| Newer Posts | Older Posts |

Why are we waiting so long to order appraisals?? |

|

I have had five transactions thus far this year where this dynamic seems to be at play....  The diagrams above are not showing the new reality for all lenders --- it is just a reflection of my experience with many lenders recently. For whatever reason, (many) lenders (on many transactions) seem to be waiting to order an appraisal until they have completely finalized the approval of the borrower. This is problematic for several reasons:

If you're buying a house, make sure your lender orders your appraisal as soon as you have made loan application --- especially since the fee that you pay at application is at least partially for the appraisal. If you're selling a house, don't assume that the appraisal has been ordered as soon as the buyer makes loan application. Follow up and make sure that the appraisal is ordered ASAP. If any lenders can explain why this is happening, or provide any good reasons for it happening this way, I'm all ears. | |

March 2012 shows a SURGE of buyers in the market! |

|

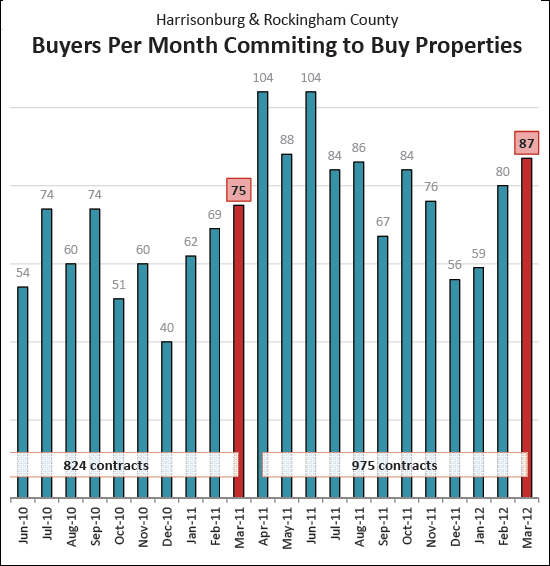

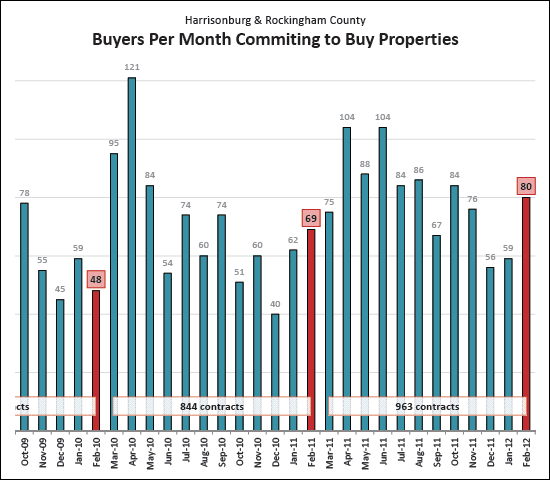

One factor that is helping our housing market to show continued signs of improvements (in the pace of sales) is that we continue to see strong levels of buyer activity in the form of contracts. Now, bear in mind, not all contracts result in closings -- but without a contract, closings rarely occur. ;) See above -- last month (March 2012) there were 87 contracts --- that is more than some of the summer months last year. We are likely due for a strong remainder of our spring housing market as well as a strong summer market based on the amount of buyers in the market these days. Of note -- even with Spring Break, and Easter, there have already been 28 contracts in the first 9 days of April. | |

Harrisonburg housing market shows continued signs of improvement in March 2012 |

|

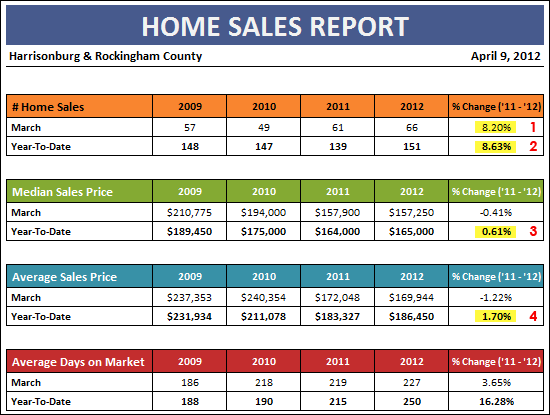

Harrisonburg and Rockingham County home sales were at a four year high during March 2012, and for the entire first quarter of 2012. Click here to jump to the PDF of the full market report, or keep reading.  March continued the trend of positive indicators in our local housing market:

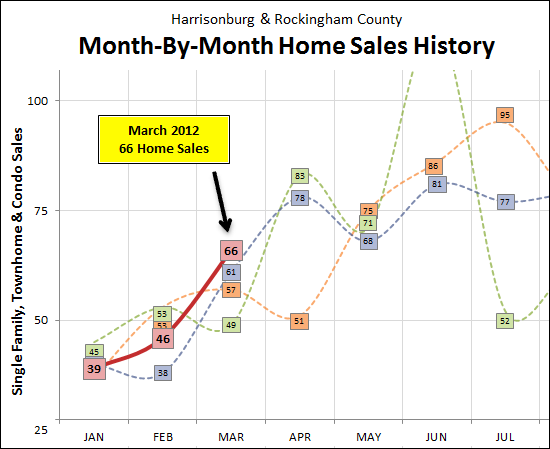

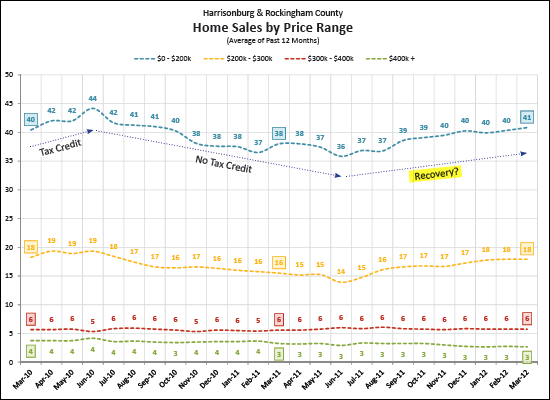

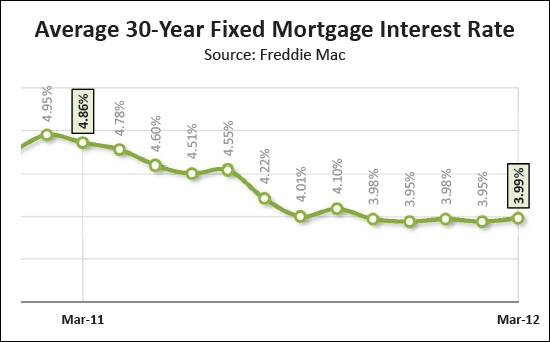

March 2012 was a fantastic month for home sales in Harrisonburg and Rockingham County, with 66 home sales closing -- the highest we have seen in the past four years. This sets the year up with a strong base as we move into the remainder of the spring and then summer market.  The pace of home sales certainly varies based on price range. The graph above shows the average number of home sales per month (given a 12-month average) as we have passed through the past two years. You'll note that the sale of homes for less than $200,000 increased through June 2010 and then declined for the next 12 months. This phenomenon is almost positively a result of the federal home buyer tax credit that encouraged these sales during 2009 and 2010. Of note, however, this segment of the market (under $200,000) has shown steady increases since June 2011, as has the $200,000 to $300,000 market.  Home buyers continue to find amazingly low interest rates on 30-year fixed rate mortgages, with the current average rate of 3.99% continuing the five-month streak of staying below 4.0%.  There is plenty more to read, analyze and understand. Click here (or on the market report cover above) to download my full monthly market report. And -- if you have questions about the local housing market, or if I can be of assistance to you with real estate that you own, or that you'd like to own, please be in touch. You can reach me most easily at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

Yes, this is a buyers market, but you still will not be able to steal a house. |

|

I certainly think buyers should be able to get a good deal on a house in the current market -- after all, there are more sellers than buyers in the market. And maybe, sometimes, buyers will get a great deal. And occasionally, an unbelievably amazing deal. But some buyers seem to think they should be able to steal any house on the market. Oh, I like that one that is listed at $225K. Let's offer $175K -- they'd be lucky to have me buy it for $175K! Hmmm, OK, so they're asking $375K. I would only be willing to pay $310K for the house -- I mean, c'mon, it is a buyers market, right? It is important for both buyers and sellers to have a firm understanding of what to expect in the current market. Are you just starting to consider buying or selling? A great starting point is my monthly market report, or I'd be happy to meet with you to give you a thorough understanding of our local real estate market -- and help you set reasonable expectations for buying or selling in today's market. Feel free to e-mail me (scott@HarrisonburgHousingToday.com) or call me (540-578-0102) to set up a time to meet. | |

Is an improving housing market good news for everyone? |

|

photo source: erix The local housing market is improving (sales up, prices up) but as someone pointed out to me earlier this week, that's not necessarily good news for everyone. But I do think it's good news for just about everyone. Certainly, it's good news for sellers -- they're now more likely to be able to sell, and don't have to worry (as much) about their home losing even more value before they sell. Certainly, it's good news for homeowners -- the value of their home now seems to be stabilizing. It's mixed news for near-term buyers -- it might mean that there are fewer deals to be had in the coming months, but since they're buying soon they can console themselves with the realization that their newly purchased property is not likely to continue to decline in value after their purchase. It is bad news for far-future buyers -- if you're not buying for a few years, it is understandable (sort of) that you'd like the market to get worse, so that you would have better buying opportunities. So, what about you? Are you glad the housing market is improving? | |

Home sales and median prices on the rise in Harrisonburg, Rockingham County |

|

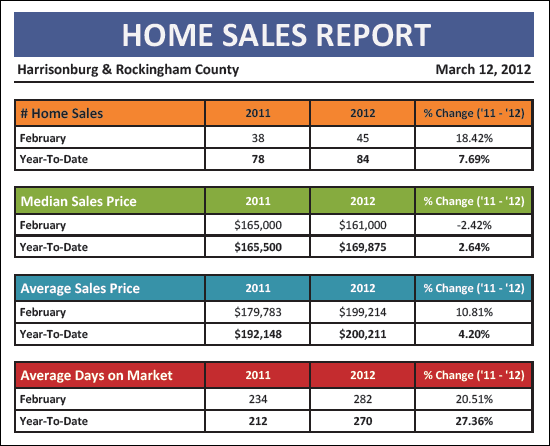

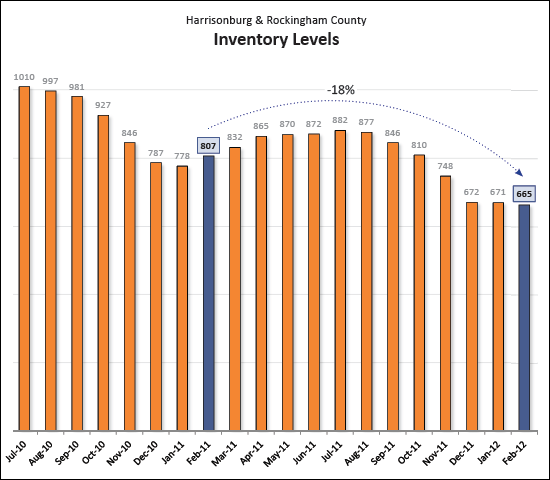

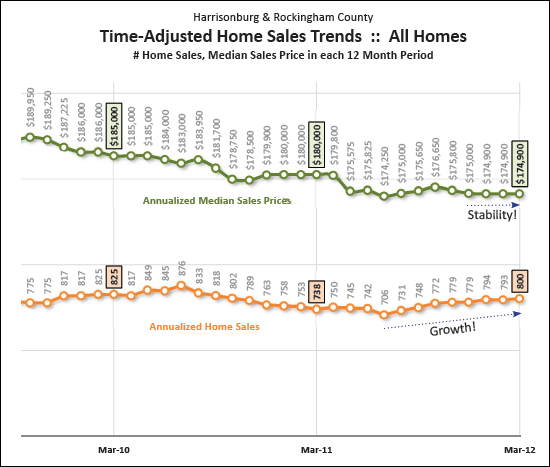

Good news! With two months of 2012 under our belts, our local housing market is showing signs of continued stability and growth. Click here to jump to the PDF of the full market report, or keep reading.  As shown above, the pace of YTD home sales has increased 8% from 78 home sales (Jan-Feb 2011) to 84 home sales (Jan-Feb 2012). Furthermore, the YTD median sales price has increased 3%, and the average sales price has increased by 4%. After quite a few years of seeing declines in median and average sales prices, this is a welcome change!. The time it takes to sell a home, however, is still on the rise --- showing a 27% YTD increase.  February 2012 was another strong month of buyer activity, with 80 buyers signing contracts to buy homes. This marks a significant 16% increase over last February -- and even comes close to the summer months of 2011.  Remarkably, even now through the beginning of March, there are fewer and fewer homes for buyers to select from in our local market. Inventory levels have dropped 18% over the past year --- from 807 homes down to 665 homes. Typically we start to see an increase at this time of year, but I welcome these lower inventory levels, as it can help our market to continue to stabilize.  After many years of a declining pace of home sales, we have now seen a reversal in this trend over the past eight months as the annualized pace of sales has increased from 706 sales/year to 800 sales/year. This is welcome news, and likely contributes to the relative stability in annualized median sales prices that we have seen over the past four months.  There is plenty more to read, analyze and understand. Click here (or on the market report cover above) to download my full monthly market report. And -- if you have questions about the local housing market, or if I can be of assistance to you with real estate that you own, or that you'd like to own, please be in touch. You can reach me most easily at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

How does this home inspection process work, anyhow? |

|

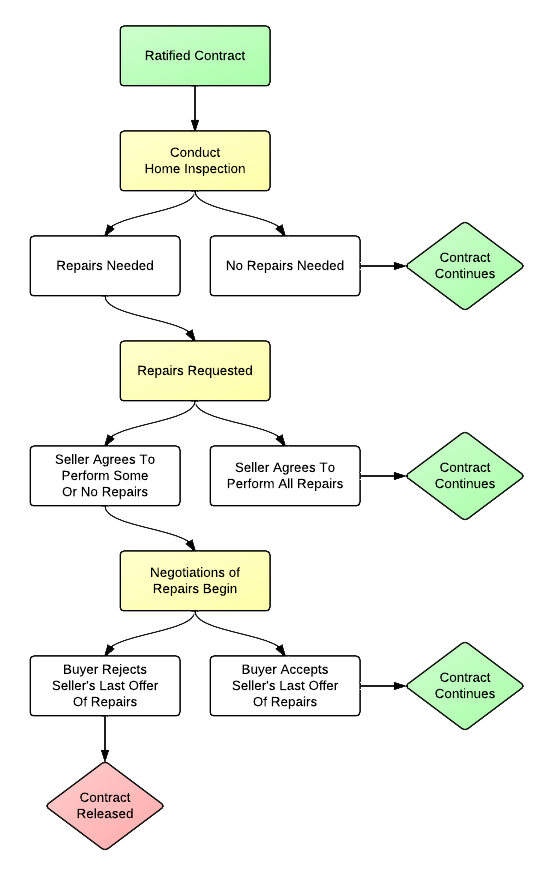

Here's a reminder of how the typical home inspection process works in Virginia....  And a brief reminder of a few of the timing issues.....

To map this all out, here's how long a home inspection contingency could really take....

Yes, that innocuous 14 day inspection contingency can really turn into a month! | |

Everything you need to know about buying an investment property in Harrisonburg, Virginia |

|

Types of Investment Properties in Harrisonburg Overview of Real Estate Investing in Harrisonburg Reasonable Goals for Buying an Investment Property in Harrisonburg Everything You Need To Know About Buying An Investment Property in Harrisonburg, Virginia Buying real estate for your son or daughter to live in while they attend JMU Analyzing Investment Properties Three ways to buy a foreclosure in Harrisonburg or Rockingham County, and how to find such opportunities OK, that's probably not EVERYTHING you need to know, but I hope it is a good start towards it. If you are ready to consider buying an investment property, please e-mail me (scott@HarrisonburgHousingToday.com) or call me (540-578-0102) to discuss your investment goals. | |

Buyers are BOLD! I think I'm happy to see that!?? |

|

Recent negotiations I've been a part of, or have heard about.... SELLER: $299,000 BUYER: $225,000 SELLER: $239,000 BUYER: $215,000 SELLER: $495,000 BUYER: $300,000 Needless to say, more and more buyers are making low offers on properties that are currently for sale. Buyers would call the offers aggressive. Sellers would call the offers ridiculous, absurd, far-fetched, tear-inducing, etc. I do think, however, that this is an important part of a real estate market that is regaining its foothold and seeing what home values really are, what they should be, and what they could be. Even if some (many?) of these low offers don't go anywhere, and even if they hurt the feelings of some sellers, I think that in a big picture sense it is good that buyers are making these offers. It puts the local real estate market in a lot better position than when buyers were just sitting on the sidelines thinking sellers' prices were too high, and not being willing to do anything about it. Buyers.....keep 'em coming! Sellers.....let's brace ourselves, and work hard to try to make a deal work! | |

When there aren't sellers in a corner of the market, or there aren't buyers, funny things happen |

|

For every buyer there is a home, and for every home there is a buyer -- right? Well, it doesn't always work out to be so neat and tidy. What happens when there aren't sellers? Twice in the past six months I have listed homes for which the sellers and I could not find good comparables when we were pricing the home. We did our best in pricing the homes, and in the end our pricing was appropriate -- but we just couldn't find many similar homes that had sold anytime in the past year. And what do you know --- when each of these two homes (one around $200K, one around $250K) came on the market , there was a flurry of showings and an offer that resulted in a contract. Sometimes, there are homes that are quite popular amongst buyers (based on size, price, location, acreage, etc) that don't become available too often. When they do become available, they sell quickly, because of the lack of similar sellers in the market. What happens when there aren't buyers? Unfortunately, sometimes the reverse takes place. There are plenty of homes currently on the market that show well, are marketed well, and just aren't selling. I typically advise people that it is either price, condition or marketing --- but it is possible optimize all three of those areas and still not sell your house. Selling your house, after all, requires that there are buyers (or at least one) in the market that want to purchase such a home. Sometimes, there just aren't buyers looking for a particular type of home (based on size, price, location, etc) -- and thus these homes can languish on the market. | |

It might get to where it is more affordable to buy than rent. Oh wait, it already did. |

|

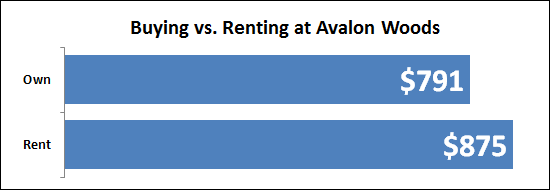

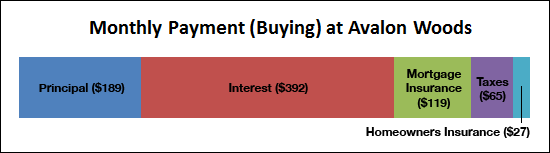

It seems likely that at least one of these active listings at Avalon Woods could be purchased for $130,000 -- and I know of several townhouses that have recently been rented for $875/month in Avalon Woods. As you can see above, this tips the scales towards owning a home being the more affordable option on a monthly basis.  Of further interest, is that of that $791 monthly payment, a full $189 goes towards the principal of your mortgage -- thus you're paying down over $2,000 of that mortgage debt in the first year alone. Certainly, there are other upfront costs (closing costs, down payment) that you will have when buying --- but it is once again an exciting time for first time buyers when you can potentially reduce your monthly housing budget through buying a home. | |

Finding a deal on a townhouse in Harrisonburg |

|

There are some deals to be had on townhouses in Harrisonburg, based on:

Some of these are bank owned properties (post-foreclosure) and some are homeowners who are just ready to move on. I have had investors take advantage of some of these great opportunities, and I have had some first time buyers take advantage of them. Send me an e-mail (scott@HarrisonburgHousingToday.com) or call me (540-578-0102) if you are looking for a great deal on a townhouse and I'll fill you in on the details. Also, don't forget that you can find out a lot of information about townhouses communities in/around Harrisonburg by visiting HarrisonburgTownhouses.com. | |

So, I'll have 671 great homes to choose from, right? |

|

With 791 home sales during 2011, and 671 homes on the market, one might assume that there are PLENTY of homes for buyers to choose from, right? That is over 10 months of supply, you know, which means that approximately 1 out of 11 homes will go under contract each month (11 not 10, to account for new listings). But looking a little closer, perhaps there won't be 671 great options to choose from....  Now admittedly, there are plenty of homes that have been on the market for more than three months that will be interesting to buyers (and will sell), because:

| |

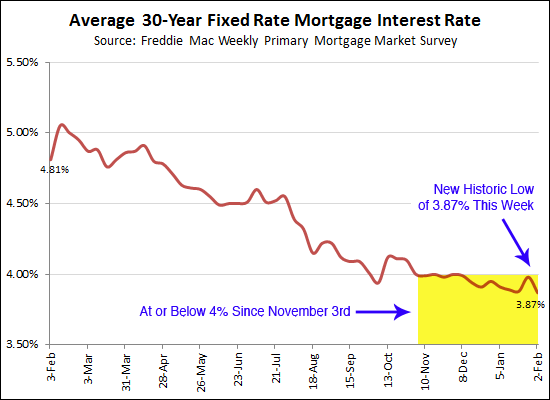

Average mortgage interest rates (3.87%) break historic low levels, again |

|

Not only have 30-year fixed mortgage interest rates been at or below 4% since November 3rd, they also hit an all-time low this past week at 3.87%. Buying a median priced home a year ago: Price: $180,000 Interest Rate: 4.81% Monthly Payment: $884 (assuming 80% LTV) Buying a median priced home now: Price: $174,900 Interest Rate: 3.87% Monthly Payment: $781 (assuming 80% LTV) | |

Three ways to buy a foreclosure in Harrisonburg or Rockingham County, and how to find such opportunities |

|

If you are in the market to buy a home, some of the properties you might be considering are foreclosures – but there are some distinctions to be aware of at different stages of the foreclosure process. It is possible to buy a home from the owner before they are foreclosed on even if they cannot pay off their mortgage – this is called a short sale. Or, you might buy a property at the courthouse steps when it is being auctioned – this is called a trustee sale. Finally, if a property does not sell at the auction, you can buy the property from the lender after they have taken ownership of the property – this is called a bank owned property or REO property. SHORT SALES: Some homeowners must sell their home, but market conditions won't allow them to sell it at a high enough price to be able to pay off their mortgage(s). In this example, a homeowner might have a $250,000 mortgage balance but can only sell the property for $230,000. As a prospective buyer, it is sometimes possible to purchase this type of a property through a process called a "short sale." In such an arrangement, the homeowner petitions their lender to accept less than the full payoff of the mortgage and in return to still release the deed of trust so that ownership of the property can be transferred over to you, the new owner. This can benefit the lender, as they skip the time delays and cost of the foreclosure process. This can also benefit the homeowner, as a short sale will have a slightly lesser negative impact on their credit as compared to a foreclosure. As a buyer, however, you must know that there are challenges to buying a property as a short sale. The biggest challenges of late seem to be the uncertainty of the purchase and the time table. Even if you and the homeowner agree to a price of $230,000, the homeowner's lender must still agree to accept that price – since it won't allow the homeowner to pay off their $250,000 mortgage balance in full. This process of waiting to hear back from a lender, and then complying with all of their various terms can sometimes take 60 to 120 days – or longer! Research potential short sales in Harrisonburg and Rockingham County online via www.HarrisonburgShortSales.com  TRUSTEE SALES: If a short sale does not take place, and a homeowner is behind on their payments (or not making them at all), eventually the property will be sold by the lender on the courthouse steps. Buying a property at a "trustee sale" can be exciting, and can be a great opportunity – but there are challenges as well. If a property to be sold at a trustee sale is also listed for sale with a Realtor, you can usually view the property ahead of time by calling your Realtor. Otherwise, you will likely not have the opportunity to see inside the property before the trustee sale, and thus you will not know too many details about the condition of the property. Furthermore, your purchase of the property at the trustee sale cannot be contingent upon viewing the property, or inspecting the property. In this instance, you are purchasing the property in "as is" condition, regardless of what you then find out about the property. It is also important to note that many times the lender will have an opening bid at the trustee sale that is close to (or sometimes higher than) the amount that they are still owed on the mortgage. Thus, in the example above, they might make an opening bid of $250,000. As a result of this opening bid process, many (or most) properties available for purchase at a trustee sale are not great opportunities. Occasionally, a property will be foreclosed upon that has had a mortgage in place for many years, whereby the balance of the mortgage is much lower than current market value – these are great opportunities for a buyer. Research upcoming trustee sales in Harrisonburg and Rockingham County online via www.HarrisonburgForeclosures.com  BANK OWNED PROPERTIES: If you don't buy the property before the auction (as a short sale), and don't buy it at the trustee sale, you'll have a third opportunity to buy it once the bank owns it. These properties are called "bank owned properties" or REO properties ("real estate owned"). Oftentimes, the prices on these properties are quite realistic, if not under market value. It would not be atypical for a house such as the one mentioned above to come on the market after the trustee sale at a price of $210,000. In such an instance, you should expect to be buying the property in "as is" condition, and you will also be buying with a slightly different contract document. Most lenders have a long standard contract or contract addendum that spell out a variety of additional contract terms designed to protect them from any future liability – and rarely will a lender agree to have these contract documents changed in any way. As you can see above, oftentimes buying the property as an REO property is where the best opportunity lies. Research currently available bank owned properties in Harrisonburg and Rockingham County online via www.HarrisonburgREO.com  When a home goes into foreclosure it is often for very sad and unfortunate reasons – such as the loss of a job – and I do not wish such circumstances on any homeowner. However, if you are a buyer in today's market it is important to be familiar with different methods for buying a property when it will be, is being, or has been foreclosed upon. For information about purchasing a property as a short sale, or purchasing a bank owned property, please e-mail me at scott@HarrisonburgHousingToday.com or call me at 540-578-0102. | |

If a resident of Rockingham County has a job and some level of job security, why wouldn't they buy a home or move into a different home? |

|

A great question from a blog reader. Any thoughts, other blog readers? | |

Crikey, mate! Good onya for that price! |

|

Would you advise your Aussie friends as to whether they're getting a good deal on the house they're buying in Sydney? Would you want to make sure they were gobsmacked about the price you were paying for a house here in Harrisonburg? What about New York City? If your friend was buying a condo in Queens, would you weigh in on what she should pay? And would you wait anxiously to hear back from her about how how you should price your duplex in Dayton? How about Richmond? If your mom lives in Glen Allen, will she get the final call on the price you pay for your new single family home in Harrisonburg? I'm sure you have intelligent Australian friends, well-read pals in Queens, and astute parents in other areas of Virginia -- but I challenge you to:

Again, I am sure you have very well intentioned, well informed friends and relatives all around Virginia, the United States, and perhaps the world. But at some point, we'll need to focus in on the nuances of the Harrisonburg and Rockingham County housing market and make the best decision in a local context. I am ready to spend as much time as needed with you to help you understand our local housing market and how such an understanding could and should guide your real estate decisions. Are you ready? | |

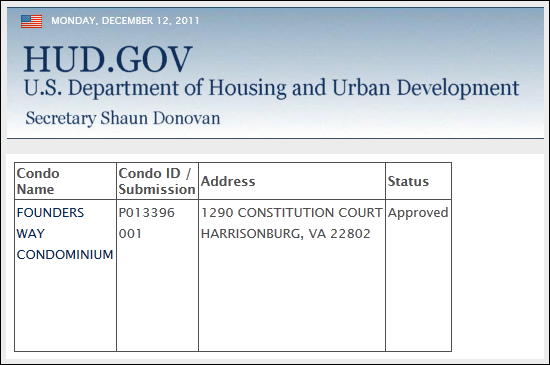

When buying a condo, make sure it's FHA approved |

|

Many condo buyers would like to purchase their condo using an FHA loan, and some condo communities are no longer approved for FHA loans. Here's the news from last month....  How might that affect you here in Harrisonburg? Well, one of the newest and most exciting condo communities in Harrisonburg is Founders Way. OK, yes, I do represent the developer and thus might be a bit biased -- but that's what we hear from the people who have bought at Founders Way too! So, if you're interested in buying at Founders Way, can you get an FHA loan?  That's right folks, you can still (quite easily) buy at Founders Way using an FHA loan. So if you're looking for an exciting new condo community in Harrisonburg, look no further than Founders Way, featuring:

To find out more about Founders Way....

| |

Budget 34% less for your housing costs at Taylor Spring |

|

Yesterday I pointed out that monthly housing costs have declined 28% since 2007 because of modest declines in median sales prices and significant declines in average mortgage interest rates. But let's make it a bit more specific.... The first townhouse pictured above was sold in 2007 for just $100 more than the median sales price at the time, and your monthly housing cost would have been $1,096 if you financed 80% of the purchase price at the average interest rate of 6.21%. The second townhouse pictured above is for sale now for only $159,200, and would require a monthly housing cost of only $719 -- again, assuming you financed 80% of the purchase price at today's average interest rate of 3.99%. This is quite a dramatic difference (-34%) in housings costs, and hopefully helps to illustrate the wonderful opportunities for buyers in today's market! | |

Declining home values don't bother today's buyers |

|

Cars, clothes, and computers all lose value over time as we use them and as they age. Houses, however, typically increase in value over time. While we don't get upset about cars, clothes and computers losing value, it can be quite upsetting if our houses diminish in value. Home values in Harrisonburg and Rockingham County increased through 2008, but then declined 5% in 2009, 3% in 2010 and are on pace to decline another 3% in 2011. But in many ways, today's home buyers aren't too concerned if home values drop even another 3% through next year! If you are considering purchasing a home today, you should be planning to own it for at least four or five years. As was the conventional wisdom of the past (as recent as ten years ago), home buying often isn't a great financial move if you are only planning to own the home for one to four years due to the costs incurred through financing the purchase and then selling the home two years later. The transactional costs of buying and selling are too high, from many people's perspectives, to make it worthwhile to buy a home for a short time period. Thus, if today's home buyers are planning to own their home for at least four or five years, a small decline in value over the next year doesn't, or shouldn't, bother them too much. Today's extraordinarily low interest rates make today's home prices a great value for buyers even if they could buy the home at a slightly lower price a year from now. It will cost you $664 per month (principal and interest only) if you purchase a median priced home ($175,000) at today's mortgage interest rates (4%) with a 20% down payment. If, a year from now, prices are 3% lower ($169,750), but mortgage interest rates are a half a percentage point higher (4.5%) you will be paying more for your house -- $678 per month. With such low interest rates, today's home buyers who are looking for a great deal are buying now to get a great (fixed!) interest rate rather than holding out for a slightly lower home prices with an interest rate that is not quite as favorable. Home buyers realize that improving their quality of life today is worth an extra dollar per day. Even aside from the leveling impact of low interest rates referenced above, most of today's home buyers decide that it is not worthwhile to delay buying and moving into the home that they love just to try to get a slightly lower price one year from now. After all, a mortgage payment on a median priced home ($175,000) will only decline by $25 in the next year if median prices decline by another 3%, assuming a 20% down payment, and a mortgage interest rate of 4% both today and a year from now. For most people, this potential cost savings of $25 per month isn't substantial enough to delay a home purchase and to live in a less than ideal situation for the next year. If you're looking at the real estate market and wondering if you should keep waiting to buy a home because home values might decline over the coming year – just assume that they probably will. But then consider that the many home buyers who are taking action today are seeing beyond a slight decline in home values over the next year. They recognize that they are in it for the mid to long term, they don't want to miss out on today's low interest rates, and they don't want to delay improving their living situation. Carefully examine your housing situation and finances, because if you will be buying a home within the next two years, it might make the most sense to buy it in the near term, even if home values decline a bit further after your purchase. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings