their real estate goals. However, I also spend additional time analyzing our local real estate market and creating online resources to assist everyone in our community. Why do I spend time compiling all of this information? I believe that home buyers and sellers can make the best decisions with a detailed understanding of our local real estate market. I hope the resources I have created are helpful to you in understanding our real estate market as you consider buying and selling real estate. You can now find a compilation of all of these resources for buying and selling real estate in Harrisonburg and Rockingham County online at HarrisonburgRealEstateResources.com. | |

86 out of 100 buyers are buying for less than $300K |

|

Looking at home sales in the past year we find that....

Clearly, that also means that only 6% of our local market is comprised of home sales over $400K. All of this points towards our YTD median sales price of $186K. | |

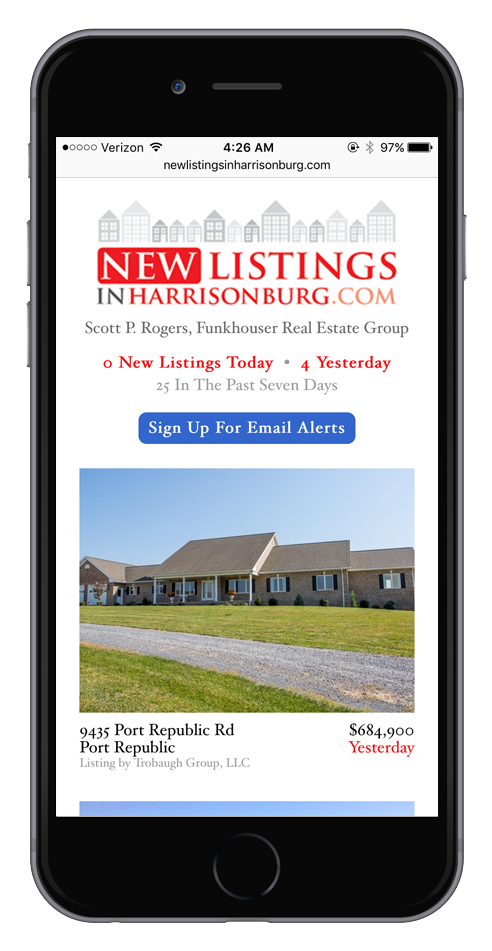

Find New Listings Fast |

|

Just a reminder, for anyone who missed it.... NewListingsInHarrisonburg.com allows you to quickly and easily scroll through the most recent residential listings in Harrisonburg and Rockingham County, view the pertinent details, all of the photographs of the home, an area map, and then quickly and easily share that new listing with a friend, your spouse, your Realtor, etc. You can also sign up to receive an email alert every time there is a new listing....  If you have any questions about this new website, or suggestions for improving it, just let me know. Until then, go check it out, at NewListingsInHarrisonburg.com. | |

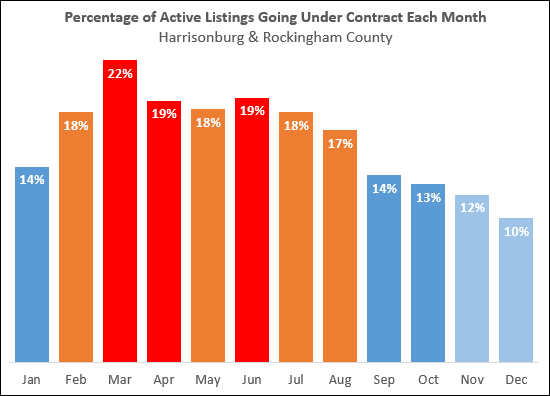

What is the worst month to sell your home? |

|

Sorry for the bad news -- but it seems that December is the worst month to sell your home -- as the lowest percentage of active listings are likely to go under contract in December as compared to any other month of the year. The graph above examines what percentage of active listings have gone under contract in each of the past12 months -- thus, accounting for both fluctuation in buyer activity as well as fluctuation in inventory levels. | |

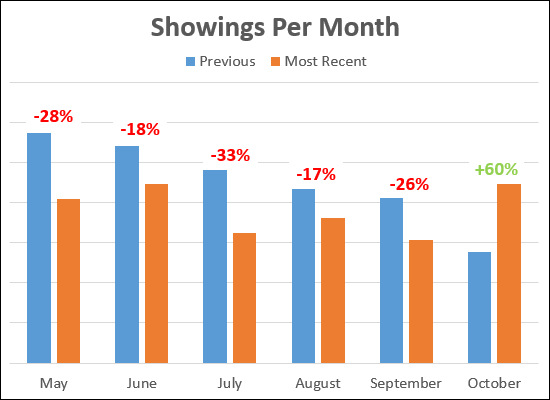

Showings strong in October after many slow months |

|

Looking at the graph above, you might not guess that home sales are up 5% year-over-year. But they are. Showings, however, as shown above, have been quite slow in many recent months. There were fewer showings in May, June, July, August and September as compared to the same month the previous year - yet despite this, home sales increased. October was a breath of fresh air, as showings increased dramatically (+60%) as compared to last year. | |

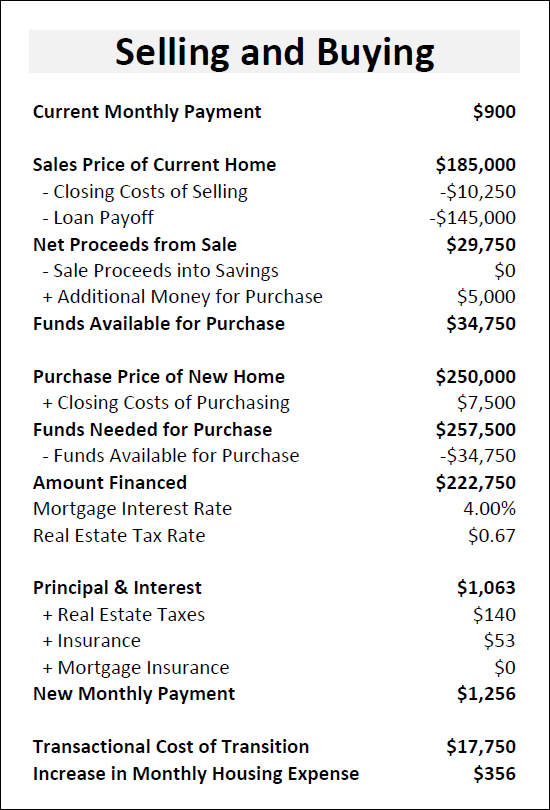

Running the numbers of selling and buying |

|

If you're selling your current home to buy a new one, you may be wondering....

So many questions -- all very helpful to think through, calculate and discuss. The worksheet above can help you think through those numbers -- and it is available here as an editable Excel file. Enjoy! | |

Introducing NewListingsInHarrisonburg.com |

|

Over the past few months, many of you have pointed out that none of the local real estate websites offer a quick and easy way to check on recent listings, particularly on your phone or tablet. That's where NewListingsInHarrisonburg.com comes into play....  Now you can quickly and easily scroll through the most recent residential listings in Harrisonburg and Rockingham County, view the pertinent details, all of the photographs of the home, an area map, and then quickly and easily share that new listing with a friend, your spouse, your Realtor, etc. You can also sign up to receive an email alert every time there is a new listing....  And, finally, you can add the website to the home screen if you'd like, for quick and easy access....  If you have any questions about this new website, or suggestions for improving it, just let me know. Until then, go check it out, at NewListingsInHarrisonburg.com. | |

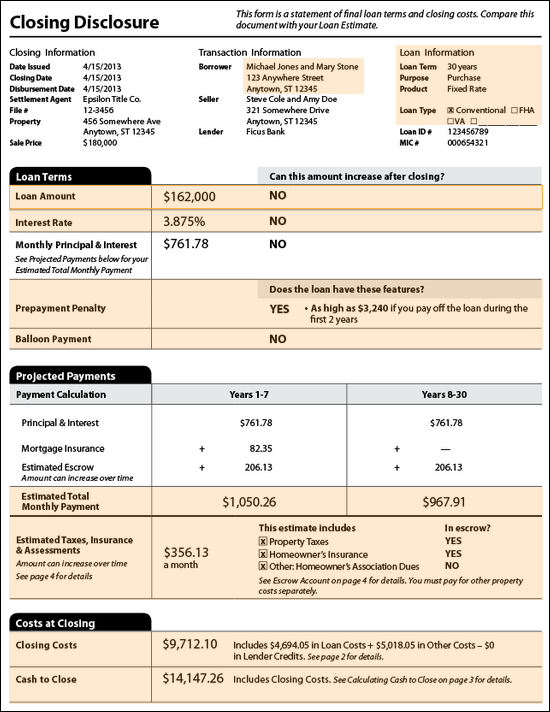

After 29 years (?) the Settlement Statement changes |

|

The settlement statement (or HUD-1) that every buyer and seller has signed in every closing that I've been a part of (since I started my career in 2003) has always been the same. And that document is labeled "REV.HUD.1 (3/86)" at the bottom -- so I'm assuming that the form has been around (unchanged??) since 1986. But no longer! Now, instead of a "Settlement Statement" or "HUD-1" there will be a "Closing Disclosure" to be reviewed and signed at closing. The image above is the first of five pages of this new document. Learn all about this new document over here, at the Consumer Financial Protection Bureau. | |

How much can you spend versus how much you want to spend |

|

Most folks who buy a home this year will not be paying cash. An important early stage of the home buying process is to talk to a lender to become pre-approved for a mortgage. As you meet with a lender, remember that there is often a difference between:

If you are looking for a qualified mortgage professional, I would recommend that you contact one of the individuals listed below. Most of my buyer clients work with one of these lenders:

Learn more about the home buying process at BuyingAHomeInHarrisonburg.com. | |

Introducing BuyingAHomeInHarrisonburg.com |

|

If you are thinking about buying a home in Harrisonburg or Rockingham County, you now have another resource to use to learn about the home buying process. Check out BuyingAHomeInHarrisonburg.com where I offer an overview of the home buying process as well as information about....

Check out BuyingAHomeInHarrisonburg.com and let me know if you have any further questions about buying a home, or if you have ideas for how to make this an even more helpful resource for home buyers. | |

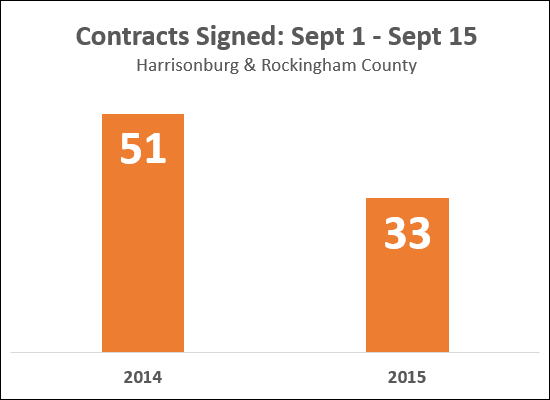

Surprisingly, September Sales Seem Somewhat Sluggish |

|

OK, admittedly, the month is only halfway over at this point, but thus far, buyers have been signing contracts at a slower pace than last September. Last September, 51 buyers had signed contracts in the first 15 days of the month -- this September, only 33 buyers have done so. Hopefully we will see some renewed buying activity in the last two weeks of September. | |

We should talk through the numbers |

|

There are a lot of numbers to calculate, understand and discuss if you are considering selling your home -- especially if it will involve then purchasing a new home....

Many of these questions are interrelated, some require talking to a loan officer, and all of them are questions that should be discussed and considered before we put your house on the market. I want you to have a clear view of the big picture financial transition you will be making if you decide to sell your current home and buy a new one. This conversation can happen at my office, at your home, or at a coffee shop of your choosing. You don't need to have come to the conclusion that you will definitely be selling in order for us to have these conversations -- let's start chatting to help you determine whether a move now makes sense, given all of the pertinent numbers and details. | |

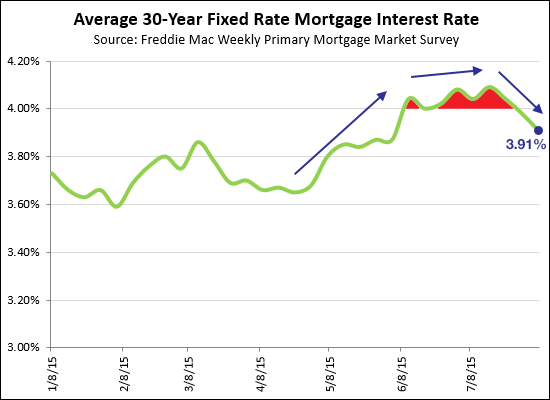

30 Year Mortgage Interest Rates Dip Below 4%, Again |

|

Home buyers enjoyed mortgage interest rates below 4% for the first five months of this year -- and they even dropped as low as 3.6% in February. But after rates started rising in mid-April, they did not stop at 4% -- they kept on rising, and stayed largely above 4% for much of June and July. But no longer! Just when you thought mortgage interest rates were going to keep on climbing, to 4.5%, 5%, 5.5%, 6% and beyond -- they dropped again! The average mortgage interest rate for a 30 year fixed rate mortgage has again been below 4% for the past two weeks. Despite numerous false alarms of interest rates getting ready to go up, up, up over the past few years -- it still has not happened. I'm sure the rates will eventually go up, and yes, that will affect your monthly payment relative to your home's purchase price -- but for now, we can continue to enjoy these super (super) low interest rates below 4% -- yet again. | |

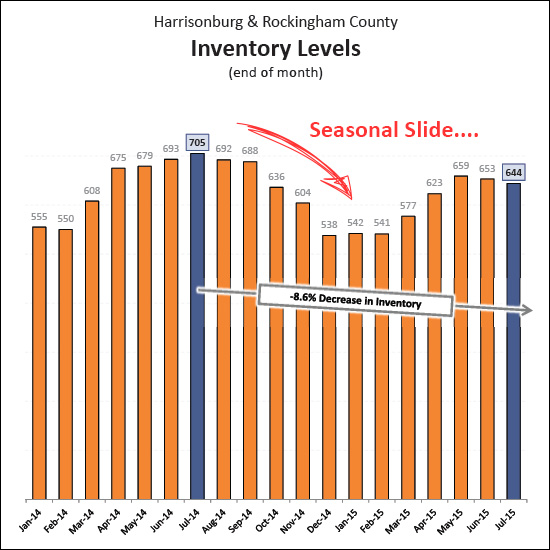

Inventory Levels Headed Down For The Winter |

|

Wait... what?? Inventory levels are headed down... for the winter?? Yep, in some ways, we're already in that seasonal decline. Inventory levels have declined over the past 60 days, and are likely to continue to decline from now until next March based on seasonal trajectories of past years. Furthermore, there is an 8.6% year-over-year decline in inventory levels, further limiting the number of homes that are on the market. BUYERS: If you want to buy a home in the next three to six months, you likely have more options now than you will have in a month, and in another month, and the next after that. SELLERS: While we'll see fewer buyers in the Fall (and then the Winter) those buyers will have fewer and fewer buying options since inventory levels are declining. As such, the declining inventory levels work to your benefit -- giving you fewer sellers to compete with. | |

Most Sellers Provide Buyers With Closing Cost Credit |

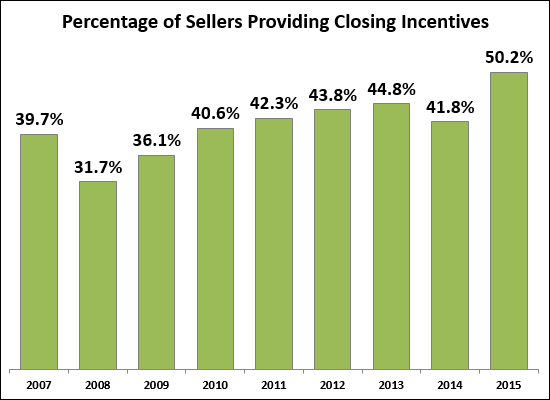

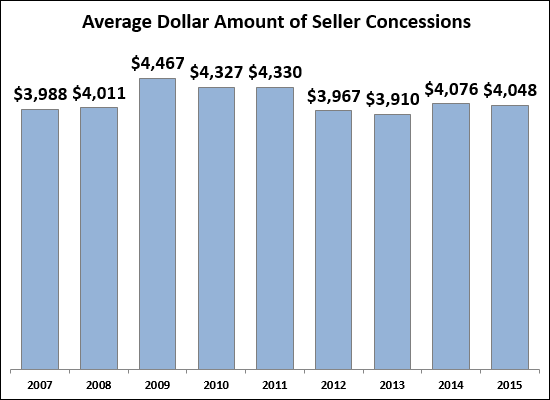

|

Just more than half (0.2% more than half) of sellers in 2015 have paid for some or all of the buyer's closing costs via a credit at settlement. This is an increase over previous years, particularly over 2014.  The average amount of that closing cost credit is not increasing -- it is still hovering around an average of $4,000. Of note -- that means that quite often the closing cost credit is higher than $4,000. So, is a seller paying a buyer's closing costs something that is normal, to be expected, likely to happen if you are selling your home? Yes, certainly so! Expect it, and be ready to negotiate offers accordingly. | |

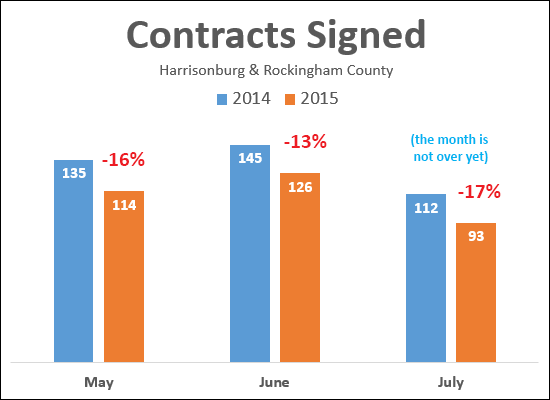

Contracts Still Slow in July 2015 |

|

There were 16% fewer contracts in May 2015 as compared to in May 2014. There were 13% fewer contracts in June 2015 as compared to June 2014. Thus far, July 2015 is also lagging behind July 2014 -- by 17% -- though we still have a few more days for deals to stay together. These slower months of contract activity will eventually, inevitably, lead to slower months of closed sales as well. | |

The Great East West Divide of Harrisonburg (and Rockingham County) |

|

click here to view this map as a larger image A few questions for ya....

EAST: Most of the residential development over the past 15 to 20 years has been on the East side of Harrisonburg, in the general vicinity of the new hospital. This makes it an exciting place to live -- for some people. There are many newer developments where homes have recently been built, and there are newer commercial destinations (Stone Port, Martin's grocery store, Target, etc) all on the East side of town. But this also makes it a bit more hectic for getting around. Of note, there is also plenty of outbound traffic East of town, towards Massanutten, Elkton, Charlottesville, etc. WEST: There hasn't been as much residential development West of Harrisonburg over the past 15 to 20 years (other than Belmont and Monte Vista Estates) and this is just fine with most people who live on the Western side of Harrisonburg. Things are a bit calmer, without as much hustle and bustle, and in some cases with more established neighborhoods. The towns of Dayton and Bridgewater end up falling into this side of town as well for many people. I am not doing justice to all of the differences between the East side of town and the West side of town, but I believe that most people in this area are oriented towards one side of town or the other, for very specific reasons. Furthermore, most people who have spent any considerable amount of time living on one side of Harrisonburg likely wouldn't think about moving over to the other side of Harrisonburg. | |

Are sellers accepting home sale contingencies? |

|

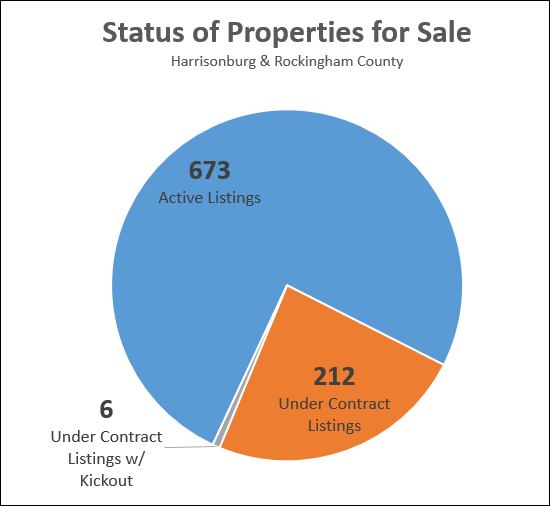

Based on the analysis above, it would seem that sellers are not (in almost all cases) accepting home sale contingencies. Here's the logic....

I must say, I was quite surprised to find this to be the case --- I thought perhaps 10% - 20% of contracts might have kickout clauses (and thus home sale contingencies) because plenty of buyers have to sell before buying. It would seem that most buyers are likely waiting to make offers until they have their own properties under contract (thus eliminating the need for the kickout clause) AND/OR most sellers are not accepting offers with home sale contingencies unless the buyers' houses are already under contract (thus eliminating the need for the kickout clause). If you are a buyer, I would certainly suggest the strategy outlined above (and the only one that is apparently working with sellers right now) --- get a contract on your house and THEN make an offer on the property you would like to purchase! | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings