| Newer Posts | Older Posts |

Looking for a good primer on the home buying process? |

|

I am happy to help you learn all about the home buying process --- so feel free to e-mail me and we can set up a time to meet. And....hopefully the variety of information on my web site serves as a good learning tool for you to gain a better understanding of how to buy a home. But wait, there's more! Click on the image above (or here) to check out VHDA's online, free educational course about the home buying process. VHDA's 8 hour course offers information in areas such as....

If you are going to finance your home with a VHDA loan, you must take the class above --- but regardless of your financing plans, you can take the class for free and learn a LOT about the home buying process. Again, I am certainly willing to help you learn all about the home buying process, but the resource above might be helpful for you as well. Check it out and let me know what you think. | |

You had better lock in that mortgage interest rate, because they are headed up, oh wait, nevermind! |

|

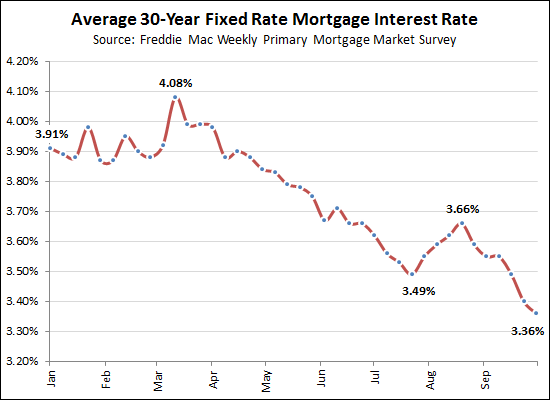

After some increase in the average mortgage interest rate between late July and late August, it looked like we were finally going to see mortgage interest rates start to climb. But now, they have achieved yet another historic low this week, with an average 30-year fixed rate mortgage at 3.36%. Wow! If you bought a $300K house with 20% down, your payment would be another $74/month less expensive because of the decline in interest rates that we have seen since the beginning of the year. If you're buying soon, buy now. Lock in a 30-year mortgage interest rate at these ridiculously low rates, and brag about it for years to come! | |

Zillow, Trulia are not as accurate as a local broker or agent web site |

|

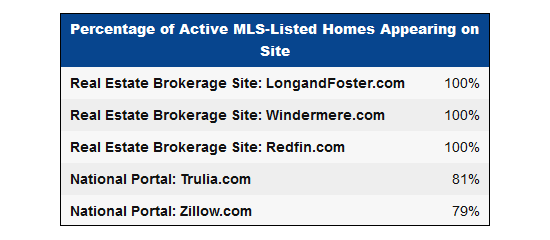

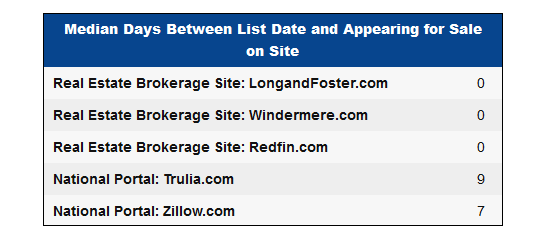

The WAV Group published a rather interesting study yesterday, analyzing the data on Zillow, Trulia, and broker web sites in 11 major markets including the Washington Metro area. Several key findings are represented below....  As shown above, Trulia and Zillow were likely to show a significantly incomplete set of listings --- mainly because they do not have a direct feed from the MLS, and thus they piece together their listing data from multiple sources.  As shown above, it takes Zillow and Trulia much longer to show new listings than a local broker or agent web site.  Finally, over a third of the listings on Trulia or Zillow will appear to be active, when they are really under contract. Read the full study here for further details, and remember that when you are using Zillow or Trulia for your home search, you are dealing with a partial data set, that is always running about a week behind, and that 1 out of 3 of the houses that you'll be viewing is really already under contract. Feel free to search on my web site here, and stay tuned for exciting announcements about my web site in the coming weeks. | |

How to find a great deal on an investment property |

|

During the real estate boom, many people were trying to "get rich quick" by investing in real estate – and many people succeeded. Now that the market has cooled back down, there are still great investment opportunities, but you have to know where to look. Foreclosure Auctions offer a unique opportunity to buy a property at a price that could be much lower than market value. A lender will open up the bidding at such a Trustee Sale with a price typically dictated by the remaining balance on the owner's mortgage plus the Trustee's fees. In many cases, this opening bid is higher than market value --- but occasionally, there will be great opportunities to buy a property at the courthouse steps and then keep it as a rental property, or fix it up and sell it. The caveat to this, of course, is that you will usually not have the opportunity to view the interior of these properties before the auction. You can review upcoming Trustee Sales online at HarrisonburgForeclosures.com. Bank Owned Properties are those that do not sell at the courthouse steps and thus come to be owned by the bank that foreclosed on them. These properties typically offer better than average buying opportunities – but they are not amazing deals – the bank wants to recoup as much of their loss as possible. Buying a bank owned property is relatively straightforward, though it requires wading through the lengthy additional contract documents provided by the lender. You can review upcoming Trustee Sales online at HarrisonburgREO.com. Under-Priced Homes don't come around too often, but occasionally you (or I) will spot a property on the market that is priced lower than it should be. Typically this happens as the result of an above-average motivation to sell – perhaps an owner needs to leave the area for a new job, or there might be bigger picture financial issues, or a divorce, etc. Whatever the reason, there are usually a few properties on the market with better-than-they-should-be asking prices, providing unique buying opportunities for the alert investor. Buying in bulk can offer you a discount, just as when you shop at Costco. If you are in a position to acquire several properties at once, from the same owner, you will typically have much more negotiating ability than you would otherwise. This could include multiple investment properties owned by one individual or entity, or perhaps new construction properties. If you are interested in investing in real estate in Harrisonburg or Rockingham County, there are opportunities to be tracked down, at the sources above and using a few other research strategies depending on your specific goals . Don't forget, of course, to also consider how you will finance the purchase, whether you will rent or flip the property, and the tax implications of investing. It can still be an exciting time to invest in real estate, though you must be more strategic now than was required during the real estate boom. | |

Harrisonburg Promotes Language Proficiency Through Smithland Elementary's Dual Language Immersion Program |

|

Click above to view parents of kids in Smithland's Dual Language Immersion Program talk about their experience with the program. Smithland Elementary's Dual Language Immersion Program offers elementary students (K-2) the opportunity to have half of their instruction during the day in English, and half in Spanish. The program was started two years ago with Kindergarten, and has now been expanded to include first and second grade. Click here to read the recent (Sept 4, 2012) Daily News Record article on the program. Looking to buy a home in Smithland to have a chance at enrolling your child in the Dual Langauge Immersion Program? Here's one fantastic house that is currently on the market....  3 BR, 2.5 BA, 2252 SF, fenced backyard, large basement family room (learn more) | |

Should I be concerned if the seller wants my home inspection to be for informational purposes only? |

|

Sometimes a seller is stating this as soon as they list a property: All inspectors are for informational purposes only. But sometimes a seller will introduce this amidst negotiations. It can certainly trigger some warning signals for a buyer......but should it? Here are the top three innocent reasons why a seller would want a home inspection to be for informational purposes only....

So, as you can see, it's not all bad if a seller wants an inspection to be for informational purposes only --- though I would still suggest (in such a situation) that you reserve the right to reconsider the purchase on the basis of the home inspection, just in case a big issue is discovered. | |

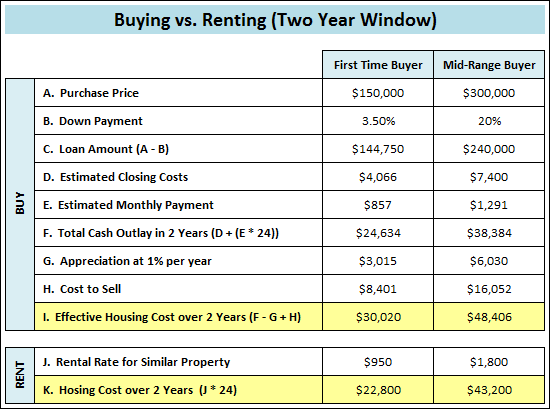

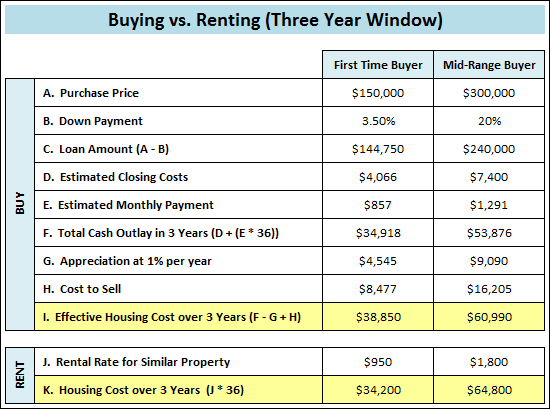

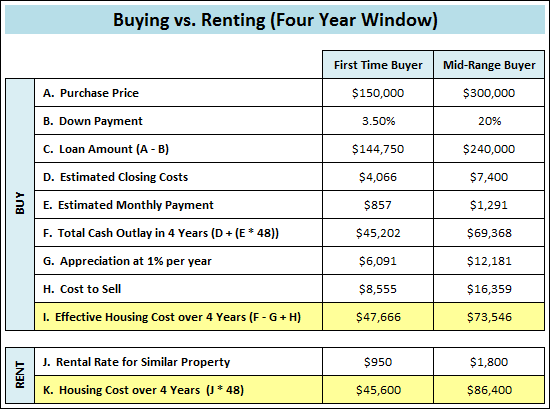

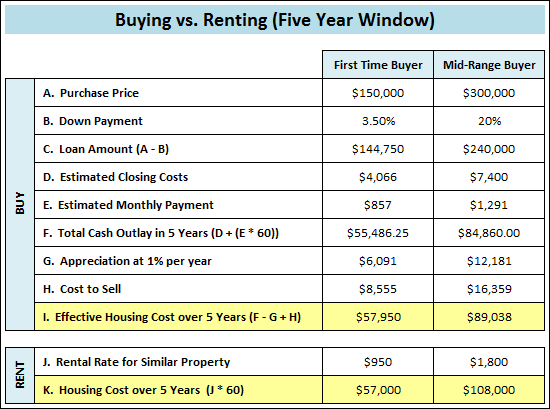

Should I buy a home if I am only going to be there for two years? |

|

It depends on the price range, how much of a down payment you are making, whether you are willing to keep the property as a rental property after you move out, and many other factors. However, below is a 2-year, 3-year, 4-year and 5-year analysis of buying versus renting a property valued at $150K compared to $300K, which shows that....

There are, of course, plenty of extenuating circumstances. Many people might buy a $150K house (or townhouse) even if they are planning to be there for only 3 years --- because they want their own home (not their landlord's), or to get in a certain neighborhood, or because of the tax benefits (not shown below). Every buyer's situation is different, and I'd be happy to help you run an analysis similar to those shown below if you're interested in analyzing your best housing move.

| |

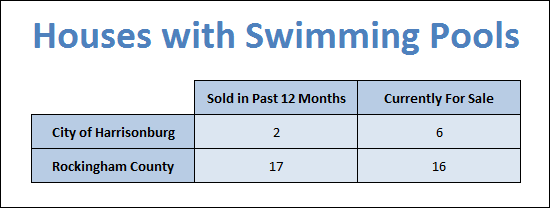

So, you're looking for a house with a pool, are you? |

|

There aren't too many houses with swimming pools in Harrisonburg and Rockingham County --- at least not that many that you can actually buy. To refine it even further, last evening I was talking to a colleague who has (potential, future) interest in relocating to the Harrisonburg area and buying a home on several acres with a swimming pool (and tennis courts, but we'll ignore that for now). There are only 4 (!!!) houses currently for sale on 3+ acres in Rockingham County with a swimming pool..... 3817 Treasure Hill Ln Timberville, VA 22853 --- $799,900 14838 Little Dry River Rd Fulks Run, VA 22830 --- $315,000 7124 Windy Cove Rd Bridgewater, VA 22812 --- $379,900 9377 Fox Hill Dr Port Republic, VA 24471 --- $499,000 It might be a slow and tedious hunt, but if you want a house with a pool, let me know, and I'll start looking for you now. | |

Both builders and buyers now prefer custom homes over spec homes |

|

These definitions do not describe all possible situations, but they will give you a general idea of the two ways to go about buying/building a new home.... CUSTOM HOME: A home designed jointly by builder and buyer, which is then built to the buyer's specifications. SPEC HOME: A home designed by a builder, and built speculatively by the builder, who then works to find a buyer for the completed home. Back in the height of the housing market (a.k.a. housing boom)....

Now, after the market has cooled off quite a bit (a.k.a. housing bust?)....

Thankfully, these desires actually coincide. There were lots of spec builds in the height of the market, and lots of buyers to buy them. There are very few spec builds now, and very few buyers to buy them. Given the givens, here is some guidance for today's market.... Builders --- if you're going to build speculatively, put a good deal of thought into the floor plan and make sure it is going to be an attractive layout for a wide spectrum of buyers. Also, consider finishing the house through the drywall stage and then marketing it to find a buyer that can make their own selections for interior finishes. Buyers --- talk to your lender early to know what will be possible for you. Buying a lot, obtaining construction financing, and building a custom home is quite a different financial transaction than buying a finished home with a traditional mortgage. | |

The specs can be good on paper, and the photos can continue the story, but.... |

|

Do you ever see a house for sale online that seems to be too good to be true? It has everything you are looking for (4 bedrooms, 2 bathrooms, 2400 square feet) and it is priced $40K below all of the other homes you have been considering. Shocked at the low asking price of your apparent dream home (per the specs) your hand trembles as you move your mouse over towards the "more photos" link to look inside. Could it be? Could it really be? (Side note: Could it be what?? That the seller has grossly under-priced his house? And that no other buyers have figured it out yet?) Your excitement builds even further as you look through the online photos --- the hardwood floors, the new gas range, the beautiful light fixtures! It is at this moment that you are thankful you have my phone number (540-578-0102) set on speed dial......and we quickly set up a time to meet at the house. Walking quickly up the sidewalk, we look over our shoulders, wondering if other buyers and their Realtors will be showing up soon, joining into a frenzied pursuit of this wonder-house. But sadly, as we start to walk through the house, we realize we've been fooled again --- by what the specs didn't tell us, and by what the photos didn't show us....

Walking back out of the house, our gait is notably slower and our shoulders slump in despair. Yet another house that was too good to be true. While the house looked good on paper, it was quite a different value proposition once we were actually inside. Having experienced this several times lately, here is some advice...

| |

Smiling: I absolutely LOVE your house (whispering: but I have to sell mine) |

|

I've been on both sides of the table, multiple times, in the past three weeks. Deals that should come together, but won't necessarily, yet. These days, it seems that there are plenty of both.... ....SELLERS who are elated to see so many showings of their house, especially when it is new on the market, and further delighted that buyers have nothing but wonderful compliments about the property and its value in the current market. ....and BUYERS who have found the house of their dreams, and know it is priced quite well, but (BUT) are not yet able to take action, because they need to sell their own house before buying. So, what is each party to do in such a circumstance? Let's flip it around..... If serious about the house they'd like to buy, then BUYERS should quickly get their own house on the market (if it isn't already) to try to generate a buyer in time to make an offer on the house of their dreams. Don't be greedy when listing your home --- price it fairly, and appropriately per the market, so that it has a good chance of selling in time for you to buy your dream home. Don't bother (in most circumstances) making an offer contingent upon the sale of your home, as that can be quickly moved out of the way when a more qualified buyer comes along. SELLERS, balance carefully the pro's and con's of accepting a contingent offer if you should receive one. It can certainly lock in a buyer, but that might discourage other buyers from considering your home --- and if a buyer already has your home under contract, it might make them less anxious to sell their own house quickly. It's a tricky thing, this proposition of buying and selling simultaneously, but it can happen --- and does happen, regularly. When you're ready to buy, or sell, I'd be happy to consult with you and help make the transition a smooth one. | |

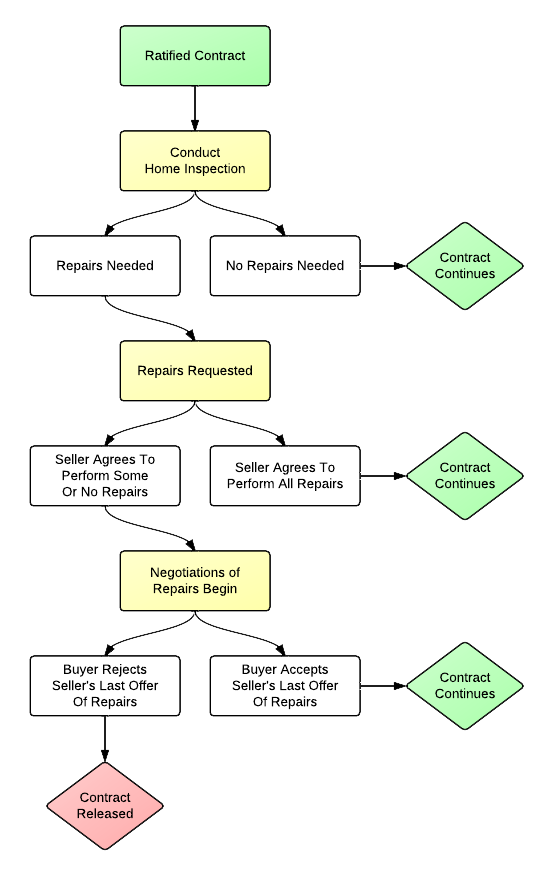

How does the home inspection process work in Virginia? |

|

The first thing to know about the home inspection process is that it is a process for the benefit of the buyer. However, the standard contingency form and negotiation document typically used in our market are balanced documents that attempt to respect the needs and priorities of both the buyer and seller. The Context When making an offer on a property, a buyer negotiates the price and other terms based on their understanding of the property at the time of the offer. However, often buyers will include a home inspection contingency to allow themselves an opportunity to learn more about the property with the help of a professional home inspector. Thus, if a buyer negotiates a contract on a house that has two broken windows, it would not be reasonable to try to negotiate for the repair of the windows during the home inspection process, since that fact was already known about the house --- but if a leaky sink is discovered, it would be perfectly reasonable to request that repair. The Substance The standard inspection contingency references a long list of areas for inspection, including: geotechnical inspections, inspections of the structure, foundations, roof, flooring, HVAC systems, electrical system, plumbing system, appliances, exterior insulation finishing systems, drainage, windows, well and septic systems, and lead-based paint and radon. Yet at the same time, the inspection contingency specifies that the buyer may only request the repair of "material defects" which is described as "those items that could affect the decision of a reasonable person to purchase the Property" and would not include "cosmetic items, matters of preference, or grandfathered systems or features that are properly functioning but would not comply with current building codes if constructed or installed today." The Flow Post-inspection, a buyer may provide the seller with a list of requested repairs. The seller would then respond by offering any of the following:

The Problems Potential pitfalls during the inspection and re-negotiation process include:

| |

Making a low offer? Beef up your other offering terms. |

|

I know, I know, you want to make a low offer on the house. It seems like every buyer does these days -- and why not, as it is certainly still a buyer's market in Harrisonburg and Rockingham County. But when making that low offer, you can increase the appeal of your offer by strengthening your other offering terms.... DEPOSITS Make the largest deposit you are comfortable with so the seller knows you have money "on the line" and that you won't risk losing that money by attempting to walk away from the deal. CLOSING COST ASSISTANCE Sellers don't just look at the contract price --- they calculate their net proceeds based on the offer price and any credits or closing cost assistance. Only ask for assistance if you truly need it. FINANCING Provide as much detail as possible about your financing intentions, and always include a pre-approval letter. Sellers who believe you are capable of financing the purchase will be less hesitant as they consider other terms of your offer. PERSONAL PROPERTY Don't automatically ask for everything the seller intends to convey --- if you don't need them all, leave them out of the offer. Allowing the seller to keep their washer/dryer (for example) may make them more flexible in other areas. INSPECTIONS Having a professional inspect the property you are purchasing is usually a good idea; however if you only intend to do it for informational purposes, consider leaving it out of the contract negotiations and conducting it post-settlement. SETTLEMENT & POSSESSION If possible, cater your settlement date and the details of transferring possession of the property to the needs or wants of the seller. This can go a long way towards gaining seller flexibility on other contract terms. Finally, research the seller's context for selling. That information can be invaluable in negotiating a successful contract. | |

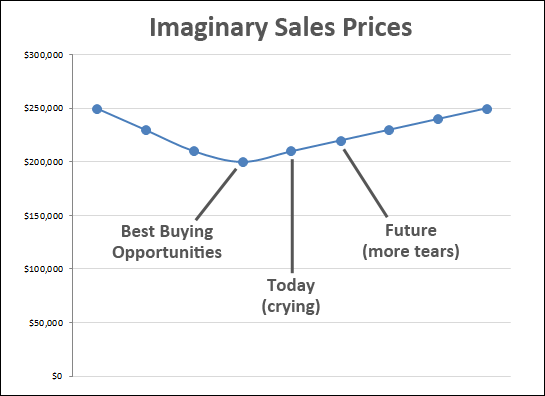

In a market upswing, crying over missed past buying opportunities can lead to even more tears |

|

In the fictitious value trend graph above, the best opportunities were yesterday (or some time before now). As a housing market starts to improve, some buyers have a tendency to get stuck on the fact that they just missed out on the lowest prices seen during a market downturn. It is important for those tearful buyers to remember, however, that there will likely be more tears and larger tears tomorrow (or some amount of time into the future) when prices have recovered even further. For example....

A few notes and disclaimers....

| |

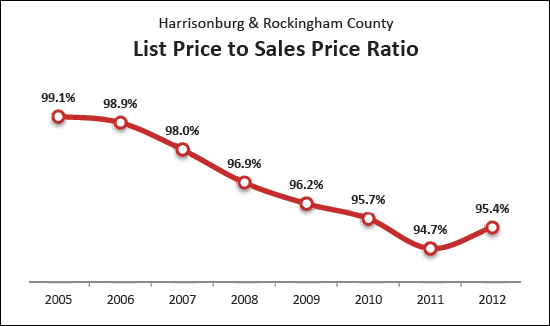

Is the window of maximum negotiating ability closing? |

|

Hidden in yesterday's monthly market report was this new graph that explores the amount that sellers negotiate off of their asking prices. As you can see, at the peak of the market (2005) sellers only negotiated 0.9% (on average) off of their asking price. That metric has since fallen all the way down to 94.7% in 2011 --- well below the assumed normal of 97.4% in 2000, before the real estate market started taking off like a rocket. The important thing to note, though, is that this metric is edging back upwards thus far in 2012 --- to an average of 95.4%. That means that sellers are finding themselves negotiating less on their asking price because of gradual overall market improvements. Sellers -- be encouraged that you won't be beat up as much on price as we move forward. Buyers -- if you want to negotiate heavily on price, consider buying now, not next year. | |

Check out these apps if you're in the market for a home! |

|

If you're in the market to buy a home, and you have an iPhone or Android phone, you might consider some of these apps profiled by Fox Business.... Ten Apps Every Homebuyer Should Have | |

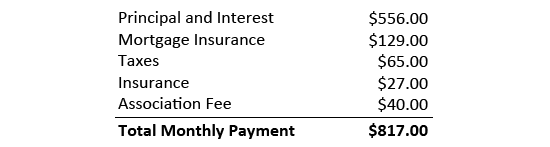

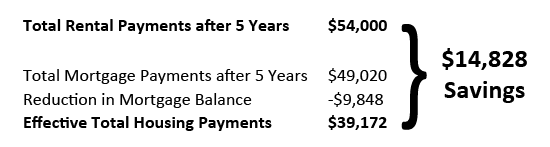

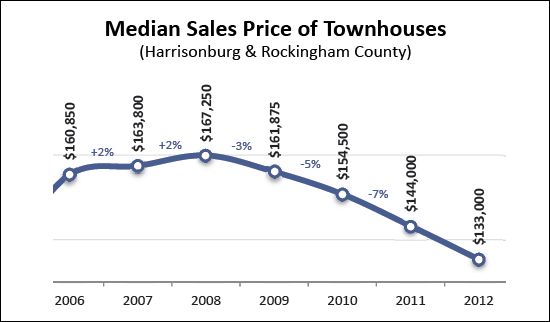

To rent, or to buy a Harrisonburg townhouse |

|

In meeting with a potential buyer of a City townhouse yesterday, we found ourselves comparing the opportunities in buying versus renting. RENT = $900/m. There are regularly options for renting a two-story townhouse in Harrisonburg for $875-$950 in Avalon Woods, Beacon Hill, Stonewall Heights, Liberty Square, etc. BUY = $817/m. With an FHA loan, buying such a townhouse apparently may cost as little as $777 per month assuming a $130K purchase price, 3.25% interest rate, 3.5% down payment.  This shows an $83/month cost savings of buying instead of renting. If we then look at the difference between renting and buying over a five year time period, the advantages start to pile up.  You'll also want to keep closing costs in mind (for buying) but as you can see, there are some compelling reasons to consider buying a townhouse if you are in the market to rent one but know that you'll be in the area for the next five years. The mortgage details were generated using Wells Fargo's online mortgage estimate tool and this is the scenario I was considering. | |

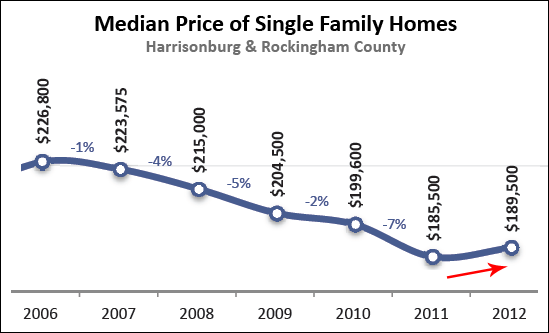

If (single family) home prices are about to head back up, then now is the time to... |

|

As mentioned earlier this week, home prices may be ready to head back up. So, if you have been waiting to buy until you were confident about the future of the market --- now may be the OPTIMAL time to buy. This may be the lowest point for prices, with a brighter future ahead. These are likely the lowest interest rates we'll see in the next few years. These are likely the lowest home prices we'll see anytime in the near future. If you're on the fence as to buying, talk to your Realtor today about getting the ball moving forward on a purchase! And if you don't have a Realtor, I, of course, would be more than willing to assist you with your home purchase. Drop me a line at scott@HarrisonburgHousingToday.com or call me at 540-578-0102. | |

True Story: Bidding wars after lengthy time on market |

|

Timing is everything when it comes to real estate. For example, 2006 was not the best time to buy, and 2011 was not the best time to sell. But moving beyond those obvious realities, it is wild to see how the timing of offers can affect listings that have been on the market for "quite some time" -- sometimes defined as 6+ months, sometimes 12+ months, and sometimes even 18+ months. I have had two situations thus far this year when listings had been on the market for "quite some time" with no offers at all, and all of a sudden, two offers were received within the same week. It is quite a strange situation....

Now, let's be clear here -- multiple offer situations used to involve ultimate sales prices at or above the list price -- and that is rarely happening these days in multiple offer scenarios. However, sellers in such circumstances are certainly selling for a bit more than they would have if both offers had not happened to come in simultaneously. | |

Leasing instead of selling your townhouse |

|

Plenty of townhouse buyers from the past five years would now like to sell their townhouse and move up to a single family home. But it has been difficult to do so recently because of adjustments in townhouse values.  Thus, I have counseled many townhouse owners that if they really want to move up to a single family home, that they ought to seriously consider leasing their townhouse instead of selling it. This doesn't work for everyone (especially if you need to free up some equity in your townhouse) but it can be a great long-term decision. Read about how unwillingly keeping your townhouse might be your best (unintentional) financial move yet to see how the owner of such a townhouse could potentially experience $230,000 of gain over 30 years of owning the townhouse. If you can't sell, you should seriously consider leasing your townhouse, and I'd be happy to help you analyze the opportunity to see what would make the most sense for your situation. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings