Buying

| Newer Posts | Older Posts |

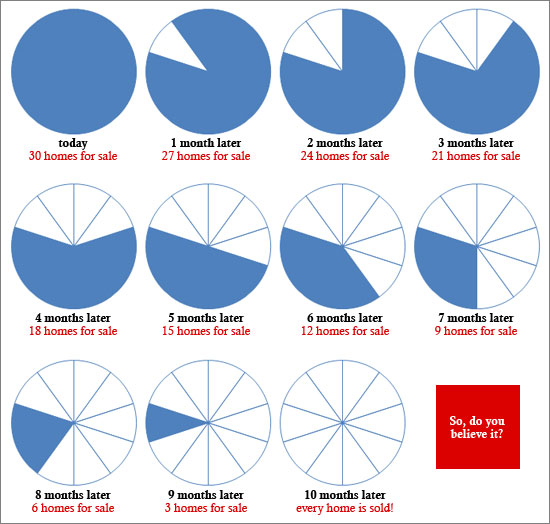

If there are 10 months of housing supply available.... |

|

Follow this "months of supply" logic with me....

Remember....30 houses for sale, 3 houses sell per months, so it probably looks like this....  Do you believe it? It doesn't really work that way. Here's the problem (for sellers) --- each month when three houses sell (go under contract), they will always almost be replaced by another three new listings. Thus, every month the odds are the same (roughly) --- there will again be 30 houses for buyers to choose from, and only 3 houses will be chosen. It then becomes clear that some houses will NOT be chosen, month after month. Again and again, a house will be a part of the 27 instead of a part of the 3. Thus, if 10 months of housing supply exists in a particular market segment, and a house has been on the market for 11 months, it isn't necessarily a terrible house --- it just has not been able to rise to the top 10% during any of the past 11 months. That, then, is an interesting object lesson for sellers. What do you need to do (with marketing, price, etc) to be in the top 10% of the houses for sale? Settling for being in the top 30% might not work so well for youIf the top 10% keeps selling, and new listings keep landing in the top 10% --- your "top 30% house" could sit on the market for month after month. | |

Founders Way Condos Proving Popular With Buyers |

|

Full Disclosure: I represent the developer of Founders Way. Harrisonburg home buyers haven't had too many condo options to choose from in the recent past if they actually wanted to live in the condo....

Now, however, there is a new option in town --- Founders Way Condominiums. The condos at Founders Way feature 2 or 3 bedrooms, and start at only $142,900 (see all pricing). These newly built condos feature upscale kitchens, an open floor plan and spacious master suites -- think hardwood laminate floors, granite countertops, contemporary lighting fixtures, nine foot ceilings, decorative archways and colonnades, etc. Oh, and quite a few of these new condos are selling! The community will eventually consist of 72 condos -- but for now the first building of 12 has been constructed, and the condos are at various stages of completion. Of the twelve condos in the first building at Founders Way....

Let me know if you'd like a tour of Founders Way --- I'd be happy to meet you on site. You can reach me at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

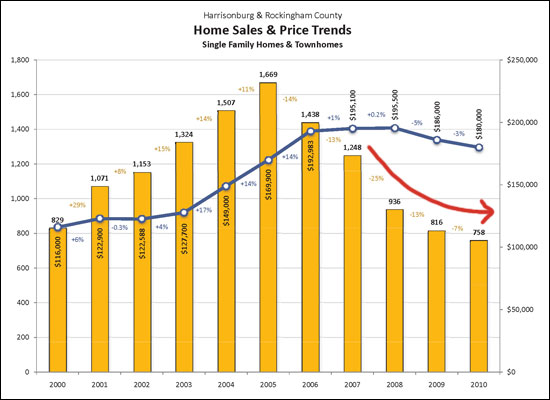

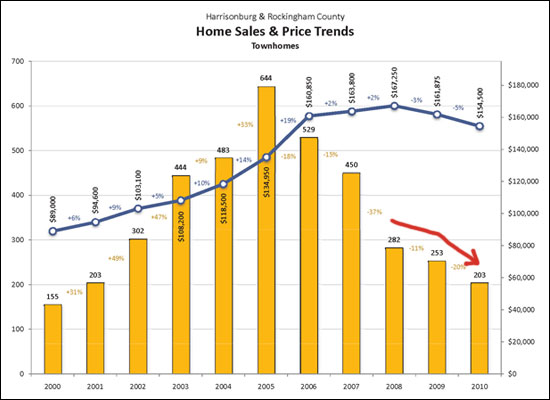

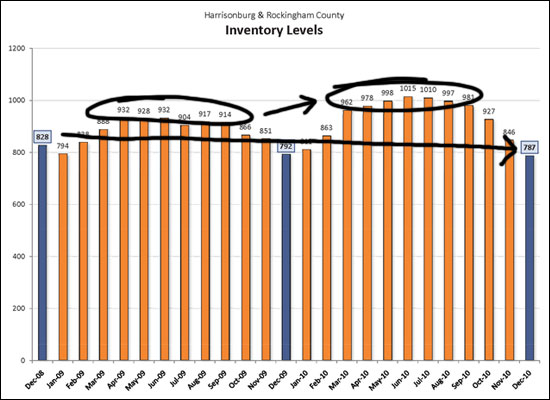

Harrisonburg Housing Market Steadies in 2010, Except Townhomes |

|

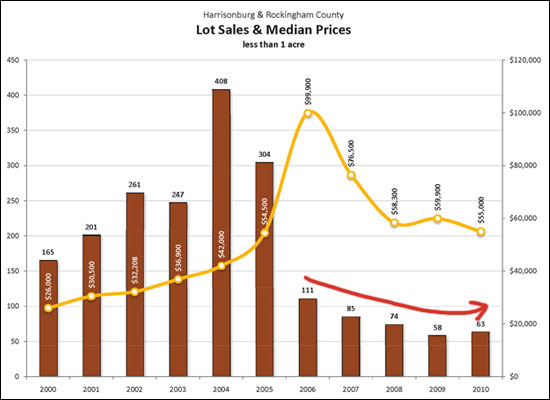

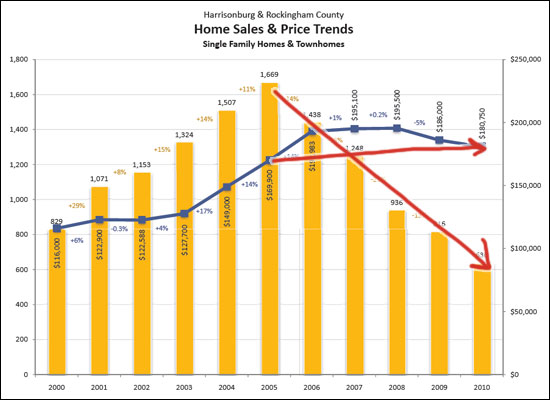

I have just published my most recent real estate market report with lots of information about the Harrisonburg and Rockingham County real estate market to help you make more informed real estate decisions in 2011. Click here to download the PDF, or read on....  While there were even fewer home sales in 2010 than in 2009, we seem to be nearing the bottom of a gradual decline we have been experiencing since 2005. After 14%, 13%, 25% and 13% year over year declines, there was only a 7% drop in sales between 2009 and 2010. Perhaps 2011 will finally be the year when we meet or exceed the prior year's sales count.  While the overall market may be recovering, the townhouse market continues to struggle to pick up any momentum. After only an 11% decline in the number of townhome sales between 2008 and 2009, we saw a full 20% drop between 2009 and 2010. And yes, this was amidst the first time buyer tax credit season!  While inventory levels were higher for most months of 2010 than in the same months in 2009, we have seen a significant decline in inventory over the past six months. After a high of 1,015 homes for sale in June 2010, the market is now down to only 787 homes for sale --- the lowest in the past two years.  Lot sales finally recovered -- at least in their pace, if not their price. After several very (VERY) slow years of lot sales, 2010 lot sales exceeded 2009 sales -- just barely. These sales are of lots smaller than an acre. Prices, as you can see, have dropped quite a bit over the past several years, down to the current median lot price of $55,000.  Click the image above (or here) to review the entire market report. If you have questions about this report, or if I can be of assistance with real estate that you own, or that you'd like to own, please be in touch. You can reach me most easily at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

Hidden Opportunities in Real Estate |

|

"There are deals to be had" one of my clients commented to me today as we were discussing the local market and a particular property that he was considering. I agreed, but we then both remarked that many of them are hidden opportunities. With many more sellers in the market then buyers, there are certainly some sellers who are getting fed up with waiting around to see when their house will sell. They either really want to or really need to sell NOW! Some of them, however, haven't yet adjusted their asking price to communicate that to the outside world. How do we discover these hidden opportunities, you might ask? Unfortunately, many of them can only be discovered by making an offer to purchase the property. Does it need to be a written offer, with all of the details spelled out? Yes -- to truly find out how much of an opportunity might exist with a given property you are much better off making the offer in writing, with all the details such as price, closing date, financing terms, inspection contingency, etc. Now, of course, there are always some opportunities that stare right out at you --- prices on houses that are obviously lower than they should be. However there are quite a few other houses on the market right now that could be purchased at a price that would likely be very compelling to you --- but we won't know that until and unless you make an offer. There are only two risks in making a low / low-ish offer to see how much flexibility may exist in the pricing of a house. First, you may become emotionally attached to the house, and decide you'll pay whatever it takes to get that house of your dreams --- this could be problematic, so let's discuss it if you know you are prone to such inclinations. Second, you might actually buy the house at a price that you're excited about --- oh wait, that would be the goal! While there are plenty of houses on the market (maybe most?) where you won't find much negotiating room, there are always some where you'll be pleasantly surprised at how much you can negotiate on price. Let's find them! | |

Listing Inventory Drops 12% In Less Than A Month |

|

As I type, active listing inventory in Harrisonburg and Rockingham County stands at 745 residential listings --- which I believe is the lowest level we've seen in the past two years. This includes single family detached homes, townhomes and condos. Less a month ago, in my most recent market report, active inventory was at 846 listings. Thus, we've seen a 12% drop in less than a month. Furthermore, current listing inventory (745) is 27% below the highest inventory we've ever seen --- 1,015 active listings, just seven months ago in June 2010. We still have a largely imbalanced housing market in Harrisonburg and Rockingham County, with many more sellers in the market than buyers. Thus, a decline in listing inventory is great -- it helps to balance the market, making it a healthier market. The question, therefore, is whether this low inventory level will last.... A significant portion of the lower inventory levels are a result of listings that expired on 12/31/2010. There are 101 fewer listings now as compared to December 8th (745 vs 846) --- but 80 listings expired between 12/31/2010 and 1/1/2011. It is possible that a small (or large) portion of those 80 listings were not intended to have expired, and that they'll return to the market in the next few days. Within the next week we'll have a better idea of whether these low inventory levels will last. What do you think? And what do you hope? | |

Is Homeownership For Everyone? |

|

Several decades ago (and earlier) home buyers would wait to purchase a home until they had at least 20% of the purchase price saved up in their bank account, and they would only buy if they were going to stay in the same home and town for many years. At the time, the percentage of homes that were owner-occupied hovered between 40% and 50% (U.S. Census Bureau). Just a few short years ago, home buyers were buying with no down payment at all (or less), even if they planned to stay in the house for only a year or two. This led to an ever increasing homeownership rate, which peaked at 69.2% of families owning their home in the early 2000's (U.S. Census Bureau). Why the sudden change of pace? And what is a buyer to do today? Many of today's first time buyers are still buying with a very small down payment, and that can be o.k. Many loan programs are available with a small down payment, such as the FHA loan program which only requires a 3.5% down payment. The risk here is that a buyer doesn't have too much built-in equity in case they need to sell sooner than they think. Purchasing a $100,000 house with a 96.5% FHA loan results in a $96,500 loan, which has only been paid down to $95,000 one year later. With such a small down payment, it can be difficult to re-sell the home in a short time frame without bringing cash to closing. As becomes evident, the down payment and the length of ownership are quite intertwined. As shown above, a small down payment with a small length of ownership can be financially difficult. A small down payment with a longer length of ownership can work just fine. Conversely, a larger down payment provides security and makes even a small length of ownership feasible. What may become clear here is that homeownership is not for everyone. Even if you're making great money when you move to Harrisonburg for a new job, if there is a strong chance you'll be leaving again in 12 months, it may not make sense to buy right away. But for those with good credit, a down payment of some sort, and a solid job that will keep you employed and in the area for the next 3, 4, 5, 6, 7 years – homeownership may be a very exciting option for you right now. With low interest rates, lots of homes on the market, and many sellers ready to negotiate, this can be a most opportune time to act. Owning a home is a passive savings account of sorts, with money accruing as you pay down the principal of your mortgage each month. Owning a home also gives you the ability to establish yourself and potentially your family in a neighborhood that may be your home for years to come. Finally, owning your home gives you the ability to invest time, energy and money into your home that will provide a future resale benefit to you – as opposed to when you paint, re-model or otherwise improve a property that you are leasing. Now being excited about buying and thus owning a home, you might look around and realize that the local real estate market isn't booming right now. Median prices have dropped a few percentages per year for the last few years. Is the local market poised for a recovery? It seems that it might be, with sales volume possibly leveling off in 2011, but no one knows for sure. Is it wise to invest in real estate when the market, and prices are down? Many think that it is wise, given that you can fix your housing costs when prices are potentially the lowest that they'll ever be, and when interest rates are potentially the lowest that they'll ever be. In many ways, your housing costs compared to what you are buying couldn't be much lower than they are right now. Buying a home isn't for everyone, but excellent housing opportunities abound for those who plan to make the Central Shenandoah Valley their home for the years to come. | |

Understanding Home Values -- When Analysis Fails Us |

|

It's easy to understand and agree upon the value of some homes, but quite difficult for some others. What is the difference? It all comes down to how easy it is to find recent comparable sales. EASY: If the home we are trying to evaluate exists within a neighborhood where all homes are relatively similar in age, square footage, architectural style, etc., it's often easy to understand the value of the home. Assuming some of these quite-similar homes have sold recently, we simply need to make minor adjustments to the sales prices of the comparable homes and we can quickly get a good feel for the value of the house. HARD: When you start to throw any unique factors into the mix, it can become quite difficult to agree upon the value of a home. For example, if the house is on a busy road, or has great views, or is on several acres, or is close to town but offers privacy -- all of these factors affect value, but it is usually difficult to find recently sold comparable homes that share all or most of these unique traits. In the HARD category above, you'll find yourself with some relatively similar comparable properties (either sold, or for sale), but with no easy way to adjust those comparable properties' values to better understand the subject property's value. In such a case, we have to do some mental not-math in our heads to come to a position on value. What I mean is this..... we can't look in a book or perform some analysis to determine the value difference between a house on two acres on Indian Trail Road versus a home on four acres on Pleasant Valley Road. Not only that, but there are likely even more unique factors in each property beyond location and lot size. Thus, we're left with consuming all of the information about all of the properties and then coming to some sort of a range of understood value for a particular property. The process I am describing above is relevant both to a seller pricing a property for sale, as well as to a buyer considering making an offer on a listed property. In both cases, there is not an obvious, clear answer to the value of a particular home. Analysis and math can only take us so far in with these unique properties! | |

City Homes Outperform County Homes |

|

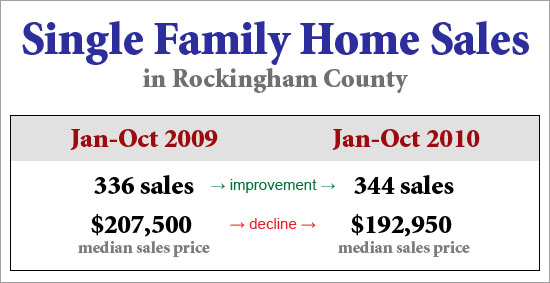

As I reported earlier this week, the single family home market in the City of Harrisonburg is improving, both in the number of homes sold, and the median price of those sold homes. There is also some good news in Rockingham County, but it's not quite as exciting.  As you'll note above, more single family homes are selling in Rockingham County this year as compared to last year. The bad news is that they are selling for less --- there has been a 7% decline in median sales prices. What does this mean if you are buying or selling a single family home in Rockingham County? SELLERS: Know they market! If prices have declined 7% over the past year, you shouldn't be basing your list price on sales prices from a year ago --- unless you are then adjusting downward. Furthermore, consider making your list price compelling today rather than potentially selling at a lower cost 6 to 12 months from now. BUYERS: Make sure that you are comfortable with what you are paying for a house --- and that you are comfortable staying in that home for several years. Median prices will likely still decline a bit further this coming year (2011) before starting to level off and increase. | |

Assessments of $300k+ Rockingham County Homes |

|

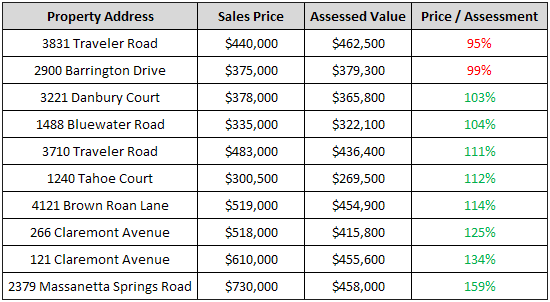

Property assessments are used to determine the amount of taxes that each property owner will pay. Can these assessed values also be used to estimate the value of a home? In theory, yes --- after all, the assessed value is intended to be the true market value of the home --- but it doesn't always seem to work. Case in point....one of my clients is considering two homes (among others) that have very similar assessed values, but have asking prices over $50k apart. Is the owner of the higher priced home just being unrealistic? Or are the assessments less than accurate? One way to examine this is to compare recent sales prices to assessed values. I'm going to focus on homes over $300k, as I sense that there might be more disparity in assessments with higher priced homes. In the past three months, there have been 10 sales of homes in Rockingham County with sale prices over $300k, with Harrisonburg mailing addresses.  As you can see, there is an enormous swing in the ratio between sales prices and assessed values. These ten buyers paid, on average, 16% more than assessed value for their homes. A few inconclusive conclusions:

| |

How to sell and buy at the same time when you only want to sell if you find something you want to buy. |

|

It is hard to do, but is still a reasonable approach. I am working with three couples right now who each want to move to a new home. One family wants more space in the house, one wants more space around the house (land), and one wants to live in a different part of town. Each of these three couples must sell their home in order to buy a new home. In our current market (with many more sellers than buyers) I always encourage seller/buyers (people who have to sell before buying) to put their house on the market before they make an offer on the replacement house. Since it is a lot easier to buy than it is to sell, it's usually best to start marketing your home for sale and seeking a buyer before you try to contract on the house that you are going to buy to replace your current home. These three couples want to take a different approach, however, and it is quite understandable! As they look at the market to find homes that they might purchase they each find that there are not too many homes that meet their unique set of buying criteria -- size, price, location, etc. They thus conclude that they don't want to put their house on the market yet because if they don't find the right home, they won't sell their current home. You might push back on that and suggest that they could and should go ahead and put their current home on the market anyhow, since they won't necessarily sell it right away, and because they could always turn down an offer from a buyer. Their position, however, runs deeper:

If you are hoping to sell your current home and buy a new home, the first step might not always be to put your house on the market. If you know of plenty of homes that you would buy as a replacement home, then it probably is appropriate to start by listing your home for sale. If, however, you aren't sure whether you'll be able to find a new home to buy, the most appropriate first step may be to start checking out the candidates for a replacement home before you go to the great lengths of putting your home on the market for sale. | |

Despite Slow Sales, Home Values Remain Relatively Stable in Harrisonburg and Rockingham County |

|

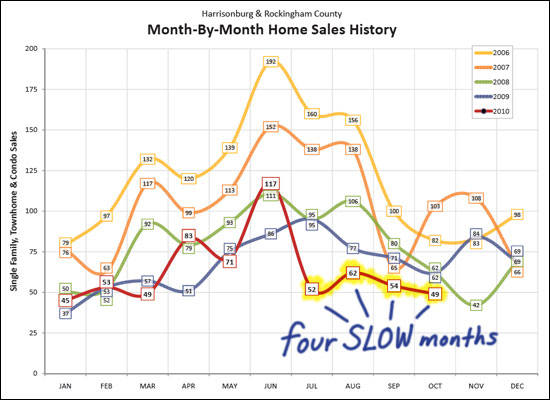

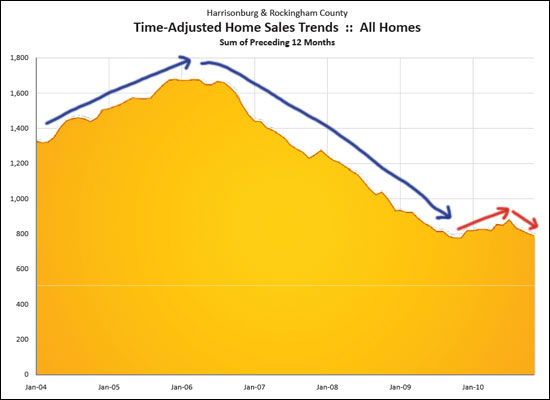

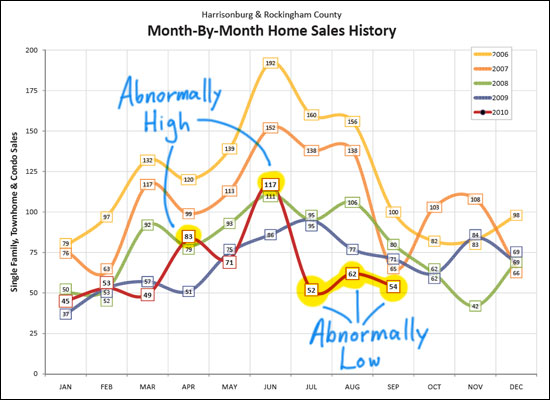

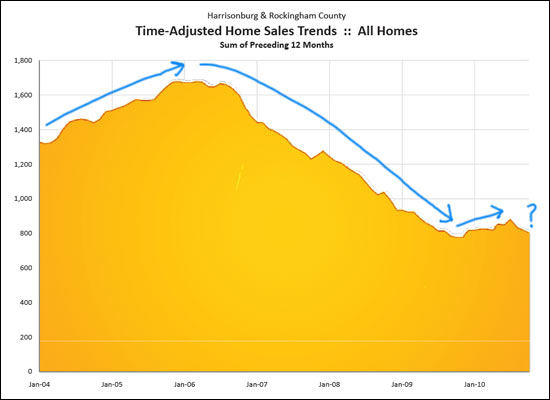

Read on for several highlights of the November 2010 Harrisonburg and Rockingham County Real Estate Market Report. Or click here to view the PDF.  Despite early gains in 2010 (particularly in April and June) home sales have stagnated over the past several months. July, August, September and October of 2010 have been the slowest such months during the past five years. Despite these low sales figures, however, year-to-date sales are only 4% below last year's sales.  Late 2009 through mid 2010 showed some promise. After several years of declining home sales (pace, not values) it seemed that our local market had finally turned around. Now looking back, that increase in sales pace may have been largely related to the home buyer tax credit, as the pace of sales is now on the decline yet again. What surprises lie in store for us in 2011?  As demand falls, prices should fall --- isn't that what I learned back in my economics class at JMU? Not so in the Harrisonburg and Rockingham housing market!?! Fewer and fewer buyers have been present in the market over the past six years (demand fell) but prices have not fallen in the way that that shift in demand would suggest. Calling all economists....how can we explain this?  Click the image above (or here) to review the entire November 2010 Harrisonburg and Rockingham County Real Estate Market Report, complete with an all new Executive Summary this month. If you have questions about this report, or if I can be of assistance with real estate that you own, or that you'd like to own, please be in touch. You can reach me most easily at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

Just because a house is your best option, doesn't mean you should buy it! |

|

There is a strange conundrum in the market right now --- how can inventory levels be so high, buy yet buyers aren't finding any homes they want to purchase? As you can imagine, this is quite frustrating for both sellers and buyers. Sellers can't fathom how, with 20+ months of homes for sale (in some price range) a buyer couldn't find just the right house to purchase. Buyers can't fathom how, with more options than ever before, they can't find the right home to purchase. But it happens, relatively frequently! Over the past few weeks I have worked with several buyer clients to try to find a next home for them to purchase. We have looked at quite a few homes (8 in one case, 10 in the other), but none were the right fit for them. Whether it was the location, the floor plan of the house, the amount of yard space, the interior finishes, or the price, there was *something* about each property that made it not quite right. The first set of my clients did eventually find something to buy --- by looking at a slightly higher price range, and then being fortunate enough to want to buy a house where the seller was able and willing to negotiate down to the buyer's initial price range. The second set of clients did not find the right home for them. They did find two houses that were pretty close to working --- both of which we perceived to be pretty good "deals" in the market --- but they would have been compromising in some way to purchase either home. My clients thus concluded that even though one of those two houses was their best option, and was a reasonable deal in the market, that this still didn't mean that they should buy it. By no means am I encouraging all buyers to hold out for the perfect house, nor am I suggesting that you won't have to compromise on some of your goals and desires as a buyer. But I do hope that buyers remember that unless they will truly be homeless if they don't find a house to buy, that just because a particular house is the best option on the market today, that doesn't necessarily mean you should go ahead and buy it. Look at the full picture, and think of the short term and the long term! | |

The Split Foyer vs. The Ranch |

|

We've had a turbulent real estate market over the past several years, and one of my clients was wondering if all property types had weathered the storm similarly. More specifically, the question was raised of whether split foyers or ranches typically held their value better. Let's take a look....  As you'll see above, both split foyers and ranches have seen a decline in sales over the past (almost) five years.

The median sales price of both home styles have declined since 2006.

Finally, examining the time it takes to sell each type of home (average days on market) we find that there used to be a difference in how long it took to see each type of home, but there is not any longer.

Finally, let's examine the supply of each type of home.

Buyers, please remember.... This information can be wisely understood to mean both that you should and that you should not buy a split foyer (or a ranch).

Please Note: The 2010 figures above are based on sales from 1/1/2010 - 10/20/2010. Additionally, the "split foyer" data includes split foyers, split 3-level homes and split 4-level homes. | |

A Falling Tide . . . Some Ships Sink Sooner |

|

Yesterday I discussed that when the real estate market improves all homes will increase in value. Thus, holding out to sell your current home for a higher price won't do you any good -- as you'll then also have to pay more for the house you are buying. But let's flip that on it's head....when the market is getting worse, do all ships sink at the same rate? I'd suggest that some sink faster than others, and that they sink deeper than others, for example:

This is primarily the result of the high inventory levels that almost always exist in times of slower market activity. A few years ago, being located on a busy road might have only equated as a $5k price difference because buyers didn't have many houses from which to choose. Now, however, when buyers have LOTS of houses from which to choose, most buyers will look past the house on the busy road, instead choosing a house within a neighborhood. More choices for buyers means that houses with significant "issue" (see bullet points above) will sit longer and longer on the market, and sell for less than you would expect them to sell for, given their other characteristics. | |

A Rising Tide . . . Your House Will Be Worth More Later, But So Will Their House! |

|

It is said that a rising tide lifts all boats. Apparently, there are some larger political or economic meanings to the concept, but for today we'll just consider it within the context of the local real estate market.

"You see -- if we wait until later to sell your house, you'll be able to sell it at a higher price -- but the owners of the house that you want to buy will also be able to demand a higher price for their home!" The rising tide lifts all boats! Put another way, it's o.k. to sell low in a tough market, as long as you are also buying low in that same tough market. This is especially important to remember given today's low interest rates. Let's compare buying now versus buying later....

| |

Harrisonburg Home Sales Decrease, Contracts Increase, in September 2010 |

|

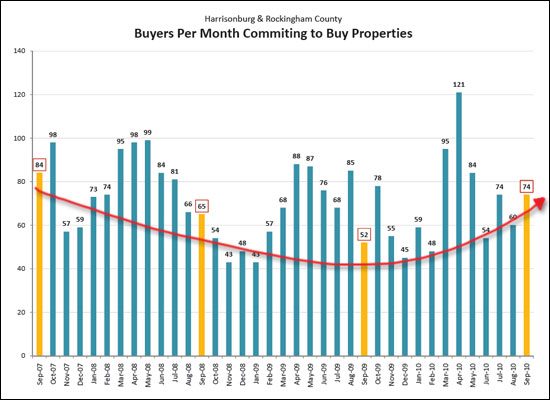

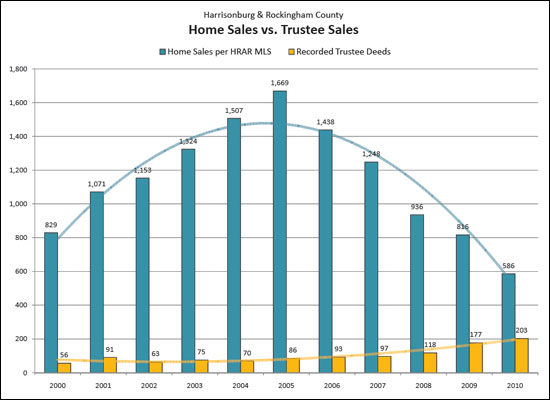

Below are several highlights from the October 2010 Harrisonburg & Rockingham County Real Estate Market Report. Read on, or click here to download a PDF of the entire report.  As you'll note above, there were very few home sales in September 2010. In fact, there were very few home sales in in July, August and September! That was, however, after very high home sales in April and June. Thus, it would seem that the home buyer tax credit certainly rearranged the timing of 2010 home sales, regardless of whether it brought new buyers into the market nor not. The question now, of course, is how many of the October, November and December closings were borrowed by the first half of 2010.  After multiple years of a declining sales pace, the graph above shows that we were finally seeing a reversal for the first six months of this year. However, the past three months of slow sales has turned us back around into a declining market again. The fourth quarter of 2010 will be quite indicative as to a reasonable 2011 forecast.  Please note, above, the silver lining. Despite a lower than normal number of closings in September 2010 -- the buyers were out yet again, contracting to buy real estate. In fact, with 74 properties going under contract, buyers in our market outpaced the past two Septembers. This should be a good indicator for the coming months.  Above you'll see a decade-long comparison of two imprecise measures. The blue bars show the number of home sales recorded in the HRAR MLS -- this does not include private sales (sans Realtor), and some new home sales. The yellow bars show the number of Trustee Deeds recorded during each of the past 10+ years. Some of these foreclosed properties (203 in 2010) then show up in the blue bar when they are listed and then sold as bank owned properties. It would seem that foreclosures have increased nearly four-fold over the past ten years, and now make up somewhere between 15% and 26% of all home sales.  My full market report (click above -- or here -- for a 20 page PDF) includes LOTS more analysis to help you make informed real estate decisions. Read through it and let me know if you have any questions, or if any additional information would be helpful to you. You can contact me (nearly) anytime at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

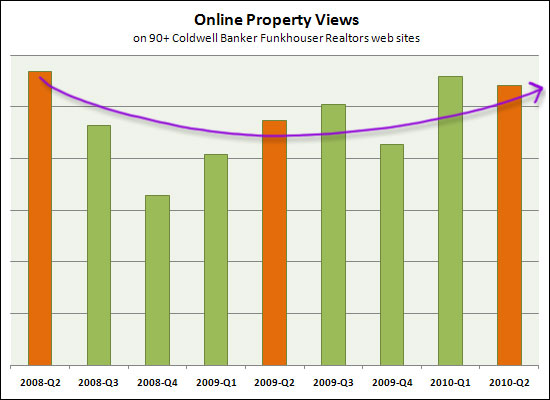

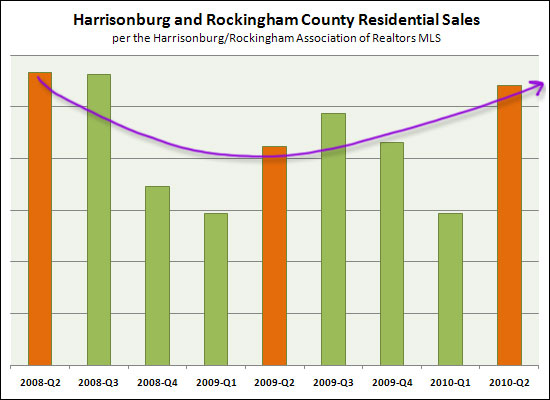

Online Property Views and Residential Property Sales Appear To Be Heading Up! |

|

A lot of you might view properties online today --- only a few of you might close on a home sale today. That said, there often seems to be a correlation between the number of people viewing properties online, and the number of people closing on properties. It makes sense --- if more people are going to buy a home, there will likely be more people looking at said homes online. Take a look at the interesting two year trends below. Not only do they mimic each other, but they are both headed up!   Now, I don't wear the rose colored glasses 24x7 --- I know we're not out of the woods yet. We still have super-high inventory levels, we haven't decidedly seen a turn of the tide in sales volume, and it will probably be another year or more before we see prices starting to stabilize. However, there are more and more indicators of late that we may be seeing a gradual change towards more positive times in the Harrisonburg and Rockingham County housing market. | |

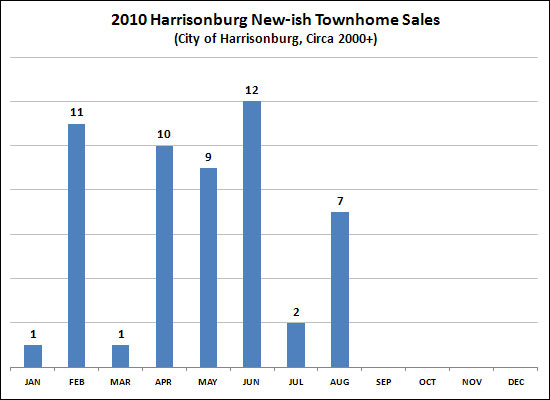

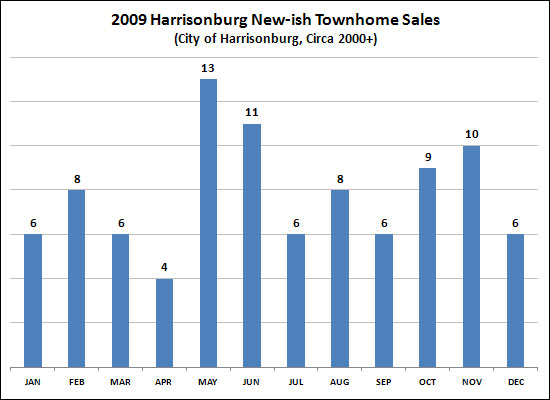

The Yo-Yo Effect of Harrisonburg Townhome Sales |

|

The one thing I try to tell all of my seller clients is that the market is very unpredictable. It's impossible to know if a given house will sell in three months, six months, a year, or even longer. Most of this uncertainty is related to the vast number of homes for sale relative to the number of buyers in the market. It's hard to predict which houses buyers will actually choose. But here is another unpredictable and turbulent market trend --- the sale of new-ish (circa 2000-2010) townhomes in the City of Harrisonburg.  What a roller coaster this year has been! Only a single sale in January and March, and only two in July!?!?! The dip in July is likely because of the original June 30th tax credit expiration --- but why were January and March so terribly low, with a strong February between them? Maybe there is always this much turbulence in the townhouse market? Let's take a look at last year....  Here you see some variation, but not the extreme ups and downs that the townhome market has experienced this year. If you own a townhome and are trying to sell it, I suppose this coming month could be wonderful, or it could be terrible. Townhome buyers are coming in small bursts these days, and then disappearing again. | |

Could September be showing signs of an improved real estate market in Harrisonburg and Rockingham County? |

|

Last year, 816 homes sold in Harrisonburg and Rockingham County. Per my most recent market report, it seems probably that we'll be at the same pace in home sales for 2010. But follow me for a minute....

One last exciting statistic for your Monday --- last September, only 52 homes went under contract in the entire month. In the first half (less than half, really) of this September, 36 homes have already gone under contract! Thanks Kemper, for pointing out last week's astounding buying pace! | |

Remember 2003? "With home values increasing so much, let's buy as big of a house as we can!" |

|

As home values escalated between 2003 and 2006 in Harrisonburg and Rockingham County, buyers bought larger and larger homes!  The graph above shows the average size of single family homes sales per the Harrisonburg Rockingham Assocation of Realtors MLS. As can be seen, the average size of a single family home increased quite steadily between 2002 (1,698 square feet) through 2007 (2,162 square feet). That is a 27% increase in the average sized home! Over the past few years, however, the size of the average home has decreased, all back down to 1,971 square feet thus far in 2010. This is not a trend only taking place in the Shenandoah Valley. Read about it nationally at MSN: At annual builders' show, small is in. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings