Buying

| Newer Posts | Older Posts |

Per The Atlantic: Is Now the Right Time to Buy a Home? |

|

For your daily real estate reading, consider perusing this article from The Atlantic a few weeks ago entitled "Is Now the Right Time to Buy a Home?" The author considers factors such as:

Again, enjoy the read of "Is Now the Right Time to Buy a Home?" | |

Buyers will act, once there is equity on the table |

|

A house can sit on the market for months, or even years, without selling or even having an offer. Then, the list price is reduced by a negligible amount, and an offer quickly comes in, or sometimes multiple offers. What is it that makes all of the buyers sit on the sidelines at $249,900 but makes several of them jump into the fray when the house is lowered to $239,900? One of my Realtor colleagues made an excellent observation this week when he pointed out that despite the rather slow real estate market of late, buyers will indeed act, once there is equity on the table. That is to say that if you expect a house to sell for $250K and it has listed as such, the opportunity isn't quite enough for a buyer. But when the list price declines to $240K (and the prospective buyer assumes she'll buy for $230K), then the buyer is willing to act. She thinks the house is worth $250K, you see, but now she believes she can purchase it for only $230K. The buyer has the opportunity to buy a house $20K under perceived market value, picking up $20K of equity. Now more than ever buyers must be comfortable with the purchase price they are paying for a home. After all, while we are starting to see some positive signs in the local housing market (lower inventory levels, more contracts signed), we still aren't out of the woods yet. Without being able to assume that home values will increase 2% to 3% per year (as they have for many, many decades) many buyers want to make sure they are paying a fair price, or getting a deal on a property. This pricing phenomenon introduces some challenges for you if you are hoping to sell your home. In a stable and growing real estate market, if homes like yours were selling around $250K, you might list your home for $259,900 and hope to also sell your home for $250K. Now, however, if houses similar to your home have been selling for around $250K, you likely need to list it for either $240K or $250K. If you list it at $250K, buyers will see it as an appropriate price, but not a great price and you may soon be reducing the price to $240K. As a seller, bear in mind that roughly one-third of homes that are selling these days sell (close) within three months of hitting the market. Many other homes stay on the market for ages, so the key is to price your home appropriately from Day 1, not from Day 90 or 180. As a buyer, you need to be ready to act quickly if you see a house that is being offered at a price where equity will be left on the table. There are many buyers waiting on the sidelines these days, watching and looking for attractive, well priced properties. | |

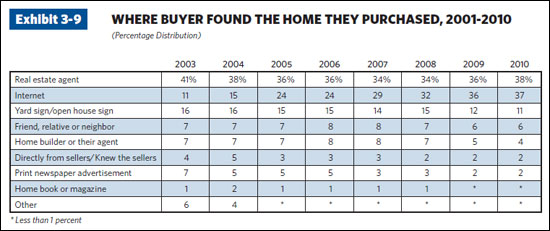

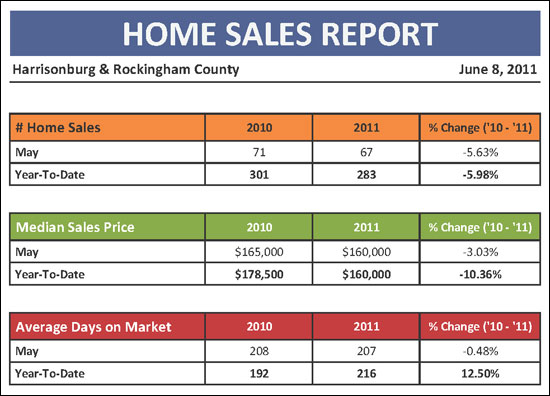

Home sales pace, sales price decline in Harrisonburg and Rockingham County |

|

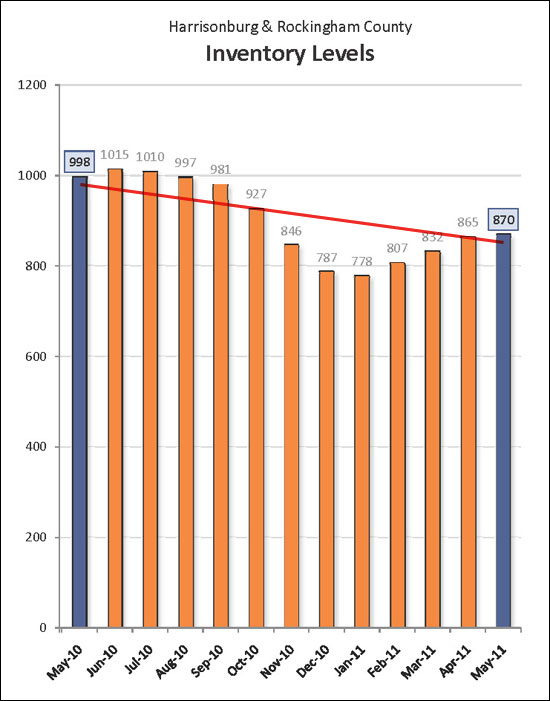

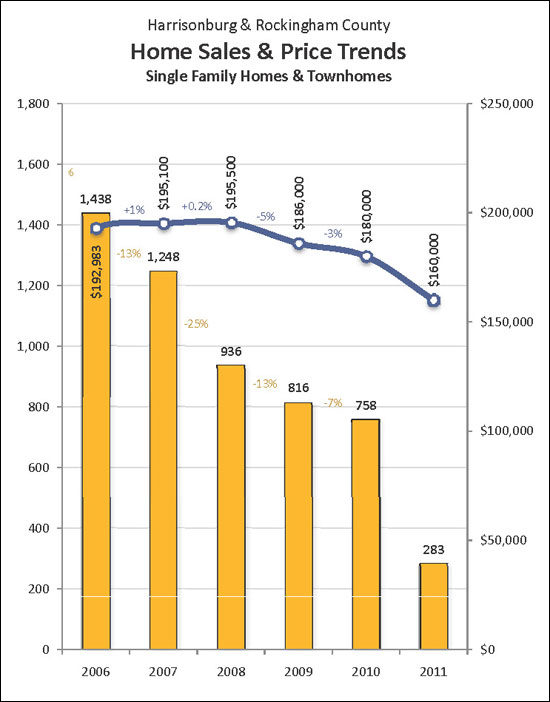

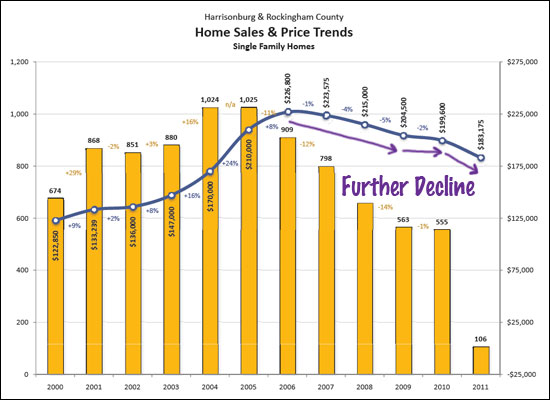

I just completed my monthly analysis of the Harrisonburg and Rockingham County real estate market. Click here for a PDF of the 24-page report or read on for some highlights. While there are several indicators that Harrisonburg and Rockingham County might be starting to see a recovery in the housing market, there are still plenty of trends that are not as hopeful.  Above you will note that sales are still lower this year than in 2010, with a 6% decline in May 2011 sales (compared to May 2010) and a 6% decline in year-to-date home sales. Median prices also continue to decline, with a rather steep 10% decline in median sales price over the past year (Jan-May 2010 vs. Jan-May 2011).  Despite a downward trend in the pace of home sales and in median prices, we are still on a several-month run of lots of buyers committing to buy homes in Harrisonburg and Rockingham County. This should, in theory, help to stabilize the pace of home sales over the next few months. May 2011 contracts exceeded both May 2010 and May 2009!  The graph above (inventory) is one trendline that we're happy to see decline. There are currently 13% fewer homes on the market as compared to a year ago! This helps to balance the market, though there are still many more sellers in the market than buyers.  Over the past five years, the pace of home sales has declined almost 50% in Harrisonburg and Rockingham County. Despite this tremendous decline in the number of home buyers in our market, the median price did not start declining until 2008, and even then, only had a slight decline (8%) through the end of 2010. As 2011 finishes out, we'll get a better idea of how these two trends (pace, price) will perform. For more reading, click here to download the full Harrisonburg & Rockingham County Real Estate Market Report as a PDF. As always, if you have questions about this report, or if I can be of assistance with real estate that you own, or that you'd like to own, please be in touch. You can reach me most easily at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

Another perspective on pricing, negotiating and low offers |

|

I received a low (LOW) offer on one of my listings at the end of this past week. I'll round the numbers a bit to protect the anonymity if my clients and I will suggest that it was equivalent to a $280K offer on a $350K listing. We were not (surprise, surprise) able to negotiate a contract after starting with such an enormous gap in pricing. After it was all said and done, I had a new insight on pricing that hadn't occurred to me before. I found myself thinking.... Wait, really?? The buyers thought the sellers priced their home $70,000 above a price that they'd really take for the house? Certainly, if I had clients who wanted to sell at or above $280K, I would never suggest that they list their home at $350K. Perhaps we list the home at $309,900 at first, and then we might reduce it to $299,900. But again, this is what it seems that the buyers must have been thinking --- that the sellers had come up with a list price that was $70,000 higher than what they would actually be willing to take. OK, I know, there are some other angles here:

That said, of course, I don't want buyers paying unreasonably high prices for homes. Thus, if a house should be listed at $300K but is listed at $350K, my advise above shouldn't restrain you from making an offer for what you really think the house is worth. | |

Do you have an iPad, iPhone, Android, or Windows Phone? |

|

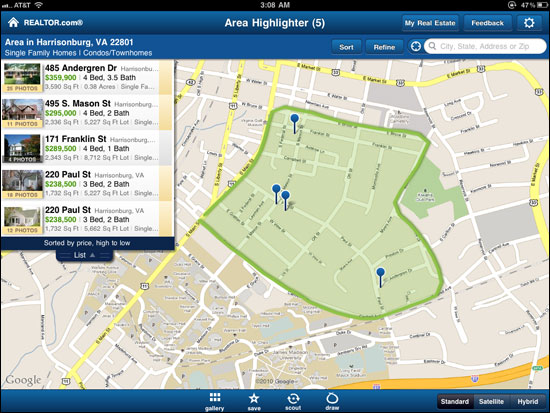

My iPad is one of my favorite real estate tools, allowing me to pull up a tremendous amount of helpful information right when I am at a house with a client. One app that is particularly helpful to me (that might also be of interest to you) is the Realtor.com iPad app, though Realtor.com offers helpful apps on the iPad, iPhone, Android and Windows Phone. Here is a screenshot from the Realtor.com iPad app....  (click the image for a larger view) One of the brand new features of this app is that you can easily draw an search selection around an area where you are interested in buying to see homes for sale. All of this can be achieved right out in the field when driving around from neighborhood to neighborhood. If you love real estate, and love your phone, check out the apps from Realtor.com! | |

How much do banks typically negotiate in selling a bank owned property? |

|

Buyers can often find great opportunities in bank owned properties, but they often wonder how much they should expect to be able to negotiate off of the list price of a bank owned property. Let's take a look.... For all residential sales in Harrisonburg and Rockingham County in the past year, we find:

I suppose the important thing to remember is that the list-to-sell ratio of any property is largely dependent on how realistic the asking price is. Both a homeowner and a bank can price a home too high when putting it on the market. Perhaps banks do that less often, and thus achieve a (slightly) higher list-to-sell ratio despite still offering great deals on properties? Additional Relevant Information:

| |

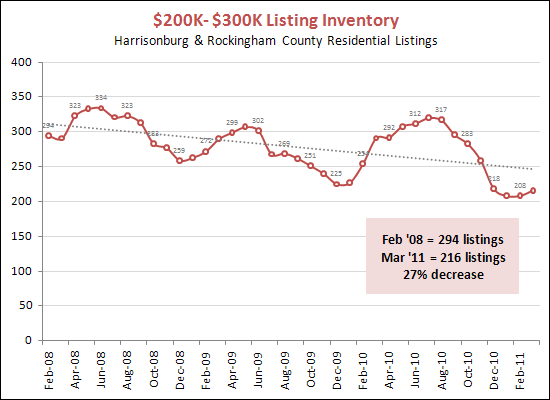

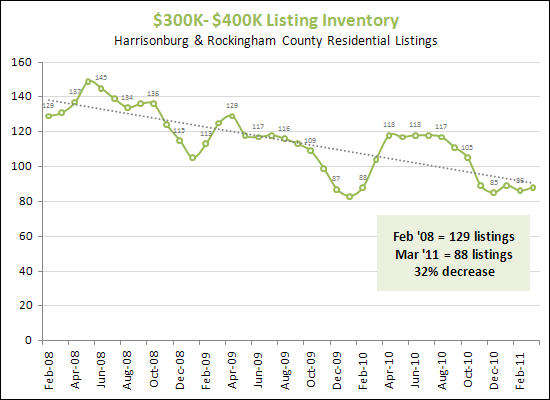

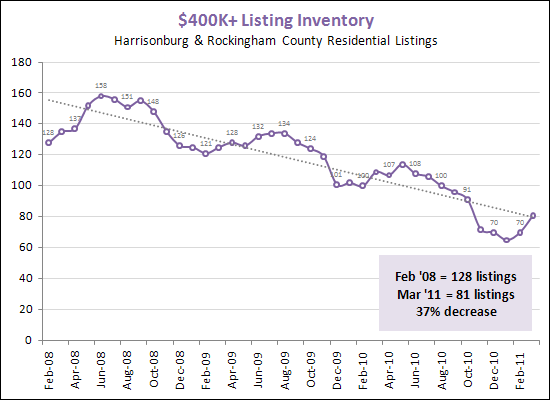

Buying options under $200K keep increasing, but otherwise, your options are vanishing |

|

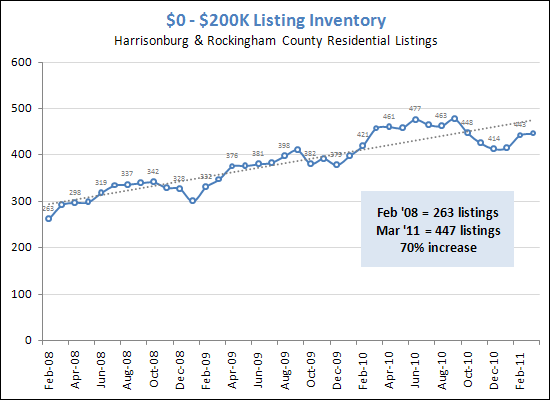

I often hear that there are too many homes for sale (sellers tell me this) and that there aren't nearly enough homes on the market (buyers tell me this). Let's examine how inventory levels have changed over the past several years.....  It may be a result of an overall decline in median sales prices (home values), but whatever the reason, the number of options under $200K keeps increasing. Three years ago, you would only have had 263 homes to choose from in Harrisonburg and Rockingham County -- but that has now ballooned to 447 listings.  Listing inventory between $200K and $300K has gradually declined over the past several years, though it did surge upwards in the spring and summer of 2010. We may again see a surge as homeowners prepare to list their homes for the summer 2011 buying season.  The decline in $300K to $400K listings has been a bit faster than in the $200K to $300K range (32% versus 27%).  Housing options over $400K have drastically declined over the past several years, with an overall 37% decline. This is likely an appropriate decline relative to the overall decline in the number of buyers in the market. Whatever the price range, we will likely start to see a surge in homes listed for sale as we continue through spring and summer of 2011. Hopefully we will not reach past seasonal peaks of 1,000+ homes as we did in mid-2010. | |

Four Multiple Offer Scenarios In One Week! |

|

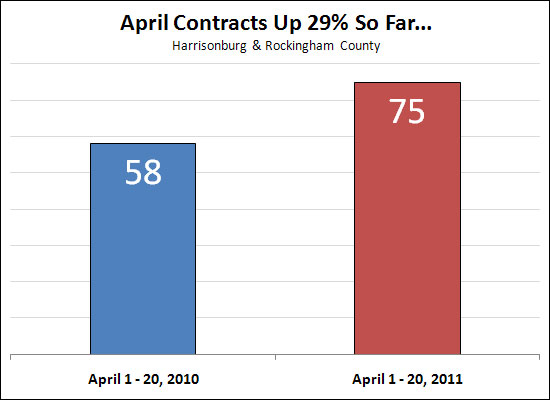

It looks like this could be a fantastic spring/summer real estate market in Harrisonburg and Rockingham County. The real estate market may finally be picking up some speed after several years of declining sales figures. First -- I have been involved in four different multiple offer scenarios in the past week. One contract even had an escalation clause! It's been years since I have seen this much buyer activity in our market all at once. Second -- If you compare the first 25 days of April this year versus last year, we're looking solid for this year!

Stay tuned! | |

Housing Market Sees A New Normal |

|

My article from this month's issue of the Shenandoah Valley Business Journal... Change has been the only constant in the housing market over the past five years. Between 2000 and 2005, our local housing market (and most markets across the country) witnessed unprecedented increases in the number of homes selling, and the prices for which these homes sold. Then, however, the bubble (as some call it) popped. Over the past five years, we have seen fewer and fewer homes sell, and the prices for which they are selling have also slowly declined. Some observe that the local housing market might finally be steadying, with smoother sailing in the near future. If this is indeed the case, what might we expect as some new norms in the local housing market? More Renters. During the real estate boom, home values were increasing by double digit percentages per year. With such rapid appreciation, would-be renters decided to buy homes instead. After all, even if you were only going to be in the area for a year or two, with home prices increasing so quickly and steadily, why wouldn't you buy? These days, the new norm is that many would-be buyers (per recent logic) are now delaying a home purchase. Unless you will be in the area for 4, 5, 6 or more years, it may make more sense to rent instead of buying. After all, with home values currently falling a few percentage points per year, and with the cost of getting in and getting out of owning a home, buying for the short term just isn't as prudent. Thus, as the local housing market moves forward, we'll see fewer first time buyers and thus more renters. Slow Growth. Between 2000 and 2005, many new subdivisions were created as the real estate market shot skyward. Re-zoning after re-zoning created many new neighborhoods of single family homes and townhomes. Some people even became concerned that new developments were too quickly overtaking farmland in some areas in the Valley. Alas, these days of rampant and unfettered growth seem to be over. With the drastic real estate slowdown over the past five years, builders are not building speculatively, nonetheless developing new subdivisions speculatively. There will certainly be new neighborhoods and subdivisions over time, but they will develop much more slowly. Slow Sales. Depending on the price range, there are 12 to 24 months of housing inventory on the market in Harrisonburg and Rockingham County. Even a stellar month or two of sales won't cut into this excess inventory that exists because of a now persistent imbalance between the number of sellers and buyers in the market. Thus, with so many homes for sale, it will take a long time for the housing market to return to more normal inventory levels such as when there are six months of homes available for purchase at any given time. Living Close to Work. Gas prices spiked a several years ago which caused many people to reconsider how far they lived from their place of employment. Afterwards, gas prices subsided, and the length of commute lost a bit of its focus, but the home buying public seemed to hold onto a part this new mentality. Even if gas was cheap, buyers were now also thinking about how their quality of life was impacted by the length of their commute. Now that higher gas prices are upon us once again, it is quite possible that this concept has been cemented into our home buying perspective – it is important to live close to where you work. Larger Down Payments. While there are still low and no down payment programs available (FHA, VA), there are certainly nowhere near as many such programs available to home buyers. Gone are the days when anyone could obtain a mortgage so long as you had a pulse (as some joked). Mortgages are still widely available to those with decent credit and some funds set aside for a home purchase, but there will no longer be enormous swaths of the public buying homes without putting any funds into the deal. These are just a few of the new norms that are starting to emerge in the current housing market. It seems that we may be through the most turbulent of times in the local housing market, but we are still adjusting as a whole to what buying and selling a home now means given the financial changes that our society has witnessed over the past five years. | |

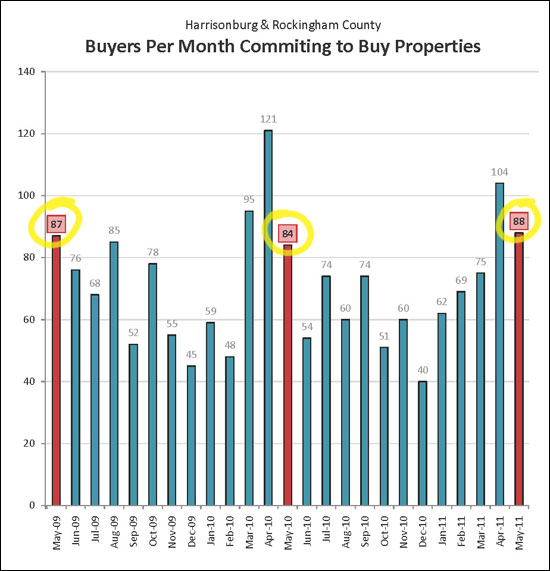

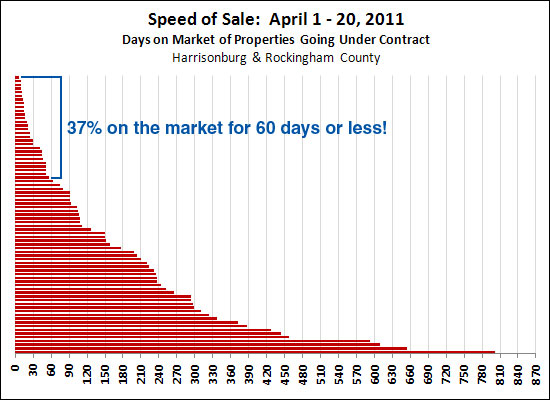

Buyers Are Moving Fast! Contracts Up 29% In April 2011! |

|

In the first 20 days April 2010..............58 contracts were written... In the first 20 days of April 2011..............75 contracts were written! Beyond this 29% increase in the pace of sales this April, it is interesting to note how many buyers are moving quickly once they see a house come on the market that works well for them, and is priced right.  Note the large percentage of homes above that went under contract within the first two months that they were on the market. | |

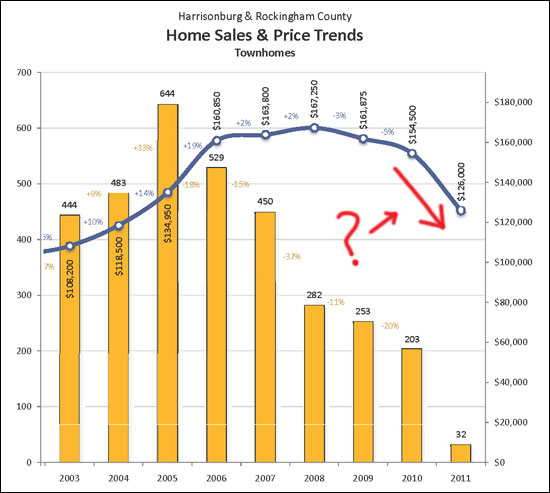

How could townhome values have dipped so far, so fast? |

|

After staying relatively stable over the past few years, townhome values are dropping quite quickly in 2011 -- per the median home value of Harrisonburg and Rockingham County townhomes....  Townhome Sales between January and March 2010:

Townhome Sales between January and March 2011:

I believe what we're seeing here is that the median (and average) sales prices are coming down because of the composition of which (townhome) properties have actually sold in the first quarter of 2011. If my theory is correct. the median (and average) sales prices might increase quickly as the year continues. Alternatively, they could stay quite low if the smaller, older, more remote townhomes continue to sell -- at lower prices than most. Properties selling in 2011 (1Q) under the $126,000 median sales price included:

| |

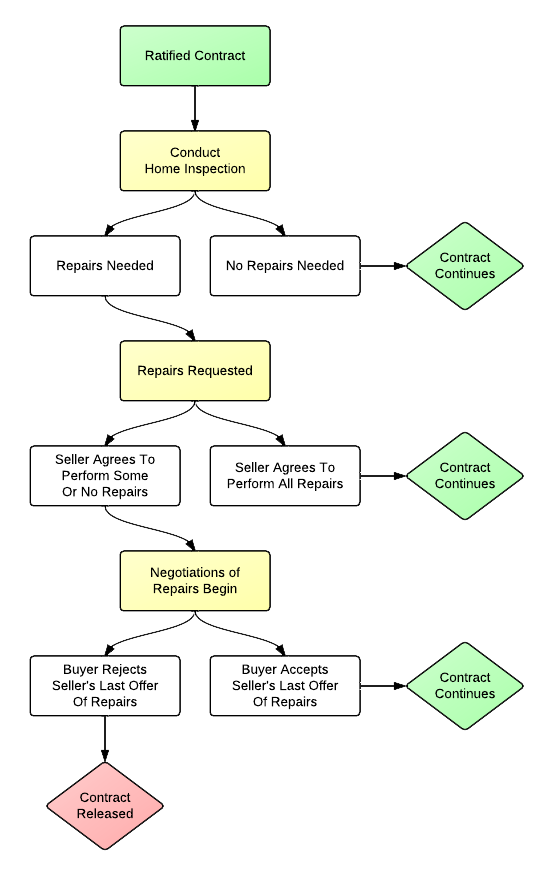

Understanding The Home Inspection Process |

|

Many buyers (and sellers) have a misunderstanding of how the home inspection process works. For example:

| |

There are so MANY (and so FEW) houses for sale!?! |

|

It's been an interesting week showing houses over $400,000 in Harrisonburg and Rockingham County. Both of the following seem to be true:

But wait --- if there are soooooo many homes for sale, how are there also TOO FEW homes for sale over $400K? Well, as I drove my clients through neighborhood after neighborhood, there were so many areas where there was not a single home for sale. In fact, looking back two years, there were 125 homes for sale over $400K, but now there are only 81 homes for sale over $400K. This 35% reduction in inventory significantly limits the homes from which a buyer can choose. So, what happened? I think many (many) sellers who wanted to sell their homes, and tried over the past year or two, have become discouraged and have taken their homes off the market. They look at the oversupply (25 months) and figure they'll be better off just taking their home off the market. Many sellers are out of the game! And what is happening now? Given limited inventory levels, (some) buyers aren't finding what they are looking for. Frustrated by not finding a home that works well for them, buyers are also out of the game! What a conundrum! | |

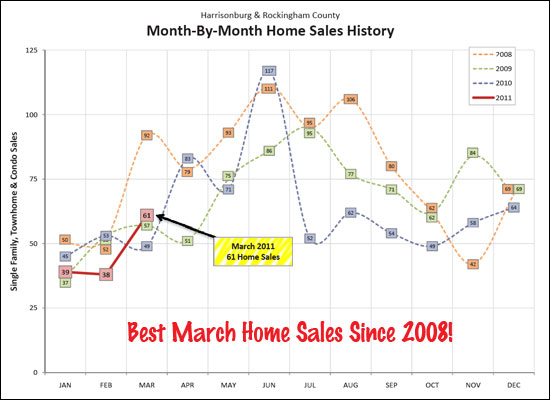

Home Sales Strong Despite (or because of) Price Declines |

|

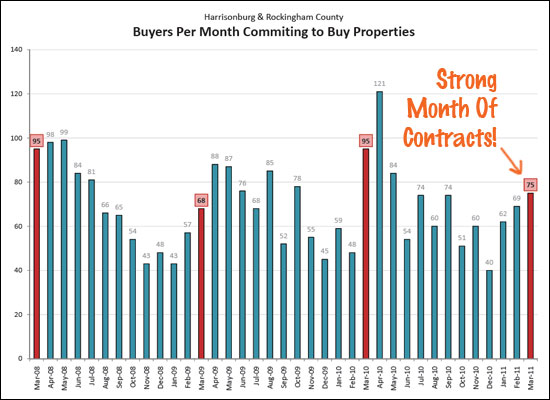

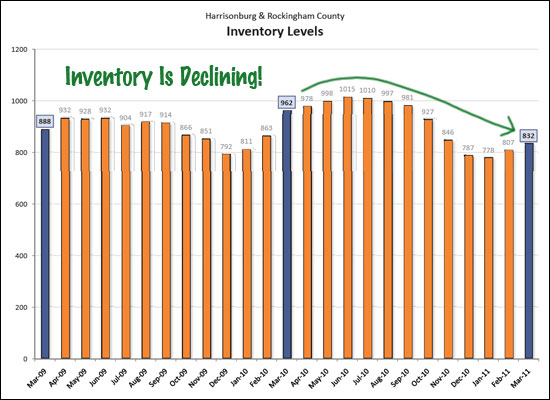

March 2011 home sales show plenty of positive indicators, though the local market is still a ways off from a full recovery.  After mediocre performance in January and February, the Harrisonburg and Rockingham County housing market finally witnessed some growth in March 2011. March's 61 home sales exceeded March 2010 (49 sales) and March 2009 (57 sales), and contributed to an overall decline in home sales of only 6% between 2010 (YTD) and 2011 (YTD).  Not only did buyers close on properties in March, they also contracted on properties --- though probably not the same buyers. March 2011 showed another strong month of contracts (75), exceeding March 2009 figures (68). Last March's contract figures (95) were significantly affected by the home buyer tax credit.  Despite increases in inventory over the past two months, it appears that 2010's peak of over 1,000 properties for sale will not be met this year. We have seen an overall decline of 13.5% over the past year in the number of residential properties for sale, which can help restore balance to the market.  Despite the strong indicators noted above, we do see that the median sales price of single family homes has started to decline again more sharply after a relatively steady year last year. We may not be totally out of the woods yet.  There's plenty more news in my monthly housing market report -- click on the image above (or here) to download and view the full PDF. As always, if you have questions about this report, or if I can be of assistance with real estate that you own, or that you'd like to own, please be in touch. You can reach me most easily at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

There Are Buyers Waiting In The Wings |

|

I recently listed a home in Barrington that, in the first month, had multiple showings and two offers. One of the offers was accepted, and the property will be under contract later this week. Oh wait, think for a minute about the price range that this home was in -- over $400,000. Does that price range strike you as particularly hot right now? There were 57 home sales in Harrisonburg and Rockingham County during March 2011 (as reported thus far), and only one of them was a house over $400,000. So no, the housing market over $400,000 isn't tremendously active right now --- but there seem to be buyers waiting in the wings, waiting for good opportunities to present themselves. It was somewhat humorous when the property first came on the market, as I relatively quickly had showings scheduled by Realtors who had shown my other similar listings in Barrington and Lakewood during the recent months. It was clear that these buyers were just waiting for the right property to come along. What does this mean to you? While there are no guarantees, if you price your house well, and it is marketed well, you might just have a chance to sell your property, even in a not-quite-so-good-yet real estate market. | |

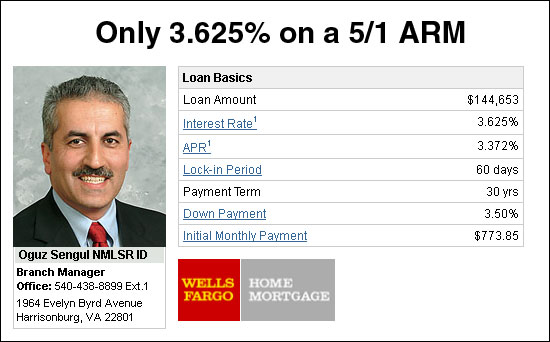

FHA Adjustable Rate Mortgages For Only 3.625% |

|

As of today, you can obtain an amazing 3.625% interest rate on a 5/1 adjustable rate mortgage through FHA. Until recently, I had thought that 30 year fixed rate mortgages were the only product offered through FHA, but Oguz Sengul pointed out that FHA also offers a 5/1 ARM. A "5/1 ARM" is a mortgage that has a fixed rate (3.625%) for five years, and then can adjust once every year. If you anticipate only being in your home for 3, 4, 5 or 6 years, this can be a fantastic loan program to consider! | |

Did Your Property Lose Value? Buy Another! |

|

In a recent real estate conversation, I was presented with what seemed at first to be a very bold real estate investment strategy. If you bought high, and now the value of your home is lower, buy another home! This CERTAINLY doesn't work in all cases, but it is very interesting to think about how it can work well in some situations. For example, Hunters Ridge.... If you bought a townhouse for $140k a few years ago --- and now realize that it is worth around $70k --- might you improve your situation ($70k underwater) by trying to negotiate a deal to purchase a second townhouse for $60k? You would then have paid $200k for $140k of property, making each property only $30k underwater. To the extent that you are looking at your losses over a long term period, you'll be better off trying to recoup a $30k loss on each property instead of trying to recoup a $70k loss on one property. What do you think? Smart? Bold? Strategic? Foolish? | |

If (When) You Can't Find A Perfect Home |

|

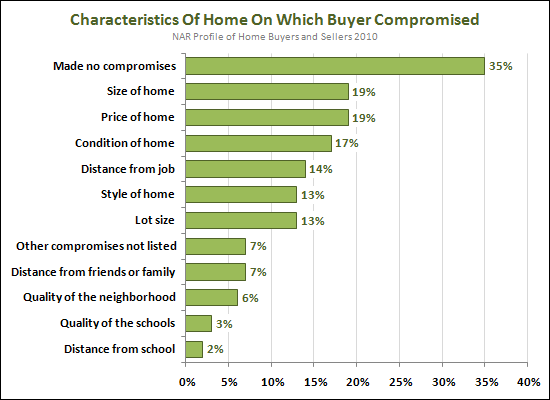

Even when there are plenty of homes for sale, some (or many?) buyers won't be able to find "the perfect house" -- even after looking at a lot of houses. What is a buyer to do?  Some would say every buyer must compromise on some aspects of the house they are searching for. Above you can see that a full third of home buyers responding to the National Association of Realtors research methods did not consider themselves to have compromised at all in their home purchase. From there, we jump down to size and price of the home, followed by condition. The areas where buyers were unwilling to compromise included items such as schools, neighborhood and distance from family and friends. Where would you prefer to compromise as a buyer? | |

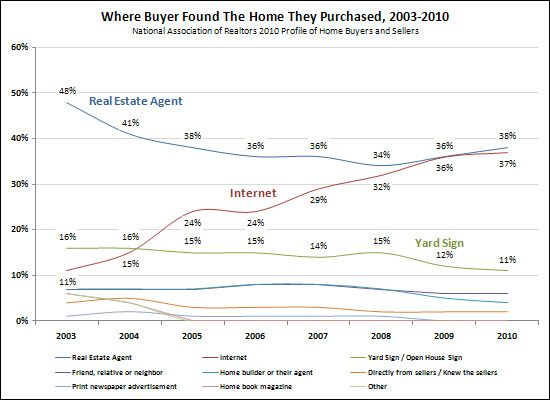

Answer: Real Estate Agents, The Internet and Yard Signs |

|

Home Sales Down, Prices Down, Is There A Silver Lining? |

|

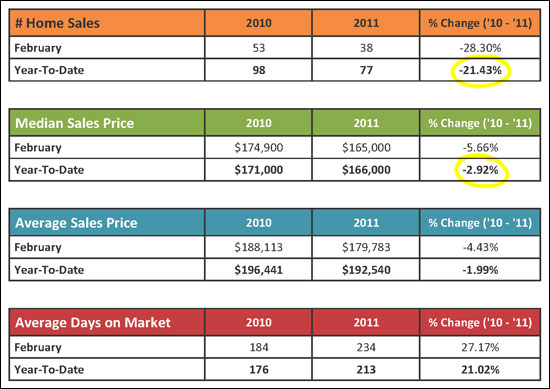

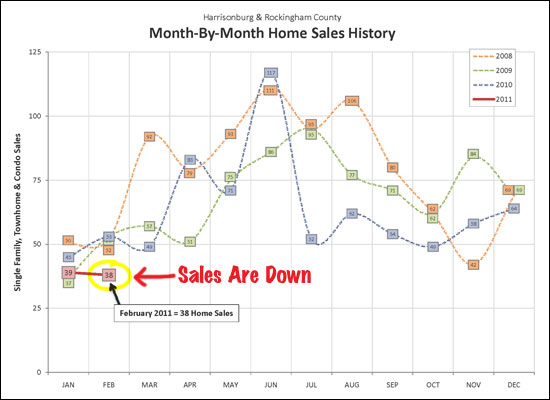

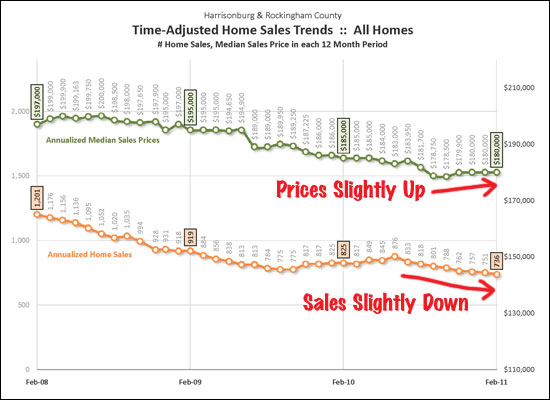

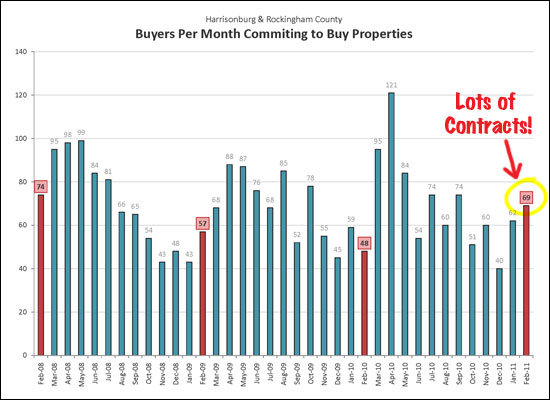

Despite many negative indicators in our local housing market, there may be hope for better news in the coming months. Click here to view a PDF of my most recent market report on the Harrisonburg and Rockingham County Real Estate Market, or read on for several excerpts....  As can be seen above, sales have dropped significantly as compared to a year ago -- both in February alone (28% decline) and in year-to-date figures (21% decline). Furthermore, we continue to see declines in both median sales prices (3% decline) and average sales prices (2%). As would be expected, this has lead to an increase (21%) in the time it takes to sell a house.  Above you will note that January home sales (39) were roughly equivalent to previous years' January sales. February 2011 home sales however (38) were significantly lower than February sales in 2008, 2009 and 2010. Thus far, the trend line for 2011 home sales is headed in the wrong direction -- if you're one of those people who likes to see positive improvement.!  The pace of home sales has declined steadily for three years (orange line above), as has the median sales price in this area (green line above). Of note, the median sales price has actually stabilized and increased somewhat over the past six months.  Above (in red and blue, instead of silver) is the silver lining of this month's housing market report. Buyers were out in full force in February 2011 --- with a full 69 properties going under contract. This marks a 44% increase over February 2010, which should lead to strong sales figures in March and April.  There's plenty more news in my monthly housing market report -- click on the image above (or here) to download and view the full PDF. As always, if you have questions about this report, or if I can be of assistance with real estate that you own, or that you'd like to own, please be in touch. You can reach me most easily at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings