Buying

| Newer Posts | Older Posts |

Days On Market? Sorry, that is classified information, given out on a need-to-know basis only. |

|

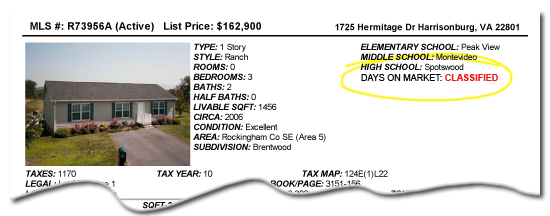

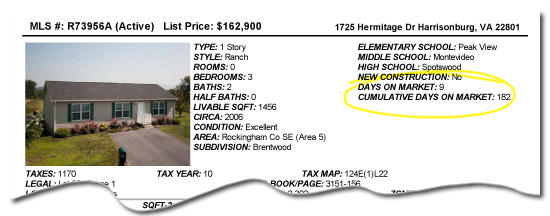

When I show properties to my buyer clients, I give them a printout of the data sheet from the HRAR MLS with lots of pertinent information about the property for sale. This data sheet used to include a DAYS ON MARKET field that would show how long a property had been listed. No longer....  The data sheet doesn't really say CLASSIFIED --- but the entire field is now gone. The information is, however, on the Realtor version of the data sheet, which begs the question --- is this change solely to provide opportunities for small talk amongst shy buyers and timid Realtors? Here's the Realtor version of the same data sheet....  As it has been explained to me, the DAYS ON MARKET field was taken off the buyer data sheet for a few reasons:

| |

Local Home Sales Slow in August, Still Strong YTD |

|

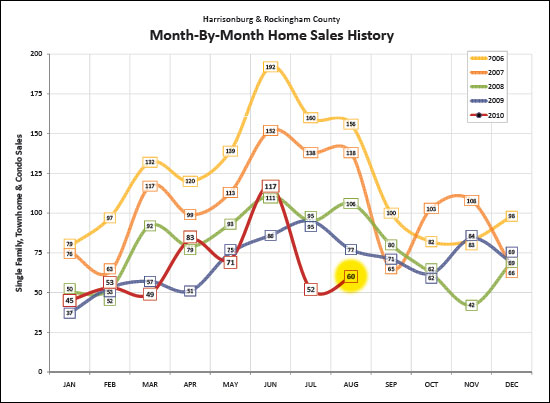

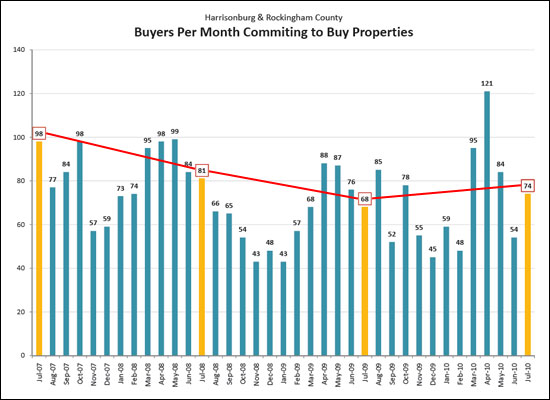

Below are several highlights from the September 2010 Harrisonburg & Rockingham County Real Estate Market Report. Read on, or click here to download a PDF of the entire report. Home sales in Harrisonburg and Rockingham County... Are they up? Down? Stable?  In fact, they are up, down AND stable! A mix of indicators this month:

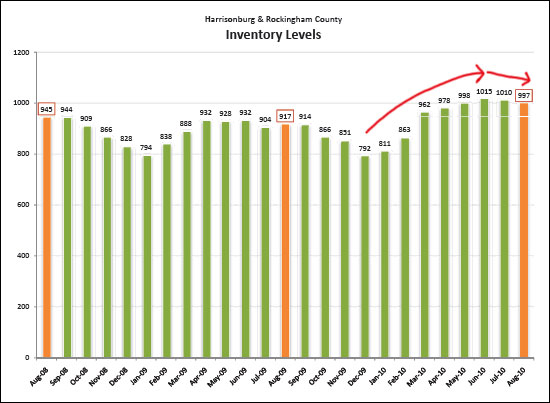

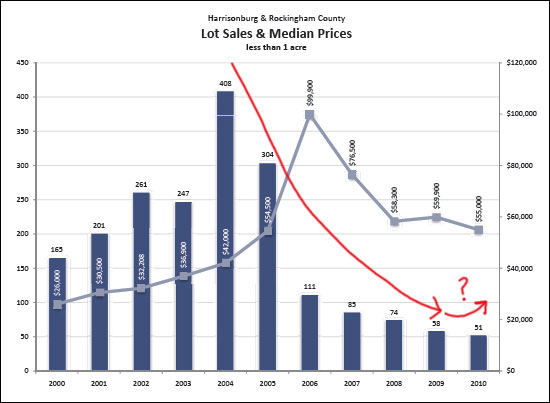

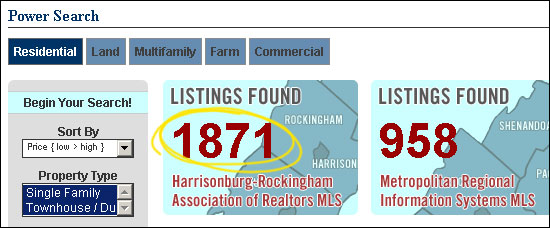

Another good indicator, as shown above, is that the local housing inventory has peaked --- at least for now. A few months ago the number of homes for sale in Harrisonburg and Rockingham County broke 1,000 for the first time -- but it has now started to decline again, as is typical for this season of the year.  Lot sales (less than an acre) have been very, very slow over the past several years, falling from a peak in 2004 of 408 lot sales to only 58 lot sales last year. As shown above, lot sales might actually rebound this year! There is even more in the 19-page September 2010 Harrisonburg & Rockingham County Real Estate Market Report. Download the entire report by clicking on the image below.  Thanks for reading, and if you have any questions, or if I can assist you with buying or selling real estate in Harrisonburg or Rockingham County, please contact me at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

I really, really want to spend a million dollars on a home in Harrisonburg or Rockingham County! |

||||||||||||||||||||||||||||||||||

You are in luck! Even though only one $1M+ home has sold in the past three years*, there are 16 on the market for you to buy! * per the Harrisonburg / Rockingham MLS Here are the six $1M+ sales from the last 10 years in the Harrisonburg Rockingham MLS....

What then, you might ask, can I buy for $1,000,000 today? You have 16 homes to choose from, ranging from $1.1M to $20M, from 3000 to 9000 SF, with up to 9 bedrooms.  | ||||||||||||||||||||||||||||||||||

Harrisonburg / Rockingham MLS Changes Days On Market Accounting Practices |

|

Here's how it started, or so they tell me.... In some other city or town in Virginia, a relocating buyer swept into town looking to buy a house. He found a great house, discovered that it had only been on the market for a few weeks, and made a offer on the house relatively close to asking price given the short length of time on the market. After moving in, he was talking to a neighbor, and commented on how glad he was that he was able to secure the house even though it was such a new listing. The neighbor laughed, saying "What are you talking about? They had been trying to sell that house for three years!" How was it possible there? Was it happening here? The buyer's confusion, it seems, was based on the "Days on Market' field in the local MLS. The information that the buyer reviewed showed a very low number for "Days on Market" and he understood that to mean (as most people would) that it was a very recent listing. But in that area (and yes, in Harrisonburg and Rockingham County -- until recently) this "Days on Market' field could be conveniently reset by re-listing a property with a new company. Indeed, even around here, if a seller became worried about buyers' perceptions of an ever increasing "Days of Market' value, that seller could list their home with a new real estate company, and start over at ZERO! But now, things have changed around here.... Our local association of Realtors (HRAR) MLS changed in the past two weeks, introducing a new "Cumulative Days on Market" field. This field will now track the total length of time that a property has been on the market, even if it is listed by multiple companies. Thus, if Brokerage A has a property listed for 300 days, and after the listing agreement expires, the property owner hires Brokerage B, the "Days on Market" slate will no longer be wiped completely clean. "Days on Market" will indeed return to ZERO, showing the length of time on the market with the new listing broker, but "Cumulative Days on Market" will continue to increase, to 301, 302, etc. Does "Cumulative Days on Market" EVER reset?? If a property has been off the market (not listed) for 120 days (4 months), then both the "Days on Market" and "Cumulative Days on Market" will reset to ZERO when the property is re-listed. How does this affect buyers, or sellers? As a buyer, it will now be easier than ever for your Realtor to quickly discover how long a seller has truly been attempting to sell their home. As a seller, it will no longer be able to present your home as a NEW LISTING all over again just by switching real estate companies. So, good or bad? I'm glad the change has been made --- it makes it more difficult for a seller to be deceptive (which is reasonable) and it makes it easier for a buyer to have a clearer understanding of the status of the property. But what do you think? | |

What Do You Mean I Did Well? I Brought Thousands Of Dollars To Closing! |

|

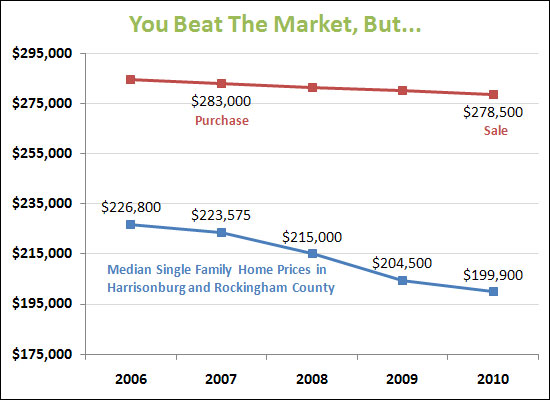

In these crazy times, it's possible to "beat the market" and yet still be hurting financially...  The blue line above shows the trend in single family home prices over the past five years in Harrisonburg and Rockingham County. As you can see, prices have declined, though only a total of 12% over the past five years. The red line shows the purchase and sale of a single home in Harrisonburg, as experienced by some of my clients. You'll note that while the red line declines, it's not by anywhere near as much as the blue line. Thus, my client's home outperformed the market --- they beat the market, and experienced a smaller decline that perhaps they should have. How exciting, right?? But no, actually, it wasn't too exciting. The heroic act of selling the house at a higher price than the market suggested would be possible was still painful. My clients had financed most of their home purchase in 2007, so they actually had to bring thousands of dollars to closing in 2010 in order for the sale to proceed. You see, it's not as simple as the purchase price minus the sales price --- you also have to factor in the closing costs on the buying side (2007) and the closing costs on the selling side (2010). So....when the market is declining, even if it is declining slowly, it can be difficult to purchase and then sell within a short time period. Thus, buyers and sellers should note that:

| |

Owner Financing In Harrisonburg & Rockingham County |

|

Can't obtain traditional financing? Perhaps the owner of the house you are purchasing can finance the purchase for you! Actually...there don't seem to be too many owner financing opportunities available. Searching our local MLS, I'm finding five properties in Harrisonburg and Rockingham County that are advertised as having owner financing opportunities....   (1) 3318 Friedens Church Road - 3 BR, 3 BA, 2700 SF, $326k (2) 216 Emerald Drive - 3 BR, 3.5 BA, 2581 SF, $199k (3) 150 Inglewood Court - 3 BR, 2 BA, 1408 SF, $178k (4) 1380 J Hunters Road - 2 BR, 2 BA, 953 SF, $57k (5) 1372 J Hunters Road - 2 BR, 1 BA, 837 SF, $47k In many (not all) cases, an owner that can provide owner financing either owns the property outright (no mortgage remains), or has a low balance on their mortgage that they can pay it off entirely. Then, with no mortgage in place, they'll expect some portion of the purchase price from you as a down payment, and the rest will be repaid over a term and on a schedule negotiated between you and the owner. Most owner financing scenarios are not 30 year arrangements, but may involve owner financing for 5 or 7 years, with a balloon payment at the end. To be more specific --- a $200k purchase might involve a $20k down payment, and then the $180k balance amortized over 30 years at 6% interest, but with a 5 year balloon. This would mean that you'd pay a monthly payment of principal and interest as if the $180k loan were stretched out over 30 years, but after 5 years you would have to pay off the entire remaining balance of the loan. Typically the balloon payoff is accomplished by refinancing the property with a traditional lender at some point prior to when the balloon payment is due. If you own a property, and are trying to sell it, and could offer owner financing --- do it! There aren't too many properties with this option readily available, so you might entice additional buyers if you can offer to finance their purchase. If you're a buyer looking for owner financing, you'll probably need to approach owners (in addition to the five above) who aren't offering owner financing, to see if they can or would consider it. | |

Types of Investment Properties In Harrisonburg |

|

Below are several general categories of investment properties in Harrisonburg that you might consider purchasing. Each has its own pros and cons. College Rentals - There are many more bedrooms than college students in Harrisonburg right now, so this is not necessarily a great choice, but it can work well given the current pricing of these properties. Hunters Ridge Condos, Hunters Ridge Townhomes and Madison Manor are your main choices in this area, and with a decent down payment, the cash flow can actually work well now that prices have dropped considerably over the past few months. New-ish Townhomes - Here you'll be aiming for graduate students or young professionals as tenants. I suggest buying a townhouse with two full bathrooms, and either two bedrooms or three bedrooms can work well. Your main choices are: Liberty Square, Liberty Square II, Beacon Hill, Avalon Woods, Harmony Heights, Wellington Park and Blakely Park, though there are some other areas to consider as well. Being new or new-ish townhomes, these are usually in good condition and relatively easy to rent. Old-ish Single-Family / Multi-Family Homes - If you don't mind tackling some maintenance on a home that is 40 to 70 years old, you might find some good opportunities in and around the downtown area where you can buy a home that could be fixed up and rented to college students, graduate students, young professionals or a family. These properties range from 2 bedroom homes that may currently be owner occupied to 5+ bedroom homes that have been rented to college students for years. Depending on your goals as an investor, each of these categories of investment properties can make more or less sense. Feel free to call (540-578-0102) or e-mail (scott@HarrisonburgHousingToday.com) if you'd like to discuss your goals, and which properties would work best for you. Read more about the numbers of investing here. | |

Harrisonburg and Rockingham County Home Sales Fall Dramatically In July 2010, But The Future Still Looks Bright (Really!) |

|

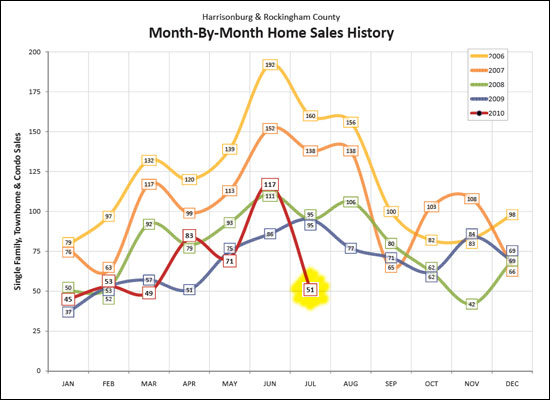

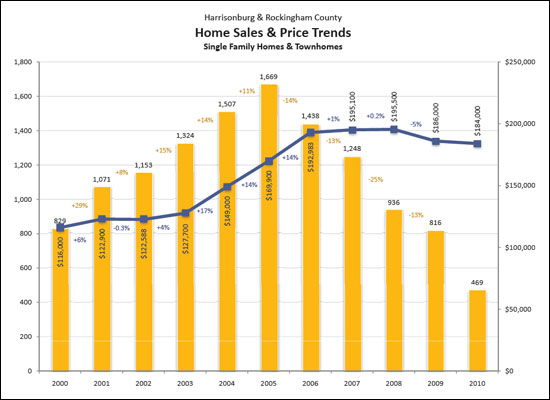

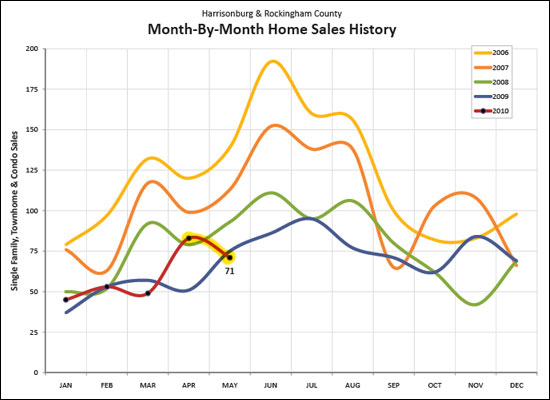

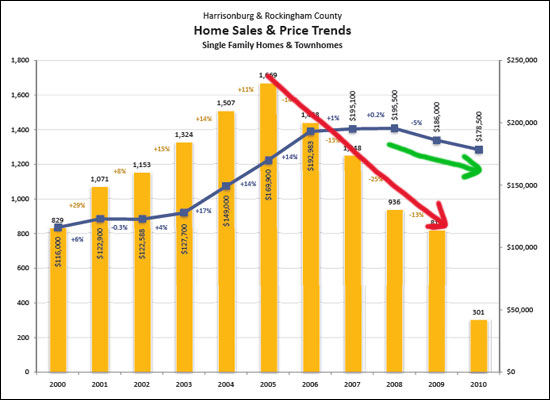

Click here for the full August 2010 Harrisonburg & Rockingham County Real Estate Market Report. If we only looked at July 2010 home sales (and ignored several other key indicators, and the bigger picture) we might get a little worried about our local housing market.  As can be seen above, there were very few home sales in July 2010. This is likely because of the original June 30th deadline for closing under the home buyer tax credit (the deadline has now been extended to September 30th). But after a very slow July, we'll probably start to see things pick back up, since contracts looked healthy in July 2010.  As can be seen above, there weren't too many buyers committing to buy properties last month, but there was a return to the contract-signing-table in July 2010. This month's buyer commitments actually exceeded last July's data, showing a reversal of the downward trend of the last several years. For another reversal, read on.  The yellow bars above show the number of home sales over the past ten years -- it is very likely that after four years of declining home sales, we might finally see an increase in 2010. Year to date, 2010 shows a 3% improvement over 2009 to date. The blue line above shows the change in median sales price over the past ten years. The median sales price declined by 5% between 2008 and 2009, but the decline appears to be much smaller this year. Learn even more about what's going on in the Harrisonburg and Rockingham County real estate market by reading the full report.  Do you have questions about this report, or about the Harrisonburg and Rockingham County real estate market? Or about your house? Or about a house you might buy? Be in touch . . . Scott Rogers | 540-578-0102 | scott@HarrisonburgHousingToday.com | |

The Five Best Deals In The Last Ten Days |

|

Over the past few weeks I have received (on behalf of my seller clients) quite a few offers that I considered to be quite low:

First, do note that of the 27 homes sold in Harrisonburg and Rockingham County over the last 10 days, on average, 5.4% was negotiated off of the list price. Now, for the houses where the buyers negotiated the highest percentage off of the list price....  4377 Hilltop Road (Massanetta Spring) - sold for 22% less than the list price  160 Wildwood Drive (Bridgewater) - sold for 15% less than the list price  253 S Sunset Drive (Broadeway) - sold for 11% less than the list price  2965 Pin Oak Drive (Belmont Estates) - sold for 10% less than the list price  545 Tabb Court (Preston Heights) - sold for 10% less than the list price So, with average negotiations of 5.4%, what do you think? Where the four offers of 10%, 15%, 16% and 20% below asking price reasonable? Perhaps negotiations have to start somewhere! | |

So, you're not having an showings on your house? What could the problem be? |

|

I talked to a local Realtor yesterday who has three listings that have been on the market for two months now, and have yet to be shown. By yet to be shown, I mean that not a single buyer has come to view the house. What is going on here? Have all of the buyers left town? There were some people who thought that after the home buyer tax credit ended, that the local real estate market would slow down to a crawl. That didn't exactly happen, as we'll see in a few days in my monthly report. So, given that properties are still selling in Harrisonburg and Rockingham County, why are some listings not seeing any showing activity at all? PRICE: It is possible that the price of the home is simply too high to motivate any buyers to come view the property. Some sellers figure "well, they can make an offer, so it's o.k. if my house is priced $10k, $20k, $40k higher than what I'd really accept." This logic doesn't work well in today's market, as buyers will often not even go to view a house if they think the asking price is too high. As a tangible example, I was talking to an agent in my office last week who had a house listed for around $225k. After a month of very few showings, they lowered it to $215k. After another month of very few showings, they lowered it to $205k. Within two weeks they had roughly 10 showings, and an offer that was successfully negotiated. (These prices have been changed slightly to keep things anonymous around here). As you can see, once the property was at a price that made sense to the buying public, they were willing to come and see the house, in droves! NO/FEW BUYERS: It is (quite) possible that there are not very many buyers in your home's price range or "product range". It is certainly obvious that if you have a house priced at $5,000,000 that there would be very few buyers, thus very few showings, thus very few offers. It is also quite possible that there are (for example) very few buyers in the $250k - $300k range who would be satisfied with only having three bedrooms and two bathrooms. If everyone looking in that price range wants four bedrooms, then you can lower your list price from $300k to $290k to $280k to $270k, etc., and you might still see very few showings and market activity. POOR MARKETING: Your property must be presented well and widely (primarily online, as that is where nearly all home buyers start their search) so that you can maximize the number of people who are even considering coming to view your home. If the photos of your home are dark, or if there are very few photos, or if the square footage calculations are inaccurate, then you probably can't expect too many showings, or offers. The good news here is that you (and/or your Realtor) can affect/fix any instances of poor marketing. You can also fix a pricing problem --- to some extent, depending on how much you owe on the house and many other aspects of your personal financial situation. The bad news is that you can't do anything to fix the problem if it is a result of very few buyers looking for what you happen to be selling. A house can be marketed wonderfully, priced very well, and may still have very few showings. Again --- if there isn't anyone looking for what you are selling, then you still won't have showings. | |

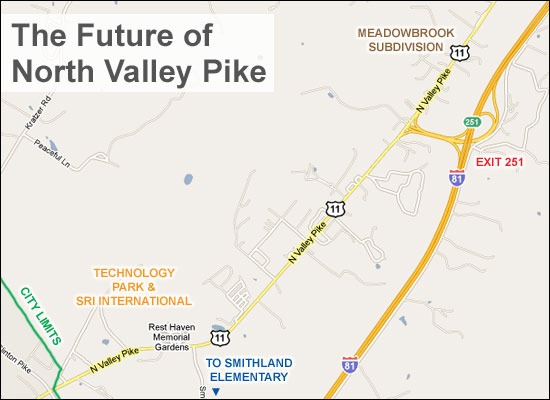

The Future of North Valley Pike (Route 11 North) |

|

There is a slowly growing area just north of Harrisonburg that you may not have heard of or visited, but there are a variety of factors that may make it a growth area over the next several to many years.  A strategic plan has been created for this North Valley Pike corridor, that suggests turning an existing section of Route 11 into a main street area, with most through traffic diverted to a new road. For an overview with lots of helpful links, read the post on hburgnews.  A research and technology park has been established amidst this corridor on 365 acres, owned and operated by Rockingham County.  SRI International has established a 25-acre campus in the above-referenced research and technology park, and opened the Center for Advanced Drug Research, which is a "state-of-the-art research facility for conducting systems biology research in the areas of biodefense and neglected diseases."  An attractive subdivision of single family homes is being developed in this corridor area (I am marketing this subdivision) with prices starting in the low $200,000's.  A new elementary school was recently built on Smithland Road, not too far from this North Valley Pike corridor. This has created new traffic flow patterns, bringing greater awareness to the north side of Harrisonburg. While most development has taken place just southeast of Harrisonburg in the recent past, the area just north of Harrisonburg will be a key area to watch over the next 3 to 20 years. | |

Buying A House In A Buyer's Market |

|

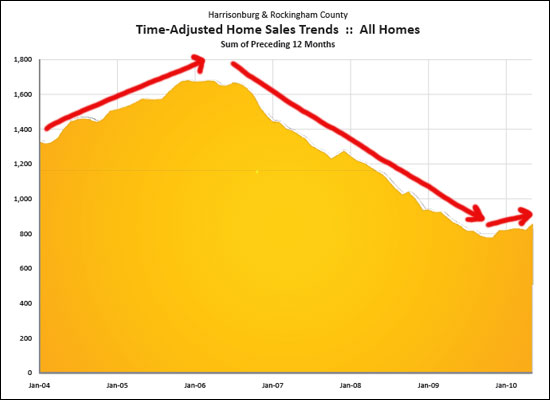

For each of the past four years, fewer and fewer home buyers have purchased homes in Harrisonburg and Rockingham County. The annual rate of home sales has declined from 1,669 in 2005 down to 816 in 2009 – a decline of more than 50%. Even though the first five months of 2010 indicate that sales activity may finally be starting to increase again, it is still a buyer's market. There are far more sellers needing, hoping or wanting to sell than there are buyers who need, hope or want to buy. In many senses, this is great news for buyers – there are fewer buyers to compete with, and more houses to choose from. Add to that the amazingly low interest rates and you'll see why today's home buyer is excited to be in the market to buy. But despite this excitement, most buyers want to make sure they are making a wise investment. In years past, just about any home would do – when the overall market was increasing by 15% to 20% per year, just about any home would see great appreciation. Now, however, prices are holding relatively stable, so it becomes more important which house a buyer chooses. As you look at which particular house you choose, one perspective to consider is how you'll do when you re-sell the house you are buying. Some homes currently for sale need updating – hardwood floors to be refinished, a roof to be replaced, wallpaper to be removed, or a driveway to be re-surfaced. These homes that are need of some updates can be a good opportunity for buyers – if the seller is pricing based on these imminent costs. An even better opportunity, however, is a home where brand new value can be added through your improvements. If you sand and stain the hardwood floors, you will have added value through improving the look and ambiance of the home – but you had hardwood floors before your work, and you still do. If you replace the roof, you will have added value through lower roof maintenance for the next buyer – but you had a roof before your work, and you still do. As you look at homes as a buyer you should not only look for updates that you might choose to or need to make, but also totally new areas where you can create space to add value. Homes with unfinished bonus rooms or unfinished basements offer lots of potential for adding brand new value. The layout of some homes invites the addition of a deck or screened porch – both of which add brand new value – or perhaps an existing porch can be converted into a sunroom. When you're just refinishing the existing spaces, you usually aren't changing the functional space offered to the next buyer – but if there is an easy way to add more functional spaces, this can offer you many options during your time of homeownership, and when you re-sell. A second perspective to consider when buying in a buyer's market is the "timeless value" or quality found in a home you are considering. Look for appropriately sized rooms, the types of rooms that you use on a daily basis, and the quality of construction and craftsmanship that means your home will still look great in 5, 10 or 15 years. In this case, it's not just about buying the biggest house, or the house with the biggest yard. Some 2,000 square foot homes have layouts that won't fit most people's lifestyles, where an 1,800 square foot home down the street might be perfectly designed for comfortable daily use. In her very well read book, The Not So Big House, Sarah Susanka encourages us to think differently about the layout of a house: "It's time for a different kind of house. A house that is more than square footage; a house that is Not So Big, where each room is used every day. A house with a floorplan inspired by our informal lifestyle instead of the way our grandparents lived. A house for the future that embraces a few well-work concepts from the past. A house that expresses our values and our personalities. It's time for the Not So Big House." Saranka points out that it's not all about quantity in a house, but about quality – quality in design and materials. Finally, it is very important to consider location and neighborhood, when buying a home in a buyer's market. A home can be beautiful, well designed, and desirable to all – but if it is located on a busy road, or in the far corner of the county, or on a street where most homes are old and poorly maintained, the future value of the home suddenly changes. Buying an older home, or one that needs work, can be a much better opportunity for you, as you have more control over the changes to the value of your home. You'll likely never reduce the traffic count on the road in front of your house, you'll never make city and employment growth stretch all the way out to your corner of the county, and you won't spend your free time fixing up the other ten houses on your block. With many more homes for sale than buyers to buy them, and with amazingly low interest rates, and with fewer buyers to compete with when negotiating a deal with a seller, it can be a very exciting time to buy a home. When you do so, it is important to consider how well the home will fit your needs, but it is also wise to consider how the home you are considering will fare when you need to sell in 5, 10 or 15 years down the road. | |

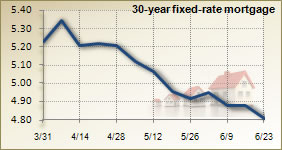

Mortgage Interest Rates Have Never Been Lower -- Get Out Your Calculator! |

|

I had heard from several of my clients this week that interest rates were VERY low --- but I didn't know they were the lowest EVER! Current rates are the lowest on record, according to BankRate.com and others. I had heard from several of my clients this week that interest rates were VERY low --- but I didn't know they were the lowest EVER! Current rates are the lowest on record, according to BankRate.com and others. Of note, I two of my clients locked in this week at 4.375% and 4.5% --- wow! How do these incredibly low interest rates affect you?

Put another way --- if you were buying a new townhome this week, could it be helpful to have an extra $1,600 in your pocket? Or an extra $2,700 in your pocket? Buying now, with low rates, can save you that much (annually) as compared to your costs if rates start to increase. | |

The Layout of a House Often Trumps Everything Else! |

|

There are a LOT of homes on the market in the $300k - $400k price range, and I have recently been showing a lot of them to buyers. I will then have follow up calls from the Realtors representing the sellers, wondering how things went. Some of the houses are priced more competitively than others, and those sellers (and their Realtors) are often confused and frustrated when my buyer clients aren't ready to make an offer on their home. Why aren't buyers necessarily jumping at the "best-priced" house on the block? The main conclusion I have come to is that the layout of the house seems to be a significant trump card above all other factors.

The bad news is that if the layout or floor plan of your house is unpalatable to most buyers, your home may languish on the market. Back in 2002-2006, just about any home would sell (regardless of the layout) because there were very few choices in homes. Now that buyers have so many choices, they are often quite specific in wanting a layout in a home that works well for their day to day needs. | |

Local Home Sales Up 10% in 2010, Prices Down 4% |

|

Click here to view my full June 2010 Harrisonburg & Rockingham County Real Estate Market Report. Exciting Fact #1 --- May 2010 home sales declined 5% as compared to May 2009, but year-to-date sales (January through May) are up 10% over last January through May.  Exciting Fact #2 --- After three and a half years of steadily declining home sales (quantity, not prices), we have now seen stabilization or increases in home sales for over six months.  Not-So-Exciting Fact #3 --- Sales volume has declined sharply for four years now (red line), and median home values have declined gradually for two years (green line). Despite early positive indicators for the past several months, we're not out of the woods yet.  Other tidbits that you'll discover in my June 2010 Harrisonburg & Rockingham County Real Estate Market Report include:

| |

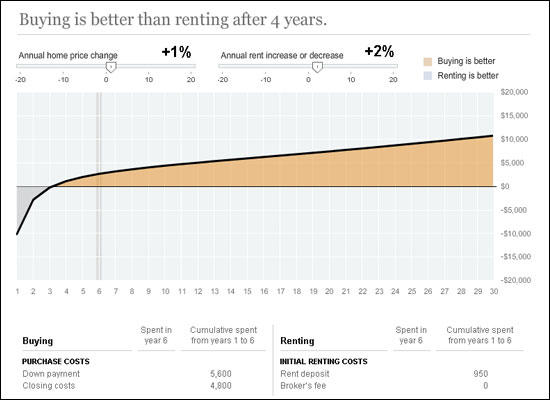

Is It Better to Buy or Rent? |

|

Lots of people who are renting have thought about buying . . . and lots of people who are thinking of buying wonder whether they should keep renting. Here's a highly interactive calculator to help you compare your options, thanks to the New York Times.  Using this online calculator, you can enter in all sorts of variables including all of your up front and ongoing costs for buying as well as renting. The resulting graph shows you how long it would take for it to have been worthwhile to have bought instead of renting. The illustration above is with a $160,000 townhome purchase, compared to renting the same townhome for $950 per month. With a 5% interest rate on a 97.5% mortgage, it would take four years to be worthwhile to buy --- if home values were increasing at 1% per year. In the first three years, your annual costs would be higher for having bought. Starting in the fourth year, your annual costs would be LOWER for having bought. Longer term normalized price increases per year range from 3% to 4%. With 3% per year increases in home values, you start having annual savings each year after only two years. If you are wondering whether you should rent or buy a home, feel free to use this handy calculator, or schedule a time to meet with me and I can help you explore the pros and cons of each option. | |

Home Sales Slow, Prices Remain (Somewhat) Steady In Harrisonburg, Rockingham County |

|

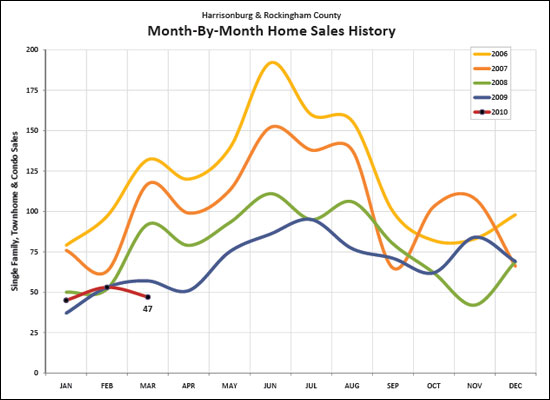

Click here or on the image below to view the full April 2010 Harrisonburg & Rockingham County Real Estate Market Report (PDF). Read on below for a few highlights.  Mixed indicators this month . . .

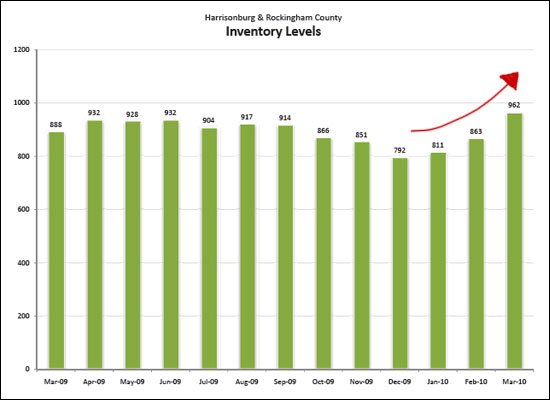

Also of note, we have seen a steady increase in Inventory over the past several months. Lots of options for buyers --- lots of competition for sellers! Also of note, we have seen a steady increase in Inventory over the past several months. Lots of options for buyers --- lots of competition for sellers! Don't delay -- get all of the exciting (and not as exciting) details and beautiful charts by downloading the full April 2010 Harrisonburg & Rockingham County Real Estate Market Report (PDF). If you find the information in this report to be helpful....

| |

Conflicting Real Estate Market Indicators |

|

Explain this....  The number of properties viewed online (on our company site and all of our company's agent sites) has increased dramatically over the past year. Thus, it seems that more buyers are hunting for homes. But when we compare the number of closings in the first 28 days of last March and this March, we see a rather significant decline. What is going on here?

| |

Will You Be Buying A New Home in Harrisonburg or Rockingham County? |

|

If you are considering the purchase of a new home in Harrisonburg or Rockingham County, you may want to check out HarrisonburgNewHomes.com, where you'll find an overview of many of the new communities being built in our area.  I represent the builders of each of these communities, and am assisting them with the marketing of the new single family homes, duplexes and townhomes. For more information about any of these neighborhoods, feel free to contact me or one of the other Realtors also marketing these communities:

| |

How To Close On Your Home Purchase ON TIME! |

|

It is a challenge! It seems that these days over half of home purchases don't close on time, and it is often because of delays in the financing process. Financing guidelines are much more stringent, requiring more documentation than ever before. So how CAN you close on time? Wells Fargo is confident that they can make it happen. They are so confident that they're putting their money on the line in promising to close your loan on time. The program is called the "Wells Fargo Closing Guarantee" and states that if Wells Fargo doesn't close your loan on or before the date in your sales contract, they'll pay your first month's principal and interest! Wells Fargo typically has great programs and rates, so this closing guarantee certainly boosts them up on my list of top lenders that I'd recommend that you speak with in determining where you'll obtain your financing. For financing via Wells Fargo in Harrisonburg, contact Jon Ischinger at 540-478-5223 or jonathan.ischinger@wellsfargo.com. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings