Buying

| Newer Posts | Older Posts |

Home sales, contracts increase in October 2011, despite continued slow decline of home values |

|

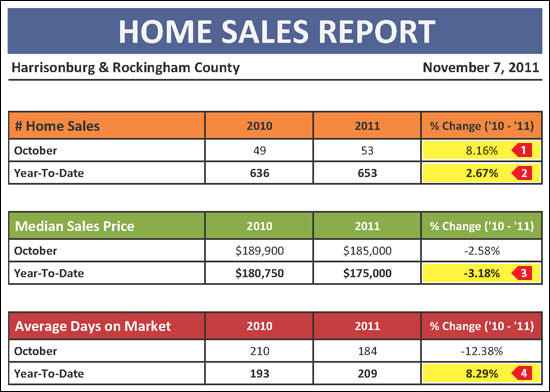

Click here to download my full market report (27 pages, 7 MB, PDF) or read on for highlights....  October was a relatively positive month for the local housing market:

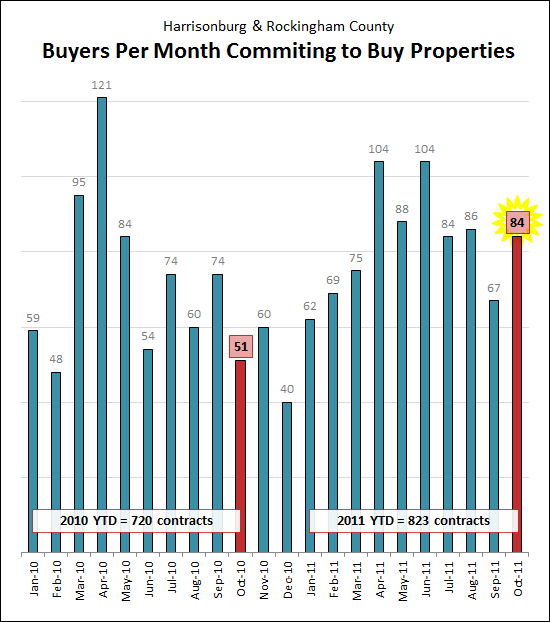

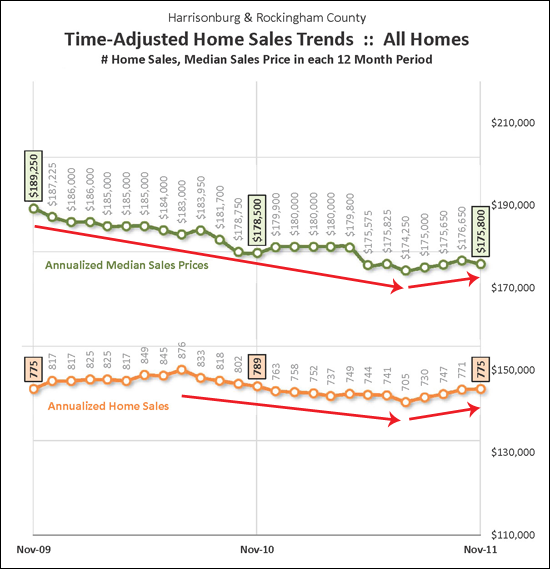

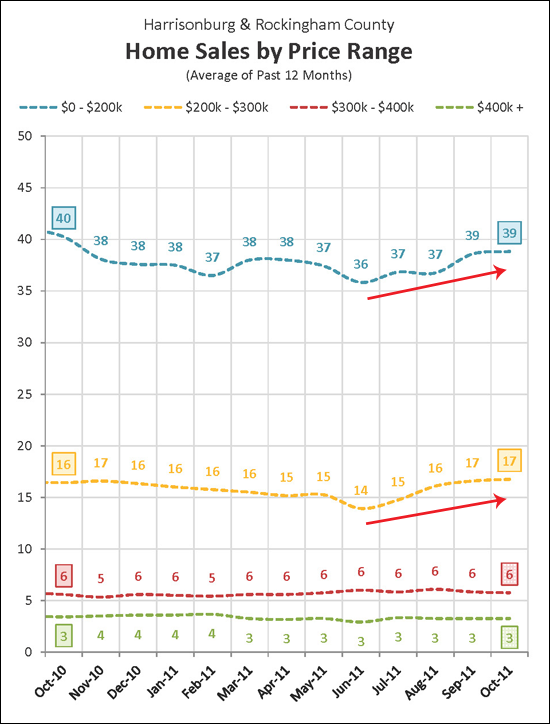

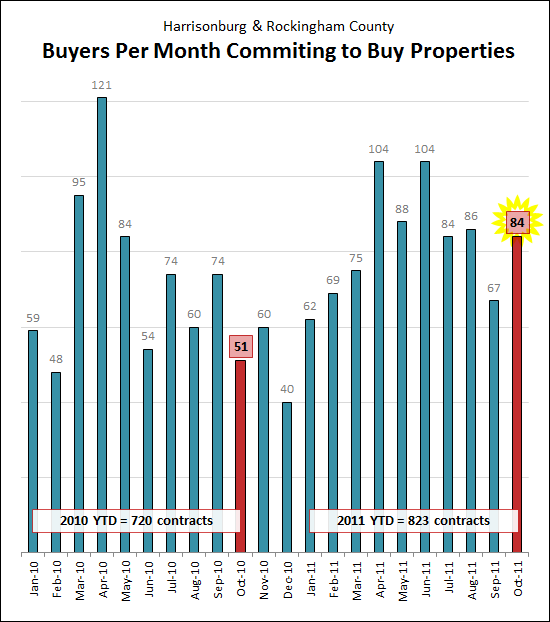

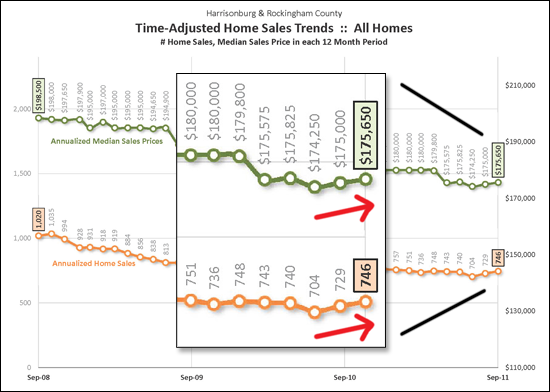

A strong sign of strength to come in the local housing market, October 2011 was a great month of buying activity, with 84 buyers committing to buy homes in Harrisonburg or Rockingham County. This marks a 65% increase in buyer activity as compared to October 2010!  Trends are very slow to reveal themselves in annualized sales figures (shown above) because they are an indication of 12-month rolling averages. That said, it seems that it may be a safe bet that home sales and home prices are on the mend when examining the graph above, which has now been showing increases in these long-term indicators for four months.  Some price ranges are recovering more quickly than others. The graph above shows that the price ranges under $300K have been starting to see increases in sales over the past several months. This should eventually roll over into the higher price ranges as buyers move up the price spectrum.  For an even more in-depth look at the Harrisonburg and Rockingham County real estate market, click the image above to download my full market report (27 pages, 7MB, PDF). If you have questions about the report, or if I can be of assistance to you with real estate that you own, or that you'd like to own, please be in touch. You can reach me most easily at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

Am I incented to try to get you to pay more for your home? |

|

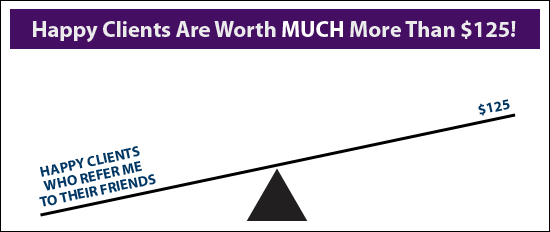

One of my buyer clients recently asked an excellent question -- whether I am really trying to get the purchase price as low as possible when I am representing a buyer in a transaction. It's a fair question -- my compensation out of said transaction, after all, is based on the purchase price. My client's concern was whether I would really be working hard alongside them in trying to get the price down as low as possible. I reassured that this was the case, for two reasons:

$10,000 increase in sales price leads to.... $500 increase in gross commissions (based on 5%).... $250 increase in commission on the buyer side of the transaction.... $125 increase in commission after broker/agent split. As you can see here, by trying to coerce my clients into paying $10,000 more for the house they are buying, I only stand to gain $125 (approximately). As is probably clear, I'd much rather have $125 less in my pocket and have clients who are happy about the deal we were able to find for them! | |

Want a bit more house? Move closer to work! |

|

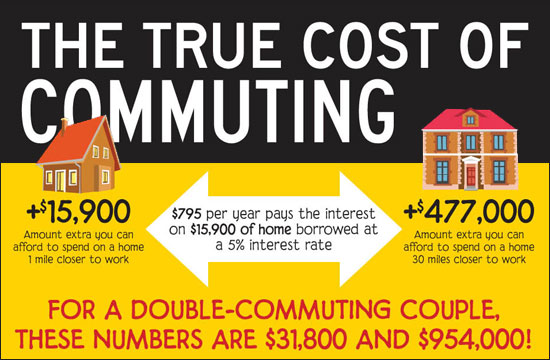

Sometimes a house closer to your workplace might cost more, but, there can be significant cost savings in buying a house closer to work. Click on the graphic below for the entire story.  Click here to view this entire (very interesting) infographic. | |

LOTS of buyers signed contracts in October 2011 |

|

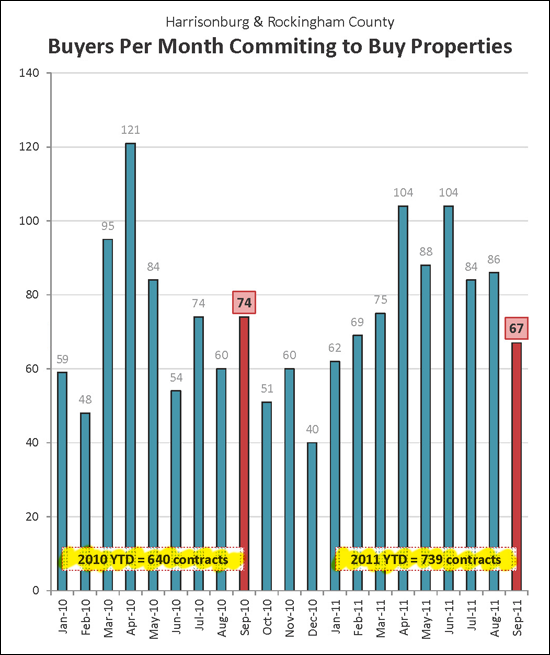

Despite starting to see some colder weather (and the first snowfall of the year) October 2011 was a strong month of contracts for Harrisonburg and Rockingham County. These 84 contracts was a significant increase over last October's 51 contracts -- and at 84 was right in line with May (88), June (84) and July (86). Wow! | |

Should I buy or should I rent? |

|

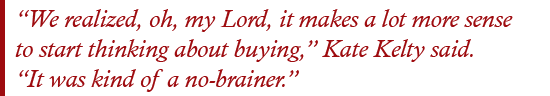

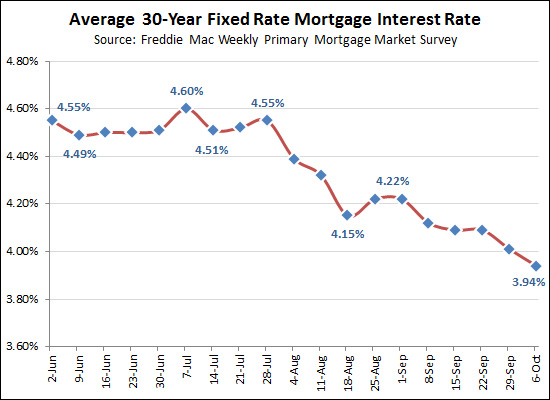

Yesterday's Daily News Record had a thorough look at buying vs. renting from a variety of perspectives. Here are a few (long-ish) excerpts....  HARRISONBURG — Chris and Kate Kelty had no plans of jumping back into the housing market a year after selling their townhouse. The couple with three young children figured they'd remain renters for a few years while building back up money for a down payment. Then they watched mortgage rates start plummeting. After a bit of number-crunching, the Keltys switched gears. "We realized, oh, my Lord, it makes a lot more sense to start thinking about buying," Kate Kelty said. "It was kind of a no-brainer." In August, the Keltys closed on a 2,500-square-foot home west of Bridgewater for $230,900. Their mortgage is $1,300 a month through a USDA Rural Development loan. Kelty, 32, said that's about how much renting a similar-sized house in the area would cost.  A good deal on a home in the county near Rockingham Memorial Hospital enticed Chris Foster, 25, to buy his first house in early October for $220,000. His mortgage payments are about $200 more per month than what Foster shelled out as a renter, but he doubled his living space while adding a garage and a finished backyard. "I had a goal all along to purchase sooner rather than later," said Foster, a pharmaceutical representative. "This was kind of a perfect storm, so to say."  Record-low mortgage rates have made buying a more attractive option for some renters. Interest rates on the average 30-year loan are hovering around 4 percent. "It would be difficult for renters to not strongly consider buying a home," said William Haithcock, chief executive officer of the Harrisonburg-Rockingham Association of Realtors. Those were just some excerpts, so be sure to read the full article online if you have a subscription. Of course, as usual, buying doesn't make sense for everybody, but it is becoming a much more compelling option for many these days. | |

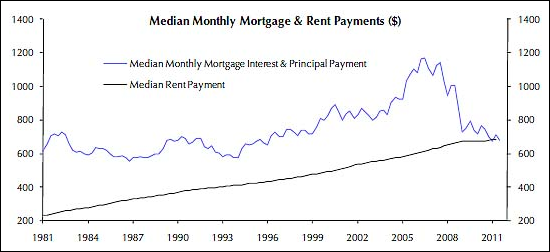

Median rental payment now equivalent to median mortgage payment |

|

There are plenty of ways to compare the opportunities of renting versus when buying. For example, a tenant in Avalon Woods recently discovered that he is paying more in rent per month than he would have to pay for a mortgage in purchasing this fantastic townhouse. This phenomenon is apparently also happening from an overall perspective as well, though, as median rental payments have now increased enough and mortgage payments have now decreased enough such that the median values are equivalent. The extraordinarily low interest rates we're seeing these days definitely help!  Source: Capital Economics, Thomson Reuters As this insightful article points out, however, the up front costs of buying (closing costs) are typically much higher than those related to renting (a refundable security deposit). Furthermore, it is quite a bit easier to decide to stop renting (provide notice to landlord) than it is to stop owning a home that you bought (sell it). | |

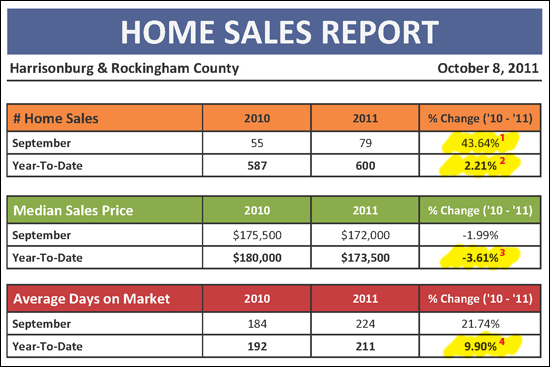

Home sales increase 44% in September |

|

Click here to download my full, 27-page report on the Harrisonburg and Rockingham County real estate market, or read on for highlights....  The housing market in Harrisonburg and Rockingham County continues to show signs of stabilization and recovery:

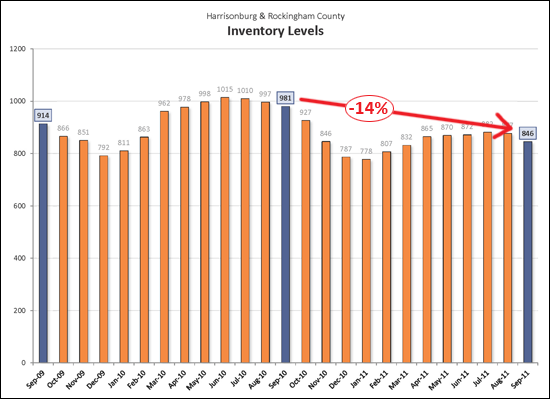

While contracts were down slightly in September (67 compared to 74 last September), contracts year-to-date are up 15%. Yes, that's right, 15% more buyers have committed to buy properties this year as compared to last year -- indicating that we should see continued strength in closed home sales over the next several months.  Helping to balance the housing market, inventory levels have declined 14% over the past year.  After three years of declining sales pace and sales prices, both metrics are now increasing when examined from an annualized basis.  If you have questions about the report, or if I can be of assistance to you with real estate that you own, or that you'd like to own, please be in touch. You can reach me most easily at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

Record low interest rates spur on buyer activity |

|

Average 30-year fixed mortgage interest rates are now below 4.0%. Wow! I have shown houses to quite a few people over the past two weeks who are seriously considering a housing transition because of the extraordinary opportunity provided by these record low interest rates. Are you considering a move? Talk to a lender (ask me if you need references), and let's start exploring your opportunities. | |

New Homes Just East of Harrisonburg, Virginia |

|

Many of the new homes built in Rockingham County over the past ten (to twenty) years have been built just east of Harrisonburg, in an area bounded by Boyers Road, Route 33, Cross Keys Road and Port Republic Road. Take a look...  These neighborhoods (shown above) offer quite a variety of housing options. Click on a link below to browse currently available homes for sale:

| |

Three things you (think you) need in your next home |

|

The following three features or attributes of a home are wonderful to have in a house, but I believe there is a disconnect between how much buyers want these things, and how much they they use them.  For many buyers, a whirlpool tub in the master bathroom is a must! But I hear from a lot of sellers that they never used their whirlpool tub.  Buyers are always impressed if the windows in a home can be tilted in to be cleaned. But sellers often admit that they rarely (if ever) actually took advantage of that easy opportunity for cleaning.  If a backyard has a bit of slope to it, buyers start to shy away from it, longing for a perfectly level backyard for endless hours of sporting fun with their children. But as a seller pointed out to me yesterday, they rarely see children outside in their neighborhood taking advantage of such a yard. What do you think? Are these three items essentials? Are they overrated? What else captivates a buyer's attention when they are buying a house, and then is quickly forgotten or taken for granted once they own the house? | |

First Time Buyers Beware! You might accidentally set yourself up for long term financial success!?! |

|

Frank is renting a townhome in Avalon Woods, and is paying $875 per month for the privilege to do so. He has thought about buying a home, but assumes he'd have to pay quite a bit more per month. Well, maybe not! If Frank were to buy a townhome in Avalon Woods (or Liberty Square, Beacon Hill, Harmony Heights, etc) he might pay around $140,000 for the townhouse --- or even less! Assuming $140,000, here is an illustration of what Frank's mortgage payment might look like, with a ridiculously low rate of 3.875% (which one of my clients was quoted yesterday)....  Frank will still have to pay $40/month for the Property Owners Association on top of this mortgage payment, but his monthly housing cost is now going to be $775. Wait a minute.......Frank is going to move from paying $875 in rent to paying $775 for a mortgage payment? How could this be?

What are you waiting for? If you're a potential first time buyer, let's talk through your situation to see if a home purchase might fit into your short term (housing) and long term (investment) plans. | |

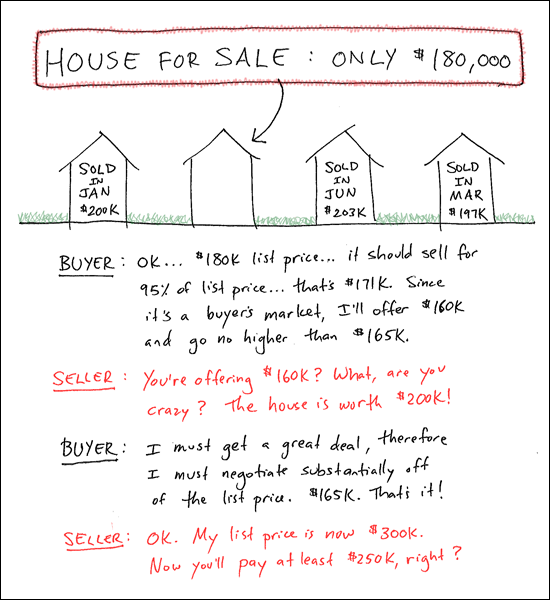

Buyers, keep a context for price in mind when making your super-low offer! |

|

Perhaps it doesn't always happen with such extreme price variations, but certainly you have had a seller who priced their home very competitively and then was shocked by an extremely low offer brought from someone locally. | |

Sellers are now landlords, and buyers are now tenants |

|

Five (or so) years ago, there were LOTS of first time buyers purchasing $150K new/newish townhomes in the City of Harrisonburg. Many of these buyers were young professionals or newly married couples. At the time, 100% mortgages were readily available, and sellers frequently paid closing costs, so a buyer could get into a house with just about no money at all. Buying a house was the cool and hip thing to do, so young people were buying houses/townhouses let and right. Fast forward to today, and we find that things are a bit different. People who would have bought five years ago are now renting because they would now need at least 3.5% of the purchase price as a down payment, and may have to pay their own closing costs. They also aren't buying because home values aren't increasing at a pace that would allow them to sell the house in the next few years without taking a loss. Thus, lots of the buyers of yesteryear are now not buyers at all --- they are deciding to rent a townhouse instead. But wait......so if there are lots of townhouse sellers, and fewer and fewer townhouse buyers, what is happening, or what will happen? In large part, many of today's would-be sellers are turning into landlords. After not being able to sell their townhouse that they bought five years ago, they decide to try to rent the property instead. This entire shift in who is (not) buying and who is (not) selling will likely take several years to sort itself out. One interest side effect is that there will be lots of 30-somethings who will unintentionally end up owning an investment property when they hadn't been aiming to do so. | |

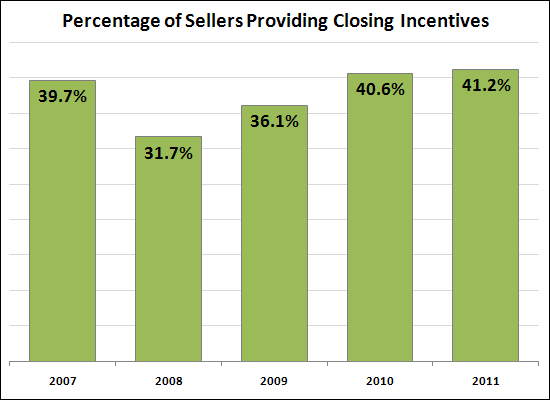

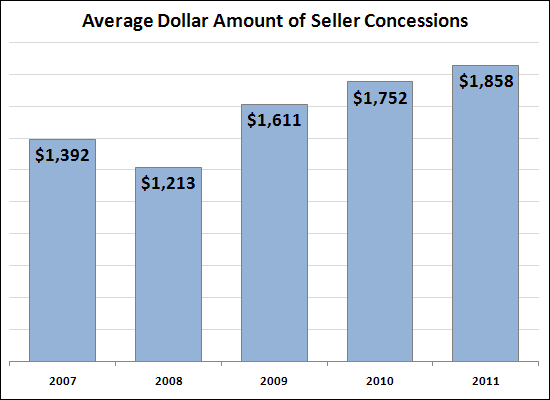

Seller concessions increase as market activity decreases |

|

Thank you, Michael, for suggesting that I analyze this....  As seen above, more sellers are giving concessions these days to close the deal. These concessions are most often a credit towards closing costs -- and thus far in 2011, 41.2% of sellers have provided such concessions at closing in Harrisonburg and Rockingham County home sales. This is a 30% increase over just three years ago.  Not only are more sellers making concessions, the average concessions are also on the rise --- from $1,213 three years ago to $1,858 thus far in 2011. This shows 53% increase, though the current average of $1,858 is less than 1% of the current average sales price of $201,364. | |

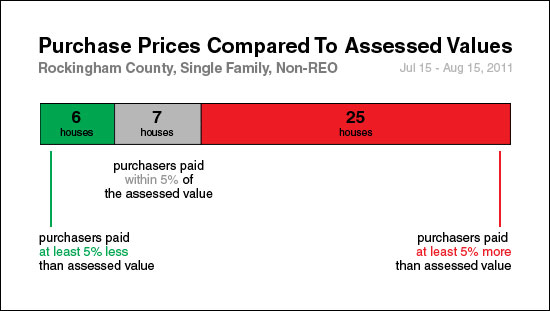

Should I be worried if I am paying more than the assessed value for a house? |

|

If you're buying a single family home in Rockingham County, chances are, you're paying more than assessed value for the house. Should you be concerned? No --- it just means that the assessed values aren't currently as close to market value as they are intended to be. To check in on the relationship between purchase prices and assessed values, I pulled all single family homes that sold in the past month in Rockingham County that were not bank owned sales. I then compared each sales price to the assessed value and found that most buyers paid at least 5% more than the assessed value (shown in red above). If almost all buyers were paying significantly less than assessed value, I'd be concerned about you paying more than assessed value --- but assessed values in Rockingham County are still quite low right now, leading to the data above. For your reference, in these 38 transactions, buyers paid (on average) 15% more than the assessed value of the home. | |

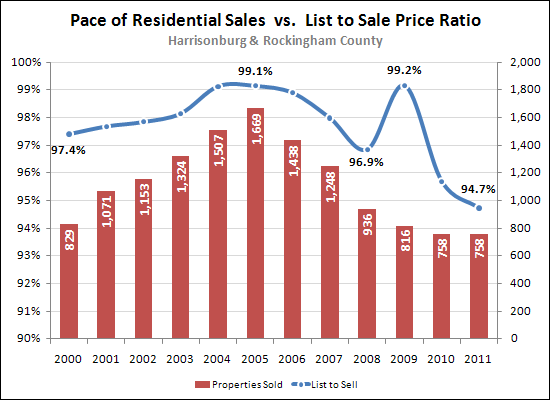

The list price to sale price ratio has adjusted with market, but not as much as you might have thought |

|

Back in 2000, homes sold at an average of 97.4% of the list price --- now, they sell for an average of 94.7% of the list price. That's not actually much of a shift --- only a decline of 2.7%. A few other observations....

| |

What Monday's (rather positive) local real estate market report does and does not mean for you |

|

There are lots of positive trends in the local housing market right now!

Is the future now rosy and bright? Will home value start going up, up, up again? While there are some wonderful, positive indicators in Monday's housing market report (PDF) here are some other not-as-exciting current market realities:

I would suggest cautious optimism. While we're not out of the woods yet, there are lots of indicators that would suggest that we're nearing a turning point in the market. | |

Just wait until all of these contracts turn into home sales! |

|

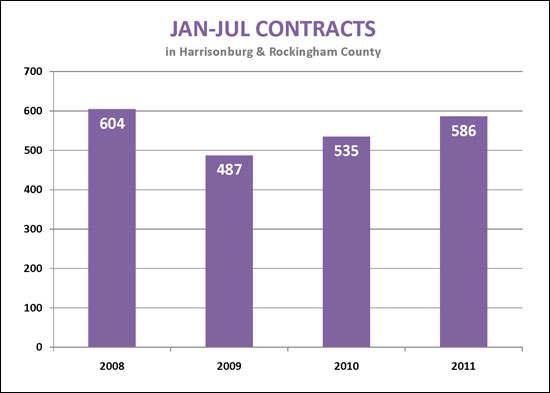

It is exciting to see how quickly contracts are coming together on homes in Harrisonburg and Rockingham County compared to the past several years. At the rate that properties are currently going under contract, 2011 should finish out a (relatively) strong year of home sales -- very likely exceeding 2010 sales. Increased contracts will eventually lead to increased sales will eventually lead to stabilized home values will eventually lead to a more balanced real estate market. Stay tuned! | |

What goes into determining an asking price for a house? |

|

I was in Virginia Beach for a few days last week, and the house where we stayed (pictured above) is currently listed for sale. The price (near $1M) seemed high, but it is a almost-beachfront property, and I don't really know much about the Virginia Beach real estate market. In talking with the neighbors, however, we were told that the asking price really was too high, and that it was a result of what is owed on the property. The scenario above is not unusual -- plenty of homes on the market today are priced relative to how much the seller owes the bank, instead of based on market realities. Closer to home, in conversation two weeks ago with a buyer client, he asked "so why is that house priced so high?" I responded with "because they wanted to price it that high." Indeed, a home seller can price their home (if their Realtor is willing) however high (or low) they want to --- which means that the asking prices of homes are not always logical. Don't read too much into the asking price of a house -- it could be extraordinarily high, or the deal of the decade. Talk to your Realtor about the recent sales prices of comparable homes to ground yourself in current market realities. | |

Are lower inventory levels leading to fewer home sales? |

|

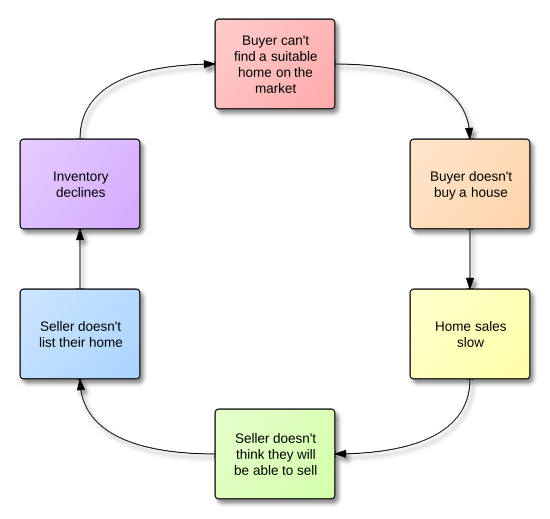

After showing a house to some buyer clients yesterday, we were reflecting on the fact that there don't seem to be too many options on the market in the price range that they are considering with the characteristics that they are seeking in a home. We wondered aloud as to why it might be that we can't find them a home right now --- yet at the same time, sellers are wondering why they can't find a buyer for their home right now. Here's what I think is going on.....  If this is what is occurring (generally speaking), it begs the question of how we break out of this cycle. One suggestion is that perhaps more potential sellers ought to consider putting their homes on the market if they can offer a product and price combination that would be compelling in the current market. What are your thoughts? Does this accurately portray one dynamic of the current local real estate market? | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings