Buying

| Newer Posts | Older Posts |

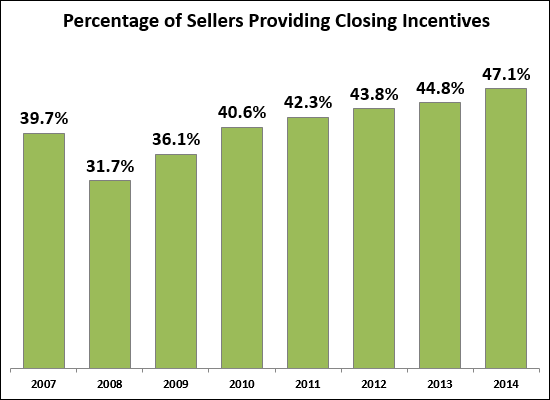

Nearly half of all sellers provide buyers with closing cost assistance |

|

As you can see above, an increasing percentage of real estate transactions have some sort of "seller concession" -- which is usually a credit from the seller to the buyer to help pay for closing costs. Sometimes it could also be related to repairs that have not been completed. I suppose that while it is true that an increasing number of sellers are providing closing cost assistance to buyers -- it is also likely true (perhaps even truer) that an increasing number of buyers need closing cost assistance. How much money is changing hands here? Let's take a look....  | |

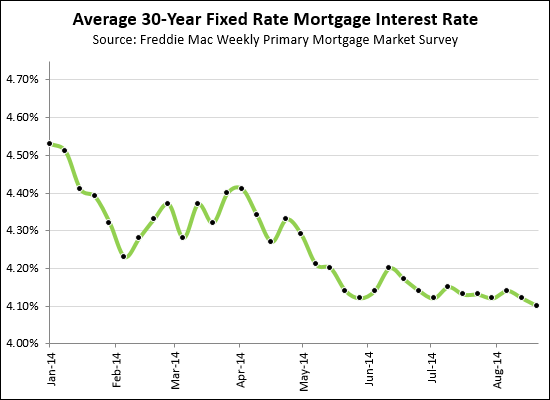

Mortgage interest rates dip to lowest level of 2014 |

|

Fixed mortgage interest rates keep declining....now to their lowest level thus far in 2014. The average rate for a 30-year fixed rate mortgage is now 4.1%. If you are under contract to buy a home, it may be wise to lock in your rate now! | |

Strengthen your other offer terms when making a low offer |

|

If you are making a low offer, you can increase the appeal of your offer by strengthening your other offering terms.... DEPOSITS Make the largest deposit you are comfortable with so the seller knows you have money "on the line" and that you won't risk losing that money by attempting to walk away from the deal. CLOSING COST ASSISTANCE Sellers don't just look at the contract price --- they calculate their net proceeds based on the offer price and any credits or closing cost assistance. Only ask for assistance if you truly need it. FINANCING Provide as much detail as possible about your financing intentions, and always include a pre-approval letter. Sellers who believe you are capable of financing the purchase will be less hesitant as they consider other terms of your offer. PERSONAL PROPERTY Don't automatically ask for everything the seller intends to convey --- if you don't need them all, leave them out of the offer. Allowing the seller to keep their washer/dryer (for example) may make them more flexible in other areas. INSPECTIONS Having a professional inspect the property you are purchasing is usually a good idea; however if you only intend to do it for informational purposes, consider leaving it out of the contract negotiations and conducting it post-settlement. SETTLEMENT & POSSESSION If possible, cater your settlement date and the details of transferring possession of the property to the needs or wants of the seller. This can go a long way towards gaining seller flexibility on other contract terms. Finally, research the seller's context for selling. That information can be invaluable in negotiating a successful contract. | |

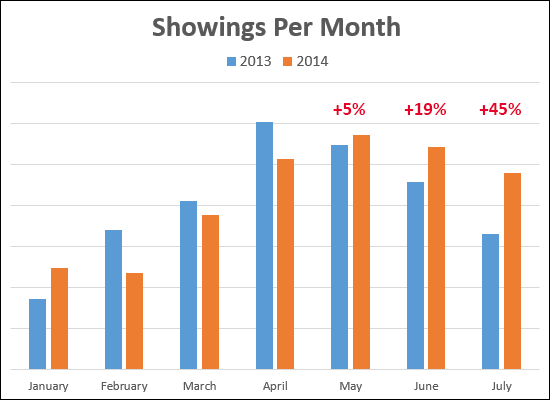

More buyers are viewing properties this Spring and Summer than were doing so last year |

|

After a slow February, March and April --- as it pertains to showings --- you can see that there have been many more buyers in the market this year during May, June and July as compared to the same months last year. * July 2014 data is extrapolated from 7/1/2014-7/22/2014 data. | |

Steps to Preparing an Offer to Purchase a Home |

|

How, you might ask, do we go about getting from the point of wanting to make an offer --- to actually making the offer? Here's a brief overview....

| |

Recently built, one level homes in Harrisonburg under $200K |

|

Guess what, they largely don't exist....with one exception. If you were a home buyer looking for a home under $200K with everything on one level.....and you wanted something built in the past 20 years so you wouldn't have too much maintenance, you wouldn't find many options. Nearly all of the properties built in the past 20 years for less than $200K (with 2+ beds and 2+ baths) are two-story townhouses. The one exception.... Founders Way Condominiums. These brand new 2 bedroom, 2 bathroom condos offer an open floor plan with upgrades including hardwood laminate flooring, granite countertops and more. Check out some photos here and here. Check out pricing and availability here. | |

Understanding Lead Based Paint |

|

Many houses and apartments built before 1978 have paint that contains high levels of lead (called lead-based paint). Lead from paint, chips, and dust can pose serious health hazards if not taken care of properly. Click here to download a full guide from the EPA on how to Protect Your Family From Lead In Your Home. | |

Homes in Old Town Harrisonburg |

|

Many buyers consider living in Old Town Harrisonburg, to be within walking distance of all that downtown Harrisonburg offers. This "Old Town" neighborhood is generally considered to be bounded by Main Street, Market Street, Myers Avenue and Martin Luther King Jr Way. Click here to explore homes for sale in Old Town Harrisonburg. | |

How much SHOULD you spend on your next home? |

|

There are LOTS of ways to answer this question, usually within the context of a monthly payment....

These conversations can be had with your spouse, with your loan officer, with me, etc. -- the important part, however, is to have these conversations. We need to know how much money you want to spend on your new home, so that we can be looking for the right houses for you! | |

New Townhouses at The Townes at Bluestone |

|

Exciting news! Townhouses are now for sale in Section 2 at The Townes at Bluestone, starting at $184,900. You can see the location of the first two buildings, as well as the pricing, here, and you can view and download the floor plans here. If you are looking for a NEW townhouse in the City of Harrisonburg, The Townes at Bluestone may be a great option for you. Find out more at TheTownesAtBluestone.com, or let me know (540-578-0102) if you would like to meet me over at the model home to take a look at the community. | |

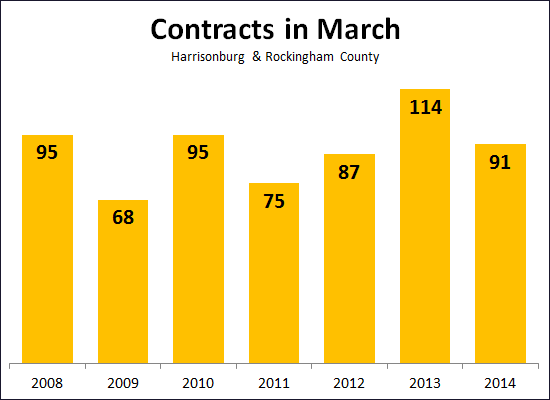

Average Number of Contracts in March 2014 |

|

Many people I talked to during March said it seemed as if LOTS AND LOTS of properties were going under contract during March. As it turns out (shown above) there were only 91 contracts signed during March 2014. This is roughly the average of the number of contracts seen per month during the previous six months of March. I had hoped for better --- though perhaps the shortage of buyers signing contracts is related to the low inventory levels, leaving buyers with a smaller number of choices than they would like to have. | |

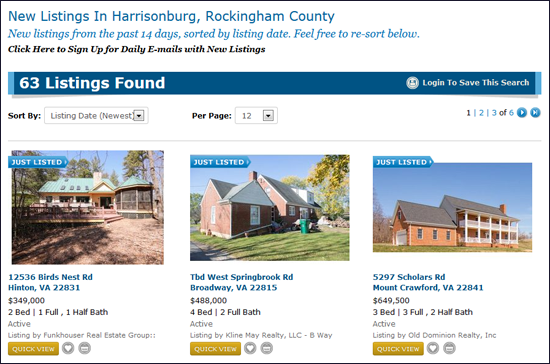

New Listings in Harrisonburg, Rockingham County |

|

(Some) new listings are selling FAST! For all of you out there who are trying to keep up with new listings coming on the market, you can bookmark this website.... NewListingsInHarrisonburg.comOr, click here to sign up to receive a daily email with ALL new listings in Harrisonburg and Rockingham County. | |

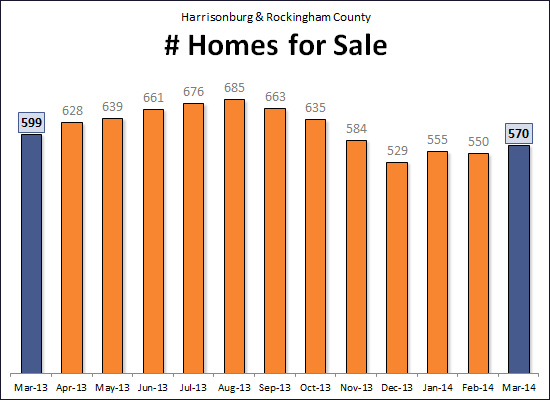

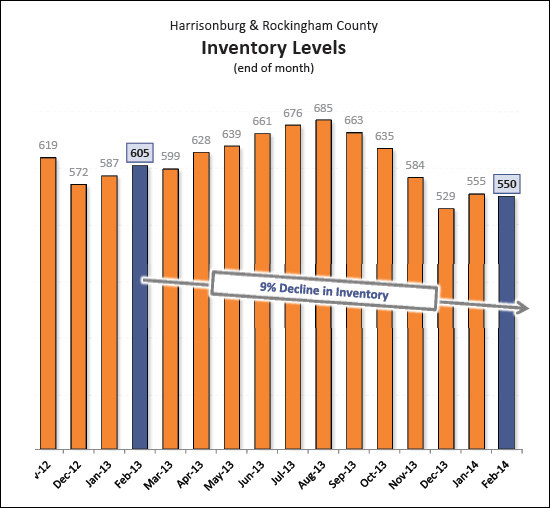

Inventory Levels Down Year Over Year |

|

Much to some home sellers' dismay, my post yesterday was merely an April Fools Day joke. So, where do we really stand as far as current inventory levels? There are more homes (+20) on the market as compared to a month ago --- but there are fewer homes (-29) on the market as compared to a year ago. Sellers -- you will likely have the least competition (from other sellers) now --- if you're listing your home this spring, consider doing so NOW! Buyers -- be encouraged, inventory levels are starting to increase, and you should have further options of homes to buy as we continue through the next 15, 30, 60 days. | |

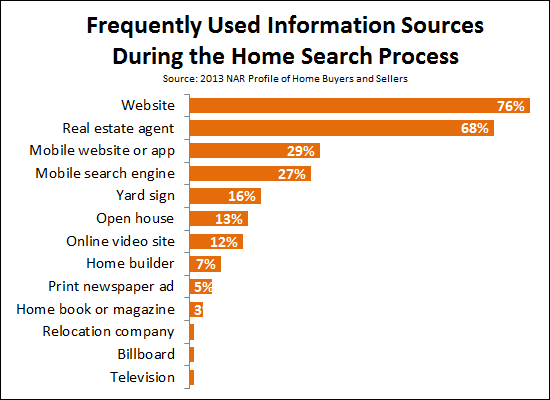

Which information sources do YOU use frequently during the home search process? |

|

Buyers across the country have spoken -- the graph above shows the information sources that are used "frequently" during the home search process. | |

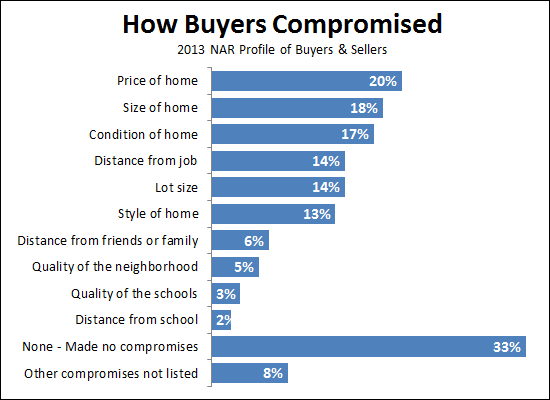

How will YOU compromise on your next home purchase? |

|

I will be working hard to find you the HOME OF YOUR DREAMS -- but statistics show (see above) that two-thirds of buyers have to compromise in some way on the home that they purchase. Of note, neighborhood and location don't seem to be areas where most buyers are willing to compromise. | |

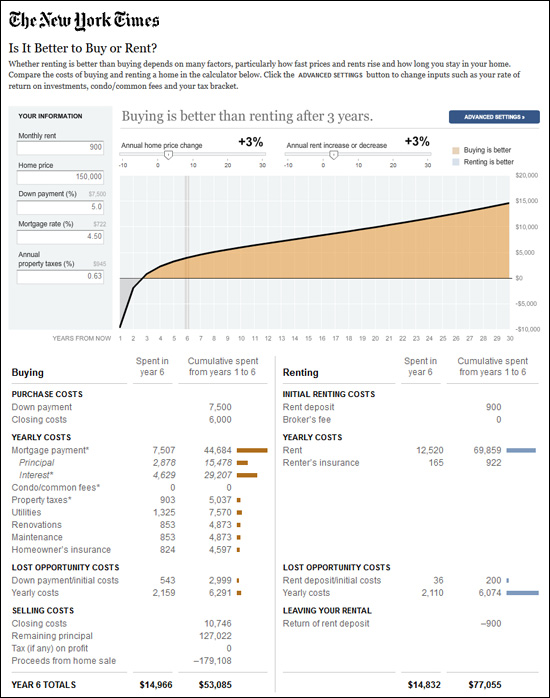

Cool Buying vs. Renting Tool from the New York Times |

|

Check out this cool buying vs. renting tool from the New York Times that gives you the ability to easily these two compare scenarios. In the sample property that I scoped out (above) it made sense to buy a $150K townhouse (instead of renting it for $900/m) if you were going to be in the home for 3 or more years. Click here to check it out, and let me know (scott@HarrisonburgHousingToday.com) if you would like to sit down to talk through these details together. | |

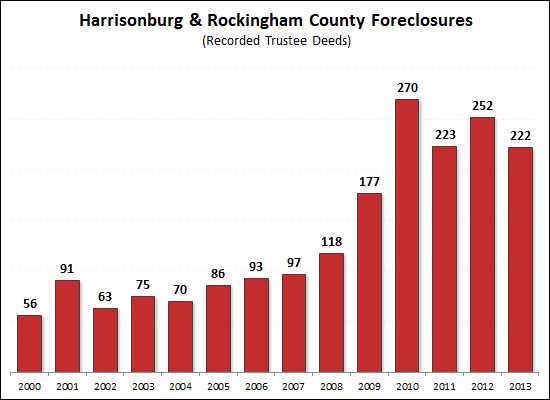

How to buy a foreclosure in Harrisonburg or Rockingham County |

|

As shown above, we are starting to see fewer foreclosures in Harrisonburg and Rockingham County. With some regularity, I am asked by potential purchasers how they would go about buying a foreclosure. First, here is a list of upcoming foreclosure sales, but more importantly, below is a description of a few ways to buy what you might be thinking of as a foreclosure. If you are in the market to buy a home, some of the properties you might be considering are foreclosures – but there are some distinctions to be aware of at different stages of the foreclosure process. It is possible to buy a home from the owner before they are foreclosed on even if they cannot pay off their mortgage – this is called a short sale. Or, you might buy a property at the courthouse steps when it is being auctioned – this is called a trustee sale. Finally, if a property does not sell at the auction, you can buy the property from the lender after they have taken ownership of the property – this is called a bank owned property or REO property. SHORT SALES: Some homeowners must sell their home, but market conditions won't allow them to sell it at a high enough price to be able to pay off their mortgage(s). In this example, a homeowner might have a $250,000 mortgage balance but can only sell the property for $230,000. As a prospective buyer, it is sometimes possible to purchase this type of a property through a process called a "short sale." In such an arrangement, the homeowner petitions their lender to accept less than the full payoff of the mortgage and in return to still release the deed of trust so that ownership of the property can be transferred over to you, the new owner. This can benefit the lender, as they skip the time delays and cost of the foreclosure process. This can also benefit the homeowner, as a short sale will have a slightly lesser negative impact on their credit as compared to a foreclosure. As a buyer, however, you must know that there are challenges to buying a property as a short sale. The biggest challenges of late seem to be the uncertainty of the purchase and the time table. Even if you and the homeowner agree to a price of $230,000, the homeowner's lender must still agree to accept that price – since it won't allow the homeowner to pay off their $250,000 mortgage balance in full. This process of waiting to hear back from a lender, and then complying with all of their various terms can sometimes take 60 to 120 days – or longer! Visit HarrisonburgShortSales.com for a list of potential short sale properties currently on the market. TRUSTEE SALES: If a short sale does not take place, and a homeowner is behind on their payments (or not making them at all), eventually the property will be sold by the lender on the courthouse steps. Buying a property at a "trustee sale" can be exciting, and can be a great opportunity – but there are challenges as well. If a property to be sold at a trustee sale is also listed for sale with a Realtor, you can usually view the property ahead of time by calling your Realtor. Otherwise, you will likely not have the opportunity to see inside the property before the trustee sale, and thus you will not know too many details about the condition of the property. Furthermore, your purchase of the property at the trustee sale cannot be contingent upon viewing the property, or inspecting the property. In this instance, you are purchasing the property in "as is" condition, regardless of what you then find out about the property. It is also important to note that many times the lender will have an opening bid at the trustee sale that is close to (or sometimes higher than) the amount that they are still owed on the mortgage. Thus, in the example above, they might make an opening bid of $250,000. As a result of this opening bid process, many (or most) properties available for purchase at a trustee sale are not great opportunities. Occasionally, a property will be foreclosed upon that has had a mortgage in place for many years, whereby the balance of the mortgage is much lower than current market value – these are great opportunities for a buyer. Visit HarrisonburgForeclosures.com for a list of upcoming trustee sales. BANK OWNED PROPERTIES: If you don't buy the property before the auction (as a short sale), and don't buy it at the trustee sale, you'll have a third opportunity to buy it once the bank owns it. These properties are called "bank owned properties" or REO properties ("real estate owned"). Oftentimes, the prices on these properties are quite realistic, if not under market value. It would not be atypical for a house such as the one mentioned above to come on the market after the trustee sale at a price of $210,000. In such an instance, you should expect to be buying the property in "as is" condition, and you will also be buying with a slightly different contract document. Most lenders have a long standard contract or contract addendum that spell out a variety of additional contract terms designed to protect them from any future liability – and rarely will a lender agree to have these contract documents changed in any way. As you can see above, oftentimes buying the property as an REO property is where the best opportunity lies. Visit HarrisonburgREO.com for a list of bank owned properties currently on the market for sale. When a home goes into foreclosure it is often for very sad and unfortunate reasons – such as the loss of a job – and I do not wish such circumstances on any homeowner. However, if you are a buyer in today's market it is important to be familiar with different methods for buying a property when it will be, is being, or has been foreclosed upon. | |

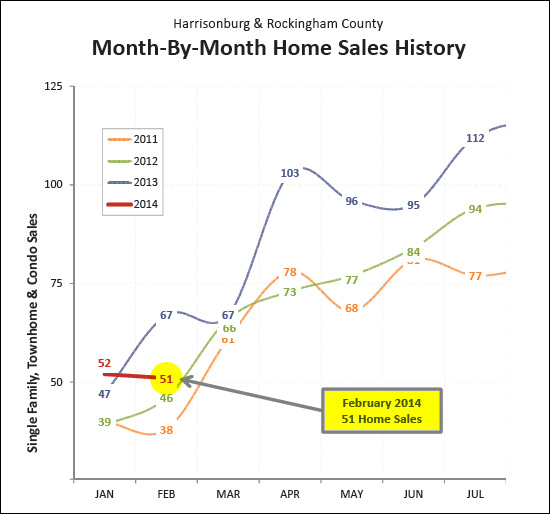

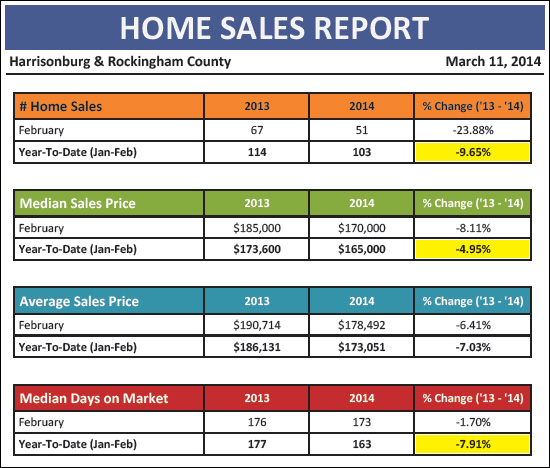

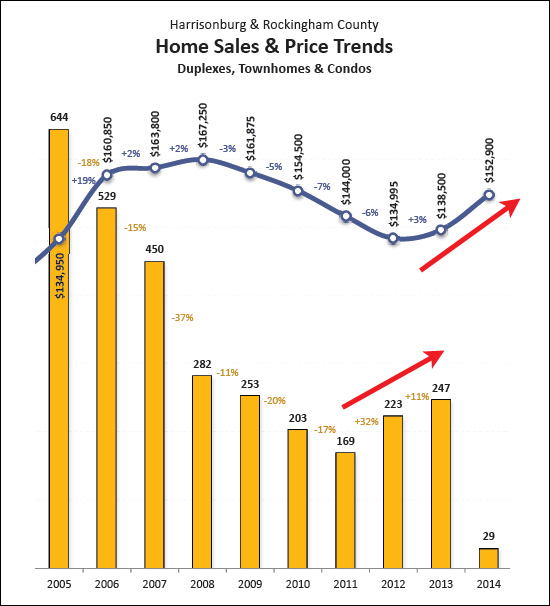

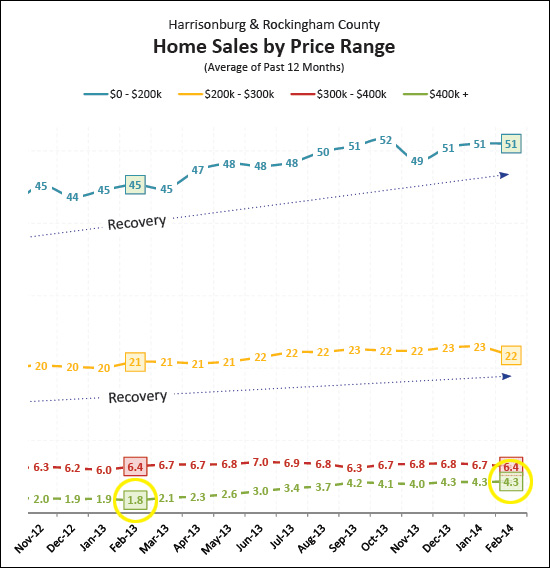

Mixed Signals in March 2014 Housing Market Report |

|

Featured Property: 4320 Wiltshire Street, Harrisonburg VA I just published my monthly report on the Harrisonburg and Rockingham County real estate market -- click here to review the entire report online -- and here are a few highlights you might be interested to know about....  FEBRUARY SALES DECLINE Perhaps as a result of the frigid temperatures, multiple snowfalls, and a record number of days without school, February home sales declined (to 51) below where we would expect them to be (67) based on last year's trajectory.  SALES, PRICES, DAYS ON MARKET DOWN Due to a slow month of sales in February, year-to-date home sales are down 9.65% thus far in 2014 -- probably related to the weather. Median home prices also declined 5% over the past year -- probably related to the small sample size of only Jan + Feb data. In (possibly) better news, the time it takes to sell a home (days on market) fell 8% over the past year -- this is either a signal of a quickening pace in the market, or related to the small sample size of only Jan + Feb data.  LISTING INVENTORY DECLINES AGAIN Despite fewer sales in February 2014 (compared to last Feb) the overall number of active listings on the market DECLINED this month. Either homeowners are taking their properties off the market ---- or the weather has delayed homeowners from listing their properties for sale. Even though I was wrong a month ago when I said this, I really do expect we'll see an increase in inventory over the next 30 days. Really.  TOWNHOUSE (DUPLEX, CONDO) MARKET GROWING QUICKLY Every segment of the local housing market is different -- generalizations are helpful, but you need to dig deeper to see the facts that pertain to your property. As shown above, the pace of townhouse sales has quickly increased over the past several years (+46% in 2 Years) and median prices have also shot up (+13% in 2 Years).  HIGH END MARKET BOOMING I will repeat myself --- every segment of the local housing market is different! As shown above, the high end market ($400K+) has seen a 139% increase in the pace of sales over the past year! OK, enough highlights for now -- there is plenty more inside the full report. As always, if you're interested in talking to me about buying a home in Harrisonburg or Rockingham County.....or if you are interested in selling your current home.....just drop me a line by email (scott@HarrisonburgHousingToday.com) or call me at 540-578-0102.  | |

The Financial Benefits of Keeping Your First Home |

|

Many people who bought their first home when home prices peaked between 2005 and 2008 have had difficulty selling their homes without taking a financial hit. It was, after all, during those same years that 100% financing was all the range – and some lenders were even making loans for more than the purchase price at the time. Understandably, when home values declined in the years that followed, many of those first time buyers with high loan-to-value mortgages did not have enough equity to sell when they were otherwise ready to move on to a second home. Some of these first time buyers opted to keep their first home as a rental property to avoid the pain of the financial hit of selling when they were under water. For many such people, keeping their first home will be a decision they will cherish in years to come. Let's imagine for a moment that you purchased a $160,000 townhouse in the City of Harrisonburg on January 1, 2005 and financed 100% of the purchase price – that results in a $973 monthly mortgage payment. You stayed in the townhouse for seven years, and then (in 2012) either had to move out of the area for a new job, or needed to purchase a new home for your growing family. Facing a tough townhouse sales market, you felt forced to keep the townhouse. You start off, in 2012, renting your townhouse for $850 per month, leaving you still footing a part of the monthly payment ($123/month) but as the years progress, your mortgage payment stays constant, and your rental income grows as rental rates slowly increase. Life is busy, and before you know it, the kids have grown up and headed off to college, and in 2034 you send in your last mortgage payment on that first home you ever purchased. You pause, looking back, to reflect on the 30 years that you have owned that townhouse, and decide to check to see how much you contributed towards paying down that mortgage, and how much help you received from your tenants. Shockingly, in that 30 year period, a total of $350,280 was paid to your mortgage company – but you only had to pay $79,380 --- your tenants over the years paid 77% of the total mortgage costs over the 30 year period. Never have you been so grateful for your tenants. There are, of course, some extra expenses over the years, and to be fair we must consider those. Increases in taxes and insurance will likely cost you around $7K (+1% per year), we'll estimate maintenance costs a $15K, vacancy (1 month / 2 years) would cost you $11K, and hiring a property manager (after you are 15 years in) would cost around $14K. Despite the $47K of extra expenses above, there are also some fantastic upsides to this accidental ownership of an investment property. The $149K of interest that you (and your tenants) paid during the life of the loan is tax deductible, thus $149K of your income has been sheltered, which (with a 25% tax bracket) provides $37K of extra income. Eventually, property values will start increasing again. If your property increases an average of 1% per year since the time that you became a landlord for the property (quite a conservative estimate!), the appreciation would add up to $39K of extra income. While your head is starting to hurt from all of these calculations, you are determined to come to a final conclusion about whether it was a wonderful or terrible decision to keep that first home. Delightfully, you will discover that after investing $0 in 2005 to purchase your townhouse, you have had a cumulative $230,000 gain over those 30 years, thanks to your simple decision to keep your first home. For all the details of this fictional scenario, click here. | |

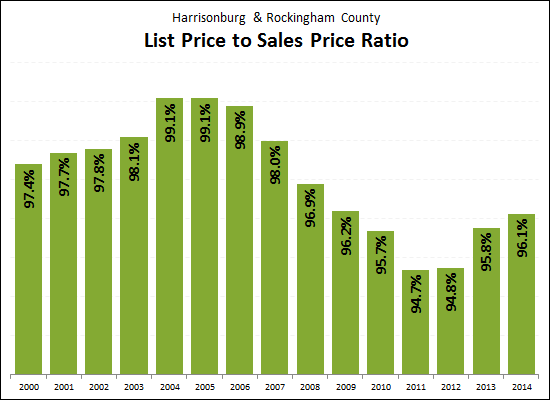

The best deals (compared to list prices) are behind us. |

|

It seems that 2011 and 2012 were the years when sellers had to negotiate the most off of their list price -- giving up over 5%, on average. Now, that has shifted down to less than 4%, and I expect that average amount of negotiating will continue to decrease through 2014. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings