| Newer Posts | Older Posts |

How many homes will you have to choose from? |

|

If you are entering the market to buy a home, the number of homes you will have to choose from will vary widely based on what you are looking for in a new home. Some buyers have a very narrow scope and find themselves on a prolonged hunt for what seems to be an elusive or mythical home. Some buyers find plenty of options, evaluate quite a few, make a decision and move forward with an offer.  As you consider the over 600 homes currently on the market for sale, keep in mind that some of them have been on the market for 3 months, 6 months, 9 months or even longer. The freshest of fresh listings are those that have come on in the past 30 days -- which (this time of year) is only around 100 - 125 homes out of the 600+ current listings for sale. Depending on your time frame for buying, and the narrowness of your scope, sometimes it makes sense to quickly evaluate the current options -- and then to wait and see what new and exciting listings will be coming on the market in coming days and weeks. Steps to get started include talking to a lender to get a sense of your target price range, and then chatting with me (in person, by email, by phone) so that I can also be keeping an eye out for suitable properties for you. | |

Layout is a very important factor, especially in an expensive home |

|

If a buyer is buying over $400K, or even over $300K, the layout of the home becomes very important to them. That is not to say that it is unimportant for a $200K buyer -- but someone buying a more expensive home is oftentimes planning to stay in it for a longer time frame. Back in the red hot market of 2004-2008, this did not matter as much -- inventory was low, buyers were happy to just get a house at all -- but that has changed. Now days, buyers are assuming that they may want to (or have to, if prices aren't increasing over time) stay in their home for quite a while. As a result, they want a layout that works really well for their family. If not the #1 feedback, the #2 feedback I receive from showings of homes priced over $400K is that the layout just didn't work for the buyers. They wanted another bedroom here, instead of there. They wanted a more open floor plan. They wanted a more formal dining room. They wanted a more spacious basement. Challengingly, the layout is something that is hard (nearly impossible) for a seller to change in order to appeal to a wider segment of buyers. Thus, if your home has a layout that continues to not work for buyer after buyer, you must either wait (and potentially wait and wait and wait) for the buyer who loves that layout -- or adjust the list price to make the house (even with its layout) more appealing to more buyers. That said, as reflected in the conversation at the top of this post -- a great deal on a house is not always enough to sway a buyer beyond the layout challenges that a house offers. | |

Balancing what you can afford with what you want to pay |

|

An important part of getting ready to buy a home is to talk to a mortgage lender (ask if you need recommendations) to find out how much money they will lend you to purchase a home. Lenders have a variety of calculations that they perform to determine how much money they will lend you -- most related to the highest percentage of your income that they are comfortable with having you spend on housing. However -- this does not always mean that you should borrow as much as you possibly can. Spending the most on a house that your lender would be comfortable with may not make you comfortable -- as it would then reduce the amount of money in your monthly budget that you could use for vacations, retirement savings, college savings, and so much more. Check with your lender to find out how much of a home you CAN afford to buy -- but then decide how much you WANT to buy. | |

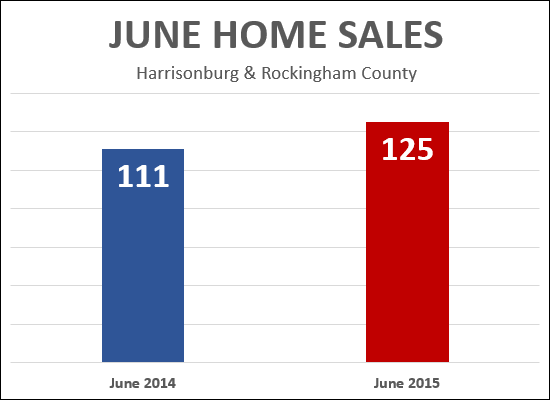

Go ahead, set off those fireworks, June 2015 home sales were hot, hot, hot |

|

Despite having fewer showings in May/June and fewer contracts in June, it looks like June 2015 was a great month for (closed) home sales. With a few more sales likely to trickle in over the next few days, June 2015 home sales are already showing a 13% improvement over last June. Stay tuned for more analysis in the days to come.....and Happy Independence Day! | |

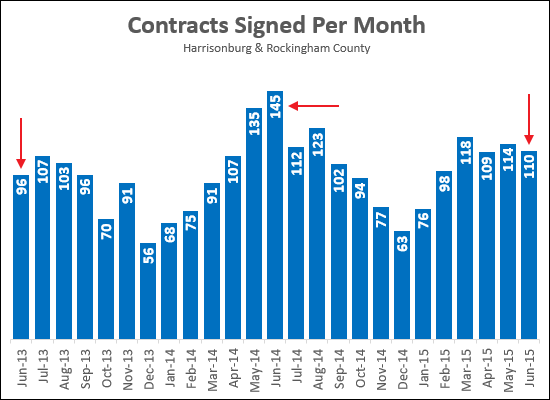

Another month of 100+ contracts |

|

June 2015 will be the fourth straight month with 100+ contracts being signed by buyers in Harrisonburg and Rockingham County. In 2014, we saw 100+ contracts every month between April and September. In 2015, the 100+ months started in March. It seems unlikely that we will hit the high of 145 contracts that we saw in June 2014 this month, but we'll double check again in a few more days. | |

Maximize strength of other offer terms when making a low offer |

|

If you are making a low offer, you can increase the appeal of your offer by strengthening your other offering terms.... DEPOSITS Make the largest deposit you are comfortable with so the seller knows you have money "on the line" and that you won't risk losing that money by attempting to walk away from the deal. CLOSING COST ASSISTANCE Sellers don't just look at the contract price --- they calculate their net proceeds based on the offer price and any credits or closing cost assistance. Only ask for assistance if you truly need it. FINANCING Provide as much detail as possible about your financing intentions, and always include a pre-approval letter. Sellers who believe you are capable of financing the purchase will be less hesitant as they consider other terms of your offer. And yes -- offer cash, a large pile of it, if you are able. :) PERSONAL PROPERTY Don't automatically ask for everything the seller intends to convey --- if you don't need them all, leave them out of the offer. Allowing the seller to keep their washer/dryer (for example) may make them more flexible in other areas. INSPECTIONS Having a professional inspect the property you are purchasing is usually a good idea; however if you only intend to do it for informational purposes, consider leaving it out of the contract negotiations and conducting it post-settlement. SETTLEMENT & POSSESSION If possible, cater your settlement date and the details of transferring possession of the property to the needs or wants of the seller. This can go a long way towards gaining seller flexibility on other contract terms. Finally, research the seller's context for selling. That information can be invaluable in negotiating a successful contract. | |

Home Warranties for Buyers and Sellers |

|

Click here to download the full information packet on home warranties from American Home Shield -- or read on for more details.... What is a Home Warranty? It's a one-year service agreement that covers the repair or replacement of many major home system components and appliances that typically breakdown over time due to normal wear and tear. Homeowners Insurance and a Home Warranty - What's the Difference? You sensibly protect your house with homeowners insurance. While homeowners insurance covers many appliances and system components in the event of a disaster (such as a fire), having an AHS® Home Warranty will cover those items against the high costs of repair or replacement in the event a breakdown occurs. Who is AHS? The leader in home warranties, AHS was founded in 1971 to help homeowners across the country protect their hard-earned investments. Recognized with the 2013 Best in Service Award from HomeWarrantyReviews.com and the 2014 Women's Choice Award, our customer service is well-respected, with professional agents ready 24/7 to accept your service requests. AHS Home Warranty Packages There are three AHS Home Warranty packages available during the real estate transaction, making it easy for you to get exactly the coverage you need, at a price you can afford. ShieldEssentialSMAHS offers the same high level of coverage across all three packages, such as repairs and replacements for mismatched systems, undetectable pre-existing conditions, improper installations, lack of maintenance, rust and corrosion, and more. Click here to download the full information packet on home warranties from American Home Shield. | |

How to buy a house (everything leading up to moving day) |

|

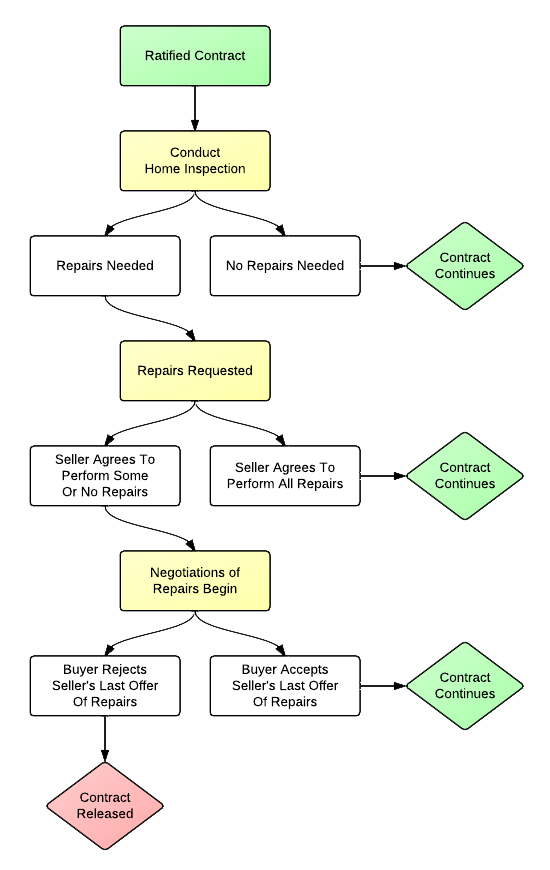

Purchasing a home can be fun, exciting, thrilling, and fulfilling….but that very same process can also have its moments of being hard, frustrating, disappointing and overwhelming. In my role as a Buyer's Agent, I will be working with you through the entire home buying process to make it as educational and stress-free as possible. The very first step in this process is for us to discuss your needs, goals, dreams and desires. This may involve specifics such as the number of bedrooms and bathrooms, or may focus more on the layout of homes, the feel of a neighborhood, and the long term plans for your growing family. I will be focusing on listening well, and hearing what it is you are working to achieve with our home purchase – and then helping to identify the best housing options for accomplishing those goals. An important, parallel, part of starting the home buying process is to identify a target price range. This can best be determined through consultation with a reputable, local mortgage lender (just ask… I know who they are) but will involve more than just determining the highest priced home that they would allow you to purchase. It will be important to consider both your purchasing power, and your goals for how your housing costs will fit into your overall budget. You will also talk with your mortgage lender about how different loan programs might work better (or worse) for your situation. Once we have a shared understanding of what you are hoping to purchase, and we know what the price tag can and should look like, we can start to evaluate homes that are currently on the market. This will usually start online, perhaps through an exchange of emails, and saving some searches in your account on my web site. Then, you might choose to drive by some of the prospects before determining a list of homes to go view – or you may be ready to start seeing all of the homes on the list right away. As we view this first set of homes, we will learn a lot – about the opportunities in the market, and about your preferences. If we don't identify a home after looking at all of the homes on the market that seem to offer what you are looking for in a new home, we will either re-evaluate our criteria to expand our search, or we will wait to view new listings that come on the market. This extended home search process might take us weeks, or months, depending on the type of property you are hoping to purchase, and how often such a property becomes available. All along the way, I'll be following up on previous homes we have viewed to let you know if their prices have dropped, and will be letting you know of new opportunities as soon as those houses hit the market. Once we have identified the home you are hoping to purchase, we will prepare to make an offer. This will include researching similar home sales to guide our discussions of price, creating a negotiation strategy, and preparing and reviewing the pertinent contract documents. There is quite a bit of paperwork involved in making an offer on a home, and I want to make sure that you understand these contract documents and make sure that we have drafted them in a way to protect your best interests. Negotiating the final deal on the property you purchase may take a few hours, or a few days. We may go back and forth with the seller on price alone, or on many terms of the contract such as timing, contingencies, and more. Once we have a final agreement, all parties will sign and initial the final documents, and we will have a full ratified contract. Immediately following the ratification of the contract, we will need to schedule and perform a home inspection and radon inspection (assuming you are conducting both) to learn more about the property you are purchasing. If these inspections reveal new (detrimental) information about the property, we will have the opportunity to request that the seller make repairs to the property, which may result in a renegotiation on price. Typically, we are able to work through this second round of negotiations relatively quickly, so long as the seller is being realistic and rational given the new information about their property. Simultaneously with conducting these inspections, you will need to be starting the financing process to work towards obtaining full loan approval. This will start with signing your loan application and paying any applicable loan application or appraisal fees. Your lender will then be diligently working to further qualify you as a purchaser as well as the property via an appraisal. You will be providing many documents to your lender during this process as they work towards securing a loan for you to purchase the property. Within the first few weeks after your contract is in place, we will need to select service providers to coordinate the additional aspects of your home purchase. This will include a settlement agent or attorney who will conduct a title search of the property and prepare all documents for your settlement. You will also need to set up a new homeowners insurance policy on your new property, as well as schedule utility service to start in your name as of the settlement date. We'll now be just a few weeks before closing, and the final pre-settlement details will include reviewing the settlement statement (which shows all of the funds coming into and going out of the closing), conducting a final walk though of the property (to confirm the condition is as we expect it to be), and obtaining a cashier's check to bring the necessary funds to settlement. All of the details should be falling in place now, and if all goes well, we will be set for an on-time settlement. In nearly all real estate transactions (in this area) at your real estate closing you will sign all of the loan and settlement documents as well as receive the keys to your new property. The house will now be your new home, and you can take possession and starting moving in immediately after settlement. Later that day, the settlement agent will record the deed at the courthouse that officially transfers ownership of the property into your name. You are bound to have questions about the home buying process – before you begin, as we go, and even after settlement. I am here to answer all of those questions, or to guide you to the professional who can. There is plenty to learn about the home buying process, and I am here to help guide you through it and to help you make excellent decisions about your purchase of a home. | |

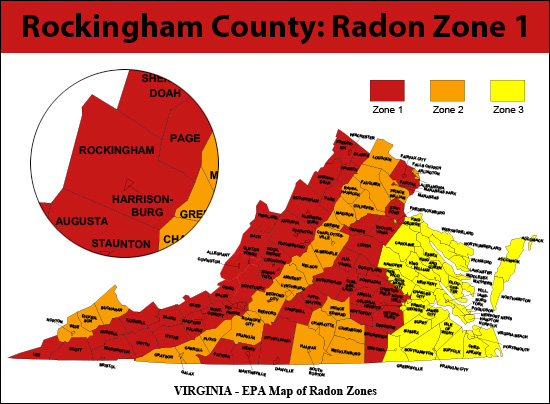

The Shenandoah Valley is in ZONE 1 for Radon |

|

As you can see above, Rockingham County is in Zone 1 -- which means we are in an area that is likely to have high radon levels. What is radon, and what does it mean for you? Read on, from the EPA.... Radon is a radioactive gas that comes from the natural breakdown of uranium in soil, rock and water and gets into the air you breathe. Radon typically moves up through the ground to the air above and into your home through cracks and other holes in the foundation. Radon can also enter your home through well water. Your home can trap radon inside.Learn more about radon and real estate here. If you are buying a home with a basement, I would recommend that you consider a radon test as a part of your home inspection process. | |

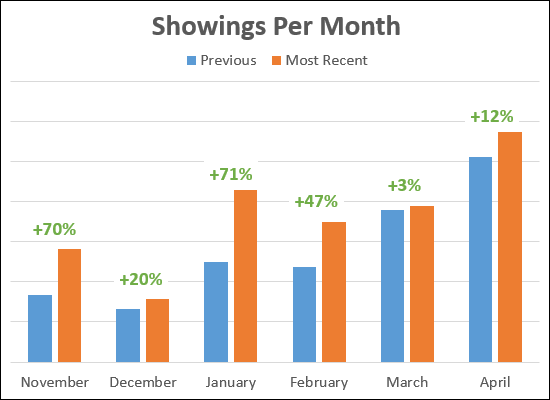

Lots of Showings! (and contracts, too, of course) |

|

In each of the past six months there have been more showings than in the same month during the previous year. This increase in showings has amounted to a 30% year-over-year increase in showings when looking at November - April. It should be no surprise, then, that contracts and closings are also increasing. | |

What did home buyers buy in April 2015? |

|

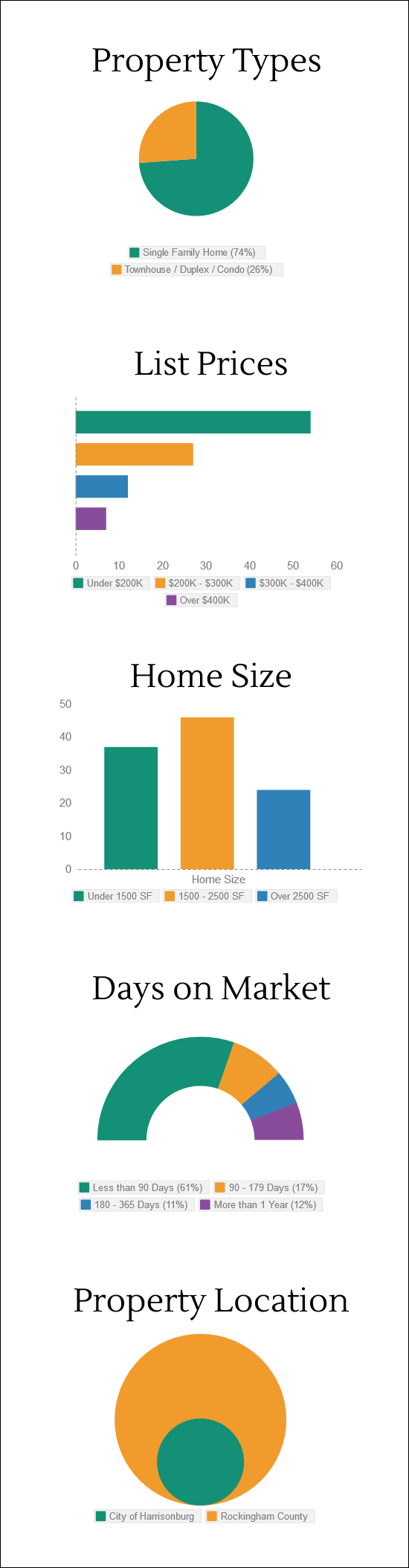

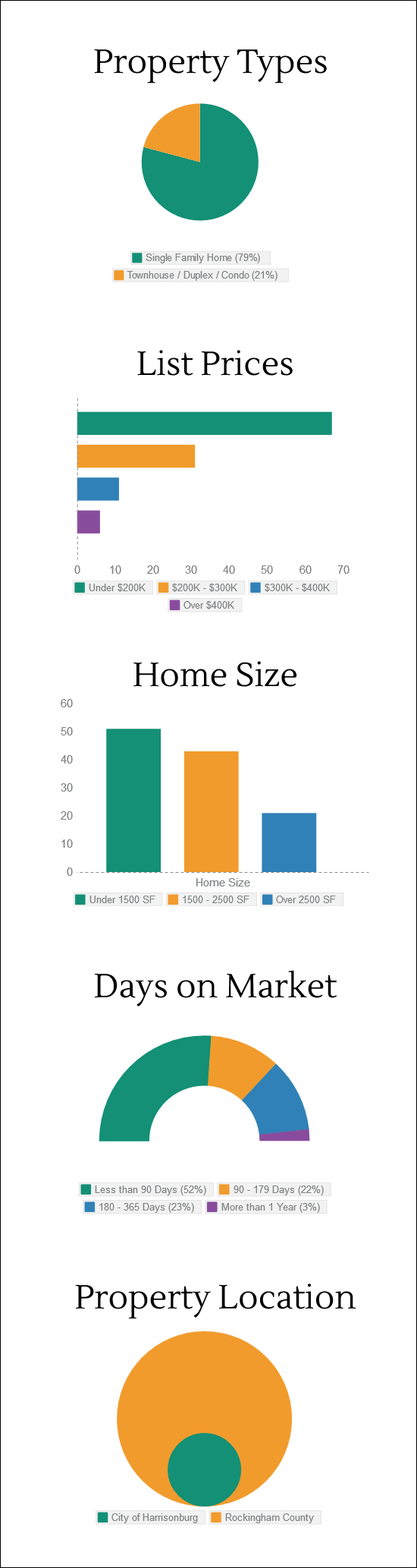

Home buyers wrote contracts on 107 listings in Harrisonburg and Rockingham County during April 2015. These are the properties. Below is a brief analysis of what buyers bought....  | |

How to Make an Offer on a House |

|

First hint - it's more than just signing some documents.... How, you might ask, do we go about getting from the point of wanting to make an offer --- to actually making the offer? Here's a brief overview....

| |

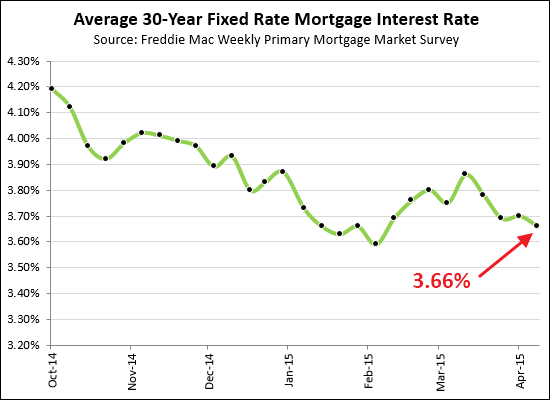

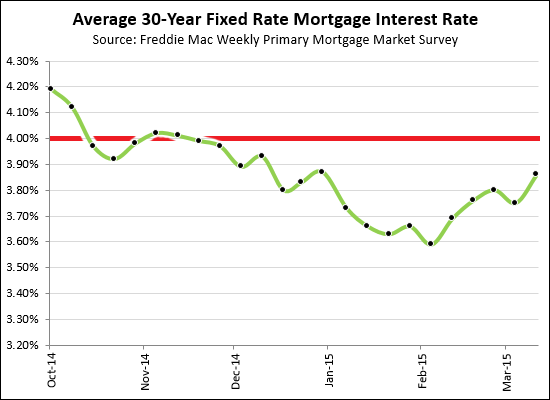

And... mortgage interest rates go back down, again! |

|

Well....after having edged up a bit a month ago, mortgage interest rates have headed back down, AGAIN. If you're buying a home this Spring, it's an exciting time to lock in an interest rate. Imagine -- a 3.66% interest rate, available to you for the next 30 years. We are still in historic times as to the (LOW) cost of money -- which provides LOTS of purchasing power for buyers in today's market. Let me know if you are looking for some lender recommendations. | |

What did home buyers buy in March 2015? |

|

How did buyer activity and seller activity compare in March 2015?

| |

New floor plans now available at Heritage Estates, an active adult community in Harrisonburg, VA |

|

Exciting News! We have several new, more affordable, floor plans now available at Heritage Estates! THE OAKMONT This to-be-built home features French Country architecture, a stone and stucco exterior, all located in an active adult community pool with a swimming pool. Enjoy an open floor plan, upscale kitchen cabinets, granite countertops, a kitchen island, an expansive walk-in pantry, and a spacious first floor master suite. Three new floor plan options....

If you are considering a home purchase in Heritage Estates, an active adult community in Harrisonburg, Virginia, you'll want to check out these new floor plans. Let me know if you'd like to set up a time to view the model home and review these floor plans. | |

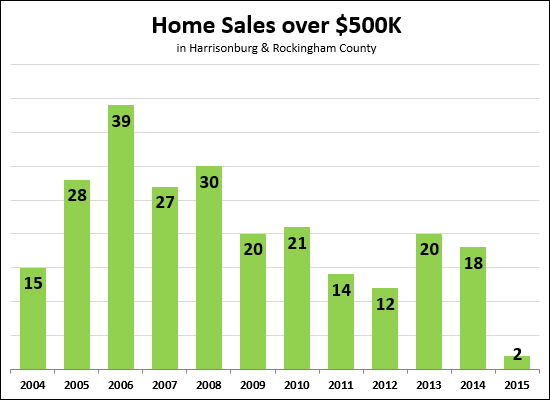

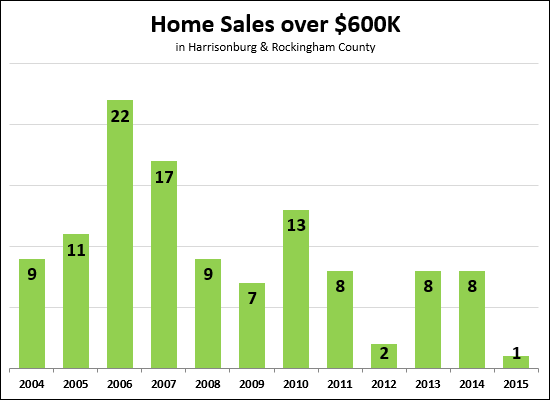

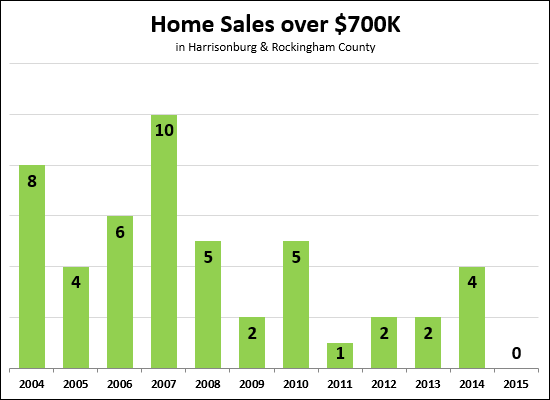

High End Home Sales Relatively Stable in 2014 |

|

Exploring home sales over $500K, we see that home sales levels in 2014 stayed relatively on track with where they were in 2013....  Despite the drop from 20 to 18 sales over $500K, the $600K+ market stayed completely stable....  And the sale of $700K+ homes actually increased....  As a side note, you may recall that 2014 marked the first $1M+ home sale (in the MLS) since 2010. Looking for a full listing of all the $500K homes currently for sale? Check out HarrisonburgLuxuryHomes.com. | |

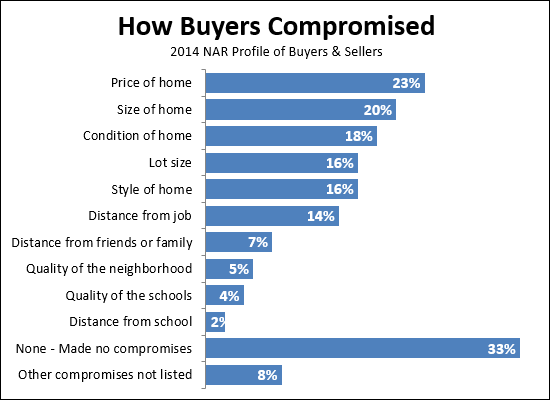

Will you compromise on your home purchase? And how? |

|

Most buyers (67%) have to compromise in some way when it comes to finding the home of their dreams. Most (23%) of those buyers who compromise do so on price, though many (20%) compromise on home size, and quite a few (18%) compromise on the condition of the home. Of note, most buyers do not seem willing to compromise on the neighborhood or location where they purchase. | |

Understanding Buyer Representation |

|

OK, here it comes, a long one, folks....everything (or close to it) you need to know about buyer representation.... THE HOME BUYING PROCESS Purchasing a home can be fun, exciting, thrilling, and fulfilling….but that very same process can also have its moments of being hard, frustrating, disappointing and overwhelming. In my role as a Buyer's Agent, I will be working with you through the entire home buying process to make it as educational and stress-free as possible. The very first step in this process is for us to discuss your needs, goals, dreams and desires. This may involve specifics such as the number of bedrooms and bathrooms, or may focus more on the layout of homes, the feel of a neighborhood, and the long term plans for your growing family. I will be focusing on listening well, and hearing what it is you are working to achieve with our home purchase – and then helping to identify the best housing options for accomplishing those goals. An important, parallel, part of starting the home buying process is to identify a target price range. This can best be determined through consultation with a reputable, local mortgage lender (just ask… I know who they are) but will involve more than just determining the highest priced home that they would allow you to purchase. It will be important to consider both your purchasing power, and your goals for how your housing costs will fit into your overall budget. You will also talk with your mortgage lender about how different loan programs might work better (or worse) for your situation. Once we have a shared understanding of what you are hoping to purchase, and we know what the price tag can and should look like, we can start to evaluate homes that are currently on the market. This will usually start online, perhaps through an exchange of emails, and saving some searches in your account on my web site. Then, you might choose to drive by some of the prospects before determining a list of homes to go view – or you may be ready to start seeing all of the homes on the list right away. As we view this first set of homes, we will learn a lot – about the opportunities in the market, and about your preferences. If we don't identify a home after looking at all of the homes on the market that seem to offer what you are looking for in a new home, we will either re-evaluate our criteria to expand our search, or we will wait to view new listings that come on the market. This extended home search process might take us weeks, or months, depending on the type of property you are hoping to purchase, and how often such a property becomes available. All along the way, I'll be following up on previous homes we have viewed to let you know if their prices have dropped, and will be letting you know of new opportunities as soon as those houses hit the market. Once we have identified the home you are hoping to purchase, we will prepare to make an offer. This will include researching similar home sales to guide our discussions of price, creating a negotiation strategy, and preparing and reviewing the pertinent contract documents. There is quite a bit of paperwork involved in making an offer on a home, and I want to make sure that you understand these contract documents and make sure that we have drafted them in a way to protect your best interests. Negotiating the final deal on the property you purchase may take a few hours, or a few days. We may go back and forth with the seller on price alone, or on many terms of the contract such as timing, contingencies, and more. Once we have a final agreement, all parties will sign and initial the final documents, and we will have a full ratified contract. Immediately following the ratification of the contract, we will need to schedule and perform a home inspection and radon inspection (assuming you are conducting both) to learn more about the property you are purchasing. If these inspections reveal new (detrimental) information about the property, we will have the opportunity to request that the seller make repairs to the property, which may result in a renegotiation on price. Typically, we are able to work through this second round of negotiations relatively quickly, so long as the seller is being realistic and rational given the new information about their property. Simultaneously with conducting these inspections, you will need to be starting the financing process to work towards obtaining full loan approval. This will start with signing your loan application and paying any applicable loan application or appraisal fees. Your lender will then be diligently working to further qualify you as a purchaser as well as the property via an appraisal. You will be providing many documents to your lender during this process as they work towards securing a loan for you to purchase the property. Within the first few weeks after your contract is in place, we will need to select service providers to coordinate the additional aspects of your home purchase. This will include a settlement agent or attorney who will conduct a title search of the property and prepare all documents for your settlement. You will also need to set up a new homeowners insurance policy on your new property, as well as schedule utility service to start in your name as of the settlement date. We'll now be just a few weeks before closing, and the final pre-settlement details will include reviewing the settlement statement (which shows all of the funds coming into and going out of the closing), conducting a final walk though of the property (to confirm the condition is as we expect it to be), and obtaining a cashier's check to bring the necessary funds to settlement. All of the details should be falling in place now, and if all goes well, we will be set for an on-time settlement. In nearly all real estate transactions (in this area) at your real estate closing you will sign all of the loan and settlement documents as well as receive the keys to your new property. The house will now be your new home, and you can take possession and starting moving in immediately after settlement. Later that day, the settlement agent will record the deed at the courthouse that officially transfers ownership of the property into your name. You are bound to have questions about the home buying process – before you begin, as we go, and even after settlement. I am here to answer all of those questions, or to guide you to the professional who can. There is plenty to learn about the home buying process, and I am here to help guide you through it and to help you make excellent decisions about your purchase of a home. FOUR TYPES OF BUYER REPRESENTATION Exclusive Representation: The Seller and Buyer are exclusively represented by separate Agents and separate Firms. The Agent and the Firm are solely representing the interests of their respective clients. This representation arrangement is created through a written Exclusive or Non-Exclusive Brokerage Agreement.

OK.....who made it to the bottom? If so, and if you still have questions? Let me know, and we can chat briefly -- by phone, email, or in person. More soon, on everything you need to know about buying a home. | |

Navigating the Home Inspection process |

|

How does the home inspection process work? Can I (as a buyer) walk for any reason if I don't like the results? Does the seller have to fix everything I complain about? Take a look at how the process typically works to understand how things might work out for you....  | |

Mortgage Interest Rates Edge Up, A Bit |

|

Fear not, you will still (likely) be able to obtain an interest rate below 4%. That said, rates have ended up a bit over the past month -- now close to 3.9%. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings